Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Licious, a Bangalore-based startup that sells fresh meat and seafood online, has secured $30 million in a new financing round as it looks to expand its footprint in the nation.

The new financing round, dubbed Series E, for the four-year-old startup was led by Singapore-based Vertex Growth Fund, it said Monday. Existing investors 3one4 Capital, Bertelsmann India Investments, Vertex Ventures Southeast Asia and India and Sistema Asia Fund also participated in the round.

The Series E pushes Licious’ to-date raise to $94.5 million.

Licious operates an eponymous e-commerce platform to sell meat and seafood in cities in India (Bengaluru, NCR, Hyderabad, Chandigarh, Panchkula, Mohali, Mumbai, Pune, and Chennai). The startup does not stock any inventory, so any raw material it procures, it processes and ships on the same or next day. It processes more than 17,000 orders every day.

The startup, which employs more than 2,000 people, has built its own supply chain network to control sourcing and production of food, it said. Licious executives said the startup is growing at a healthy rate of 300% year-over-year and aims to generate $140 million in annual revenue by 2023.

Licious will use the fresh capital to expand to more cities in India, and launch new products, said Vivek Gupta, co-founder of the startup.

The startup competes with Bangalore-based FreshToHome, which has amassed more than 650,000 customers in 10 cities in India. As of August, when FreshToHome raised $20 million in a new funding round, the startup was handling 14,000 orders a day.

Gupta said the vast majority of the Indian meat and seafood industry remains unorganized, which has created an immense opportunity for startups to address the sector. The cold-chain market of India is estimated to grow to $37 billion in the next five years, according to industry estimates.

“The traditional meat and seafood industry are in dire need of tech intervention, quality standardisation and a skilled talent pool. Licious is working towards creating these differentiators and will stay committed towards elevating India’s meat and seafood experience,” he said.

Powered by WPeMatico

Seoul and South Korea may well be the secret startup hub that (still) no one talks about.

While often dwarfed by the scale and scope of the Chinese startup market next door, South Korea has proven over the last few years that it can — and will — enter the top-tier of startup hubs.

Case in point: Baedal Minjok (typically shortened to Baemin), one of the country’s leading food delivery apps, announced an acquisition offer by Berlin-based Delivery Hero in a blockbuster $4 billion transaction late this week, representing potentially one of the largest exits yet for the Korean startup world.

The transaction faces antitrust review before closing, since Delivery Hero owns Baemin’s largest competitor Yogiyo, and therefore is conditional on regulatory approval. Delivery Hero bought a majority stake in Yogiyo way back in 2014.

What’s been dazzling though is to have witnessed the growth of this hub over the past decade. As TechCrunch’s former foreign correspondent in Seoul five years ago and a university researcher locally at KAIST eight years ago, I’ve been watching the growth of this hub locally and from afar for years now.

While the country remains dominated by its chaebol tech conglomerates — none more important than Samsung — it’s the country’s startup and culture industries that are driving dynamism in this economy. And with money flooding out of the country’s pension funds into the startup world (both locally and internationally), even more opportunities await entrepreneurs willing to slough off traditional big corporate career paths and take the startup route.

Baemin’s original branding was heavy on the illustrations.

Five years ago, Baemin was just an app for chicken delivery with a cutesy and creative interface facing criticism from restaurant franchise owners over fees. Now, its motorbikes are seen all over Seoul, and the company has installed speakers in many restaurants where a catchy whistle and the company’s name are announced every time there is an online delivery order.

(Last week when I was in Seoul, one restaurant seemingly received an order every 1-3 minutes with a “Baedal Minjok Order!” announcement that made eating a quite distracted experience. Amazing product marketing tactic though that I am surprised more U.S.-based food delivery startups haven’t copied yet).

The strengths of the ecosystem remain the same as they have always been. A huge workforce of smart graduates (Korea has one of the highest education rates in the world), plus a high youth unemployment and underemployment rate have driven more and more potential founders down the startup path rather than holding out for professional positions that may never materialize.

What has changed is venture capital funding. It wasn’t so long ago that Korea struggled to get any funding for its startups. Years ago, the government initiated a program to underwrite the creation of venture capital firms focused on the country’s entrepreneurs, simply because there was just no capital to get a startup underway (it was not uncommon among some deals I heard of at the time for a $100k seed check to buy almost a majority of a startup’s equity).

