Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Apple doesn’t care about news, it cares about recurring revenue. That’s why publishers are crazy to jump into bed with Apple News+. They’re rendering their own subscription options unnecessary in exchange for a sliver of what Apple pays out from the mere $10 per month it charges for unlimited reading.

The unfathomable platform risk here makes Facebook’s exploitative Instant Articles program seem toothless in comparison. On Facebook, publishers became generic providers of dumb content for the social network’s smart pipe that stole the customer relationship from content creators. But at least publishers were only giving away their free content.

Apple News+ threatens to open a massive hole in news site paywalls, allowing their best premium articles to escape. Publishers hope they’ll get exposure to new audiences. But any potential new or existing direct subscriber to a publisher will no longer be willing to pay a healthy monthly fee to occasionally access that top content while supporting the rest of the newsroom. They’ll just cherry pick what they want via News+, and Apple will shave off a few cents for the publisher while owning all the data, customer relationship and power.

“Why subscribe to that publisher? I already pay for Apple News+” should be the question haunting journalists’ nightmares. For readers, $10 per month all-you-can-eat from 300-plus publishers sounds like a great deal today. But it could accelerate the demise of some of those outlets, leaving society with fewer watchdogs and storytellers. If publishers agree to the shake hands with the devil, the dark lord will just garner more followers, making its ruinous offer more tempting.

There are so many horrifying aspects of Apple News+ for publishers, it’s best just to list each and break them down.

To succeed, publishers need attention, data and revenue, and Apple News+ gets in the way of all three. Readers visit Apple’s app, not the outlet’s site that gives it free rein to promote conference tickets, merchandise, research reports and other money-makers. Publishers don’t get their Apple News+ readers’ email addresses for follow-up marketing, cookies for ad targeting and content personalization, or their credit card info to speed up future purchases.

At the bottom of articles, Apple News+ recommends posts by an outlet’s competitors. Readers end up without a publisher’s bookmark in their browser toolbar, app on their phone or even easy access to them from News+’s default tab. They won’t see the outlet’s curation that highlights its most important content, or develop a connection with its home screen layout. They’ll miss call-outs to follow individual reporters and chances to interact with innovative new interactive formats.

Perhaps worst of all, publishers will be thrown right back into the coliseum of attention. They’ll need to debase their voice and amp up the sensationalism of their headlines or risk their users straying an inch over to someone else. But they’ll have no control of how they’re surfaced…

Which outlets earn money on Apple News+ will be largely determined by what Apple decides to show in those first few curatorial slots on screen. At any time, Apple could decide it wants more visual photo-based content or less serious world news because it placates users even if they’re less informed. It could suddenly preference shorter takes because they keep people from bouncing out of the app, or more generic shallow-dives that won’t scare off casual readers who don’t even care about that outlet. What if Apple signs up a publisher’s biggest competitor and sends them all the attention, decimating the first outlet’s discovery while still exposing its top paywalled content for cheap access?

Remember when Facebook wanted to build the world’s personalized newspaper and delivered tons of referral traffic, then abruptly decided to favor “friends and family content” while leaving publishers to starve? Now outlets are giving Apple News+ the same iron grip on their businesses. They might hire a ton of talent to give Apple what it wants, only for the strategy to change. The Wall Street Journal says it’s hiring 50 staffers to make content specifically for Apple News+. Those sound like some of the most precarious jobs in the business right now.

Remember when Facebook got the WSJ, Guardian and more to build “social reader apps” and then one day just shut off the virality and then shut down the whole platform? News+ revenue will be a drop in the bucket of iPhone sales, and Apple could at any time decide it’s not thirsty any more and let News+ rot. That and the eventual realization of platform risk and loss of relationship with the reader led the majority of Facebook’s Instant Articles launch partners like The New York Times, The Washington Post and Vox to drop the format. Publishers would be wise to come to that same conclusion now before they drive any more eyeballs to News+.

Apple acquired the magazine industry’s self-distribution app Texture a year ago. Now it’s trying to cram in traditional text-based news with minimal work to adapt the product. That means National Geographic and Sports Illustrated get featured billing with animated magazine covers and ways to browse the latest “issue.” News outlets get demoted far below, with no intuitive or productive way to skim between articles beyond swiping through a chronological stack.

I only see WSJ’s content below My Magazines, a massive At Home feature from Architectural Digest, a random Gadgets & Gear section of magazine articles, another huge call-out for the new issue of The Cut plus four pieces inside of it, and one more giant look at Bloomberg’s profile of Dow Chemical. That means those magazines are likely to absorb a ton of taps and engagement time before users even make it to the WSJ, which will then only score few cents per reader.

Magazines often publish big standalone features that don’t need a ton of context. News articles are part of a continuum of information that can be laid out on a publisher’s own site where they have control, but not on Apple News+. And to make articles more visually appealing, Apple strips out some of the cross-promotional recirculation, sign-up forms and commerce opportunities on which publishers depend.

The whole situation feels like the music industry stumbling into the disastrous iTunes download era. Musicians earned solid revenue when someone bought their whole physical album for $16 to listen to the single, then fell in love with the other songs and ended up buying merchandise or concert tickets. Then suddenly, fans could just buy the digital single for $0.99 from iTunes, form a bond with Apple instead of the artist and the whole music business fell into a depression.

The whole situation feels like the music industry stumbling into the disastrous iTunes download era. Musicians earned solid revenue when someone bought their whole physical album for $16 to listen to the single, then fell in love with the other songs and ended up buying merchandise or concert tickets. Then suddenly, fans could just buy the digital single for $0.99 from iTunes, form a bond with Apple instead of the artist and the whole music business fell into a depression.

Apple News+’s onerous revenue-sharing deal puts publishers in the same pickle. That occasional flagship article that’s a breakout success no longer serves as a tentpole for the rest of the subscription.

Formerly, people would need to pay $30 per month for a WSJ subscription to read that article, with the price covering the research, reporting and production of the whole newspaper. Readers felt justified paying the price because they got access to the other content, and the WSJ got to keep all the money even if people didn’t read much else or declined to even visit during the month. Now someone can pop in, read the WSJ’s best or most resource-intensive article, and the publisher effectively gets paid à la carte like with an iTunes single. Publishers will be scrounging for a cut of readers’ $10 per month, which will reportedly be divided in half by Apple’s oppressive 50 percent cut, then split between all the publishers someone reads — which will be heavily skewed towards the magazines that get the spotlight.

I’ve already had friends ask why they should keep paying if most of the WSJ is in Apple News along with tons of other publishers for a third of the price. Hardcore business news addicts that want unlimited access to the finance content that’s only available for three days in Apple News+ might keep their WSJ subscription. But anyone just in it for the highlights is likely to stop paying WSJ directly — or never start.

I’m personally concerned because TechCrunch has agreed to put its new Extra Crunch $15 per month subscription content inside Apple News+ despite all the warning signs. We’re saving some perks, like access to conference calls just for direct Extra Crunch subscribers, and perhaps a taste of EC’s written content might convince people they want the bonus features. But even more likely seems the possibility that readers would balk at paying again for just some extra perks when they already get the rest from Apple News, and many newsrooms aren’t set up to do anything but write articles.

![]() It’s the “good enough” strategy we see across tech products playing out in news. When Instagram first launched Stories, it lacked a ton of Snapchat’s features, but it was good enough and conveniently located where people already spent their time and had their social graph. Snapchat didn’t suddenly lose all its users, but there was little reason for new users to sign up and growth plummeted.

