Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Locus, an Indian startup that uses AI to help businesses map out their logistics, has raised $22 million in Series B funding to expand its operations in international markets.

The financing round for the four-year-old startup was led by Falcon Edge Capital and Tiger Global. Existing investors Exfinity Venture Partners and Blume Ventures also participated in the round. The startup has raised $29 million to date, Nishith Rastogi, co-founder and CEO of Locus, told TechCrunch in an interview.

Locus works with companies that operate in FMCG, logistics and e-commerce spaces. Some of its clients include Tata Group companies, Myntra, BigBasket, Lenskart and Bluedart. It helps these clients automate their logistics workload — tasks such as planning, organizing, transporting and tracking of inventories, and finding the best path to reach a destination — that have traditionally required intensive human labor.

“Say a Lenskart representative is visiting a house or an office to offer an eye checkup, and suddenly two more people there are interested in getting their eyes checked. The representative could attend these two new potential clients, or wrap things up with the first client and take care of his or her next appointment,” said Rastogi.

Locus looks at a client’s past data, identifies patterns and automates these kind of decisions on a large scale. In an example shared earlier with TechCrunch, Rastogi talked about how Locus had built a scanner for e-commerce companies for measuring products.

Rastogi said he will use the fresh capital to develop products and expand Locus in Southeast Asian and North American markets. The startup says half of its 110-person workforce is outside of India. Half of the IP it has built and the revenue it generates comes from its team outside of India.

He said the startup has spent the recent quarters studying these international markets, and has secured some anchor clients to expand the business. Locus is operationally profitable already and any additional capital goes into expanding its business, he added.

The logistics market in India has long been riddled with challenges. A growing number of startups, including BlackBuck — which raised $150 million last week — have emerged in recent years to tackle these problems.

The new funding also illustrates Tiger Global’s new strategy for the Indian market. The VC fund, which has invested in B2C businesses Flipkart and Ola in India, has made a number of investments in B2B startups in recent months. Last month, it invested $90 million in agritech supply chain startup Ninjacart, and weeks later, it gave cloud-based solutions provider Zenoti $50 million. It also participated in customer marketing service ClearTap’s $26 million round.

Powered by WPeMatico

Indian video streaming giant Hotstar, owned by Disney, today set a new global benchmark for the number of people an OTT service can draw to a live event.

Some 18.6 million users simultaneously tuned into Hotstar’s website and app to watch the deciding game of the 12th edition of the Indian Premier League (IPL) cricket tournament. The streaming giant, which competes with Netflix and Amazon in India, broke its own “global best” 10.3 million concurrent views milestone that it had set last year.

Hotstar topped the 10 million concurrent viewership mark a number of times during this year’s 51-day IPL season. More than 12.7 million viewers huddled to watch an earlier game in the tournament (between Royal Challengers Bangalore and Mumbai Indians), a spokesperson for the four-year-old service said. In mid-April, Hotstar said that the cricket series had already garnered a 267 million overall viewership, creating a new record for the streamer. (Last year’s IPL had clocked a 202 million overall viewership.)

Fans of Mumbai Indians celebrate their team’s victory against Chennai Super Kings in IPL cricket tournament in India.

These figures coming out of India, the fastest-growing internet market, are astounding to say the least. In comparison, a 2012 live stream of skydiver Felix Baumgartner jumping from near-space to the Earth’s surface, remains the most concurrently viewed video on YouTube. It amassed about 8 million concurrent viewers. The live viewership of the royal wedding between Prince Harry and Meghan Markle was also a blip in comparison.

As Netflix and Amazon scramble to find the right content strategy to lure Indians, Hotstar and its local parent firm Star India have aggressively focused on securing broadcast and streaming rights to various cricket series. Cricket is almost followed like a religion in India.

In 2017, Star India, then owned by 21st Century Fox, secured the rights to broadcast and stream the IPL cricket tournament for five years for a sum of roughly $2.5 billion. Facebook had also participated in the bidding, offering north of $600 million for streaming. (Star India was part of 21st Century Fox’s business that Disney acquired for $71.3 billion earlier this year.)

That bet has largely paid off. Hotstar said last month that its service has amassed 300 million monthly active users, up from 150 million it had reported last year. In comparison, both Netflix and Amazon Prime Video have less than 30 million subscribers in India, according to industry estimates.

In the last two years, Hotstar has expanded to three international markets — the U.S., Canada, and most recently, the UK — to chase new audiences. The streaming service is hoping to attract Indians living overseas and anyone else who is interested in Bollywood movies and cricket, Ipsita Dasgupta, president of Hotstar’s international operations, told TechCrunch in an interview.

The streaming service plans to enter Sri Lanka, Pakistan, Nepal, Middle East, Australia, and New Zealand in the next few quarters, Dasgupta said.

That’s not to say that Hotstar has a clear path ahead. According to several estimates, the streaming service typically sees a sharp decline in its user base after the conclusion of an IPL season. Despite the massive engagement it generates, it remains operationally unprofitable, people familiar with Hotstar’s finances said.

The ad-supported streaming service offers about 80 percent of its content catalog — which includes titles produced by Star India, and shows and movies syndicated from international partners HBO, ABC, and Showtime among others — for no cost to users. One of the most watched international shows on the platform, “Game of Thrones,” will be ending soon, too.

The upcoming World Cup cricket tournament, which Hotstar will stream in India, should help it avoid the major headache for sometime. In the meantime, the service is aggressively expanding its slate of original shows in the nation. One of the shows is a remake of BBC/NBC’s popular “The Office.”

Powered by WPeMatico

Truecaller, an app that helps users screen strangers and robocallers, will soon allow users in India, its largest market, to borrow up to a few hundred dollars.

The crediting option will be the fourth feature the nine-year-old app adds to its service in the last two years. So far it has added to the service the ability to text, record phone calls and mobile payment features, some of which are only available to users in India. Of the 140 million daily active users of Truecaller, 100 million live in India.

The story of the ever-growing ambition of Truecaller illustrates an interesting phase in India’s internet market that is seeing a number of companies mold their single-functioning app into multi-functioning so-called super apps.

This may sound familiar. Truecaller and others are trying to replicate Tencent’s playbook. The Chinese tech giant’s WeChat, an app that began life as a messaging service, has become a one-stop solution for a range of features — gaming, payments, social commerce and publishing platform — in recent years.

