Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Law firms have little incentive to build or buy software that will save their lawyers time because they often bill clients by the hour. Tasks like tracking down legal documents, extracting key information and drawing up hiring offers or funding term sheets add up to make lawyers expensive, even if they’re constantly repeating mindless busy work.

That’s why legal startup Atrium is so exciting — even though it’s developing tech that might seem boring on the surface. After raising $75 million from Andreessen Horowitz and General Catalyst while growing to 400 clients, today Atrium is announcing its first customer-facing products.

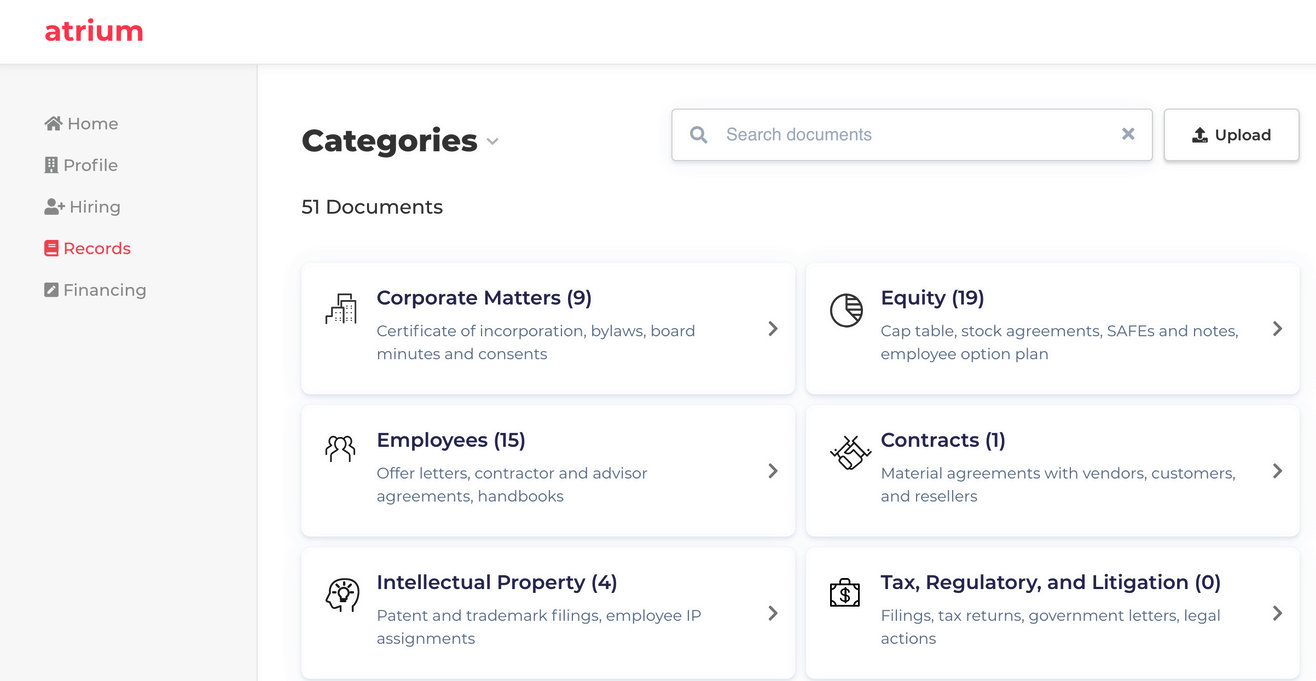

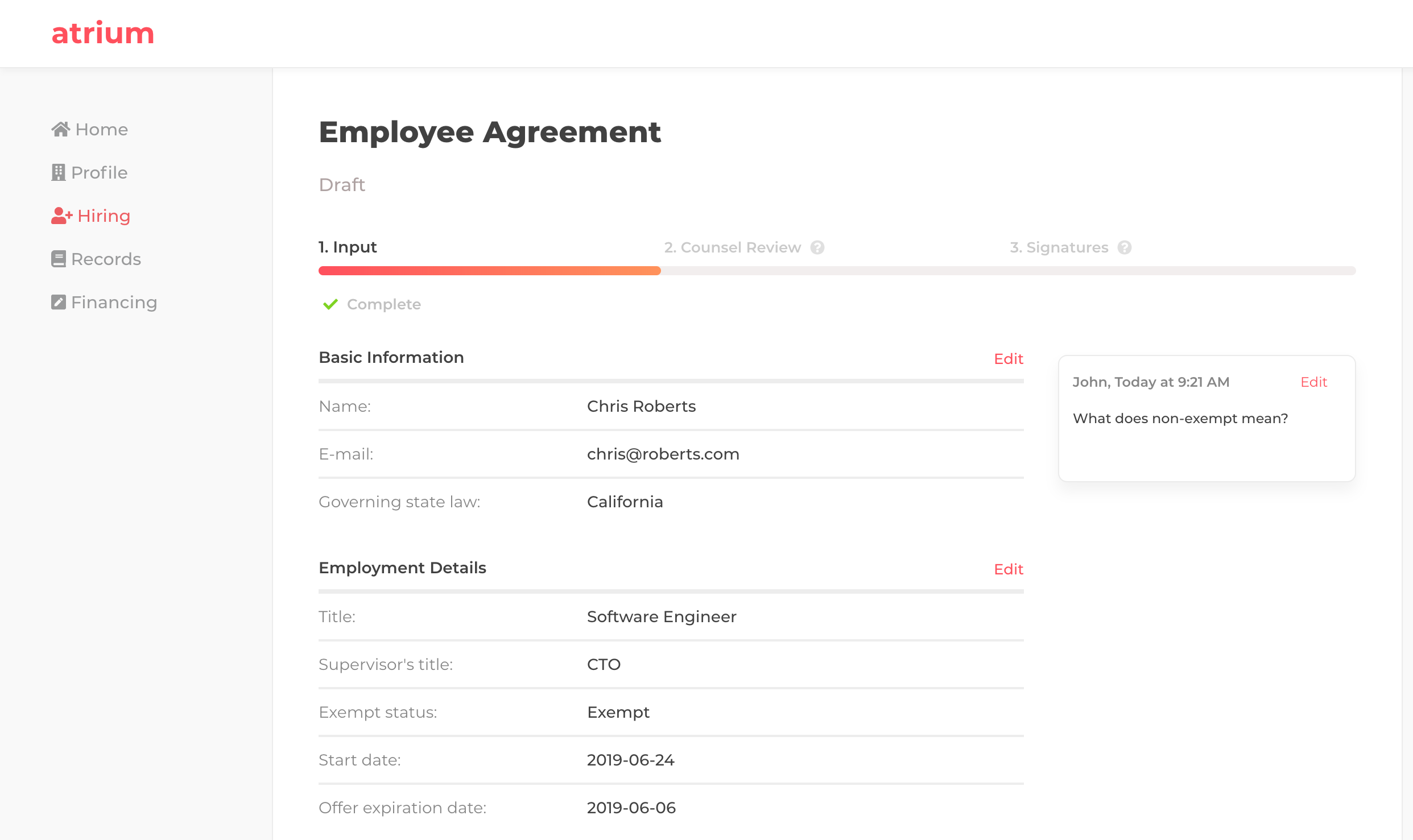

Atrium Records creates a collaborative file locker for you and your lawyer so you always have access to the latest versions of corporate documents. Atrium Hiring automatically generates hiring offers and contracts from details you add to a form, and tracks everyone’s approvals and signatures.

Atrium Records

Rather than having to pay for these tools separately, they come as part of a subscription to a bundle of Atrium’s legal services, with special projects like counsel through an acquisition costing extra. This business model incentivizes Atrium to work as efficiently as possible instead of bilking hourly rates, and build tools to eliminate less-skilled work or assist with common corporate duties. That’s allowed it to speed up legal work on incorporations, financings, M&A and contract negotiations.

“One of the reasons we partnered with Andreessen Horowitz on the last round [a $65 million Series B] was we really align with the way they approach venture capital,” Atrium co-founder and CEO Justin Kan tells me. “Marc’s initial observation was . . . let’s not just provide capital but also other services like a talent network. We have kind of done the same stuff. Not only are we helping people with the legal stuff they want to get done but with the other stuff surrounding it.”

