Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Google’s Gradient Ventures, the search giant’s dedicated AI fund, is casting its eye to Asia after it led a $7 million Series A round for Elsa, a startup that operates an app for English language learners.

The deal is Gradient’s first in Asia, and it includes participation from existing investors Monk’s Hill Ventures and SOSV. Elsa has now raised $12 million to date.

Elsa was founded in 2015 as a way to help non-English speakers improve their accent and general speaking ability. Vu Van, CEO and one half of the founding team, is a Vietnamese national who, despite being fluent in English, struggled to be understood after moving to the U.S. to study and then work. Together with speech recognition researcher Dr. Xavier Anguera — the startup’s CTO who leads its Portugal-based tech team — Van started Elsa to help people in the same predicament.

“I was very good at grammar, reading and writing but I realized people had a hard time understanding me because I had a very strong accent and my pronunciation wasn’t proper,” Van, who is based in San Francisco but travels extensively, told TechCrunch in an interview. “This impacts confidence when you apply for jobs or are even just meeting friends.”

“There are so many English learning solutions but they are mostly focused on expanding vocabulary or grammar, very few deal with pronunciation,” she added.

Elsa uses voice recognition and AI to grade a user’s speaking versus standard American English (and I thought us Brits were the global standard…) giving them a score at the end. That helps track their progress, while it focuses on pronunciation with a detailed review on how a user is speaking.

The service uses a freemium model that grants users full access to 1,000 courses for around $3-6 per month depending on the length of the package they select. That ranges from one month of access to 12 months. New content is added every week, Van said.

With this money in the bag, Elsa is going after growth in a number of its most promising markets.

The service has users in more than 100 countries, but Vietnam is its top market, with two million paying users. Partly because it is Van’s home market, Elsa has doubled down on Vietnam with a local sales team and localized payments, including the likes of bank transfers and local wallets.

That’s the blueprint for expansion in its next three target countries: Japan, Indonesia and India. Elsa has opened an office in Tokyo and is planning to introduce more localized content for Japanese users. Similar efforts will happen in Indonesia and India, where Van said the app sees strong engagement and downloads without any paid marketing efforts.

Elsa is also working on expanding its content from English to include other languages. Spanish is currently on the horizon and the company is already preparing the back-end technology to make it possible.

“We have to build the voice recognition technology to recognize those languages accurately. We have the infrastructure but now just need to collect voice data to train the model,” explained Van.

Vu Van started Elsa in 2015 with Dr. Xavier Anguera to help non-English speakers improve their accent and general speaking ability.

Beyond geographic expansion, Elsa is also going after schools and classrooms. Already, in Vietnam, it is working with a handful of schools that have added the app to their classroom work. The company allows schools to upload their specific content or curriculum to Elsa to make it part of a student’s homework or assessment. Teachers can see if a student has completed oral homework, and the app grades their efforts.

“We want to help these teachers help their students,” Van said. “Even with the best intentions, they simply can’t teach speaking.”

The model for the education push sees schools pay a licensing fee per student, which Van said is subsidized, while uploading their content is free.

Snagging investment from Gradient is a notable achievement for Elsa, but it will also allow the startup to tap into the company’s talent, too. That’s because Gradient operates a rotational program that allows Google employees to spend three to six months working at portfolio startups on secondment. That process hasn’t kicked off for Elsa just yet, but Van is hopeful of securing an engineer who might otherwise be prohibitively expensive for her company.

Gradient Ventures was founded in 2017 and this deal is the fund’s 18th, according to Crunchbase. Its previous investments include Canvass Analytics and Test.ai.

The Elsa team

Powered by WPeMatico

Huawei’s rotating chairman Guo Ping kicked off a keynote speech this morning at the world’s biggest mobile industry tradeshow with a wry joke. “There has never been more interest in Huawei,” he told delegates at Mobile World Congress. “We must be doing something right!”

The Chinese company is seeking to dispel suspicion around the security of its 5G network equipment which has been accelerated by U.S. president Trump who has been urging U.S. allies not to buy kit or services from Huawei. (And some, including Australia, have banned carriers from using Huawei kit.)

Last week Trump also tweet-shamed U.S. companies — saying they needed to step up their efforts to rollout 5G networks or “get left behind”.