WeChat has become such a dominant player in the Chinese internet ecosystem that it is effectively serving as an operating system and getting away with it. The service maintains its own “app store” that hosts mini apps. This has put it at odds with Apple, though the iPhone-maker has little choice but to make peace with it.

For all its dominance in China, WeChat has struggled to gain traction in India and elsewhere. But its model today is prominently on display in other markets. Grab and Go-Jek in Southeast Asian markets are best known for their ride-hailing services, but have begun to offer a range of other features, including food delivery, entertainment, digital payments, financial services and healthcare.

The proliferation of low-cost smartphones and mobile data in India, thanks in part to Google and Facebook, has helped tens of millions of Indians come online in recent years, with mobile the dominant platform. The number of internet users has already exceeded 500 million in India, up from some 350 million in mid-2015. According to some estimates, India may have north of 625 million users by year-end.

This has fueled the global image of India, which is both the fastest growing internet and smartphone market. Naturally, local apps in India, and those from international firms that operate here, are beginning to replicate WeChat’s model.

Founder and chief executive officer (CEO) of Paytm Vijay Shekhar Sharma speaks during the launch of Paytm payments Bank at a function in New Delhi on November 28, 2017 (AFP PHOTO / SAJJAD HUSSAIN)

Leading that pack is Paytm, the popular homegrown mobile wallet service that’s valued at $18 billion and has been heavily backed by Alibaba, the e-commerce giant that rivals Tencent and crucially missed the mobile messaging wave in China.

In recent years, the Paytm app has taken a leaf from China with additions that include the ability to text merchants; book movie, flight and train tickets; and buy shoes, books and just about anything from its e-commerce arm Paytm Mall . It also has added a number of mini games to the app. The company said earlier this month that more than 30 million users are engaging with its games.

Why bother with diversifying your app’s offering? Well, for Vijay Shekhar Sharma, founder and CEO of Paytm, the question is why shouldn’t you? If your app serves a certain number of transactions (or engagements) in a day, you have a good shot at disrupting many businesses that generate fewer transactions, he told TechCrunch in an interview.

At the end of the day, companies want to garner as much attention of a user as they can, said Jayanth Kolla, founder and partner of research and advisory firm Convergence Catalyst.

“This is similar to how cable networks such as Fox and Star have built various channels with a wide range of programming to create enough hooks for users to stick around,” Kolla said.

“The agenda for these apps is to hold people’s attention and monopolize a user’s activities on their mobile devices,” he added, explaining that higher engagement in an app translates to higher revenue from advertising.

Paytm’s Sharma agrees. “Payment is the moat. You can offer a range of things including content, entertainment, lifestyle, commerce and financial services around it,” he told TechCrunch. “Now that’s a business model… payment itself can’t make you money.”

Other businesses have taken note. Flipkart -owned payment app PhonePe, which claims to have 150 million active users, today hosts a number of mini apps. Some of those include services for ride-hailing service Ola, hotel booking service Oyo and travel booking service MakeMyTrip.

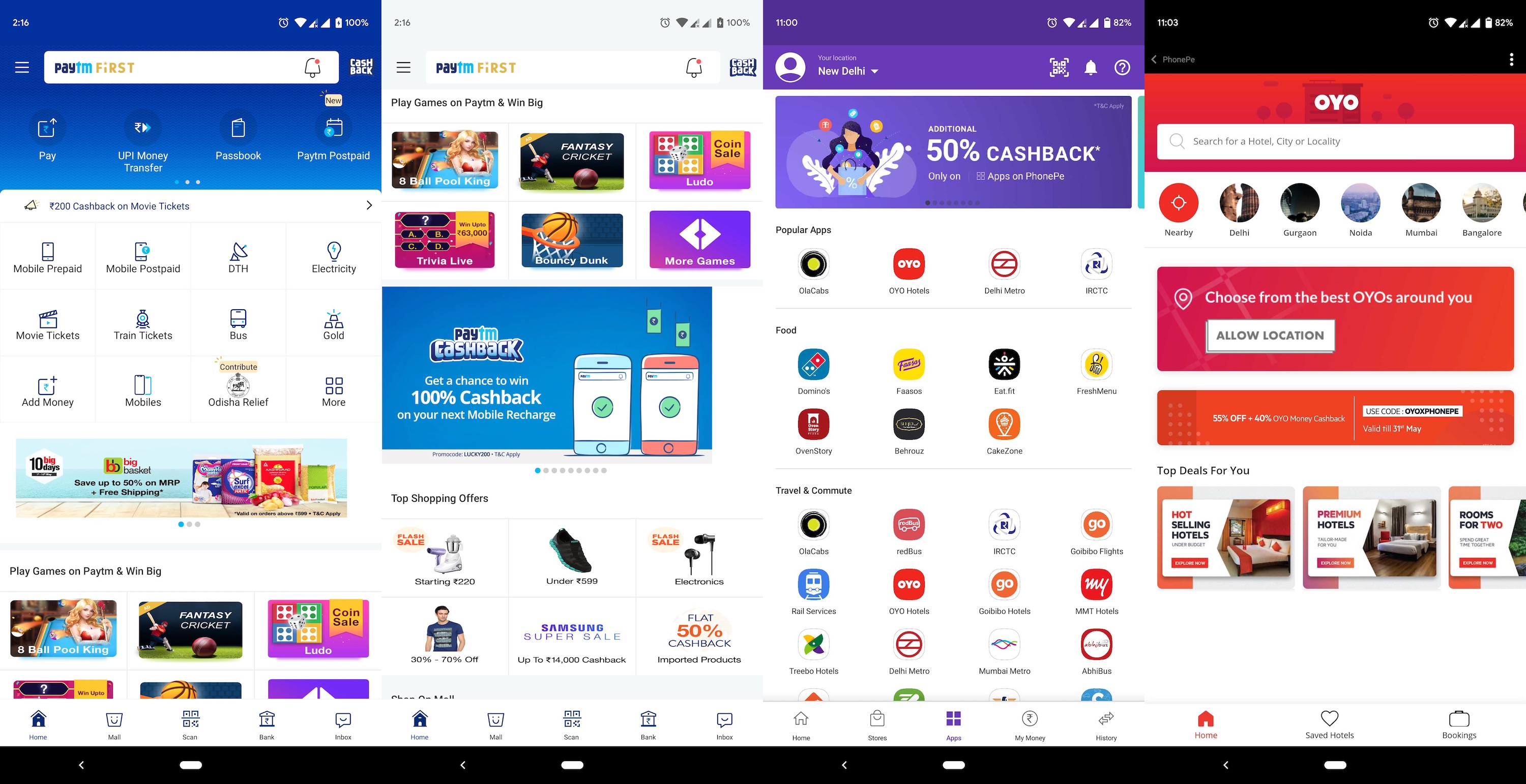

Paytm (the first two images from left) and PhonePe offer a range of services that are integrated into their payments apps

What works for PhonePe is that its core business — payments — has amassed enough users, Himanshu Gupta, former associate director of marketing and growth for WeChat in India, told TechCrunch. He added that unlike e-commerce giant Snapdeal, which attempted to offer similar offerings back in the day, PhonePe has tighter integration with other services, and is built using modern architecture that gives users almost native app experiences inside mini apps.

