Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Mobile Premier League (MPL) has raised $90 million in a new financing round as the two-year-old Bangalore-based esports and mobile gaming platform demonstrates fast-growth and looks to expand outside of India.

SIG, early-stage tech investor RTP Global and MDI Ventures led MPL’s $90 million Series C financing round, with participation from existing investors Sequoia India, Go-Ventures and Base Partners. Times Internet is also an early investor in MPL. The new investment brings MPL’s to-date raise to $130.5 million. It was valued between $375 million to $400 million pre-money, according to a person familiar with the matter.

MPL operates a pure-play gaming platform that hosts a range of tournaments. The app, which has amassed more than 60 million users, also serves as a publishing platform for other gaming firms. MPL, which does not develop games of its own, hosts about 70 games across multiple sports on the app today.

It’s a heist! And it has gone rogue! Can you beat the others to win the game? Rogue Heist, India’s very own multi-player shooter game, coming soon on MPL! Here’s a sneak peek 😉 pic.twitter.com/PkVAjN2b4O

— Mobile Premier League (@PlayMPL) April 20, 2020

The Bangalore-based startup also offers fantasy sports, a segment that has taken off in many parts of India in recent years.

Because fantasy sports is only one part of the business, the coronavirus outbreak that has shut most real-world matches has not impeded the startup’s growth in recent months. The startup claimed it has grown four times since March this year, and more than 2 billion cash transactions have been recorded on the app to date.

“We’re competing with battle-hardened, decade old companies with much, much deeper pockets but it’s incredible what the young team has achieved over the past couple of years. When we were on the Play Store, a couple of years back, MPL was the fastest app to reach a 1M DAU ever in India!” tweeted Abhishek Madhavan, SVP of Marketing at MPL. “We signed Virat Kohli (pictured above), when we were a 3-month old company! When we got out of the Play Store, we were told growth will be very very hard to come by, every single marketing metric would fall.”

Sai Srinivas, co-founder and chief executive of Mobile Premier League, told TechCrunch in an interview that the new financing round validates that esports is here to stay and it is beginning to see its e-commerce moment.

“I believe that esports will be inducted by the Olympics way before than cricket does. And the market cap of esports will most probably will exceed those of all physical sports combined in the next 10 years,” he said.

“Even in an environment as challenging as the current one, we are impressed with the success and accessibility of the platform concept – giving users a unique variety of experiences and social interaction. MPL’s track record speaks for itself, so we’re excited to support the team as they grow and expand,” said Galina Chifina, managing partner at RTP Global, in a statement.

But since an aspect of MPL is about fantasy sports, its app is not available on the Google Play Store. Google Play Store prohibits online casinos, and other kinds of betting, a guideline Google reiterated last week as it pulled Indian financial services platform Paytm from the app store for eight hours. Srinivas declined to comment on Google and Paytm’s episode.

The startup plans to expand outside of India in the following months, said Srinivas. He did not name the new markets, but suggested that India’s neighboring countries as well as Japan and South Korea will likely be part of it.

The startup also plans to expand its gaming catalog and offer more marketing support to third-party developers, who currently either sell licenses to MPL or work through a revenue-sharing agreement with the Indian startup.

Powered by WPeMatico

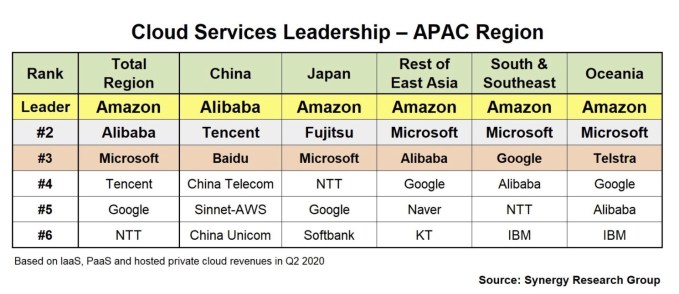

When you look at the Asia-Pacific (APAC) regional cloud infrastructure numbers, it would be easy to think that one of the Chinese cloud giants, particularly Alibaba, would be the leader in that geography, but new numbers from Synergy Research show Amazon leading across the region overall, which generated $9 billion in revenue in Q2.

