From launch to launch: Peter Beck on building Rocket Lab’s orbital business

Breaking into the launch industry is no easy task, but New Zealand’s Rocket Lab has done it without missing a step. The company has just completed its third commercial launch of 2019, and is planning to increase the frequency of its launches until there’s one a week. It’s ambitious, but few things in spaceflight aren’t.

Although it has risen to prominence over the last two years at a remarkable rate, the appearance of Rocket Lab in the launch market isn’t exactly sudden. One does not engineer and test an orbital launch system in a day.

The New Zealand-based company was founded in 2006, and for years pursued smaller projects while putting together the Rutherford rocket engine, which would eventually power its Electron launch vehicle.

Far from the ambitions of the likes of SpaceX and Blue Origin, which covet heavy-launch capabilities to compete with ULA to bring payloads beyond Earth orbit, Rocket Lab and its Electron LV have been laser-focused on frequent and reliable access to orbit.

Utilizing 3D printed engine components that can be turned out in a single day rather than weeks, and other manufacturing efficiencies, the company has gone from producing a rocket a year to one a month, with the goal of one a week, to match or exceed its launch cadence.

Seem excessive? The years-long backlog of projects waiting to go to orbit disagrees. There’s demand to spare and the market is only growing.

Peter Beck, the company’s founder and CEO, sat down with us to talk about the process of building a launch provider from scratch, and where the company goes from here — other than up.

Devin: To start with, why don’t we talk about the recent launches? Congratulations on everything going well, by the way. Any thoughts on these most recent ones?

Peter: Thanks, it’s great to be hitting our stride. We wanted electron to be an accurate vehicle and we’re averaging within around 1.4 kilometers. When you get into what that means, at those speeds it takes 180 milliseconds to travel 1.4 km, so we’ve got the accuracy down pat.

Powered by WPeMatico

Indian PM Narendra Modi’s reelection spells more frustration for US tech giants

Amazon and Walmart’s problems in India look set to continue after Narendra Modi, the biggest force to embrace the country’s politics in decades, led his Hindu nationalist Bharatiya Janata Party to a historic landslide re-election on Thursday, reaffirming his popularity in the eyes of the world’s largest democracy.

The re-election, which gives Modi’s government another five years in power, will in many ways chart the path of India’s burgeoning startup ecosystem, as well as the local play of Silicon Valley companies that have grown increasingly wary of recent policy changes.

At stake is also the future of India’s internet, the second largest in the world. With more than 550 million internet users, the nation has emerged as one of the last great growth markets for Silicon Valley companies. Google, Facebook, and Amazon count India as one of their largest and fastest growing markets. And until late 2016, they enjoyed great dynamics with the Indian government.

But in recent years, New Delhi has ordered more internet shutdowns than ever before and puzzled many over crackdowns on sometimes legitimate websites. To top that, the government recently proposed a law that would require any intermediary — telecom operators, messaging apps, and social media services among others — with more than 5 million users to introduce a number of changes to how they operate in the nation. More on this shortly.

Growing tension

Powered by WPeMatico

Automattic acquires subscription payment company Prospress

Automattic, the company behind WordPress.com, WooCommerce, Longreads, Simplenote and a bunch of other cool things, is acquiring a small startup called Prospress. Among other things, Prospress has developed WooCommerce Subscriptions, a recurring payment solution specifically designed for WooCommerce.

Given that physical and digital subscriptions are taking over the e-commerce world, it makes sense that Automattic wants to own WooCommerce Subscriptions. Charging customers on a regular basis is one of the most painful challenges when it comes to payment.

Prospress also works on a marketing automation tool to remind customers that they have abandoned their carts, follow up, cross sell and more. The company also has a tool to test your checkout functionality before going live. After the acquisition, the Prospress team will keep iterating on its own products and join the rest of the WooCommerce team.

This is a strategic acquisition more than anything else. Prospress has around 20 employees, so it’s not going to change the face of Automattic and its team of 900 people. But it’s an important move so that Automattic can own a bigger chunk of the (e-commerce) stack.

WooCommerce competitor Shopify doesn’t provide subscriptions out of the box. You have to use third-party products, such as Bold or ReCharge.

