Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Business, now more than ever before, is going digital, and today a startup that’s building a vertically integrated solution to meet business banking needs is announcing a big round of funding to tap into the opportunity. Airwallex — which provides business banking services directly to businesses themselves as well as via a set of APIs that power other companies’ fintech products — has raised $200 million, a Series E round of funding that values the Australian startup at $4 billion.

Lone Pine Capital is leading the round, with new backers G Squared and Vetamer Capital Management, and previous backers 1835i Ventures (formerly ANZi), DST Global, Salesforce Ventures and Sequoia Capital China also participating.

The funding brings the total raised by Airwallex — which has head offices in Hong Kong and Melbourne, Australia — to $700 million, including a $100 million injection that closed out its Series D just six months ago.

Airwallex will be using the funding both to continue investing in its product and technology as well as to continue its geographical expansion and to focus on some larger business targets. The company has started to make some headway into Europe and the U.K. and that will be one big focus, along with the U.S.

The quick succession of funding and rising valuation underscore Airwallex’s traction to date around what CEO and co-founder Jack Zhang describes as a vertically integrated strategy.

That involves two parts. First, Airwallex has built all the infrastructure for the business banking services that it provides directly to businesses with a focus on small and medium enterprise customers. Second, it has packaged up that infrastructure into a set of APIs that a variety of other companies use to provide financial services directly to their customers without needing to build those services themselves — the so-called “embedded finance” approach.

“We want to own the whole ecosystem,” Zhang said to me. “We want to be like the Apple of business finance.”

That seems to be working out so far for Airwallex. Revenues were up almost 150% for the first half of 2021 compared to a year before, with the company processing more than US$20 billion for a global client portfolio that has quadrupled in size. In addition to tens of thousands of SMEs, it also, via APIs, powers financial services for other companies like GOAT, Papaya Global and Stake.

Airwallex got its start like many of the strongest startups do: It was built to solve a problem that the founders encountered themselves. In the case of Airwallex, Zhang tells me he had actually been working on a previous startup idea. He wanted to build the “Blue Bottle Coffee” of Asia Pacific out of Australia, and it involved buying and importing a lot of different materials, packaging and, of course, coffee from all around the world.

“We found that making payments as a small business was slow and expensive,” he said, since it involved banks in different countries and different banking systems, manual efforts to transfer money between them and many days to clear the payments. “But that was also my background — payments and trading — and so I decided that it was a much more fascinating problem for me to work on and resolve.”

Eventually one of his co-founders in the coffee effort came along, with the four co-founders of Airwallex ultimately including Zhang, along with Xijing Dai, Lucy Liu and Max Li.

It was 2014, and Airwallex got attention from VCs early on in part for being in the right place at the right time. A wave of startups building financial services for SMBs were definitely gaining ground in North America and Europe, filling a long-neglected hole in the technology universe, but there was almost nothing of the sort in the Asia Pacific region, and in those earlier days solutions were highly regionalized.

From there it was a no-brainer that starting with cross-border payments, the first thing Airwallex tackled, would soon grow into a wider suite of banking services involving payments and other cross-border banking services.

“In the last six years, we’ve built more than 50 bank integrations and now offer payments across 95 countries, payments through a partner network,” he added, with 43 of those offering real-time transactions. From that, it moved on to bank accounts and “other primitive stuff” with card issuance and more, he said, eventually building an end-to-end payment stack.

Airwallex has tens of thousands of customers using its financial services directly, and they make up about 40% of its revenues today. The rest is the interesting turn the company decided to take to expand its business.

Airwallex had built all of its technology from the ground up itself, and it found that — given the wave of new companies looking for more ways to engage customers and become their one-stop shop — there was an opportunity to package that tech up in a set of APIs and sell that on to a different set of customers, those who also provided services for small businesses. That part of the business now accounts for 60% of Airwallex’s business, Zhang said, and is growing faster in terms of revenues. (The SMB business is growing faster in terms of customers, he said.)

A lot of embedded finance startups that base their business around building tech to power other businesses tend to stay at arm’s length from offering financial services directly to consumers. The explanation I have heard is that they do not wish to compete against their customers. Zhang said that Airwallex takes a different approach, by being selective about the customers they partner with, so that the financial services they offer would not be in direct competition with those of its customers. The GOAT marketplace for sneakers, or Papaya Global’s HR platform are classic examples of this.

However, as Airwallex continues to grow, you can’t help but wonder whether one of those partners might like to gobble up all of Airwallex and take on some of that service provision role itself. In that context, it’s very interesting to see Salesforce Ventures returning to invest even more in the company in this round, given how widely the company has expanded from its early roots in software for salespeople into a massive platform providing a huge range of cloud services to help people run their businesses.

For now, it’s been the combination of its unique roots in Asia Pacific, plus its vertical approach of building its tech from the ground up, plus its retail acumen that has impressed investors and may well see Airwallex stay independent and grow for some time to come.

“Airwallex has a clear competitive advantage in the digital payments market,” said David Craver, MD at Lone Pine Capital, in a statement. “Its unique Asia-Pacific roots, coupled with its innovative infrastructure, products and services, speak volumes about the business’ global growth opportunities and its impressive expansion in the competitive payment providers space. We are excited to invest in Airwallex at this dynamic time, and look forward to helping drive the company’s expansion and success worldwide.”

Updated to note that the coffee business was in Australia, not Hong Kong.

Powered by WPeMatico

Taha Ahmed and Rooshan Aziz left their jobs in strategy consulting and investment banking in London earlier this year in order to found a mobile-only education platform startup, Maqsad, in Pakistan, with a goal “to make education more accessible to 100 million Pakistani students.”

