Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

It has the simplest name, but the sort of shadowy overtones that national security writers lust after.

Team Telecom, a mostly informal working committee of the Departments of Defense, Homeland Security and Justice (along with affiliated agencies) has for years been quietly tasked with evaluating and maintaining the security of America telecom infrastructure in concert with the FCC. Its primary objective as far as we have been able to ascertain is to monitor the ownership of key telecom assets to ensure they don’t fall into the hands of suspect nations (think China, Russia, etc).

Last year, Mark Harris over on Extra Crunch took an in-depth look at the extreme delays companies can experience going through a Team Telecom review (membership required), which in the case of China Mobile’s expansion into the U.S., extended up to seven years before the Team rejected the Chinese bid for market entry.

That informal arrangement is disappearing, as the administration over the weekend published a new executive order formally instantiating Team Telecom as a legal process for reviewing applications for telecom licenses, deals and other requests made to the FCC.

Under a newly christened “Committee for the Assessment of Foreign Participation in the United States Telecommunications Services Sector” (CAFPUSTSS?), the Committee will be charged with assisting “the FCC in its public interest review of national security and law enforcement concerns that may be raised by foreign participation in the United States telecommunications services sector.”

Like its Team Telecom forerunner, the Committee will be made up of the heads of Justice, Defense and Homeland Security, with the attorney general playing the role of chair. Applications to the Committee will be referred to the U.S. government’s highest-ranking intelligence officer, the Director of National Intelligence, for analysis.

Unlike in the past, where the timeline for reviews was anything but standardized, the executive order provides for a 120-day adjudication process, with a 90-day extension if the Committee has additional concerns and goes through a secondary review.

In a brief press statement, FCC Chairman Ajit Pai said, “I applaud the President for formalizing Team Telecom review and establishing a process that will allow the Executive Branch to provide its expert input to the FCC in a timely manner.” The FCC intends to finish its own rulemaking around Team Telecom, a process which was first proposed at the tail end of the Obama administration and has been on-going ever since.

These reforms to Team Telecom are in line with similar reforms made to CFIUS, the Committee for Foreign Investment in the United States, which were finalized at the beginning of this year after Congress passed a reform bill in 2018.

While the new rules will provide some certainty to areas of telecom like fiber optic cable expansion and wireless services, expect the new rules to be used to put even more restrictions on countries like China hoping to get a slice of the U.S. infrastructure market. Indeed, in the FCC’s statement today, the agency said, “As we demonstrated last year in rejecting the China Mobile application, this FCC will not hesitate to act to protect our networks from foreign threats.”

