Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Snap is taking a leaf out of the Asian messaging app playbook as its social messaging service enters a new era.

The company unveiled a series of new strategies that are aimed at breathing fresh life into the service that has been ruthlessly cloned by Facebook across Instagram, WhatsApp and even its primary social network. The result? Snap has consistently lost users since going public in 2017. It managed to stop the rot with a flat Q4, but resting on its laurels isn’t going to bring back the good times.

Snap has taken a three-pronged approach: extending its stories feature (and ads) into third-party apps and building out its camera play with an AR platform, but it is the launch of social games that is the most intriguing. The other moves are logical, and they fall in line with existing Snap strategies, but games is an entirely new category for the company.

It isn’t hard to see where Snap found inspiration for social games — Asian messaging companies have long twinned games and chat — but the U.S. company is applying its own twist to the genre.

Powered by WPeMatico

Fresh from closing a notable investment from Airbnb, India’s OYO has expanded its footprint into Japan. The move comes through a joint venture with investor SoftBank — which led OYO’s $1 billion round last year through its Vision Fund — which will cover hotel-based accommodation and home rentals.

Financial details around the joint venture were not disclosed. An OYO representative declined to go into details when asked.

OYO started in India, where it initially aggregated budget hotels; it has since expanded into China, Malaysia, Nepal, the U.K., the UAE, Indonesia, the Philippines and — now — Japan. China, in particular, has shown promise, with OYO’s room inventory there reportedly double what it is in India.

The evolution has not just been a geographical one. Its business has moved from a laser focus on the long-tail of budget hotels to a broader “hospitality” play. It now includes managed private homes and, in India, wedding venues, holiday packages and co-working — while its hotel supply is a mixture of franchised and leased. It has also advanced its focus from budget-minded consumers to cover business travelers, too.

The Japanese JV will be led by Prasun Choudhary, whom OYO describes as a founding member of its team. Like OYO business elsewhere in the world, the company is appealing to small and medium hotel franchises and owners. On the consumer side, its prime segment is domestic and international travelers who seek “budget to mid-segment hospitality,” to use part of a statement from OYO founder and CEO Ritesh Agarwal, who is pictured in the image at the top of this post.

Agarwal is a Thiel fellow who started the company in 2011 when aged just 18. His original business, called Oravel, was an Airbnb clone that pivoted to become OYO. Today, that company is valued at $5 billion after raising more than $1.5 billion from investors.

SoftBank has previously struck joint ventures to bring other Vision Fund companies to Japan. Those include WeWork, Chinese ride-hailing firm Didi Chuxing and India’s Paytm, which launched a payment service in the country.

Powered by WPeMatico

The internet is often lauded for the potential to increase the impact of a range of primary services in emerging markets, including education, commerce, banking and healthcare. While many of those platforms are now being built, a few are finding that a hybrid approach combining online and offline is advantageous.

That’s exactly what Jio Health, a “full stack” (forgive the phrase) healthcare startup is bringing to consumers in Southeast Asia, starting in Vietnam.

The company started as a U.S.-based venture that worked with healthcare providers around the “Obamacare” initiative, before sensing the opportunity overseas and relocating to Vietnam, the Southeast Asian market of 95 million people and a fast-growing young population.

Today, it operates an online healthcare app and a physical facility in Saigon; it also has licenses for prescriptions and over the counter drug sales. The serviced launched nearly a year ago; already the company has some 130 staff, including 70 caregivers — including doctors — and a tech team of 30.

The idea is to offer services digitally, but also provide a physical location for when it is needed. Therein, the company ensures that “every element of that journey” is controlled and of the required standard; that’s in contrast to services that partner with hospitals or other care centers.

The scope of Jio Health’s services range from pediatrics to primary care, chronic disease management and ancillary services, which will soon cover areas like eye care, dermatology and cancer.

“Our initial research [before moving] found that healthcare in Vietnam was unlike the U.S.,” Raghu Rai, founder and CEO of Jio Health, told TechCrunch in an interview. “Spending is primarily driven by the consumer (out of pocket) and there’s no real digital infrastructure to speak of.”

