Facebook changes algorithm to promote worthwhile & close friend content

Facebook is updating the News Feed ranking algorithm to incorporate data from surveys about who you say are your closest friends and which links you find most worthwhile. Today Facebook announced it’s trained new classifiers based on patterns linking these surveys with usage data so it can better predict what to show in the News Feed. The change could hurt Pages that share clickbait and preference those sharing content that makes people feel satisfied afterwards.

For close friends, Facebook surveyed users about which people they were closest too. It then detected how this matches up with who you are tagged in photos with, constantly interact with, like the same post and check in to the same places as, and more. That way if it recognizes those signals about other people’s friendships, it can be confident those are someone’s closest friends they’ll want to see the most of. You won’t see more friend content in total, but more from your best pals instead of distant acquaintances.

A Facebook News Feed survey from 2016, shared by Varsha Sharma

For worthwhile content, Facebook conducted surveys via News Feed to find out which links people said were good uses of their time. Facebook then detected which types of link posts, which publishers and how much engagement the posts got and matched that to survey results. This then lets it determine that if a post has a similar style and engagement level, it’s likely to be worthwhile and should be ranked higher in the feed.

The change aligns with CEO Mark Zuckerberg’s recent comments declaring that Facebook’s goal isn’t total time spent, but time well spent with meaningful content you feel good about. Most recently, that push has been about demoting unsafe content. Last month Facebook changed the algorithm to minimize clickbait and links to crappy ad-filled sites that receive a disproportionately high amount of their traffic from Facebook. It cracked down on unoriginality by hiding videos ripped off from other creators, and began levying harsher demotions to repeat violators of its policies. And it began to decrease the distribution of “borderline content” on Facebook and Instagram that comes close to but doesn’t technically break its rules.

While many assume Facebook just juices News Feed to be as addictive in the short-term as possible to keep us glued to the screen and viewing ads, that would actually be ruinous for its long-term business. If users leave the feed feeling exhausted, confused and unfulfilled, they won’t come back. Facebook’s already had trouble with users ditching its text-heavy News Feed for more visual apps like Instagram (which it luckily bought) and Snapchat (which it tried to). While demoting clickbait and viral content might decrease total usage time today, it could preserve Facebook’s money-making ability for the future while also helping to rot our brains a little less.

Powered by WPeMatico

SugarCRM moves into marketing automation with Salesfusion acquisition

SugarCRM announced today that it has acquired Atlanta-based Salesfusion to help build out the marketing automation side of its business. The deal closed last Friday. The companies did not share the purchase price.

CEO Craig Charlton, who joined the company in February, says he recognized that marketing automation was an area of the platform that badly needed enhancing. Faced with a build or buy decision, he decided it would be faster to buy a company and began looking for an acquisition target.

“We spent the last three or four months doing a fairly intensive market scan and dealing with a number of the possible opportunities, and we decided that Salesfusion was head and shoulders above the rest for a variety of reasons,” he told TechCrunch.

Among those was the fact the company was still growing and some of the targets Sugar looked at were actually shrinking in size. The real attraction for him was Salesfusion’s customer focus. “They have a very differentiated on-boarding process, which I hadn’t seen before. I think that’s one of the reasons why they get such a quick time to value for the customers is because they literally hold their hand for 12 weeks until they graduate from the on-boarding process. And when they graduate, they’re actually live with the product,” he said.

Brent Leary, principal at CRM Essentials, who is also based in Atlanta, thinks this firm could help Sugar by giving it a marketing automation story all its own. “Salesfusion gives Sugar a marketing automation piece they can fully bring into their fold and not have to be at the whims of marketing automation vendors, who end up not being the best fit as partners, whether it’s due to acquisition or instability of leadership at chosen partners,” Leary told TechCrunch.

It has been a period of transition for SugarCRM, which has had a hard time keeping up with giants in the industry, particularly Salesforce. The company dipped into the private equity market last summer and took a substantial investment from Accel-KKR, which several reports pegged as a nine-figure deal, and PitchBook characterized as a leveraged buyout.

