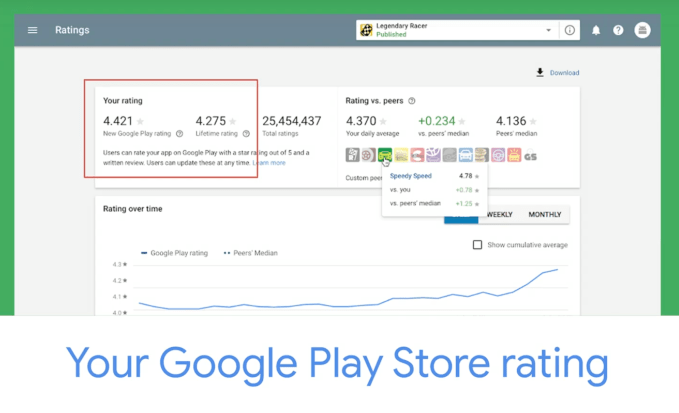

Google Play is changing how app ratings work

Two years ago, Apple changed the way its app store ratings worked by allowing developers to decide whether or not their ratings would be reset with their latest app update — a feature that Apple suggests should be used sparingly. Today, Google announced it’s making a change to how its Play Store app ratings work, too. But instead of giving developers the choice of when ratings will reset, it will begin to weight app ratings to favor those from more recent releases.

“You told us you wanted a rating based on what your app is today, not what it was years ago, and we agree,” said Milena Nikolic, an engineering director leading Google Play Console, who detailed the changes at the Google I/O Developer conference today.

She explained that, soon, the average rating calculation for apps will be updated for all Android apps on Google Play. Instead of a lifetime cumulative value, the app’s average rating will be recalculated to “give more weight” to the most recent users’ ratings.

With this update, users will be able to better see, at a glance, the current state of the app — meaning, any fixes and changes that made it a better experience over the years will now be taken into account when determining the rating.

“It will better reflect all your hard work and improvements,” touted Nikolic, of the updated ratings.

On the flip side, however, this change also means that once high-quality apps that have since failed to release new updates and bug fixes will now have a rating that reflects their current state of decline.

It’s unclear how much the change will more broadly impact Google Play Store SEO, where today app search results are returned based on a combination of factors, including app names, descriptions, keywords, downloads, reviews and ratings, among other factors.

The updated app ratings was one of numerous Google Play changes announced today, along with the public launch of dynamic delivery features, new APIs, refreshed Google Play Console data, custom listings and even “suggested replies” — like those found in Gmail, but for responding to Play Store user reviews.

End users of the Google Play Store won’t see the new, recalculated rating until August, but developers can preview their new rating today in their Play Store Console.

Powered by WPeMatico

Sextech company scorned by CES scores $2M and an apology

Lora DiCarlo, a startup coupling robotics and sexual health, has $2 million to shove in the Consumer Electronics Show’s face.

The same day the company was set to announce their fundraise, The Consumer Technology Association, the event producer behind CES, decided to re-award the Bend, Oregon-based Lora DiCarlo with the innovation award it had revoked from the company ahead of this year’s big event.

In January, the CTA nullified the award it had granted the business, which is building a hands-free device that uses biomimicry and robotics to help people achieve a blended orgasm by simultaneously stimulating the G spot and the clitoris. Called Osé, the device uses micro-robotic technology to mimic the sensation of a human mouth, tongue and fingers in order to produce a blended orgasm for people with vaginas.

Lora DiCarlo’s debut product, Osé, set to release this fall. The company says the device is currently undergoing changes and may look different upon release.

“CTA did not handle this award properly,” CTA senior vice president of marketing and communications Jean Foster said in a statement released today. “This prompted some important conversations internally and with external advisors and we look forward to taking these learnings to continue to improve the show.”

Lora DiCarlo had applied for the CES Innovation Award back in September. In early October, the CTA notified the company of its award. Fast-forward to October 31, 2018 and CES Projects senior manager Brandon Moffett informed the company they had been disqualified. The press storm that followed only boosted Lora DiCarlo’s reputation, put Haddock at the top of the speakers’ circuit and proved, once again, that sexuality is still taboo at CES and that the gadget show has failed to adapt to the times.

