Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

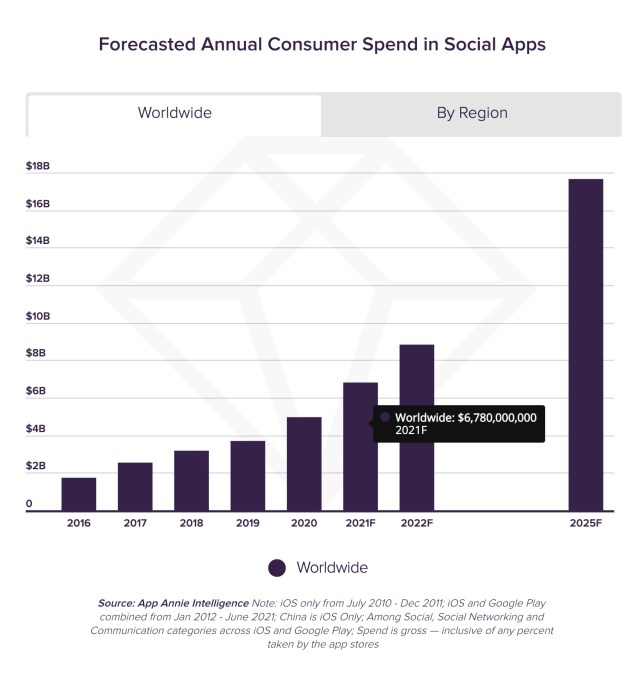

The livestreaming boom is driving a significant uptick in the creator economy, as a new forecast estimates consumers will spend $6.78 billion in social apps in 2021. That figure will grow to $17.2 billion annually by 2025, according to data from mobile data firm App Annie, which notes the upward trend represents a five-year compound annual growth rate (CAGR) of 29%. By that point, the lifetime total spend in social apps will reach $78 billion, the firm reports.

Image Credits: App Annie

Initially, much of the livestream economy was based on one-off purchases like sticker packs, but today, consumers are gifting content creators directly during their livestreams. Some of these donations can be incredibly high, at times. Twitch streamer ExoticChaotic was gifted $75,000 during a live session on Fortnite, which was one of the largest-ever donations on the game-streaming social network. Meanwhile, App Annie notes another platform, Bigo Live, is enabling broadcasters to earn up to $24,000 per month through their livestreams.

Apps that offer livestreaming as a prominent feature are also those that are driving the majority of today’s social app spending, the report says. In the first half of this year, $3 out every $4 spent in the top 25 social apps came from apps that offered livestreams, for example.

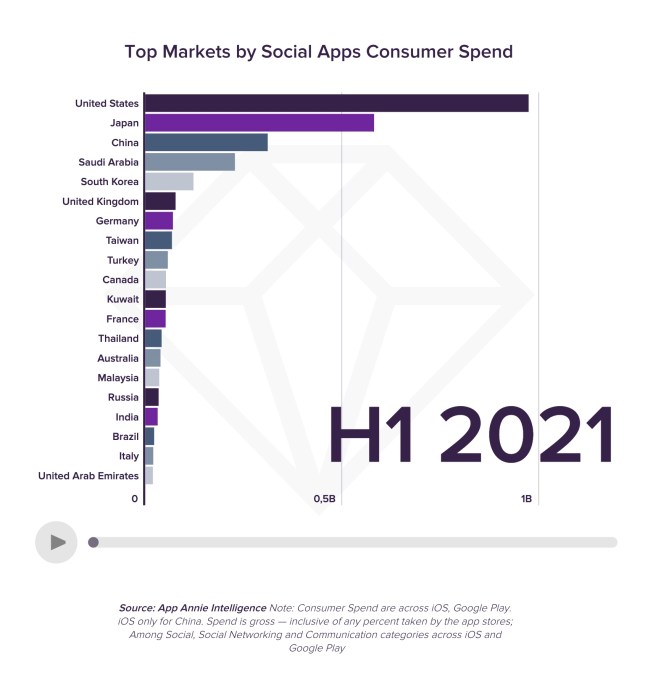

Image Credits: App Annie

During the first half of 2021, the U.S. become the top market for consumer spending inside social apps, with 1.7x the spend of the next largest market, Japan, and representing 30% of the market by spend. China, Saudi Arabia and South Korea followed to round out the top 5.

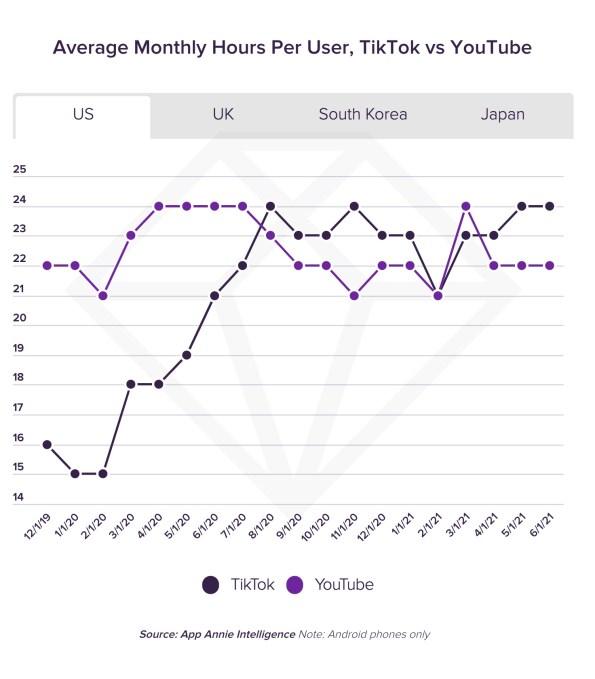

Image Credits: App Annie

While both creators and the platforms are financially benefitting from the livestreaming economy, the platforms are benefitting in other ways beyond their commissions on in-app purchases. Livestreams are helping to drive demand for these social apps and they help to boost other key engagement metrics, like time spent in app.

