Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Skymind, a Y Combinator-incubated AI platform that aims to make deep learning more accessible to enterprises, today announced that it has raised an $11.5 million Series A round led by TransLink Capital, with participation from ServiceNow, Sumitomo’s Presidio Ventures, UpHonest Capital and GovTech Fund. Early investors Y Combinator, Tencent, Mandra Capital, Hemi Ventures, and GMO Ventures, also joined the round/ With this, the company has now raised a total of $17.9 million in funding.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

The inclusion of TransLink Capital gives a hint as to how the company is planning to use the funding. One of TransLink’s specialties is helping entrepreneurs develop customers in Asia. Skymind believes that it has a major opportunity in that market, so having TransLink lead this round makes a lot of sense. Skymind also plans to use the round to build out its team in North America and fuel customer acquisition there.

“TransLink is the perfect lead for this round, because they know how to make connections between North America and Asia,” Skymind CEO Chris Nicholson told me. “That’s where the most growth is globally, and there are a lot of potential synergies. We’re also really excited to have strategic investors like ServiceNow and Sumitomo’s Presidio Ventures backing us for the first time. We’re already collaborating with ServiceNow, and Skymind software will be part of some powerful new technologies they roll out.”

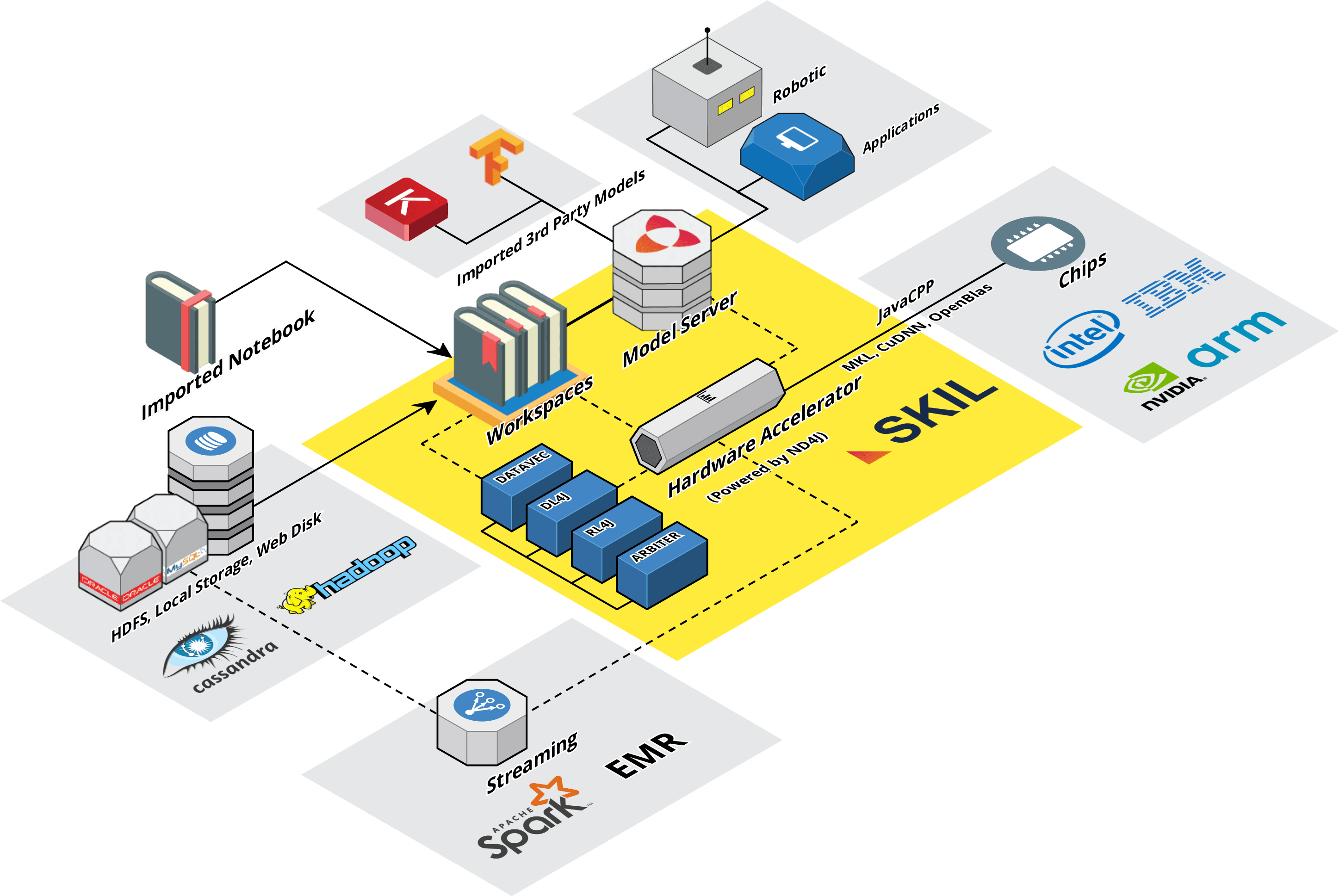

It’s no secret that enterprises know that they have to adapt AI in some form but are struggling with figuring out how to do so. Skymind’s tools, including its core SKIL framework, allow data scientists to create workflows that take them from ingesting the data to cleaning it up, training their models and putting them into production. The promise here is that Skymind’s tools eliminate the gap that often exists between the data scientists and IT.

“The two big opportunities with AI are better customer experiences and more efficiency, and both are based on making smarter decisions about data, which is what AI does,” said Nicholson. “The main types of data that matter to enterprises are text and time series data (think web logs or payments). So we see a lot of demand for natural-language processing and for predictions around streams of data, like logs.”

Current Skymind customers include the likes of ServiceNow and telco company Orange, while some of its technology partners that integrate its services into their portfolio include Cisco and SoftBank .

It’s worth noting that Skymind is also the company behind Deeplearning4j, one of the most popular open-source AI tools for Java. The company is also a major contributor to the Python-based Keras deep learning framework.

Powered by WPeMatico

Opera had a couple of tumultuous years behind it, but it looks like the Norwegian browser maker (now in the hands of a Chinese consortium) is finding its stride again and refocusing its efforts on its flagship mobile and desktop browsers. Before the sale, Opera offered a useful stand-alone and built-in VPN service. Somehow, the built-in VPN stopped working after the acquisition. My understanding is that this had something to do with the company being split into multiple parts, with the VPN service ending up on the wrong side of that divide. Today, it’s officially bringing this service back as part of its Android app.

The promise of the new Opera VPN in Opera for Android 51 is that it will give you more control over your privacy and improve your online security, especially on unsecured public WiFi networks. Opera says it uses 256-bit encryption and doesn’t keep a log or retain any activity data.

Since Opera now has Chinese owners, though, not everybody is going to feel comfortable using this service, though. When I asked the Opera team about this earlier this year at MWC in Barcelona, the company stressed that it is still based in Norway and operates under that country’s privacy laws. The message being that it may be owned by a Chinese consortium but that it’s still very much a Norwegian company.

If you do feel comfortable using the VPN, though, then getting started is pretty easy (I’ve been testing in the beta version of Opera for Android for a while). Simply head to the setting menu, flip the switch, and you are good to go.

“Young people are being very concerned about their online privacy as they increasingly live their lives online, said Wallman. “We want to make VPN adoption easy and user-friendly, especially for those who want to feel more secure on the Web but are not aware on how to do it. This is a free solution for them that works.”

