Carbonite to acquire endpoint security company Webroot for $618.5M

Carbonite, the online backup and recovery company based in Boston, announced late yesterday that it will be acquiring Webroot, an endpoint security vendor, for $618.5 million in cash.

The company believes that by combining its cloud backup service with Webroot’s endpoint security tools, it will give customers a more complete solution. Webroot’s history actually predates the cloud, having launched in 1997. The private company reported $250 million in revenue for fiscal 2018, according to data provided by Carbonite . That will combine with Carbonite’s $296.4 million in revenue for the same time period.

Carbonite CEO and president Mohamad Ali saw the deal as a way to expand the Carbonite offering. “With threats like ransomware evolving daily, our customers and partners are increasingly seeking a more comprehensive solution that is both powerful and easy to use. Backup and recovery, combined with endpoint security and threat intelligence, is a differentiated solution that provides one, comprehensive data protection platform,” Ali explained in a statement.

The deal not only enhances Carbonite’s backup offering, it gives the company access to a new set of customers. While Carbonite sells mainly through Value Added Resellers (VARs), Webroot’s customers are mainly 14,000 Managed Service Providers (MSPs). That lack of overlap could increase its market reach through to the MSP channel. Webroot has 300,000 customers, according to Carbonite.

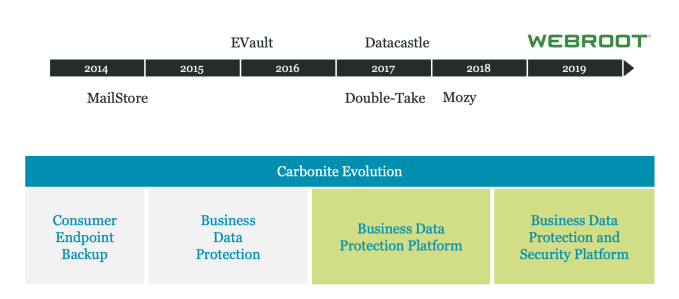

This is not the first Carbonite acquisition. It has acquired several other companies over the last several years, including buying Mozy from Dell a year ago for $145 million. The acquisition strategy is about using its checkbook to expand the capabilities of the platform to offer a more comprehensive set of tools beyond core backup and recovery.

Graphic: Carbonite

The company announced it is using cash on hand and a $550 million loan from Barclays, Citizens Bank and RBC Capital Markets to finance the deal. Per usual, the acquisition will be subject to regulatory approval, but is expected to close this quarter.

Powered by WPeMatico