Carta was just valued at $1.7 billion by Andreessen Horowitz, in a deal some see as rich

Carta, a seven-year-old, San Francisco-based startup, is the newest unicorn in tech. The company, which largely helps private company investors, founders, and employees manage their equity and ownership, tells TechCrunch it has raised $300 million in a Series E round at a $1.7 billion valuation, led by Andreessen Horowitz. Firm co-founder Marc Andreessen is also joining the board.

The round has been a poorly kept secret. The outlet The Information reported more than a month ago the details that Carta is sharing today. In fact, that leak has given people in the industry who understand Carta’s business time to quietly ask of its valuation whether it isn’t high for a company that does what it does.

Unsurprisingly, Carta argues that it is not, that it has evolved considerably from the outset — which is true. Though it launched as a way for venture-backed companies to mange equity, issue securities, and track their cap tables, by 2014, Carta, formerly known as eShares, had moved beyond replacing paper records and into selling as a monthly service appraisals of the fair market value of private companies’ common stock in order to determine their strike price. It calls this “409A-as-a-service.”

Carta has continued tacking on more services. Among the most notable was the launch last year of a fund administration product designed to help venture capital firms not only manage their portfolio stakes more easily but to more seamlessly work with their own investors or limited partners. Toward this end, Carta now provides portfolio analytics, including deal IRRs and cash management, it helps VCs distribute their quarterly investor reports and it integrates with third-party tax and payroll providers.

Carta has so many pieces in place that in a call on Friday, founder and CEO Henry Ward told us Carta is taking what may be its biggest step yet and becoming the first real “private stock market for companies.” Its massive new funding round is “about act three,” he said. “Now that you have this network of companies and investors all on one platform and the ability to transfer securities, you can build liquidity on top of it.” It’s this vision that enticed Andreessen to jump aboard, he suggested.

There’s unquestionably a need for a kind of private stock market. Private funding has been outpacing IPO funding for years, and it shows no sign of stopping. It’s largely why the SEC is trying to better enable people who are not accredited investors to access private company shares. Most of the U.S. has missed out on the wealth creation happening before companies go public or sell to other companies.

It’s also true that Carta has its hooks into a meaningful number of startups and venture firms at this point. The company says more than 700,000 shareholders are on its platform, that it works with more than 11,000 companies and that its fund administration product now serves 143 venture firms.

Still, some longtime industry observers wonder if Carta isn’t mashing together a lot of disparate, moderately lucrative businesses and positioning it as the next-big platform company, and the view resonates. For one thing, Carta likes to talk about assets managed, though it’s really talking about how much in assets the startups and VCs that use its platform control, which is $575 billion altogether. Carta — which now employs nearly 600 employees across seven offices — says its own annual revenue run rate is currently $55 million.

Relatedly, while Ward says Carta’s primary revenue right now is its software subscription business — another revenue stream is the money it’s paid by the venture firms that use it as a fund administrator — people who question Carta’s fundraising note the people-intensive nature of the kind of work that Carta has been systemizing. Yes, there’s a sophisticated software component, but Carta is more Accenture than Salesforce, and services businesses are valued very differently.

There’s also the question of growth. Ward points to the roughly 450 startups that are garnering venture funding each month right now — all potential customers for Carta. But plenty of companies are also quietly going out of business all the time, a process that will accelerate whenever this very long funding boom finally slows.

This newest business conveys the impression that big things are coming, though it doesn’t sound exactly like a private stock market as Ward describes it, either. Primarily, it won’t provide the relative transparency that stock markets do. We don’t think that’s the case, anyway. Ward was somewhat dismissive of questions we asked about how Carta’s newest business will be fundamentally different than that of secondary players in the market that are already making it possible for shareholders to value and transact shares.

Indeed, though Carta says it’s changing how assets are acquired, valued and transacted, Ward also did not respond to several simple follow-up queries sent to him on Friday about the mechanics of this new business, dubbed CartaX. Instead, he thanked us for our efforts to understand and articulate Carta’s business. Meanwhile, his press team told us it was limited in what it can say about how CartaX operates for now.

