Samsung reportedly pushes back Galaxy Fold release

Update: The delay has been confirmed by Samsung.

Can’t say we didn’t see this coming. Four days out from the Galaxy Fold’s official release date, Samsung is pushing things back a bit, according to a report from The Wall Street Journal that cites “people familiar with the matter.”

There’s no firm time frame for the launch, though the phone is still expected “in the coming weeks,” at some point in May. We’ve reached out to Samsung for comment and will update accordingly. When a number a reviewers reported malfunctioning displays among an extremely small sample size, that no doubt gave the company pause.

I’ve not experienced any issues with my own device yet, but this sort of thing can’t be ignored. Samsung’s initial response seemed aimed at mitigating pushback, writing, “A limited number of early Galaxy Fold samples were provided to media for review. We have received a few reports regarding the main display on the samples provided. We will thoroughly inspect these units in person to determine the cause of the matter.”

Samsung Galaxy Fold launch events in Hong Kong and Shanghai have been postponed. They were originally scheduled for this Tuesday and Wednesday, respectively.

— Richard Lai (@richardlai) April 21, 2019

It also went on to note that the problems may have stemmed from users attempting to peel back a “protective layer.” Things took a turn to the more cautious over the weekend, however, when it was reported that the phone’s launch events in parts of Asia would be delayed (we reached out about that, as well, but haven’t heard back). Since then, a larger delay has seemed all but inevitable.

Powered by WPeMatico

Corporations and private investors are backing new ‘green’ deals as climate worries mount

In the nine years since private equity and venture capital investments into sustainable technologies last crossed the $6 billion threshold, the problems caused by global carbon emissions have only intensified.

Now, as the world confronts the reality that there’s not much time left to reverse course on carbon emissions and the impact they will have on life on earth, both corporate and private investors are once again stepping up their commitments to startups in the space.

In 2018, global venture capital investment into startups focused on sustainability jumped 127 percent, to $9.2 billion, the highest since 2010, according to a January report from Bloomberg New Energy Finance. Powering that boost was a $1.1 billion investment in the smart window maker, View, and another $795 million for Chinese electric vehicle firm Youxia Motors. In fact, there were no fewer than eight VC/PE financings of Chinese EV specialist companies in 2018, totaling some $3.3 billion.

That stark assessment is coming from more corners of the scientific community, and the reality of the danger is being emphasized by politicians and concerned citizens around the globe.

The simple truth is that things are getting worse. And for the past two years, emissions have been increasing as countries continue to use oil and gas and coal to fuel economic growth, even as the global community realizes that carbon emissions are an increasing threat.

A recent assessment by the U.S. government put the cost of climate change caused by carbon emissions at $500 billion annually by the end of the century. And the financial toll doesn’t begin to assess the cost to the quality of human life and the potential lives that will be lost because of climate-related disasters.

This isn’t the first time the world has realized the threat climate change poses. It’s not even the second. Back in 1979 — and throughout the next decade — the U.S. grappled with how to craft an appropriate response to the coming climate-related crisis. Perhaps unsurprisingly, the government failed, and the issue of imminent climate disaster was set aside.

Former Vice President Al Gore picked up the thread in the mid-2000s in the wake of his defeat to the Connecticut Yankee turned Texas oilman George W. Bush in the contested 2000 presidential election. Through advocacy work and the popular climate-focused documentary “An Inconvenient Truth,” Gore was able to proselytize among a group of technocrats looking for the next big thing in the wake of the internet explosion that had transformed professional and personal lives.

Venture capital investors flocked to invest in renewable technologies — from biofuels to new solar energy generating technologies to new battery chemistries and beyond.

Over the next seven years billion-dollar companies would rise and fall on the back of speculative investment in the promise of a cleaner energy future that would disrupt the oil industry and turn billionaires into multi-billionaires — all while saving the world.

It didn’t work out.

Problems with scaling technologies beyond a controlled laboratory setting; global economic pressures wrought by an explosion of manufacturing capacity in countries like China; and the hubris of investors who thought that their investment acumen in picking winners of the information age could work just as well in centuries-old industries like oil and gas, or electricity, found themselves floundering in complicated, regulated markets with deep-pocketed incumbents and entrenched interests in promoting the status quo.

In the process, investors lost hundreds of millions of dollars in the U.S. alone, and destabilized some of the oldest firms in the investment industry.

