Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

India said on Wednesday it plans to spend nearly $6 billion to revive loss-making state-funded telecom operators Bharat Sanchar Nigam Ltd (BSNL) and Mahanagar Telephone Nigam Ltd (MTNL).

In a press conference, telecom minister Ravi Shankar Prasad said today the Narendra Modi government has given its in-principle approval to the merger of BSNL and MTNL and infuse billions of dollars in capital, though he did not specify a time frame.

BSNL offers telecom services across the nation, while MTNL serves people in New Delhi and Mumbai. Both the firms have been bleeding money for years as competition from private players intensified in recent years after the arrival of India’s richest man Mukesh Ambani’s aggressive firm Reliance Jio. BSNL and MTNL have debt of about $5.65 billion.

The arrival of Reliance Jio, which undercut the market with its 4G-only telecom network, free voice calls and incredibly low-cost data prices, saw incumbents Vodafone and Airtel lower their prices and expand their 4G networks across the country.

MTNL, which is a listed company, will become a subsidiary of BSNL until the merger is completed, Prasad told journalists. “Neither BSNL nor MTNL are being closed, nor are they being disinvested or being hived off to third party,” he said, refuting weeks-long speculation that the government wanted to shut the carriers that serve about 120 million subscribers.

The revival plan includes a capital infusion of $2.8 billion to enable BSNL to purchase 4G spectrum, and write off of $520 million worth of taxes these purchases would incur. The network operators will additionally raise about $2.1 billion of long-term bonds that the New Delhi government will back and monetize $5.3 billion worth of assets over the next four years, the minister said.

“We want to make BSNL and MTNL competitive, and bring in professionalism,” Shankar said. The government is hopeful that BSNL would become operationally profitable in the next two years, he said.

The existence of BSNL, which alone serves more than 116 million subscribers, is in the strategic interest of the nation, Prasad said in a conference last week. “Whenever we have flood or cyclone, BSNL is the first one to offer services for free,” he said.

BSNL, which uses about 75% of its revenue to pay its roughly 176,000 employees, was unable to process their salaries last month. The government said today that it will soon address this and also offer various “attractive voluntary retirement packages” to employees aged 50 or more. In a press release, the government said it would spend about $2.4 billion on the employee retirement packages.

Powered by WPeMatico

In China, Toutiao is literally big news.

Not only has its parent company ByteDance achieved a $75 billion valuation, two of its apps — Toutiao, a news aggregator, and Douyin (Tik Tok in China) — are chipping into WeChat’s user engagement numbers, no small feat considering the central role WeChat plays in the daily lives of the region’s smartphone users.

The success of Toutiao (its name means “headline”) prompts the question: why hasn’t one news aggregator app achieved similar success in the United States? There, users can pick from a roster of news apps, including Google News, Apple News (on iOS), Flipboard, Nuzzel and SmartNews, but no app is truly analogous to Toutiao, at least in terms of reach. Many readers still get news from Google Search (not the company’s news app) and when they do use an app for news, it’s Facebook.

The top social media platform continues to be a major source of news for many Americans, even as they express reservations about the reliability of the content they find there. According to research from Columbia Journalism Review, 43% of Americans use Facebook and other social media platforms to get news, but 57% said they “expect the news they see on those platforms to be largely inaccurate.” Regardless, they stick with Facebook because it’s timely, convenient and they can share content with friends and read other’s comments.

The social media platform is one of the main reasons why no single news aggregator app has won over American users the same way Toutiao has in China, but it’s not the only one. Other factors, including differences between how the Internet developed in each country, also play a role, says Ruiwan Xu, the founder and CEO of CareerTu, an online education platform that focuses on data analytics, digital marketing and research.

While Americans first encountered the Internet on PCs and then shifted to mobile devices, many people in China first went online through their smartphones and the majority of the country’s 800 million Internet users access it through mobile. This makes them much more open to consuming content — including news and streaming video — on mobile.

Powered by WPeMatico

MyGate, a Bangalore-based startup that offers security management and convenience service for guard-gated premises, said today it has bagged more than $50 million in a new financing round as it looks to expand its footprint in the nation.

