Instagram’s IGTV copies TikTok’s AI, Snapchat’s design

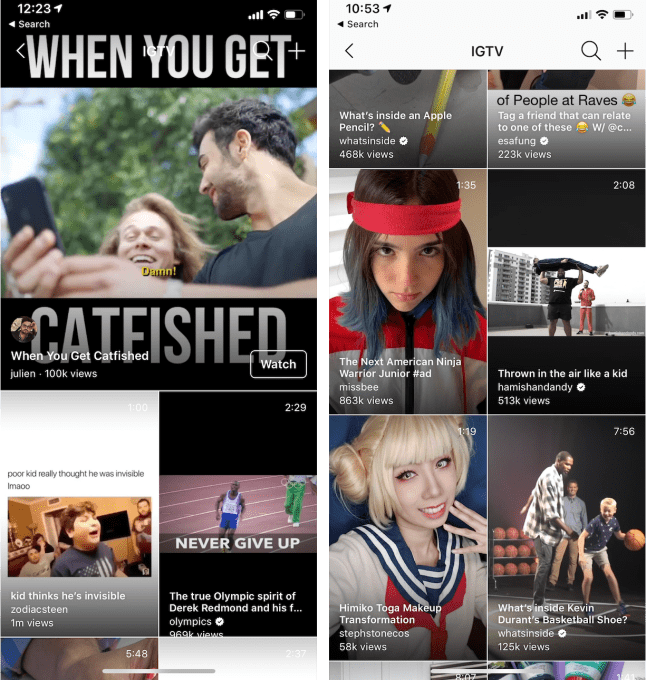

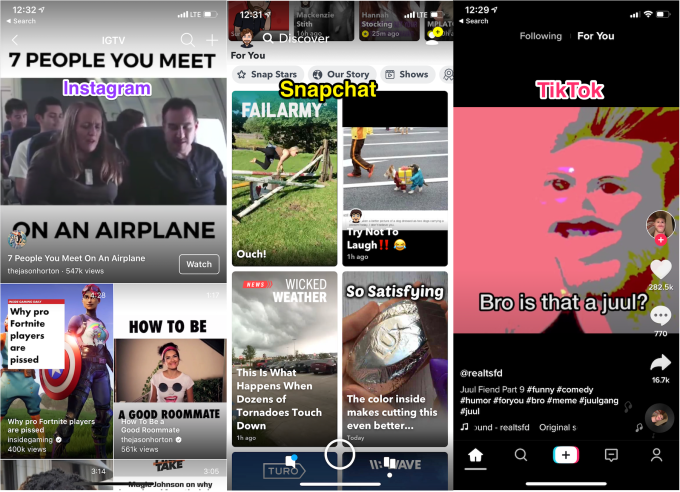

Instagram conquered Stories, but it’s losing the battle for the next video formats. TikTok is blowing up with an algorithmically suggested vertical one-at-a-time feed featuring videos of users remixing each other’s clips. Snapchat Discover’s 2 x infinity grid has grown into a canvas for multi-media magazines, themed video collections and premium mobile TV shows.

Instagram’s IGTV…feels like a flop in comparison. Launched a year ago, it’s full of crudely cropped and imported viral trash from around the web. The long-form video hub that lives inside both a homescreen button in Instagram as well as a standalone app has failed to host lengthier must-see original vertical content. Sensor Tower estimates that the IGTV app has just 4.2 million installs worldwide, with just 7,700 new ones per day — implying less than half a percent of Instagram’s billion-plus users have downloaded it. IGTV doesn’t rank on the overall charts and hangs low at No. 191 on the US – Photo & Video app charts, according to App Annie.

Now Instagram has quietly overhauled the design of IGTV’s space inside its main app to crib what’s working from its two top competitors. The new design showed up in last week’s announcements for Instagram Explore’s new Shopping and IGTV discovery experiences. At the time, Instagram’s product lead on Explore Will Ruben told us that with the redesign, “the idea is this is more immersive and helps you to see the breadth of videos in IGTV rather than the horizontal scrolling interface that used to exist,” but the company declined to answer follow-up questions about it.

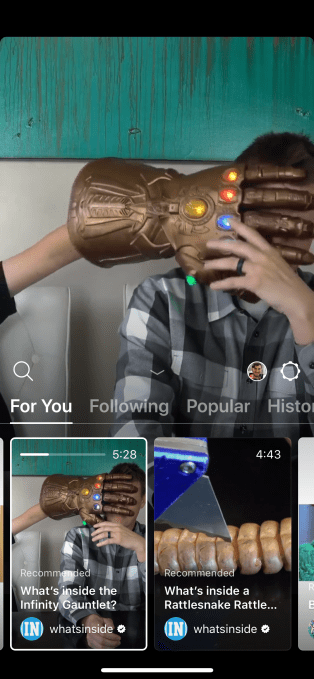

IGTV has ditched its category-based navigation system’s tabs like “For You”, “Following”, “Popular”, and “Continue Watching” for just one central feed of algorithmically suggested videos — much like TikTok. This affords a more lean-back, ‘just show me something fun’ experience that relies on Instagram’s AI to analyze your behavior and recommend content instead of putting the burden of choice on the viewer.