Now, Korea has become a startup target for many international funds, including Goldman Sachs and Sequoia. It has also been at the center of many of the developments of blockchain in recent years, with the massive funding boom and crash that market sustained. Altogether, the increased funding has led to a number of unicorn startups — a total of seven according to the The Crunchbase Unicorn Leaderboard.

And the country is just getting started – with a bunch of new startups looking poised to driven toward huge outcomes in the coming years.

Thus, there continues to be a unique opportunity for venture investors who are willing to cross the barriers here and engage. That said, there are challenges to overcome to make the most of the country’s past and future success.

Perhaps the hardest problem is simply getting insight on what is happening locally. While China attracts large contingents of foreign correspondents who cover everything from national security to the country’s startups and economy, Korea’s foreign media coverage basically entails coverage of the funny guy to the North and the occasional odd cultural note. Dedicated startup journalists do exist, but they are unfortunately few and far between and vastly under-resourced compared to the scale of the ecosystem.

Plus, similar to New York City, there are also just a number of different ecosystems that broadly don’t interact with each other. For Korea, it has startups that target the domestic market (which makes up the bulk of its existing unicorns), plus leading companies in industries as diverse as semiconductors, gaming, and music/entertainment. My experience is that these different verticals exist separately from each other not just socially, but also geographically as well, making it hard to combine talent and insights across different industries.

Yet ultimately, as valuations soar in the Valley and other prominent tech hubs, it is the next tier of startup cities that might well offer the best return profiles. For the early investors in Baemin, this was a week to celebrate, perhaps with some fried chicken delivery.

Powered by WPeMatico

Reliance Industries, one of India’s largest industrial houses, has acquired a majority stake in NowFloats, an Indian startup that helps businesses and individuals build online presence without any web developing skills.

In a regulatory filing on Thursday, Reliance Strategic Business Ventures Limited said (PDF) it has acquired an 85% stake in NowFloats for 1.4 billion Indian rupees ($20 million).

Seven-and-a-half-year old, Hyderabad-headquartered NowFloats operates an eponymous platform that allows individuals and businesses to easily build an online presence. Using NowFloats’ services, a mom and pop store, for instance, can build a website, publish their catalog, as well as engage with their customers on WhatsApp.

The startup, which has raised about 12 million in equity financing prior to today’s announcement, claims to have helped over 300,000 participating retail partners. NowFloats counts Blume Ventures, Omidyar Network, Iron Pillar, IIFL Wealth Management, and Hyderabad Angels among its investors.

Last year, NowFloats acquired LookUp, an India-based chat service that connects consumers to local business — and is backed by Vinod Khosla’s personal fund Khosla Impact, Twitter co-founder Biz Stone, Narayana Murthy’s Catamaran Ventures and Global Founders Capital.

Reliance Strategic Business Ventures Limited, a wholly-owned subsidiary of Reliance Industries, said that it would invest up to 750 million Indian rupees ($10.6 million) of additional capital into the startup, and raise its stake to about 89.66%, if NowFloats achieves certain unspecified goals by the end of next year.

In a statement, Reliance Industries said the investment will “further enable the group’s digital and new commerce initiatives.” NowFloats is the latest acquisition Reliance has made in the country this year. In August, the conglomerate said it was buying a majority stake in Google-backed Fynd for $42.3 million. In April, it bought a majority stake in Haptik in a deal worth $100 million.

There are about 60 million small and medium-sized businesses in India. Like hundreds of millions of Indians, many in small towns and cities, who have come online in recent years thanks to world’s cheapest mobile data plans and inexpensive Android smartphones, businesses are increasingly building online presence as well.

But vast majority of them are still offline, a fact that has created immense opportunities for startups — and VCs looking into this space — and major technology giants. New Delhi-based BharatPe, which helps merchants accept online payments and provides them with working capital, raised $50 million in August. Khatabook and OkCredit, two digital bookkeeping apps for merchants, have also raised significant amount of money this year.

In recent years, Google has also looked into the space. It has launched tools — and offered guidance — to help neighborhood stores establish some presence on the web. In September, the company announced that its Google Pay service, which is used by more than 67 million users in India, will now enable businesses to accept digital payments and reach their customers online.