As part of that investment, the company replaced long-time CEO Larry Augustin with Charlton and began creating a plan to spend some of that money. In March, it bought email integration firm Collabspot, and Charlton says they aren’t finished yet, with possibly two or three more acquisitions on target for this quarter alone.

“We’re looking to make some waves and grow very aggressively and to drive home some really compelling differentiation that we have, and that will be building over the next 12 to 24 months,” he said.

Salesfusion was founded in 2007 and raised $16 million, according to the company. It will continue to operate out of its offices in Atlanta. The company’s 50 employees are now part of Sugar.

Powered by WPeMatico

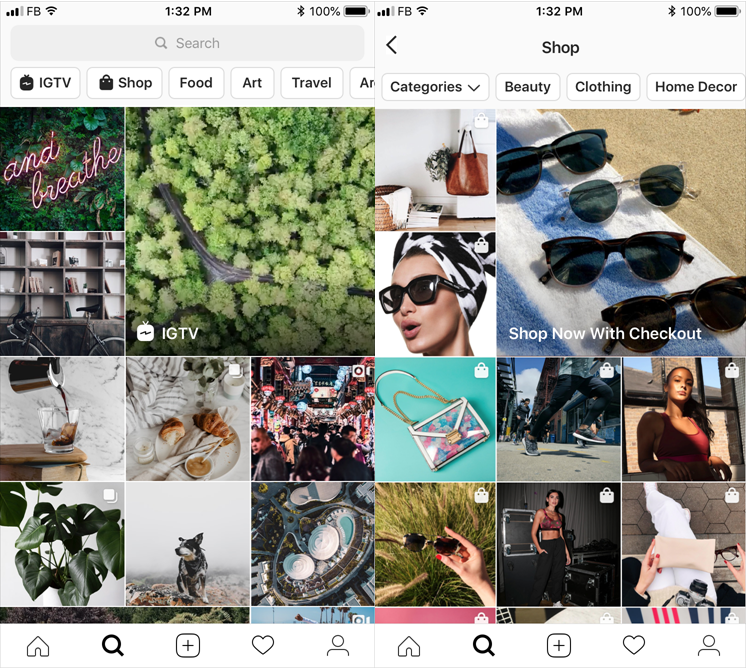

Instagram adds Stories to Explore tab. Here’s how to get on it

Instagram’s pivot to Stories continues with an overhaul of Explore designed to let users dig deeper into their niche interests. Stories are now eligible to show up in the Explore tab for the first time, giving creators a way to get discovered through their intimate, silly, behind-the-scenes content instead of just their manicured feed posts. Since Stories themselves don’t get Likes, Instagram will personalize which Stories you see on Explore by showing accounts similar to ones you do Like and Follow. We’ve got more tips on how the Explore Stories algorithm works below.

Additionally, Instagram Explore is getting a redesigned navigation bar up to with shortcuts to Shopping and IGTV first, followed by channels for topics like Travel, Food, and Design. In a nod to how central Instagram sees Shopping and IGTV to its future, those categories will also get big square portals inset within the Explore grid. Tapping these squares or shortcuts for Shopping reveals category filters for specific proucts like Clothing, Beauty, and Home Decor. For IGTV, they pull up an new vertical scrolling IGTV discovery grid to contrast with its old horizontal scrolling carousel.

The goal is that “Explore shows you the full breath of content on Instagram that are relevant to your interests” says Instagram product lead for discovery Will Ruben. The more creators you discover through Explore, the more you have to look at on Instagram, and the more ads you end of seeiing. “These changes also signal the future direction we’ll be taking with Explore. We’re really investing in making IGTV and Shopping a big part of Explore experience. A home for Instagram’s big bets like Shopping and IGTV. We want to provide a more immersive experience so people can actively engage with content and be more specific about what they want to discover.” That should quiet questions about whether Instagram will abandon IGTV after a lackluster first year in the market.

How To Get On The Instagram Explore Tab

You’ll now start to see auto-playing Stories clips on the Explore grid. Tapping one will let you watch that Story, and then swipe through more topically similar Stories. For example, if you tap into a Story about dogs on Explore, you’ll likely see more dog Stories queued up. This seamless way to sift through content means there’s a ton of opportunity for influencers and artists to gain followers through Explore.

