Sonic the Hedgehog director says character is getting makeover after backlash

In 2006, New Line Cinema added five days of reshoots for Snakes on a Plane, six months after principal filming had wrapped. The new shoots helped change the film’s rating from PG-13 to R, courtesy of, among other things, the addition of the line “I have had it with these motherf****** snakes on this motherf****** plane!”

It was an early and still one of the best known instances of a film being altered in post-production over internet consensus. The forthcoming Sonic the Hedgehog is likely still gunning for a family friendly rating.

Of course, the bizarre CGI take on the 90s character was one of dozens of glaring issues with the two-and-a-half-minute trailer, but it may well be the easiest to address without extensive reshoots. Certainly social media had no shortage of suggestions for how Sega and company could firmly remove Sonic’s feet from the furcanny valley — and hey, what’s a little post-production on top of a $90 million budget?

Jeff Fowler, who is making his feature film directorial debut with Sonic, took to Twitter to address the issue, noting, “Thank you for the support. And the criticism. The message is loud and clear… you aren’t happy with the design & you want changes. It’s going to happen.”

Thank you for the support. And the criticism. The message is loud and clear… you aren’t happy with the design & you want changes. It’s going to happen. Everyone at Paramount & Sega are fully committed to making this character the BEST he can be… #sonicmovie #gottafixfast

— Jeff Fowler (@fowltown) May 2, 2019

Paramount has yet to offer an official statement on the matter, including whether such a move might impact release date. On the upside, there’s still some time, with the film not scheduled to arrive until November. And besides, the internet had plenty of suggestions on how Sonic could be improved. It always does.

Left is original screenshot. Right is my rework to make #Sonic more stylized. pic.twitter.com/IhXeAZYlQI

— Edward Pun (@EdwardPun1) April 30, 2019

The old adage among online writers is “never read the comments.” It’s a bit of self-preservation of one’s own sanity. And certainly it’s possible to be too responsive to an online fan base when creating a work of art, or whatever Sonic purports to be. But in the case of a decades-late film adaptation of a video, honestly, it might be for the best.

Powered by WPeMatico

Asto, the bookkeeping app from Santander, adds invoice financing for freelancers and SMEs

Asto, the Santander-owned “upstart” developing financial tools for freelancers and SMEs, is adding invoice financing to its bookkeeping app.

The new offering, which potentially opens up so-called “micro-financing” to a much broader business market, comes hot on the heels of Santander Group acquiring Albert, an invoicing and expenses app for freelancers and micro-businesses. Albert’s functionality has now been integrated into Asto, with Albert co-founder Ivo Weevers becoming Asto’s chief product and design officer.

In a call, Weevers described Asto’s mission as wanting to create a “full stack of financial services for self-employed people [and other micro businesses].” Financial services for SMEs is a “huge, fast-growing market,” he says, adding that “Asto is innovating on the bookkeeping side, [while] other players on the market are working on the bank account side.”

“A lot of people are struggling with trying to understand and get access to finances that might help them in growing their business or overcoming certain periods of their business where extra cash would be really handy,” he tells me.

“What we’re doing now is providing a comprehensive solution where we help people with their daily tasks around bookkeeping and understanding where they are financially, but also connecting dots seamlessly with a financial solution. This is what this new micro-financing solution is all about.”

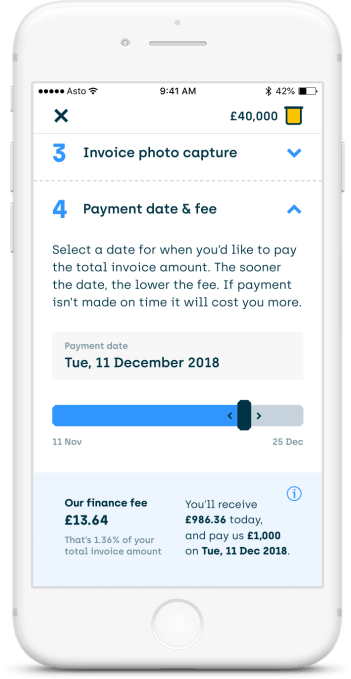

In a demo I’m given of the new invoice financing feature, it all feels relatively painless. After signing up to Asto and applying for the micro-finance option, you’re given an estimated pot of credit from which to drawn down on per invoice financed.