It’s the “good enough” strategy we see across tech products playing out in news. When Instagram first launched Stories, it lacked a ton of Snapchat’s features, but it was good enough and conveniently located where people already spent their time and had their social graph. Snapchat didn’t suddenly lose all its users, but there was little reason for new users to sign up and growth plummeted.

Apple News is pre-loaded on your device, where you already have a credit card set up, and it’s bundled with lots of content, at a cheaper price than most individual news outlets. Even if it doesn’t offer unlimited, permanent access to every WSJ Pro story, Apple News+ will be good enough. And it gets better with each outlet that allies with this Borg.

But this time, good enough won’t just determine which tech giant wins. Apple News+ could decimate the revenue of a fundamental pillar of society we rely on to hold the powerful accountable. Yet to the journalists that surrender their content, Apple will have no accountability.

Powered by WPeMatico

Update: The issue appears to have been fixed.

While you’ll have to wait for a not-yet-announced date to pay a not-yet-announced price for several of the subscription services that Apple announced yesterday, Apple News+ actually launched pretty quickly … and then started crashing.

At least, that was my experience this morning after I updated my iPad to iOS 12.2, then reinstalled and opened the News app. The app started loading, then kicked me out a few seconds later. Then it did it again, and again, and again.

It’s not clear how widespread the issue is, but my colleague Matt Burns had a similar experience on his iPhone 8, and a number of other users seem to be tweeting about their own crashes on iPads, iPhones and Macs.

Wow, Apple News is instant crash this AM for a bunch of us.@AppleNews

If I cancel my sub will it start working again? pic.twitter.com/mLAWgsMzyb— Ty Graham (@tygraham) March 26, 2019

There are, however, reports that you can circumvent the issue by immediately selecting the News+ tab and letting it load.

In fact, I managed to do that myself, so that I could sign-up for the new $9.99 subscription (which includes TechCrunch’s own Extra Crunch). I appear to have subscribed successfully — only to have the app start crashing on me again.

Not the most auspicious start for a paid product, and one that’s already spurring debate about whether or not it can help the news industry.

Why is Apple News crashing today? Why, bad data pushed to the client, of course. Should be something they can fix remotely pic.twitter.com/YS6U3DNKih

— Steve Troughton-Smith (@stroughtonsmith) March 26, 2019

Powered by WPeMatico

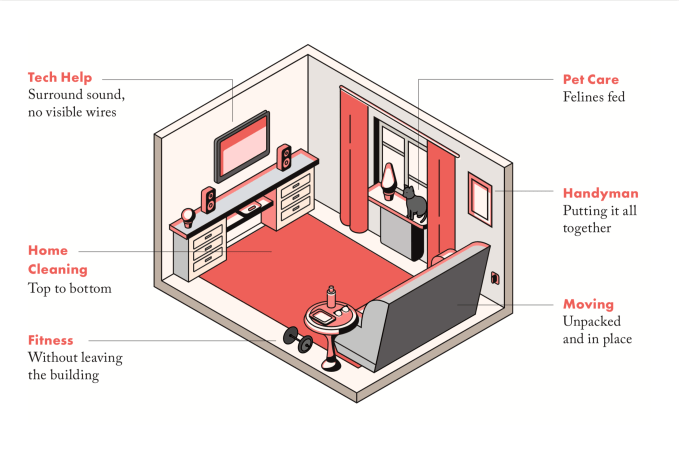

Hello Alfred — the startup that assigns in-home assistants to take care of your recurring chores and tasks — has announced the launch of a new service tier that will provide more properties and residents with access to the company’s underlying technology.

The company, which won the Startup Battlefield competition at our 2014 Disrupt event in San Francisco, looks to unlock valuable time for users by handling the long list of small routine items that add up over the course of a week and still require human oversight.

Hello Alfred partners with building owners to provide residents with dedicated home managers that assist with various errands and on-request services, such as apartment cleaning, grocery delivery, laundry services, prescription refills and more. Users have a direct line of communication with the company’s hospitality team through Hello Alfred’s mobile app, where they can manage tasks and set recurring appointments.

The new platform, “Powered by Alfred,” acts as a fairly similar but more accessible alternative to the company’s current offering. Residents in buildings equipped with “Powered by Alfred” are given access to all of the company’s solutions with the exception of the weekly visits from dedicated home managers currently included in the existing service. By excluding the dedicated in-home service, Hello Alfred is able to offer its new service tier at a lower price point and integrate with more buildings faster.

Property owners using “Powered by Alfred” can customize packages to include the services that best fit the needs of their residents and can upgrade or change service levels at any time. Both residents and building owners using the new platform are also given more control and direct access to Hello Alfred’s proprietary technology, allowing users to control functions that normally fall under the purview of the company’s dedicated home managers.

Additionally, with the launch of the new offering, Hello Alfred will be consolidating its various solutions under one central app, where residents and building managers can handle all inquiries, appointments and payments.

Hello Alfred’s new service tier, “Powered by Alfred,” provides a single, shared access point for resident and property owners to manage inquiries and drive property performance / Hello Alfred Press Kit

The launch of “Powered by Alfred” seems to be a natural evolution for the company, which seeks to make its offering more accessible to all residents of all backgrounds.

Hello Alfred previously employed a consumer-facing business model, in which customers would pay a monthly subscription fee for the array of in-home services and access to the company’s team of hospitality specialists, referred to as Alfreds.

However, around the time of the startup’s Series B round, Hello Alfred adopted the model of partnering directly with property owners to offer its services complimentary to residents. The partnership structure was not only a more conducive model for scaling but also enabled the company to offer the same services to any resident in an Alfred-equipped building, regardless of socioeconomic status.

Hello Alfred quickly built up a sizeable backlog of property owners hoping to integrate the platform into their units, according to the company. However, the task of maintaining dedicated staffing for every unit in every location made it difficult for the Alfred team to satisfy its swelling demand, having to instead focus resources primarily on luxury properties.

With “Powered by Alfred” removing in-home management services, the company has been able to improve accessibility and better satisfy the market’s appetite for its services, now rolling out the offering to non-luxury buildings and properties that previously sat in its pipeline.

Behind the launch of the new platform — which the company has piloted over the course of several months — Hello Alfred has increased its market share by more than 50 percent, with its services now available in more than 150,000 residential properties.

“We want Alfred to be a utility. We want to make “help” a universal utility and make it something anyone can access,” Hello Alfred CEO and co-founder Marcela Sapone told TechCrunch. “We wanted to find a way where we could accelerate growth and get human-focused help into urban buildings to help most urban environments.”

The launch represents the latest step in Hello Alfred’s broader expansion plans, which appear to have ramped up in recent months. Hello Alfred is now active in 16 cities — including Houston, where the company plans to launch next week — with its new offering available across all of its active markets. The startup already boasts an impressive partnership roster that includes more than 20 of the largest property owners in the U.S., and the Alfred team expects its new offering to open up further opportunities for partnerships across different property classes and different stages of a resident’s life cycle.

“As WeWork transformed commercial real estate, Hello Alfred is transforming residential real estate, and redefining what it means to live in a city today,” said Sapone. “This business expansion allows us to not only satisfy increasing demand for our service, but to connect every part of the resident experience — from the moment you sign your lease, until the moment you move to another Hello Alfred building.”

To date, the company has raised just over $63.5 million in venture capital, according to data from PitchBook, from prestigious investment brands that include New Enterprise Associates, Spark Capital, SV Angel, Moderne Ventures, Invesco and others.

