Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

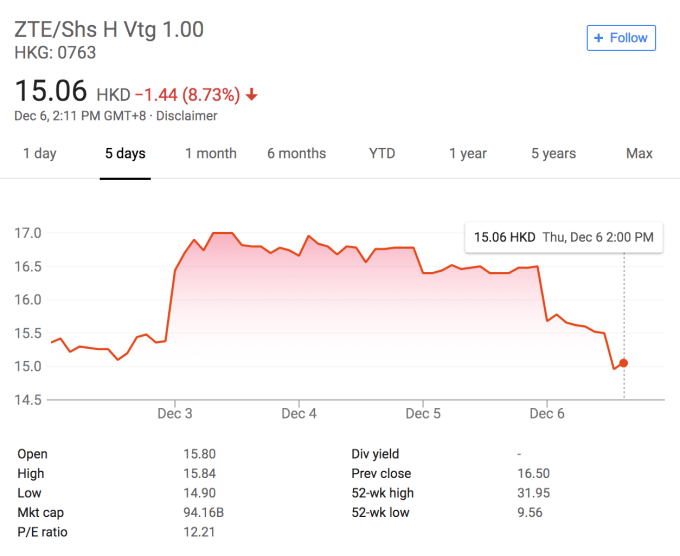

A string of Chinese stocks fell hard on Thursday after the arrest of Huawei’s chief financial officer Meng Wanzhou in Vancouver deepened concerns over U.S.-China trade tensions.

The Hang Seng China Enterprises Index of Chinese companies listed in Hong Kong was off 2.76 percent as of 12:40 p.m. On the Mainland side, the CSI 300 index of the top 300 stocks trading in Shanghai and Shenzhen fell 2.1 percent. The U.S. stock market is closed Wednesday to honor former U.S. President George H.W. Bush.

The crash arrived after Canadian officials detained Meng, daughter of Huawei’s founder and chief executive officer Ren Zhengfei, on suspicion that Huawei has violated American sanctions on Iran. Meng is facing extradition to the U.S.

Shares of Huawei’s main rival ZTE nose-dived nearly 6 percent in Hong Kong by midday. Meng’s news also hit the suppliers of employee-owned Huawei across the Asian stock markets. Among the worst performers is Shennan Circuit, which slipped nearly 10 percent in Shenzhen as of this writing.

Huawei and its main rival ZTE have been targets of the U.S. government that worries about the alleged ties between the telecom equipment makers and the Chinese government. The U.S.’s ban on ZTE sparks concerns that Huawei will face a similar fate. In April, the U.S. Department of Commerce announced a seven-year ban that would restrict American component makers from selling to ZTE, which in 2017 pleaded guilty to violating sanctions on Iran and North Korea.

Chinese stocks had been on a downward trend prior to Meng’s arrest as a result of rising U.S. tariffs over the last few months. In October, the Shanghai benchmark index dropped to a four-year low.

Updated with charts on HSCEI and ZTE.

Powered by WPeMatico

First some notes on SoftBank’s rumored expansion into China and its weird fund math, then Foxconn and then quick notes on tech depression, Huawei and more.

TechCrunch is experimenting with new content forms. This is a rough draft of something new — provide your feedback directly to the author (Danny at danny@techcrunch.com) if you like or hate something here.

Kane Wu at Reuters reported overnight that SoftBank is looking to open an office and hire an investment team in China, which Wu says will be based in Shanghai. That’s following the fund’s recent global expansion with new targeted offices in Saudi Arabia and India.

When I saw this, I sort of did a double-take: SoftBank doesn’t have a presence in China? The fund has reportedly been seeking investments in some of China’s leading unicorn stars, including controversial face recognition startup SenseTime, and leading edtech startup Zuoyebang (作业帮, which literally translates as “school assignment help”). (Hat-tips to Selina Wang at Bloomberg, who seems to just be sitting in Vision Fund partner meetings). And of course, it dumped a pretty penny into WeWork China, where it was part of a $500 million syndicate, and is a huge investor in Didi.

It’s sort of obvious that SoftBank would expand to China. What will be interesting though is to see how the fund structures itself long-term. As far as I know, the Vision Fund is a singular “fund” that invests worldwide (send me an email if I am wrong on this count). China has a thicket of regulations on funds and companies, which is one of several reasons we see specifically China-focused vehicles (such as Lightspeed and Lightspeed China or Sequoia and Sequoia China). If the Vision Fund continues to be a unified fund, that would be a notable strategy shift that might be cloned by other trans-Pacific funds.

Rajeev Misra, board director of SoftBank Group and CEO of SoftBank Investment Advisors. Photo by Drew Angerer/Getty Images.

When it first closed the Vision Fund, SoftBank explained they had raised just over $93 billion in committed capital or, more precisely, around $93.15-$93.2 billion, according to the initial investor presentations and its annual Form D filings. In those docs, SoftBank said that the fund was financed with $28 billion from SoftBank and $65 billion from third-party investors.

On top of the $93 billion raised for the Vision Fund, SoftBank detailed that it had committed $4.5 billion of its own capital to a separate “Delta Fund,” which was used to alleviate conflicts around SoftBank’s Didi investment. Thus, SoftBank’s total VC funding aggregates to around $97.7 billion.

To add a complication, SoftBank later shifted $1.6 billion of the Vision Fund’s previously disclosed $65 billion in third-party capital over to the Delta Fund. In current disclosures, SoftBank shows $91.7 billion of committed capital for the Vision Fund ($28.1 billion from SoftBank and $63.6 billion from third-party investors). For the Delta Fund, SoftBank shows $6 billion in committed capital ($4.5 billion SoftBank contribution and $1.6 billion from third-party investors).

Here is where it gets even more complicated. In its latest filings, SoftBank also notes that it completed the interim closing of an additional $5 billion for the Vision Fund in mid-October, “intended for the installment of an incentive scheme for operations of SoftBank Vision Fund.” That additional cash would bring Vision Fund’s total committed capital to $96.7 billion, and $102.7 billion together with the Delta Fund.

While it wouldn’t be included in the committed equity capital total, SoftBank is also rumored to be raising a $4 billion credit facility to help finance additional acquisitions.

So, it’s probably best to say that the Vision Fund — as constituted right now — is $97 billion or $96.7 billion with precision, assuming this $5 billion reaches a final close.

We have, of course, covered SoftBank quite obsessively, particularly its debt situation (Part 1, Part 2, Part 3, Part 4 and Part 5). What we haven’t covered more recently are the latest developments in SoftBank’s IPO, which is slated for December 19th and expected to bring in a haul of $21 billion. More to come on that front in the coming days.