Chinese internet giant Tencent, Tiger Global, JS Capital and existing investor Prime Venture Partners funded the three-year-old startup’s $56 million Series B financing round. The new round pushes MyGate’s total fundraise to $67.5 million.

MyGate offers an eponymous mobile app that allows home residents to approve entries and exits, communicate with their neighbors, log attendance and pay society maintenance bills and daily help workers.

The startup says it is operational in 11 cities in India and has amassed over 1.2 million home customers. Its customer base is increasing by 20% each month, it claimed. The service is handling 60,000 requests each minute and clocking over 45 million check-in requests each month.

The idea of MyGate came after its co-founder and CEO, Vijay Arisetty, left the Indian armed force. In an interview with TechCrunch, he said his family was appalled to learn about the poor state of security across societies in India.

“This was also when e-commerce companies and food delivery firms were beginning to gain strong foothold in the nation. This meant that many people were entering a gated community each day,” he said.

MyGate has inked partnerships with many e-commerce players to create a system to offer a silent and secure delivery experience for its users. The startup also trains guards to understand the system.

According to industry estimates, more than 4.5 million people in India today live in gated communities, and that figure is growing by 13% each year. The private security industry in the country is a $15 billion market.

Arisetty says he believes the startup could significantly accelerate its growth as its solution understands the price-sensitive market. Using MyGate costs an apartment about Rs 20 (28 cents) per month. Even at that price, the startup says it is making a profit. “Today, we are seeing more demand than we can handle,” he said.

That’s where the new funding would come into play for the startup, which today employs about 700 people.

The startup plans to use the fresh capital to expand its technology infrastructure, its marketing and operations teams and build new features. The startup aims to reach 15 million homes in 40 Indian cities in the next 18 months.

In a statement, Sanjay Swamy, managing partner at Prime Venture Partners, said, “It’s been great to see a fledgling startup execute consistently and holistically, and grow into a category-creating market-leader.”