In a demo I’m given of the new invoice financing feature, it all feels relatively painless. After signing up to Asto and applying for the micro-finance option, you’re given an estimated pot of credit from which to drawn down on per invoice financed.

Invoices can be issued simply within the mobile app (or uploaded to it), which in itself is quite a time saver. Anyone who freelances knows that writing invoices and tracking them is a pain. Even more so is waiting to be paid.

Next to each invoice is a finance button. Clicking on it initiates the micro loan, with clear signposting on how much you’ll need to pay back and when. The time frame is based on the payment terms of your issued invoice with a bit of extra leeway if needed.

“Micro-financing used to be accessible only for the larger SMEs, people with financial knowledge and the time to go into a branch and talk to an account manager and wait for a few weeks to get a decision,” explains Weevers.

“One of the innovate steps we are trying to do here is we are making this option available for the smaller end of the SME market, which is by far the biggest and by far the most unserved. By doing it on mobile, which is their favourite device, and also doing it in a matter of minutes rather than having to wait for weeks,” he adds.

Meanwhile, I’m told that the credit itself is provided by Asto via owner Santander. Noteworthy is that the invoice financing feature doesn’t for the time being use transaction data pulled in from bank accounts you have linked to the app. Instead, Asto is using a range of other data points and info you provide when first applying for the micro-financing option.

Powered by WPeMatico

WorldCover raises $6M round for emerging markets’ climate insurance

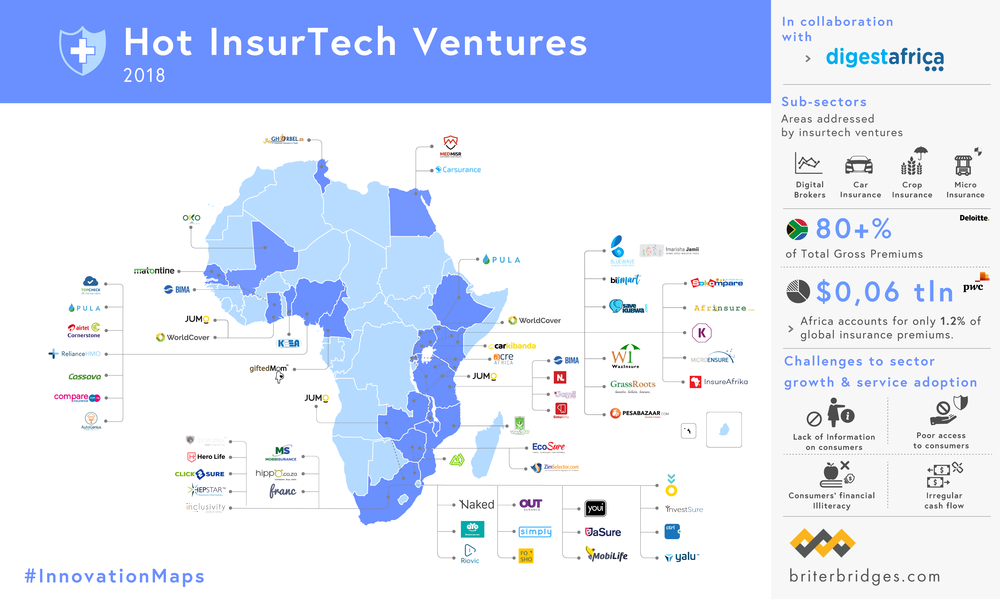

WorldCover, a New York and Africa-based climate insurance provider to smallholder farmers, has raised a $6 million Series A round led by MS&AD Ventures.

Y Combinator, Western Technology Investment and EchoVC also participated in the round.