Powered by WPeMatico

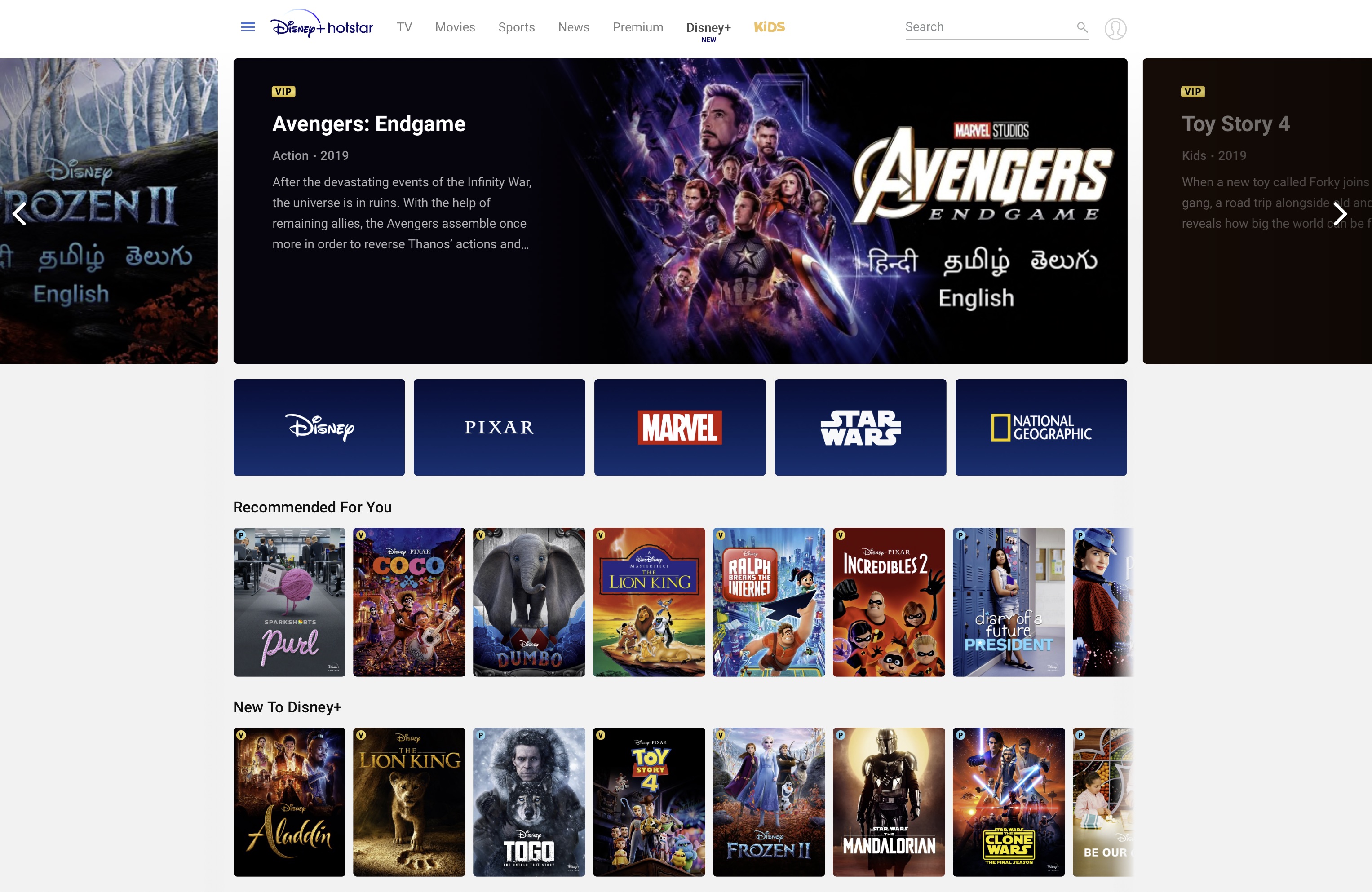

Disney+ has arrived in the land of Bollywood. The company on Friday (local time) rolled out its eponymous streaming service in India through Hotstar, a popular on-demand video streamer it picked up as part of the Fox deal.

To court users in India, the largest open entertainment market in Asia, Disney is charging users 1,499 Indian rupees (about $19.5) for a year, the most affordable plan in any of the more than a dozen markets where Disney+ is currently available.

Subscribers of the revamped streaming service, now called Disney+ Hotstar, will get access to Disney Originals in English as well as several local languages, live sporting events, dozens of TV channels, and thousands of movies and shows, including some sourced from HBO, Showtime, ABC and Fox that maintain syndication partnerships with the Indian streaming service. It also maintains partnership with Hooq — at least for now.

Unlike Disney+’s offering in the U.S. and other markets, in India, the service does not support 4K and streams content at nearly a tenth of their bitrate.

Disney+ Hotstar is also offering a cheaper yearly premium tier, priced at Rs 399 (about $5.3), that will offer subscribers access to movies, shows (but not those sourced from aforementioned U.S. networks and studios) and live sporting events; it won’t include Disney Originals.

Access to streaming of sporting events, especially of cricket matches, has helped five-year-old Hotstar become the most popular on-demand video streaming in India. During the cricket tournament Indian Premier League (IPL) last year, the service amassed more than 300 million monthly active users and more than 100 million daily active users.

It also holds the global record for most simultaneous views on a live stream, about 25 million — more than thrice its nearest competitor.

Prior to today’s launch, Hotstar offered its premium plans at 999 Indian rupees, and 365 Indian rupees. Existing subscribers won’t be affected by the price revision for the duration of their current subscription.

The service, run by Indian conglomerate Star India, offers access to about 80% of its catalog at no cost to users. The company monetizes these viewers through ads.

But in recent years, the company has begun to explore ways to turn its users into subscribers. Two years ago, Hotstar stopped offering cricket match streaming to non-paying users.

People familiar with the matter told TechCrunch that Hotstar has about 1.5 million paying subscribers, lower than what most industry firms estimate. But that figure is still higher than most of its competitors.

And there are many.

Disney+ will compete with more than three dozen international and local players in India, including Netflix, Amazon Prime Video, Times Internet’s MX Player (which has over 175 million monthly active users), Zee5, Apple TV+ and Alt Balaji, which has amassed over 27 million subscribers.

“The arrival of Disney+ in India is another case study in the globalization of entertainment in the digital era. For decades, the biggest companies in the world have expanded their reach into different markets. But it’s new, and actually quite profound, that everyone on earth receives the very same version of such a specific cultural product,” Matthew Ball, former head of strategic planning for Amazon Studios, told TechCrunch.

As in some other markets, including the U.S., streaming services have inked deals with telecom networks, TV vendors, cable TV operators and satellite TV players to extend their reach in India.

Most of these streaming services monetize their viewers by selling ads, and those who do charge have kept their premium plans below $3.

Why that figure? That’s the number most industry executives think — by spending years in the Indian market — that people in the country are willing to pay for viewing content. The average of how much an individual pays for cable TV, for instance, in India is also about $3.

“I think everyone is still trying to sort out the right pricing. It’s true the average Indian consumer is used to far lower prices and can’t afford more. However, we need to focus on the consumers likely to buy this, who have the requisite broadband access and income, etc,” said Ball.

Commuters drive along a road past a billboard in Mumbai advertising the Amazon Prime Video online series “The Forgotten Army”. (Photo by INDRANIL MUKHERJEE / AFP via Getty Images)

At stake is India’s booming on-demand video streaming market that, according to Boston Consulting Group, is estimated to grow to $5 billion from half a billion two years ago.

Hotstar’s hold on India could make it easier for Disney+, which has launched in more than a dozen markets and has amassed over 28 million subscribers.

As the country spends about two more weeks in lockdown that New Delhi ordered last month to curtail the spread of coronavirus, this could also compel many to give Disney+ a try.

On the flip side, if the lockdown is extended, the current season of IPL, which has been postponed until mid-April, might be further delayed or cancelled altogether. Either of those scenarios could hurt the reach of Hotstar, which sees a massive drop in its user base after the conclusion of each cricket tournament.

Disney initially planned to launch its streaming service in India on March 28, the day IPL was supposed to commence. But the company later postponed the launch by six days.

Industry executives told TechCrunch that if IPL is cancelled, it could severely hurt the financials of Hotstar, which clocks more than 50% of its revenue during the 50-odd days of the cricket season.

Some said Disney+’s premier catalog might not be relevant for most of Hotstar’s user base, who seem to care about this streaming service only during the cricket season or to catch up on Indian soap operas.

Hotstar has also received criticism for censoring more content on its platform than any other streaming service in India. Last month, Hotstar blocked from streaming on its platform an episode of “Last Week Tonight with John Oliver” that was critical of Indian Prime Minister Narendra Modi. YouTube made that segment available without any edits.

