Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

India has long been a wonderland for cellphone users. At a time when most telecom operators across the globe charge anywhere between $5 to $10 for a gigabyte of mobile data, telcos in India deliver that for just a few cents.

Spare another $2 to the same telecom operator and you get a gigabyte of mobile data everyday for a month and all your nationwide calls become free.

How is that possible, you ask? In 2016, India’s richest man launched Reliance Jio, a telecom network that undercut the local competition by offering unlimited voice calls and the bulk of 4G mobile data at industry-low prices. Vodafone and Airtel — two of the top three carriers in India — dramatically moved to revise their tariffs to aggressively compete with Jio, but in doing so they began to bleed a lot of money.

So now they are making some changes that suddenly make cellphone plans in the country less attractive — but fret not, these plans are still miles ahead of comparable offerings in most other markets.

Vodafone Idea, Bharti Airtel and Reliance Jio — three telecom operators that command over 90% of India’s mobile subscriber base of more than 1.1 billion users — have hiked their tariffs by up to 42% for their prepaid customers. (In India, unlike many other markets, the vast majority of people prefer to pay as they go instead of signing up for a monthly subscription.)

The revised plans from Vodafone start from 26 cents for daily usage and go up to $33.4 for a year-long commitment — that is about 42% costlier compared to the previous offerings. The operator’s new tariffs will go into effect starting Tuesday.

Bharti Airtel’s new tariffs are priced similarly, though the operator says it will offer “generous data and calling benefits” to make up for the hike.

The changes are a direct result to make up for the massive losses Airtel and Vodafone reported last month. In the quarter that ended in September, Airtel lost more than $3.2 billion, while Vodafone posted a loss of $7.1 billion.

While these losses reflect the competition heat that both the networks have been facing from Reliance Jio, which now leads the market with over 350 million subscribers, they largely address a one-time potential outstanding payment these companies owe to the government related to a court dispute surrounding 14-year-old adjusted gross revenue.

Last month, chief executives of both the telecom networks requested the Indian government give them more time to pay the fine. Vodafone’s chief executive added that if the government did not budge, the British firm’s India business might just collapse.

The Indian government budged and offered a small bailout after it postponed certain payments.

Over the weekend, Reliance Jio said it would be introducing new plans, too, that will be “priced up to 40% higher” in a move to “strengthen the telecom sector” and strangely “keep consumers at the center of everything.” Its revised plans would go into effect this Friday.

Its announcement follows a two-month-old decision to hike the prices after other telecom operators floated the idea that they would continue to levy what they call an “interconnect fee.”

When a call from one network is placed to a phone on another network, the former carrier has to pay an “interconnect fee” to the latter. Prior to 2017, the interconnect fee in the country was set at about 14 paise (roughly 1.8 cents) for each minute of the call. In 2017, the Indian telecom regulator cut the interconnect charge to 6 paise per minute, adding that in January 2020, the interconnect fee would no longer be valid. In recent months, Airtel and Vodafone, among other networks (but obviously not Reliance Jio), have been exploring ways to extend this deadline.

At any rate, some industry executives say these tariff hikes were inevitable. Rajan Mathews, who heads the trade group Cellular Operators Association of India, said in a recent interview that the old prices were simply unsustainable for these businesses and carriers needed to address the price war more maturely.

Powered by WPeMatico

The FCC has finally put the seal of approval on its plan to cut funding going to equipment from companies it deems a “national security threat,” currently an exclusive club of two: Huawei and ZTE.

No money from the FCC’s $8.5 billion Universal Service Fund, used to subsidize purchases to support the rollout of communications infrastructure, will be spent on equipment from these companies.

“We take these actions based on evidence in the record as well as longstanding concerns from the executive and legislative branches,” said FCC Chairman Ajit Pai in a statement. “Both companies have close ties to China’s Communist government and military apparatus. Both companies are subject to Chinese laws broadly obligating them to cooperate with any request from the country’s intelligence services and to keep those requests secret. Both companies have engaged in conduct like intellectual property theft, bribery, and corruption.”

The Chinese companies have faced federal scrutiny for years, and vague suspicions of selling compromised hardware that the government there could take advantage of, but it was only at the beginning of 2019 that things began to heat up with the controversial arrest of Huawei CFO Meng Wanzhou. The companies, it hardly needs mentioning, have vehemently denied all allegations.

Increasingly complicated relations between China and the U.S. generally compounded the difficulty of ZTE and Huawei operating in the States, as well as selling to or purchasing from American companies.

The FCC’s new rule was actually proposed well before things escalated, a fact that Commissioner Jessica Rosenworcel, though she supported the measure, emphasized.

“This is not hard,” she wrote in a statement accompanying the new rule. “It should not have taken us eighteen months to reach the conclusion that federal funds should not be used to purchase equipment that undermines national security.”

Working out the details may have been difficult, however, given the generally chaotic state of the federal government right now. For instance, one month this summer it was going to be illegal for U.S. firms to sell their products to Huawei — and then it wasn’t. Just yesterday several senators wrote to protest the Department of Commerce issuing licenses to firms doing business with Huawei.

Another proposal discussed today but not yet adopted would require companies that receive USF funds to remove equipment from those companies that they may have already installed.

Admittedly it may be a financial burden for smaller carriers to comply with these rules. There’s a plan for that, though, as Chairman Pai explained: “To mitigate the financial impact of this requirement, particularly on small, rural carriers, we propose to establish a reimbursement program to help offset the cost of transitioning to more trusted vendors.”

