Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Rutter, a remote-first company, is developing a unified e-commerce API that enables companies to connect with data across any platform.

On Friday the company announced it was emerging from stealth with $1.5 million in funding from a group of investors including Haystack, Liquid 2 and Basis Set Ventures.

Founders Eric Yu and Peter Zhou met in school and started working on Rutter, which Zhou called “Plaid for commerce,” in 2017 before going through the summer 2019 Y Combinator cohort.

They stumbled upon the e-commerce API idea while working in education technology last year. The pair were creating subscription kits and learning materials for parents concerned about how their children would be learning during the global pandemic. Then their vendor customers had problems listing their storefronts on Amazon, so they wrote scripts to help them, but found that they had to write separate scripts for each platform.

With Rutter, customers only need one script to connect anywhere. Its APIs connect to e-commerce platforms like Shopify, Walmart and Amazon so that tech customers can build functions like customer support and chatbots, Yu told TechCrunch.

Lan Xuezhao, founding and managing partner of Basis Set Ventures, said via email that she was “super excited” about Rutter first because of the founders’ passion, grit and speed of iteration to a product. She added it reminded her of another team that successfully built a business from zero to over $7 billion.

“After watching them (Rutter) for a few years, it’s clear what they built is powerful: it’s the central nervous system of online commerce,” Xuezhao added.

As the founders see it, there are two big explosions going on in e-commerce: the platform side with the adoption of headless commerce — the separating of front end and back end functions of an e-commerce site, and new companies coming in to support merchants.

The new funding will enable Yu and Zhou to build up their team, including hiring more engineers.

Due to the company officially launching at the beginning of the year, Yu did not disclose revenue metrics, but did say that Rutter’s API volume was doubling and tripling in the last few months. It is also supporting merchants that connect with over 5,000 stores.

Some of Rutter’s customers are building one aspect of commerce, like returns, warranties and checkouts, but Yu said that since Shopify represents just 10% of e-commerce, the company’s goal is to take merchants beyond the marketplace by being “that unified app store for merchants to find products.”

“We think that in the future, the e-commerce stack of a merchant will look like the SaaS stack of a software company,” Zhou added. “We want to be the glue that holds that stack together for merchants.”

Powered by WPeMatico

Facebook is a monopoly. Right?

Mark Zuckerberg appeared on national TV today to make a “special announcement.” The timing could not be more curious: Today is the day Lina Khan’s FTC refiled its case to dismantle Facebook’s monopoly.

To the average person, Facebook’s monopoly seems obvious. “After all,” as James E. Boasberg of the U.S. District Court for the District of Columbia put it in his recent decision, “No one who hears the title of the 2010 film ‘The Social Network’ wonders which company it is about.” But obviousness is not an antitrust standard. Monopoly has a clear legal meaning, and thus far Lina Khan’s FTC has failed to meet it. Today’s refiling is much more substantive than the FTC’s first foray. But it’s still lacking some critical arguments. Here are some ideas from the front lines.

To the average person, Facebook’s monopoly seems obvious. But obviousness is not an antitrust standard.

First, the FTC must define the market correctly: personal social networking, which includes messaging. Second, the FTC must establish that Facebook controls over 60% of the market — the correct metric to establish this is revenue.

Though consumer harm is a well-known test of monopoly determination, our courts do not require the FTC to prove that Facebook harms consumers to win the case. As an alternative pleading, though, the government can present a compelling case that Facebook harms consumers by suppressing wages in the creator economy. If the creator economy is real, then the value of ads on Facebook’s services is generated through the fruits of creators’ labor; no one would watch the ads before videos or in between posts if the user-generated content was not there. Facebook has harmed consumers by suppressing creator wages.

A note: This is the first of a series on the Facebook monopoly. I am inspired by Cloudflare’s recent post explaining the impact of Amazon’s monopoly in their industry. Perhaps it was a competitive tactic, but I genuinely believe it more a patriotic duty: guideposts for legislators and regulators on a complex issue. My generation has watched with a combination of sadness and trepidation as legislators who barely use email question the leading technologists of our time about products that have long pervaded our lives in ways we don’t yet understand. I, personally, and my company both stand to gain little from this — but as a participant in the latest generation of social media upstarts, and as an American concerned for the future of our democracy, I feel a duty to try.

According to the court, the FTC must meet a two-part test: First, the FTC must define the market in which Facebook has monopoly power, established by the D.C. Circuit in Neumann v. Reinforced Earth Co. (1986). This is the market for personal social networking services, which includes messaging.

