Apps

Auto Added by WPeMatico

Auto Added by WPeMatico

Facebook is updating the News Feed ranking algorithm to incorporate data from surveys about who you say are your closest friends and which links you find most worthwhile. Today Facebook announced it’s trained new classifiers based on patterns linking these surveys with usage data so it can better predict what to show in the News Feed. The change could hurt Pages that share clickbait and preference those sharing content that makes people feel satisfied afterwards.

For close friends, Facebook surveyed users about which people they were closest too. It then detected how this matches up with who you are tagged in photos with, constantly interact with, like the same post and check in to the same places as, and more. That way if it recognizes those signals about other people’s friendships, it can be confident those are someone’s closest friends they’ll want to see the most of. You won’t see more friend content in total, but more from your best pals instead of distant acquaintances.

A Facebook News Feed survey from 2016, shared by Varsha Sharma

For worthwhile content, Facebook conducted surveys via News Feed to find out which links people said were good uses of their time. Facebook then detected which types of link posts, which publishers and how much engagement the posts got and matched that to survey results. This then lets it determine that if a post has a similar style and engagement level, it’s likely to be worthwhile and should be ranked higher in the feed.

The change aligns with CEO Mark Zuckerberg’s recent comments declaring that Facebook’s goal isn’t total time spent, but time well spent with meaningful content you feel good about. Most recently, that push has been about demoting unsafe content. Last month Facebook changed the algorithm to minimize clickbait and links to crappy ad-filled sites that receive a disproportionately high amount of their traffic from Facebook. It cracked down on unoriginality by hiding videos ripped off from other creators, and began levying harsher demotions to repeat violators of its policies. And it began to decrease the distribution of “borderline content” on Facebook and Instagram that comes close to but doesn’t technically break its rules.

While many assume Facebook just juices News Feed to be as addictive in the short-term as possible to keep us glued to the screen and viewing ads, that would actually be ruinous for its long-term business. If users leave the feed feeling exhausted, confused and unfulfilled, they won’t come back. Facebook’s already had trouble with users ditching its text-heavy News Feed for more visual apps like Instagram (which it luckily bought) and Snapchat (which it tried to). While demoting clickbait and viral content might decrease total usage time today, it could preserve Facebook’s money-making ability for the future while also helping to rot our brains a little less.

Powered by WPeMatico

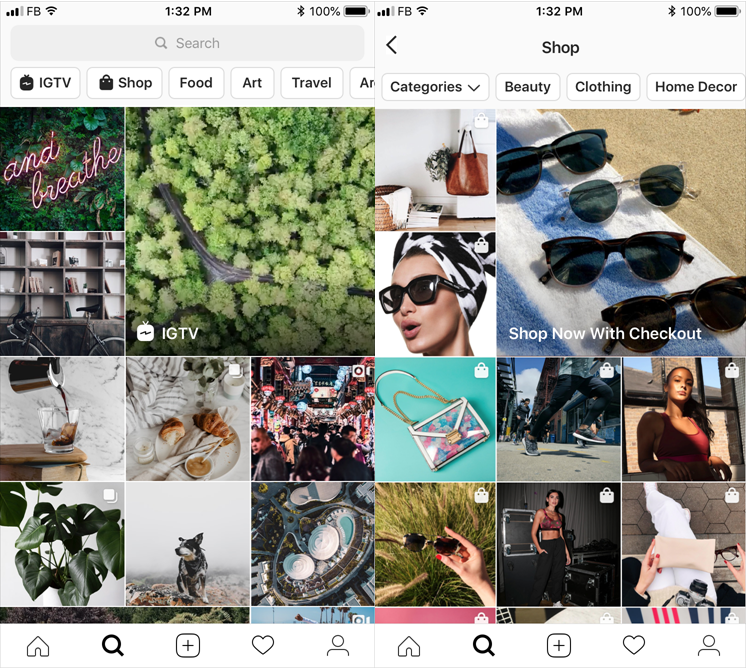

Instagram’s pivot to Stories continues with an overhaul of Explore designed to let users dig deeper into their niche interests. Stories are now eligible to show up in the Explore tab for the first time, giving creators a way to get discovered through their intimate, silly, behind-the-scenes content instead of just their manicured feed posts. Since Stories themselves don’t get Likes, Instagram will personalize which Stories you see on Explore by showing accounts similar to ones you do Like and Follow. We’ve got more tips on how the Explore Stories algorithm works below.

Additionally, Instagram Explore is getting a redesigned navigation bar up to with shortcuts to Shopping and IGTV first, followed by channels for topics like Travel, Food, and Design. In a nod to how central Instagram sees Shopping and IGTV to its future, those categories will also get big square portals inset within the Explore grid. Tapping these squares or shortcuts for Shopping reveals category filters for specific proucts like Clothing, Beauty, and Home Decor. For IGTV, they pull up an new vertical scrolling IGTV discovery grid to contrast with its old horizontal scrolling carousel.

The goal is that “Explore shows you the full breath of content on Instagram that are relevant to your interests” says Instagram product lead for discovery Will Ruben. The more creators you discover through Explore, the more you have to look at on Instagram, and the more ads you end of seeiing. “These changes also signal the future direction we’ll be taking with Explore. We’re really investing in making IGTV and Shopping a big part of Explore experience. A home for Instagram’s big bets like Shopping and IGTV. We want to provide a more immersive experience so people can actively engage with content and be more specific about what they want to discover.” That should quiet questions about whether Instagram will abandon IGTV after a lackluster first year in the market.

You’ll now start to see auto-playing Stories clips on the Explore grid. Tapping one will let you watch that Story, and then swipe through more topically similar Stories. For example, if you tap into a Story about dogs on Explore, you’ll likely see more dog Stories queued up. This seamless way to sift through content means there’s a ton of opportunity for influencers and artists to gain followers through Explore.

