HTC introduces a cheaper blockchain phone, opens Zion Vault SDK

Happy Blockchain Week to you and yours. HTC helped kick off this important national holiday by announcing the upcoming release of the HTC Exodus 1s. The latest version of the company’s intriguing blockchain phone shaves some of price off the Exodus 1 — which eventually sold for $699 when the company made it available in more traditional currency.

HTC’s being predictably cagey about exact pricing here, instead simply calling it “a more value-oriented version” of the original. Nor is the company discussing the actions it’s taking to reduce the cost here — though I’d expect much of them to be similar to those undergone by Google for the Pixel 3a, which was built by the former HTC team. There, most of the hits were to processing power and building material. Certainly the delightfully gimmicky transparent rear was a nice touch on the Exodus 1.

Most interesting here is the motivation behind the price drop. Here’s HTC in the press release:

It will allow users in emerging economies, or those wanting to dip their toes into the crypto world for the first time, easier access to the technology with a more accessible price point. This will democratize access to crypto and blockchain technology and help its global proliferation and adoption. HTC will release further details on exact specification and cost over the coming months.

A grandiose vision, obviously, but I think there’s something to be said for the idea. Access to some blockchain technology is somewhat price-prohibitive. Even so. Many experts in the space agree that blockchain will be an important foundation for microtransactions going forward. The Exodus 1 wasn’t exactly a smash from the look of things, but this could be an interesting first step.

Another interesting bit in all of this is the opening of the SDK for Zion Vault, the Trusted Execution Environment (TEE) product vault the company introduced with the Exodus 1. HTC will be tossing it up on GitHub for developers. “We understand it takes a community to ensure strength and security,” the company says, “so it’s important to the Exodus team that our community has the best tools available to them.”

Powered by WPeMatico

Startups Weekly: Venture capitalists are crazy for cannabis

Lately, my inbox has been chock-full of pitches for weed businesses.

A couple of years ago it was bitcoin/blockchain startups, then came scooters; now, it seems “CannTech” is hitting an all-time high thanks to support from venture capitalists. By the way, I didn’t make up the term CannTech, but it seems just as good as anything else, so I’m rolling with it.

According to data collected by PitchBook, VCs have put $1.2 billion in U.S.-based cannabis companies so far in 2019. That’s significantly more than last year’s record high of $836 million, and we aren’t even halfway through 2019.

At this rate, we can expect roughly $2.5 billion invested in CannTech in 2019, i.e. more capital invested in the space in a single year than has been funneled into the space in the last decade.

What’s going on? A few things. Of course, states are increasingly legalizing medical and/or recreational marijuana. That’s allowed companies like Eaze, a marijuana delivery company, to grow at unprecedented rates. The startup, for example, closed its Series C in December on $65 million and is already fundraising again, this time at a $500 million valuation.

In addition to legalization, VCs, and more importantly, limited partners, have woken up to the business opportunity of cannabis. Soon, gone will be the days of strict morality clauses that dissuaded VC firms from supporting startups focused on weed. The firms that were early to understand the space, like DCM Ventures or Snoop Dogg’s Casa Verde Capital, will reap the benefits.

Speaking of DCM, the firm put on a huge, first-of-its-kind summit this week focused on CannTech: “For three years I was struggling with a lot of pain issues,” DCM co-founder David Chao told the audience. “One day I was playing Xbox with Blake Krikorian [co-founder of Sling Media] and I said ‘you know Blake, I have this pain problem’ and he said, ‘oh, you should try pot.’ And I said ‘why should I do that? I haven’t smoked since college?’ “

Long story short, Chao can thank his friend Blake for making him aware of an exploding market, and he can thank DCM’s scrappy partner, Kyle Lui, for helping the firm score some major investments in the space, like Eaze.

“We were the first Sand Hill VCs to invest in cannabis and everyone started calling me saying ‘you’re crazy, why are you doing this?’ ” Lui said.

It’s still very early days in the CannTech space, but the market is expected to be worth as much as $80 billion by 2030. That can only mean interest will soar from here.

Want more TechCrunch newsletters? Sign up here.

Uber: It was a disappointing debut, to say the least. The ride-hailing business (NYSE: UBER), previously valued at $72 billion by venture capitalists, priced its stock at $45 apiece for a valuation of $82.4 billion on Thursday. Then it began trading Friday morning at $42 apiece, only to close even lower at $41.57, down 7.6% from its IPO price.

Slack: Not a whole lot of news to share here yet, other than that the workplace messaging business will host its investor day on Monday. It’s invite-only, though Slack, like Spotify, will live-stream the event to the public. More details on that here.

Luckin Coffee: The Chinese upstart going after Starbucks is set to debut on the Nasdaq under the symbol “LK.” In a new filing, Luckin said it plans to sell 30 million shares at an initial range of $15-$17. That gives an estimated raise of $450 million to $510 million, but it could be bumped up if underwriters take up the additional allocation of 4.5 million shares. So, as a grand total, the listing could raise $586.5 million if the full offering is bought at the top of the range.

Lyft: Not an IPO update but the company did release its first-ever earnings report. Here’s the TL;DR: revenues of $776 million on losses of $1.14 billion, including $894 million of stock-based compensation and related payroll tax expenses. The company’s revenues surpassed Wall Street estimates of $740 million, while losses came in much higher as a result of IPO-related expenses.