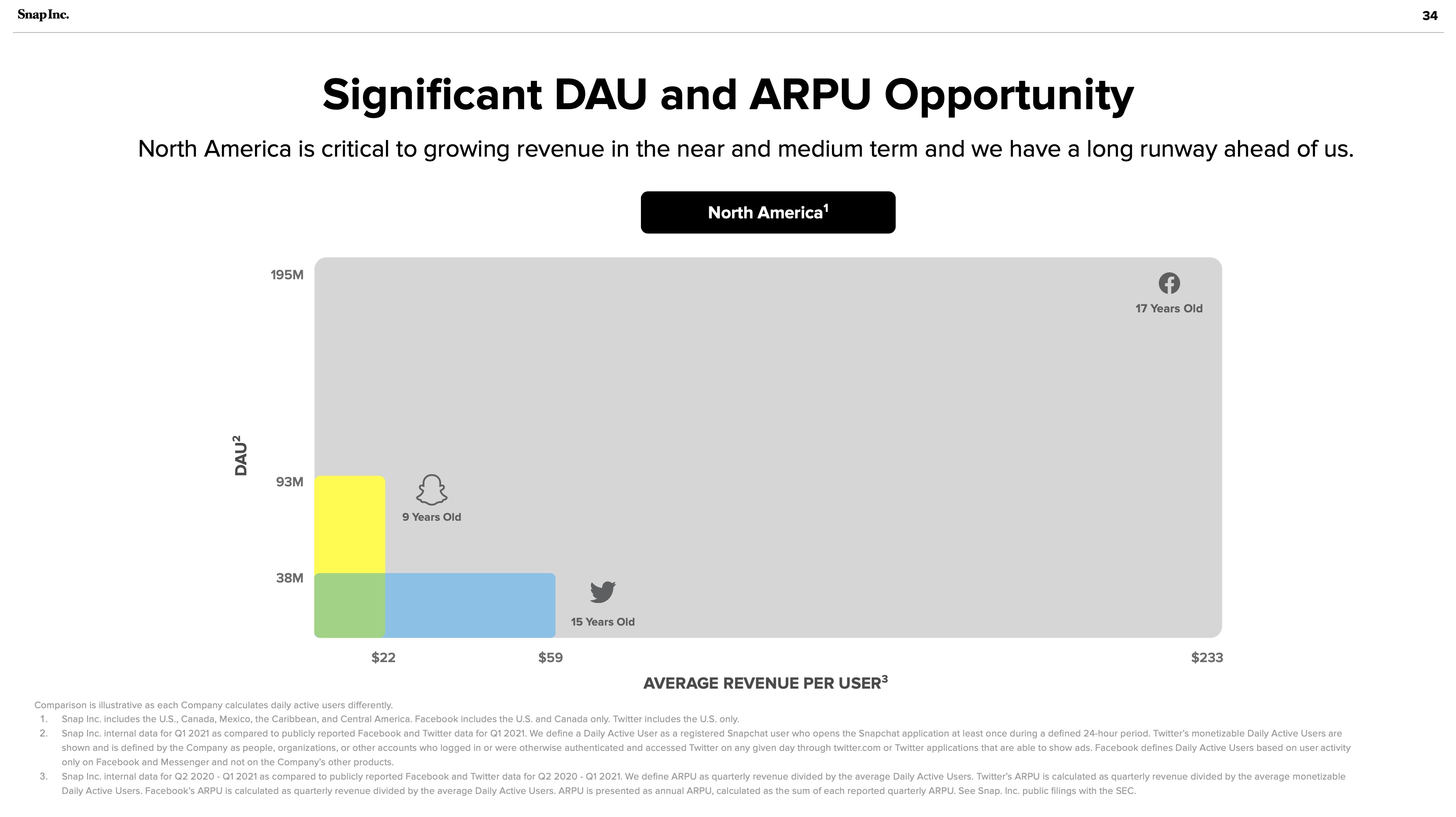

Second, the FTC must establish that Facebook controls a dominant share of that market, which courts have defined as 60% or above, established by the 3rd U.S. Circuit Court of Appeals in FTC v. AbbVie (2020). The right metric for this market share analysis is unequivocally revenue — daily active users (DAU) x average revenue per user (ARPU). And Facebook controls over 90%.

The answer to the FTC’s problem is hiding in plain sight: Snapchat’s investor presentations:

Snapchat July 2021 investor presentation: Significant DAU and ARPU Opportunity. Image Credits: Snapchat

This is a chart of Facebook’s monopoly — 91% of the personal social networking market. The gray blob looks awfully like a vast oil deposit, successfully drilled by Facebook’s Standard Oil operations. Snapchat and Twitter are the small wildcatters, nearly irrelevant compared to Facebook’s scale. It should not be lost on any market observers that Facebook once tried to acquire both companies.

The FTC initially claimed that Facebook has a monopoly of the “personal social networking services” market. The complaint excluded “mobile messaging” from Facebook’s market “because [messaging apps] (i) lack a ‘shared social space’ for interaction and (ii) do not employ a social graph to facilitate users’ finding and ‘friending’ other users they may know.”

This is incorrect because messaging is inextricable from Facebook’s power. Facebook demonstrated this with its WhatsApp acquisition, promotion of Messenger and prior attempts to buy Snapchat and Twitter. Any personal social networking service can expand its features — and Facebook’s moat is contingent on its control of messaging.