In its original letter to Lora DiCarlo, obtained by TechCrunch, the CTA called the startup’s product “immoral, obscene, indecent, profane or not in keeping with the CTA’s image” and that it did “not fit into any of [its] existing product categories and should not have been accepted” to the awards program. CTA later apologized for the mishap before ultimately re-awarding the prize.

At the request of the CTA, Haddock and her team have been working with the organization to create a more inclusive show and better incorporate both sextech companies and women’s health businesses.

“We were a catalyst to a huge, resounding amount of support from a very large community of people who have been quietly thinking this is something that needs to happen,” Haddock told TechCrunch. “For us, it was all about timing.”

Lora DiCarlo plans to use its infusion of funding, provided by new and existing investors led by the Oregon Opportunity Zone Limited Partnership, to hire ahead of the release of its first product. Pre-orders for the Osé, which will retail for $290, will open this summer with an expected official release this fall.

Haddock said four other devices are in the pipeline, one specifically for clitoral stimulation, another for clitoral and vaginal stimulation, one for anywhere on the body and the other, she said, is a different approach to the way people with vulvas masturbate.

“We are aiming for that hands-free, human experience,” Haddock said. “We wanted to make something really interesting and very different and beautiful.”

Next year, Haddock says they plan to integrate their products with virtual reality, a step that will require a larger boost of capital.

Haddock and her employees don’t plan to quiet down any time soon. With their newfound fame, the team will continue supporting the expanding sextech industry and gender equity within tech generally.

“We’ve realized our social mission is so important,” Haddock said. “Gender equality, at its source, is about sex. We absolutely demonize sex and sexuality … When you talk about removing sexual stigmas, you are also talking about removing gender stigmas and creating gender equity.”

Powered by WPeMatico

Rent the Runway just opened its largest brick-and-mortar store yet

Who would have thought Rent the Runway would emerge as a competitor to The Wing and all traditional brick-and-mortar retail?

Its newest store, complete with co-working space, shows it’s more than just a designer gown rental service. Shortly after landing a $125 million investment at a $1 billion valuation, Rent the Runway (RTR) has replanted roots in San Francisco, opening an 8,300 square foot West Coast flagship in the city’s Union Square neighborhood.

Located on 228 Grant Avenue, the store is RTR’s fifth and largest location yet. In addition to 3,000 pieces of merchandise curated daily, the store includes stylists, a coffee cart, space for evening programming and networking events, desk space for co-working, a beauty bar and some 20 dressing rooms.

“Think of it like your gym or your Starbucks; it’s part of what you do on a daily basis,” RTR chief operating officer Maureen Sullivan told TechCrunch.

RTR was founded in 2009 by Jenn Hyman and Jenny Fleiss as a website for renting expensive, designer dresses. Since then it’s expanded to become a fashion rental marketplace equipped with accessories, casual pieces and its bread and butter: formal wear.

The company’s core product, RTR Reserve, lets customers rent one piece of clothing for four to eight days with prices starting at $30 per garment. RTR Update, at $89 per month, gives customers access to up to four pieces of clothing per month. And finally, RTR Unlimited charges users $159 for unlimited swaps every month, meaning you get up to four pieces at a time but can visit a store daily and swap the pieces out, if you wanted.

Its new space is essentially The Wing with an enormous closet of designer clothing available to rent. RTR even used the same all-female design team that crafted The Wing’s spaces to create its newest spot, which mimics The Wing’s airy, West Elm-like vibe.

Of course, RTR isn’t trying to compete with co-working spaces or salons or coffee shops; rather, the team recognizes that sometimes women need to find beautiful clothes and get shit done simultaneously.

“Our subscriber is a busy working woman,” Sullivan said. “Sometimes she may want to come in and work.”