Carta has savvy investors. In addition to Andreessen Horowitz, this newest round includes Lightspeed Venture Partners, Goldman Sachs Principal Strategic Investments, Tiger Global, Thrive Capital and earlier backers Tribe Capital, Menlo Ventures and Meritech Capital.

No doubt that in valuing the company, they took into account that Solium — a Canada-based software-as-a-service for stock administration, financial reporting and compliance that was publicly traded — sold for $900 million in cash earlier this year to Morgan Stanley. That’s roughly double Carta’s total funding so far of $447 million.

More likely, they were viewing the company based on its potential as a kind of more liquid market, ambitious as that might seem today. Consider that the parent company to both the NYSE and the Chicago Stock Exchange currently has a market cap of roughly $45 billion. Then again, that company operates 12 exchanges and marketplaces altogether, and it enjoyed more than $6 billion in revenue last year by transacting more than a $100 billion dollars in volume on the NYSE alone on a daily basis.

Perhaps most important to them, Carta is now as well-positioned as anyone to capture and cater to the growing number of privately held companies looking to provide more of their employees liquidity and to cash out early investors. Add to the mix a mega-round and a star board member, and the company may well get to where Ward and his investors want it to go.

We’ll be watching to see.

[Correction: We’d originally misstated the market cap of Intercontinental Exchange, owner of the NYSE and Chicago Stock Exchange, among other marketplaces; we cited its annual revenue instead.]

Powered by WPeMatico

Grocery startup BigBasket becomes India’s newest unicorn with new $150M investment

India has a new unicorn after BigBasket, a startup that delivers groceries and perishables across the country, raised $150 million for its fight against rivals Walmart’s Flipkart, Amazon and hyperlocal startups Swiggy and Dunzo.

The new financing round — a Series F — was led by Mirae Asset-Naver Asia Growth Fund, the U.K.’s CDC Group and Alibaba, BigBasket said on Monday. The closing of the round has officially helped the seven-year-old startup surpass $1 billion valuation, co-founder Vipul Parekh, who heads marketing and finances for the company, told TechCrunch in an interview. Chinese giant Alibaba, which also led the Series E round in BigBasket last year, is the largest investor in the company, with about 30% stake, a person familiar with the matter said.

The company, which offers more than 20,000 products from 1,000 brands in more than two dozen cities, will deploy the fresh capital into expanding its supply-chain network, adding more cold storage centers and distribution centers to serve customers faster, Parekh said. The company also plans to add about 3,000 vending machines that offer daily eatable items, such as vegetables, snacks and cold drinks in residential apartments and offices by next month, he added.

Infusion of $150 million for BigBasket, which raised $300 million last year, comes at a time when both Walmart’s Flipkart and Amazon are increasingly expanding their grocery businesses in India.

Amazon Retail India, which operates Amazon Pantry and Prime Now services and has a presence in mire than 100 cities, is reportedly planning to expand its business in India. Flipkart Group CEO Kalyan Krishnamurthy said in an interview with the Economic Times last month that the e-commerce giant may pilot a fresh foods business soon. Last week, Flipkart was said to be in talks to acquire grocery chain Namdhari’s Fresh.

Parekh largely brushed off the challenge his company faces from Flipkart and Amazon at this stage, saying that “it is a very large market, and it is unlikely to be dominated by one single company for the simple reason of its complex nature.” Flipkart and Amazon may eventually get serious about this space, but so far their play with groceries is mostly an additional differentiation checkpoint, he said.

“The success in this business requires having the ability to build and manage a very complex supply chain across multiple categories such as vegetables, meat and beauty products among others. Our focus has been on building the supply chain, and also ensuring that we are able to deliver a very large assortment of products to consumers,” he added. He said BigBasket today offers the largest catalog and fastest delivery among any of its rivals.

Besides, BigBasket, which is increasingly growing its subscription business to supply milk and other daily eatables, is also inching closer to becoming financially stronger. Parekh said BigBasket expects to become operationally profitable in six to eight months. “The idea is that business by itself does not consume cash. If we use cash, it will be for investment in new businesses or scaling of existing businesses,” he said.