Having grown up in Karachi, childhood friends Ahmed and Aziz are aware of the challenges about the Pakistani education system, which is notably worse for those not living in large urban areas (the nation’s student-teacher ratio is 44:1). Pakistani children are less likely to go to school for each kilometer of distance between school and their home — with girls being four times affected, Maqsad co-founder Aziz said.

Maqsad announced today its $2.1 million pre-seed round to enhance its content platform growth and invest in R&D.

The pre-seed round, which was completed in just three weeks via virtual meetings, was led by Indus Valley Capital, with participation from Alter Global, Fatima Gobi Ventures and several angel investors from Pakistan, the Middle East and Europe.

Maqsad will use the proceeds for developing in-house content, such as production studio, academics and animators, as well as bolstering R&D and engineering, Aziz told TechCrunch. The company will focus on the K-12 education in Pakistan, including 11th and 12th grade math, with plans to expand into other STEM subjects for the next one-two years, Aziz said.

Maqsad’s platform, which provides a one-stop shop for after-school academic content in a mix of English and Urdu, will be supplemented by quizzes and other gamified features that will come together to offer a personalized education to individuals. Its platform features include adaptive testing that alter a question’s level of difficulty depending on users’ responses, Aziz explained.

The word “maqsad” means purpose in Urdu.

“We believe everyone has a purpose. Maqsad’s mission is to enable Pakistani students to realize this purpose; whether you are a student from an urban centre, such as Lahore, or from a remote village in Sindh: Maqsad believes in equal opportunity for all,” Aziz said.

“We are building a mobile-first platform, given that 95% of broadband users in Pakistan are via mobile. Most other platforms are not mobile optimized,” Aziz added.

“It’s about more than just getting students to pass their exams. We want to start a revolution in the way Pakistani students learn, moving beyond rote memorization to a place of real comprehension,” said co-founder Taha Ahmed, who was a former strategy consultant at LEK.

The company ran small pilots in April and May and started full-scale operations on 26 July, Aziz said, adding that Maqsad will launch its mobile app, currently under development, in the coming months in Q4 2021 and has a waitlist for early access.

“Struggles of students during the early days of the pandemic motivated us to run a pilot. With promising initial traction and user feedback, the size of the opportunity to digitize the education sector became very clear,” Aziz said.

The COVID-19 pandemic reshaped the education industry, heating up the global edtech startups that made online education more accessible for a wider population, for example in countries like India and Indonesia, Aziz mentioned.

The education market size in Pakistan is estimated at $12 billion and is projected to increase to $30 billion by 2030, according to Aziz.

It plans to build the company as a hybrid center offering online and offline courses like Byju’s and Aakash, and expand classes for adults such as MasterClass, the U.S.-based online classes for adults, as its long-term plans, Aziz said.

“Maqsad founders’ deep understanding of the problem, unique approach to solving it and passion for impact persuaded us quickly,” the founder and managing partner of Indus Valley Capital, Aatif Awan, said.

“Pakistan’s edtech opportunity is one of the largest in the world and we are excited to back Maqsad in delivering tech-powered education that levels access, quality and across Pakistan’s youth and creates lasting social change,” Ali Mukhtar, general partner of Fatima Gobi Ventures said.

Powered by WPeMatico

CoderSchool, a Ho Chi Minh City, Vietnam-based online coding school startup, announced today $2.6 million in pre-Series A funding to scale up its online coding school platform.

This round was led by Monk’s Hill Ventures, with participation from returning seed investors Iterative, XA Network and iSeed Ventures. CoderSchool raised a seed round led by TRIVE Ventures in 2018.

CoderSchool will use the funding to accelerate its online teaching platform growth and technology infrastructure expansion for the company’s technical education programs that guarantee employment upon graduation.

The company, founded in 2015 by Charles Lee and Harley Trung, who previously worked as software engineers, pivoted from offline to online in early 2020 to bring high-quality technical training to everyone, everywhere. After switching to a fully online learning program, the company recorded 100% quarter-over-quarter (QoQ) growth in fully online enrollment, it said in a statement.

“Coding is the future. At CoderSchool, we believe everyone in Southeast Asia deserves a chance to be part of that future,” the company co-founder and CEO Lee said.

In Vietnam, the demand for IT talent is dramatically increasing by 47% a year, while supply is only increasing by 8% year-on-year.

“The need for strong engineers and developers in Southeast Asia has never been as pertinent as it is today with the growth of tech companies and digital businesses,” said Michele Daoud, partner of Monk’s Hill Ventures. “We have been impressed by the team’s focus on setting the standard for coding education in the region. We are excited to partner with CoderSchool to provide both opportunity and access to the millions of aspiring students in Vietnam.”

Given the strong engineer demand in Vietnam, the domestic market size is estimated between $100 million – $200 million, and still increasing every year, according to Lee. CoderSchool has been focusing on Vietnam for the last six years, but plans to enter the global market following the next round, Lee said, without providing exact timetable.

CoderSchool, which offers full-stack web development, machine learning and data sciences courses at a lower cost, has trained more than 2,000 alumni up to date, and recorded over 80% job placement rate for full-time graduates, getting jobs at companies such as BOSCHE, Microsoft, Lazada, Shopee, FE Credit, FPT Software, Sendo, Tiki and Momo.

“After having taught over 2,000 students, we’ve been able to refine our [coding education] content. We rewrote our full-stack web development course — from Ruby, Phyton to JavaScript — in two years, and added new machine learning and data science courses to our program,” Lee told TechCrunch.