Instagram tells me that its algorithm is looking for several things when determining what to show on Explore. This is not an exhaustive list of signals that determine what shows up on Explore, which would also include recency and other factors. Explore is also personalized for every user, so showing up to one person doesn’t mean others will see a piece of content there too But here’s what Instagram told us were some of inputs for deciding what Stories appear in Explore:

- The strongest input is what the viewer already follows and Likes in the feed. Instagram will try to show similar Stories in Explore, so if someone Likes and follows a lot of accounts you, it will show Stories from other people they Like and follow but you don’t yet

- Videos have the potential to be ranked higher than photos since videos auto-play in Explore and tend to get more attention, but great photos will still rank above mediocre videos

- Highly-visual Stories that don’t include too much text will get preference

- Stories with content more similar to and representative of a creator’s typical feed posts are more likely to show up on Explore

- Certain content types like reposts of other people’s feed posts are demoted by the algorithm

- Computer vision that detects what the actual content of a Story is helps Instagram show you ones similar to the content you interact with most, though this is a weaker signal than those above.

So if you’re followed and Liked by people similar to someone, and post visually-compelling video Stories without too much text that are indicative of the topics you typically post, you could earn a spot on the Explore tab.

Powered by WPeMatico

Samsung reportedly readying Galaxy Fold for release after finding ‘fix’

Samsung’s been mostly quiet on the Fold front after recalling review units and indefinitely delaying the phone’s release. Understandably so. It couldn’t have been easy going back to the drawing board with one of the buzziest handsets in recent memory. While we’ve been waiting word, the company has been exploring fixes and attempting to determine the magnitude of the issue.

According to reporting from Yonhap News Agency, Samsung is currently testing the handset with mobile carriers in Korea, putting the phone’s official release some time next month. There are a few grains of salt to be taken from these unnamed sources. The release time frame depends on approval from carriers and will vary country by country.

What is notable, however, is that Samsung has apparently found fixes for the two primary problems. First, there’s the issue with the protective laminate, which some reviewers apparently peeled off. I get it. I looks an awful lot like the peel-able screen covers the company’s phones ship with.

The protective cover will remain, but the edges will be tucked away, making it much more difficult to remove. As for the issue with matter falling through cracks in the hinge and getting wedged behind the display, Samsung’s apparently just making the holes smaller.

Last week, CEO DJ Koh addressed the issue, noting that “news” was coming soon. This isn’t that, but Samsung does appear to still be committed to what could ultimately prove a very pricey mistake. At $1,980, consumers, too, are advised to approach this one with caution.

Powered by WPeMatico

GetYourGuide picks up $484M, passes 25M tickets sold through its tourism activity app

As we swing into the summer tourist season, a company poised to capitalise on that has raised a huge round of funding. GetYourGuide — a Berlin startup that has built a popular marketplace for people to discover and book sightseeing tours, tickets for attractions and other experiences around the world — is today announcing that it has picked up $484 million, a Series E round of funding that will catapult its valuation above the $1 billion mark.

The funding is a milestone for a couple of reasons. GetYourGuide says it is the highest-ever round of funding for a company in the area of “travel experiences” (tours and other activities) — a market estimated to be worth $150 billion this year and rising to $183 billion in 2020. And this Series E is also one of the biggest-ever growth rounds for any European startup, period.

The company has now sold 25 million tickets for tours, attractions and other experiences, with a current catalog of some 50,000 experiences on offer. That’s a sign of strong growth: in 2017 it sold 10 million tickets, and its last reported catalog number was 35,000. It will be using the funding to build more of its own “Originals” tour experiences — which have now passed the 40,000 tickets sold mark — as well as to build up more activities in Asia and the U.S., two fast-growing markets for the startup.