Instagram tells me that its algorithm is looking for several things when determining what to show on Explore. This is not an exhaustive list of signals that determine what shows up on Explore, which would also include recency and other factors. Explore is also personalized for every user, so showing up to one person doesn’t mean others will see a piece of content there too But here’s what Instagram told us were some of inputs for deciding what Stories appear in Explore:

So if you’re followed and Liked by people similar to someone, and post visually-compelling video Stories without too much text that are indicative of the topics you typically post, you could earn a spot on the Explore tab.

Powered by WPeMatico

As we swing into the summer tourist season, a company poised to capitalise on that has raised a huge round of funding. GetYourGuide — a Berlin startup that has built a popular marketplace for people to discover and book sightseeing tours, tickets for attractions and other experiences around the world — is today announcing that it has picked up $484 million, a Series E round of funding that will catapult its valuation above the $1 billion mark.

The funding is a milestone for a couple of reasons. GetYourGuide says it is the highest-ever round of funding for a company in the area of “travel experiences” (tours and other activities) — a market estimated to be worth $150 billion this year and rising to $183 billion in 2020. And this Series E is also one of the biggest-ever growth rounds for any European startup, period.

The company has now sold 25 million tickets for tours, attractions and other experiences, with a current catalog of some 50,000 experiences on offer. That’s a sign of strong growth: in 2017 it sold 10 million tickets, and its last reported catalog number was 35,000. It will be using the funding to build more of its own “Originals” tour experiences — which have now passed the 40,000 tickets sold mark — as well as to build up more activities in Asia and the U.S., two fast-growing markets for the startup.

The funding is being led by SoftBank, via its Vision Fund, with Temasek, Lakestar, Heartcore Capital (formerly Sunstone Capital) and Swisscanto Invest among others also participating. (Swisscanto is part of Zürcher Kantonalbank: GetYourGuide was originally founded in Zurich, where the founders had studied, and it still runs some R&D operations there.) The company has now raised well over $600 million.

It’s notable how SoftBank — which is on the hunt for interesting opportunities to invest its $100 billion superfund — has been stepping up a gear in Germany to tap into some of the bigger tech players that have emerged out of that market, which today is the biggest in Europe. Other big plays have included €460 million into Auto1 and €900 million into payments provider Wirecard. Other companies it has backed, such as hotel company Oyo out of India, are using its funding to break into Europe (and buy German companies in the process).

There had been reports over the last several months that GetYouGuide was in the process of raising anywhere between $300 million and more than $500 million. In late April, we were told by sources that the round hadn’t yet closed, and that numbers published in the media up to then had been inaccurate, even as we nailed down that SoftBank was indeed involved in the round.

The valuation in this round is not being disclosed, but CEO Johannes Reck (who co-founded the app with Martin Sieber, Pascal Mathis, Tobias Rein and Tao Tao) said in an interview with TechCrunch that it was definitely “now a unicorn” — meaning that its valuation had passed the $1 billion mark. For additional context, the rumor last month was that GetYourGuide’s valuation was up to €1.6 billion ($1.78 billion), but I have not been able to get firm confirmation of that number.

GetYourGuide’s growth — and investor interest in it — has closely followed the rise of new platforms like Airbnb that have changed the face of how we travel, and what we do when we get somewhere. We have moved far beyond the days of visiting a travel agent that books everything, from flight to hotel to all your activities, as you sit on the other side of a desk from her or him. Now with the tap of a finger or the click of a mouse, we have thousands of choices.

Within that, GetYourGuide thinks that it has jumped on an interesting opportunity to rethink the activity aspect of tourism. Tour packages and other highly organized travel experiences are often associated with older people, or those with families — essentially people who need more predictability when they are not at home.

Reck noted that the earliest users of GetYourGuide in 2010 were precisely those people — or at least those who were more inclined to use digital platforms to begin with: the demographic, he said, was 40-50 year olds, most likely travelling with family.

That is one thing that has really started to change, in no small part because of GetYourGuide itself. Making the experience of booking experiences mobile-friendly, GetYourGuide has played into the culture of doing and showing, which has propelled the rise of social media.

“They want to do things, to have something to post on Instagram,” he said. The average age of a GetYourGuide user now, he said, is 25-40.

This has even evolved into what GetYourGuide provides to users. “At some point, staff in Asia had the idea of crafting a ‘GetYourGuide Instagram Tour of Bali.’ That really took off, and now this is the number-one tour booked in the region.” It has since expanded the concept to 50 destinations.

Not by coincidence, today the company is also announcing that Ameet Ranadive is joining as the company’s first chief product officer. Ranadive comes from Instagram, where he led the Well-being product team (the company’s health and safety team). He’d also been VP and GM of Revenue Product at Twitter. Nils Chrestin is also coming on as CFO, having recently been at Rocket Internet-incubated Global Fashion Group.

That has also led GetYourGuide to conclude it has a ways to go to continue developing its model and scope further, expanding into longer sightseeing excursions, beyond one or two-hour tours into day trips and even overnight experiences.

As it continues to play around with some of these offerings, it’s also increasingly taking a more direct role in the branding and the provision of the content. Initially, all tickets and tours were posted on GetYourGuide by third parties. Now, GetYourGuide is building more of what Reck calls “Originals” — which it might develop in partnership with others but ultimately handles as its own first-party content. (That Instagram tour was one of those Originals.)

It’s worth noting that others are closing in on the same “experiences” model that forms the core of GetYourGuide’s business: Airbnb, to diversify how it makes revenues and to extend its touchpoints with guests beyond basic accommodation bookings, has also started to sell experiences. Meanwhile, daily deals pioneer Groupon has also positioned itself as a destination for purchasing “experiences” as a way to offset declines in other areas of its business. Similarly, travel portals that sell plane tickets regularly default to pushing more activities on you.