IGTV has ditched its category-based navigation system’s tabs like “For You”, “Following”, “Popular”, and “Continue Watching” for just one central feed of algorithmically suggested videos — much like TikTok. This affords a more lean-back, ‘just show me something fun’ experience that relies on Instagram’s AI to analyze your behavior and recommend content instead of putting the burden of choice on the viewer.

IGTV has also ditched its awkward horizontal scrolling design that always kept a clip playing in the top half of the screen. Now you’ll scroll vertically through a 2 x infinity grid of recommended clips in what looks just like a Snapchat Discover feed. Once you get past a first video that auto-plays up top, you’ll find a full-screen grid of things to watch. You’ll only see the horizontal scroller in the standalone IGTV app, or if you tap into an IGTV video, and then tap the Browse button for finding a next clip while the last one plays up top.

Instagram seems to be trying to straddle the designs of its two competitors. The problem is that TikTok’s one-at-a-time feed works great for punchy, short videos that get right to the point. If you’re bored after five seconds you swipe to the next. IGTV’s focus on long-form means its videos might start too slowly to grab your attention if they were auto-played full-screen in the feed rather than being chosen by a viewer. But Snapchat makes the most of the two previews per row design IGTV has adopted because professional publishers take the time to make compelling cover thumbnail images promoting their content. IGTV’s focus on independent creators means fewer have labored to make great cover images, so viewers have to rely on a screenshot and caption.

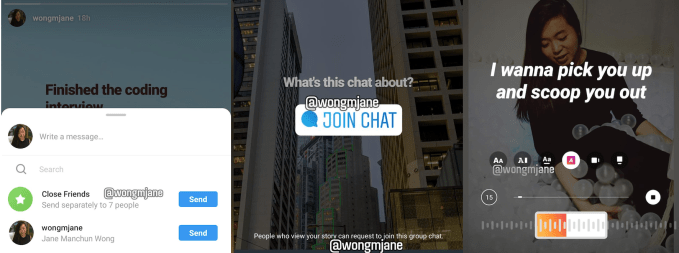

Instagram is prototyping a number of other features to boost engagement across its app, as discovered by reverse-engineering specialist and frequent TechCrunch tipster Jane Manchun Wong. Those include options to blast a direct message to all your Close Friends at once but in individual message threads, see a divider between notifications and likes you have or haven’t seen, or post a Chat sticker to Stories that lets friends join a group message thread about that content. And to better compete with TikTok, it may let you add lyrics stickers to Stories that appear word-by-word in sync with Instagram’s licensed music soundtrack feature, and share Music Stories to Facebook. What we haven’t seen is any cropping tool for IGTV that would help users reformat landscape videos. The vertical-only restriction keeps lots of great content stuck outside IGTV, or letterboxed with black, color-matched backgrounds, or meme-style captions with the video as just a tiny slice in the middle.

When I spoke with Instagram co-founder and ex-CEO Kevin Systrom last year a few months after IGTV’s launch, he told me, “It’s a new format. It’s different. We have to wait for people to adopt it and that takes time . . . Everything that is great starts small.”

But to grow large, IGTV needs to demonstrate how long-form portrait mode video can give us a deeper look at the nuances of the influencers and topics we care about. The company has rightfully prioritized other drives like safety and well-being with features that hide bullies and deter overuse. But my advice from August still stands despite all the ground Instagram has lost in the meantime. “Concentrate on teaching creators how to find what works on the format and incentivizing them with cash and traffic. Develop some must-see IGTV and stoke a viral blockbuster. Prove the gravity of extended, personality-driven vertical video.” Until the content is right, it won’t matter how IGTV surfaces it.

Powered by WPeMatico

Select FCC leaders announce support for T-Mobile, Sprint merger

It’s been more than a year since T-Mobile and Sprint formally announced a merger agreement. This morning, members of FCC leadership have issued statements voicing their support for the $26 billion proposal.

Ajit Pai was first out with a statement, suggesting that the pricey consolidation of two of the Unites States’ largest carriers would help accelerate his longstanding desire to provide more internet coverage to rural areas.

“Demonstrating that 5G will indeed benefit rural Americans,” Pai wrote, “T-Mobile and Sprint have promised that their network would cover at least two-thirds of our nation’s rural population with highs peed, mid-band 5G, which could improve the economy and quality of life in many small towns across the country.”

