Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Software grabs so much attention that it even has its own catchphrase — there’s an app for that. It’s not a bad thing, but we know nothing happens without hardware. That’s why we’re hunting for the best early-stage hardware startups to take center stage at Hardware Battlefield at TC Shenzhen on November 11-12 in China.

Apply here to compete in TC Hardware Battlefield 2019, our hardware-focused pitch competition. If selected, you’ll go head-to-head against some of the world’s most innovative hardware makers for a shot at $25,000. What’s more, you’ll pitch your creations to the world’s top investors. Imagine what that kind of exposure could do for your bottom line.

This is our fifth Hardware Battlefield and our first in China. Shenzhen has a global reputation for the support it offers hardware startups through a combination of accelerators, rapid prototyping and world-class manufacturing. We’re thrilled to collaborate with our partner TechNode to host TC Hardware Battlefield 2019 as part of the larger TechCrunch Shenzhen that runs November 9-12.

Any early-stage hardware startup — from any country — can apply to this competition. We’ve seen an impressive range of hardware in previous Battlefields, including robotic arms, food testing devices, malaria diagnostic tools, smart socks for diabetics and e-motorcycles. Show us what you’ve got!

Meet the minimum requirements listed below, and you’re qualified for consideration:

If you’ve never experienced one of our Battlefield pitch competitions, you’re in for the ride of a lifetime. Here’s how this Hardware Battlefield works.

The vetting process is very selective, and TechCrunch editors thoroughly review every qualified application. They’ll pick 10-15 outstanding hardware startups to compete. Every participating team receives extensive coaching from TechCrunch editors wise in the ways of Battlefield competitions. How extensive? Try six weeks of training that leaves you ready to step on the main stage in front of a panel of judges comprised of expert VCs, founders and technologists.

Each team has just six minutes to pitch and demo their products and then respond to an in-depth Q&A from the judges. One team will rise above the rest to become the Hardware Battlefield champion and take home a check for $25,000.

Even if you don’t win the whole shooting match, you’ll walk away with invaluable — some might say life-changing — media and investor exposure. Of course, we’ll capture the entire event on video and publish it on TechCrunch to a global audience.

Hardware Battlefield at TC Shenzhen takes place on November 11-12. Don’t miss your chance to launch your hardware startup on the world’s most famous tech stage. Apply today!

Is your company interested in sponsoring or exhibiting at Hardware Battlefield at TC Shenzhen? Contact our sponsorship sales team by filling out this form.

Powered by WPeMatico

The rise of data breaches, along with an expanding raft of regulations (now numbering 80 different regional regimes, and growing) have thrust data protection — having legal and compliant ways of handling personal user information — to the top of the list of things that an organization needs to consider when building and operating their businesses. Now a startup called InCountry, which is building both the infrastructure for these companies to securely store that personal data in each jurisdiction, as well as a comprehensive policy framework for them to follow, has raised a Series A of $15 million. The funding is coming in just three months after closing its seed round — underscoring both the attention this area is getting and the opportunity ahead.

The funding is being led by three investors: Arbor Ventures of Singapore, Global Founders Capital of Berlin and Mubadala of Abu Dhabi. Previous investors Caffeinated Capital, Felicis Ventures, Charles River Ventures and Team Builder Ventures (along with others that are not being named) also participated. It brings the total raised to date to $21 million.

Peter Yared, the CEO and founder, pointed out in an interview the geographic diversity of the three lead backers: he described this as a strategic investment, which has resulted from InCountry already expanding its work in each region. (As one example, he pointed out a new law in the UAE requiring all health data of its citizens to be stored in the country — regardless of where it originated.)

As a result, the startup will be opening offices in each of the regions and launching a new product, InCountry Border, to focus on encryption and data handling that keep data inside specific jurisdictions. This will sit alongside the company’s compliance consultancy as well as its infrastructure business.

“We’re only 28 people and only six months old,” Yared said. “But the proposition we offer — requiring no code changes, but allowing companies to automatically pull out and store the personally identifiable information in a separate place, without anything needed on their own back end, has been a strong pull. We’re flabbergasted with the meetings we’ve been getting.” (The alternative, of companies storing this information themselves, has become massively unpalatable, given all the data breaches we’ve seen, he pointed out.)

In part because of the nature of data protection, in its short six months of life, InCountry has already come out of the gates with a global viewpoint and global remit.

It’s already active in 65 countries — which means it’s already equipped to store, process and regulate profile data in the country of origin in these markets — but that is actually just the tip of the iceberg. The company points out that more than 80 countries around the world have data sovereignty regulations, and that in the U.S., some 25 states already have data privacy laws. Violating these can have disastrous consequences for a company’s reputation, not to mention its bottom line: In Europe, the U.K. data regulator is now fining companies the equivalent of hundreds of millions of dollars when they violate GDPR rules.