Reck pointed out that the area of business where GetYourGuide is active is becoming increasingly attractive to these players as other aspects of the travel industry become increasingly commoditised. Indeed, you can visit dozens of sites to compare pricing on plane tickets, and if you are flexible, pick up even more of a bargain at the last minute. And the rise of multiple Airbnb-style platforms offering private accommodation has made competition among those supplying those platforms — as well as hotels — increasingly fierce.

All of that leaves experiences — for now at least — as the place where these companies can differentiate themselves from the pack. Reck believes that focusing on this, however, means you just do it much better than companies that have added experiences on to a platform that is not a native destination for discovering or buying that kind of content or product. (That doesn’t mean there aren’t others natively tackling “experiences” from the world of startups. Klook is one also funded by SoftBank.)

“Consumers, especially millennials, are spending an increasing portion of their disposable income on travel experiences. We believe GetYourGuide is leading this seismic shift by consolidating the fragmented global supply base of tour operators and modernizing access for travelers globally,” said Ted Fike, partner at SoftBank Investment Advisers, in a statement. “This combination creates powerful network effects for their business that is fueling their strong growth. We are excited to partner with their passionate and talented leadership team.” Fike is joining the board with this round.

Powered by WPeMatico

OpenFin, the company looking to provide the operating system for the financial services industry, has raised $17 million in funding through a Series C round led by Wells Fargo, with participation from Barclays and existing investors including Bain Capital Ventures, J.P. Morgan and Pivot Investment Partners. Previous investors in OpenFin also include DRW Venture Capital, Euclid Opportunities and NYCA Partners.

Likening itself to “the OS of finance,” OpenFin seeks to be the operating layer on which applications used by financial services companies are built and launched, akin to iOS or Android for your smartphone.

OpenFin’s operating system provides three key solutions which, while present on your mobile phone, has previously been absent in the financial services industry: easier deployment of apps to end users, fast security assurances for applications and interoperability.

Traders, analysts and other financial service employees often find themselves using several separate platforms simultaneously, as they try to source information and quickly execute multiple transactions. Yet historically, the desktop applications used by financial services firms — like trading platforms, data solutions or risk analytics — haven’t communicated with one another, with functions performed in one application not recognized or reflected in external applications.

“On my phone, I can be in my calendar app and tap an address, which opens up Google Maps. From Google Maps, maybe I book an Uber . From Uber, I’ll share my real-time location on messages with my friends. That’s four different apps working together on my phone,” OpenFin CEO and co-founder Mazy Dar explained to TechCrunch. That cross-functionality has long been missing in financial services.

As a result, employees can find themselves losing precious time — which in the world of financial services can often mean losing money — as they juggle multiple screens and perform repetitive processes across different applications.

Additionally, major banks, institutional investors and other financial firms have traditionally deployed natively installed applications in lengthy processes that can often take months, going through long vendor packaging and security reviews that ultimately don’t prevent the software from actually accessing the local system.

OpenFin CEO and co-founder Mazy Dar (Image via OpenFin)

As former analysts and traders at major financial institutions, Dar and his co-founder Chuck Doerr (now president & COO of OpenFin) recognized these major pain points and decided to build a common platform that would enable cross-functionality and instant deployment. And since apps on OpenFin are unable to access local file systems, banks can better ensure security and avoid prolonged yet ineffective security review processes.

And the value proposition offered by OpenFin seems to be quite compelling. OpenFin boasts an impressive roster of customers using its platform, including more than 1,500 major financial firms, almost 40 leading vendors and 15 of the world’s 20 largest banks.

More than 1,000 applications have been built on the OS, with OpenFin now deployed on more than 200,000 desktops — a noteworthy milestone given that the ever-popular Bloomberg Terminal, which is ubiquitously used across financial institutions and investment firms, is deployed on roughly 300,000 desktops.

Since raising their Series B in February 2017, OpenFin’s deployments have more than doubled. The company’s headcount has also doubled and its European presence has tripled. Earlier this year, OpenFin also launched it’s OpenFin Cloud Services platform, which allows financial firms to launch their own private local app stores for employees and customers without writing a single line of code.

To date, OpenFin has raised a total of $40 million in venture funding and plans to use the capital from its latest round for additional hiring and to expand its footprint onto more desktops around the world. In the long run, OpenFin hopes to become the vital operating infrastructure upon which all developers of financial applications are innovating.

“Apple and Google’s mobile operating systems and app stores have enabled more than a million apps that have fundamentally changed how we live,” said Dar. “OpenFin OS and our new app store services enable the next generation of desktop apps that are transforming how we work in financial services.”

Powered by WPeMatico

TodayTix, a mobile ticketing company that makes it easy and relatively affordable to go to Broadway shows and other live performances, is announcing a new $73 million round of funding led by private equity firm Great Hill Partners.

Founded in 2013, the company initially served as the mobile equivalent of New York’s TKTS booths for discounted, last-minute theater tickets. TodayTix says it’s now sold more than 4 million tickets, representing 8% of annual Broadway ticket sales and 4% for London’s West End.

Beyond that, co-founder and CEO Brian Fenty said that a little over 10% of the tickets sold now fall outside “theater and performing arts, narrowly defined,” covering things like comedy shows and experiential theater.

“I think to the consumer, we will be a holistic ecosystem to engage in the city’s art and experiences,” Fenty predicted. “However culture is defined … we want to be their partner in discovering those things.”

To do that, TodayTix will add more cities to its current list of 15 markets. Fenty said this expansion is driven by existing collaborations (like launching in Australia through its partnership with “Harry Potter and the Cursed Child”) and by seeing where people are already downloading the TodayTix app. His ultimate goal is to be “geographically agnostic.”

Fenty also said the company will continue investing in the TodayTix Presents program, through which the company puts on its own shows (albeit at a much smaller scale than a Broadway production).

