Cytora secures £25M Series B for its AI-powered commercial insurance underwriting solution

Cytora, a U.K. startup that developed an AI-powered solution for commercial insurance underwriting, has raised £25 million in a Series B round. Leading the investment is EQT Ventures, with participation from existing investors Cambridge Innovation Capital, Parkwalk and a number of unnamed angel investors.

A spin-out of the University of Cambridge, Cytora was founded in 2014 by Richard Hartley, Aeneas Wiener, Joshua Wallace and Andrzej Czapiewski — although both Wallace and Czapiewski have since departed.

Its first product launched in late 2016 to a number of large insurance customers, with the aim of applying AI to commercial insurance supported by various public and proprietary data. This includes property construction features, company financials and local weather, combined with an insurance company’s own internal risk data.

“Commercial insurance underwriting is inaccurate and inefficient,” says Cytora co-founder and CEO Richard Hartley. “It’s inaccurate because underwriting decisions are made using sparse and outdated information. It’s inefficient because the underwriting process is so manual. Unlike buying car or travel insurance, which can be purchased in minutes, buying business insurance can take up to seven days. This means operating costs for insurers are extremely high and customer experience isn’t good leading to a lack of trust.”

To illustrate how inefficient commercial insurance can be, Hartley says that for every £1 of premium that businesses pay to insurers, only 60 pence is set aside to pay total claims. The other 40 pence evaporates as the “frictional cost of delivering insurance.”

Powered by AI, Hartley claims that Cytora is able to distill the seven-day underwriting process down to 30 seconds via its API. This enables insurers to underwrite programmatically and build workflows that provide faster and more accurate decisions.

“Our APIs are powered by a risk engine which learns the subtle patterns of good and bad risks over time,” he explains. “This gives insurers a better understanding of the underlying risk of each business and helps them set a more accurate price. Both customers and insurers benefit.”

Typical Cytora customers are commercial insurers that are digitally transforming their underwriting process. Users of the software are either underwriters within insurance companies who are underwriting large commercial risks (i.e. an average insurance premium ~£500k and above) or business customers of insurance companies who are buying insurance direct online with an average premium of £1,000-£5,000.

“For the latter, our customers have built quotation workflows on top of Cytora’s APIs, enabling business owners to buy policies online in less than a minute without having to fill in a form,” says Hartley. “We require only a business name and postcode to issue a quote, which revolutionises the customer experience.”

To that end, Cytora generates revenue by charging a yearly ARR license fee, which increases based on usage and per line of business. The company says today’s Series B funding will be used to accelerate the expansion of its product suite and for scaling into new geographies.

Powered by WPeMatico

Sila Nano’s battery tech is now worth over $1 billion with Daimler partnership and $170 million investment

Sila Nanotechnologies and its battery materials manufacturing technology are now worth more than $1 billion.

The company, which announced a $170 million funding led by Daimler and a partnership with the famed German automaker, started building out its first production lines for its battery materials last year. That first line is capable of producing the material to supply the equivalent of 50 megawatts of lithium-ion batteries, according to Sila Nano’s chief executive officer Gene Berdichevsky.

That construction, made on the heels of a $70 million investment round, is now going to be expanded with the new cash from Daimler and 8VC along with previous investors Bessemer Venture Partners, Chengwei Capital, Matrix Partners, Siemens Next47 and Sutter Hill Ventures.

Berdichevsky would not comment on how much production capacity would increase, but did say that the company’s battery materials would find their way into consumer devices before the end of 2020. That means the potential for longer-lasting batteries in smart watches, earbuds and health trackers, initially.

From its headquarters in Alameda, Calif., Sila Nanotechnologies has developed a silicon-based anode to replace graphite in lithium-ion batteries. The company claims that its materials can improve the energy density of batteries by 20 percent.

“If you can increase energy density by 20 percent… you can use 20 percent fewer cells and each pack can cost 20 percent less,” says Berdichevsky. “The subtext of it is that it is the way to drive price of energy storage down. And that’s the way for the electric vehicle market to sand more and more on its own.”

That kind of cost reduction is what brought BMW and Daimler to partner with the company — and what led to the massive funding round and the company’s newfound unicorn status.

“Our valuation is over $1 billion dollars now,” Berdichevsky says.

Image courtesy of Sila Nanotechnologies

For Daimler, the materials that Sila Nanotechnologies are developing will give the company’s commitment to electrification a much needed boost.

Mercedes-Benz has plans to electrify its entire product suite by 2022, the company has said. That means Daimler has to accelerate its production of electrified alternatives to its fuel-powered fleet — everything from its 48-volt electrical system (the EQ Boost), to its plug-in hybrids (EQ-Power) and the more than 10 fully electric vehicles powered by batteries or fuel cells. The company is projecting that between 15 percent and 25 percent of its total sales will be electric by 2025 — depending on customer preferences, infrastructure development and the regulatory environment in each of the markets in which it sells vehicles, the company said.

