Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Yesterday we broke the news that Corel — the company behind WordPerfect, Corel Draw and a number of other apps, as well as the new owner of Parallels — had itself gotten acquired by KKR. Today, the news is confirmed and official: KKR today announced it has closed the deal, purchasing Corel from private equity firm Vector Capital.

The terms of the acquisition are not being disclosed, but when the first rumors of a deal started to emerge a couple of months ago, the price being reported was over $1 billion.

Corel may not be the first name you think of in the world of apps and software today. Founded in the 1980s as one of the first big software companies to capitalize on the first wave of personal computer ownership, it tried to compete against Microsoft in those early days (unsuccessfully), and has seen a lot of ups and downs, including two retreats from the stock market, an insider trading scandal and patent disputes (and even detentes) with its onetime rival.

But in more recent years it has, under the radar, built itself to be a solid and — in these days of startups that claim to intentionally operate at a loss for years in order to scale — profitable business with 90 million users. (Vector said in the past that Corel had paid dividends of $300 million over the years it owned the company.)

Founded in the days when you went to electronics store and bought physical boxes of software with installation disks and hefty manuals, Corel has brought itself into the modern era, with acquisitions like Parallels — a virtualization giant that lets businesses run far-flung and very fragmented networks as if they weren’t — underscoring that strategy.

And that is where KKR appears to be putting its focus. In the memo that a source passed us yesterday, Corel’s CEO Patrick Nichols assured staff that there would be no layoffs and that this acquisition would mean a significant new infusion of capital both to expand its existing business as well as to make more acquisitions to grow. (As we pointed out yesterday, there are a lot of very promising software startups in the market today, and not all of them will scale on their own, so that could present interesting opportunities for companies like Corel.)

“Corel has differentiated itself by offering an impressive portfolio of essential tools and services for connected knowledge workers – across devices, operating systems, and a range of fast-growing industries. KKR looks forward to working together with management to drive continued growth across its existing platforms while leveraging the team’s extensive experience in M&A to deliver a new chapter of innovation and growth on a global scale,” said John Park, member at KKR, in a statement.

That’s not to say that Corel does not have a specific strategy in mind. The company has apps and services today in three verticals serving consumers (mostly “prosumers”) and so-called knowledge workers: Creativity, Productivity and Desktop-as-a-Service. That will likely be the trajectory that it will continue to pursue as it looks for more growth.

Although Vector is known as a tech investor, KKR is another step up in to the “bigger” leagues, and so it will be interesting to see what Corel can do with the larger coffers, and the larger network of contacts, that KKR will bring to the table.

“KKR recognizes the value of our people and their impressive achievements, especially in terms of our commitment to customers, technology innovation, and our highly successful acquisition strategy. With KKR’s support and shared vision, our management team is excited by the opportunities ahead for our company, products, and users,” Nichols said in a statement.

If reports of the acquisition price are accurate, that would represent a big premium to Vector: over the last 16 years the PE firm had acquired, taken public and reacquired Corel, paying no more than $124 million for the company in those two acquisitions (the second time it paid just $30 million).

“Corel has been an important part of the Vector Capital family for many years and we are pleased to have achieved a fantastic outcome for our investors with the sale to KKR,” said Alex Slusky, Vector Capital’s founder and chief investment officer, in a statement. “Under Vector’s ownership, Corel completed multiple transformative acquisitions, grew revenue and meaningfully improved profitability, highlighting Vector’s proven strategy of partnering with management teams to position companies for long-term success. We are confident the company has found a great partner with KKR and wish them continued success together.”

Powered by WPeMatico

TikTok is being investigated in the U.K. for how it handles the safety and personal data of underage users. According to The Guardian, information commissioner Elizabeth Denham told a parliamentary committee that the probe started in February after the U.S. Federal Trade Commission levied a $5.7 million fine against TikTok for breaking children’s privacy law.

Denham told The Guardian that the commission is examining how TikTok collects private data and has concerns about the open messaging system, which may allow adult users to contact children. “We are looking at the transparency tools for children. We’re looking at the messaging system, which is completely open, we’re looking at the kind of videos that are collected and shared by children online. We do have an active investigation into TikTok right now, so watch this space,” she said.

The investigation will also examine if the popular app, owned by ByteDance, violates the General Data Protection Regulation (GDPR), which requires companies to put special protections in place for underage users and provide them with different services than adults.

The FTC’s investigation, which began when TikTok was still known as Musical.ly, ruled that the app broke the Children’s Online Privacy Protection Act by failing to seek parental consent before collecting names, email addresses and other personal information from users under 13. The ruling resulted in an age gate being added to an app that prevents users under 13 from filming and posting videos on it.

ByteDance, the Chinese media startup now valued at $75 billion, told The Guardian in a statement that “We cooperate with organizations such as the ICO to provide relevant information about our product to support their work. Ensuring data protection principles are upheld is a top priority for TikTok.”

Powered by WPeMatico

Only six months after snapping up virtualization specialist Parallels, Canadian software company Corel is itself getting acquired. TechCrunch has learned and confirmed with multiple sources that private equity giant KKR has closed a deal to buy the company from Vector Capital, which has owned some or all of Corel since 2003.

KKR’s interest in Corel was first rumored in May, when PE Hub reported the two were in talks for a sale valued at over $1 billion. At the time, representatives of Corel declined to comment, although our sources inside the company indicated that the reports were not inaccurate.

Fast-forward to today, and both KKR and and a spokesperson for Parallels/Corel declined to comment. But, we now have a copy of the memo provided by an internal source that has been sent out to staff announcing that the deal has indeed closed, and that Corel is now officially part of the KKR family of companies.