Like WordPress, WooCommerce is an open-source project — it integrates directly with WordPress. It means that anyone can download WooCommerce and host it on their servers. And the WooCommerce ecosystem is one of the main advantages of WooCommerce compared to obscure e-commerce solutions.

Many WooCommerce users probably host their e-commerce website on WordPress.com. But by controlling the payment module, Automattic can also generate some revenue if WooCommerce users choose to use WooCommerce Subscriptions as their payment solution.

Powered by WPeMatico

Zero raises $20 million from NEA and others for a credit card that works like debit

Just ahead of the launch of the Apple Card, a startup that has its own take on modernizing the credit card industry, Zero, is announcing the close of its $20 million Series A. The new round of funding was led by New Enterprise Associates (NEA), and brings Zero’s total raised to date to $35 million, including both equity and debt funding.

Other investors in the round include SignalFire, Eniac Ventures, Nyca Partners and some unnamed school endowments. Zero had previously announced an $8.5 million raise in fall 2017, led by Eniac, and had raised $7 million in venture debt from Silicon Valley Bank.

Zero has a clever idea that targets millennials’ hesitance to sign up for credit cards.

Today, only 33% of millennials have a major credit card, a Bankrate survey found — largely because they’re wary of falling into the vicious debt cycle. Instead, this younger demographic often only carries a debit card. But that also means they’re missing out on credit card benefits — like points, rewards and cash back.

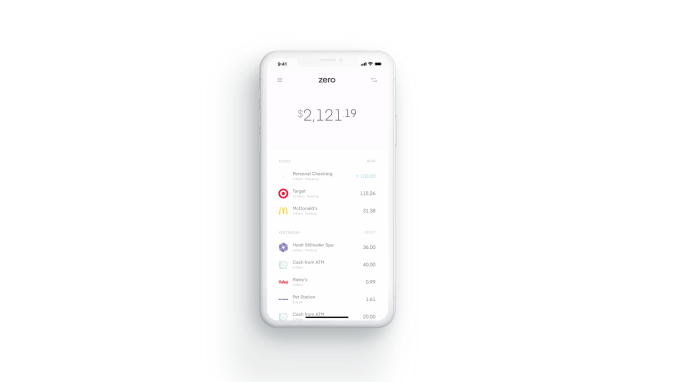

Zero’s idea is to offer a rewards credit card that works like debit.

The Zerocard itself is a World Mastercard, so it earns credit card cash back. But unlike a traditional credit card, it’s combined with an FDIC-backed checking account called Zero Checking. That means Zerocard and Zero Checking work together in the app, allowing cardholders to see one net number they can spend from.

That way, they won’t make the mistake of accidentally going over budget, as is often the case with traditional credit cards, which then benefit from charging interest on the unpaid balance.