India’s retail market, valued at mire than $900 billion, is increasingly attracting the attention of VC funds. Since 2014, online retailers alone have participated in more than 163 financing rounds, clocking over $1.38 billion, analytics firm Tracxn told TechCrunch. More than 882 players are operational in the market, the firm said.

The challenge for BigBasket remains fighting a growing army of rivals, including hyperlocal delivery startups including Grofers, which raised $60 million earlier this year, unicorn Swiggy and Google-backed Dunzo, which is increasingly becoming a verb in urban Indian cities.

Powered by WPeMatico

Health coaching app Noom will expand its product team after raising $58M led by Sequoia

Health coaching app developer Noom announced today that it has raised $58 million led by Sequoia Capital.

Other participants include Aglaé Ventures, the tech investment arm of French holding company Groupe Arnault, WhatsApp co-founder and former CEO Jan Koum, DoorDash co-founder and CEO Tony Xu, Oscar Health co-founder Josh Kushner, SB Project co-founder Scooter Braun and returning investor Samsung Ventures.

Headquartered in New York City with offices in Seoul and Tokyo, Noom is best known for its direct-to-consumer weight loss app, but it also develops enterprise products, including an app focused on diabetes and hypertension. Noom’s consumer app competes for users with Under Armour’s MyFitnessPal and Weight Watchers, but its closest rival is probably nutrition and weight loss app Rise because both offer personalized programs and coaching for a subscription fee.

Noom aims to set itself apart by focusing on long-term lifestyle and behavior changes, in addition to calorie, nutrition and exercise tracking. Users get access to 1:1 coaching and fitness programs personalized by an algorithm based on how they answer a questionnaire.

The company will use its new funding to hire more people for product development. In a press statement, Koum said he invested in Noom because it “has many of the same traits that helped WhatsApp disrupt the communications industry. Noom is so far ahead of the competition when it comes to technology, execution and brand recognition that it will be difficult for any company to catch up.”

Powered by WPeMatico

SendBird snags additional $50M for messaging API tool, as it extends Series B to $102M

SendBird, a startup that enables developers to add messaging to their apps with a couple of lines of code, announced a secondary Series B investment of $50 million today. This additional funding comes on top of the $52 million, the company raised in February.

The new money was led by Tiger Global Management, with significant participation from Iconiq, the firm that led the initial Series B round. Today’s investment brings the total raised to more than $120 million, according to Crunchbase data.

This is a huge investment for a Series B-level company, and what appears to be driving such a large influx of cash is a fast-growing market with tremendous demand for user-to-user messaging inside apps. By offering this as an API service, developers can drop the capability into their apps without having to build it from scratch. It’s a similar value proposition as Twilio for communications or Stripe for payments.

As SendBird CEO John Kim told us in the first part of the Series B investment in February, his company is aiming to make it simple for developers to add in-app messaging:

We are a very flexible, fully customizable, white label messaging capability. We come with a fully managed infrastructure. So basically, you can log into any mobile applications or websites out there, and use our messaging capability.

Kim says today’s additional money comes at a time when his company is accelerating its go-to-market strategy. “Starting from marketing and sales, we are building the go-to-market engine to scale our global presence by hiring leaders in key areas of the business and building teams around those leaders. To accelerate this process, we’re working with our new investors for Series B, who have made many investments in our target markets and built strong connections there,” Kim told TechCrunch.

Founded in South Korea in 2013, SendBird has 98 employees, with headquarters in San Mateo, Calif. It was a member of the Y Combinator Winter 2016 class.

Powered by WPeMatico

Startups Weekly: Will the Seattle tech scene ever reach its full potential?

Greetings from Seattle, the land of Amazon, Microsoft, two of the world’s richest men and some startups.

I’m always surprised the Seattle startup ecosystem hasn’t grown to compete with the likes of Silicon Valley — or at least Boston and New York City — since the dot-com boom. Today, it’s the strongest it’s been due to the successes of companies like the newly minted unicorn Outreach, trucking business Convoy and, of course, the dog walking startup Rover. But the city still lags behind, failing to adopt the culture of entrepreneurship that defines San Francisco.