And of course he wants to improve the app itself, introducing more personalization and curation — Fenty pointed to Netflix and Amazon as models. After all, he said TodayTix is currently offering tickets to 297 shows in New York alone, so it needs ways to “effectively guide people through that.”

“We’re actually a media company, with our own content and perspective — not on the quality of the shows, but to have a point of view on how users should and could engage with this content,” he said.

He added that those improvements will include more basic things, like the process of purchasing a ticket: “The hardest part is to complete the purchase in 30 seconds or less, as compared to the average ticketing platform, which is somewhere between 3 and 7 minutes … How we continue to squish that conversion?”

Fenty is also hoping to work more closely with show producers, providing them with data about which shows are selling, as well as helping them use data to find the most effective ways to promote themselves.

TodayTix says it’s raised a total of $90 million since it announced its Series B back in February 2016. Fenty told me the new round includes a direct investment in the company, as well as secondary purchases of TodayTix shares from previous investors.

“TodayTix is rapidly changing the way millennials and other consumers connect with live cultural experiences,” said Great Hill Managing Partner Michael Kumin in a statement. “We look forward to working with Brian, [co-founder] Merritt [Baer] and their talented management team to expand the Company’s product and service offerings and accelerate its push into new geographies.”

Powered by WPeMatico

Twitter is finally modernizing its core APIs after seven years of stagnation, and it wants early feedback from developers. That’s why today it’s launching Twitter Developer Labs, which app makers can sign up for to experiment with pre-release beta APIs. First up will be re-engineered versions of GET /Tweets and GET /Users APIs. The first functional changes will come next, including real-time streaming access to the Twitter firehose with the expansion of tweet filtering plus impressions and engagement metrics that were previously only available in its expensive enterprise API tiers. Twitter will also be adding newer features like Polls to the API.

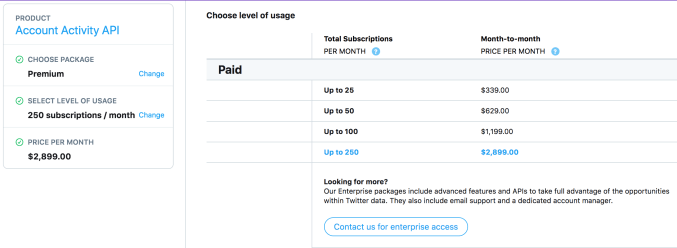

Giving developers longer lead-times and more of a voice when it comes to rebuilding its APIs could help Twitter get more app makers paying for its premium API ($339 to $2,899 per month for just one specific API) and enterprise API tiers (even more expensive). It might also stimulate the creation of dev-made analytics, measurement and ads businesses that convince brands to spend more money on Twitter marketing. The Labs program and the first API endpoint changes will roll out in the coming weeks. To join, people can sign up for developer accounts, join an email list for updates on the Labs site, follow the TwitterDev account and start providing feedback.

Twitter’s data and enterprise solutions product manager Ian Cairns acknowledged some of the whiplash Twitter has put developers through in the past, rapidly changing strategies and restricting rate limits in ways that made developers’ businesses unsustainable. For example, last year a change broke many third-party Twitter reading clients. “There are certainly times over the years when the ways in which we’ve managed our APIS . . . have changed and we know some of those have changed in ways that have been disruptive to developers. What we’re doing with the Twitter Developer Labs program is focusing on trying to use that as a vehicle to build trust and make sure we’re having a two-way conversation and that the voice of the people who use our platform the most are driving the future.”

Twitter’s main API hasn’t been overhauled since its release in August 2012, despite a bunch of progress on enterprise and ads APIs in the meantime. The advantage of that is that the old API was optimized for backwards compatibility so developers didn’t have to constantly update their apps, allowing old utilities to survive. But that also prohibited integrating some newer features like Polls. Twitter plans to move to a more regular versioning system where breaking changes are communicated far enough in advance for developers to adapt.

More recently, Twitter announced a streamlining of its APIs that also instituted the paid tiers in 2017. But last year it broke Twitter clients and sold its Fabric developer toolset to Google as part of cost-cutting measures that previously spelled the demise of Vine. And this year, Twitter has made moves to crack down on API abuse for spamming and services for buying followers. That comes after the Cambridge Analytica scandal rocked confidence in developer platforms and forced their owners to limit functionality in order to preserve safety and privacy.

Developer Labs will serve as the nerdy brother of the new “twttr” beta consumer app that launched in March to let people try out potential changes to how replies and the feed work. Twitter writes that “Our initial focus in Labs will be on developers who work with conversational data, including academics and researchers who study and explore what’s happening on Twitter, and social listening and analytics companies that build products for other businesses.”

Twitter’s relationship with developers has always been rocky, in large part due to lack of communication. If a developer builds something, and then Twitter either messes it up with API changes or builds a similar feature itself, it can cost a ton in wasted engineering effort. If Labs opens a clearer dialogue with developers, Twitter could count them as allies instead of PR liabilities.

Powered by WPeMatico

WhatsApp just fixed a vulnerability that allowed malicious actors to remotely install spyware on affected phones, and an unknown number reportedly did so with a commercial-grade snooping package usually sold to nation-states.

The vulnerability (documented here) was discovered by the Facebook-owned WhatsApp in early May, the company confirmed to TechCrunch. It apparently leveraged a bug in the audio call feature of the app to allow the caller to allow the installation of spyware on the device being called, whether the call was answered or not.

The spyware in question that was detected as having been installed was Israel-based NSO Group’s Pegasus, which is usually (ostensibly) licensed to governments looking to infect targets of investigations and gain access to various aspects of their devices.

This is, as you can imagine, an extremely severe security hole, and it is difficult to fix the window during which it was open, or how many people were affected by it. Without knowing exactly what the exploit was and what data WhatsApp keeps regarding that type of activity, we can only speculate.