According to the memo, KKR is very optimistic about Corel’s prospects. It plans to give Corel an “infusion of capital” to accelerate its growth, which will go into two areas. First will be expanding operations for the existing business: Corel is the company behind a number of longstanding software brands including WordPerfect, Corel Draw, WinZip, PaintShop Pro. Second will be making acquisitions (and the sheer proliferation of promising startups in the last decade dedicated to all variety of apps and other software that may have found it a challenge to scale means Corel could have rich pickings).

There are no layoffs planned as part of the deal, and the official announcement had been planned to go out next week, but now looks like it may be moved up to tomorrow (Wednesday).

Vector and Corel itself have never publicly disclosed much on user numbers or financials, but Vector has described the company as “highly profitable,” with dividends of more than $300 million to date. The memo we’ve seen notes that Corel (including Parallels) has millions of customers across its various software platforms and apps.

The acquisition of Corel by KKR marks another chapter in the company’s long corporate history.

Founded in the 1980s — when personal computers were just starting to enter the mainstream but well before we had anything like the internet (not to mention the world of cloud-based apps) that we know today — Corel once positioned itself as a potential competitor to Microsoft in the software wars.

When Corel purchased WordPerfect from Novel in 1996, Corel founder Michael Cowpland viewed the software package as an integral part of that rivalry, describing it as the Pepsi to Microsoft’s Coke — that is, Word.

Microsoft proved the mightier of the two, and it even eventually signed a partnership with Corel that saw it investing in the company: a sell out, as one disappointed Canadian journalist described it at the time. The two have also sparred over patents.

Corel, which went public early in its life, got battered in the first dot-com bust (which was not helped by an insider trading scandal that led to Cowpland’s departure). Vector stepped in and took it private in 2003.

After restructuring the company, Vector listed Corel again in 2006. But, amid another recession that again hit Corel hard, it once more took it private in 2010. In the intervening years, Corel has been focused on modernising its offerings, bringing in e-commerce, direct downloads, subscriptions and acquisitions to bring the company’s products and wider business closer to how consumers and workers use computers today.

Parallels was a part of that strategy: its products help people work seamlessly across multiple platforms, letting employees (and IT managers) run a unified workflow regardless of the device or operating system, with Parallels providing support for Windows, Mac, iOS, Android, Chromebook, Linux, Raspberry Pi and cloud — a timely offering in the current, fragmented IT market.

If the $1 billion+ figure is accurate, that strategy seems to have worked: across the two times that Vector took Corel private, it never paid more than $124 million for the company (the second time, as its stock was tanking, it paid just $30 million).