The FCC chairman went on to suggest that the merger “is in the public interest,” adding that he would recommend fellow members of the commission’s leadership approve it. Commissioner Brendan Carr followed soon after with his own statement of approval, suggesting that a merger would actually increase competition.

“I support the combination of T-Mobile and Sprint because Americans across the country will see more competition and an accelerated buildout of fast, 5G services,” the Commissioner writes. “The proposed transaction will strengthen competition in the U.S. wireless market and provide mobile and in-home broadband access to communities that demand better coverage and more choices.”

A number of ground rules have been laid out for approval. In a bid for approval, Sprint has promised to sell off prepaid brand Boost Mobile. “[W]e have committed to divest Sprint’s Boost pre-paid business to a third party following the closing of the merger,” T-Mobile CEO John Legere said in a blog post following the statements of support. “We’ll work to find a serious, credible, financially capable and independent buyer for all the assets needed to run – and grow – the business, and we’ll make sure that buyer has attractive wholesale arrangements.”

Powered by WPeMatico

Trump’s Huawei ban also causing tech shocks in Europe

The escalating U.S.-China trade war that’s seen Chinese tech giant Huawei slapped on a U.S. trade blacklist is causing ripples of shock across Europe too, as restrictions imposed on U.S. companies hit regional suppliers concerned they could face U.S. restrictions if they don’t ditch Huawei.

Reuters reports shares fell sharply today in three European chipmakers — Infineon Technologies, AMS and STMicroelectronics — after reports suggested some already had, or were about to, halt shipments to Huawei following the executive order barring U.S. firms from trading with the Chinese tech giant.

The interconnectedness of high-tech supply chains coupled with U.S. dominance of the sector and Huawei’s strong regional position as a supplier of cellular, IT and network kit in Europe suddenly makes political risk a fast-accelerating threat for EU technology companies, large and small.

On the small side is French startup Qwant, which competes with Google by offering a pro-privacy search engine. In recent months it has been hoping to leverage a European antitrust decision against Google Android last year to get smartphones to market in Europe that preload its search engine, not Google’s.

Huawei was its intended first major partner for such devices. Though, prior to recent trade war developments, it was already facing difficulties related to price incentives Google included in reworked EU Android licensing terms.

Still, the U.S.-China trade war threatens to throw a far more existential spanner in European Commission efforts to reset the competitive planning field for smartphone services — certainly if Google’s response to Huawei’s blacklisting is to torch its supply of almost all Android-related services, per Reuters.

A key aim of the EU antitrust decision was intended to support the unbundling of popular Google services from Android so that device makers can try selling combinations that aren’t entirely Google-flavored — while still being able to offer enough “Google” to excite consumers (such as preloading the Play Store but with a different search and browser bundle instead of the usual Google + Chrome combo).

Yet if Google intends to limit Huawei’s access to such key services, there’s little chance of that.

(In a statement responding to the Reuters report Google suggested it’s still deciding how to proceed, with a spokesperson writing: “We are complying with the order and reviewing the implications. For users of our services, Google Play and the security protections from Google Play Protect will continue to function on existing Huawei devices.”)

Going on Google’s initial response, Qwant co-founder and CEO Eric Léandri told us he thinks Google has overreacted — even as he dubbed the U.S.-China trade war “world war III — economical war but it’s a world war for sure.”

“I really need to see exactly what President Trump has said about Huawei and how to work with them. Because I think maybe Google has overreacted. Because I haven’t [interpreted it] that way so I’m very surprised,” he told TechCrunch.

“If Huawei can be [blacklisted] what about the others?,” he added. “Because I would say 60% of the cell phone sales in Europe today are coming from China. Huawei or ZTE, OnePlus and the others — they are all under the same kind of risk.

“Even some of our European brands who are very small like Nokia… all of them are made in China, usually with partnership with these big cell phone manufacturers. So that means several things but one thing that I’m sure is we should not rely on one OS. It would be difficult to explain how the Play Store is not as important as the search in Android.”

Léandri also questioned whether Google’s response to the blacklisting will include instructing Huawei not to even use its search engine — a move that could impact its share of the smartphone search market.

“At the end of the day there is just one thing I can say because I’m just a search engine and a European one — I haven’t seen Google asking to not be by default in Huawei as search engine. If they can be in the Huawei by default as a search engine so I presume that everyone else can be there.”

Léandri said Qwant will be watching to see what Huawei’s next steps will be — such as whether it will decide to try offering devices with its own store baked in in Europe.

And indeed how China will react.

“We have to understand the result politically, globally, the European consequences. The European attitude. It’s not only American and China — the rest of the world exists,” he said.

“I have plan b, plan c, plan d, plan f. To be clear we are a startup — so we can have tonnes of plans, The only thing is right now is it’s too enormous.