When you talk about strategy for Flipkart, the homegrown e-commerce giant acquired by Walmart last year for a cool $16 billion, chances are arch rival Amazon is also hatching similar plans, and that’s indeed the case for super apps.

In India, Amazon offers its customers a range of payment features such as the ability to pay phone bills and cable subscription through its Amazon Pay service. The company last year acquired Indian startup Tapzo, an app that offers integration with popular services such as Uber, Ola, Swiggy and Zomato, to boost Pay’s business in the nation.

Another U.S. giant, Microsoft, is also aboard the super train. The Redmond-based company has added a slew of new features to SMS Organizer, an app born out of its Microsoft Garage initiative in India. What began as a texting app that can screen spam messages and help users keep track of important SMSs recently partnered with education board CBSE in India to deliver exam results of 10th and 12th grade students.

This year, the SMS Organizer app added an option to track live train schedules through a partnership with Indian Railways, and there’s support for speech-to-text. It also offers personalized discount coupons from a range of companies, giving users an incentive to check the app more often.

Like in other markets, Google and Facebook hold a dominant position in India. More than 95% of smartphones sold in India run the Android operating system. There is no viable local — or otherwise — alternative to Search, Gmail and YouTube, which counts India as its fastest growing market. But Google hasn’t necessarily made any push to significantly expand the scope of any of its offerings in India.

India is the biggest market for WhatsApp, and Facebook’s marquee app too has more than 250 million users in the nation. WhatsApp launched a pilot payments program in India in early 2018, but is yet to get clearance from the government for a nationwide rollout. (It isn’t happening for at least another two months, a person familiar with the matter said.) In the meanwhile, Facebook appears to be hatching a WeChatization of Messenger, albeit that app is not so big in India.

Ride-hailing service Ola too, like Grab and Go-Jek, plans to add financial services such as credit to the platform this year, a source familiar with the company’s plans told TechCrunch.

“We have an abundance of data about our users. We know how much money they spend on rides, how often they frequent the city and how often they order from restaurants. It makes perfect sense to give them these valued-added features,” the person said. Ola has already branched out of transport after it acquired food delivery startup Foodpanda in late 2017, but it hasn’t yet made major waves in financial services despite giving its Ola Money service its own dedicated app.

The company positioned Ola Money as a super app, expanded its features through acquisition and tie ups with other players and offered discounts and cashbacks. But it remains behind Paytm, PhonePe and Google Pay, all of which are also offering discounts to customers.

Super apps indeed come in all shapes and sizes, beyond core services like payment and transportation — the strategy is showing up in apps and services that entertain India’s internet population.

MX Player, a video playback app with more than 175 million users in India that was acquired by Times Internet for some $140 million last year, has big ambitions. Last year, it introduced a video streaming service to bolster its app to grow beyond merely being a repository. It has already commissioned the production of several original shows.

In recent months, it has also integrated Gaana, the largest local music streaming app that is also owned by Times Internet. Now its parent company, which rivals Google and Facebook on some fronts, is planning to add mini games to MX Player, a person familiar with the matter said, to give it additional reach and appeal.

Some of these apps, especially those that have amassed tens of millions of users, have a real shot at diversifying their offerings, analyst Kolla said. There is a bar of entry, though. A huge user base that engages with a product on a daily basis is a must for any company if it is to explore chasing the super app status, he added.

Indeed, there are examples of companies that had the vision to see the benefits of super apps but simply couldn’t muster the requisite user base. As mentioned, Snapdeal tried and failed at expanding its app’s offerings. Messaging service Hike, which was valued at more than $1 billion two years ago and includes WeChat parent Tencent among its investors, added games and other features to its app, but ultimately saw poor engagement. Its new strategy is the reverse: to break its app into multiple pieces.

“In 2019, we continue to double down on both social and content but we’re going to do it with an evolved approach. We’re going to do it across multiple apps. That means, in 2019 we’re going to go from building a super app that encompasses everything, to Multiple Apps solving one thing really well. Yes, we’re unbundling Hike,” Kavin Mittal, founder and CEO of Hike, wrote in an update published earlier this year.

It remains unclear how users are responding to the new features on their favorite apps. Some signs suggest, however, that at least some users are embracing the additional features. Truecaller said it is seeing tens of thousands of users try the payment feature for the first time each day. It’s also being used to send 3 billion texts a month.

Regardless, the race is still on, and there are big horses waiting to enter to add further competition.

Reliance Jio, a subsidiary of conglomerate Reliance Industry that is owned by India’s richest man, Mukesh Ambani, is planning to introduce a super app that will host more than 100 features, according to a person familiar with the matter. Local media first reported the development.

It will be fascinating to see how that works out. Reliance Jio, which almost single-handedly disrupted the telecom industry in India with its low-cost data plans and free voice calls, has amassed tens of millions of users on the bouquet of apps that it offers at no additional cost to Jio subscribers.

Beyond that diverse selection of homespun apps, Reliance has also taken an M&A-based approach to assemble the pieces of its super app strategy.

It bought music streaming service Saavn last year and quickly integrated it with its own music app JioMusic. Last month, it acquired Haptik, a startup that develops “conversational” platforms and virtual assistants, in a deal worth more than $100 million. It already has the user bases required. JioTV, an app that offers access to over 500 TV channels; and JioNews, an app that additionally offers hundreds of magazines and newspapers, routinely appear among the top apps in Google Play Store.

India’s super app revolution is in its early days, but the trend is surely one to keep an eye on as the country moves into its next chapter of internet usage.