Powered by WPeMatico

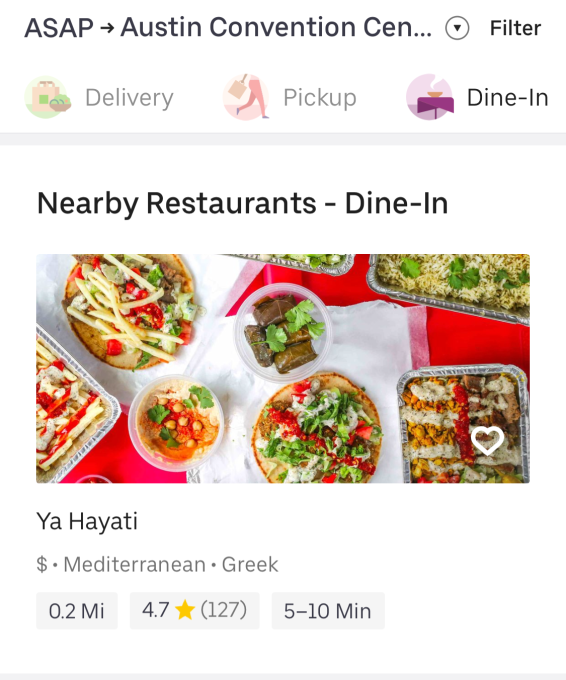

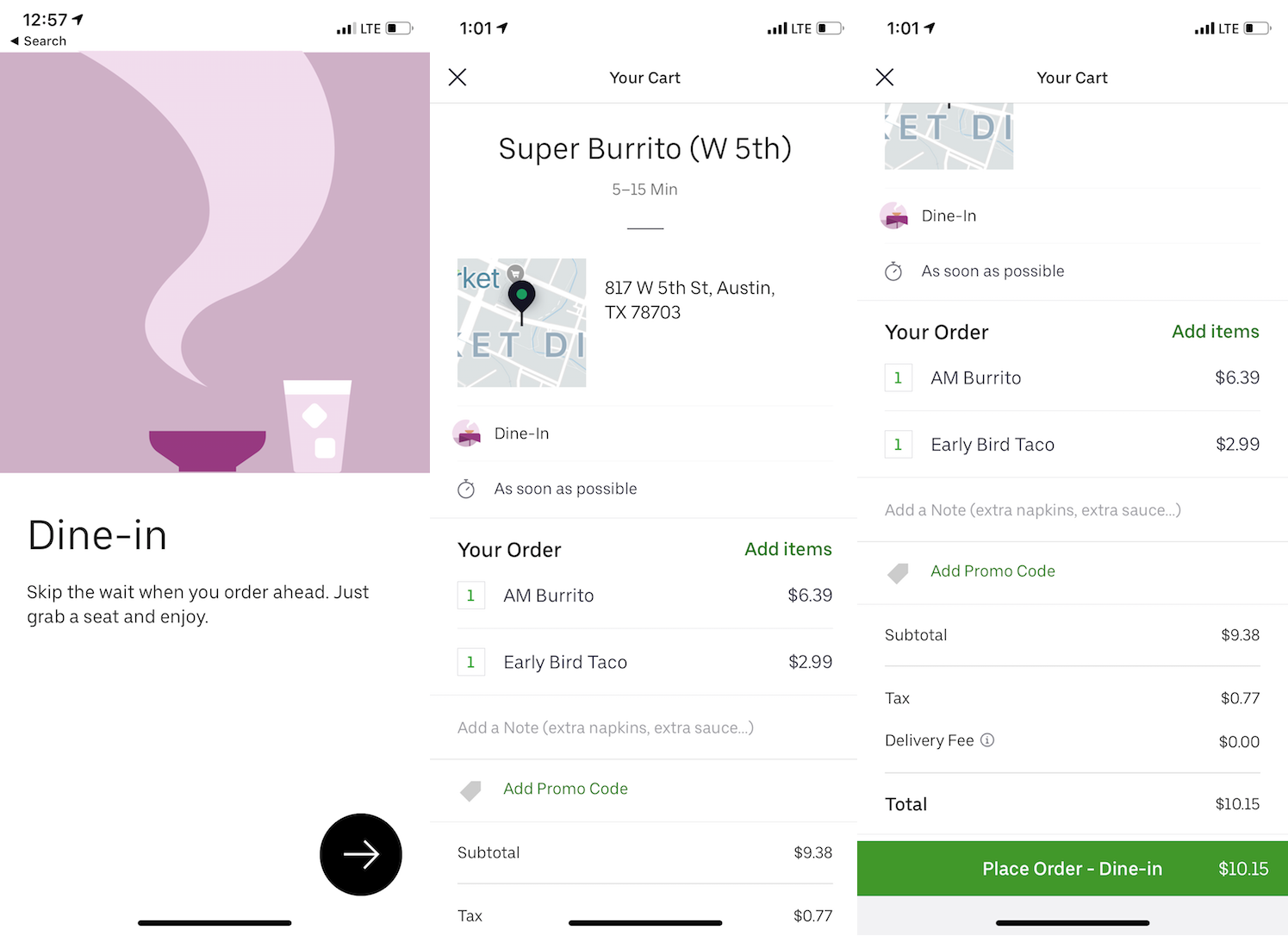

Tired of cleaning up after take-out or getting hangry waiting at your table in restaurants? Well Uber Eats is barging into the dine-in business. A new option in some cities lets you order your food ahead of time, go to the restaurant, then sit down inside to eat, a tipster from competing dine-in app Allset tells us. We tested it, and Uber Eats Dine-In even waives the standard Uber delivery and service fees.

Adding Dine-In lets Uber Eats insert itself into more food transactions, expand to restaurants that care about presentation and don’t do delivery and avoid paying drivers while earning low-overhead revenue. Uber’s Dine-In option is now available in some cities, including Austin, Dallas, Phoenix and San Diego, where it could save diners time and fees while helping restaurants fill empty tables and waiters earn tips. But it also could coerce more restaurants to play ball with UberEats if their competitors do, eating into their margins.

Uber confirmed the existence of the Dine-In option, telling me, “We’re always thinking about new ways to enhance the Eats experience.” They also verified there are no delivery or service fees, and restaurants get 100% of tips left in-app by users. However, we found some items were silently marked up from restaurants’ listed prices in both Uber Eats Delivery and Dine-In options, which could help it make some money directly from these purchases. We also discovered this buried Uber Help Center FAQ with more details.

Uber has been rapidly experimenting with Uber Eats, trying discounted specials, Uber Eats Pool, where you pay less for slower delivery, and $9.99 unlimited delivery subscriptions. It’s steadily becoming an omnivore.

Dine-in appears next to the Delivery and Pick-Up options across the top of the Uber Eats app in select cities. You can choose to go eat “ASAP” or in some cases schedule when you want to arrive and sit down. You’ll be shown how long the food will take to prep, distance to the restaurant, your price and the restaurant’s rating. You’ll then be notified as the order is prepared and approaches readiness. Then you just deliver yourself to the restaurant and add a tip in-app or on the table.

Uber Eats should obviously make it easy for you to hail an Uber with the restaurant as the pre-set destination. An Uber spokesperson called that a good idea but not something it’s doing yet. Back in 2016, Uber tried a merchant-sponsored rides option where you’d get a rebate on your travel if you spent money at a given store. You could imagine restaurants that want to show off their ambiance giving customers some money back if they come across town to eat there.

The new feature could spell trouble for other dine-in apps like Allset that’s been in the business for four years. Users might also opt for Uber Eats Dine-In over restaurant reservation apps like OpenTable and Resy. Why waste time waiting to order and for your food to be cooked when you could just show up as it comes out of the oven?

“I think that more delivery players will be tapping into dine-in space. It’s all about convenience and time saving. But it’s going to be very difficult for them, given their focus on delivery,” Allset CEO Stas Matviyenko said of Uber becoming a competitor. He believes dedicated apps for different modes of dining will succeed. But Uber Eats’ ubiquity and its one-stop-shop model for all your dining needs could make it stickier than a dine-in only app you use less frequently.

With Dine-In, Uber could aid restaurants that are empty at the start or end of their open hours. Last year we reported that Uber Eats was giving restaurants prominence in a Featured section of the app to drive up demand if they offered discounts to customers. Similarly, Uber could let restaurants entice more Dine-In customers, especially when foot-traffic was slow, by providing discounts on food or subsidized Uber transportation. Better to knock a dollar or two off an entree if it means filling the restaurant at 5:30 or 9:30 pm.