What’s important to note here is that the point of the VPN is to protect your privacy, not to give you a way to route around geo-restrictions (though you can do that, too). That means you can’t choose a specific country as an endpoint, only ‘America,’ ‘Asia,’ and ‘Europe.’

Powered by WPeMatico

Chinese smartphone maker Xiaomi has announced a new entry level smartphone at an event in Delhi.

The entry-level smartphone is targeted at the Indian market and looks intended to woo feature phone owners to upgrade from a more basic mobile.

It runs Google’s flavor of Android optimized for low-powered smartphones (Android Go) which supports lightweight versions of apps.

Under the hood the dual-SIM handset has a Qualcomm Snapdragon 425 chipset, 1GB RAM and 8GB of storage (though there’s a slot for expanding storage capacity up to 128GB).

Also on board: 4G cellular connectivity and a 3000mAh battery.

Up front there’s a 5 inch HD display with a 16:9 aspect ration, and 5MP selfie camera. An 8MP camera brings up the rear, with support for 1080p video recording.

At the time of writing the Redmi Go is being priced at 4,499 rupee (~$65). Albeit a mark-down graphic on the company’s website suggests the initial price may be a temporary discount on a full RRP of 5,999 rupees (~85). We’ve asked Xiaomi for confirmation.

Xiaomi’s website lists it as available to buy at 12PM March 22.

Mi fans, presenting #RedmiGo #AapkiNayiDuniya

– Qualcomm® Snapdragon

425

– AndroidOreo

(Go Edition)

– 3000mAh Battery

– 8MP Rear camera with LED Flash

– 5MP Selfie camera

– 5″ HD display

– 4G Network Connectivity

– Color: Blue & black

– Price: ₹4,499RT & spread the

pic.twitter.com/aanAoiauqj

— Mi India (@XiaomiIndia) March 19, 2019

While Xiaomi is squeezing its entry level smartphone price-tag here, the Redmi Go’s cost to consumers in India still represents a sizeable bump on local feature phone prices.

For example the Nokia 150 Dual SIM candybar can cost as little as 1,500 rupees (~20). Though there’s clearly a big difference between a candybar keypad mobile and a full-screen smartphone. Yet 3x more expensive represents an immovable barrier for many consumers in the market.

The Redmi Go also looks intended to respond to local carrier Reliance Jio’s 4G feature phones, which are positioned — price and feature wise — as a transitionary device, sitting between a dumber feature phone and full-fat smartphone.

The JioPhone 2 launched last year with a price tag of 2,999 rupees (~40). So the Redmi Go looks intended to close the price gap — and thus try to make a transitionary handset with a smaller screen less attractive than a full screen Android-powered smartphone experience.

That said, the JioPhone handsets run a fork of Firefox OS, called KaiOS, which can also run lightweight versions of apps like Facebook, Twitter and Google.

So, again, many India consumers may not see the need (or be able) to shell out ~1,500 rupees more for a lightweight mobile computing experience when they can get something similar for cheaper elsewhere. And indeed plenty of the early responses to Xiaomi’s tweet announcing the Redmi Go brand it “overpriced”.

Powered by WPeMatico

With the smartphone operating system market sewn up by Google’s Android platform, which has a close to 90% share globally, leaving Apple’s iOS a slender (but lucrative) premium top-slice, a little company called Jolla and its Linux-based Sailfish OS is a rare sight indeed: A self-styled ‘independent alternative’ that’s still somehow in business.

The Finnish startup’s b2b licensing sales pitch is intended to appeal to corporates and governments that want to be able to control their own destiny where device software is concerned.

And in a world increasingly riven with geopolitical tensions that pitch is starting to look rather prescient.

Political uncertainties around trade, high tech espionage risks and data privacy are translating into “opportunities” for the independent platform player — and helping to put wind in Jolla’s sails long after the plucky Sailfish team quit their day jobs for startup life.

Jolla was founded back in 2011 by a band of Nokia staffers who left the company determined to carry on development of mobile Linux as the European tech giant abandoned its own experiments in favor of pivoting to Microsoft’s Windows Phone platform. (Fatally, as it would turn out.)

Nokia exited mobile entirely in 2013, selling the division to Microsoft. It only returned to the smartphone market in 2017, via a brand-licensing arrangement, offering made-in-China handsets running — you guessed it — Google’s Android OS.

If the lesson of the Jolla founders’ former employer is ‘resistance to Google is futile’ they weren’t about to swallow that. The Finns had other ideas.

Indeed, Jolla’s indie vision for Sailfish OS is to support a whole shoal of differently branded, regionally flavored and independently minded (non-Google-led) ecosystems all swimming around in parallel. Though getting there means not just surviving but thriving — and doing so in spite of the market being so thoroughly dominated by the U.S. tech giant.

TechCrunch spoke to Jolla ahead of this year’s Mobile World Congress tradeshow where co-founder and CEO, Sami Pienimäki, was taking meetings on the sidelines. He told us his hope is for Jolla to have a partner booth of its own next year — touting, in truly modest Finnish fashion, an MWC calendar “maybe fuller than ever” with meetings with “all sorts of entities and governmental representatives”.

Jolla co-founder, Sami Pienimaki, showing off a Jolla-branded handset in May 2013, back when the company was trying to attack the consumer smartphone space.

(Photo credit: KIMMO MANTYLA/AFP/Getty Images)

Even a modestly upbeat tone signals major progress here because an alternative smartphone platform licensing business is — to put it equally mildly — an incredibly difficult tech business furrow to plough.

Jolla almost died at the end of 2015 when the company hit a funding crisis. But the plucky Finns kept paddling, jettisoning their early pursuit of consumer hardware (Pienimäki describes attempting to openly compete with Google in the consumer smartphone space as essentially “suicidal” at this point) to narrow their focus to a b2b licensing play.

The early b2b salespitch targeted BRIC markets, with Jolla hitting the road to seek buy in for a platform it said could be moulded to corporate or government needs while still retaining the option of Android app compatibility.

Then in late 2016 signs of a breakthrough: Sailfish gained certification in Russia for government and corporate use.

Its licensing partner in the Russian market was soon touting the ability to go “absolutely Google-free!“.

Since then the platform has gained the backing of Russian telco Rostelecom, which acquired Jolla’s local licensing customer last year (as well as becoming a strategic investor in Jolla itself in March 2018 — “to ensure there is a mutual interest to drive the global Sailfish OS agenda”, as Pienimäki puts it).

Rostelecom is using the brand name ‘Aurora OS‘ for Sailfish in the market which Pienimäki says is “exactly our strategy” — likening it to how Google’s Android has been skinned with different user experiences by major OEMs such as Samsung and Huawei.

“What we offer for our customers is a fully independent, regional licence and a tool chain so that they can develop exactly this kind of solution,” he tells TechCrunch. “We have come to a maturity point together with Rostelecom in the Russia market, and it was natural move plan together, that they will take a local identity and proudly carry forward the Sailfish OS ecosystem development in Russia under their local identity.”

“It’s fully compatible with Sailfish operating system, it’s based on Sailfish OS and it’s our joint interest, of course, to make it fly,” he adds. “So that as we, hopefully, are able to extend this and come out to public with other similar set-ups in different countries those of course — eventually, if they come to such a fruition and maturity — will then likely as well have their own identities but still remain compatible with the global Sailfish OS.”