In all, Mercedes-Benz cars has committed to investing €10 billion ($11.3 billion) in the production of vehicles and another $1.3 billion into a global battery production network. The global battery production network of Mercedes-Benz Cars will in the future consist of nine factories on three continents.

“We are on our way to a carbon free future mobility. While our all-new EQC model enters the markets this year we are already preparing the way for the next generation of powerful battery electric vehicles,” said Sajjad Khan, executive vice president for Connected, Autonomous, Shared & Electric Mobility, Daimler AG in a statement.

Still, consumers shouldn’t expect to see vehicles with Sila Nano’s technology until at least the mid 2020s, as automakers look to prove that the company’s battery technology meets their quality assurance standards. “The qualification time means there’s many years of work to make sure it is reliable for next 10 to 20 years,” says Berdichevsky. “Our partnership is geared towards mid-2020s production targets, but the qualification is something that takes quite a while.”

The company’s latest round brings its total financing to just under $300 million since its launch in 2011. And as a result of the latest funding, former General Electric chief executive Jeff Immelt will take a seat on the company’s board of directors.

“Advancements in lithium-ion batteries have become increasingly limited, and we are fighting for incremental improvements,” said Immelt. “I’ve seen first-hand that this is a huge opportunity that is also incredibly hard to solve. The team at Sila Nano has not only created a breakthrough chemistry, but solved it in a way that is commercially viable at scale.”

Powered by WPeMatico

Xbox One does away with discs in new $249 All-Digital Edition

Discs! What are they good for? Well, they’re nice if you don’t want to be tied to an online-only ecosystem. But if you don’t mind that, Microsoft’s latest Xbox One S “All-Digital Edition” might be for you. With no slots to speak of, the console is limited to downloading games to its drive — which is how we’ve been doing it on PC for quite some time.

Announced during today’s “Inside Xbox” video presentation, the Xbox One S All-Digital Edition — honestly, why not just give it a different letter? — is identical to the existing One S except for, of course, not having a disc slot in the front.

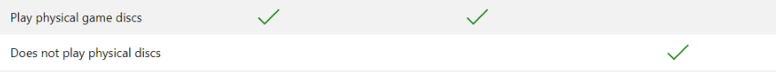

The Xbox One X (left) and S (center) are missing this valuable feature exclusive to the All-Digital Edition (right)

The impact of the news was lessened somewhat by Sony’s strategically timed tease of its next-generation console, revealing little — but enough to get gamers talking on a day Microsoft would have preferred was about its game ecosystem. But to return to the disc-free Xbox.

“We’re not looking to push customers toward digital,” explained Microsoft’s Jeff Gattis in a press release. “It’s about meeting the needs of customers that are digital natives that prefer digital-based media. Given this is the first product of its kind, it will teach us things we don’t already know about customer preferences around digital and will allow us to refine those experiences in the future. We see this as a step forward in extending our offerings beyond the core console gamer.”

The CPU and GPU are the same, RAM is the same, everything is the same. Even, unfortunately, the hard drive: a single lonely terabyte (imagine saying that a few years ago) that could fill up fast if every game has to be downloaded in full rather than loaded from disc.

It’s also the exact same shape and size as the S, which seems like a missed opportunity — they couldn’t make it a little smaller or thinner after taking out the whole Blu-ray assembly? Well, at least the original is a nice-looking little box to begin with. (“Changes that affect the form of a console can be complex and costly,” said Gattis.)

It’s also the exact same shape and size as the S, which seems like a missed opportunity — they couldn’t make it a little smaller or thinner after taking out the whole Blu-ray assembly? Well, at least the original is a nice-looking little box to begin with. (“Changes that affect the form of a console can be complex and costly,” said Gattis.)

At $249 it’s $50 cheaper than the disc-using edition, and comes with copies of Sea of Thieves, Minecraft and Forza Horizon 3. That’s a pretty decent value, I’d say. If you’re looking to break into the Xbox ecosystem and don’t want to clutter your place with a bunch of discs and cases, this is a nice option. Sea of Thieves had kind of a weak start but has grown quite a bit, FH3 is supposed to be solid and Minecraft is of course Minecraft.

You may also want to spring for the new Xbox Game Pass Ultimate service, which combines Xbox Live Gold and Xbox Game Pass — meaning you get the usual online benefits as well as access to the growing Game Pass library. There’s enough there now that, with the games you get in the box, you shouldn’t have to buy much of anything until whatever Microsoft announces at E3 comes out. (There’s even a special offer for three months of Game Pass for a buck to get you started.)