“I know that they are the two giants in the tech field… but the rest of the world have some words today and let’s see how the European Commission will react, my government will react and some of us will react because it’s not only a small commercial problem right now. It’s a real political power demonstration and it’s global so I will not be more — I am nobody in all this. I do my job and I do my job well and I will use the maximum opportunity that I can find on the market.”

We’ve reached out to the Commission to ask how it intends to respond to escalating risks for European tech firms as Trump’s trade war steps up.

Also today, Reuters reports that the German Economy Minister is examining the impact of U.S. sanctions against Huawei on local companies.

But while a startup like Qwant waits to see what the next few months will bring — and how the landscape of the smartphone market might radically reconfigure in the face of sharply spiking political risk, a different European startup is hoping to catch some uplift: Finland-based Jolla steers development of a made-in-Europe Android alternative, called Sailfish OS.

It’s a very tiny player in a Google-dominated smartphone world. Yet could be positioned to make gains amid U.S. and Chinese tech clashes — which in turn risk making major platform pieces feel a whole lot less stable.

A made-in-Europe non-Google-led OS might gain more ground among risk averse governments and enterprises — as a sensible hedge against Trump-fueled global uncertainty.

“Sailfish OS, as a non-American, open-source based, secure mobile OS platform, is naturally an interesting option for different players — currently the interest is stronger among corporate and governmental customers and partners, as our product offering is clearly focused on this segment,” says Jolla co-founder and CEO Sami Pienimäki .

“Overall, there definitely has been increased interest towards Sailfish OS as a mobile OS platform in different parts of the world, partly triggered by the on-going political activity in many locations. We have also had clearly more discussions with e.g. Chinese device manufacturers, and Jolla has also recently started new corporate and governmental customer projects in Europe.”

Powered by WPeMatico

Robin picks up $20 million Series B to optimize the office

Robin Powered, a startup looking to help offices run better, has today announced the close of a $20 million Series B funding. The round was led by Tola Capital, with existing investors Accomplice and FirstMark participating in the round, along with a new strategic Allegion Ventures.

Robin started as part of an agency called One Mighty Roar, where Robin Powered co-founder Sam Dunn and his two co-founders built out RFID and beacon tech for clients’ live events. In 2014, they spun out the tech as Robin and tweaked the focus on the modern office.

The office stands to be one of the least efficient pieces of any business. As a company grows, or even if it doesn’t, it’s particularly difficult to understand the “inventory” of the office and how it is used by workers throughout the day.

“Before, if I asked you what you needed out of your next office, you might go around and survey employees or hire an architecture firm,” said Dunn. “I heard a story where a manager sent around an intern every Thursday at 3pm to talk to employees about the office, and that was one of two pieces of information handed over to the architecture firm. At the end of the day, it’s hard to know if there’s a shortage of meeting rooms, or teleconference-enabled rooms, or collaborative workspaces.”

That’s where Robin comes in. Robin hooks into Google Calendar and Outlook to help employees get a sense of what meeting rooms and activity spaces are available in the office, complete with tablet signage out front. Meetings are the starting point for Robin, but the company can also offer tools for seating charts and office maps, as well as insights. The company wants to offer insights about how the space in this or that office is being used — what they lack and what they have too much of.

Robin charges its clients per room ($300) and per desk ($24 – $60). The hope is to build out the same technological backbone for clients’ offices as WeWork provides alongside its physical space, giving every business the opportunity to optimize one of their biggest investments: the office itself.

Robin has raised a total of $30 million.

Powered by WPeMatico

Wagestream closes $51M Series A to plug the payday gap without putting workers in debt

Getting your work wages on a monthly (not weekly nor biweekly) basis has become a more widespread trend as the price of running payrolls has gone up, and organizations’ cashflow has gone down. That 30-day shift may be a boost to employers, but not employees, who may need access to those wages more immediately and find it a challenge to stretch out their income month to month.

Now, a startup based out of London has raised a large round of funding for service that’s aiming to plug that gap. Wagestream — which works with employers to let employees draw down a percentage of their income in the month for a small, flat fee — today said that it has closed a Series A round of £40 million ($51 million).

The funding is coming in the form of equity and debt, with Balderton and Northzone leading on the equity side, which makes up £15 million of the raise, and savings bank Shawbrook investing £25 million on the debt side to finance employee draw-downs. Other investors in the round include QED, the Rowntree Foundation, the London Co-investment Fund (LCIF) and Village Global, a social venture firm backed by Bill Gates and Jeff Bezos, among others.

The company is not disclosing its valuation, but this brings the total raised to just under £45 million, and “the valuation is definitely higher now,” according to CEO and co-founder Peter Briffett.

The list of investors is proving to be a useful one for Wagestream as it grows. I asked if Bezos’ company, Amazon, was working with Wagestream. Briffett confirmed it is not a customer currently, “but we are talking to them.” It does, however, have a number of other customers already signed up, including pest removal service Rentokil PLC, Camden Town Brewery, the Slug & Lettuce pub chain and Carluccio’s chain of eateries, along with the NHS and Hackney Council — covering some 120,000 workers in all.