Jolla says the Russian government plans to switch all circa 8M state officials to the platform by the end of 2021 — under a project expected to cost RUB 160.2 billion (~$2.4BN). (A cut of which will go to Jolla in licensing fees.)

It also says Sailfish-powered smartphones will be “recommended to municipal administrations of various levels,” with the Russian state planning to allocate a further RUB 71.3 billion (~$1.1BN) from the federal budget for that. So there’s scope for deepening the state’s Sailfish uptake.

Russian Post is one early customer for Jolla’s locally licensed Sailfish flavor. Having piloted devices last year, Pienimäki says it’s now moving to a full commercial deployment across the whole organization — which has around 300,000 employees (to give a sense of how many Sailfish powered devices could end up in the hands of state postal workers in Russia).

A rugged Sailfish-powered device piloted by Russian post

Jolla is not yet breaking out end users for Sailfish OS per market but Pienimäki says that overall the company is now “clearly above” 100k (and below 500k) devices globally.

That’s still of course a fantastically tiny number if you compare it to the consumer devices market — top ranked Android smartphone maker Samsung sold around 70M handsets in last year’s holiday quarter, for instance — but Jolla is in the b2b OS licensing business, not the handset making business. So it doesn’t need hundreds of millions of Sailfish devices to ship annually to turn a profit.

Scaling a royalty licensing business to hundreds of thousands of users is sums to “good business”, , says Pienimäki, describing Jolla’s business model for Sailfish as “practically a royalty per device”.

“The success we have had in the Russian market has populated us a lot of interesting new opening elsewhere around the world,” he continues. “This experience and all the technology we have built together with Open Mobile Platform [Jolla’s Sailfish licensing partner in Russia which was acquired by Rostelecom] to enable that case — that enables a number of other cases. The deployment plan that Rostelecom has for this is very big. And this is now really happening and we are happy about it.”

Jolla’s “Russia operation” is now beginning “a mass deployment phase”, he adds, predicting it will “quickly ramp up the volume to very sizeable”. So Sailfish is poised to scale.

While Jolla is still yet to turn a full-year profit Pienimäki says several standalone months of 2018 were profitable, and he’s no longer worried whether the business is sustainable — asserting: “We don’t have any more financial obstacles or threats anymore.”

It’s quite the turnaround of fortunes, given Jolla’s near-death experience a few years ago when it almost ran out of money, after failing to close a $10.6M Series C round, and had to let go of half its staff.

It did manage to claw in a little funding at the end of 2015 to keep going, albeit as much leaner fish. But bagging Russia as an early adopter of its ‘independent’ mobile Linux ecosystem looks to have been the key tipping point for Jolla to be able to deliver on the hard-graft ecosystem-building work it’s been doing all along the way. And Pienimäki now expresses easy confidence that profitability will flow “fairly quickly” from here on in.

“It’s not an easy road. It takes time,” he says of the ecosystem-building company Jolla hard-pivoted to at its point of acute financial distress. “The development of this kind of business — it requires patience and negotiation times, and setting up the ecosystem and ecosystem partners. It really requires patience and takes a lot of time. And now we have come to this point where actually there starts to be an ecosystem which will then extend and start to carry its own identity as well.”

In further signs of Jolla’s growing confidence he says it hired more than ten people last year and moved to new and slightly more spacious offices — a reflection of the business expanding.

“It’s looking very good and nice for us,” Pienimäki continues. “Let’s say we are not taking too much pressure, with our investors and board, that what is the day that we are profitable. It’s not so important anymore… It’s clear that that is soon coming — that very day. But at the same time the most important is that the business case behind is proven and it is under aggressive deployment by our customers.”

The main focus for the moment is on supporting deployments to ramp up in Russia, he says, emphasizing: “That’s where we have to focus.” (Literally he says “not screwing up” — and with so much at stake you can see why nailing the Russia case is Jolla’s top priority.)

While the Russian state has been the entity most keen to embrace an alternative (non-U.S.-led) mobile OS — perhaps unsurprisingly — it’s not the only place in the world where Jolla has irons in the fire.

Another licensing partner, Bolivian IT services company Jalasoft, has co-developed a Sailfish-powered smartphone called Accione.

Jalasoft’s ‘liberty’-touting Accione Sailfish smartphone

It slates the handset on its website as being “designed for Latinos by Latinos”. “The digitalization of the economy is inevitable and, if we do not control the foundation of this digitalization, we have no future,” it adds.

Jalasoft founder and CEO Jorge Lopez says the company’s decision to invest effort in kicking the tyres of Jolla’s alternative mobile ecosystem is about gaining control — or seeking “technological libration” as the website blurb puts it.

“With Sailfish OS we have control of the implementation, while with Android it is the opposite,” Lopez tells TechCrunch. “We are working on developing smart buildings and we need a private OS that is not Android or iOS. This is mainly because our product will allow the end user to control the whole building and doing this with Android or iOS a hackable OS will bring concerns on security.”

Lopez says Jalasoft is using Accione as its development platform — “to gather customer feedback and to further develop our solution” — so the project clearly remains in an early phase, and he says that no more devices are likely to be announced this year.

But Jolla can point to more seeds being sewn with the potential, with work, determination and patience, to sprout into another sizeable crop of Sailfish-powered devices down the line.

Even more ambitiously Jolla is also targeting China, where investment has been taken in to form a local consortium to develop a Chinese Sailfish ecosystem.

Although Pienimäki cautions there’s still much work to be done to bring Sailfish to market in China.

“We completed a major pilot with our licensing customer, Sailfish China Consortium, in 2017-18,” he says, giving an update on progress to date. “The public in market solution is not there yet. That is something that we are working together with the customer — hopefully we can see it later this year on the market. But these things take time. And let’s say that we’ve been somewhat surprised at how complex this kind of decision-making can be.”

“It wasn’t easy in Russia — it took three years of tight collaboration together with our Russian partners to find a way. But somehow it feels that it’s going to take even more in China. And I’m not necessarily talking about calendar time — but complexity,” he adds.

While there’s no guarantee of success for Jolla in China, the potential win is so big given the size of the market that even if they can only carve out a tiny slice, such as a business or corporate sector, it’s still worth going after. And he points to the existence of a couple of native mobile Linux operating systems he reckons could make “very lucrative partners”.

That said, the get-to-market challenge for Jolla in China is clearly distinctly different vs the rest of the world. This is because Android has developed into an independent (i.e. rather than Google-led) ecosystem in China as a result of state restrictions on the Internet and Internet companies. So the question is what could Sailfish offer that forked Android doesn’t already?

An Oppo Android powered smartphone on show at MWC 2017

Again, Jolla is taking the long view that ultimately there will be appetite — and perhaps also state-led push — for a technology platform bolster against political uncertainty in U.S.-China relations.

“What has happened now, in particular last year, is — because of the open trade war between the nations — many of the technology vendors, and also I would say the Chinese government, has started to gradually tighten their perspective on the fact that ‘hey simply it cannot be a long term strategy to just keep forking Android’. Because in the end of the day it’s somebody else’s asset. So this is something that truly creates us the opportunity,” he suggests.

“Openly competing with the fact that there are very successful Android forks in China, that’s going to be extremely difficult. But — let’s say — tapping into the fact that there are powers in that nation that wish that there would be something else than forking Android, combined with the fact that there is already something homegrown in China which is not forking Android — I think that’s the recipe that can be successful.”

Not all Jolla’s Sailfish bets have paid off, of course. An earlier foray by an Indian licensing partner into the consumer handset market petered out. Albeit, it does reinforce their decision to zero in on government and corporate licensing.