Rai — a U.S. citizen — said doctors typically “have minutes per patient” and get through “hundreds” of consultations in every morning shift. That gave him an idea to make things more efficient.

“We can probably address north of 80 percent of consumers’ health needs,” he said of Jio Health,” but we also have referral partnerships with certain hospitals.”

Raghu Rai is CEO and founder of Jio Health

The process begins when a consumer downloads the Jio Health app and inputs primary information. A representative is then dispatched to visit the consumer in person, potentially within “hours” of the submission of information, according to Rai.

He believes that Jio Health can save its users money and time by using remote consultancy for many diagnoses. The company also works with health insurance companies for areas like annual checkups, and Rai said that McDonald’s and 7-Eleven are among the corporations that offer Jio Health among the providers for their staff; they’re not exclusive.

This week, Jio Health announced that it has closed a $5 million Series A funding from Southeast Asia’s Monk’s Hill Ventures . Rai said the company plans to use the capital for expansion. In particular, he said, the company is adding new care categories this month — including eye care and dermatology — and it is working toward expanding its brand through marketing.

Further down the line, Rai said the company hopes to expand to Hanoi before the end of this year. While there is interest in moving into other markets within Southeast Asia, that isn’t about to happen soon.

“We have begun to investigate other markets, but at this point feel the market in Vietnam is substantial in itself,” he told TechCrunch. “It’s very plausible that we’d be looking at international expansion plans in 2020… we’re going to be focused on Southeast Asia.”

Powered by WPeMatico

Alibaba has made an acquisition as it continues to square up to the opportunity in enterprise services in China and beyond, akin to what its U.S. counterpart Amazon has done with AWS. TechCrunch has confirmed that the e-commerce and cloud services giant has acquired Teambition, a Microsoft and Tencent-backed platform for co-workers to plan and collaborate on projects, similar to Trello and Asana.

There were rumors of an acquisition circulating yesterday in Chinese media. Alibaba has now confirmed the acquisition to TechCrunch but declined to provide any other details.

Teambition had raised about $17 million in funding since 2013, with investors including Tencent, Microsoft, IDG Capital and Gobi Ventures. Gobi also manages investments on behalf of Alibaba, and that might have been one route to how the two became acquainted. Alibaba’s last acquisition in enterprise was German big data startup Data Artisans for $103 million.

As with others in the project management and collaboration space, Teambition provides users with mobile and desktop apps to interact with the service. In addition to the main planning interface, there is one designed for CRM, called Bingo, as well as a “knowledge base” where businesses can keep extra documentation and other collateral.

The deal is another sign of how Alibaba has been slowly building a business in enterprise powerhouse over the last several years as it races to keep its pole position in the Chinese market, as well as gain a stronger foothold in the wider Asian region and beyond.

In China alone, it has been estimated that enterprise services is a $1 billion opportunity, but with no clear leader at the moment across a range of verticals and segments that fall under that general umbrella, there is a lot to play for, and likely a lot more consolidation to come. (And it’s not the only one: ByteDance — more known for consumer services like TikTok — is rumored to be building a Slack competitor, and Tencent also has its sights on the sector, as does Baidu.)

As with AWS, Alibaba’s enterprise business stems out of the cloud-based infrastructure Alibaba has built for its own e-commerce powerhouse, which it has productised as a service for third parties that it calls Alibaba Cloud, which (like AWS) offers a range of cloud-storage and serving tiers to users.

On top of that, Alibaba has been building and integrating a number of apps and other services that leverage that cloud infrastructure, providing more stickiness for the core service as well as the potential for developing further revenue streams with customers.

These apps and services range from the recently launched “A100” business transformation initiative, where Alibaba proposes working with large companies to digitise and modernize (and help run) their IT backends, through to specific products, such as Alibaba’s Slack competitor DingTalk.

With Alibaba declining to give us any details beyond a confirmation of the acquisition, and Teambition not returning our requests for comment, our best guess is that this app could be a fit in either area. That is to say, one option for Alibaba would be to integrate it and use it as part of a wider “business transformation” and modernization offering, or as a standalone product, as it currently exists.