Powered by WPeMatico

Disney plans to bring its on-demand video streaming service to India and some Southeast Asian markets as soon as the second half of next year, two sources familiar with the company’s plan told TechCrunch.

In India, the company plans to bring Disney+’s catalog to Hotstar, a popular video streaming service it owns, after the end of next year’s IPL cricket tournament in May, the people said.

Soon afterwards, the company plans to expand Hotstar with the Disney+ catalog to Indonesia and Malaysia, among other Southeast Asian nations, said those people on the condition of anonymity.

A spokesperson for Hotstar declined to comment.

Hotstar leads the Indian video streaming market. The service said it had more than 300 million monthly subscribers during the IPL cricket tournament and ICC World Cup earlier this year. More than 25 million users simultaneously streamed one of the matches, setting a new global record.

However, Hotstar’s monthly user base plummeted below 60 million in the weeks following the IPL tournament, according to people who have seen the internal analytics. The arrival of more originals from Disney on Hotstar, which already offers a number of Disney-owned titles in India, could help the service sustain users after cricket season.

The international expansion of Hotstar isn’t a surprise as it has entered the U.S., Canada and the U.K. in recent years. In an interview with TechCrunch earlier this year, Ipsita Dasgupta, president of Hotstar’s international operations, said so far the platform’s international strategy has been to enter markets with “high density of Indians.”

In an earnings call for the quarter that ended in June this year, Disney CEO Robert Iger hinted that the company, which snagged Indian entertainment conglomerate Star India as part of its $71.3 billion deal with 21st Century Fox, would bring Star India-operated Hotstar to Southeast Asian markets, though he did not offer a timeline.

Disney+, currently available in the U.S, Canada and the Netherlands, will expand to Australia and New Zealand next week, and the U.K., Germany, Italy, France and Spain on March 31, the company announced last week.

Disney, which debuted its video streaming service in the U.S. this week and has already amassed more than 10 million subscribers, plans to raise the monthly subscription fee of Hotstar in India, where the service currently costs $14 a year, one of the two aforementioned people said.

A screenshot of Hotstar’s homepage

The price hike will happen toward the end of the first quarter next year, just ahead of commencement of next the IPL cricket tournament season, they said. The company has not decided exactly how much it intends to charge, but one of the people said that it could go as high as $30 a year.

In other Southeast Asian markets, the service is likely to cost above $30 a year, as well, both of the sources said. The prices have yet to be finalized, however, they said.

Even at those suggested price points, Disney would be able to undercut rivals on price. Until recently, Netflix charged at least $7 a month in India and other Southeast Asian markets. But this year, the on-demand streaming pioneer introduced a $2.8 monthly tier in India and $4 in Malaysia.

Hotstar offers a large library of local movies and titles syndicated from international cable networks and studios Showtime, HBO and ABC (also owned by Disney). In its current international markets, Hotstar’s catalog is limited to some local content and a large library of Indian titles.

In recent quarters, Hotstar has also set up an office in Tsinghua Science Park in Beijing, China and hired more than 60 engineers and researchers to expand its tech infrastructure to service more future users, according to job recruitment posts and other data sourced from LinkedIn.

Powered by WPeMatico

According to Nikkei, messaging app Line and Yahoo Japan are about to merge and form a single tech company. Despite the name, Yahoo Japan is currently 100% owned by Z Holdings, a company that is controlled by Japanese telecom company SoftBank (Yahoo Japan isn’t related with TechCrunch’s parent company Verizon Media). Line Corporation is owned by Naver Corporation, a South Korean internet giant.

The two companies are still discussing terms of the deal according to Nikkei. But you could imagine Z Holdings becoming a 50-50 joint venture between SoftBank and Naver, with Z Holdings owning both Yahoo Japan and Line.

Line operates one of the most popular messaging apps in Japan. In addition to conversations, the company operates Line Pay, Line Taxi and other services. But competition has been fierce in the messaging space.

Yahoo Japan was originally formed by Yahoo and SoftBank in the late 1990s. When Verizon acquired Yahoo in 2017, Verizon didn’t acquire Yahoo’s stake in Alibaba and Yahoo Japan. Yahoo created a spin-out company called Altaba to hold those stakes.

Altaba first sold its stake in Yahoo Japan. In July 2018, SoftBank acquired part of Altaba’s stake in Yahoo Japan in order to increase its ownership of Yahoo Japan. Altaba later sold its remaining Yahoo Japan shares, its Alibaba shares and shut down. In 2019, SoftBank received additional shares to become Yahoo Japan’s parent company.

Yahoo Japan is a household name and a big internet conglomerate in Japan. It has an online advertising business, an e-commerce business, finance services and more. Yahoo Japan and Line probably hope to reach more users and boost engagement with the merger.

We’ve reached out to Line Corporation and Z Holdings and will update if we hear back.