And now that Uber Eats does delivery, take-out and dine-in, it’d make perfect sense to offer traditional restaurant reservations through the app as well. That would pit it directly against OpenTable, Resy and Yelp. Instead of trying to own a single use case that might only appeal to certain demographics in certain situations, Uber Eats’ strategy is crystallizing: be the app you open whenever you’re hungry.

Powered by WPeMatico

Meditation app unicorn Calm wants you to doze off to the dulcet tones of actor Matthew McConaughey’s southern drawl or writer Stephen Fry’s English accent. Calm’s Sleep Stories feature that launched last year is a hit, with more than 150 million listens from its 2 million paid subscribers and 50 million downloads. While lots of people want to meditate, they need to sleep. The seven-year-old app has finally found its must-have feature that makes it a habit rather than an aspiration.

Keen to capitalize on solving the insomnia problems plaguing people around the world, Lightspeed tells TechCrunch it has just invested $27 million into a Series B extension round in Calm alongside some celebrity angels at a $1 billion valuation. The cash will help the $70 per year subscription app further expand from guided meditations into more self-help masterclasses, stretching routines, relaxing music, breathing exercises, stories for children and celebrity readings that lull you to sleep.

The funding adds to Calm’s $88 million Series B led by TPG that was announced in February that was also at a $1 billion valuation, bringing the full B round to $115 million and Calm’s total funding to about $141 million. Lightspeed partner Nicole Quinn confirms the fund started talks with Calm around the same time as TPG, but took longer to finish due diligence, which is why the valuation didn’t grow despite Calm’s progress since February.

“Nicole and Lightspeed are valuable partners as we continue to double down on entertainment through our content,” Calm’s head of communications Alexia Marchetti tells me. The startup plans to announce more celebrity content tie-ins later this summer.

Broadening its appeal is critical for Calm amidst a crowded meditation app market that includes Headspace, Simple Habit and Insight Timer, plus newer entrants like Peloton’s mindfulness sessions and Journey’s live group classes. It’s become easy to find guided meditations online for free, so Calm needs to become a holistic mental wellness hub.

While it risks diluting its message by doing so much, Calm’s plethora of services could make it a gateway to more of your personal health spend, including therapy, meditation retreats and health merchandise from airy clothing to yoga mats. But subscription fees alone are powering a big business. Calm quadrupled revenue in 2018 to reach $150 million in ARR and hit profitability.

Calm is poised to keep up its rapid revenue growth. After the launch of Sleep Stories, “it was incredible to see the engagement spike up and also the retention,” says Quinn. Users can choose from having McConaughey describe the wonders of the cosmos, John McEnroe walk them through the rules of tennis, fairy tales like The Little Mermaid and more.

Quinn tells me “Sleep Stories is now a huge percentage of the business, and also the length of time people spend on the app has gone up dramatically.” She tells me that so many startups are “trying to invent a problem where there isn’t one.” But difficulty snoozing is so widespread and detrimental that users are eager to pay for an app instead of a sleeping pill. Having the Interstellar actor talk about the universe until I pass out sounds alright, alright, alright.