In an MWC keynote speech yesterday the European Commission’s digital commissioner Mariya Gabriel signalled the executive is prepared to step in and regulate to ensure a “common approach” on the issue of network security — to avoid the risk of EU member states taking individual actions that could delay 5G rollouts across Europe.

Huawei appeared to welcome the prospect today.

“Government and the mobile operators should work together to agree what this assurance testing and certification rating for Europe will be,” said Guo, suggesting that’s Huawei’s hope for any Commission action on 5G security.

“Let experts decide whether networks are safe or not,” he added, implying Trump is the opposite of an expert. “Huawei has a strong track record in security for three decades. Serving three billion people around the world. The U.S. security accusation of our 5G has no evidence. Nothing.”

Geopolitical tensions about network security have translated into the biggest headache for Huawei which has positioned itself as a key vendor for 5G kit right as carriers are preparing to upgrade their existing cellular networks to the next-gen flavor.

Guo claimed today that Huawei is “the first company who can deploy 5G networks at scale”, giving a pitch for what he described as “powerful, simple and intelligent” next-gen network kit, while clearly enjoying the opportunity of being able to agree with U.S. president Trump in public — that “the U.S. needs powerful, faster and smarter 5G”.

But any competitive lead in next-gen network tech also puts the company in prime position for political blowback linked to espionage concerns related to the Chinese state’s access to data held or accessed by commercial companies.

Huawei’s strategy to counter this threat has been to come out fighting for its commercial business — and it had plenty more of that spirit on show this morning. As well as a bunch of in-jokes. Most notably a reference to NSA whistleblower Edward Snowden which drew a knowing ripple of laughter from the audience.

“We understand innovation is nothing without security,” said Guo, segwaying from making a sales pitch for Huawei’s 5G network solutions straight into the giant geopolitical security question looming over the conference.

“Prism, prism on the wall who is the most trustworthy of them all?” he said, throwing up a colorful slide to illustrate the joke. “It’s a very important question. And if you don’t ask them that you can go ask Edward Snowden.”

You can’t use “a crystal ball to manage cybersecurity”, Guo went on, dubbing it “a challenge we all share” and arguing that every player in the mobile industry has responsibility to defuse the network security issue — from kit vendors to carriers and standards bodies, as well as regulators.

“With 5G we have made a lot of progress over 4G and we can proudly say that 5G is safer than 4G. As a vendor we don’t operate carriers network, and we don’t all carry data. Our responsibility — what we promise — is that we don’t do anything bad,” he said. “We don’t do bad things.”

“Let me says this as clear as possible,” he went on, putting up another slide that literally underlined the point. “Huawei has not and will never plant backdoors. And we will never allow anyone to do so in our equipment.

“We take this responsibility very seriously.”

Guo’s pitch on network trust and security was to argue that where 5G networks are concerned security is a collective industry responsibility — which in turn means every player in the chain plays a monitoring role that allows for networks to be collectively trusted.

“Carriers are responsible for secure operations of their own networks. 5G networks are private networks. The boundary between different networks are clear. Carriers can prevent outside attacks with firewalls and security gateways. For internal threats carriers can manage, monitor and audit all vendors and partners to make sure their network elements are secure,” he said, going on to urge the industry to work together on standards which he described as “our shared responsibility”.

“To build safer networks we need to standardize cybersecurity requirements and these standards must be verifiable for all vendors and all carriers,” he said, adding that Huawei “fully supports” the work of industry standards and certification bodies the GSMA and 3GPP who he also claimed have “strong capabilities to verify 5G’s security”.

Huawei’s strategy to defuse geopolitical risk by appealing to the industry as a whole to get behind tackling the network trust issue is a smart one given the uncertainty generated by Trump’s attacks is hardly being welcomed by anyone in the mobile business.

Huawei’s headache might lead to the industry as a whole catching a cold — and no one at MWC wants that.

Later in the keynote Guo also pointed to the awkward “irony” of the U.S Cloud Act — given the legislation allows U.S. entities to “access data across borders”.

U.S. overreach on accessing the personal data of foreign citizens continues to cause major legal headaches in Europe as a result of the clash between its national security interest and EU citizens fundamental privacy rights. So Guo’s point there won’t have been lost on an MWC audience packed with European delegates attending the annual tradeshow.

