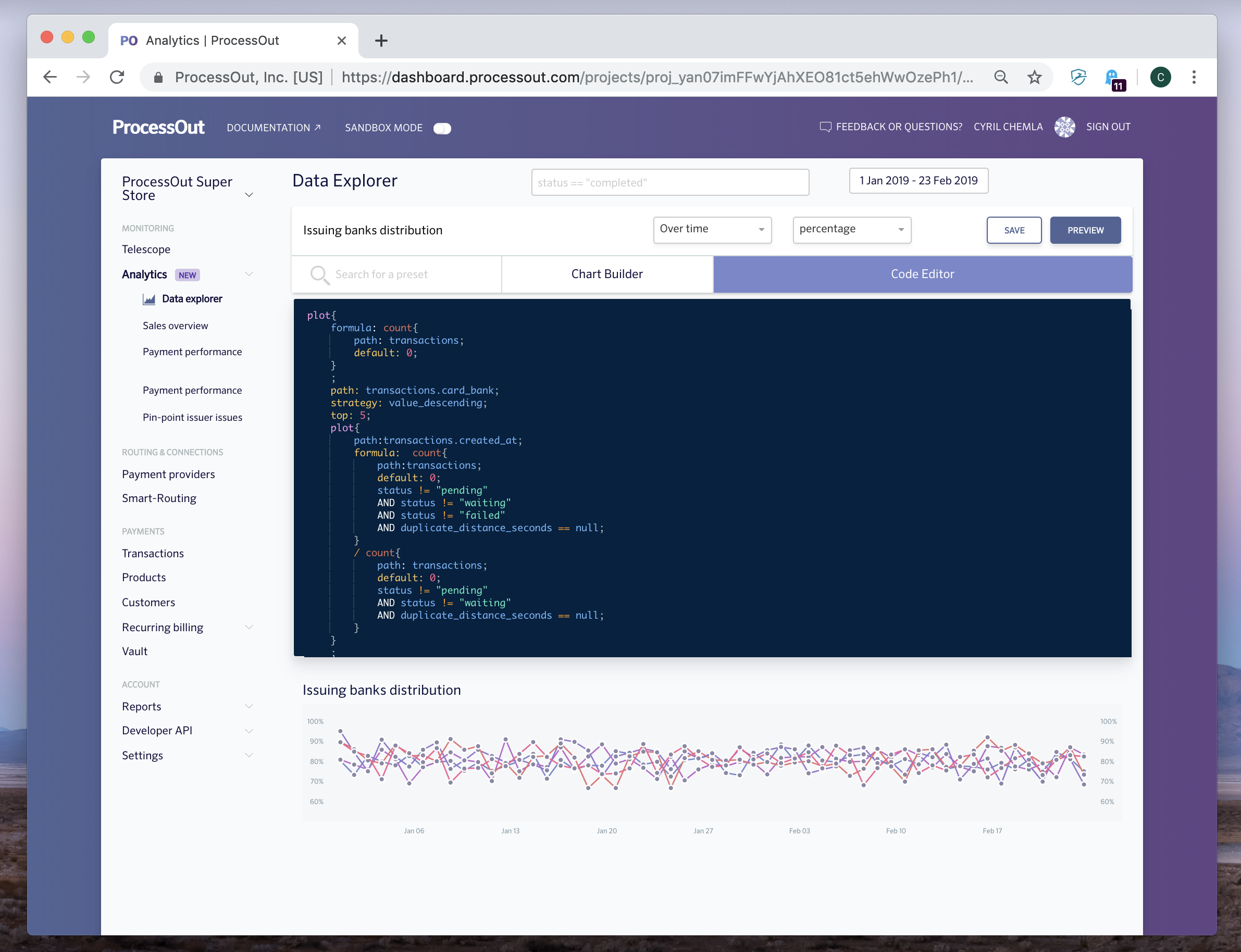

ProcessOut improves payment data visualization

ProcessOut has grown quite a lot since I first covered the startup. The company now has a ton of small and big clients, from Glovo to Vente-Privée and Dashlane. The company has become an expert on payment providers and payment analytics.

The core of the product remains the same. Clients sign up to get an overview on the performance of their payment systems. After setting up ProcessOut Telescope, you can monitor payments with expensive fees, failed payments and disappointing payment service providers.

And this product is quite successful. Back in October 2018, the company had monitored $7 billion in transactions since its inception — last month, that number grew to $13 billion.

The company is adding new features to make it easier to get insights from your payment data. You can now customize your data visualization dashboards with a custom scripting language called ProcessOut Lang. This way, if you have an internal payment team, they can spot issues more easily.

ProcessOut can also help you when it comes to generating reports. The company can match transactions on your bank account with transactions on different payment providers.

If you’re a smaller company and can’t optimize your payment module yourself, ProcessOut also builds a smart-routing checkout widget. When a customer pays something, the startup automatically matches card information with the best payment service provider for that transaction in particular.

Some providers are quite good at accepting all legit transactions, such as Stripe or Braintree. But they are also more expensive than more traditional payment service providers. ProcessOut can predict if a payment service provider is going to reject this customer before handing the transaction to that partner. It leads to lower fees and a lower rejection rate.