Powered by WPeMatico

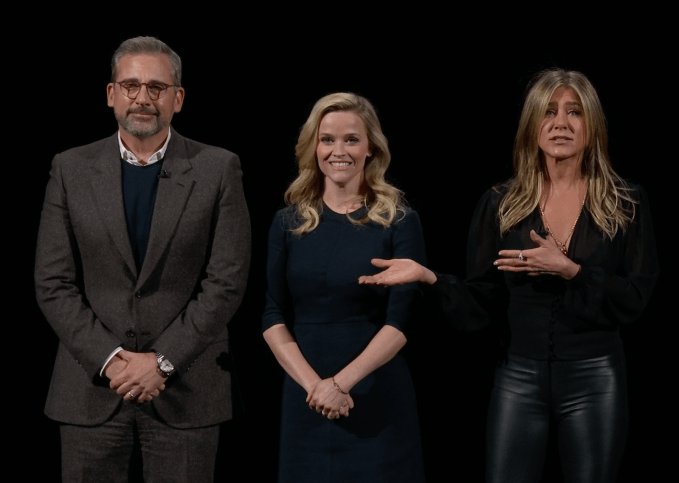

Apple flexed its wallet today in a way Facebook has scared to do. Tech giants make money by the billions, not the millions, which should give them an easy way to break into premium video distribution: buy some must-see content. That’s the strategy I’ve been advocating for Facebook but that Apple actually took to heart. Tim Cook wrote lines of zeros on some checks, and suddenly Steven Spielberg, JJ Abrams, Reese Witherspoon, Jennifer Aniston, and Oprah became the well-known faces of Apple TV+.

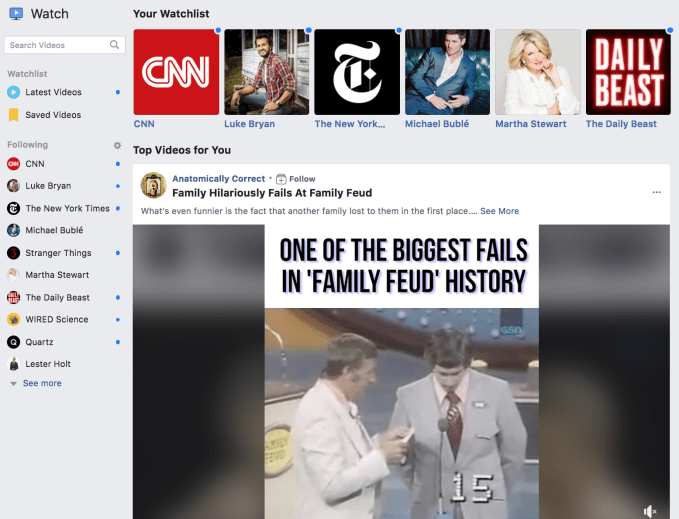

Facebook Watch has…MTV’s The Real World? The other Olsen sister? Re-runs of Buffy The Vampire Slayer? Actually, Facebook Watch is dominated by the kind of low-quality viral video memes the social network announced it would kick out of its News Feed for wasting people’s time.

And so while Apple TV+ at least has a solid base camp from which to make the uphill climb to compete with Netflix, Facebook Watch feels like it’s tripping over its own feet.

Today, Apple gave a preview of its new video subscription service that will launch in fall offering unlimited access to old favorites and new exclusives for a monthly fee. Yet even without any screenshots or pricing info, Apple still got people excited by dangling its big-name content.

Spielberg is making short films out of the Amazing Stories anthology that inspired him as a child. Abrams is spinning a tale of a musician’s rise called Little Voice Witherspoon and Aniston star in The Morning Show about anchoring a news program. And Oprah is bringing documentaries about workplace harassment and mental health.

This tentpole tactic will see Apple try to draw users into a free trial of Apple TV+ with this must-see content and then convince them to stay. And a compelling, exclusive reason to watch is exactly what’s been missing from…Facebook Watch. Instead, it chose to fund a wide array of often unscripted reality and documentary shorts that never felt special or any better than what else was openly available on the Internet, let alone what you could get from a subscription. It now claims to have 75 million people Watching at least one minute per day, but it’s failed to spawn a zeitgeist moment. Even as Facebook has scrambled to add syndicated TV cult favorites like Firefly or soccer matches to free, ad-supported video service, it’s failed to sign on anything truly newsworthy.

That’s just not going to fly anymore. Tech has evolved past the days when media products could win just based on their design, theoretical virality, or the massive audiences they’re cross-promoted to. We’re anything but starved for things to watch or listen to. And if you want us to frequent one more app or sign up for one more subscription, you’ll need A-List talent that makes us take notice. Netflix has Stranger Things. HBO has Game Of Thrones. Amazon has the Marvelous Mrs. Maisel. Disney+ has…Marvel, Star Wars, and the princesses. And now Apple has the world’s top directors and actresses.

Video has become a battle of the rich. Apple didn’t pull any punches. Facebook will need to buy some new fighters if Watch is ever going to deserve a place in the ring.

Powered by WPeMatico

Social investing and trading platform eToro announced that it has acquired Danish smart contract infrastructure provider Firmo for an undisclosed purchase price.

Firmo’s platform enables exchanges to execute smart financial contracts across various assets, including crypto derivatives, and across all major blockchains. Firmo founder and CEO Dr. Omri Ross described the company’s mission as “…enabl[ing] our users to trade any asset globally with instant settlement by tokenizing assets and executing all essential trade processes on the blockchain.” Firmo’s only disclosed investment, according to data from Pitchbook, came in the form of a modest pre-seed round from the Copenhagen Fintech Lab accelerator.

Firmo’s mission aligns well with that of eToro — which is equal parts trading platform, social network and educational resource for beginner investors — with the company having long communicated hopes of making the capital markets more open, transparent and accessible to all users and across all assets. By gobbling up Firmo, eToro will be able to accelerate its development of offerings for tokenized assets.

The acquisition represents the latest step in eToro’s broader growth plan, which has ramped up as of late. Earlier in March, the company launched a crypto-only version of its platform in the US, as well as a multi-signature digital wallet where users can store, send and receive cryptocurrencies.

The Firmo deal and eToro’s other expansion activities fit squarely into the company’s belief in the tokenization of assets and the immense, sector-defining opportunity that it creates. Etoro believes that asset tokenization and the movement of financial services onto the blockchain are all but inevitable and the company has employed the long-tailed strategy of investing heavily in related blockchain and crypto technologies despite the ongoing crypto winter.

“Blockchain and the tokenization of assets will play a major role in the future of finance,” said eToro co-founder and CEO Yoni Assia. “We believe that in time all investible assets will be tokenized and that we will see the greatest transfer of wealth ever onto the blockchain.” Assia expressed a similar sentiment in a recent conversation with TechCrunch, stating “We think [the tokenization of assets] is a bigger opportunity than the internet…”

After the acquisition, Firmo will operate as an internal R&D arm within eToro focused on developing blockchain-oriented trade execution and the infrastructure behind the digital representation of tokenized assets.

“The Firmo team has done ground-breaking work in developing practical applications for blockchain technology which will facilitate friction-less global trading,” said Assia.

“The adoption of smart contracts on the blockchain increases trust and transparency in financial services. We are incredibly proud and excited that [Firmo] will be joining the eToro family. We believe that together we have a very bright future and look forward to pursuing our shared goal to become the first truly global service provider allowing people to trade, invest and save.”

Powered by WPeMatico

A large-scale independent study of pre-installed Android apps has cast a critical spotlight on the privacy and security risks that preloaded software poses to users of the Google developed mobile platform.

