Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

LG was once a stalwart of the smartphone industry — remember its collaboration with Facebook back in the day? — but today the company is swiftly descending into irrelevance.

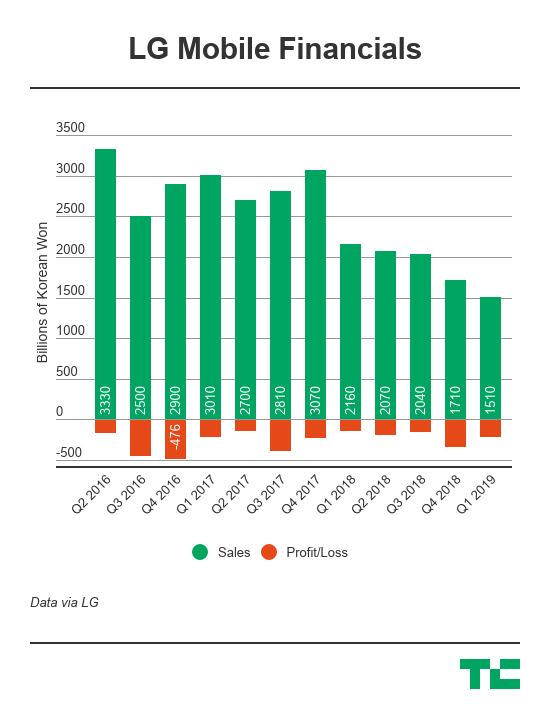

The latest proof is LG’s Q1 financials, released this week, which show that its mobile division grossed just KRW 1.51 trillion ($1.34 billion) in sales for the quarter. That’s down 30% year-on-year and the lowest income for LG Mobile for at least the last eight years. We searched back eight years to Q1 2011 — before that LG was hit and miss with releasing specific financial figures for its divisions.

To give an indication of its decline, LG shipped more than 15 million phones in Q4 2015 when its revenue was 3.78 trillion RKW, or $3.26 billion. That’s 2.5 times higher than this recent Q1 2019 period.

Regular readers will be aware that LG mobile is a loss-making division. That’s the reason its activities — and consequently sales — have scaled down in recent years. But the losses are still coming.

LG put Brian Kwon, who leads its lucrative Home Entertainment business, in charge of its mobile division last November and his task remains ongoing, it appears.

LG Mobile recorded a loss of 203.5 billion KRW ($181.05 million) for Q1 which it described as “narrowed.”

It is true that LG Mobile’s Q1 loss is lower than the 322.3 billion KRW ($289.8 million) loss it carded in the previous quarter, but it is wider than one year previous. Indeed, the mobile division lost 136.1 billion KRW ($126.85 million) in Q1 2018.

LG said Mr. Kwon is presiding over “a revised smartphone launch strategy,” which is why the numbers are changing so drastically. Going forward, it said that the launch of its G7 ThinQ flagship phone and a new upgrade center — first announced last year — are in the immediate pipeline, but it is hard to see how any of this will reverse the downward trend.

LG Mobile is increasingly problematic because the parent company is seeing success in other areas, but that’s being countered by a poor-performing smartphone business. Last quarter, mobile dragged LG to its first quarterly loss in two years, for example.

Just looking at the Q1 numbers, LG’s overall profit was 900.6 billion KRW ($801.25 million) thanks to its home appliance business ($647.3 million profit) and that home entertainment business, which had a profit of $308.27 million. Its automotive business — which is, among other things, focused on EVs — did bite into the profits, but that is at least a business that is going places.

Powered by WPeMatico

TechCrunch’s Connie Loizos published some interesting stats on seed and Series A financings this week, courtesy of data collected by Wing Venture Capital. In short, seed is the new Series A and Series A is the new Series B. Sure, we’ve been saying that for a while, but Wing has some clean data to back up those claims.

Years ago, a Series A round was roughly $5 million and a startup at that stage wasn’t expected to be generating revenue just yet, something typically expected upon raising a Series B. Now, those rounds have swelled to $15 million, according to deal data from the top 21 VC firms. And VCs are expecting the startups to be making money off their customers.