You can pre-order the All-Digital Edition (which really should have been called the Xbox One D) now, and it should ship and be available at retailers starting May 7.

Powered by WPeMatico

Unicorns: A tale of two continents

Contributor

If you’re hoping to create a unicorn on a budget, look to the European technology sector for inspiration. Despite the well-documented increase in available funding for tech companies across the continent, startups are reaching unicorn status with much lower totals of venture capital than U.S. rivals. In fact, this level of “capital efficiency” is one major attraction for international investors weary of the “burn rate” of many U.S. companies aspiring to valuations of $1 billion+.

It costs a staggering 50-100 percent more in the U.S. to create a company valued at $1 billion than in Europe. For U.S. tech companies that achieved unicorn status in 2018, the median amount of funding required was more than $125 million, whereas their contemporaries in Europe required a lesser total of $80 million. For 2017, the gap was even wider; U.S. companies again required just over $100 million, the smaller pool of Europeans slightly above $50 million.

| Region | Year | Median funding required prior to reaching a valuation of $1B |

| U.S. | 2017 | $107 million |

| Europe | 2017 | $53.15 million |

| U.S. | 2018 | $125.38 million |

| Europe | 2018 | $80.8 million |

The median funding secured prior to (not including) the round in which tech companies in the U.S. and Europe achieved a $1 billion valuation during 2017/18 (Data source: PitchBook)

A key reason for this greater efficiency in scaling is because European companies have had to make do with less. Europe has historically had a much smaller pool of “late-stage growth” funding (typically rounds of $30-75 million), and even today it is far easier to raise $20 million for a European tech company than $50 million, while that does not hold true in the U.S. to anywhere near the same degree.

This dearth of late-stage money has forced European tech companies to scale more efficiently, with lower overheads and a focus on profitability at an earlier stage, rather than the aggressive growth patterns often witnessed in the U.S. But this “enforced prudence” has come at a price.

The cost of creating more unicorns

Greater capital efficiency has arguably resulted in fewer European tech companies achieving unicorn status, with Europe lagging far behind the number created each year in the U.S. In 2018, the U.S. birthed 53 unicorns; Europe, only 10. So how much funding is required to close the gap?

Let’s assume (safely) product innovation and quality is available both in the U.S. and Europe, and let’s assume (less safely) there are many more quality European companies built to “unicorn potential” that are currently unable to raise enough to fuel scale to the point where they achieve $1 billion valuations. To plug this funding gap, we estimate Europe would require a multi-year capital pool of $10-20 billion in additional late-stage capital.

That math is based on a large number, up to 40, of companies a year missing out on becoming unicorns because of a lack of available funding, alongside the assumption that each unicorn needs more than $100 million in funding in total.

The extremely good news is that it is not $100 billion. Due to the inherent efficiency of risk capital, $10-20 billion can go an awfully long way. Arguably, there is no other industry or sector that can yield such a high return on committed money within a reasonably short few years.

Is it all about the money?

No, Europe is still a trickier market to scale than the U.S. Not only does Europe have to compete with the ready availability of capital in the U.S., but different regulatory environments, language barriers and a brain drain of talent attracted to Silicon Valley all combine to create impediments for European tech companies scaling in an interconnected world.

Funding, however, stands as the simplest of limiting factors to address. Especially when an analysis of the stats shows that whilst European tech companies are “saving” a lot of money, this directly contributes to far fewer of them being worth the mythical $1 billion+. A marginal uplift in capital would produce a disproportionately higher number of unicorns.

Powered by WPeMatico

Daily Crunch: Hands-on with the Samsung Galaxy Fold

The Daily Crunch is TechCrunch’s roundup of our biggest and most important stories. If you’d like to get this delivered to your inbox every day at around 9am Pacific, you can subscribe here.

1. Unfolding the Samsung Galaxy Fold

After eight years of teasing a folding device, Samsung finally pulled the trigger with an announcement at its developer’s conference late last year. But the device itself remained mysterious.

Earlier this week, Brian Heater finally held the Galaxy Fold in his hands, and he was pretty impressed.

2. YouTube’s algorithm added 9/11 facts to a live stream of the Notre-Dame Cathedral fire

Some viewers following live coverage of the Notre-Dame Cathedral broadcast on YouTube were met with a strangely out-of-place info box offering facts about the September 11 attacks. Ironically, the feature is supposed to fact check topics that generate misinformation on the platform.

3. Hulu buys back AT&T’s minority stake in streaming service now valued at $15 billion

Disney now has a 67 percent ownership stake in Hulu — which it gained, in part, through its $71 billion acquisition of 21st Century Fox. Comcast has a 33 percent stake.