John Oliver slammed Hotstar for censoring the episode and noted that the streaming service had additionally edited out parts from his older episodes where he made fun of Disney. In 2017, Hotstar also edited out a segment from Oliver’s show in which he mocked Samsung for the Galaxy Note 7 fiasco. Hotstar and Samsung had a commercial partnership.

Hotstar did not respond to multiple requests for comment in 2017. Hotstar did not respond to multiple requests for comment on the recent controversy.

Powered by WPeMatico

Vijay Shekhar Sharma, founder and chief executive of India’s most valuable startup, Paytm, posed an existential question in a recent press conference.

“What do you think of the commercial model for digital mobile payments. How do we make money?” Sharma asked Nandan Nilekani, one of the key architects of the Universal Payments Infrastructure that created a digital payments revolution in the country.

It’s the multi-billion-dollar question that scores of local startups and international giants have been scrambling to answer as many of them aggressively shift their focus to serving merchants and building lending products and other financial services .

New Delhi’s abrupt move to invalidate much of the paper bills in the cash-dominated nation in late 2016 sent hundreds of millions of people to cash machines for months to follow.

For a handful of startups such as Paytm and MobiKwik, this cash crunch meant netting tens of millions of new users in a span of a few months.

India then moved to work with a coalition of banks to develop the payments infrastructure that, unlike Paytm and MobiKwik’s earlier system, did not act as an intermediary “mobile wallet” to serve as an intermediary between users and their banks, but facilitated direct transaction between two users’ bank accounts.

Silicon Valley companies quickly took notice. For years, Google and the likes have attempted to change the purchasing behavior of people in many Asian and African markets, where they have amassed hundreds of millions of users.

In Pakistan, for instance, most people still run errands to neighborhood stores when they want to top up credit to make phone calls and access the internet.

With China keeping its doors largely closed for foreign firms, India, where many American giants have already poured billions of dollars to find their next billion users, it was a no-brainer call.

“Unlike China, we have given equal opportunities to both small and large domestic and foreign companies,” said Dilip Asbe, chief executive of NPCI, the payments body behind UPI.

And thus began the race to participate in the grand Indian experiment. Investors have followed suit as well. Indian fintech startups raised $2.74 billion last year, compared to 3.66 billion that their counterparts in China secured, according to research firm CBInsights.

And that bet in a market with more than half a billion internet users has already started to pay off.

“If you look at UPI as a platform, we have never seen growth of this kind before,” Nikhil Kumar, who volunteered at a nonprofit organization to help develop the payments infrastructure, said in an interview.

In October, just three years after its inception, UPI had amassed 100 million users and processed over a billion transactions. It has sustained its growth since, clocking 1.25 billion transactions in March — despite one of the nation’s largest banks going through a meltdown last month.

“It all comes down to the problem it is solving. If you look at the western markets, digital payments have largely been focused on a person sending money to a merchant. UPI does that, but it also enables peer-to-peer payments and across a wide-range of apps. It’s interoperable,” said Kumar, who is now working at a startup called Setu to develop APIs to help small businesses easily accept digital payments.

Vice-president of Google’s Next Billion Users Caesar Sengupta speaks during the launch of the Google “Tez” mobile app for digital payments in New Delhi on September 18, 2017 (Photo: Getty Images via AFP PHOTO / SAJJAD HUSSAIN)

The Google Pay app has amassed over 67 million monthly active users. And the company has found the UPI pipeline so fascinating that it has recommended similar infrastructure to be built in the U.S.

In August, the Federal Reserve proposed to develop a new inter-bank 24×7 real-time gross settlement service that would support faster payments in the country. In November, Google recommended (PDF) that the U.S. Federal Reserve implement a real-time payments platform such as UPI.

“After just three years, the annual run rate of transactions flowing through UPI is about 19% of India’s Gross Domestic Product, including 800 million monthly transactions valued at approximately $19 billion,” wrote Mark Isakowitz, Google’s vice president of Government Affairs and Public Policy.

Paytm itself has amassed more than 150 million users who use it every year to make transactions. Overall, the platform has 300 million mobile wallet accounts and 55 million bank accounts, said Sharma.

But despite on-boarding more than a hundred million users on their platform, payment firms are struggling to cut their losses — let alone turn a profit.

At an event in Bangalore late last year, Sajith Sivanandan, managing director and business head of Google Pay and Next Billion User Initiatives, said current local rules have forced Google Pay to operate in India without a clear business model.

Mobile payment firms never levied any fee to users as a strategy to expand their reach in the country. A recent directive from the government has now put an end to the cut they were receiving to facilitate UPI transactions between users and merchants.

Google’s Sivanandan urged the local payment bodies to “find ways for payment players to make money” to ensure every stakeholder had incentives to operate.

Paytm, which has raised more than $3 billion to date, reported a loss of $549 million in the financial year ending in March 2019.

The firm, backed by SoftBank and Alibaba, has expanded to several new businesses in recent years, including Paytm Mall, an e-commerce venture, social commerce, financial services arm Paytm Money and a movies and ticketing category.

This year, Paytm has expanded to serve merchants, launching new gadgets such as a stand that displays QR check-out codes that comes with a calculator and a battery pack, a portable speaker that provides voice confirmations of transactions and a point-of-sale machine with built-in scanner and printer.

In an interview with TechCrunch, Sharma said these devices are already garnering impressive demand from merchants. The company is offering these gadgets to them as part of a subscription service that helps it establish a steady flow of revenue.

The firm’s Money arm, which offers lending, insurance and investing services, has amassed over 3 million users. The head of Paytm Money, Pravin Jadhav, resigned from the company this week, a person familiar with the matter said. A Paytm spokeswoman declined to comment. (Indian news outlet Entrackr first reported the development.)

Flipkart’s PhonePe, another major player in India’s payments market, today serves more than 175 million users, and over 8 million merchants. Its app serves as a platform for other businesses to reach users, explained Rahul Chari, co-founder and CTO of the firm, in an interview with TechCrunch. The company is currently not taking a cut for the real estate on its app, he added.