The more time in an ecosystem the more valuable it becomes. Value in social networks is calculated, depending on whom you ask, algorithmically (Metcalfe’s law) or logarithmically (Zipf’s law). Either way, in social networks, 1+1 is much more than 2.

Social networks become valuable based on the ever-increasing number of nodes, upon which companies can build more features. Zuckerberg coined the “social graph” to describe this relationship. The monopolies of Line, Kakao and WeChat in Japan, Korea and China prove this clearly. They began with messaging and expanded outward to become dominant personal social networking behemoths.

In today’s refiling, the FTC explains that Facebook, Instagram and Snapchat are all personal social networking services built on three key features:

Unfortunately, this is only partially right. In social media’s treacherous waters, as the FTC has struggled to articulate, feature sets are routinely copied and cross-promoted. How can we forget Instagram’s copying of Snapchat’s stories? Facebook has ruthlessly copied features from the most successful apps on the market from inception. Its launch of a Clubhouse competitor called Live Audio Rooms is only the most recent example. Twitter and Snapchat are absolutely competitors to Facebook.

Messaging must be included to demonstrate Facebook’s breadth and voracious appetite to copy and destroy. WhatsApp and Messenger have over 2 billion and 1.3 billion users respectively. Given the ease of feature copying, a messaging service of WhatsApp’s scale could become a full-scale social network in a matter of months. This is precisely why Facebook acquired the company. Facebook’s breadth in social media services is remarkable. But the FTC needs to understand that messaging is a part of the market. And this acknowledgement would not hurt their case.

Boasberg believes revenue is not an apt metric to calculate personal networking: “The overall revenues earned by PSN services cannot be the right metric for measuring market share here, as those revenues are all earned in a separate market — viz., the market for advertising.” He is confusing business model with market. Not all advertising is cut from the same cloth. In today’s refiling, the FTC correctly identifies “social advertising” as distinct from the “display advertising.”

But it goes off the deep end trying to avoid naming revenue as the distinguishing market share metric. Instead the FTC cites “time spent, daily active users (DAU), and monthly active users (MAU).” In a world where Facebook Blue and Instagram compete only with Snapchat, these metrics might bring Facebook Blue and Instagram combined over the 60% monopoly hurdle. But the FTC does not make a sufficiently convincing market definition argument to justify the choice of these metrics. Facebook should be compared to other personal social networking services such as Discord and Twitter — and their correct inclusion in the market would undermine the FTC’s choice of time spent or DAU/MAU.

Ultimately, cash is king. Revenue is what counts and what the FTC should emphasize. As Snapchat shows above, revenue in the personal social media industry is calculated by ARPU x DAU. The personal social media market is a different market from the entertainment social media market (where Facebook competes with YouTube, TikTok and Pinterest, among others). And this too is a separate market from the display search advertising market (Google). Not all advertising-based consumer technology is built the same. Again, advertising is a business model, not a market.

In the media world, for example, Netflix’s subscription revenue clearly competes in the same market as CBS’ advertising model. News Corp.’s acquisition of Facebook’s early competitor MySpace spoke volumes on the internet’s potential to disrupt and destroy traditional media advertising markets. Snapchat has chosen to pursue advertising, but incipient competitors like Discord are successfully growing using subscriptions. But their market share remains a pittance compared to Facebook.

The FTC has correctly argued for the smallest possible market for their monopoly definition. Personal social networking, of which Facebook controls at least 80%, should not (in their strongest argument) include entertainment. This is the narrowest argument to make with the highest chance of success.

But they could choose to make a broader argument in the alternative, one that takes a bigger swing. As Lina Khan famously noted about Amazon in her 2017 note that began the New Brandeis movement, the traditional economic consumer harm test does not adequately address the harms posed by Big Tech. The harms are too abstract. As White House advisor Tim Wu argues in “The Curse of Bigness,” and Judge Boasberg acknowledges in his opinion, antitrust law does not hinge solely upon price effects. Facebook can be broken up without proving the negative impact of price effects.

However, Facebook has hurt consumers. Consumers are the workers whose labor constitutes Facebook’s value, and they’ve been underpaid. If you define personal networking to include entertainment, then YouTube is an instructive example. On both YouTube and Facebook properties, influencers can capture value by charging brands directly. That’s not what we’re talking about here; what matters is the percent of advertising revenue that is paid out to creators.

YouTube’s traditional percentage is 55%. YouTube announced it has paid $30 billion to creators and rights holders over the last three years. Let’s conservatively say that half of the money goes to rights holders; that means creators on average have earned $15 billion, which would mean $5 billion annually, a meaningful slice of YouTube’s $46 billion in revenue over that time. So in other words, YouTube paid creators a third of its revenue (this admittedly ignores YouTube’s non-advertising revenue).

Facebook, by comparison, announced just weeks ago a paltry $1 billion program over a year and change. Sure, creators may make some money from interstitial ads, but Facebook does not announce the percentage of revenue they hand to creators because it would be insulting. Over the equivalent three-year period of YouTube’s declaration, Facebook has generated $210 billion in revenue. one-third of this revenue paid to creators would represent $70 billion, or $23 billion a year.