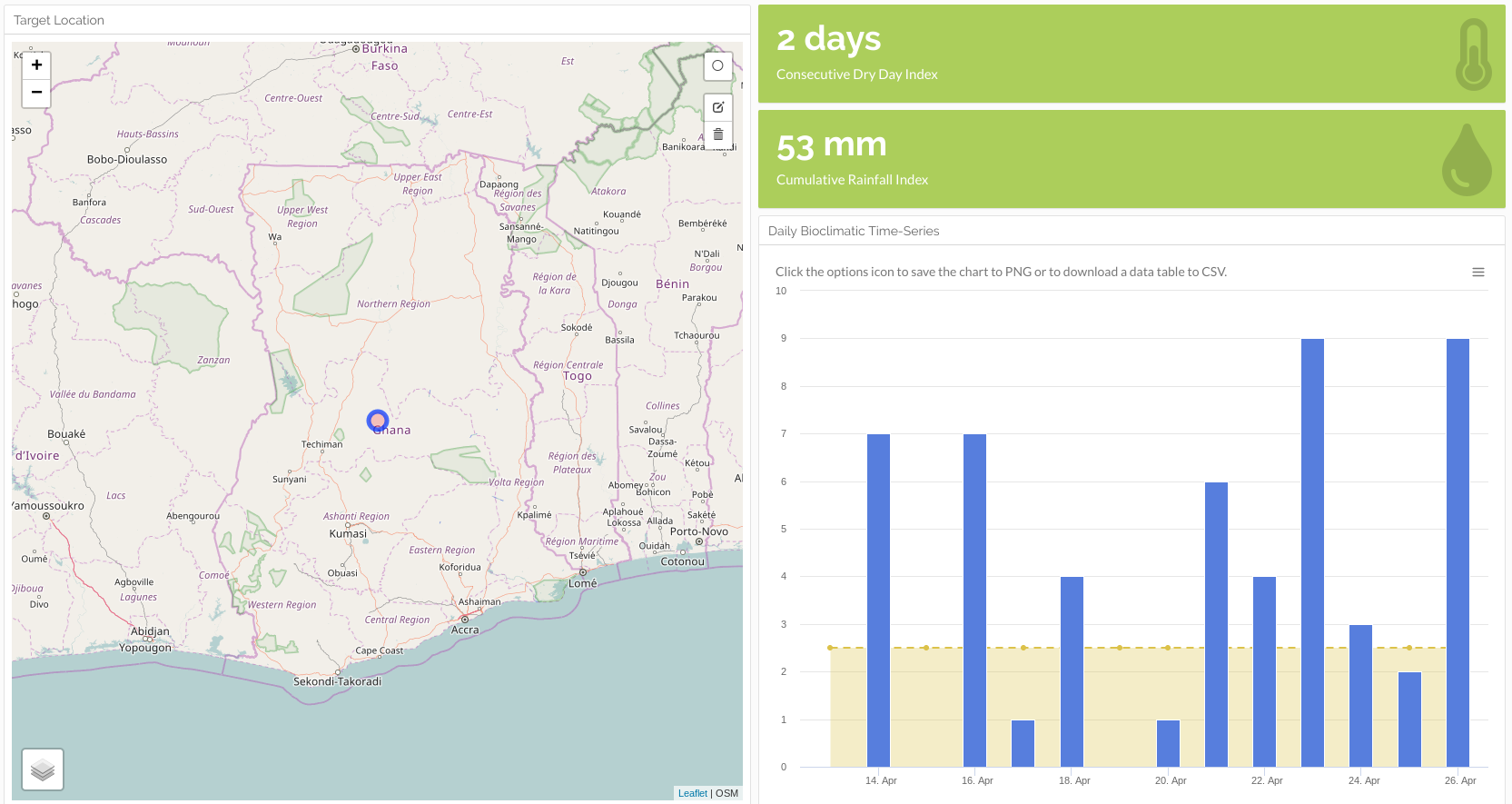

WorldCover’s platform uses satellite imagery, on-ground sensors, mobile phones and data analytics to create insurance options for farmers whose crop yields are affected adversely by weather events — primarily lack of rain.

The startup currently operates in Ghana, Uganda and Kenya . With the new funding, WorldCover aims to expand its insurance offerings to more emerging market countries.

“We’re looking at India, Mexico, Brazil, Indonesia. India could be first on an 18-month timeline for a launch,” WorldCover co-founder and chief executive Chris Sheehan said in an interview.

The company has served more than 30,000 farmers across its Africa operations. Smallholder farmers are those earning all or nearly all of their income from agriculture, farming on 10-20 acres of land and earning around $500 to $5,000, according to Sheehan.

