Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Ride-hailing company Grab is going to focus some of its efforts on Vietnam with a $500 million investment over the next five years to grow its activities in the country.

While Grab started as a ride-hailing company, it is now much more than that. The company has become a “super app” that you can open to order a ride, order food from restaurants, make payments, get insurance products, loans and much more. It is mostly active in Southeast Asia.

The company recently announced that it would use some of the $7 billion that it has raised to date to bet on Indonesia. Grab plans to invest $2 billion in Indonesia to modernize the country’s transportation infrastructure. The Indonesian government is supporting the move, and Grab is using this opportunity to capture market share.

With today’s move, Grab is essentially doing the same thing at a smaller scale in Vietnam. In particular, Grab is once again partnering with government officials. It has announced a “Tech for Good” road map in the country that should foster Vietnam’s economic development at large.

Grab plans to provide work opportunities in 63 cities in order to fight unemployment. The company is looking for drivers, delivery persons and merchants. They will be able to access credit and insurance products. Of course, this plan will only work if there are enough Grab customers in those cities over the long term.

The company plans to invest in local startups through GrabVentures. Grab will also launch programs to improve digital and financial literacy. Finally, Grab plans to share data with local governments in order to tackle traffic congestion and pollution.

When it comes to metrics, Grab is already quite big in Vietnam. For instance, the company is currently handling 300,000 food deliveries per day through GrabFood. It represents a 400% increase in gross merchandise volume during the first half of 2019. Grab drivers have generated close to $1 billion in revenue over the years.

Powered by WPeMatico

Many Silicon Valley companies and fintech startups in India today share a common mission: They all want to bring their financial services to the next billion users. Dozens of fintech startups that we have spoken to in recent months have told us that they all want to address much of India, one of the last great growth markets globally, in the next few years.

So you can imagine our excitement when we learned there is at least one startup that is going after just a few million users in the immediate future. We’re talking about CRED, a nine-month-old, Bangalore-based startup that is building solutions to incentivize credit card users in India to become more responsible with money and thereby improve their credit score.

CRED has raised $120 million in a Series B financing round, Kunal Shah, founder and CEO of the startup, told TechCrunch on Monday. He declined to share more information. The startup, which has raised about $145 million to date, is now valued between $430 million to $450 million, a person familiar with the matter told TechCrunch.

According to a regulatory filing, existing investors Sequoia Capital, Ribbit Capital and DST Global’s Gemini Investments led the round, with participation from Tiger Global, Hillhouse Capital, General Catalyst, Greenoaks Capital and Dragoneer.

Hundreds of millions of Indians today don’t have a credit score because they have never taken a loan from a recognized entity nor owned a credit card. According to the government’s official figures, fewer than 50 million credit cards are in circulation in India currently, with industry reports suggesting that the actual number of unique credit card holders is about half of that.

“Nobody taught us about how to use money,” Shah told TechCrunch in a recent interview. “This has created a huge trust gap in India. If you look at developed markets, systematic trust is very high between all the entities. Members don’t have to rely on third-parties. In India, even if you wanted to rent a flat, you look for brokers, for instance.”

You can build that trust when you know how someone handles their money, and how they have handled it in recent history. “Our aim is to create a big membership community with high credit worthiness, therefore open up more opportunities for them,” Shah explained.

Shah is not going after the masses. He wants to focus on just the credit card users for now, and if he could win the trust of just half of those plastic card holders in India, he would consider it a success.

“Instead of chasing the mythological mass customers who are currently useful only on paper if you wanted to boast about your daily active user or monthly active user metric, our goal is to serve the existing users,” he said.

On CRED, users are offered a range of features, including the ability to better track their spending, get reminders and check their credit score, but more importantly, access to a range of lofty offers such as membership to a gym at a discounted price, access to good restaurants at low prices and subscription to various services at little to no charge. Users can access these features by earning points, which they can secure every time they pay their credit card bills on time.

Varun Krishnan, editor of technology news site FoneArena, told TechCrunch that he has found CRED useful in getting reminders to pay his bills and likes that he can pay them through a range of payment options, including UPI apps and debit cards. “I have several cards and it is hard to track amounts and due dates of payment for each one. They send all these alerts on WhatsApp, which is a blessing,” he said.