The researchers behind the paper, which has been published in preliminary form ahead of a future presentation at the IEEE Symposium on Security and Privacy, unearthed a complex ecosystem of players with a primary focus on advertising and “data-driven services” — which they argue the average Android user is unlikely to be unaware of (while also likely lacking the ability to uninstall/evade the baked in software’s privileged access to data and resources themselves).

The study, which was carried out by researchers at the Universidad Carlos III de Madrid (UC3M) and the IMDEA Networks Institute, in collaboration with the International Computer Science Institute (ICSI) at Berkeley (USA) and Stony Brook University of New York (US), encompassed more than 82,000 pre-installed Android apps across more than 1,700 devices manufactured by 214 brands, according to the IMDEA institute.

“The study shows, on the one hand, that the permission model on the Android operating system and its apps allow a large number of actors to track and obtain personal user information,” it writes. “At the same time, it reveals that the end user is not aware of these actors in the Android terminals or of the implications that this practice could have on their privacy. Furthermore, the presence of this privileged software in the system makes it difficult to eliminate it if one is not an expert user.”

An example of a well-known app that can come pre-installed on certain Android devices is Facebook .

Earlier this year the social network giant was revealed to have inked an unknown number of agreements with device makers to preload its app. And while the company has claimed these pre-installs are just placeholders — unless or until a user chooses to actively engage with and download the Facebook app, Android users essentially have to take those claims on trust with no ability to verify the company’s claims (short of finding a friendly security researcher to conduct a traffic analysis) nor remove the app from their device themselves. Facebook pre-loads can only be disabled, not deleted entirely.

The company’s preloads also sometimes include a handful of other Facebook-branded system apps which are even less visible on the device and whose function is even more opaque.

Facebook previously confirmed to TechCrunch there’s no ability for Android users to delete any of its preloaded Facebook system apps either.

“Facebook uses Android system apps to ensure people have the best possible user experience including reliably receiving notifications and having the latest version of our apps. These system apps only support the Facebook family of apps and products, are designed to be off by default until a person starts using a Facebook app, and can always be disabled,” a Facebook spokesperson told us earlier this month.

But the social network is just one of scores of companies involved in a sprawling, opaque and seemingly interlinked data gathering and trading ecosystem that Android supports and which the researchers set out to shine a light into.

In all 1,200 developers were identified behind the pre-installed software they found in the data-set they examined, as well as more than 11,000 third party libraries (SDKs). Many of the preloaded apps were found to display what the researchers dub potentially dangerous or undesired behavior.

The data-set underpinning their analysis was collected via crowd-sourcing methods — using a purpose-built app (called Firmware Scanner), and pulling data from the Lumen Privacy Monitor app. The latter provided the researchers with visibility on mobile traffic flow — via anonymized network flow metadata obtained from its users.

They also crawled the Google Play Store to compare their findings on pre-installed apps with publicly available apps — and found that just 9% of the package names in their dataset were publicly indexed on Play.

Another concerning finding relates to permissions. In addition to standard permissions defined in Android (i.e. which can be controlled by the user) the researchers say they identified more than 4,845 owner or “personalized” permissions by different actors in the manufacture and distribution of devices.

So that means they found systematic user permissions workarounds being enabled by scores of commercial deals cut in a non-transparency data-driven background Android software ecosystem.

“This type of permission allows the apps advertised on Google Play to evade Android’s permission model to access user data without requiring their consent upon installation of a new app,” writes the IMDEA.

The top-line conclusion of the study is that the supply chain around Android’s open source model is characterized by a lack of transparency — which in turn has enabled an ecosystem to grow unchecked and get established that’s rife with potentially harmful behaviors and even backdoored access to sensitive data, all without most Android users’ consent or awareness. (On the latter front the researchers carried out a small-scale survey of consent forms of some Android phones to examine user awareness.)

tl;dr the phrase ‘if it’s free you’re the product’ is a too trite cherry atop a staggeringly large yet entirely submerged data-gobbling iceberg. (Not least because Android smartphones don’t tend to be entirely free.)

“Potential partnerships and deals — made behind closed doors between stakeholders — may have made user data a commodity before users purchase their devices or decide to install software of their own,” the researchers warn. “Unfortunately, due to a lack of central authority or trust system to allow verification and attribution of the self-signed certificates that are used to sign apps, and due to a lack of any mechanism to identify the purpose and legitimacy of many of these apps and custom permissions, it is difficult to attribute unwanted and harmful app behaviors to the party or parties responsible. This has broader negative implications for accountability and liability in this ecosystem as a whole.”

The researchers go on to make a series of recommendations intended to address the lack of transparency and accountability in the Android ecosystem — including suggesting the introduction and use of certificates signed by globally-trusted certificate authorities, or a certificate transparency repository “dedicated to providing details and attribution for certificates used to sign various Android apps, including pre-installed apps, even if self-signed”.

They also suggest Android devices should be required to document all pre-installed apps, plus their purpose, and name the entity responsible for each piece of software — and do so in a manner that is “accessible and understandable to users”.

“[Android] users are not clearly informed about third-party software that is installed on their devices, including third-party tracking and advertising services embedded in many pre-installed apps, the types of data they collect from them, the capabilities and the amount of control they have on their devices, and the partnerships that allow information to be shared and control to be given to various other companies through custom permissions, backdoors, and side-channels. This necessitates a new form of privacy policy suitable for preinstalled apps to be defined and enforced to ensure that private information is at least communicated to the user in a clear and accessible way, accompanied by mechanisms to enable users to make informed decisions about how or whether to use such devices without having to root their devices,” they argue, calling for overhaul of what’s long been a moribund T&Cs system, from a consumer rights point of view.

In conclusion they couch the study as merely scratching the surface of “a much larger problem”, saying their hope for the work is to bring more attention to the pre-installed Android software ecosystem and encourage more critical examination of its impact on users’ privacy and security.

They also write that they intend to continue to work on improving the tools used to gather the data-set, as well as saying their plan is to “gradually” make the data-set itself available to the research community and regulators to encourage others to dive in.

Google has responded to the paper with the following statement — attributed to a spokesperson:

We appreciate the work of the researchers and have been in contact with them regarding concerns we have about their methodology. Modern smartphones include system software designed by their manufacturers to ensure their devices run properly and meet user expectations. The researchers’ methodology is unable to differentiate pre-installed system software — such as diallers, app stores and diagnostic tools–from malicious software that has accessed the device at a later time, making it difficult to draw clear conclusions. We work with our OEM partners to help them ensure the quality and security of all apps they decide to pre-install on devices, and provide tools and infrastructure to our partners to help them scan their software for behavior that violates our standards for privacy and security. We also provide our partners with clear policies regarding the safety of pre-installed apps, and regularly give them information about potentially dangerous pre-loads we’ve identified.

Powered by WPeMatico

Heathcare kiosks, a home-cooked food marketplace, and a way for startups to earn interest on their funding topped our list of high-potential companies from Y Combinator’s Winter 2019 Demo Day 2. 88 startups launched on stage at the lauded accelerator, though some of the best skipped the stage as they’d already raised tons of money.

Be sure to check out our write-ups of all 85 startups from day 1 plus our top picks, as well as the full set from day 2. But now, after asking investors and conferring with the TechCrunch team, here are our 9 favorites from day 2.