I spent a lot of time wondering why it hasn’t reached its full potential. Is it because Microsoft and Amazon pay their employees so well they don’t have the same urge to build something from the ground up? Is it a lack of access to capital? Is the city not attracting top talent? If you have thoughts, send them my way.

“We think part of the issue is a lack of capital and a lack of help,” Rover and Pioneer Square Labs co-founder Greg Gottesman told TechCrunch earlier this year. “If we can provide a little bit of both of those things, we can really put Seattle where it deserves to be, should be and will be.”

Despite its shortcomings, there is still some action in the city I want to highlight this week. A same-day delivery business, Dolly, is on the rise. The startup told me on Thursday it had raised a $7.5 million round from Unlock Venture Partners, Maveron and Jeff Wilke, the chief executive officer of Amazon Worldwide Consumer. Maveron, if you remember, is the VC fund co-founded by Starbucks founder Howard Schultz.

In other Seattle news, Madrona Venture Group, a well-regarded fund, raised an additional $100 million this week. Typically, Madrona focuses on companies based in the Pacific Northwest, but this fund will deploy capital throughout the entire U.S. Hmmm, that’s not necessarily a good sign for Seattle founders, but great progress for the ecosystem nonetheless.

If you’re interested in learning more about Seattle tech, I’ve covered it a bit because it’s my hometown! Start with this story, which dives deep into a Seattle accelerator that’s working hard to encourage entrepreneurship in the city. Alright, on to other news.

Want more TechCrunch newsletters? Sign up here.

WeWork: The co-working giant now known as The We Company submitted confidential IPO documents to the SEC, the company confirmed in a press release Monday. Is this the next massive startup win or a house of cards waiting to be toppled by the glare of the public markets? TechCrunch’s Danny Crichton investigates.

Slack: The business is in its final steps toward a much-anticipated direct listing, with one source telling TechCrunch the listing will be complete within 45 days. The WSJ reported this week that Slack will make an online presentation to potential shareholders on May 13. This week, we dug deep into Slack’s S-1 and decided to evaluate just how well the tech press, us included, did in covering the company. For the most part, the tech press did decently well, except for one curious, $162 million gap.

Uber: Finally! That ride-hailing company is going public next week. That latest news? Uber co-founder Travis Kalanick won’t be ringing the opening bell. Uber would not be where it is today without Kalanick, but him being there would surely be a reminder of Uber’s rocky past.

Beyond Meat: Shares of the company surged up 135 percent in their market opener last week, valuing the company as high as $3.52 billion. Volatility was so high on the company’s stock that the Nasdaq had to pause trading of “BYND” shares.

Ofo has run into its fair share of issues, laying off hundreds of workers, shutting down its international division and more. Now, you can buy a piece of the startup’s history.

Now you can buy a piece of startup history… Ofo bikes for ~$60 https://t.co/LLJbDOXm0C

— Jon Russell (@jonrussell) April 29, 2019

In other micro-mobility news, Lyft’s head of scooter & bikes Liam O’Connor, who was hired to help transportation company Lyft build its bike and scooter operations, has left after seven months with the newly-public company. TechCrunch’s Ingrid Lunden has the scoop. Plus, Bird, the electric scooter unicorn doing its best to overcome regulatory barriers, has made its way back to San Francisco. Bird is using its business license in San Francisco to introduce monthly personal rentals in the city. The program enables people to rent a scooter for $24.99 a month with no cap on the number of rides. We’ll how that goes.

For some reason, people are giving Magic Leap more money. The company has secured another $280 million in a deal with Japan’s largest mobile operator, Docomo. Do you know what that means? The developer fo AR/VR headsets has raised a total of $2.6 billion. We’re just as confused as you.

Brand new venture capital funds:

Unshackled Ventures raised $20 million.

Exclusive: @UnshackledVC has a new $20M pre-seed fund to invest only in immigrants. Why? Because immigrants are “inherently more entrepreneurial:” https://t.co/ZLiZ1UczJV

— Kate Clark (@KateClarkTweets) May 2, 2019

Jungle Ventures closed on $175 million.