One top app that’s significantly gaining here is TikTok.

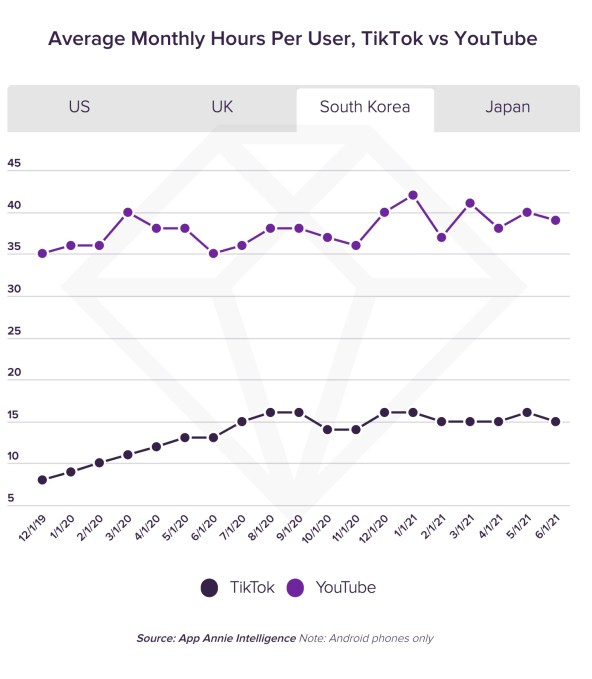

Last year, TikTok surpassed YouTube in the U.S. and the U.K. in terms of the average monthly time spent per user. It often continues to lead in the former market, and more decisively leads in the latter.

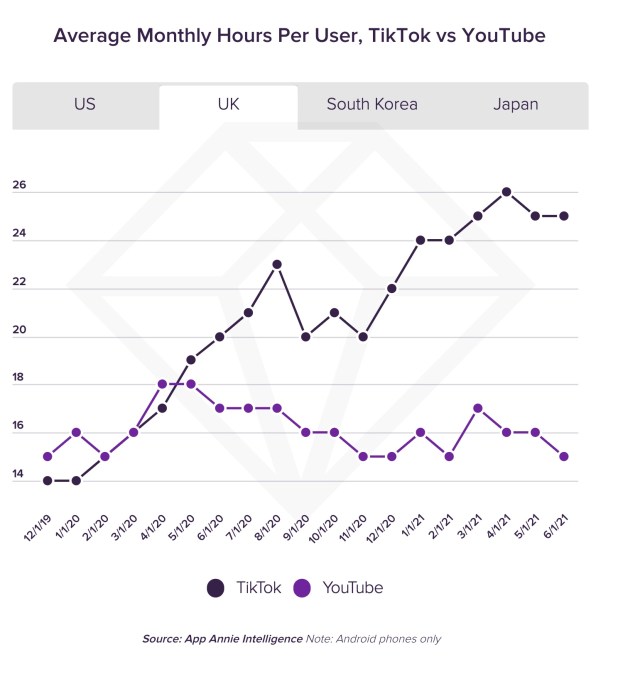

Image Credits: App Annie

Image Credits: App Annie

In other markets, like South Korea and Japan, TikTok is making strides, but YouTube still leads by a wide margin. (In South Korea, YouTube leads by 2.5x, in fact.)

Image Credits: App Annie

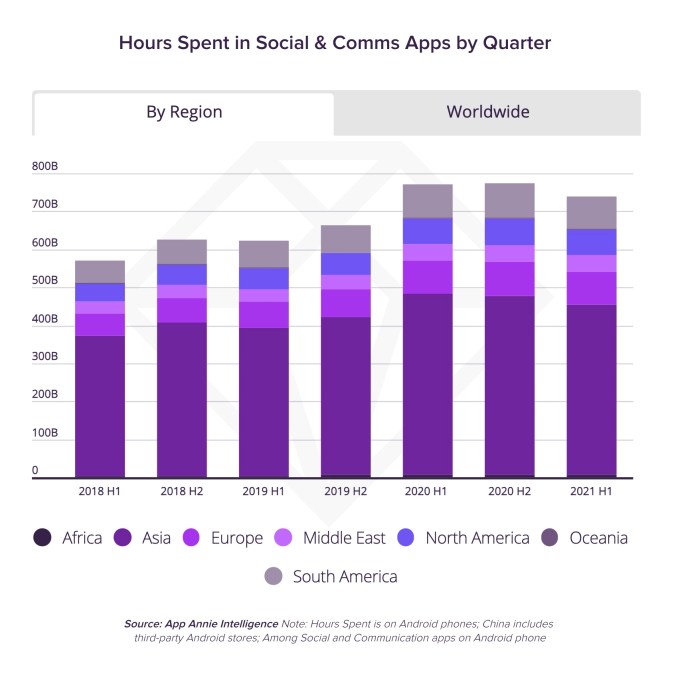

Beyond just TikTok, consumers spent 740 billion hours in social apps in the first half of the year, which is equal to 44% of the time spent on mobile globally. Time spent in these apps has continued to trend upwards over the years, with growth that’s up 30% in the first half of 2021 compared to the same period in 2018.

Today, the apps that enable livestreaming are outpacing those that focus on chat, photo or video. This is why companies like Instagram are now announcing dramatic shifts in focus, like how they’re “no longer a photo sharing app.” They know they need to more fully shift to video or they will be left behind.