Farmers connect to WorldCover by creating an account on its USSD mobile app. From there they can input their region and crop type and determine how much insurance they would like to buy and use mobile money to purchase a plan. WorldCover works with payments providers such as M-Pesa in Kenya and MTN Mobile Money in Ghana.

The service works on a sliding scale, where a customer can receive anywhere from 5x to 15x the amount of premium they have paid. If there is an adverse weather event, namely lack of rain, the farmer can file a claim via mobile phone. WorldCover then uses its data-analytics metrics to assess it, and, if approved, the farmer will receive an insurance payment via mobile money.

Common crops farmed by WorldCover clients include maize, rice and peanuts. It looks to add coffee, cocoa and cashews to its coverage list.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

The startup’s founder clarified that WorldCover’s model does not assess or provide insurance payouts specifically for climate change, though it does directly connect to the company’s business.

“We insure for adverse weather events that we believe climate change factors are exacerbating,” Sheehan explained. WorldCover also resells the risk of its policyholders to global reinsurers, such as Swiss Re and Nephila.

On the potential market size for WorldCover’s business, he highlights a 2018 Lloyd’s study that identified $163 billion of assets at risk, including agriculture, in emerging markets from negative, climate change-related events.

“That’s what WorldCover wants to go after…These are the kind of micro-systemic risks we think we can model and then create a micro product for a smallholder farmer that they can understand and will give them protection,” he said.

With the round, the startup will look to possibilities to update its platform to offer farming advice to smallholder farmers, in addition to insurance coverage.

WorldCover investor and EchoVC founder Eghosa Omoigui believes the startup’s insurance offerings can actually help farmers improve yield. “Weather-risk drives a lot of decisions with these farmers on what to plant, when to plant, and how much to plant,” he said. “With the crop insurance option, the farmer says, ‘Instead of one hector, I can now plant two or three, because I’m covered.’ ”

Insurance technology is another sector in Africa’s tech landscape filling up with venture-backed startups. Other insurance startups focusing on agriculture include Accion Venture Lab-backed Pula and South Africa based Mobbisurance.

With its new round and plans for global expansion, WorldCover joins a growing list of startups that have developed business models in Africa before raising rounds toward entering new markets abroad.

In 2018, Nigerian payment startup Paga announced plans to move into Asia and Latin America after raising $10 million. In 2019, South African tech-transit startup FlexClub partnered with Uber Mexico after a seed raise. And Lagos-based fintech startup TeamAPT announced in Q1 it was looking to expand globally after a $5 million Series A round.

Powered by WPeMatico

A quiet London-based payments startup just raised among the biggest Series A rounds ever in Europe

You probably haven’t heard of Checkout, a digital payments processing company that was founded in 2012 in London. Apparently, however, investors have been keeping tabs on the low-flying company and like what they see. Today, Checkout announced that it has raised $230 million in Series A funding at a valuation just shy of $2 billion co-led by Insight Partners and DST Global, with participation from GIC, the Singaporean sovereign-wealth fund, Blossom Capital, Endeavor Catalyst and other, unnamed strategic investors.

It’s the first institutional round for the company; it’s also one of the biggest Series A rounds ever for a European company.

What’s so special about Checkout that investors felt compelled to write such big checks? In a sea filled with fintech startups, it’s hard to know at first glance what differentiates it — or whether investors merely spy a huge opportunity, particularly given the company’s recent revenue numbers.

Checkout helps businesses — including Samsung, Adidas, Deliveroo and Virgin, among others — to accept a range of payment types across their online stores around the world. According to the WSJ, the fees from these services are adding up, too. It says Checkout’s European business generated $46.8 million in gross revenue and $6.7 million in profit in 2017, information it dug up through Companies House, the United Kingdom’s registrar of companies.

Checkout also plays into two huge trends that seem to be lifting all boats — the ongoing boom in online shopping, and the growing number of businesses using online payments. Little wonder that investors poured into payments startups last year more than four times what they invested in them in 2017 ($22 billion, according to Dow Jones VentureSource data cited by the WSJ).