This ironically is translating into a big business opportunity for startups that are building technology to help companies cope with this. Just last week, OneTrust raised a $200 million Series A to continue building out its technology and business funnel — the company is a “gateway” specialist, building the welcome screens that you encounter when you visit sites to accept or reject a set of cookies and other data requests.

Yared says that while InCountry is very young and is still working on its channel strategy — it’s mainly working directly with companies at this point — there is a clear opportunity both to partner with others within the ecosystem as well as integrators and others working on cloud services and security to build bigger customer networks.

That speaks to the complexity of the issue, and the different entry points that exist to solve it.

“The rapidly evolving and complex global regulatory landscape in our technology driven world is a growing challenge for companies,” said Melissa Guzy of Arbor Ventures, in a statement. Guzy is joining the board with this round. “InCountry is the first to provide a comprehensive solution in the cloud that enables companies to operate globally and address data sovereignty. We’re thrilled to partner and support the company’s mission to enable global data compliance for international businesses.”

Powered by WPeMatico

Netflix said on Wednesday that it will roll out a cheaper subscription plan in India, one of the last great growth markets for global companies, as the streaming giant scrambles to find ways to accelerate its slowing growth worldwide.

The company added 2.7 million new subscribers in the quarter that ended in June this year, it said today, far fewer than the 5 million figure it had forecasted earlier this year.

The company said lowering its subscription plan, which starts at $9 in the U.S., would help it reach more users in India and expand its overall subscriber base. The new plan will be available in India in Q3. According to third-party research firms, Netflix has fewer than 2 million subscribers in India.

Netflix started to test a lower-priced subscription plan in India and some other markets in Asia late last year. The plan restricts the usage of the service to one mobile device and offers only the standard definition viewing (~480p). During the period of testing, which was active as of two months ago, the company charged users as low as $4.

The company did not specify the exact amount it intends to charge users for the cheaper mobile-only plan. During the testing period, Netflix also provided some users the option to get a subscription that would only last for a week. The company also did not say if it intended to bring the cheaper plan to other markets. TechCrunch has reached out to Netflix for more details. (Update: Netflix declined to elaborate at this point.)

“After several months of testing, we’ve decided to roll out a lower-priced mobile-screen plan in India to complement our existing plans. We believe this plan, which will launch in Q3, will be an effective way to introduce a larger number of people in India to Netflix and to further expand our business in a market where Pay TV ARPU is low (below $5),” the company said in its quarterly earnings report.

Selling an entertainment service in India, the per capita GDP of which is under $2,000, is extremely challenging. The vast majority of companies that have performed exceedingly well in the nation offer their products and services at a very low price.

Just look at Spotify, which entered India earlier this year and for the first time decided to offer full access to its service at no cost to local users. Even its premium option that features playback in higher quality costs Rs 119 ($1.6) per month.

That’s not to say that winning in India, home to more than 1.3 billion people, can’t be rewarding. Disney-owned streaming service Hotstar, which offers 80% of its content catalog at no cost, has amassed more than 300 million monthly active users. There are about 500 million internet users in India, according to industry reports.

In fact, Hotstar set a global record for most simultaneous views to a live event — about 25.3 million users — during the recently concluded ICC cricket world cup. It broke its own previous records. Hotstar’s free offering comes bundled with ads, while its ad-free premium option costs Rs 999 ($14.5) for year-long access.

Amazon, another global rival of Netflix, bundles its Prime Video streaming service in its Prime membership, which includes access to faster delivery of packages and its music service, for Rs 999 a year.

For Netflix, the decision to lower its pricing in India comes at a time when it has hiked the subscription cost in many parts of the world in recent quarters. In the U.S., for instance, Netflix said earlier this year that it would raise its subscription price by up to 18%.

During a visit to India early last year, Netflix CEO Reed Hastings said the country could eventually emerge as the place that would bring the next 100 million users to his platform. “The Indian entertainment business will be much larger over the next 20 years because of investment in pay services like Netflix and others,” he said.

So far, Netflix has largely tried to lure customers through its original series. (Many popular U.S. shows such as NBC’s “The Office” that are available on Netflix’s U.S. catalog are not offered in its India palate.) The company, which has produced more than a dozen original shows and movies for India, this week unveiled five more that are in the pipeline.

“We are seeing nice, steady increases in engagement in India. Growth in that country is a marathon and we are in it for the long haul,” Ted Sarandos, chief content officer at Netflix, said during an earnings call today.