“So for best technology and greater security choose Huawei. Please choose Huawei!” Guo finished, ending his keynote with a line that could very well make it as an upbeat marketing slogan writ large on one of the myriad tech-packed booths here at Fira Gran Via, Barcelona.

Powered by WPeMatico

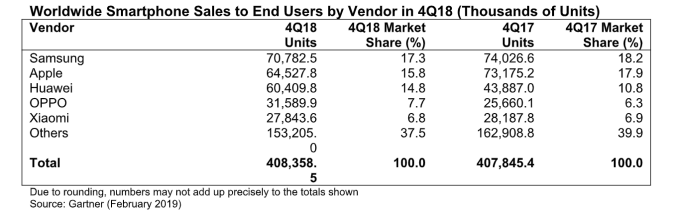

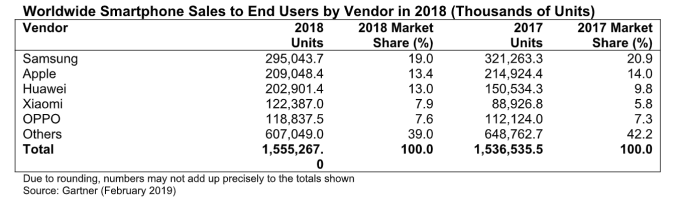

Gartner’s smartphone market share data for the just gone holiday quarter highlights the challenge for device makers going into the world’s biggest mobile trade show, which kicks off in Barcelona next week: The analyst’s data shows global smartphone sales stalled in Q4 2018, with growth of just 0.1 percent over 2017’s holiday quarter, and 408.4 million units shipped.

tl;dr: high-end handset buyers decided not to bother upgrading their shiny slabs of touch-sensitive glass.

Gartner says Apple recorded its worst quarterly decline (11.8 percent) since Q1 2016, though the iPhone maker retained its second place position with 15.8 percent market share behind market leader Samsung (17.3 percent). Last month the company warned investors to expect reduced revenue for its fiscal Q1 — and went on to report iPhone sales down 15 percent year over year.

The South Korean mobile maker also lost share year over year (declining around 5 percent), with Gartner noting that high-end devices such as the Galaxy S9, S9+ and Note 9 struggled to drive growth, even as Chinese rivals ate into its mid-tier share.

Huawei was one of the Android rivals causing a headache for Samsung. It bucked the declining share trend of major vendors to close the gap on Apple from its third-placed slot — selling more than 60 million smartphones in the holiday quarter and expanding its share from 10.8 percent in Q4 2017 to 14.8 percent.

Gartner has dubbed 2018 “the year of Huawei,” saying it achieved the top growth of the top five global smartphone vendors and grew throughout the year.

This growth was not just in Huawei “strongholds” of China and Europe, but also in Asia/Pacific, Latin America and the Middle East, via continued investment in those regions, the analyst noted. Its expanded mid-tier Honor series helped the company exploit growth opportunities in the second half of the year, “especially in emerging markets.”

By contrast, Apple’s double-digit decline made it the worst performer of the holiday quarter among the top five global smartphone vendors, with Gartner saying iPhone demand weakened in most regions, except North America and mature Asia/Pacific.

It said iPhone sales declined most in Greater China, where it found Apple’s market share dropped to 8.8 percent in Q4 (down from 14.6 percent in the corresponding quarter of 2017). For 2018 as a whole iPhone sales were down 2.7 percent, to just over 209 million units, it added.

“Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones. It also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple’s unit sales growth prospects,” said Gartner’s Anshul Gupta, senior research director, in a statement.

“Demand for entry-level and midprice smartphones remained strong across markets, but demand for high-end smartphones continued to slow in the fourth quarter of 2018. Slowing incremental innovation at the high end, coupled with price increases, deterred replacement decisions for high-end smartphones,” he added.

Further down the smartphone leaderboard, Chinese OEM, Oppo, grew its global smartphone market share in Q4 to bump Chinese upstart, Xiaomi, and bag fourth place — taking 7.7 percent versus Xiaomi’s 6.8 percent for the holiday quarter.