The company recently added support for more payment service providers in Latin America, such as Truevo, AllPago and Mercadopago. And ProcessOut now routes more transactions in one day compared to the entire month of October 2018.

As you can see, the startup is scaling nicely. It will be interesting to keep an eye on it.

Powered by WPeMatico

Uber’s self-driving car unit raises $1B from Toyota, Denso and Vision Fund ahead of spin-out

Uber has confirmed it will spin out its self-driving car business after the unit closed $1 billion in funding from Toyota, auto-parts maker Denso and SoftBank’s Vision Fund.

The development has been speculated for some time — as far back as October — and it serves to both remove a deeply unprofitable unit from the main Uber business, helping Uber scale back some of its losses, while giving Uber’s Advanced Technologies Group (known as Uber ATG) more freedom to focus on the tough challenge of bringing autonomous vehicles to market.

The deal values Uber ATG at $7.25 billion, the companies announced. In terms of the exact mechanics of the investment, Toyota and Denso are providing $667 million, with the Vision Fund throwing in the remaining $333 million.

The deal is expected to close in Q3, and it gives investors a new take on Uber’s imminent IPO, which comes with Uber ATG. The company posted a $1.85 billion loss for 2018, but R&D efforts on “moonshots” like autonomous cars and flying vehicles dragged the numbers down by accounting for more than $450 million in spending. Moving those particularly capital-intensive R&D plays into a new entity will help bring the core Uber numbers down to earth, but clearly there’s still a lot of work to reach break-even or profitability.

Still, those crazy numbers haven’t dampened the mood. Uber is still seen as a once-in-a-generation company, and it is tipped to raise around $10 billion from the IPO, giving it a reported valuation of $90 billion-$100 billion.

Like the spin-out itself, the identity of the investors is not a surprise.

The Vision Fund (and parent SoftBank) have backed Uber since a January 2018 investment deal closed, while Toyota put $500 million into the ride-hailing firm last August. Toyota and Uber are working to bring autonomous Sienna vehicles to Uber’s service by 2021 while, in further proof of their collaborative relationship, SoftBank and Toyota are jointly developing services in their native Japan, which will be powered by self-driving vehicles.

The duo also backed Grab — the Southeast Asian ride-hailing company in which Uber owns around 23 percent — perhaps more aggressively. SoftBank has been an investor since 2014, and last year Toyota invested $1 billion into Grab, which it said was the highest investment it has made in ride hailing.

“Leveraging the strengths of Uber ATG’s autonomous vehicle technology and service network and the Toyota Group’s vehicle control system technology, mass-production capability, and advanced safety support systems, such as Toyota Guardian, will enable us to commercialize safer, lower cost automated ridesharing vehicles and services,” said Shigeki Tomoyama, the executive VP who leads Toyota’s “connected company” division, said in a statement.

Here’s Uber CEO Dara Khosrowshahi’s shorter take on Twitter:

Excited to announce Toyota, Denso and the SoftBank Vision Fund are making a $1B investment in @UberATG, as we work together towards the future of mobility. pic.twitter.com/JdqhLkV7uU

— dara khosrowshahi (@dkhos) April 19, 2019

Powered by WPeMatico

Index Ventures, Stripe back bookkeeping service Pilot with $40M

Five years after Dropbox acquired their startup Zulip, Waseem Daher, Jeff Arnold and Jessica McKellar have gained traction for their third business together: Pilot.

Pilot helps startups and small businesses manage their back office. Chief executive officer Daher admits it may seem a little boring, but the market opportunity is undeniably huge. To tackle the market, Pilot is today announcing a $40 million Series B led by Index Ventures with participation from Stripe, the online payment processing system.

The round values Pilot, which has raised about $60 million to date, at $355 million.

“It’s a massive industry that has sucked in the past,” Daher told TechCrunch. “People want a really high-quality solution to the bookkeeping problem. The market really wants this to exist and we’ve assembled a world-class team that’s capable of knocking this out of the park.”

San Francisco-based Pilot launched in 2017, more than a decade after the three founders met in MIT’s student computing group. It’s not surprising they’ve garnered attention from venture capitalists, given that their first two companies resulted in notable acquisitions.

Pilot has taken on a massively overlooked but strategic segment — bookkeeping,” Index’s Mark Goldberg told TechCrunch via email. “While dry on the surface, the opportunity is enormous given that an estimated $60 billion is spent on bookkeeping and accounting in the U.S. alone. It’s a service industry that can finally be automated with technology and this is the perfect team to take this on — third-time founders with a perfect combo of financial acumen and engineering.”

The trio of founders’ first project, Linux upgrade software called Ksplice, sold to Oracle in 2011. Their next business, Zulip, exited to Dropbox before it even had the chance to publicly launch.

It was actually upon building Ksplice that Daher and team realized their dire need for tech-enabled bookkeeping solutions.