Atrium CEO Justin Kan at TechCrunch Disrupt SF 2017

For example, Atrium’s Fundraising Concierge service provides assistance to startups for defining their narrative, setting up investor meetings and generating fair term sheets. Atrium has to date aided startups with raising more than $1 billion, from seed rounds of $200,000 to huge $50 million rounds

Developing drab but useful software for enterprises is a drastic shift for Kan. He pioneered life vlogging by strapping a camera to his head at his startup Justin.tv that eventually blossomed into Twitch and sold to Amazon for $1 billion. It’s been quite an adjustment for Kan going from making video-game-streaming consumer apps and angel investing to Atrium. “Two years. It has been an interesting and crazy ride. I wanted to get back to starting companies. That was the fastest learning I’d ever had. But I forgot learning means failing a lot,” he says with a wry smile.

Whatever tribulations they required seem worth it now that Atrium’s new products are ready. Atrium Records improves on the clumsy status quo where clients have to dig through emails from their lawyers hoping to find the most up-to-date versions of important corporate documents. If they can’t, they wait around after emailing their lawyer who has to hope they remember where they buried that term sheet or cap table in their firm’s file tree. This messy process can rack up billable hours, lead to data mismatches and let important signatures or approvals fall through the cracks.

Atrium Hiring

Kan says he’s seen some grisly situations. “You never signed your equity documents so you actually have no equity in this company. And now that there’s financing, there could be a taxable event. There’s often surprisingly serious problems that happen.” Atrium’s senior product manager Sahil Bhagat walks me through how Atrium can help clients avoid an issue like, “Maybe you hired 10 employees but didn’t update your cap table and then you’re hiring the 11th employee but you don’t have any equity to grant so you have to go through the hassle of increasing your options pool.”

Atrium Records acts like your searchable legal Dropbox. The startup works with your last law firm to ingest your documents around equity, taxes, employees and IP, and make sure they’re all up to date. Machine learning extracts critical data about financings and cap tables so that’s instantly available in the Atrium dashboard and you don’t have to dig into the original docs. Plus, you don’t have to pay for lawyers or paralegals to do that manually. And your lawyer can build a task list of documents for you to edit or sign so you always know what to do next, which is a relief when you’re wrangling approvals from all your existing investors.

Atrium Hiring operationalizes one of the biggest founder time-sucks. Instead of writing hiring contracts from scratch each time, you fill out a form and use menu selections to set the salary, share count, vesting schedule and offer expiration. Looking across its anonymized data set of contracts, Atrium can recommend the best clauses and most common set ups, like four-year vesting with one-year cliffs. You can see the status of the contracts every step of the way, from drafting and finalizing to getting employees to accept.

Kan tells me Atrium’s goal is to continue building on its archive of more than 100,000 legal documents to develop aggregated pools of data clients could opt into. If they’re willing to share their salary data, vendor contract pricing and more, they’ll get access to that of Atrium’s other clients. “You’ll be able to see if you’re on the high end of being paid by Salesforce for a contract,” Kan explains. That’s a much more data-driven approach than when most lawyers just think of the last few salaries they saw for that position and give you a rough average.

“Being able to tell what the market norms are is a powerful negotiating tool.” The startup has even been offering its tips for free as part of fundraising workshops it uses to attract clients. The challenge for the company will be ensuring efficiency doesn’t mean cutting corners.

Atrium has grown to 150 staffers split between legal practitioners and its product team in its two years since launch. Kan is trying to build a culture where everyone cooperates, unlike infamously cutthroat law firms where partners can compete for cases. He hopes that talent will stick with Atrium because it’s deleting the most tedious parts of their jobs. “No one wanted go to law school to review 1,000 hiring docs.”

Powered by WPeMatico

Four-day work week. Open-plan offices. Work-life balance. Remote work. There are endless ways to set up your team and company for success. And there’s evidence for and against all of these scenarios.

Take remote work for instance. Owl Labs reports that 44% of global companies don’t allow it. While Gallup reports that 43% of all Americans work remotely at least some of the time.

So what’s the right answer? Well that depends on what your goals are. But no matter what, the important thing is to make a decision and stick with it.

Because no matter what decision you’re making – personal, professional, big or small – it’s important to commit 100%. And when that decision is likely to impact your company’s culture for years to come, you better hope to get it right.

So when Buffer’s co-founder and CEO, Joel Gascoigne, decided to close down one of their offices, I gave him one key piece of advice. Commit to either placing the entire team in the remaining office or establish a 100% remote workforce. Both scenarios can work, but a mix of the two will only set you up to fail.

When everyone is remote, that becomes one of the defining characteristics of a company’s culture. People have no option but to get their work done and collaborate virtually. And an entirely remote culture can both draw in candidates attracted to this way of working and remove those who know they won’t be able to thrive working remotely.

Powered by WPeMatico

Everyone’s worried about Mark Zuckerberg controlling the next currency, but I’m more concerned about a crypto Cambridge Analytica.

Today Facebook announced Libra, its forthcoming stablecoin designed to let you shop and send money overseas with almost zero transaction fees. Immediately, critics started harping about the dangers of centralizing control of tomorrow’s money in the hands of a company with a poor track record of privacy and security.

Facebook anticipated this, though, and created a subsidiary called Calibra to run its crypto dealings and keep all transaction data separate from your social data. Facebook shares control of Libra with 27 other Libra Association founding members, and as many as 100 total when the token launches in the first half of 2020. Each member gets just one vote on the Libra council, so Facebook can’t hijack the token’s governance even though it invented it.

With privacy fears and centralized control issues at least somewhat addressed, there’s always the issue of security. Facebook naturally has a huge target on its back for hackers. Not just because Libra could hold so much value to steal, but because plenty of trolls would get off on screwing up Facebook’s currency. That’s why Facebook open-sourced the Libra Blockchain and is offering a prototype in a pre-launch testnet. This developer beta plus a bug bounty program run in partnership with HackerOne is meant to surface all the flaws and vulnerabilities before Libra goes live with real money connected.

Yet that leaves one giant vector for abuse of Libra: the developer platform.

“Essential to the spirit of Libra . . . the Libra Blockchain will be open to everyone: any consumer, developer, or business can use the Libra network, build products on top of it, and add value through their services. Open access ensures low barriers to entry and innovation and encourages healthy competition that benefits consumers,” Facebook explained in its white paper and Libra launch documents. It’s even building a whole coding language called Move for making Libra apps.

Apparently Facebook has already forgotten how allowing anyone to build on the Facebook app platform and its low barriers to “innovation” are exactly what opened the door for Cambridge Analytica to hijack 87 million people’s personal data and use it for political ad targeting.

But in this case, it won’t be users’ interests and birthdays that get grabbed. It could be hundreds or thousands of dollars’ worth of Libra currency that’s stolen. A shady developer could build a wallet that just cleans out a user’s account or funnels their coins to the wrong recipient, mines their purchase history for marketing data or uses them to launder money. Digital risks become a lot less abstract when real-world assets are at stake.

In the wake of the Cambridge Analytica scandal, Facebook raced to lock down its app platform, restrict APIs, more heavily vet new developers and audit ones that look shady. So you’d imagine the Libra Association would be planning to thoroughly scrutinize any developer trying to build a Libra wallet, exchange or other related app, right? “There are no plans for the Libra Association to take a role in actively vetting [developers],” Calibra’s head of product Kevin Weil surprisingly told me. “The minute that you start limiting it is the minute you start walking back to the system you have today with a closed ecosystem and a smaller number of competitors, and you start to see fees rise.”

That translates to “the minute we start responsibly verifying Libra app developers, things start to get expensive, complicated or agitating to cryptocurrency purists. That might hurt growth and adoption.” You know what will hurt growth of Libra a lot worse? A sob story about some migrant family or a small business getting all their Libra stolen. And that blame is going to land squarely on Facebook, not some amorphous Libra Association.

Image via Getty Images / alashi

Inevitably, some unsavvy users won’t understand the difference between Facebook’s own wallet app Calibra and any other app built for the currency. “Libra is Facebook’s cryptocurrency. They wouldn’t let me get robbed,” some will surely say. And on Calibra they’d be right. It’s a custodial wallet that will refund you if your Libra are stolen and it offers 24/7 customer support via chat to help you regain access to your account.