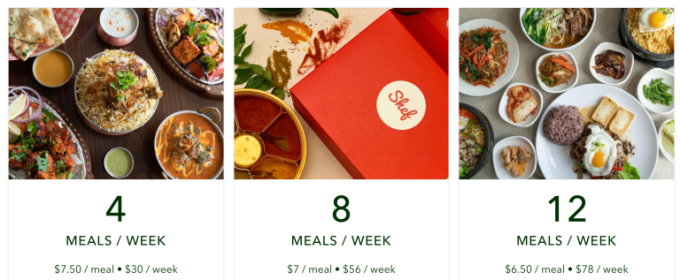

Two months ago, California passed the first law in the country legalizing the sale of home cooked food. Shef creates a marketplace where home chefs can find nearby customers. Shef’s meals cost around $6.50 compared to $20 per meal for traditional food delivery, and the startup takes a 22 percent cut of every transaction. It’s been growing 50 percent week over week thanks to deals with large property management companies that offer the marketplace as a perk to their residents. Shef wants to be the Airbnb of home cooked food.

Why we picked Shef: Deregulation creates gold rush opportunities and Shef was quick to seize this one, getting started just days after the law passed. Food delivery is a massive megatrend but high costs make it unaffordable or a luxury for many. If a parent is already cooking meals for their whole family, it takes minimal effort to produce a few extra portions to sell to the neighbors at accessible rates.

This startup automates the collection process of unpaid construction invoices. Construction companies are often forced to pay for their own jobs when customers are late on payments. According to Handle, there are $104 billion in unpaid construction invoices every year. Handle launched six weeks ago and is currently collecting $22,800 in monthly revenue. The founders previously launched an Andreessen Horowitz-backed company called Tenfold.

Why we picked Handle: Construction might seem like an unsexy vertical, but it’s massive and rife with inefficiencies this startup tackles. Handle helps contractors demand payments, instantly file liens that ensure they’re compensated for work or materials, or exchange unpaid invoices for cash. Even modest fees could add up quickly given how much money moves through the industry. And there are surely secondary business models to explore using all the data Handle collects on the construction market.

This pediatric telemedicine company provides medical care instantly to families. Blueberry provides constant contact, the ability to talk to a pediatrician 24/7 and at-home testing kits for a total of $15 per month. They’ve just completed a paid consumer pilot and say they were able to resolve 84 percent of issues without in-person care. They’ve partnered with insurance providers to reduce ER visits.

Why we picked Blueberry: Questionable emergency room visits are a nightmare for parents, a huge source of unnecessary costs, and a drain on resources for needy patients. Parents already spend so much time and money trying to keep their kids safe that this is a no-brainer subscription. And the urgent and emotional pull of pediatrics is a smart wedge into telemedicine for all demographics.

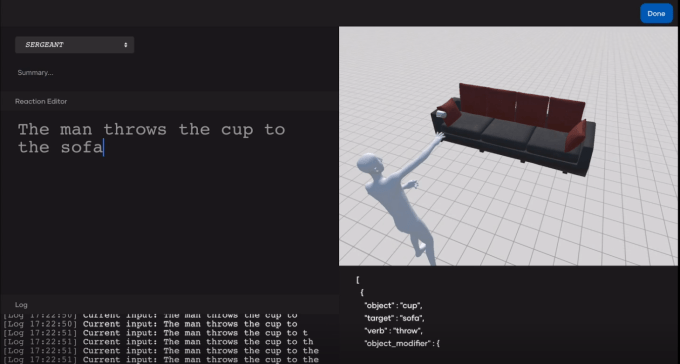

Led by a team of YC alums behind Raven, an AI startup acquired by Baidu in 2017, rct studio is a creative studio for immersive and interactive film. The platform provides a real time “text to render “engine (so the text “A man sits on a sofa” would generate 3D imagery of a man sitting on a sofa) that supports mainstream 3D engines like Unity and Unreal, as well as a creative tool for film professionals to craft immersive and open-ended entertainment experiences called Morpheus Engine.

Why we picked rct studio: Netflix’s Bandersnatch was just the start of mainstream interactive film. With strong technology, an innovative application, and proven talent, rct could become a critical tool for creating this kind of media. And even if the tech falls short of producing polished media, it could be used for storyboards and mockups.

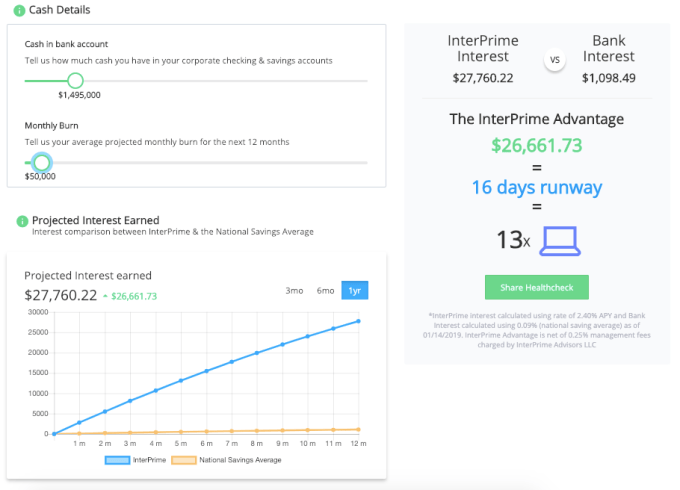

Provides “Apple level” treasury services to startups. Startups are raising a lot of money with no way to manage it, says Interprime. They want to help these businesses by managing these big investments by helping them earn interest on their funding while retaining liquidity. They take a .25 percent advisory fee for all the investment they oversee. So far, they have $10 million in investment capital they are servicing.

Why we picked Interprime: The explosion of early stage startup funding evidenced by Y Combinator itself has created new banking opportunities. Silicon Valley Bank is ripe for competition and Interprime’s focus on startups could unlock new financial services. With Interprime’s YC affiliation, it has access to tons of potential customers.

Nabis

NabisNabis is tackling the cannabis shipping and logistics business, working with suppliers to ship out goods to retailers reliably. It’s illegal for FedEx to ship weed so Nabis has swooped in and is helping ship and connect while taking cuts of the proceeds, a price the suppliers are willing to pay due to their 98 percent on-time shipping record.

Why we picked Nabis: Quirky regulation creates efficiency gaps in the marijuana business where incumbents can’t participate since they’re not allowed to handle the flower. As more states legalize and cannabis finds its way into more products, moving goods from farm to processor to retailer could spawn a big market for Nabis with a legal moat. It’s already working with many top marijuana brands, and could sell them additional services around business intelligence and distribution.

This startup measures weather damage for insurance companies. WeatherCheck has secured $4.7 million in annual bookings in the five months since it launched to help insurance carriers reduce their overall claims expense. To use the service, insurers upload data about their properties. WeatherCheck then monitors the weather and sends notifications to insurance companies, if, for example, a property has been damaged by hail.

Why we picked WeatherCheck: Extreme weather is only getting worse due to climate change. With 10.7 million US properties impacted by hail damage in 2017, WeatherCheck has found a smart initial market from which to expand. It’s easy to imagine the startup working on flood, earthquake, tornado, and wildfire claims too. Insurance is a fierce market, and old-school providers could get a leg up with WeatherCheck’s tech.