But these startups’ expansion into new categories means that they now have to face off even more rivals, and spend more money to gain a foothold. In the social commerce category, for instance, Paytm is competing with Naspers-backed Meesho and a handful of new entrants; and heavily-backed OkCredit and KhataBook today lead the bookkeeping market.

BharatPe, which raised $75 million two months ago, is digitizing mom and pop stores and granting them working capital. And PineLabs, which has already become a unicorn, and MSwipe have flooded the market with their point-of-sale machines.

A vendor holds an Mswipe terminal, operated by M-Swipe Technologies Pvt Ltd., in an arranged photograph at a roadside stall in Bengaluru, India, on Saturday, Feb. 4, 2017. (Photographer: Dhiraj Singh/Bloomberg via Getty Images)

“They have no choice. Payment is the gateway to businesses such as e-commerce and lending that you can monetize. In Paytm’s case, their earlier bet was Paytm Mall,” said Jayanth Kolla, founder and chief analyst at research firm Convergence Catalyst.

But Paytm Mall has struggled to compete with giants Amazon India and Walmart’s Flipkart. Last year, Mall pivoted to offline-to-online and online-to-offline models, wherein orders placed by customers are serviced from local stores. The company also secured about $160 million from eBay last year.

An executive who previously worked at Paytm Mall said the venture has struggled to grow because its goal-post has constantly shifted over the years. It has recently started to focus on selling fastags, a system that allows vehicle owners to swiftly pay toll fees. At least two more executives at the firm are on their way out, a person familiar with the matter said.

Kolla said the current dynamics of India’s mobile payments market, where more than 100 firms are chasing the same set of audience, is reminiscent of the telecom market in the country from more than a decade ago.

“When there were just four to five players in the telecom market, the prospect of them becoming profitable was much higher. They were scaling like crazy. They grew with the lowest ARPU in the world (at about $2) and were still profitable.

“But the moment that number grew to more than a dozen overnight, and the new players started offering more affordable plans to subscribers, that’s when profitability started to become elusive,” he said.

To top that off, the arrival of Reliance Jio, a telecom operator run by India’s richest man, in 2016 in the country with the cheapest tariff plans in the world, upended the market once again, forcing several players to leave the market, or declare bankruptcies, or consolidate.

India’s mobile payments market is now heading to a similar path, said Kolla.

If there were not enough players fighting for a slice of India’s mobile payments market that Credit Suisse estimate could reach $1 trillion by 2023, WhatsApp, the most popular app in the country with more that 400 million users, is set to roll out its mobile payments service in the country in a couple of months.

At the aforementioned press conference, Nilekani advised Sharma and other players to focus on financial services such as lending.

Unfortunately, the coronavirus outbreak that promoted New Delhi to order a three-week lockdown last month is likely going to impact the ability of millions of people to use such services.

“India has more than 100 million microfinance accounts, serviced in cash every week by gig-economy workers, who hawk vegetables on street corners or embroider saris sold in malls, among other things. Three out of four workers make a living by working casually for others or at their family firms and farms. Prolonged shutdowns will impair their ability to repay loans of 2.1 trillion rupees ($28.5 billion), putting the world’s largest microfinance industry at risk,” wrote Bloomberg columnist Andy Mukherjee.

Powered by WPeMatico

Disney said on Tuesday that it will launch its streaming service, Disney+, in India on April 3. The service, available globally in about a dozen markets, will launch in India on Hotstar, one of the most popular on-demand streaming services in the country that is also owned by Disney.

The company said it is raising the yearly subscription cost of the combined entity, Disney+Hotstar, to Rs 1,499 ($20), up from Rs 999 ($13.2) that it previously charged for its most premium content on Hotstar. TechCrunch reported last year that Disney+ will launch in India in 2020 and will increase its subscription cost.

Hotstar, which claimed to have amassed 300 million monthly active users during the cricket season in India last year, would continue to offer an ad-supported service that it will offer to users without a fee. But it is increasing the cost of both of its premium tiers.

Disney is offering a more affordable yearly tier that costs Rs 399 ($5.3) — up from Rs 365 — that will include movies from the Marvel Cinematic Universe, access to live sporting events and a wide catalog of movies and shows, and original shows produced by Hotstar. It will not include Disney+ Originals.

The $20 yearly subscription tier will offer over 100 series and 250 superhero and animated titles, including Disney+ Originals and shows from HBO, Fox, and Showtime, the company said. It will also include access to everything that Disney+Hotstar customers are availing at $5.3 tier.

All existing subscribers will be automatically upgraded to their respective new subscription plan and will be charged the new rates upon renewal, the company said.

“With the success of Hotstar, we ushered in a new era for premium video streaming in India. Today, as we unveil Disney+ Hotstar, we take yet another momentous step in staying committed to our promise of delivering high-quality impactful stories for India that have not only entertained but also made a difference in people’s lives, a promise that is even more meaningful in challenging times such as this,” said Uday Shankar, President of The Walt Disney Company APAC and Chairman, Star & Disney India, said in a statement.

“We hope the power of Disney’s storytelling, delivered through Hotstar’s technology, will help our viewers find moments of comfort, happiness and inspiration during these difficult times,” he added.

The company had originally planned to launch Disney+Hotstar in India on March 29, but it began testing the service in the country weeks prior to that.

But as the coronavirus outbreak prompted New Delhi to order a nation-wide lockdown, which put a halt to public events including the cricket tournament Indian Premier League (IPL), Disney postponed the launch of Disney+Hostar in India.

IPL cricket tournament is by far the biggest attraction on Hotstar. According to people familiar with the matter, the months following IPL saw Hotstar’s userbase drop from 300 million to about 60 million last year.