Powered by WPeMatico

Cloud kitchens are the big thing in food delivery, with ex-Uber CEO Travis Kalanick’s new business one contender in that space, with Asia, and particularly Southeast Asia, a major focus. Despite the newcomers, a more established startup from Singapore has raised a large bowl of cash to go after regional expansion.

Founded in 2014, Grain specializes in clean food while it takes a different approach to Kalanick’s CloudKitchens or food delivery services like Deliveroo, FoodPanda or GrabFood.

It adopted a cloud kitchen model — utilizing unwanted real estate as kitchens, with delivery services for output — but used it for its own operations. So while CloudKitchens and others rent their space to F&B companies as a cheaper way to make food for their on-demand delivery customers, Grain works with its own chefs, menu and delivery team. A so-called “full stack” model, if you can stand the cliched tech phrase.

Finally, Grain is also profitable. The new round has it shooting for growth — more on that below — but the startup was profitable last year, CEO and co-founder Yi Sung Yong told TechCrunch.

Now it is reaping the rewards of a model that keeps it in control of its product, unlike others that are complicated by a chain that includes the restaurant and a delivery person.

We previously wrote about Grain when it raised a $1.7 million Series A back in 2016, and today it announced a $10 million Series B, which is led by Thailand’s Singha Ventures, the VC arm of the beer brand. A bevy of other investors took part, including Genesis Alternative Ventures, Sass Corp, K2 Global — run by serial investor Ozi Amanat who has backed Impossible Foods, Spotify and Uber among others — FoodXervices and Majuven. Existing investors Openspace Ventures, Raging Bull — from Thai Express founder Ivan Lee — and Cento Ventures participated.

The round includes venture debt, as well as equity, and it is worth noting that the family office of the owners of The Coffee Bean & Tea Leaf — Sassoon Investment Corporation — was involved.

Grain covers individual food as well as buffets in Singapore

Three years is a long gap between the two deals — Openspace and Cento have even rebranded during the intervening period — and the ride has been an eventful one. During those years, Sung said the business had come close to running out of capital before it doubled down on the fundamentals before the precarious runway capital ran out.

In fact, he said, the company — which now has more than 100 staff — was fully prepared to self-sustain.

“We didn’t think of raising a Series B,” he explained in an interview. “Instead, we focused on the business and getting profitable… we thought that we can’t depend entirely on investors.”

And, ladies and gentleman, the irony of that is that VCs very much like a business that can self-sustain — it shows a model is proven — and investing in a startup that doesn’t need capital can be attractive.

Ultimately, though, profitability is seen as sexy today — particularly in the meal space, where countless U.S. startups have shuttered, including Munchery and Sprig — but the focus meant that Grain had to shelve its expansion plans. It then went through soul-searching times in 2017 when a spoilt curry saw 20 customers get food poisoning.

Sung declined to comment directly on that incident, but he said that company today has developed the “infrastructure” to scale its business across the board, and that very much includes quality control.

Grain co-founder and CEO Yi Sung Yong [Image via LinkedIn]

Grain currently delivers “thousands” of meals per day in Singapore, its sole market, with eight-figures in sales per year, he said. Last year, growth was 200 percent, Sung continued, and now is the time to look overseas. With Singha, the Grain CEO said the company has “everything we need to launch in Bangkok.”

Thailand — which Malaysia-based rival Dahamakan picked for its first expansion — is the only new launch on the table, but Sung said that could change.

“If things move faster, we’ll expand to more cities, maybe one per year,” he said. “But we need to get our brand, our food and our service right first.”

One part of that may be securing better deals for raw ingredients and food from suppliers. Grain is expanding its “hub” kitchens — outposts placed strategically around town to serve customers faster — and growing its fleet of trucks, which are retrofitted with warmers and chillers for deliveries to customers.

Grain’s journey is proof that startups in the region will go through trials and tribulations, but being able to bolt down the fundamentals and reduce burn rate is crucial in the event that things go awry. Just look to grocery startup Honestbee, also based in Singapore, for evidence of what happens when costs are allowed to pile up.

Powered by WPeMatico

In a move clearly driven by economic interests and an urgency to meet stringent regulations, the world’s largest games publisher Tencent pulled its mobile version of PlayerUnknown’s Battlegrounds on Wednesday and launched a new title called Game for Peace (the literal translation of its Chinese name 和平精英 is ‘peace elites’) on the same day.

As of this writing, Game for Peace is the most downloaded free game and top-grossing game in Apple’s China App Store, according to data from Sensor Tower data. That’s early evidence that the new title is on course to stimulate Tencent’s softening gaming revenues following a prolonged licensing freeze in China. Indeed, analysts at China Renaissance estimated that Game for Peace could generate up to $1.48 billion in annual revenue for Tencent.

Tencent licensed PUBG from South Korea’s Krafton, previously known as Bluehole, in 2017 and subsequently released a test version of the game for China’s mobile users.

Game for Peace is available only to users above the age of 16, a decision that came amid society’s growing concerns over video games’ impact on children’s mental and physical health. Tencent has recently pledged to do more ‘good’ with its technology, and the new game release appears to be a practice of that.

Tencent told Reuters the two titles are from “very different genres.” Well, many signs attest to the fact that Game for Peace is intended as a substitute for PUBG Mobile, which never received the green light from Beijing to monetize because it’s deemed too gory. Game for Peace received the license to sell in-game items on April 9.

For one, PUBG users were directed to download Game for Peace in a notice announcing its closure. People’s gaming history and achievement were transferred to the new game, and players and industry analysts have pointed out the striking resemblance between the two.

“It’s basically the same game with some tweaks,” said a Guangzhou-based PUBG player who has been playing the title since its launching, adding that the adjustment to tone down violence “doesn’t really harm the gamer experience.”

“Just ignore those details,” suggested the user.

For instance, characters who are shot don’t bleed in Game for Peace. A muzzle flash replaces gore as bloody scenes no longer pass the muster. And when people are dying, they kneel, surrender their loot box, and wave goodbye. Very civil. Very friendly.

“It’s what we call changing skin [for a game],” a Shenzhen-based mobile game studio founder said to TechCrunch. “The gameplay stays largely intact.”

Other PUBG users are less sanguine about the transition. “I don’t think this is the correct decision from the regulators. Getting oversensitive in the approval process will prevent Chinese games from growing big and strong,” wrote one contributor with more than 135 thousand followers on Zhihu, the Chinese equivalent of Quora.