Little wonder, too, that payments startups that have gone public are faring well, including the global payments company Adyen, which IPO’d on the Euronext in June of last year and has mostly seen its shares move in one direction since. Indeed, the company, valued at $2.3 billion by investors in 2015, is now valued at nearly $21 billion.

Though Checkout’s Series A is stunning for its size, according to Dealroom data, it isn’t the largest for a European company. Among other giant rounds, the U.K.-based biotech company Immunocore closed on $320 million in Series A funding in 2015. In 2017, another U.K. fintech, OakNorth, a digital bank that focuses on loans for small and medium enterprises, raised $200 million in Series A funding. (It has gone on to raise roughly $850 million altogether.)

More recently, TradePlus24, a two-year-old, Zurich, Switzerland-based fintech company that insures against default the accounts receivables of small and mid-size businesses, also raised a healthy amount: $120 million in Series A funding. Its backers include Credit Suisse and the insurance broker Kessler.

Powered by WPeMatico

Microbiome testing service uBiome puts its co-founders on administrative leave after FBI raid

The microbiome testing service uBiome has placed its founders and co-chief executives, Jessica Richman and Zac Apte, on administrative leave following an FBI raid on the company’s offices last week.

The company’s board of directors have named John Rakow, currently the company’s general counsel, as its interim chairman and chief executive, the company said in a statement.

Directors of the company are also conducting an independent investigation into the company’s billing practices, which is being overseen by a special committee of the board.

It was only last week that the FBI went to the company’s headquarters to search for documents related to an ongoing investigation. What’s at issue is the way that the company was billing insurers for the microbiome tests it was performing on customers.

“As interim CEO of uBiome, I want all of our stakeholders to know that we intend to cooperate fully with government authorities and private payors to satisfactorily resolve the questions that have been raised, and we will take any corrective actions that are needed to ensure we can become a stronger company better able to serve patients and healthcare providers,” Rakow said in a statement.

”My confidence is based on the significant clinical evidence and medical literature that demonstrates the utility and value of uBiome’s products as important tools for patients, health care providers and our commercial partners.” added Mr. Rakow.

It’s been a rough few weeks for consumer companies working on developing microbiome testing services and treatments based on those diagnosis. In addition to the FBI raid, the Seattle-based company, Arivale, was forced to shut down its “consumer program” after raising more than $50 million from investors, including Maveron, Polaris Partners and ARCH Venture Partners.

UBiome is backed by investors including Andreessen Horowitz, OS Fund, 8VC, Y Combinator, DNA Capital, Crunchfund, StartX, Kapor Capital, Starlight Ventures and 500 Startups.

Powered by WPeMatico

Microsoft brings Plug and Play to IoT

Microsoft today announced that it wants to bring the ease of use of Plug and Play, which today allows you to plug virtually any peripheral into a Windows PC without having to worry about drivers, to IoT devices. Typically, getting an IoT device connected and up and running takes some work, even with modern deployment tools. The promise of IoT Plug and Play is that it will greatly simplify this process and do away with the hardware and software configuration steps that are still needed today.

As Azure corporate vice president Julia White writes in today’s announcement, “one of the biggest challenges in building IoT solutions is to connect millions of IoT devices to the cloud due to heterogeneous nature of devices today – such as different form factors, processing capabilities, operational system, memory and capabilities.” This, Microsoft argues, is holding back IoT adoption.

IoT Plug and Play, on the other hand, offers developers an open modeling language that will allow them to connect these devices to the cloud without having to write any code.

Microsoft can’t do this alone, though, since it needs the support of the hardware and software manufacturers in its IoT ecosystem, too. The company has already signed up a number of partners, including Askey, Brainium, Compal, Kyocera, STMicroelectronics, Thundercomm and VIA Technologies . The company says that dozens of devices are already Plug and Play-ready and potential users can find them in the Azure IoT Device Catalog.

Powered by WPeMatico

Microsoft launches a drag-and-drop machine learning tool

Microsoft today announced three new services that all aim to simplify the process of machine learning. These range from a new interface for a tool that completely automates the process of creating models, to a new no-code visual interface for building, training and deploying models, all the way to hosted Jupyter-style notebooks for advanced users.