The new store was built for the 21st century tech-enabled consumer. A “physical manifestation of the shared closet,” the store’s technology allows customers to return rented items within a few seconds, check out with their RTR Pass on their phone and pick up orders without having to wait in line.

RTR currently operates physical stores in Chicago, New York, Woodland Hills, Calif. and Washington, DC. Sullivan says San Francisco is the company’s third largest market behind New York and DC.

RTR opened its first standalone location in San Francisco last year and quickly realized the space was too small for its expanding crowd of subscribers. While the service was intended to be all-digital, data collected by RTR indicated users wanted to try on clothes before they rented. With that in mind, RTR will continue to open additional stores and “experiment with its physical presence” in other ways, too.

“Data is at the heart of our company,” Sullivan said. “We aren’t a typical direct-to-consumer brand.”

RTR has raised a total of $521 million in debt and equity funding from Franklin Templeton Investments, T. Rowe Price, Female Founders Fund and others.

Powered by WPeMatico

Alibaba-backed facial recognition startup Megvii raises $750 million

One of China’s most ambitious artificial intelligence startups, Megvii, more commonly known for its facial recognition brand Face++, announced Wednesday that it has raised $750 million in a Series E funding round.

Founded by three graduates from the prestigious Tsinghua University in China, the eight-year-old company specializes in applying its computer vision solutions to a range of use cases such as public security and mobile payment. It competes with its fast-growing Chinese peers, including the world’s most valuable AI startup, SenseTime — also funded by Alibaba — and Sequoia-backed Yitu.

Bloomberg reported in January that Megvii was mulling to raise up to $1 billion through an initial public offering in Hong Kong. The new capital injection lifts the company’s valuation to just north of $4 billion as it gears up for its IPO later this year, sources told Reuters.

China is on track to overtake the United States in AI on various fronts. Buoyed by a handful of mega-rounds, Chinese AI startups accounted for 48 percent of all AI fundings in 2017, surpassing those in the U.S. for the first time, shows data collected by CB Insights. An analysis released in March by the Allen Institute for Artificial Intelligence found that China is rapidly closing in on the U.S. by the amount of AI research papers published and the influence thereof.

A critical caveat to China’s flourishing AI landscape is, as The New York Times and other publications have pointed out, the government’s use of the technology. While facial recognition has helped the police trace missing children and capture suspects, there have been concerns around its use as a surveillance tool.

Megvii’s new funding round arrives just days after a Human Rights Watch report listed it as a technology provider to the Integrated Joint Operations Platform, a police app allegedly used to collect detailed data from a largely Muslim minority group in China’s far west province of Xinjiang. Megvii denied any links to the IJOP database per a Bloomberg report.

Kai-Fu Lee, a world-renowned AI expert and investor who was Google’s former China head, warned that any country in the world has the capacity to abuse AI, adding that China also uses the technology to transform retail, education and urban traffic among other sectors.

Megvii has attracted a rank of big-name investors in and outside China to date. Participants in its Series E include Bank of China Group Investment Limited, the central bank’s wholly owned subsidiary focused on investments, and ICBC Asset Management (Global), the offshore investment subsidiary of the Industrial and Commercial Bank of China.

Foreign backers in the round include a wholly owned subsidiary of the Abu Dhabi Investment Authority, one of the world’s largest sovereign wealth funds, and Australian investment bank Macquarie Group.

Megvii says its fresh proceeds will go toward the commercialization of its AI services, recruitment and global expansion.

China has been exporting its advanced AI technologies to countries around the world. Megvii, according to a report by the South China Morning Post from last June, was in talks to bring its software to Thailand and Malaysia. Last year, Yitu opened its first overseas office in Singapore to deploy its intelligence solutions to partners in Southeast Asia. In a similar fashion, SenseTime landed in Japan by opening an autonomous driving test park this January.

“Megvii is a global AI technology leader and innovator with cutting-edge technologies, a scalable business model and a proven track record of monetization,” read a statement from Andrew Downe, Asia regional head of commodities and global markets at Macquarie Group. “We believe the commercialization of artificial intelligence is a long-term focus and is of great importance.”