Share price alone is no sign of value… @Uber trading at $44 ($45 IPO price)@Lyft trading at $53.8 ($74 IPO price)@Pinterest trading at $28.4 ($19 IPO price)@zoom_us trading at $77.5 ($36 IPO price)@pagerduty trading at $48.7 ($24 IPO price)

— Kate Clark (@KateClarkTweets) May 10, 2019

Harry’s razors are crappy, I’m told. Alas, the brand is worth $1.37 billion to Edgewell Personal Care, the company behind Schick and Banana Boat. Founded in 2013, Harry’s had raised about $375 million in venture capital funding. Edgewell says its $1.37 billion payment will break down to roughly 79% cash and 21% stock, giving Harry’s shareholders an 11% stake in Edgewell.

- VCs value Carta at $1.7B with $300M round

- Gett raises $200M at $1.5B valuation

- BigBasket becomes a unicorn with $150M investment

- Unity has filed to raise up to $125M at $6B valuation

- Sumo Logic gathers $110M at $1B valuation

- Tourlane raises $47M from Sequoia and Spark Capital

- Cybersecurity insurance startup Coalition raises $40M

- K-Zen Beverage, a cannabis-infused drink brand, nabs $5M

- Recent YC-grad MedCrypt raises $5M

- Sextech company scorned by CES scores $2M

Meet Beat Saber, an eight-person startup with no funding that’s turned into VR’s biggest success story. Venture capital isn’t always the answer, folks.

Our premium subscription service was loaded with A+ content this week. TechCrunch contributor Jon Evans wrote a piece titled “Against the Slacklash,” wherein he makes the case that Slack isn’t inherently bad. “Rather, the particular way in which you are misusing it epitomizes your company’s deeper problems.” Plus, Eric Peckham asked nine top VCs, including Cyan Banister and Charles Hudson, to share where they are putting their money when it comes to media, gaming and entertainment.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture capital-focused podcast, Equity. In this week’s episode, available here, Crunchbase News’ Alex Wilhelm, TechCrunch’s Connie Loizos and I chat with blogging pioneer and True Ventures partner Om Malik about the on-demand economy, Carta’s big raise and more.

Powered by WPeMatico

India’s most popular services are becoming super apps

Truecaller, an app that helps users screen strangers and robocallers, will soon allow users in India, its largest market, to borrow up to a few hundred dollars.

The crediting option will be the fourth feature the nine-year-old app adds to its service in the last two years. So far it has added to the service the ability to text, record phone calls and mobile payment features, some of which are only available to users in India. Of the 140 million daily active users of Truecaller, 100 million live in India.

The story of the ever-growing ambition of Truecaller illustrates an interesting phase in India’s internet market that is seeing a number of companies mold their single-functioning app into multi-functioning so-called super apps.

Inspired by China

This may sound familiar. Truecaller and others are trying to replicate Tencent’s playbook. The Chinese tech giant’s WeChat, an app that began life as a messaging service, has become a one-stop solution for a range of features — gaming, payments, social commerce and publishing platform — in recent years.

WeChat has become such a dominant player in the Chinese internet ecosystem that it is effectively serving as an operating system and getting away with it. The service maintains its own “app store” that hosts mini apps. This has put it at odds with Apple, though the iPhone-maker has little choice but to make peace with it.

For all its dominance in China, WeChat has struggled to gain traction in India and elsewhere. But its model today is prominently on display in other markets. Grab and Go-Jek in Southeast Asian markets are best known for their ride-hailing services, but have begun to offer a range of other features, including food delivery, entertainment, digital payments, financial services and healthcare.

The proliferation of low-cost smartphones and mobile data in India, thanks in part to Google and Facebook, has helped tens of millions of Indians come online in recent years, with mobile the dominant platform. The number of internet users has already exceeded 500 million in India, up from some 350 million in mid-2015. According to some estimates, India may have north of 625 million users by year-end.

This has fueled the global image of India, which is both the fastest growing internet and smartphone market. Naturally, local apps in India, and those from international firms that operate here, are beginning to replicate WeChat’s model.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma speaks during the launch of Paytm payments Bank at a function in New Delhi on November 28, 2017 (AFP PHOTO / SAJJAD HUSSAIN)

Leading that pack is Paytm, the popular homegrown mobile wallet service that’s valued at $18 billion and has been heavily backed by Alibaba, the e-commerce giant that rivals Tencent and crucially missed the mobile messaging wave in China.