And Toyota AI Ventures launched a $100 million fund.

- UiPath nabs $568M at a $7B valuation

- Utah’s Divvy raises another $200M to eliminate expense reports

- Glovo, the on-demand app, raises $169M Series D

- Awair raises $10M to help companies like WeWork monitor their office environments

I have the inside story on Menlo Ventures early Uber stake and TechCrunch’s Connie Loizos goes deep with early Uber backer Bradley Tusk.

This week, we offer TechCrunch Extra Crunch subscribers exclusive tips on building extraordinary teams. Plus, the final piece in TechCrunch’s Greg Kumparak’s series on Niantic, the fast-growing developer of Pokemon Go. If you recall, we’ve captured much of Niantic’s ongoing story in the first three parts of our EC-1, from its beginnings as an “entrepreneurial lab” within Google, to its spin-out as an independent company and the launch of Pokémon GO, to its ongoing focus on becoming a platform for others to build augmented reality products upon.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and TechCrunch’s Danny Crichton chat about updates at the Vision Fund, Cheddar’s big exit and more of this week’s headlines.

Powered by WPeMatico

Activision Blizzard has five franchises lined up for its new Call of Duty esports league

Activision Blizzard said it has lined up five franchises for a new, city-based Call of Duty esports league.

Atlanta, Dallas, New York, Paris and Toronto will all play host to franchise teams that will compete in a professional league based on what is perhaps Activision Blizzard’s most successful title, the company announced after its earnings call earlier today.

Each city is partnering with existing Overwatch League team owners to leverage the existing framework that Activision has labored over for the past few years to lay the groundwork for a global, city-based Call of Duty league, the company said.

The first teams are Atlanta Esports Ventures, the joint venture owned by Cox Enterprises and Province Inc.; the Envy Gaming esports team, which has been active in Call of Duty competitive play since 2007 and with the Dallas Fuel Overwatch league team; New York’s Sterling.VC, a sports media company backed by Sterling Equities (owners of the New York Mets); c0ntact Gaming, which owns the Overwatch League team Paris Eternal and the Paris-based Call of Duty team; and Toronto’s OverActive Media.

“The upcoming launch of our new Call of Duty esports league reaffirms our leadership role in the development of professional esports. We have already sold Call of Duty teams in Atlanta, Dallas, New York, Paris and Toronto to existing Overwatch League team owners, and we will announce additional owners and markets later this year,” said Bobby Kotick, chief executive of Activision Blizzard. “Our owners value our professional, global city-based model, the success we have had with broadcast partners, sponsors and licensees, and the passion with which our players have responded to our events.”

The announcement came on the heels of an earnings announcement that saw the company report earnings of $1.825 billion for the quarter, beating its outlook of $1.715 billion but down slightly from the year ago period when the company brought in almost $2 billion.

The company credited esports and its Overwatch League and the newly announced Call of Duty city-based league (including selling its first five teams to cities) for contributing to the better-than-expected numbers.

Powered by WPeMatico

Dear Hollywood, here are 5 female founders to showcase instead of Elizabeth Holmes

Contributor

There’s a seemingly insatiable demand for Theranos content. John Carreyrou’s best-selling book, “Bad Blood,” has already inspired an HBO documentary, The Inventor; an ABC podcast called The Dropout, a prestige limited series starring SNL’s Kate McKinnon, was just announced; and Jennifer Lawrence is reportedly going to star in the feature film version of this tawdry “true crime meets tech” tale. That’s before getting started on the various and sundry cover stories and think pieces about her fraud.