4. I asked the US government for my immigration file and all I got were these stupid photos

The “I” in question is our security reporter Zack Whittaker, who filed a Freedom of Information request with U.S. Citizenship and Immigration Services to obtain all of the files the government had collected on him in order to process his green card application. Seven months later, disappointment.

Video app TikTok has become a global success, but it stumbled hard in one of the world’s biggest mobile markets, India, over illicit content.

6. Smart speakers’ installed base to top 200 million by year end

Canalys forecasts the installed base will grow by 82.4 percent, from 114 million units in 2018 to 207.9 million in 2019.

7. Salesforce ‘acquires’ Salesforce.org for $300M in a wider refocus on the nonprofit sector

The company announced that it will integrate Salesforce.org — which had been a reseller of Salesforce software and services to the nonprofit sector — into Salesforce itself as part of a new nonprofit and education vertical.

Powered by WPeMatico

ZenGo wants to become the crypto wallet for the masses

KZen is about to release ZenGo, a mobile app to manage your cryptocurrencies securely and more easily. There are already countless crypto wallets out there, but the startup thinks they’re all either too complicated or too insecure.

If you own cryptocurrencies, chances are they’re sitting on an exchange, such as Coinbase or Binance. If somebody manages to log in to your account, nothing is stopping them from sending those assets to other wallets and stealing everything.

Worse, if somebody hacks an exchange, they could potentially divert cryptocurrencies from that exchange’s wallets. In other words, leaving your cryptocurrencies on an exchange means you give your assets to that exchange and hope they properly take care of them.

On the other end of the spectrum, you can manage your private keys yourself and rely on a hardware wallet from Ledger and Trezor. The learning curve is too hard for many people. And if you don’t follow instructions properly, you might end up losing access to your wallet or accidentally sharing private keys.

Enough about other wallets, let’s talk about ZenGo. Former TechCrunch editor Ouriel Ohayon and his team think the perfect wallet app involves a smartphone you own paired with ZenGo’s servers.