Commanding attention

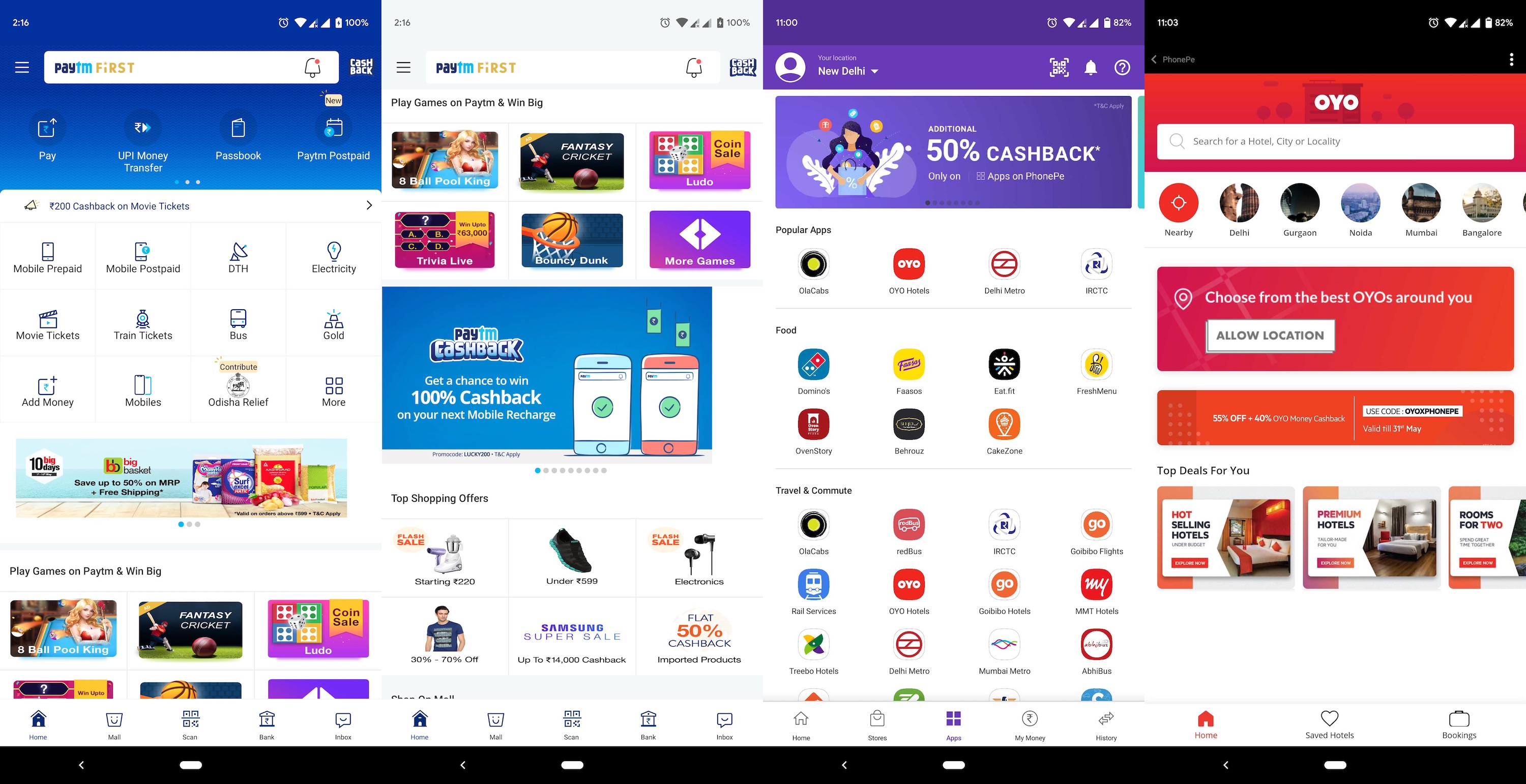

In recent years, the Paytm app has taken a leaf from China with additions that include the ability to text merchants; book movie, flight and train tickets; and buy shoes, books and just about anything from its e-commerce arm Paytm Mall . It also has added a number of mini games to the app. The company said earlier this month that more than 30 million users are engaging with its games.

Why bother with diversifying your app’s offering? Well, for Vijay Shekhar Sharma, founder and CEO of Paytm, the question is why shouldn’t you? If your app serves a certain number of transactions (or engagements) in a day, you have a good shot at disrupting many businesses that generate fewer transactions, he told TechCrunch in an interview.

At the end of the day, companies want to garner as much attention of a user as they can, said Jayanth Kolla, founder and partner of research and advisory firm Convergence Catalyst.

“This is similar to how cable networks such as Fox and Star have built various channels with a wide range of programming to create enough hooks for users to stick around,” Kolla said.

“The agenda for these apps is to hold people’s attention and monopolize a user’s activities on their mobile devices,” he added, explaining that higher engagement in an app translates to higher revenue from advertising.

Paytm’s Sharma agrees. “Payment is the moat. You can offer a range of things including content, entertainment, lifestyle, commerce and financial services around it,” he told TechCrunch. “Now that’s a business model… payment itself can’t make you money.”

Big companies follow suit

Other businesses have taken note. Flipkart -owned payment app PhonePe, which claims to have 150 million active users, today hosts a number of mini apps. Some of those include services for ride-hailing service Ola, hotel booking service Oyo and travel booking service MakeMyTrip.

Paytm (the first two images from left) and PhonePe offer a range of services that are integrated into their payments apps

What works for PhonePe is that its core business — payments — has amassed enough users, Himanshu Gupta, former associate director of marketing and growth for WeChat in India, told TechCrunch. He added that unlike e-commerce giant Snapdeal, which attempted to offer similar offerings back in the day, PhonePe has tighter integration with other services, and is built using modern architecture that gives users almost native app experiences inside mini apps.

When you talk about strategy for Flipkart, the homegrown e-commerce giant acquired by Walmart last year for a cool $16 billion, chances are arch rival Amazon is also hatching similar plans, and that’s indeed the case for super apps.