Powered by WPeMatico

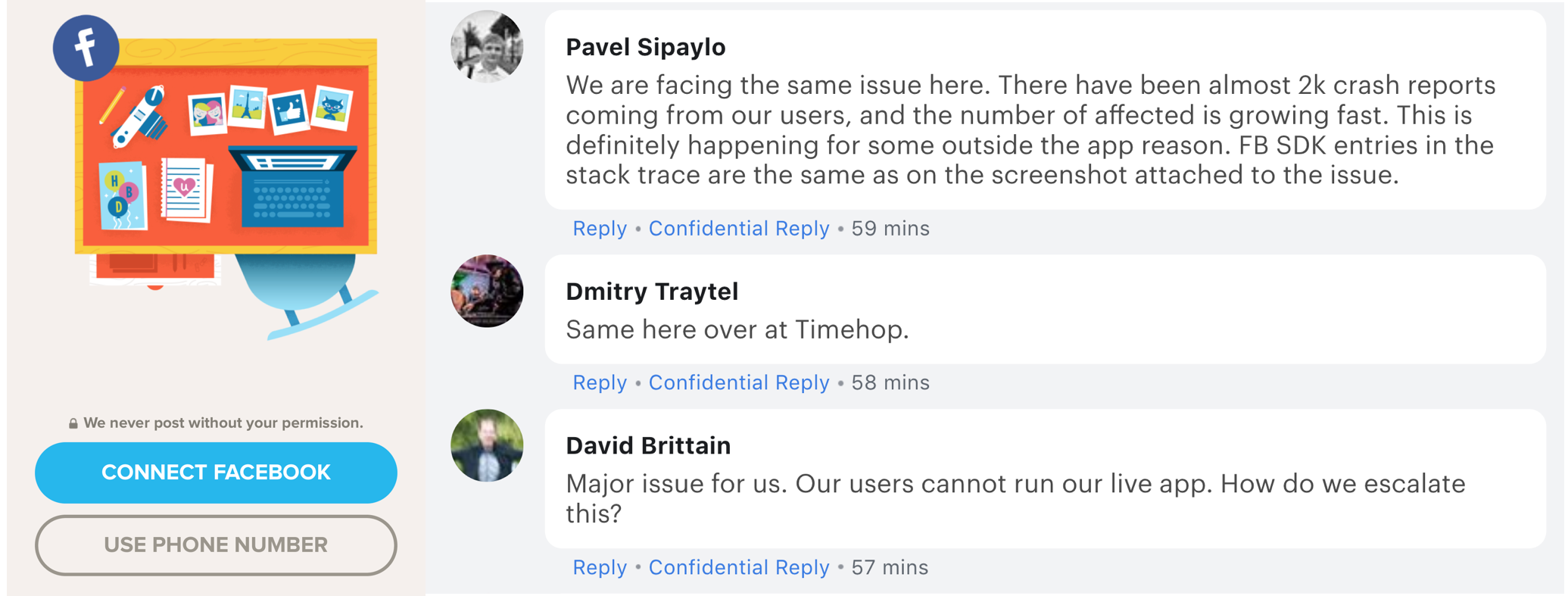

A malfunction in Facebook’s Software Development Kit that lets apps add Login With Facebook, sharing, and other features caused apps that integrate it like Timehop to repeatedly crash for about three hours. TechCrunch received a tip that developers were getting tons of user complaints and crash reports starting around noon pacific today due to a problem with the Facebook for iOS SDK. TechCrunch’s testing verified that products like Timehop, Joytunes’ Simply Piano, Momento GIFs, and more kept breaking when users access Facebook features or in some cases just opened the app.

This is a big issue for Facebook because it relies on these apps to drive user lock-in. If people use Facebook to log into or share from other apps, they’re less likely to delete their account. But if the Facebook developer platform screws up like this morning, developers could instead highlight sharing via Twitter or SMS, and divert ad buys to other platforms. Most problematically, the bug could push developers to other login platforms like Google’s or Apple’s new Sign In With Apple.

[Update: 3:45pm PT: Facebook has fixed the bug and apps integrated with the SDK are starting to work normally again. A Facebook spokesperson tells me “We started to work on the issue as soon as it was reported to us, and it has been resolved.” Facebook engineer Ram Sharma posted that “Our engineering team worked to resolve this issue as soon as it was discovered. It is now mitigated and app function should be restored.” Developers confirm the bug has been fixed. The rest of this article remains as originally published.]

The bug was initially submitted to Facebook’s developer forums by Ryan Layne. These crashes thwart normal usage of other apps, costing their developers ad views and in-app purchases, or leading their users to uninstall or abandon them.

Hitting the Connect Facebook button on Timehop causes the app to crash. Developers in Facebook’s bug reporting forum pile on saying their apps are breaking

The situation highlights the increasing centralization of the web as more and more companies depend on a small number of mobile, hosting, and social platforms. Earlier this month, a Google Cloud outage knocked down Snapchat and Discord. While these tools make it simpler to start a company or launch an app without having to build everything in-house, they introduce platform risk. Beyond technical outages, there’s also the concern that a platform could use its insights to copy its clients, or block them if they compete with the gatekeeper too vigorously as Facebook has done to chat and social media apps in the past.

Powered by WPeMatico

Mozilla today announced the first preview of a redesigned version of Firefox for Android that promises to be up to two times faster. The new version also introduces an easier to use and rather minimalist user interface, as well as support for collections, Mozilla’s new take on bookmarks. The new browser also features Firefox’s tracking protection, which is on by default. Over time, this preview will become the default Firefox for Android.

A few years ago, with Quantum, the Firefox team make a number of under-the-hood improvements to the browser’s core backend technologies. Now, it is doing something similar with GeckoView, Mozilla’s browser engine for Android. Implementing the technology the team developed for this in the browser now “paves the way for a complete makeover of the mobile Firefox experience,” the organization writes in today’s announcement.

A few years ago, with Quantum, the Firefox team make a number of under-the-hood improvements to the browser’s core backend technologies. Now, it is doing something similar with GeckoView, Mozilla’s browser engine for Android. Implementing the technology the team developed for this in the browser now “paves the way for a complete makeover of the mobile Firefox experience,” the organization writes in today’s announcement.

“While all other major Android browsers today are based on Blink and therefore reflective of Google’s decisions about mobile, Firefox’s GeckoView engine ensures us and our users independence,” says the Firefox team. “Building Firefox for Android on GeckoView also results in greater flexibility in terms of the types of privacy and security features we can offer our mobile users.”

An early version of Firefox with GeckoView is now available for testing on Android under the Firefox Preview moniker. Mozilla notes that the user experience will sill change quite a bit before it is final.

When you first launch it, Preview opens up a new default experience that lets you sign in to a Firefox account, decide on whether you want a light or dark theme (or have the system switch automatically depending on the time of day), turn on privacy features and more.

When you first launch it, Preview opens up a new default experience that lets you sign in to a Firefox account, decide on whether you want a light or dark theme (or have the system switch automatically depending on the time of day), turn on privacy features and more.

One feature I really appreciate is that, by default, the preview puts the URL bar at the bottom of the screen, so that it’s within easy reach of your thumb. If you swipe up on the URL bar, you get both a share and bookmark icon, too. That takes some getting used to but quickly becomes second nature.

I haven’t run any formal benchmarks, but the preview definitely feels significantly snappier and smoother than any previews Firefox version on Android, up to the point where I wouldn’t hesitate to make it my default browser on mobile, especially given its built-in privacy features. I haven’t run into any hard crashes so far either, but this is obviously a beta version, so your mileage may vary.

For the rest of the year, the team will focus on optimizing the preview for all Android devices, but for now, it’s already worth a look if you’re looking to play with a new mobile browser on your Android device and not afraid of the occasional bug.