“Again, for the old gangsters of the industry, that’s a big shift from 2010, when just 15 percent of seed-stage companies that raised Series A rounds were already making some money,” Connie writes.

As for seed, in 2018, the average startup raised a total of $5.6 million prior to raising a Series A, up from $1.3 million in 2010.

Now on to IPO updates, then a closer look at all the companies raising big rounds. Want more TechCrunch newsletters? Sign up here. Contact me at kate.clark@techcrunch.com or @KateClarkTweets.

![]()

Slack: The workplace communication software provider dropped its S-1 on Friday ahead of a direct listing. That’s when companies sell existing shares directly to the market, allowing them to skip the roadshow and minimize the astronomical fees typically associated with an initial public offering. Here’s the TLDR on financials: Slack reported revenues of $400.6 million in the fiscal year ending January 31, 2019, on losses of $138.9 million. That’s compared to a loss of $140.1 million on revenue of $220.5 million for the year before. Slack’s losses are shrinking (slowly), while its revenues expand (quickly). It’s not profitable yet, but is that surprising?

Zoom was the Slack we thought Slack was all along.

— alex (PVD) (@alex) April 26, 2019

Uber: The ride-hail giant is fast approaching its IPO, expected as soon as next week. On Friday, the company established an IPO price range of $44 to $50 per share to raise between $7.9 billion and $9 billion at a valuation of approximately $84 billion, significantly lower than the $100 billion previously reported estimations. The most likely outcome is Uber will price above range and all the latest estimates will be way off course. Best to sit back and see how Uber plays it. Oh, and PayPal said it would make a $500 million investment in the company in a private placement, as part of an extension of the partnership between the two.

There are a lot of fascinating companies raising colossal rounds, so I thought I’d dive a bit deeper than I normally do. Bear with me.

Carbon: The poster child for 3D printing has authorized the sale of $300 million in Series E shares, according to a Delaware stock filing uncovered by PitchBook. If Carbon raises the full amount, it could reach a valuation of $2.5 billion. Using its proprietary Digital Light Synthesis technology, the business has brought 3D-printing technology to manufacturing, building high-tech sports equipment, a line of custom sneakers for Adidas and more. It was valued at $1.7 billion by venture capitalists with a $200 million Series D in 2018.

Canoo: The electric vehicle startup formerly known as Evelozcity is on the hunt for $200 million in new capital. Backed by a clutch of private individuals and family offices from China, Germany and Taiwan, the company is hoping to line up the new capital from some more recognizable names as it finalizes supply deals with vendors, according to reporting from TechCrunch’s Jonathan Shieber. The company intends to make its vehicles available through a subscription-based model and currently has 400 employees. Canoo was founded in 2017 after Stefan Krause, a former executive at BMW and Deutsche Bank, and another former BMW executive, Ulrich Kranz, exited Faraday Future amid that company’s struggles.

Starry: The Boston-based wireless broadband internet startup has authorized the sale of Series D shares worth up to $125 million, according to a Delaware stock filing. If Starry closes the full authorized raise it will hold a post-money valuation of $870 million. A spokesperson for the company confirmed it had already raised new capital, but disputed the numbers. The company has already raised more than $160 million from investors, including FirstMark Capital and IAC. The company most recently closed a $100 million Series C this past July.

Selina & Sonder: The Airbnb competitor Sonder is in the process of closing a financing worth roughly $200 million at a $1 billion valuation, reports The Wall Street Journal. Investors including Greylock Partners, Spark Capital and Structure Capital are likely to participate. Sonder is four years old but didn’t emerge from stealth until 2018. The startup, which turns homes into hotels, quickly attracted more than $100 million in venture funding. Meanwhile, another hospitality business called Selina has raised $100 million at an $850 million valuation. The company, backed by Access Industries, Grupo Wiese and Colony Latam Partners, builds living/co-working/activity spaces across the world for digital nomads.

Fresh funds: Mary Meeker has made history with the close of her new fund, Bond Capital, the largest VC fund founded and led by a female investor to date. Bond has $1.25 billion in committed capital. If you remember, Meeker ditched Kleiner Perkins last fall and brought the firm’s entire growth team with her. Kleiner said it was a peaceful split that would allow the firm to focus more on its early-stage efforts, leaving the growth investing to Bond. Fortune, however, reported this week that a power struggle of sorts between Meeker and Mamoon Hamid, who joined recently to reenergize the early-stage side of things, was a larger cause of her exit.