The total time spent in the top five social apps that have an emphasis on livestreaming are now set to surpass half a trillion hours on Android phones alone this year, not including China. That’s a three-year CAGR of 25% versus just 15% for apps in the Chat and Photo & Video categories, App Annie noted.

Image Credits: App Annie

Thanks to growth in India, the Asia-Pacific region now accounts for 60% of the time spent in social apps. As India’s growth in this area increased over the past 3.5 years, it shrunk the gap between itself and China from 115% in 2018 to just 7% in the first half of this year.

Social app downloads are also continuing to grow, due to the growth in livestreaming.

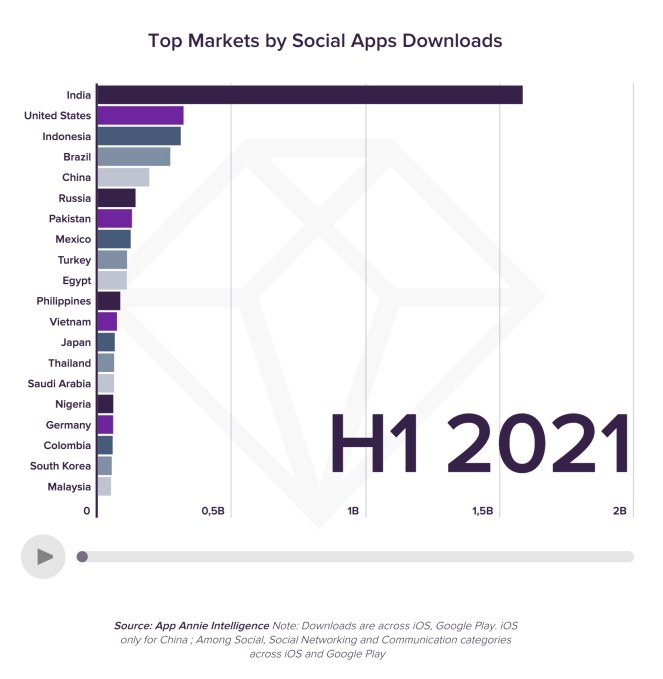

To date, consumers have downloaded social apps 74 billion times, and that demand remains strong, with 4.7 billion downloads in the first half of 2021 alone — up 50% year-over-year. In the first half of the year, Asia was the largest region region for social app downloads, accounting for 60% of the market.

This is largely due to India, the top market by a factor of 5x, which surpassed the U.S. back in 2018. India is followed by the U.S., Indonesia, Brazil and China, in terms of downloads.

Image Credits: App Annie

The shift toward livestreaming and video has also impacted what sort of apps consumers are interested in downloading, not just the number of downloads.

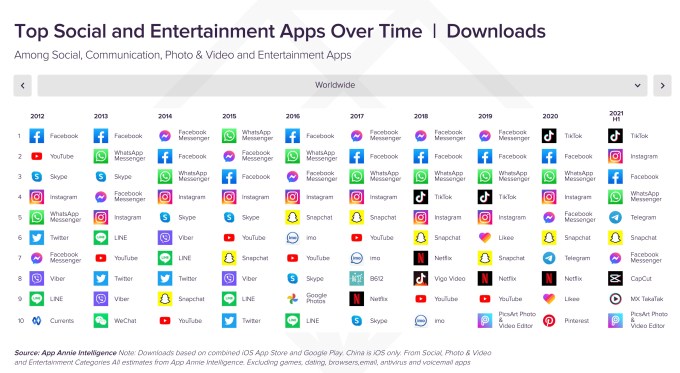

A chart that shows the top global apps from 2012 to the present highlights Facebook’s slipping grip. While its apps (Facebook, Messenger, Instagram and WhatsApp) have dominated the top spots over the years in various positions, TikTok popped into the number one position last year, and continues to maintain that ranking in 2021.

Further down the chart, other apps that aid in video editing have also overtaken others that had been more focused on photos or chat.

Image Credits: App Annie

Video apps like YouTube (#1), TikTok (#2) Tencent Video (#4), Bigo Live (#5), Twitch (#6), and others also now rank at the top of the global charts by consumer spending in the first half of 2021.

But YouTube (#1) still dominates in time spent compared with TikTok (#5), and others from Facebook — the company holds the next three spots for Facebook, WhatsApp and Instagram, respectively.

This could explain why TikTok is now exploring the idea of allowing users to upload even longer videos, by increasing the limit from 3 minutes to 5, for instance.

In addition, because of livestreaming’s ability to drive growth in terms of time spent, it’s also likely the reason why TikTok has been heavily investing in new features for its TikTok LIVE platform, including things like events, support for co-hosts, Q&As and more, and why it made the “LIVE” button a more prominent feature in its app and user experience.

App Annie’s report also digs into the impact livestreaming has had on specific platforms, like Twitch and Bigo Live, the former which doubled its monthly active user base from the pre-pandemic era, and the latter which saw $314.2 million in consumer spend during H1 2021.

“The ability of social media users to communicate with each other using live video – or watch others’ live broadcasts – has not only maintained the growth of a social media app market, but contributed to its exponential growth in engagement metrics like time spent, that might otherwise have saturated some time ago,” wrote App Annie’s Head of Insights, Lexi Sydow, when announcing the new report.

The full report is available here.

Powered by WPeMatico

The pandemic has triggered more demand for contactless and staff-less operations in the hospitality sector, and now H2O Hospitality, the unmanned hotel management company, has closed a $30 million round on the back of that boost. The South Korea and Japan-based startup automates front and backend processes including accommodation reservation, room management and front desk duties, and it will be using the funds to continue expanding its business.

