Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

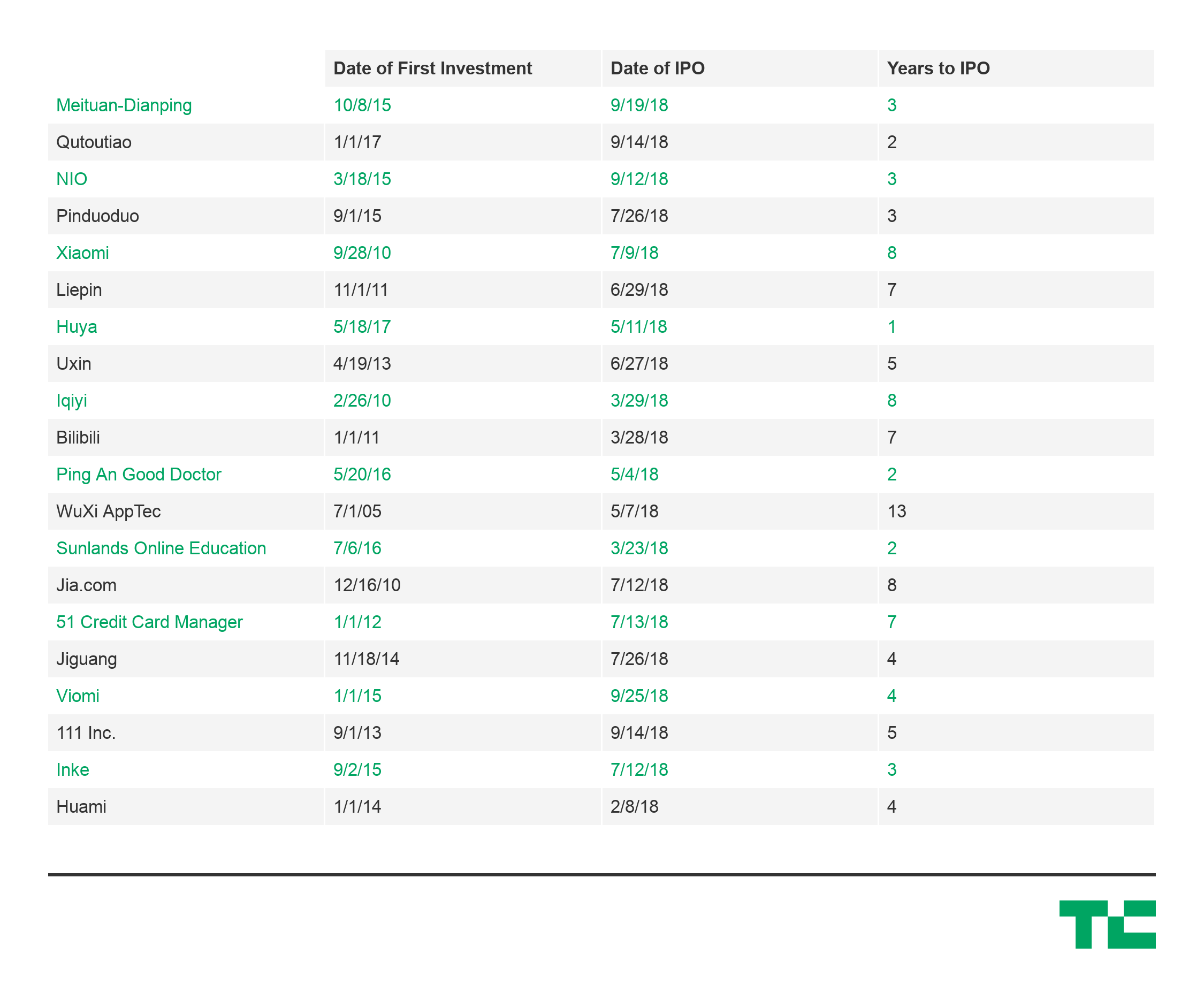

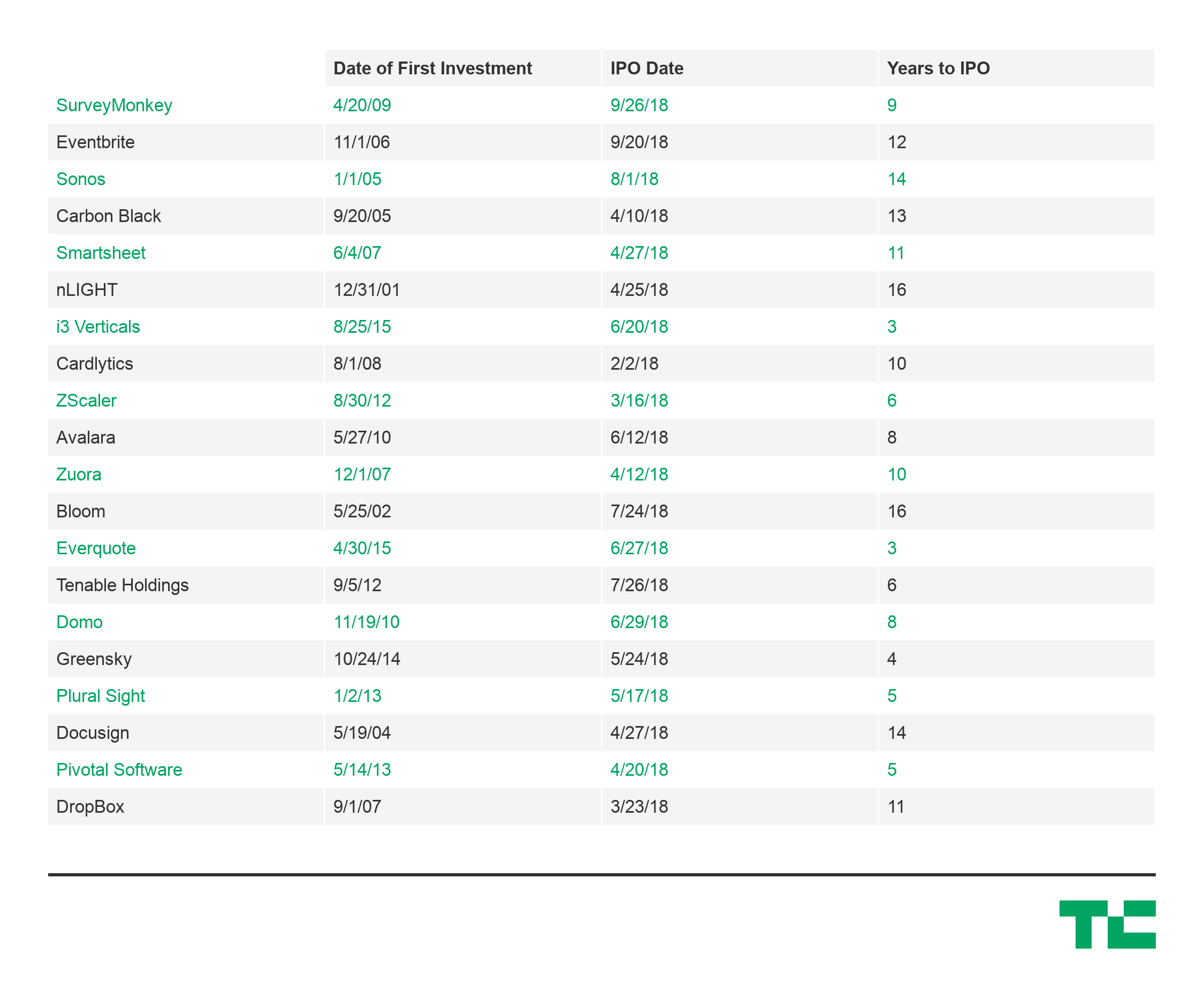

This year’s rush of IPOs from Chinese tech companies has dominated headlines, but what’s more interesting is how quickly they got there.

Traditionally, “going public” represented the gratifying culmination of sleepless nights and missed birthdays that went into building a company. The peak of a lengthy climb, where founders and VCs would finally see the fruits of their labor.

However, Chinese companies appear to be reaching that peak much quicker than their American peers, heading to the public markets only a few years after initial venture investments, and often with little operating history.

Analyzing twenty of the most high profile Chinese tech IPOs this year, the average time from first venture investment to IPO was only around three to five years. Take e-commerce platform Pinduoduo, which pulled in $1.6 billion less than three years after its Series A. Or the recent IPO of EV-manufacturer NIO, which raised a billion dollars just three-and-a-half years after its Series A and having just delivered its first car in June.

China IPO data for 2018 compiled from NASDAQ, Pitchbook, and Crunchbase

That’s less than half the average 10-year timeline for venture-backed US tech companies that went public in 2018, including Dropbox, Eventbrite, and DocuSign, which all IPO’d more than a decade after their initial investments.

Differences in market maturity, government involvement, and support from large tech incumbents all undoubtedly play a factor, but the speed to liquidity for the Chinese companies is still astounding.