The funding is being led by SoftBank, via its Vision Fund, with Temasek, Lakestar, Heartcore Capital (formerly Sunstone Capital) and Swisscanto Invest among others also participating. (Swisscanto is part of Zürcher Kantonalbank: GetYourGuide was originally founded in Zurich, where the founders had studied, and it still runs some R&D operations there.) The company has now raised well over $600 million.

It’s notable how SoftBank — which is on the hunt for interesting opportunities to invest its $100 billion superfund — has been stepping up a gear in Germany to tap into some of the bigger tech players that have emerged out of that market, which today is the biggest in Europe. Other big plays have included €460 million into Auto1 and €900 million into payments provider Wirecard. Other companies it has backed, such as hotel company Oyo out of India, are using its funding to break into Europe (and buy German companies in the process).

There had been reports over the last several months that GetYouGuide was in the process of raising anywhere between $300 million and more than $500 million. In late April, we were told by sources that the round hadn’t yet closed, and that numbers published in the media up to then had been inaccurate, even as we nailed down that SoftBank was indeed involved in the round.

The valuation in this round is not being disclosed, but CEO Johannes Reck (who co-founded the app with Martin Sieber, Pascal Mathis, Tobias Rein and Tao Tao) said in an interview with TechCrunch that it was definitely “now a unicorn” — meaning that its valuation had passed the $1 billion mark. For additional context, the rumor last month was that GetYourGuide’s valuation was up to €1.6 billion ($1.78 billion), but I have not been able to get firm confirmation of that number.

From hip replacements to hipsters

GetYourGuide’s growth — and investor interest in it — has closely followed the rise of new platforms like Airbnb that have changed the face of how we travel, and what we do when we get somewhere. We have moved far beyond the days of visiting a travel agent that books everything, from flight to hotel to all your activities, as you sit on the other side of a desk from her or him. Now with the tap of a finger or the click of a mouse, we have thousands of choices.

Within that, GetYourGuide thinks that it has jumped on an interesting opportunity to rethink the activity aspect of tourism. Tour packages and other highly organized travel experiences are often associated with older people, or those with families — essentially people who need more predictability when they are not at home.

Reck noted that the earliest users of GetYourGuide in 2010 were precisely those people — or at least those who were more inclined to use digital platforms to begin with: the demographic, he said, was 40-50 year olds, most likely travelling with family.

That is one thing that has really started to change, in no small part because of GetYourGuide itself. Making the experience of booking experiences mobile-friendly, GetYourGuide has played into the culture of doing and showing, which has propelled the rise of social media.

“They want to do things, to have something to post on Instagram,” he said. The average age of a GetYourGuide user now, he said, is 25-40.

This has even evolved into what GetYourGuide provides to users. “At some point, staff in Asia had the idea of crafting a ‘GetYourGuide Instagram Tour of Bali.’ That really took off, and now this is the number-one tour booked in the region.” It has since expanded the concept to 50 destinations.

Not by coincidence, today the company is also announcing that Ameet Ranadive is joining as the company’s first chief product officer. Ranadive comes from Instagram, where he led the Well-being product team (the company’s health and safety team). He’d also been VP and GM of Revenue Product at Twitter. Nils Chrestin is also coming on as CFO, having recently been at Rocket Internet-incubated Global Fashion Group.

That has also led GetYourGuide to conclude it has a ways to go to continue developing its model and scope further, expanding into longer sightseeing excursions, beyond one or two-hour tours into day trips and even overnight experiences.

As it continues to play around with some of these offerings, it’s also increasingly taking a more direct role in the branding and the provision of the content. Initially, all tickets and tours were posted on GetYourGuide by third parties. Now, GetYourGuide is building more of what Reck calls “Originals” — which it might develop in partnership with others but ultimately handles as its own first-party content. (That Instagram tour was one of those Originals.)

It’s worth noting that others are closing in on the same “experiences” model that forms the core of GetYourGuide’s business: Airbnb, to diversify how it makes revenues and to extend its touchpoints with guests beyond basic accommodation bookings, has also started to sell experiences. Meanwhile, daily deals pioneer Groupon has also positioned itself as a destination for purchasing “experiences” as a way to offset declines in other areas of its business. Similarly, travel portals that sell plane tickets regularly default to pushing more activities on you.