The Series C round (equivalent to about 34 billion won) is being led by Kakao Investment and Korea Development Bank (KDB), Gorilla Private Equity, Intervest and NICE Investment also participated. With Southeast Asia’s joint fund, Kejora-Intervest Growth Fund also joined in the round, it is a sign that H2O Hospitality will be focusing specifically on the Southeast Asian Market. H2O Hospitality has raised $7 million Series B round from Samsung Ventures, Stonebridge Ventures, IMM Investment and Shinhan Capital in February 2020.

H2O Hospitality will expand its business further by adding various types of accommodations in South Korea and Japan in 2021 and 2022 and plans to enter Singapore and Indonesia in 4Q in 2022 in line with its Southeast Asia penetration strategy, according to H2O Hospitality co-founder and CEO John Lee.

“H2O Hospitality is currently speaking with several global hotel chain companies to partner with their digital transformation and operation outside of Korea and Japan,” Lee told TechCrunch.

H2O will invest in R&D to advance its customer channel solutions and contactless check-in systems depending on customer needs of each country in Asia, Lee continued.

“We need optimal system development and customization for each accommodation and situation to lead successful hotel digital transformation even after COVID-19,” Lee said in an email interview.

H2O Hospitality was founded in South Korea 2015 by CEO John Lee, and it has been on something of an acquisition-expansion spree. It entered Japan in 2017, for example, by acquiring several Japanese hospitality management companies. In 2021, H2O acquired two South Korean companies such as the contactless hotel solution company, ImGATE, and a local creator startup, Replace, in order to enhance its technology and ESG competence.

These days, the company operates approximately 7,500 accommodations including hotels, ryokans and guest houses, in Tokyo, Osaka, Seoul, Busan, and Bangkok.

H2O Hospitality’s Information and Communications Technology (ICT)-based hotel management system, which enables hotel management to automate and digitize, includes the Channel Management System (CMS), Property Management System (PMS), Room Management System (RMS), and Facility Management System (FMS).

Its integrated hotel management system can reduce hotel management’s fixed operating costs by 50%, while increasing revenue by as much as 20%, according to its statement.

“COVID-19 hit the hospitality industry the most and most of the hotels wanted to decrease their fixed cost level, but it was impossible with their current operational flow,” Lee continued, “They had to go through digital transformation”.

When asked how the pandemic affected H2O as COVID-19 still freezes most of the tourism industry, Lee said H2O’s revenue has been increased by as much as 30% before the pandemic, but that percentage has been dropped to 5-15% post COVID-19. Revenue drivers these days are based around tools it’s built to improve the efficiency of its customers. They include its automated dynamic pricing (ADR) tool and diverse sales channels like online and offline travel agencies in domestic and overseas, he said.

Lee also pointed out that H2O has been onboarding a lot of properties and that has also contributed to H2O’s revenue growth in the last 18 months. H2O was the only company in Asia, he claims, and many property owners have started to get onboard since August 2020, he explained.

“Every single hotel that we onboarded during the pandemic turned around their profits & losses statements and started to recover their financial loss,” Lee said.

There are currently about 16.4 million hotel rooms in the world that generate $570 billion a year, according to Lee. H2O believes that it can digitize all the lodging accommodations in the world as the company’s main goal is not building a hotel brand but allowing hotel owners to operate their properties with better operation, he said.

Lee explained that the current hotel operation process looks a lot like that of “2G phones”, that was at a stage before turning to smartphones, and H2O is turning the overall hotel operation into a “smartphone”.

“This is a very natural transition for the (hospitality) industry as it was also natural for the cellphone users to transit from 2G phone to smartphone,” Lee said.

Unfortunately, the cross-border inbound tourism market has still been stopped for both Korea and Japan even though each domestic market is still pumping demand for the market, Lee mentioned.

“We believe the inbound tourism market will recover within a year as the vaccinations grow for both countries (Korea and Japan),” Lee said.

Managing Director at Kejora-Intervest Growth Fund Jun-seok Kang told TechCrunch: “We knew this new wave for hotel digital transformation trend was coming even before the pandemic; however, COVID-19 definitely expedited the transition period, and we believe H2O will thrive in the transforming hotel market.”

Powered by WPeMatico

Homage, the caregiving-focused startup, has raised a $30 million Series C led by Sheares Healthcare Group, which is wholly-owned by investment firm Temasek. Other participants included new investors DG Daiwa Ventures and Sagana Capital, and returning backers East Ventures (Growth), HealthXCapital, SeedPlus, Trihill Capital and Alternate Ventures.

The new funding will be used to develop Homage’s technology, continue integrating with aged and disability care payer and provider infrastructure and speed-up its regional expansion through partnerships with hospitals and care providers. Homage currently operates in Singapore, Malaysia and Australia.

The Singapore-based company’s services include home visits from caregivers, nurses, therapists and doctors; telemedicine; and services for chronic illnesses. One of the reasons Homage’s platform is able to scale up is its matching engine, which helps clients, like older adults and people living with chronic conditions, find providers who are best suited to their needs (the final matches are made by Homage’s team).

The startup says the round was oversubscribed and one of the largest fundings raised by an on-demand care platform in Southeast Asia and Oceania so far. It brings Homage’s total raised to more than $45 million.

As part of Series C, Sheares Healthcare Group chief corporate development officer Khoo Ee Ping will join Homage’s board of directors.

Homage now has a regional network of more than 6,000 pre-screened and trained care professionals. It claims that its business outside of Singapore has grown more than 600% year-over-year in 2021, and it has more than tripled revenue over the past year.

Powered by WPeMatico

Hello and welcome back to TechCrunch’s China roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world.

This week, the gaming industry again became a target of Beijing, which imposed arguably the world’s strictest limits on underage players. On the other hand, China’s tech titans are hastily answering Beijing’s call for them to take on more social responsibilities and take a break from unfettered expansion.