The only exception to Amazon’s dominance was in China, where Alibaba leads the way with Tencent and Baidu coming in second and third, respectively. As Synergy’s John Dinsdale points out, China has its own unique market dynamics, and while Amazon leads in other APAC sub-regions, it remains competitive.

“China is a unique market and remains dominated by local companies, but beyond China there is strong competition between a range of global and local companies. Amazon is the leader in four of the five sub-regions, but it is not the market leader in every country,” he explained in a statement.

Image Credits: Synergy Research

The $9 billion in revenue across the region in Q2 represents less than a third of the more than $30 billion generated in the worldwide market in the quarter, but the APAC cloud market is still growing at more than 40% per year. It’s also worth pointing out as a means of comparison that Amazon alone generated more than the entire APAC region, with $10.81 billion in cloud infrastructure revenue in Q2.

While Dinsdale sees room for local vendors to grow, he says that the global nature of the cloud market in general makes it difficult for these players to compete with the largest companies, especially as they try to expand outside their markets.

“The challenge for local players is that in most ways cloud is a truly global market, requiring global presence, leading edge technology, strong brand name and credibility, extremely deep pockets and a long-term focus. For any local cloud companies looking to expand significantly beyond their home market, that is an extremely challenging proposition,” Dinsdale said in a statement.

Powered by WPeMatico

Indian food delivery startup Zomato has raised $100 million from Tiger Global and is preparing for the next phase of its journey: an IPO.

Tiger Global financed the capital through its investment vehicle Internet Fund VI, according to a regulatory filing. Info Edge, a major investor in Zomato, confirmed the development Thursday evening, adding that the new round valued Zomato at $3.3 billion post-money.

In an email to employees earlier today, Zomato co-founder and chief executive Deepinder Goyal said the startup had about $250 million cash in the bank and several more “big name” investors would be joining the current round to increase its cash reserve to about $600 million “very soon.”

“Important note — we have no immediate plans on how to spend this money. We are treating this cash as a ‘war-chest’ for future M&A, and fighting off any mischief or price wars from our competition in various areas of our business,” he added in the letter, reviewed by TechCrunch.

Zomato, which acquired the Indian food delivery business of Uber early this year, competes with Prosus Ventures-backed Swiggy in India. A third player, Amazon, has also emerged in the market, though it is currently servicing food delivery in only select suburbs of Bangalore.

Goyal told employees that the 12-year-old startup is also working for its IPO for “sometime in the first half of next year.” (It’s unclear how Zomato plans to achieve this target, but it is likely looking at listing in the U.S. or some other market. Current Indian law requires a startup to be profitable for at least three years before they could publicly list in India — though there has been some proposal to relax this requirement.)

The new pledge from Zomato is the result of a major economic improvement in its business in recent quarters. Until mid-last year, Zomato was losing more than $50 million a month to win and sustain customers by offering heavy discounts.

The Gurgaon-headquartered firm, which like Swiggy eliminated hundreds of jobs in recent months as coronavirus ruined the appetite of Indians ordering food online, said in July that its losses for the month would be less than $1 million.

The startup also faced obstacles in raising new capital. It kickstarted its financing round a year ago, but had secured only $50 million as of a month ago. The startup had originally anticipated closing this round, at about $600 million, in January this year.

In an emailed response to TechCrunch queries in April, Goyal had attributed the delays to the spread of coronavirus and said he expected to close the round by mid-May. He wrote to employees today that Tiger Global, Temasek, Baillie Gifford and Ant Financial had already participated in the current round.

Powered by WPeMatico

Even as more than 150 million people are using digital payment apps each month in India, only about 20 million of them invest in mutual funds and stocks. A startup that is attempting to change that by courting millennials has just received a big backing.

Bangalore-headquartered Groww said on Thursday it had raised $30 million in its Series C financing round. YC Continuity, the growth-stage investment fund of Y Combinator, led the round, while existing investors Sequoia India, Ribbit Capital and Propel Ventures participated in it. The new round brings three-year-old startup Groww’s total raise-to-date to $59 million.

Groww allows users to invest in mutual funds, including systematic investment planning (SIP) and equity-linked savings. The app maintains a very simplified user interface to make it easier for its largely millennial customer base to comprehend the investment world. It offers every fund that is currently available in India.