Now, companies and investors are returning to the market in a major way. Some of the largest businesses in the food and agriculture industry are investing in new companies that are developing protein replacements and novel cultivation technologies; utilities are investing more heavily in smart grid technologies as electrification and microgrids become more real; automakers and battery manufacturers are backing new energy storage technologies; and frontier investors are backing companies tackling everything from biologically based chemical manufacturing to new construction technologies for smart homes and cities, to new kinds of nuclear power that could transform how the world conceives of energy abundance (along with geo-engineering tech to remove carbon from the atmosphere).

“In the last few years, the number of technologies ripe for investment has expanded dramatically,” Ravi Manghani, research director for energy storage at Wood Mackenzie, an energy research and consultancy firm, told CNBC in March. “It’s no longer just three or four technology verticals.”

While none of these technological advancements are a guaranteed solution to the threats carbon emissions pose, or are surefire commercially viable businesses, the fact that investors are once again looking at sustainability as a viable investment thesis — capable of producing multiple billion-dollar businesses — is a good step forward.

Any plan to address decarbonization has to confront industries as diverse as agriculture, construction, transportation, chemicals and consumer goods from clothes to chemicals.

Failure to confront these challenges would be catastrophic. Even if global warming is restricted to just the 2 degree Celsius target set at the Paris climate agreement, that could mean the extinction of the world’s tropical reefs and several meters of sea-level rise, as The New York Times reported last August. Already the impacts of climate change have meant tens of billions of dollars in damage for the U.S. in 2018 alone.

“The era of incrementalism on climate change is over,” said Massachusetts Senator Ed Markey, one of the architects of the “Green New Deal” legislation, in an interview with Vox. “We are now in the era of the Green New Deal. It’s not going away. It is creating an incentive for governors to do more, for mayors to do more, for companies to do more. The polling says it has political legs that will drive it right into the election of 2020, and when that cycle is done, I think we’re going to see a much greater capacity for us to take the kind of action that we need.”

Powered by WPeMatico

China’s new gaming rules to ban poker, blood and imperial schemes

Lots of news has surfaced from China’s gaming industry in recent weeks as the government hastens to approve a massive backlog of titles in the world’s largest market for video games.

Last Friday, On April 10th, the country’s State Administration of Press and Publication, the freshly minted gaming authority born from a months-long reshuffle last year that led to an approval blackout, held a gaming conference and enshrined a new set of guidelines for publication that are set to move some to joy and others to sorrow. TechCrunch confirmed with an attendee present at the conference and a source close to the SAPP that the event took place.

On April 22, China finally resumed the approval process to license new games for monetization. Licensing got back on track in December, but Reuters reported in February that the government stopped accepting new submissions due to a mounting pile of applications.

The bad news: The number of games allowed onto the market annually will be capped, and some genres of games will no longer be eligible. Mahjong and poker games are taken off the approval list following a wave of earlier government crackdowns over concerns that such titles may channel illegal gambling. These digital forms of traditional leisure activities are immensely popular for studios because they are relatively cheap to make and bear lucrative fruit. According to video game researcher Niko Partners, 37 percent of the 8,561 games approved in 2017 were poker and mahjong titles.

While the new rule is set to wipe out hundreds of small developers focused on the genre, it may only have a limited impact on the entrenched players as the restriction applies only to new applicants.

“It won’t affect us much because we are early to the market and have accumulated a big collection of licenses,” a marketing manager at one of China’s biggest online poker and mahjong games publishers told TechCrunch.

China will also stop approving certain games inspired by its imperial past, including “gongdou,” which directly translates to harem scheming, as well as “guandou,” the word for palace official competition. The life inside palaces has inspired blockbuster TV series such as the Story of Yanxi Palace, an in-house production from China’s Netflix equivalent iQiyi . But these plots also touch a nerve with Chinese officials who worry about “obscene contents and the risk of political metaphors,” Daniel Ahmad, senior analyst at Nikos Partners, suggested to TechCrunch.

Screenshots of Xi Fei Zhuan, a mobile game that lets users play the role of harems to win love from the emperor. Image source: Superjoy Interactive Games

Games that contain images of corpses and blood will also be rejected. Developers previously modified blood color to green to circumvent restrictions, but the renewed guidelines have effectively ruled out any color variations of blood.

“Chinese games developers are used to arbitrary regulations. They are quick at devising methods to circumvent requirements,” a Guangzhou-based indie games developer told TechCrunch.

That may only work out for companies armed with sufficient developing capabilities and resources to counter new policies. For instance, Tencent was quick to implement an anti-addiction system for underage users before the practice became an industry-wide norm as of late.

“Many smaller publishers will have a harder time under this new set of regulations, which will require them to spend extra time and money to ensure games are up to code,” suggested Ahmad. “We’ve already seen that many smaller publishers were unable to survive the temporary game license approval freeze last year and we expect to see further consolidation of the market this year.”