But such compromise is increasingly inevitable as Chinese authorities reinforce rules around what people can consume online, not just in games but also through news readers, video platforms, and even music streaming services. Content creators must be able to decipher regulators’ directives, some of which are straightforward as “the name of the game should not contain words other than simplified Chinese.” Others requirements are more obscure, like “no violation of core socialist’s values,” a set of 12 moral principles — including prosperity, democracy, civility, and harmony — that are propagated by the Chinese Communist Party in recent years.

Powered by WPeMatico

One of China’s most ambitious artificial intelligence startups, Megvii, more commonly known for its facial recognition brand Face++, announced Wednesday that it has raised $750 million in a Series E funding round.

Founded by three graduates from the prestigious Tsinghua University in China, the eight-year-old company specializes in applying its computer vision solutions to a range of use cases such as public security and mobile payment. It competes with its fast-growing Chinese peers, including the world’s most valuable AI startup, SenseTime — also funded by Alibaba — and Sequoia-backed Yitu.

Bloomberg reported in January that Megvii was mulling to raise up to $1 billion through an initial public offering in Hong Kong. The new capital injection lifts the company’s valuation to just north of $4 billion as it gears up for its IPO later this year, sources told Reuters.

China is on track to overtake the United States in AI on various fronts. Buoyed by a handful of mega-rounds, Chinese AI startups accounted for 48 percent of all AI fundings in 2017, surpassing those in the U.S. for the first time, shows data collected by CB Insights. An analysis released in March by the Allen Institute for Artificial Intelligence found that China is rapidly closing in on the U.S. by the amount of AI research papers published and the influence thereof.

A critical caveat to China’s flourishing AI landscape is, as The New York Times and other publications have pointed out, the government’s use of the technology. While facial recognition has helped the police trace missing children and capture suspects, there have been concerns around its use as a surveillance tool.

Megvii’s new funding round arrives just days after a Human Rights Watch report listed it as a technology provider to the Integrated Joint Operations Platform, a police app allegedly used to collect detailed data from a largely Muslim minority group in China’s far west province of Xinjiang. Megvii denied any links to the IJOP database per a Bloomberg report.

Kai-Fu Lee, a world-renowned AI expert and investor who was Google’s former China head, warned that any country in the world has the capacity to abuse AI, adding that China also uses the technology to transform retail, education and urban traffic among other sectors.

Megvii has attracted a rank of big-name investors in and outside China to date. Participants in its Series E include Bank of China Group Investment Limited, the central bank’s wholly owned subsidiary focused on investments, and ICBC Asset Management (Global), the offshore investment subsidiary of the Industrial and Commercial Bank of China.

Foreign backers in the round include a wholly owned subsidiary of the Abu Dhabi Investment Authority, one of the world’s largest sovereign wealth funds, and Australian investment bank Macquarie Group.

Megvii says its fresh proceeds will go toward the commercialization of its AI services, recruitment and global expansion.

China has been exporting its advanced AI technologies to countries around the world. Megvii, according to a report by the South China Morning Post from last June, was in talks to bring its software to Thailand and Malaysia. Last year, Yitu opened its first overseas office in Singapore to deploy its intelligence solutions to partners in Southeast Asia. In a similar fashion, SenseTime landed in Japan by opening an autonomous driving test park this January.

“Megvii is a global AI technology leader and innovator with cutting-edge technologies, a scalable business model and a proven track record of monetization,” read a statement from Andrew Downe, Asia regional head of commodities and global markets at Macquarie Group. “We believe the commercialization of artificial intelligence is a long-term focus and is of great importance.”

Powered by WPeMatico

China’s new rules on video games, introduced last month, are having an effect on the country’s gamers. Today, Tencent replaced hugely popular battle royale shooter game PUBG with a more government-friendly alternative that seems primed to pull in significant revenue.

The company introduced “Game for Peace” in a Weibo post at the same time as PUBG — which stands for Player Unknown Battlegrounds — was delisted from China. The title had been in wide testing but without revenue, and now it seems Tencent gave up on securing a license to monetize the title.

In its place, Game for Peace is very much the type of game that will pass the demands of China’s game censorship body. Last month, the country’s State Administration of Press and Publication released a series of demands for new titles, including bans on corpses and blood, references of imperial history and gambling. The new Tencent title bears a striking resemblance to PUBG, but there are no dead bodies, while it plays up to a nationalist theme with a focus on China’s air force — or, per the Weibo message, “the blue sky warriors that guard our country’s airspace” — and their battle against terrorists.

Game for Peace was developed by Krafton, the Korea-based publisher formerly known as BlueHole which made PUBG. Beyond visual similarities, Reuters reported that the games are twinned since some player found that their progress and achievements on PUBG had transferred over to the new game.

Tencent representatives declined to comment on the new game or the end of PUBG’s “beta testing” period in China when contacted by TechCrunch. But a company rep apparently told Reuters that “they are very different genres of games.”

Tencent’s new “Game for Peace” title is almost exactly the same as its popular PUBG game, which it is replacing [Image via Weibo]

Fortnite may have grabbed the attention for its explosive growth — we previously reported that the game helped publisher Epic Games bank a profit of $3 billion last year — but PUBG has more quietly become a fixture among mobile gamers, particularly in Asia.