Reck pointed out that the area of business where GetYourGuide is active is becoming increasingly attractive to these players as other aspects of the travel industry become increasingly commoditised. Indeed, you can visit dozens of sites to compare pricing on plane tickets, and if you are flexible, pick up even more of a bargain at the last minute. And the rise of multiple Airbnb-style platforms offering private accommodation has made competition among those supplying those platforms — as well as hotels — increasingly fierce.

All of that leaves experiences — for now at least — as the place where these companies can differentiate themselves from the pack. Reck believes that focusing on this, however, means you just do it much better than companies that have added experiences on to a platform that is not a native destination for discovering or buying that kind of content or product. (That doesn’t mean there aren’t others natively tackling “experiences” from the world of startups. Klook is one also funded by SoftBank.)

“Consumers, especially millennials, are spending an increasing portion of their disposable income on travel experiences. We believe GetYourGuide is leading this seismic shift by consolidating the fragmented global supply base of tour operators and modernizing access for travelers globally,” said Ted Fike, partner at SoftBank Investment Advisers, in a statement. “This combination creates powerful network effects for their business that is fueling their strong growth. We are excited to partner with their passionate and talented leadership team.” Fike is joining the board with this round.

Powered by WPeMatico

OpenFin raises $17 million for its OS for finance

OpenFin, the company looking to provide the operating system for the financial services industry, has raised $17 million in funding through a Series C round led by Wells Fargo, with participation from Barclays and existing investors including Bain Capital Ventures, J.P. Morgan and Pivot Investment Partners. Previous investors in OpenFin also include DRW Venture Capital, Euclid Opportunities and NYCA Partners.

Likening itself to “the OS of finance,” OpenFin seeks to be the operating layer on which applications used by financial services companies are built and launched, akin to iOS or Android for your smartphone.

OpenFin’s operating system provides three key solutions which, while present on your mobile phone, has previously been absent in the financial services industry: easier deployment of apps to end users, fast security assurances for applications and interoperability.

Traders, analysts and other financial service employees often find themselves using several separate platforms simultaneously, as they try to source information and quickly execute multiple transactions. Yet historically, the desktop applications used by financial services firms — like trading platforms, data solutions or risk analytics — haven’t communicated with one another, with functions performed in one application not recognized or reflected in external applications.

“On my phone, I can be in my calendar app and tap an address, which opens up Google Maps. From Google Maps, maybe I book an Uber . From Uber, I’ll share my real-time location on messages with my friends. That’s four different apps working together on my phone,” OpenFin CEO and co-founder Mazy Dar explained to TechCrunch. That cross-functionality has long been missing in financial services.

As a result, employees can find themselves losing precious time — which in the world of financial services can often mean losing money — as they juggle multiple screens and perform repetitive processes across different applications.

Additionally, major banks, institutional investors and other financial firms have traditionally deployed natively installed applications in lengthy processes that can often take months, going through long vendor packaging and security reviews that ultimately don’t prevent the software from actually accessing the local system.

OpenFin CEO and co-founder Mazy Dar (Image via OpenFin)

As former analysts and traders at major financial institutions, Dar and his co-founder Chuck Doerr (now president & COO of OpenFin) recognized these major pain points and decided to build a common platform that would enable cross-functionality and instant deployment. And since apps on OpenFin are unable to access local file systems, banks can better ensure security and avoid prolonged yet ineffective security review processes.

And the value proposition offered by OpenFin seems to be quite compelling. OpenFin boasts an impressive roster of customers using its platform, including more than 1,500 major financial firms, almost 40 leading vendors and 15 of the world’s 20 largest banks.

More than 1,000 applications have been built on the OS, with OpenFin now deployed on more than 200,000 desktops — a noteworthy milestone given that the ever-popular Bloomberg Terminal, which is ubiquitously used across financial institutions and investment firms, is deployed on roughly 300,000 desktops.