If the IPL cricket tournament, which has been postponed until mid next month, is further delayed — or cancelled — it might significantly hurt Hotstar’s relevance and financials.

If that wasn’t enough, some of the shows and movies on Hotstar may disappear soon as one of its partners, Hooq, filed for liquidation last week.

Disney was also recently criticized for blocking and censoring episodes of John Oliver’s “Last Week Tonight.” Hotstar did not stream a recent episode of Oliver’s show that was critical of India’s Prime Minister Narendra Modi and some of his policies. Hotstar has also edited out jokes from Oliver’s show that mocked Disney.

Oliver called out Disney and Hotstar for the censorship. Disney has not responded to multiple requests for comment on this matter.

Powered by WPeMatico

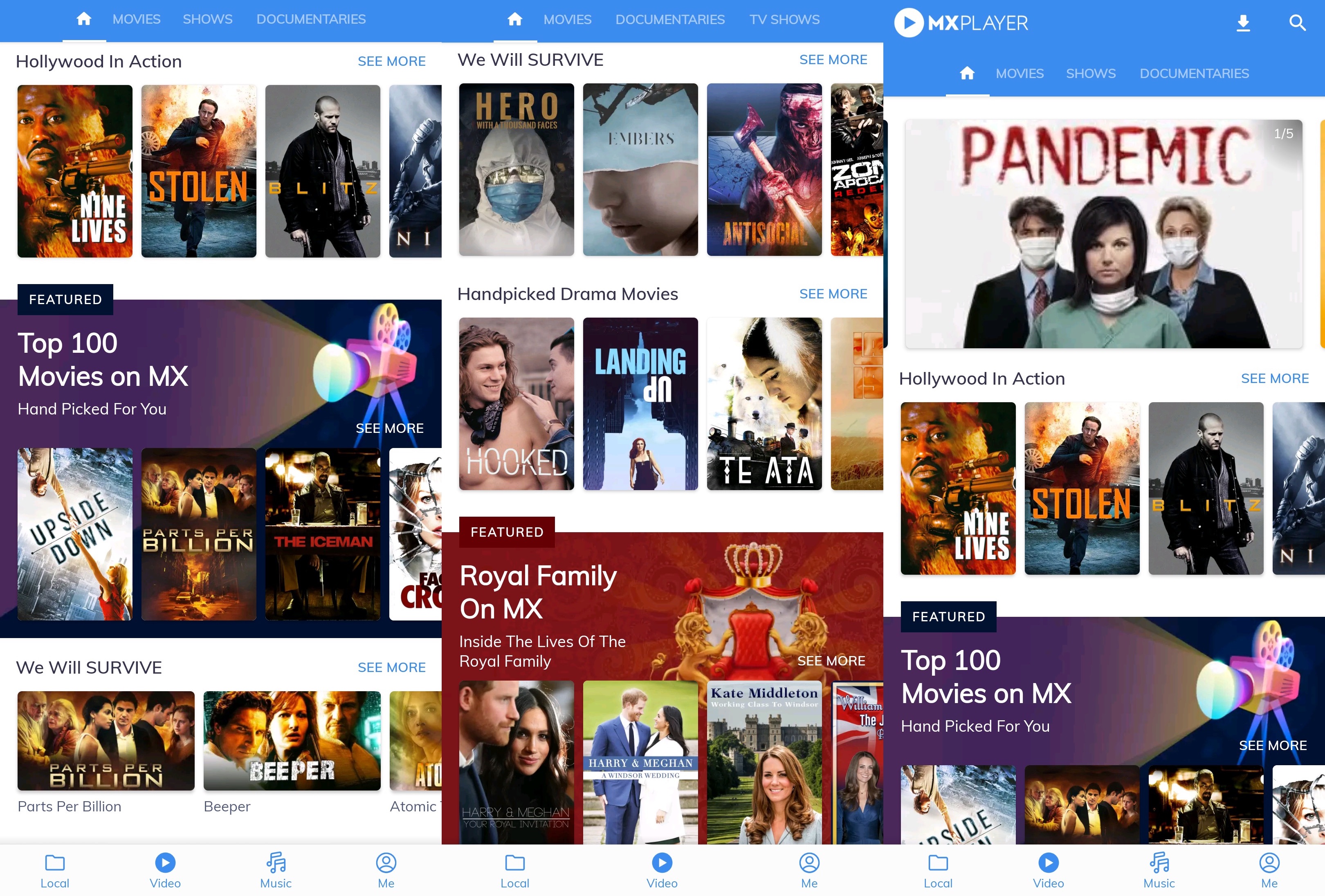

MX Player, the on-demand video streaming service owned by India’s conglomerate Times Internet, is expanding to more than half a dozen new international markets including the U.S. and the U.K. to supply more entertainment content to millions of people trapped in their homes.

The Singapore-headquartered on-demand video streaming service, which raised $111 million in a round led by Tencent last year, said it has expanded to Canada, Australia, New Zealand, Bangladesh and Nepal in addition to the U.S. and the UK.

Like in India, MX Player will offer its catalog at no charge to users in the international markets and monetize through ads, Karan Bedi, chief executive of the service, told TechCrunch in an interview.

The streaming service, which has amassed over 175 million monthly active users in India, is offering locally relevant titles in each market, he said. This is notably different from Disney’s Hotstar expansion into select international markets, where it has largely aimed to cater to the Indian diaspora.

MX Player is not currently offering any originally produced titles in any international market — instead offering movies and shows it has licensed from global and local studios — but the streamer plans to change that in the coming months, said Bedi.

Even as the expansion comes at a time when the world is grappling with containing and fighting the coronavirus outbreak, Bedi said MX Player had already been testing the service in several markets for a few months.