Speed to liquidity is a critical metric for the health of a startup ecosystem. It creates a positive cycle where faster liquidity can drive faster fundraising, faster reinvestment, faster startup building, and faster public liquidity again. An accelerated cycle could be especially appealing for funds with LPs that require faster returns due to cash commitments or otherwise.

It’s important to note that venture returns are a function of capital and time, so quicker exits will also drive higher returns for the same amount invested. For example, a $1 million investment with a $5 million exit after ten years would generate an Internal Rate of Return (a commonly used metric to evaluate VC performance) of 20%. If the same exit occurred after five years, the IRR would be 50%.

Liquidity is a key consideration as China’s influence on the flow of global venture capital intensifies. As China’s tech ecosystem sees more of its darlings mature and more consistently deliver smashing exits, investments in China will have to be a more serious consideration for VCs, even if only to minimize the sheer amount of time, resources, and painstaking energy needed to build a company in the U.S.

Powered by WPeMatico

Wednesday is Apple’s big product release day, where analysts expect the company to release the next edition of the iPhone. While the usual upgrades to the screen, CPU, and storage are expected as always, one major lingering question is how the company is going to handle 5G, the next-generation telecommunications standard.

The conventional wisdom among analysts is that Apple will ignore 5G in 2018 and 2019 just as it took extra time to rollout 3G and 4G chipsets in its phones. A typical example of this analysis comes from Chris Smith at BGR, who says that “We already saw what Apple did when 4G LTE came out. The company waited for carriers actually to offer decent coverage before launching the first 4G iPhone. That was the iPhone 5, by the way, which launched more than a year after the first Android-based LTE phones came out.”

I’m not nearly as convinced. There are many reasons for Apple to ignore the tech this year, which I will get to in a moment, but one major factor could drive an earlier discussion of 5G than expected: Apple’s growth markets, particularly in China.

China is becoming one of Apple’s most important markets for its smartphones, and particularly for its flagship iPhone X. Its greater China revenue in the third quarter of this year was $9.6 billion, and its operating income from the region was just shy of Europe’s. More importantly, greater China is just slightly behind the Americas as the fastest-growing region for Apple’s sales.

That makes 5G a particularly challenging issue for the company. China has made 5G leadership a critical pillar of its industrial strategy, and many analysts believe the country will set the pace for 5G rollouts globally. Furthermore, Chinese consumers are deeply interested in buying premium products and experiences, and adoption for 5G is expected to be strong and rapid.

With the technical specifications around the 5G standard complete, companies are racing to build the chipsets and deploy the infrastructure necessary to enable this new standard in smartphones and other devices. Early networks are expected to be deployed in 2019, and chipset maker Qualcomm has publicly unveiled more than a dozen handset manufacturers who are partnering with it on 5G. For instance, Vivo, a Chinese smartphone manufacturer, announced today that it was developing its first “pre-commercial 5G smartphones” for launch next year.

The speed and timing of the 5G rollout is awkward for Apple, which has traditionally timed its iPhone events for September. It almost certainly will make no announcements this week, but its next iPhone launch would likely be September 2019 — giving Chinese handset manufacturers with early 5G devices nearly exclusive access to the local market for the first three quarters of next year.

Apple would find itself falling behind its competitors in a fast-moving and critical growth market. While the company has built a brand in the country with devoted fans, its place in the market is not nearly as secure as in the U.S., particularly as the trade war between the two nations reaches a fevered pitch.

There’s no doubt that the challenges for Apple to include the technology are immense. First is the patent licensing cost, which Jeremy Horwitz at VentureBeat put at roughly $21 per device, up from around $9 for 4G. Second, the leading American company in 5G is believed to be Qualcomm, which Apple has been fighting in a long-running patent war, to the point that the company has been actively trying to remove Qualcomm equipment from its phones. Apple’s name was notably absent from Qualcomm’s 5G partner list.

While some early chip designs are available, they are hardly ready for primetime, and certainly not for a flagship phone like the iPhone X. Nor do I expect that Apple will imply on Wednesday that the company will support 5G in future releases and dampen enthusiasm for its newly-released devices. No one wants to be told that next year’s devices are going to be better than one released just minutes ago.

Instead, I expect Apple will use smoke signals to clearly demonstrate that it intends to remain at the cutting edge of 5G deployment. That could include joining certain industry trade groups, testing the technology in a more public fashion, and potentially releasing a roadmap next year, say at its Worldwide Developers Conference, which is traditionally held in June and thus earlier in the year than its September iPhone events.