Getting started with machine learning is hard. Even to run the most basic of experiments takes a good amount of expertise. All of these new tools greatly simplify this process by hiding away the code or giving those who want to write their own code a pre-configured platform for doing so.

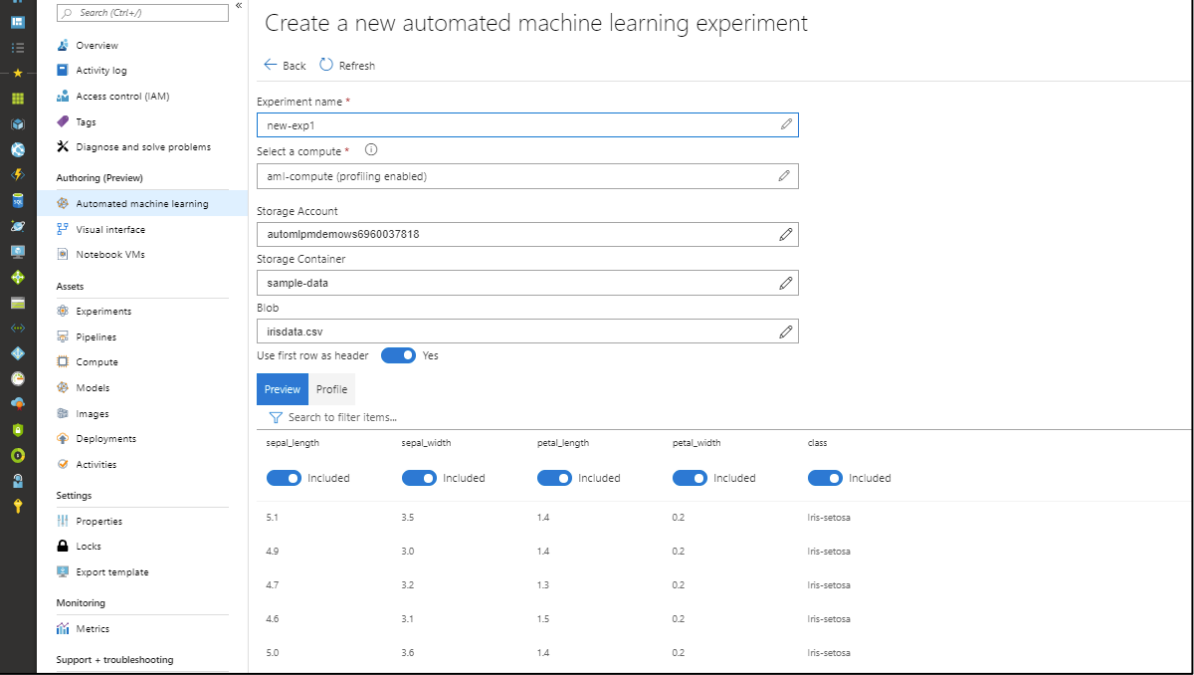

The new interface for Azure’s automated machine learning tool makes creating a model as easy as importing a data set and then telling the service which value to predict. Users don’t need to write a single line of code, while in the backend, this updated version now supports a number of new algorithms and optimizations that should result in more accurate models. While most of this is automated, Microsoft stresses that the service provides “complete transparency into algorithms, so developers and data scientists can manually override and control the process.”