U.S. President Donald Trump and Foxconn Chairman Terry Gou. BRENDAN SMIALOWSKI/AFP/Getty Images

The South China Morning Post reported yesterday that Foxconn is investigating expanding its factories to Vietnam in order to avoid tariffs. Makes sense, and I have some calls this week and next trying to suss out how much hardware supply chains have really changed in response to the trade conflict.

That decision though isn’t just about the trade conflict, but also about the quickly increasing wages of Chinese laborers, as well as political interference from Beijing. The Trump administration’s trade policies are just the excuse Foxconn needs to (at least partially) extricate itself from China, while saving face in the process.

What’s interesting is that Foxconn is also dealing with a massive brush fire in Wisconsin, where it received one of the largest economic development incentives ever offered by an American government, a whopping $3 billion package that was expected to drive manufacturing employment in the state.

Overnight, Republicans in the state legislature passed a bill that would place large restrictions on incoming Democratic governor Tony Evers. Jessie Opoien for the (Madison) Cap Times:

Under the bill, legislators would have increased influence over the Wisconsin Economic Development Corporation, and the WEDC board, not the governor, would appoint the job creation agency’s CEO. However, the governor’s power to appoint a CEO would be restored in September 2019.

That is the agency that provided the Foxconn funding, which has become a political football in Wisconsin politics. Republicans are trying to protect one of the major economic legacies of outgoing governor Scott Walker, as well as what they believe is the future direction of manufacturing work in the state. Democrats smell a boondoggle in the making.

If that wasn’t all, rumored skimpy sales for iPhones is putting enormous pressure on Foxconn’s bottom line. Debby Wu at Bloomberg reported two weeks ago that:

The contract manufacturer aims to cut 20 billion yuan ($2.9 billion) from expenses in 2019 as it faces “a very difficult and competitive year,” according to an internal document obtained by Bloomberg. The company’s spending in the past 12 months is about NT$206 billion ($6.7 billion).

Foxconn is a very dynamic organization that has weathered repeated crises over the years. It is pretty much unique in what it does today: very few other companies can scale up and down hundreds of thousands of workers to meet iPhone and other device demands with such alacrity.

But, the fundamentals of the mobile device market have apparently changed dramatically this year, and Foxconn is likely to be the company most harmed as the assembler of those devices. That could destroy not just the Chinese dream of leading in manufacturing, but also the Vietnam and Wisconsin dreams as well.

Also: If you haven’t read it, this poetry by a Foxconn worker who committed suicide really resonated with me. Foxconn’s suicide problem is well-documented, but we often don’t hear from the individuals themselves.

Blind, the anonymous enterprise chatting app that has taken the tech world by storm, published survey results asking tech employees “I believe I am depressed.” Roughly 40 percent of employees responded yes. Interestingly, there wasn’t too much variation between companies. Amazon had the highest rate at 43 percent and Apple had the lowest rate at 30 percent. It’s an informal survey, probably without high scientific validation, but it is a reminder for all of us in the community that mental health and burnout is very real in the startup and tech ecosystems and we should be vigilant in helping each other when times are rough.

This is one of those stories that we are just going to keep hearing about. After bans in Australia and New Zealand, British Telecom has announced they will not just ban Huawei’s 5G equipment, but also its 3G and 4G equipment. Britain, like Aus/NZ, Canada and the U.S., is part of the Five Eyes intelligence network, and national security officials have been leading the crusade against Huawei infrastructure. What’s interesting is not just the rapidity of the bans, but also that the bans haven’t (from what I have seen) migrated outside the Five Eyes community yet.

Raleigh skyline. Photo by James Willamor used under Creative Commons via Flickr.

Pendo is a digital product management platform that has had quite a bit of success with customers and has raised more than $100 million in VC funding, most recently a Series D from Sapphire. The company announced that they have received a grant from home state North Carolina’s economic development department to grow in the Raleigh region. Pendo is committing $34.5 million to its headquarters (with the potential of creating 590 jobs), while the state will offer around $8.8 million in potential reimbursements over the next 12 years.

Given what I wrote yesterday about Wes McKinney leaving NYC and heading to Nashville and the work Chattanooga is doing to aid startups, it’s great to see other hotspots like Raleigh, NC invest to build out their ecosystems in a compelling way.

Todd Olson, CEO of Pendo, explained to me by email that, “Office rents in our downtown are a fraction of the cost of operating in other cities, and the cost of living is appealing to our employees. They can afford to buy a house here. In some markets around the country, that is becoming more difficult. It’s also just a nice place to live and work.”

Creative work is increasingly going to have to find a lower-cost home.

I am still obsessing about next-gen semiconductors. If you have thoughts there, give me a ring: danny@techcrunch.com.

The LP Anti-Portfolio – Great short read. Lindel Eakman, former managing director at UTIMCO, the University of Texas/Texas A&M endowment, gives a list of funds that he passed on that he now regrets. Unfortunately, this is pretty rare coming from an LP, albeit a former one. It would be great to get more public discussion on which funds were missed and why by LP investors.

Hopefully more reading time tomorrow.

What I’m reading (or at least, trying to read)

Powered by WPeMatico

Presenting onstage today in the 2018 TC Disrupt Berlin Battlefield is Indian agtech startup Imago AI, which is applying AI to help feed the world’s growing population by increasing crop yields and reducing food waste. As startup missions go, it’s an impressively ambitious one.

The team, which is based out of Gurgaon near New Delhi, is using computer vision and machine learning technology to fully automate the laborious task of measuring crop output and quality — speeding up what can be a very manual and time-consuming process to quantify plant traits, often involving tools like calipers and weighing scales, toward the goal of developing higher-yielding, more disease-resistant crop varieties.

Currently they say it can take seed companies between six and eight years to develop a new seed variety. So anything that increases efficiency stands to be a major boon.

And they claim their technology can reduce the time it takes to measure crop traits by up to 75 percent.

In the case of one pilot, they say a client had previously been taking two days to manually measure the grades of their crops using traditional methods like scales. “Now using this image-based AI system they’re able to do it in just 30 to 40 minutes,” says co-founder Abhishek Goyal.

Using AI-based image processing technology, they can also crucially capture more data points than the human eye can (or easily can), because their algorithms can measure and asses finer-grained phenotypic differences than a person might pick up on or be easily able to quantify just judging by eye alone.