Powered by WPeMatico

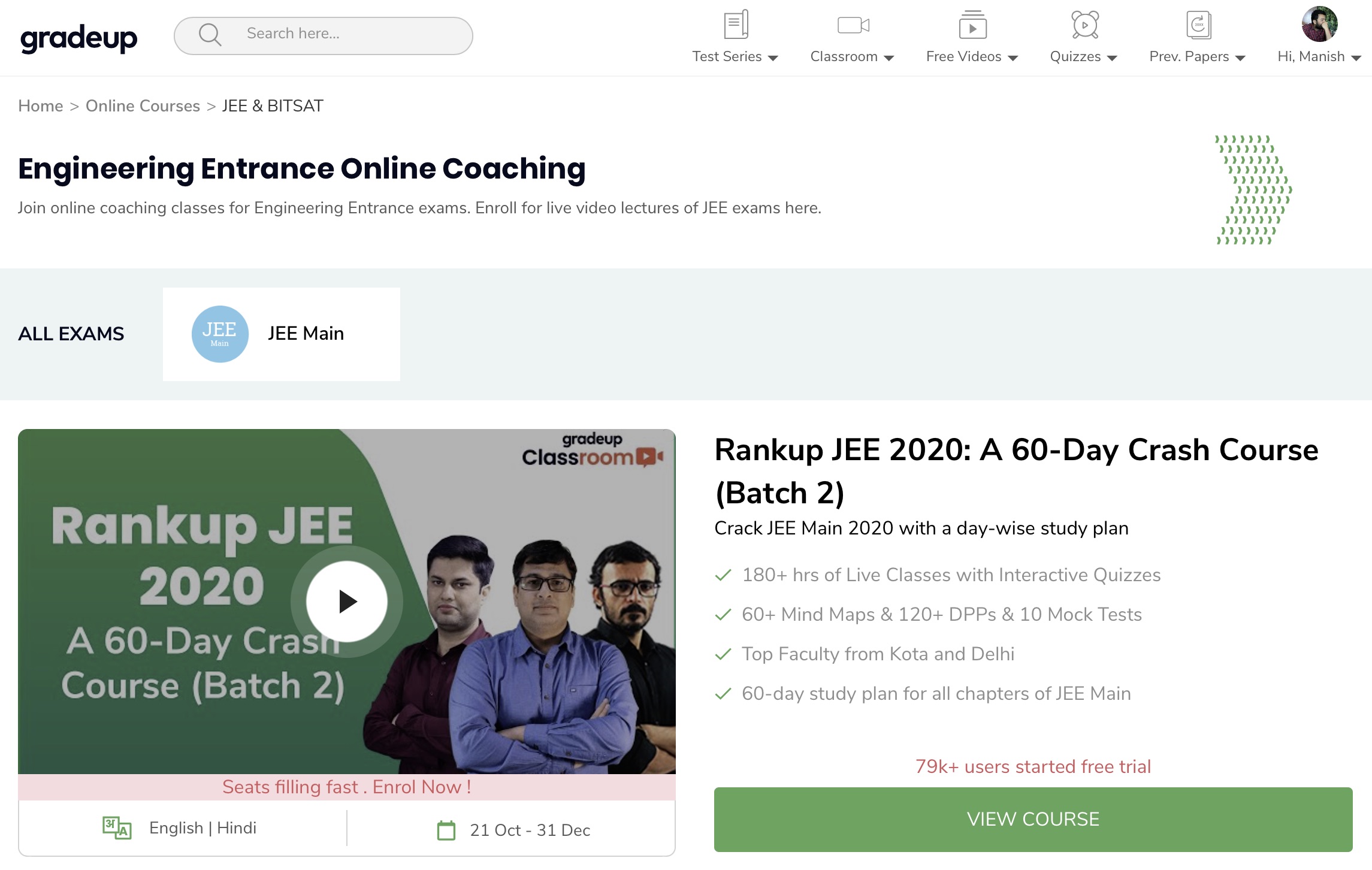

Gradeup, an edtech startup in India that operates an exam preparation platform for undergraduate and postgraduate-level courses, has raised $7 million from Times Internet as it looks to expand its business in the country.

Times Internet, a conglomerate in India, invested $7 million in Series A and $3 million in seed financing rounds of the four-year-old Noida-based startup, it said. Times Internet is the only external investor in Gradeup, they said.

Gradeup started as a community for students to discuss their upcoming exams, and help one another with solving questions, said Shobhit Bhatnagar, co-founder and CEO of Gradeup, in an interview with TechCrunch.

While those functionalities continue to be available on the platform, Gradeup has expanded in the last year to offer online courses from teachers to help students prepare for exams, he said. These courses, depending on their complexity and duration, cost anywhere between Rs 5,000 ($70) and Rs 35,000 ($500).

“These are live lectures that are designed to replicate the offline experience,” he said. The startup offers dozens of courses and runs multiple sessions in English and Hindi languages. As many as 200 students tune into a class simultaneously, he said.

Students can interact with the teacher through a chatroom. Each class also has a “student success rate” team assigned to it that follows up with each student to check if they had any difficulties in learning any concept and take their feedback. These extra efforts have helped Gradeup see more than 50% of its students finish their courses — an industry best, Bhatnagar said.

Each year in India, more than 30 million students appear for competitive exams. A significant number of these students enroll themselves to tuitions and other offline coaching centers.

“India has over 200 million students that spend over $90 billion on different educational services. These have primarily been served offline, where the challenge is maintaining high quality while expanding access,” said Satyan Gajwani, vice chairman of Times Internet.

In recent years, a number of ed tech startups have emerged in the country to cater to larger audiences and make access to courses cheaper. Byju’s, backed by Naspers and valued at more than $5.5 billion, offers a wide range of self-learning courses. Vedantu, a Bangalore-based startup that raised $42 million in late August, offers a mix of recorded and live and interactive courses.

Co-founders of Noida-based ed tech startup Gradeup

But still, only a fraction of students take online courses today. One of the roadblocks in their growth has been access to mobile data, which until recent years was fairly expensive in the country. But arrival of Reliance Jio has solved that issue, said Bhatnagar. The other is acceptance from students and, more importantly, their parents. Watching a course online on a smartphone or desktop is still a new concept for many parents in the country, he said. But this, too, is beginning to change.