What would be concerning though is if we get to the end of 2018 and into 2019 with nary a peep from the company about its plans for the technology. Given its commitment to China, as well as its leading position within the smartphone market, the company has to engage on the technologies around 5G in a public manner in order to prevent a loss in its competitive position.

Ultimately, much will depend on China Mobile and other telcos in China as well as around the world on how fast they can deploy 5G infrastructure (sadly, it looks increasingly like the U.S. faces a bumpy road in that direction). Beyond gold iPhone rumors, 5G may well be the first time that China drives the company’s product roadmaps, and it should be wary of finding itself on the defensive.

Powered by WPeMatico

Chinese Internet giant Tencent has announced it’s bringing in a new system of age checks to its video games which will be linked to a national public security database — in an effort to reliably identify minors so it can limit how long children can play its games.

The new real name-based registration system will initially be mandated for new players of its popular Honour of Kings fantasy multiplayer role-playing battle game.

It will be introduced around September 15, according to Reuters.

Tencent said the planned ID verification system — which Bloomberg couches as equivalent to a police ID check — is the first of its kind in the Chinese gaming industry, and claimed it will enable it to accurately identify underaged players and impose existing play time restrictions.

Last July Tencent said it would impose a playtime maximum of one hour per day for children up to aged 12, and a maximum of two hours a day for those between 13 and 18. But if kids can get around age checks such limits are meaningless.

“Through these measures, Tencent hopes to continue to better guide underaged players to game sensibly,” it said in a statement on its official WeChat account about the beefed up checks. It also said it plans to gradually expand the requirement to its other games.

In total Tencent’s gaming portfolio is reported to have more than 500 million players in China.

The move comes amid a crackdown by the Chinese government on video gaming over fears of health problems and addiction among children.

Late last month a statement posted on the Education Ministry website said new curbs were needed to counter worsening myopia among minors.

Ministers have long said they want to limit the amount of time kids can play games — although achieving that outcome is clearly a major challenge, given the popularity of video games and the proliferation of devices from which they can be accessed.

Tencent’s move to link age verification to a public security database does seem to represent a significant new step towards the government achieving its goal of also controlling kids’ digital activity. And investors reacted negatively to the announcement — pushing Tencent’s shares down more than 3%.

Shares in the company also dived around 3% last week when the government announced its latest gaming crackdown.

Reuters notes that shares in two other major Chinese game developers, China Youzu Interactive and Perfect World, also dropped 5.5% and 3.6%, respectively, as investors digested the regulatory risk.

Last year the Chinese government also tightened general Internet regulations, doubling down on its long standing real-name registration rules.