Plus, SOSV, a multi-stage venture firm that was founded as the personal investment vehicle of entrepreneur Sean O’Sullivan after his company went public in 1994, has raised $218 million for its third fund. The vehicle has a $250 million target that SOSV expects to meet. Already, the fund is substantially larger than the firm’s previous vehicle, which closed with $150 million.

A grocery delivery startup crumbles: Honestbee, the online grocery delivery service in Asia, is nearly out of money and trying to offload its business. Despite looking impressive from the outside, the company is currently in crisis mode due to a cash crunch — there’s a lot happening right now. TechCrunch’s Jon Russell dives in deep here.

Extra Crunch: “When it comes to working with journalists, so many people are, frankly, idiots. I have seen reporters yank stories because founders are assholes, play unfairly, or have PR firms that use ridiculous pressure tactics when they have already committed to a story.” Sign up for Extra Crunch for a full list of PR don’ts. Here are some other EC pieces to hit the wire this week:

Equity: If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase News editor-in-chief Alex Wilhelm and I chat about Kleiner Perkins, Chinese IPOs and Slack & Uber’s upcoming exits.

Powered by WPeMatico

SalesWhale, a Singapore-based startup that uses AI to help marketers and salespeople generate leads, has announced a Series A round worth $5.3 million.

The investment is led by Monk’s Hill Ventures — the Southeast Asia-focused firm that led SalesWhale’s seed round in 2017 — with participation from existing backers GREE Ventures, Wavemaker Partners and Y Combinator. That’s right, SalesWhale is one a select few Southeast Asian startups to have been through YC, it graduated back in summer 2016.

SalesWhale — which calls itself “a conversational email marketing platform” — uses AI-powered “bots” to handle email. In this case, its digital workforce is trained for sales leads. That means both covering the menial parts of arranging meetings and coordination, and the more proactive side of engaging old and new leads.

Back when we last wrote about the startup in 2017, it had just half a dozen staff. Fast-forward two years and that number has grown to 28, CEO Gabriel Lim explained in an interview. The company is going after more growth with this Series A money, and Lim expects headcount to jump past 70; SalesWhale is deliberating opening an office in California. That location would be primarily to encourage new business and increase communication and support for existing clients, most of whom are located in the U.S., according to Lim. Other hires will be tasked with increasing integration with third-party platforms, and particularly sales and enterprise services.

The past two years have also seen SalesWhale switch gears and go from targeting startups as customers, to working with mid-market and enterprise firms. SalesWhale’s “hundreds” of customers include recruiter Randstad, educational company General Assembly and enterprise service business Unit4. As it has added greater complexity to its service, so the income has jumped from an initial $39-$99 per seat all those years ago to more than $1,000 per month for enterprise customers.

SalesWhale’s founding team (left to right): Venus Wong, Ethan Lee and Gabriel Lim

While AI is a (genuine) threat to many human jobs, SalesWhale sits on the opposite side of that problem in that it actually helps human employees get more work done. That’s to say that SalesWhale’s service can get stuck into a pile (or spreadsheet) of leads that human staff don’t have time for, begin reaching out, qualifying leads and sending them on to living and breathing colleagues to take forward.

“A lot of potential leads aren’t touched” by existing human teams, Lim reflected.

But when SalesWhale reps do get involved, they are often not recognized as the bots they are.

“Customers are often so convinced they are chatting with a human — who is sending collateral, PDFs and arranging meetings — that they’ll say things like ‘I’d love to come by and visit someday,’ ” Lim joked in an interview.

“Indeed, a lot of times, sales team refer to [SalesWale-powered] sales assistant like they are a real human colleague,” he added.

Powered by WPeMatico

Mfine, an India-based startup aiming to broaden access to doctors and healthcare by using the internet, has pulled in a $17.2 million Series B funding round for growth.