Yet the Libra Blockchain itself is irreversible. Outside of custodial wallets like Calibra, there’s no getting your stolen or mis-sent money back. There’s likely no customer support. And there are plenty of crooked crypto developers happy to prey on the inexperienced. Indeed, $1.7 billion in cryptocurrency was stolen last year alone, according to CypherTrace via CNBC. “As with anything, there’s fraud and there are scams in the existing financial ecosystem today . . . that’s going to be true of Libra too. There’s nothing special or magical that prevents that,” says Weil, who concluded “I think those pros massively outweigh the cons.”

Until now, the blockchain world was mostly inhabited by technologists, except for when skyrocketing values convinced average citizens to invest in Bitcoin just before prices crashed. Now Facebook wants to bring its family of apps’ 2.7 billion users into the world of cryptocurrency. That’s deeply worrisome.

Facebook founder and CEO Mark Zuckerberg arrives to testify during a Senate Commerce, Science and Transportation Committee and Senate Judiciary Committee joint hearing about Facebook on Capitol Hill in Washington, DC, April 10, 2018. (Photo: SAUL LOEB/AFP/Getty Images)

Regulators are already bristling, but perhaps for the wrong reasons. Democrat Senator Sherrod Brown tweeted that “We cannot allow Facebook to run a risky new cryptocurrency out of a Swiss bank account without oversight.” And French Finance Minister Bruno Le Maire told Europe 1 radio that Libra can’t be allowed to “become a sovereign currency.”

Most harshly, Rep. Maxine Waters issued a statement saying, “Given the company’s troubled past, I am requesting that Facebook agree to a moratorium on any movement forward on developing a cryptocurrency until Congress and regulators have the opportunity to examine these issues and take action.”

Yet Facebook has just one vote in controlling the currency, and the Libra Association preempted these criticisms, writing, “We welcome public inquiry and accountability. We are committed to a dialogue with regulators and policymakers. We share policymakers’ interest in the ongoing stability of national currencies.”

That’s why as lawmakers confer about how to regulate Libra, I hope they remember what triggered the last round of Facebook execs having to appear before Congress and Parliament. A totally open, unvetted Libra developer platform in the name of “innovation” over safety is a ticking time bomb. Governments should insist the Libra Association thoroughly audit developers and maintain the power to ban bad actors. In this strange new crypto world, the public can’t be expected to perfectly protect itself from Cambridge Analytica 2.$.

Get up to speed on Facebook’s Libra with this handy guide:

Powered by WPeMatico

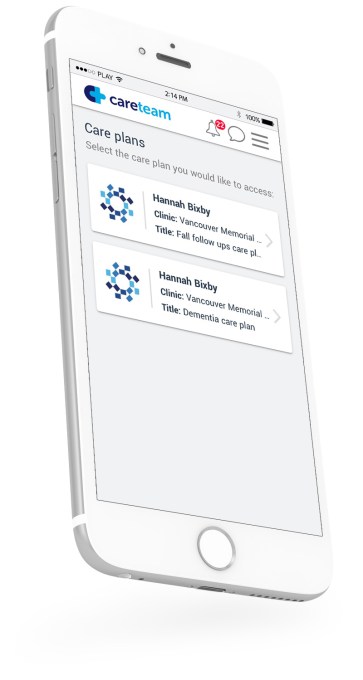

How best to untangle the Gordian knot that is navigating your own healthcare? It’s a tricky question, and one that seems to have become only more complicated as technology improves, in many regards — systems don’t necessarily speak to one another, and it’s still hard for an ordinary patient without specialist knowledge to make sense of everything. Careteam is a Canadian startup hoping to address that, looking to replicate the kind of advances made possible by technology in industries like e-commerce and enterprise software.

Careteam co-founder and CEO Dr. Alexandra Greenhill has experienced the frustration of being a tech-savvy person in a world of healthcare that can seem technologically inept — both as a practicing GP and as someone who depends on the healthcare system as a patient and a relative of patients with more sophisticated medical needs.

“I spent more than 15 years innovating within the healthcare system,” Greenhill told me in an interview. “I computerized hospitals, helped doctors adopt electronic medical records and other types of innovation practices. And then for the last eight years, I’ve been in tech, trying to figure out how to build the kind of technology we need in health, and especially digital health.”

All that experience led Greenhill to the realization that while there were many companies building specific solutions for real, but relatively narrow problems, that didn’t reflect how most people experienced care. Greenhill and her team of three other co-founders (Jeremy P. Smith, Robert I. Atwell and Kevin Lysyk) had all had unfortunate, but eye-opening experiences with family members in need of treatment for major diseases.

“You step in and you discover that cancer care, palliative care, post-surgical care — there’s so many things that would have gone wrong if we didn’t have the expertise ourselves,” Greenhill said. “But in the meantime, you end up being sort of pulled into multiple directions and saying ‘this makes no sense.’ You know, I can purchase stuff online in my private life; I can use all kinds of tools in the business world, and yet it’s back to paper and voice in health, which matters most.”

Careteam CEO and founder Dr. Alexandra Greenhill

What Careteam provides is collaboration for care — true collaboration, designed to span patients, their doctors and other healthcare pros, their families and anyone who matters to them in the course of pursuing their care. It provides the ability to communicate instantly, build care plans that integrate all aspects of their tailored health plans, receive custom-configurable notifications and measure progress toward specific goals set by patient and healthcare providers.

Part of the reason this process has become opaque or difficult is precisely due to innovation: Greenhill takes issue with the prevailing narrative that the healthcare industry is somehow allergic to innovation.

“There’s this sort of perception that healthcare doesn’t innovate, but it’s also almost insulting to the healthcare system, because we have innovated — we save people from cancer, where we couldn’t,” she noted. “We cure HIV, in some cases, and we prevent it from being transmitted to unborn babies of mothers with full-blown AIDS and things that in my working lifetime were impossibilities; it was science fiction to help someone with HIV. And, and we’ve managed to do all of that, and it’s a success story. We’ve created complexity, we’ve created people who live with 12 conditions for many, many years and take complicated drug regiments.”

In addition to advances in treatment, Greenhill notes that she and her team couldn’t have build Careteam five years ago, because cloud storage wasn’t secure and everything had to be done on a site-specific instance, and that would’ve been cost-prohibitive to build. In other words, technology has been applied to, and vastly improved, healthcare overall, regardless of the general perception of the industry as an innovation laggard.

In addition to advances in treatment, Greenhill notes that she and her team couldn’t have build Careteam five years ago, because cloud storage wasn’t secure and everything had to be done on a site-specific instance, and that would’ve been cost-prohibitive to build. In other words, technology has been applied to, and vastly improved, healthcare overall, regardless of the general perception of the industry as an innovation laggard.

That’s why Greenhill’s startup doesn’t shy away from complexity — they embrace it. Careteam is designed not to try to normalize and standardize the varied and highly specialized landscape of healthcare solutions and providers through anything like a one-size-fits-all API. Instead, the company’s tech development is cleverly designed to be flexible when it comes to integrations.

“We collectively spent $1.9 billion in Canada, to try and digitize the healthcare system, create standards and create some exchange between data,” Greenhill said. “The NHS tried the same, big U.S. hospital systems have created their own little sort of islands, including Kaiser and Mayo and others. And the conclusion of all of that is standardization in healthcare just doesn’t seem to catch on.”

Careteam’s approach has been instead to integrate specific clinics, and let practitioners and patients derive benefits and help spur the adoption of the platform to their companion organizations and clinics. It’s a sort of rhizomatic approach that starts with a node central to a patient’s care and spreads through the healthcare professionals and members of the patient’s support network that the product helps. And integration is made possible without technical demands on the part of partners thanks to the work of CTO Lysyk, according to Greenhill.

The Vancouver-based startup is working with the Centre for Aging + Brain Health in Toronto, Ontario in a validation program announced last year, and also raised an initial round of funding in January led by BCF Ventures with participation from Right Side Capital, Globalive Capital, Atrium Ventures, and angels Barney Pell and Ajay Agarwal .