Powered by WPeMatico

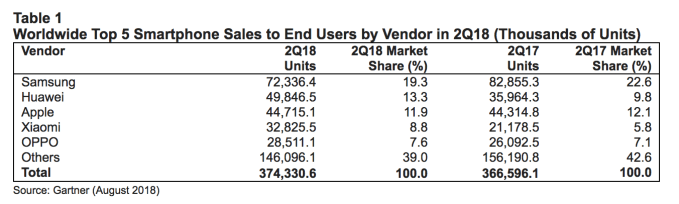

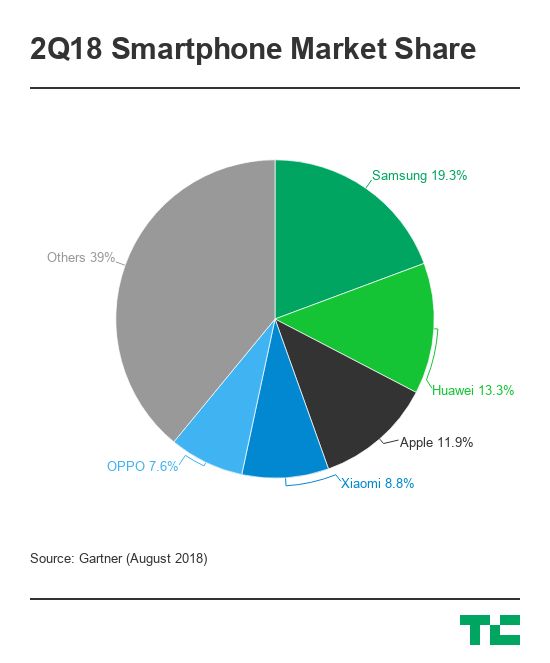

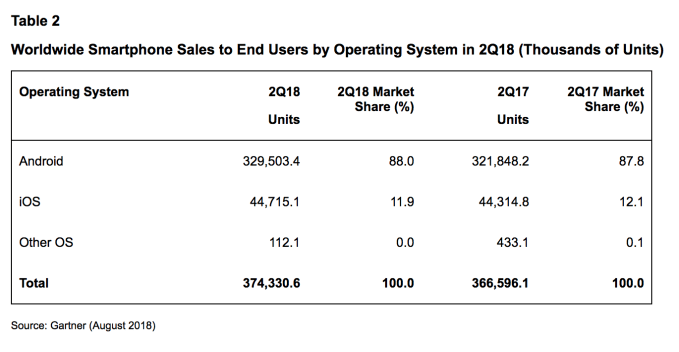

Another analyst has Huawei overtaking Apple in the global smartphone rankings for the second quarter this year. The latest figures from Gartner put Huawei ahead on sales to end users in Q2.

Overall, Gartner says sales of smartphones to end users grew 2% in the quarter, to reach 374 million units.

The analyst pegs the Chinese smartphone maker with a 13.3% marketshare, saying it sold ~49.8M devices in the quarter, up from 9.8% in the year before quarter — ahead of Apple, which it calculates took an 11.9% marketshare (down from 12.1% in Q2 2017), selling ~44.7M iPhones.

According to Gartner’s figures, Samsung also lost share year-over-year — declining 12.7% in the quarter.

The Galaxy smartphone maker retained its no.1 spot in the rankings, with 19.3% in Q2 (vs 22.6% in the equivalent quarter last year) and ~72.3M devices sold. Though Gartner notes it’s being squeezed by “ever-growing competition from Chinese manufacturers”, while slowing demand for its flagships are squeezing its profitability. Not a happy combination.

In recent years Huawei has been one of a handful of Chinese OEMs bucking the trend of a slowing global smartphone market. And Gartner’s data suggests Huawei’s smartphone sales grew 38.6 per cent in the second quarter.

As we noted earlier this month, when other analysts reported Huawei outstripping Apple on smartphone shipments in Q2, the handset maker has built momentum for its mid-range Honor handset brand while performing solidly at the premium end too, with devices such as the P20 Pro (albeit while copypasting Apple’s iPhone X ‘notch’ screen design in that instance.)

“Huawei continues to bring innovative features into its smartphones and expand its smartphone portfolio to cover larger consumer segments,” said research director Anshul Gupta in a statement. “Its investment into channels, brand building and positioning of the Honor devices helped drive sales. Huawei is shipping its Honor smartphones into 70 markets worldwide and is emerging as Huawei’s key growth driver.”

For Apple the quarter was a flat one (0.9% growth), though that’s to be expected given Cupertino structures its mobile release cycle around a big-bang annual smartphone refresh in the fall, ahead of the holiday quarter, rather than releasing devices throughout the year.

Even so, Gupta noted that Apple is also facing growing competition from Chinese brands, which in turn is amping up pressure on the company to innovate its handsets to keep increasingly demanding consumers happy by delivering “enhanced value” in exchange for the iPhone’s premium price.

And recent reports have suggested Apple is prepping a number of iPhone design changes for fall, including a splash of color.

“Demand for the iPhone X has started to slow down much earlier than when other new models were introduced,” he added, sounding another note of concern for Apple.

Fourth placed Chinese OEM Xiaomi is one device maker putting pressure on longer term players in the smartphone market. In Q2 Gartner reckons the company sold ~32.8M devices, carving itself an 8.8% marketshare — up from 5.8% in the year ago quarter.

The analyst’s data also shows Google’s Android operating system further extending its lead over Apple’s iOS in Q2, securing 88% market share vs 11.9% for iOS.

While the smartphone market is no longer a simple duopoly on the device maker front, with Huawei elbowing past Apple to bag the second spot in the global rankings, it remains very much the opposite story where smartphone operating systems are concerned.

And Gartner’s data now records the ‘other’ category of smartphone OSes at a 0.0% marketshare, down from 0.1% in the year ago quarter…

Powered by WPeMatico

One of the early backers of Musical.ly, the short video app that was acquired for $1 billion, is making a major bet that internet radio is one of the next big trends in media.

Goodwater Capital, one of a number of backers that won big when ByteDance acquired Musical.ly last year, has joined forces with Korean duo Softbank Ventures and KB Investment to invest $17 million into Korea’s Spoon Radio. The deal is a Series B for parent company Mykoon, which operates Spoon Radio and previously developed an unsuccessful smartphone battery sharing service.