Powered by WPeMatico

Amazon is having another go at expanding its reach to listeners in India. The company, which launched pay-to-use Audible in the country last year, today introduced a new service called Audible Suno that offers free access to “hundreds of hours of audio entertainment, enlightenment and learning.”

And it’s banking on major Indian celebrities to draw the listeners.

Audible Suno, which is exclusively available to users in India, features more than 60 original and exclusive episodes (of 20 to 60 minutes in length) in both Hindi and English languages. Audible, the world’s largest seller and producer of audio content, said Suno is aimed at filling the “idle time” listeners have each day during their commutes and performing other daily chores.

The company says Audible Suno, available to users through a dedicated Android app and via iOS Audible app, is also free of advertisements.

The launch of Audible Suno in India illustrates the commitment the company has in the country, said Audible founder and chief executive Don Katz. Amazon has invested more than $5.5 billion in its business in India to date. The company’s tentacles today reach a number of categories in the country, including e-commerce, payments, online ticketing business, video and audio streaming and VC deals.

“I’ve always been passionate about the transformative power of the spoken word, and I’m delighted to be able to offer this breadth of famous voices and culturally resonant genres with unlimited access, ad-free and free of charge,” said Katz.

Who are these famous voices you ask? Here’s the list: Amitabh Bachchan, Katrina Kaif, Karan Johar, Anil Kapoor, Farhan Akhtar, Mouni Roy, Anurag Kashyap, Neelesh Misra, Tabu, Nawazuddin Siddiqui, Diljit Dosanjh, Vir Das and Vicky Kaushal.

Audible Suno currently offers shows in a range of genres, including horror (Kaali Awaazein), romance and relationships (Matrimonial Anonymous and Piya Milan Chowk), suspense (Thriller Factory) and comedy series (The Unexperts by Abish Mathew). Non-fiction series include interviews with some of the country’s biggest stars, and socially relevant subjects such as mental health, sex education and the rights of the LGBTQI+ community.

Powered by WPeMatico

Zetwerk, an Indian business-to-business marketplace for manufacturing items, has closed a significantly large financing round as it scales its operations in the nation and also helps local businesses find customers overseas.

The 18-month-old startup said on Wednesday it has raised $32 million in a Series B financing round led by Lightspeed and Greenoaks Capital. Zetwerk co-founder and chief executive Amrit Acharya told TechCrunch in an interview that the startup has also raised about $14.2 million in debt from a consortium of banks, and others.

Existing investors Accel, Sequoia India and Kae Capital also participated in the round, which pushes the Bangalore-based startup’s total raise to date to about $41 million. Vaibhav Gupta, co-founder of business-to-business marketplace Udaan, and Maninder Gulati, one of the top executives at budget lodging startup Oyo also participated.

Zetwerk was founded by Acharya, Srinath Ramakkrushnan, Rahul Sharma and Vishal Chaudhary last year. The startup connects OEMs (original equipment manufacturers) and EPC (engineering procurement construction) customers with manufacturing small-businesses and enterprises.

Unlike the more common e-commerce firms we come across every day, Zetwerk sells goods such as parts of a crane, doors, chassis of different machines and ladders. The startup operates to serve customers in fabrication, machining, casting and forging businesses. Currently, Zetwerk works with more than 100 enterprises and 1,500 small and medium-sized businesses. It delivers more than 15,000 parts each month.

“These are all custom-made products,” explained Acharya. “Nobody has a stock of such inventories. You get the order, you find manufacturers and workshops that make them. Our customers are companies that are in the business of building infrastructure.”

“We index these small workshops and understand the kinds of products they have built before. These indexes help bigger companies discover and work with them,” he added.

Once a firm has placed an order, Zetwerk allows them to keep a tab on the progress of manufacturing and then the shipping. This “hand-holding” is crucial, as in this line of business, manufacturing and shipping typically take more than two to three months.

Zetwerk has also enabled manufacturers in India to discover and find clients overseas. Today, manufacturers on the platform export their goods to North America and Southeast Asia, Acharya said. “India has a lot of depth in manufacturing, but much of it has not been tapped well,” he said.

Helping these manufacturing workshops find clients online is still a new phenomenon in the nation. Acharya said Zetwerk largely competes with domain project consultants in the offline work. “They specialize in certain products and geographies. So let’s say someone wanted to buy a machine XYZ in Orissa, they reach out to consultants who help them find workshops and estimate how much time it would take to get the project done.”