In India, Amazon offers its customers a range of payment features such as the ability to pay phone bills and cable subscription through its Amazon Pay service. The company last year acquired Indian startup Tapzo, an app that offers integration with popular services such as Uber, Ola, Swiggy and Zomato, to boost Pay’s business in the nation.

Another U.S. giant, Microsoft, is also aboard the super train. The Redmond-based company has added a slew of new features to SMS Organizer, an app born out of its Microsoft Garage initiative in India. What began as a texting app that can screen spam messages and help users keep track of important SMSs recently partnered with education board CBSE in India to deliver exam results of 10th and 12th grade students.

This year, the SMS Organizer app added an option to track live train schedules through a partnership with Indian Railways, and there’s support for speech-to-text. It also offers personalized discount coupons from a range of companies, giving users an incentive to check the app more often.

Like in other markets, Google and Facebook hold a dominant position in India. More than 95% of smartphones sold in India run the Android operating system. There is no viable local — or otherwise — alternative to Search, Gmail and YouTube, which counts India as its fastest growing market. But Google hasn’t necessarily made any push to significantly expand the scope of any of its offerings in India.

India is the biggest market for WhatsApp, and Facebook’s marquee app too has more than 250 million users in the nation. WhatsApp launched a pilot payments program in India in early 2018, but is yet to get clearance from the government for a nationwide rollout. (It isn’t happening for at least another two months, a person familiar with the matter said.) In the meanwhile, Facebook appears to be hatching a WeChatization of Messenger, albeit that app is not so big in India.

Ride-hailing service Ola too, like Grab and Go-Jek, plans to add financial services such as credit to the platform this year, a source familiar with the company’s plans told TechCrunch.

“We have an abundance of data about our users. We know how much money they spend on rides, how often they frequent the city and how often they order from restaurants. It makes perfect sense to give them these valued-added features,” the person said. Ola has already branched out of transport after it acquired food delivery startup Foodpanda in late 2017, but it hasn’t yet made major waves in financial services despite giving its Ola Money service its own dedicated app.

The company positioned Ola Money as a super app, expanded its features through acquisition and tie ups with other players and offered discounts and cashbacks. But it remains behind Paytm, PhonePe and Google Pay, all of which are also offering discounts to customers.

Integrated entertainment

Super apps indeed come in all shapes and sizes, beyond core services like payment and transportation — the strategy is showing up in apps and services that entertain India’s internet population.

MX Player, a video playback app with more than 175 million users in India that was acquired by Times Internet for some $140 million last year, has big ambitions. Last year, it introduced a video streaming service to bolster its app to grow beyond merely being a repository. It has already commissioned the production of several original shows.

In recent months, it has also integrated Gaana, the largest local music streaming app that is also owned by Times Internet. Now its parent company, which rivals Google and Facebook on some fronts, is planning to add mini games to MX Player, a person familiar with the matter said, to give it additional reach and appeal.

Some of these apps, especially those that have amassed tens of millions of users, have a real shot at diversifying their offerings, analyst Kolla said. There is a bar of entry, though. A huge user base that engages with a product on a daily basis is a must for any company if it is to explore chasing the super app status, he added.

Indeed, there are examples of companies that had the vision to see the benefits of super apps but simply couldn’t muster the requisite user base. As mentioned, Snapdeal tried and failed at expanding its app’s offerings. Messaging service Hike, which was valued at more than $1 billion two years ago and includes WeChat parent Tencent among its investors, added games and other features to its app, but ultimately saw poor engagement. Its new strategy is the reverse: to break its app into multiple pieces.

“In 2019, we continue to double down on both social and content but we’re going to do it with an evolved approach. We’re going to do it across multiple apps. That means, in 2019 we’re going to go from building a super app that encompasses everything, to Multiple Apps solving one thing really well. Yes, we’re unbundling Hike,” Kavin Mittal, founder and CEO of Hike, wrote in an update published earlier this year.

It remains unclear how users are responding to the new features on their favorite apps. Some signs suggest, however, that at least some users are embracing the additional features. Truecaller said it is seeing tens of thousands of users try the payment feature for the first time each day. It’s also being used to send 3 billion texts a month.

And Reliance Jio, of course

Regardless, the race is still on, and there are big horses waiting to enter to add further competition.

Reliance Jio, a subsidiary of conglomerate Reliance Industry that is owned by India’s richest man, Mukesh Ambani, is planning to introduce a super app that will host more than 100 features, according to a person familiar with the matter. Local media first reported the development.

It will be fascinating to see how that works out. Reliance Jio, which almost single-handedly disrupted the telecom industry in India with its low-cost data plans and free voice calls, has amassed tens of millions of users on the bouquet of apps that it offers at no additional cost to Jio subscribers.

Beyond that diverse selection of homespun apps, Reliance has also taken an M&A-based approach to assemble the pieces of its super app strategy.

It bought music streaming service Saavn last year and quickly integrated it with its own music app JioMusic. Last month, it acquired Haptik, a startup that develops “conversational” platforms and virtual assistants, in a deal worth more than $100 million. It already has the user bases required. JioTV, an app that offers access to over 500 TV channels; and JioNews, an app that additionally offers hundreds of magazines and newspapers, routinely appear among the top apps in Google Play Store.