Powered by WPeMatico

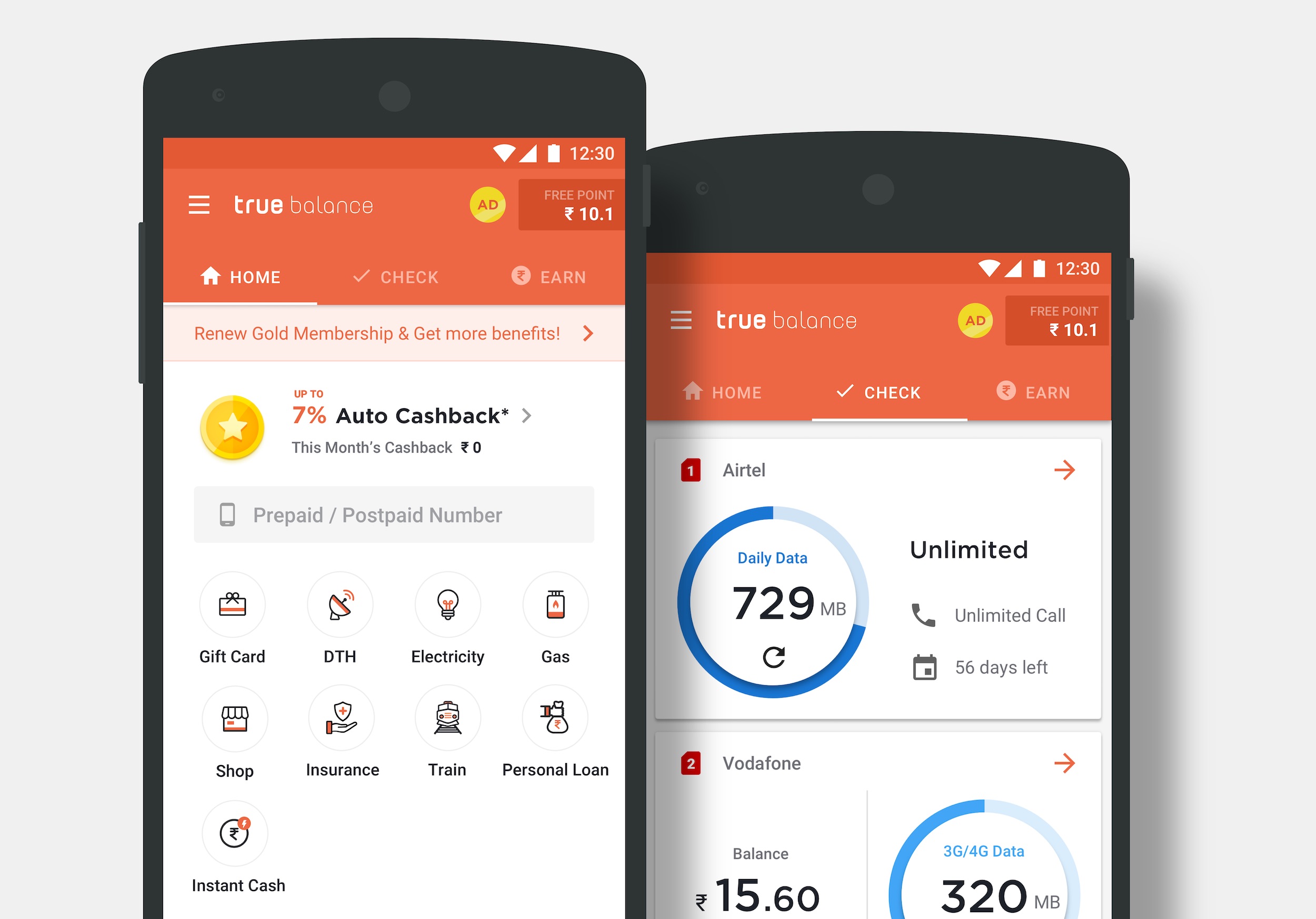

South Korean startup True Balance, which operates an eponymous financial services app aimed at tens of millions of users in small cities and towns in India, has closed a new financing round as it looks to court more first-time users in the world’s second largest internet market.

True Balance said on Tuesday that it has raised $23 million in its Series C financing round from seven Korean investors — NH Investment & Securities, IBK Capital, D3 Jubilee Partners, SB Partners, Shinhan Capital and existing partners IMM Investment and HB Investment.

TechCrunch reported earlier this year that True Balance — which has raised $65 million to date, including the $38 million that it closed in its previous financing round — was looking to raise as much as $70 million in its Series C round.

True Balance began its life as a tool to help users easily find their mobile balance, or top up pre-pay mobile credit. But in its four-year journey, its ambition has significantly grown beyond that. Today, it serves as a digital wallet app that helps users pay their mobile and electricity bills, and offer credit to customers so that they can pay later for their digital purchases.

The startup says it has amassed more than 60 million registered users in India, most of whom live in small cities and towns — or dubbed India 2 and India 3. Most of these users are coming online for the first time and True Balance says it has an army of local agents — who get certain incentives — to help first-time internet users understand the benefit of online transactions and start using the app.

True Balance says it clocks more than 300,000 digital transactions on its app each day. The startup, which recently introduced e-commerce shopping services on its app to sell products like smartphones, has clocked $100 million in GMV sales in the country to date.

Charlie Lee, founder of True Balance, said the startup will use the fresh capital to bulk up the offerings on the app. Some of the features that True Balance intends to add before the end of this fiscal year include the ability to purchase bus and train tickets, digital gold and book cooking gas cylinders.

True Balance will also expand its lending and e-commerce services, Lee said. Its lending feature was used 1 million times in three months when it was introduced earlier this year. “We aim to strengthen our data and alternative credit scoring strategy to provide better financial services to our target — the next billion Indian users. Our goal is to reach 100 million digital touch points and become one of the top fintech companies in India by 2022,” he added in a statement.

Even as more than 600 million users in India are online today, just about as many remain offline. In recent years, many major companies in India have started to customize their services to appeal to users in India 2 and India 3 — who also have limited financial power.