According to industry reports, manufacturing today accounts for 14% of India’s GDP. But the nation lacks a supporting ecosystem to execute projects in an efficient manner.

Vaibhav Agarwal, a partner at Lightspeed, said it was unusual to come across a market that is as large as $40 billion to $60 billion in India and global trade-tailwinds that creates opportunity to serve international demand.

The startup plans to infuse portions of the fresh capital into expanding its international operations. Acharya did not share exactly how many clients it has outside of India but said exports currently account for less than 5% of the startup’s GMV, or gross merchandize value.

He said the startup will continue to focus on helping Indian manufacturers find clients outside, as it is better suited to address this, as opposed to helping Indian companies find manufacturers overseas.

The startup will also explore helping its manufacturing workshops access working capital, though Acharya cautioned that it is not something that would happen anytime soon.

In a statement, Prayank Swaroop, a partner at Accel, said, “the use of technology in project planning, procurement, audits, and supply chain transparency is the core offering of Zetwerk which is completely original. Accel is very fortunate to be part of Zetwerk journey since the startup’s inception.”

Powered by WPeMatico

Neuron Mobility, a Singapore-based startup, has closed an $18.5 million financing round as it looks to scale its e-scooter startup in international markets — a month after the nation introduced difficult regulatory changes.

The new financing round, dubbed Series A, was funded by GSR Ventures, a venture capital firm that was the first institutional investor in Chinese ride-hailing giant DiDi Chuxing, and Square Peg, Australia’s largest venture capital firm.

Existing investors SeedPlus and SEEDS Capital also participated in the round. The three-year-old startup has raised about $23.5 million to date.

Neuron Mobility, which began its journey in Singapore, operates an eponymous e-scooter rental platform. In recent years and quarters, Neuron has expanded to cities in Malaysia, Thailand, Australia and New Zealand.

Neuron’s e-scooters are affordable in every market where they are available. In Brisbane, Australia, for instance, anyone can begin a trip with a Neuron bike by paying one Australian Dollar (68 U.S. cents) and then 38 Australian cents for each minute of the ride, Zachary Wang, co-founder and chief executive of Neuron, told TechCrunch in an interview.

These electric scooters can go as fast as 25 kilometre per hour (15.5 miles per hour), and automatically slow down at certain places, such as near a school. Wang said the startup closely works with city councils to understand how these e-scooters should operate.

In a statement, Square Peg’s Tushar Roy said, “the culture of collaboration with cities permeates through Neuron. Its entire DNA is built around working very closely with local leadership to bring new mobility solutions to citizens in a safe and sustainable way.”

On a single charge, a Neuron scooter can travel up to 60 kilometres (37.2 miles). These e-scooters are equipped with a swappable battery. Once the ride is finished, a customer can drop the bike at any nearby parking station or any suitable location. Neuron works with a large number of people who actively swap the batteries on these scooters.

Like India’s electric scooter and bike startups Bounce and Yulu, Neuron Mobility also designs its electric scooters, but relies on a Chinese equipment manufacturer for producing them. (Yulu recently inked a strategic deal with Bajaj Auto to task the Indian auto manufacturing giant with the production job.)

As Neuron expands to international markets, it has had to halt its e-scooter rental service in the home market of Singapore. Last month, Singapore said e-scooters could no longer operate on footpaths, creating major challenges for all the players. Wang and executives from other startups have expressed concerns over the decision.

Telepod, which uses e-scooters to deliver food; GrabFood, another food delivery startup; and shared e-scooter service startup Beam, said they could no longer offer the same level of customer service to their users, and had little choice but to focus on other markets.

Wang said that Neuron still has teams that work from Singapore, but they have always focused on the larger Asia Pacific region and other markets. Besides, Neuron stopped its service in Singapore months before the nation passed any new law. (Prior to the recent order, Singapore had other issues with electric scooters.)

Neuron will use the fresh capital to further its footprint in the markets where it operates and explore building new categories, Wang said. “We feel we are in the midst of a wave where a number of technologies are falling into place that could help us improve our electric scooter and build more mobility solutions.” The startup is also exploring new markets, though Wang declined to name them.