In recent months, the startup has expanded its offerings to allow users to buy stocks of Indian firms and digital gold, said Lalit Keshre, co-founder and chief executive of Groww, in an interview with TechCrunch. Keshre and other three co-founders of Groww worked at Flipkart before launching their own startup.

Groww has amassed over 8 million registered users for its mutual fund offering, and over 200,000 users have bought stocks from the platform, said Keshre. The new fund will allow Groww to further expand its reach in the country and also introduce new products, he said.

One of those products is the ability to allow users to buy stocks of U.S.-listed firms and derivatives, he said. The startup is already testing this with select users, he said.

“We believe Groww is building the largest retail brokerage in India. At YC, we have known the founders since the company was just an idea and they are some of the best product people you will meet anywhere in the world. We are grateful to be partners with Groww as they build one of the largest retail financial platforms in the world,” said Anu Hariharan, partner at YC Continuity, in a statement.

More than 60% of Groww users come from smaller cities and towns of India and 60% of these have never made such investments before, said Keshre. The startup is conducting workshops in several small cities to educate people about the investment world. And that’s where the growth opportunities lie.

“India is seeing increased participation of retail investors in financial markets — with 2 million new stock market investors added in the last quarter alone,” said Ashish Agrawal, principal at Sequoia Capital India, in a statement.

Scores of startups such as Zerodha, INDWealth and Cube Wealth have emerged and expanded in India in recent years to offer wealth management platforms to the country’s growing internet population. Many established financial firms such as Paytm have also expanded their offerings to include investments in mutual funds. Amazon, which has aggressively expanded its financial services catalog in India in recent months, also sells digital gold in the country.

Powered by WPeMatico

Based in Bangkok, Freshket simplifies the process of getting fresh produce from farms to tables. Launched in 2017, the startup has now raised a $3 million Series A, led by Openspace Ventures.

Other participants included Thai private equity firm ECG-Research; Innospace; and Pamitra Wineka and Ivan Sustiawan, the co-founders of Indonesian agriculture technology startup TaniHub. French-Singaporean food conglomerate Denis Asia Pacific and Thai family office Seedersclub, who made previous investments in Freshket, also returned for the Series A.

Freshket’s technology includes an e-commerce marketplace that connects farmers and food processors to businesses, like restaurants, and consumers in Thailand. The startup was co-founded by chief executive Ponglada Paniangwet and chief marketing officer Tuangploi Chiwalaksanangkoon, who each worked in marketing before launching Freshket three years ago.

Paniangwet told TechCrunch she wanted to enter agritech because her family has worked in the agriculture business for 25 years. “I grew up learning a lot about what worked and didn’t work in the industry,” Paniangwet said. “Overall, the industry is tedious, messy and highly manual.”

Freshket’s goal is to become “an enabler for the entire food supply chain,” she added.

Before Freshket, Paniangwet started a processing center, which sources, cuts and trims fresh produce at wholesale fresh markets before delivering them to restaurants and other customers. She realized technology could be used to simplify the supply chain, increasing farmers’ incomes and the quality of produce received by customers.

There is also ample market opportunity. According to an April 2019 Euromonitor International report, the food service market in Thailand is worth over $7.7 billion in annual purchases, made by more than 200,000 restaurants (link in Thai).

Chiwalaksanangkoon, who was already good friends with Paniangwet, left her position at one of Thailand’s largest banks to co-found Freshket. The company’s platform pull together Thailand’s fragmented produce supply chain by bringing together processing centers and suppliers, and connecting them directly with farmers, who usually rely on middlemen. Freshket also provides its users with data to help them predict supply and demand for their crops.

The expenses of operating a delivery business, especially for perishable goods, can be very high. To stay cost-efficient, Freshket itself doesn’t stock fresh produce. Instead, Freshket tells its network, including farmers, how much product they will need to provide on a daily basis, so they can plan their supply chains.

Paniangwet also said the B2B food delivery business has high average order values, fortifying its unit economics. Freshket’s order, warehouse and logistics management systems are all linked together and “because of that, we are able to control the flow of goods, limit additional and labor costs and keep our overall cost base manageable,” she said.

Freshket’s main rivals in the B2B space are traditional supply chain businesses; in the consumer space, it is up against include grocery delivery startups. It competes with delivery apps by offering lower retail prices, since Freshket is already tapped into a streamlined supply chain. For B2B customers, Freshket’s selling points include more precise delivery, a wider variety of products and produce gradings.