Powered by WPeMatico

After years of heel dragging, Nintendo finally opened itself up to the smartphone world in late-2016. The gaming giant hasn’t exactly opened the floodgates in the intervening years, but Fire Emblem Heroes, Animal Crossing: Pocket Camp and Dragalia Lost have filled the void in some form or other.

There’s something to be said for the company’s thoughtful approach to the category. Nintendo clearly values its IP and is only interested in releasing games that make sense on the platform. Dr. Mario is pretty high on that list. After all, similar puzzle-style games have come to dominate the mobile platform, and Nintendo had a perfectly good title gathering dust.

Dr. Mario World was unveiled back in February — or the title was, at least — with a broad summer release for iOS and Android. Last night, Nintendo offered a deeper glimpse in the form of a YouTube video. The basics of the game are similar to the original NES title, with falling capsules that disappear when colors are matched up. Kind of like Tetris, but with more drugs.

The graphics have been improved, of course, along with a social element that lets user connect around the world in networks like Facebook. Mario is joined by “friends,” as well, including familiar characters like Princess Peach, Luigi and Bowser, all of whom apparently studied medicine in whatever sort of universities they have in the mushroom kingdom.

The game will be available on July 10, beating the previously announced Mario Kart Tour, which is also said to be due out this summer.

Powered by WPeMatico

Youper, a mental health app with a chatbot it calls an “emotional health assistant,” has raised $3 million in seed funding from Goodwater Capital. The funds will be used to accelerate development of Youper’s artificial intelligence-based capabilities and grow its user base.

Based in San Francisco, Youper was co-founded in 2016 by Dr. Jose Hamilton. For a decade, Hamilton worked as a psychiatrist in clinical settings, seeing more than 3,000 patients. While talking to them, he realized that a handful of barriers kept many people from seeking help earlier, even if they had dealt with anxiety or depression for years.

“The first one is fear, taking care of yourself, talking about your mental health, understanding your mental health,” he tells TechCrunch. “Seeing a therapist or psychiatrist is super intimidating. That’s why all of my patients used to say the same things. The second barrier is cost, of course. Psychiatrists and therapists are super expensive.”

Hamilton teamed up with co-founders Diego Couto, the startup’s chief product and growth officer, and Thiago Marafon, its CTO, to create an app that would make mental healthcare less intimidating and more accessible. They originally created an app that did not have a conversational interface. Instead, Hamilton says it took a similar approach to Calm and Headspace. But that resulted in a very low user engagement rate and, after a year, the team realized Youper needed to provide a more personalized experience, matching users to the right psychological techniques, including cognitive behavioral techniques and mindfulness, for their needs.

Youper is part of a growing roster of apps that use AI-based chatbots to help users improve their emotional health, including Woebot, Wysa and X2’s Tess. Hamilton says Youper wants to differentiate with its focus on personalization, combining mental health research and user data to match the right psychological techniques with users.

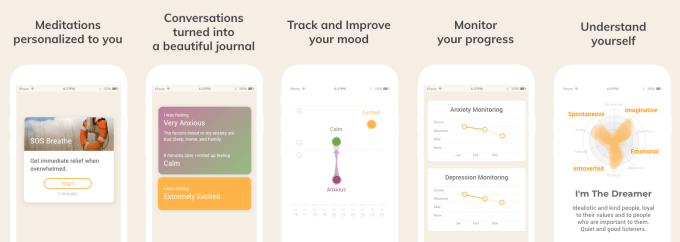

Screenshots from Youper, an app for emotional well-being.

The startup claims Youper has been downloaded more than one million times so far. Most of its users are young adults, and there are more women than men who use Youper.

“I think that’s because women are facing new challenges in our society by conquering new spaces and assuming new roles, and that poses an emotional toll. Another reason is that women are more tuned into self-care than men,” he says. “Sometimes I feel that we men wait for too long suffering in silence.”

For users who have never consulted with a provider, Youper provides a gentle introduction to the types of questions and exercises they might experience in therapy. The questions and exercises given by Youper’s chatbot are meant to help users achieve a better understanding of their emotions, thoughts and behavior.

Youper’s chatbot asks users to focus on their thoughts and identify how they are feeling from a menu of descriptive words. Then a scale lets them rate the strength of that emotion from “slightly” to “extremely.” More questions help them narrow down what is causing those feelings and track their mood. Users are also given options for mindfulness exercises and journaling prompts.

Hamilton says that the average time users spend during each session with its chatbot is about seven minutes, with 80% reporting a reduction in negative moods after one conversation. The startup also claims that after 30 days, a quarter of people who signed up for Youper are still active users.

Youper is currently free, though the company may test a freemium model in the future with premium features. It uses anonymized user data in its own research to improve Youper, but keeps it private and does not share or sell user data or information.

Of course, an app is not a replacement for seeing a therapist or psychiatrist, but Youper presents a much lower barrier to entry for people who worried about the stigma of seeing a professional. Hamilton says he hopes using Youper will encourage more people to seek medical treatment sooner if they need it by making them more comfortable with the idea of discussing their emotional health.

“On average, it takes 10 years for someone to finally talk to a health provider. This could become 10 minutes with an app like Youper,” Hamilton says. “Having an app with a super low barrier to entry, no stigma, something that is about emotional health and taking care of yourself, shows that you don’t need to be afraid.”

Powered by WPeMatico

While Facebook makes a bold move into cryptocurrency to capitalise on its multi-billion user base, a social network that was once a credible competitor to it has quietly been snapped up by a subsidiary of Amazon. TechCrunch has learned and confirmed that Bebo, one of the earlier platforms to let people share thoughts and media with their friends, has been acquired by Twitch, the streaming video platform owned by Amazon. Together the two will be working on building out Twitch’s esports business, and specifically Twitch Rivals.

A spokesperson for Twitch confirmed the acquisition, which includes both people (around 10 employees) and IP, but declined to provide further comment.

From what we understand from our sources, Twitch paid up to $25 million for the company earlier this month, after beating out at least two other bidders, Discord (which itself has been building out its own esports business), and… wait for it… Facebook. (Our source says the latter offered $20 million.) Indeed, LinkedIn profiles for ex-Bebo employees — see here, here, and here — now at Twitch note June as the changeover date. (Note: original sources say $25 million, others close to the deal say it was materially less than this. As you know, these things can be described differently depending on who is doing the describing.)

It has been a long and winding road for Bebo over the years. Starting out way back in 2005 by Michael and Xochi Birch as an early social networking site, Bebo quickly became the market leader in a couple of English-speaking countries, specifically UK and Ireland.

Bebo’s growth trajectory and the bigger opportunity in social were enough to get it acquired for about $850 million by AOL back in 2008, apparently beating out a number of other interested large tech and media companies interested in getting their own social media platform and the audience that would come with it (disclaimer: AOL eventually also acquired TechCrunch, too).

But the deal was a certifiable dud, with Bebo never managing to build on its early traction, and AOL not being in a position to know how to fix that. Less than two years later, it was sold on to Criterion Capital for $25 million.

Yet as the social wheels continued to turn, and even once-global market leader MySpace also fell back as Facebook, Twitter, Instagram and other mobile-friendly platforms pulled out ahead, even that $25 million price turned out to be too high. After Bebo filed for Chapter 11 bankruptcy protection, the original founders, the Birches, bought it back in 2013 for $1 million with a pledge to reinvent it.

And so they did, putting in place a small team led by Shaan Puri, who worked on a number of ideas to see which of them could fly. (And I don’t know if this was a tongue in cheek joke about how challenging they knew the task would be, but it seems that the holding company set up to house some of the IP and legal aspects of the endeavor was called “Pigs in Flight.”)

The new app studio effort, which went by the name Monkey Inferno (another great one), came out of the gates with “Blab”, a “walkie-talkie” ephemeral video messaging service, which picked up millions of users quickly but found it hard to retain them. It shut down a year later, and it looks like Monkey Inferno dabbled in a few other things before coming to esports.

In that last pivot, Bebo first tried out streaming services for esports players, but that proved to be tough competition against dominant platforms like OBS and Xsplit. Then, in an interesting nod to its earlier history in social networking and organising groups of friends, it shifted once more, into organising and running tournaments for streamers, with leagues and more: the streams ran on Twitch and Bebo organised viewers, leagues and other things around that.