“We got excellent business connections,” says Pienimäki of India, suggesting also that it’s still a ‘watch this space’ for Jolla. The company has a “second move” in train in the market that he’s hopeful to be talking about publicly later this year.

It’s also pitching Sailfish in Africa. And in markets where target customers might not have their own extensive in-house IT capability to plug into Sailfish co-development work Pienimäki says it’s offering a full solution — “a ready made package”, together with partners, including device management, VPN, secure messaging and secure email — which he argues “can be still very lucrative business cases”.

Looking ahead and beyond mobile, Pienimäki suggests the automotive industry could be an interesting target for Sailfish in the future — though not literally plugging the platform into cars; but rather licensing its technologies where appropriate — arguing car makers are also keen to control the tech that’s going into their cars.

“They really want to make sure that they own the cockpit. It’s their property, it’s their brand and they want to own it — and for a reason,” he suggests, pointing to the clutch of major investments from car companies in startups and technologies in recent years.

“This is definitely an interesting area. We are not directly there ourself — and we are not capable to extend ourself there but we are discussing with partners who are in that very business whether they could utilize our technologies there. That would then be more or less like a technology licensing arrangement.”

While Jolla looks to be approaching a tipping point as a business, in terms of being able to profit off of licensing an alternative mobile platform, it remains a tiny and some might say inconsequential player on the global mobile stage.

Yet its focus on building and maintaining trusted management and technology architectures also looks timely — again, given how geopolitical spats are intervening to disrupt technology business as usual.

Chinese giant Huawei used an MWC keynote speech last month to reject U.S.-led allegations that its 5G networking technology could be repurposed as a spying tool by the Chinese state. And just this week it opened a cybersecurity transparency center in Brussels, to try to bolster trust in its kit and services — urging industry players to work together on agreeing standards and structures that everyone can trust.

In recent years U.S.-led suspicions attached to Russia have also caused major headaches for security veteran Kaspersky — leading the company to announce its own trust and transparency program and decentralize some of its infrastructure, including by spinning up servers in Europe last year.

Businesses finding ways to maintain and deepen the digital economy in spite of a little — or even a lot — of cross-border mistrust may well prove to be the biggest technology challenge of all moving forward.

Especially as next-gen 5G networks get rolled out — and their touted ‘intelligent connectivity’ reaches out to transform many more types of industries, bringing new risks and regulatory complexity.

The geopolitical problem linked to all this boils down to how to trust increasing complex technologies without any one entity being able to own and control all the pieces. And Jolla’s business looks interesting in light of that because it’s selling the promise of neutral independence to all its customers, wherever they hail from — be it Russia, LatAm, China, Africa or elsewhere — which makes its ability to secure customer trust not just important but vital to its success.

Indeed, you could argue its customers are likely to rank above average on the ‘paranoid’ scale, given their dedicated search for an alternative (non-U.S.-led) mobile OS in the first place.

“It’s one of the number one questions we get,” admits Pienimäki, discussing Jolla’s trust balancing act — aka how it manages and maintains confidence in Sailfish’s independence, even as it takes business backing and code contributions from a state like Russia.

“We tell about our reference case in Russia and people quickly ask ‘hey okay, how can I trust that there is no blackbox inside’,” he continues, adding: “This is exactly the core question and this is exactly the problem we have been able to build a solution for.”

Jolla’s solution sums to one line: “We create a transparent platform and on top of fully transparent platform you can create secure solutions,” as Pienimäki puts it.

“The way it goes is that Jolla with Sailfish OS is always offering the transparent Sailfish operating system core, on source code level, all the time live, available for all the customers. So all the customers constantly, in real-time, have access to our source code. Most of it’s in public open source, and the proprietary parts are also constantly available from our internal infrastructure. For all the customers, at the same time in real-time,” he says, fleshing out how it keeps customers on board with a continually co-developing software platform.

“The contributions we take from these customers are always on source code level only. We don’t take any binary blobs inside our software. We take only source code level contributions which we ourselves authorize, integrate and then we make available for all the customers at the very same moment. So that loopback in a way creates us the transparency.

“So if you want to be suspicion of the contributions of the other guys, so to say, you can always read it on the source code. It’s real-time. Always available for all the customers at the same time. That’s the model we have created.”

“It’s honestly quite a unique model,” he adds. “Nobody is really offering such a co-development model in the operating system business.

“Practically how Android works is that Google, who’s leading the Android development, makes the next release of Android software, then releases it under Android Open Source and then people start to backboard it — so that’s like ‘source, open’ in a way, not ‘open source’.”

Sailfish’s community of users also have real-time access to and visibility of all the contributions — which he dubs “real democracy”.

“People can actually follow it from the code-line all the time,” he argues. “This is really the core of our existence and how we can offer it to Russia and other countries without creating like suspicion elements each side. And that is very important.

“That is the only way we can continue and extend this regional licensing and we can offer it independently from Finland and from our own company.”

With global trade and technology both looking increasingly vulnerable to cross-border mistrust, Jolla’s approach to collaborative transparency may offer something of a model if other businesses and industries find they need to adapt themselves in order for trade and innovation to keep moving forward in uncertain political times.

Last but not least there’s regulatory intervention to consider.

A European Commission antitrust decision against Google’s Android platform last year caused headlines around the world when the company was slapped with a $5BN fine.

More importantly for Android rivals Google was also ordered to change its practices — leading to amended licensing terms for the platform in Europe last fall. And Pienimäki says Jolla was a “key contributor” to the Commission case against Android.

European competition commissioner Margrethe Vestager, on April 15, 2015 in Brussels, as the Commission said it would open an antitrust investigation into Google’s Android operating system. (Photo credit: JOHN THYS/AFP/Getty Images)

The new Android licensing terms make it (at least theoretically) possible for new types of less-heavily-Google-flavored Android devices to be developed for Europe. Though there have been complaints the licensing tweaks don’t go far enough to reset Google’s competitive Android advantage.

Asked whether Jolla has seen any positive impacts on its business following the Commission’s antitrust decision, Pienimäki responds positively, recounting how — “one or two weeks after the ruling” — Jolla received an inbound enquiry from a company in France that had felt hamstrung by Google requiring its services to be bundled with Android but was now hoping “to realize a project in a special sector”.

The company, which he isn’t disclosing at this stage, is interested in “using Sailfish and then having selected Android applications running in Sailfish but no connection with the Google services”.

“We’ve been there for five years helping the European Union authorities [to build the case] and explain how difficult it is to create competitive solutions in the smartphone market in general,” he continues. “Be it consumer or be it anything else. That’s definitely important for us and I don’t see this at all limited to the consumer sector. The very same thing has been a problem for corporate clients, for companies who provide specialized mobile device solutions for different kind of corporations and even governments.”

While he couches the Android ruling as a “very important” moment for Jolla’s business last year, he also says he hopes the Commission will intervene further to level the smartphone playing field.

“What I’m after here, and what I would really love to see, is that within the European Union we utilize Linux-based, open platform solution which is made in Europe,” he says. “That’s why we’ve been pushing this [antitrust action]. This is part of that. But in bigger scheme this is very good.”

He is also very happy with Europe’s General Data Protection Regulation (GDPR) — which came into force last May, plugging in a long overdue update to the bloc’s privacy rules with a much beefed up enforcement regime.