Powered by WPeMatico

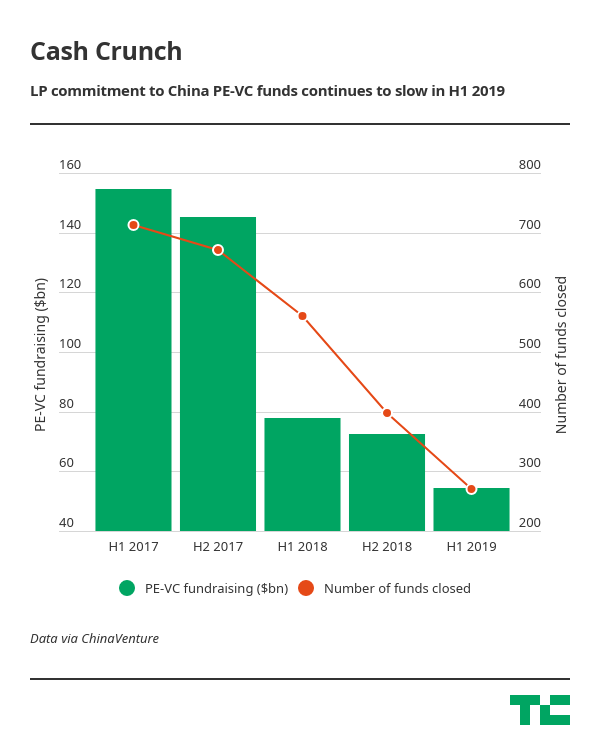

Chinese startups continue to weather tough times as private investors, caught in a cash crunch, are concentrating money into fewer deals.

China’s deal-making activity for startups in the six months ended June halved from a year ago to 1,910, according to data from consulting firm ChinaVenture’s research arm. The amount invested in domestic startups during the first half of 2019 plummeted 54% to $23.2 billion.

The slide in startup investment comes as the money behind the money shrinks amid a cooling economy in China that is exacerbated by a trade war with the U.S. Fundraising for investors was already showing signs of slowdown a year earlier. In the first half of this year, private equity and venture capital firms in China secured 30% less than what they had raised over the same period a year ago, amounting to a total of $54.44 billion; 271 funds managed to raise, down 52%.

That money from limited partners is also flowing to a small rank of investors. Twelve institutions accounted for 57% of all the capital landed by VCs and PEs in the period. Investment coffers that have gotten a big boost include the likes of TPG Capital, Warburg Pincus, DCG Capital, Legend Capital and Source Code Capital.

Healthcare was the most-backed sector during the six months, although proptech startups scored the biggest average deal size. Some of the highest funded companies from the period were artificial intelligence chip maker Horizon Robotics, shared housing upstart Danke and China’s Starbucks challenger, Luckin.

Powered by WPeMatico

India’s Oyo has expanded its hotel chain business to more than 80 countries and entered the co-living spaces segment in recent years. The firm, which has raised about $1 billion since last September from several big names, including Airbnb, has now identified a new business to target: co-working spaces.

The Gurgaon-headquartered firm on Tuesday announced Oyo Workspaces, which is already operational across 10 cities in India with more than 20 centres. It currently has the capacity to serve more than 15,000 people. More than 6,000 employees from firms such as Swiggy, Paytm, Pepsi, Nykaa, OLX and Lenskart have already signed up for the service.

At a press conference in New Delhi, Rohit Kapoor, CEO of New Real Estate Businesses, said Oyo plans to have 50 Oyo Workspaces centres by the end of the year and aims to make it the largest co-working business in Asia by the end of next year.

As part of the announcement, Oyo confirmed that it has acquired Innov8, a co-working startup with more than 200 employees and 16 operational centres. The four-year-old startup was acquired for about $30 million, two sources familiar with the matter told TechCrunch.

Innov8 is one of the three in-house brands that is part of Oyo Workspaces. The other two brands — Workflo and Powerstation — are aimed at people who are looking for economical offering. A user could access one of these co-working spaces for as low as Rs 6,999 ($102) a month. Innov8 has been positioned as a premium option.

India’s co-working space, still a relatively new business category locally, is worth $390 million — a fraction of the $30 billion office and commercial real estate business. Kapoor said Oyo believes it can not only become a market leader in the nation but also expand the size of the market itself. Oyo Workspaces will compete with a range of companies, including 91Springboard, GoHive, Awfis, GoWork and the global giant WeWork.

Oyo Workspaces will offer a range of services across all of its centres, such as a Wi-Fi connection, in-house kitchen, housekeeping, storage and parking spaces. It is also offering users monthly and quarterly passes — currently being offered at heavily discounted rates — to further lower the price points of its co-working spaces.