That site, Bebo.com, is now offline, and all its tweets seem to have been deleted, but the idea was to build out leagues and tournaments for any and all kinds of groups and players, for example complete beginners, or high school students.

It was the last of these that turned out to line up with a growing market segment.

According to a report in eMarketer, esports attracted some 400 million users in 2018 and pulled in revenues of $869 million from sponsorships, player fees and advertising, and it is projected to be worth between $1.58 billion and $2.96 billion by 2022. And Bebo was helping organise and build those communities.

And that is now linking up neatly with Twitch, which had been developing its own casual esports operation in the form of Twitch Rivals. This launched in beta in 2018 and is now widely available wherever Twitch is.

The Bebo tech and its team are now both being put to use on Twitch Rivals, to help continue expanding it with more features and more users. To be clear, though, it seems there is no intention — from what I understand — to parlay Bebo’s past efforts in social networking into a wider social networking play at Twitch: the focus is on esports.

Still, the acquisition comes at a key moment. Since January, there have been reports that Amazon is working on a new game streaming service (just like Apple, Google and others), which likely won’t be out until next year. While there is no news on that today, you can see how expanding the variety and breadth of content on Twitch by way of esports leagues and tournaments fits in with a wider effort to bring more regular, engaged users into the Amazon fold, using this as one of the big draws.

(Updated with more detail on the price.)

Powered by WPeMatico

Truecaller, an app best known for helping users screen calls from strangers and spammers, is adding yet another feature to its service as it bolsters its super app status. The Stockholm-based firm said today that its app can now be used to place free VoIP-powered voice calls.

The company told TechCrunch on Tuesday that it has started to roll out the free voice calling feature to its Android users. It expects the rollout to reach all Android users in the coming days. The feature, which currently only supports calls between two users, will arrive on its iOS app soon.

In emerging markets such as India, where 100 million of Truecaller’s 140 million users live, free voice calls has been a long-sought after feature. Until late 2016, voice calls were fairly expensive in India, with telecom operators counting revenue from traditional calls as their biggest profit generator.

But in last two and a half years, things have changed dramatically for hundreds of millions of people in India after Reliance Jio, a telecom operator owned by India’s richest man Mukesh Ambani, launched its network with free voice calls and low-priced data services. Reliance Jio has already amassed over 300 million users to become one of the top three telcos in the nation.

Yet, the quality of network still leaves much to be desired in India as traditional calls drop abruptly and run into quality issues more often than one would like. Truecaller said that its voice calls rely on data services — mobile data and Wi-Fi — and claimed that they can work swiftly even on patchy network.

The addition of voice calling functionality comes as Truecaller aggressively looks to expand its business. The service, which offers both ad-support free tier and subscription bundle, has added messaging, mobile payments, and call recording features in recent years. Earlier this year, it also added a crediting option, allowing users in India to borrow a few hundred dollars.

A representative with the company said Truecaller began exploring the free voice calling feature a few months ago. It began testing the new functionality with alpha and beta test group users four weeks ago. It now plans to introduce group voice calling support soon, the company said.

With the new feature, Truecaller now competes even more closely with WhatsApp . The Facebook-owned app has become ubiquitous in India with more than three-quarters of India’s smartphone base using the app. WhatsApp added voice calling feature to its app in 2015. Last year, Facebook said users around the world were spending 2 billion minutes per day on WhatsApp video and audio calls.

Powered by WPeMatico

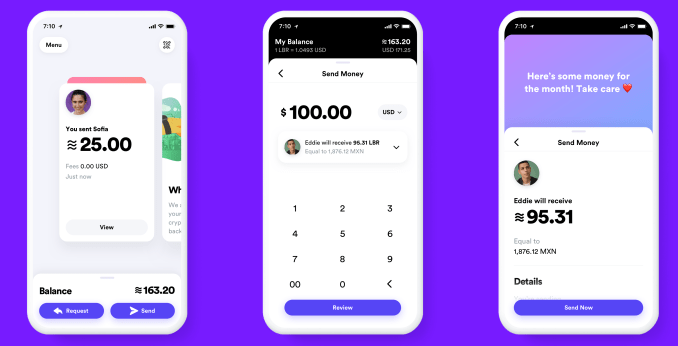

Facebook has finally revealed the details of its cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees. You’ll pseudonymously buy or cash out your Libra online or at local exchange points like grocery stores, and spend it using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. Today Facebook released its white paper explaining Libra and its testnet for working out the kinks of its blockchain system before a public launch in the first half of 2020.

Facebook won’t fully control Libra, but instead get just a single vote in its governance like other founding members of the Libra Association, including Visa, Uber and Andreessen Horowitz, which have invested at least $10 million each into the project’s operations. The association will promote the open-sourced Libra Blockchain and developer platform with its own Move programming language, plus sign up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook is launching a subsidiary company also called Calibra that handles its crypto dealings and protects users’ privacy by never mingling your Libra payments with your Facebook data so it can’t be used for ad targeting. Your real identity won’t be tied to your publicly visible transactions. But Facebook/Calibra and other founding members of the Libra Association will earn interest on the money users cash in that is held in reserve to keep the value of Libra stable.

Facebook’s audacious bid to create a global digital currency that promotes financial inclusion for the unbanked actually has more privacy and decentralization built in than many expected. Instead of trying to dominate Libra’s future or squeeze tons of cash out of it immediately, Facebook is instead playing the long-game by pulling payments into its online domain. Facebook’s VP of blockchain, David Marcus, explained the company’s motive and the tie-in with its core revenue source during a briefing at San Francisco’s historic Mint building. “If more commerce happens, then more small businesses will sell more on and off platform, and they’ll want to buy more ads on the platform so it will be good for our ads business.”

In cryptocurrencies, Facebook saw both a threat and an opportunity. They held the promise of disrupting how things are bought and sold by eliminating transaction fees common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a competitor like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what people buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might choose whoever offers them a financial services alternative as their online identity provider too. That’s another thing Facebook wants to be.

Yet existing cryptocurrencies like Bitcoin and Ethereum weren’t properly engineered to scale to be a medium of exchange. Their unanchored price was susceptible to huge and unpredictable swings, making it tough for merchants to accept as payment. And cryptocurrencies miss out on much of their potential beyond speculation unless there are enough places that will take them instead of dollars, and the experience of buying and spending them is easy enough for a mainstream audience. But with Facebook’s relationship with 7 million advertisers and 90 million small businesses plus its user experience prowess, it was well-poised to tackle this juggernaut of a problem.

Now Facebook wants to make Libra the evolution of PayPal . It’s hoping Libra will become simpler to set up, more ubiquitous as a payment method, more efficient with fewer fees, more accessible to the unbanked, more flexible thanks to developers and more long-lasting through decentralization.