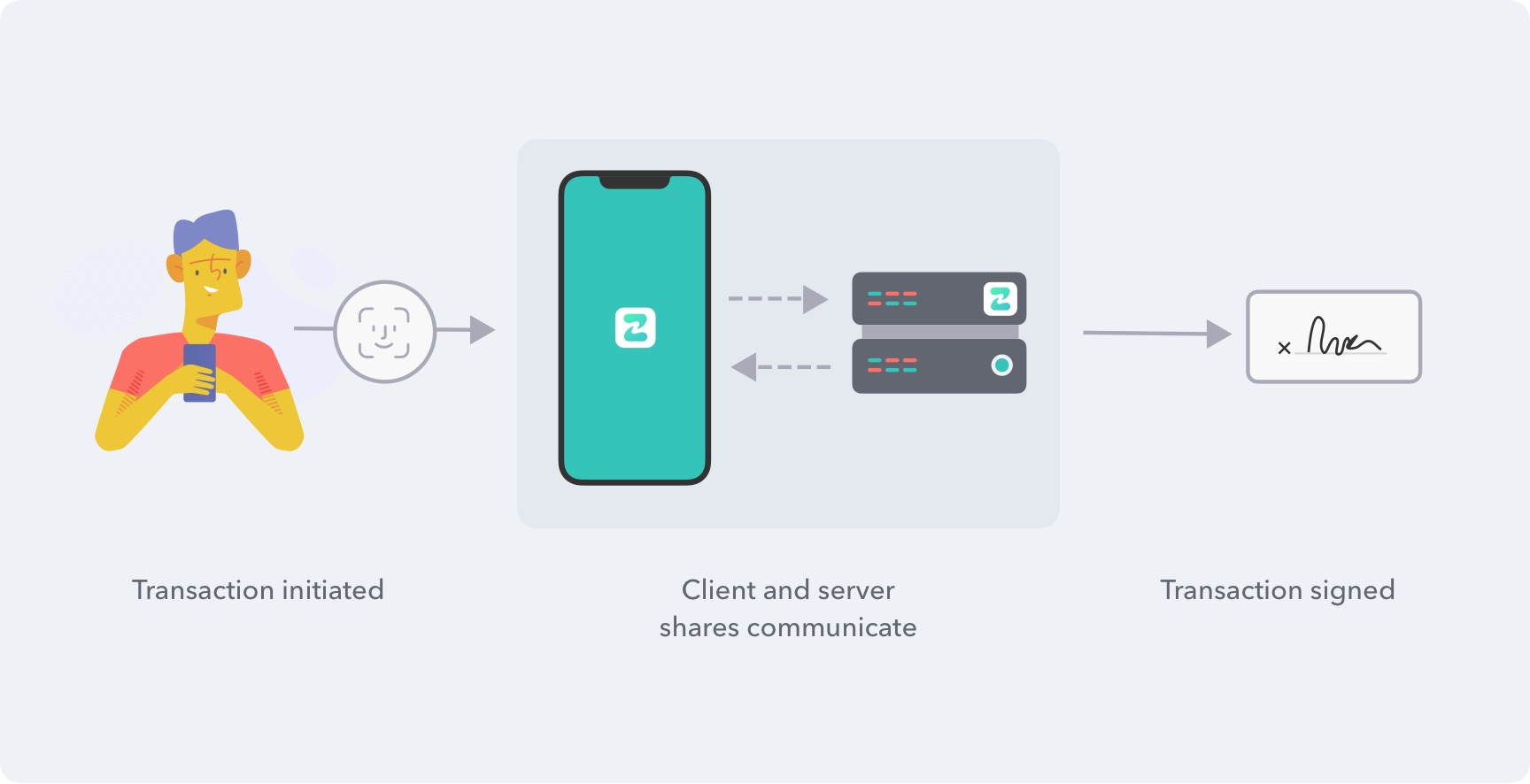

The company uses threshold signatures, which means that you need both ZenGo’s servers and your smartphone to initiate a transaction. If you lose your device, you can recover your funds. But the startup can’t access your cryptocurrencies on its own.

Behind the scene, ZenGo still uses a public key and private secrets, but everything is completely transparent for the end user.