Oyo, which serves more than half a million users each day across more than 850,000 rooms it operates, is aggressively expanding its business through partnerships with local players as it emerges as the third-largest hotel chain in the world. The six-year-old startup was valued at more than $5 billion at its last funding round, TechCrunch reported earlier.

Oyo, which serves as both listings and reservations platforms, makes most of its money from fee-paying franchises and bookings. Kapoor said the company will use part of the $200 million Oyo has committed to invest in its India and Southeast Asia businesses this year.

Powered by WPeMatico

A UK parliamentary committee has concluded there are no technical grounds for excluding Chinese network kit vendor Huawei from the country’s 5G networks.

In a letter from the chair of the Science & Technology Committee to the UK’s digital minister Jeremy Wright, the committee says: “We have found no evidence from our work to suggest that the complete exclusion of Huawei from the UK’s telecommunications networks would, from a technical point of view, constitute a proportionate response to the potential security threat posed by foreign suppliers.”

Though the committee does go on to recommend the government mandate the exclusion of Huawei from the core of 5G networks, noting that UK mobile network operators have “mostly” done so already — but on a voluntary basis.

If it places a formal requirement on operators not to use Huawei for core supply the committee urges the government to provide “clear criteria” for the exclusion so that it could be applied to other suppliers in future.

Reached for a response to the recommendations, a government spokesperson told us: “The security and resilience of the UK’s telecoms networks is of paramount importance. We have robust procedures in place to manage risks to national security and are committed to the highest possible security standards.”

The spokesperson for the Department for Digital, Media, Culture and Sport added: “The Telecoms Supply Chain Review will be announced in due course. We have been clear throughout the process that all network operators will need to comply with the Government’s decision.”

In recent years the US administration has been putting pressure on allies around the world to entirely exclude Huawei from 5G networks — claiming the Chinese company poses a national security risk.

Australia announced it was banning Huawei and another Chinese vendor ZTE from providing kit for its 5G networks last year. Though in Europe there has not been a rush to follow the US lead and slam the door on Chinese tech giants.

In April leaked information from a UK Cabinet meeting suggested the government had settled on a policy of granting Huawei access as a supplier for some non-core parts of domestic 5G networks, while requiring they be excluded from supplying components for use in network cores.

On this somewhat fuzzy issue of delineating core vs non-core elements of 5G networks, the committee writes that it “heard unanimously and clearly” from witnesses that there will still be a distinction between the two in the next-gen networks.

It also cites testimony by the technical director of the UK’s National Cyber Security Centre (NCSC), Dr Ian Levy, who told it “geography matters in 5G”, and pointed out Australia and the UK have very different “laydowns” — meaning “we may have exactly the same technical understanding, but come to very different conclusions”.

In a response statement to the committee’s letter, Huawei SVP Victor Zhang welcomed the committee’s “key conclusion” before going on to take a thinly veiled swiped at the US — writing: “We are reassured that the UK, unlike others, is taking an evidence based approach to network security. Huawei complies with the laws and regulations in all the markets where we operate.”

The committee’s assessment is not all comfortable reading for Huawei, though, with the letter also flagging the damning conclusions of the most recent Huawei Oversight Board report which found “serious and systematic defects” in its software engineering and cyber security competence — and urging the government to monitor Huawei’s response to the raised security concerns, and to “be prepared to act to restrict the use of Huawei equipment if progress is unsatisfactory”.

Huawei has previously pledged to spend $2BN addressing security shortcomings related to its UK business — a figure it was forced to qualify as an “initial budget” after that same Oversight Board report.

“It is clear that Huawei must improve the standard of its cybersecurity,” the committee warns.

It also suggests the government consults on whether telecoms regulator Ofcom needs stronger powers to be able to force network suppliers to clean up their security act, writing that: “While it is reassuring to hear that network operators share this point of view and are ready to use commercial pressure to encourage this, there is currently limited regulatory power to enforce this.”

Another committee recommendation is for the NCSC to be consulted on whether similar security evaluation mechanisms should be established for other 5G vendors — such as Ericsson and Nokia: Two European based kit vendors which, unlike Huawei, are expected to be supplying core 5G.

“It is worth noting that an assurance system comparable to the Huawei Cyber Security Evaluation Centre does not exist for other vendors. The shortcomings in Huawei’s cyber security reported by the Centre cannot therefore be directly compared to the cyber security of other vendors,” it notes.

On the issue of 5G security generally the committee dubs this “critical”, adding that “all steps must be taken to ensure that the risks are as low as reasonably possible”.