CorderSchool’s online program enables students to interact with instructors and classmates before, during and after scheduled class sessions with its human-driven learning strategy. CoderSchool currently has 15 instructional staff, and plans to hire 35 additional instructors by Q4 2022.

CoderSchool’s data analytics has improved individual student performance while also allowing CoderSchool to increase its classroom size at scale, reaching a peak of 107 enrollments in a data science class.

Powered by WPeMatico

A 22-month-old startup that is helping millions of blue- and gray-collar workers in India learn new skills and find jobs has become the youngest firm to join the coveted unicorn status in the world’s second-largest internet market.

Apna announced on Thursday that it has raised $100 million in a round led by Tiger Global. The new round — a Series C — valued Apna at $1.1 billion. TechCrunch reported last month that Tiger Global, an existing investor in Apna, was in talks to lead a $100 million financing round in the startup at the unicorn valuation.

Owl Ventures, Insight Partners, Sequoia Capital India, Maverick Ventures and GSV Ventures also participated in the new round, which is the third investment secured by Apna this year. Apna was valued at $570 million in its Series B round in June this year.

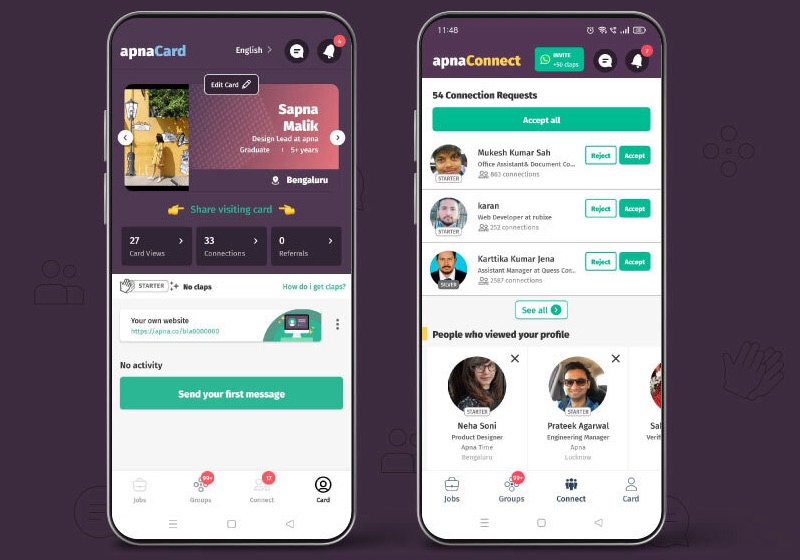

The investors’ excitement comes as Apna has demonstrated an impressive growth in recent months. The startup has amassed over 16 million users on its 15-month-old eponymous Android app, up from 10 million in June this year.

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the South Asian market.

Apna has built a platform that provides a community to these workers. In the community, they engage with each other, exchange notes to perform better at interviews and share tips to negotiate better compensation.

Image Credits: Apna

On top of this, Apna connects these workers to potential employers. In an interview with TechCrunch, Apna founder and chief executive Nirmit Parikh said more than 150,000 employers — including Zomato, Bharti AXA, Urban Company, BYJU’S, PhonePe, Burger King, Delhivery, Teamlease and G4S Global — are on the platform, and over 5 million jobs are active.

The startup, whose name is inspired from a cheerful 2019 Bollywood song, has facilitated over 18 million job interviews in the past 30 days, he said. Apna is currently operational in 28 Indian cities.

The idea for Apna came, Parikh has said, after he was puzzled to find that even as there are hundreds of millions of blue- and gray-collar workers in India, locating them when you need assistance with a task often proves very difficult.

Prior to starting Apna, Parikh, who previously worked at Apple, met these workers and went undercover as an electrician and floor manager to understand the problems they were facing. The problem, he found, was the disconnect. Workers had no means to find who needed them for jobs, and they were also not connected with one another. The community aspect of Apna, which now has over 70 such groups, is aimed at addressing this challenge.

The Apna app allows these workers to learn new skills to become eligible for more work opportunities. Apna has emerged as one of the fastest growing upskilling platforms — and that would explain why GSV Ventures and Owl Ventures, two high-profile firms known to back edtech startups, are investing in the Bangalore-based firm.

“Apna’s viral adoption is driven by a novel social and interactive approach to connecting employers with job seekers. We expect job seekers in search of meaningful connections and vetted opportunities to drive Apna’s continued explosive growth across India — and the world,” said Griffin Schroeder, partner at Tiger Global, in a statement.

Now the startup, which has started to monetize the platform, is ready to aggressively expand. Parikh said Apna will continue to expand to more cities in India and by early next year, Apna will begin its global expansion. Parikh said the startup is eyeing expansion in the USA, South East Asia and Middle East and Africa.

“We have already created a dent. Now we want to impact the lives of 2.3 billion,” he said. “We will require crazy amounts of resources and a world-class team to deliver. It’s a herculean task, and is going to take a village. But somebody has to solve it.”

Powered by WPeMatico

Are founders in fundraising mode short-sighted when it comes to working with Chinese venture funds?

Runa Capital’s Asia business development manager Denis Kalinin studied data from iTjuzi, a database of Chinese venture capitalists, and found:

“…Chinese funds invested around $250 billion in 2020 (three times higher than the figure reported in Crunchbase). This figure puts Chinese VC investments only 30% lower than investments by U.S. funds, but three times that of U.K. funds and 12.5 times more than German funds.”

The pandemic, geopolitical tensions and other factors led many Chinese venture funds to pare back their international investments, but that’s largely “because during COVID, China’s economy recovered much faster than other countries’,” writes Kalinin.