Why hasn’t Facebook paid creators before? Because it hasn’t needed to do so. Facebook’s social graph is so large that creators must post there anyway — the scale afforded by success on Facebook Blue and Instagram allows creators to monetize through directly selling to brands. Facebooks ads have value because of creators’ labor; if the users did not generate content, the social graph would not exist. Creators deserve more than the scraps they generate on their own. Facebook suppresses creators’ wages because it can. This is what monopolies do.

Facebook has long been the Standard Oil of social media, using its core monopoly to begin its march upstream and down. Zuckerberg announced in July and renewed his focus today on the metaverse, a market Roblox has pioneered. After achieving a monopoly in personal social media and competing ably in entertainment social media and virtual reality, Facebook’s drilling continues. Yes, Facebook may be free, but its monopoly harms Americans by stifling creator wages. The antitrust laws dictate that consumer harm is not a necessary condition for proving a monopoly under the Sherman Act; monopolies in and of themselves are illegal. By refiling the correct market definition and marketshare, the FTC stands more than a chance. It should win.

A prior version of this article originally appeared on Substack.

Powered by WPeMatico

Consumer shift to buying online during the global pandemic — and keeping that habit — continues to boost revenue for makers of developer tools that help e-commerce sites provide better shopping experiences.

LA-based Nacelle is one of the e-commerce infrastructure companies continuing to attract investor attention, and at a speedy clip, too. It closed on a $50 million Series B round from Tiger Global. This is just six months after its $18 million Series A round, led by Inovia, and follows a $4.8 million seed round in 2020.

The company is working in “headless” commerce, which means it is disconnecting the front end of a website, a.k.a. the storefront, from the back end, where all of the data lives, to create a better shopping experience, CEO Brian Anderson told TechCrunch. By doing this, the back end of the store, essentially where all the magic happens, can be updated and maintained without changing the front end.

“Online shopping is not new, but how the customer relates to it keeps changing,” he said. “The technology for online shopping is not up to snuff — when you click on something, everything has to reload compared to an app like Instagram.”

More people shopping on their mobile devices creates friction due to downloading an app for each brand. That is “sucking the fun out of shopping online,” because no one wants that many apps on their phone, Anderson added.

Steven Kramer, board member and former EVP of Hybris, said via email that over the past two decades, the e-commerce industry went through several waves of innovation. Now, maturing consumer behaviors and expectations are accelerating the current phase.

“Retailers and brands are struggling with adopting the latest technologies to meet today’s requirements of agility, speed and user experience,” Kramer added. “Nacelle gives organizations a future-proof way to accelerate their innovation, leverage existing investments and do so with material ROI.”

Data already shows that COVID-era trends accelerated e-commerce by roughly five years, and Gartner predicts that 50% of new commerce capabilities will be incorporated as API-centric SaaS services by 2023.

Those kinds of trends are bringing in competitors that are also attracting investor attention — for example, Shopistry, Swell, Fabric, Commerce Layer and Vue Storefront are just a few of the companies that raised funding this year alone.

Anderson notes that the market continues to be hot and one that can’t be ignored, especially as the share of online retail sales grows. He explained that some of his competitors force customers to migrate off of their current tech stack and onto their respective platforms so that their users can get a good customer experience. In contrast, Nacelle enables customers to keep their tech stack and put components together as they see fit.

“That is painful in any vertical, but especially for e-commerce,” he said. “That is your direct line to revenue.”

Meanwhile, Nacelle itself grew 690% in the past year in terms of revenue, and customers are signing multiyear contracts, Anderson said.

Anderson, who is an engineer by trade, wants to sink his teeth into new products as adoption of headless commerce grows. These include providing a dynamic layer of functionality on top of the tech stack for storefronts that are traditionally static, and even introducing some livestream capabilities later this year.

As such, Nacelle will invest the new round into its go-to-market strategy and expand its customer success, partner relations and product development. He said Nacelle is already “the de facto standard” for Shopify Plus merchants going headless.

“We want to put everything in a tailor-made API for e-commerce that lets front-end developers do their thing with ease,” Anderson added. “We also offer starter kits for merchants as a starting point to get up-and-running.”

Powered by WPeMatico

Enable, a startup developing a cloud-based software tool for business-to-business rebate management, announced Wednesday a $45 million Series B funding round.

The round is led by Norwest Venture Partners with participation from existing investors Menlo Ventures and Sierra Ventures, and a group of angel investors. Including the new round, the company has raised a total of $62 million, which includes a $13 million Series A raised in 2020.

The company, which started in the U.K. and moved to San Francisco in 2020, was co-founded by Andrew Butt and Denys Shortt in 2015 but launched fully in 2016. Its technology automates how distributors and manufacturers create, execute and track rebates. These types of trading programs are a common industry practice and are relied on by distributors as a way to turn a profit.