Where “essential services” that make use of 5G networks are concerned, the committee says witnesses were clear such services must be able to continue to operate safely even if the network connection is disrupted. Government must ensure measures are put in place to safeguard operation in the event of cyber attacks, floods, power cuts and other comparable events, it adds.

While the committee concludes there is no technical reason to limit Huawei’s access to UK 5G, the letter does make a point of highlighting other considerations, most notably human rights abuses, emphasizing its conclusion does not factor them in at all — and pointing out: “There may well be geopolitical or ethical grounds… to enact a ban on Huawei’s equipment”.

It adds that Huawei’s global cyber security and privacy officer, John Suffolk, confirmed that a third party had supplied Huawei services to Xinjiang’s Public Security Bureau, despite Huawei forbidding its own employees from misusing IT and comms tech to carry out surveillance of users.

The committee suggests Huawei technology may therefore be being used to “permit the appalling treatment of Muslims in Western China”.

Powered by WPeMatico

NiYO Solutions, a Bangalore-based “neo-bank” that helps salaried employees and blue-collar workers access company benefits and other financial services, has raised $35 million in a new funding round to expand its business in the nation and explore international markets for some of its products.

The four-year-old startup, which serves small and medium businesses and other salaried employees across India, raised its Series B from Horizons Ventures, Tencent and existing investor JS Capital. It has raised $49.2 million to date, with its $13.2 million Series A closing in January last year.

NiYO Solutions serves as a “neo-bank” that relies on traditional financial institutions (Yes Bank and DCB banks, in its case) and offers to customers additional features such as lending and insurance. Blue-collared employees in India (and many other markets) continue to struggle in availing crucial financial services from banks that typically reserve them for the privileged segment. With its payroll solution and other products, NiYO is trying to drive financial inclusion in the country, it said.

The startup also offers a global travel card with no mark-up fee. More than 50,000 users have already signed up for the travel card — and NiYO intends to scale that figure to 500,000 by April next year. In an interview with TechCrunch, Vinay Bagri, co-founder and CEO of NiYO, said the startup is exploring bringing the travel card to other markets — though he did not share any names.

He said the startup will also use the fresh capital to build new product offerings and in expansion of its distribution and marketing efforts. It also wants to grow its customer base from about 1 million currently to 5 million in the next three years. Bagri said NiYO is looking to acquire other startups that are a good fit for its vision.

Neo banks are increasingly becoming popular across the globe as traditional banks show little interest in addressing the needs of niche customer bases. Tide and N26 are showing remarkable growth in European markets, while Azlo in the U.S. and Tyro Payments and Volt Bank in Australia are also among the top players.

In developing regions such as India, too, this tried and tested idea is increasingly being replicated. Open, another Bangalore-based neo-bank, helps businesses automate their finances. It raised $30 million last month.

Powered by WPeMatico

India ordered an investigation into Google’s alleged abuse of Android’s dominance in the country to hurt local rivals. A document made public by the local antitrust watchdog has now further revealed the nature of the allegations and identified the people who filed the complaint.

Umar Javeed and Sukarma Thapar, two associates at Competition Commission of India — and Aaqib Javeed, brother of Umar and who interned at the watchdog last year, filed the complaint, the document revealed. The revelation puts an end to months-long interest from industry executives, many of whom wondered if a major corporation was behind it.

The case, filed against Google’s global unit and Indian arm on April 16 this year, makes several allegations, including the possibility that Google used Android’s dominant position in India to hurt local companies. The accusation is that Google requires handset and tablet vendors to pre-install its own applications or services if they wish to get the full-blown version of Android . Google’s Android mobile operating system powered more than 98% of smartphones that shipped in the country last year, research firm Counterpoint said.

This accusation is partly true, if at all. To be sure, Google does offer a “bare Android” version, which a smartphone vendor could use and then they wouldn’t need to pre-install Google Mobile Services (GMS). Though by doing so, they will also lose access to Google Play Store, which is the largest app store in the Android ecosystem. Additionally, phone vendors do partner with other companies to pre-install their applications. In India itself, most Android phones sold by Amazon India and Flipkart include a suite of their apps preloaded on the them.

“OEMs can offer Android devices without preinstalling any Google apps. If OEMs choose to preinstall Google mobile apps, the MADA (Mobile Application Distribution Agreement) allows OEMs to preinstall a suite of Google mobile apps and services referred to as Google Mobile Services (GMS),” said Google in response.

The second allegation is that Google is bundling its apps and services in a way that they are able to talk to each other. “This conduct illegally prevented the development and market access of rival applications and services in violation of Section 4 read with Section 32 of the Act,” the trio wrote.