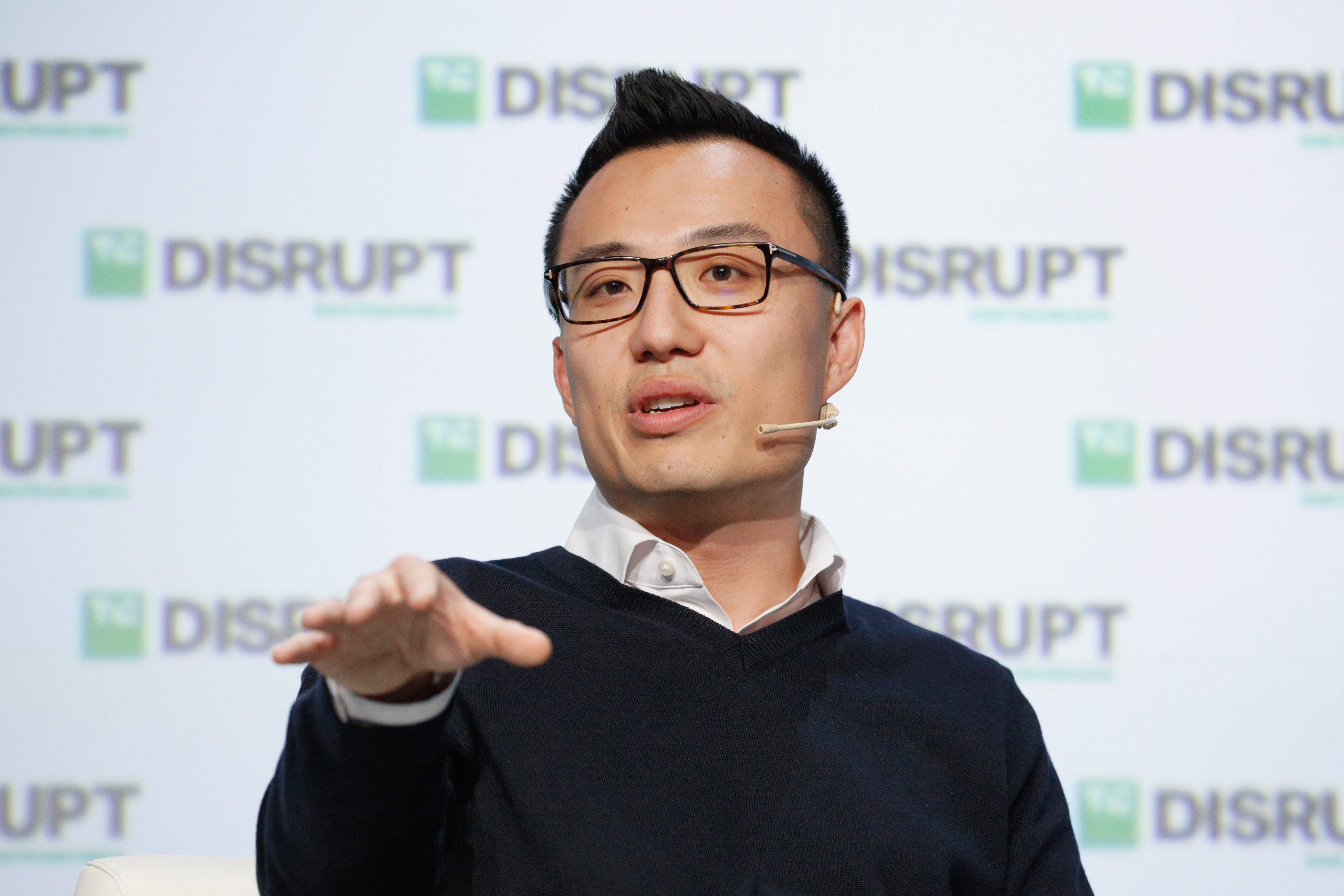

Zero co-founder and CEO Bryce Galen says he had always liked optimizing his personal finances, but didn’t see the value in overspending to chase rewards.

“People spend 10 to 15% more on average just because they’re putting it on a credit card, and not seeing where they stand all the time,” he says. “Spending 10 to 15% more to chase 1 to 2% in rewards doesn’t make sense.”

Plus, he adds, “half of all credit card points are never even redeemed.”

With Zerocard, the company does away with other credit card annoyances as well.

Zerocard doesn’t charge annual fees like many traditional credit cards do. And Zero Checking doesn’t add any additional ATM fees beyond what the ATM owner charges. It also does away with foreign transaction fees, minimum balance fees and overdraft fees — like many of today’s challenger banks.

Meanwhile, the Zero app is built with an eye toward what makes apps great.

Galen, who led product development for Zynga’s “Words with Friends” has experience in this department, while co-founder and COO Joel Washington previously co-founded car sales marketplace Shift. The executive team, combined, has backgrounds that include time at Affirm, Apple, Capital One, Dropbox, Google, Postmates, Silicon Valley Bank, Upgrade and Wells Fargo.