“The first wave of online solutions were built around on-demand video content, either free or paid. Today, the next wave is online live courses like Gradeup, with teacher-student interactivity, personalisation and adaptive learning strategies, delivering high-quality solutions that scale, which is particularly valuable in semi-urban and rural markets,” said Times Internet’s Gajwani.

“These match or better the experience quality of offline education, while being more cost-effective. This trend will keep growing in India, where online live education will grow very quickly for test prep, reskilling and professional learning,” he added.

Gradeup has amassed more than 15 million registered students who have enrolled to live lectures. The startup plans to use the fresh capital to expand its academic team to 100 faculty members (from 50 currently) and 200 subject matters and reach more users in smaller cities and towns in India.

“Students even in smaller cities and towns are paying a hefty amount of fee and are unable to get access to high-quality teachers,” Bhatnagar said. “This is exactly the void we can fill.”

Powered by WPeMatico

Paidy, a Japanese financial tech startup that provides instant credit to consumers in Japan, announced today that it has raised a total of $143 million in new financing. This includes a $83 million Series C extension from investors including PayPal Ventures and debt financing of $60 million. The funding will be used to advance Paidy’s goals of signing large-scale merchants, offering new financial services and growing its user base to 11 million accounts by the end of 2020.

In addition to PayPal Ventures, investors in the Series C extension also include Soros Capital Management, JS Capital Management and Tybourne Capital Management, along with another undisclosed investor. The debt financing is from Goldman Sachs Japan, Mizuho Bank, Sumitomo Mitsui Banking Corporation and Sumitomo Mitsui Trust Bank. Earlier this month, Paidy and Goldman Sachs Japan established a warehouse facility valued at $52 million. Paidy also established credit facility worth $8 million with the three banks.

This is the largest investment to date in the Japanese financial tech industry, according to data cited by Paidy and brings the total investment the company has raised so far to $163 million. A representative for the startup says it decided to extend its Series C instead of moving onto a D round to preserve the equity ratio for existing investors and issue the same preferred shares as its previous funding rounds.

Launched in 2014, Paidy was created because many Japanese consumers don’t use credit cards for e-commerce purchases, even though the credit card penetration rate there is relatively high. Instead, many prefer to pay cash on delivery or at convenience stores and other pickup locations. While this makes online shopping easier for consumers, it presents several challenges for sellers, because they need to cover the cost of merchandise that hasn’t been paid for yet or deal with uncompleted deliveries.

Paidy’s solution is to make it possible for people to pay for merchandise online without needing to create an account first or use their credit cards. If a seller offers Paidy as a payment method, customers can check out by entering their mobile phone numbers and email addresses, which are then authenticated with code sent through SMS or voice. Paidy covers the cost of the items and bills customers monthly. Paidy uses proprietary machine learning models to score the creditworthiness of users, and says its service can help reduce incomplete transactions (or items that buyers ultimately don’t pick up and pay for), increase conversion rates, average order values and repeat purchases.

Powered by WPeMatico

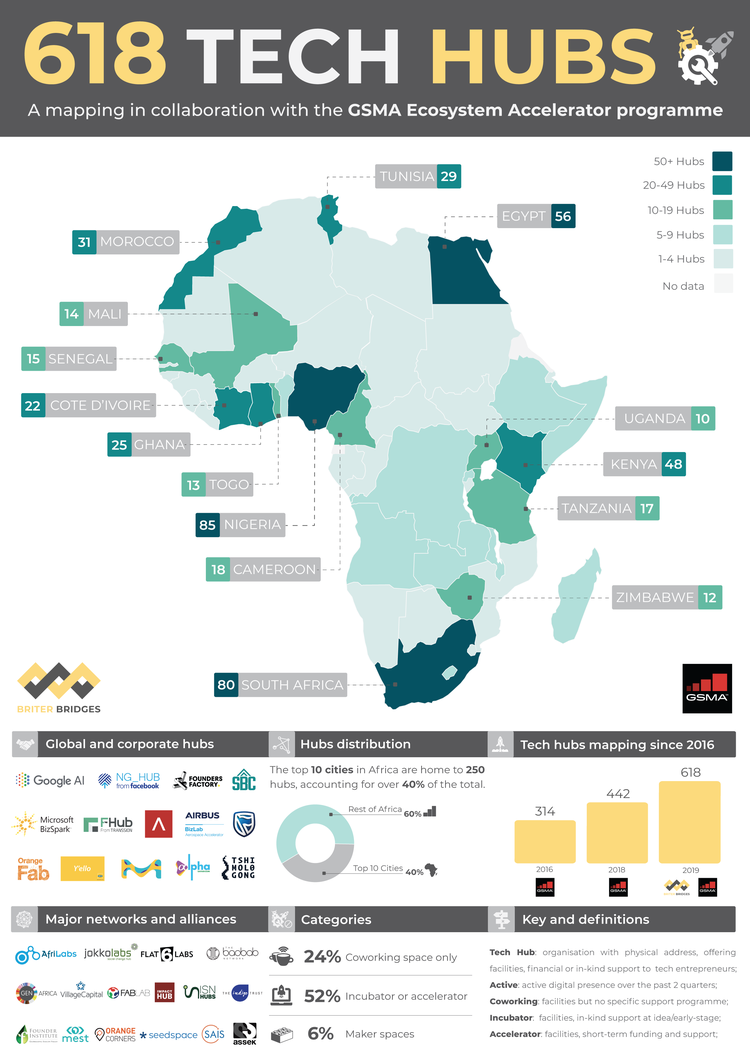

With CcHub‘s acquisition of iHub in September, Nigerian Bosun Tijani is at the helm of (arguably) the largest tech network in Africa.