Powered by WPeMatico

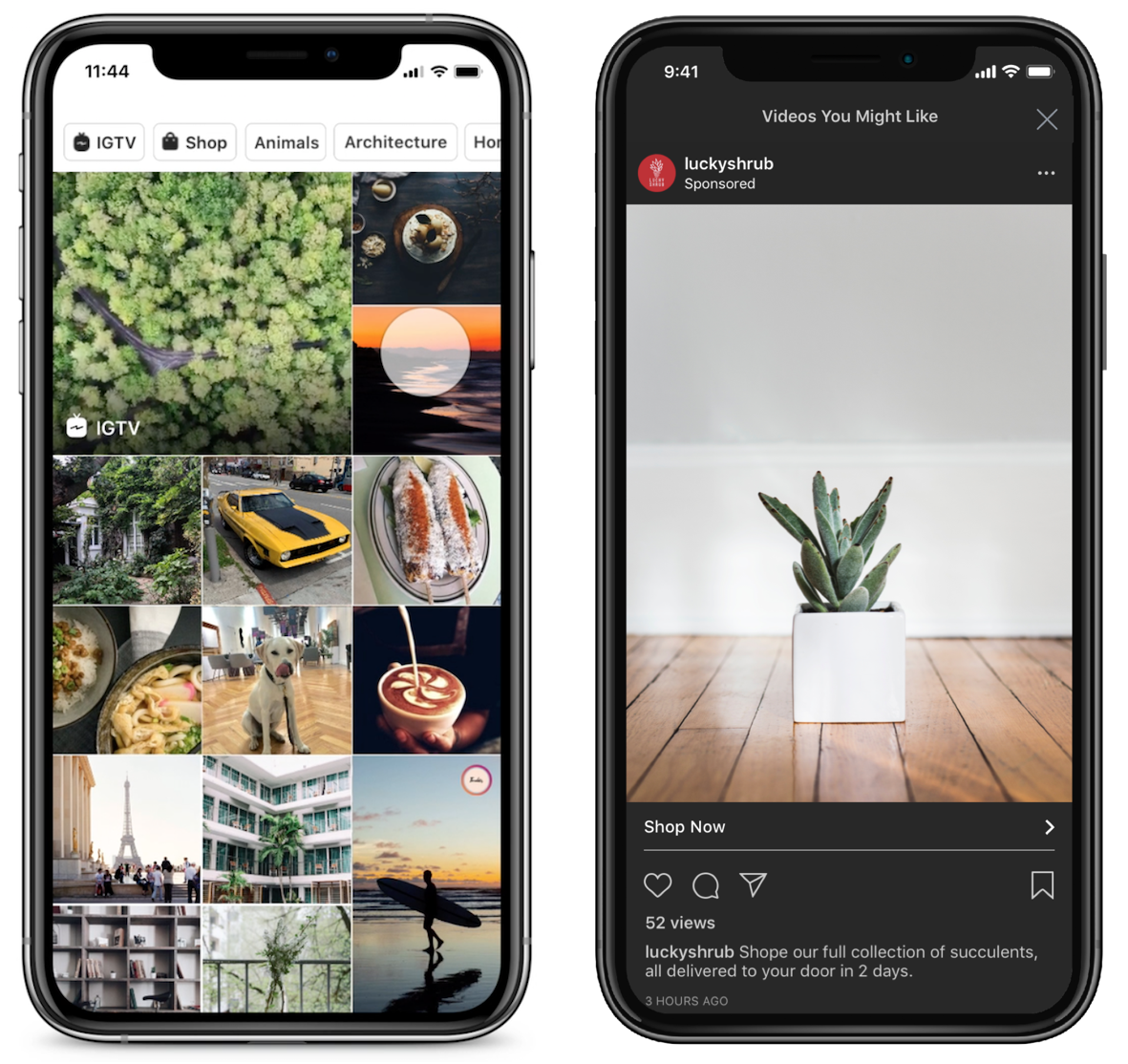

Half of Instagram’s billion-plus users open its Explore tab each month to find fresh content and creators. Now the Facebook-owned app will do more to carry its weight by injecting ads into Instagram Explore for the first time. But rather than bombard users with marketing right on the Explore grid, Instagram will instead only show ads after users tap into a post and then start scrolling through similar imagery.

The move feels like a respectful way to monetize Explore without annoying users too much or breaking the high visual quality of the space. Instagram’s director of business product marketing Susan Bucker Rose tells me she believes the ads will feel natural because users already come to Explore “in the mindset of discovery. They want to be exposed to new accounts, people, and brands.”

Instagram will test the ad slots itself at first to promote its ailing IGTV feature before they “launch to a handful of brands over the coming weeks” Rose says. That includes both big name corporations and smaller advertisers looking to drive conversions, video views, or reach. Instagram hopes to roll the ad format out broadly in the next few months.

Advertisers will buy the slots through the same Facebook ads manager and API they use to buy Instagram feed and Stories space. At first advertisers will have to opt in to placing their ads in Instagram Explore too, but eventually that will be the default with an opportunity to opt out.

Here’s how ads work in Instagram Explore. When you open the tab it will look the same as always with a scrollable grid of posts with high engagement that are personalized based on your interests. When you tap into a photo or video, you’ll first see that full-screen. But if you keep scrolling down, Instagram will show you a contextual feed of content similar to the original post where it will insert photo and video ads. And if you tap into one of the themed video channels and then keep scrolling after watching the clip to check out more videos in the same vein, you may see Instagram video ads.

Instagram describes the introduction as “slowly and thoughtfully” — which makes it sound like the volume of ads will ramp up over time.

Explore was first launched in 2012, some two years after Instagram itself, as a merger of the app’s search and “popular” tabs, with an aim of using algorithms that were informed by your existing interests to give you a new way to discover new people and themes to follow in the app beyond those you might pick up by way of you own social circles. It’s had a few revamps, such as the addition of topical channels and hashtags, and the addition of Stories, the format that has proven to be such a hit on Instagram itself. There won’t be any ads in Stories that recently started appearing in Explore.