Since raising their Series B in February 2017, OpenFin’s deployments have more than doubled. The company’s headcount has also doubled and its European presence has tripled. Earlier this year, OpenFin also launched it’s OpenFin Cloud Services platform, which allows financial firms to launch their own private local app stores for employees and customers without writing a single line of code.

To date, OpenFin has raised a total of $40 million in venture funding and plans to use the capital from its latest round for additional hiring and to expand its footprint onto more desktops around the world. In the long run, OpenFin hopes to become the vital operating infrastructure upon which all developers of financial applications are innovating.

“Apple and Google’s mobile operating systems and app stores have enabled more than a million apps that have fundamentally changed how we live,” said Dar. “OpenFin OS and our new app store services enable the next generation of desktop apps that are transforming how we work in financial services.”

Powered by WPeMatico

Mobile ticketing company TodayTix raises $73M in new funding

TodayTix, a mobile ticketing company that makes it easy and relatively affordable to go to Broadway shows and other live performances, is announcing a new $73 million round of funding led by private equity firm Great Hill Partners.

Founded in 2013, the company initially served as the mobile equivalent of New York’s TKTS booths for discounted, last-minute theater tickets. TodayTix says it’s now sold more than 4 million tickets, representing 8% of annual Broadway ticket sales and 4% for London’s West End.

Beyond that, co-founder and CEO Brian Fenty said that a little over 10% of the tickets sold now fall outside “theater and performing arts, narrowly defined,” covering things like comedy shows and experiential theater.

“I think to the consumer, we will be a holistic ecosystem to engage in the city’s art and experiences,” Fenty predicted. “However culture is defined … we want to be their partner in discovering those things.”

To do that, TodayTix will add more cities to its current list of 15 markets. Fenty said this expansion is driven by existing collaborations (like launching in Australia through its partnership with “Harry Potter and the Cursed Child”) and by seeing where people are already downloading the TodayTix app. His ultimate goal is to be “geographically agnostic.”

Fenty also said the company will continue investing in the TodayTix Presents program, through which the company puts on its own shows (albeit at a much smaller scale than a Broadway production).

And of course he wants to improve the app itself, introducing more personalization and curation — Fenty pointed to Netflix and Amazon as models. After all, he said TodayTix is currently offering tickets to 297 shows in New York alone, so it needs ways to “effectively guide people through that.”

“We’re actually a media company, with our own content and perspective — not on the quality of the shows, but to have a point of view on how users should and could engage with this content,” he said.

He added that those improvements will include more basic things, like the process of purchasing a ticket: “The hardest part is to complete the purchase in 30 seconds or less, as compared to the average ticketing platform, which is somewhere between 3 and 7 minutes … How we continue to squish that conversion?”

Fenty is also hoping to work more closely with show producers, providing them with data about which shows are selling, as well as helping them use data to find the most effective ways to promote themselves.

TodayTix says it’s raised a total of $90 million since it announced its Series B back in February 2016. Fenty told me the new round includes a direct investment in the company, as well as secondary purchases of TodayTix shares from previous investors.

“TodayTix is rapidly changing the way millennials and other consumers connect with live cultural experiences,” said Great Hill Managing Partner Michael Kumin in a statement. “We look forward to working with Brian, [co-founder] Merritt [Baer] and their talented management team to expand the Company’s product and service offerings and accelerate its push into new geographies.”

Powered by WPeMatico

Reality Check: The marvel of computer vision technology in today’s camera-based AR systems

Contributor

British science fiction writer, Sir Arther C. Clark, once said, “Any sufficiently advanced technology is indistinguishable from magic.”

Augmented reality has the potential to instill awe and wonder in us just as magic would. For the very first time in the history of computing, we now have the ability to blur the line between the physical world and the virtual world. AR promises to bring forth the dawn of a new creative economy, where digital media can be brought to life and given the ability to interact with the real world.

AR experiences can seem magical but what exactly is happening behind the curtain? To answer this, we must look at the three basic foundations of a camera-based AR system like our smartphone.