Freshket’s new funding will be used to upgrade its supply management technology. In the future, Paniangwet said the company plans to add more services, like financing, demand forecasting and price matching.

Freshket is among several startups in Southeast Asia markets focused on streamlining the food supply chain in different countries. Others include TaniHub and Eden Farm in Indonesia, Agribuddy in Cambodia and Singapore-based Glife.

This is the third agritech investment Openspace Ventures, which focuses on early-stage companies in Southeast Asia, has made (the other are TaniHub and Singaporean grocery platform RedMart).

In a press statement about the investment, Openspace Ventures founding partner Hian Goh said, “As Openspace Ventures’ second investment in Thailand this year, Freshket reflects our growing conviction in the potential of the Thai market for high quality and innovative startups.”

Powered by WPeMatico

Nreal, one of the most-watched mixed reality startups in China, just secured $40 million from a group of high-profile investors in a Series B round that could potentially bring more adoption to its portable augmented headsets.

Kuaishou, the archrival to TikTok’s Chinese version Douyin, led the round, marking yet another video platform to establish links with Nreal, following existing investor iQiyi, China’s own Netflix. Like other major video streaming sites around the world, Kuaishou and iQiyi have dabbled in making augmented reality content, and securing a hardware partner will no doubt be instrumental to their early experiments.

Other backers in the round with plentiful industry resources include GP Capital, which counts state-owned financial holding group Shanghai International Group and major Chinese movie studio Hengdian Group as investors; CCEIF Fund, set up by state-owned telecom equipment maker China Electronics Corporation and state-backed investment bank China International Capital Corporation; GL Ventures, the early-stage fund set up by prominent private equity firm Hillhouse Capital; and Sequoia Capital China.

In early 2019, Nreal brought onboard Xiaomi founder’s venture fund Shunwei Capital for its $15 million Series A funding. As I wrote at the time, AR, VR, MR, XR — whichever marketing coinage you prefer — will certainly be a key piece in Xiaomi’s Internet of Things empire. It’s not hard to see the phone titan sourcing smart glasses from Nreal down the road.

The other key partner of Nreal, a three-year-old company, is Qualcomm . The chipmaker has played an active part in China’s 5G rollout, powering major Chinese phone makers’ next-gen handsets. It supplies Nreal with its Snapdragon processors, allowing the startup’s lightweight mixed reality glasses to easily plug into an Android phone.

“Its closer partnership with Qualcomm will allow it to access Qualcomm’s network of customers, including telecoms companies,” Seewan Toong, an industry consultant on AR and VR, told TechCrunch.

Indeed, the mixed reality developer has already signed a deal with Japanese telco KDDI and in Korea, it’s working with LG’s cellular carrier LG Uplus Corp.

The latest round brings Nreal’s total raise to more than $70 million and will accelerate mass adoption of its mixed reality technology in the 5G era, the company said.

It remains to be seen how Nreal will live up to its promise, secure users at scale and move beyond being a mere poster child for tech giants’ mixed reality ambitions. So far its deals with big telcos are in a way reminiscent of that of Magic Leap, which has been in a legal spat with Nreal, though the Chinese company appears to burn through less cash so far. The troubled American company is currently pivoting to relying on enterprise customers after failing to crack the consumer market.

“Nreal is patient and not in a rush to show they can start selling high volume. It’s trying to prove that there’s a user scenario for its technology,” said Toong.

Powered by WPeMatico

As Slack ramps up its investment in Asia, Toss Lab, the South Korea-based creator of enterprise collaboration platform JANDI, is preparing to become a more formidable rival. The startup announced today that it has raised a $13 million Series B led by SoftBank Ventures Asia, the early-stage venture arm of SoftBank Group. Participating investors also included SV Investment, Atinum Investment, Must Asset Management, Shinhan Capital, SparkLabs and T Investment.

Founded in 2014, Toss Lab said the round means it is the first Korean company in the collaboration space to raise over $20 million to date. The company says JANDI is the top collaboration platform in Japan and Taiwan. It serves companies ranging from small to mid-sized businesses to large enterprises with thousands of employees. Its clients include LG CNS (the Korean conglomerate’s IT services subsidiary), Korean tire manufacturer Nexen Tire and Lexus. Toss Labs says its revenue has grown more than 100% over the past three years.