These are the reasons that attracted many people like Krishnan to join CRED. That, and some incentive to pay his bills — though he hopes that CRED expands the range of offers it currently provides to customers.

That wish may soon come true. In the coming months, CRED will enable these highly sought-after customers to access some financial services from banks in a single-click. Additionally, it is also exploring expansion to some international markets, the aforementioned source said.

CRED does not charge users any money for joining its platform, nor for availing any of the features it offers. But it is generating revenue from some of the partners that are supplying offers on the app.

It’s not a surprise that Shah, an industry veteran known for speaking the uncomfortable truths at conferences, has won the trust of so many investors already. He built one of the biggest payment apps in India, Freecharge, and sold it to e-commerce giant Snapdeal for a whopping $400 million in one of the increasingly rare exits that India’s fintech market has seen to date.

Powered by WPeMatico

FreshToHome, a Bangalore-based e-commerce startup that sells fresh vegetable, fish, chicken and other kinds of meat, has raised $20 million in a new financing round as it looks to expand its footprint in the nation.

The Series B round for the startup was led by Iron Pillar, with Joe Hirao, the founder of Japan’s ZIGExn, also participating. The startup, which closed its $11 million Series A financing round three months ago, has raised $33 million to date.

FreshToHome sells “100 percent” pure and fresh vegetables and meat in Bangalore, Mumbai and Pune — the latter two of which it recently entered. It says it does not add any preservatives or other chemicals to prolong the life of the produce. (Typical meat sold by a retail store is riddled with chemicals and could be months old.)

Unlike most other marketplaces, FreshToHome has built its own supply chain network, which gives it better control over quality and delivery of the food items. It uses trains and planes to move inventory, and has become one of the biggest clients of several local airlines.

The startup sources vegetables and fish directly from 1,500 fishermen and farmers across the nation. It uses an app to negotiate with farmers and fishermen.

It continues to expand its control over all aspects of its business. “Today a large part of our poultry comes from institutional farmers. Now we are going a step ahead and processing the chicken at the slaughtering level ourselves,” Shan Kadavil, CEO of FreshToHome, told TechCrunch in an interview.

FreshToHome is able to deliver the perishables on the same day and as soon as up to two hours, Kadavil said.

The startup also began operations in UAE recently and has opened physical stores in Bangalore and Chennai.

FreshToHome has amassed 650,000 customers — up from 400,000 in late May — in 10 cities in India, and recently started to sell milk in Bangalore, another market segment that remains largely unstructured in the nation. Every day it receives 14,000 orders, and processes 20 tons of fresh food.

It recently crossed $30 million in annualized direct to consumer sales, which makes it the largest e-commerce platform serving this category. It is seeing 30% month-to-month growth, said Kadavil, who has previously managed tech support for Support, and India operations for gaming firm Zynga.

And that growth has helped the startup attract some attention. Several major players in the nation, including Amazon India that recently expanded to include perishable category and Flipkart, have held talks with FreshToHome to acquire some stake in the startup, a person familiar with the matter told TechCrunch.

And there is a big opportunity in the space. The cold-chain market of India is estimated to grow to $37 billion in next five years.

In addition to directly procuring its supplies from farmers and fishermen, FreshToHome also serves as a micro-VC, giving them access to some money upfront and resources to produce more from their farms. It also gives them an assurance that it will buy back their produce.

Kadavil founded FreshToHome with Mathew Joseph, a veteran in the industry who has dealt with fish export for more than 30 years. Joseph started India’s first e-commerce venture in fish and meat, called SeaToHome, in 2012.

FreshToHome will use the fresh capital to expand its network of contract farmers, and add 200 to 300 tons of additional produce each month.

In a prepared statement, Anand Prasanna, managing partner of Iron Pillar, for which it is the first investment in food-tech space, said, “FreshToHome’s brand proposition has been to provide 100% fresh food with 0% chemicals — not an easy thing to achieve in India at a large scale. By smartly using big data and machine learning, they have created a sustainable supply chain, which offers a fair price to consumers, fishermen and farmers, for their premium produce… We love companies that solve such hard issues in large market segments in India through unique tech enabled moats!”