The latter had a generally flat Q4, with just a slight decline in units shipped, according to Gartner’s data — underlining Xiaomi’s motivations for teasing a dual folding smartphone.

Because, well, with eye-catching innovation stalled among the usual suspects (who’re nonetheless raising high-end handset prices), there’s at least an opportunity for buccaneering underdogs to smash through, grab attention and poach bored consumers.

Or that’s the theory. Consumer interest in “foldables” very much remains to be tested.

In 2018 as a whole, the analyst says global sales of smartphones to end users grew by 1.2 percent year over year, with 1.6 billion units shipped.

The worst declines of the year were in North America, mature Asia/Pacific and Greater China (6.8 percent, 3.4 percent and 3.0 percent, respectively), it added.

“In mature markets, demand for smartphones largely relies on the appeal of flagship smartphones from the top three brands — Samsung, Apple and Huawei — and two of them recorded declines in 2018,” noted Gupta.

Overall, smartphone market leader Samsung took 19.0 percent market share in 2018, down from 20.9 percent in 2017; second-placed Apple took 13.4 percent (down from 14.0 percent in 2017); third-placed Huawei took 13.0 percent (up from 9.8 percent the year before); while Xiaomi, in fourth, took a 7.9 percent share (up from 5.8 percent); and Oppo came in fifth with 7.6 percent (up from 7.3 percent).

Powered by WPeMatico

Mobile World Congress, the mobile industry’s annual shindig, is next week, but Xiaomi can’t wait to reveal its newest top-end phone. The Chinese company instead picked today to unveil the Mi 9.

Once again Xiaomi’s design ethic closely resembles Apple’s iPhone, with a minimal bezel and notch-like front-facing camera, but Xiaomi has gone hard on photography with a triple lens camera.

There are two models available, with the regular Mi 9 priced from RMB 2,999, or $445, and the Mi 9SE priced from RMB 1,999, or $300. A premium model, the Transparent Edition, includes beefed-up specs for RMB 3,999, or $595.

The phone runs on Qualcomm’s Snapdragon 855 chipset and the headline feature, or at least the part that Xiaomi is shouting about most, is the triple lens camera array on the back of the device. That trio combines a 48-megapixel main camera with a 16-megapixel ultra-wide-angle camera and a 12-megapixel telephoto camera, Xiaomi said. The benefits of that lineup are improved wide-angle shots, better-quality close-up photography and performance in low-light conditions, according to the company.

The premium Mi 9 model, the Transparent Edition, sports 12GB of RAM and 256GB internal storage and features a transparent back cover

There’s also a “supermoon” mode for taking shots of the moon and presumably other night-sky images, while Xiaomi touts an improved night mode and, on the video side, 960fps capture and advanced motion tracking. We haven’t had the chance to test these out, which is worth noting at this point.

Xiaomi also talked up the battery features of the Mi 9, which ships with an impressive 3,300mAh battery that features wireless charging support and Qi EPP certification, meaning it will work with third-party charging mats. Xiaomi claims that the Mi 9 can charge to 70 percent in 30 minutes, and reach 100 percent in an hour using 27W wired charging.

Alongside the Mi 9, it unveiled its three wireless charging products — a charging pad (RMB 99, $15), a car charger (RMB 169, $25) and a 10,000mAh wireless power bank (RMB 149, $22.)

Xiaomi, as ever, offers a range of different options for customers, as follows:

Notably, the Mi 9 goes on sale February 26 — pre-orders open this evening — with the SE version arriving on March 1. As expected, the launch market is China but you can imagine that India — where Xiaomi is among the top players — and other global launches will follow.

Xiaomi said it plans to announce more products on Sunday, the eve of Mobile World Congress. It recently teased a foldable phone, so it’ll be interesting to see if it will follow suit and join Samsung, which had its first foldable phone outed by a leak.

Note: The original version of this article was updated to correct the Transparent Edition price and specs.

Powered by WPeMatico

While Amazon has been methodical (read: a little slow) in launching local versions of its site for various global markets, it has now embarked on a secondary track to snag more business outside the 14 countries where it has built out full operations.