China has over the past year taken aim at the gaming industry over concerns related to gaming addiction among minors and illegal content, such as those that promote violence or deviate from the government’s ideologies. To enforce the growing list of requirements, an Online Game Ethics Committee launched in December under the guidance of the Publicity Department of the Chinese Communist Party to help the new gaming regulator in vetting title submissions.

More than 1,000 games have been approved since China ended the gaming freeze in December, though Tencent, the dominant player in the market, has yet to receive the coveted license required for monetizing its hugely popular mobile title PlayerUnknown’s Battlegrounds.

Uncertain waters in the gaming industry have wiped billions of dollars off the giant’s market cap and prompted it to initiate a bigger push in such non-game segments as cloud computing and financial technologies. NetEase, the runner-up in China’s gaming market, reacted by trimming its staff to cut costs.

The article was updated to correct the date for the gaming conference and clarify that the new guidelines were announced at the conference.

Powered by WPeMatico

From lab-grown meat to fermented fungus, here’s what corporate food VCs are serving up

Contributor

In a foodie’s ideal world, we’d all eat healthy, minimally processed cuisine sourced from artisanal farmers, bakers and chefs.

In the real world, however, most of us derive the lion’s share of calories from edibles supplied by a handful of giant food conglomerates. As such, the ingredients and processing techniques they favor have an outsized impact on our daily diets.

With this in mind, Crunchbase News decided to take a look at corporate food VCs and the startups they are backing to see what their dealmaking might say about our snacking future. We put together a list of venture funds operated by some of the larger food and beverage producers, covering literally everything from soup to nuts (plus lunch meat and soda, too!).

Like their corporate backers, startups funded by “Big Food” are a diverse bunch. Recent funding recipients are pursuing endeavors ranging from alternative protein to biospectral imaging to fermented fungus. But if one were to pinpoint an overarching trend, it might be a shift away from cost savings to consumer-friendliness.

“You think of food-tech and ag-tech 1.0, these were technologies that were primarily beneficial to the producers,” said Rob LeClerc, founding partner at AgFunder, an agrifood investor network. “This new generation of companies are really more focused on what does the consumer want.”

And what does the consumer want? This particular consumer would currently like a zero calorie hot fudge sundae. More broadly, however, the general trends LeClerc sees call for food that is healthier, tastier, nutrient-dense, satiating, ethically sourced and less environmentally impactful.

Below, we look at some of the trends in more detail, including funded companies, active investors and the up-and-coming edibles.

The new, new protein

Mass-market foods may get better but also weirder. This is particularly true for one of the more consistently hot areas of food-tech investment: alternative protein.

Demand for protein-rich foods, combined with ethical concerns about consuming animal products, has, for a number of years, led investors to startups offering meaty tasting tidbits sourced from the plant world.

But lately, corporate food giants have been looking farther beyond soy and peas. Lab-grown meat, once an oddball endeavor good for headlines about $1,000 meatballs, has been attracting serious cash. Since last year, at least two companies in the space have closed rounds backed by Tyson Ventures, the VC arm of the largest U.S. meat producer. They include pricey meatball maker Memphis Meats (actually based in California), which raised $20 million, and Israel-based Future Meat Technologies, a biotech startup working on animal-free meat, which secured $2 million.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat.

If you cringe at the notion of lab-grown cell meat, then there’s always the option of getting your protein through microbes in volcanic springs. That’s the general aim of Sustainable Bioproducts, a startup that raised $33 million in Series A funding from backers including ADM and Danone Manifesto Ventures. The Chicago company’s technology for making edible protein emerged out of research into extremophile organisms in Yellowstone National Park’s volcanic springs.

Meanwhile, if you hanker for real dairy milk but don’t want to trouble cows, another startup, Perfect Day, is working on a solution. Per the company website: “Instead of having cows do all the work, we use microflora and age-old fermentation techniques to make the very same dairy protein that cows make.” Toward that end, the Berkeley company closed a $35 million Series B in February, with backing from ADM.

Fermentation

Perfect Day isn’t the only fermentation play raising major funding.

Corporate food-tech investors have long been interested in the processing technologies that turn an obscure microbe or under-appreciated crop into a high-demand ingredient. And lately, LeClerc said, they’ve been particularly keen on startups finding new ways to apply the age-old technology known as fermentation.

Most of us know fermentation as the process that turns a yucky mix of grain, yeast and water into the popular beverage known as beer. More broadly, however, fermentation is a metabolic process that produces chemical changes in organic substrates through the action of enzymes. That is, take a substance, add something it reacts with and voilà, you have a new substance.