Powered by WPeMatico

Seoul-based education technology startup Mathpresso announced today that it has raised $14.5 million in Series B funding. The company’s flagship app is Qanda, which provides students with math and science help and tutoring. Participants in the round include Legend Capital, InterVest, NP Investments and Mirae Asset Venture Investment.

This brings Mathpresso’s total funding so far to $21.2 million. Its previous round of funding was a $5.3 million Series A announced at the end of last year.

Mathpresso says Qanda (the name stands for “Q and A”) is currently used by a third of students in South Korea. The app launched in markets including Japan, Vietnam, Indonesia and Singapore last year and now has users in more than 50 countries. Qanda uses AI-based optical character recognition to scan math problems. Students take a photo of a problem and upload it to get instructions for how to solve it from the app or tutors.

In a statement, Legend Capital managing director Joon Sung Park said, “As an early investor of China’s leading mobile education companies such as Zuoyebang and Onion Math, Legend Capital has witnessed robust growth of China’s mobile education market. We strongly believe that Mathpresso has the technological and operation capabilities to expand overseas and grasp new opportunities emerging from the digitization of education, such as offering personalized learning for each student.”

Powered by WPeMatico

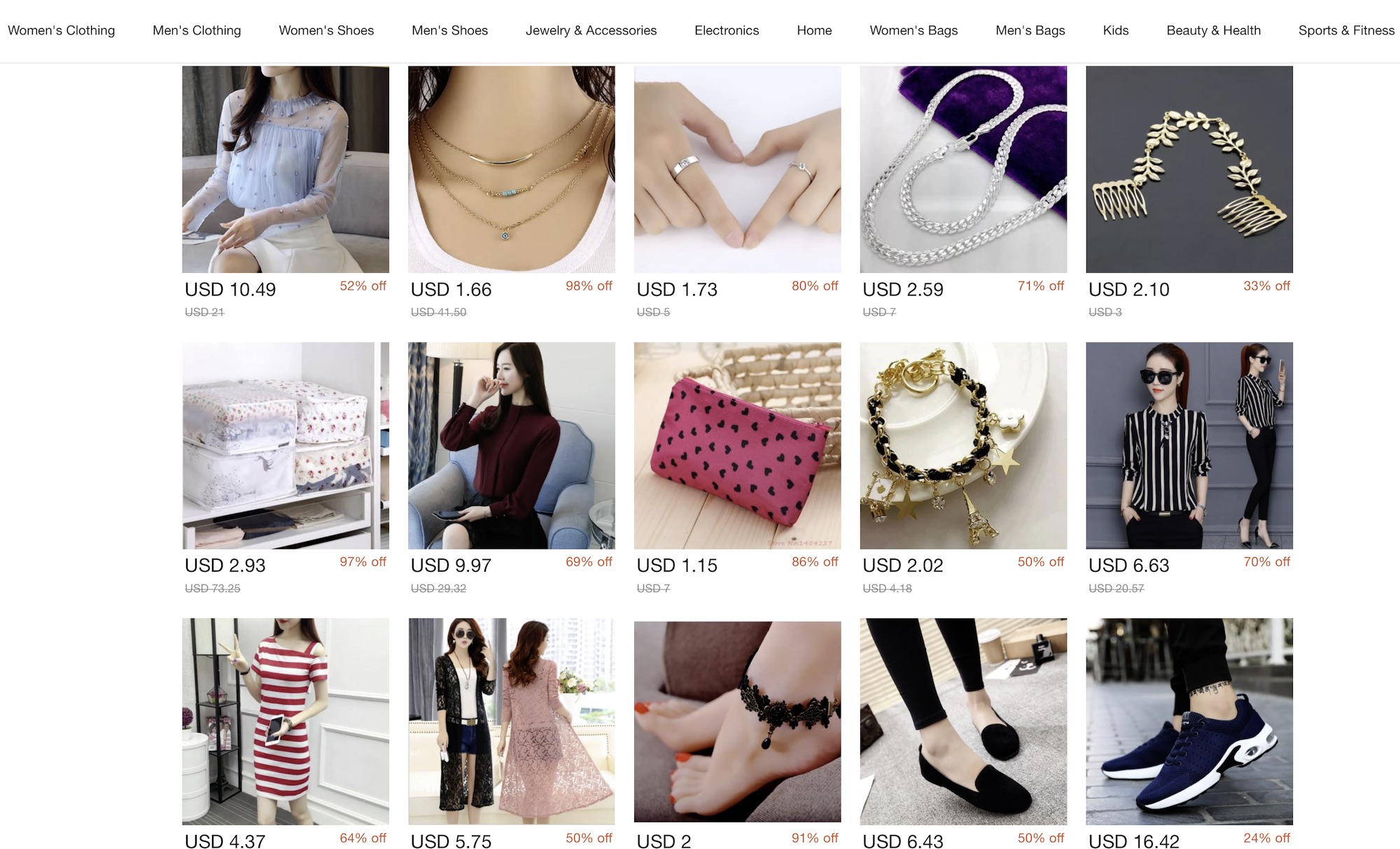

Club Factory, a Chinese e-commerce platform that sells fashion and beauty items and electronics accessories, has raised $100 million in a new financing round as it looks to expand its footprint in India.

The new financing round — Series D — was led by Qiming Venture Partners, Bertelsmann, IDG Capital “and other Fortune 500 companies from the U.S. and Asia,” the five-year-old Hangzhou-headquartered startup said. Club Factory, which raised $100 million in its previous financing round early last year, has raised about $220 million to date.

Club Factory has amassed more than 70 million users on its platform, of which about 40 million live in India. The startup cited figures from app analytics firm App Annie to claim that Club Factory is now the third-largest e-commerce platform in India, surpassing once a market-leader Snapdeal.

Club Factory does not charge local sellers any commission fee, incentivizing them to cut down the cost of their items and expand offerings. The number of sellers on its platform in India has grown by 10X in the last six months, the startup claimed. Club Factory, which has about 5,000 sellers in India, plans to double that figure by year-end, it said.