I think it’s fair to say the Theranos story has been sufficiently well-documented, and I’m worried that this negative perception may be reinforced now that uBiome founder Jessica Richman has been placed on administrative leave. While it’s hard to pass on a chance to stoke startup schadenfreude, perhaps we could focus less on these rare, unrepresentative and dispiriting examples? Instead, Hollywood could put the spotlight on women who pioneered the bleeding edge of tech and actually produced billion-dollar successes. Here are a few candidates ready for their close-ups:

Judith Faulkner, founder and chief executive officer, Epic Systems

Judith Faulkner – Founder/CEO, Epic Systems

In the late 1970s, the picture of a working woman in Wisconsin was likely Laverne or Shirley. Little did anyone know that in the basement of a Victorian manse in Madison, the future of healthcare was being coded by Judith Faulkner, the founder and CEO of what would become Epic Systems. Epic is arguably the most impactful startup in the history of health software, and Faulkner was building medical scheduling software before most people could even picture a PC. Her efforts established the Electronic Medical Records market as we know it and today. Her company manages records for more than 200 million people, employs nearly 10,000 and generates around $2.7 billion per year in revenue — not bad for a math graduate who never raised any venture capital.

One might argue that the origins of medical software are too tepid to make for exciting TV, but something tells me the kind of CEO who hires Disney alums to design her corporate campus and dresses up like a wizard to address her employees might make for a compelling subject.

SANTA BARBARA, CA – FEBRUARY 09: Lynda Weinman speaks onstage (Photo by Rebecca Sapp/Getty Images for SBIFF)

Lynda Weinman – Founder/CEO, Lynda.com

Lynda Weinman might have the most esoteric path to becoming a billion-dollar entrepreneur in history. After getting a humanities degree from Evergreen College, where she was classmates with “Simpsons” creator Matt Groenig, Lynda opened a pair of punk rock fashion boutiques on LA’s Sunset Strip.

After those folded in the early 1980s, she taught herself enough computer graphics to become a freelance animator on movies like “Bill & Ted’s Excellent Adventure,” which in turn led to her becoming a teacher at the prestigious Art Center College of Design. Her academic pedigree provided the launching pad to write an influential textbook; that, in turn, gave her the star power to strike out on her own as one of the first web celebrities.

Keep in mind; this dramatic arc only covers the time before she started the eponymous Lynda.com, and bootstrapped it to a $1.5 billion exit in edtech — an industry most VCs and entrepreneurs fear to tread. In terms of material for a memoir, Hannah Horvath has nothing on Lynda Weinman.

FRAMINGHAM, MA – MAY 30: Shira Goodman, former chief executive at Staples, poses for a portrait in Framingham, MA on May 30, 2017 (Photo by Suzanne Kreiter/The Boston Globe via Getty Images)

Shira Goodman – CEO, Staples.com

Shira Goodman has arguably done more for online shopping in the U.S. than anyone not named Bezos. She didn’t found Staples, but she did start and scale its “delivery business,” as she humbly calls it, to the point where it became the fourth largest e-commerce company in the U.S.

At a time when more nimble startups were disrupting big-box retailers, Shira did what few of her contemporaries could do — rapidly shifted a multi-billion-dollar legacy company in an ancient industry into the future, and eventually became CEO of the entire enterprise. She did this while also raising three children and supporting her husband when he decided to change careers and go to Rabbinical school. Sitcoms have been premised on less, and since two versions of “The Office” have captivated audiences, perhaps it’s time to provide the perspective from the CEO of Dunder-Mifflin HQ?

Helen Greiner, co-founder, iRobot

Helen Greiner – Co-founder, iRobot

From C. A. Rotwang in “Metropolis” to Tony Stark in the Marvel movies, there have been plenty of cinematic explorations of robot builders, but the story of iRobot co-founder Helen Greiner might be more interesting than anything yet committed to celluloid. As a recent grad from MIT, Greiner spent a substantial chunk of the 1990s applying her mechanical genius to everything from a mechatronic dinosaur for Disney to a store cleaning robot with the potential for mass destruction for SC Johnson.

Far from an ivory-tower academic, Grenier helped the government deploy search and rescue efforts at Ground Zero after 9/11 and cave-clearing ‘bots in Afghanistan, and the bomb-disposing Packbot she developed has saved the lives of thousands of service members. Grenier, at age 38, took her company public and made the Jetson’s vision of a robot housekeeper a reality in the form of the Roomba.