Powered by WPeMatico

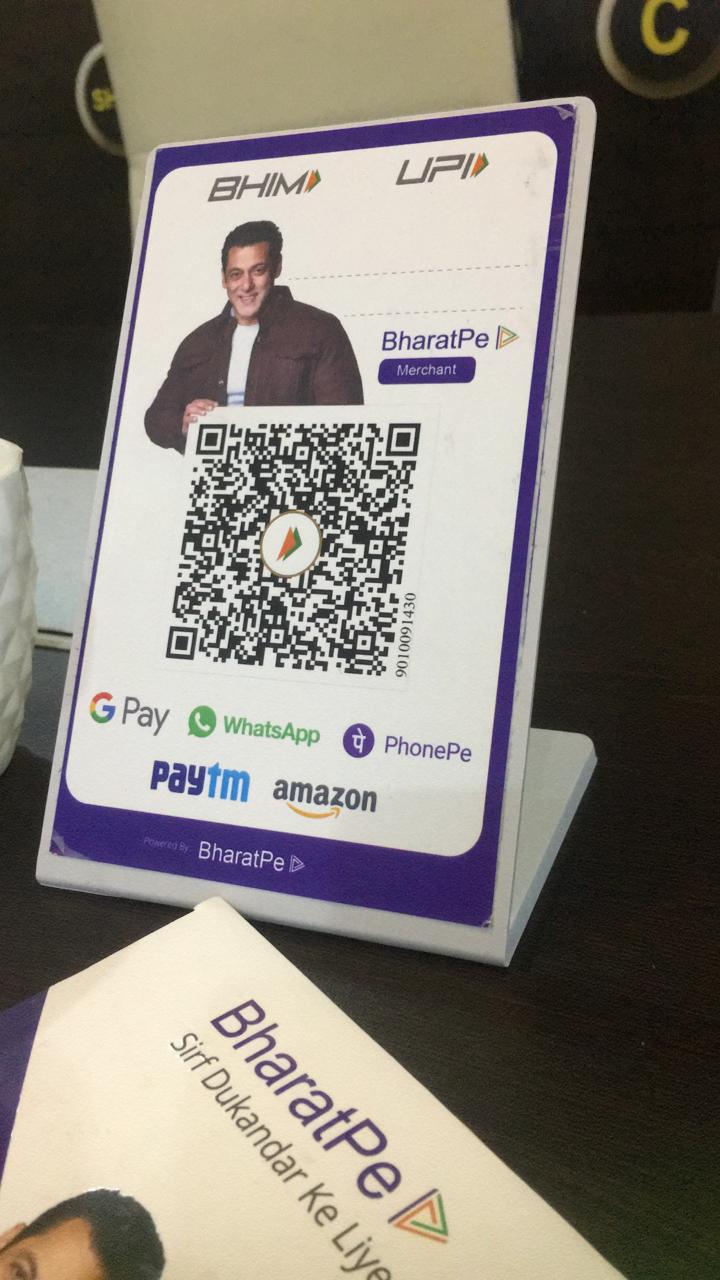

BharatPe, a New Delhi-based firm that is enabling hundreds of thousands of merchants to start accepting digital payments for the first time, and is also giving them access to working capital, has raised $50 million as it looks to scale its business in the nation.

The Series B round for the one-year-old startup was led by San Francisco-headquartered VC firm Ribbit Capital and London-based Steadview Capital, both of which have previously invested in a number of financial services in India.

Existing investors Sequoia Capital, Beenext Capital and Insight Partners also participated in the round, pushing BharatPe’s all-time raise to $65 million. The new round valued the startup at $225 million, Ashneer Grover, co-founder and CEO of BharatPe, told TechCrunch in an interview.

Google and Amazon, both of which offer payment services in India, were also in advanced stages of talks to fund BharatPe’s Series B financing round, but the startup’s founding team was not keen on diluting their stakes, especially in the wake of BharatPe’s recent growth, a person familiar with the matter told TechCrunch.

BharatPe operates an eponymous service to help offline merchants accept digital payments. Even as India has already emerged as the second largest internet market, with more than 500 million users, much of the country remains offline. Among those outside of the reach of the internet are merchants running small businesses, such as roadside tea stalls.