Teambition today counts a number of Chinese giants, and giants with Chinese outposts, as customers, including Huawei, Xiaomi, TCL and McDonald’s in its customer list. The company currently has nothing on its site indicating an acquisition or any notices regarding future services, so it seems to be business as usual for now.

The opportunity around collaboration and workplace communication has become a very hot area in the last few years, spurred by the general growth of social media in the consumer market and people in business environments wanting to bring in the same kinds of tools to help them get work done. Planning and project management — the area that Teambition and its competitors address — is considered a key pillar in the wider collaboration space alongside cloud services to store and serve files and real-time communication services.

Slack, which is now valued at more than $7 billion, has said it has filed paperwork for a public listing, while Asana is now valued at $1.5 billion and Trello’s owner Atlassian now has a market cap of nearly $26 billion.

Powered by WPeMatico

The latest report by a UK oversight body set up to evaluation Chinese networking giant Huawei’s approach to security has dialled up pressure on the company, giving a damning assessment of what it describes as “serious and systematic defects” in its software engineering and cyber security competence.

Although the report falls short of calling for an outright ban on Huawei equipment in domestic networks — an option U.S. president Trump continues dangling across the pond.

The report, prepared for the National Security Advisor of the UK by the Huawei Cyber Security Evaluation Centre (HCSEC) Oversight Board, also identifies new “significant technical issues” which it says lead to new risks for UK telecommunications networks using Huawei kit.

The HCSEC was set up by Huawei in 2010, under what the oversight board couches as “a set of arrangements with the UK government”, to provide information to state agencies on its products and strategies in order that security risks could be evaluated.

And last year, under pressure from UK security agencies concerned about technical deficiencies in its products, Huawei pledged to spend $2BN to try to address long-running concerns about its products in the country.

But the report throws doubt on its ability to address UK concerns — with the board writing that it has “not yet seen anything to give it confidence in Huawei’s capacity to successfully complete the elements of its transformation programme that it has proposed as a means of addressing these underlying defects”.

So it sounds like $2BN isn’t going to be nearly enough to fix Huawei’s security problem in just one European country.

The board also writes that it will require “sustained evidence” of better software engineering and cyber security “quality”, verified by HCSEC and the UK’s National Cyber Security Centre (NCSC), if there’s to be any possibility of it reaching a different assessment of the company’s ability to reboot its security credentials.

While another damning assessment contained in the report is that Huawei has made “no material progress” on issues raised by last year’s report.

All the issues identified by the security evaluation process relate to “basic engineering competence and cyber security hygiene”, which the board notes gives rise to vulnerabilities capable of being exploited by “a range of actors”.

It adds that the NCSC does not believe the defects found are a result of Chinese state interference.

This year’s report is the fifth the oversight board has produced since it was established in 2014, and it comes at a time of acute scrutiny for Huawei, as 5G network rollouts are ramping up globally — pushing governments to address head on suspicions attached to the Chinese giant and consider whether to trust it with critical next-gen infrastructure.

“The Oversight Board advises that it will be difficult to appropriately risk-manage future products in the context of UK deployments, until the underlying defects in Huawei’s software engineering and cyber security processes are remediated,” the report warns in one of several key conclusions that make very uncomfortable reading for Huawei.

“Overall, the Oversight Board can only provide limited assurance that all risks to UK national security from Huawei’s involvement in the UK’s critical networks can be sufficiently mitigated long-term,” it adds in summary.

Reached for its response to the report, a Huawei UK spokesperson sent us a statement in which it describes the $2BN earmarked for security improvements related to UK products as an “initial budget”.

It writes:

The 2019 OB [oversight board] report details some concerns about Huawei’s software engineering capabilities. We understand these concerns and take them very seriously. The issues identified in the OB report provide vital input for the ongoing transformation of our software engineering capabilities. In November last year Huawei’s Board of Directors issued a resolution to carry out a companywide transformation programme aimed at enhancing our software engineering capabilities, with an initial budget of US$2BN.