“We believe in meeting this rapidly rising demand from discerning entertainment lovers with stories that strike a chord. To that end, we have collaborated with some of the best talent and content partners globally who will help bring us a step closer to becoming the go-to destination for entertainment across the world,” said Nakul Kapur, Business Head for International markets at MX Player, in a statement.

Times Internet acquired MX Player, an app popular for efficiently playing a plethora of locally-stored media files on entry-level Android smartphones, in 2018 for about $140 million. In the years since, Times Internet has introduced video streaming service to it, and then live TV channels in India.

MX Player has also bundled free music streaming (through Gaana, another property owned by Times Internet) and has introduced in-app casual games for users in the country.

Bedi said the company is working on bringing these additional services to international markets, and also looking to enter additional regions including the Middle East and South Asia.

Powered by WPeMatico

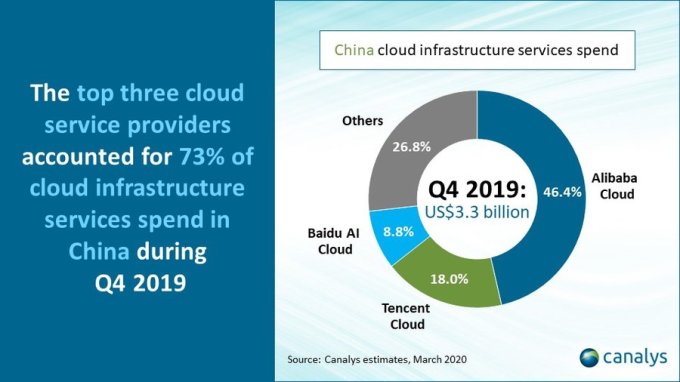

Research firm Canalys reports that the Chinese cloud infrastructure market grew 66.9% to $3.3 billion in the last quarter of 2019, right before the COVID-19 virus hit the country. China is the second largest cloud infrastructure market in the world, with 10.8% share.

The quarter puts the Chinese market on a $13.2 billion run rate. Canalys pegged the U.S. market at $14 billion for the same time period, with a 47% worldwide market share.

Alibaba led the way in China, with more than 46% market share. Like its American e-commerce giant counterpart, Amazon, Alibaba has a cloud arm, and it dominates in its country much the same way AWS does in the U.S.

Tencent was in second, with 18%, roughly the equivalent of Microsoft Azure’s share in the U.S., and Baidu AI Cloud came in third, with 8.8%, roughly the equivalent of Google’s U.S. market share.

Slide: Canalys

Matthew Ball, an analyst at Canalys, says the fourth quarter numbers predate the medical crisis due to the COVID-19 outbreak in China. “In terms of growth drivers for Q4, we have seen the ongoing demand for on-demand compute and storage accelerate throughout 2019, as private and public organizations embark on digital transformation projects and start building platforms and applications to develop new services.”

Ball says gaming was a big cloud customer, as was healthcare, finance, transport and industry. He also pointed to growth in facial recognition technology as part of the smart city sector.

As for next year, Ball says the firm still sees big growth in the market despite the virus impact in Q12020. “In addition to the continuation of digital projects once business returns to normality, we anticipate many businesses new to using cloud services during the crisis will continue use and become paying customers,” he said. The cloud companies have been offering a number of free options to businesses during the crisis.

“The overall outcome of current events around the world will be that companies will assess their business continuity measures and make sure they can continue to operate if events are ever repeated,” he said.

Powered by WPeMatico

Salesforce, the global giant in CRM, said on Wednesday that former banker Arundhati Bhattacharya will be joining the company on April 20 as chairperson and chief executive of its India division.

The San Francisco-headquartered firm said Bhattacharya, who served as the chairperson of the state-run State Bank of India for nearly four decades and oversees financial services group SWIFT India, will be tasked with helping the global giant scale rapidly in India, one of its fastest growing overseas markets.

Arundhati will report to Ulrik Nehammer, General Manager of Salesforce in the APAC region. “Arundhati is an incredible business leader, and we are delighted to welcome her to Salesforce as chairperson and CEO India,” said Gavin Patterson, President and CEO of Salesforce International, in a statement.

“India is an important growth market for Salesforce and a world-class innovation and talent hub and Arundhati’s leadership will guide our next phase of growth, customer success and investment in the region,” he said.

Salesforce offers a range of cloud services to customers in India, where it has over 1 million developers and more Trailhead users than in any other market outside of the U.S. The company, which competes with local players Zoho and Freshworks, counts Indian firms redBus, Franklin Templeton and CEAT as some of its clients.

The company said it expects to add 3,000 jobs in India in the next three years and turn the nation into a “leading global talent and innovation hub” for the company. Sunil Jose, who joined the firm in 2017, oversaw some of the company’s India operations previously.

“I could not be more excited to join the Salesforce team to ensure we capture this tremendous opportunity and contribute to India’s development and growth story in a meaningful way,” said Bhattacharya in a statement.

According to research firm IDC, Salesforce and its ecosystem of customers and partners in India are expected to create over $67 billion in business revenues and create more than 540,000 jobs by 2024.

Powered by WPeMatico

Hello and welcome back to TechCrunch’s China Roundup, a digest of recent events shaping the Chinese tech landscape and what they mean to people in the rest of the world. This week, a post from Sequoia Capital sounding the alarm of the coronavirus’s impact on businesses is reaching far corners of tech communities around the world, including China.

Many echo Sequoia’s observation that the companies that are the “most adaptable” are the likeliest to survive. Others cling to the hope of “[turning] a challenging situation into an opportunity to set yourself up for enduring success.”

Two weeks ago I wrote about how the private sector and the government in China are working together to contain the epidemic, bringing a temporary boost to the technology industry. This week I asked a number of investors and founders which of these changes will stand to last, and why.