GDPR has been good for Jolla’s business, according to Pienimäki, who says interest is flowing its way from customers who now perceive a risk to using Android if customer data flows outside Europe and they cannot guarantee adequate privacy protections are in place.

“Already last spring… we have had plenty of different customer discussions with European companies who are really afraid that ‘hey I cannot offer this solution to my government or to my corporate customer in my country because I cannot guarantee if I use Android that this data doesn’t go outside the European Union’,” he says.

“You can’t indemnify in a way that. And that’s been really good for us as well.”

Powered by WPeMatico

Venture investors are pouring billions of dollars into feeding their hunger for food and agriculture startups. Whether that trend line is due to enthusiasm for the sector or just broader heavy investing in the VC space is much less clear.

According to a recent report published by AgFunder – a VC and investing marketplace focused on the agriculture and food sectors – the “AgriFood” space is booming. Using data from Crunchbase and several other data partners, the organization published its “2018 AgriFood Tech Investing Report” this morning, finding that investment in AgriFood companies increased 43% year-over-year, reaching $16.9 billion in 2018.

AgFunder classifies AgriFood tech as “the small but growing segment of the startup and venture capital universe that’s aiming to improve or disrupt the global food and agriculture industry.” Their definition is intentionally broad, encompassing everything from crop and livestock biotech, property management systems, and payments, to biomaterials and meat alternatives, all the way up to tech platforms for restaurants, grocers, deliveries and at-home cooks.

While some of the AgriFood tech categories – such as delivery or restaurant software – have long been popular destinations for venture capital, we’re now seeing a more diverse array of startups innovating across the entire food supply chain. According to the report, expansion in AgriFood is fairly consistent across upstream (agricultural and farming) subsectors to downstream (more consumer-facing) subsectors, with each group growing roughly 44% and 42% year-over-year respectively.

The data also shows growth occurring across almost all deal stages. AgriFood saw huge increases in the average deal size and total investment for late-stage companies in particular, as venture-backed startups have grown to global scale. And penetrating and attracting capital from international markets seems more feasible than ever. AgriFood investing, which traditionally has been largely US-centric, is rapidly becoming a global phenomenon, with more than half of total funding – and some of the largest rounds – now coming from companies and investors outside the US.

Powered by WPeMatico

5G kit maker Huawei opened a Cyber Security Transparency center in Brussels yesterday as the Chinese tech giant continues to try to neutralize suspicion in Western markets that its networking gear could be used for espionage by the Chinese state.

Huawei announced its plan to open a European transparency center last year but giving a speech at an opening ceremony for the center yesterday the company’s rotating CEO, Ken Hu, said: “Looking at the events from the past few months, it’s clear that this facility is now more critical than ever.”

Huawei said the center, which will demonstrate the company’s security solutions in areas including 5G, IoT and cloud, aims to provide a platform to enhance communication and “joint innovation” with all stakeholders, as well as providing a “technical verification and evaluation platform for our

customers”.

“Huawei will work with industry partners to explore and promote the development of security standards and verification mechanisms, to facilitate technological innovation in cyber security across the industry,” it said in a press release.

“To build a trustworthy environment, we need to work together,” Hu also said in his speech. “Both trust and distrust should be based on facts, not feelings, not speculation, and not baseless rumour.

“We believe that facts must be verifiable, and verification must be based on standards. So, to start, we need to work together on unified standards. Based on a common set of standards, technical verification and legal verification can lay the foundation for building trust. This must be a collaborative effort, because no single vendor, government, or telco operator can do it alone.”

The company made a similar plea at Mobile World Congress last week when its rotating chairman, Guo Ping, used a keynote speech to claim its kit is secure and will never contain backdoors. He also pressed the telco industry to work together on creating standards and structures to enable trust.

“Government and the mobile operators should work together to agree what this assurance testing and certification rating for Europe will be,” he urged. “Let experts decide whether networks are safe or not.”

Also speaking at MWC last week the EC’s digital commissioner, Mariya Gabriel, suggested the executive is prepared to take steps to prevent security concerns at the EU Member State level from fragmenting 5G rollouts across the Single Market.

She told delegates at the flagship industry conference that Europe must have “a common approach to this challenge” and “we need to bring it on the table soon”.

Though she did not suggest exactly how the Commission might act.

A spokesman for the Commission confirmed that EC VP Andrus Ansip and Huawei’s Hu met in person yesterday to discuss issues around cybersecurity, 5G and the Digital Single Market — adding that the meeting was held at the request of Hu.

“The Vice-President emphasised that the EU is an open rules based market to all players who fulfil EU rules,” the spokesman told us. “Specific concerns by European citizens should be addressed. We have rules in place which address security issues. We have EU procurement rules in place, and we have the investment screening proposal to protect European interests.”

“The VP also mentioned the need for reciprocity in respective market openness,” he added, further noting: “The College of the European Commission will hold today an orientation debate on China where this issue will come back.”

In a tweet following the meeting Ansip also said: “Agreed that understanding local security concerns, being open and transparent, and cooperating with countries and regulators would be preconditions for increasing trust in the context of 5G security.”

Met with @Huawei rotating CEO Ken Hu to discuss #5G and #cybersecurity.

Agreed that understanding local security concerns, being open and transparent, and cooperating with countries and regulators would be preconditions for increasing trust in the context of 5G security. pic.twitter.com/ltATdnnzvL

— Andrus Ansip (@Ansip_EU) March 4, 2019

Reuters reports Hu saying the pair had discussed the possibility of setting up a cybersecurity standard along the lines of Europe’s updated privacy framework, the General Data Protection Regulation (GDPR).

Although the Commission did not respond when we asked it to confirm that discussion point.

GDPR was multiple years in the making and before European institutions had agreed on a final text that could come into force. So if the Commission is keen to act “soon” — per Gabriel’s comments on 5G security — to fashion supportive guardrails for next-gen network rollouts a full blown regulation seems an unlikely template.

More likely GDPR is being used by Huawei as a byword for creating consensus around rules that work across an ecosystem of many players by providing standards that different businesses can latch on in an effort to keep moving.

Hu referenced GDPR directly in his speech yesterday, lauding it as “a shining example” of Europe’s “strong experience in driving unified standards and regulation” — so the company is clearly well-versed in how to flatter hosts.

“It sets clear standards, defines responsibilities for all parties, and applies equally to all companies operating in Europe,” he went on. “As a result, GDPR has become the golden standard for privacy protection around the world. We believe that European regulators can also lead the way on similar mechanisms for cyber security.”

Hu ended his speech with a further industry-wide plea, saying: “We also commit to working more closely with all stakeholders in Europe to build a system of trust based on objective facts and verification. This is the cornerstone of a secure digital environment for all.”

Huawei’s appetite to do business in Europe is not in doubt, though.

The question is whether Europe’s telcos and governments can be convinced to swallow any doubts they might have about spying risks and commit to working with the Chinese kit giant as they roll out a new generation of critical infrastructure.

Powered by WPeMatico

This year’s Mobile World Congress — the CES for Android device makers — was awash with 5G handsets.

The world’s No.1 smartphone seller by marketshare, Samsung, got out ahead with a standalone launch event in San Francisco, showing off two 5G devices, just before fast-following Android rivals popped out their own 5G phones at launch events across Barcelona this week.

We’ve rounded up all these 5G handset launches here. Prices range from an eye-popping $2,600 for Huawei’s foldable phabet-to-tablet Mate X — and an equally eye-watering $1,980 for Samsung’s Galaxy Fold; another 5G handset that bends — to a rather more reasonable $680 for Xiaomi’s Mi Mix 3 5G, albeit the device is otherwise mid-tier. Other prices for 5G phones announced this week remain tbc.