The company is led by four co-founders from Myntra, the fashion commerce startup acquired by Flipkart in 2014. They include CEO Prasad Kompalli and Ashutosh Lawania who started the business in 2017 and were later joined by Ajit Narayanan and Arjun Choudhary, Myntra’s former CTO and head of growth, respectively.

The round is led by Japan’s SBI Investment with participation from sibling fund SBI Ven Capital and another Japanese investor, Beenext. Existing Mfine backers Stellaris Venture Partners and Prime Venture Partners also returned to follow-on. Mfine has now raised nearly $23 million to date.

“In India, at a macro-level, good doctors are far and few and distributed very unevenly,” Kompalli said in an interview with TechCrunch. “We asked ‘Can we build a platform that is a very large hospital on the cloud?,’ that’s the fundamental premise.”

There’s already plenty of money in Indian healthtech platforms — Practo, for one, has raised more than $180 million from investors like Tencent — but Mfine differentiates itself with a focus on partnerships with hospitals and clinics, while others have offered more daily health communities that include remote sessions with doctors and healthcare professionals who are recruited independently of their day job.

“We are entering a different phase of what is called healthtech… the problems that are going to be solved will be much deeper in nature,” Kompalli said in an interview with TechCrunch.

Mfine makes its money as a digital extension of its healthcare partners, essentially. That means it takes a cut of spending from consumers. The company claims to work with more than 500 doctors from 100 “top” hospitals, while there’s a big focus on tech. In particular, it says that an AI-powered “virtual doctor” can help in areas that include summarising diagnostic reports, narrowing down symptoms, providing care advice and helping with preventative care. There are also other services, including medicine delivery from partner pharmacies.

To date, Mfine said that its platform has helped with more than 100,000 consultations across 800 towns in India during the last 15 months. It claims it is seeing around 20,000 consultations per month. Beyond helping increase the utilization of GPs — Mfine claims it can boost their productivity 3 to 4X — the service can also help hospitals and centers increase their revenue, a precious commodity for many.

Going forward, Kompalli said the company is increasing its efforts with corporate companies, where it can help cover employee healthcare needs, and developing its insurance-style subscription service. Over the coming few years, that channel should account for around half of all revenue, he added.

A more immediate goal is to expand its offline work beyond Hyderabad and Bangalore, the two cities where it currently operates.

“This round is a real endorsement from global investors that the model is working,” he added.

Powered by WPeMatico

It’s one of the greatest technology “startup” success stories of the personal computer and smartphone eras. Yet, despite selling 59 million smartphones and netting $27 billion in revenue last quarter in its first-ever public earnings report this morning, a strange and tantalizing question shrouds the world’s number two handset manufacturer behind Samsung.

Who owns Huawei?

To hear the company tell it, it’s 100% employee-owned. In a statement circulated last week, it said that “Huawei is a private company wholly owned by its employees. No government agency or outside organization holds shares in Huawei or has any control over Huawei.”

That’s a simple statement, but oh is it so much more complicated.

As with all things related to Huawei, which outside of its 5G archrival Qualcomm is probably the tech company most entrenched in geopolitics today, the story is never as simple as it appears at first glance.

Powered by WPeMatico

Lots of news has surfaced from China’s gaming industry in recent weeks as the government hastens to approve a massive backlog of titles in the world’s largest market for video games.

Last Friday, On April 10th, the country’s State Administration of Press and Publication, the freshly minted gaming authority born from a months-long reshuffle last year that led to an approval blackout, held a gaming conference and enshrined a new set of guidelines for publication that are set to move some to joy and others to sorrow. TechCrunch confirmed with an attendee present at the conference and a source close to the SAPP that the event took place.

On April 22, China finally resumed the approval process to license new games for monetization. Licensing got back on track in December, but Reuters reported in February that the government stopped accepting new submissions due to a mounting pile of applications.

The bad news: The number of games allowed onto the market annually will be capped, and some genres of games will no longer be eligible. Mahjong and poker games are taken off the approval list following a wave of earlier government crackdowns over concerns that such titles may channel illegal gambling. These digital forms of traditional leisure activities are immensely popular for studios because they are relatively cheap to make and bear lucrative fruit. According to video game researcher Niko Partners, 37 percent of the 8,561 games approved in 2017 were poker and mahjong titles.