The business-to-business (B2B) space was rarely a hot topic in China until online consumer businesses became relatively saturated in recent times. And now, the COVID-19 epidemic has unexpectedly breathed life into the once-boring field, which stretches from virtual meetings, online education, digital healthcare, cybersecurity, telecommunications, logistics to smart cities, analysis from investment firm Yunqi Partners shows.

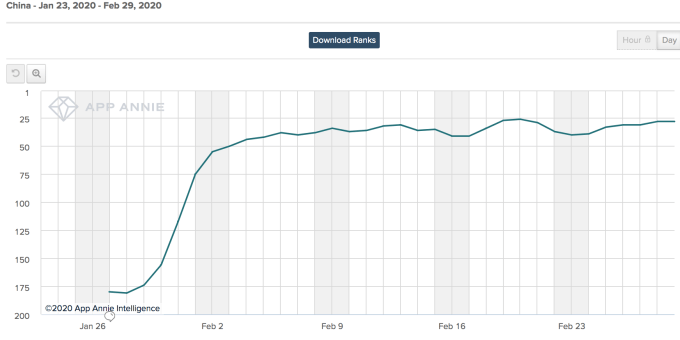

For one, there is an obvious opportunity for remote collaboration tools as people work from home. Downloads of indigenous work apps like Dingtalk, WeChat Work, TikTok’s sister Lark as well as America’s Zoom jumped exponentially amid the health crisis. While some argue that the boom is overblown and will dissipate as soon as businesses are back to normal, others suggest that the shift in behavior will endure.

Like other work collaboration services, Zoom soared in China amid the coronavirus outbreak, jumping from No. 180 in late January to No. 28 as of late February in overall app installs. Data: App Annie

“People are reluctant to change once they form a new habit,” suggests Joe Chan, partner at Hong Kong-based Mindworks Ventures. The virus outbreak, he believes, has educated the Chinese masses to work remotely.

“Meeting in person and through Zoom both have their own merits, depending on the social norm. Some people are used to thinking that relationships need to be established through face-to-face encounters, but those who don’t hold that view will have fewer meetings. [The epidemic] presents a chance for a paradigm shift.”

Growth in enterprise businesses might be less visible than what China witnessed over the SARS epidemic that fueled internet consumer verticals such as ecommerce. That’s because software-as-a-services (SaaS), cloud computing, health tech, logistics and other enterprise-facing services are intangible for most consumers.

“Compared to changes in consumer behavior, the adoption of new technologies by enterprises happen at a slower pace, so the impact of coronavirus on new-generation innovations [B2B] won’t come as rapidly and thoroughly as what happened during SARS,” contended Jake Xie, vice president of investment at China Growth Capital.

Xie further suggested that the opportunities presented by the outbreak are reserved for companies that have been steadily investing in the field, in part because enterprise services have a longer life cycle and require more capital-intensive infrastructure. “Opportunists don’t stand a chance,” he concluded.

As for changing consumer behavior, such as the uptick in grocery delivery usage by seniors trapped indoors, the impact might be short-lived. “The only benefit that the epidemic brings to these apps is getting more people to try their services. But how many of them will stay? The argument that people will keep using these apps over concerns of getting sick in offline markets is unsubstantiated. The strength of a business lies in its ability to solve user problems in the long term, for example, providing affordability and convenience,” suggested Derek Shen, chairman of Danke Apartment, the Chinese co-living startup slated to list on NYSE.

The adjacent sector of enterprise services — at-scale technologies tailored to energizing government functions — has also seen traction over the course of the epidemic. Private firms in China have teamed up with regional authorities to better track people’s movements, ramp up facial recognition capacities aimed at a mask-wearing public, develop contact-free consumer experience, among other measures.

Tech firms touting services to the government are no stranger to criticisms concerning the lack of transparency in how user data is used. But the appeal to private firms is huge, not only because state contracts tend to provide a steady stream of long-term revenue, but also that certain public-facing projects can be billed as a fulfillment of corporate social responsibilities. Following the virus outbreak, Chinese tech companies of all sizes hastened to offer contributions, with efforts ranging from making monetary donations to building tools that keep the public informed.

On the flip side, the government also needs private help in emergency management. As prominent Chinese historian Luo Xin poignantly pointed out in podcast SurplusValue’s recent episode [1:00:00], some of the most efficient and effective responses to the public health crisis came not from the government but the private sector, whether it is online retailer JD.com or logistics firm SF Express delivering relief supplies to the epicenter of the outbreak.

That said, Luo argued there are signs that some local authorities’ tendency to centralize control is getting in the way of private efforts. For example, some government offices have stumbled in their attempts to develop crisis management systems from scratch, overlooking a pool of readily available and proven infrastructure powered by the country’s tech giants.

Powered by WPeMatico

Google Cloud today announced its plans to open four new data center regions. These regions will be in Delhi (India), Doha (Qatar), Melbourne (Australia) and Toronto (Canada) and bring Google Cloud’s total footprint to 26 regions. The company previously announced that it would open regions in Jakarta, Las Vegas, Salt Lake City, Seoul and Warsaw over the course of the next year. The announcement also comes only a few days after Google opened its Salt Lake City data center.

GCP already had a data center presence in India, Australia and Canada before this announcement, but with these newly announced regions, it now offers two geographically separate regions for in-country disaster recovery, for example.

Google notes that the region in Doha marks the company’s first strategic collaboration agreement to launch a region in the Middle East with the Qatar Free Zones Authority. One of the launch customers there is Bespin Global, a major managed services provider in Asia.

“We work with some of the largest Korean enterprises, helping to drive their digital transformation initiatives. One of the key requirements that we have is that we need to deliver the same quality of service to all of our customers around the globe,” said John Lee, CEO, Bespin Global. “Google Cloud’s continuous investments in expanding their own infrastructure to areas like the Middle East make it possible for us to meet our customers where they are.”