India’s super app revolution is in its early days, but the trend is surely one to keep an eye on as the country moves into its next chapter of internet usage.

Powered by WPeMatico

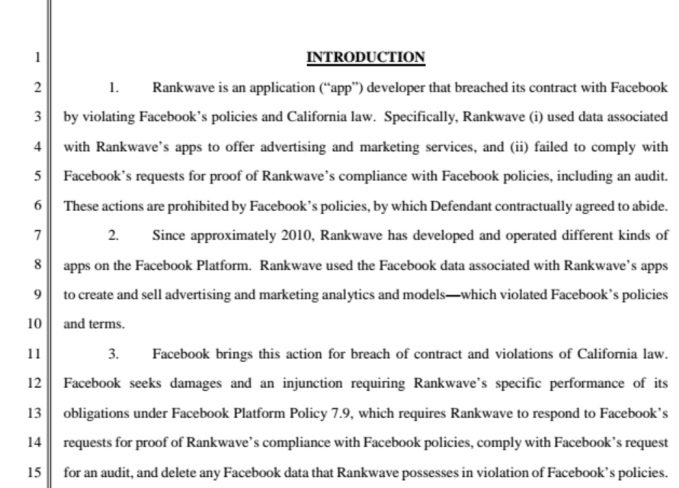

Facebook sues analytics firm Rankwave over data misuse

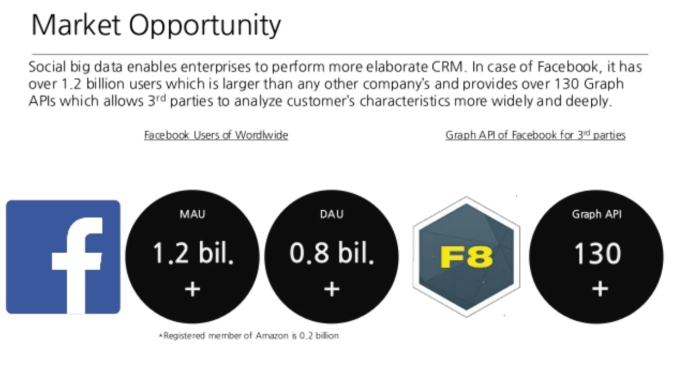

Facebook might have another Cambridge Analytica on its hands. In a late Friday news dump, Facebook revealed that today it filed a lawsuit alleging South Korean analytics firm Rankwave abused its developer platform, and has refused to cooperate with a mandatory compliance check regarding how it used Facebook data.

TechCrunch has attained a copy of the lawsuit that alleges that Rankwave misused Facebook data outside of the apps where it was collected, purposefully delayed responding to a cease-and-desist order, claimed it didn’t violate Facebook policy, lied about not using its apps since 2018 when they were accessed in April 2019, and then refused to comply with a mandatory audit of its data practices.

“By filing the lawsuit, we are sending a message to developers that Facebook is serious about enforcing our policies, including requiring developers to cooperate with us during an investigation” Facebook’s director of platform enforcement and litigation Jessica Romero wrote. Facebook tells TechCrunch that “To date Rankwave has not participated in our investigation and we are trying to get more info from them to determine if there was any misuse of Pages data.”

Facebook explains that “Rankwave used the Facebook data associated with Rankwave’s apps to create and sell advertising and marketing analytics and models — which violated Facebook’s policies and terms” and that it “failed to comply with Facebook’s requests for proof of Rankwave’s compliance with Facebook policies, including an audit.”

More specifically, Facebook cites that its “Platform Policies largely restrict Developers from using Facebook data outside of the environment of the app, for any purpose other than enhancing the app users’ experience on the app.” But Rankwave used Facebook data outside those apps.

Facebook alleges that “Rankwave’s B2B apps were installed and used by businesses to track and analyze activity on their Facebook Pages . . . Rankwave operated a consumer app called the “Rankwave App.” This consumer app was designed to measure the app user’s popularity on Facebook by analyzing the level of interaction that other users had with the app user’s Facebook posts. On its website, Rankwave claimed that this app calculated a user’s ‘Social influence score’ by ‘evaluating your social activities’ and receiving ‘responses from your friends.’”

Facebook is seeking monetary damages plus injunctive relief restraining Rankwave from accessing the Facebook Platform, requiring it to comply with Facebook’s audit, requiring that it delete all Facebook data.

You can learn more about Rankwave’s analytics practices from this 2014 presentation.

Powered by WPeMatico

Equity Shot: Judging Uber’s less-than-grand opening day

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We are back, as promised. Kate Clark and Alex Wilhelm re-convened today to discuss the latest from the Uber IPO. Namely that it opened down, and then kept falling.

A few questions spring to mind. Why did Uber lose ground? Was it the company’s fault? Was it simply the macro market? Was it something else altogether? What we do know is that Uber’s pricing wasn’t what we were expecting and its first day was not smooth.

There are a whole bunch of reasons why Uber went out the way it did. Firstly, the stock market has had a rough week. That, coupled with rising U.S.-China tensions made this week one of the worst of the year for Uber’s monstrous IPO.

But, to make all that clear, we ran back through some history, recalled some key Lyft stats, and more.