Like in the United States, electric scooters and bikes have imploded in Southeast Asian markets, where a growing number of familiar brands such as Lime, Bird, Ofo, oBike and local players are increasingly expanding their presence.

Powered by WPeMatico

Netflix continues to bet heavily on India, one of the world’s largest entertainment markets, where it competes with more than three dozen rivals, including Disney.

Reed Hastings, the chief executive of Netflix, said on Friday that the company is on track to spend 30 billion Indian rupees, or $420.5 million, on producing and licensing content in India this year and next.

“This year and next year, we plan to spend about Rs 3,000 crores developing and licensing content and you will start to see a lot of stuff hit the screens,” he said at a conference in New Delhi.

The rare revelation today has quickly become the talk of the town. “This is significantly higher than what we have invested in content over the past years,” an executive at one of the top five rival services told TechCrunch. Another industry source said that no streaming service in India is spending anything close to that figure on just content.

While it remains unclear exactly how much capital other streaming services are pouring into content, a recent KPMG report estimated that Hotstar was spending about $17 million on producing seven original shows this year, while Eros Now had pumped about $50 million into its India business to create 100 new original shows. (The report does not talk about licensing content expenses.)

Netflix, which entered India as part of its global expansion to more than 200 nations and territories in early 2016, has so far produced more than two dozen original shows and movies in the country and inked partnerships with a number of local studios, including actor Shah Rukh Khan’s Red Chillies Entertainment.

Hastings said several of the shows the company has produced in India, including A-listed cast thriller “Sacred Games” and animated show “Mightly Little Bheem,” have “traveled around the world.” More than 27 million households outside of India, said Hastings, have started to watch “Mighty Little Bheem,” a show aimed at children.

Netflix, which is expected to spend about $15 billion on content globally next year, has never shared the number of subscribers it has in India. (It has over 158 million subscribers globally.) But the company’s financials in the country, where it employs about 100 people, have improved in recent quarters. In the financial year that ended in March, the company posted revenue of $65 million and profit of about $720,000 for its India business.

India has emerged as one of the last great growth markets for global technology and entertainment firms. About half of the nation’s 1.3 billion population is now online and the country’s on-demand video market is expected to grow to $5 billion in the next four years, according to Boston Consulting Group.

But the propensity — or the capacity — of most of these internet users to pay for a subscription service remains significantly low. Most services operating in India today generate the majority of their revenue from ads. And others, which rely on a recurring model, are making major changes to their offerings in the nation.

To broaden its reach in the nation, Netflix earlier this year introduced a new monthly price tier — $2.8 — that allows users in India to watch the streaming service in standard quality on a mobile device. (The company has since expanded this offering to Malaysia.)

Netflix competes with more than three dozen on-demand video streaming services in India. Chief among its competitors in the nation is Disney’s Hotstar. Hotstar’s content includes live TV channels, streaming of sports events and thousands of movies and shows, many syndicated from global networks and studios such as HBO and Showtime.

The ad-supported service offers more than 80% of its catalog at no charge to users and charges 999 Indian rupees ($14) a year for its premium tier.

Among the licensed content that Hotstar — or its operator Star India — owns in the country includes rights to stream a number of cricket tournaments. Cricket is incredibly popular in India and has helped Hotstar set global streaming records.

In May this year, Hotstar reported that more than 25 million people simultaneously watched a cricket match on the platform — a global record. The service, at the time, had more than 300 million monthly active users.

Commenting on the competition, Hastings said the next five to 10 years is going to be “the golden age of television” as “unbelievable and unrivaled levels of investment” go into producing content. “They are all investing here in India. We are seeing more content made than ever before. It’s a great export,” he added.

Disney+, the recently launched streaming service from the global content conglomerate, is set to be available in India and Southeast Asian markets next year through Hotstar, TechCrunch reported last month.

Powered by WPeMatico

After growing its lending business in West Africa, emerging markets credit startup Migo is expanding to Brazil on a $20 million Series B funding round led by Valor Capital Group.

The San Franicso-based company — previously branded Mines.io — provides AI-driven products to large firms so those companies can extend credit to underbanked consumers in viable ways.

That generally means making lending services to low-income populations in emerging markets profitable for big corporates, where they previously were not.

Founded in 2013, Migo launched in Nigeria, where the startup now counts fintech unicorn Interswitch and Africa’s largest telecom, MTN, among its clients.