A high-level plan for the programme has been developed and we will continue to work with UK operators and the NCSC during its implementation to meet the requirements created as cloud, digitization, and software-defined everything become more prevalent. To ensure the ongoing security of global telecom networks, the industry, regulators, and governments need to work together on higher common standards for cyber security assurance and evaluation.

Seeking to find something positive to salvage from the report’s savaging, Huawei suggests it demonstrates the continued effectiveness of the HCSEC as a structure to evaluate and mitigate security risk — flagging a description where the board writes that it’s “arguably the toughest and most rigorous in the world”, and which Huawei claims shows at least there hasn’t been any increase in vulnerability of UK networks since the last report.

Though the report does identify new issues that open up fresh problems — albeit the underlying issues were presumably there last year too, just laying undiscovered.

The board’s withering assessment certainly amps up the pressure on Huawei which has been aggressively battling U.S.-led suspicion of its kit — claiming in a telecoms conference speech last month that “the U.S. security accusation of our 5G has no evidence”, for instance.

At the same time it has been appealing for the industry to work together to come up with collective processes for evaluating the security and trustworthiness of network kit.

And earlier this month it opened another cyber security transparency center — this time at the heart of Europe in Brussels, where the company has been lobbying policymakers to help establish security standards to foster collective trust. Though there’s little doubt that’s a long game.

Meanwhile, critics of Huawei can now point to impatience rising in the U.K., despite comments by the head of the NCSC, Ciaran Martin, last month — who said then that security agencies believe the risk of using Huawei kit can be managed, suggesting the government won’t push for an outright ban.

The report does not literally overturn that view but it does blast out a very loud and alarming warning about the difficulty for UK operators to “appropriately” risk-manage what’s branded defective and vulnerable Huawei kit. Including flagging the risk of future products — which the board suggests will be increasingly complex to manage. All of which could well just push operators to seek alternatives.

On the mitigation front, the board writes that — “in extremis” — the NCSC could order Huawei to carry out specific fixes for equipment currently installed in the UK. Though it also warns that such a step would be difficult, and could for example require hardware replacement which may not mesh with operators “natural” asset management and upgrades cycles, emphasizing it does not offer a sustainable solution to the underlying technical issues.

“Given both the shortfalls in good software engineering and cyber security practice and the currently unknown trajectory of Huawei’s R&D processes through their announced transformation plan, it is highly likely that security risk management of products that are new to the UK or new major releases of software for products currently in the UK will be more difficult,” the board writes in a concluding section discussing the UK national security risk.

“On the basis of the work already carried out by HCSEC, the NCSC considers it highly likely that there would be new software engineering and cyber security issues in products HCSEC has not yet examined.”

It also describes the number and severity of vulnerabilities plus architectural and build issues discovered by a relatively small team in the HCSEC as “a particular concern”.

“If an attacker has knowledge of these vulnerabilities and sufficient access to exploit them, they may be able to affect the operation of the network, in some cases causing it to cease operating correctly,” it warns. “Other impacts could include being able to access user traffic or reconfiguration of the network elements.”

In another section on mitigating risks of using Huawei kit, the board notes that “architectural controls” in place in most UK operators can limit the ability of attackers to exploit any vulnerable network elements not explicitly exposed to the public Internet — adding that such controls, combined with good opsec generally, will “remain critically important in the coming years to manage the residual risks caused by the engineering defects identified”.

In other highlights from the report the board does have some positive things to say, writing that an NCSC technical review of its capabilities showed improvements in 2018, while another independent audit of HCSEC’s ability to operate independently of Huawei HQ once again found “no high or medium priority findings”.

“The audit report identified one low-rated finding, relating to delivery of information and equipment within agreed Service Level Agreements. Ernst & Young concluded that there were no major concerns and the Oversight Board is satisfied that HCSEC is operating in line with the 2010 arrangements between HMG and the company,” it further notes.

Last month the European Commissioner said it was preparing to step in to ensure a “common approach” across the European Union where 5G network security is concerned — warning of the risk of fragmentation across the single market. Though it has so far steered clear of any bans.

Earlier this week it issued a set of recommendations for Member States, combining legislative and policy measures to assess 5G network security risks and help strengthen preventive measures.