“Some of the phenotypic traits they are not possible to identify manually,” says co-founder Shweta Gupta. “Maybe very tedious or for whatever all these laborious reasons. So now with this AI-enabled [process] we are now able to capture more phenotypic traits.

“So more coverage of phenotypic traits… and with this more coverage we are having more scope to select the next cycle of this seed. So this further improves the seed quality in the longer run.”

The wordy phrase they use to describe what their technology delivers is: “High throughput precision phenotyping.”

Or, put another way, they’re using AI to data-mine the quality parameters of crops.

“These quality parameters are very critical to these seed companies,” says Gupta. “Plant breeding is a very costly and very complex process… in terms of human resource and time these seed companies need to deploy.

“The research [on the kind of rice you are eating now] has been done in the previous seven to eight years. It’s a complete cycle… chain of continuous development to finally come up with a variety which is appropriate to launch in the market.”

But there’s more. The overarching vision is not only that AI will help seed companies make key decisions to select for higher-quality seed that can deliver higher-yielding crops, while also speeding up that (slow) process. Ultimately their hope is that the data generated by applying AI to automate phenotypic measurements of crops will also be able to yield highly valuable predictive insights.

Here, if they can establish a correlation between geotagged phenotypic measurements and the plants’ genotypic data (data which the seed giants they’re targeting would already hold), the AI-enabled data-capture method could also steer farmers toward the best crop variety to use in a particular location and climate condition — purely based on insights triangulated and unlocked from the data they’re capturing.

One current approach in agriculture to selecting the best crop for a particular location/environment can involve using genetic engineering. Though the technology has attracted major controversy when applied to foodstuffs.

Imago AI hopes to arrive at a similar outcome via an entirely different technology route, based on data and seed selection. And, well, AI’s uniform eye informing key agriculture decisions.

“Once we are able to establish this sort of relation this is very helpful for these companies and this can further reduce their total seed production time from six to eight years to very less number of years,” says Goyal. “So this sort of correlation we are trying to establish. But for that initially we need to complete very accurate phenotypic data.”

“Once we have enough data we will establish the correlation between phenotypic data and genotypic data and what will happen after establishing this correlation we’ll be able to predict for these companies that, with your genomics data, and with the environmental conditions, and we’ll predict phenotypic data for you,” adds Gupta.

“That will be highly, highly valuable to them because this will help them in reducing their time resources in terms of this breeding and phenotyping process.”

“Maybe then they won’t really have to actually do a field trial,” suggests Goyal. “For some of the traits they don’t really need to do a field trial and then check what is going to be that particular trait if we are able to predict with a very high accuracy if this is the genomics and this is the environment, then this is going to be the phenotype.”

So — in plainer language — the technology could suggest the best seed variety for a particular place and climate, based on a finer-grained understanding of the underlying traits.

In the case of disease-resistant plant strains it could potentially even help reduce the amount of pesticides farmers use, say, if the the selected crops are naturally more resilient to disease.

While, on the seed generation front, Gupta suggests their approach could shrink the production time frame — from up to eight years to “maybe three or four.”

“That’s the amount of time-saving we are talking about,” she adds, emphasizing the really big promise of AI-enabled phenotyping is a higher amount of food production in significantly less time.

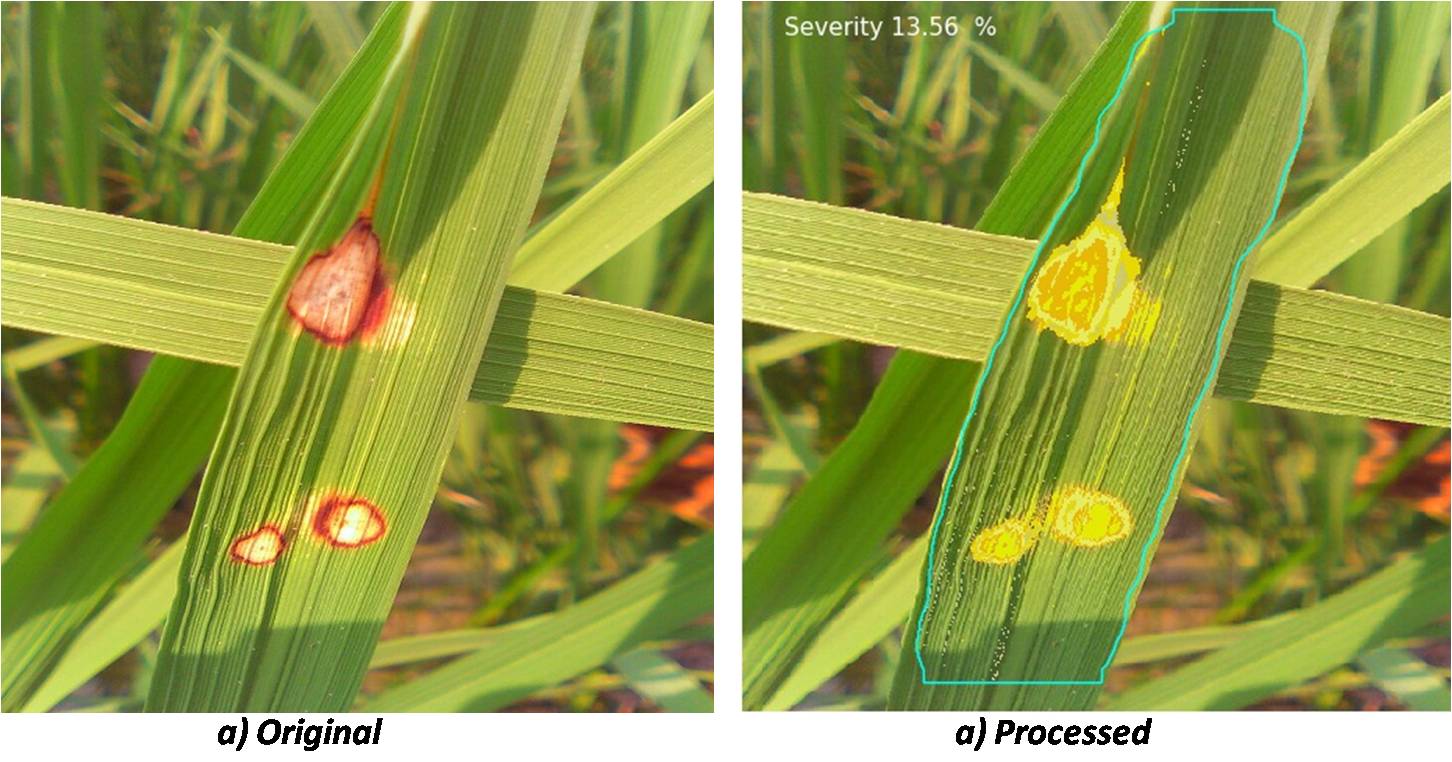

As well as measuring crop traits, they’re also using computer vision and machine learning algorithms to identify crop diseases and measure with greater precision how extensively a particular plant has been affected.