To make these merchants comfortable in accepting digital payments, BharatPe relies on QR codes built as part of government-backed UPI payments infrastructure. “We get them to put up a QR code in their shops, and any customer that uses a UPI-powered payments app — which is now supported by nearly every payments app in India — can pay these shop owners digitally,” said Grover.

Through BharatPe, these merchants also get access to a simplified dashboard on their phones to track the customers who owe them money and get periodic reminders.

BharatPe has amassed more than 1.5 million merchants on its platform. It processes more than 21 million transactions a month, worth more than $83 million, Grover said.

BharatPe also allows merchants to secure short-term loans. New merchants can secure about $500 for a period of three months from BharatPe. As merchants spend more time on BharatPe, the firm increases the amount to about $2,000.

The lending business is crucial to BharatPe. Payment apps make little to no money through making transactions on their platforms. Those processing UPI payments can not even charge a small commission to merchants. “There is no money to be made in doing payments in India,” Grover said. So you charge small interest on loans.

Access to working capital is a major challenge in developed markets such as India. According to a World Bank report, more than 2 billion people globally do not have access to working capital.

Grover said BharatPe aims to use the fund to add about 3.5 million merchants in the next 12 months. The firm has more than 2,000 sales people who are adding 400,000 new merchants to BharatPe each month, he said.

The rest of the money will go into financing the loans on the platform and building new solutions. Later today, BharatPe will launch a new service to connect suppliers and merchants through BharatPe so that their accounts are in sync.

Powered by WPeMatico

India today addressed a long-standing challenge that has been affecting the country’s booming startup ecosystem. As part of a raft of measures to boost overall economic growth from a five-year low, Finance Minister Nirmala Sitharaman said New Delhi is exempting startups from Section 56(2) — a provision more popularly known as an “angel tax” in the local income tax laws — that required startups to pay a certain tax if they received an investment at a rate higher than their “fair market valuation.”

Local tax authority in India does not recognize the discounted cash flow method that many investors use to value early-stage startups, and instead value the company for what it is worth currently, which as you can imagine, is very little. Investors assess a startup’s value based on what it could eventually become in the future.

Prior to today’s announcement, the government levied a 30% tax on affected startups. Sitharaman said any startup that is registered with the Department of Industrial Policy & Promotion, a government body, will be exempted from the angel tax. Those not registered will remain subjected to it, she said in a press conference Friday.

More than 24,000 startups are currently registered with the Department of Industrial Policy & Promotion. The law was originally introduced amid concerns that wealthy people could invest in bogus startups as a way to launder money.

“Angel tax was there to stop shell companies from creating capital from nowhere,” Piyush Goyal, a minister for commerce and industry as well as railways, said in a statement Friday.

The angel tax, which was introduced in 2012, became a roadblock for many investors who wanted to fund early-stage startups. The announcement today comes weeks after the Narendra Modi government said it would address this issue.

Many prominent investors, startup founders, analysts and other industry executives have long publicly criticized the angel tax, telling the government that it is severely hurting the health of the local ecosystem.

Anand Mahindra, chairman of Mahindra Group, said last year that the angel tax needs “immediate attention or else all chances of building a rival to Silicon Valley in India will be lost.”

Sreejith Moolayil, a founder of health food startup True Elements, said the existence of an angel tax would leave many entrepreneurs like him with no choice but to shut down their companies.

Late last year, India’s tax department sent a flurry of notices to startups demanding them to pay the angel tax on funds they received from individual investors. The notices sparked an uproar, with many calling it “harassment.”

“Hope this will address the concerns of DPIIT registered startups. The proposed cell should look into concerns of all startups including those who are already under notice,” said Ashish Aggarwal, who oversees Public Policy at industry body Nasscom, of today’s announcement.

The government will also set up a dedicated cell to address other tax problems that startups face, Sitharaman said. “A startup having any income-tax issue can approach the cell for quick resolution,” the ministry said in a statement.

Jayanth Kolla, founder and chief analyst at research firm Convergence Catalyst, told TechCrunch earlier that the angel tax was the primary reason early-stage startups in the nation were struggling to raise money from investors.