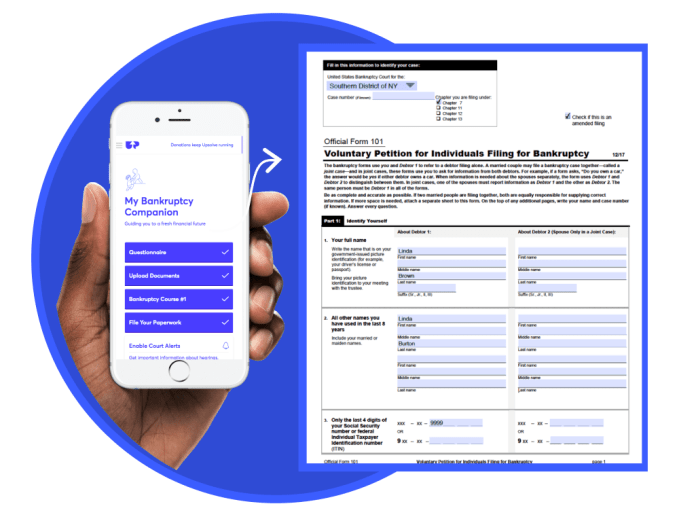

Upsolve wants to help low-income individuals file for bankruptcy more easily. The non-profit service gets referral fees from pointing non low-income families to bankruptcy lawyers and is able to offer the service for free. The company says that medical bills, layoffs and predatory loans can leave low-income families in dire situations and that in the last 6 months, their non-profit has alleviated customers from $24 million in debt.

Why we picked Upsolve: Financial hardship is rampant. With the potential for another recession and automation threatening jobs, many families could be at risk for bankruptcy. But the process is so stigmatized that some people avoid it at all costs. Upsolve could democratize access to this financial strategy while inserting itself into a lucrative transaction type.

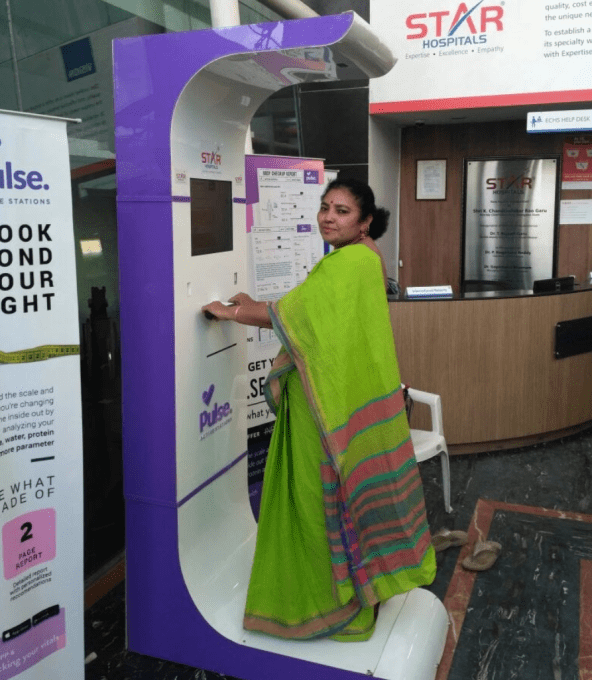

This startup makes health kiosks for India, meant to be installed in train stations. Co-founder Joginder Tanikella says that there are 600,000 preventable deaths in India as many in the region don’t get regular doctor checkups. “But everyone takes trains,” he says. Their in-station kiosk measures 21 health parameters. The company made $28,000 in revenue last month. Charging $1 per test, Tanikella says each machine pays for itself within 3 months. In the future, the kiosks will allow them to sell insurance and refer users to doctors.

Why we picked Pulse: Telemedicine can’t do everything, but plenty of people around the world can’t make it in to a full-fledged doctor’s office. Pulse creates a mid-point where hardware sensors can measure body fat, blood pressure, pulse, and bone strength to improve accuracy for diagnosing diabetes, osteoarthritis, cardiac problems, and more. Pulse’s companion app could spark additional revenue streams, and there’s clearly a much bigger market for this than just India.

-Allo, a marketplace where parents can exchange babysitting and errand-running

-Shiok, a lab-grown shrimp substitute

-WithFriends, a subscription platform for small retail businesses

—

More Y Combinator coverage from TechCrunch:

Additional reporting by Kate Clark, Lucas Matney, and Greg Kumparak

Powered by WPeMatico

Mozilla today announced a new iOS version of Firefox that has been specifically optimized for Apple’s iPad. Given the launch of the new iPad mini this week, that’s impeccable timing. It’s also an admission that building a browser for tablets is different from building a browser for phones, which is what Mozilla mostly focused on in recent years.

“We know that iPads aren’t just bigger versions of iPhones,” Mozilla writes in today’s announcement. “You use them differently, you need them for different things. So rather than just make a bigger version of our browser for iOS, we made Firefox for iPad look and feel like it was custom made for a tablet.”

So with this new version, Firefox for iPad gets support for iOS features like split screen and the ability to set Firefox as the default browser in Outlook for iOS. The team also optimized tab management for these larger screens, including the option to see tabs as large tiles, “making it easy to see what they are, see if they spark joy and close with a tap if not.” And if you have a few tabs you want to share, then you can do so with the Send Tabs feature Mozilla introduced earlier this year.

Starting a private browsing session on iOS always took a few extra tabs. The iPad version makes this a one-tap affair as it prominently highlights this feature in the tab bar.

Because quite a few iPad users also use a keyboard, it’s no surprise that this version of Firefox also supports keyboard shortcuts.

If you are an iPad user in search of an alternative browser, Firefox may now be a viable option for you. Give it a try and let us know what you think in the comments (just don’t remind us how you work from home for only a few hours a day and make good money… believe me, we’re aware).