A screenshot of Club Factory’s homepage

“At the same time, we have also pioneered to strengthen the ‘store-within-platform’ concept in India’s e-commerce industry, allowing direct contact between buyers and sellers through our application,” said Vincent Lou, co-founder and chief executive of Club Factory, in a statement.

He added, “We have changed the status of the Indian e-commerce industry that monopolized information of buyers and sellers, allowing SMEs to own their customers and run their business better. All this, combined with our strategy to reduce the transaction costs of buyers and sellers and allow more local players to enter the ecosystem, has worked very well for us in India.”

The startup said in the coming months it will also bulk up more items on its platform and introduce new product categories.

Powered by WPeMatico

The Massachusetts Institute of Technology said it is reviewing the university’s relationship with SenseTime, one of eight Chinese tech companies placed on the U.S. Entity List yesterday for their alleged role in human rights abuses against Muslim minority groups in China.

An MIT spokesperson told Bloomberg that “MIT has long had a robust export controls function that pays careful attention to export control regulations and compliance. MIT will review all existing relationships with organizations added to the U.S. Department of Commerce’s Entity List, and modify any interactions, as necessary.”

A SenseTime representative told Bloomberg, “We are deeply disappointed with this decision by the U.S. Department of Commerce. We will work closely with all relevant authorities to fully understand and resolve the situation.”

The companies placed on the blacklist included several of China’s top AI startups and companies that have supplied software to mass surveillance systems that may have been used by the Chinese government to persecute Uighurs and other Muslim minority groups.

Over one million Uighurs are believed to currently be held in detention camps, where human rights observers report they have been subjected to forced labor and torture.

SenseTime, the world’s mostly highly valued AI startup, provided software to the Chinese government for its national surveillance system, including CCTV cameras. It was the first company to join an MIT Intelligence Quest initiative launched last year with the goal of “driv[ing] technological breakthroughs in AI that have the potential to confront some of the world’s greatest challenges.” Since then, it has provided funding for 27 projects by MIT researchers.

Earlier this year, MIT ended its working relationships with Huawei and ZTE over alleged sanction violations.