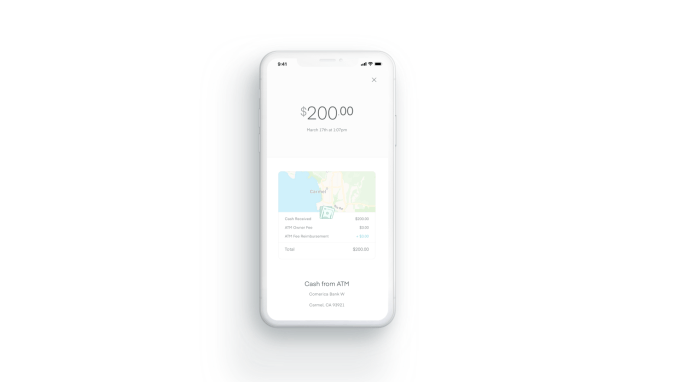

Overall, Zero’s design feels clean and simple, compared to the cluttered and dated apps from traditional banks. It has smart features, too, like a detailed transaction view that shows the vendor’s logo and location on a map to make it easier to recognize purchases.

“Zero creates an innovative debit-style experience, with an elegant design, and truly compelling rewards. It’s a fabulous banking experience,” said Hans Morris, managing partner of Nyca Partners and former president of Visa, Inc., in a statement. “Few people understand how complex it is to launch either a credit card or a checking account program, and I believe Zero is the first U.S. startup to launch both,” he said.

Zero launched in November 2018, but only to a small number of customers. Though officially open for business, it was functioning more like a public beta — though it didn’t call it that at the time. Meanwhile, its waitlist continued to grow.

Today, there are still 204,000 people waiting to be allowed in — something that Galen says is now going to happen.

“We haven’t launched to everyone on the waitlist yet, but we expect to within the next few weeks,” he says.

Another interesting twist on traditional credit cards is Zero’s path to card upgrades: it encourages but also rewards customers for telling their friends. By doing so, customers gain access to better-looking cards and higher cash-back percentages.

Zero customers start with a “Quartz” card offering 1% back on purchases. When a friend they refer joins, they receive a higher-level card called “Graphite” that offers 1.5% back. Two friends earns you the “Magnesium” card with 2% back and four friends gets you the “Carbon” card with 3% back. The Carbon card is also solid metal, capitalizing on the millennial trend of wanting their cards to look cool. And metal cards are in particular demand.

To receive the full cash-back rates, customers have to pay their balances in full by the due date, Zero says.

The company has partnered with Salt Lake City-based WebBank to issue the card, and deposits are held at Memphis-based Evolve Bank & Trust, an FDIC member. Zero makes money primarily on interchange and interest on deposits.

While some users may leave balances on the card that generate interest, Zero isn’t focused on that aspect of the business for revenue generation.

“Most companies in fintech today are launching undifferentiated debit cards as a feature or extension to their product for an additional engagement and monetization stream,” says Rick Yang, partner at NEA, as to why he invested.

“Zero is completely focused on their card programs and building a differentiated solution that actually provides a value proposition that resonates with consumers. We’ve also been fascinated by the growth of debit outpacing credit, and we think that our solution gives consumers the best of both worlds,” he adds.

Zero is currently iOS-only, but is working on an Android version that is expected to be ready in August.

Powered by WPeMatico

DoorDash, now valued at $12.6B, shoots for the moon

More than five years ago, Sequoia partner Alfred Lin called Tony Xu, the founder of a small on-demand delivery startup called DoorDash, to say he was passing on the company’s seed round.

This was, of course, before venture capital funding in food delivery startups had taken off. DoorDash, launched out of Xu’s Stanford graduate school dorm room, wasn’t worth Sequoia’s capital — yet.

Today, venture capitalists are valuing the San Francisco-based company at a whopping $12.6 billion with a $600 million Series G. New investors Darsana Capital Partners and Sands Capital participated in the deal, which nearly doubles DoorDash’s previous valuation, alongside existing backers Coatue Management, Dragoneer, DST Global, Sequoia Capital, the SoftBank Vision Fund and Temasek Capital Management.

As for Sequoia’s Alfred Lin, he realized his mistake years ago and jumped in on DoorDash’s 2014 Series A, and has participated in every subsequent round since. DoorDash, a graduate of Y Combinator’s Summer 2013 cohort, is also backed by Kleiner Perkins, CRV and Khosla Ventures, among others. In total, the company has raised $2.5 billion in VC funding, making it one of the most well-capitalized private companies in the U.S.