Android OEMs are clearly hoping the hype around next-gen mobile networks can work a little marketing magic and kick-start stalled smartphone growth. Especially with reports suggesting Apple won’t launch a 5G iPhone until at least next year. So 5G is a space Android OEMs alone get to own for a while.

Chipmaker Qualcomm, which is embroiled in a bitter patent battle with Apple, was also on stage in Barcelona to support Xiaomi’s 5G phone launch — loudly claiming the next-gen tech is coming fast and will enhance “everything”.

“We like to work with companies like Xiaomi to take risks,” lavished Qualcomm’s president Cristiano Amon upon his hosts, using 5G uptake to jibe at Apple by implication. “When we look at the opportunity ahead of us for 5G we see an opportunity to create winners.”

Despite the heavy hype, Xiaomi’s on stage demo — which it claimed was the first live 5G video call outside China — seemed oddly staged and was not exactly lacking in latency.

“Real 5G — not fake 5G!” finished Donovan Sung, the Chinese OEM’s director of product management. As a 5G sales pitch it was all very underwhelming. Much more ‘so what’ than ‘must have’.

Whether 5G marketing hype alone will convince consumers it’s past time to upgrade seems highly unlikely.

Phones sell on features rather than connectivity per se, and — whatever Qualcomm claims — 5G is being soft-launched into the market by cash-constrained carriers whose boom times lie behind them, i.e. before over-the-top players had gobbled their messaging revenues and monopolized consumer eyeballs.

All of which makes 5G an incremental consumer upgrade proposition in the near to medium term.

Use-cases for the next-gen network tech, which is touted as able to support speeds up to 100x faster than LTE and deliver latency of just a few milliseconds (as well as connecting many more devices per cell site), are also still being formulated, let alone apps and services created to leverage 5G.

But selling a network upgrade to consumers by claiming the killer apps are going to be amazing but you just can’t show them any yet is as tough as trying to make theatre out of a marginally less janky video call.

“5G could potentially help [spark smartphone growth] in a couple of years as price points lower, and availability expands, but even that might not see growth rates similar to the transition to 3G and 4G,” suggests Carolina Milanesi, principal analyst at Creative Strategies, writing in a blog post discussing Samsung’s strategy with its latest device launches.

“This is not because 5G is not important, but because it is incremental when it comes to phones and it will be other devices that will deliver on experiences, we did not even think were possible. Consumers might end up, therefore, sharing their budget more than they did during the rise of smartphones.”

The ‘problem’ for 5G — if we can call it that — is that 4G/LTE networks are capably delivering all the stuff consumers love right now: Games, apps and video. Which means that for the vast majority of consumers there’s simply no reason to rush to shell out for a ‘5G-ready’ handset. Not if 5G is all the innovation it’s got going for it.

LG V50 ThinQ 5G with a dual screen accessory for gaming

Use cases such as better AR/VR are also a tough sell given how weak consumer demand has generally been on those fronts (with the odd branded exception).

The barebones reality is that commercial 5G networks are as rare as hen’s teeth right now, outside a few limited geographical locations in the U.S. and Asia. And 5G will remain a very patchy patchwork for the foreseeable future.

Indeed, it may take a very long time indeed to achieve nationwide coverage in many countries, if 5G even ends up stretching right to all those edges. (Alternative technologies do also exist which could help fill in gaps where the ROI just isn’t there for 5G.)

So again consumers buying phones with the puffed up idea of being able to tap into 5G right here, right now (Qualcomm claimed 2019 is going to be “the year of 5G!”) will find themselves limited to just a handful of urban locations around the world.

Analysts are clear that 5G rollouts, while coming, are going to be measured and targeted as carriers approach what’s touted as a multi-industry-transforming wireless technology cautiously, with an eye on their capex and while simultaneously trying to figure out how best to restructure their businesses to engage with all the partners they’ll need to forge business relations with, across industries, in order to successfully sell 5G’s transformative potential to all sorts of enterprises — and lock onto “the sweep spot where 5G makes sense”.

Enterprise rollouts therefore look likely to be prioritized over consumer 5G — as was the case for 5G launches in South Korea at the back end of last year.

“4G was a lot more driven by the consumer side and there was an understanding that you were going for national coverage that was never really a question and you were delivering on the data promise that 3G never really delivered… so there was a gap of technology that needed to be filled. With 5G it’s much less clear,” says Gartner’s Sylvain Fabre, discussing the tech’s hype and the reality with TechCrunch ahead of MWC.

“4G’s very good, you have multiple networks that are Gbps or more and that’s continuing to increase on the downlink with multiple carrier aggregation… and other densification schemes. So 5G doesn’t… have as gap as big to fill. It’s great but again it’s applicability of where it’s uniquely positioned is kind of like a very narrow niche at the moment.”

“It’s such a step change that the real power of 5G is actually in creating new business models using network slicing — allocation of particular aspects of the network to a particular use-case,” Forrester analyst Dan Bieler also tells us. “All of this requires some rethinking of what connectivity means for an enterprise customer or for the consumer.

“And telco sales people, the telco go-to-market approach is not based on selling use-cases, mostly — it’s selling technologies. So this is a significant shift for the average telco distribution channel to go through. And I would believe this will hold back a lot of the 5G ambitions for the medium term.”

To be clear, carriers are now actively kicking the tyres of 5G, after years of lead-in hype, and grappling with technical challenges around how best to upgrade their existing networks to add in and build out 5G.

Many are running pilots and testing what works and what doesn’t, such as where to place antennas to get the most reliable signal and so on. And a few have put a toe in the water with commercial launches (globally there are 23 networks with “some form of live 5G in their commercial networks” at this point, according to Fabre.)

But at the same time 5G network standards are yet to be fully finalized so the core technology is not 100% fully baked. And with it being early days “there’s still a long way to go before we have a real significant impact of 5G type of services”, as Bieler puts it.

There’s also spectrum availability to factor in and the cost of acquiring the necessary spectrum. As well as the time required to clear and prepare it for commercial use. (On spectrum, government policy is critical to making things happen quickly (or not). So that’s yet another factor moderating how quickly 5G networks can be built out.)

And despite some wishful thinking industry noises at MWC this week — calling for governments to ‘support digitization at scale’ by handing out spectrum for free (uhhhh, yeah right) — that’s really just whistling into the wind.

Rolling out 5G networks is undoubtedly going to be very expensive, at a time when carriers’ businesses are already faced with rising costs (from increasing data consumption) and subdued revenue growth forecasts.

“The world now works on data” and telcos are “at core of this change”, as one carrier CEO — Singtel’s Chua Sock Koong — put it in an MWC keynote in which she delved into the opportunities and challenges for operators “as we go from traditional connectivity to a new age of intelligent connectivity”.

Chua argued it will be difficult for carriers to compete “on the basis of connectivity alone” — suggesting operators will have to pivot their businesses to build out standalone business offerings selling all sorts of b2b services to support the digital transformations of other industries as part of the 5G promise — and that’s clearly going to suck up a lot of their time and mind for the foreseeable future.

In Europe alone estimates for the cost of rolling out 5G range between €300BN and €500BN (~$340BN-$570BN), according to Bieler. Figures that underline why 5G is going to grow slowly, and networks be built out thoughtfully; in the b2b space this means essentially on a case-by-case basis.