Since raising its Series A last year, Butt, chief executive officer, moved to the Bay Area, grew its North American operations to 60 people, tripled revenue and more than tripled its customer base, he told TechCrunch. The new funding will be used for product innovation and building sales and go-to-market teams.

“The Series A was proving traction in the U.S. and Canada and gave us the ability to hire a U.S. leadership team,” he added. “When we saw that momentum, the market size was large and the opportunity was now getting bigger and bigger, we started scaling up the business.”

As customer needs changed and incentives were growing in terms of revenue and profitability, Enable saw that they were more critical to manage; the incentives needed to be more dynamic and easy to make targeted and personalized. In a sense, incentives have “gone from being blunt instruments to very sharp in size and volume,” Butt said.

Reaching the year over year revenue doubling was a milestone for the company, and his immediate next steps are to get a fully ramped team so Enable can continue on that growth trajectory. The market for incentives is big, but “there is no credible competition,” so the company is also working to build that distribution and sales team now, he added.

It was also over the past year that Butt met Sean Jacobsohn, partner at Norwest Venture Partners, who, as part of the investment, joined Enable’s board of directors.

Jacobsohn had noticed Enable and asked for an introduction to the company when it hired Jerry Brooner as its president of global field operations. Jacobsohn was tracking Brooner’s next moves after leaving Scout, a Workday company, and the hire got his attention.

Enable checks all of the boxes Jacobsohn said he looks for in a company: strong CEO, a good team and good customer feedback — many of them were dissatisfied with the legacy software, he said.

“I also love companies going after a big market where there is no credible competition,” Jacobsohn added. “There is a lot of greenfield space here. What’s great about a player like that is they can come in, create a category and be the new generation cloud player. This isn’t something someone can wake up and start. You need deep domain expertise.”

Powered by WPeMatico

Canada-based Shopistry wants to turn the concept of headless commerce, well, on its head. On Monday, the e-commerce startup announced $2 million in seed funding to continue developing its toolkit of products, integrations, services and managed infrastructure for brands to scale online.

Jaafer Haidar and Tariq Zabian started Shopistry in 2019. Haidar’s background is as a serial technology founder with exits and ventures in e-commerce and cloud software. He was working as a venture capitalist when he got the idea for Shopistry. Zabian is a former general manager at OLX, an online classified marketplace.

Shopistry enables customers to create personalized commerce experiences accessible to all. Haidar expects headless will become the dominant architecture over the next five years, though he isn’t too keen on calling it “headless.” He much prefers the term “modular.”

“It’s a modular system, we call it ‘headless without the headaches,’ where you grab the framework to manage APIs,” Haidar told TechCrunch. “After a company goes live, they can spend 50% of their budget just to keep the lights on. They use marketplaces like Shopify to do the tech, and we are doing the same thing, but providing way more optionality. We are not a monolithic system.”

Currently, the company offers five products:

Investors in the seed round include Shoptalk founder Jonathan Weiner, Hatch Labs’ Amar Varma, Garage Capital, Mantella Venture Partners and Raiven Capital.

“At MVP we love companies that can simplify complexity to bring the proven innovations of large, technically sophisticated retailers to the masses of small to midsize retailers trying to compete with them,” said Duncan Hill, co-founder and general partner at Mantella Venture Partners, in a written statement. “Shopistry has the team and tech to be a major player in this next phase of the e-commerce evolution. This was easy to get excited about.”

Shopistry is already working with retailers like Honed and Oura Ring to manage their e-commerce presences without the cost, complexity or need for a big technology team.

Prior to going after the seed funding, Haidar and Zabian spent two years working with high growth brands to build out its infrastructure. Haidar intends to use the new capital to future that development as well as bring on sales and marketing staff.

Haidar was not able to provide growth metrics just yet. He did say the company was growing its customer base and expects to be able to share that growth next year. He is planning to add more flexibility and integrations to the back end of Shopistry’s platform and add support for other platforms.

“We are focusing next on the go-to-market perspective while we gear up for our big launch coming in the fourth quarter,” he added. “There is also a big component to ‘after the sale,’ and we want to create some amazing experiences and focus on back office operations. We want to be the easiest way to control and manage data while maintaining a storefront.”

Powered by WPeMatico

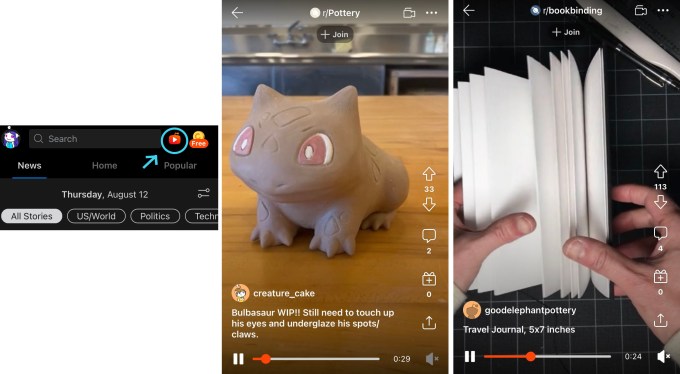

From Instagram’s Reels to Snapchat’s Spotlight, most social media platforms are looking toward the TikTok boom for inspiration. Now, even Reddit, a discussion-based forum, is making short-form video more pronounced on its iOS app.