Offering its branded products through partner channels, Migo has originated more than 3 million loans to over 1 million customers in Nigeria since 2017, according to company stats.

“The global social inequality challenge is driven by a lack of access to credit. If you look at the middle class in developed countries, it is largely built on access to credit,” Migo founder and CEO Ekechi Nwokah told TechCrunch.

“What we are trying to do is to make prosperity available to all by reinventing the way people access and use credit,” he explained.

Migo does this through its cloud-based, data-driven platform to help banks, companies and telcos make credit decisions around populations they previously may have bypassed.

These entities integrate Migo’s API into their apps to offer these overlooked market segments digital accounts and lines of credit, Nwokah explained.

“Many people are trying to do this with small micro-loans. That’s the first place you understand risk, but we’re developing into point of sale solutions,” he said.

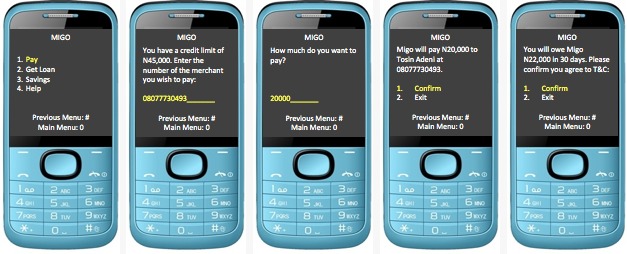

Migo’s client consumers can access their credit lines and make payments by entering a merchant phone number on their phone (via USSD) and then clicking on “Pay with Migo.” Migo can also be set up for use with QR codes, according to Nwokah.

He believes structural factors in frontier and emerging markets make it difficult for large institutions to serve people without traditional credit profiles.

“What makes it hard for the banks is its just too expensive,” he said of establishing the infrastructure, technology and staff to serve these market segments.

Nwokah sees similarities in unbanked and underbanked populations across the world, including Brazil and African countries such as Nigeria.

“Statistically, the number of people without credit in Nigeria is about 90 million people and its about 100 million adults that don’t have access to credit in Brazil. The countries are roughly the same size and the problem is roughly the same,” he said.

On clients in Brazil, Migo has a number of deals in the pipeline — according to Nwokah — and has signed a deal with a big-name partner in the South American country of 210 million, but could not yet disclose which one.

Migo generates revenue through interest and fees on its products. With lead investor Valor Capital Group, Velocity Capital and The Rise Fund joined the startup’s $20 million Series B.

Increasingly, Africa — with its large share of the world’s unbanked — and Nigeria — home to the continent’s largest economy and population — have become proving grounds for startups looking to create scalable emerging market finance solutions.

Migo could become a pioneer of sorts by shaping a fintech credit product in Africa with application in frontier, emerging and developed markets.

“We could actually take this to the U.S. We’ve had discussions with several partners about bringing the technology to the U.S. and Europe,” said founder Ekechi Nwokah. In the near-term, though, Migo is more likely to expand to Asia, he said.

Powered by WPeMatico

Singapore-headquartered FinAccel has secured $90 million in one of the largest funding rounds for a fintech startup in Southeast Asia as it looks to further grow its credit lending app Kredivo and build more financial services.

The financing round, dubbed Series C, for the three-and-a-half-year-old startup was jointly led by Asia Growth Fund — a joint venture between Mirae Asset and Naver — and Square Peg.

Singtel Innov8, TMI (Telkomsel Indonesia), Cathay Innovation, Kejora-InterVest, Mirae Asset Securities, Reinventure and DST Partners participated in the “oversubscribed” financing round, the startup said.

FinAccel said it has raised more than $200 million in debt and equity this year itself. It has raised $140 million in equity to date.

FinAccel operates credit lending app Kredivo in Indonesia, where it has amassed more than a million customers and is growing by a whopping 300% each year, Akshay Garg, chief executive of FinAccel, told TechCrunch in an interview.

The app enables customers to secure credit between $100 and $2,200. If a customer pays it back in full in a month, FinAccel does not charge them any fee. Otherwise, the service levies an interest rate of 2.95%, he explained.

Kredivo’s payments option is also integrated with a number of e-commerce firms, including Lazada and Shoppe, and food delivery startups in Indonesia, so users can quickly access the credit to purchase things and pay the app later.