Simply put carriers must make the economics stack up. Which means no “huge enormous gambles with 5G”. And omnipresent ROI pressure pushing them to try to eke out a premium.

“A lot of the network equipment vendors have turned down the hype quite a bit,” Bieler continues. “If you compare this to the hype around 3G many years ago or 4G a couple of years ago 5G definitely comes across as a soft launch. Sort of an evolutionary type of technology. I have not come across a network equipment vendors these days who will say there will be a complete change in everything by 2020.”

On the consumer pricing front, carriers have also only just started to grapple with 5G business models. One early example is TC parent Verizon’s 5G home service — which positions the next-gen wireless tech as an alternative to fixed line broadband with discounts if you opt for a wireless smartphone data plan as well as 5G broadband.

From the consumer point of view, the carrier 5G business model conundrum boils down to: What is my carrier going to charge me for 5G? And early adopters of any technology tend to get stung on that front.

Although, in mobile, price premiums rarely stick around for long as carriers inexorably find they must ditch premiums to unlock scale — via consumer-friendly ‘all you can eat’ price plans.

Still, in the short term, carriers look likely to experiment with 5G pricing and bundles — basically seeing what they can make early adopters pay. But it’s still far from clear that people will pay a premium for better connectivity alone. And that again necessitates caution.

5G bundled with exclusive content might be one way carriers try to extract a premium from consumers. But without huge and/or compelling branded content inventory that risks being a too niche proposition too. And the more carriers split their 5G offers the more consumers might feel they don’t need to bother, and end up sticking with 4G for longer.

It’ll also clearly take time for a 5G ‘killer app’ to emerge in the consumer space. And such an app would likely need to still be able to fallback on 4G, again to ensure scale. So the 5G experience will really need to be compellingly different in order for the tech to sell itself.

On the handset side, 5G chipset hardware is also still in its first wave. At MWC this week Qualcomm announced a next-gen 5G modem, stepping up from last year’s Snapdragon 855 chipset — which it heavily touted as architected for 5G (though it doesn’t natively support 5G).

If you’re intending to buy and hold on to a 5G handset for a few years there’s thus a risk of early adopter burn at the chipset level — i.e. if you end up with a device with a suckier battery life vs later iterations of 5G hardware where more performance kinks have been ironed out.

Intel has warned its 5G modems won’t be in phones until next year — so, again, that suggests no 5G iPhones before 2020. And Apple is of course a great bellwether for mainstream consumer tech; the company only jumps in when it believes a technology is ready for prime time, rarely sooner. And if Cupertino feels 5G can wait, that’s going to be equally true for most consumers.

Zooming out, the specter of network security (and potential regulation) now looms very large indeed where 5G is concerned, thanks to East-West trade tensions injecting a strange new world of geopolitical uncertainty into an industry that’s never really had to grapple with this kind of business risk before.

Chinese kit maker Huawei’s rotating chairman, Guo Ping, used the opportunity of an MWC keynote to defend the company and its 5G solutions against U.S. claims its network tech could be repurposed by the Chinese state as a high tech conduit to spy on the West — literally telling delegates: “We don’t do bad things” and appealing to them to plainly to: “Please choose Huawei!”

Huawei rotating resident, Guo Ping, defends the security of its network kit on stage at MWC 2019

When established technology vendors are having to use a high profile industry conference to plead for trust it’s strange and uncertain times indeed.

In Europe it’s possible carriers’ 5G network kit choices could soon be regulated as a result of security concerns attached to Chinese suppliers. The European Commission suggested as much this week, saying in another MWC keynote that it’s preparing to step in try to prevent security concerns at the EU Member State level from fragmenting 5G rollouts across the bloc.

In an on stage Q&A Orange’s chairman and CEO, Stéphane Richard, couched the risk of destabilization of the 5G global supply chain as a “big concern”, adding: “It’s the first time we have such an important risk in our industry.”

Geopolitical security is thus another issue carriers are having to factor in as they make decisions about how quickly to make the leap to 5G. And holding off on upgrades, while regulators and other standards bodies try to figure out a trusted way forward, might seem the more sensible thing to do — potentially stalling 5G upgrades in the meanwhile.

Given all the uncertainties there’s certainly no reason for consumers to rush in.

Smartphone upgrade cycles have slowed globally for a reason. Mobile hardware is mature because it’s serving consumers very well. Handsets are both powerful and capable enough to last for years.

And while there’s no doubt 5G will change things radically in future, including for consumers — enabling many more devices to be connected and feeding back data, with the potential to deliver on the (much hyped but also still pretty nascent) ‘smart home’ concept — the early 5G sales pitch for consumers essentially boils down to more of the same.

“Over the next ten years 4G will phase out. The question is how fast that happens in the meantime and again I think that will happen slower than in early times because [with 5G] you don’t come into a vacuum, you don’t fill a big gap,” suggests Gartner’s Fabre. “4G’s great, it’s getting better, wi’fi’s getting better… The story of let’s build a big national network to do 5G at scale [for all] that’s just not happening.”

“I think we’ll start very, very simple,” he adds of the 5G consumer proposition. “Things like caching data or simply doing more broadband faster. So more of the same.

“It’ll be great though. But you’ll still be watching Netflix and maybe there’ll be a couple of apps that come up… Maybe some more interactive collaboration or what have you. But we know these things are being used today by enterprises and consumers and they’ll continue to be used.”

So — in sum — the 5G mantra for the sensible consumer is really ‘wait and see’.

Powered by WPeMatico

A Chinese startup that’s taking a dorm-like approach to urban housing just raised $500 million as its valuation jumped over $2 billion. Danke Apartment, whose name means “eggshell” in Chinese, closed the Series C round led by returning investor Tiger Global Management and newcomer Ant Financial, Alibaba’s e-payment and financial affiliate controlled by Jack Ma.

Four years ago, Beijing-based Danke set out with a mission to provide more affordable housing for young Chinese working in large urban centers. It applies the co-working concept to housing by renting apartments that come renovated and fully furnished, a model not unlike that of WeWork’s WeLive. The idea is by slicing up a flat designed for a family of three to four — the more common type of urban housing in China — into smaller units, young professionals can afford to live in nicer neighborhoods as Danke takes care of hassles like housekeeping and maintenance. To date, the startup has set foot in 10 major Chinese cities.

With the new funds, Danke plans to upgrade its data processing system that deals with rental transactions. Housing prices are set by AI-driven algorithms that take into account market forces such as locations rather than rely on the hunches of a real estate agent. The more data it gleans, the smarter the system becomes. That layout is the engine of the startup, which believes an internet platform play is a win-win for both homeowners and tenants because it provides greater transparency and efficiency while allowing the company to scale faster.

“We are focused on business intelligence from day one,” Danke’s angel investor and chairman Derek Shen told TechCrunch in an interview. Shen was the former president of LinkedIn China and was instrumental in helping the professional networking site enter the country. “By doing so we are eliminating the need to set up offline retail outlets and are able to speed up the decision-making process. What landlords normally care is who will be the first to rent out their property. The model is also copyable because it requires less manpower.”

“We’ve proven that the rental housing business can be decentralized and done online,” added Shen.