According to Reddit, most iOS users should have a button on their app directly to the right of the search bar — when tapped, it will show a stream of videos in a TikTok-like configuration. When presented with a video, (which shows the poster who uploaded it and the subreddit it’s from), users can upvote or downvote, comment, gift an award or share it. Like TikTok, users can swipe up to see another video, feeding content from subreddits the user is subscribed to, as well as related ones. For instance, if you’re subscribed to r/printmaking, you might see content from r/pottery or r/bookbinding.

The user interface of the videos isn’t new — Reddit has been experimenting with this format over the last year. But before, this manner of watching Reddit videos was only accessible by tapping on a video while scrolling through your feed — rather than promoting discovery of other communities, the first several videos recommended would be from the same subreddit.

Image Credits: Reddit, screenshots by TechCrunch

“Reddit’s mission is to bring community and belonging to everyone in the world, and subsequently, Reddit’s video team’s mission is to bring community through video,” a Reddit spokesperson told TechCrunch, about the new addition. “Over the course of the last year, our goal was to build a unified video player, and re-envision the player interface to match what users (new and old) expect when it comes to an in-app video player — especially commenting, viewing, engaging and discovering new content and communities through video,” they noted.

Reddit doesn’t yet have a timeline for when the feature will roll out to everyone, but confirmed that this icon first appeared for some users in late July and has continued to roll out to almost all iOS users. But by placing a broader, yet still personalized video feed on the home screen, Reddit is signaling a growing curiosity in short form video. In December 2020, Reddit acquired Dubsmash, a Brooklyn-via-Berlin-based TikTok competitor. The terms of the deals were undisclosed, but Facebook and Snap also reportedly showed interest in the platform, which hit 1 billion monthly views in January 2020.

Reddit declined to comment on whether or not its new video player is using an algorithm to promote discovery of new subreddits based on user activity. However, a Reddit spokesperson confirmed that the company will use Dubsmash’s technology to develop other features down the road, though not for this particular product, they said.

Reddit first launched its native video platform in 2017, which allows users to upload MP4 and MOV files to the site. Then, in August 2019, it launched RPAN (Reddit Public Access Network), which lets people livestream to selected subreddits — the most popular livestreams are promoted across the platform. Reddit currently attracts 50 million daily active visitors and hosts 100,000 active subreddits.

Powered by WPeMatico

The dollars keep flowing into Latin America.

Today, Argentine personal finance management app Ualá announced it has raised $350 million in a Series D round at a post-money valuation of $2.45 billion.

SoftBank Latin America Fund and affiliates of China-based Tencent co-led the round, which included participation from a slew of existing backers, including funds managed by Soros Fund Management LLC, funds managed by affiliates of Goldman Sachs Asset Management, Ribbit Capital, Greyhound Capital, Monashees and Endeavor Catalyst. New funds, such as D1 Capital Partners and 166 2nd, also put money in the round in addition to angel investors such as Jacqueline Reses and Isaac Lee.

The round is believed to be the largest private raise ever by an Argentinian company and brings Ualá’s total raised to $544 million since its 2017 inception.

Founder and CEO Pierpaolo Barbieri, a Buenos Aires native and Harvard University graduate, has said his ambition was to create a platform that would bring all financial services into one app linked to one card.

Today, Ualá says it has developed “a complete financial ecosystem,” including universal accounts, a global Mastercard card, bill payment options, investment products, personal loans, installments (BNPL) and insurance. It has also launched merchant acquiring, Ualá Bis, a solution for entrepreneurs and merchants that allows selling through a payment link or mobile point-of-sales (mPOS).

The startup has issued more than 3.5 million cards in its home country and in Mexico, where it launched operations last year. The company claims that more than 22% of 18 to 25-year-olds in Argentina have a Ualá card. At the time of its Series C raise in November 2019, it had issued 1.3 million cards.

Image Credits: Ualá

Over 1 million users invest in the mutual fund available on the Ualá app, which the company claims is the second largest mutual fund in Argentina in number of participants. The company, which has aimed to provide more financial transparency and inclusion in the region, says that 65% of its users had no credit history prior to downloading the app.

Ualá plans to use its new capital to continue expanding within Latin America, develop new business verticals and do some hiring, with the plan of having 1,500 employees by year’s end. It currently has more than 1,000 employees.

“We are most impressed by Ualá’s ambition and execution. Our investment will propel the next stage of their vision, furthering a regional ecosystem that can make financial services more accessible and transparent across LatAm,” said Marcelo Claure, CEO of SoftBank Group International and COO of SoftBank Group, in a written statement.