Amazon has partnered with Western Union to set up a service called PayCode, which lets people shop and pay for Amazon items using local currencies that would not have been accepted on the site before, starting with services in 10 countries: Chile, Columbia, Hong Kong, Indonesia, Kenya, Malaysia, Peru, Philippines, Taiwan and Thailand.

Specifically, shoppers in these markets will now be able to go into Western Union outposts and pay for their Amazon purchases in cash, which also means that payment cards or other virtual payment methods will also not be required to buy from Amazon — one of the barriers to expanding the service up to now into more emerging economies, where card and bank account penetration is much lower than in developed markets like the U.S. and Europe.

“Amazon is committed to enabling customers anywhere in the world to shop on Amazon.com, and a big part of that is to allow customers to pay for their cross-border online purchases in a way that is most convenient for them,” said Ben Volk, director, Payment Acceptance and Experience at Amazon, in a statement. “Amazon PayCode leverages the reach of Western Union to make cross-border online shopping a reliable and convenient experience for customers who do not have access to international credit cards, or prefer to pay in cash.”

In terms of what they will be able to buy, people can shop across the breadth of the Amazon marketplace, but Amazon notes that they will only be able to use PayCode if it’s offered as an option at checkout (which will only happen in the markets where PayCode is supported); if the item that is chosen is “export eligible,” and if the item’s value “exceeds the maximum value allowed for use on this payment type” — although Amazon doesn’t appear to specify what that maximum value is. Once you complete the purchase online (or possibly more likely, on mobile), you get a “PayCode” QR code that you will have 48 hours to take to a Western Union to pay for the goods; otherwise your order gets cancelled.

The deal between Amazon and Western Union was initially announced last October, with very little detail and fanfare. The PayCode name then appeared to leak out a month later around what appeared to be a test in India (where it has not launched… yet). Today was the first time that the companies unveiled the first launch countries.

PayCode is a significant advance for Amazon as it seeks to step up to the next level of being a global e-commerce powerhouse to compete against the likes of Alibaba.

The latter company has made a lot of inroads to work in a wider array of markets beyond its home base of China, specifically tapping into a long tail of supply from its home market and demand for those goods abroad. Alibaba is also taking care of business when it comes to making more seamless transactions related to those trades. Just today, its financial services affiliate Ant Financial announced that it would acquire U.K.’s WorldFirst, which provides foreign money transfer for businesses and individuals, for a price that we heard from sources was in the region of $700 million.

Amazon currently operates 15 Amazon websites globally: in the U.S., U.K., Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Netherlands, Spain and Turkey. (It appears also to have a Prime-only site in Singapore.) Up to now, these would have been the only countries where Amazon would offer goods in local currencies.

Adding a new tranche of countries using PayCode will potentially massively expand how many people can shop on Amazon without Amazon going through the steps of setting up full-fledged operations in those countries to serve those consumers and sellers. (Or, this being Amazon, this would be a key way for the company to start testing the waters to figure out which market might do best with a full-fledged store.) Over time, you might imagine that Amazon might extend PayCode to markets where it has sites, too, to give shoppers more flexibility in how they pay for goods for themselves or that they are buying for others.

It’s a big market opportunity. Amazon cites estimates from Forrester Research that say cross-border shopping will represent 20 percent of e-commerce by 2022, accounting for $630 billion.

For Western Union, this is a potentially big partnership, too.

Today, PayCode allows people to use Western Union to act as a physical pay station for their Amazon goods, giving Western Union a small cut on those transactions. But you might imagine how this could evolve over time, where remittances sent from family members abroad via Western Union — a very common use of remittance networks — might immediately get redeemed to cover purchases on Amazon.

Similarly, Western Union is working closer with MPesa, the African mobile wallet service that lets people essentially use their phone top-up account as a payment account, and you could imagine how this too could get incorporated into the PayCode experience to facilitate buying and paying on devices, without having to go into Western Union shops and use actual cash.

“We’re helping to unlock access to Amazon.com for customers who need and want items that can only be found online in many parts of the world,” said Khalid Fellahi, SVP and General Manager of Western Union Digital, in a statement. “This is a great example of two global brands innovating and collaborating to bring customers more convenience and choice. In a world where cross-border buyers and sellers are often located on different continents and in completely different financial ecosystems, our platform is ideally suited to solving the complexity of collecting local currency and converting it into whatever currency merchants need on the other end.”