“We built something internally like this as a byproduct of just running [Ksplice],” Daher explained. “When Oracle was acquiring our company, we met with their finance people and we described this system to them and they were blown away.”

It took a few years for the team to refocus their efforts on streamlining back-office processes for startups, opting to build business chat software in Zulip first.

Pilot’s software integrates with other financial services products to bring the bookkeeping process into the 21st century. Its platform, for example, works seamlessly on top of QuickBooks so customers aren’t wasting precious time updating and managing the accounting application.

“It’s better than the slow, painful process of doing it yourself and it’s better than hiring a third-party bookkeeper,” Daher said. “If you care at all about having the work be high-quality, you have to have software do it. People aren’t good at these mechanical, repetitive, formula-driven tasks.”

Currently, Pilot handles bookkeeping for more than $100 million per month in financial transactions but hopes to use the infusion of venture funding to accelerate customer adoption. The company also plans to launch a tax prep offering that they say will make the tax prep experience “easy and seamless.”

“It’s our first foray into Pilot’s larger mission, which is taking care of running your companies entire back office so you can focus on your business,” Daher said.

As for whether the team will sell to another big acquirer, it’s unlikely.

“The opportunity for Pilot is so large and so substantive, I think it would be a mistake for this to be anything other than a large and enduring public company,” Daher said. “This is the company that we’re going to do this with.”

Powered by WPeMatico

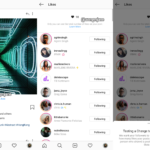

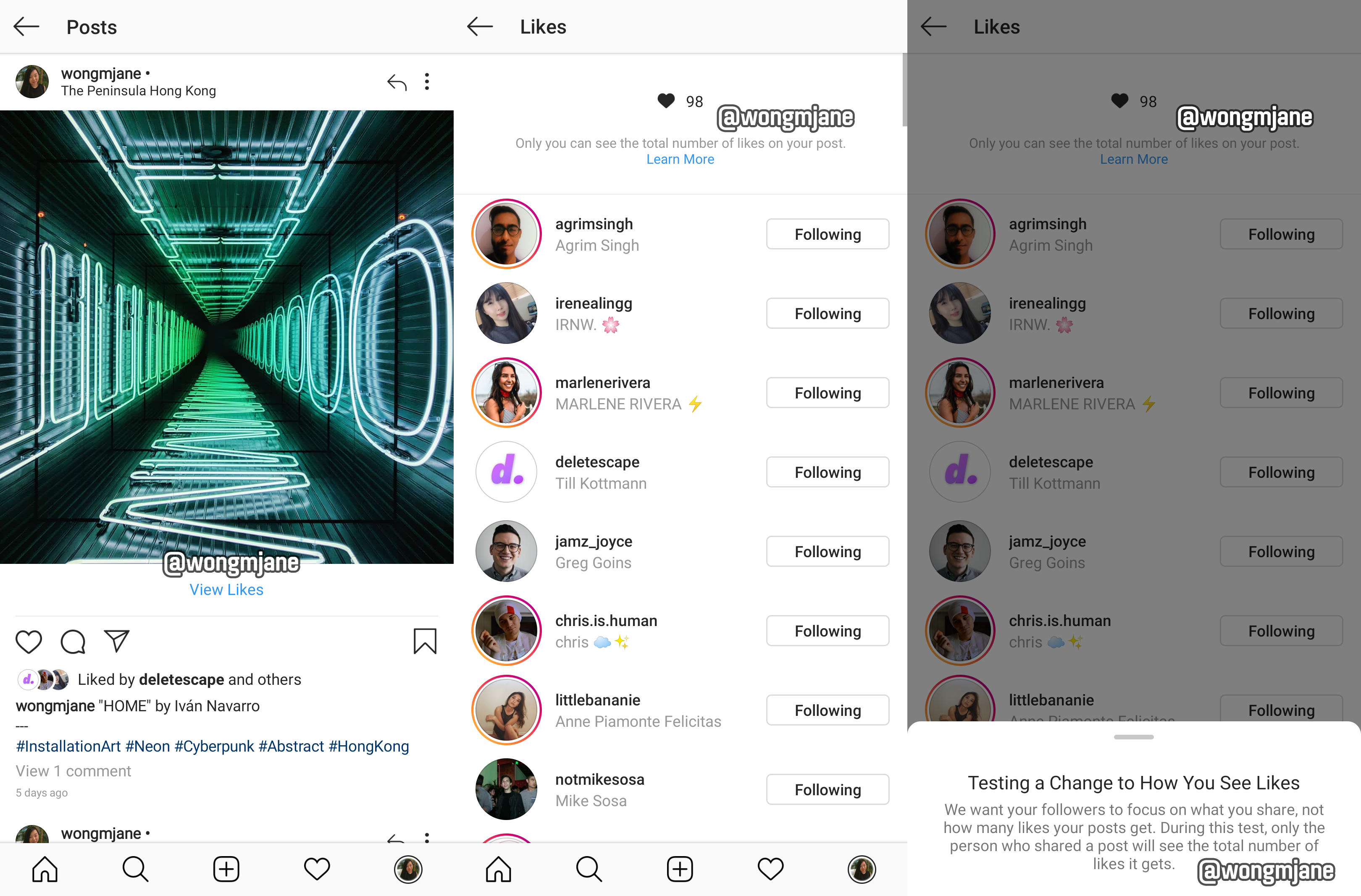

Instagram hides Like counts in leaked design prototype

“We want your followers to focus on what you share, not how many likes your posts get. During this test, only the person who share a post will see the total number of likes it gets.” That’s how Instagram describes a seemingly small design change test with massive potential impact on users’ well-being.