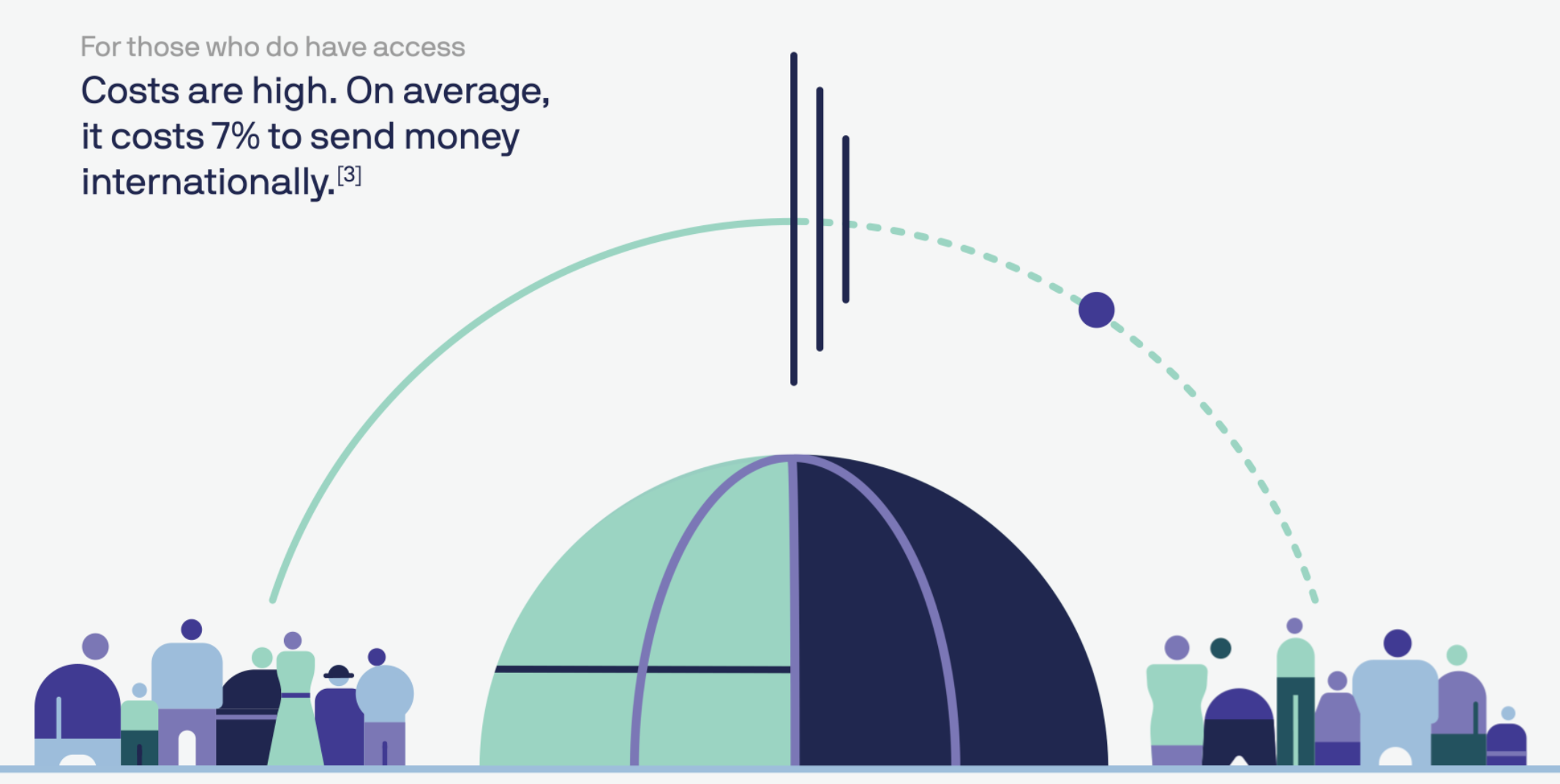

“Success will mean that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee,” Facebook writes in its Libra documentation. That would be a big improvement on today, when you’re stuck paying rent in insecure checks while exploitative remittance services charge an average of 7% to send money abroad, taking $50 billion from users annually. Libra could also power tiny microtransactions worth just a few cents that are infeasible with credit card fees attached, or replace your pre-paid transit pass.

…Or it could be globally ignored by consumers who see it as too much hassle for too little reward, or too unfamiliar and limited in use to pull them into the modern financial landscape. Facebook has built a reputation for over-engineered, underused products. It will need all the help it can get if wants to replace what’s already in our pockets.

By now you know the basics of Libra. Cash in a local currency, get Libra, spend them like dollars without big transaction fees or your real name attached, cash them out whenever you want. Feel free to stop reading and share this article if that’s all you care about. But the underlying technology, the association that governs it, the wallets you’ll use and the way payments work all have a huge amount of fascinating detail to them. Facebook has released more than 100 pages of documentation on Libra and Calibra, and we’ve pulled out the most important facts. Let’s dive in.

Facebook knew people wouldn’t trust it to wholly steer the cryptocurrency they use, and it also wanted help to spur adoption. So the social network recruited the founding members of the Libra Association, a not-for-profit which oversees the development of the token, the reserve of real-world assets that gives it value and the governance rules of the blockchain. “If we were controlling it, very few people would want to jump on and make it theirs,” says Marcus.

Each founding member paid a minimum of $10 million to join and optionally become a validator node operator (more on that later), gain one vote in the Libra Association council and be entitled to a share (proportionate to their investment) of the dividends from interest earned on the Libra reserve into which users pay fiat currency to receive Libra.

The 28 soon-to-be founding members of the association and their industries, previously reported by The Block’s Frank Chaparro, include:

Facebook says it hopes to reach 100 founding members before the official Libra launch and it’s open to anyone that meets the requirements, including direct competitors like Google or Twitter. The Libra Association is based in Geneva, Switzerland and will meet biannually. The country was chosen for its neutral status and strong support for financial innovation including blockchain technology.

To join the association, members must have a half rack of server space, a 100Mbps or above dedicated internet connection, a full-time site reliability engineer and enterprise-grade security. Businesses must hit two of three thresholds of a $1 billion USD market value or $500 million in customer balances, reach 20 million people a year and/or be recognized as a top 100 industry leader by a group like Interbrand Global or the S&P.

Crypto-focused investors must have more than $1 billion in assets under management, while Blockchain businesses must have been in business for a year, have enterprise-grade security and privacy and custody or staking greater than $100 million in assets. And only up to one-third of founding members can by crypto-related businesses or individually invited exceptions. Facebook also accepts research organizations like universities, and nonprofits fulfilling three of four qualities, including working on financial inclusion for more than five years, multi-national reach to lots of users, a top 100 designation by Charity Navigator or something like it and/or $50 million in budget.

The Libra Association will be responsible for recruiting more founding members to act as validator nodes for the blockchain, fundraising to jump-start the ecosystem, designing incentive programs to reward early adopters and doling out social impact grants. A council with a representative from each member will help choose the association’s managing director, who will appoint an executive team and elect a board of five to 19 top representatives.

Each member, including Facebook/Calibra, will only get up to one vote or 1% of the total vote (whichever is larger) in the Libra Association council. This provides a level of decentralization that protects against Facebook or any other player hijacking Libra for its own gain. By avoiding sole ownership and dominion over Libra, Facebook could avoid extra scrutiny from regulators who are already investigating it for a sea of privacy abuses as well as potentially anti-competitive behavior. In an attempt to preempt criticism from lawmakers, the Libra Association writes, “We welcome public inquiry and accountability. We are committed to a dialogue with regulators and policymakers. We share policymakers’ interest in the ongoing stability of national currencies.”

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

A Libra is a unit of the Libra cryptocurrency that’s represented by a three wavy horizontal line unicode character ≋ like the dollar is represented by $. The value of a Libra is meant to stay largely stable, so it’s a good medium of exchange, as merchants can be confident they won’t be paid a Libra today that’s then worth less tomorrow. The Libra’s value is tied to a basket of bank deposits and short-term government securities for a slew of historically stable international currencies, including the dollar, pound, euro, Swiss franc and yen. The Libra Association maintains this basket of assets and can change the balance of its composition if necessary to offset major price fluctuations in any one foreign currency so that the value of a Libra stays consistent.

The name Libra comes from the word for a Roman unit of weight measure. It’s trying to invoke a sense of financial freedom by playing on the French stem “Lib,” meaning free.

The Libra Association is still hammering out the exact start value for the Libra, but it’s meant to be somewhere close to the value of a dollar, euro or pound so it’s easy to conceptualize. That way, a gallon of milk in the U.S. might cost 3 to 4 Libra, similar but not exactly the same as with dollars.

The idea is that you’ll cash in some money and keep a balance of Libra that you can spend at accepting merchants and online services. You’ll be able to trade in your local currency for Libra and vice versa through certain wallet apps, including Facebook’s Calibra, third-party wallet apps and local resellers like convenience or grocery stores where people already go to top-up their mobile data plan.

Each time someone cashes in a dollar or their respective local currency, that money goes into the Libra Reserve and an equivalent value of Libra is minted and doled out to that person. If someone cashes out from the Libra Association, the Libra they give back are destroyed/burned and they receive the equivalent value in their local currency back. That means there’s always 100% of the value of the Libra in circulation, collateralized with real-world assets in the Libra Reserve. It never runs fractional. And unliked “pegged” stable coins that are tied to a single currency like the USD, Libra maintains its own value — though that should cash out to roughly the same amount of a given currency over time.