Matthew Kim, chief executive of Toss Lab, told TechCrunch that the Series B will be used for global expansion and to increase the company’s headcount by 20% to 25%.

JANDI has seen a 80% increase in the number of users acquired during the COVID-19 pandemic across its Asian markets. To serve remote workers, JANDI added integration with Zoom, enhanced its security and developed an advanced admin dashboard.

The platform currently supports English, Chinese, Japanese, Korean and Vietnamese, and plans to grow its operations in Japan, Taiwan, Malaysia, Vietnam and the Middle East.

Last October, Slack said it was planning to increase its investment in Asia, including new data regions in Japan and Australia.

But Kim said JANDI’s biggest rival isn’t Slack. Instead, it is competing against popular messaging apps, like Line, Kakao, WhatsApp, Zalo and Facebook Messenger, which Kim said the majority of workers in Asia still rely on for workplace communication. While Slack is used by some startups and tech companies in Asia, Chatwork and Base.vn are the top collaboration platforms in Japan and Vietnam, respectively, while JANDI is the leader in South Korea and Taiwan.

One of JANDI’s advantages is that “we are currently integrating with the legacy systems that are unique in each region and we have the local onboarding support team for enterprise,” said Kim. He added that Japan and Taiwan have the most growth potential in the near-term, followed by the United Arab Emirates, Malaysia and Indonesia.

Like other collaboration platforms, JANDI offers messaging and group chats. But it also features collaboration tools that the company says is geared toward work culture in its Asian markets. These include organization charts to help people find colleagues by department; a “board view” for company announcements and reports; video calls that can support up to 300 participants at a time; read receipts; and a secure file manager for storing confidential team documents.

As part of the funding, Toss Labs also added four new board directors: Ticket Monster founder Daniel Shin and former Kakao chief strategy officer Joon-yeol Kang, the founders of Bass Investment; SoftBank Ventures Asia CEO JP Lee; and SBI Investment Korea CEO Joon-hyo Lee. Sendbird CEO John S. Kim and Bespin Global founder HanJoo Lee are joining as advisors to Toss Labs.

Powered by WPeMatico

For years, India has served as the largest open battleground for Silicon Valley and Chinese firms searching for their next billion users.

With more than 400 million WhatsApp users, India is already the largest market for the Facebook-owned service. The social juggernaut’s big blue app also reaches more than 300 million users in the country.

Google is estimated to reach just as many users in India, with YouTube closely rivaling WhatsApp for the most popular smartphone app in the country.

Several major giants from China, like Alibaba and Tencent (which a decade ago shut doors for most foreign firms), also count India as their largest overseas market. At its peak, Alibaba’s UC Web gave Google’s Chrome a run for its money. And then there is TikTok, which also identified India as its biggest market outside of China.

Though the aggressive arrival of foreign firms in India helped accelerate the growth of the local ecosystem, their capital and expertise also created a level of competition that made it too challenging for most Indian firms to claim a slice of their home market.

New Delhi’s ban on 59 Chinese apps on June 30 on the basis of cybersecurity concerns has changed a lot of this.

Indian apps that rarely made an appearance in the top 20 have now flooded the charts. But are these skyrocketing download figures translating to sustaining users?

An industry executive leaked the download, monthly active users, weekly active users and daily active users figures from one of the top mobile insight firms. In this Extra Crunch report, we take a look at the changes New Delhi’s ban has enacted on the world’s second largest smartphone market.

Scores of startups in India, including news aggregator DailyHunt, on-demand video streamer MX Player and advertising giant InMobi Group, have launched their short-video format apps in recent months.

Powered by WPeMatico

Taiwanese startup iKala, which offers an artificial intelligence-based customer acquisition and engagement platform, will expand into new Southeast Asian markets after raising a $17 million Series B. The round was led by Wistron Digital Technology Holding Company, the investment arm of the electronics manufacturer, with participation from returning investors Hotung Investment Holdings Limited and Pacific Venture Partners. It brings iKala’s total raised so far to $30.3 million.

The new funding will be used to launch in Indonesia and Malaysia, and expand in markets where iKala already operates, including Singapore, Thailand, Hong Kong, the Philippines, Vietnam and Japan. Wistron Digital Technology Holding Company, which also offers big data analytics, will serve as a strategic investor, and this also marks the Taiwanese firm’s entry into Southeast Asia.