Powered by WPeMatico

Luis Mario Garcia grew up in Mexico making deliveries for the grocery stores in his neighborhood. After honing his startup skills in San Francisco, he returned to Mexico with the idea of building a software company.

That’s when he met his co-founder Javier Gonzalez and the pair started Orchata in 2020, a mobile app enabling consumers to get groceries delivered in 15 minutes, with no substitutes and at supermarket prices. Products delivered include fresh fruit, beverages, bread, medicine and household essentials, Garcia told TechCrunch.

Orchata does this by operating a network of micro fulfillment centers — it is already operating in two cities — with technology for efficient picking and hyperfast delivery.

Online food delivery sales in Latin America are projected to reach $9.8 billion by 2024, with the global pandemic driving demand for faster delivery, according to Statista. Garcia sees three different waves in this market: the first one being traditional supermarkets, where you can spend hours, which led to the second wave of food delivery companies, including some big players in the region — for example Rappi in Colombia, which in July raised $500 million in Series F funding at a $5.25 billion valuation in a round led by T. Rowe Price, and Cornershop in Chile, which was acquired by Uber in 2019.

However, Garcia said many of these services still take more than an hour from order to doorstep and may require phone calls if an item is not available. He wants to be part of a third wave — software that is integrated with inventory and delivery that is super fast, and no substitutions.

“This is similar to what is going on around the world, but there is a huge opportunity to bring convenience, to be the Gopuff for Latin America, and we want to build it first in the region,” Garcia said.

The Monterrey-based company was part of Y Combinator’s summer 2020 cohort and on Friday announced a $4 million seed round from a group of investors, including Y Combinator, JAM Fund, FJ Labs, Venture Friends, Investo and Foundation Capital, and angel investors Ross Lipson, Mike Hennessey, Brian Requarth and Javier Mata.

Jonathan Lewy, co-founder of Grin Scooters and founder of Investo, is also an investor in Rappi. He said Garcia was building a product for the end user, with the key being the building of the infrastructure and inventory. Lewy believes Garcia understands how quick delivery should be done and that it is not just about offering a mobile app, but building the technology behind it.

Meanwhile, Justin Mateen, general partner at JAM Fund, and co-founder of Tinder and an early-stage investor, met Garcia over a year ago and was one of the company’s first investors. He said Garcia’s and Gonzalez’s initial idea for the model of grocery stores was still not solving the problem, but then they pivoted to doing fulfillment and inventory themselves.

“He fits the mold of what I look for in a founder, and he is the type of founder that doesn’t give up,” Mateen said. “Luis finally agreed to let me double down on my investment. The model makes sense now, he is on to something and it is now going to be about execution of capital as he scales.”

Both Mateen and Lewy agree that there will be similar apps coming because food delivery is such a large market, but that Orchata has a clear advantage of owning the customer experience from beginning to end.

Having only launched four months ago, Orchata is already processing thousands of orders and is seeing 100% monthly growth. The new funding will enable Orchata to expand into three new cities in Mexico. Garcia is also eyeing Colombia, Brazil, Peru and Chile for future expansion.

The company is also targeting multiple use cases, including someone noticing a forgotten item while cooking to consumers shopping for the week or teenagers needing food for a party.

“We are going to be super convenient to customers, and we think every use case for food delivery will be this way in the future,” Garcia said. “We will eventually introduce our own brands and foods with the goal of being that app that is there anytime you need it.”

Powered by WPeMatico

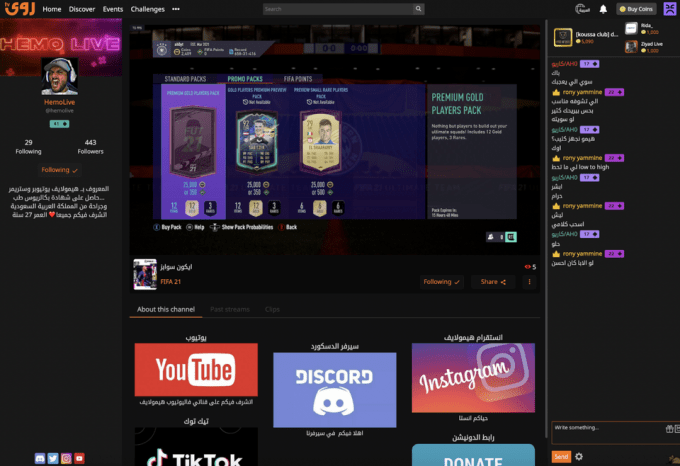

Medal.tv, a short-form video clipping service and social network for gamers, is entering the livestreaming market with the acquisition of Rawa.tv, a Twitch rival based in Dubai, which had raised around $1 million to date. The seven-figure, all-cash deal will see two of Rawa’s founders, Raya Dadah and Phil Jammal, now joining Medal, and further integrations between the two platforms going forward.

The Middle East and North African region (MENA) is one of the fastest-growing markets in gaming and still one that’s mostly un-catered to, explained Medal.tv CEO Pim de Witte, as to his company’s interest in Rawa.