He is now CEO of both organizations, including their robust membership rosters, startup incubation programs, global partnerships and VC activities from Nigeria to Kenya .

One could conclude Tijani has become one of the most powerful figures in African tech with the CcHub/iHub merger. But that would be a little shortsighted.

The techie from Lagos still faces plenty of challenges and unknowns in integrating two innovation hubs that lie 3,818 flight kilometers apart. Several sources speaking on background over the last year have indicated iHub was experiencing financial difficulties.

Tijani offered TechCrunch some initial details last month on how the acquisition will fall together.

But more recently he shared greater detail on his strategy for operating the multi-country innovation network. A big test for Tijani will be aligning the organizations on a path to sustainability. The buzzword is usually code for generating consistent operating income beyond expenses.

The growth of innovation spaces, accelerators and incubators in Africa — which tally 618 per GSMA stats — is often lauded as an achievement for the continent’s tech ecosystem.

But debate on how these focal points for startup formation, training and IT activity fund themselves is ever-present.

Grant income has served as a dominant revenue source for Africa’s tech hubs — including iHub in its early days — though many have worked to diversify.

That includes CcHub, according to Tijani, who plans to continue the trend across the expanded CcHub/iHub organization.

“When people talk about sustainability, we’ve been in business for nine years,” he notes of CcHub Nigeria.

“We de-emphasized grant funding six years ago; most of our revenue is actually earned revenue.”

On income sources Tijani looks to foster across both organizations, he named consulting services (for corporates, governments and development agencies), events services and generating greater return on investment.

iHub has been active with startup seed investments and CcHub has a portfolio of companies through its Growth Capital Fund.

“Our size will become a major part of us being able to invest in startups, and the longer we stay invested the more we will start to see significant returns and exits,” said Tijani.

The CcHub/iHub nexus will also use its size to leverage more partnerships. Tijani and team have already mastered gaining collaborations with big African and global tech names, such as MainOne and Facebook.

Tijani will look to connect iHub to CcHub’s Google-sponsored Pitch Drive — which has done African startup tours of Asia and Europe — and potentially take the show to the U.S.

“We’re talking about it,” Tijani said, of a U.S. pitch trip. And this could lead to a permanent presence in San Francisco for the new CcHub/iHub entity.

“Beyond just a tour, we want to build strong presence in the Bay Area,” Tijani said, but didn’t offer more specifics on what that could mean.

So on the list of things to emerge from the CcHub-iHub acquisition, African tech planting a big flag in San Francisco is a future possibility.

A more immediate result of the union between the innovation spaces will be Bosun Tijani becoming a regular sight on flights between Lagos and Nairobi.