We don’t know what’s next but we will be keeping a close watch, specifically on the next cohort of unicorn companies ready to IPO (Postmates, hi!).

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico

Uber’s trading debut: who was (and wasn’t) at the opening bell

Uber finally made its debut Friday on the New York Stock Exchange, ending its decade-long journey from startup to publicly traded company.

So far, it’s been a ho-hum beginning, with shares opening at $42, down from the IPO price. The share price is hovering just under $44.

Thirteen people, including executives, early employees, drivers and customers, were on the balcony for the historic bell ringing that opened the markets Friday. Noticeable absentees were co-founder Garrett Camp and former CEO and co-founder Travis Kalanick, who was ousted from the company in June 2017 after a string of scandals around Uber’s business practices.

Kalanick, who still sits on the board and has an 8.6% stake in Uber, wasn’t part of the opening bell ceremony. However, Kalanick and Camp were both at the NYSE for the event.

Here is who participated in the opening bell ceremony.

The bell ringer

Austin Geidt, who rang the bell, was employee No. 4 when she started as an intern in 2010, and is one of Uber’s earliest employees.

Geidt joined Uber in 2010 and has since worked in numerous positions at the company. She led Uber’s expansion in hundreds of new cities and dozens of new countries. Geidt now heads up strategy for Uber’s Advanced Technologies Group, the unit working on autonomous vehicles.

Executives

CEO Dara Khosrowshahi stood next to Geidt at the opening of the market Friday. Khosrowshahi joined Uber in 2017 after Kalanick resigned and the board launched an extensive search for an executive who could change the culture at the company and prepare it for an eventual IPO.

Khosrowshahi was the CEO of Expedia before joining Uber. Khosrowshahi gave a one-year update on his time at Uber during TechCrunch Disrupt in September 2018.

Uber CTO Thuan Pham has been with the company since 2013. Prior to coming to Uber, Pham was vice president of engineering at VMware.

Rachel Holt, vice president and head of New Mobility, was also on hand. Holt has worked at Uber since October 2011, when the company was live in just three cities. In May 2016, she became VP and regional general manager of Uber’s operations in the U.S. and Canada.

She was promoted to head up new mobility in June 2018. She’s responsible for the ramp-up and onboarding of additional mobility services, including public transit integration, scooters, car rentals and bikes.

Other executives included Pierre-Dimitry Gore-Coty and Andrew MacDonald, both vice presidents and regional general managers at Uber, as well as Jason Droege, a vice president who heads up Uber Eats.

Droege, who joined Uber in 2014, has the official title of head of UberEverything. This is the team that created the food delivery service Uber Eats, which now operates in 35 countries.

Drivers

Uber had five drivers on hand for the opening bell, who represented different services and geographies.

Among the drivers were:

- Jerry Bruner, a Los Angeles-based driver who is a military veteran and former professional golfer. Bruner has completed more than 30,000 Uber trips.

- Tiffany Hanna, a military veteran, is based out of Springfield, Missouri. Hanna is a truck driver who uses the Uber Freight carrier app.

- Jonelle Bain, a New York-based driver. Uber, which shared the bios of the drivers, said Bain is taking coding classes and plans to become a software engineer.

- Onur Kerey is a driver based out of London. Kerey is deaf. According to his bio, “He doesn’t let his disability get in the way of his passion for driving or connecting with others.”

- J. Alexander Palacio Sanchez is based in Australia and has been driving with Uber since 2015. His true passion is acting, according to Uber, and at the urging of his riders, he auditioned for the role of Kevin in “The Heights” — and landed it.

Customers

One customer, Elise Wu, also participated in the opening bell. Wu owns Kampai, a family of restaurants in France that serves affordable cuisine made available for delivery through Uber Eats.

Powered by WPeMatico

Meet Bobbie, a baby formula delivery startup promising healthier ingredients

Don’t like the idea of your baby guzzling down liquid candy all day? It may surprise you to find corn syrup is the main ingredient in most infant formulas in the U.S. That’s where Bobbie, a Bay Area-based baby formula delivery startup promising only wholesome ingredients, hopes to fill in.

Just go down the baby food aisle of any supermarket in America and start reading the ingredients and you’ll likely find corn syrup, soy bean oil, glucose syrup, maltodextrin and palm oil at the top. Even “organic” options often add these ingredients.

While it’s high-fructose corn syrup we should be most concerned with when it comes to diabetes (and some doctors might even recommend adding some sort of syrup to your baby’s diet to combat constipation), corn syrup is not something some parents may want their baby drinking all day.

Touting itself as “European” style, Bobbie’s first product features fresh, grass-fed cows’ milk as the main ingredient. What it does not include, however, is key for the concerned parent. There’s zero corn syrup, maltodextrin or other artificial sugars or unhealthy oils.

Touting itself as “European” style, Bobbie’s first product features fresh, grass-fed cows’ milk as the main ingredient. What it does not include, however, is key for the concerned parent. There’s zero corn syrup, maltodextrin or other artificial sugars or unhealthy oils.

Of course, some babies might not be able to stomach the lactose from bovine sources, but grass-fed and corn syrup-free is music to the ears of many parents (me included) who’ve resorted to ordering bulk from Germany just to avoid feeding our kids Snickers in a bottle.