Even as Indian tech startups raised a record $10.5 billion in 2018, early-stage startups saw a decline in the number of deals they participated in and the amount of capital they received. Early-stage startups participated in 304 deals in 2018 and raised $916 million in funds last year, down from $988 million they raised from 380 rounds in 2017 and $1.096 billion they raised from 430 deals the year before, research firm Venture Intelligence told TechCrunch.

I’ve said before, a willingness to relook at policies is a display of strength, not https://t.co/8y4tPp8Iva’s press conference by @nsitharaman will, I hope, mark the start of a new, interactive & interdependent relationship between Govt&business. @narendramodi @AmitShah (1/4)

— anand mahindra (@anandmahindra) August 23, 2019

Sitharaman also announced the country was scrapping a recently introduced additional levy on foreign funds. The government would revoke the surcharge, which increased tax on foreign companies investing in India to over 40%, she said. She also promised to pay out all pending tax refunds owed to small and medium enterprises within 30 days. Companies have long complained that the tax authority takes too much time to refund the money owed to them.

Powered by WPeMatico

One of the private companies aiming to deliver a commercial lunar lander to the Moon has adjusted the timing for its planned mission, which isn’t all that surprising, given the enormity of the task. Japanese startup ispace is now targeting 2021 for their first lunar landing, and 2023 for a second lunar mission that will also include deploying a rover on the Moon’s surface.

The company’s HAKUTO-R program was originally planned to include a mission in 2020 that would involve sending a lunar orbital vehicle for demonstration purposes without any payloads, but that part of the plan has been scrapped in favor of focusing all efforts on delivering actual payloads for commercial customers by 2021 instead.

This updated focus, the company says, is due mostly to the speeding up of the global market for private launch services and payload delivery, including for things like NASA’s Commercial Lunar Payload Services program, wherein the agency is looking for a growing number of private contractors to support its own needs in terms of getting stuff to the Moon.

Although ispace itself isn’t on the list of nine companies selected in round one of NASA’s program, the Japanese company is supporting American nonprofit Draper in its efforts, which was one of the chosen. The Draper/ispace team-up happened after ispace’s initial commitment to its 2020 orbital demo, so its change in priorities makes sense given the new tie-up.

HAKUTO-R will use SpaceX’s Falcon 9 for its first missions, and the company has also signed partnerships with JAXA, Japan’s space agency, as well as new corporate partners including Suzuki, Sumitomo Corporation, Shogakukan and Citizen Watch.

Powered by WPeMatico

After his tenure as chief scientist at Baidu, Andrew Ng, the founder of the Google Brain project and former CEO of Coursera, set up a number of different projects that all focus on making AI more approachable. These include the education startup Deeplearning.ai, the AI Fund startup studio for building AI companies and Landing.ai, which helps enterprises (and especially manufacturing companies) use AI. Today, Ng announced he has opened a second office for these projects in Medellin, Colombia.

At first, Medellin may seem like an odd choice. But today’s Medellin is very different from the one you may have seen on Narcos (and a lot safer). It’s home to a number of universities and, over the course of the last few years, it’s a hub for Colombia’s startup scene thanks to incubators like Ruta N and others.

Ng told me that he chose Medellin after looking at a wide range of cities in Europe, Asia and Latin America. Medellin, he believes, offers a strong talent pool, educational system and business ecosystem. It also helps that the Colombia government has made tech a focus in recent years.

“I see early signs of momentum for Colombia being a talent magnet both regionally and globally,” he told me. Indeed, the company was able to hire team members from Poland, Bangladesh, Egypt and Chile for its offices in Medellin, which now has just under 50 people. Over the course of the next two years, Ng plans to expand this team to between 150 and 200 employees.

It’s important, Ng argues, that we set up AI hubs outside of Silicon Valley and China, in part, because they’ll provide a different perspective. “We are able to share our AI ecosystem and Silicon Valley know-how with Medellín,” he writes in today’s announcement. “We’re equally thrilled for our Silicon Valley team to be learning from the Medellín community. Local knowledge and innovation shared with a global community is what will catapult the technology forward.”