Powered by WPeMatico

Wattpad’s ambitions to grow beyond a storytelling community for young adults took another leap forward today with the announcement of a new partnership that will help expand its reach in Asia. The company has teamed up with Huayi Brothers in Korea, which will now be Wattpad’s exclusive entertainment partner in the region. The two companies will co-produce content sourced from Wattpad’s community as it’s adapted for film, TV and other digital media projects in the country.

Development deals like this are not new to Wattpad at this point.

In the U.S., the storytelling app made headlines for bringing to Netflix the teen hit “The Kissing Booth,” which shot up to become the No. 4 movie on IMDb for a time.

Wattpad also recently announced a second season for “Light as a Feather,” which it produces with AwesomenessTV and Grammnet for Hulu.

It additionally works with eOne, Sony, SYFY, Universal Cable Productions (a division of NBCUniversal) and Germany’s Bavaria Fiction.

Outside the U.S., Wattpad has 26 films in development with iflix in Indonesia.

And WattPad’s feature film “After,” based on Anna Todd’s novel, will arrive in theaters on April 12.

Key to these deals is Wattpad’s ability to source the best content from the 565 million stories on its platform. Do to so, it uses something it calls its “Story DNA Machine Learning technology,” which helps to deconstruct stories by analyzing things like sentence structure, word use, grammar and more in order to help identify the next big hits using more than just readership numbers alone.

The stories it identifies as promising are then sent over to content specialists (aka human editors) for further review.

This same combination of tech and human curation has been used in the past to help source its writing award winners and is now being used to find the next stories to be turned into novels for its new U.S. publishing arm, Wattpad Books.

In addition to its hit-finding technology, studios working with Wattpad also have a way to reach younger users who today are often out of touch with traditional media, as much of youth culture has shifted online.

These days, teens and young adults are more likely to know YouTube stars than Hollywood actors. They’re consuming content online in communities like Reddit, TikTok, Instagram, YouTube, Twitter and elsewhere. And when it comes to reading, they’re doing more of that online, too — whether that’s through chat fiction apps like Hooked or by reading Wattpad’s longer stories.

Wattpad says it now has 70 million users worldwide, who now spend 22 billion combined minutes per month engaged with its website and app.

Wattpad says it now has 70 million users worldwide, who now spend 22 billion combined minutes per month engaged with its website and app.

With the Korean deal, Wattpad is further growing its international footprint after several other moves focused on its international expansions.

For example, today’s news follows Wattpad’s raise of $51 million in funding from Tencent; its appointment of its first Head of Asia for Wattpad Studios, Dexter Ong, last year; and its hiring of its first GM of India, Devashish Sharma, who is working with local partners to turn its stories into movies, TV, digital and print in the region.

Huayi Brothers Korea hasn’t announced any specific projects from the Wattpad deal at this point, but those will follow.

“Wattpad’s model is the future of entertainment, using technology to find great storytellers and bring them to an international audience,” said, Jay Ji, CEO, Huayi Brothers Korea, in a statement. “In an era of entertainment abundance, working with Wattpad means access to the most important things in the industry: a data-backed approach to development, and powerful, proven stories that audiences have already fall in love with,” he said.

Powered by WPeMatico

One of China’s top smartphone brands Vivo appears to have joined its fellows Oppo, Huawei and Xiaomi in setting up a new sub-brand as a softening market and heightened competition at home drive players to venture upon their original reach.

A new smartphone brand called iQoo made its debut on Weibo, China’s answer to Twitter, on Tuesday by greeting in English: “Hello, this is iQoo.” It also playfully encouraged people to guess how its name is pronounced, as the spelling doesn’t resonate with either Chinese or English speakers. Vivo immediately reposted iQoo’s message, calling iQoo a “new friend.”

Vivo has not further revealed its ties with iQoo, although the latter’s Weibo account is verified under Vivo’s corporate name. TechCrunch has contacted Vivo and will update the story when we have more information.

Screenshot of iQoo’s first Weibo post

Sub-brands have become a popular tactic for Chinese smartphone makers to lure new demographics without undermining and muddling their existing brand reputation. As the third-ranked player by shipments in 2018 according to research firm Counterpoint, Vivo is the only one in China’s top five smartphone companies without a subsidiary brand.