SoftBank, via its prolific dealmaker Jeffrey Housenbold, was responsible for making DoorDash a unicorn in early 2018. The nearly $100 billion Vision Fund led DoorDash’s $535 million Series D, valuing the business at $1.4 billion. Just three months ago, the SoftBank Vision Fund, DST Global, Coatue Management, GIC, Sequoia and Y Combinator put an additional $400 million in the fast-growing business.

SAN FRANCISCO, CA – SEPTEMBER 05: DoorDash CEO Tony Xu speaks onstage during Day 1 of TechCrunch Disrupt SF 2018 at Moscone Center on September 5, 2018 in San Francisco, California. (Photo by Kimberly White/Getty Images for TechCrunch)

Xu told TechCrunch the company’s Series F was “a reflection of superior performance over the past year.” DoorDash was currently seeing 325% growth year-over-year, he said, pointing to recent data from Second Measure showing the service had overtaken Uber Eats in the U.S., coming in second only to GrubHub.

“I think the numbers speak for themselves,” Xu said at the time. “If you just run the math on DoorDash’s course and speed, we’re on track to be number one.”

At a venture capital-focused summit hosted in April, Xu added that DoorDash was the largest delivery platform in America by “pretty wide margins,” explaining that it was, in fact, growing 4x faster than its next closest peer. In this morning’s announcement, the company added that it’s grown 60% since its late February Series F, with its annualized total sales hitting $7.5 billion in March, an increase of 280% year-over-year.

Still, one wonders what kind of growth metrics DoorDash might be sharing to attract that kind of valuation multiple. The company has yet to disclose revenues and is not yet profitable, but has seen its price tag grow astronomically in just two years. Since March 2018, DoorDash’s valuation has skyrocketed from $1.4 billion to $4 billion with a $250 million Series E to $7.1 billion with a $350 million Series F and, finally, to nearly $13 billion with its Series G.

The $12.6 billion valuation makes DoorDash one of the 10 most valuable venture-backed companies in the U.S., surpassing Coinbase, Instacart and even Slack, according to PitchBook.

DoorDash is currently active in more than 4,000 cities in the U.S. and Canada, with hundreds of partners, including both restaurants and supermarkets (Walmart is using DoorDash for grocery deliveries). The company also operates DoorDash Drive, which allows businesses to use the DoorDash network to make their own deliveries.

Powered by WPeMatico

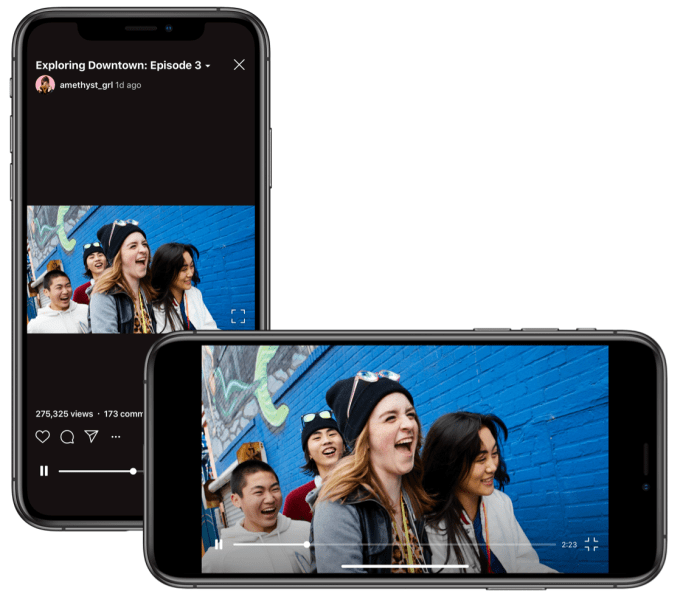

Instagram’s vertical IGTV surrenders to landscape status quo

A year ago Instagram made a bold bet with the launch of IGTV: That it could invent and popularize a new medium of long-form vertical videos. Landscape uploads weren’t allowed. Co-founder Kevin Systrom told me in August that “What I’m most proud of is that Instagram took a stand and tried a brand new thing that is frankly hard to pull off. Full-screen vertical video that’s mobile only. That doesn’t exist anywhere else.”