- How do computers know where it is in the world? (Localization + Mapping)

- How do computers understand what the world looks like? (Geometry)

- How do computers understand the world as we do? (Semantics)

Part 1: How do computers know where it is in the world? (Localization)

Mars Rover Curiosity taking a selfie on Mars. Source: https://www.nasa.gov/jpl/msl/pia19808/looking-up-at-mars-rover-curiosity-in-buckskin-selfie/

When NASA scientists put the rover onto Mars, they needed a way for the robot to navigate itself on a different planet without the use of a global positioning system (GPS). They came up with a technique called Visual Inertial Odometry (VIO) to track the rover’s movement over time without GPS. This is the same technique that our smartphones use to track their spatial position and orientation.

A VIO system is made out of two parts.

Powered by WPeMatico

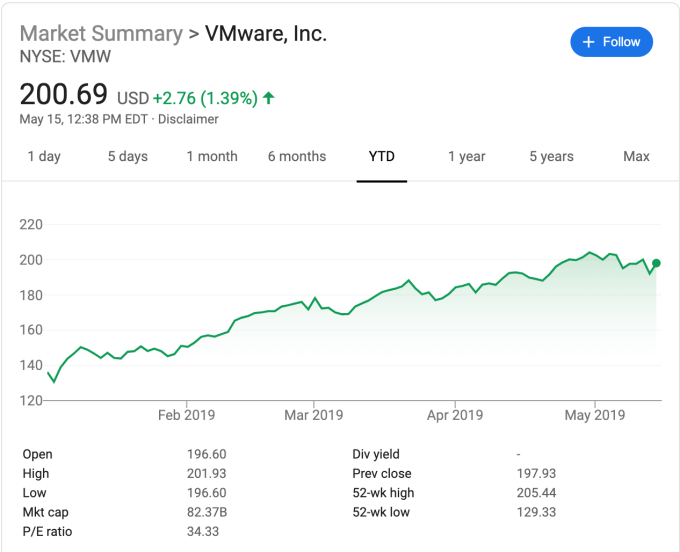

VMware acquires Bitnami to deliver packaged applications anywhere

VMware announced today that it’s acquiring Bitnami, the package application company that was a member of the Y Combinator Winter 2013 class. The companies didn’t share the purchase price.

With Bitnami, the company can now deliver more than 130 popular software packages in a variety of formats, such as Docker containers or virtual machine, an approach that should be attractive for VMware as it makes its transformation to be more of a cloud services company.

“Upon close, Bitnami will enable our customers to easily deploy application packages on any cloud — public or hybrid — and in the most optimal format — virtual machine (VM), containers and Kubernetes helm charts. Further, Bitnami will be able to augment our existing efforts to deliver a curated marketplace to VMware customers that offers a rich set of applications and development environments in addition to infrastructure software,” the company wrote in a blog post announcing the deal.

Per usual, Bitnami’s founders see the exit through the prism of being able to build out the platform faster with the help of a much larger company. “Joining forces with VMware means that we will be able to both double-down on the breadth and depth of our current offering and bring Bitnami to even more clouds as well as accelerating our push into the enterprise,” the founders wrote in a blog post on the company website.

Holger Mueller, an analyst at Constellation Research says the deal fits well with VMware’s overall strategy. “Enterprises want easy, fast ways to deploy packaged applications and providers like Bitnami take the complexity out of this process. So this is a key investment for VMware that wants to position itselfy not only as the trusted vendor for virtualizaton across the hybrid cloud, but also as a trusted application delivery vendor,” he said.

The company has raised a modest $1.1 million since its founding in 2011 and says that it has been profitable since early days when it took the funding. In the blog post, the company states that nothing will change for customers from their perspective.

“In a way, nothing is changing. We will continue to develop and maintain our application catalog across all the platforms we support and even expand to additional ones. Additionally, if you are a company using Bitnami in production, a lot of new opportunities just opened up.”

Time will tell whether that is the case, but it is likely that Bitnami will be able to expand its offerings as part of a larger organization like VMware. The deal is expected to close by the end of this quarter (which is fiscal Q2 2020 for VMware).

VMware is a member of the Dell federation of products and came over as part of the massive $67 billion EMC deal in 2016. The company operates independently, is sold as a separate company on the stock market and makes its own acquisitions.