When Libra Association members join and pay their $10 million minimum, they receive Libra Investment Tokens. Their share of the total tokens translates into the proportion of the dividend they earn off of interest on assets in the reserve. Those dividends are only paid out after Libra Association uses interest to pay for operating expenses, investments in the ecosystem, engineering research and grants to nonprofits and other organizations. This interest is part of what attracted the Libra Association’s members. If Libra becomes popular and many people carry a large balance of the currency, the reserve will grow huge and earn significant interest.

Every Libra payment is permanently written into the Libra Blockchain — a cryptographically authenticated database that acts as a public online ledger designed to handle 1,000 transactions per second. That would be much faster than Bitcoin’s 7 transactions per second or Ethereum’s 15. The blockchain is operated and constantly verified by founding members of the Libra Association, which each invested $10 million or more for a say in the cryptocurrency’s governance and the ability to operate a validator node.

When a transaction is submitted, each of the nodes runs a calculation based on the existing ledger of all transactions. Thanks to a Byzantine Fault Tolerance system, just two-thirds of the nodes must come to consensus that the transaction is legitimate for it to be executed and written to the blockchain. A structure of Merkle Trees in the code makes it simple to recognize changes made to the Libra Blockchain. With 5KB transactions, 1,000 verifications per second on commodity CPUs and up to 4 billion accounts, the Libra Blockchain should be able to operate at 1,000 transactions per second if nodes use at least 40Mbps connections and 16TB SSD hard drives.

Transactions on Libra cannot be reversed. If an attack compromises over one-third of the validator nodes causing a fork in the blockchain, the Libra Association says it will temporarily halt transactions, figure out the extent of the damage and recommend software updates to resolve the fork.

Transactions aren’t entirely free. They incur a tiny fraction of a cent fee to pay for “gas” that covers the cost of processing the transfer of funds similar to with Ethereum. This fee will be negligible to most consumers, but when they add up, the gas charges will deter bad actors from creating millions of transactions to power spam and denial-of-service attacks. “We’ve purposely tried not to innovate massively on the blockchain itself because we want it to be scalable and secure,” says Marcus of piggybacking on the best elements of existing cryptocurrencies.

Currently, the Libra Blockchain is what’s known as “permissioned,” where only entities that fulfill certain requirements are admitted to a special in-group that defines consensus and controls governance of the blockchain. The problem is this structure is more vulnerable to attacks and censorship because it’s not truly decentralized. But during Facebook’s research, it couldn’t find a reliable permissionless structure that could securely scale to the number of transactions Libra will need to handle. Adding more nodes slows things down, and no one has proven a way to avoid that without compromising security.

That’s why the Libra Association’s goal is to move to a permissionless system based on proof-of-stake that will protect against attacks by distributing control, encourage competition and lower the barrier to entry. It wants to have at least 20% of votes in the Libra Association council coming from node operators based on their total Libra holdings instead of their status as a founding member. That plan should help appease blockchain purists who won’t be satisfied until Libra is completely decentralized.

The Libra Blockchain is open source with an Apache 2.0 license, and any developer can build apps that work with it using the Move coding language. The blockchain’s prototype launches its testnet today, so it’s effectively in developer beta mode until it officially launches in the first half of 2020. The Libra Association is working with HackerOne to launch a bug bounty system later this year that will pay security researchers for safely identifying flaws and glitches. In the meantime, the Libra Association is implementing the Libra Core using the Rust programming language because it’s designed to prevent security vulnerabilities, and the Move language isn’t fully ready yet.

Move was created to make it easier to write blockchain code that follows an author’s intent without introducing bugs. It’s called Move because its primary function is to move Libra coins from one account to another, and never let those assets be accidentally duplicated. The core transaction code looks like: LibraAccount.pay_from_sender(recipient_address, amount) procedure.

Eventually, Move developers will be able to create smart contracts for programmatic interactions with the Libra Blockchain. Until Move is ready, developers can create modules and transaction scripts for Libra using Move IR, which is high-level enough to be human-readable but low-level enough to be translatable into real Move bytecode that’s written to the blockchain.

The Libra ecosystem and the Move language will be completely open to use and build, which presents a sizable risk. Crooked developers could prey on crypto novices, claiming their app works just the same as legitimate ones, and that it’s safe because it uses Libra. But if consumers get ripped off by these scammers, the anger will surely bubble up to Facebook. Yet still, Calibra’s head of product tells me, “There are no plans for the Libra Association to take a role in actively vetting [developers],” Calibra’s head of product Kevin Weil tells me.

Even though it’s tried to distance itself sufficiently via its subsidiary Libra and the association, many people will probably always think of Libra as Facebook’s cryptocurrency and blame it for their woes.

Read our full story on the dangers of Libra’s unvetted developer platform

The Libra Association wants to encourage more developers and merchants to work with its cryptocurrency. That’s why it plans to issue incentives, possibly Libra coins, to validator node operators who can get people signed up for and using Libra. Wallets that pull users through the Know Your Customer anti-fraud and money laundering process or that keep users sufficiently active for over a year will be rewarded. For each transaction they process, merchants will also receive a percentage of the transaction back.

Businesses that earn these incentives can keep them, or pass some or all of them along to users in the form of free Libra tokens or discounts on their purchases. This could create competition between wallets to see which can pass on the most rewards to their customers, and thereby attract the most users. You could imagine eBay or Spotify giving you a discount for paying in Libra, while wallet developers might offer you free tokens if you complete 100 transactions within a year.

“One challenge for Spotify and its users around the world has been the lack of easily accessible payment systems – especially for those in financially underserved markets,” Spotify’s Chief Premium Business Officer Alex Norström writes. “In joining the Libra Association, there is an opportunity to better reach Spotify’s total addressable market, eliminate friction and enable payments in mass scale.”

This savvy incentive system should massively help ratchet up Libra’s user count without dictating how businesses balance their margins versus growth. Facebook also has another plan to grow its developer ecosystem. By offering venture capital firms like Andreessen Horowitz and Union Square Ventures a portion of the reserve interest, they’re motivating to fund startups building Libra infrastructure.

So how do you actually own and spend Libra? Through Libra wallets like Facebook’s own Calibra and others that will be built by third-parties, potentially including Libra Association members like PayPal. The idea is to make sending money to a friend or paying for something as easy as sending a Facebook Message. You won’t be able to make or receive any real payments until the official launch next year, though, but you can sign up for early access when it’s ready here.