“Sub-brands can help fill the gap in parent companies,” Counterpoint’s research director James Yan told TechCrunch. “I think iQoo is a brand born for the gaming market, the online sales channel, or young consumers, similar to what Honor did to Huawei.”

Huawei cemented its top spot with solid growth in shipments last year by playing a two-pronged strategy. Its sub-brand Honor has its eyes on the mid-range and Huawei stays at the top end. Vivo’s sibling Oppo, which falls under the same electronics manufacturing outfit BBK, came up with an exclusively online brand Realme in 2018 to go after Xiaomi’s Redmi in India’s burgeoning smartphone market. Xiaomi pressed on by launching Poco for India’s high-tier market. To further solidify its multi-faceted approach, Redmi shed the Xiaomi branding in January to start operating as an independent brand focusing on cost efficiency.

These moves arrived as years of breakneck growth in China’s smartphone space comes to an end. Overall smartphone sales contracted 11 percent in 2018 according to Counterpoint, as users become more pragmatic and less likely to upgrade their handsets. Local players reacted swiftly by going global and introducing headline-grabbing features like Xiaomi’s folding screen and Honor’s pole-punch display, putting a squeeze on global players Apple and Samsung. In 2018, Huawei shored up a 25 percent market share to take the crown. Trailing behind was Oppo, Vivo, Xiaomi and Apple . Samsung plunged 67 percnet to take seventh place.

Powered by WPeMatico

Japanese messaging app company Line is pumping 20 billion JPY ($182 million) into its mobile payment business as it tries to turn things around following a challenging year in 2018.

The company announced the infusion into Line Pay, a subsidiary that it fully owns, in a filing that stated the new capital is “necessary funds for its future business operation.” No further details were provided.

The investment comes on the heels of Line’s latest financial report which saw it post a 5.79 billion JPY loss as revenue grew by 24 percent to reach 207.18 billion JPY in 2018. Line has long been a top money maker in the App Store, but its efforts to build out content around its messaging platform and games division have turned out to be expensive, with a job service, manga platform and e-commerce business among its ventures.

In addition to more content, payments are also seen as “glue” that can increase engagement within the Line ecosystem and its main messaging app.

The company is going after the cashless opportunity in Japan, where it is the dominant chat app with an estimated 50 million registered users. The country is notable for its continued use of cash, but the government is using the upcoming 2020 Olympic Games as an opportunity to move toward a digital future. Aside from its core Line Pay service, which sits inside the Line chat app, Line is introducing its own credit card with Visa and has gone after Chinese tourists through a tie-in with Tencent, the internet giant behind China’s top messaging app WeChat.

Outside of Japan, Line Pay is also available in Thailand (where it works with the Bangkok metro provider), Taiwan (where it counts two banks as partners) and Indonesia, which Line says are its next three largest markets in terms of user numbers. Together, across those four countries, Line claims it has 165 million monthly active users and 40 million registered Line Pay users. Line said GMV reached 55 billion JPY ($482 million) per month back in November 2017; there’s been no update since.

The service was launched more widely but it has shuttered in other markets, including Singapore where it was ended in February 2018.

Beyond payment, Line is also moving into banking and financial services. It is working to launch a digital bank in Japan and last year it announced plans to investigate the potential to roll out loans, insurance and other services backed by its own cryptocurrency. While it didn’t hold an ICO — its “Link” token is earned or can be bought on exchanges — Line did dive into crypto in a major way, opening its own exchange and starting a crypto investment fund, too. With the bear market in full effect, and token valuations dropping by 90 percent across the board, we haven’t heard too much more from Line regarding its crypto plans.