CAMBRIDGE, MA – MARCH 15: Kelsey Wirth, who has a grassroots organization called Mothers Out Front: Mobilizing For A Livable Climate (Photo by Essdras M Suarez/The Boston Globe via Getty Images)

Kelsey Wirth – Co-founder, Align Technologies

While the original startup bros were inflating the tech bubble in the late 1990s, Kelsey Wirth was pioneering 3D printing, which at the time was as fantastical as anything Theranos promised. Wirth’s story as the co-founder of Align Technology is especially compelling in the way it shares some surface similarities with Holmes’ narrative. Prominent skeptics of Invisalign cast doubts on the company in its early days, noting that the startup’s PR had outstripped its clinical validation. Wirth had to solve seemingly intractable technical challenges, including scanning misaligned incisors, developing algorithms to overcome underbites, pioneering new manufacturing process, convincing the FDA to clear the product and then selling it across the country — armed only with an English lit degree and an MBA. Despite the long odds of curing crossbites with software, Wirth started what has become a publicly traded business that is currently worth more than 20 billion dollars.

Most of these founders faced setbacks, including external obstacles and those of their own making. There were layoffs, bad deals and few of these stories had perfectly happy endings. Still, while a contemporary startup can earn plaudits for simply repackaging CBD and pushing it on Facebook, these entrepreneurs demonstrated a level of ambition rarely seen among modern upstarts.

The sensational focus on Elizabeth Holmes’ misdeeds steal focus from a group of landmark female entrepreneurs and waste a tremendous opportunity to inspire the next generation with heroic tales instead of fables of fabrication. None of these accounts have the black and white morality of the Theranos debacle, but these founders cleared hurdles both scientific and social. They flipped the script and made history; surely Hollywood can find some drama in that.

Thanks to Parul Singh, Elizabeth Condon and Alyssa Rosenzweig for reviewing drafts of this post.

Powered by WPeMatico

Spotify’s leanback instant listening app Stations hits iOS

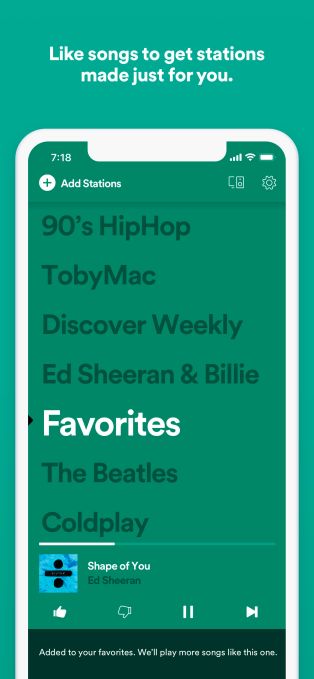

Spotify has launched its instant listening app Stations on iOS, but only in Australia for the time being. The release comes nearly a year and a half after the Stations app first arrived on the market, initially for Android users in Australia. Dubbed an “experiment,” the app allows users to jump right into streaming instead of having to curate their own playlists or stations, or save favorite music to their library.

Unlike Spotify’s flagship application, the Stations app presents users with a minimalist interface where available playlists are displayed with an oversized font. You can scroll up and down between the playlists to select one, instead of typing in a search box or searching through voice commands.

When launching Stations, music begins playing automatically — a feature that had some calling it a “Pandora copycat” at the time of launch, given that instant music playback is something that Spotify’s rival Pandora already supports.

Stations was largely designed for those who want a more radio-like experience that involves less manual input. Free users will hear ads, be able to thumbs up and down songs, but can’t skip tracks. Premium users who download Stations get unlimited skips and ad-free listening.