Powered by WPeMatico

Steve Singh stepping down as Docker CEO

TechCrunch has learned that Docker CEO Steve Singh will be stepping down after two years at the helm, and former Hortonworks CEO Rob Bearden will be taking over. An email announcement went out this morning to Docker employees.

People close to the company confirmed that Singh will be leaving the CEO position, staying on the job for several months to help Bearden with the transition. He will then remain with the organization in his role as chairman of the board. They indicated that Bearden has been working closely with Singh over the last several months as a candidate to join the board and as a consultant to the executive team.

Singh clicked with him and viewed him as a possible successor, especially given his background with leadership positions at several open-source companies, including taking Hortonworks public before selling to Cloudera last year. Singh apparently saw someone who could take the company to the next level as he moved on. As one person put it, he was tired of working 75 hours a week, but he wanted to leave the company in the hands of a capable steward.

Last week in an interview at DockerCon, the company’s annual customer conference in San Francisco, Singh appeared tired, but a leader who was confident in his position and who saw a bright future for his company. He spoke openly about his leadership philosophy and his efforts to lift the company from the doldrums it was in when he took over two years prior, helping transform it from a mostly free open-source offering into a revenue-generating company with 750 paying enterprise customers.

In fact, he told me that under his leadership the company was on track to become free cash flow positive by the end of this fiscal year, a step he said would mean that Docker would no longer need to seek outside capital. He even talked of the company eventually going public.

Apparently, he felt it was time to pass the torch before the company took those steps, saw a suitable successor in Bearden and offered him the position. While it might have made more sense to announce this at DockerCon with the spotlight focused on the company, it was not a done deal yet by the time the conference was underway in San Francisco, people close to the company explained.

Docker took a $92 million investment last year, which some saw as a sign of continuing struggles for the company, but Singh said he took the money to continue to invest in building revenue-generating enterprise products, some of which were announced at DockerCon last week. He indicated that the company would likely not require any additional investment moving forward.

As for Bearden, he is an experienced executive with a history of successful exits. In addition to his experience at Hortonworks, he was COO at SpringSource, a developer tool suite that was sold to VMware for $420 million in 2009 (and is now part of Pivotal). He was also COO at JBoss, an open-source middleware company acquired by Red Hat in 2006.

Whether he will do the same with Docker remains to be seen, but as the new CEO, it will be up to him to guide the company moving forward to the next steps in its evolution, whether that eventually results in a sale or the IPO that Singh alluded to.

Email to staff from Steve Singh:

Note: Docker has now confirmed this story in a press release.

Powered by WPeMatico

SoFi launches gig-focused ETF

SoFi is one of the leading fintech startups to emerge from San Francisco and breach the financial markets. Originally started as a way to better finance student debt, it has since expanded to include products targeted at personal loans and home loans.

Today, the company announced a new exchange-traded fund (ETF) product focused on the gig economy. GIGE, which trades on Nasdaq, is an actively managed fund advised by Toroso Investments that allows investors to capitalize on this hot sector of the economy. Toroso offers a range of services around creating and managing ETFs.

The company also announced the creation of an ETF focused on high-growth stocks. That ETF, which trades as SFYF on the NYSE, is designed to identify and capture the growth of the top 50 of the 1,000 largest publicly traded issues.

It has formerly used that growth focus to create two ETFs, targeting 500 high-growth companies under the trading name SFY and a product it called “SoFi Next 500 ETF,” which trades under SFYX, both of which have no management fees.

SoFi’s SFYF fund is composed specifically of public companies that show the strongest growth on three key metrics: top-line revenue growth, net income growth and forward-looking consensus estimates of net income growth.

For its GIGE fund, SoFi defines the “gig economy” as a group of companies that “embrace and support the workforce in which employment is based around short-term engagements that allow for flexibility and personal freedom and temporary contracts.”

SoFi’s new funds add value to investors primarily through providing 1) access to industry disruptors at 2) an earlier-stage point in their growth cycle.