The teams in Medellin will work on all of Ng’s projects, including four unannounced stealth portfolio companies that are looking into using AI in sectors like healthcare, education and customer support. In total, the teams in Medellin are working on about a dozen projects right now. And that’s very much Ng’s approach to AI — and for Landing.ai in particular: build lots of specialized components for various verticals that can then be generalized. “AI isn’t some piece of SaaS software that everybody can just swipe their credit card and use,” he said.

Andrew Ng will also join us for our first TechCrunch Sessions: Enterprise event in San Francisco on September 5 to talk about Landing.ai and the future of AI in general. You can find more information about the event (and buy tickets) here.

Powered by WPeMatico

Tala, a Santa Monica, Calif.-headquartered startup that creates a credit profile to provide uncollateralized loans to millions of people in emerging markets, has raised $110 million in a new financing round to enter India’s burgeoning fintech space.

The Series D financing for the five-year-old startup was led by RPS Ventures, with GGV Capital and previous investors IVP, Revolution Growth, Lowercase Capital, Data Collective VC, ThomVest Ventures and PayPal Ventures also participating in the round.

The new round, which takes the startup’s total fundraising to more than $215 million, valued it above $750 million, a person familiar with the matter told TechCrunch. Tala has also raised an additional $100 million in debt, including a $50 million facility led by Colchis in the last year.

Tala looks at a customer’s texts and calls logs, merchant transactions, overall app usage and other behavioral data through its Android app to build their credit profile. Based on these pieces of information, its machine learning algorithms evaluate the individual risk and provide instant loans in the range of $10 to $500 to customers.

This model is different from how banks and most other online lenders assess a person’s eligibility for a loan. Banks look at a user’s credit score while most online lenders check the financial history.

Tala is also much faster. It approves loans within minutes and disburses the money via mobile payment platforms. The startup has lent over $1 billion to more than 4 million customers to date — up from issuing $300 million in loans to 1.3 million customers last year, Shivani Siroya, founder and CEO of Tala, told TechCrunch in an interview.

The startup, which employs more than 550 people, will use the new capital to enter India, said Siroya, who built Tala after interviewing thousands of small and micro-businesses.

In the run up to launch in India, Tala began a 12-month pilot program in the country last year to conduct user research and understand the market. It has also set up a technology hub in Bangalore, she said.

Shivani Siroya (Tala CEO) at TechCrunch Disrupt NY 2017

“The opportunity is very massive in India, so we spent some time customizing our service for the local market,” she said.

According to World Bank, more than 2 billion people globally have limited access to financial services and working capital. For these people, many of whom live in India, securing a small size loan is extremely challenging as they don’t have a credit score.

In recent years, several major digital payment platforms in India, including Paytm and MobiKwik, have started to offer small-sized loans to users. Traditional banks are still lagging to serve this segment, industry executives say. (Outside India, Tala competes with Branch, a five-year-old San Francisco-based startup that has raised more than $170 million to date and earlier this year inked a deal with Visa.)

Tala goes a step further and takes liability for any unpaid returns, Siroya said. More than 90% of Tala users pay back their loan in 20 to 30 days and are recurring customers, she added.

The startup also forwards the positive credit history and rankings to the local credit bureaus to help people secure bigger and long-term loans in the future, she added.

Tala, which charges a one-time fee that is as low as 5% for each loan, relies on referrals, and some marketing through radio and television to acquire new customers. “But a lot of these users come because they heard about us from their friends,” Siryoa said.

As part of the new financing round, Kabir Misra, founding general partner of RPS Ventures, has joined Tala’s board of directors, the startup said.

Tala said it will use a portion of its new fund to expand its footprint and team in its existing markets — East Africa, Mexico and the Philippines — and also build new solutions.

Siroya said the startup has identified some more markets that it wishes to serve. She did not disclose the names, but said she is eyeing more countries in South Asia and Latin America.

Powered by WPeMatico

Royal Dutch Shell, the energy giant known for its fossil fuel production and hundreds of Shell gas stations, is creeping into the electric vehicle-power business.

The company’s first DC fast charger from its newly acquired company Greenlots launched Monday at a Shell gas station in Singapore. Greenlots, an EV charging startup acquired by Shell in January, installed the charger. This is the first of 10 DC fast chargers that Greenlots plans to bring to Shell service stations in Singapore over the next several months.