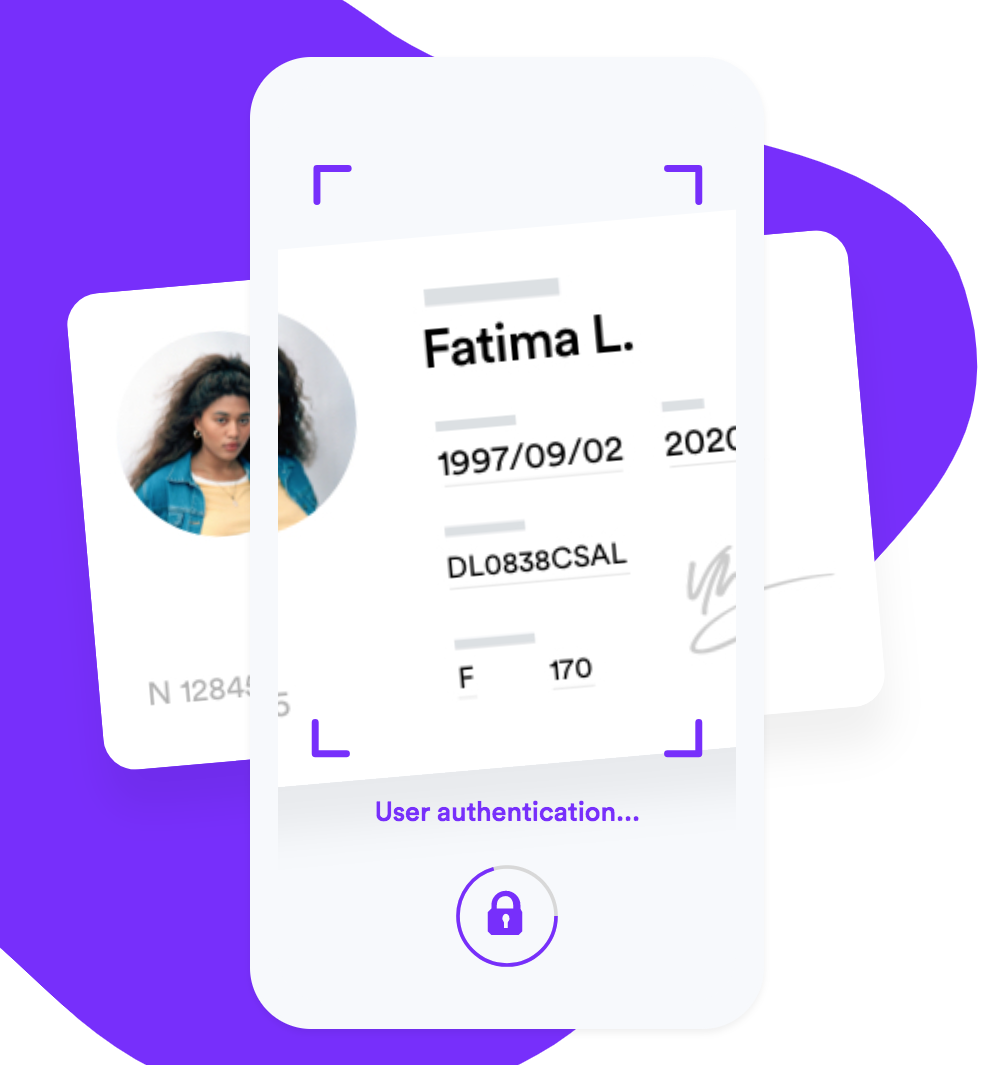

None of the Libra Association members agreed to provide details on what exactly they’ll build on the blockchain, but we can take Facebook’s Calibra wallet as an example of the basic experience. Calibra will launch alongside the Libra currency on iOS and Android within Facebook Messenger, WhatsApp and a standalone app. When users first sign up, they’ll be taken through a Know Your Customer anti-fraud process where they’ll have to provide a government-issued photo ID and other verification info. They’ll need to conduct due diligence on customers and report suspicious activity to the authorities.

From there you’ll be able to cash in to Libra, pick a friend or merchant, set an amount to send them and add a description and send them Libra. You’ll also be able to request Libra, and Calibra will offer an expedited way of paying merchants by scanning your or their QR code. Eventually it wants to offer in-store payments and integrations with point-of-sale systems like Square.

The Libra Association’s e-commerce members seem particularly excited about how the token could eliminate transaction fees and speed up checkout. “We believe blockchain will benefit the luxury industry by improving IP protection, transparency in the product life cycle and — as in the case of Libra — enable global frictionless e-commerce,” says FarFetch CEO Jose Neves.

Facebook CEO Mark Zuckerberg explained some of the philosophy behind Libra and Calibra in a post today. “It’s decentralized — meaning it’s run by many different organizations instead of just one, making the system fairer overall. It’s available to anyone with an internet connection and has low fees and costs. And it’s secured by cryptography which helps keep your money safe. This is an important part of our vision for a privacy-focused social platform — where you can interact in all the ways you’d want privately, from messaging to secure payments.”

By default, Facebook won’t import your contacts or any of your profile information, but may ask if you wish to do so. It also won’t share any of your transaction data back to Facebook, so it won’t be used to target you with ads, rank your News Feed, or otherwise earn Facebook money directly. Data will only be shared in specific instances in anonymized ways for research or adoption measurement, for hunting down fraudsters or due to a request from law enforcement. And you don’t even need a Facebook or WhatsApp account to sign up for Calibra or to use Libra.

“We realize people don’t want their social data and financial data commingled,” says Marcus, who’s now head of Calibra. “The reality is we’ll have plenty of wallets that will compete with us and many of them will not be in social, and if we want to successfully win people’s trust, we have to make sure the data will be separated.”

In case you are hacked, scammed or lose access to your account, Calibra will refund you for lost coins when possible through 24/7 chat support because it’s a custodial wallet. You also won’t have to remember any long, complex crypto passwords you could forget and get locked out from your money, as Calibra manages all your keys for you. Given Calibra will likely become the default wallet for many Libra users, this extra protection and smoother user experience is essential.

For now, Calibra won’t make money. But Calibra’s head of product Kevin Weil tells me that if it reaches scale, Facebook could launch other financial tools through Calibra that it could monetize, such as investing or lending. “In time, we hope to offer additional services for people and businesses, such as paying bills with the push of a button, buying a cup of coffee with the scan of a code or riding your local public transit without needing to carry cash or a metro pass,” the Calibra team writes. That makes it start to sound a lot like China’s everything app WeChat.

Facebook got one thing right for sure: Today’s money doesn’t work for everyone. Those of us living comfortably in developed nations likely don’t see the hardships that befall migrant workers or the unbanked abroad. Preyed on by greedy payday lenders and high-fee remittance services, targeted by muggers and left out of traditional financial services, the poor get poorer. Libra has the potential to get more money from working parents back to their families and help people retain credit even if they’re robbed of their physical possessions. That would do more to accomplish Facebook’s mission of making the world feel smaller than all the News Feed Likes combined.

If Facebook succeeds and legions of people cash in money for Libra, it and the other founding members of the Libra Association could earn big dividends on the interest. And if suddenly it becomes super quick to buy things through Facebook using Libra, businesses will boost their ad spend there. But if Libra gets hacked or proves unreliable, it could cost lots of people around the world money while souring them on cryptocurrencies. And by offering an open Libra platform, shady developers could build apps that snatch not just people’s personal info like Cambridge Analytica, but their hard-earned digital cash.

Facebook just tried to reinvent money. Next year, we’ll see if the Libra Association can pull it off. It took me 4,000 words to explain Libra, but at least now you can make up your own mind about whether to be scared of Facebook crypto.

Powered by WPeMatico

MobiKwik, a mobile wallet app in India that has expanded to add several financial services in recent years, said today it plans to enter international markets as it approaches profitability with the local operation. The company is kick-starting its overseas ambitions with cross-border mobile top-ups support.

The 10-year-old firm said it has partnered with DT One, a Singapore-headquartered payments network, to enable international mobile recharge (topping up credit to a mobile account), rewards and airtime credit services in more than 150 nations across some 550 mobile operators. The feature is now live on the app.

The feature is aimed at Indians living overseas and immigrants in India, Upasana Taku, co-founder of MobiKwik told TechCrunch in an interview. Millions of Indians go overseas to pursue education or look for a job. Currently, there is no convenient way for them to either help — or receive help from — their families and friends in India when they need to top up their phones.

Similarly, millions of people come to India in search of a job. The new functionality from MobiKwik will allow their families and friends to top up their mobile credit as well. Taku said there is no processing fee for customers, as MobiKwik is absorbing all the overhead expenses.

For MobiKwik, mobile recharge is just the entry point to assess interest from users, Taku added. “This is the first service we are launching. We will eventually add other essential services as well. Mobile recharge will offer us good data points and will help us understand different markets,” she added.

MobiKwik is also studying different regulatory frameworks in overseas markets and holding conversations with stakeholders, she added.

The announcement comes at a time when MobiKwik is inching closer to profitability, a feat unheard of for a mobile wallet app provider in India. The firm, which claims to have grown its revenue by 100% in the last two years, expects to be profitable by this year and go public by 2022. (Interestingly, MobiKwik was looking to raise a big round at $1 billion valuation two years ago — which never happened.)

In the last year, the firm has expanded to offer financial services such as loans, insurance and investment advice. MobiKwik competes with a handful of payment services in India, including Paytm, PhonePe and Google Pay that either support, or fully work on top of a government-backed payment infrastructure called UPI. In April, UPI apps were used to carry out 782 million transactions, according to official figures.

The big numbers have attracted major investors, too. With $285.6 million in funding, India emerged as Asia’s top fintech market in the quarter that ended in March this year.

Powered by WPeMatico