Credit lending apps are increasingly gaining popularity across the globe, but especially in Southeast Asian markets, where the penetration of credit cards remains low — hence, there are very few people with a traditional credit score. This has created an opportunity for startups to look at other metrics to determine who should get a loan.

FinAccel’s team poses for a picture

Garg said Kredivo looks at a range of data points, including the kind of smartphone model a customer is using, and the apps they have installed on it. “Basically what we’re doing is almost like creating a user profile about the user using a combination of different data signals that come from the existing credit bureaus, the telcos, the e-commerce accounts, the bank accounts and the users themselves,” he said.

“All of that creates a 360-degree overview of the customer that helps us determine the risk factors and decide whether to issue the credit,” he added. As of today, Kredivo is only approving about one-third of the applications it receives.

Jikwang Chung, managing director of Mirae Asset Capital, the strategic investment arm of Mirae Asset, said in a statement that FinAccel is one of the leading companies in Southeast Asia that is able to “combine a strong technology DNA with top-tier risk management and a bold vision of financial inclusion.”

FinAccel, which works with banks to finance the credit to customers, has evaluated more than 3 million applications to date and disbursed nearly 30 million loans. Garg said the startup is now working to develop more financial services, such as low-interest education and healthcare loans.

In the next three to four years, it aims to grow to 10 million users and expand to other Southeast Asian markets such as the Philippines, Thailand, and Vietnam.

A handful of other startups also operate in this space in Indonesia. C88, which also offers credit to customers, last year raised $28 million in a financing round led by Experian.

Powered by WPeMatico

Accel, one of the world’s most influential venture capitalist firms, is getting more bullish on India.

The Silicon Valley-headquartered firm, which largely focuses on early-stage investments, said today it has closed $550 million for its sixth venture fund in India.

This is a significant amount of capital for Accel’s efforts in the country, where it began investing 15 years ago and has infused roughly $1 billion through all its previous funds.

Anand Daniel, a partner for Accel in India, told TechCrunch in an interview that the VC fund will continue to focus on identifying and investing in seed and early-stage startups.

But the fund realized it needed more money so it could actively participate in follow-on rounds (later-stage financing rounds) of its portfolio startups. The announcement today follows Accel’s similar recent push in Europe and Israel, where it closed a $575 million fund.