That’s much like Musical.ly, which famously pivoted to a karaoke app after failing to build an education service.

“We decided to create a service, now known as Spoon Radio, that was inspired by what gave us hope when [previous venture] ‘Plugger’ failed to take off. We wanted to create a service that allowed people to truly connect and share their thoughts with others on everyday, real-life issues like the ups and downs of personal relationships, money, and work.

“Unlike Facebook and Instagram where people pretend to have perfect lives, we wanted to create an accessible space for people to find and interact with influencers that they could relate with on a real and personal level through an audio and pseudo-anonymous format,” Mykoon CEO Neil Choi told TechCrunch via email.

Choi started the company in 2013 with fellow co-founders Choi Hyuk jun and Hee-jae Lee, and today Spoon Radio operates much like an internet radio station.

Users can tune in to talk show or music DJs, and leave comments and make requests in real-time. The service also allows users to broadcast themselves and, like live-streaming, broadcasters — or DJs, as they are called — can monetize by receiving stickers and other virtual gifts from their audience.

Spoon Radio claims 2.5 million downloads and “tens of millions” of audio broadcasts uploaded each day. Most of that userbase is in Korea, but the company said it is seeing growth in markets like Japan, Indonesia and Vietnam. In response to that growth — which Choi said is over 1,000 percent year-on-year — this funding will be used to invest in expanding the service in Southeast Asia, the rest of Asia and beyond.

Audio social media isn’t a new concept.

Singapore’s Bubble Motion raised close to $40 million from investors but it was sold in an underwhelming and undisclosed deal in 2014. Reportedly that was after the firm had failed to find a buyer and been ready to liquidate its assets. Altruist, the India-based mobile services company that bought Bubble Motion has done little to the service. Most changes have been bug fixes and the iOS app, for example, has not been updated for nearly a year.

Things have changed in the last four years, with smartphone growth surging across Asia and worldwide. That could mean different fortunes but there are also differences between the two in terms of strategy.

Bubbly was run like a social network — a ‘Twitter for voice’ — whereas Spoon Radio is focused on a consumption-based model that, as the name suggests, mirrors traditional radio.

“This is mobile consumer internet at its best,” Eric Kim, one of Goodwater Capital’s two founding partners, told TechCrunch in an interview. “Spoon Radio is taking an offline experience that exists in classic radio and making it even better.”

Kim admitted that when he first used the service he didn’t see the appeal — he claimed the same was true for Musical.ly — but he said he changed his tune after talking to listeners and using Spoon Radio. He said it reminded him of being a kid growing up in the U.S. and listening to radio shows avidly.

“It’s a really interesting phenomenon taking off in Asia because of smartphone growth and people being keen for content, but not always able to get video content. It was a net new behavior that we’d never seen before… Musical.ly was in the same bracket as net new content for the new generation, we’ve been paying attention to this category broadly,” Kim — whose firm’s other Korean investments include chat app giant Kakao and fintech startup Toss — explained.

Powered by WPeMatico

Chinese AI startup Tianrang has raised a $26 million (RMB180 million) funding round from China’s Gaorong Capital and co-lead CMB International Capital. Other investors included Ziniu Fund and Chinese fintech company Wacai. In 2016, the company raised an angel round led by Gaorong Capital and participated in by Shanghai Jindi Investment Management Ltd.

Based on deep learning and other AI technology, Tianrang provides data analysis and smart solutions for enterprises. It was founded by in 2016 by Xu Guirong, former director of Alibaba’s Ali Cloud and chief scientist at Alibaba’s cloud platform Alimama. So no slouch on the AI front.

Tianrang claims to be able to automatically collect and analyze marketing trends and purchase-related information on Alibaba’s e-commerce platform, allowing vendors to make better marketing decisions.

Wang Hongbo, chief investment officer at CMB International Capital says: “With algorithm and AI, Tianrang lowers the requirement of complex machine decision-making and makes it accessible and scalable for commercial use.”

Tianrang also plans to set up a project to apply machine learning to the urban development of cities, led by Jessie Li, a professor at the College of Information Sciences and Technology of Pennsylvania State University.

Powered by WPeMatico

The official launch promo video for Samsung’s next flagship smartphone in the long-running Galaxy Note line — the Note 9 — appears to have leaked, with links to the video now cropping up on YouTube.