This is another key data point if your goal is to help select for phenotypic traits associated with better natural resistance to disease, with the founders noting that around 40 percent of the world’s crop load is lost (and so wasted) as a result of disease.

And, again, measuring how diseased a plant is can be a judgement call for the human eye — resulting in data of varying accuracy. So by automating disease capture using AI-based image analysis the recorded data becomes more uniformly consistent, thereby allowing for better quality benchmarking to feed into seed selection decisions, boosting the entire hybrid production cycle.

Sample image processed by Imago AI showing the proportion of a crop affected by disease

In terms of where they are now, the bootstrapping, nearly year-old startup is working off data from a number of trials with seed companies — including a recurring paying client they can name (DuPont Pioneer); and several paid trials with other seed firms they can’t (because they remain under NDA).

Trials have taken place in India and the U.S. so far, they tell TechCrunch.

“We don’t really need to pilot our tech everywhere. And these are global [seed] companies, present in 30, 40 countries,” adds Goyal, arguing their approach naturally scales. “They test our technology at a single country and then it’s very easy to implement it at other locations.”

Their imaging software does not depend on any proprietary camera hardware. Data can be captured with tablets or smartphones, or even from a camera on a drone or using satellite imagery, depending on the sought for application.

Although for measuring crop traits like length they do need some reference point to be associated with the image.

“That can be achieved by either fixing the distance of object from the camera or by placing a reference object in the image. We use both the methods, as per convenience of the user,” they note on that.

While some current phenotyping methods are very manual, there are also other image-processing applications in the market targeting the agriculture sector.

But Imago AI’s founders argue these rival software products are only partially automated — “so a lot of manual input is required,” whereas they couch their approach as fully automated, with just one initial manual step of selecting the crop to be quantified by their AI’s eye.

Another advantage they flag up versus other players is that their approach is entirely non-destructive. This means crop samples do not need to be plucked and taken away to be photographed in a lab, for example. Rather, pictures of crops can be snapped in situ in the field, with measurements and assessments still — they claim — accurately extracted by algorithms which intelligently filter out background noise.

“In the pilots that we have done with companies, they compared our results with the manual measuring results and we have achieved more than 99 percent accuracy,” is Goyal’s claim.

While, for quantifying disease spread, he points out it’s just not manually possible to make exact measurements. “In manual measurement, an expert is only able to provide a certain percentage range of disease severity for an image example; (25-40 percent) but using our software they can accurately pin point the exact percentage (e.g. 32.23 percent),” he adds.

They are also providing additional support for seed researchers — by offering a range of mathematical tools with their software to support analysis of the phenotypic data, with results that can be easily exported as an Excel file.

“Initially we also didn’t have this much knowledge about phenotyping, so we interviewed around 50 researchers from technical universities, from these seed input companies and interacted with farmers — then we understood what exactly is the pain-point and from there these use cases came up,” they add, noting that they used WhatsApp groups to gather intel from local farmers.

While seed companies are the initial target customers, they see applications for their visual approach for optimizing quality assessment in the food industry too — saying they are looking into using computer vision and hyper-spectral imaging data to do things like identify foreign material or adulteration in production line foodstuffs.

“Because in food companies a lot of food is wasted on their production lines,” explains Gupta. “So that is where we see our technology really helps — reducing that sort of wastage.”

“Basically any visual parameter which needs to be measured that can be done through our technology,” adds Goyal.

They plan to explore potential applications in the food industry over the next 12 months, while focusing on building out their trials and implementations with seed giants. Their target is to have between 40 to 50 companies using their AI system globally within a year’s time, they add.

While the business is revenue-generating now — and “fully self-enabled” as they put it — they are also looking to take in some strategic investment.

“Right now we are in touch with a few investors,” confirms Goyal. “We are looking for strategic investors who have access to agriculture industry or maybe food industry… but at present haven’t raised any amount.”

Powered by WPeMatico

Asana, a service that teams and individuals use to plan and track the progress of work projects, is doubling down on its own project: to shape “the future of work,” in the words of co-founder and CEO Dustin Moskovitz. The startup, whose products are used by millions of free and paying users, today is announcing that it has raised another $50 million in funding — a Series E that catapults Asana into unicorn status with a $1.5 billion valuation — to invest in international and product expansion.

Asana has been on a funding tear: It raised $75 million just 11 months ago at a $900 million post-money valuation, bringing the total this year to $125 million, and $213 million since being founded in 2008.

Led by Generation Investment Management — the London firm co-founded by former US Vice President Al Gore that also led that Series D in January — this latest round also includes existing investors 8VC, Benchmark Capital and Founders Fund as well as new investors Lead Edge Capital and World Innovation Lab.

Asana has lately been focused on international growth — half of its new sales are already coming from outside the US — and expanding its product as it inches toward profitability. These are the areas where its latest investment will go, too.

Specifically, it plans to open an AWS-based data center in Frankfurt in the first half of next year, and it will set down more roots in Asia-Pacific, with offices in Sydney and Tokyo. It is also hiring in both markets. Asana has customers in 195 countries and six languages, and it looks like it’s homing in on these two regions because it’s seeing the most traction there.

On the product side, the company has been gradually adding machine learning, predictive and other AI features and it will continue to do that as part of a “long-term vision for marrying computer and human intelligence to run entire companies.”

“Our role is to help leaders understand where their attention can be most useful and what to be focused on,” Moskovitz, pictured right with co-founder Justin Rosenstein, said to me in an interview earlier this month when describing the company’s AI push.

The funding caps off an active year for Asana.

In addition to raising $75 million in January, it announced 50,000 paying organizations and “millions” of free users in September. It also introduced new products and features, such as a paid tier, Asana for Business, for larger organizations managing multiple projects; Timelines for drilling into sequential tasks and milestones; and its first steps into AI, services that start to anticipate what users need to see first and prioritise, based on previous behaviour, which team the user is on, and so on:

Asana has been close to profitability this year, although it doesn’t look like it has quite reached that point yet. Moskovitz told me that in fact, it has held on to most of its previous funding (that’s before embarking on this next wave of ambitious expansions, though).