Now a dedicated hub for multi-minute portrait-mode video won’t exist anywhere at all. Following lackluster buy-in from creators loathe to shoot in a proprietary format that’s tough to reuse, IGTV is retreating from its vertical-only policy. Starting today, users can upload traditional horizontal landscape videos too, and they’ll be shown full-screen when users turn their phones sideways while watching IGTV’s standalone app or its hub within the main Instagram app. That should hopefully put an end to crude ports of landscape videos shown tiny with giant letterboxes slapped on to soak up the vertical screen.

Instagram spins it saying, “Ultimately, our vision is to make IGTV a destination for great content no matter how it’s shot so creators can express themselves how they want . . . . In many ways, opening IGTV to more than just vertical videos is similar to when we opened Instagram to more than just square photos in 2015. It enabled creativity to flourish and engagement to rise – and we believe the same will happen again with IGTV.”

Last year I suggested IGTV might have to embrace landscape after a soggy start. “Loosening up to accept landscape videos too might nullify a differentiator, but also pipe in a flood of content it could then algorithmically curate to bootstrap IGTV’s library. Reducing the friction by allowing people to easily port content to or from elsewhere might make it feel like less of a gamble for creators deciding where to put their production resources,” I wrote.

The coming influx of repurposed YouTube videos could drive more creators and their fans to IGTV. To date there have been no break-out stars, must-see shows or cultural zeitgeist moments on IGTV. Instagram refused to provide a list of the most viewed long-form clips. Sensor Tower estimates just 4.2 million installs to date for IGTV’s standalone app, amounting to less than half a percent of Instagram’s billion-plus users downloading the app. It saw 3.8 times more downloads per day in its first three months on the market than than last month. The iOS app sank to No. 191 on the US – Photo & Video app charts, according to App Annie, and didn’t make the overall chart.

Instagram has tried several changes to reinvigorate IGTV already. It started allowing creators to share IGTV previews to the main Instagram feed that’s capped at 60 seconds. Users can tap through those to watch full clips of up to 60 minutes on IGTV, which has helped to boost view counts for video makers like BabyAriel. And earlier this week we reported that IGTV had been quietly redesigned to ditch its category tabs for a central feed of videos that relies more on algorithmic recommendations like TikTok and a two-wide vertical grid of previews to browse like Snapchat Discover.

But Instagram has still refused to add what creators have been asking for since day one: monetization. Without ways to earn a cut of ad revenue, accept tips, sign up users to a monthly patronage subscription or sell merchandise, it’s been tough to justify shooting a whole premium video in vertical. Producing in landscape would make creators money on YouTube and possibly elsewhere. Now at least creators can shoot once and distribute to IGTV and other apps, which could fill out the feature with content before it figures out monetization.

For viewers and the creators they love, IGTV’s newfound flexibility is a positive. But I can’t help but think this is Instagram’s first truly massive misstep. Nine months after safely copying Snapchat Stories in 2016, Instagram was happy to tout it had 200 million daily users. The company still hasn’t released a single usage stat about IGTV usage. Perhaps after seemingly defeating Snap, Instagram thought it was invincible and could dictate how and what video artists create. But the Facebook pet proved fallible after all. The launch and subsequent rethinking should serve as a lesson. Even the biggest platforms can’t demand people produce elaborate proprietary content for nothing in return but “exposure.”

Powered by WPeMatico

Takeaways from KubeCon; the latest on Kubernetes and cloud native development

Extra Crunch offers members the opportunity to tune into conference calls led and moderated by the TechCrunch writers you read every day. This week, TechCrunch’s Frederic Lardinois and Ron Miller discuss major announcements that came out of the Linux Foundation’s European KubeCon/CloudNativeCon conference and discuss the future of Kubernetes and cloud-native technologies.

Nearly doubling in size year-over-year, this year’s KubeCon conference brought big news and big players, with major announcements coming from some of the world’s largest software vendors including Google, AWS, Microsoft, Red Hat, and more. Frederic and Ron discuss how the Kubernetes project grew to such significant scale and which new initiatives in cloud-native development show the most promise from both a developer and enterprise perspective.