“Most companies that target that market don’t really understand the nuances and try to replicate existing Western or Far-Eastern models that are doomed to fail,” he said. “Absorbing a local team will increase Medal’s chances of success here. Overall, we believe that MENA is an underserved market without a clear leader in the livestreaming space, and Rawa brings to Medal the local market expertise that we need to capitalize on this opportunity,” de Witte added.

Medal.tv’s community had been asking for the ability to do livestreaming for some time, the exec also noted, but the technology would have been too expensive for the startup to build using off-the-shelf services at its scale, de Witte said.

“People increasingly connect around live and real-time experiences, and this is something our platform has lacked to date,” he noted.

But Rawa, as the first livestreaming platform dedicated to Arab gaming, had built out its own proprietary live and network streaming technology that’s now used in all its products. That technology is now coming to Medal.tv.

Image Credits: Medal.tv

The two companies were already connected before today, as Rawa users have been able to upload their gaming clips to Medal.tv, and some Rawa partners had joined Medal’s skilled player program. Going forward, Rawa will continue to operate as a separate platform, but it will become more tightly integrated with Medal, the company says. Currently, Rawa sees around 100,000 active users on its service.

The remaining Rawa team will continue to operate the livestreaming platform under co-founder Jammal’s leadership following the deal’s close, and the Rawa HQ will remain based in Dubai. However, Rawa’s employees have been working remotely since the start of the pandemic, and it’s unclear if that will change in the future, given the uncertainty of COVID-19’s spread.

Medal.tv detailed its further plans for Rawa on its site, where the company explained it doesn’t aim to build a “general-purpose” livestreaming platform where the majority of viewers don’t pay — a call-out that clearly seems aimed at Twitch. Instead, it says it will focus on matching content with viewers who would be interested in subscribing to the creators. This addresses one of the challenges that has faced larger platforms like Twitch in the past, where it’s been difficult for smaller streamers to get off the ground.

The company also said it will remain narrowly focused on serving the gaming community as opposed to venturing into non-gaming content, as others have done. Again, this differentiates itself from Twitch which, over the years, expanded into vlogs and even streaming old TV shows. And it’s much different from YouTube or Facebook Watch, where gaming is only a subcategory of a broader video network.

The acquisition follows Medal.tv’s $9 million Series A led by Horizons Ventures in 2019, after the startup had grown to 5 million registered users and “hundreds of thousands” of daily active users. Today, the company says over 200,000 people create content every day on Medal, and 3 million users are actively viewing that content every month.

Powered by WPeMatico

Mobile field service startup Youreka Labs Inc. raised an $8.5 million Series A round of funding co-led by Boulder Ventures and Grotech Ventures, with participation from Salesforce Ventures.

The Maryland-based company also officially announced its CEO — Bill Karpovich joined to lead the company after previously general manager at IBM Cloud & Watson Platform.

Youreka Labs spun out into its own company from parent company Synaptic Advisors, a cloud consulting business focused on the customer relationship management transformations using Salesforce and other artificial intelligence and automation technologies.

The company is developing robotic smart mobile assistants that enable frontline workers to perform their jobs more safely and efficiently. This includes things like guided procedures, smart forms and photo or video capture. Youreka is also embedded in existing Salesforce mobile applications like Field Service Mobile so that end-users only have to operate from one mobile app.

Youreka has identified four use cases so far: healthcare, manufacturing, energy and utilities and the public sector. Working with companies like Shell, P&G, Humana and the Transportation Security Administration, the company’s technology makes it possible for someone to share their knowledge and processes with their colleagues in the field, Karpovich told TechCrunch.

“In the case of healthcare, we are taking complex medical assessments from a doctor and pushing them out to nurses out in the field by gathering data into a simple mobile app and making it useful,” he added. “It allows nurses to do a great job without being doctors themselves.”

Karpovich said the company went after Series A dollars because it was “time for it to be on its own.” He was receiving inbound interest from investors, and the capital would enable the company to proceed more rapidly. Today, the company is focused on the Salesforce ecosystem, but that can evolve over time, he added.

The funding will be used to expand the company’s reach and products. He expects to double the team in the next six to 12 months across engineering to be able to expand the platform. Youreka boasts 100 customers today, and Karpovich would also like to invest in marketing to grow that base.

In addition to the use cases already identified, he sees additional potential in financial services and insurance, particularly for those assessing damage. The company is also concentrated in the United States, and Karpovich has plans to expand in the U.K. and Europe.

In 2020, the company grew 300%, which Karpovich attributes to the need of this kind of tool in field service. Youreka has a licensing model with charges per end user per month, along with an administrative license, for the people creating the apps, that also charges per user and per month pricing.

“There are 2.5 million jobs open today because companies can’t find people with the right skills,” he added. “We are making these jobs accessible. Some say that AI is doing away with jobs, but we are using AI to enhance jobs. If we can take 90% of the knowledge and give a digital assistant to less experienced people, you could open up so many opportunities.”

Powered by WPeMatico