Powered by WPeMatico

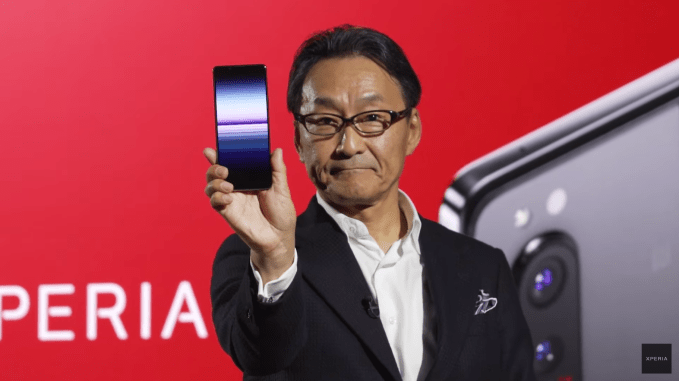

Sony has announced its first 5G smartphone: The Xperia 1 II. (For the curious or confused, it is pronounced ‘Xperia One, Mark Two.’)

“No one understands the entertainment experience better than Sony,” said president of mobile communications, Mitsuya Kishida, claiming the company is “uniquely positioned” in the era of 5G cellular technology to offer its target users an “enriched” experience thanks to Sony’s extensive content portfolio.

“Whether you are a broadcast professional who requires dynamic speed or an everyday user who desires enhanced entertainment, Xperia with 5G takes your mobile experience to the next level,” he said.

As ever with Sony — a major b2b supplier of image sensors to other smartphone makers (rather than a major seller of its own phones) — it’s made the camera a huge focus for the new Android 10 flagship, which has a 6.5in 21:9 “CinemaWide” 4K HDR OLED (3840×1644) display and is powered by a Qualcomm 865 Snapdragon chip (with 8GB of RAM on board).

Round the back the Xperia 1 II packs three lenses which offer a selection of focal lengths (16mm, 24mm and 70mm) for capturing different types of photos — from super wide angle to portraits.

All three rear lenses have a 12MP sensor, while round the front there’s an 8MP lens. Sony is also using Zeiss optics for the first time in a smartphone, expanding a long-running collaboration to a new device type.

Talking up the camera, Kishida touted ultra-fast, low light autofocus, noting that it supports 20fps autofocus and auto-tracking burst (which he called a world first in a smartphone) for capturing crisp action shots.

“Our new continuous auto focus keeps tracking of moving subjects. What’s special about this is with 20fps it calculates the object 3x per frame — that’s 60x per second — capturing the very moment,” he said.

“With the power and speed of 5G you will be able to share those moments more quickly and more easily across the network,” he added.

Another photo-friendly feature is real-time eye auto focus. Sony demoed this by showing it working on a video of a cat playing with a toy. So, tl;dr: Sony has trained its model on data-sets of pets too, not just humans.

A ‘Photo Pro’ interface on the handset, meanwhile, has been designed to be familiar to users of Sony’s mirrorless Alpha cameras — letting photographers tune shots via access to tweakable parameters they’re used to using on Sony’s high end digital cameras.

Sony is paying the same mind to video makers, with a video editing interface on the device that offers features such as touch autofocus and custom white balance — which Kishida said will help “visual storytellers” control the camera more easily.

There’s also a noise reduction feature to improve audio capture.

Best of all, the Xperia 1II has a 3.5mm headphone jack — enabling audiophiles to enjoy the simple pleasure of plugging in their favorite pair of high-end wired headphones and tuning out everything else.

Kishida flagged the use of an AI technology, called DSEE Ultimate, which he said upscales the sound signal to “near high resolution audio” — including when streaming. “This the best on the go acoustic experience available,” he claimed.

On the games front he touted a collaboration that will let users of the device play a mobile optimized version of Call of Duty using PlayStation 4’s DualShock 4 wireless controller.

The handset, meanwhile, packs a 4,000mAh battery as well as fast wireless charging.

Per Kishida the Xperia 1 II will start shipping from Spring onwards, though it’s not yet clear which markets Sony will be bringing the device to. (Last year the company’s mobile division was reported to have defocused most of the global market in a bid to focus on profitability.)

The Xperia 1 II may have a fairly niche target buyer, as Sony is a relative bit player in consumer smartphone sales vs giants like Samsung and Huawei, but is intended to act as a showcase for what the company’s camera technologies can offer other mobile makers.

Sony’s mobile chief was making the announcements at a virtual press conference screened via YouTube after the company became one of the first big companies to pull out of attending the Mobile World Congress tradeshow.

MWC’s organizer, the GSMA, subsequently cancelled the annual mobile industry event, which had been due to take place in Barcelona this week, after scores of exhibitors said they would not attend due to public health concerns attached to the novel coronavirus.

MWC typically attracts more than 100,000 visitors across four days. So the sight of Sony’s press conference being streamed to an empty room — entirely devoid of cameras, claps or woos but still with built in pauses for the media to take photos of the new hardware — was more than a little surreal.

Kishida had another 5G handsets to tease: the Xperia Pro, a flagship handset aimed at video professionals. It features 5G mm wavelength technology for improved capability to stream high-resolution video, as well as a handy micro HDMI port for easy plugging in of other high end camera kit.

Sony touted tests it’s done with U.S. carrier Verizon (TechCrunch’s parent company) to use the forthcoming 5G handset for live streaming of live sports events.

“Sony’s expertise and long history in providing profession digital imaging solutions is very unique,” added Kishida. “Only Sony has such deep and well established relationships, and we are bringing decades of experience to an end-to-end solution — from professional content creation to mobile communications technology in 5G.”

There was a mid-range smartphone announcement, too, also shipping from Spring onwards: The Xperia 10 II packs a 6″ display and also features a triple lens camera as well as water resistance.

Powered by WPeMatico