“This ecosystem starts sprawling, and we’ve got everything from security companies to service mesh companies to storage companies. Everybody is here. The whole hall is full of them. Sometimes it’s hard to distinguish between them because there are so many competing start-ups at this point.

I’m pretty sure we’re going to see a consolidation in the next six months or so where some of the bigger players, maybe Oracle, maybe VMware, will start buying some of these smaller companies. And I’m sure the show floor will look quite different about a year from now. All the big guys are here because they’re all trying to figure out what’s next.”

Frederic and Ron also dive deeper into the startup ecosystem rapidly developing around Kubernetes and other cloud-native technologies and offer their take on what areas of opportunity may prove to be most promising for new startups and founders down the road.

For access to the full transcription and the call audio, and for the opportunity to participate in future conference calls, become a member of Extra Crunch. Learn more and try it for free.

Powered by WPeMatico

Andreessen pours $22M into PlanetScale’s database-as-a-service

PlanetScale’s founders invented the technology called Vitess that scaled YouTube. Now they’re selling it to any enterprise that wants their data both secure and consistently accessible. And thanks to its ability to re-shard databases while they’re operating, it can solve businesses’ troubles with GDPR, which demands they store some data in the same locality as the user to whom it belongs.

The potential to be a computing backbone that both competes with and complements Amazon’s AWS has now attracted a mammoth $22 million Series A for PlanetScale. Led by Andreessen Horowitz and joined by the firm’s Cultural Leadership Fund, head of the US Digital Service Matt Cutts, plus existing investor SignalFire, the round is a tall step up from the startup’s $3 million seed it raised a year ago. Andreessen general partner Peter Levine will join the PlanetScale board, bringing his enterprise launch expertise.

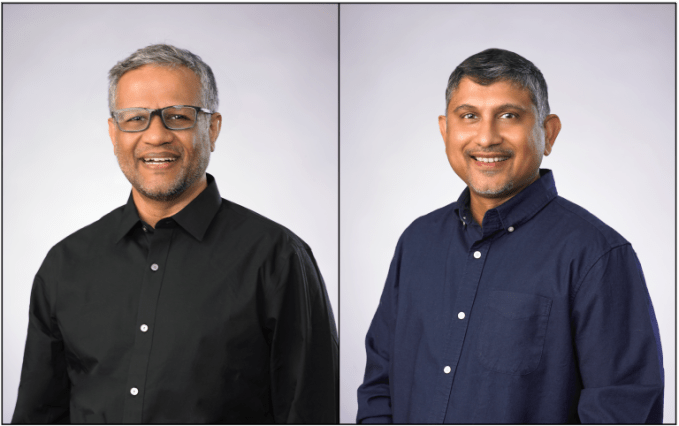

PlanetScale co-founders (from left): Jitendra Vaidya and Sugu Sougoumarane

“What we’re discovering is that people we thought were at one point competitors, like AWS and hosted relational databases — we’re discovering they may be our partners instead since we’re seeing a reasonable demand for our services in front of AWS’ hosted databases,” says CEO Jitendra Vaidya. “We are growing quite well.” Competing database startups were raising big rounds, so PlanetScale connected with Andreessen in search of more firepower.

Vitess is a horizontal scaling sharding middleware engineered for MySQ that was built to run on “Borg” the predecessor to Kubernetes at Google. It lets businesses segment their database to boost memory efficiency without sacrificing reliable access speeds. PlanetScale sells Vitess in four ways: hosting on its database-as-a-service, licensing of the tech that can be run on-premises for clients or through another cloud provider, professional training for using Vitess and on-demand support for users of the open-source version of Vitess. PlanetScale now has 18 customers paying for licenses and services, and plans to release its own multi-cloud hosting to a general audience soon.