His analysis covers multiple angles: Chinese investments in Europe are catching up with those in Asia and the United States, half of China’s top cross-border investors are CVCs, and investors are particularly interested in fintech, deep tech and digital health at the moment.

“Chinese investors can bring value to foreign startups, but you need to study their expertise and how it can be useful for you.”

Full Extra Crunch articles are only available to members

Use discount code ECFriday to save 20% off a one- or two-year subscription

Today at 2 p.m. PT/5 p.m. ET on Twitter Spaces, Managing Editor Danny Crichton and immigration law attorney Sophie Alcorn will discuss whether remote work is making H-1B visas less critical for international founders.

It’s a provocative question: If remote teams are becoming the norm, tech hubs are decentralizing and investors are comfortable cutting checks after a Zoom call, how important is it to do business as a startup inside the U.S?

It’s sure to be an interesting conversation; to get a reminder, please follow @TechCrunch on Twitter.

Thanks very much for reading Extra Crunch this week!

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: Nigel Sussman (opens in a new window)

Toast released an early IPO price range of $30 to $33 per share on Monday, and Alex Wilhelm digs into the S-1/A filing to “better understand how to value vertical SaaS startups that are pursuing a payments-and-SaaS business approach.”

Is the restaurant software startup worth the $18 billion valuation it’s aiming for?

Image Credits: Peter Dazeley (opens in a new window) / Getty Images

Every founder who launches an enterprise software startup has to figure out the “right” pricing model for their products.

It’s a consequential decision: Per-seat licenses are easy to manage, but what if customers prefer a concurrent licensing model?

“Early pricing discussions should center around the buyer’s perspective and the value the product creates for them,” says Ridge Ventures partner Yousuf Khan, who previously worked as a CIO.

“Of course,” he notes, “self-evaluation is hard, especially when you’re asking someone else to pay you for something you’ve created.”

Image Credits: jayk7 / Getty Images

India’s mom-and-pop businesses are experiencing a digital transformation that’s creating new e-commerce opportunities; smartphones have replaced paper records, and a new government-backed instant payments system is disrupting how value is exchanged.

But instead of importing legacy credit systems, buy now, pay later systems are the “next step for solving the digital B2B puzzle,” writes Anubhav Jain, co-founder and CEO of Rupifi.

Image Credits: scyther5 / Getty Images

Freshworks, which develops and offers a variety of business software tools, set an IPO price range of $28 to $32 per share on Monday, meaning its valuation could reach nearly $10 billion, Alex Wilhelm writes.

“It appears that the Freshworks IPO is pretty reasonably priced as is, though a boost to its price range is not out of the question if public market investors decide that they are bullish on its future growth prospects. We just don’t see dramatic upside.”

ish on its future growth prospects. We just don’t see dramatic upside.”

Image Credits: Nigel Sussman (opens in a new window)

The multibillion-dollar exits of Japanese startup Paidy (to PayPal) and Australian buy now, pay later company Afterpay (to Square) “provided hard market proof that what BNPL startups are building has value beyond simple operating results,” Alex Wilhelm writes in The Exchange.

He breaks down the value of Afterpay, Paidy and Klarna using a simple metric: What would you pay for $1 of BNPL GMV?

Image Credits: mikkelwilliam (opens in a new window) / Getty Images

Video game livestreaming is booming.

Twitch has an average of almost 3 million concurrent viewers; by comparison, on the night of the 2020 U.S. presidential election, CNN’s livestream averaged 1.1 million.

The most successful streamers use their ad revenue and sponsorship money to hire video editors and social media teams to make them look good, but new automated tools are giving part-time streamers the ability to spotlight their best moments as well.

Image Credits: Boris Zhitkov (opens in a new window) / Getty Images

A data breach costs a company an average of $3.8 million, Marc Ellenbogen, Foursquare’s general counsel, notes in a guest post, adding up to a “concrete financial incentive to having The Privacy Talk.”

What is it?

“It’s the conversation that goes beyond the written, publicly posted privacy policy and dives deep into a customer, vendor, supplier or partner’s approach to ethics,” he writes.

If you think the talk doesn’t apply to you, think again.

Image Credits: Alexander Spatari (opens in a new window) / Getty Images

In an effort to “reassure local administrations that micromobility is safe, compliant and a good thing for cities,” scooter operators are “implementing technology similar to advanced driver assistance systems (ADAS) usually found in cars,” Rebecca Bellan writes.

She breaks down how the tech could help prevent unwanted behavior and explores the cost for scooter operators and opportunities for startups.

Powered by WPeMatico

Both as a term and as a financial product, “buy now, pay later” has become mainstream in the past few years. BNPL has evolved to assume various forms today, from small-ticket offerings by fintechs on consumer checkout platforms and marketplaces, to closed-loop products offered on marketplaces such as Amazon Pay Later (which they are now extending for outside use as well). You can also see some variants offered by companies that want to expand the scope of consumption and consumer credit.

Globally, BNPL has seen the most growth in the consumer segment and has driven retail consumption and lending over the past few years. Consumer BNPL offerings are a good alternative to credit cards, especially for people who do not have a credit history and can’t get credit from banks. That said, a specific vertical of BNPL products is gaining traction — one targeted toward small and medium enterprises (SMEs). This new vertical is known as “SME BNPL.”

BNPL can be particularly useful when flow-based underwriting or transaction-based underwriting is used to offer credit to small businesses.

E-commerce has seen tremendous growth in India over the past decade. Skyrocketing smartphone and internet penetration led to rapid growth in e-commerce across large cities and smaller towns alike. Consumer credit has also taken off in parallel as credit cards and digital lending spurred credit-based consumption across offline and online stores.