While the new rule is set to wipe out hundreds of small developers focused on the genre, it may only have a limited impact on the entrenched players as the restriction applies only to new applicants.

“It won’t affect us much because we are early to the market and have accumulated a big collection of licenses,” a marketing manager at one of China’s biggest online poker and mahjong games publishers told TechCrunch.

China will also stop approving certain games inspired by its imperial past, including “gongdou,” which directly translates to harem scheming, as well as “guandou,” the word for palace official competition. The life inside palaces has inspired blockbuster TV series such as the Story of Yanxi Palace, an in-house production from China’s Netflix equivalent iQiyi . But these plots also touch a nerve with Chinese officials who worry about “obscene contents and the risk of political metaphors,” Daniel Ahmad, senior analyst at Nikos Partners, suggested to TechCrunch.

Screenshots of Xi Fei Zhuan, a mobile game that lets users play the role of harems to win love from the emperor. Image source: Superjoy Interactive Games

Games that contain images of corpses and blood will also be rejected. Developers previously modified blood color to green to circumvent restrictions, but the renewed guidelines have effectively ruled out any color variations of blood.

“Chinese games developers are used to arbitrary regulations. They are quick at devising methods to circumvent requirements,” a Guangzhou-based indie games developer told TechCrunch.

That may only work out for companies armed with sufficient developing capabilities and resources to counter new policies. For instance, Tencent was quick to implement an anti-addiction system for underage users before the practice became an industry-wide norm as of late.

“Many smaller publishers will have a harder time under this new set of regulations, which will require them to spend extra time and money to ensure games are up to code,” suggested Ahmad. “We’ve already seen that many smaller publishers were unable to survive the temporary game license approval freeze last year and we expect to see further consolidation of the market this year.”

China has over the past year taken aim at the gaming industry over concerns related to gaming addiction among minors and illegal content, such as those that promote violence or deviate from the government’s ideologies. To enforce the growing list of requirements, an Online Game Ethics Committee launched in December under the guidance of the Publicity Department of the Chinese Communist Party to help the new gaming regulator in vetting title submissions.

More than 1,000 games have been approved since China ended the gaming freeze in December, though Tencent, the dominant player in the market, has yet to receive the coveted license required for monetizing its hugely popular mobile title PlayerUnknown’s Battlegrounds.

Uncertain waters in the gaming industry have wiped billions of dollars off the giant’s market cap and prompted it to initiate a bigger push in such non-game segments as cloud computing and financial technologies. NetEase, the runner-up in China’s gaming market, reacted by trimming its staff to cut costs.

The article was updated to correct the date for the gaming conference and clarify that the new guidelines were announced at the conference.

Powered by WPeMatico

Thomas Kurian, the newly minted CEO of Google Cloud, used the company’s Cloud Next conference last week to lay out his vision for the future of Google’s cloud computing platform. That vision involves, in part, a hiring spree to give businesses that want to work with Google more people to talk to and get help from. Unsurprisingly, Kurian is also looking to put his stamp on the executive team, too, and today announced that former SAP executive Robert Enslin is joining Google Cloud as its new president of Global Customer Operations.

Enslin’s hire is another clear signal that Kurian is focused on enterprise customers. Enslin, after all, is a veteran of the enterprise business, with 27 years at SAP, where he served on the company’s executive board until he announced his resignation from the company earlier this month. After leading various parts of SAP, including as president of its cloud product portfolio, president of SAP North America and CEO of SAP Japan, Enslin announced that he had “a few more aspirations to fulfill.” Those aspirations, we now know, include helping Google Cloud expand its lineup of enterprise customers.

Enslin’s hire is another clear signal that Kurian is focused on enterprise customers. Enslin, after all, is a veteran of the enterprise business, with 27 years at SAP, where he served on the company’s executive board until he announced his resignation from the company earlier this month. After leading various parts of SAP, including as president of its cloud product portfolio, president of SAP North America and CEO of SAP Japan, Enslin announced that he had “a few more aspirations to fulfill.” Those aspirations, we now know, include helping Google Cloud expand its lineup of enterprise customers.