Yes, it seems crazy to order all the way from Europe when there are so many choices here in the U.S. — and there are some formula manufacturers here making an effort to offer better options — but finding something that meets the simple standard of no sugar, corn syrup or processed oils in the baby food is weirdly difficult.

The other nugget Bobbie provides is delivery. Heaven knows every second is precious when you are a new parent. Delivery can be an especially big help in maintaining some semblance of order in those early days. Sure, Amazon delivers many baby things — it even ships the popular, German-based Hipp brand of formula — but it comes at a premium price and will only ship in bulk.

You can also get the European brands delivered straight from sites like Organic Start, Huggable and a number of others easily Googled. But for those wanting something local, slightly less expensive and with presumably less of a carbon footprint than shipping from another continent, Bobbie is here for you (and we’re told will be delivered with a soft knock on the door, in case baby is sleeping).

The company was founded by two San Francisco moms and former Airbnb operation leaders Laura Modi and Sarah Hardy. Both found out how hard it was, after returning from maternity leave, to pump each day while keeping up with the demands of the job. However, neither of them liked the formula options they found at the grocery store for their own little broods.

Modi and Hardy thought it was time to give parents a more local choice in healthy formula. The two founded the company in 2018 and pulled in $2.5 million in funding last year from Bolt Capital, Nextview Ventures, Lakehouse and Precursor while Modi was pregnant, closing the round a week before giving birth to her baby boy.

Bobbie will (appropriately) begin taking orders this Mother’s Day. Unfortunately, Bobbie only delivers to the Bay Area for now. However, those interested can order one 400 g trial box for $27, which should make about 22 bottles at 6 ounces per bottle, according to a company spokesperson. You can also sign up for the subscription package for $23 per box.

Bobbie Baby – Evolving the conversation of parenthood from Laura Modi on Vimeo.

Powered by WPeMatico

How the trade war with China hit Uber’s public offering

Uber’s much heralded public offering has arrived not so much with a bang as with a whimper, thanks largely to the ongoing trade war between the U.S. and China.

Overnight, the U.S. government made good on the threat from President Donald Trump to hike tariffs on $200 billion worth of Chinese goods to 25% up from 10%.

As a result, stock markets slid further on Friday, and their decline hit Uber’s initial public offering. The company’s shares began trading at $42.54, below its initial pricing of $45 per share.

At its initial pricing, Uber was valued at $75.5 billion, below the $120 billion price that Wall Street thought the company would fetch late last year, but still among the biggest public offerings in history. Only Facebook’s $81 billion public offering and the whopping $169 billion debut of Alibaba were bigger, according to a Dealogic analysis cited by Business Insider.

Uber’s historic public offering — which was designed to raise at least $90 billion for the ride-hailing giant — was no match for the equally historic struggle between the U.S. and China’s emerging economic superpower.

The rising tariffs were designed to hit business equipment, but will also affect prices on some $40 billion in consumer goods — ranging from clothes to furniture, refrigerators, washers and dryers.

Trump boosted tariffs after China reneged on certain concessions it had made during the trade negotiations. Chiefly, the U.S. was looking for written commitments from the Chinese government that it would provide less direct support to its state-owned enterprises and loosen restrictions on U.S. companies operating in the country.

Uber’s disappointing debut can’t be chalked up to trade woes alone. Its immediate American rival, Lyft, has seen its stock decline precipitously since its opening at nearly $79 per share. Lyft is now trading at around $55 per share.

Yesterday, Lyft reported its first earnings as a public company, losing $1.14 billion on $776 million in revenue.

While Lyft is focused on consumer transportation, Uber has expanded to include freight shipping and meal delivery as part of its attempts to become an all-in-one hub for consumer and business logistics.

That expansion has come at a cost. The company may have generated revenues of $11.3 billion in 2018, but it operated at a $3 billion loss for the year. And Uber is deeply in the red. With deficits reaching nearly $8 billion by the end of 2018, as MarketWatch points out.

Trade wars, it seems, trump transportation disruption.

Powered by WPeMatico

Uber opens at a disappointing $42 per share

At long last, it’s lift-off for Uber. After pricing its initial public offering at $45 per share, at the bottom end of the range it set previously, to raise $8.1 billion, the transportation startup began trading today on the New York Stock Exchange, and the shares opened at $42, down from the IPO price.

Ahead of Uber finally making its debut, the company had an indication price that went as low as $42 ahead of live trading. With the overall market in a slump this week over trade woes with China, it’s a challenging time to list, to say the least.

Uber had raised $28.5 billion as a private company from no less than 166 different backers, with its last valuation in the region of $75 billion. The $82.4 billion valuation that it finally settled on for the IPO (selling 180 million shares at $45/share) is definitely up from that, but far from the lofty projections of $120 billion that banks and analysts that floated in the months leading up to today.

The figures nevertheless cement Uber, alongside Alibaba and Facebook, as one of the most valuable tech IPOs in history, and a major beacon for breaking ground in a new area of tech, transportation.

But if it is the sheer scale and potential of Uber that catapulted it to such financial heights (real and imaginary), it’s the bare financials that have tempered some of those notions.

On one side, Uber essentially created and currently dominates the market for on-demand transportation, which started with the premise of connecting drivers with passengers by way of an app that tracked the location of both, but eventually evolved into a wider two-sided marketplace ambition that brings together different modes of transportation — including bikes, public buses and more — with human passengers, as well as the movement of other goods like food, all on a global scale.