“We have so much money in the bank that we have quite a lot of options [and are in a] strong position so choose what makes the most sense strategically,” he said. “We’ve been fortunate with investors. The prime thing is vision match: do they think about the long-term future in the same way we do? Do they have the same values and priorities? Generation nailed that on so many levels as a firm.”

Asana’s growth and mission both mirror trends in the wider world of enterprise IT and collaboration within it.

Slack, Microsoft Teams, Workplace from Facebook and other messaging and chat apps have transformed how coworkers communicate with each other, both within single offices and across wider geographies: they have replaced email, phone and other communication channels to some extent.

Meanwhile, the rise of cloud-based services like Dropbox, Box, Google Cloud, AWS and Microsoft’s Azure have transformed how people in organizations manage and ultimately collaborate on files: the rise of mobile and mobile working have increased the need for more flexible file management and access.

The third area that has been less covered is work management: as people continue to multitask on multiple projects – partly spurred by the rise in the other two collaboration categories – they need a platform that helps keep them organised and on top of all that work. This is where Asana sits.

“We think about collaboration as three markets,” Moskovitz said, “file collaboration, messaging, and work management. Each of these has a massive surface area and depth to them. We think it’s important that all companies have tools that they use from each of these big buckets.”

It is not the only one in that big bucket.

Asana alternatives include Airtable, Wrike, Trello and Basecamp. As we have pointed out before, that competitive pressure is another reason Asana is on the path to continue growing and making its service more sticky.

Indeed, just earlier this month Airtable raised $100 million at a $1.1 billion valuation. Airtable has a different approach – its platform can be used for more than project management – but it’s most definitely used to build templates precisely to track projects.

You might even argue that Airtable’s existing offering could present a type of product roadmap for what might be considered next for Asana.

For now, though, Asana is building up big customers for its existing services.

The product initially got its start when Moskovitz and Rosenstein – as respectively as co-founder and early employee of Facebook – built something to help their coworkers at the social network manage their workloads. Now, it has a range of users that include a number of other tech firms, but also others.

London’s National Gallery, for example, uses Asana to plan and launch exhibitions and business projects; the supermarket chain Tesco’s digital campaigns; Sony Music, which also uses it for marketing management but also to track a digitization project for its back music catalog; Uber, which has managed some 600 city expansions through Asana to date.

“At Generation Investment Management, we’re grounded in the philosophy that through strategic investments in leading, mission-driven companies we can move towards a more sustainable future,” said Colin le Duc, co-founder and partner, Generation Investment Management, in a statement.

“We see Collaborative Work Management as a distinct and rapidly expanding segment, and Asana has the right product and team to lead the market. Through Dustin and the team, Asana is changing how businesses around the world collaborate, epitomizing what it means to deliver results with a mission-driven ethos.”

Powered by WPeMatico

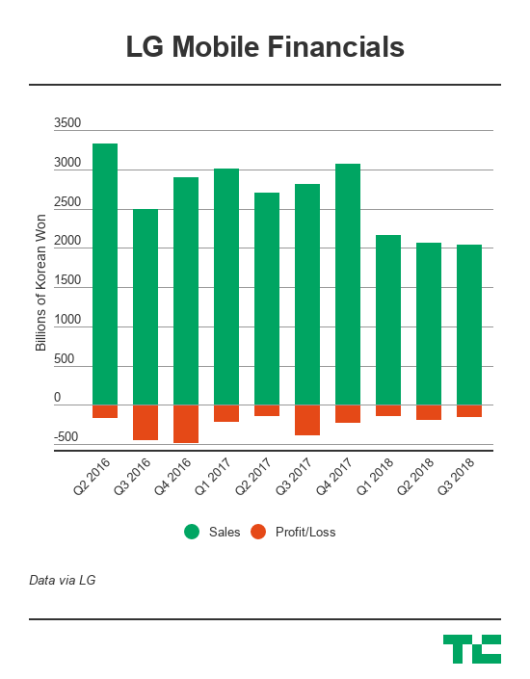

Mission impossible: A new executive at LG is charged with fixing the company’s long-time loss-making smartphone division following a leadership change.

Hwang Jeong-hwan took the job as president of LG Mobile Communications last October, and this week LG announced that he will be replaced by Brian Kwon, who is head of LG’s hugely profitable home entertainment business, starting December 1.

“Mr. Kwon played a critical role in transforming LG’s TV, audio and PC business into category leaders and his knowledge and experience in the global marketplace will be instrumental in continuing LG’s mobile operations turnaround,” LG wrote in an announcement.

The company said Jeong-hwan had “successfully bolstered the operation’s quality assurance and product development efficiency.”

Those are interesting words; none of them mention the crisis that has seen LG’s mobile business continue to post big losses. This year to date, it lost the wider company some $410 million, including a $130.5 million net loss in the last quarter. In contrast, Kwon’s unit was the standout performer of the quarter, generating total sales of 3.71 trillion RKW ($3.31 billion) and a 325.1 billion KRW ($289.9 million) profit. That burn rate was cut during Hwang Jeong-hwan’s tenure, but it seems like there’s still much work to be done. Kwon — who LG describes as a “turnaround expert” — will combine his new role at the mobile business with his existing position as president of LG’s Home Entertainment Company. Hwang Jeong-hwan will move on to lead the company’s “Convergence Business Development Office.”

That burn rate was cut during Hwang Jeong-hwan’s tenure, but it seems like there’s still much work to be done. Kwon — who LG describes as a “turnaround expert” — will combine his new role at the mobile business with his existing position as president of LG’s Home Entertainment Company. Hwang Jeong-hwan will move on to lead the company’s “Convergence Business Development Office.”

LG has also shuffled at the top of the tree. CEO Jo Seong-jin will “focus more on strategy and planning for the future,” with president and CFO David Jung taking over a number of day-to-day responsibilities. LG has also restructured its vehicle component and business services divisions.

Powered by WPeMatico

After focusing on Asian markets, particularly in Southeast Asia, Bangkok-based Eko Communications is getting ready to take on Slack, Microsoft Teams, and other enterprise messaging apps in Europe. The startup announced today that it has raised a Series B of $20 million and opened offices in London (which will serve as its new commercial headquarters), Amsterdam, and Berlin.

The funding, led by SMD Ventures, with participation from AirAsia’s digital investment arm Redbeat Ventures, Gobi Partners, East Ventures, and returning investors, brings Eko Communication’s total raised to $28.7 million. The company’s Series A was announced in 2015, followed by $2 million in strategic funding from Japanese conglomerate Itochu last year. Eko Communications (not to be confused with Eko, an interactive video startup) has already served clients like Thai mobile operator True, Radisson, and 7-Eleven.