“Rob brings great international experience to his role having worked in South Africa, Europe, Asia and the United States—this global perspective will be invaluable as we expand Google Cloud into established industries and growth markets around the world,” Kurian writes in today’s announcement.

For the last two years, Google Cloud already had a president of Global Customer Operations, though, in the form of Paul-Henri Ferrand, a former Dell exec who was brought on by Google Cloud’s former CEO Diane Greene . Kurian says that Ferrand “has decided to take on a new challenge within Google.”

Powered by WPeMatico

CleverTap, an India-based startup that lets companies track and improve engagement with users across the web, has pulled in $26 million in new funding thanks to a round led by Sequoia India.

Existing investor Accel and new backer Tiger Global also took part in the deal, which values CleverTap at $150-$160 million, the startup disclosed. The deal takes CleverTap to around $40 million from investors to date.

Founded in 2015 and based in Mumbai, CleverTap competes with a range of customer experience services, including Oracle Cloud. Its service covers a range of touchpoints with consumers, including email, in-app activity, push notifications, Facebook, WhatsApp (for business) and Viber. Its service helps companies map out how their users are engaging across those vectors, and develop “re-engagement” programs to help reactive dormant users or increase engagement among others.

The company says its SDK is installed in more than 8,000 apps and its customers include Southeast Asia-based startups Go-Jek and Zilingo, Hotstar in India and U.S.-based Fandango . With a considerable customer base in Asia, CleverTap puts a particular focus on mobile because many of these markets are all about personal devices.

“Asia is mobile-first and massively growing,” CleverTap CEO and co-founder Sunil Thomas told TechCrunch in an interview. “A lot of engagement in this [part of the] world is timely… we were sort of born physically on the east side of the world, so we got to scale with all these diverse set of devices.”

That stands to benefit CleverTap as it seeks to grow market share outside of Asia, and in markets like the U.S. and Europe where mobile is — right now — just one part of the marketing and customer engagement process. The company believes that engagement by mobile has a long way to develop there.

“Engagement [in the West] is still email-heavy and not really timely,” Thomas said. “Whereas the East thinks of it as ‘Hey, let’s be proactive… instead of a user coming in to hunt for information, can I provide it when I think he or she will need it?’ ”

Of course, mobile push and in-app notifications can be easily abused.

Most people will know of an app on their phone that falls into that category. So, how does a company know what is too much or what isn’t enough?

“As long as you use push or in-app as an extension of your brand, then I think it’s extremely useful,” explained Thomas. “After all, this is a really competitive world; it isn’t just your app out there — if you can make your brand count when this person isn’t in your app, that’ll help you.”

More broadly, Thomas argued that CleverTap brings data to the table which, ultimately, “changes the whole context in real time.” So a customer can really look holistically at their online presence and figure out what is working, and with which users. In real terms, when used to acquire new users online, he said he believes that CleverTap typically doubles registration conversions and triples the buying rate.

“The cost of acquisition to first purchase is what we really effect,” said Thomas. “It’s that moment you get a new person into your house.”

CleverTap has an office in Sunnyvale and it has just landed in Singapore. Now it plans to add a location in Indonesia before the end of the year. Those expansions are centered around business development, with some customer support, since tech and other teams are in India. Already, according to Thomas, the company is looking to grow in Europe while it is weighing the potential to enter Latin America in a move that could include a local partnership.

The CleverTap CEO is also considering raising more money toward the end of the year, when he believes that the company can push its valuation as high as $400 million.

“That’s very doable based on revenue growth,” he said. “We think that the revenue will demand that valuation.”

Powered by WPeMatico

The San Francisco-based startup Branch International, which makes small personal loans in emerging markets, has raised $170 million and announced a partnership with Visa to offer virtual, pre-paid debit cards to Branch client networks in Africa, South-Asia and Latin America.

Branch — which has 150 employees in San Francisco, Lagos, Nairobi, Mexico City and Mumbai — makes loans starting at $2 to individuals in emerging and frontier markets. The company also uses an algorithmic model to determine credit worthiness, build credit profiles and offer liquidity via mobile phones.