Several of the most heavily funded, buzz-generating companies in the food space are applying fermentation, LeClerc said. Besides Perfect Day, examples he points to include the unicorn Ginkgo Bioworks, Geltor (another alt-protein startup) and mushroom-focused MycoTechnology.

Colorado-based MycoTechnology has been a particularly attractive investor target of late. The company has raised $83 million from a mix of corporate and traditional VCs, including a $30 million Series C in January that included Tyson and Kellogg’s venture arm, Eighteen94 Capital . Founded six years ago, the company is pursuing a range of applications for its fermented fungi, including flavor enhancers, protein supplements and preservatives.

Supply chain

Besides adding strange new ingredients to our grocery shelves, corporate food-tech investors are also putting money into technologies and platforms aimed at boosting the security and efficiency of existing supply chains.

Just like new foods, much of the food safety tech sounds odd, too. Silicon Valley-based ImpactVision, a seed-funded startup backed by Campbell Soup VC arm Acre Venture Partners, wants to employ hyper-spectral imaging to perceive information about contamination, food quality and ripeness.

Boston-based Spoiler Alert, another Acre portfolio company, develops software and analytics for food companies to manage unsold inventory. And Pensa Systems, which uses AI-powered autonomous drones to track in-store inventory, raised a Series A round this year with backing from the venture arm of Anheuser-Busch InBev.

Is weirder better?

We highlighted a few trends in corporate food-tech investment, but there are others that merit attention, as well. Probiotics plays, including the maker of the GoodBelly drink line, are generating investor interest. New ingredients other than proteins are also attracting capital, such as UCAN, a startup developing energy snacks based on a novel, slow-digesting carbohydrate. And the list goes on.

Much of the early enthusiasm for new products stems from disillusionment with the existing ingredients we overeat. But LeClerc noted that new products aren’t always better in the long run — they just might seem so at first.

“The question in the back of our head is: Are we ever creating margarine 2.0,” he said. “Just because it’s a plant product doesn’t mean it’s actually better for you.”

Powered by WPeMatico

Acquisitions, more than IPOs, will create Africa’s early startup successes

Africa has made its global IPO debut. Pan-African e-commerce company Jumia—a $1 billion-valued company—began trading live on the NYSE last week.

The stock offering made Jumia the first upstart operating in Africa to list on a major global exchange.

This raises expectations for unicorns and IPOs to create the continent’s first wave of startup moguls. But unlike other markets, big public listings and nine-figure valuations could remain rare in Africa.

The rise of venture arms and startup acquisitions will factor more prominently than IPOs in creating Africa’s early startup successes.

I’ll break down why. First, a quick briefer.

Primer on African tech

Not everyone may be aware, but yes, Africa has a booming tech scene. When measured by monetary values, it’s minuscule by Shenzen or Silicon Valley standards.

Powered by WPeMatico

Startups Weekly: Zoom CEO says its stock price is ‘too high’

When Zoom hit the public markets Thursday, its IPO pop, a whopping 81 percent, floored everyone, including its own chief executive officer, Eric Yuan.

Yuan became a billionaire this week when his video conferencing business went public. He told Bloomberg that he actually wished his stock hadn’t soared quite so high. I’m guessing his modesty and laser focus attracted Wall Street to his stock; well, that, and the fact that his business is actually profitable. He is, this week proved, not your average tech CEO.

I chatted with him briefly on listing day. Here’s what he had to say.

“I think the future is so bright and the stock price will follow our execution. Our philosophy remains the same even now that we’ve become a public company. The philosophy, first of all, is you have to focus on execution, but how do you do that? For me as a CEO, my number one role is to make sure Zoom customers are happy. Our market is growing and if our customers are happy they are going to pay for our service. I don’t think anything will change after the IPO. We will probably have a much better brand because we are a public company now, it’s a new milestone.”

“The dream is coming true,” he added.

For the most part, it sounded like Yuan just wants to get back to work.

Want more TechCrunch newsletters? Sign up here. Otherwise, on to other news…

You thought I was done with IPO talk? No, definitely not:

- Pinterest completed its IPO this week too! Here’s the TLDR: Pinterest popped 25 percent on its debut Thursday and is currently trading up 28 percent. Not bad, Pinterest, not bad.

- Fastly, a startup I’d admittedly never heard of until this week, filed its S-1 and displayed a nice path to profitability. That means the parade of tech IPOs is far from over.

- Uber… Surprisingly, no Uber IPO news this week. Sit tight, more is surely coming.