The company said that it suspects a relatively small number of users were targeted, since it would be nontrivial to deploy, limiting it to advanced and highly motivated actors.

Once alerted to the issue’s existence, the company said it took less than 10 days to make the required changes to its infrastructure that would render the attack inoperable. After that, an update went out to the client that further secured against the exploit.

“WhatsApp encourages people to upgrade to the latest version of our app, as well as keep their mobile operating system up to date, to protect against potential targeted exploits designed to compromise information stored on mobile devices,” the company said in a statement.

So what about NSO Group? Is this attack their work as well? The company told the Financial Times, which first reported the attack, that it was investigating the issue. But it noted that it is careful not to involve itself with the actual applications of its software — it vets its customers and investigates abuse, it said, but it has nothing to do with how its code is used or against whom.

WhatsApp did not name NSO in its remarks, but its suspicions seem clear:

“This attack has all the hallmarks of a private company known to work with governments to deliver spyware that reportedly takes over the functions of mobile phone operating systems.”

Naturally when a security-focused app like WhatsApp finds that a private company has, potentially at least, been secretly selling a known and dangerous exploit of its protocols, there’s a certain amount of enmity. But it’s all part of the 0-day game, an arms race to protect against or breach the latest security measures. WhatsApp notified the Department of Justice and “a number of human rights organisations” of the issue.

You should, as WhatsApp suggests, always keep your apps up to date for situations like this, although in this case the problem was able to be fixed in the backend before clients could be patched.