“We’ll use [the money] to deepen existing business in Africa. Later this year we’ll announce high-yield savings accounts…in Africa,” says Branch co-founder and chief executive Matt Flannery.

The $170 million round from Foundation Capital and its new debit card partner, Visa, will support Branch’s international expansion, which could include Brazil and Indonesia, according to Flannery. Branch launched in Mexico and India within the last year. In Africa, it offers its services in Kenya, Nigeria and Tanzania.

A potential Branch customer

The Branch-Visa partnership will allow individuals to obtain virtual Visa accounts with which to create accounts on Branch’s app. This gives Branch larger reach in countries such as Nigeria — Africa’s most populous country with 190 million people — where cards have factored more prominently than mobile money in connecting unbanked and underbanked populations to finance.

Founded in 2015, Branch started operating in Kenya, where mobile money payment products such as Safaricom’s M-Pesa (which does not require a card or bank account to use) have scaled significantly. M-Pesa now has 25 million users, according to sector stats released by the Communications Authority of Kenya. Branch has more than 3 million customers and has processed 13 million loans and disbursed more than $350 million, according to company stats.

Branch has one of the most downloaded fintech apps in Africa, per Google Play app numbers combined for Nigeria and Kenya, according to Flannery.

Already profitable, Branch International expects to reach $100 million in revenues this year, with roughly 70 percent of that generated in Africa, according to Flannery.

In addition to Visa and Foundation Capital, the $170 Series C round included participation from Branch’s existing investors Andreessen Horowitz, Trinity Ventures, Formation 8, the IFC, CreditEase and Victory Park, while adding new investors Greenspring, Foxhaven and B Capital.

Branch last raised $70 million in 2018. The company’s overall VC haul and $100 million revenue peg register as pretty big numbers for a startup focused primarily on Africa. Pan-African e-commerce startup Jumia, which also announced its NYSE IPO last month, generated $140 million in revenue (without profitability) in 2018.

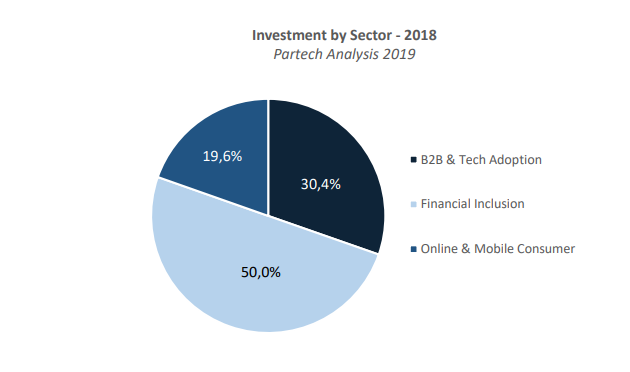

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Startups building financial technologies for Africa’s 1.2 billion population have gained the attention of investors. As a sector, fintech (or financial inclusion) attracted 50 percent of the estimated $1.1 billion funding to African startups in 2018, according to Partech.

Branch’s recent round and plans to add countries internationally also tracks a trend of fintech-related products growing in Africa, then expanding outward. This includes M-Pesa, which generated big numbers in Kenya before operating in 10 countries around the world. Nigerian payments startup Paga announced its pending expansion in Asia and Mexico late last year. And payment services such as Kenya’s SimbaPay have also connected to global networks like China’s WeChat.

Powered by WPeMatico

The HBO sci-fi blockbuster Westworld has been an inspiring look into what humanlike robots can do for us in the meatspace. While current technologies are not quite advanced enough to make Westworld a reality, startups are attempting to replicate the sort of human-robot interaction it presents in virtual space.

Rct studio, which just graduated from Y Combinator and ranked among TechCrunch’s nine favorite picks from the batch, is one of them. The “Westworld” in the TV series, a far-future theme park staffed by highly convincing androids, lets visitors live out their heroic and sadistic fantasies free of consequences.

There are a few reasons why rct studio, which is keeping mum about the meaning of its deliberately lower-cased name for later revelation, is going for the computer-generated world. Besides the technical challenge, playing a fictional universe out virtually does away the geographic constraint. The Westworld experience, in contrast, happens within a confined, meticulously built park.