While I’m on the subject of Uber, the company’s autonomous vehicles unit did, in fact, raise $1 billion, a piece of news that had been previously reported but was confirmed this week. With funding from Toyota, Denso and SoftBank’s Vision Fund, Uber will spin-out its self-driving car unit, called Uber’s Advanced Technologies Group. The deal values ATG at $7.25 billion.

The TechCrunch staff traveled to Berkeley this week for a day-long conference on robotics and artificial intelligence. The highlight? Boston Dynamics CEO Marc Raibert debuted the production version of their buzzworthy electric robot. As we noted last year, the company plans to produce around 100 models of the robot in 2019. Raibert said the company is aiming to start production in July or August. There are robots coming off the assembly line now, but they are betas being used for testing, and the company is still doing redesigns. Pricing details will be announced this summer.

#TCRobotics pic.twitter.com/Vf4kUWH0fR

— Lucas Matney (@lucasmtny) April 19, 2019

Digital health investment is down

Despite notable rounds for digital health businesses like Ro, known for its direct-to-consumer erectile dysfunction medications, investment in the digital health space is actually down, reports TechCrunch’s Jonathan Shieber. Venture investors, private equity and corporations funneled $2 billion into digital health startups in the first quarter of 2019, down 19 percent from the nearly $2.5 billion invested a year ago. There were also 38 fewer deals done in the first quarter this year than last year, when investors backed 187 early-stage digital health companies, according to data from Mercom Capital Group.

Byton loses co-founder and former CEO, reported $500M Series C to close this summer

Lyric raises $160M from VCs, Airbnb

Brex, the credit card for startups, raises $100M debt round

Ro, a D2C online pharmacy, reaches $500M valuation

Logistics startup Zencargo gets $20M to take on the business of freight forwarding

Co-Star raises $5M to bring its astrology app to Android

Y Combinator grad Fuzzbuzz lands $2.7M seed round to deliver fuzzing as a service

Hundreds of billions of dollars in venture capital went into tech startups last year, topping off huge growth this decade. VCs are reviewing more pitch decks than ever, as more people build companies and try to get a slice of the funding opportunities. So how do you do that in such a competitive landscape? Storytelling. Read contributor’s Russ Heddleston’s latest for Extra Crunch: Data tells us that investors love a good story.

Plus: The different playbook of D2C brands

And finally, for the first of a new series on VC-backed exits aptly called The Exit. TechCrunch’s Lucas Matney spoke to Bessemer Venture Partners’ Adam Fisher about Dynamic Yield’s $300M exit to McDonald’s.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about rounds for Brex, Ro and Kindbody, plus special guest Danny Crichton joined us to discuss the latest in the chip and sensor world.

Powered by WPeMatico

Notes from the Samsung Galaxy Fold: day four

Apologies for skipping day three. This kept me extremely busy yesterday. Though the Galaxy Fold remained a constant companion.

Before you ask (or after you ask on Twitter without having read beyond the headline), no it’s hasn’t broken yet. It’s actually been fairly robust, all things considered. But here’s the official line from Samsung on that,

A limited number of early Galaxy Fold samples were provided to media for review. We have received a few reports regarding the main display on the samples provided. We will thoroughly inspect these units in person to determine the cause of the matter.

Separately, a few reviewers reported having removed the top layer of the display causing damage to the screen. The main display on the Galaxy Fold features a top protective layer, which is part of the display structure designed to protect the screen from unintended scratches. Removing the protective layer or adding adhesives to the main display may cause damage. We will ensure this information is clearly delivered to our customers.

I’ll repeat what I said the other day: breakages and lemons have been known to happen with preproduction units. I’ve had it happen with device in a number of occasions in my many years of doing this. That said, between the amount of time it took Samsung to let us reviewers actually engage with the device and the percentage of problems we’ve seen from the limited sample size, the results so far are a bit of a cause for a concern.

The issue with the second bit is that protective layer looks A LOT like the temporary covers the company’s phones ship with, which is an issue. I get why some folks attempted to peel it off. That’s a problem.

At this point into my life with the phone, I’m still impressed by the feat of engineering went into this technology, but in a lot of ways, it does still feel like a very first generation product. It’s big, it’s expensive and software needs tweaks to create a seamless (so to speak) experience between screens.

That said, there’s enough legacy good stuff that Samsung has built into the phone to make it otherwise a solid experience. If you do end up biting the bullet and buying a Fold, you’ve find many aspects of it to be a solid workhorse and good device, in spite of some of the idiosyncrasies here (assuming, you know, the screen works fine).