That model has propelled Uber to 93 million active platform consumers (from 70 million a year ago) and 17 million trips per day across 700 cities on six continents, along with a lot of high hopes from others like PayPal — which are making very late-stage, strategic investments to bank on what it believes could shape up to be a lucrative e-commerce empire in the years to come.

But Uber’s prospects are not without competition — which includes a host of more regional players like Lyft, Gett, Heetch, MyTaxi, Bolt and more — and not without controversy. Even as it goes public, the company is dealing with high-profile driver protests, lawsuits and ongoing regulatory pressures, not to mention a bigger cloud over its business practices that has hovered for years that the company has worked to dispel.

Even today, during the iconic bell ringing, there was a notable absence: former CEO and co-founder Travis Kalanick, who was ousted over the controversies around business practices but still sits on the board, was not up there — although he did show up at the NYSE for the event.

$UBER The Uber drama Continues: Travis Kalanick — who built @Uber in his image and still sits on the board with an 8.6% stake in the company after being ousted almost two years ago — was not on the balcony to ring the Opening… https://t.co/aUKNKSkFd2 pic.twitter.com/R1h6kOli3d

— Silentmax (@silentmax) May 10, 2019

Outside, meanwhile, protesters against the company were also making their voices heard.

Two drivers hold up a protest sign as the Uber banner hangs on the front of the New York Stock Exchange May 10, 2019 in New York. – Uber is set for its Wall Street debut Friday with a massive share offering that is a milestone for the ride-hailing industry, but which comes with simmering concerns about its business model. Shares will be priced at $45 for the initial public offering (IPO). (Photo: DON EMMERT/AFP/Getty Images)

On the pure metric of profit and loss, Uber’s been firmly in the latter column, most recently posting a loss of some $1 billion in the last quarter on revenues of $3 billion-$3.1 billion, versus $2.6 billion a year ago.

Today’s listing is a small pause on the bigger question of how and if Uber will ever turn that boat around. It has made some significant shifts, such as divesting certain regional assets and reducing some of the incentive payments and discounts it made to drivers around the world to lure them to its platform; and under current CEO Dara Khosrowshahi, it has made a concerted effort to play nice on a number of fronts. Khosrowshahi acknowledged the new set of challenges that staff would be facing as of today in a memo he sent out this morning:

As we move from a private to a public company, our jobs will no doubt become harder and all eyes will be on us. We’ll have an even deeper responsibility to our customers, to our shareholders, to our cities, and to each other. With every share purchased, someone else will join us as a co-owner of Uber — and we’ll gain another person to whom we owe a duty to always ‘do the right thing, period.’

Remember: while the public markets will keep their version of the ‘score’ and the value of what we build, our true north will be determined over the long term. We will go through periods when we will be misunderstood, as well as periods when we will be hailed as heroes. It’s during those days, regardless of the ups and downs, that we should focus on our work: on creating opportunity, on moving the world, and relentlessly innovating and executing.

But the big question will still remain of whether all these changes and the recast approach will be enough, and whether — now that it’s listed — public investors will be patient enough. At least in the short term, the performance of its smaller rival, Lyft, which largely operates on similar metrics and business model to Uber, might give some pause: it is currently trading at around $55, well below its debut of $78.29 on March 29.

Powered by WPeMatico

Why Om Malik thinks ‘the VC subsidized life is over’

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week we had the full Equity staff on hand to dig through the week’s news, helmed by Kate Clark and Connie Loizos, with Alex Wilhelm in the studio too. Plus, Om Malik, a former scribbler and current venture capitalist, joined us to riff on the latest.

Before we dig into what we covered, a small note from the team: As this episode is going out before Uber will trade, we’ll have another episode coming to you tomorrow after the madness. Stay tuned.

Uber priced its IPO at $45 per share right before we hit record, so we first touched on the final pricing of what should be the year’s largest tech IPO. Pricing toward the lower-end of its range, Uber could be setting itself up for a strong first day. Or, demand was lower than expected following Lyft’s slide. Either way, Uber will trade tomorrow as a public company at last. Om predicts Uber and Lyft rides will get a whole lot more expensive in the next eighteen months, so hold onto your hats, the future for riders and drivers alike is… unclear.

Next, we debated Harry’s exit to Edgewell Personal Care. The direct-to-consumer razor supplier sold this week for more than $1 billion in a deal reminiscent of the Dollar Shave Club’s sale to Unilever. From there, we spoke about the latest from the Luckin Coffee IPO. The news, in brief, is that its IPO is moving forward. Next up is pricing; we’ll be sure to discuss any updates on the podcast.

In big deal news, Carta closed a $300 million round. Connie has learned a lot about the business in recent weeks and it turns out, Om wishes he was an investor!

Finally, Cruise’s latest new round, and the capital needs of autonomous driving. As we all quickly agree, it’s an expensive business and not one that will get cheaper. But, given that so many companies are working on the tech, we hope it works out. Especially Om, who doesn’t have a driver’s license, it turns out.

All that and we had fun! Chat tomorrow!

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Pocket Casts, Downcast and all the casts.

Powered by WPeMatico