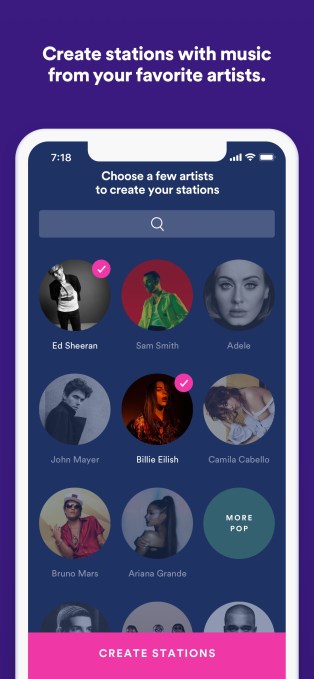

The Stations app today features a range of playlists by genre, decade, activity and more, but also becomes personalized to the end-user over time. You can also opt to create your own stations by selecting from favorite artists in an experience that’s reminiscent of the customization offered today by YouTube Music — right down to the rounded artist profile photos you tap on.

As you listen to music on Stations, you can thumbs up and down songs in order to have it create custom stations personalized to you — including a Discover Weekly playlist, Release Radar and a Favorites playlist.

Not much had been heard about Stations since its January 2018 debut. And its limited release — it never hit the U.S., for example — could have indicated it was an experiment that didn’t quite pan out.

But it now seems that’s not the case, given the new expansion to iOS.

By offering the app to more users, Spotify has the chance to learn and collect data from a larger and more representative group of people. Whether or not it takes any ideas from Stations to its main app remains to be seen.

The company declined to comment on its plans, when asked.

“At Spotify, we routinely conduct a number of tests in an effort to improve our user experience,” a spokesperson said. “Some of those tests end up paving the path for our broader user experience and others serve only as an important learning. We aren’t going to comment on specific tests at this time,” they added.

Stations is live now on iOS in Australia. More information on the app is on the (newly updated) Help site here.

Powered by WPeMatico

How tech entrepreneurs think of Universal Basic Income

As tech has grown, policy debates have become an important pastime. Today’s tech industry aspires to replace human drivers with self-driving cars, secretaries with AI assistants, permanent jobs with gigs — and as a result, the human impact of tech has become an everyday conversation.

No other idea is as emblematic of this as Universal Basic Income, a policy that would distribute a monthly sum to every adult regardless of their income or employment status.

The conversation is widespread. Mark Zuckerberg and Elon Musk have said that UBI may be desirable or necessary. Y-Combinator Research and Facebook co-founder Chris Hughes are running basic income studies. Tech-friendly presidential hopefuls Bernie Sanders and Andrew Yang support the issue.

But should the average tech entrepreneur or investor support UBI? The answer is not entirely clear.

The good news is that the tech industry is deeply familiar with risk, which is an important component of arguments for UBI. The bad news: risk isn’t the whole story, and both positive and negative evidence for the policy are currently thin.

Image via H. Armstrong Roberts/ClassicStock/Getty Images

The role of risk

Entrepreneurs understand the risk component of UBI because it’s the same risk they take in starting companies. Many entrepreneurs start with savings or seed funding that reduce their downside risk — and it’s not hard for them to imagine that others lack these resources. A UBI could solve the issue.

Powered by WPeMatico

Google’s budget Pixel 3a XL pops up at an Ohio Best Buy

The Pixel 3a is arriving next week at Google I/O. That statement felt like all but a given before, and now that the handset is showing up at Ohio-area Best Buys, well, you can pretty much bank on it at this point.

Google’s budget take on its Pixel flagship is expected to take the stage during the May 7 keynote at Mountain View. Meantime, we’ve got another pretty good look at the thing courtesy of an Android Police reader who spotted boxes at a Springfield store.

The shots confirm Google’s strict adherence to silly color naming conventions, with the appearance of “Purple-ish” alongside “Just Black.” The former is a new color and looks to be about as subtle as you can get with a purple piece of electronics. Other side-of-the-box specs confirm what we’ve seen so far, including a 6-inch display on the XL version, coupled with 64GB of storage.

The handsets arrive just six or so months after the release of the Pixel 3. The company addressed the flagship device’s poor sales on this week’s earnings call, noting, among other things, that it had some hardware planned for I/O, marking a break from past years. It will be interesting to see how Google positions the product, as it continues to make software, AI and ML the focus of upgrades over hardware specs.

More info on what to expect next week in Mountain View can be found here.

Powered by WPeMatico