Among the operational measures it suggests Member States take is to complete a national risk assessment of 5G network infrastructures by the end of June 2019, and follow that by updating existing security requirements for network providers — including conditions for ensuring the security of public networks.

“These measures should include reinforced obligations on suppliers and operators to ensure the security of the networks,” it recommends. “The national risk assessments and measures should consider various risk factors, such as technical risks and risks linked to the behaviour of suppliers or operators, including those from third countries. National risk assessments will be a central element towards building a coordinated EU risk assessment.”

At an EU level the Commission said Member States should share information on network security, saying this “coordinated work should support Member States’ actions at national level and provide guidance to the Commission for possible further steps at EU level” — leaving the door open for further action.

While the EU’s executive body has not pushed for a pan-EU ban on any 5G vendors it did restate Member States’ right to exclude companies from their markets for national security reasons if they fail to comply with their own standards and legal framework.

Powered by WPeMatico

Xiaomi is back with another teaser of the foldable concept device it first showed off in January.

This time around, in a video posted to its Weibo account, the Chinese company showed off the device working in tablet mode and, after folding, regular phone mode to illustrate how seamlessly it can be tucked up and put away… in this case atop a cup of noodles.

Video: hat tip The Verge

Xiaomi has said it is developing a device — the previous video included a call-out for ideas and feedback — so the project isn’t likely as advanced as soon-to-launch products from Samsung, Huawei or lesser-known Chinese brand Royole.

Unlike those three, Xiaomi’s offers two foldable edges instead of just one. That would appear to present a much tougher challenge in terms of design and logistics, but this new teaser (and there’s no doubt Xiaomi chose it carefully) seems to show impressive results. The phone folds nicely in terms of hardware and software, but you’d imagine those edges will make it thicker than others.

It’s all ifs and buts for now, though, since Xiaomi isn’t giving up details of what this product might become… or even whether it will become one at all. But Xiaomi being Xiaomi, you’d imagine that when it does drop, it won’t just be the two folds that set it apart from the rest. The Chinese firm is massively price-sensitive, so you can expect that it’ll price any foldable phone it releases much lower than the $2,000 or so that Samsung and Huawei are asking for their gen-one efforts.

Powered by WPeMatico

Kong, the open core API management and life cycle management company previously known as Mashape, today announced that it has raised a $43 million Series C round led by Index Ventures. Previous investors Andreessen Horowitz and Charles River Ventures (CRV), as well as new investors GGV Capital and World Innovation Lab, also participated. With this round, Kong has now raised a total of $71 million.

The company’s CEO and co-founder Augusto Marietti tells me the company plans to use the funds to build out its service control platform. He likened this service to the “nervous system for an organization’s software architecture.”

Right now, Kong is just offering the first pieces of this, though. One area the company plans to especially focus on is security, in addition to its existing management tools, where Kong plans to add more machine learning capabilities over time, too. “It’s obviously a 10-year journey, but those two things — immunity with security and machine learning with [Kong] Brain — are really a 10-year journey of building an intelligent platform that can manage all the traffic in and out of an organization,” he said.

In addition, the company also plans to invest heavily in its expansion in both Europe and the Asia Pacific market. This also explains the addition of World Innovation Lab as an investor. The firm, after all, focuses heavily on connecting companies in the U.S. with partners in Asia — and especially Japan. As Marietti told me, the company is seeing a lot of demand in Japan and China right now, so it makes sense to capitalize on this, especially as the Chinese market is about to become more easily accessible for foreign companies.

Kong notes that it doubled its headcount in 2018 and now has more than 100 enterprise customers, including Yahoo! Japan, Ferrari, SoulCycle and WeWork.

It’s worth noting that while this is officially a Series C investment, Marietti is thinking of it more like a Series B round, given that the company went through a major pivot when it moved from being Mashape to its focus on Kong, which was already its most popular open-source tool.