It’s a very interesting and very impressive device, and it does feel like a sign post of the future. But it’s also a sometimes awkward reminder that we’re not quite living in the future just yet.

Powered by WPeMatico

Fastly, the content delivery network, files for an IPO

Fastly, the content delivery network that’s raised $219 million in financing from investors (according to Crunchbase), is ready for its close up in the public markets.

The eight-year-old company is one of several businesses that improve the download time and delivery of different websites to internet browsers and it has just filed for an IPO.

Media companies like The New York Times use Fastly to cache their homepages, media and articles on Fastly’s servers so that when somebody wants to browse the Times online, Fastly’s servers can send it directly to the browser. In some cases, Fastly serves up to 90 percent of browser requests.

E-commerce companies like Stripe and Ticketmaster are also big users of the service. They appreciate Fastly because its network of servers enable faster load times — sometimes as quickly as 20 or 30 milliseconds, according to the company.

The company raised its last round of financing roughly nine months ago, a $40 million investment that Fastly said would be the last before a public offering.

True to its word, the company is hoping public markets have the appetite to feast on yet another “unicorn” business.

While Fastly lacks the sizzle of companies like Zoom, Pinterest or Lyft, its technology enables a huge portion of the activities in which consumers engage online, and it could be a bellwether for competitors like Cloudflare, which recently raised $150 million and was also exploring a public listing.

The company’s public filing has a placeholder amount of $100 million, but given the amount of funding the company has received, it’s far more likely to seek closer to $1 billion when it finally prices its shares.

Fastly reported revenue of roughly $145 million in 2018, compared to $105 million in 2017, and its losses declined year on year to $29 million, down from $31 million in the year-ago period. So its losses are shrinking, its revenue is growing (albeit slowly) and its cost of revenues are rising from $46 million to around $65 million over the same period.

That’s not a great number for the company, but it’s offset by the amount of money that the company’s getting from its customers. Fastly breaks out that number in its dollar-based net expansion rate figure, which grew 132 percent in 2018.

It’s an encouraging number, but as the company notes in its prospectus, it’s got an increasing number of challenges from new and legacy vendors in the content delivery network space.

The market for cloud computing platforms, particularly enterprise-grade products, “is highly fragmented, competitive and constantly evolving,” the company said in its prospectus. “With the introduction of new technologies and market entrants, we expect that the competitive environment in which we compete will remain intense going forward. Legacy CDNs, such as Akamai, Limelight, EdgeCast (part of Verizon Digital Media), Level3, and Imperva, and small business-focused CDNs, such as Cloudflare, InStart, StackPath, and Section.io, offer products that compete with ours. We also compete with cloud providers who are starting to offer compute functionality at the edge like Amazon’s CloudFront, AWS Lambda, and Google Cloud Platform.”

Powered by WPeMatico

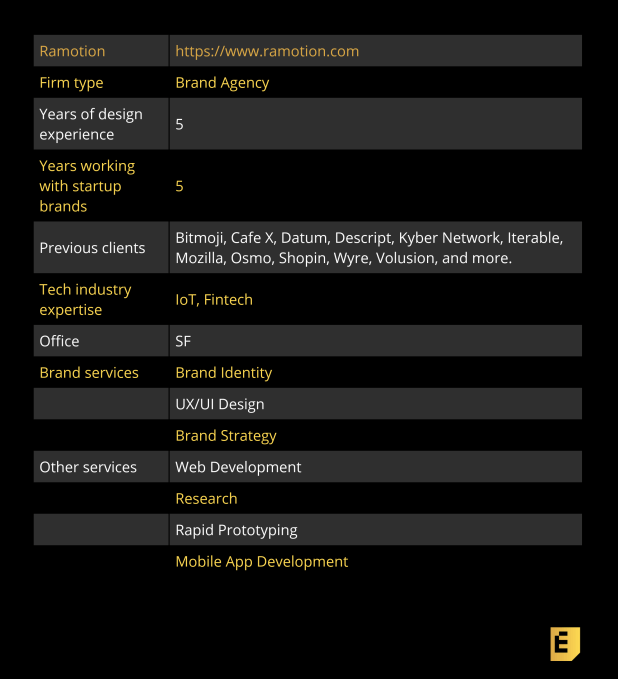

Verified Expert Brand Designer: Ramotion

Ramotion is a remote branding and product design agency that has worked with Bay Area tech startups since 2014. While they typically do branding for funded, fast-growing startups, Ramotion has helped companies ranging from Bitmoji’s early brand identity to Mozilla’s rebrand. We spoke to Ramotion’s CEO Denis Pakhaliuk about their iterative approach, his favorite branding projects and more.