In recent years, more and more investors have been trying to get a piece of the hottest tech companies earlier with a growing number of traditional institutional investors now dipping their toes into startup and tech investing.

Furthermore, a number of platforms and funds were launched to support the high-demand for access to some of the top public and private companies and major disruptive trends, including funds focused on themes such as artificial intelligence, big data, cybersecurity or the next manufacturing revolution.

SoFi argues that its GIGE fund offers compelling value due to the speed at which it offers investors access to new equity issues, as the fund is structured so that most post-IPO companies can join the GIGE within 31 days of IPO, relative to the 60-90 days traditional passive funds that often have to wait to add a newly IPO’d company.

Additionally, because SoFi’s GIGE fund is actively managed, SoFi is also offering fund investors access to experienced asset managers and an alternative to algorithmic, machine-led passive funds that have increasingly dominated the capital markets.

“Our members are excited by high-growth and gig economy companies because these companies are in many cases part of their lives,” said SoFi CEO Anthony Noto in a press release. “We’re giving our members a way to get started investing by buying what they know and investing in themselves.”

The announcement is the company’s latest step in its attempt to further establish itself under the new guard of CEO Anthony Noto, formerly of Goldman Sachs, who replaced former head Michael Cagney in 2018, as the company looks to move further away from dark clouds in its past established by lawsuits, sexual harassment claims, FTC penalties and chunky rounds of layoffs. In the past week, the company also announced that CMO and former COO, Joanne Bradford, will be leaving the company at the end of May, though the split was reportedly long-planned and amicable.

The launch of SoFi’s new investment products also comes just weeks after the company was reportedly in discussions to raise $500 million from the Qatar Investment Authority.

To date, SoFi has raised roughly $2 billion in venture capital, according to data from Crunchbase, with backing from a number of Silicon Valley and Wall Street heavy hitters, including SoftBank, Silver Lake Partners, Morgan Stanley, Founders Fund and a host of others.

Already at a valuation of nearly $4.5 billion, according to PitchBook, SoFi appears well on its way to an eventual IPO. Noto, however, noted in a recent interview with Yahoo Finance that “an IPO is not a priority at this point” for SoFi as the company remains focused on executing on a high-quality sustainable growth path.

Powered by WPeMatico

Sumo Logic announces $110M Series G investment on valuation over $1B

Sumo Logic, a cloud data analytics and log analysis company, announced a $110 million Series G investment today. The company indicated that its valuation was “north of a billion dollars,” but wouldn’t give an exact figure.

Today’s round was led by Battery Ventures with participation from new investors Tiger Global Management and Franklin Templeton. Other unnamed existing investors also participated, according to the company. Today’s investment brings the total raised to $345 million.

When we spoke to Sumo Logic CEO Ramin Sayar at the time of its $75 million Series F in 2017, he indicated the company was on its way to becoming a public company. While that hasn’t happened yet, he says it is still the goal for the company, and investors wanted in on that before it happened.

“We don’t need to raise capital. We had plenty of capital already, but when you bring on crossover investors and others in this stage of a company, they have minimum check sizes and they have a lot of appetite to help you as you get ready to address a lot of the challenges and opportunities as you become a public company,” he said.

He says the company will be investing the money in continuing to develop the platform, whether that’s through acquisitions, which of course the money would help with, or through the company’s own engineering efforts.

The IPO idea remains a goal, but Sayar was not willing or able to commit to when that might happen. The company clearly has plenty of runway now to last for quite some time.

“We could go out now if we wanted to, but we made a decision that that’s not what we’re going to do, and we’re going to continue to double down and invest, and therefore bring some more capital in to give us more optionality for strategic tuck-ins and product IP expansion, international expansion — and then look to the public markets [after] we do that,” he said.

Dharmesh Thakker, general partner at investor Battery Ventures, says his firm likes Sumo Logic’s approach and sees a big opportunity ahead with this investment. “We have been tracking the Sumo Logic team for some time, and admire the company’s early understanding of the massive cloud-native opportunity and the rise of new, modern application architectures,” he said in a statement.