“Modern software is now built in the cloud, with applications consuming other applications, service to service,” said Martin Casado, general partner at Andreessen Horowitz . “We’re at the tipping point of enterprise adoption of microservices architectures, and companies are turning to new open-source-based developer tools and platforms to fuel their next wave of innovation. Kong is uniquely suited to help enterprises as they make this shift by supporting an organization’s entire service architecture, from centralized or decentralized, monolith or microservices.”

Powered by WPeMatico

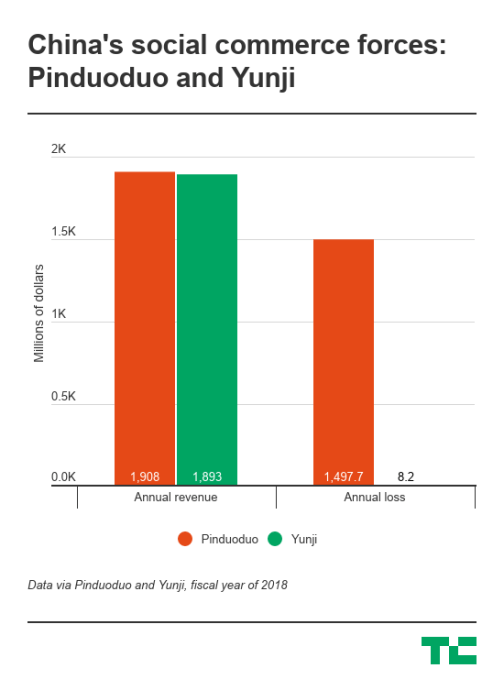

China’s Pinduoduo was all the rage in 2018 as the e-commerce upstart quickly rose to challenge Alibaba and raised $1.63 billion through a Nasdaq listing. Much of its success was attributable to its link to WeChat, China’s messaging leader. Now, another emerging e-commerce player that has leveraged WeChat is gearing up for a listing in the United States.

Yunji, which was founded in 2015 (the same year Pinduoduo launched), is raising up to $200 million according to its prospectus filed with the Securities and Exchange Commission last week. Reuters reported citing sources in September that Yunji planned to raise around $1 billion in the IPO at a valuation of between $7 billion and $10 billion.

Like Pinduoduo, Yunji bills itself as a “social e-commerce” service, which means it takes advantage of social relationships on apps like WeChat to acquire, engage and sell to users. The pair differ, however, in how exactly they make money. Pinduoduo generates the bulk of its revenues — nearly 90 percent in the fourth quarter — from advertising fees collected from merchants. This is akin to Alibaba’s marketplace play of connecting buyers and third-party sellers. Yunji, which was started by e-commerce veteran Xiao Shanglue, focuses on direct sales like Alibaba’s arch-foe JD.com, derived 88 percent of its fourth-quarter revenues from selling to users.

In terms of size, Yunji was about $15 million behind Pinduoduo in revenue last year. It had 23.2 million buyers in 2018, compared to Pinduoduo’s 272.6 million monthly active users. Yunji was, however, much closer to achieving profitability than Pinduoduo, which spent most of its money on sales and marketing. Most of Yunji’s expenses went to fulfillment and logistics.

From inception, Yunji has boasted of its “innovative” membership-based e-commerce model. To join, people typically pay a fee, upon which they gain access to a variety of benefits and discounts as well as the permission to open their own micro-stores. Members then get compensated for successfully selling to others and recruiting new members.

The marketing practice helped Yunji quickly build up a large network of users. As of 2018, Yunji had 7.4 million members who contributed 11.9 percent of its annual revenues and 66.4 percent of annual transactions. But the firm went too far in exploiting the social links it controlled that it started to look like a pyramid scheme, which is banned in China. In 2017, the local government slapped Yunji with a $1.4 million fine for pyramid selling. The firm subsequently apologized and promised to revamp its marketing strategy. For instance, to avoid crossing the red line of awarding salespeople with “material” or “financial” benefits, Yunji resorted to virtual Yun-coins, which are not redeemable for cash and can only be used as coupons for future purchase.

But Yunji is still on the edge. The company warns in its prospectus that China could at any time redefine what constitutes pyramid selling.