Amazon is an indicative example of one of the big opportunities for the company, which today is active in the U.K. but aiming to expand across Europe and the rest of the world.

While it is one of the biggest employers in the tech world, where it might typically pay out six-figure salaries in senior management, operational and technical roles, it’s also building out its business by being one of the biggest employers of hourly workers in its warehouses, wider logistics operations and similar areas. It’s employees like these who might be considered the first wave of employees that Wagestream is initially targeting, some of whom may be earning just enough or slightly more than enough to get by (at best), and face being victims of what Briffett referred to as the “payday poverty cycle.”

Getting paid monthly accounts for some 85% of all paychecks in the U.K. today, and the proportion is similar in Europe and also getting increasingly common in the U.S., Briffett — who has also worked at Microsoft, LivingSocial (when it was still backed by Amazon, and where he started the U.K. operation and ran it as the CEO for years) and YPlan (acquired by Time Out) — said in an interview. You might ask: Why don’t the workers just budget better? But it doesn’t always work out that way, especially the longer the gap is between paychecks, and if you, for example, have an unexpected expense to cover.

Because of that ubiquity, and the acuteness of the problem (if you’ve ever earned just about enough, or been a child in a family whose parents did, you may understand the predicament quite well), Wagestream is not the first time we’ve seen a financial services startup emerge to target that demographic.

Some other attempts have been scandalously disastrous, however: recall “Payday Loan” provider Wonga, backed by an illustrious set of investors but ultimately accused of, and hit hard by regulators and the public for, preying on people who were in need of funds with loans that were not transparent enough in their terms and led the borrowers into deep debt.

Wonga itself paid a big price for its practices, and the company is now bankrupt (and apparently still unable to replay creditors, as of the last report in March).

It was the disaster of Wonga — and an article in the WSJ about alternatives to payday loans — that Briffett said got him thinking about the possibilities and building Wagestream. (Ironic note: if you use PitchBook as I do, Wonga is listed among Wagestream’s backers, which Briffett assures me is an error.)

Wagestream positions itself as a “social impact” startup for targeting a very real problem that impacts financial inclusion for a proportion of the population, and it says this represents one of the highest rounds ever for a startup in the U.K. aimed at social impact.

“We fell in love with the strong product-market fit of Wagestream. We very rarely hear such universal positive feedback from all who have tried a product,” said Rob Moffat, a partner at Balderton, in a statement. “Companies used to take an active role in supporting the financial health of their users but this has slowly been eroded, to the extent where employees paid at the end of the month are effectively subsidising their employer for 29 days a month. Wagestream starts to restore the right balance.”

Wagestream operates by striking deals with employers to offer its services to its workers, who download an app and link up Wagestream with their salary and banking details. Businesses are able to set limits for what percentage of their wages employees can draw down each month, and how often the service can be used. Typically the limit is around 40% of a monthly wage, Briffett said.

Employees then can get the money instantly by paying a fee of £1.75 per withdrawal. “We are funding all of the withdrawals up front,” Briffett said. “We are the first company to marry workforce management and financial data.”

Down the road, the plan will be to expand to Europe as well as to the U.S., where there are already some other services that are trying to tackle the same problem, such as Instant Financial and DailyPay. There are also a number of areas the company could move into, such as working with companies that employ contract workers, and providing additional financial services to workers already using the app to draw down funds.

More expansion, Briffett said, will inevitably also mean more funding, particularly on the debt side.

For now, the emergence of Wagestream is an encouraging sign of how VCs are not just interested in tapping their coffers to bet on tech companies that they think will be hits. They also want to hunt for those whose returns may well be strong, but ultimately are made stronger by the longer-term effect they might have on the wider landscape of consumers, how they interface with fintech, and continue their own progress in the world.

Powered by WPeMatico

Google reportedly suspends select business with Huawei over U.S. ban

The Trump administration Huawei ban is sure to have wide-ranging and long lasting effects for all parties. In the meantime, it seems, a number of those involved in the periphery are treading lightly in hope of not burning bridges on either side. Google has taken accidental center stage, in its role providing Android and a variety of apps for the embattled handset maker.

According to a new report from Reuters, the U.S. software giant has taken some steps toward disentangling itself. Word comes from unnamed sources, who say the company has suspended all businesses with Huawei, aside from those covered by open-source licenses. The list appears to include updates to Android and popular apps like Gmail.

From the sound of it, Google is still attempting to wrap its head around how to proceed with the matter. Huawei, too, is assessing its options. Given the complexity of smartphone hardware and software, handsets routinely utilize components source from a variety of different locations. This fact has complicated things as trade tensions have begun to rise, hitting ZTE particularly hard over accusations that the company had violated U.S.-Iran sanctions.