Powered by WPeMatico

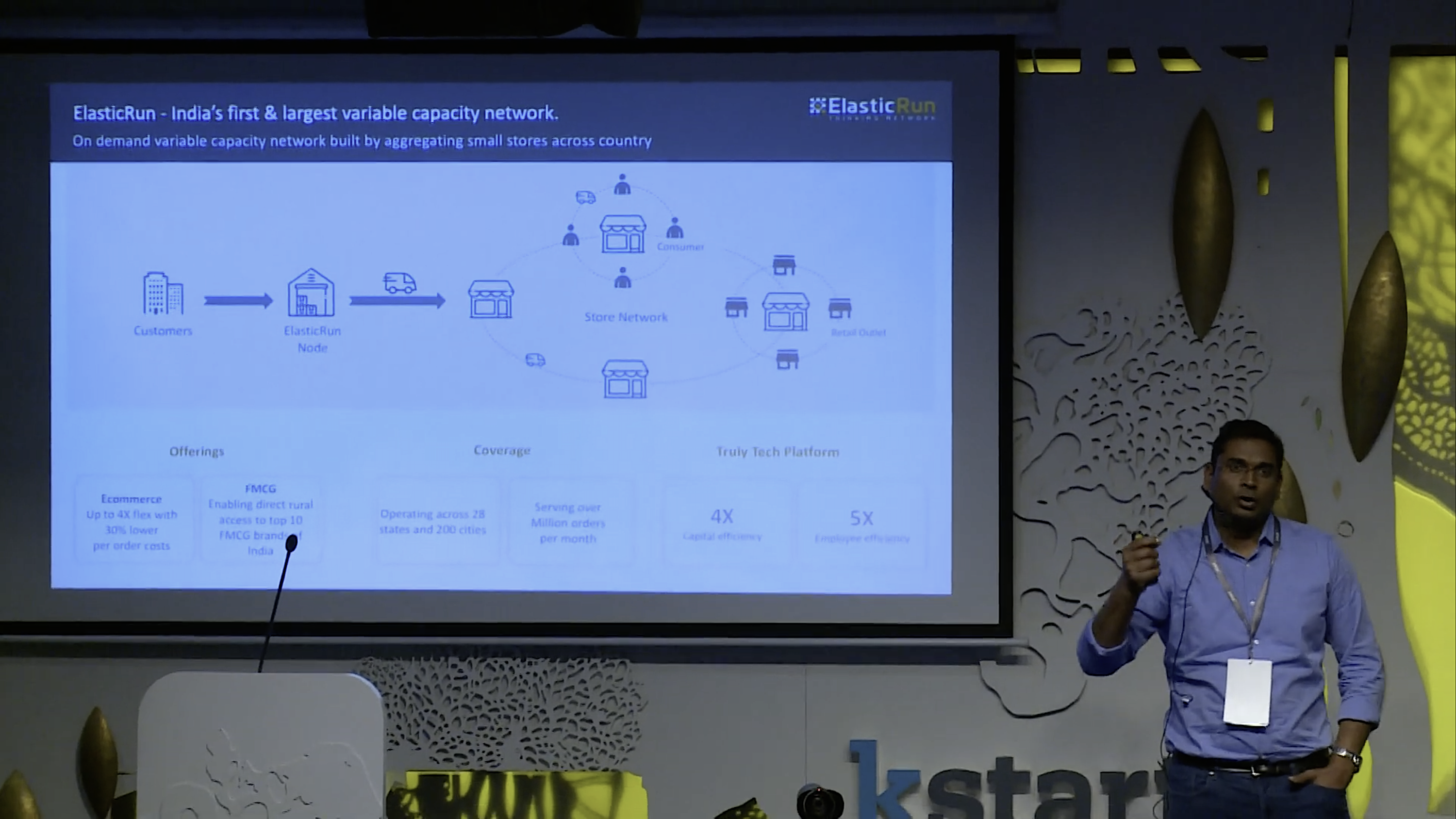

Millions of neighborhood stores that dot large and small cities, towns and villages in India and have proven tough to beat for e-commerce giants and super-chain retailers are at the center of a new play in the country. A score of e-commerce companies, offline retail chains and fintech startups are now racing to work with these mom and pop stores as they look to tap a massive untapped opportunity.

A Pune-based startup with an idea to build a logistics network using these kirana stores said today it has won the backing of a major international investor. Three-and-a-half-year-old ElasticRun said it has raised $40 million in a Series C financing round led by Prosus Ventures (formerly Naspers Ventures). Existing investors Avataar Ventures and Kalaari Capital also participated in the round.

The startup has raised $55.5 million to date, Sandeep Deshmukh, co-founder and CEO of ElasticRun, told TechCrunch in an interview.

Most of these kirana stores each day go through hours of down time — when the footfall is low and the business is slow. ElasticRun works with hundreds of thousands of these stores across 200 Indian cities to have them deliver goods to other kirana stores and consumers.

Supplying goods to these stores are FMCG (fast moving consumer goods) brands that are trying to reach the last mile in the nation. Nearly every top FMCG brand in the country today is a partner of ElasticRun, said Deshmukh.

Deshmukh, co-founder and CEO of ElasticRun, talking about the startup’s business at a recent conference

It’s a win-win scenario for every stakeholder, Deshmukh said. Stores are getting access to more goods than ever, and also getting the opportunity to increase their business in slow hours. And for brands and e-commerce companies, access to such a wide-reaching delivery pool has never been easier, he said.

Deshmukh, who previously worked at Amazon and helped the e-commerce company build its transportation network in India, said he and his other co-founders built ElasticRun because traditional logistics networks are beginning to show cracks.

India’s trucking system, for instance, has long been a laggard in India’s economy. A World Bank report five years ago noted that lorries in India spend about 60% of their time sitting idle.

Because there is a digital log of each transaction, Deshmukh said the startup has a good idea about the financial capacity of these kirana stores. This has enabled it to connect them with relevant financial partners to access working capital, he said.

Deshmukh said the startup will use the fresh capital to on-board more neighborhood stores and deepen its penetration in the country. ElasticRun is also working on new products to expand its offerings for brands and kirana stores and improving its analytics and machine learning algorithms to tackle larger scale.

“By working with the network of small stores across the country, we solve that problem while helping the store owners grow their businesses at the same time. In addition, offering a flexible logistics extension to consumer goods companies to directly reach these small retail shops is a huge advantage over traditional distribution networks,” he said.

In a statement, Ashutosh Sharma, head of Investments for India, Prosus Ventures, said, “ElasticRun is one of those rare businesses that identified a massive need in the market, matched it with a local solution paired with technology, for the benefit of all parties involved. Consumers get faster deliveries and greater choice of goods, store owners realize increased revenues and touchpoints with their customers, and consumer goods companies get better access and insight into their target audiences.”

Update: At an event organised by Prosus Ventures this evening, Deshmukh said while ElasticRun is focused on building solutions, in the future he may consider expanding to some Southeast Asian markets that are facing similar challenges.