The company crossed the $100 million revenue mark last year and has 2,000 customers, including Airbnb, Anheuser-Busch and Samsung. It competes with companies like Splunk, Scalyr and Loggly.

Powered by WPeMatico

Tencent replaces hit mobile game PUBG with a Chinese government-friendly alternative

China’s new rules on video games, introduced last month, are having an effect on the country’s gamers. Today, Tencent replaced hugely popular battle royale shooter game PUBG with a more government-friendly alternative that seems primed to pull in significant revenue.

The company introduced “Game for Peace” in a Weibo post at the same time as PUBG — which stands for Player Unknown Battlegrounds — was delisted from China. The title had been in wide testing but without revenue, and now it seems Tencent gave up on securing a license to monetize the title.

In its place, Game for Peace is very much the type of game that will pass the demands of China’s game censorship body. Last month, the country’s State Administration of Press and Publication released a series of demands for new titles, including bans on corpses and blood, references of imperial history and gambling. The new Tencent title bears a striking resemblance to PUBG, but there are no dead bodies, while it plays up to a nationalist theme with a focus on China’s air force — or, per the Weibo message, “the blue sky warriors that guard our country’s airspace” — and their battle against terrorists.

Game for Peace was developed by Krafton, the Korea-based publisher formerly known as BlueHole which made PUBG. Beyond visual similarities, Reuters reported that the games are twinned since some player found that their progress and achievements on PUBG had transferred over to the new game.

Tencent representatives declined to comment on the new game or the end of PUBG’s “beta testing” period in China when contacted by TechCrunch. But a company rep apparently told Reuters that “they are very different genres of games.”

Tencent’s new “Game for Peace” title is almost exactly the same as its popular PUBG game, which it is replacing [Image via Weibo]