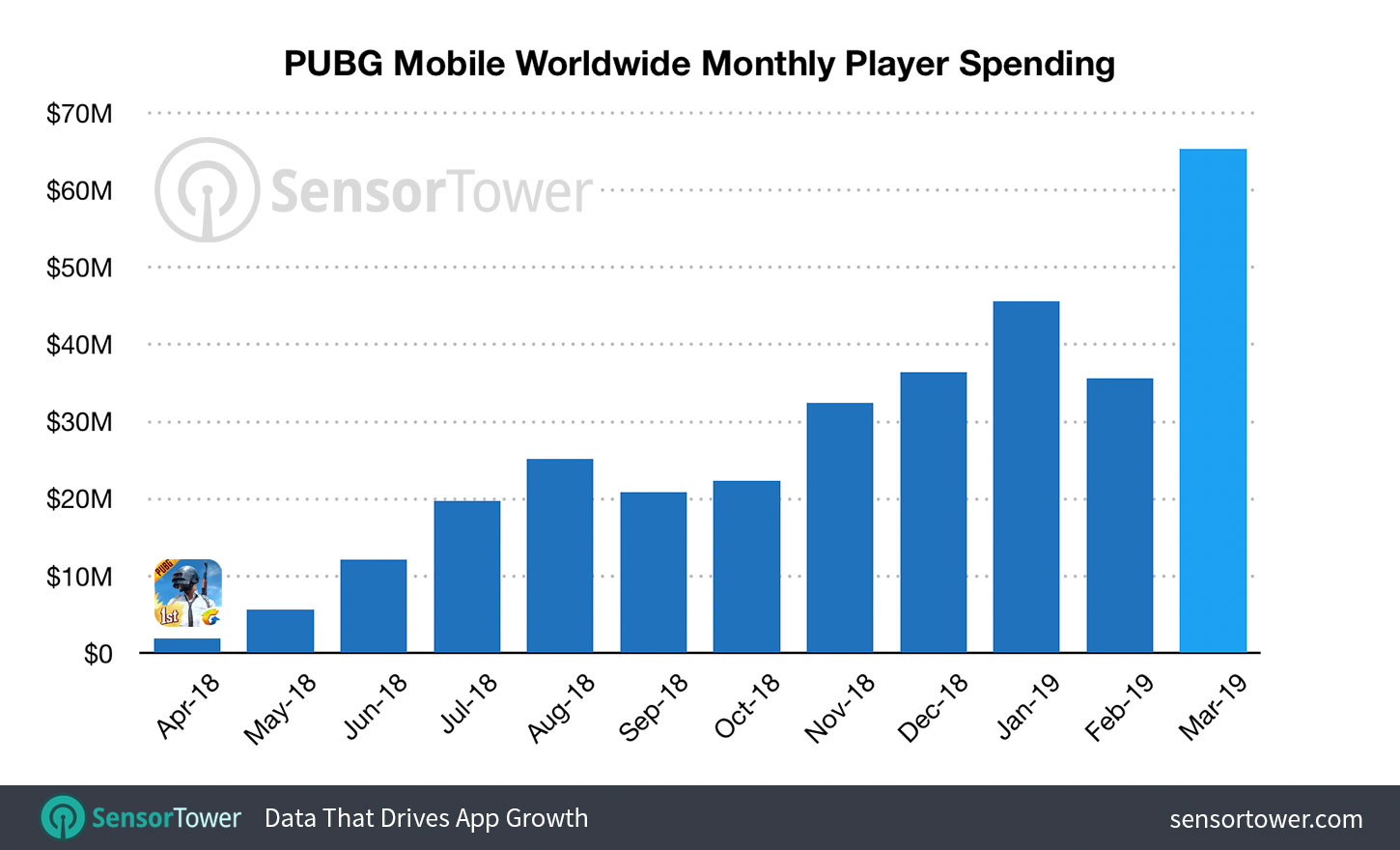

At the end of last year, Krafton told The Verge that it was past 200 million registered gamers, with 30 million players each day. According to app analytics company Sensor Tower, PUBG grossed more than $65 million from mobile players in March thanks to 83 percent growth, which saw it even beat Fortnite. There is also a desktop version.

PUBG made more money than Fortnite on mobile in March 2019, according to data from Sensor Tower

That is really the point of Tencent’s switcheroo: to make money.

The company suffered at the hands of China’s gaming license freeze last year, and a regulatory-compliant title like Game for Peace has a good shot at getting the green light for monetization — through the sale of virtual items and seasonal memberships.

Indeed, analysts at China Renaissance believe the new title could rake in as much as $1.5 billion in annual revenue, according to the Reuters report. That’s a lot to get excited about and resuscitating gaming will be an important part of Tencent’s strategy this year — which has already seen it restructure its business to focus emerging units like cloud computing, and pledge to use its technology to “do good.”

Powered by WPeMatico

Indian edtech startup CollegeDekho, which helps students connect with prospective colleges and keep track of exams, has raised $8 million in a Series B round.

The new financing round for the four-year-old Gurgaon-based startup was led by its parent company GirnarSoft Education and London-based private equity investor Man Capital, which also participated in the startup’s Series A round last year.

Ruchir Arora, founder and CEO of CollegeDekho, told TechCrunch in an interview that the startup will use the capital to expand its presence in more schools and also begin connecting students with international educational institutions. The startup, which has raised $13 million to date, will also ramp up its research and development efforts.

CollegeDekho, Hindi for search for college, maintains a website that helps students identify the right career choices for them. The website has a chatbot that answers some of the questions students have while logging their responses, and other activities such as the kind of colleges they are searching for, their preferred location and budget.

Arora said the startup, which also has about 3,000 call center representatives and counselors, builds profiles of students to make college recommendations. He said each month the site observes more than five million sessions from students. Last year, more than 8,000 students used CollegeDekho to take admission in a college.

Parents in India, a country of 1.3 billion people with not the best literacy record, see education as an upward mobility for their children. Each year, more than six to seven million students go to a college. But because of a range of factors that can include cultural stigma, many students end up choosing the wrong path and thus don’t excel in college. Indeed, many students ultimately don’t pursue the subject they are best suited for, Arora said, and that’s where CollegeDekho aims to make an impact.

Most high school students in India often gravitate toward engineering or medical college, as a result of which, each year India produces many engineers and doctors who struggle for years to find a job. Arora said his startup looks at more than 2,000 career paths a student could pursue.

What works in favor of Arora is that the country will continue to turn out millions of students each year who will be looking to go to a college soon. It also helps that CollegeDekho is operationally profitable, Arora said, adding that it generates about $3.2 million in revenue in a year. Any additional cash the startup raises will go into its expansion, he said.

CollegeDekho charges a nominal fee from students, and also takes a cut when they join a college. More than 36,000 educational institutes are listed on CollegeDekho. The startup also works with more than 400 colleges to conduct an exam for direct admission, and there too it earns a cut.

India’s education market, estimated to grow to $5.7 billion by next year, has emerged as a lucrative opportunity for startups and VCs alike. Bangalore-based Byju’s, which helps millions of students in India prepare for competitive exams, raised $540 million from Naspers and others late last year. Unacademy, which like Byju’s offers online tutoring to students, has raised more than $38.5 million to date.

A legion of other education startups today are vying for the attention of students in the nation. Noida-based AskIITians, not too far from the offices of CollegeDekho, aims to help school-going students prepare for medical and engineering exams. Extramarks, also based in Noida, operates in the same space as AskIITians. Reliance Industries, owned and controlled by India’s richest man, Mukesh Ambani, bought a 38.5% stake in the startup three years ago.