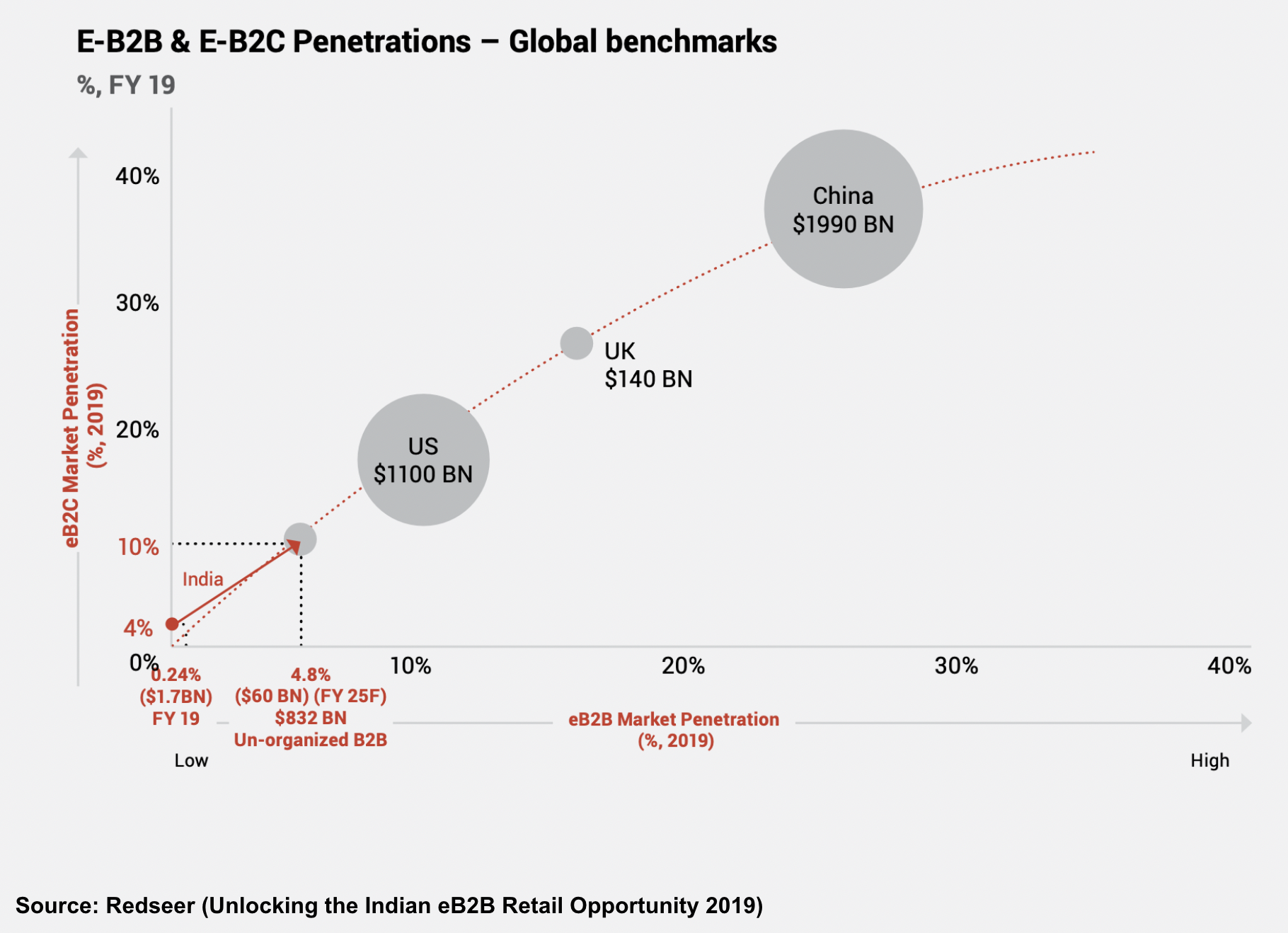

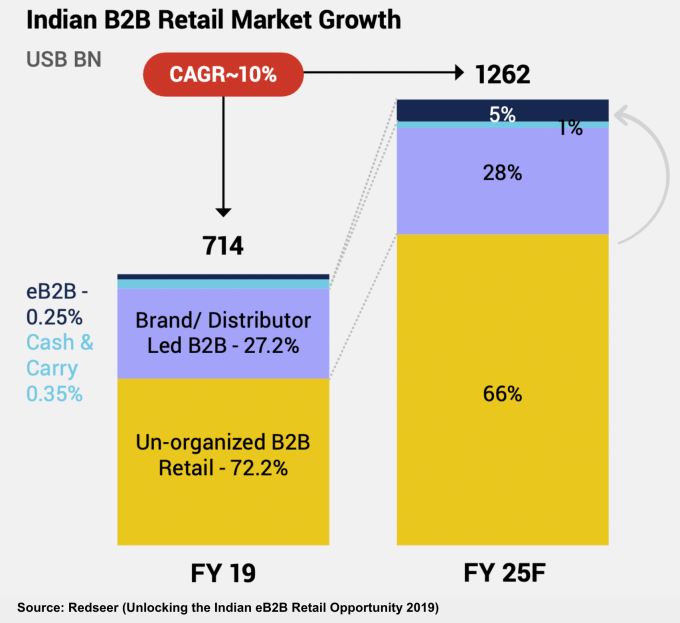

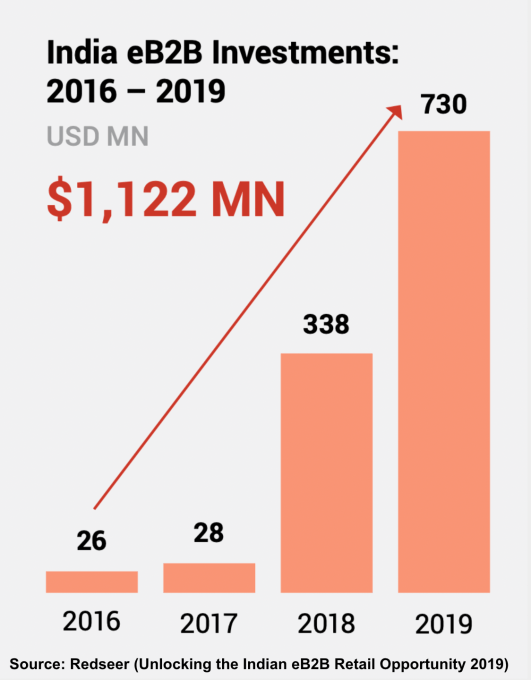

However, the large B2B supply chain enabling the burgeoning retail market was plagued by bottlenecks and inefficiencies because it involved a plethora of intermediaries and streamlining became a big problem. A number of tech players responded by organizing the previously disorganized B2B commerce market at various touch points, inserting convenience, pricing and easier product access through tech-enabled logistics and a modern supply chain.

Image Credits: Redseer

India’s B2B e-commerce space has developed rapidly since 2020. Small businesses have moved from using paper to smartphone apps for running a significant part of their day-to-day business, leading to widespread disruption in how businesses transact today. The COVID-19 pandemic also forced small businesses, which were earlier using physical means to procure goods and services, to try new and online models to conduct their affairs.

Image Credits: Redseer

Moreover, the Indian government’s widespread promotion of an instant payments system in the form of the Unified Payments Interface (UPI) has changed how people send money to each other or pay merchants for their goods and services. The next step for solving the digital B2B puzzle is to embed credit inside every transaction and invoice.

Image Credits: Redseer

If we compare online B2B transactions to the offline world, there is only one missing link: The terms offered to small businesses by their supplier/distributor or vendor. Businesses, unlike consumers, must buy goods and services to eventually trade them, or add value and sell to consumers or others down the value chain. This process is not immediate and has a certain time cycle attached.

The longer sales cycle means many small businesses require credit payment terms when buying inventory. As B2B commerce scales and grows through digital means, a BNPL product that caters to the needs of SMEs can support their growth and alleviate the burden on their cash flows.

An SME BNPL product is a purchase financing product for small businesses transacting with suppliers, distributors, aggregator platforms or B2B marketplaces.

Powered by WPeMatico

China’s first data privacy laws go into effect on November 1, 2021. Will your company be in compliance?

Modeled after the EU’s GDPR, the new regulations “[introduce] perhaps the most stringent set of requirements and protections for data privacy in the world,” writes Scott W. Pink, special counsel in O’Melveny’s Data Security & Privacy practice.

In a comprehensive overview, he explains its key requirements and compliance steps for U.S.-based firms that service Chinese consumers.