China dropped a bombshell on the country’s young gamers. As of September 1, users under the age of 18 are limited to only one hour of online gaming time: on Fridays, Saturdays and Sundays between 8-9 p.m.

The stringent rule adds to already tightening gaming policies for minors, as the government blames video games for causing myopia, as well as deteriorating mental and physical health. Remember China recently announced a suite of restrictions on after-school tutoring? The joke going around is that working parents will have an even harder time keeping their kids occupied.

A few aspects of the new regulation are worth unpacking. For one, the new rule was instituted by the National Press and Publication Administration (NPPA), the regulatory body that approves gaming titles in China and that in 2019 froze the approval process for nine months, which led to plunges in gaming stocks like Tencent.

It’s curious that the directive on playtime came from the NPPA, which reviews gaming content and issues publishing licenses. Like other industries in China, video games are subject to regulations by multiple authorities: NPPA; the Cyberspace Administration of China (CAC), the country’s top internet watchdog; and the Ministry of Industry and Information Technology, which oversees the country’s industrial standards and telecommunications infrastructure.

As analysts long observe, the mighty CAC, which sits under the Central Cyberspace Affairs Commission chaired by President Xi Jinping, has run into “bureaucratic struggles” with other ministries unwilling to relinquish power. This may well be the case for regulating the lucrative gaming industry.

For Tencent and other major gaming companies, the impact of the new rule on their balance sheet may be trifling. Following the news, several listed Chinese gaming firms, including NetEase and 37 Games, hurried to announce that underage players made up less than 1% of their gaming revenues.

Tencent saw the change coming and disclosed in its Q2 earnings that “under-16-year-olds accounted for only 2.6% of its China-based grossing receipts for games and under-12-year-olds accounted for just 0.3%.”

These numbers may not reflect the reality, as minors have long found ways around gaming restrictions, such as using an adult’s ID for user registration (just as the previous generation borrowed IDs from adult friends to sneak into internet cafes). Tencent and other gaming firms have vowed to clamp down on these workarounds, forcing kids to seek even more sophisticated tricks, including using VPNs to access foreign versions of gaming titles. The cat and mouse game continues.

While China curtails the power of its tech behemoths, it has also pressured them to take on more social responsibilities, which include respecting the worker’s rights in the gig economy.

Last week, the Supreme People’s Court of China declared the “996” schedule, working 9 a.m. to 9 p.m. six days a week, illegal. The declaration followed years of worker resistance against the tech industry’s burnout culture, which has manifested in actions like a GitHub project listing companies practicing “996.”

Meanwhile, hardworking and compliant employees have often been cited as a competitive advantage of China’s tech industry. It’s in part why some Silicon Valley companies, especially those run by people familiar with China, often set up branches in the country to tap its pool of tech talent.

The days when overworking is glorified and tolerated seem to be drawing to an end. Both ByteDance and its short video rival Kuaishou recently scrapped their weekend overtime policies.

Similarly, Meituan announced that it will introduce compulsory break time for its food delivery riders. The on-demand services giant has been slammed for “inhumane” algorithms that force riders into brutal hours or dangerous driving.

In groundbreaking moves, ride-hailing giant Didi and Alibaba’s e-commerce rival JD.com have set up unions for their staff, though it’s still unclear what tangible impact the organizations will have on safeguarding employee rights.

Tencent and Alibaba have also acted. On August 17, President Xi Jinping delivered a speech calling for “common prosperity,” which caught widespread attention from the country’s ultra-rich.

“As China marches towards its second centenary goal, the focus of promoting people’s well-being should be put on boosting common prosperity to strengthen the foundation for the Party’s long-term governance.”

This week, both Tencent and Alibaba pledged to invest 100 billion yuan ($15.5 billion) in support of “common prosperity.” The purposes of their funds are similar and align neatly with Beijing’s national development goals, from growing the rural economy to improving the healthcare system.

Powered by WPeMatico

Summer is still technically in session, but a snowball is slowly developing in the world of apps, and specifically the world of in-app payments. A report in Reuters today says that the Competition Commission of India, the country’s monopoly regulator, will soon be looking at an antitrust suit filed against Apple over how it mandates that app developers use Apple’s own in-app payment system — thereby giving Apple a cut of those payments — when publishers charge users for subscriptions and other items in their apps.

The suit, filed by an Indian nonprofit called “Together We Fight Society”, said in a statement to Reuters that it was representing consumer and startup interests in its complaint.

The move would be the latest in what has become a string of challenges from national regulators against app store operators — specifically Apple but also others like Google and WeChat — over how they wield their positions to enforce market practices that critics have argued are anti-competitive. Other countries that have in recent weeks reached settlements, passed laws or are about to introduce laws include Japan, South Korea, Australia, the U.S. and the European Union.

And in India specifically, the regulator is currently working through a similar investigation as it relates to in-app payments in Android apps, which Google mandates use its proprietary payment system. Google and Android dominate the Indian smartphone market, with the operating system active on 98% of the 520 million devices in use in the country as of the end of 2020.

It will be interesting to watch whether more countries wade in as a result of these developments. Ultimately, it could force app store operators, to avoid further and deeper regulatory scrutiny, to adopt new and more flexible universal policies.

In the meantime, we are seeing changes happen on a country-by-country basis.

Just yesterday, Apple reached a settlement in Japan that will let publishers of “reader” apps (those for using or consuming media like books and news, music, files in the cloud and more) to redirect users to external sites to provide alternatives to Apple’s proprietary in-app payment provision. Although it’s not as seamless as paying within the app, redirecting previously was typically not allowed, and in doing so the publishers can avoid Apple’s cut.

South Korean legislators earlier this week approved a measure that will make it illegal for Apple and Google to make a commission by forcing developers to use their proprietary payment systems.