Eko Communications’ Series B is earmarked for its ambitious global expansion plans in the first quarter of 2019. Korawad Chearavanont, the company’s CEO and co-founder, told TechCrunch in an email that it has already localized products for target markets including the UK, Ireland, Benelux, and the DACH region (Germany, Austria, and Switzerland).

Eko Communications wants to expand in the European Union and the United States because their economies are both significantly larger than Southeast Asia’s, said Chearavanont. This, plus the fact that both have larger enterprise IT markets thanks to higher spending on software by companies, means that “for Eko to achieve the necessary scale to become a global player in the mobile enterprise market, continued growth in these markets is critical,” he added.

The company claims that its revenues have more than tripled in the past year and that it now has more than 500,000 recurring paid users. Of course, any enterprise messaging startup has to contend with the specter of Slack and Microsoft Teams. Positioning Eko Communications as a rival to those services, however, isn’t totally accurate because they are aimed at different customers.

Slack and Microsoft Teams are “primarily utilized by ‘knowledge workers’ and these systems are priced for these types of users,” Chearavanont said. “Being a mobile-first company, we target companies that have a large presence of mobile-first staff traditionally in industries like retail and hospitality (the services sector in general).” Many employees in those sectors still rely on messaging apps like WhatsApp or email to communicate, so Eko Communications seeks to make it easy for companies to transition from their ad hoc communication methods to a more secure and efficient system with tools like APIs to help them integrate legacy systems.

Powered by WPeMatico

Xiaomi is diversifying into a new range of phones as the Chinese smartphone maker announced impressive growth with its latest financials.

The company announced it will take over selfie app maker Meitu’s smartphone business to go after new demographics, particularly women, while it lodged impressive 49 percent revenue growth in Q3.

Xiaomi posted a net profit of 2.481 billion RMB ($357 million) for the quarter on total sales of 50.846 billion RMB ($7.3 billion). The bulk of that income came from smartphones sales — 35 billion RMB, $5 billion — as Xiaomi surpassed its annual target of 100 million shipments with two months of the year still to go. The majority of those phones are sold in China, but the company said that international revenue overall was up by 113 percent year-on-year.

The company has ventured into Europe this year, with its most recent launch in the U.K. this month, but now it is taking aim at a more diverse set of customers in the Chinese market through this tie-in with Meitu. Best known for its “beautification” selfie apps, Meitu also sells smartphones that tap its selfie brand with optimized cameras and advanced editing features.

Now Xiaomi is taking over that business through a partnership that will see Meitu paid 10 percent of the profits for all devices sold, with a minimum guaranteed fee of $10 million per year. For other smart products, its cut increases to 15 percent.

Meitu is hardly a mainstream phone brand. Its first device launched in 2013 and has sold 3.5 million units to date. Recently, the company cut back on its hardware — it has launched just one device this year compared to five last year — while the average sell price of its devices has fallen, causing it to forecast a net loss of up to 1.2 billion RMB (or $173 million) up from just 197 million RMB last year. Shifting the heavy-lifting to Xiaomi makes a lot of sense — despite its total cut of sales dropping to just 10 percent, Xiaomi has impressive reach and a sales platform that already features third-party hardware.

Back to Xiaomi, these results are its first “true” financials since the company went public through a Hong Kong IPO back in July. It posted a $2.1 billion profit in the previous quarter but a large chunk of spending and revenue was down to the listing.

Powered by WPeMatico

Truecaller may already be a familiar name, but many of you probably don’t know that it’s slowly becoming a significant messaging app. That’s why I’m excited to announce that Truecaller co-founder and CEO Alan Mamedi will join us at TechCrunch Disrupt Berlin.

Truecaller first started as a call screening app. Some countries are more affected than others. But it’s clear that text and call spam is the most intrusive form of spam.

The Swedish company then leveraged this user base to quietly turn the app into a full-fledged messaging app with one focus in particular — India.

With the acquisition of Chillr, the company shows that it wants to recreate a sort of WeChat for India. The company launched payment features — Truecaller Pay lets you pay other Truecaller users as well as pay your bills.

Eventually, Truecaller wants to open up its platform to third-party services. Back in April, the company reported that it had 100 million daily active users.

If you’re impressed by Truecaller’s growth strategy, you should buy your ticket to Disrupt Berlin to listen to this discussion and many others. The conference will take place on November 29-30.

In addition to fireside chats and panels, like this one, new startups will participate in the Startup Battlefield Europe to win the highly coveted Battlefield cup.

CEO & Co-founder, Truecaller

Alan Mamedi is the CEO and Co-founder of Truecaller. Truecaller is one of the leading communication apps in the world with services in messaging, payment, caller ID, spam detection, dialer functionalities, and has more than 300 million users globally. In this position, Alan focuses on product development and innovation, and charting the strategic roadmap for the company’s success. To date, Truecaller has raised 80 million USD from Sequoia Capital, Atomico, and Kleiner Perkins Caufield & Byers.

Powered by WPeMatico

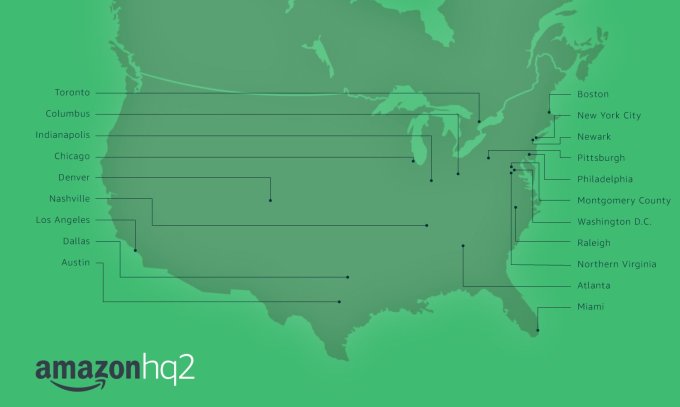

The big news today is that — finally — we have Amazon’s selection of cities for its dual second headquarters (Northern Virginia and NYC). Then some notes on China. But first, semiconductors and open sourcing analysis.

We are experimenting with new content forms at TechCrunch. This is a rough draft of something new — provide your feedback directly to the authors: Danny at danny@techcrunch.com or Arman at Arman.Tabatabai@techcrunch.com if you like or hate something here.

Last week, I focused on SoftBank’s debt and Form D filings by startups. On Friday, I asked what I should start to analyze next. There were several feedback hotspots, but the one that popped out to me was around next-generation chips and the battle for dominance at the hardware layer.