Hiding Like counts could reduce herd mentality, where people just Like what’s already got tons of Likes. It could reduce the sense of competition on Instagram, since users won’t compare their own counts with those of more popular friends or superstar creators. And it could encourage creators to post what feels most authentic rather than trying to rack of Likes for everyone to see.

The design change test was spotted by Jane Manchun Wong, the prolific reverse engineering expert and frequent TechCrunch tipster whose spotted tons of Instagram features before they’re officially confirmed or launched. Wong discovered the design change test in Instagram’s Android code and was able to generate the screenshots above.

You can see on the left that the Instagram feed post lacks a Like count, but still shows a few faces and a name of other people who’ve Liked it. Users are alerted that only they’ll see their post’s Like counts, and anyone else won’t. Many users delete posts that don’t immediately get ‘enough’ Likes or post to their fake ‘Finstagram’ accounts if they don’t think they’ll be proud of the hearts they collect. Hiding Like counts might get users posting more since they’ll be less self-conscious.

An Instagram confirmed to TechCrunch that this design is an internal prototype that’s not visible to the public yet. A spokesperson told us: “We’re not testing this at the moment, but exploring ways to reduce pressure on Instagram is something we’re always thinking about.” Other features we’ve reported on in the same phase, such as video calling, soundtracks for Stories, and the app’s time well spent dashboard all went on to receive official launches.

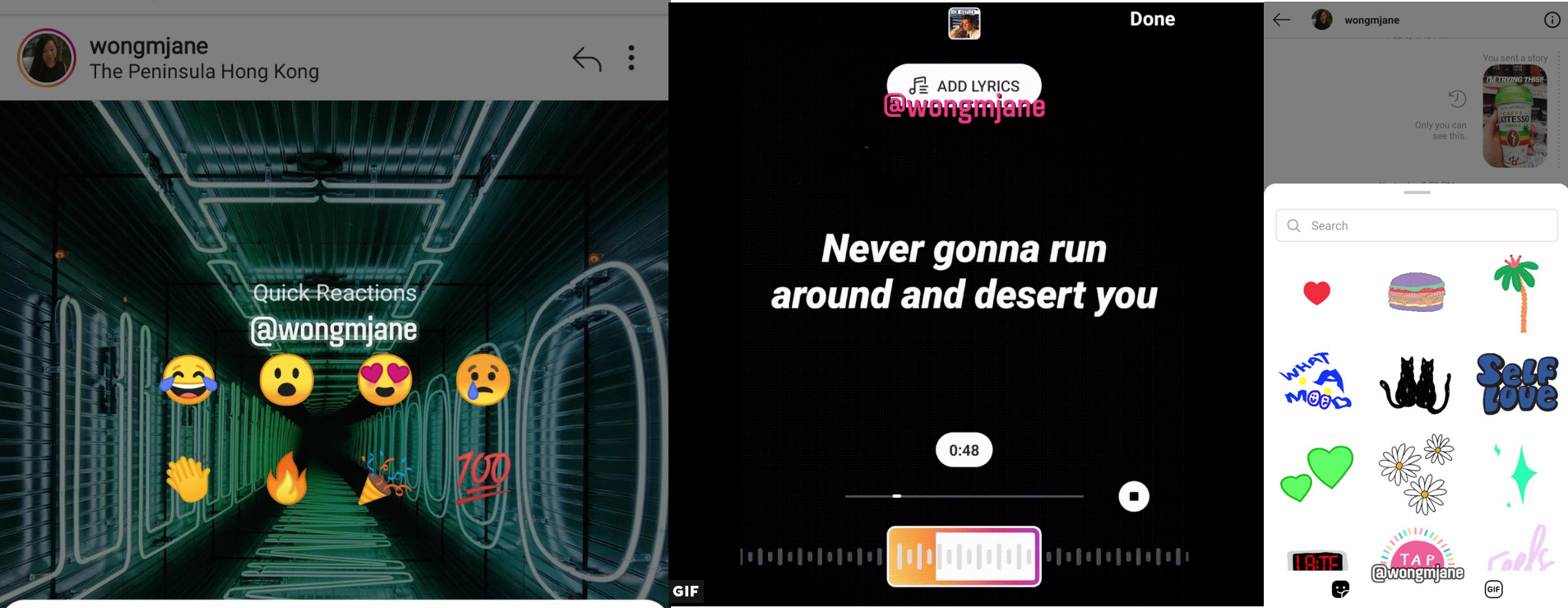

Instagram’s prototypes (from left): feed post reactions, Stories lyrics, and Direct stickers

Meanwhile, Wong has also recently spotted several other Instagram prototypes lurking in its Android code. Those include chat thread stickers for Direct messages, augmented reality filters for Direct Video calls, simultaneous co-watching of recommended videos through Direct, karaoke-style lyrics that appear synced to soundtracks in Stories, emoji reactions to feed posts, and a shopping bag for commerce.