Powered by WPeMatico

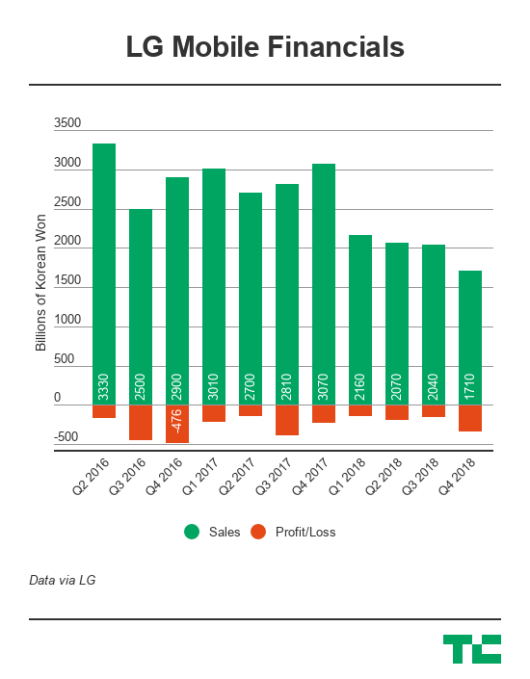

We’ve written extensively about LG’s struggling mobile business, which has suffered at the hands of aggressive Chinese Android makers, and now that unit has dragged its parent company into posting its first quarterly loss for two years.

The Korean electronics giant is generally in good health — it posted a $2.4 billion profit for 2018 — but its smartphone business’s failings saw it post a loss in Q4 2018, its first quarterly negative since Q4 2016.

Overall, the company posted a KRW 75.7 billion ($67.1 million) operating loss as revenue slid seven percent year-on-year to KRW 15.77 trillion ($13.99 billion). LG said the change was “primarily due to lower sales of mobile products.”

We’ve known for some time that LG’s mobile business is struggling — the division got another new head last November — but things went from bad to worse in Q4. LG Mobile saw revenue fall by 42 percent to reach KRW 1.71 trillion, $1.51 billion. The operating loss for the period grew to KRW 322.3 billion, or $289.8 million, from KRW 216.3 billion, $194 million, one year previous.

Over the full year, LG Mobile posted a $700 million loss (KRW 790.1 billion) but the company claimed things are improving thanks to “better material cost controls and overhead efficiencies based on the company’s platform modularization strategy.”

LG used CES to showcase a range of home entertainment products — that division is doing far better than mobile, with a record annual profit of $1.35 billion in 2018 — so we’ll have to wait until Mobile World Congress in February to see exactly what LG has in mind. Already, though, we have a suggestion, and it isn’t exactly set-the-world-on-fire stuff.

“LG’s mobile division will push 5G products and smartphones featuring different form factors while focusing on key markets where the LG brand remains strong,” the company said in a statement.

It will certainly take something very special to turn things around. It seems more likely that LG Mobile head Brian Kwon — who also heads up that hugely profitable home entertainment business — will focus on cutting costs and squeezing out the few sweet spots left. Continued losses, particularly against success from other units, might eventually see LG shutter its mobile business.

Still, things could be worse for LG — it could be HTC.

Powered by WPeMatico

Nintendo has cut its ambitious annual Switch sales forecast despite enjoying a strong Christmas Q3 quarter.

The Japanese games giant recorded a 104.21 billion JPY ($958 million) net profit on revenue of 608.39 billion JPY ($5.59 billion) between October and December 2018. Revenue was up 26 percent year-on-year, which is an impressive feature given that quarter was a successful one for Nintendo, yielding its biggest operating profit in a Q3 for eight years.

The Nintendo Switch is now closing down on lifetime sales of the N64. Nintendo shifted a record 9.41 million consoles during the three-month period, up 30 percent annually, to take it to 14.49 million this financial year, which began in April 2018. However, despite a success last quarter, likely helped in no small amount by Christmas, Nintendo has trimmed its ambitious goal to sell 20 million Switch units this financial year. Instead, the target is 17 million, which means it is estimating around 2.5 million sales during January, February and March.

In terms of games, a bunch of new releases performed well in the last quarter. Pokémon: Let’s Go sold million titles since its November release, Super Smash Bros. Ultimate sold 12.08 million since its December launch and Super Mario Party, released in October, reached 5.3 million sales. Total game sales jumped by 101 percent to reach 94.64 million sales during the period.

Nintendo’s retro consoles — the NES Classic and Super NES Classic — sold 5.83 million. But there is bad news for Nintendo loyalists, the upcoming Mario Kart Tour mobile game won’t ship in March — its revised launch date is this summer.

Powered by WPeMatico