Huawei has called the ban bad for all parties, but has continued to be defiant, noting its plans to become “self-reliant.” The company has no doubt been preparing for the seeming inevitability of heightened trade tensions, but its determination has some industry observers unconvinced that it can carry on with without any input from Google or U.S. chipmakers like Qualcomm.

Powered by WPeMatico

Myneral.me wins the TechCrunch Hackathon at VivaTech

It’s been a long night at VivaTech. The building hosted a very special competition — the TechCrunch Hackathon in Paris.

Hundreds of engineers and designers got together to come up with something cool, something neat, something awesome. The only condition was that they only had 36 hours to work on their projects. Some of them were participating in our event for the first time, while others were regulars. Some of them slept on the floor in a corner, while others drank too much Red Bull.

We could all feel the excitement in the air when the 64 teams took the stage to present a one-minute demo to impress fellow coders and our judges. But only one team could take home the grand prize and €5,000. So, without further ado, meet the TechCrunch Hackathon winner.

Winner: Myneral.me

Current mining operations lack transparency and clarity in the way they are monitored. In order to understand how a material went from initial discovery in the mine to end product, a new tool is necessary to monitor operations. Myneral.me offers an all-encompassing platform for the metal and mining sector that showcases CSR to both industry partners and end users. Find out more on Myneral.me.

Runner-Up #1: Vyta

Vyta takes patient information and helps doctors understand which patient needs to be treated first. A simple tool like this could make things smoother for everyone at the emergency room and improve treatments.

Runner-Up #2: Scrub

SCRUB = SCRUM + BUGS. Easily track your errors across applications and fix them using our algorithmic suggestions and code samples. Our open-source bug tracker automagically collects all errors for you. Find out more on GitHub.

Runner-Up #3: Chiche

Finding the future upcoming brand depends on the set of data you are using to detect it. First, they do a simple quantification of the most famous brands on social medias to identify three newcomers. Second, they use Galerie Lafayette’s website as a personal shopping tool to propose customers the most adequate product within the three newcomers.

Judges

Dr. Aurélie Jean has been working for more than 10 years as a research scientist and an entrepreneur in computational sciences, applied to engineering, medicine, education, economy, finance and journalism. In the past, Aurélie worked at the Massachusetts Institute of Technology and at Bloomberg. Today, Aurélie works and lives between USA and France to run In Silico Veritas, a consulting agency in analytics and computer simulations. Aurélie is an advisor at the Boston Consulting Group and an external collaborator for The Ministry of Education of France. Aurélie is also a science editorial contributor for Le Point, teaches algorithms in universities and conducts research.

Julien Meraud has a solid track record in e-commerce after serving international companies for several years, including eBay, PriceMinister and Rakuten. Before joining Doctolib, Julien was CMO of Rakuten Spain, where he improved brand online acquisition, retention, promotions and campaigns. Julien joined Doctolib at the very beginning (2014), becoming the company’s first CMO and quickly holding CPO functions additionally. At Doctolib, Julien also leads Strategy teams that are responsible for identifying and sizing Doctolib’s potential new markets. Julien has a Master’s degree in Marketing, Statistics and Economics from ENSAI and a specialized Master in Marketing Management from ESSEC Business School.

Laurent Perrin is the co-founder and CTO of Front, which is reinventing email for teams. Front serves more than 5,000 companies and has raised $79 million in venture funding from investors such as Sequoia Capital, DFJ and Uncork Capital. Prior to Front, Laurent was a senior engineer at various startups and helped design scalable real-time systems. He holds a Master’s in Computer Science from École Polytechnique and Télécom ParisTech.

Neesha Tambe is the head of Startup Battlefield, TechCrunch’s global startup launch competition. In this role she sources, recruits and vets thousands of early-stage startups per year while training and coaching top-tier startups to launch in the infamous Startup Battlefield competition. Additionally, she pioneered the concept and launched CrunchMatch, the networking program at TechCrunch events that has facilitated thousands of connections between founders, investors and the startup community at-large. Prior to her work with TechCrunch, Neesha ran the Sustainable Brands’ Innovation Open — a startup competition for shared value and sustainability-focused startups with judges from Fortune 50 companies.

Renaud Visage is the technical co-founder of San Francisco-based Eventbrite (NYSE: EB), the globally leading event technology platform that went public in September 2018. Renaud is also an angel investor, guiding founders that are solving challenging technical problems in realizing their global ambitions, and he works closely with seed VC firm Point Nine Capital as a board partner, representing the fund on the board of several of their portfolio companies. Renaud also serves on the board of ShareIT, the Paris-based tech for good acceleration program launched in collaboration with Ashoka, and is an advisor to the French impact investing fund, Ring for Good. In 2014, Renaud was included in Wired UK’s Top 100 digital influencers in Europe.