But interestingly, through all of that, Instagram stayed hands-off when it came to advertising and Explore. The idea is that the content that each person sees in Explore is individualized, with algorithms detecting the kinds of things you like to show you photos, videos and subjects you might most want to see. Apparently Instagram didn’t want to deter browsing of this content.

On the other side of the coin, this has meant that up to now, individuals and brands have not been able to proactively request or pay to be in anyone’s specific Explore tab — although that doesn’t mean that people don’t game this situation (just Google “how to get on Instagram Explore” and you will find many how-to’s to show you the way).

The move to bring ads into the Explore experience has some logic to it. Even before monetization made its way to Instagram in the form of feed advertising, shoppable links and sponsored content posted by influencers, brands and businesses had started using the platform to promote products and to connect with customers. Instagram says that today, 80 percent of its users follow at least one business on Instagram. Now instead of trying desperately to game the Explore algorithm, Instagram can just sell businesses space instead.

With Facebook’s News Feed usage in danger as attention shifts to Stories that it’s still learning to monetize, the company is leaning more on Instagram to keep revenue growing. But Instagram must be sure not to suffocate the golden goose with too many ads.

Powered by WPeMatico

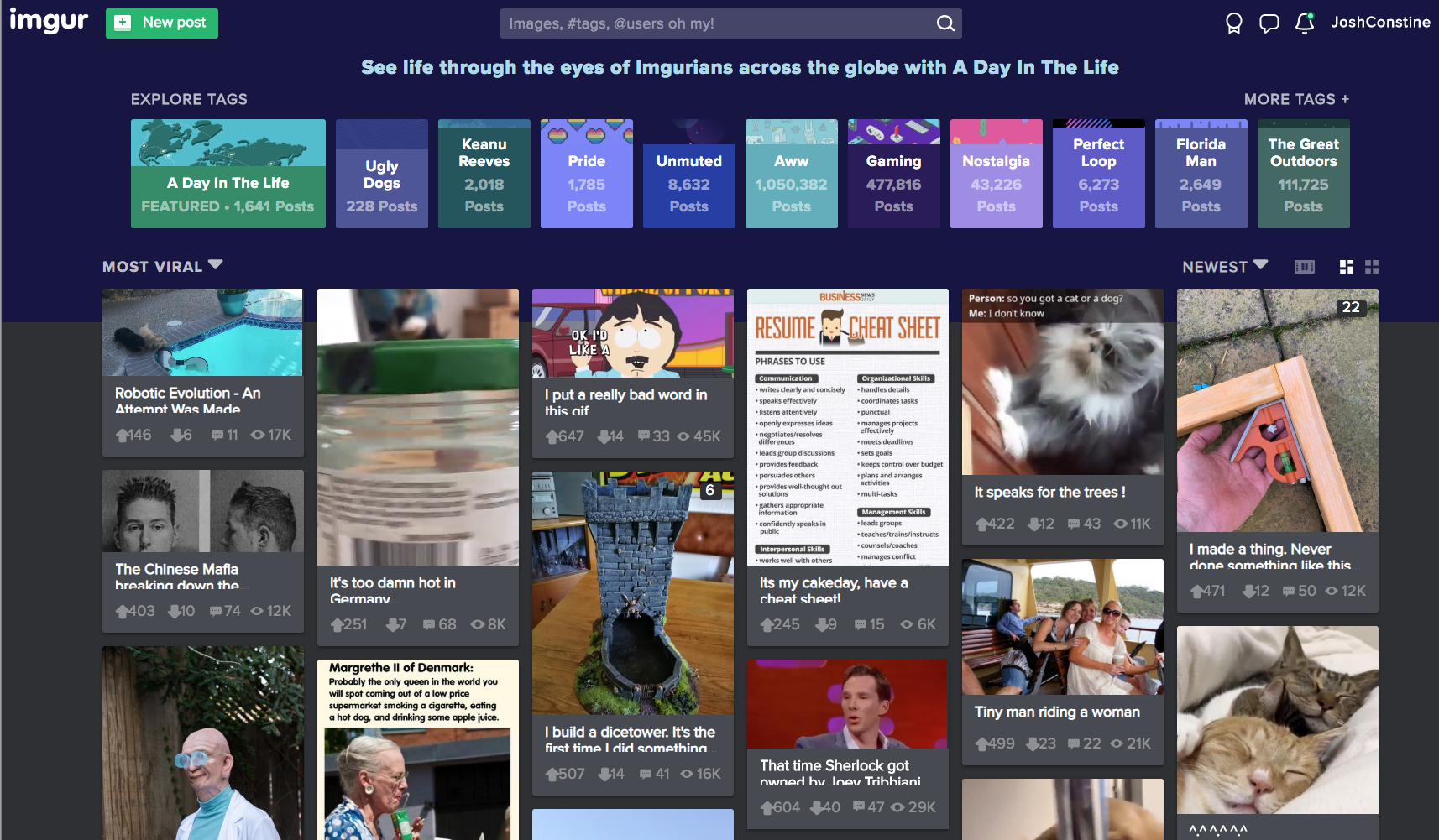

Meme creators have never gotten their fair share. Remixed and reshared across the web, their jokes prop up social networks like Instagram and Twitter that pay back none of their ad revenue to artists and comedians. But 300 million monthly user meme and storytelling app Imgur wants to pioneer a way to pay creators per second that people view their content.