“American firms doing business in China or with companies inside China will need to immediately start assessing how this new law will impact their activities,” he advises.

Now that the world has embraced remote work, are visas as critical for startup founders who want to succeed in the United States?

On Tuesday, September 14, at 2 p.m PT/5 p.m. ET, Managing Editor Danny Crichton and immigration law attorney Sophie Alcorn will discuss the matter on Twitter Spaces.

Join @DannyCrichton on Tuesday, September, 14 at 2 p.m. PT/5 p.m. ET as he discusses if remote work will make H-1B visas redundant with @Sophie_Alcorn https://t.co/SCMUiqUj8J

— TechCrunch (@TechCrunch) September 10, 2021

They’ll take questions from the audience, so mark your calendar and follow @techcrunch on Twitter to get a reminder before the chat.

Thanks very much for reading Extra Crunch; I hope you have a great weekend.

Walter Thompson

Senior Editor, TechCrunch

@yourprotagonist

Image Credits: hauged (opens in a new window) / Getty Images

Whether or not he actually said it, “buy land, they ain’t making any more of it,” is one of Mark Twain’s best quotes on capitalism.

Past recessions and the ongoing pandemic have created real uncertainty about the future of commercial and residential real estate, but farmland is “historically stable,” says Artem Milinchuk, founder and CEO of FarmTogether.

Image Credits: mikroman6 (opens in a new window) / Getty Images

Online mortgage company Better.com isn’t waiting to complete its SPAC merger before making big moves: Ryan Lawler reported that it purchased Property Partners, a U.K.-based startup that offers fractional property ownership.

It’s the second company Better bought in recent months: In July, it snapped up digital mortgage brokerage Trussle.

“We aren’t so easily categorized,” said Better CEO Vishal Garg, who told Ryan that the company plans to soon expand into traditional financial services like auto loans and insurance.

Said CFO Kevin Ryan, “a lot of people have their niches in the way they’re attacking this, but we feel like we’re on a path to being full stack where everything’s embedded in the same flow.”

Image Credits: JoKMedia (opens in a new window) / Getty Images

If you don’t have a good story to share, it doesn’t matter how big your marketing budget is.

“Paid marketing can be a useful tool in your toolkit to accelerate an already humming flywheel. Just don’t let it be the only one,” suggests Brian Rothenberg, a two-time founder who’s now a partner at Defy.

Drawing from his time as VP of growth for Eventbrite, he shares five critical factors for kick-starting, maintaining and measuring growth over the long term.

Image Credits: Peter Dazeley (opens in a new window) / Getty Images

Many potential founders are well-versed in startup economics — and many are completely green.