In addition to our judges, here’s the hackmaster who was the MC for the event:

Romain Dillet is a senior writer at TechCrunch. Originally from France, Romain attended EMLYON Business School, a leading French business school specialized in entrepreneurship. He covers many things, from mobile apps with great design to privacy, security, fintech, Apple, AI and complex tech achievements. He also speaks at major tech conferences. He likes pop culture more than anything in the world. He now lives in Paris when he’s not on the road. He used to live in New York and loved it.

Powered by WPeMatico

Startups Weekly: There’s an alternative to raising VC and it’s called revenue-based financing

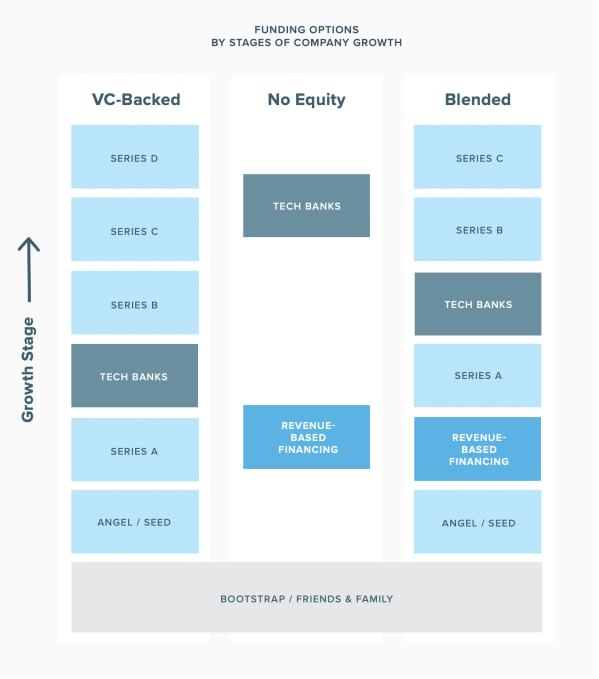

Revenue-based financing is on the rise, at least according to Lighter Capital, a firm that doles out entrepreneur-friendly debt capital.

What exactly is RBF you ask? It’s a relatively new form of funding for tech companies that are posting monthly recurring revenue. Here’s how Lighter Capital, which completed 500 RBF deals in 2018, explains it: “It’s an alternative funding model that mixes some aspects of debt and equity. Most RBF is technically structured as a loan. However, RBF investors’ returns are tied directly to the startup’s performance, which is more like equity.”

Source: Lighter Capital

What’s the appeal? As I said, RBFs are essentially dressed up debt rounds. Founders who opt for RBFs as opposed to venture capital deals hold on to all their equity and they don’t get stuck on the VC hamster wheel, the process in which you are forced to continually accept VC while losing more and more equity as a means of pleasing your investors.

RBFs, however, are better than traditional debt rounds because the investors are more incentivized to help the companies they invest in because they are receiving a certain portion of that business’s monthly revenues, typically 1% to 9%. Eventually, as is explained thoroughly in Lighter Capital’s newest RBF report, monthly payments come to an end, usually 1.3 to 2.5X the amount of the original financing, a multiple referred to as the “cap.” Three to five years down the line, any unpaid amount of said cap is due back to the investor. When all is said in done, ideally, the startup has grown with the support of the capital and hasn’t lost any equity.

At this point, they could opt to raise additional revenue-based capital, they could turn to venture capital or they could tap a tech bank to help them get to the next step. The idea is RBF is easier on the founder and it allows them optionality, something that is often lost when companies turn to VCs.

IPO corner, rapid-fire edition

Slack’s direct listing will be on June 20th. Get excited.

China’s Luckin Coffee raised $650 million in upsized U.S. IPO

Crowdstrike, a cybersecurity unicorn, dropped its S-1.

Freelance marketplace Fiverr has filed to go public on the NYSE.

Plus, I had a long and comprehensive conversation with Zoom CEO Eric Yuan this week about the company’s closely watched IPO. You can read the full transcript here.

Silicon Valley entrepreneur Hosain Rahman, the man behind Jawbone, has managed to raise $65.4 million for his new company, according to an SEC filing. The paperwork, coincidentally or otherwise, was processed while most of the world’s attention was focused on Uber’s IPO. Jawbone, if you remember, produced wireless speakers and Bluetooth earpieces, and went kaput in 2017 after burning up $1 billion in venture funding over the course of 10 years. Ouch.