It appears that there’s no plan to hide follower counts on user profiles, which are the true measure of popularity but also serve a purpose of distinguishing great content creators and assessing their worth to marketers. Hiding Likes could just put more of a spotlight on follower and comment counts. And even if users don’t see Like counts, they still massively impact the feed’s ranking algorithm, so creators will still have to battle for them to be seen.

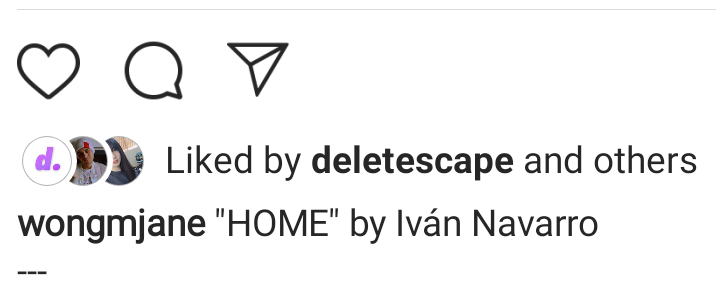

Close-up of Instagram’s design for feed posts without Like counters

The change matches a growing belief that Like counts can be counter-productive or even harmful to users’ psyches. Instagram co-founder Kevin Systrom told me back in 2016 that getting away from the pressure of Like counts was one impetus for Instagram launching Stories. Last month, Twitter began testing a design which hides retweet counts behind an extra tap to similarly discourage inauthentic competition and herd mentality. And Snapchat has never shown Like counts or even follower counts, which has made it feel less stressful but also less useful for influencers.

Narcissism, envy spiraling, and low self-image can all stem from staring at Like counts. They’re a constant reminder of the status hierarchies that have emerged from social networks. For many users, at some point it stopped being fun and started to feel more like working in the heart mines. If Instagram rolls the feature out, it could put the emphasis back on sharing art and self-expression, not trying to win some popularity contest.

Powered by WPeMatico

Working backwards to uncover key success factors

If you’re a SaaS business, you’re likely overwhelmed with data and an ever-growing list of acronyms that purport to unlock secret keys to your success. But like most things, tracking with you do has very little impact on what you actually do.

It’s really important to find one, or a very small number, of key indicators to track and then base your activities against those. It’s arguable that SaaS businesses are becoming TOO data driven — at the expense of focussing on the core business and the reason they exist.

In this article, we’ll look at focusing on metrics that matter, metrics that help form activities, not just measure them in retrospect.

Most of the metrics we track, such as revenue growth, are lagging indicators. But growth is a result, not an activity you can drive. Just saying you want to grow an extra 10% doesn’t mean anything towards actually achieving it.

Since growth funnels are generally looked at from top to bottom, and in a historical context — a good exercise can be the other way around — go bottom-up, starting with the end result (the growth goal) and figure out what each stage needs to contribute to achieve it.

You can do this by looking at leading indicators. These are metrics that you can influence — and that as you act, and see them increase or decrease, you can be relatively certain of the knock-on effects on the rest of the business. For example — if you run a project management product, the number of tasks created is likely to be a good leading indicator for the growth of the business — more tasks created on the platform equals more revenue.

Powered by WPeMatico

Uber, Lyft implement new safety measures

Uber and Lyft instituted new safety features and policies this week.

The move follows the death of Samantha Josephson, a student at the University of South Carolina, who was kidnapped and murdered in late March. She was found dead after getting into a vehicle that she believed to be her Uber ride. The murder, which has garnered nationwide media attention, seems to have spurred action by the ridesharing behemoths.

In response, Uber is launching the Campus Safety Initiative, which includes new features in the app. Currently, the features are in testing, and they remind riders to check the license plate, make and model of the car, as well as the driver’s name and picture, before ever entering into a vehicle. The test is running in South Carolina, in partnership with the University of South Carolina, with plans to roll out nationwide.

Lyft, which went public on March 29, has implemented continuous background checks for drivers this week. (Uber has had this in place since last year.) Lyft also enhanced its identity verification process for drivers, which combines driver’s license verification and photographic identity verification to prevent driver identity fraud on the platform.

Uber, prepping to debut on the public market, is taking the safety precautions seriously. The new system reminds riders about checking their ride three separate times: the first is a banner at the bottom of the app once the ride has been ordered, the second is a warning to check license plate, car details and photo, and the third is an actual push notification before the driver arrives reminding riders to check once more.

Alongside the reminder system, Uber is also working to build out dedicated pickup zones in the Five Points district of Columbia, with plans to roll out dedicated pickup zones at other U.S. universities.