Powered by WPeMatico

India has a new unicorn after BigBasket, a startup that delivers groceries and perishables across the country, raised $150 million for its fight against rivals Walmart’s Flipkart, Amazon and hyperlocal startups Swiggy and Dunzo.

The new financing round — a Series F — was led by Mirae Asset-Naver Asia Growth Fund, the U.K.’s CDC Group and Alibaba, BigBasket said on Monday. The closing of the round has officially helped the seven-year-old startup surpass $1 billion valuation, co-founder Vipul Parekh, who heads marketing and finances for the company, told TechCrunch in an interview. Chinese giant Alibaba, which also led the Series E round in BigBasket last year, is the largest investor in the company, with about 30% stake, a person familiar with the matter said.

The company, which offers more than 20,000 products from 1,000 brands in more than two dozen cities, will deploy the fresh capital into expanding its supply-chain network, adding more cold storage centers and distribution centers to serve customers faster, Parekh said. The company also plans to add about 3,000 vending machines that offer daily eatable items, such as vegetables, snacks and cold drinks in residential apartments and offices by next month, he added.

Infusion of $150 million for BigBasket, which raised $300 million last year, comes at a time when both Walmart’s Flipkart and Amazon are increasingly expanding their grocery businesses in India.

Amazon Retail India, which operates Amazon Pantry and Prime Now services and has a presence in mire than 100 cities, is reportedly planning to expand its business in India. Flipkart Group CEO Kalyan Krishnamurthy said in an interview with the Economic Times last month that the e-commerce giant may pilot a fresh foods business soon. Last week, Flipkart was said to be in talks to acquire grocery chain Namdhari’s Fresh.

Parekh largely brushed off the challenge his company faces from Flipkart and Amazon at this stage, saying that “it is a very large market, and it is unlikely to be dominated by one single company for the simple reason of its complex nature.” Flipkart and Amazon may eventually get serious about this space, but so far their play with groceries is mostly an additional differentiation checkpoint, he said.

“The success in this business requires having the ability to build and manage a very complex supply chain across multiple categories such as vegetables, meat and beauty products among others. Our focus has been on building the supply chain, and also ensuring that we are able to deliver a very large assortment of products to consumers,” he added. He said BigBasket today offers the largest catalog and fastest delivery among any of its rivals.

Besides, BigBasket, which is increasingly growing its subscription business to supply milk and other daily eatables, is also inching closer to becoming financially stronger. Parekh said BigBasket expects to become operationally profitable in six to eight months. “The idea is that business by itself does not consume cash. If we use cash, it will be for investment in new businesses or scaling of existing businesses,” he said.

India’s retail market, valued at mire than $900 billion, is increasingly attracting the attention of VC funds. Since 2014, online retailers alone have participated in more than 163 financing rounds, clocking over $1.38 billion, analytics firm Tracxn told TechCrunch. More than 882 players are operational in the market, the firm said.

The challenge for BigBasket remains fighting a growing army of rivals, including hyperlocal delivery startups including Grofers, which raised $60 million earlier this year, unicorn Swiggy and Google-backed Dunzo, which is increasingly becoming a verb in urban Indian cities.

Powered by WPeMatico

WorldCover, a New York and Africa-based climate insurance provider to smallholder farmers, has raised a $6 million Series A round led by MS&AD Ventures.

Y Combinator, Western Technology Investment and EchoVC also participated in the round.