And last week, Apple also made some movements in the U.S. around allowing alternative forms of payments, but, relatively speaking, the concessions were somewhat indirect: app publishers can refer to alternative, direct payment options in apps now, but not actually offer them. (Not yet at least.)

Some developers and consumers have been arguing for years that Apple’s strict policies should open up more. Apple however has long said in its defense that it mandates certain developer policies to build better overall user experiences, and for reasons of security. But, as app technology has evolved, and consumer habits have changed, critics believe that this position needs to be reconsidered.

One factor in Apple’s defense in India specifically might be the company’s position in the market. Android absolutely dominates India when it comes to smartphones and mobile services, with Apple actually a very small part of the ecosystem.

As of the end of 2020, it accounted for just 2% of the 520 million smartphones in use in the country, according to figures from Counterpoint Research quoted by Reuters. That figure had doubled in the last five years, but it’s a long way from a majority, or even significant minority.

The antitrust filing in India has yet to be filed formally, but Reuters notes that the wording leans on the fact that anti-competitive practices in payments systems make it less viable for many publishers to exist at all, since the economics simply do not add up:

“The existence of the 30% commission means that some app developers will never make it to the market,” Reuters noted from the filing. “This could also result in consumer harm.”

Powered by WPeMatico

On the heels of Heroes announcing a $200 million raise earlier today, to double down on buying and scaling third-party Amazon Marketplace sellers, another startup out of London aiming to do the same is announcing some significant funding of its own. Olsam, a roll-up play that is buying up both consumer and B2B merchants selling on Amazon by way of Amazon’s FBA fulfillment program, has closed $165 million — a combination of equity and debt that it will be using to fuel its M&A strategy, as well as continue building out its tech platform and to hire more talent.

Apeiron Investment Group — an investment firm started by German entrepreneur Christian Angermayer — led the Series A equity round, with Elevat3 Capital (another Angermayer firm that has a strategic partnership with Founders Fund and Peter Thiel) also participating. North Wall Capital was behind the debt portion of the deal. We have asked and Olsam is only disclosing the full amount raised, not the amount that was raised in equity versus debt. Valuation is also not being disclosed.

Being an Amazon roll-up startup from London that happens to be announcing a fundraise today is not the only thing that Olsam has in common with Heroes. Like Heroes, Olsam is also founded by brothers.

Sam Horbye previously spent years working at Amazon, including building and managing the company’s business marketplace (the B2B version of the consumer marketplace); while co-founder Ollie Horbye had years of experience in strategic consulting and financial services.

Between them, they also built and sold previous marketplace businesses, and they believe that this collective experience gives Olsam — a portmanteau of their names, “Ollie” and “Sam” — a leg up when it comes to building relationships with merchants; identifying quality products (versus the vast seas of search results that often feel like they are selling the same inexpensive junk as each other); and understanding merchants’ challenges and opportunities, and building relationships with Amazon and understanding how the merchant ecosystem fits into the e-commerce giant’s wider strategy.

Olsam is also taking a slightly different approach when it comes to target companies, by focusing not just on the usual consumer play, but also on merchants selling to businesses. B2B selling is currently one of the fastest-growing segments in Amazon’s Marketplace, and it is also one of the more overlooked by consumers. “It’s flying under the radar,” Ollie said.

“The B2B opportunity is very exciting,” Sam added. “A growing number of merchants are selling office supplies or more random products to the B2B customer.”

Estimates vary when it comes to how many merchants there are selling on Amazon’s Marketplace globally, ranging anywhere from 6 million to nearly 10 million. Altogether those merchants generated $300 million in sales (gross merchandise value), and it’s growing by 50% each year at the moment.

And consolidating sellers — in order to achieve better economies of scale around supply chains, marketing tools and analytics, and more — is also big business. Olsam estimates that some $7 billion has been spent cumulatively on acquiring these businesses, and there are more out there: Olsam estimates there are some 3,000 businesses in the U.K. alone making more than $1 million each in sales on Amazon’s platform.

(And to be clear, there are a number of other roll-up startups beyond Heroes also eyeing up that opportunity. Raising hundreds of millions of dollars in aggregate, others that have made moves this year include Suma Brands [$150 million], Elevate Brands [$250 million], Perch [$775 million], factory14 [$200 million], Thrasio [currently probably the biggest of them all in terms of reach and money raised and ambitions], Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group [X2], Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.)

“The senior team behind Olsam is what makes this business truly unique,” said Angermayer in a statement. “Having all been successful in building and selling their own brands within the market and having worked for Amazon in their marketplace team – their understanding of this space is exceptional.”

Powered by WPeMatico

Even as hundreds of millions of people in India have a bank account, only a tiny fraction of this population invests in any financial instrument.

Fewer than 30 million people invest in mutual funds or stocks, for instance. In recent years, a handful of startups have made it easier for users — especially the millennials — to invest, but the figure has largely remained stagnant.

Now, an Indian startup believes that it has found the solution to tackle this challenge — and is already seeing good early traction.

Nishchay AG, former director of mobility startup Bounce, and Misbah Ashraf, co-founder of Marsplay (sold to Foxy), founded Jar earlier this year.

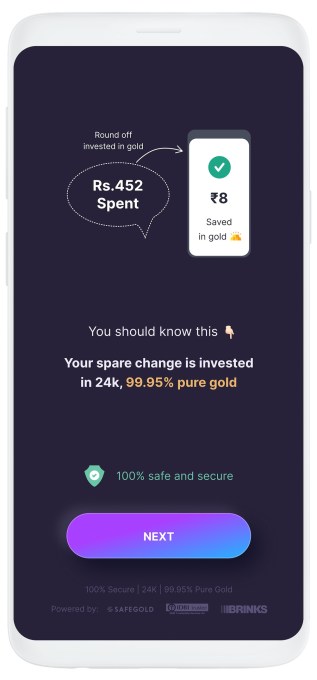

The startup’s eponymous six-month-old Android app enables users to start their savings journey for as little as 1 Indian rupee.