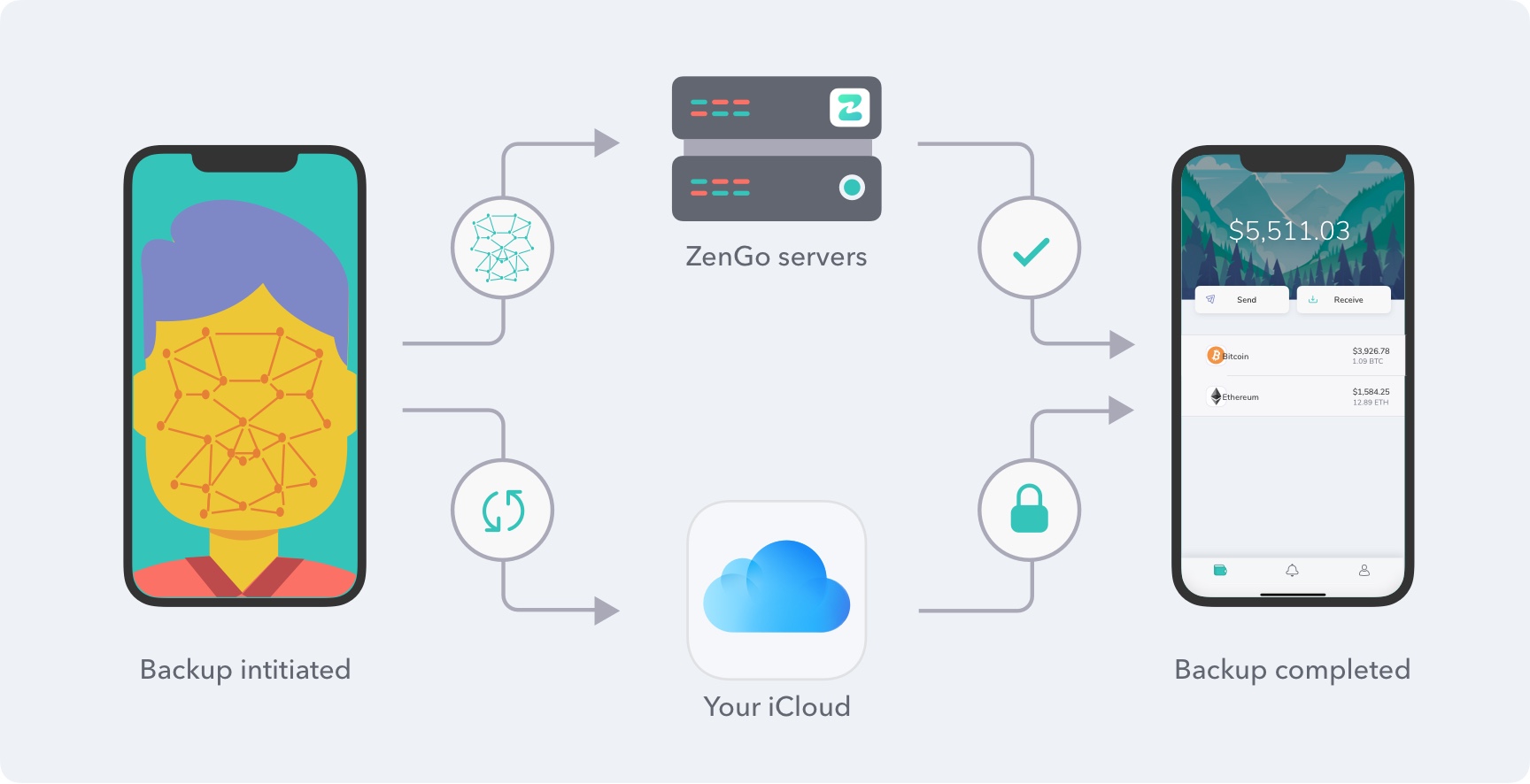

When you set up your wallet, two private secrets are generated separately and stored in multiple ways — one part is on your smartphone, the other is on the servers. You need both parts to sign a transaction. If you back up your device part to ZenGo’s servers, you can recover all parts in case you lose your device, for instance.

ZenGo can’t directly access the second part on its own because it is encrypted using a decryption code that is stored on your iCloud account. But accessing your iCloud is not enough — if you want to recover your wallet, you need to prove your identity.

That’s why the company stores a 3D biometric face map to let you restore your wallet on a new device. The company partners with ZoOm so that you can create a face map from any smartphone with a selfie camera.

The security model has been open-sourced and I hope many security experts will try to find vulnerabilities. That’s the only way you can know for sure that it’s a secure system.

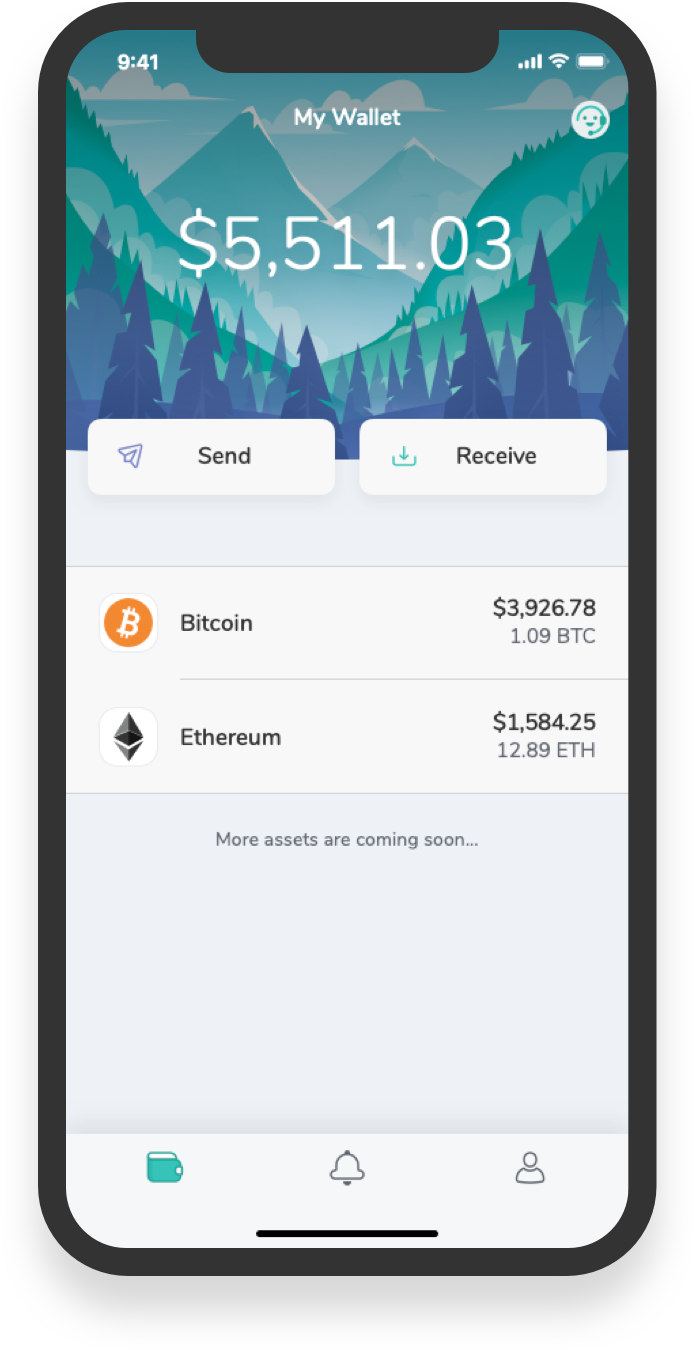

All of this sounds complicated, but most users won’t even realize what’s happening. I tried the app and it’s a well-designed mobile app. Right now, it only supports Bitcoin and Ethereum, but more assets are on the way. The company tracks your public addresses to notify you when you receive funds.