With data becoming so valuable and security concerns rising, many companies want cross-data center durability so one failure doesn’t break their app or delete information. But often the trade-off is unevenness in how long data takes to access. “If you take 100 queries, 99 might return results in 10 milliseconds, but one will take 10 seconds. That unpredictability is not something that apps can live with,” Vaidya tells me. PlanetScale’s Vitess gives enterprises the protection of redundancy but consistent speeds. It also allows businesses to continually update their replication logs so they’re only seconds behind what’s in production rather than doing periodic exports that can make it tough to track transactions and other data in real-time.

Now equipped with a ton of cash for a 20-person team, PlanetScale plans to double its staff by adding more sales, marketing and support. “We don’t have any concerns about the engineering side of things, but we need to figure out a go-to-market strategy for enterprises,” Vaidya explains. “As we’re both technical co-founders, about half of our funding is going towards hiring those functions [outside of engineering], and making that part of our organization work well and get results.”

But while a $22 million round from Andreessen Horowitz would be exciting for almost any startup, the funding for PlanetScale could assist the whole startup ecosystem. GDPR was designed to reign in tech giants. In reality, it applied compliance costs to all companies — yet the rich giants have more money to pay for those efforts. For a smaller startup, figuring out how to obey GDPR’s data localization mandate could be a huge engineering detour they can hardly afford. PlanetScale offers them not only databases but compliance-as-a-service too. It shards their data to where it has to be, and the startup can focus on their actual product.

Powered by WPeMatico

EFounders backs Yousign to build a European e-signature company

French startup Yousign is partnering with startup studio eFounders. While eFounders usually builds software-as-a-service startups from scratch, the company is trying something new with this partnership.

Indeed, eFounders wants to create all the tools you need to make your work more efficient. The startup studio is behind many respectable SaaS successes, such as Front, Aircall and Spendesk. And electronic signatures are a must if you want to speed up your workflow.

Sure, there are a ton of well-established players in the space — DocuSign, SignNow, Adobe Sign, HelloSign, etc. But nobody has really cracked the European market in a similar way.

Yousign has been around for a while in France. When it comes to features, it has everything you’d expect. You can upload a document and set up automated emails and notifications so that everybody signs the document.

Signatures are legally binding and Yousign archives your documents. You also can create document templates and send contract proposals using an API.

The main challenge for Yousign is that Europe is still quite fragmented. The company will need to convince users in different countries that they need to switch to an e-signature solution. Starting today, Yousign is now available in France, Germany, the U.K. and Spain.

Yousign had only raised some money; eFounders is cleaning the cap table by buying out existing investors and replacing them.

“We can’t really communicate on the details of the investment, but what I can tell you is that we bought out existing funds for several millions of euros in order to replace them — founders still have the majority of shares,” eFounders co-founder and CEO Thibaud Elzière told me.

In a blog post, Elzière writes that eFounders has acquired around 50% of the company through an SPV (Single Purpose Vehicle) that it controls. The startup studio holds 25% directly, and investors in the eFounders eClub hold 25%.

Yousign now looks pretty much like any other eFounders company when they start. Of course, founders and eFounders might get diluted further down the road if Yousign ends up raising more money.

Powered by WPeMatico

Google Assistant gets NYC subway arrival times ahead of MTA Google Pay support

Next week, New York City’s Metro Transit Authority will be adding contactless payment support for Google Pay. In the meantime, Google’s getting ready by bringing a key new commuting feature to Android.

Starting today, NYC straphangers can use Google Assistant to find out the ETA of the next train. Saying, “Hey Google, when is the next 4 train arriving?” or “Hey Google, when is the next train?” Will pop up its estimated arrival in each direction, along with walking directions to the closet station. Something I could have used this morning, after narrowly missing the R train.

If you’re located in the New York City area, odds are you’ve already seen the contactless payments pop up in a handful of locations along the 4,5,6 line. Next week, those commuting between Grand Central in Manhattan and Atlantic Avenue-Barclays Center in Brooklyn will be able to swipe their phone as part of a public pilot.

For now, at least, it seems the future is limited to single-ride payment (versus daily/weekly/monthly cards), as the MTA works on hammering out the finer details. Stations that accept Google Pay will be added to Maps in coming weeks. Android users will also be able to add a credit or debit card via the app. That feature is also arriving for riders in Melbourne and London.

Powered by WPeMatico