“[T]here is no assurance that the competent governmental authorities in China that we communicate with will not change their views, or the other relevant government authorities will share the same view as our PRC legal counsel, or they will find our business model, not in violation of any applicable regulations, given the uncertainties in the interpretation and application of existing PRC laws, regulations and policies relating to our current business model, including, but not limited to, regulations regulating pyramid selling.”

Some of Yunji’s more notable investors include China’s CDH Investments and Huaxing Growth Capital, China Renaissance’s subsidiary focusing on high-growth startups.

Powered by WPeMatico

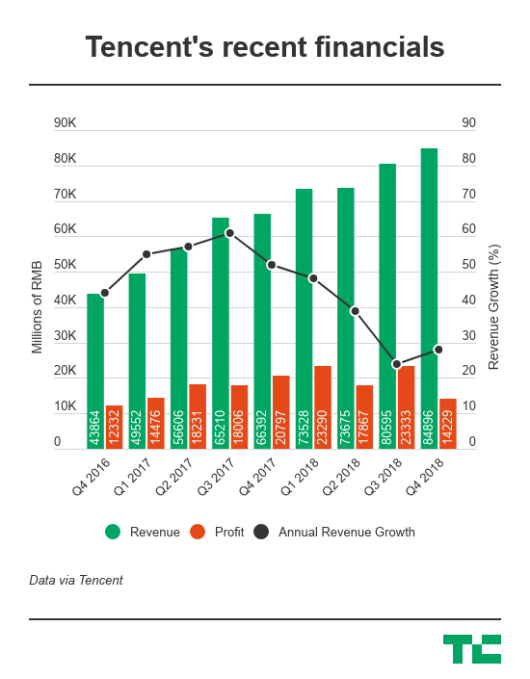

China’s Tencent reported disappointing profits in the fourth quarter on the back of surging costs but saw emerging businesses pick up steam as it plots to diversify amid slackening gaming revenues.

Net profit for the quarter slid 32 percent to 14.2 billion yuan ($2.1 billion), behind analysts’ forecast of 18.3 billion yuan. The decrease was due to one-off expenses related to its portfolio companies and investments in non-gaming segments like video content and financial technology.

Excluding non-cash items and M&A deals, Tencent’s net profit from the period rose 13 percent to 19.7 billion yuan ($2.88 billion). The company has to date invested in more than 700 companies, 100 of which are valued over $1 billion each and 60 of which have gone public.

Quarterly revenue edged up 28 percent to 84.9 billion yuan ($12.4 billion) beating expectations.

The Hong Kong-listed company is best known for its billion-user WeChat messenger but had for years relied heavily on a high-margin gaming business. That was until a months-long freeze on games approvals last year that delayed monetization for new titles, spurring a major reorg in the firm to put more focus on enterprise services, including cloud computing and financial technology.

Tencent has received approvals for eight games since China resumed the licensing process, although its blockbusters PlayerUnknown Battlegrounds and Fortnite have yet to get the green light. The firm also warned of a “sizeable backlog” for license applications in the industry, which means its “scheduled game releases will initially be slower than in some prior years.”

Video games for the quarter contributed 28.5 percent of Tencent’s total revenues, compared to 36.7 percent in the year-earlier period. Despite the domestic fiasco, Tencent remains as the world’s largest games publisher by revenue, according to data compiled by NewZoo. The firm has also gotten more aggressive in taking its titles global.

Social network revenues rose 25 percent on account of growth in live streaming and video subscriptions. The segment made up 22.9 percent of total revenues. Tencent has in recent years spent heavily on making original content and licensing programs as it competes with Baidu’s iQiyi video streaming site. Tencent claimed 89 million subscribers in the latest quarter, compared with iQiyi’s 87.4 million.

Tencent has been relatively slow to monetize WeChat in contrast to its western counterpart Facebook, though it’s under more pressure to step up its game. Tencent’s advertising revenue from the quarter grew 38 percent thanks to expanding advertising inventory on WeChat. Ads accounted for 20 percent of the firm’s quarterly revenues.

All told, WeChat and its local version Weixin reached nearly 1.1 billion monthly active users; 750 million of them checked their friends’ WeChat feeds, and Tencent recently introduced a Snap Story-like feature to lock users in as it vies for eyeball time with challenger TikTok.