As a software engineer, I know almost nothing about silicon (the beauty of abstraction). But it is clear that the future of all kinds of workflows will increasingly be driven by capabilities at the hardware/silicon level, particularly in future applications like artificial intelligence, machine learning, AR/VR, autonomous driving and more. Furthermore, China and other countries are spending billions to go after the leaders in this space, such as Nvidia and Intel. Startups, funding, competition, geopolitics — we’ve got it all here.

Arman and I are now diving deeper into this space. We will start to post once we have some interesting things to share, but if you have ideas, opinions, companies or investments in this space: tell us about them, as we are all ears: danny@techcrunch.com and Arman.tabatabai@techcrunch.com.

Since I launched this daily “column” last week, I have included the text near the top that “We are experimenting with new content forms at TechCrunch.” One of those forms is what might be called open-source journalism. Definitions are fuzzy, but I take it to mean working “in the open” — allowing you, the audience of this column, to engage in not just feedback around finalized and published posts, but to actually affect the entire process of analysis, from sourcing and ideation to data science and writing.

I am thankful to work at a publication like TechCrunch where my readers are often working in the exact sectors that I am writing about. When I wrote about Form Ds last week, a number of startup attorneys reached out with their own thoughts and analysis, and also explained key aspects of how the law is changing around SEC disclosure for startups. That’s really powerful, and I want to apply it to as many fields as possible.

This thesis is ultimately intentional — now I have to operationalize it. There aren’t good tools (yet!) that I know of that allow for easy sharing of data and notes that don’t rely on a hacked-together set of Google Docs and GitHub. But I’m exploring the stack, and will publish more things publicly as we have them.

Amazon’s long process for selecting an HQ2 is finally over, and the official answer is two: Northern Virginia and NYC. Tons of words have been spilled about the search, and I am sure even more analysis will strike today about what put those two locations over the top.

To me, the key for mayors is to start using these reverse searches (where a company seeks a city and not vice versa) as leverage to actually get resources to fund infrastructure and other critical services.

This is a theme that I discussed about a year ago:

Take Boston’s bid for GE’s new headquarters. Yes, the city offered property tax rebates of about $25 million , but GE’s move also pushed the state to fund a variety of infrastructure improvements, including the Northern Avenue bridge and new bike lanes. That bridge adds a critical path for vehicles and pedestrians in Boston’s central business district, yet has gone unfunded for years.

Ideally, governments could debate, vote, and then fund these sorts of infrastructure projects and community improvements. The reality is that without a time-sensitive forcing function like a reverse RFP process, there is little hope that cities and states will make progress on these sorts of projects. The debates can literally go on forever in American democracy.

So if you are a mayor or economic planning official, use these processes as tools to get stuff done. Use the allure of new jobs and tax revenues to spur infrastructure spending and get a rezoning through a recalcitrant city council. Use that “prosperity bomb” to upgrade old parts of the urban landscape and prepare the city for the future. A healthier, more humane city can be just around the corner.

Take DC. The city has seen one of the best-run Metro systems deteriorate to abysmal levels over the past few years due to a complete dumpster fire of organizational design (the DC transit agency WMATA is funded by inconsistent revenue sources that ensure it will never be sustainable). Here is an opportunity to use Amazon’s announcement to get the tax framework and operations figured out to ensure that real estate, transportation and other critical urban infrastructure are designed effectively.

Timothy Allen/Getty Images

Talking about second headquarters, the technology industry clearly has separated into poles, one based around the United States and the other based around China. Two articles I read recently gave good insights of the benefits and challenges for China in this world.

The first is from Sam Byford writing at The Verge, who investigates the native OS options that Chinese consumers receive from companies like Xiaomi, Huawei, Oppo and others. The headline is much more shrill than the text, so don’t let that frighten you.

Byford provides an overview of the lineage of Chinese mobile OSes, and also notes that what might look like design gaffes in Western consumer eyes might be critical needs for Chinese buyers:

But what is true today is that not all Chinese phone software is bad. And when it is bad from a Western perspective, it’s often bad for very different reasons than the bad Android skins of the past. Yes, many of these phones make similar mistakes with overbearing UI decisions — hello, Huawei — and yes, it’s easy to mock some designs for their obvious thrall to iOS. But these are phones created in a very different context to Android devices as we’ve previously understood them.

The article is perhaps a tad long for what it is, but Byford’s key viewpoint should be repeated as a mantra by any person connected to the technology sector today: “The Chinese phone market is a spiraling behemoth of innovation and audacity, unlike anything we’ve ever seen. If you want to be on board with the already exciting hardware, it’s worth trying to understand the software.”

Of course, while China may be a huge country, its leading technology companies do want to globalize and expand their user bases outside of the Middle Kingdom’s borders. That may well be a challenging proposition.

Writing at Factor Daily, Shadma Shaikh dives into the failure of WeChat to break into the Indian market. The product lessons learned by WeChat’s owner Tencent could be applied to any Silicon Valley company — cultural knowledge and appropriate product design are key to entering overseas markets.

Shaikh gives a couple of examples:

Another design feature in the app allowed users to look up and send add-friend requests to WeChat users nearby. During initial onboarding when users were just checking app’s features, many would tap the “people nearby” feature, which would switch on location sharing by default – including with strangers. Once location sharing with strangers was switched on, it wasn’t very intuitive to turn it off.

“Women used to get a lot of unwarranted messages from men, which was a major turn off and many of them left the platform,” Gupta says. “China probably didn’t have this stalking problem.”

And

In China, where the internet was cheaper than in India in 2012, sending video files of, say, 4 MB was not a challenge. WhatsApp compresses a 5 MB photo to 40 kilobytes. WeChat did not compress the files and took many minutes and data to send and receive media files.

Internationalization will never be easy, but the lessons that Silicon Valley has slowly learned over the past two decades will need to be learned again by Chinese companies if they want to export their software to other countries.

Powered by WPeMatico

Some more comments from readers on the changing culture around startups filing their Form Ds with the SEC, and then a short update on SoftBank and a bunch more article reviews.

We are experimenting with new content forms at TechCrunch. This is a rough draft of something new – provide your feedback directly to the authors: Danny at danny@techcrunch.com or Arman at Arman.Tabatabai@techcrunch.com if you like or hate something here.

If you haven’t been following our obsession with Form Ds, be sure to read our original piece and follow up. The gist is that startups are increasingly foregoing filing a Form D with the SEC that provides details of their venture rounds like investment size and main investors in order to stay stealth longer. That has implications for journalists and the public, since we rely on these filings in many cases to know who is funding what in the Valley.