The decision to target Singapore is part of Greenlots’ broader strategy to provide EV charging solutions across all applications throughout Asia and North America, the company said. Both Shell and Greenlots have a presence in Singapore. Greenlots, which is based in Los Angeles, was founded in Singapore; and Shell is one of Singapore’s largest foreign investors.

Singapore has been promoting the use of electric vehicles, particularly for car-sharing and ride-hailing platforms. The island city-state has been building up its EV infrastructure to meet anticipated demand as ride-hailing drivers and commercial fleets switch to electric vehicles.

Greenlots was backed by Energy Impact Partners, a cleantech investment firm, before it was acquired by Shell. The company, which combines its management software with the EV charging hardware, has landed some significant customers in recent years, notably Volkswagen. Greenlots is the sole software provider to Electrify America, the entity set up by Volkswagen as part of its settlement with U.S. regulators over its diesel emissions cheating scandal.

Clarification: Shell has other EV chargers. These are the first through its newly acquired company Greenlots.

Powered by WPeMatico

Each month millions of Indians are coming online for the first time, making India the last great growth market for internet companies worldwide. But winning them presents its own challenges.

These users, most of whom live in small cities and villages in India, can’t speak English. Their interests and needs are different from those of their counterparts in large cities. When they come online, the world wide web that is predominantly focused on the English-speaking masses, suddenly seems tiny, Google executives acknowledged at a media conference last year. According to a KPMG-Google report (PDF) on Indian languages, there will be 536 million non-English speaking users using internet in India by 2021.

Many companies are increasingly adding support for more languages, and Silicon Valley giants such as Google are developing tools to populate the web with content in Indian languages.

But there is still room for others to participate. On Friday, a new startup announced it is also in the race. And it has already received the backing of Y Combinator (YC).