And via Twitter…

Samsung accidentally posted its Galaxy Note 9 into video to YouTube. Oops. pic.twitter.com/NfzikY4tLG

— Tom Warren (@tomwarren) August 3, 2018

The forthcoming phablet has been pretty comprehensively leaked already. And clearly hasn’t had a radical (cosmetic nor form factor) makeover. (This is not the fabled folding phone Samsung is slated to be working on for next year.)

The Note 9 will also be officially unveiled on August 9. So Samsung fans don’t have long left to wait for any last minute details they were keen to nail down.

But, in the few days remaining, the Samsung-branded video offers a more polished look at what’s going to be up for pre-order next week…

Samsung kicks off touting the power of the Note 9 — telling us it’s not just powerful but “super powerful” (leaked benchmarks have previously suggested a big performance boost); and with a bottoms-up ports & rear view pan that shows a 3.5mm headphone jack sitting in the frame — confirming my TC colleague Brian Heater’s eagle eye.

Also of note: A repositioned fingerprint sensor (now in a less stupid location below the dual lens camera housing).

Next, the video flips focus to a snazzy yellow (or is that gold?) S Pen stylus, which Samsung describes as “all new powerful”, before showing its physical button being pressed by an invisible force (human, we hope) which then does a spot of aimless doodling.

After this, Samsung moves to brag about the Note 9’s “all day battery” (which it’s confidently teased before — so the company looks to have put the Note 7 battery fiasco well and truly behind it), although the usual small print disclaimers warn about variable battery performance.

On the storage front, there’s a big bold claim of the device being “1 terabyte ready” — although this is on account of a 512GB SD card shown being pulled out of the expandable memory slot.

And in the small print displayed on the video at that point the company caveats that the 1TB claim is for 512GB models equipped with another 512GB in expandable memory (at the owner’s separate expense).

“The power to store more” [photos] “Delete less” [photos] is what the company’s marketing team has come up with to try to excite people over the utility of owning a smartphone that can have 1TB in storage capacity. i.e. if you stump up extra for the extra storage.

The video shows a camera roll chock-full of stock photos of pets, snacks and people. Hopefully Note 9 owners will find more creative things to do with 1TB storage.

Powered by WPeMatico

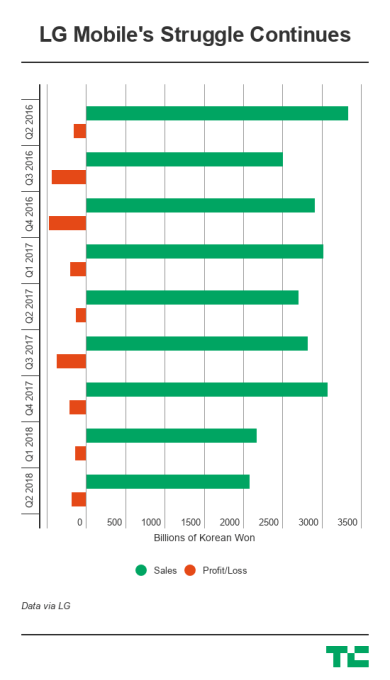

Korean electronics giant LG is soaring to new heights, but its mobile division continues to lag well behind the rest of the company and the signs aren’t promising.

LG’s latest financials released today recorded another quarter of success with operating profit jumping 16 percent year-on-year to hit KRW 771 billion ($715.1 million) as overall sales rose 3.2 percent across the group. LG said its sales and profit for the first half of 2018 are at all-time highs but — and you knew a but was coming… — its smartphone division remains a significant loss-maker.

The company’s mobile and communications division — which houses LG Mobile — posted yet another quarter in the red. Sales of KRW 2.07 trillion ($1.92 billion) represented an annual drop of 23 percent, while the division carded an operating loss of KRW 185.4 billion, or $171.95 million.

That’s compared to a quarterly profit of KRW 407 billion ($377.48 million) for LG’s home entertainment business and a KRW 457.2 billion ($424.04 million) profit for its home appliance unit, which are LG’s two stand-out business units.

There’s nothing new here, losses are commonplace for LG Mobile.

It hasn’t been break-even or profitable since 2014. Those losses have been cut by some degree since the company shook up the division with new leadership in November 2017, but there’s plenty to worry about with sales dipping noticeably over the past two quarters of business.

This time around in Q2, LG put its mobile losses down to “the slowing growth of the global smartphone market and a decline in mid- to low-end smartphone sales in Latin America.” While it claimed that the size of the operating loss was down to investments in sales and marketing ahead of the release of its next flagship devices.