That said, Uber has also warned investors ahead of its IPO about a forthcoming safety report on the company, which could be damaging to the brand. The report is supposed to be released sometime this year, and will give the public its first comprehensive look at the scale of safety incidents and issues that occur on the platform.

“The public responses to this transparency report or similar public reporting of safety incidents claimed to have occurred on our platform … may result in negative media coverage and increased regulatory scrutiny and could adversely affect our reputation with platform users,” said Uber in its April 14 IPO paperwork.

Indeed, the issue of safety on platforms like Uber and Lyft, or really any app that asks you to be alone with total strangers, goes well beyond any single incident. A CNN investigation found that 103 Uber drivers had been accused of sexual assault or abuse in the last four years.

Powered by WPeMatico

Microsoft delves deeper into IoT with Express Logic acquisition

Microsoft has never been shy about being acquisitive, and today it announced it’s buying Express Logic, a San Diego company that has developed a real-time operating system (RTOS) aimed at controlling the growing number of IoT devices in the world.

The companies did not share the purchase price.

Express Logic is not some wide-eyed, pie-in-the-sky startup. It has been around for 23 years, building (in its own words) “industrial-grade RTOS and middleware software solutions for embedded and IoT developers.” The company boasts some 6.2 billion (yes, billion) devices running its systems. That number did not escape Sam George, director of Azure IoT at Microsoft, but as he wrote in a blog post announcing the deal, there is a reason for this popularity.

“This widespread popularity is driven by demand for technology to support resource constrained environments, especially those that require safety and security,” George wrote.

Holger Mueller, an analyst with Constellation Research, says that market share also gives Microsoft instant platform credibility. “This is a key acquisition for Microsoft: on the strategy side Microsoft is showing it is serious with investing heavily into IoT, and on the product side it’s a key step to get into the operating system code of the popular RTOS,” Mueller told TechCrunch.

The beauty of Express Logic’s approach is that it can work in low-power and low-resource environments and offers a proven solution for a range or products. “Manufacturers building products across a range of categories — from low-capacity sensors like lightbulbs and temperature gauges to air conditioners, medical devices and network appliances — leverage the size, safety and security benefits of Express Logic solutions to achieve faster time to market,” George wrote.

Writing in a blog post to his customers announcing the deal, Express Logic CEO William E. Lamie, expressed optimism that the company can grow even further as part of the Microsoft family. “Effective immediately, our ThreadX RTOS and supporting software technology, as well as our talented engineering staff join Microsoft. This complements Microsoft’s existing premier security offering in the microcontroller space,” he wrote.

Microsoft is getting an established company with a proven product that can help it scale its Azure IoT business. The acquisition is part of a $5 billion investment in IoT the company announced last April that includes a number of Azure pieces, such as Azure Sphere, Azure Digital Twins, Azure IoT Edge, Azure Maps and Azure IoT Central.

“With this acquisition, we will unlock access to billions of new connected endpoints, grow the number of devices that can seamlessly connect to Azure and enable new intelligent capabilities. Express Logic’s ThreadX RTOS joins Microsoft’s growing support for IoT devices and is complementary with Azure Sphere, our premier security offering in the microcontroller space,” George wrote.

Powered by WPeMatico

The different playbooks of D2C brands

Over the past half a decade, the tidal wave of niche brands delivering new kinds of products to consumers and doing so online has changed the retail and CPG landscapes forever.

This shift has in some way caused a shakeout in traditional retail, with once-popular retailers announcing store closures (JCPenney, Sears) or even liquidation (Payless, Toys R Us) and has sent fashion houses and CPG brands on a soul-searching journey. The changing demographics and desires of shoppers have also fueled the decline of traditional brands and their distribution mechanisms.

This bleak scenario of incumbent consumer brands is in stark contrast to the rapid emergence of a host of digitally-native Direct to Consumer (D2C) brands. A few D2C brands have been successful enough to become unicorns! Retailers like Walmart, Nordstrom, and Target have quickly adapted to the D2C era.

Walmart has made a string of acquisitions beginning with Jet.com and Bonobos. Nordstrom has broadened its assortment to include D2C brands, Target has partnered with Harry’s, Quip, and Flamingo – all of which have rolled out their products in Target’s stores across the country. Target has also invested in Casper, which is the latest D2C brand to become a Unicorn.

Venture capital firms have invested over four billion dollars in D2C brands since 2012, with 2018 alone accounting for over a billion. With investment comes pressure to scale and deliver profits. And this pressure is bringing the focus on some pertinent questions – How are these D2C brands going to evolve and how could they sustain as businesses?

Like always, the pioneering companies find their path and we then derive the playbooks out of them. From PipeCandy’s analysis of several D2C brands, we see the following approaches taken by D2C brands.

- Playbook 1: Brand’s purpose anchored around one product category

- Playbook 2: Brand’s purpose anchored around multiple product categories

- Playbook 3: Brand’s purpose anchored around aggregation of other brands (for sale or rent)

We discuss the market size and capital availability factors that influence the paths and the outcomes.