This also does not seem accurate. Very much every Android app is capable of talking to one another through APIs. Additionally, defunct software firm Cyanogen partnered with Microsoft to “deeply integrate” Cortana into its Android phones — replacing Google Assistant as the default virtual voice assistant. So it is unclear what advantage Google has here.

Google’s response: “This preinstallation obligation is limited in scope. It was pointed out that preinstalled Google app icons take up very little screen space. OEMs can and do use the remaining space to preinstall and promote both their own, and third-party apps. It was also submitted that the MADA preinstallation conditions are not exclusive. Nor are they exclusionary. The MADA leaves OEMs free to preinstall rival apps and offer them the same or even superior placement.”

The third accusation is that Google prevents smartphone and tablet manufacturers in India from developing and marketing modified and potentially competing versions of Android on other devices.

This is also arguably incorrect. Micromax, which once held tentpole position among smartphone vendors in India, partnered with Cyanogen in their heyday to launch and market Android smartphones running a customized operating system. Chinese smartphone vendor OnePlus followed the same path briefly.

Google’s response: “Android users have considerable freedom to customise their phones and to install apps that compete with Google’s. Consumers can quickly and easily move or disable preinstalled apps, including Google’s apps. Disabling an app makes it disappear from the device screen, prevents it from running, and frees up device memory – while still allowing the user to restore the app at a later time or to factory reset the device to its original state.”

Additionally, Google says it requires OEMs to “adhere to a minimum baseline compatibility standard” for Android called Compatibility Definition Document (COD) to ensure that apps written for Android run on their phones. Otherwise, this risks creating a “threat to the viability and quality of the platform.”

“If companies make changes to the Android source code that create incompatibilities, apps written for Android will not run on these incompatible variants. As a result, fewer developers will write apps for Android, threatening to make Android less attractive to users and, in turn, even fewer developers will support Android,” the company said.

The antitrust is ongoing, but based on an initial probe of the case, CCI has found that Google has “reduced the ability and incentive of device manufacturers to develop and sell devices” running Android forks, the watchdog said. Google’s condition to include “the entire GMS suite” to devices from OEMs that have opted for full-blown a version of Android, amounts to “imposition of unfair condition on the device manufacturers,” the watchdog added.

The document also reveals that Google has provided CCI with some additional responses that have been kept confidential. A Google spokesperson declined to comment.

Powered by WPeMatico

Away from the limelight of the press and the frenzy of fundraising, a tech startup in India has achieved a feat that few of its peers have managed: going public.

IndiaMART, the country’s largest online platform for selling products directly to businesses, raised nearly $70 million in a rare tech IPO for India this week.

The milestone for the 23-year-old firm is so uncommon for India’s otherwise burgeoning startup ecosystem that, beyond being over-subscribed 36 times, pent up demand for IndiaMART’s stock saw its share price pop 40% on its first day of trading on National Stock Exchange on Thursday — a momentum that it sustained on Friday.

The stock ended Friday at Rs 1326 ($19.3), compared to its issue price of Rs 973 ($14.2).

IndiaMART is the first business-to-business e-commerce firm to go public in India. Its IPO also marks the first listing for a firm following the May reelection of Narendra Modi as the nation’s Prime Minister and the months-long drought that led to it.

Accounting firm EY said it expects more companies from India to follow suit and file for IPO in the coming months.

“Now that national elections are over and favorable results secured, IPO activity is expected to gain momentum in H2 2019 (second half of the year). Companies that had filed their offer documents with the Indian stock markets regulator during H2 2018 and Q1 2019 may finally come to market in the months ahead,” it said in a statement (PDF).

The fireworks of the IPO are just as impressive as IndiaMART’s journey.

The startup was founded in 1996 and for the first 13 years, it focused on exports to customers abroad, but it has since modernized its business following the wave of the internet.

“The thesis was, in 1996, there were no computers or internet in India. The information about India’s market to the West was very limited,” Dinesh Agarwal, co-founder and CEO of IndiaMART, told TechCrunch in an interview.

Until 2008, IndiaMART was fully bootstrapped and profitable with $10 million in revenue, Agarwal said. But things started to dramatically change in that year.

“The Indian rupee became very strong against the dollar, which dwindled the exports business. This is also when the stock market was collapsing in the West, which further hurt the exports demand,” he explained.

Dinesh Agarwal, founder and CEO of IndiaMart.com, poses for a profile shot on July 29, 2015 in Noida, India.

By this time, millions of people in India were on the internet and, with tens of millions of people owning a feature phone, the conditions of the market had begun to shift towards digital.

“This is when we decided to pursue a completely different path. We started to focus on the domestic market,” Agarwal said.