Photo: Danke Apartment via Weibo

Danke doesn’t just want to digitize the market it’s after. Half of the company’s core members have hailed from Nuomi, the local services startup that Shen founded and was sold to Baidu for $3.2 billion back in 2015. Having worked for a business whose mission was to let users explore and hire offline services from their connected devices, these executives developed a propensity to digitize all business aspects, including Danke’s day-to-day operations, a scheme that will also take up some of the new funds. This will allow Danke to “boost operational efficiency and cut costs” as it “actively works with the government to stabilize rental prices in the housing market,” the company says.

The rest of the proceeds will go toward improving the quality of Danke’s apartment amenities and tenant experiences, a segment that Shen believes will see great revenue potential down the road, akin to how WeWork touts software services to enterprises. The money will also enable Danke, which currently zeroes in on office workers and recent college graduates, to explore the emerging housing market for blue-collar workers.

Other investors from the round include new backer Primavera Capital and existing investors CMC Capital, Gaorong Capital and Joy Capital.

China’s rental housing market has boomed in recent years as Beijing pledges to promote affordable apartments in a country where few have the money to buy property. As President Xi Jinping often stresses, “houses are for living in, not for speculation.” As such, investors and entrepreneurs have been piling into the rental flat market, but that fervor has also created unexpected risks.

One much-criticized byproduct is the development of so-called “rental loans.” It goes like this: Housing operators would obtain loans in tenants’ names from banks or other lending institutions allegedly by obscuring relevant details from contracts. So when a tenant signs an agreement that they think binds them to rents, they have in fact agreed to take on loans and their “rent” payments become monthly loan repayments.

Housing operators are keen to embrace such practices because the loans provide working capital for renovation and their pipeline of properties. On the other hand, the capital allows companies like Danke to lower deposits for cash-strapped young tenants. “There’s nothing wrong with the financial instrument itself,” suggested Shen. “The real issue is when the housing operator struggles to repay, so the key is to make sure the business is well-functioning.”

Danke, alongside competitors Ziroom and 5I5J, has drawn fire for not fully informing tenants when signing contracts. Shen said his company is actively working to increase transparency. “We will make it clear to customers that what they are signing are loans. As long as we give them enough notice, there should be little risk involved.”

Powered by WPeMatico

SoftBank’s Vision Fund is taking a bet on China’s auto market after it agreed to pour $1.5 billion into online car trading group Chehaoduo, which literally means “many cars” in Chinese.

The Beijing-based company operates two main sites — peer-to-peer online marketplace Guazi for used vehicles, and Maodou, which retails new sedans through direct sales and financial leasing. (These sub-brands are more subtly named; they translate to “sunflower seeds” and “edamame,” respectively.)

Chehaoduo said it will deploy the proceeds on technology investments as well as the development of new products and services. It also plans to ramp up its marketing efforts and continue to open brick-and-mortar stores, an omnichannel move it believes can enhance trust in consumers used to meeting dealers in person and differentiate it from peers with an exclusively online focus. Chehaoduo currently runs 600 offline stores nationwide supporting new and used car dealing along with after-sales services.

The sizable funding round arrived at a time when China’s softening economy is sapping consumer confidence, but the company’s two-pronged strategy makes sure it covers a broad range of consumer demands. New passenger car sales in China — the world’s largest auto market — fell for the first time since the 1990s to 23.7 million units last year, according to a report by China’s Association of Automobile Manufacturers, the country’s top auto association.

On the other hand, used cars became a more economical choice in a consumer culture that, unlike many countries in the west, has been slow to embrace second-hand goods. But that mindset is shifting as people feel the heat of the Chinese economic downturn: Secondhand car sales were up 13 percent during the first 11 months of 2018, data from China’s Automobile Dealers Association show.

“China’s used car market is growing rapidly but online penetration remains low and auto financing is underutilized compared to developed markets. In just three years, Chehaoduo Group, through the Guazi brand, has leveraged the latest innovations in data-driven technology to establish China’s leading car trading platform,” says Eric Chen, partner at SoftBank’s Investment Advisers, in a statement.

The Japanese investment group has been a prolific backer in the mobility industry through a variety of affiliated companies with Vision Fund being one. SoftBank’s massive portfolio includes the likes of Uber, Didi Chuxing and Grab .

Chehaoduo counts Uxin and Renrenche as its most serious rivals. Uxin raised $225 million from a U.S. initial public offering last June while Renrenche lured Goldman Sachs in a $300 million funding round last year that also saw participation from Didi and Tencent.

Powered by WPeMatico

NetEase, China’s second-biggest online games publisher with a growing ecommerce segment, is laying off a significant number of its employees, adding to a list of Chinese tech giants that have shed staff following the Lunar New Year.

A NetEase employee who was recently let go confirmed with TechCrunch that the company had fired a large number of people spanning multiple departments, including ecommerce, education, agriculture (yes, founder and executive officer Ding Lei has a thing for organic farming) and public relations, although downsizing at Yanxuan, its ecommerce brand that sells private-label goods online and offline, had started before the Lunar New Year holiday.

Multiple Chinese media outlets covered the layoff on Wednesday. According to a report from Caijing Magazine, Yanxuan fired 30-40 percent of its staff; the agricultural brand Weiyang got a 50 percent cut; the education unit downsized from 300 to 200 employees; and 40 percent of NetEase’s public relations staff was gone.

A spokesperson from NetEase evaded TechCrunch’s questions about the layoff but said the company is “indeed undergoing a structural optimization to narrow its focus.” The goal, according to the person, is to “boost innovation and organizational efficiency so NetEase can fully play to its own strengths and adapt to market competition in the longer term.”

NetEase CEO Ding Lei pictured picking Longjing tea leaves in Hangzhou. Photo: NetEase Yanxuan via Weibo

Oddly, ecommerce and education appear to be some of NetEase’s brighter spots. The company singled them out alongside music streaming during its latest earnings call as the three sectors that saw “strong profit growth potential” and “will be the focus of [the company’s] next phase of strategic growth.” The staff cuts, then, may represent an urgency to tighten the purse strings for even NetEase’s rosiest businesses.

The shakeup fits into market speculation about company staff cuts to save costs as China copes with a weakening domestic economy. JD.com, a rival to Alibaba, is firing 10 percent of its senior management to cut costs, Caixin reported last week. Ride-hailing giant Didi Chuxing plans to let go 15 percent of its staff this year as part of a reorganization to boost internal efficiency, though it’s adding new members to focus on more promising segments.

Alibaba took an unexpected turn, announcing last week that it will continue to hire new talent in 2019. “We are poised to provide more resources to our platforms to help businesses navigate current environment and create more job opportunities overall,” the firm said in a statement.

2018 was a tough year for China’s games companies of all sorts. The industry took a hit after regulators froze all licensing approvals to go through a reshuffle, dragging down stock prices of big players like Tencent and NetEase. These companies continue to feel the chill even after approvals resumed, as the newly minted regulatory body imposes stricter checks on games, slowing down the application process altogether and delaying companies’ plans to monetize lucrative new titles.

That bleak domestic outlook compelled NetEase to take what Ding dubs a “two-legged” approach to game publishing, with one foot set in China and the other extending abroad. Tencent, too, has been finding new channels for its games through regional partners like Sea’s Garena in Southeast Asia.

NetEase started in 1997 and earned its name by making PC games and providing email services in the early years of the Chinese internet. More recently the company has intended to diversify its business by incubating projects across the board. It has so far enjoyed growth in segments like music streaming and ecommerce (which is reportedly swallowing up Amazon China’s import-led service) while stepping back from others such as comics publishing, an asset it is selling to youth-focused video streaming site Bilibili.

Powered by WPeMatico