Powered by WPeMatico

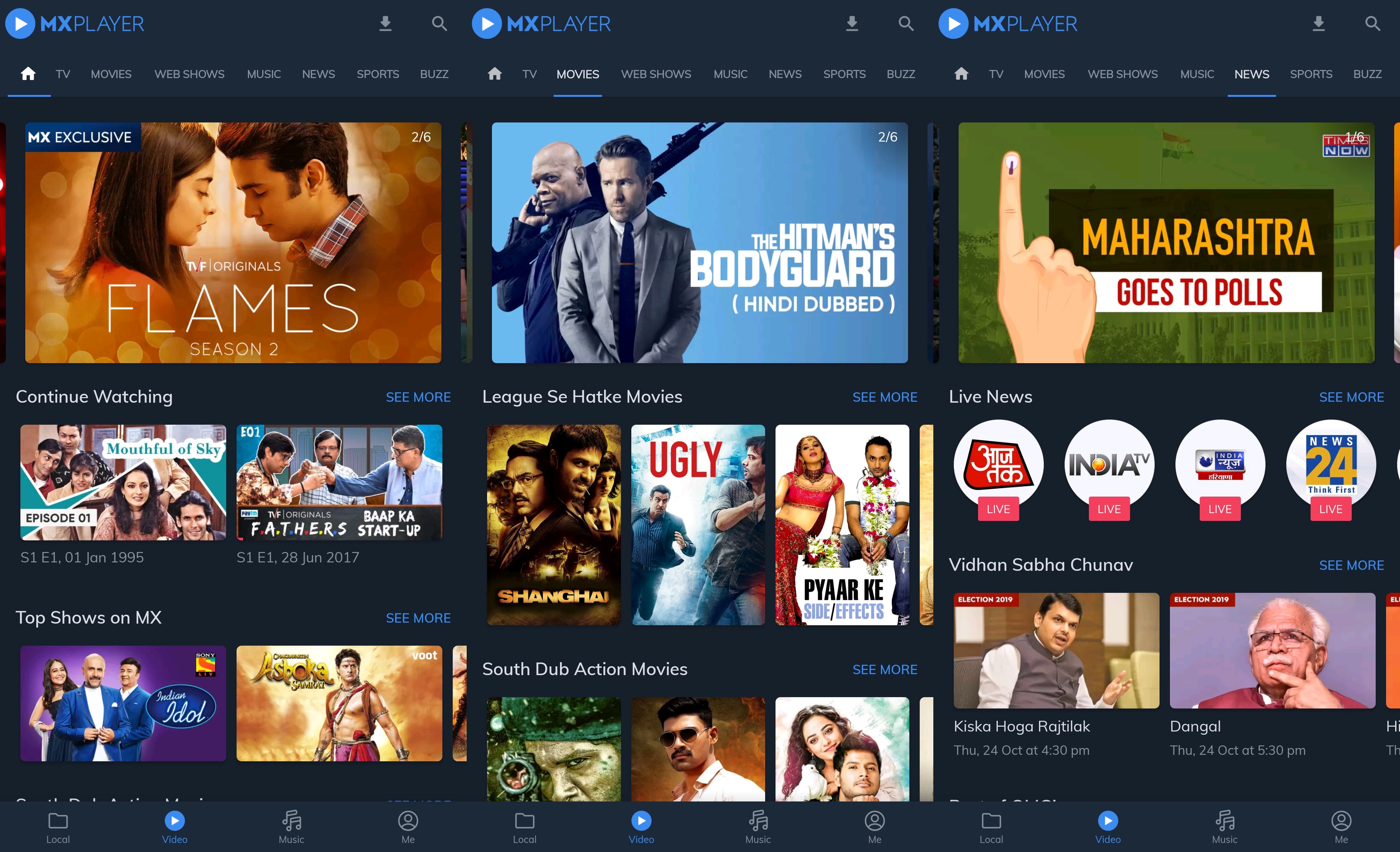

MX Player, a popular video app that offers both local playback and streaming services, said on Wednesday that it has raised $110.8 million in a new financing round led by Chinese internet giant Tencent as the video app looks to expand its business in India and other international markets.

Times Internet, which acquired a majority stake in MX Player in late 2017 for $140 million, also participated in the Series A financing round. The post-money valuation of MX Player was $500 million, a person familiar with the matter told TechCrunch.

The addition of Tencent — which has invested in a handful of Indian startups including Times Internet-owned Gaana, ride-hailing giant Ola, ed tech startup Byju’s, B2B e-commerce startup Udaan and a bookkeeping service for merchants, Khatabook — “is a great sign of confidence,” said Satyan Gajwani, vice chairman of Times Internet. “Tencent is a leading global force in music and video, and there’s a lot for us to learn and leverage from their capabilities,” he added.

Karan Bedi, CEO of MX Player, said in an interview that the video app will use the fresh capital to double down on producing original TV shows and broadening its catalog of licensed content. The firm, which has so far added 15 original shows to its platform, has already commissioned production of another 20 by year-end, he said.

The Singapore-headquartered firm’s push into original shows and licensed content underscores one of the strangest evolution for a video app. MX Player originated in Korea as an app that could run video files in a wide-range of formats locally stored on a phone.

The app did all of this while consuming little resources, an ability that helped it win tens of millions of users with low-cost Android smartphones in emerging markets such as India. In fact, India is MX Player’s largest market, with 175 million monthly active users, Bedi said. Globally, the app has amassed more than 280 million users.

MX Player is ad-supported and does not charge users any monthly subscription fee. The service, which introduced movies and shows streaming in mid-2018, today also offers access to about 200 TV channels, their current and back catalog of shows, and a music streaming feature through an integration with Gaana.

Bedi said the company has tied up with all-web show producers such as HoiChoi in India and three of the top five TV local cable networks, including Sony and Sun. Missing from the list is Star India, the largest TV network in the country.

Thanks to the acquisition of 21st Century Fox, Disney now owns Star India. Star India has emerged as one of the gems in Disney’s new portfolio. The firm, which runs dozens of TV channels in India, operates Hotstar, the market-leading video streaming service.

Hotstar reported 300 million monthly active users and 100 million daily active users during the ICC Cricket World Cup tournament. The service has cashed in on the popularity of cricket to boost its numbers.

Bedi said MX Player is working on building new entertainment experiences, but sports content is not something it is exploring. The reason is simple: Cricket drives most of the sports streaming in India and Star India has secured rights to most of such content. (Facebook recently grabbed a slice of it, too.)

But cricket alone can’t help a streaming service win and sustain customers. Even Hotstar’s monthly user base plummets below 60 million in the months following the cricketing season, people familiar with Hotstar’s internal figures have told TechCrunch.