IKala’s products are targeted toward e-commerce companies, and include KOL Radar, for influencer marketing, and Shoplus, a social commerce service focused on Southeast Asian markets.

In a statement about the funding, iKala board member Lee-feng Chien, former managing director at Google Taiwan, said, “Taiwan has an excellent reputation for having some of the best high-tech talents in both hardware and software around the region. With Wistron as a strategic partner, iKala can become a major driving force for transforming Taiwan into an AI industry and talent hub in Asia.”

While Taiwan’s technology industry is best-known for hardware, especially semiconductor manufacturers like Foxconn and TSMC, a new crop of startups are helping the country establish a reputation for AI prowess.

In addition to iKala, these include Appier, which also provides a customer analytics, and enterprise translation platform WritePath. Big American tech companies, including Amazon, Google and Microsoft, have also set up AI-focused research and development centers in Taiwan, drawing on the country’s engineering talent and government programs.

Powered by WPeMatico

In Indonesia, about half of adults are “underbanked,” meaning they don’t have access to bank accounts, credit cards and other traditional financial services. A growing list of tech companies are working on solutions, from Payfazz, which operates a network of financial agents in small towns, to digital payment services from GoJek and Grab. As a result, financial inclusion is increasing for consumers and small businesses in Southeast Asia’s largest country, but one group remains underserved: schools.

InfraDigital was founded in 2018 by chief executive officer Ian McKenna and chief operating officer Indah Maryani. Both have backgrounds in financial tech, and their platform enables parents to pay school tuition with the same digital services they use for electricity bills or online shopping. The startup currently serves about 400 schools and recently raised a Series A led by AppWorks.

Many Indonesian schools still rely on cash payments, which are often delivered by kids to their teachers.

“My kid had just started school, and one day I spotted my wife giving him an envelope full of cash for tuition. He was only three years old,” McKenna said. “That triggered my curiosity about how these financial systems work.”

To give parents an easier alternative, InfraDigital, which is registered with Indonesia’s central bank, partners with banks, convenience store chains like Indomaret, online wallets and digital payment services like GoPay to allow them to send tuition money online.

“The way you pay your electricity bill, it’s likely that your school is already there, regardless of whether you have a bank account or live in a really remote place” where many people make cash payments for services at convenience stores, McKenna said. The startup is now working on a system for schools in areas that don’t have access to convenience store chains and banks.

Before building InfraDigital’s network, McKenna and Maryani had to understand why many schools still rely on cash payments and paper ledgers to manage tuition.

“Banks have been trying to tap into the education market for a long time, 12 to 15 years probably, but no one has become the biggest bank for schools,” said Maryani. “The reason behind that is because they come in with their own products and they don’t try to resolve the issues schools are facing. Since they are focused on the consumer side, they don’t really see schools or other offline businesses as their customers, and there is a lot of customization that they need to do.”

For example, a school might have 2,000 students and charge each of them about USD $10 a month in school fees. But they also collect separate payments for books, uniforms, and building fees. InfraDigital’s founders say schools typically send out an average of about 2.5 invoices a month.

Digitizing payments also makes it easier for schools to track their finances. InfraDigital provides its clients with a backend application for accounting and enrollment management. It automatically tracks tuition payments as they come in.

“People don’t get paid that much and they are ridiculously busy taking care of thousands of kids. It’s really, really tough,” McKenna said. “When you’re giving them a solution, it’s not about features, it’s not about tools, it’s about the practicalities of their day-to-day life and how we are going to assist them with it. So you remove that burden from them.”

During the COVID-19 pandemic, which resulted in movement restriction orders in different areas of Indonesia, InfraDigital’s founders say the platform was able to forecast trends even before schools officially closed. They started surveying schools in their client base, and sent back data to help them forecast how school closures would affect their income.

“From the school’s perspective, it’s a really damaging situation, with 30% to 60% income drops. Teachers don’t get paid. If the economy goes down, parents at lower-income schools, which are a big part of our client base, won’t be able to pay,” McKenna said. “It’s built into the model, and we’ll continue seeing that however long the economic impact of COVID-19 lasts.”

Powered by WPeMatico