When it comes to raising funds, understanding the relative benefits (and limitations) of debt and equity financing is required knowledge, however.

Founders who are less willing to dilute their control may be willing to use debt financing to fund their capital expenditures, “but it doesn’t make sense for everyone,” says six-time entrepreneur David Friend.

Image Credits: Getty Images

Last year, startups based in Southeast Asia raised more than $8.2 billion, a 4x increase from 2015.

In the first half of 2021, regional M&A has increased 83% to a record $124.8 billion.

It’s not just venture capitalists and Big Tech who are beefing up their presence in the region.

“Over 229 family offices have been registered in Singapore since 2020, with total assets under management of an estimated $20 billion,” writes Amit Anand, a founding partner of Jungle Ventures.

Image Credits: Bryce Durbin / TechCrunch

Natasha Mascarenhas examined the parallels between edtech and the creator economy, both of which boomed amid the pandemic — and blurred amid the rise of cohort-based classes.

“Edtech and the creator economy certainly differ in the problems they try to solve: Finding a VR solution to make online STEM classes more realistic is a different nut to crack than streamlining all of a creator’s different monetization strategies into one platform. Still, the two sectors have found common ground in the past year.”

Image Credits: Liyao Xie (opens in a new window) / Getty Images

Were the shoes, jacket and makeup that looked so good on Instagram (and in your shopping cart) disappointing when you put them on for the first time?

Due to buyer’s remorse, it’s not uncommon for apparel or beauty products to languish in the back of a drawer or end up as gifts, but there are also serious consequences.

“The beauty industry produces over 120 billion units of packaging every year, little of which is recycled. Globally, an estimated 92 million tons of textile waste ends up in landfills,” Sindhya Valloppillil, founder and CEO of Skin Dossier, notes in a guest column.

The answer to bringing sustainability to the industry, she says, is using tech to personalize the retail experience:

Image Credits: Bryce Durbin / TechCrunch

Twenty million people live in Lagos, Nigeria, and each day, 14 million of them use the city’s transit system.

Travelers rely on overcrowded public buses that navigate congested routes: What should be a 30-minute trip is often a three-hour journey, but Treepz CEO and co-founder Onyeka Akumah “has big plans to ameliorate the public transport infrastructure in Africa and beyond,” writes Rebecca Bellan.

“We wanted to give people a better way to commute with predictability, where they can know when the bus will get here, the certainty that they will have a seat in a vehicle, that it’s a decent vehicle and a safe one where you can bring your laptop,” said Akumah.

“Those are the things we said we wanted to change.”

Image Credits: Bryce Durbin/TechCrunch

Dear Sophie,

My husband just accepted a job in Silicon Valley. His new employer will be sponsoring him for an E-3 visa.

I would like to continue working after we move to the United States. I understand I can get a work permit with the E-3 visa for spouses.

How soon can I apply for my U.S. work permit?

— Adaptive Aussie

Powered by WPeMatico

Epic Games has asked Apple to rejoin its Fortnite developer account in South Korea as the U.S. game maker plans to re-release Fortnite on iOS in South Korea, offering both Epic and Apple payments side-by-side, it said in a tweet.

Epic has asked Apple to restore our Fortnite developer account. Epic intends to re-release Fortnite on iOS in Korea offering both Epic payment and Apple payment side-by-side in compliance with the new Korean law.

— Fortnite (@FortniteGame) September 9, 2021

This request comes after South Korea passed a bill, the updated Telecommunications Business Act, in late August that will force Apple and other tech giants to let developers use their third-party payment systems.

“Epic intends to re-release Fortnite on iOS in Korea offering both Epic payment and Apple payment side-by-side in compliance with the new Korea law,” according to the official Fortnite Twitter account.

“As we’ve said all along, we would welcome Epic’s return to the App Store if they agree to play by the same rules as everyone else. Epic has admitted to breach of contract and as of now, there’s no legitimate basis for the reinstatement of their developer account,” Apple said in its statement.

Epic would also have to agree to comply with Apple’s App Store Review Guidelines regarding all apps, but Epic has not consistently abided by the Guidelines, and their request of Apple does not indicate any change in Epic’s position, added Apple’s statement.

Even if the South Korean legislation, which is not yet effective, were to become law in the country, it would impose no obligation on Apple to approve any developer program account application, based on Apple’s statement.

In August 2020, Apple kicked Fortnite off the App Store after Epic introduced a direct payment system in Fortnite that violated Apple’s in-app purchase requirement. The two companies have been embroiled in a legal dispute over the Apple Store’s payment system.

Apple is changing its app policy to allow developers to link to external websites and it also has reached a settlement with Japan for allowing developers of “reader” apps to link to their own websites.

An Epic Games spokesperson did not immediately respond to a request for comment.