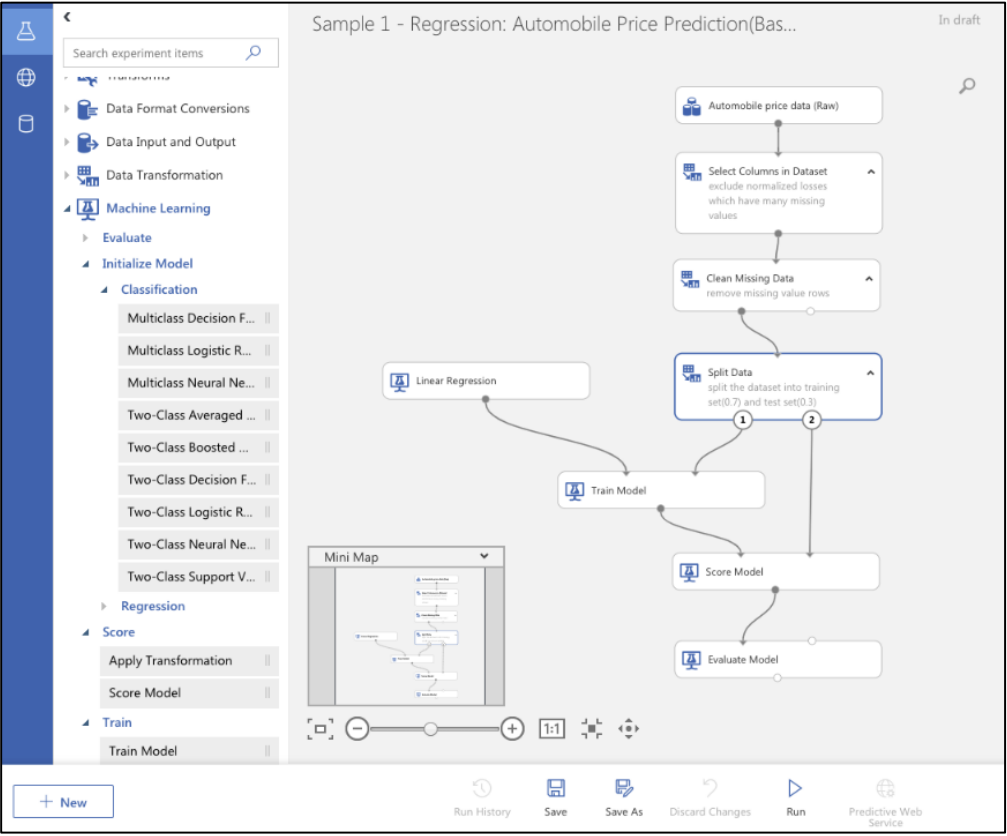

For those who want a bit more control from the get-go, Microsoft also today launched into preview a visual interface for its Azure Machine Learning service that will allow developers to build, train and deploy machine learning models without having to touch any code.

This tool, the Azure Machine Learning visual interface, looks suspiciously like the existing Azure ML Studio, Microsoft’s first stab at building a visual machine learning tool. Indeed, the two services look identical. The company never really pushed this service, though, and almost seemed to have forgotten about it despite the fact that it always seemed like a really useful tool for getting started with machine learning.

Microsoft says this new version combines the best of Azure ML Studio with the Azure Machine Learning service. In practice, this means that while the interface is almost identical, the Azure Machine Learning visual interface extends what was possible with ML Studio by running on top of the Azure Machine Learning service and adding that services’ security, deployment and life cycle management capabilities.

The service provides an easy interface for cleaning up your data, training models with the help of different algorithms, evaluating them and, finally, putting them into production.

While these first two services clearly target novices, the new hosted notebooks in Azure Machine Learning are clearly geared toward the more experienced machine learning practitioner. The notebooks come pre-packaged with support for the Azure Machine Learning Python SDK and run in what the company describes as a “secure, enterprise-ready environment.” While using these notebooks isn’t trivial either, this new feature allows developers to quickly get started without the hassle of setting up a new development environment with all the necessary cloud resources.

Powered by WPeMatico

Microsoft launches a fully managed blockchain service

Microsoft didn’t rush to bring blockchain technology to its Azure cloud computing platform, but over the course of the last year, it started to pick up the pace with the launch of its blockchain development kit and the Azure Blockchain Workbench. Today, ahead of its Build developer conference, it is going a step further by launching Azure Blockchain Services, a fully managed service that allows for the formation, management and governance of consortium blockchain networks.

We’re not talking cryptocurrencies here, though. This is an enterprise service that is meant to help businesses build applications on top of blockchain technology. It is integrated with Azure Active Directory and offers tools for adding new members, setting permissions and monitoring network health and activity.

The first support ledger is J.P. Morgan’s Quorum. “Because it’s built on the popular Ethereum protocol, which has the world’s largest blockchain developer community, Quorum is a natural choice,” Azure CTO Mark Russinovich writes in today’s announcement. “It integrates with a rich set of open-source tools while also supporting confidential transactions—something our enterprise customers require.” To launch this integration, Microsoft partnered closely with J.P. Morgan.