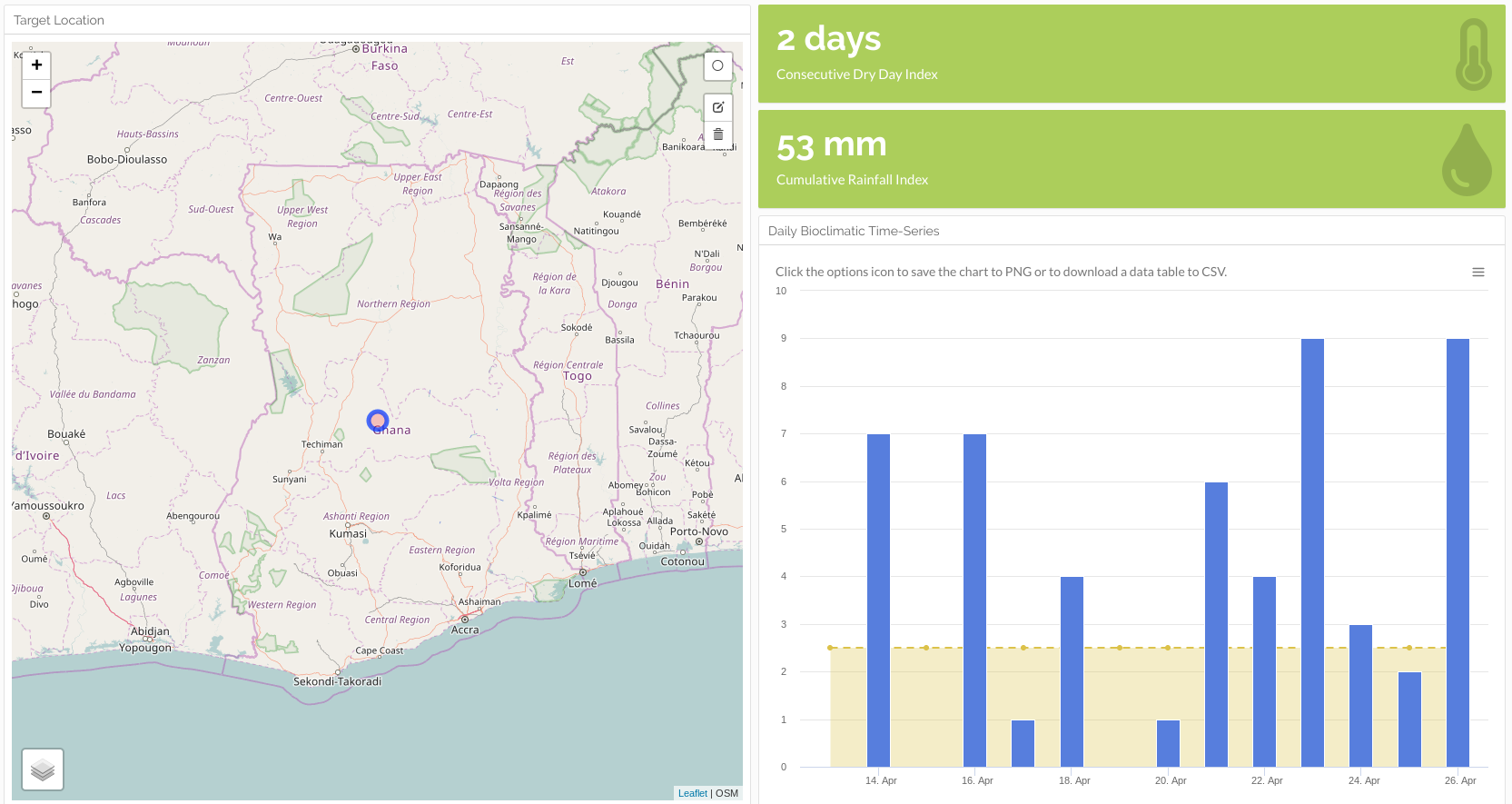

WorldCover’s platform uses satellite imagery, on-ground sensors, mobile phones and data analytics to create insurance options for farmers whose crop yields are affected adversely by weather events — primarily lack of rain.

The startup currently operates in Ghana, Uganda and Kenya . With the new funding, WorldCover aims to expand its insurance offerings to more emerging market countries.

“We’re looking at India, Mexico, Brazil, Indonesia. India could be first on an 18-month timeline for a launch,” WorldCover co-founder and chief executive Chris Sheehan said in an interview.

The company has served more than 30,000 farmers across its Africa operations. Smallholder farmers are those earning all or nearly all of their income from agriculture, farming on 10-20 acres of land and earning around $500 to $5,000, according to Sheehan.

Farmers connect to WorldCover by creating an account on its USSD mobile app. From there they can input their region and crop type and determine how much insurance they would like to buy and use mobile money to purchase a plan. WorldCover works with payments providers such as M-Pesa in Kenya and MTN Mobile Money in Ghana.

The service works on a sliding scale, where a customer can receive anywhere from 5x to 15x the amount of premium they have paid. If there is an adverse weather event, namely lack of rain, the farmer can file a claim via mobile phone. WorldCover then uses its data-analytics metrics to assess it, and, if approved, the farmer will receive an insurance payment via mobile money.

Common crops farmed by WorldCover clients include maize, rice and peanuts. It looks to add coffee, cocoa and cashews to its coverage list.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

For the moment, WorldCover only insures for events such as rainfall risk, but in the future it will look to include other weather events, such as tropical storms, in its insurance programs and platform data analytics.

The startup’s founder clarified that WorldCover’s model does not assess or provide insurance payouts specifically for climate change, though it does directly connect to the company’s business.

“We insure for adverse weather events that we believe climate change factors are exacerbating,” Sheehan explained. WorldCover also resells the risk of its policyholders to global reinsurers, such as Swiss Re and Nephila.

On the potential market size for WorldCover’s business, he highlights a 2018 Lloyd’s study that identified $163 billion of assets at risk, including agriculture, in emerging markets from negative, climate change-related events.

“That’s what WorldCover wants to go after…These are the kind of micro-systemic risks we think we can model and then create a micro product for a smallholder farmer that they can understand and will give them protection,” he said.

With the round, the startup will look to possibilities to update its platform to offer farming advice to smallholder farmers, in addition to insurance coverage.

WorldCover investor and EchoVC founder Eghosa Omoigui believes the startup’s insurance offerings can actually help farmers improve yield. “Weather-risk drives a lot of decisions with these farmers on what to plant, when to plant, and how much to plant,” he said. “With the crop insurance option, the farmer says, ‘Instead of one hector, I can now plant two or three, because I’m covered.’ ”

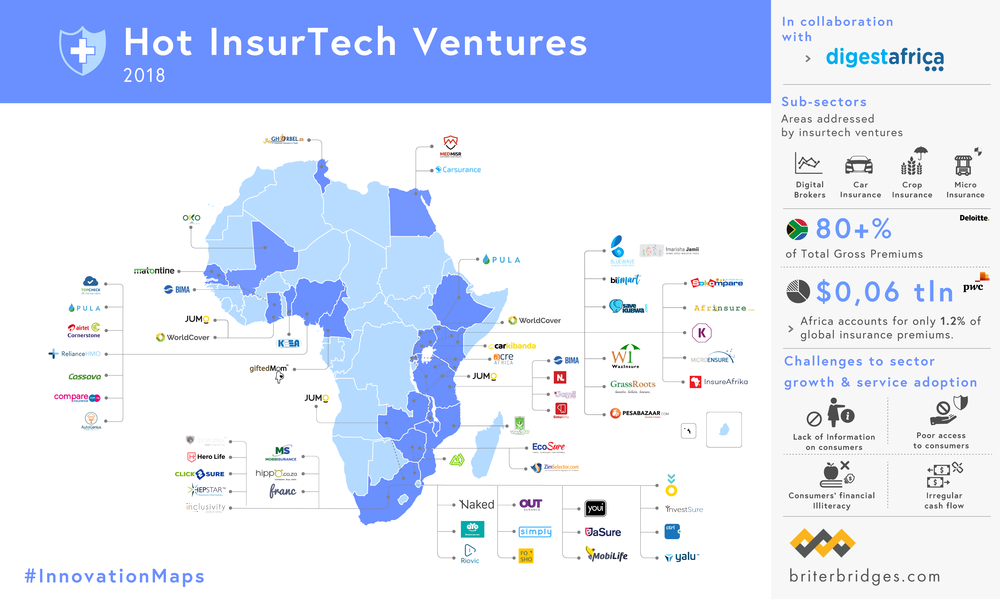

Insurance technology is another sector in Africa’s tech landscape filling up with venture-backed startups. Other insurance startups focusing on agriculture include Accion Venture Lab-backed Pula and South Africa based Mobbisurance.

With its new round and plans for global expansion, WorldCover joins a growing list of startups that have developed business models in Africa before raising rounds toward entering new markets abroad.

In 2018, Nigerian payment startup Paga announced plans to move into Asia and Latin America after raising $10 million. In 2019, South African tech-transit startup FlexClub partnered with Uber Mexico after a seed raise. And Lagos-based fintech startup TeamAPT announced in Q1 it was looking to expand globally after a $5 million Series A round.

Powered by WPeMatico