The app isn’t available just yet. It should launch as a beta this week and arrive in the stores pretty soon.

Powered by WPeMatico

Google expands its container service with GKE Advanced

With its Kubernetes Engine (GKE), Google Cloud has long offered a managed service for running containers on its platform. Kubernetes users tend to have a variety of needs, but so far, Google only offered a single tier of GKE that wasn’t necessarily geared toward the high-end enterprise users the company is trying to woo. Today, however, the company announced a new advanced edition of GKE that introduces a number of new features and an enhanced financially backed SLA, additional security tools and new automation features. You can think of GKE Advanced as the enterprise version of GKE.

The new service will launch in the second quarter of the year and hasn’t yet announced pricing. The regular version of GKE is now called GKE Standard.

Google says the service builds upon the company’s own learnings from running a complex container infrastructure internally for years.

For enterprise customers, the financially backed SLA is surely a nice bonus. The promise here is 99.95 percent guaranteed availability for regional clusters.

Most users who opt for a managed Kubernetes environment do so because they don’t want to deal with the hassle of managing these clusters themselves. With GKE Standard, there’s still some work to be done with regard to scaling the clusters. Because of this, GKE Advanced includes a Vertical Pod Autoscaler that keeps on eye on resource utilization and adjusts it as necessary, as well as Node Auto Provisioning, an enhanced version of cluster autoscaling in GKE Standard.

In addition to these new GKE Advanced features, Google is adding GKE security features like the GKE Sandbox, which is currently in beta and will come exclusively to GKE Advanced once it’s launched, and the ability to enforce that only signed and verified images are used in the container environment.

The Sandbox uses Google’s gVisor container sandbox runtime. With this, every sandbox gets its own user-space kernel, adding an additional layer of security. With Binary Authorization, GKE Advanced users also can ensure that all container images are signed by a trusted authority before they are put into production. Somebody could theoretically still smuggle malicious code into the containers, but this process, which enforces standard container release practices, for example, should ensure that only authorized containers can run in the environment.

GKE Advanced also includes support for GKE usage metering, which allows companies to keep tabs on who is using a GKE cluster and charge them according. This feature, too, will be exclusive to GKE Advanced.

Powered by WPeMatico

Sony shares some details about the PlayStation 5

Lead architect for the PlayStation 4 and PlayStation Vita Mark Cerny gave a lengthy interview to Wired’s Peter Rubin and shared some details about Sony’s next-gen console — the console that is likely to be called the PlayStation 5.

The next PlayStation will be based on an AMD architecture just like the PlayStation 4 and PlayStation 4 Pro. The custom-made CPU will be based on the third-generation AMD Ryzen CPU line. It’ll feature eight 7nm cores.

As for the GPU, Sony plans to use a custom version of AMD Radeon’s Navi GPUs. While AMD is supposed to unveil this new generation of GPUs in the coming months, Cerny says that the next-gen PlayStation GPU will support ray tracing.

Those chips should also lead to a jump in audio performance. You can expect better 3D audio support if you have a set of speakers or headphones that support this kind of stuff.

The PlayStation 5 will also ship with SSD hard drives by default. This is a key differentiating factor between PC games and console games. Spinning hard drives lead to endless loading screens.

Opting for an SSD changes everything. For instance, Cerny says that fast-travel in Spider-Man running on a PlayStation 4 Pro takes approximately 15 seconds, while it takes less than a second on a next-generation PlayStation devkit.

On the hardware front, Cerny also said that the PlayStation 5 will have a Blu-ray drive to read physical games. And you’ll also be able to play PlayStation 4 games on the new console.

Based on the interview, it’s unclear whether Sony wants to launch a second-generation PlayStation VR headset. But if you already bought a VR headset, it’ll be compatible with the future PlayStation.

Sony is skipping E3 this year, which means that we won’t hear more about the PlayStation 5 for a while. The company most likely will launch the new console in 2020.

Powered by WPeMatico

Why it just might make sense that Salesforce.com is buying Salesforce.org

Yesterday, Salesforce .com announced its intent to buy its own educational/nonprofit arm, Salesforce.org, for $300 million. On its face, this feels like a confusing turn of events, but industry experts say it’s really about aligning educational and nonprofit verticals across the entire organization.

Salesforce has always made a lot of hay about being a responsible capitalist. It’s something it highlights at events and really extends with the 1-1-1 model it created, which gives one percent of profit, time and resources (product) to education and nonprofits. Its employees are given time off and are encouraged to work in the community. Salesforce.org has been the driver behind this, but something drove the company to bring Salesforce.org into the fold.