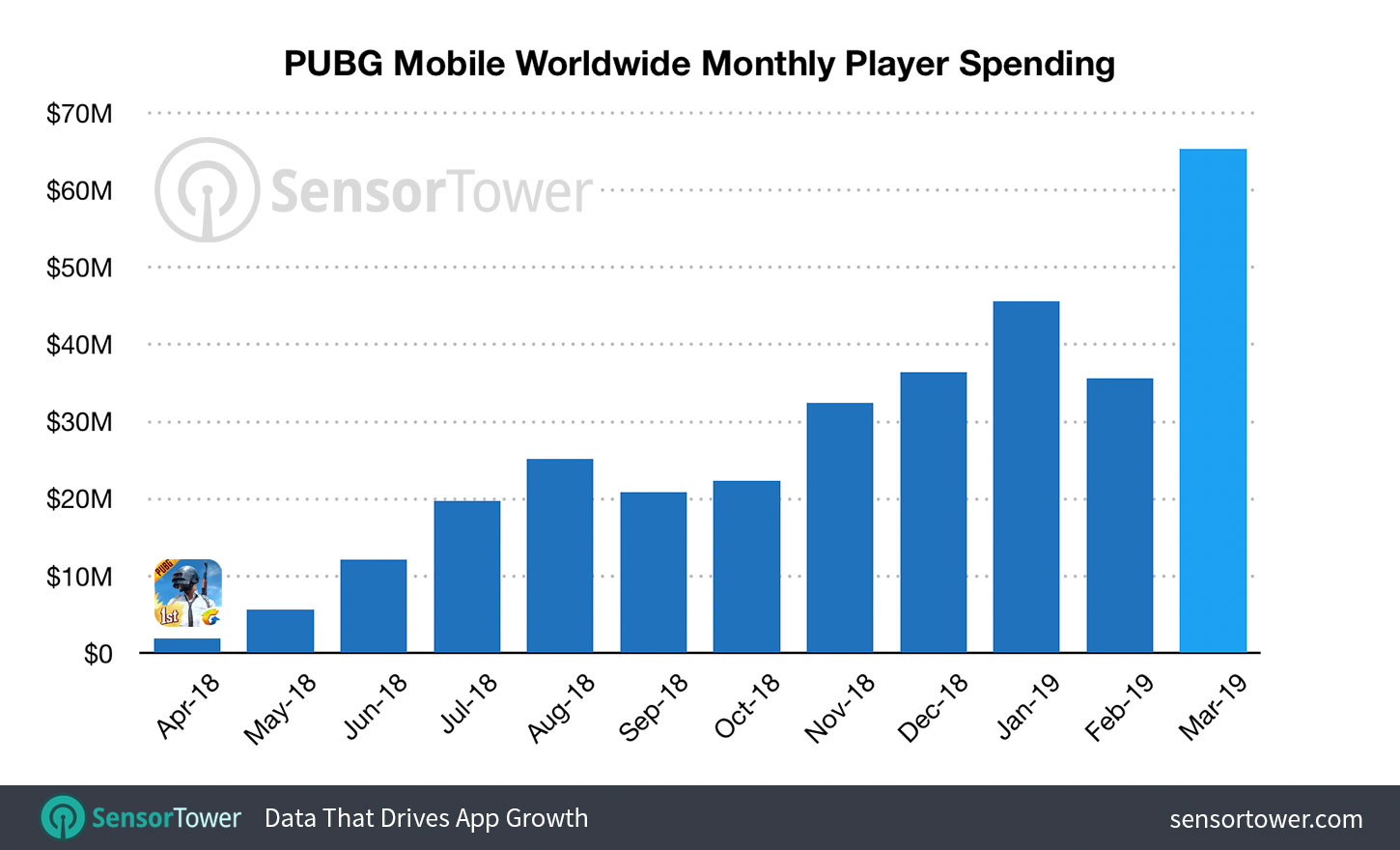

Fortnite may have grabbed the attention for its explosive growth — we previously reported that the game helped publisher Epic Games bank a profit of $3 billion last year — but PUBG has more quietly become a fixture among mobile gamers, particularly in Asia.

At the end of last year, Krafton told The Verge that it was past 200 million registered gamers, with 30 million players each day. According to app analytics company Sensor Tower, PUBG grossed more than $65 million from mobile players in March thanks to 83 percent growth, which saw it even beat Fortnite. There is also a desktop version.

PUBG made more money than Fortnite on mobile in March 2019, according to data from Sensor Tower

That is really the point of Tencent’s switcheroo: to make money.

The company suffered at the hands of China’s gaming license freeze last year, and a regulatory-compliant title like Game for Peace has a good shot at getting the green light for monetization — through the sale of virtual items and seasonal memberships.

Indeed, analysts at China Renaissance believe the new title could rake in as much as $1.5 billion in annual revenue, according to the Reuters report. That’s a lot to get excited about and resuscitating gaming will be an important part of Tencent’s strategy this year — which has already seen it restructure its business to focus emerging units like cloud computing, and pledge to use its technology to “do good.”

Powered by WPeMatico

HeyJobs, a ‘talent acquisition’ platform out of Berlin, raises $12M Series A

HeyJobs, a three-year-old Berlin startup that helps large employers scale recruitment, has raised $12 million in Series A funding.

The round is led by Notion Capital, with participation from existing investors Creathor Ventures, Rocket Internet’s GFC and newly re-branded Heartcore Capital.

Founded in 2016 and launched the following year, HeyJobs aims to tackle the recruitment problem European employers are facing due to steep declines in available workforce as the so-called the “boomer” generation nears retirement (this is seeing Germany alone losing 500,000 workers annually, apparently).

The HeyJobs platform leverages machine learning in an attempt to make high-skilled recruitment more scalable. It promises to match talent with job profiles and draw in the best candidates via targeted marketing and a “personalized application and assessment flow.”

“We use a fully automated technological approach to help candidates find jobs and companies find employees,” says HeyJobs co-founder and CEO Marius Luther.

“For example, we deploy multiple machine learning algorithms to find the right potential candidates for a specific role (asking ‘who are the most likely candidates for an intensive care nurse role in East London?’). Our technology then makes sure candidates see the job proposal on channels such as Facebook, Instagram, job platforms and across the web.”