Table of Contents

- D2C playbooks

- Access to capital and how D2C playbooks are impacted

- The VC route to scale

- The non-VC route to scale

- Outcome without hitting scale

- Roll-ups by strategic buyers

- Roll-ups by financial buyers

- Brand incubators

Brand’s Purpose anchored around one product category

Many of these D2C brands that have experienced early success owe their rise largely to an authentic relationship with consumers that is built on the promise of one product. In many ways, focusing on one product line and a small set of SKUs makes total business sense.

Design, Production, Marketing & Customer Support complexities can stay manageable with such deliberate narrowing down of focus.

In some categories, you could stay focused on one product line for a long time and build a successful company.

Powered by WPeMatico

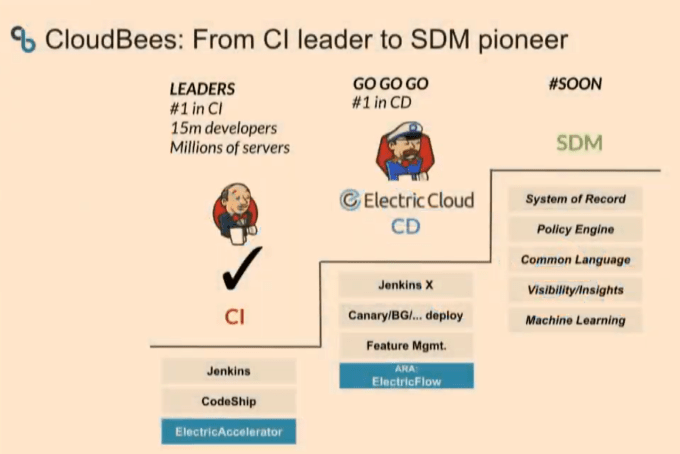

CloudBees acquires Electric Cloud to build out its software delivery management platform

CloudBees, the enterprise continuous integration and delivery service (and the biggest contributor to the Jenkins open-source automation server), today announced that it has acquired Electric Cloud, a continuous delivery and automation platform that first launched all the way back in 2002.

The two companies did not disclose the price of the acquisition, but CloudBees has raised a total of $113.2 million while Electric Cloud raised $64.6 million from the likes of Rembrandt Venture Partners, U.S. Venture Partners, RRE Ventures and Next47.

CloudBees plans to integrate Electric Cloud’s application release automation platform into its offerings. Electric Flow’s 110 employees will join CloudBees.

“As of today, we provide customers with best-of-breed CI/CD software from a single vendor, establishing CloudBees as a continuous delivery powerhouse,” said Sacha Labourey, the CEO and co-founder of CloudBees, in today’s announcement. “By combining the strength of CloudBees, Electric Cloud, Jenkins and Jenkins X, CloudBees offers the best CI/CD solution for any application, from classic to Kubernetes, on-premise to cloud, self-managed to self-service.”

Electric Cloud offers its users a number of tools for automating their release pipelines and managing the application life cycle afterward.

“We are looking forward to joining CloudBees and executing on our shared goal of helping customers build software that matters,” said Carmine Napolitano, CEO, Electric Cloud. “The combination of CloudBees’ industry-leading continuous integration and continuous delivery platform, along with Electric Cloud’s industry-leading application release orchestration solution, gives our customers the best foundation for releasing apps at any speed the business demands.”

As CloudBees CPO Christina Noren noted during her keynote at CloudBees’ developer conference today, the company’s customers are getting more sophisticated in their DevOps platforms, but they are starting to run into new problems now that they’ve reached this point.

“What we’re seeing is that these customers have disconnected and fragmented islands of information,” she said. “There’s the view that each development team has […] and there’s not a common language, there’s not a common data model, and there’s not an end-to-end process that unites from left to right, top to bottom.” This kind of integrated system is what CloudBees is building toward (and that competitors like GitLab would argue they already offer). Today’s announcement marks a first step into this direction toward building a full software delivery management platform, though others are likely to follow.

During his company’s developer conference, Labourey also today noted that CloudBees will profit from Electric Cloud’s longstanding expertise in continuous delivery and that the acquisition will turn CloudBees into a “DevOps powerhouse.”

Today’s announcement follows CloudBees’ acquisition of CI/CD tool CodeShip last year. As of now, CodeShip remains a standalone product in the company’s lineup. It’ll be interesting to see how CloudBees will integrate Electric Cloud’s products to build a more integrated system.