While it’s easy to be cynical about the possible motivations, it could be a simple business reason, says Ray Wang, founder and principal analyst at Constellation Research. As he pointed out, it didn’t make a lot of sense from a business perspective to be running two separate entities with separate executive teams, bookkeeping systems and sales teams. What’s more, he said there was some confusion over lack of alignment and messaging between the Salesforce.com education sales team and what was happening at Salesforce.org. Finally, he says because Salesforce.org couldn’t issue Salesforce.com stock options, it might not have been attracting the best talent.

“It allows them to get better people and talent, and it’s also eliminating redundancies with the education vertical. That was really the big driver behind this,” Wang told TechCrunch.

Tony Byrne, founder and principal analyst at Real Story Group agreed. “My guess is that they were struggling to align roadmaps between the offerings (.com and .org), and they see .org as more strategic now and want to make sure they’re in the fold,” he said.

Focusing on the charity arm

Brent Leary, principal and co-founder at CRM Essentials, says it’s also about keeping that charitable focus front and center, while pulling that revenue into the Salesforce.com revenue stream. “It seems like doing good is set to be really good for business, making it a potentially very good idea to be included as part of Salesforce’s top line revenue numbers, Leary said.

For many, this was simply about keeping up with Microsoft and Google in the nonprofit space, and being part of Salesforce.com makes more sense in terms of competing. “I believe Salesforce’s move to bring Salesforce.org in house was a well-timed strategic move to have greater influence on the company’s endeavors into the Not for Profit (NFP) space. In the wake of Microsoft’s announcements of significantly revamping and adding resources to its Dynamics 365 Nonprofit Accelerator, Salesforce would be well-served to also show greater commitment on their end to helping NFPs acquire greater access to technologies that enable them to carry out their mission,” Daniel Newman, founder and principal analyst at Futurum Research, said.

Good or bad idea?

But not everyone sees this move in a positive light. Patrick Moorhead, principal analyst and founder at Moor Insights and Strategies, says it could end up being a public relations nightmare for Salesforce if the general public doesn’t understand the move. Salesforce could exacerbate that perception if it ends up raising prices for nonprofits and education.

“Salesforce and Benioff’s move with Salesforce.org is a big risk and could blow up in its face. The degree of negative reaction will be dependent on how large the price hikes are and how much earnings get diluted. We won’t know that until more details are released,” Moorhead said.

The deal is still in progress, and will take some months to close, but if it’s simply an administrative move designed to create greater efficiencies, it could make sense. The real question that remains is how this will affect educational and nonprofit institutions as the company combines Salesforce.org and Salesforce.com.

Salesforce did not wish to comment for this story.

Powered by WPeMatico

Notes from the Samsung Galaxy Fold: day one

More like day 1.5, honestly. I spent most of yesterday sick in bed, with fever dreams of flexible displays. This morning, however, I’m already at the airport. Out of the the frying pan and into the fire, as it were.

Point is, after spending an hour or so with the phone yesterday, I now find myself with the Galaxy Fold in hand (or hands, as the case may be). I’ll be using the foldable as my day to day phone as I travel to California for our robotics event.

I’ll have a full review for you in a few days, but in the meantime, I’ll be using these pages to offer up something a bit more stream of consciousness, as I learn to adapt to life with a folding phone.

- The main reaction of bystanders is that of bafflement. I had the phone unfolded, with the Delta app open and an airline employee asked, “Is that a phone?” Fair enough.

- When I responded in the affirmative, the same employee asked, “is it a Nokia?” No sir, it is not a Nokia.

- Attempting to scan my boarding pass at the TSA check-in, I realized it was actually too large for the scanner. I had to readjust it at a weird angle, but I was able to get it to scan.

- Three hours into the day, battery’s at 87 percent with standard usage, including some Spotify.

- App continuity is swell, being able to open an app on the small screen and pick up where you left off when the phone is open. It’s super annoying for those apps that haven’t updated, though. Twitter, for instance, opens with letterbox bars and asks if you’d like to restart.

- I really like the size here. It fits nicely in pants pockets when folded, and the 7.3-inch display is big, but not too big.

- Every surface is a fingerprint magnet.

- The crease is noticeable, but generally not distracting. Occasionally when the light hits it, it really does pick up, though.

- The Fold comes with a pair of Galaxy Buds, which is pretty terrific. They’re great AirPod competitors, and it’s a nice touch for those willing to pay nearly $2,000 for a phone.

- Samsung compares the fold mechanism to a book in the way it’s opened and closed. Interestingly, I actually find myself using the phone half-opened at a 45 degree angle more than I expected.

- Yes, the snap shut is still satisfying.

Questions about the Galaxy Fold? Hit me up on Twitter: @bheater

Powered by WPeMatico