Powered by WPeMatico

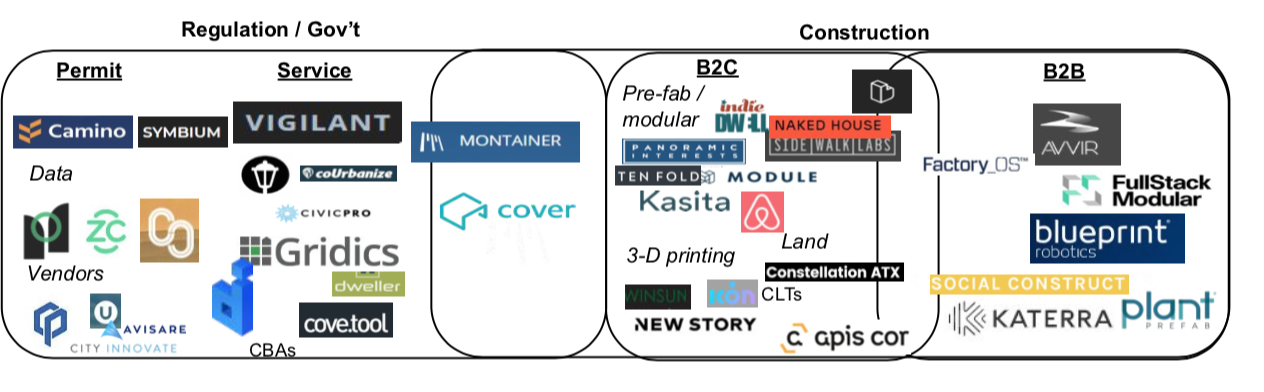

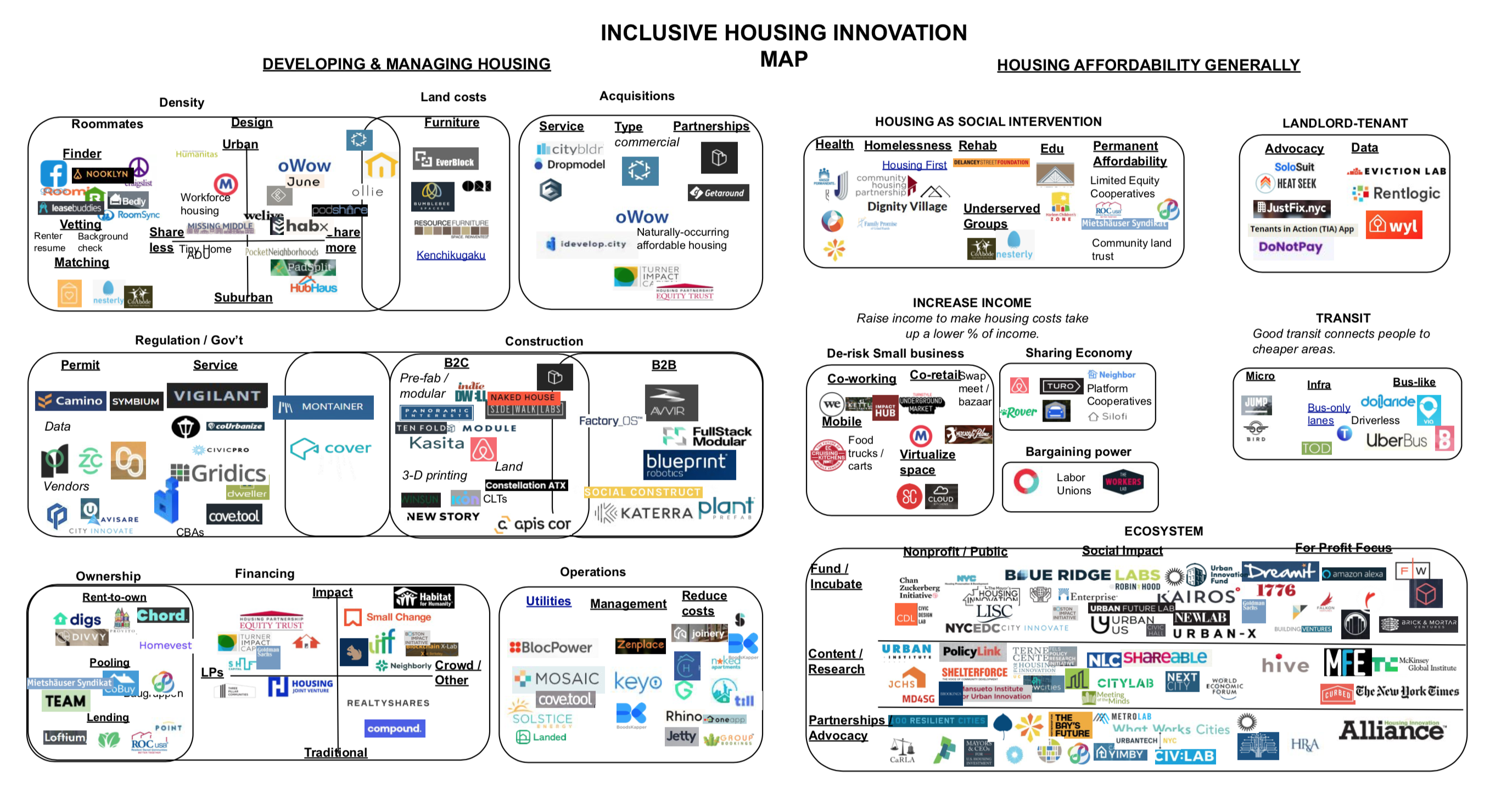

In this section of my exploration into innovation in inclusive housing, I am digging into the 200+ companies impacting the key phases of developing and managing housing.

Innovations have reduced costs in the most expensive phases of the housing development and management process. I explore innovations in each of these phases, including construction, land, regulatory, financing, and operational costs.

This is one of the top three challenges developers face, exacerbated by rising building material costs and labor shortages.

Powered by WPeMatico

Housing is big money. The industry has trillions under management and hundreds of billions under development.

And investors have noticed the potential. Opendoor raised nearly $1.3 billion to help homeowners buy and sell houses more quickly. Katerra raised $1.2 billion to optimize building development and construction, and Compass raised the same amount to help brokers sell real estate better. Even Amazon and Airbnb have entered the fray with high-profile investments.

Amidst this frenetic growth is the seed of the next wave of innovation in the sector. The housing industry — and its affordability problem — is only likely to balloon. By 2030, 84% of the population of developed countries will live in cities.

Yet innovation in housing lags compared to other industries. In construction, a major aspect of housing development, players spend less than 1% of their revenues on research and development. Technology companies, like the Amazons of the world, spend nearly 10% on average.

Innovations in older, highly regulated industries, like housing and real estate, are part of what Steve Case calls the “third wave” of technology. VCs like Case’s Revolution Fund and the SoftBank Vision Fund are investing billions into what they believe is the future.

These innovations are far from silver bullets, especially if they lack involvement from underrepresented communities, avoid policy and ignore distributive questions about who gets to benefit from more housing.

Yet there are hundreds of interventions reworking housing that cannot be ignored. To help entrepreneurs, investors and job seekers interested in creating better housing, I mapped these innovations in this package of articles.

To make sense of this broad field, I categorize innovations into two main groups, which I detail in two separate pieces on Extra Crunch. The first (Part 1) identifies the key phases of developing and managing housing. The second (Part 2) section identifies interventions that contribute to housing inclusion more generally, such as efforts to pair housing with transit, small business creation and mental rehabilitation.

Unfortunately, many of these tools don’t guarantee more affordability. Lowering acquisition costs, for instance, doesn’t mean that renters or homeowners will necessarily benefit from those savings. As a result, some tools likely need to be paired with others to ensure cost savings that benefit end users — and promote long-term affordability. I detail efforts here so that mission-driven advocates as well as startup founders can adopt them for their own efforts.

Today:

Coming Tomorrow:

Please feel free to let me know what else is exciting by adding a note to your LinkedIn invite here.

If you’re excited about this topic, feel free to subscribe to my future of inclusive housing newsletter by viewing a past issue here.

Powered by WPeMatico

Truecaller, an app that helps users screen strangers and robocallers, will soon allow users in India, its largest market, to borrow up to a few hundred dollars.

The crediting option will be the fourth feature the nine-year-old app adds to its service in the last two years. So far it has added to the service the ability to text, record phone calls and mobile payment features, some of which are only available to users in India. Of the 140 million daily active users of Truecaller, 100 million live in India.

The story of the ever-growing ambition of Truecaller illustrates an interesting phase in India’s internet market that is seeing a number of companies mold their single-functioning app into multi-functioning so-called super apps.

This may sound familiar. Truecaller and others are trying to replicate Tencent’s playbook. The Chinese tech giant’s WeChat, an app that began life as a messaging service, has become a one-stop solution for a range of features — gaming, payments, social commerce and publishing platform — in recent years.

WeChat has become such a dominant player in the Chinese internet ecosystem that it is effectively serving as an operating system and getting away with it. The service maintains its own “app store” that hosts mini apps. This has put it at odds with Apple, though the iPhone-maker has little choice but to make peace with it.

For all its dominance in China, WeChat has struggled to gain traction in India and elsewhere. But its model today is prominently on display in other markets. Grab and Go-Jek in Southeast Asian markets are best known for their ride-hailing services, but have begun to offer a range of other features, including food delivery, entertainment, digital payments, financial services and healthcare.

The proliferation of low-cost smartphones and mobile data in India, thanks in part to Google and Facebook, has helped tens of millions of Indians come online in recent years, with mobile the dominant platform. The number of internet users has already exceeded 500 million in India, up from some 350 million in mid-2015. According to some estimates, India may have north of 625 million users by year-end.