Ramotion’s branding philosophy:

“We are a big fan of starting small: designing a small package, releasing it and then iterating on top of that. So, founders need to be focused on what’s really necessary right now for their next round of investment or product releases.”

On common founder mistakes:

“I think some founders think they need everything, but they actually need an MVP and product design. The same goes for brand identity. They need to have some key elements like colors, typeface and the logo. There is no need to do everything in the beginning, because the logo and brand identity becomes meaningful after it’s used. It’ll eventually improve.”

“They’re the reason we have such an amazing logo today.” Kevin Sproles, Austin, founder & CEO at Volusion

Below, you’ll find the rest of the founder reviews, the full interview and more details like pricing and fee structures. This profile is part of our ongoing series covering startup brand designers and agencies with whom founders love to work, based on this survey and our own research. The survey is open indefinitely, so please fill it out if you haven’t already.

Interview with Ramotion’s CEO Denis Pakhaliuk

Yvonne Leow: Can you tell me about your journey and how you came to create Ramotion?

Denis Pakhaliuk: Yeah, I started as a CG designer more than 10 years ago. I was doing computer graphics, CG modeling, digitalization of architectural design and automotive design. I was initially very focused on German cars and industrial design. Once iPhone 3G came out, I switched to doing UI design for mobile apps, which was a very hot topic at the time.

From that point I met a guy who just said, “Hey, I’m thinking of building an agency,” and so we decided to do it together. It started with a few people and now we have up to 30. We focus on different products, from small companies to more established brands, like Salesforce, among others. So yeah, it’s been a fun journey.

Yvonne Leow: At what point did Ramotion start working with startups?

Powered by WPeMatico

How do you hire a great growth marketer?

Editors Note: This article is part of a series that explores the world of growth marketing for founders. If you’ve worked with an amazing growth marketing agency, nominate them to be featured in our shortlist of top growth marketing agencies in tech.

Startups often set themselves back a year by hiring the wrong growth marketer.

This post shares a framework my marketing agency uses to source and vet high-potential growth candidates.

With it, early-stage startups can identify and attract a great first growth hire.

It’ll also help you avoid unintentionally hiring candidates who lack broad competency. Some marketers master 1-2 channels, but aren’t experts at much else. When hiring your first growth marketer, you should aim for a generalist.

This post covers two key areas:

- How I find growth candidates.

- How I identify which candidates are legitimately talented.

Great marketers are often founders

One interesting way to find great marketers is to look for great potential founders.

Let me explain. Privately, most great marketers admit that their motive for getting hired was to gain a couple years’ experience they could use to start their own company.

Don’t let that scare you. Leverage it: You can sidestep the competitive landscape for marketing talent by recruiting past founders whose startups have recently failed.

Why do this? Because great founders and great growth marketers are often one and the same. They’re multi-disciplinary executors, they take ownership and they’re passionate about product.

You see, a marketing role with sufficient autonomy mimics the role of a founder: In both, you hustle to acquire users and optimize your product to retain them. You’re working across growth, brand, product and data.

As a result, struggling founders wanting a break from the startup roller coaster often find transitioning to a growth marketing role to be a natural segue.

How do we find these high-potential candidates?

Finding founders

To find past founders, you could theoretically monitor the alumni lists of incubators like Y Combinator and Techstars to see which companies never succeeded. Then you can reach out to their first-time founders.

You can also identify future founders: Browse Product Hunt and Indie Hackers for old projects that showed great marketing skill but didn’t succeed.

There are thousands of promising founders who’ve left a mark on the web. Their failure is not necessarily indicative of incompetence. My agency’s co-founders and directors, including myself, all failed at founding past companies.

How do I attract candidates?

To get potential founders interested in the day-to-day of your marketing role, offer them both breadth and autonomy:

- Let them be involved in many things.

- Let them be fully in charge of a few things.

Remember, recreate the experience of being a founder.

Further, vet their enthusiasm for your product, market and its product-channel fit:

- Product and market: Do their interests line up with how your product impacts its users? For example, do they care more about connecting people through social networks, or about solving productivity problems through SaaS? And which does your product line up with?

- Product-channel fit: Are they excited to run the acquisition channels that typically succeed in your market?

The latter is a little-understood but critically important requirement: Hire marketers who are interested in the channels your company actually needs.

Let’s illustrate this with a comparison between two hypothetical companies:

- A B2B enterprise SaaS app.

- An e-commerce company that sells mattresses.