The managed service is only one part of this package, though. Microsoft also today launched an extension to Visual Studio Code to help developers create smart contracts. The extension allows Visual Studio Code users to create and compiled Etherium smart contracts and deploy them other on the public chain or on a consortium network in Azure Blockchain Service. The code is then managed by Azure DevOps.

Building applications for these smart contracts is also going to get easier thanks to integrations with Logic Apps and Flow, Microsoft’s two workflow integration services, as well as Azure Functions for event-driven development.

Microsoft, of course, isn’t the first of the big companies to get into this game. IBM, especially, made a big push for blockchain adoption in recent years and AWS, too, is now getting into the game after mostly ignoring this technology before. Indeed, AWS opened up its own managed blockchain service only two days ago.

Powered by WPeMatico

Microsoft announces the $3,500 HoloLens 2 Development Edition

As part of its rather odd Thursday afternoon pre-Build news dump, Microsoft today announced the HoloLens 2 Development Edition. The company announced the much-improved HoloLens 2 at MWC Barcelona earlier this year, but it’s not shipping to developers yet. Currently, the best release date we have is “later this year.” The Development Edition will launch alongside the regular HoloLens 2.

The Development Edition, which will retail for $3,500 to own outright or on a $99 per month installment plan, doesn’t feature any special hardware. Instead, it comes with $500 in Azure credits and three-month trials of Unity Pro and the Unity PiXYZ plugin for bringing engineering renderings into Unity.

To get the Development Edition, potential buyers have to join the Microsoft Mixed Reality Developer Program and those who already pre-ordered the standard edition will be able to change their order later this year.

As far as HoloLens news goes, that’s all a bit underwhelming. Anybody can get free Azure credits, after all (though usually only $200) and free trials of Unity Pro are also readily available (though typically limited to 30 days).

Oddly, the regular HoloLens 2 was also supposed to cost $3,500. It’s unclear if the regular edition will now be somewhat cheaper, cost the same but come without the credits or really why Microsoft is doing this at all. Turning this into a special “Development Edition” feels more like a marketing gimmick than anything else, as well as an attempt to bring some of the futuristic glamour of the HoloLens visor to today’s announcements.

The folks at Unity are clearly excited, though. “Pairing HoloLens 2 with Unity’s real-time 3D development platform enables businesses to accelerate innovation, create immersive experiences, and engage with industrial customers in more interactive ways,” says Tim McDonough, GM of Industrial at Unity, in today’s announcement. “The addition of Unity Pro and PiXYZ Plugin to HoloLens 2 Development Edition gives businesses the immediate ability to create real-time 2D, 3D, VR, and AR interactive experiences while allowing for the importing and preparation of design data to create real-time experiences.”

Microsoft also today noted that Unreal Engine 4 support for HoloLens 2 will become available by the end of May.

Powered by WPeMatico

Microsoft brings Azure SQL Database to the edge (and Arm)

Microsoft today announced an interesting update to its database lineup with the preview of Azure SQL Database Edge, a new tool that brings the same database engine that powers Azure SQL Database in the cloud to edge computing devices, including, for the first time, Arm-based machines.

Azure SQL Edge, Azure corporate vice president Julia White writes in today’s announcement, “brings to the edge the same performant, secure and easy to manage SQL engine that our customers love in Azure SQL Database and SQL Server.”

The new service, which will also run on x64-based devices and edge gateways, promises to bring low-latency analytics to edge devices as it allows users to work with streaming data and time-series data, combined with the built-in machine learning capabilities of Azure SQL Database. Like its larger brethren, Azure SQL Database Edge will also support graph data and comes with the same security and encryption features that can, for example, protect the data at rest and in motion, something that’s especially important for an edge device.

As White rightly notes, this also ensures that developers only have to write an application once and then deploy it to platforms that feature Azure SQL Database, good old SQL Server on premises and this new edge version.

SQL Database Edge can run in both connected and fully disconnected fashion, something that’s also important for many use cases where connectivity isn’t always a given, yet where users need the kind of data analytics capabilities to keep their businesses (or drilling platforms, or cruise ships) running.

Powered by WPeMatico