Today Imgur announces that it’s raised a $20 million venture equity round from Coil, a micropayment tool for creators that Imgur has agreed to build into its service. Imgur will eventually launch a premium membership with exclusive features and content reserved for Coil subscribers.

Users pay Coil a fixed monthly fee, install its browser extension, the Interledger protocol is used to route assets around, and then Coil pays creators dollars or XRP tokens per second that the subscriber spends consuming their content at a rate of 36 cents per hour. Imgur and Coil will earn a cut too, diversifying the meme network’s revenue beyond ads.

“Imgur began in 2009 as a gift to the internet. Over the last 10 years we’ve built one of the largest, most positive online communities, based on our core value to ‘give more than we take’” says Alan Schaaf, founder and CEO of Imgur. The startup bootstrapped for its first five years before raising a $40 million Series A from Andreessen Horowitz and Reddit. It’s grown into the premier place to browse ‘meme dumps’ of 50+ funny images and GIFs, as well as art, science, and inspirational tales. With the same unpersonalized homepage for everyone, it’s fostered a positive community unified by esoteric inside jokes.

While the new round brings in fewer dollars, Schaaf explains that Imgur raised at a valuation that’s “higher than last time. Our investors are happy with the valuation. This is a really exciting strategic partnership.” Coil founder and CEO Stefan Thomas who was formerly the CTO of cryptocurrency company Ripple Labs will join Imgur’s board. Coil received the money it’s investing in Imgur from Ripple Labs’ Xpring Initiative, which aims to fund proliferation of the Ripple XRP ecosystem, though Imgur received US dollars in the funding deal.

Thomas tells me that “There’s no built in business model” as part of the web. Publishers and platforms “either make money with ads or with subscriptions. The problem is that only works when you have huge scale” that can bring along societal problems as we’ve seen with Facebook. Coil will “hopefully offer a third potential business model for the internet and offer a way for creators to get paid.”

Founded last year, Coil’s $5 per month subscription is now in open beta, and it provides extensions for Chrome and Firefox as it tries to get baked into browsers natively. Unlike Patreon where you pick a few creators and choose how much to pay each every month, Coil lets you browse content from as many creators as you want and it pays them appropriately. Sites like Imgur can code in tags to their pages that tell Coil’s Web Monetization API who to send money to.

The challenge for Imgur will be avoiding the cannibalization of its existing content to the detriment of its non-paying users who’ve always known it to be free. “We’re in the business of making the internet better. We do not plan on taking anything away for the community” Schaaf insists. That means it will have to recruit new creators and add bonus features that are reserved for Coil subscribers without making the rest of its 300 million users feel deprived.

It’s surprising thT meme culture hasn’t spawned more dedicated apps. Decade-old Imgur precedes the explosion in popularity of bite-sized internet content. But rather than just host memes like Instagram, Imgur has built its own meme creation tools. If Imgur and Coil can prove users are willing to pay for quick hits of entertainment and creators can be fairly compensated, they could inspire more apps to help content makers turn their passion into a profession…or at least a nice side hustle.

Powered by WPeMatico

Big money continues to flow in India’s growing education market. Bangalore-based Unacademy, which operates an online learning platform to help millions prepare for competitive exams in India, has raised $50 million to further scale its reach.

The Series D financing round was led by Steadview Capital, Sequoia India, Nexus Venture Partners and Blume Ventures, with Unacademy’s own co-founders Gaurav Munjal and Roman Saini also participating in it. The new round means the startup has raised close to $90 million to date.

The four-year-old startup is aimed at students who are preparing for competitive exams to get into a college and those who are pursuing graduation-level courses. Unacademy allows students to watch live classes from educators and later engage in sessions to review topics in more detail. It has 10,000 registered educators and 13 million learners — up from 3 million a year ago.

The startup said it will use the new fund to expand the number of educators it has on the platform, and also add more exam courses, Unacademy CEO Munjal told TechCrunch. It will also improve its product and expand the team.

Unacademy began its journey as a YouTube channel, but has since expanded to its own app where it offers some courses for free and others through a recently launched subscription business. The subscription service — called Unacademy Plus Subscription — has 50,000 users.

Unacademy also maintains an archive of all the classes, giving students the option to reference older lectures at any time through the app. The startup says YouTube is still its largest distribution channel. Overall, the platform sees more than 100 million monthly views across the platforms.

“We are seeing unprecedented growth and engagement from learners in smaller towns and cities, and are also very humbled to see that top-quality educators are choosing Unacademy as their primary platform to reach out to students. In the last few months, we have taken bigger strides toward achieving this mission. We have more than 400 top educators from across the country taking live classes every day on Unacademy Plus. This is available to every student, irrespective of their location,” said Munjal.

Unacademy competes with unicorn Byju’s, which is widely believed to be the largest edtech startup in the world with its valuation nearing $4 billion. Byju’s, which has more than 2.4 million paid subscribers (and over 30 million users), offers courses for students in kindergarten to year 12, in addition to those preparing for competitive under graduation level courses.

India has the largest population in the world in the age bracket of 5 to 24 years. The education space in the nation is estimated to grow to $35 billion in the next six years.

In recent months, Unacademy has grown more aggressive with marketing. Last year it tied up with web-production house The Viral Fever to fund a show called “Kota Factory,” which revolves around the lives of students who are preparing to go to an engineering college. In the midst of it, Unacademy also offered low-cost, discounted subscription plans to attract users to its subscription platform.

Unacademy has presence in Indonesia as well, where as of last year, it had about 30 educators. The startup did not offer an update on how its international ambitions are holding up. A representative of Unacademy told TechCrunch recently that the platform does not rely on ads for monetization.

Powered by WPeMatico