This has fueled the global image of India, which is both the fastest growing internet and smartphone market. Naturally, local apps in India, and those from international firms that operate here, are beginning to replicate WeChat’s model.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma speaks during the launch of Paytm payments Bank at a function in New Delhi on November 28, 2017 (AFP PHOTO / SAJJAD HUSSAIN)

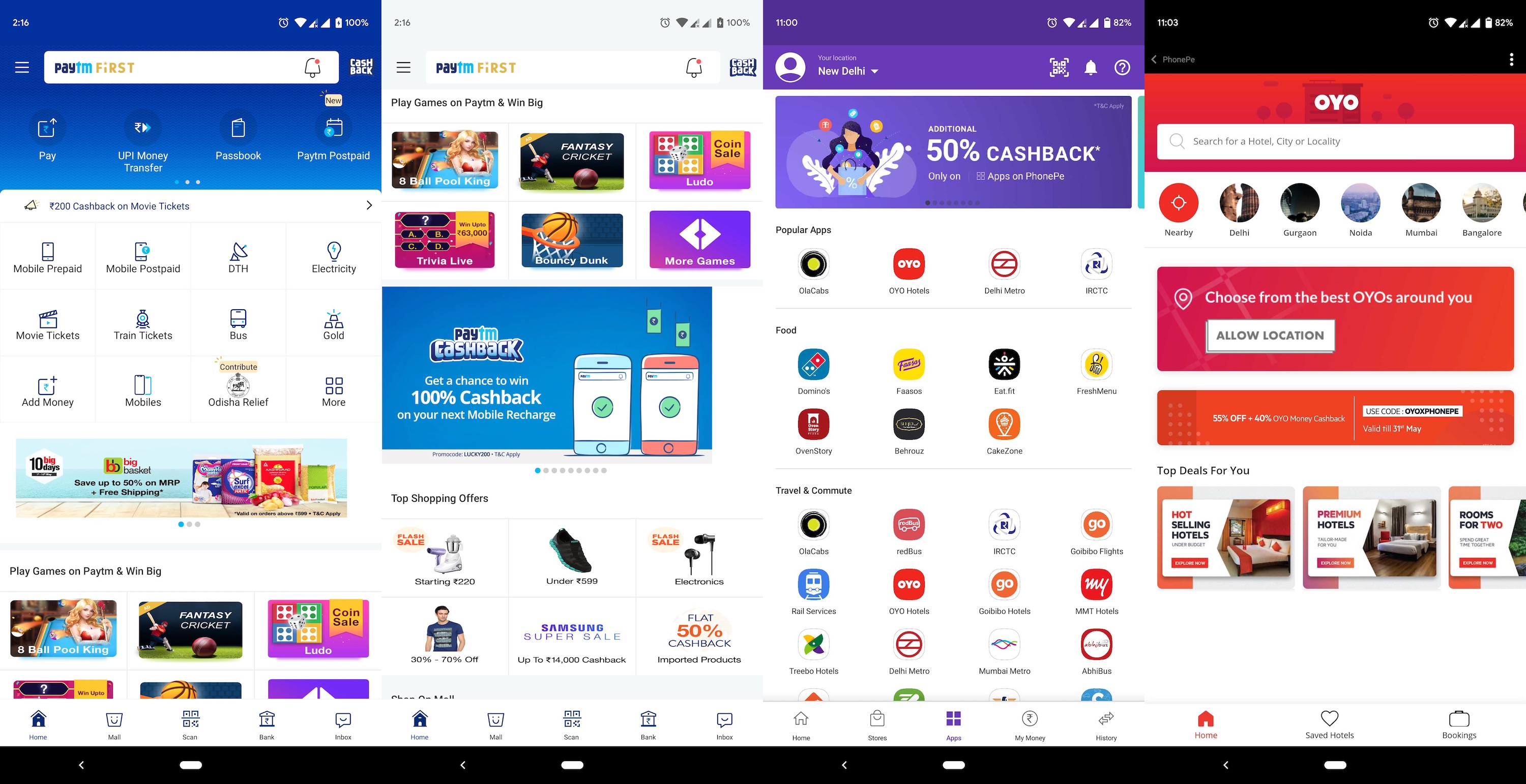

Leading that pack is Paytm, the popular homegrown mobile wallet service that’s valued at $18 billion and has been heavily backed by Alibaba, the e-commerce giant that rivals Tencent and crucially missed the mobile messaging wave in China.

In recent years, the Paytm app has taken a leaf from China with additions that include the ability to text merchants; book movie, flight and train tickets; and buy shoes, books and just about anything from its e-commerce arm Paytm Mall . It also has added a number of mini games to the app. The company said earlier this month that more than 30 million users are engaging with its games.

Why bother with diversifying your app’s offering? Well, for Vijay Shekhar Sharma, founder and CEO of Paytm, the question is why shouldn’t you? If your app serves a certain number of transactions (or engagements) in a day, you have a good shot at disrupting many businesses that generate fewer transactions, he told TechCrunch in an interview.

At the end of the day, companies want to garner as much attention of a user as they can, said Jayanth Kolla, founder and partner of research and advisory firm Convergence Catalyst.

“This is similar to how cable networks such as Fox and Star have built various channels with a wide range of programming to create enough hooks for users to stick around,” Kolla said.

“The agenda for these apps is to hold people’s attention and monopolize a user’s activities on their mobile devices,” he added, explaining that higher engagement in an app translates to higher revenue from advertising.

Paytm’s Sharma agrees. “Payment is the moat. You can offer a range of things including content, entertainment, lifestyle, commerce and financial services around it,” he told TechCrunch. “Now that’s a business model… payment itself can’t make you money.”

Other businesses have taken note. Flipkart -owned payment app PhonePe, which claims to have 150 million active users, today hosts a number of mini apps. Some of those include services for ride-hailing service Ola, hotel booking service Oyo and travel booking service MakeMyTrip.