Powered by WPeMatico

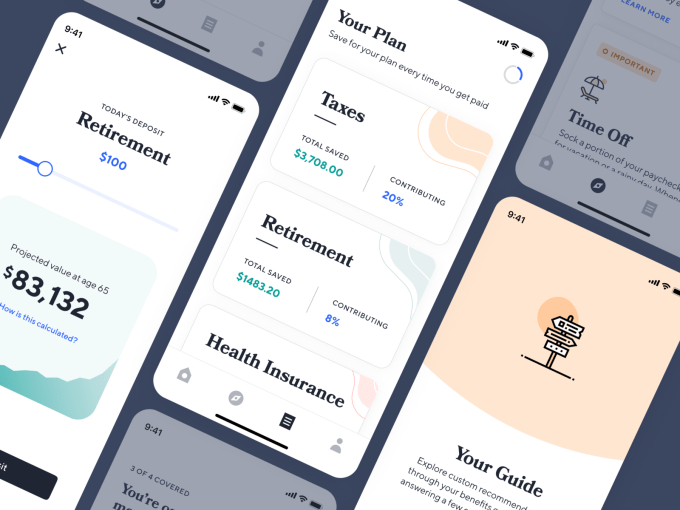

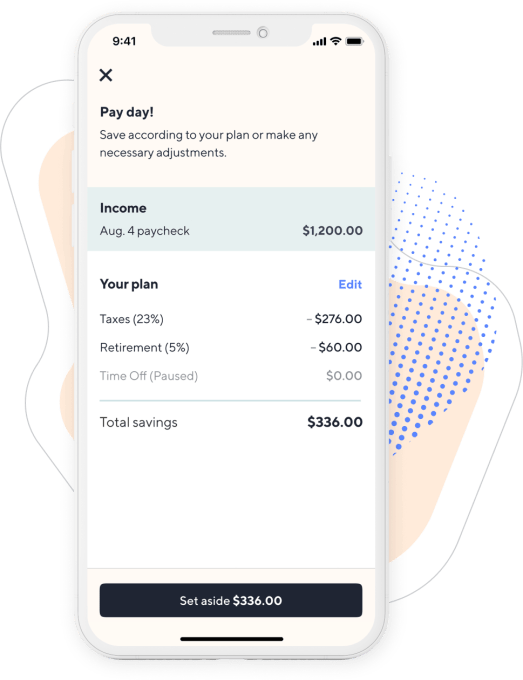

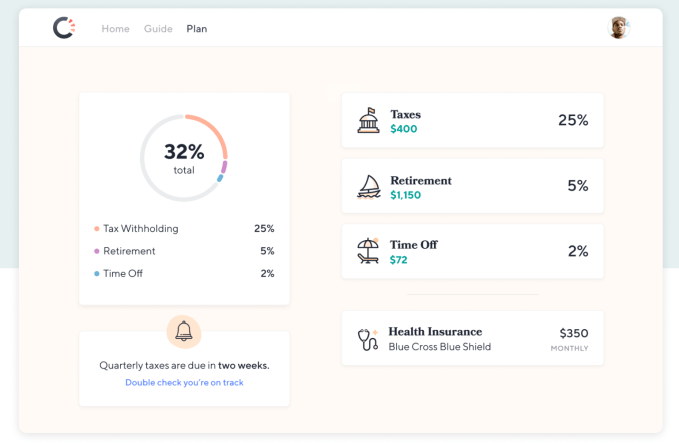

One of the hottest Y Combinator startups just raised a big seed round to clean up the mess created by Uber, Postmates and the gig economy. Catch sells health insurance, retirement savings plans and tax withholding directly to freelancers, contractors, or anyone uncovered. By building and curating simplified benefits services, Catch can offer a safety net for the future of work.

“In order to stay competitive as a society, we need to address inequality and volatility. We think Catch is the first step to offering alternatives to the mandate that benefits can only come from an employer or the government,” writes Catch co-founder and COO Kristen Tyrrell. Her co-founder and CEO Andrew Ambrosino, a former Kleiner Perkins design fellow, stumbled onto the problem as he struggled to juggle all the paperwork and programs companies typically hire an HR manager to handle. “Setting up a benefits plan was a pain. You had to become an expert in the space, and even once you were, executing and getting the stuff you needed was pretty difficult.” Catch does all this annoying but essential work for you.

Now Catch is getting its first press after piloting its product with tens of thousands of users. TechCrunch caught wind of its highly competitive seed round closing, and Catch confirms it has raised $5.1 million at a $20.5 million post-money valuation co-led by Khosla Ventures, Kindred Ventures, and NYCA Partners. This follow-up to its $1 million pre-seed will fuel its expansion into full heath insurance enrollment, life insurance and more. Catch is part of a growing trend that sees the best Y Combinator startup fully funded before Demo Day even arrives.

“Benefits, as a system built and provided by employers, created the mid-century middle class. In the post-war economic boom, companies offering benefits in the form of health insurance and pensions enabled familial stability that led to expansive growth and prosperity,” recalls Tyrrell, who was formerly the director of product at student debt repayment benefits startup FutureFuel.io. “Emboldened by private-sector growth (and apparent self-sufficiency), the 1970s and 80s saw a massive shift in financial risk management from the government to employers. The public safety net contracted in favor of privatized solutions. As technological advances progressed, employers and employees continued to redefine what work looked like. The bureaucratic and inflexible benefits system was unable to keep up. The private safety net crumbled.”

That problem has ballooned in recent years with the advent of the on-demand economy, where millions become Uber drivers, Instacart shoppers, DoorDash deliverers and TaskRabbits. Meanwhile, the destigmatization of remote work and digital nomadism has turned more people into permanent freelancers and contractors, or full-time employees without benefits. “A new class of worker emerged: one with volatile, complex income streams and limited access to second-order financial products like automated savings, individual retirement plans, and independent health insurance. We entered the new millennium with rot under the surface of new opportunity from the proliferation of the internet,” Tyrrell declares. “The last 15 years are borrowed time for the unconventional proletariat. It is time to come to terms and design a safety net that is personal, portable, modern and flexible. That’s why we built Catch.”

Catch co-founders Andrew Ambrosino and Kristen Tyrrell

Currently Catch offers the following services, each with their own way of earning the startup revenue:

These and the rest of Catch’s services are curated through its Guide. You answer a few questions about which benefits you have and need, connect your bank account, choose which programs you want and get push notifications whenever Catch needs your decisions or approvals. It’s designed to minimize busy work so if you have a child, you can add them to all your programs with a click instead of slogging through reconfiguring them all one at a time. That simplicity has ignited explosive growth for Catch, with the balances it holds for tax withholding, time off and retirement balances up 300 percent in each of the last three months.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

In 2019 it plans to add Catch-branded student loan refinancing, vision and dental enrollment plus payments via existing providers, life insurance through a partner such as Ladder or Ethos and full health insurance enrollment plus subsidies and premium payments via existing insurance companies like Blue Shield and Oscar. And in 2020 it’s hoping to build out its own blended retirement savings solution and income-smoothing tools.

If any of this sounds boring, that’s kind of the point. Instead of sorting through this mind-numbing stuff unassisted, Catch holds your hand. Its benefits Guide is available on the web today and it’s beta testing iOS and Android apps that will launch soon. Catch is focused on direct-to-consumer sales because “We’ve seen too many startups waste time on channels/partnerships before they know people truly want their product and get lost along the way,” Tyrrell writes. Eventually it wants to set up integrations directly into where users get paid.

Catch’s biggest competition is people haphazardly managing benefits with Excel spreadsheets and a mishmash of healthcare.gov and solutions for specific programs. Twenty-one percent of Americans have saved $0 for retirement, which you could see as either a challenge to scaling Catch or a massive greenfield opportunity. Track.tax, one of its direct competitors, charges a subscription price that has driven users to Catch. And automated advisors like Betterment and Wealthfront accounts don’t work so well for gig workers with lots of income volatility.

So do the founders think the gig economy, with its suppression of benefits, helps or hinders our species? “We believe the story is complex, but overall, the existing state of the gig economy is hurting society. Without better systems to provide support for freelance/contract workers, we are making people more precarious and less likely to succeed financially.”

When I ask what keeps the founders up at night, Tyrrell admits “The safety net is not built for individuals. It’s built to be distributed through HR departments and employers. We are very worried that the products we offer aren’t on equal footing with group/company products.” For example, there’s a $6,000/year IRA limit for individuals while the corporate equivalent 401k limit is $19,000, and health insurance is much cheaper for groups than individuals.

To surmount those humps, Catch assembled a huge list of angel investors who’ve built a range of financial services, including NerdWallet founder Jake Gibson, Earnest founders Louis Beryl and Ben Hutchinson, ANDCO (acquired by Fiverr) founder Leif Abraham, Totem founder Neal Khosla, Commuter Club founder Petko Plachkov, Playable (acquired by Stripe) founder Tad Milbourn and Synapse founder Bruno Faviero. It also brought on a wide range of venture funds to open doors for it. Those include Urban Innovation Fund, Kleiner Perkins, Y Combinator, Tempo Ventures, Prehype, Loup Ventures, Indicator Ventures, Ground Up Ventures and Graduate Fund.

Hopefully the fact that there are three lead investors and so many more in the round won’t mean that none feel truly accountable to oversee the company. With 80 million Americans lacking employer-sponsored benefits and 27 million without health insurance and median job tenure down to 2.8 years for people ages 25 to 34 leading to more gaps between jobs, our workforce is vulnerable. Catch can’t operate like a traditional software startup with leniency for screw-ups. If it can move cautiously and fix things, it could earn labor’s trust and become a fundamental piece of the welfare stack.