Over the last 10 years, IndiaMART has become the largest e-commerce platform for businesses with about 60% market share, according to research firm KPMG. It handles 97,000 product categories — ranging from machine parts, medical equipment and textile products to cranes — and has amassed 83 million buyers and 5.5 million suppliers from thousands of towns and cities of India.

According to the most recent data published by the Indian government, there are about 50 to 60 million small and medium-sized businesses in India, but only around 10 million of them have any presence on the web. Some 97% of the top 50 companies listed on National Stock Exchange use IndiaMART’s services, Agarwal said.

That’s not to say that the transition to the current day was a straightforward process for the company. IndiaMART tried to capitalize on its early mover advantage with a stream of new services which ultimately didn’t reap the desired rewards.

In 2002, it launched a travel portal for businesses. A year later, it launched a business verification service. It also unveiled a payments platform called ABCPayments. None of these services worked and the firm quickly moved on.

Part of IndiaMART’s success story is its firm leadership and how cautiously it has raised and spent its money, Rajesh Sawhney, a serial angel investor who sits on IndiaMART’s board, told TechCrunch in an interview.

IndiaMART, which employs about 4,000 people, is operationally profitable as of the financial year that ended in March this year. It clocked some $82 million in revenue in the year. It has raised about $32 million to date from Intel Capital, Amadeus Capital Partners and Quona Capital. (Notably, Agarwal said that he rejected offers from VCs for a very long time.)

The firm makes most of its revenue from subscriptions it sells to sellers. A subscription gives a seller a range of benefits including getting featured on storefronts.

4/4. So many Indian small businesses have so much to thank @DineshAgarwal for. And after the iconic IPO, so many Indian entreprenuers will have so much to thank him for – forever unlocking the Indian public markets to current & future generation of Indian internet companies

— Kunal Bahl (@1kunalbahl) July 4, 2019

There are only a handful of internet companies in India that have gone public in the last decade. Online travel service MakeMyTrip went public in 2010. Software firm Intellect Design Arena and e-commerce store Koovs listed in 2014, then travel portal Yatra and e-commerce firm Infibeam followed two years later.

India has consistently attracted billions of dollars in funding in recent years and produced many unicorns. Those include Flipkart, which was acquired by Walmart last year for $16 billion, Paytm, which has raised more than $2 billion to date, Swiggy, which has bagged $1.5 billion to date, Zomato, which has raised $750 million, and relatively new entrant Byju’s — but few of them are nearing profitability and most likely do not see an IPO in their immediate future.

In that context, IndiaMART may set a benchmark for others to follow.

“The fact that we have a homegrown digital commerce business, serving both the urban and smaller cities, and having struggled and been around for so long building a very difficult business and finally going public in the local exchange is a phenomenal story,” Ganesh Rengaswamy, a partner at Quona Capital, told TechCrunch in an interview. “It keeps the story of India tech, to the Western world, going.”

Congratulations @DineshAgarwal for an iconic IPO! @IndiaMART has set an example and hope for all Indian Internet companies looking to go public. Cheers! https://t.co/yJumFjfitS

— Vani Kola (@VaniKola) July 4, 2019

Generally, it is agreed that there are too few IPOs in India and the industry can benefit from momentum and encouragement of high profile and successful public listings.

“There is a firm consensus that in India, markets will prefer only the IPOs of companies that are profitable. And investors in India might not value those companies. Both of these issues are being addressed by IndiaMART,” said Sawhney.

“We need 30 to 40 more IPOs. This will also mean that the stock market here has matured and understands the tech stocks and how it is different from other consumer stocks they usually handle. More tech companies going public would also pave the way for many to explore stock exchanges outside of India.

“Indian market is ready for more tech stocks. We just need to get more companies to go out there,” Sawhney added, although he did predict that it will take a few years before the vast majority of leading startups are ready for the public market.

The Indian government, for its part, this week announced a number of incentives to uplift the “entrepreneurial spirit” in the nation.

Finance minister Nirmala Sitharaman said the government would ease foreign direct investment rules for certain sectors — including e-commerce, food delivery, grocery — and improve the digital payments ecosystem. Sitharaman, who is the first woman to hold this position in India, said the government would also launch a TV program to help startups connect with venture capitalists.

IndiaMART has managed to build a sticky business that compels more than 55% of its customers to come back to the platform and make another transaction within 90 days, Agarwal — its CEO — said. With some 3,500 of its 4,000 employees classified as sales executives, the company is aggressive in its pursuit of new customers. Moving forward, that will remain one of its biggest focuses, according to Agarwal.

“Most of our time still goes into educating MSMEs on how to use the internet. That was a challenge 20 years ago and it remains a challenge today,” he told TechCrunch.

In recent years, IndiaMART has begun to expand its suite of offerings to its business customers in a bid to increase the value they get from its platform and thus increase their reliance on its service.