“Westworld is built in a physical world. I think in this age and time, that’s not what we want to get into,” Xinjie Ma, who heads up marketing for rct, told TechCrunch. “Doing it in the physical environment is too hard, but we can build a virtual world that’s completely under control.”

Rct studio wants to build the Westworld experience in virtual worlds. / Image: rct studio

The startup appears suitable to undertake the task. The eight-people team is led by Cheng Lyu, the 29-year-old entrepreneur who goes by Jesse and helped Baidu build up its smart speaker unit from scratch after the Chinese search giant acquired his voice startup Raven in 2017. Along with several of Raven’s core members, Lyu left Baidu in 2018 to start rct.

“We appreciate a lot the support and opportunities given by Baidu and during the years we have grown up dramatically,” said Ma, who previously oversaw marketing at Raven.

Immersive films, or games, depending on how one wants to classify the emerging field, are already available with pre-written scripts for users to pick from. Rct wants to take the experience to the next level by recruiting artificial intelligence for screenwriting.

At the center of the project is the company’s proprietary engine, Morpheus. Rct feeds it mountains of data based on human-written storylines so the characters it powers know how to adapt to situations in real time. When the codes are sophisticated enough, rct hopes the engine can self-learn and formulate its own ideas.

“It takes an enormous amount of time and effort for humans to come up with a story logic. With machines, we can quickly produce an infinite number of narrative choices,” said Ma.

To venture through rct’s immersive worlds, users wear a virtual reality headset and control their simulated self via voice. The choice of audio came as a natural step given the team’s experience with natural language processing, but the startup also welcomes the chance to develop new devices for more lifelike journeys.

“It’s sort of like how the film Ready Player One built its own gadgets for the virtual world. Or Apple, which designs its own devices to carry out superior software experience,” explained Ma.

On the creative front, rct believes Morpheus could be a productivity tool for filmmakers as it can take a story arc and dissect it into a decision-making tree within seconds. The engine can also render text to 3D images, so when a filmmaker inputs the text “the man throws the cup to the desk behind the sofa,” the computer can instantly produce the corresponding animation.

Investors are buying into rct’s offering. The startup is about to close its Series A funding round just months after banking seed money from Y Combinator and Chinese venture capital firm Skysaga, the startup told TechCrunch.

The company has a few imminent tasks before achieving its Westworld dream. For one, it needs a lot of technical talent to train Morpheus with screenplay data. No one on the team had experience in filmmaking, so it’s on the lookout for a creative head who appreciates AI’s application in films.

Rct studio’s software takes a story arc and dissects it into a decision-making tree within seconds. / Image: rct studio

“Not all filmmakers we approach like what we do, which is understandable because it’s a very mature industry, while others get excited about tech’s possibility,” said Ma.

The startup’s entry into the fictional world was less about a passion for films than an imperative to shake up a traditional space with AI. Smart speakers were its first foray, but making changes to tangible objects that people are already accustomed to proved challenging. There has been some interest in voice-controlled speakers, but they are far from achieving ubiquity. Then movies crossed the team’s mind.

“There are two main routes to make use of AI. One is to target a vertical sector, like cars and speakers, but these things have physical constraints. The other application, like Alpha Go, largely exists in the lab. We wanted something that’s both free of physical limitation and holds commercial potential.”

The Beijing and Los Angeles-based startup isn’t content with just making the software. Eventually, it wants to release its own films. The company has inked a long-term partnership with Future Affairs Administration, a Chinese sci-fi publisher representing about 200 writers, including the Hugo award-winning Cixin Liu. The pair is expected to start co-producing interactive films within a year.

Rct’s path is reminiscent of a giant that precedes it: Pixar Animation Studios . The Chinese company didn’t exactly look to the California-based studio for inspiration, but the analog was a useful shortcut to pitch to investors.

“A confident company doesn’t really draw parallels with others, but we do share similarities to Pixar, which also started as a tech company, publishes its own films, and has built its own engine,” said Ma. “A lot of studios are asking how much we price our engine at, but we are targeting the consumer market. Making our own films carry so many more possibilities than simply selling a piece of software.”

Powered by WPeMatico