Powered by WPeMatico

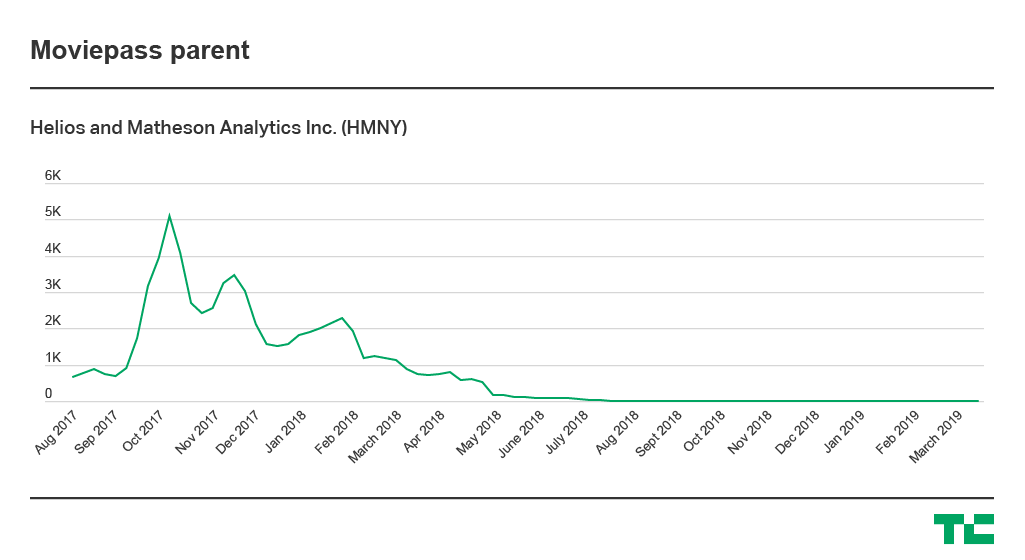

Two days after MoviePass announced the return of the company’s unlimited ticket plan, Ted Farnsworth, CEO of its parent company Helios and Matheson Analytics, sat down with TechCrunch to offer insight into the state of the beleaguered service.

According to the executive, MoviePass Uncapped is already seeing positive results. While he didn’t share concrete numbers, he says that sign-ups have increased “well over 800 percent in the last few days. And that’s conservative.”

Asked what it would take to make the company’s subscription business profitable, Farnsworth says, “Well, it’s profitable right now.” As for when it turned the corner, he added, “I will tell you this, because it’s out there: MoviePass has actually paid Helios back money over the past several months, towards the loans that they have. So, that gives you an idea of when we really started focusing on getting rid of the 20 percent of the abusers.”

Important caveat: A Helios & Matheson spokesperson later clarified that Farnsworth meant MoviePass’ subscription business is profitable on a revenue-per-subscriber basis. In other words, it’s not losing money on subscriptions, but the business unit isn’t necessarily profitable when you take overhead and debt into account.

The plan marks a return to the initial unlimited model that helped turn MoviePass into a household name in the past year. But that success arrived with a massive price, as the service began hemorrhaging money. MoviePass withdrew the unlimited plan and began reworking its plans on what seemed to be a weekly basis.

In July, at the height of what was supposed to be the Summer of MoviePass, the service experienced an outage as it struggled to pay bills. Helios secured a $5 million loan from creditors Hudson Bay Capital Management in order to turn the lights back on.

WEST HOLLYWOOD, CA – FEBRUARY 24: Ted Farnsworth attends the 27th annual Elton John AIDS Foundation Academy Awards Viewing Party sponsored by IMDb and Neuro Drinks celebrating EJAF and the 91st Academy Awards on February 24, 2019 in West Hollywood, California. (Photo by Jamie McCarthy/Getty Images for EJAF)

“I think the big SNAFU there was the credit card company,” the executive explains. “When one company sold to the other, we had been doing business with them for four years. They decided it was too much credit for them and literally call the credit line on a Friday night and I do a personal guarantee on a Saturday.”

However things might have gone down on the back end, the optics of such a situation were clearly less than ideal. MoviePass’ struggles were very public from the beginning, as part of a publicly traded company. A literal shut down for the service appeared to be just the latest sign that the too good to be true service was exactly that.

And while Farnsworth admits that the company would have benefited from a bit more privacy, he claims that he never had any doubts about MoviePass’ future, even as he negotiated with creditors for a fresh cash injection.

“There were no moments in my mind where I thought it would go down. In my mind, I thought it was too big to fail,” he says. “You created a household name in less than a year. I think any time you have something like that, where you’re going to run into issues from sheer growth. Our investors did well investing along the way. The investors believed in us and they still do. We knew we had to slow it down to get in front of the fraud side because there were so many moving parts. It was moving so fast.”

It’s that “fraud” that was at the center of MoviePass’ woes, says Farnsworth. MoviePass’ initial downfall, he believes, was the product of too many users “gaming the system.” He believes the total number of users that fall into that category to have been around 20 percent of the overall subscriber base.

It was a minority, certainly, but still a sizable figure, given that, by June of last year, that total figure had exceeded three million. By that point, the service also comprised around five percent of U.S. box office receipts. Much of the past year has been spent attempting to plug holes in the subscription service as the MoviePass boat began rapidly taking on water.

To be clear, “gaming the system” doesn’t just mean watching a lot of movies — Farnsworth says he’s happy to have “hardcore” users, even if they’re buying way more than $9.95 or $14.95 worth of tickets. Instead, his concern is users who are doing things like sharing their subscription or just using a MoviePass ticket to use the theater’s restroom — something surprisingly common in places like Times Square, where public bathrooms are hard to come by.

One of the primary fixes, Farnsworth says, is utilizing mobile tracking to ensure that subscribers are, in fact, using the service as intended, and looking for “red flags” like constantly changing the device using the app. Users are already required to enable location-based tracking in order to enable ticket purchase. This will utilize that to ping the ticket purchaser’s location, in order to make sure that they’re actually attending the movies for which they’ve purchased tickets.

“For instance, another issue is where people would go to the theater, they’ll pick up the ticket, they’ll hand their ticket to the kid or their child or their friend or whatever it is … and the person that’s paying the subscription goes back home or whatever they do,” he says. The new strategy: “When the movie starts, 30 minutes later [we’re] able to ping them inside the theater, just to make sure they still are at that theater.”

Looking ahead, Farnsworth says that the days of constantly changing pricing and restrictions are over, and that the company is committed to the unlimited plan. In fact, in his telling, the goal was always to get back to the unlimited plan — it was just that MoviePass had to figure out how to cut down on fraud to make the plan work.

At the same time, he says MoviePass’ film studio will also be an important part of the business. It has been overshadowed by the headlines about the company’s subscription struggles, but MoviePass Films has titles starring Bruce Willis, Al Pacino and Sylvester Stallone scheduled for this year.

MoviePass also invested in “Gotti,” and although the film was reviled by critics and only grossed $4.3 million at the box office, Farnsworth doesn’t see it as a failure.

“We never looked at Gotti as a money-maker” he says. “They only projected that it would do a $1.3 million in the box office here. Because then, when we pushed it with MoviePass, we took that up to five million. So, I mean, when you can take a movie — I gotta be careful here, but when you take a movie that might not be that great or perfect, and you can move that needle, [that] was always our theory of subscription.”

Check back later for our full interview with Farnsworth. Also, this post has been updated to reflect that MoviePass recently saw 800 percent growth in sign-ups (not subscribers), and to clarify Farnsworth’s remarks about profitability.

Powered by WPeMatico