IndiaMART has built a customer relationship management (CRM) tool so that customers need not rely on spreadsheets or other third-party services.

“We will continue to explore more SaaS offerings and look into solving problems in accounting, invoice management and other areas,” said Agarwal.

The firm also recently started to offer payment facilitation between buyers and sellers through a PayPal -like escrow system.

“This will bridge the trust gap between the entities and improve an MSME’s ability to accept all kinds of payment options including the new age offerings.”

There’s an elephant in the room, however.

A bigger challenge that looms for IndiaMART is the growing interest of Amazon and Walmart in the business-to-business space. Several startups including Udaan — which has raised north of $280 million from DST Global and Lightspeed Venture Partners — have risen up in recent years and are increasingly expanding their operations. Agarwal did not seem much worried, however, telling TechCrunch that he believes that his prime competition is more focused on B2C and serving niche audiences. Besides he has $100 million in the bank himself.

Indeed, as Quona Capital’s Rengaswamy astutely noted, competition is not new for IndiaMART — the company has survived and thrived more than two decades of it.

“Alibaba came and gave up,” he noted.

An important — and unanswered question — that follows the successful IPO is how IndiaMART’s stock will fare over the coming months. A glance to the U.S. — where hyped companies like Uber, Lyft and others have seen prices taper off — shows clearly that early demand and sustained stock performance are not one and the same.

Nobody knows at this point, and the added complexity at play is that the concept of a tech IPO is so uncommon in India that there is no definitive answer to it… yet. But IndiaMART’s biggest achievement may be that it sets the pathway that many others will follow.

Powered by WPeMatico

China’s war on garbage is as digitally savvy as the country itself. Think QR codes attached to trash bags that allow a municipal government to trace exactly where its trash comes from.

On July 1, the world’s most populated city (Shanghai) began a compulsory garbage-sorting program. Under the new regulations (in Chinese), households and companies must classify their wastes into four categories and dump them in designated places at certain times. Noncompliance can lead to fines. Companies and properties that don’t comply risk having their credit rating lowered.

The strict regime became the talk of the city’s more than 24 million residents, who criticized the program’s inflexibility and confusing waste categorization. Gratefully, China’s tech startups are here to help.

For instance, China’s biggest internet companies responded with new search features that help people identify which wastes are “wet” (compostable), “dry,, “toxic,” or “recyclable.” Not even the most environmentally conscious person can get all the answers right. Like, which bin does the newspaper you just used to pick up dog poop belong to? Simply pull up a mini app on WeChat, Baidu or Alipay and enter the keyword. The tech firms will give you the answer and why.

A WeChat mini program that lets users learn the category of cash

Alipay, Alibaba’s electronics payment affiliate, claims its garbage-sorting mini app added one million users in just three days. The lite app, which is available without download inside the e-wallet with one billion users, has so far indexed more than 4,000 types of rubbish. Its database is still growing, and soon it will save people from typing by using image recognition to classify trash when they snap a photo of it. Alibaba’s answer to Alexa Tmall Genie can already answer (in Chinese) the question “what kind of trash is a wet wipe?” and more.

If people are too busy or lazy to hit the collection schedule, well, startups are offering valet trash service at the doorstep. A third-party developer helped Alipay build a recycling mini app (“垃圾分类回收平台”) and is now collecting garbage from 8,000 apartment complexes across 11 cities. To date, two million people have sold recyclable material through its platform.

Ele.me, Alibaba’s food delivery arm, added trash pickup to its list of valet services its fleets offer on top of “apologize to the girlfriend” and dog walking.

Alibaba’s food delivery & local service platform https://t.co/Yh95Bt0DPG just rolled out a “throw out the trash” service for $2. The delivery guy can also “apologize to the girlfriend” on your behalf among other things #DigitalEconomyinChina $BABA pic.twitter.com/C2ey1ePDvJ

— Krystal Hu (@readkrystalhu) June 24, 2019

Besides helping households, companies are also building software to make property managers’ lives easier. Some residential complexes in Shanghai began using QR codes to trace the origin of garbage, state-owned media outlet Xinhua reported. Each household is asked to attach a unique QR code to their trash bags, which will be scanned for sources and classification when they arrive at the waste management station.

Workers at a waste management station in Shanghai scan codes on trash bags to check their source (Screenshot from Xinhua feature)

This way, regulators in the region know exactly which family has produced the trash — although the city’s current garbage regulations do not require real-name tracking — and those who correctly categorized receive a small reward of 0.1 yuan, or 1.45 cents, per day, according to another report (in Chinese) from Xinhua.

Powered by WPeMatico