Broadly speaking, the enterprise app will most likely succeed through the following customer acquisition channels: sales, offline networking, Facebook desktop ads and Google Search.

In contrast, the e-commerce company will most likely succeed through Instagram ads, Facebook mobile ads, Pinterest ads and Google Shopping ads.

We can narrow it even further: In practice, most companies only get one or two of their potential channels to work profitably and at scale.

Meaning, most companies have to develop deep expertise in just a couple of channels.

There are enterprise marketers who can run cold outreach campaigns on autopilot. But, many have neither the expertise nor the interest to run, say, Pinterest ads. So if you’ve determined Pinterest is a high-leverage ad channel for your business, you’d be mistaken to assume that an enterprise marketer’s cold outreach skills seamlessly translate to Pinterest ads.

Some channels take a year or longer to master. And mastering one channel doesn’t necessarily make you any better at the next. Pinterest, for example, relies on creative design. Cold email outreach relies on copywriting and account-based marketing.

(How do you identify which ad channels are most likely to work for your company? Read my Extra Crunch article for a breakdown.)

To summarize: To attract the right marketers, identify those who are interested in not only your product but also how your product is sold.

Other approaches

The founder-first approach I’ve shared is just one of many ways my agency recruits great marketers. The point is to remind you that great candidates are sometimes a small career pivot away from being your perfect hire. You don’t have to look in the typical places when your budget is tight and you want to hire someone with high, senior potential.

This is especially relevant for early-stage, bootstrapping startups.

If you have the foresight to recognize these high-potential candidates, you can hopefully hire both better and cheaper. Plus, you empower someone to level up their career.

Speaking of which, here are other ways to hire talent whose potential hasn’t been fully realized:

- Find deep specialists (e.g. Facebook Ads experts) and offer them an opportunity to learn complementary skills with a more open-ended, strategic role. (You can help train them with my growth guide.)

- Poach experienced junior marketers from a company in your space by offering senior roles.

- Hire candidates from top growth marketing schools.

Vetting growth marketers

If you don’t yet have a growth candidate to vet, you can stop reading here. Bookmark this and return when you do!

Now that you have a candidate, how do you assess whether they’re legitimately talented?

At Bell Curve, we ask our most promising leads to incrementally complete three projects:

- Create Facebook and Instagram ads to send traffic to our site. This showcases their low-level, tactical skills.

- Walk us through a methodology for optimizing our site’s conversion rate. This showcases their process-driven approach to generating growth ideas. Process is everything.

- Ideate and prioritize customer acquisition strategies for our company. This showcases their ability to prioritize high-leverage projects and see the big picture.

We allow a week to complete these projects. And we pay them market wage.

Here’s what we’re looking for when we assess their work.

Level 1: Basics

First — putting their work aside — we assess the dynamics of working with them. Are they:

- Competent: Can they follow instructions and understand nuance?

- Reliable: Will they hit deadlines without excuses?

- Communicative: Will they proactively clarify unclear things?

- Kind: Do they have social skills?

If they follow our instructions and do a decent job, they’re competent. If they hit our deadline, they’re probably reliable. If they ask good questions, they’re communicative.

And if we like talking to them, they’re kind.

Level 2: Capabilities

A level higher, we use these projects to assess their ability to contribute to the company:

- Do they have a process for generating and prioritizing good ideas?

- Did their process result in multiple worthwhile ad and landing page ideas? We’re assessing their process more so than their output. A great process leads to generating quality ideas forever.

- Resources are always limited. One of the most important jobs of a growth marketer is to ensure growth resources are focused on the right opportunities. I’m looking for a candidate that has a process for identifying, evaluating and prioritizing growth opportunities.

- Can they execute on those ideas?

- Did they create ads and propose A/B tests thoughtfully? Did they identify the most compelling value propositions, write copy enticingly and target audiences that make sense?

- Have they achieved mastery of 1-2 acquisition channels (ideally, the channels your company is dependent on to scale)? I don’t expect anyone to be an expert in all channels, but deep knowledge of at least a couple of channels is key for an early-stage startup making their first growth hire.

If you don’t have the in-house expertise to assess their growth skills, you can pay an experienced marketer to assess their work. It’ll cost you a couple hundred bucks, and give you peace of mind. Look on Upwork for someone, or ask a marketer at a friend’s company.

Recap

- If you’re an early-stage company with a tight budget, there are creative ways to source high-potential growth talent.

- Assess that talent on their product fit and market fit for your company. Do they actually want to work on the channels needed for your business to succeed?

- Give them a week-long sample project. Assess their ability to generate ideas and prioritize them.

Powered by WPeMatico