Powered by WPeMatico

Tealium, a big data platform for structuring disparate customer information, raises $55M at $850M valuation

The average enterprise today uses about 90 different software packages, with between 30-40 of them touching customers directly or indirectly. The data that comes out of those systems can prove to be very useful — to help other systems and employees work more intelligently, to help companies make better business decisions — but only if it’s put in order: now, a startup called Tealium, which has built a system precisely to do just that and works with the likes of Facebook and IBM to help manage their customer data, has raised a big round of funding to continue building out the services it provides.

Today, it is announcing a $55 million round of funding — a Series F led by Silver Lake Waterman, the firm’s late-stage capital growth fund; with ABN AMRO, Bain Capital, Declaration Partners, Georgian Partners, Industry Ventures, Parkwood and Presidio Ventures also participating.

Jeff Lunsford, Tealium’s CEO, said the company is not disclosing valuation, but he did say that it was “substantially” higher than when the company was last priced three years ago. That valuation was $305 million in 2016, according to PitchBook — a figure Lunsford didn’t dispute when I spoke with him about it, and a source close to the company says it is “more than double” this last valuation, and actually around $850 million.

He added that the company is close to profitability and is projected to make $100 million in revenues this year, and that this is being considered the company’s “final round” — presumably a sign that it will either no longer need external funding and that if it does, the next step might be either getting acquired or going public.

This brings the total raised by Tealium to $160 million.

The company’s rise over the last eight years has dovetailed with the rapid growth of big data. The movement of services to digital platforms has resulted in a sea of information. Much of that largely sits untapped, but those who are able to bring it to order can reap the rewards by gaining better insights into their organizations.

Tealium had its beginnings in amassing and ordering tags from internet traffic to help optimise marketing and so on — a business where it competes with the likes of Google and Adobe.

Over time, it has expanded and capitalised to a much wider set of data sources that range well beyond web and commerce, and one use of the funding will be to continue expanding those data sources, and also how they are used, with an emphasis on using more AI, Lunsford said.

“There are new areas that touch customers like smart home and smart office hardware, and each requires a step up in integration for a company like us,” he said. “Then once you have it all centralised you could feed machine learning algorithms to have tighter predictions.”

That vast potential is one reason for the investor interest.

“Tealium enables enterprises to solve the customer data fragmentation problem by integrating and enriching data across sources, in real-time, to create audiences while providing data governance and fidelity,” said Shawn O’Neill, managing director of Silver Lake Waterman, in a statement. “Jeff and his team have built a great platform and we are excited to support the company’s continued growth and investment in innovation.”

The rapid growth of digital services has already seen the company getting a big boost in terms of the data that is passing through its cloud-based platform: it has had a 300% year-over-year increase in visitor profiles created, with current tech customers including the likes of Facebook, IBM, Visa and others from across a variety of sectors, such as healthcare, finance and more.

“You’d be surprised how many big tech companies use Tealium,” Lunsford said. “Even they have a limited amount of bandwidth when it comes to developing their internal platforms.”

People like to say that “data is the new oil,” but these days that expression has taken on perhaps an unintended meaning: just like the overconsumption of oil and fossil fuels in general is viewed as detrimental to the long-term health of our planet, the overconsumption of data has also become a very problematic spectre in our very pervasive world of tech.

Governments — the European Union being one notable example — are taking up the challenge of that latter issue with new regulations, specifically GDPR. Interestingly, Lunsford says this has been a good thing rather than a bad thing for his company, as it gives a much clearer directive to companies about what they can use, and how it can be used.

“They want to follow the law,” he said of their clients, “and we give them the data freedom and control to do that.” It’s not the only company tackling the business opportunity of being a big-data repository at a time when data misuse is being scrutinised more than ever: InCountry, which launched weeks ago, is also banking on this gap in the market.

I’d argue that this could potentially be one more reason why Tealium is keen on expanding to areas like IoT and other sources of customer information: just like the sea, the pool of data that’s there for the tapping is nearly limitless.

Powered by WPeMatico