Morrison Foerster put together a good presentation two years ago that provides an overview of the different routes that startups can take in disclosing their rounds properly.

Traditionally, the vast majority of startups used Rule 506 for their securities, which mandates that a Form D be filed within 15 days of the first money of the round closing. These days though, more and more startups are opting to use Section 4(a)(2), which doesn’t require a Form D, but also doesn’t provide a “blue sky” exception to start securities laws, which means that startups have to file in relevant state jurisdictions and no longer have preemption from the SEC.

David Willbrand, who chairs the Early Stage & Emerging Company Practice at Thompson Hine LLP, read our original articles on Form Ds and explained by email that the practices around securities disclosures have indeed been changing at his firm and others:

We started pushing 4(a)(2) very hard when our clients kept getting “outed” thru the Form D and upset about it. In my experience, for 99% is the desire to remain in stealth mode, period.

[…]

When I started in 1996, Form Ds were paper, there was no internet, and no one looked. Now they are electronic and the media and blogs scrape daily and publish the information. It actually really is true disclosure! And it’s kind of ironic, right, which goes to your point – now that it’s working, these issuers don’t want it.

[…]

What I find is that the proverbial Series A is the brass ring, and issuers wants to call everything seed rounds (saving the title) until something chunky shows up, and stay below the radar too. So they pop out of the cake publicly for the first time with a big “Series A” that they build press around – and their first Form D.

Another piece of feedback we received was from Augie Rakow, the co-founder and managing partner of Atrium, which bills itself as a “better law firm for startups” that TechCrunch has covered a few times before. He wrote to us that in addition to the media concerns, startups also have to be aware of the broad cross-section of interested parties to Form Ds that hasn’t existed in the past:

Today, there is a bigger audience in terms of who cares about venture backed companies. Whether this spun off from the launch of the Facebook movie or the fact that over two billion people across the global have the internet at their fingertips via smartphones, people are connected and curious. The audience is not only larger but also encompasses more national and international interests. This means there are simply more eyes on trends, announcements, and intel on privately held companies whether they are media, investors, or your competitors. Companies that have a good reason to stay stealth may want to avoid attracting this attention by not making a public Form D filing.

For startups, the obvious advice is to just consult your attorney and consider the tradeoffs of having a very clean safe harbor versus more work around regulatory filings to stay stealthy.

But the real message here is for journalists. Form Ds are no longer common among seed-stage startups, and indeed, startup founders and venture investors have a lot of latitude in choosing how and when they file. You can no longer just watch the SEC’s EDGAR search platform and break stories anymore. Building up a human sourcing capability is the only way to get into those early investment rounds today.

Finally — and this is something that is hard to prove one way or the other — the lack of disclosure may also mean that the fears around seed financing dropping off a cliff may be at least a little bit unfounded. Eliot Brown at the Wall Street Journal reported just yesterday that the number of seed financings is down 40 percent, according to PitchBook data. How much of that drop is because of changing macroeconomic conditions, versus changes in filing disclosures?

Tokyo Stock Exchange. Photo by electravk via Getty Images

Last week, I also got obsessed with SoftBank. The company confirmed today that it intends to move forward with the IPO of its Japanese mobile telecom unit, according to WSJ and many other sources. The company is targeting more than $20 billion in proceeds, and its overallotment could drive that above $25 billion, or roughly the level of Alibaba’s record IPO haul.

One interesting note from Taiga Uranaka at Reuters on the public issue is that everyday investors will likely play an outsized role in the IPO process:

Yet SoftBank’s brand name is still likely to draw retail investors long accustomed to using SoftBank’s phone and internet services. Many still see CEO Son as a tech visionary who challenged entrenched rivals NTT DoCoMo Inc ( 9437.T ) and KDDI, and brought Apple Inc’s ( AAPL.O ) iPhone to Japan.

Japanese households are commonly seen as an attractive target in IPOs with their 1,829 trillion yen in financial assets, even if they are traditionally risk-averse with over 50 percent of assets in cash and deposits.

More than 80 percent of the shares will be offered to domestic retail investors, a person with knowledge of the matter told Reuters.

Pavel Alpeyev at Bloomberg noted that “SoftBank is looking to tempt investors with a dividend payout ratio of about 85 percent of net income, according to the filing. Based on net income in the last fiscal year, that would work out to an almost 5 percent yield at the indicated IPO price.” A higher dividend ratio is particularly attractive to retired individual investors.

Despite SoftBank’s horrifying levels of debt, Japanese consumers may well save the company from itself and allow it to effectively jump start its balance sheet yet again. Complemented with a potential Vision Fund II, Masayoshi Son’s vision for a completely transformed SoftBank seems waiting for him in the cards.

Tech C.E.O.s Are in Love With Their Principal Doomsayer – Nellie Bowles writes a feature on Yuval Noah Harari, the noted philosopher and popular author of Sapiens. Bowles investigates the paradoxical popularity of Harari, who sees technology as creating a permanent “useless class” and criticizes Silicon Valley with his now enduring popularity in the region. Interesting personal details on the somewhat reclusive Israeli, but ultimately the question of the paradox remains sadly mostly unanswered. (2,800 words)

Why Doctors Hate Their Computers – Atul Gawande discusses learning and using Epic, the dominant electronic medical records software platform, and discovers the challenges of building static software for the complex adaptive system that is health care. His observations of the challenges of software engineering will be well-known to anyone who has read Fred Brooks, but the piece does an excellent job of exploring the balancing act between the needs of technocratic systems and the human design needed to make messy and complicated professions work. Worth a read. (8,900 words)

Picking flowers, making honey: The Chinese military’s collaboration with foreign universities – An excellent study by Alex Joske at the Australia Strategic Policy Institute on the hundreds of military scientists from China who use foreign academic exchanges as a means of information acquisition for critical scientific and engineering knowledge, including in the United States. China’s government under Xi Jinping has made indigenous technology development a chief domestic priority, and the U.S. innovation economy is encouraged to increasingly guard its intellectual property. (6,500 words)

The Digital Deciders – New America report by Robert Morgus who investigates the fracturing of the internet, which I have written about at some length. Morgus finds that a small group of countries (the “digital deciders”) will determine whether the internet continues to be open or whether nationalist interests will close it off. Let’s all hope that Iraq believes in freedom of expression and not Chinese-style surveillance. Worth a skim. (45 page report, but with prodigious tables)

Powered by WPeMatico