Users on Jar can invest in multiple ways and get started within seconds. The app works with Paytm (PhonePe support is in the works) to set up a recurring payment. (The startup is the first to use UPI 2.0’s recurring payment support.) They can set up any amount between 1 Indian rupee to 500 for daily investments.

The Jar app can also glean users’ text messages and save a tiny amount based on each monetary transaction they do. So, for instance, if a user has spent 31 rupees in a transaction, the Jar app rounds that up to the nearest tenth figure (40, in this case) and saves nine rupees. Users can also manually open the app and spend any amount they wish to invest.

Once users have saved some money in Jar, the app then invests that into digital gold.

The startup is using gold investment because people in the South Asian market already have an immense trust in this asset class.

India has a unique fascination for gold. From rural farmers to urban working class, nearly everyone stashes the yellow metal and flaunts jewelry at weddings.

Indian households are estimated to have a stash of over 25,000 tons of the precious metal whose value today is about half of the country’s nominal GDP. Such is the demand for gold in India that the South Asian nation is also one of the world’s largest importers of this precious metal.

Jar’s Android app (Image Credits: Jar)

“When you’re thinking about bringing the next 500 million people to institutional savings and investments, the onus is on us to educate them on the efficacies of the other instruments that are in the market,” said Nishchay.

“We want to give them the instrument they trust the most, which is gold,” he said. The startup plans to eventually offer several more investment opportunities, he said.

The founders met several years ago when they were exploring if MarsPlay and Bounce could have any synergies. They stayed in touch and, last year during one of their many conversations, realized that neither of them knew much about investments.

“That’s when the dots started to connect,” said Misbah, drawing stories from his childhood. “I come from a small town in Bihar called Bihar Sharif. During my childhood days, I saw my family deeply troubled with debt because of poor financial decisions and no savings,” he said.

“We both understand what a typical middle class family goes through. Someone who comes from this background never had any means in the past but their aspirations are never-ending. So when you start earning, you immediately start to spend it all,” said Nishchay.

“The market needs products that will help them get started,” he said.

That idea, which is similar to Acorn and Stash’s play in the U.S. market, is beginning to make inroads. The app has already amassed about half a million downloads, the founders said. Investors have taken notice, too.

On Wednesday, Jar announced it has raised $4.5 million from a clutch of high-profile investors, including Arkam Ventures, Tribe Capital, WEH Ventures, and angels including Kunal Shah (founder of CRED), Shaan Puri (formerly with Twitch), Ali Moiz (founder of Stonks), Howard Lindzon (founder of Social Leverage), Vivekananda Hallekere (co-founder of Bounce), Alvin Tse (of Xiaomi) and Kunal Khattar (managing partner at AdvantEdge).

“Over 400 million Indians are about to embrace digital financial services for the first time in their lives. Jar has built an app that is poised to help them — with several intuitive ways including gamification — start their investment journey. We love the speed at which the team has been executing and how fast they are growing each week,” said Arjun Sethi, co-founder of Tribe Capital, in a statement.

Transactions and AUM on the Jar app are surging 350% each month, said Nishchay. The startup plans to broaden its product offerings in the coming days, he said.

Powered by WPeMatico

Heroes, one of the new wave of startups aiming to build big e-commerce businesses by buying up smaller third-party merchants on Amazon’s Marketplace, has raised another big round of funding to double down on that strategy. The London startup has picked up $200 million, money that it will mainly be using to snap up more merchants. Existing brands in its portfolio cover categories like babies, pets, sports, personal health and home and garden categories — some of them, like PremiumCare dog chews, the Onco baby car mirror, gardening tool brand Davaon and wooden foot massager roller Theraflow, category best-sellers — and the plan is to continue building up all of these verticals.

Crayhill Capital Management, a fund based out of New York, is providing the funding, and Riccardo Bruni — who co-founded the company with twin brother Alessio and third brother Giancarlo — said that the bulk of it will be going toward making acquisitions, and is therefore coming in the form of debt.

Raising debt rather than equity at this point is pretty standard for companies like Heroes. Heroes itself is pretty young: it launched less than a year ago, in November 2020, with $65 million in funding, a round comprised of both equity and debt. Other investors in the startup include 360 Capital, Fuel Ventures and Upper 90.

Heroes is playing in what is rapidly becoming a very crowded field. Not only are there tens of thousands of businesses leveraging Amazon’s extensive fulfillment network to sell goods on the e-commerce giant’s marketplace, but some days it seems we are also rapidly approaching a state of nearly as many startups launching to consolidate these third-party sellers.

Many a roll-up play follows a similar playbook, which goes like this: Amazon provides the marketplace to sell goods to consumers, and the infrastructure to fulfill those orders, by way of Fulfillment By Amazon and its Prime service. Meanwhile, the roll-up business — in this case Heroes — buys up a number of the stronger companies leveraging FBA and the marketplace. Then, by consolidating them into a single tech platform that they have built, Heroes creates better economies of scale around better and more efficient supply chains, sharper machine learning and marketing and data analytics technology, and new growth strategies.

What is notable about Heroes, though — apart from the fact that it’s the first roll-up player to come out of the U.K., and continues to be one of the bigger players in Europe — is that it doesn’t believe that the technology plays as important a role as having a solid relationship with the companies it’s targeting, key given that now the top marketplace sellers are likely being feted by a number of companies as acquisition targets.