Paytm (the first two images from left) and PhonePe offer a range of services that are integrated into their payments apps

What works for PhonePe is that its core business — payments — has amassed enough users, Himanshu Gupta, former associate director of marketing and growth for WeChat in India, told TechCrunch. He added that unlike e-commerce giant Snapdeal, which attempted to offer similar offerings back in the day, PhonePe has tighter integration with other services, and is built using modern architecture that gives users almost native app experiences inside mini apps.

When you talk about strategy for Flipkart, the homegrown e-commerce giant acquired by Walmart last year for a cool $16 billion, chances are arch rival Amazon is also hatching similar plans, and that’s indeed the case for super apps.

In India, Amazon offers its customers a range of payment features such as the ability to pay phone bills and cable subscription through its Amazon Pay service. The company last year acquired Indian startup Tapzo, an app that offers integration with popular services such as Uber, Ola, Swiggy and Zomato, to boost Pay’s business in the nation.

Another U.S. giant, Microsoft, is also aboard the super train. The Redmond-based company has added a slew of new features to SMS Organizer, an app born out of its Microsoft Garage initiative in India. What began as a texting app that can screen spam messages and help users keep track of important SMSs recently partnered with education board CBSE in India to deliver exam results of 10th and 12th grade students.

This year, the SMS Organizer app added an option to track live train schedules through a partnership with Indian Railways, and there’s support for speech-to-text. It also offers personalized discount coupons from a range of companies, giving users an incentive to check the app more often.

Like in other markets, Google and Facebook hold a dominant position in India. More than 95% of smartphones sold in India run the Android operating system. There is no viable local — or otherwise — alternative to Search, Gmail and YouTube, which counts India as its fastest growing market. But Google hasn’t necessarily made any push to significantly expand the scope of any of its offerings in India.

India is the biggest market for WhatsApp, and Facebook’s marquee app too has more than 250 million users in the nation. WhatsApp launched a pilot payments program in India in early 2018, but is yet to get clearance from the government for a nationwide rollout. (It isn’t happening for at least another two months, a person familiar with the matter said.) In the meanwhile, Facebook appears to be hatching a WeChatization of Messenger, albeit that app is not so big in India.

Ride-hailing service Ola too, like Grab and Go-Jek, plans to add financial services such as credit to the platform this year, a source familiar with the company’s plans told TechCrunch.

“We have an abundance of data about our users. We know how much money they spend on rides, how often they frequent the city and how often they order from restaurants. It makes perfect sense to give them these valued-added features,” the person said. Ola has already branched out of transport after it acquired food delivery startup Foodpanda in late 2017, but it hasn’t yet made major waves in financial services despite giving its Ola Money service its own dedicated app.

The company positioned Ola Money as a super app, expanded its features through acquisition and tie ups with other players and offered discounts and cashbacks. But it remains behind Paytm, PhonePe and Google Pay, all of which are also offering discounts to customers.

Super apps indeed come in all shapes and sizes, beyond core services like payment and transportation — the strategy is showing up in apps and services that entertain India’s internet population.

MX Player, a video playback app with more than 175 million users in India that was acquired by Times Internet for some $140 million last year, has big ambitions. Last year, it introduced a video streaming service to bolster its app to grow beyond merely being a repository. It has already commissioned the production of several original shows.

In recent months, it has also integrated Gaana, the largest local music streaming app that is also owned by Times Internet. Now its parent company, which rivals Google and Facebook on some fronts, is planning to add mini games to MX Player, a person familiar with the matter said, to give it additional reach and appeal.

Some of these apps, especially those that have amassed tens of millions of users, have a real shot at diversifying their offerings, analyst Kolla said. There is a bar of entry, though. A huge user base that engages with a product on a daily basis is a must for any company if it is to explore chasing the super app status, he added.

Indeed, there are examples of companies that had the vision to see the benefits of super apps but simply couldn’t muster the requisite user base. As mentioned, Snapdeal tried and failed at expanding its app’s offerings. Messaging service Hike, which was valued at more than $1 billion two years ago and includes WeChat parent Tencent among its investors, added games and other features to its app, but ultimately saw poor engagement. Its new strategy is the reverse: to break its app into multiple pieces.

“In 2019, we continue to double down on both social and content but we’re going to do it with an evolved approach. We’re going to do it across multiple apps. That means, in 2019 we’re going to go from building a super app that encompasses everything, to Multiple Apps solving one thing really well. Yes, we’re unbundling Hike,” Kavin Mittal, founder and CEO of Hike, wrote in an update published earlier this year.

It remains unclear how users are responding to the new features on their favorite apps. Some signs suggest, however, that at least some users are embracing the additional features. Truecaller said it is seeing tens of thousands of users try the payment feature for the first time each day. It’s also being used to send 3 billion texts a month.

Regardless, the race is still on, and there are big horses waiting to enter to add further competition.

Reliance Jio, a subsidiary of conglomerate Reliance Industry that is owned by India’s richest man, Mukesh Ambani, is planning to introduce a super app that will host more than 100 features, according to a person familiar with the matter. Local media first reported the development.

It will be fascinating to see how that works out. Reliance Jio, which almost single-handedly disrupted the telecom industry in India with its low-cost data plans and free voice calls, has amassed tens of millions of users on the bouquet of apps that it offers at no additional cost to Jio subscribers.

Beyond that diverse selection of homespun apps, Reliance has also taken an M&A-based approach to assemble the pieces of its super app strategy.

It bought music streaming service Saavn last year and quickly integrated it with its own music app JioMusic. Last month, it acquired Haptik, a startup that develops “conversational” platforms and virtual assistants, in a deal worth more than $100 million. It already has the user bases required. JioTV, an app that offers access to over 500 TV channels; and JioNews, an app that additionally offers hundreds of magazines and newspapers, routinely appear among the top apps in Google Play Store.

India’s super app revolution is in its early days, but the trend is surely one to keep an eye on as the country moves into its next chapter of internet usage.

Powered by WPeMatico