Figuring out what exactly resonates with the users in India, the world’s second largest internet market, is the billion-dollar question. The video streaming market in India is on track to be worth $1.7 billion in the next four years, according to PricewaterhouseCoopers.

Bedi, who spearheaded Eros Now’s India business before joining MX Player, said users are increasingly enjoying the original shows. Most of the shows that MX Player has produced so far, such as “Hey Prabhu,” “Thinkistan” and “Immature,” are largely targeted at college students and those who have just joined the work force. But the company is slowly populating the platform with shows such as “Queen” that appeal “universally,” he said.

MX Player today competes with more than three dozen local and international players, nearly all of which offer their services at dirt-cheap prices in India. Even Netflix, which launched in India with a $8 plan in 2016, this year introduced a $2.8 monthly tier. In recent months, several more firms including e-commerce giant Flipkart and food delivery startup Zomato have launched their video streaming services in the country.

Tencent-rival Alibaba announced earlier this year that it would invest $100 million to expand social video app Vmate in India.

Once cautious about each megabyte they spent consuming internet services, Indians are now spending about 10GB of data on their smartphones each month as data prices crash in the country, according to an Ericsson report. Indian billionaire Mukesh Ambani disrupted the local telecom market in 2016 when he launched Reliance Jio. The 4G-only carrier undercut the market by first offering bulk of mobile data at no cost, and then charging very little fee.

An analyst TechCrunch spoke with said it’s only a matter of time before India’s video market begins to see some consolidation and pull back. “You have to offer something appealing that none of your rivals have,” he said, requesting anonymity as he advises many of these businesses.

For MX Player, its odd evolution story may be its biggest advantage. The app’s local video playback feature continues to draw many to it, and keeps the app among the top rated in Google’s Play Store. Bedi said the startup, which today employs about 300 people, maintains a large team that continues to improve the tech stacks to improve video playback support.

Moving forward, MX Player will also look into expanding to some international markets. It recently started beta testing the video streaming service in the U.S., Canada, Australia and New Zealand. Eventually, the startup hopes to make original shows for these markets that are relevant to the local audience there.

MX Player maintains a premium app on Google Play Store that strips ads for $5. But the app continues to mostly rely on revenue it generates from ads. Times Internet’s Gajwani said that at some point in the future, the video service will expand monetization beyond pure advertising. “That said, MX is consumed daily as much as the leading TV channel in India, so there’s significant headroom to capture larger advertising spends as well,” he added.

Paytm, a leading financial services firm in India, was also in talks with MX Player to invest in this financial round. It may invest in the video streaming services app at a later stage, a person familiar with the talks said.

Powered by WPeMatico

Netflix is ready to take its lower-cost, mobile-only plan beyond India as it looks to expand the reach of its service in other international markets. The American on-demand video streaming giant today launched a new price tier in Malaysia that will allow people in the nation to access the video service for RM 17 ($4) a month.

The new tier, which is being offered alongside existing regular monthly plans that start from $7.8, limits access to Netflix to just one mobile device and in lower video quality (standard definition, ~480p). (Customers subscribed to this plan are not allowed to watch — or cast — Netflix on their TVs and laptops.)

The company, which began testing cheaper mobile plans last year in many markets, including Malaysia, said it is hopeful that its new plan would “broaden access to Netflix in this truly mobile-first nation.”

More than 88% of people in Malaysia own a smartphone and 78% of internet users in the Southeast Asian nation — home to roughly 32 million people — stream and download media content, according to industry estimates.

In a statement, Ajay Arora, director of Product Innovation at Netflix, said, “our members in Malaysia love to watch shows on their smartphones and tablets. With the first-ever Mobile plan in Southeast Asia, all of Netflix’s shows and movies will be even more accessible for Malaysians to stream and download.”

Like in India, Netflix competes with a range of aggressively priced services in Malaysia, such as iFlix, Dimsum, playTV and Astro Go. And like in other markets, the company has invested in production of original content to better serve customers in Malaysia, too. Upcoming series “The Ghost Bride” was filmed and produced in Malaysia. Comedy series “Polis Evo” and “Jagat” have also been popular among customers in the nation.

As we have argued in the past, Netflix’s standard pricing has limited its reach in many parts of the world, especially because a number of rivals are offering their services at lower cost. On its part, Netflix is increasingly admitting this publicly. During its quarterly earnings call last week, the company executives noted that it was “pleased” with the way its $2.8 monthly mobile-only plan in India was gaining adoption.

“Our approach with pricing is to grow revenue and so far, uptake and retention on our mobile plan in India has been better than our initial testing suggested. This will allow us to invest more in Indian content to further satisfy our members. While still only a very small percentage of our total subscriber base, we’re continuing to test mobile-only plans in other markets,” they said.

Greg Peters, chief product officer at Netflix, said the company continues to explore more plan structures and “feature value benefits” in other markets to see how the audiences react to them. In some markets, Netflix has tested weekly plans.

The announcement comes at a time when Netflix is slowly increasing prices in developed nations. In the U.S., for instance, the company this year revised the cost of its most popular monthly plan to $13. As more technology giants, cable networks and studios prepare to launch their own services, people across the globe are being confronted with a tough question: How many video apps do you need in your life?

Last week, Netflix reported that it had missed subscriber forecast for the second quarter in a row. The company said it added 6.8 million subscribers in the quarter that ended in September, below its guidance for 7 million. Of this figure, 6.3 million subscribers — above analyst forecasts for 6 million — came from outside the U.S.

Powered by WPeMatico