Powered by WPeMatico

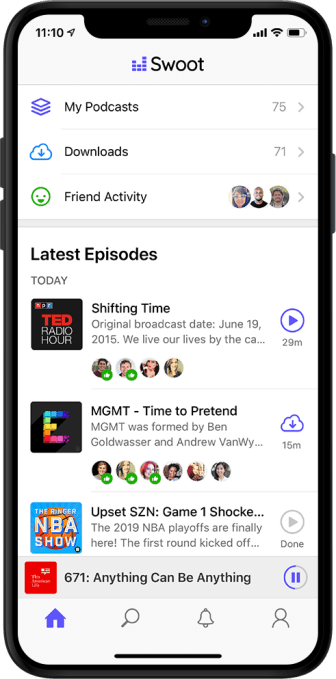

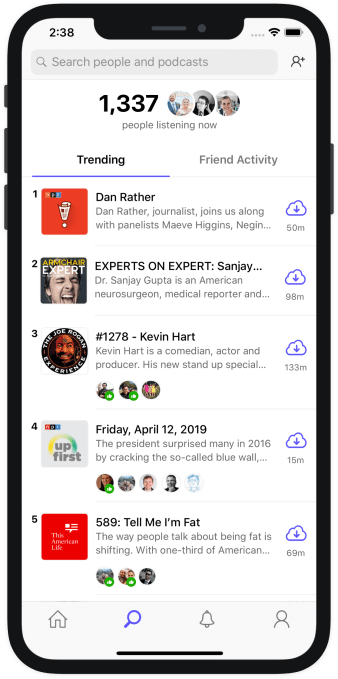

HipChat founders launch Swoot, a social podcast app

Pete Curley and Garret Heaton, who previously co-founded team chat app HipChat and sold it to Atlassian, are officially launching their new product, Swoot, today. The app makes it easy for users to recommend podcasts and see what their friends are listening to.

This might seem like a big leap from selling enterprise software — and indeed, Curley said the company was initially focused on creating another set of team collaboration tools.

What they realized, however, was that HipChat is “actually a consumer product that the company just happens to pay for, because the employees demand it” — and he said they weren’t terribly interested in trying to build a business around a more traditional “top-down sales process.”

Meanwhile, Curley said he’d injured his back while lowering one of his children into a crib, which meant that for months, his only form of exercise was walking. He recalled walking around for hours each day and, for the first time, keeping himself entertained by listening to podcasts.

“I was actually way behind the times,” he said. “I didn’t know this, that everyone else was listening to them … This is like the dark web of content.”

The startup has already raised a $3 million seed funding round led by True Ventures .

“Pete and Garret both have incredible product and entrepreneurial experience, plus they have built successful businesses together in the past,” said True Ventures co-founder Jon Callaghan in a statement. “Their focus of solving the disjointed podcast listening experience through Swoot’s elegant design fills a clear gap in media discovery.”

Discovery — namely, finding new podcasts beyond the handful that you already subscribe to — is one of the biggest issues in podcasting right now. It’s something a number of companies are trying to solve, but in Curley’s view, the key is to make the listening experience more social.

He noted that social sharing features are getting added to “literally everything,” including your bathroom scale, except “the one thing that I actually wanted it for.”

Curley also contrasted the podcast listening experience with YouTube: “We don’t realize how big [podcasting] is because there is no social thing where you see that Gangnam Style has 8 billion views, and you realize that the entire world is watching. There’s no view count, no anything that tells you what’s popular.”

So he’s trying to provide that view with Swoot. Instead of focusing on overall listen counts (which might not be that impressive in a new app), Swoot gives you two main ways to track what’s popular among your friends.

There’s a feed that shows you everything that your friends are listening to or recommending, plus a list of episodes that are currently trending, with little icons showing you the friends who have listened to at least 20 percent of an episode.

Curley said the team has been beta testing the app by simply releasing it on the App Store and telling friends about it, then letting it spread by word of mouth until it was in the hands of around 1,000 users. During that test, it found that 25 percent of the podcasts that users listened to were coming from friends.

Curley also noted that this approach is “episode-centric” rather than “show-centric.” In other words, it’s not just helping you find the next podcast that you want to subscribe to and listen to for years — it also helps surface the specific episode that everyone’s listening to right now.

“In the 700,000 shows that exist, if you’re the 690,000 worst-ranked show, but you have one great episode that should be able to go viral, that’s basically impossible to do right now, because audio is crazy hard to share,” Curley said.

In the course of our conversation, I brought up my experience with Spotify — I like knowing what’s popular, but when a friend recently mentioned specific songs that they could see I’d been listening to on the service, I was a bit creeped out.

“It’s funny, I actually thought, how ironic that Spotify is getting into podcasting now [through the acquisitions of Gimlet and Anchor],” Curley replied. “They actually had this correct mechanism applied to the wrong thing. Music is a deeply personal thing.”

Which isn’t to say that podcast listening isn’t personal, but there’s more of an opportunity to discover overlapping interests, say the fact that you and your friends all listen to true crime podcasts.

Curley also said that the app is deliberately designed to ensure that “the service does not get worse because a ton of people follow you” — so they see what you are listening to, but they can’t comment on it or tell you that you’re an idiot for listening.

At the same time, he also said the team will be adding a mode to only share podcasts you actively recommend, rather than posting everything you listen to.

As for making money, Curley suggested that he’s interested in exploring a variety of possibilities, whether that’s integrating with other subscription or tipping services, or in creating ad opportunities around promoting podcasts.

“My actual answer is, there are a bunch of people trying to monetize right now, but I don’t think there’s a platform even close to mature enough to even try to monetize podcasting yet, other than podcasters doing their own advertising,” he said. “I think the endgame, where the real money is made in podcasting, actually hasn’t been come up with yet.”

Powered by WPeMatico