Powered by WPeMatico

Southeast Asian real estate portal 99.co has agreed to form a joint venture with iProperty. As part of the deal, iProperty owner REA Group will invest $8 million of working capital into the venture, expected to be finalized by the second quarter of 2020.

99.co and REA Group, a real estate-focused digital advertising conglomerate that is listed on the Australian Securities Exchange (ASX), say that the joint venture immediately makes 99.co the market leader in Indonesia and positions it to take the top spot in Singapore, as well. The deal also makes 99.co a more formidable rival to PropertyGuru. Backed by TPG Capital and KKR, PropertyGuru is expected to raise up to AUD $380.2 million (about USD $255.9 million) in an IPO on the ASX this month.

The joint venture is expected to be finalized by the second quarter of 2020 and 99.co will assume full control of REA Group brands iProperty.com.sg in Singapore and Rumah123.com in Indonesia. The joint venture will be led by 99.co’s management team, including co-founder and CEO Darius Cheung.

99.co’s last round of funding was a $15.2 million Series B, announced in August, that the company says took its valuation to over $100 million.

In a press statement, Cheung said, “We are coming for market leadership. This is a key milestone that positions us instantly as number one in Indonesia, and well on our way to that in Singapore. Our innovative DNA plus REA’s unrivaled experience and resources makes this partnership a lethal combination Southeast Asia has not seen before.”

The company’s existing shareholders, including Facebook co-founder Eduardo Saverin, Sequoia Capital, MindWorks Ventures, Allianz X, East Ventures and 500 Startups, will have a combined stake of 73%, with REA Group holding the remaining 27%.

Launched in 2014, 99.co was created to make real estate listings more navigable for renters and buyers in Singapore and other Southeast Asian markets. REA Group owns portals in Malaysia, Hong Kong, Indonesia, Singapore and China, and a property review site in Thailand. It is also a stakeholder in Move, the American real estate site, and Indian property portal PropTiger.

Powered by WPeMatico

Fyle, a Bangalore-headquartered startup that operates an expense management platform, has extended its previous financing round to add $4.5 million of new investment as it looks to court more clients in overseas markets.

The additional $4.5 million tranche of investment was led by U.S.-based hedge fund Steadview Capital, the startup said. Tiger Global, Freshworks and Pravega Ventures also participated in the round. The new tranche of investment, dubbed Series A1, means that the three-and-a-half-year-old startup has raised $8.7 million as part of its Series A financing round, and $10.5 million to date.

The SaaS startup offers an expense management platform that makes it easier for employees of a firm to report their business expenses. The eponymous service supports a range of popular email providers, including G Suite and Office 365, and uses a proprietary technology to scan and fetch details from emails, Yash Madhusudhan, co-founder and CEO of Fyle, demonstrated to TechCrunch last week.

A user, for instance, could open a flight ticket email and click on Fyle’s Chrome extension to fetch all details and report the expense in a single click in real-time. As part of today’s announcement, Madhusudhan unveiled an integration with WhatsApp . Users will now be able to take pictures of their tickets and other things and forward it to Fyle, which will quickly scan and report expense filings for them.

These integrations come in handy to users. “Eighty percent to ninety percent of a user’s spending patterns land on their email and messaging clients. And traditionally it has been a pain point for them to get done with their expense filings. So we built a platform that looks at the challenges faced by them. At the same time, our platform understands frauds and works with a company’s compliances and policies to ensure that the filings are legitimate,” he said.

“Every company today could make use of an intelligent expense platform like Fyle. Major giants already subscribe to ERP services that offer similar capabilities as part of their offerings. But as a company or startup grows beyond 50 to 100 people, it becomes tedious to manage expense filings,” he added.

Fyle maintains a web application and a mobile app, and users are free to use them. But the rationale behind introducing integrations with popular services is to make it easier than ever for them to report filings. The startup retains its algorithms each month to improve their scanning abilities. “The idea is to extend expense filing to a service that people already use,” he said.

Until late last year, Fyle was serving customers in India. Earlier this year, it began searching for clients outside the nation. “Our philosophy was if we are able to sell in India remotely and get people to use the product without any training, we should be able to replicate this in any part of the world,” he said.