There’s a hint a reorganization — perhaps even layoffs — as the company added that it would “seek to further improve its business structure” as it aims prepares to push its LG G7 ThinQ and LG V35 ThinQ devices worldwide and get ready for those new launches.

More changes are on their way, you’d imagine, as LG is surely looking for a way to stem the bleeding but also retain a mobile business has certainly been iconic despite its struggles in recent times. Perhaps the answer is a downsizing in a similar style to Sony in 2016. Back then, the Japanese firm was losing even more than LG is per quarter but it began to be more strategic with its new device launches and target sales markets. The end result of that strategy was an end to the big losses and a more sustainable mobile business.

Powered by WPeMatico

Line, the company best-known for its popular Asian messaging app, is doubling down on games after it acquired a controlling stake in Korean studio NextFloor for an undisclosed amount.

NextFloor, which has produced titles like Dragon Flight and Destiny Child, will be merged with Line’s games division to form the Line Games subsidiary. Dragon Flight has racked up 14 million users since its 2012 launch — it clocked $1 million in daily revenue at peak. Destiny Child, a newer release in 2016, topped the charts in Korea and has been popular in Japan, North America and beyond.

Line’s own games are focused on its messaging app, which gives them access to social features such as friend graphs, and they have helped the company become a revenue generation machine. Alongside income from its booming sticker business, in-app purchases within games made Line Japan’s highest-earning non-game app publisher last year, according to App Annie, and the fourth highest worldwide. For some insight into how prolific it has been over the years, Line is ranked as the sixth highest earning iPhone app of all time.

But, despite revenue success, Line has struggled to become a global messaging giant. The big guns WhatsApp and Facebook Messenger have in excess of one billion monthly users each, while Line has been stuck around the 200 million mark for some time. Most of its numbers are from just four countries: Japan, Taiwan, Thailand and Indonesia. While it has been able to tap those markets with additional services like ride-hailing and payments, it is certainly under pressure from those more internationally successful competitors.

With that in mind, doubling down on games makes sense and Line said it plans to focus on non-mobile platforms, which will include the Nintendo Switch among others consoles, from the second half of this year.

Line went public in 2016 via a dual U.S.-Japan IPO that raised over $1 billion.

Powered by WPeMatico

Xiaomi gave Google’s well-intentioned but somewhat-stalled Android One project a major boost last year when it unveiled its first device under the program, Mi A1. That’s now joined by not one but two sequel devices, after the Chinese phone maker unveiled the Mi A2 and Mi A2 Lite at an event in Spain today.

Xiaomi in Spain? Yes, that’s right. International growth is a major part of the Xiaomi story now that it is a listed business, and Spain is one of a handful of countries in Europe where Xiaomi is aiming to make its mark. These two new A2 handsets are an early push and they’ll be available in over 40 countries, including Spain, France, Italy and 11 other European markets.

Both phones run on Android One — so none of Xiaomi’s iOS-inspired MIUI Android fork — and charge via type-C USB. The 5.99-inch A2 is the more premium option, sporting a Snapdragon 660 processor and 4GB or 6GB RAM with 32GB, 64GB or 128GB in storage. There’s a 20-megapixel front camera and dual 20-megapixel and 16-megapixel cameras on the rear. On-device storage ranges between 32GB, 64GB and 128GB.

The Mi A2 Lite is the more budget option that’s powered by a lesser Snapdragon 625 processor with 3GB or 4GB RAM, and 32GB or 64GB storage options. It comes with a smaller 5.84-inch display, there’s a 12- and 5-megapixel camera array on the reverse and a front-facing five-megapixel camera.

The A2 is priced from €249 to €279 ($291-$327) based on specs. The A2 Lite will sell for €179 or €229 ($210 or $268), against based on RAM and storage selection.

The 40 market availability mirrors the A1 launch last year, but on this occasion, Xiaomi has been busy preparing the ground in a number of countries, particularly in Europe. It has been in Spain for the past year, but it also launched local operations in France and Italy in May and tied up with CK Hutchison to sell phones in other parts of the continent via its 3 telecom business. While it isn’t operational in the U.S., Xiaomi has expanded into Mexico and it has set up partnerships with local retailers in dozens of other countries.

Xiaomi has been successful with its move into India, where it one of the top smartphone sellers, but it has not yet replicated that elsewhere outside of China so far.

China is, as you’d expect, the primary revenue market but Xiaomi is increasingly less dependent on its homeland. For 2017 sales, China represented 72 percent, but it had been 94 percent and 87 percent, respectively, in 2015 and 2016.

Powered by WPeMatico