“The tech is very important,” said Alessio in an interview. “It helps us build robust processes that tie all the systems together across multiple brands and marketplaces. But what we have is very different from a SaaS business. We are not building an app, and tech is not the core of what we do. From the acquisitions side, we believe that human interactions ultimately win. We don’t think tech can replace a strong acquisition process.”

Image Credits: Heroes

Heroes’ three founder-brothers (two of them, Riccardo and Alessio, pictured above) have worked across a number of investment, finance and operational roles (the CVs include Merrill Lynch, EQT Ventures, Perella Weinberg Partners, Lazada, Nomura and Liberty Global) and they say there have been strong signs so far of its strategy working: of the brands that it has acquired since launching in November, they claim business (sales) has grown five-fold.

Collectively, the roll-up startups are raising hundreds of millions of dollars to fuel these efforts. Other recent hopefuls that have announced funding this year include Suma Brands ($150 million); Elevate Brands ($250 million); Perch ($775 million); factory14 ($200 million); Thrasio (currently probably the biggest of them all in terms of reach and money raised and ambitions), Heyday, The Razor Group, Branded, SellerX, Berlin Brands Group (X2), Benitago, Latin America’s Valoreo and Rainforest and Una Brands out of Asia.

The picture that is emerging across many of these operations is that many of these companies, Heroes included, do not try to make their particular approaches particularly more distinctive than those of their competitors, simply because — with nearly 10 million third-party sellers today on Amazon globally — the opportunity is likely big enough for all of them, and more, not least because of current market dynamics.

“It’s no secret that we were inspired by Thrasio and others,” Riccardo said. “Combined with COVID-19, there has been a massive acceleration of e-commerce across the continent.” It was that, plus the realization that the three brothers had the right e-commerce, fundraising and investment skills between them, that made them see what was a ‘perfect storm’ to tackle the opportunity, he continued. “So that is why we jumped into it.”

In the case of Heroes, while the majority of the funding will be used for acquisitions, it’s also planning to double headcount from its current 70 employees before the end of this year with a focus on operational experts to help run their acquired businesses.

Powered by WPeMatico

Apna, a 21-month-old startup that is helping millions of blue- and gray-collar workers in India upskill themselves, find communities and land jobs, is inching closer to becoming the fastest tech firm in the world’s second-largest internet market to become a unicorn.

Tiger Global is in advanced stages of talks to lead a $100 million round in Apna, according to four sources familiar with the matter. The proposed terms value the startup at over $1 billion, the sources said.

The round hasn’t closed yet, so terms of the deal may change, some of the sources cautioned.

If the round materializes, Apna will become the youngest Indian startup to attain the much-coveted unicorn status. The startup, which launched its app in December 2019, was valued at $570 million in its Series B financing round in June this year. It will also be the third financing round Apna would have secured in a span of less than seven months.

Tiger Global, an existing investor in Apna, didn’t respond to a request for comment earlier this month. Apna founder and chief executive Nirmit Parikh, an Apple alum, declined to comment on Tuesday.

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the world’s second-largest internet market.

Apna, whose name is inspired from a 2019 Bollywood song, is building a scalable networking infrastructure so that these workers can connect to the right employers and secure jobs. On its eponymous Android app, users also upskill themselves, review their interview skills and become eligible for more jobs.

As of June this year, Apna had amassed over 10 million users and was facilitating more than 15 million job interviews each month. All jobs listed on the Apna platform are verified by the startup and free of cost for the candidates.

The startup has also partnered with some of India’s leading public and private organizations and is providing support to the Ministry of Minority Affairs of India, National Skill Development Corporation and UNICEF YuWaah to provide better skilling and job opportunities to candidates.

The investment talks further illustrate Tiger Global’s growing interest in India. The New York-headquartered firm has made several high-profile investments in India this year, including in BharatPe, Gupshup, DealShare, Classplus, Urban Company, CoinSwitch Kuber and Groww.

More than two dozen Indian startups have become a unicorn this year, up from 11 last year, as several high-profile investors, including Tiger Global, SoftBank and Falcon Edge, have increased the pace of their investments in the world’s second most populous nation.

Apna also counts Insight Partners, Lightspeed and Sequoia Capital among its existing investors.

Powered by WPeMatico

China’s National Press and Publication Administration has released a notice imposing limits on online gaming for minors. On September 1st, video game companies will have to restrict gaming time to three hours a week — from 8 PM to 9 PM on Friday, Saturday and Sunday.

With this new set of restrictions, Chinese authorities want to tackle addition to online games. According to the National Press and Publication Administration, online gaming has an impact on both the physical and mental health of minors.

In order to implement those time limits, game companies will have to leverage a real-name-based registration system. In 2018, Tencent started using this system to limit play time on Honor of Kings, a widely popular mobile game.

Back then, limits weren’t as strict, though, as children up to aged 12 could play one hour per day, and up to two hours per day for children between 13 and 18. At the time, authorities were concerned about worsening myopia among minors.

During the signup flow, users must go through an ID verification system, which means that you can only have one account associated with your real name. Regulators will regularly check whether gaming companies comply with local regulation.

It’s going to be interesting to see how the new rules affect video games as a whole. Online gaming is mentioned specifically, which could mean that solo games won’t be restricted going forward. Similarly, it’s unclear whether console games and foreign games will have to implement the new real-name-based registration system.

Some young gamers will also be tempted to circumvent the restrictions by signing up on a foreign server. It’s also worth noting that adult players will still be able to play 24/7.

Following the news, Tencent issued a statement. “Tencent expressed its strong support and will make every effort to implement the relevant requirements of the Notice as soon as possible,” the company says.

As Bloomberg noticed, NetEase shares are currently down 8% compared to yesterday’s closing price. NetEase is another popular Chinese game development company and its activities aren’t as diversified as Tencent’s activities.

Powered by WPeMatico