And that bet has worked. Fyle has amassed more than 300 clients, more than 250 of which are from outside of India. Today, the startup says it has customers in 17 nations, including the U.S. and the U.K. Furthermore, Fyle’s revenue has grown by five times in the last five months, said Madhusudhan, without disclosing the exact figures.

To accelerate its momentum, the startup is today also launching an enterprise version of Fyle that will serve the needs of major companies. The enterprise version supports a range of additional security features, such as IP restriction and a single sign-in option.

Fyle will use the new capital to develop more product solutions and integrations and expand its footprint in international markets, Madhusudhan said. The startup, which just recently set up its sales and marketing team, will also expand the headcount, he said.

Moving forward, Madhusudhan said the startup would also explore tie-ups with ERP providers and other ways to extend the reach of Fyle.

In a statement, Ravi Mehta, MD at Steadview Capital, said, “intelligent and automated systems will empower businesses to be more efficient in the coming decade. We are excited to partner with Fyle to transform one of the core business processes of expense management through intelligence and automation.”

Powered by WPeMatico

Even as tens of millions of Indians have come online for the first time in recent years, most businesses in the nation remain offline. They continue to rely on long notebooks to keep a log of their financial transactions. A nine-month old startup which is digitizing the bookkeeping and allowing merchants to accept online payments just raised a significant amount of capital.

Khatabook, a Bangalore-based startup, said on Tuesday it has raised $25 million in a new financing round. The Series A round for the startup was funded by GGV Capital, Partners of DST Global, RTP Ventures, Sequoia India, Tencent, and Y Combinator. A clutch of high-profile angel investors including Amrish Rau, Anand Chandrasekharan, Deep Nishar, Gokul Rajaram, Jitendra Gupta, Kunal Bahl, and Kunal Shah also participated in the round. The startup has raised $29 million to date.

Khatabook operates an eponymous Android app that allows small and medium businesses to keep a log of their financial transactions and accept payments online. The app, which was launched on Google Play Store in December last year, has amassed 5 million merchants from more than 3,000 cities, towns, and villages in India, Ravish Naresh, cofounder and CEO of Khatabook told TechCrunch in an interview this week.

The app, which remains free of charge, was used to process transactions worth more than $3 billion in August, said Naresh. Most merchants in developing markets are not online currently. They continue to rely on logging their financial transactions — credit, for instance — on notebooks. As you can imagine, this methodology is not structured.

Even has Reliance Jio, a telecom operator launched by India’s richest man Mukesh Ambani, upended the Indian market and brought tens of millions of Indians online for the first time in last three years, most businesses in the country are still carrying out their operations without the use of any technology, said Naresh. “Could we build an app that makes it very easy for merchants to digitize their bookkeeping?” he said.

“As soon as we launched the app, we instantly started to go viral,” he said. For several months now, the startup is seeing 20% growth each month, he said. In six months, the app has helped businesses recover $5 billion in previously unpaid credits, Naresh claimed. Without any marketing, the app has also gained a significant number of users in Nepal, Pakistan, and Bangladesh, said Naresh.

“At Khatabook, we have taken early but significant steps towards leveraging this trend to digitize India’s shopkeepers. For most of our merchants, we are the first business software they’ve used in their entire life. And we will continue to build more India-first innovations to further enable the growth of what is still a largely untapped sector,” he said.

In a statement, Hans Tung, Managing Partner of GGV Capital, said, “as a global investor, we seek out founders who understand the local market and respond to growth opportunities with speed and agility – we certainly see this with the Khatabook team.”

Naresh, a cofounder of property startup Housing, said the startup will use the capital to build new features to serve merchants. In next 12 months, Khatabook will aim to add 25 million businesses, he said.

A growing number of startups in India are attempting to help businesses. OkCredit, which raised $67 million last month, serves 5 million merchants. IndiaMART, a 23-year-old B2B firm that went public this year, led a round in a startup called Vyapar last month that is addressing similar problems.

Powered by WPeMatico