Powered by WPeMatico

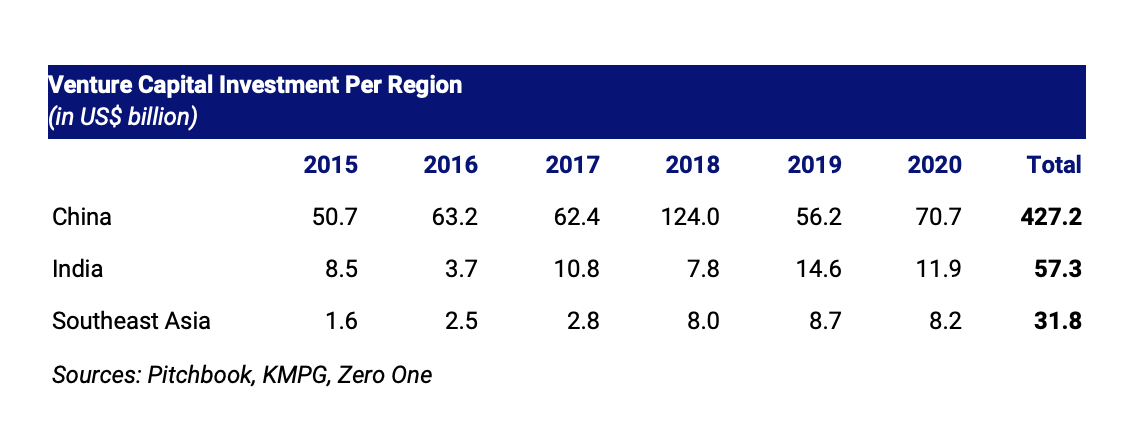

Southeast Asian tech companies are drawing the attention of investors around the world. In 2020, startups in the region raised over $8.2 billion, about four times more than they did in 2015. This trend continued in 2021, with regional M&A hitting a record high of $124.8 billion in the first half of 2021, up 83% from a year earlier.

This begs the question: Who exactly is investing in Southeast Asia?

Let’s explore the three key types of investors pouring money into and driving the growth of Southeast Asia’s tech ecosystem.

Over 229 family offices have been registered in Singapore since 2020, with total assets under management of an estimated $20 billion.

Southeast Asia has become an attractive market for U.S. and Chinese tech firms. Internet penetration here stands at 70%, higher than the global average, and digital adoption in the region remains nascent — it wasn’t until the pandemic that adoption of digital services such as e-wallets and online shopping took off.

China’s tech giants Tencent and Alibaba were among the first to support early e-commerce growth in Southeast Asia with investments in Sea Limited and Lazada, and have since expanded their footprint into other internet verticals. Alibaba has backed Akulaku, M-Pay (eMonkey), DANA, Wave Money and Mynt (GCash), while Tencent has invested in Voyager Innovations (PayMaya), SHAREit, iflix, Ookbee and Sanook.

U.S. tech firms have also recently entered the scene. In June 2020, Gojek closed a $3 billion Series F round from Google, Facebook, Tencent and Visa. Google, together with Singapore’s Temasek Holdings, invested some $350 million in Tokopedia in October. Meanwhile, Microsoft invested an undisclosed amount in Grab in 2018 and has invested $100 million in Indonesian e-commerce firm Bukalapak.

In Q1 2021, Southeast Asian startups raised $6 billion, according to DealStreetAsia, positioning 2021 as another record year for VC investment in the region.

The region is also rising in prominence as a destination for investment capital relative to the rest of Asia. Regional VC investment grew 5.2 times to $8.2 billion in 2020 from $1.6 billion in 2015, as we can see in the table below.

Image Credits: Jungle VC

Southeast Asia also has many opportunities for VC investment relative to its market size. From 2015 to 2020, China saw VC investment of nearly $300 per person; for Southeast Asia — despite a recent investment boom — this metric sits at just $47.50 per person, or just a sixth of that in China. This implies a substantial opportunity for investments to develop the region’s digital economy.

The region’s rising population and growth prospects are higher due to China’s population growth challenges, alongside the latter’s higher digital economy market saturation and maturity.

Powered by WPeMatico

PayPal Holdings, the U.S. fintech company, announced an acquisition of Paidy, a Japanese buy now, pay later (BNPL) service platform, for approximately $2.7 billion (300 billion yen), mostly in cash, to enhance its business in Japan.

The transaction completion, including the regulatory approval, is expected in the fourth quarter of 2021.

After the acquisition, the Japan-based company will continue to operate its existing business and maintain the brand while the leaders, Paidy’s president and CEO Riku Sugie and founder and executive chairman Russell Cummer, keep their positions.

Japan is the third largest e-commerce market in the world, and so this is a significant move by PayPal to gain more market share both in the country and the region, specifically in the area of providing deferred payment services as an alternative to credit cards.

PayPal has long played nice with payment cards — users can upload details of their cards to PayPal and use it as a kind of digital wallet to manage how they pay for things online through it — but it got its start actually as a payment platform in itself, where people could pay into and out of PayPal accounts. Paidy is, in that sense, a strengthening of PayPal’s first-party rails, providing a way to “own” that flow of money on its own infrastructure, not involving the card networks.

Paidy is basically a two-sided payments service, acting as a middleman between consumers and merchants in Japan. Using machine learning it determines the creditworthiness of a consumer related to a particular purchase, and then it underwrites those transactions in seconds, guaranteeing payments to merchants. Consumers then make deferred payment to Paidy for those goods.

Paidy’s platform, which offers a monthly payment installment service branded “3-Pay”, enables shoppers to make purchases online and then pay for them each month in a consolidated bill at a convenience store or via bank transfer.

“Paidy pioneered buy now, pay later solutions tailored to the Japanese market and quickly grew to become the leading service, developing a sizable two-sided platform of consumers and merchants,” said Peter Kenevan, vice president, head of Japan at PayPal.

Paidy has more than 6 million registered users, and the plan is to integrate PayPal and other digital and QR wallets with Paidy Link to connect further online and offline merchants.

In April 2021, the Japan-based company launched Paidy Link, allowing users to link digital wallets with their Paidy account. PayPal was the first digital wallet partner to integrate with Paidy Link.

“PayPal was a founding partner for Paidy Link and we look forward to looking together to create even more value,” Sugie said in a statement.

“Japan has been a vibrant environment for our growth to date and we’re honored to have our team’s hard work and potential recognized by a global leader. Together with PayPal, we will be able to further achieve our mission of taking the hassle out of shopping,” Cummer said.

Powered by WPeMatico