The “others” category, composed of financial technology and cloud computing, grew 71.8 percent to generate 28.5 percent of total revenues. WeChat’s e-wallet, which is going neck-and-neck with Alibaba affiliate Alipay, saw daily transaction volume exceed 1 billion last year. During the fourth quarter, merchants who used WeChat Pay monthly grew more than 80 percent year-over-year.

Meanwhile, cloud revenues doubled to 9.1 billion yuan in 2018, thanks to Tencent’s dominance in the gaming sector as its cloud infrastructure now powers over half of the China-based games companies and is following these clients overseas. Tencent meets Alibaba head-on again in the cloud sector. For comparison, Alibaba’s most recent quarterly cloud revenue was 6.6 billion yuan. Just yesterday, the e-commerce leader claimed that its cloud business is larger than the second to eight players in China combined.

Powered by WPeMatico

Razer is summoning a big gun as it bids to develop its mobile gaming strategy. The Hong Kong-listed company — which sells laptops, smartphones and gaming peripherals — said today it is working with Tencent on a raft of initiatives related to smartphone-based games.

The collaboration will cover hardware, software and services. Some of the objectives include optimizing Tencent games — which include megahit PUBG and Fortnite — for Razer’s smartphones, mobile controllers and its Cortex Android launcher app. The duo also said they may “explore additional monetization opportunities for mobile gaming,” which could see Tencent integrate Razer’s services, which include a rewards/loyalty program, in some areas.

The news comes on the same day as Razer’s latest earnings, which saw annual revenue grow 38 percent to reach $712.4 million. Razer recorded a net loss of $97 million for the year, down from $164 million in 2017.

The big-name partnership announcement comes at an opportune time for Razer, which has struggled to convince investors of its business. The company was among a wave of much-championed tech companies to go public in Hong Kong — Razer’s listing raised more than $500 million in late 2017 — but its share price has struggled. Razer currently trades at HK$1.44, which is some way down from a HK$3.88 list price and HK$4.58 at the end of its trading day debut. Razer CEO Min Liang Tan has previously lamented a lack of tech savviness within Hong Kong’s public markets despite a flurry of IPOs, which have included names like local services giant Meituan.

Nabbing Tencent, which is one of (if not the) biggest games companies in the world, is a PR coup, but it remains to be seen just what impact the relationship will have at this stage. Subsequent tie-ins, and potentially an investor, would be notable developments and perhaps positive signals that the market is seeking.

Still, Razer CEO Min Liang Tan is bullish about the company’s prospects on mobile.

The company’s Razer smartphones were never designed to be “iPhone-killers” that sold on volume, but there’s still uncertainty around the unit with recent reports suggesting the third-generation phone may have been canceled following some layoffs. (Tan declined to comment on that.)

Mobile is tough — just ask past giants like LG and HTC about that… and Razer’s phone and gaming-focus was quickly copied by others, including a fairly brazen clone effort from Xiaomi, to make sales particularly challenging. But Liang maintains that, in doing so, Razer created a mobile gaming phone market that didn’t exist before, and ultimately that is more important than shifting its own smartphones.

“Nobody was talking about gaming smartphones [before the Razer phone], without us doing that, the genre would still be perceived as casual gaming,” Tan told TechCrunch in an interview. “Even from day one, it was about creating this new category… we don’t see others as competition.”

With that in mind, he said that this year is about focusing on the software side of Razer’s mobile gaming business.

Tan said Razer “will never” publish games as Tencent and others do, instead, he said that the focus is on helping discovery, creating a more immersive experience and tying in other services, which include its Razer Gold loyalty points.

Outside of gaming, Razer is also making a push into payments through a service that operates in Southeast Asia. Fueled by the acquisition of MOL one year ago, Razer has moved from allowing people to buy credit over-the-counter to launch an e-wallet in two countries, Malaysia and Singapore, as it goes after a slice of Southeast Asia’s fintech boom, which has attracted non-traditional players that include AirAsia, Grab and Go-Jek, among others.

Powered by WPeMatico