- Amazon leads $575M investment in Deliveroo

- GetYourGuide picks up $484M

- Impossible Foods raises $300M

- Away packs on $100M at $1.4B valuation

- Innowatts raises $18M for its energy monitoring toolkit

- D2C underwear brand TomboyX raises $18M

On the heels of enterprise startup UiPath raising at a $7 billion valuation, the startup’s biggest investor is announcing a new fund to double down on making more investments in Europe. VC firm Accel has closed a $575 million fund — money that it plans to use to back startups in Europe and Israel, investing primarily at the Series A stage in a range of between $5 million and $15 million, reports TechCrunch’s Ingrid Lunden. Plus, take a closer look at Contrary Capital. Part accelerator, part VC fund, Contrary writes small checks to student entrepreneurs and recent college dropouts.

Our paying subscribers are in for a treat this week. Our in-house venture capital expert Danny Crichton wrote down some thoughts on Uber and Lyft’s investment bankers. Here’s a snippet: “Startup CEOs heading to the public markets have a love/hate relationship with their investment bankers. On one hand, they are helpful in introducing a company to a wide range of asset managers who will hopefully hold their company’s stock for the long term, reducing price volatility and by extension, employee churn. On the other hand, they are flagrantly expensive, costing millions of dollars in underwriting fees and related expenses…”

Read the full story here and sign up for Extra Crunch here.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about the notable venture rounds of the week, CrowdStrike’s IPO and more of this week’s headlines.

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Starbucks’ Chinese nemesis surges 20% in public debut

Shares of Luckin Coffee jumped 20% in its first day of trading on the Nasdaq stock market.

After opening at $17.00, shares of the Chinese Starbucks competitor climbed as high as $25.96, or more than 50%, before settling back down to $20.38 at the market’s close. The company has a market cap north of $5 billion after its first day of trading.

The brick-and-mortar coffee chain has achieved major success in China by offering speedy delivery services to Chinese consumers. The company has nearly 2,400 stores compared to Starbucks’ 3,500, but it has plans to more than double that number by the end of the year as it seeks to become the country’s coffee king.

Luckin’s success doesn’t immediately seem to be thwarting the stock market success of Starbucks, which has had a glowing 2019. The company hit another all-time high Friday, closing out the day at $78.91, up more than 35% from a year ago, giving the Seattle company a market cap of nearly $96 billion.

Starbucks and Luckin Coffee may seem like mortal enemies, but their rivalry is more complicated than one might immediately think. Check out our Extra Crunch deep dive from earlier this week on the Xiamen-based company’s financials.

Powered by WPeMatico

DNA Script picks up $38.5 million to make DNA production faster and simpler

DNA Script has raised $38.5 million in new financing to commercialize a process that it claims is the first big leap forward in manufacturing genetic material.

The revolution in synthetic biology that’s reshaping industries from medicine to agriculture rests on three, equally important pillars.

They include: analytics — the ability to map the genome and understand the function of different genes; synthesis — the ability to manufacture DNA to achieve certain functions; and gene editing — the CRISPR-based technologies that allow for the addition or subtraction of genetic code.

New technologies have already been introduced to transform the analytics and editing of genomes, but little progress has been made over the past 50 years in the ways in which genetic material is manufactured. That’s exactly the problem that DNA Script is trying to solve.

Traditionally, making DNA involved the use of chemical compounds to synthesize (or write) DNA in chains that were limited to around 200 nucleotide bases. Those synthetic pieces of genetic code are then assembled to make a gene.

DNA Script’s technology holds the promise of making longer chains of nucleotides by mirroring the enzymatic process through which DNA is assembled within cells — with fewer errors and no chemical waste material. The enzymatic process can accelerate commercial applications in healthcare, chemical manufacturing and agriculture.

“Any technology that can make that faster is going to be very valuable,” says Christopher Voigt, a synthetic biologist at the Massachusetts Institute of Technology in Cambridge, told the journal Nature.

DNA Script isn’t the only company in the market that’s looking to make the leap forward in enzymatic DNA production. Nuclear, a startup working with Harvard University’s famed geneticist, George Church, and Ansa Bio, a startup affiliated with Jay Keasling’s Berkeley lab at the University of California, are also moving forward with the technology.

But the Paris-based company has achieved some milestones that would make its technology potentially the first to come to market with a commercially viable approach.

At least, that’s what new investors LSP and Bpifrance, through its Large Venture fund, are hoping. They’re joined by previous investors Illumina Ventures, M. Ventures, Sofinnova Partners, Kurma Partners and Idinvest Partners in backing the company’s latest funding.

The company said the money would be used to accelerate the development of its first products and establish a presence in the United States.

“As we announced earlier this year at the AGBT General Meeting, DNA Script was the first company to enzymatically synthesize a 200mer oligo de novo with an average coupling efficiency that rivals the best organic chemical processes in use today,” said Thomas Ybert, chief executive and co-founder of DNA Script. “Our technology is now reliable enough for its first commercial applications, which we believe will deliver the promise of same-day results to researchers everywhere, with DNA synthesis that can be completed in just a few hours.”

Powered by WPeMatico