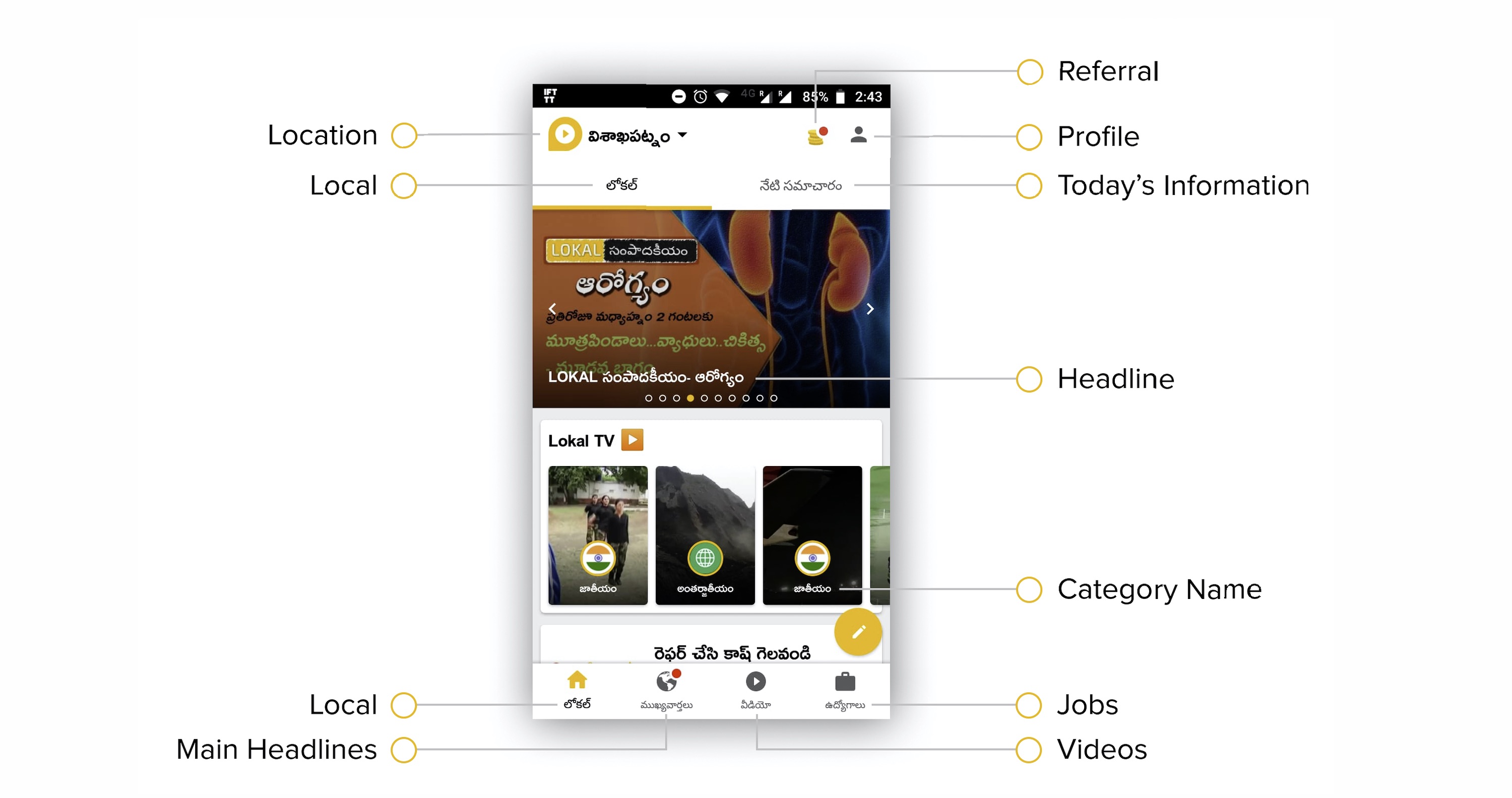

Lokal is a news app that wants to bring local news to hundreds of millions of users in India in their regional languages. The startup, which is currently available in the Telugu language, has already amassed more than two million users, Jani Pasha, co-founder of Lokal, told TechCrunch in an interview.

There are tens of thousands of publications in India and several news aggregators that showcase the top stories from the mainstream outlets. But very few today are focusing on local news and delivering it in a language that the masses can understand, Pasha said.

Lokal is building a network of stringers and freelance reporters who produce original reporting around the issues and current affairs of local towns and cities. The app is updated throughout the day with regional news and also includes an “information” stream that shows things like current price of vegetables, upcoming events and contact details for local doctors and police stations.

The platform has grown to cover 18 districts in South India and is slowly ramping up its operations to more corners of the country. The early signs show that people are increasingly finding Lokal useful. “In 11 of the 18 districts we cover, we already have a larger presence and reader base than other media houses,” Pasha said.

Before creating Lokal, Pasha and the other co-founder of the startup, Vipul Chaudhary, attempted to develop a news aggregator app. The app presented news events in a timeline, offering context around each development.

“We made the biggest mistake. We built the product for four to five months without ever consulting with the users. We quickly found that nobody was using it. We went back to the drawing board and started interviewing users to understand what they wanted. How they consumed news, and where they got their news from,” he said.

“One thing we learned was that most of these users in tier 2 and tier 3 India still heavily rely on newspapers. Newspapers still carry a lot of local news and they rely on stringers who produce these news pieces and source them to publications,” he added.

But newspapers have limited pages, and they are slow. So Pasha and the team tried to build a platform that addresses these two things.

Pasha tried to replicate it through distributing local news, sourced from stringers, on a WhatsApp group. “That one WhatsApp group quickly became one of many as more and more people kept joining us,” he recalls. And that led to the creation of Lokal.

Along the journey, the team found that classifieds, matrimonial ads and things like birthday wishes are still driving people to newspapers, so Lokal has brought those things to the platform.

Pasha said Lokal will expand to three more states in the coming months. It will also begin to experiment with monetization, though that is not the primary focus currently. “The plan is to eventually bring this to entire India,” he said.

A growing number of startups today are attempting to build solutions for what they call India 2 and India 3 — the users who don’t live in major cities, don’t speak English and are financially not as strong.

ShareChat, a social media platform that serves users in 15 regional languages — but not English — said recently it has raised $100 million in a round led by Twitter. The app serves more than 60 million users each month, a figure it wants to double in the next year.

Powered by WPeMatico