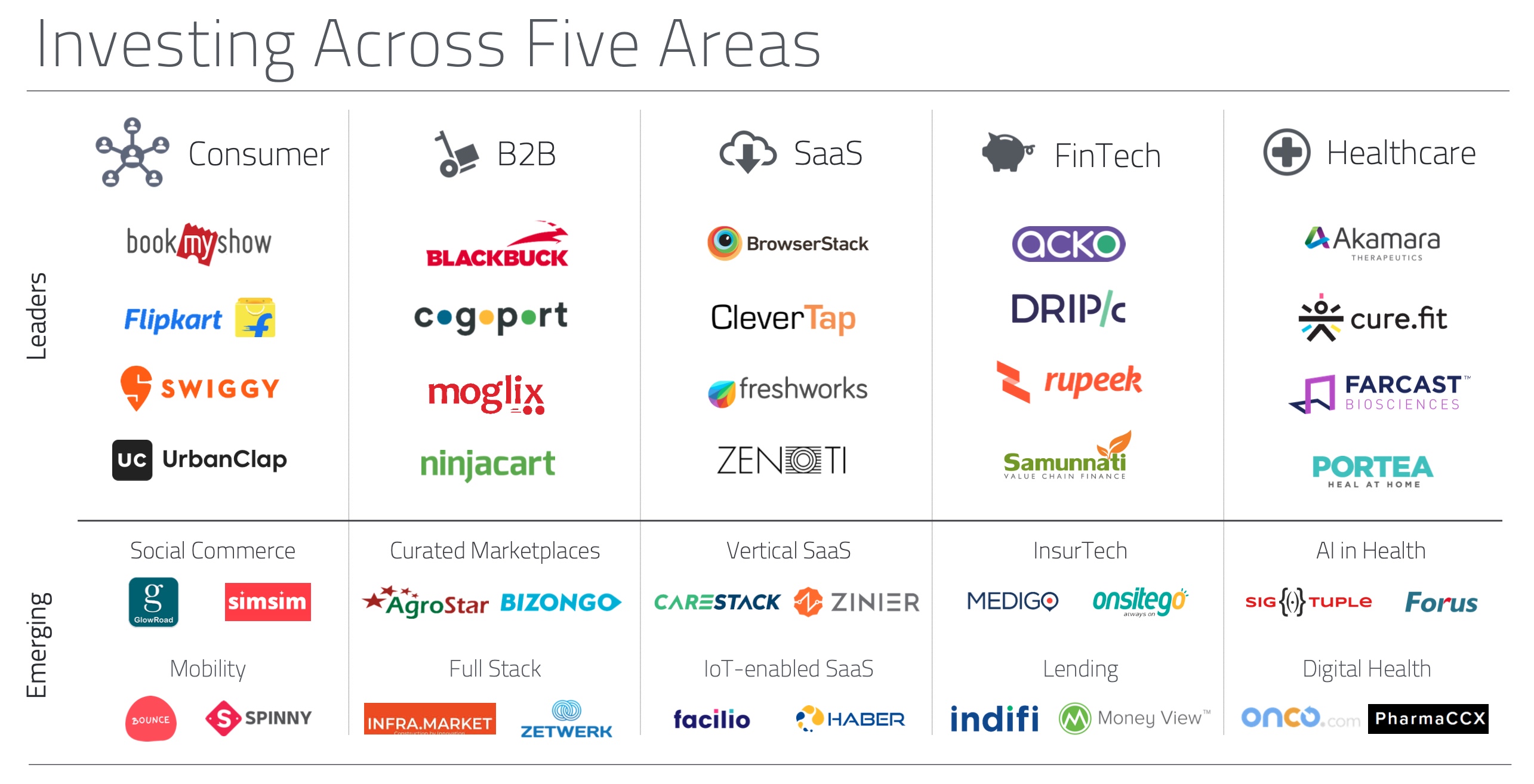

“We also selectively do growth investments for companies that are scaling well, such as Swiggy, UrbanClap, BlackStone and Bounce. We have continued to back them through Series B and Series C rounds,” he said.

At the risk of being accused of bias, I’ll say this: Accel India is a rare Indian fund that had credible exits and more promising exits in the pipeline. They’re also some of the nicest people to work with. https://t.co/aZGjDgSQKe

— JPK (@therealjpk) December 2, 2019

Like in many other markets, Accel’s track record in India is quite impressive. It participated in the seed financing round of e-commerce firm Flipkart, which was then valued at $4 million post-money. Walmart bought a majority stake in Flipkart last year for $16 billion. (This helped Accel net more than $1 billion in return from Flipkart.)

Accel, which has nine partners and more than 50 members in total in India, also invested in the seed round of SaaS giant Freshworks, which is now valued at more than $3 billion, food delivery startup Swiggy, also valued at north of $3 billion, and recently turned unicorn BlackBuck. Accel has been the first institutional investor for 85% of startups in its portfolio.

The VC firm says 44 of the 100-odd startups in its India portfolio today are valued at over $100 million each. In total, including Flipkart’s $21 billion market value, Accel’s portfolio firms have created $44 billion in market value.

Some of the investments Accel has made in India

“When we started our first fund in India in 2005, the world was a very different place. Just 1 in 50 Indians had access to the internet and mobile phone ownership was nascent. Yet we firmly believed that India was on the cusp of a big change,” the firm said in a statement.

“Today, the opportunity ahead is significantly bigger than when we started in 2005: India can now digitally identify 1.3 billion people, has 600 million internet users and 150 million online transacting customers with a national payments platform that processes $20 billion a month.”

Daniel said moving forward Accel will continue to focus on consumer, business-to-business, fintech, healthcare and global SaaS categories. “We have nine partners with their own areas of interest. They invest from their own conviction and finance seed rounds. If we see a particular sector evolving, then we do a deeper thesis work,” he said.

“We then develop deeper confidence for the space. For example, back in the day we invested in mobility startup TaxiForSure, long before Uber had arrived in India. That helped us understand mobility well. We have used those learnings to invest in several more mobility startups.”

Accel’s growing interest in India comes at a time when several other giants, including SoftBank and Prosus Ventures, have also become more active in the nation — though they tend to finance later-stage rounds.

For Indian startups that are already having their best year, this can only be good news.

Powered by WPeMatico