In addition, Luther says that HeyJobs’ personalized assessment ensures that the company only delivers to employers high-quality, hireable candidates, something he dubs as “predictable hiring” at scale.

“Our clients are typically the talent acquisition teams of employers with high-volume recruitment needs,” he explains. “In Germany, 8/10 largest employers (by headcount) are our clients. Typical industries would be logistics (i.e. DPD, UPS), retail (i.e. Vodafone) and hospitality (i.e. h-hotels, Five Guys). However our real customer is the non-academic job seeker who is looking for a job that will help him/her live a more fulfilling life — be it by being paid more, switching to better employment conditions or finding a job closer to home.”

To that end, HeyJobs says it is now serving more than 500 enterprise clients, including United Parcel Service, PayPal, Five Guys, Vodafone and Securitas. The company generates revenue via a range of business models, from subscription to per-hire success fees.

“The cost per hire is typically a fraction of what clients would pay job boards on a per-post basis or what they would pay to staffing firms on a per-hire basis,” adds the HeyJobs CEO.

Powered by WPeMatico

India’s edtech startup CollegeDekho raises $8 million to connect students with colleges

Indian edtech startup CollegeDekho, which helps students connect with prospective colleges and keep track of exams, has raised $8 million in a Series B round.

The new financing round for the four-year-old Gurgaon-based startup was led by its parent company GirnarSoft Education and London-based private equity investor Man Capital, which also participated in the startup’s Series A round last year.

Ruchir Arora, founder and CEO of CollegeDekho, told TechCrunch in an interview that the startup will use the capital to expand its presence in more schools and also begin connecting students with international educational institutions. The startup, which has raised $13 million to date, will also ramp up its research and development efforts.

CollegeDekho, Hindi for search for college, maintains a website that helps students identify the right career choices for them. The website has a chatbot that answers some of the questions students have while logging their responses, and other activities such as the kind of colleges they are searching for, their preferred location and budget.

Arora said the startup, which also has about 3,000 call center representatives and counselors, builds profiles of students to make college recommendations. He said each month the site observes more than five million sessions from students. Last year, more than 8,000 students used CollegeDekho to take admission in a college.

Parents in India, a country of 1.3 billion people with not the best literacy record, see education as an upward mobility for their children. Each year, more than six to seven million students go to a college. But because of a range of factors that can include cultural stigma, many students end up choosing the wrong path and thus don’t excel in college. Indeed, many students ultimately don’t pursue the subject they are best suited for, Arora said, and that’s where CollegeDekho aims to make an impact.

Most high school students in India often gravitate toward engineering or medical college, as a result of which, each year India produces many engineers and doctors who struggle for years to find a job. Arora said his startup looks at more than 2,000 career paths a student could pursue.

What works in favor of Arora is that the country will continue to turn out millions of students each year who will be looking to go to a college soon. It also helps that CollegeDekho is operationally profitable, Arora said, adding that it generates about $3.2 million in revenue in a year. Any additional cash the startup raises will go into its expansion, he said.

CollegeDekho charges a nominal fee from students, and also takes a cut when they join a college. More than 36,000 educational institutes are listed on CollegeDekho. The startup also works with more than 400 colleges to conduct an exam for direct admission, and there too it earns a cut.

India’s education market, estimated to grow to $5.7 billion by next year, has emerged as a lucrative opportunity for startups and VCs alike. Bangalore-based Byju’s, which helps millions of students in India prepare for competitive exams, raised $540 million from Naspers and others late last year. Unacademy, which like Byju’s offers online tutoring to students, has raised more than $38.5 million to date.

A legion of other education startups today are vying for the attention of students in the nation. Noida-based AskIITians, not too far from the offices of CollegeDekho, aims to help school-going students prepare for medical and engineering exams. Extramarks, also based in Noida, operates in the same space as AskIITians. Reliance Industries, owned and controlled by India’s richest man, Mukesh Ambani, bought a 38.5% stake in the startup three years ago.

Powered by WPeMatico