Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

In a bid to cut down on the spread of false information and spam, WhatsApp recently added labels that indicate when a message has been forwarded. Now the company is sharpening that strategy by imposing limits on how many groups a message can be sent on to.

Originally, users could forward messages on to multiple groups, but a new trial will see that forwarding limited to 20 groups worldwide. In India, however, which is WhatsApp’s largest market with 200 million users, the limit will be just five. In addition, a ‘quick forward’ option that allowed users to pass on images and videos to others rapidly is being removed from India.

“We believe that these changes — which we’ll continue to evaluate — will help keep WhatsApp the way it was designed to be: a private messaging app,” the company said in a blog post.

The changes are designed to help reduce the amount of information that goes viral on the service, although clearly this isn’t a move that will end the problem altogether.

The change is in direct response to a series of incidents in India. The BBC recently wrote about an incident which saw one man dead and two others severely beaten after rumors of their efforts to abduct children from a village spread on WhatsApp. Reportedly 17 other people have been killed in the past year under similar circumstances, with police saying false rumors had spread via WhatsApp.

In response, WhatsApp — which is of course owned by Facebook — has bought full-page newspaper ads to warn about false information on its service.

Beyond concern about firing up vigilantes, the saga may also spill into India’s upcoming national general election next year. Times Internet today reports that Facebook and WhatsApp plan to introduce a fake news verification system that it used recently in Mexico to help combat spam messages and the spreading of incorrect news and information. The paper said that the companies have already held talks with India’s Election Commission.

Powered by WPeMatico

Samsung has put out earnings guidance for its Q2 which indicate quarterly growth at its slowest for more than a year — as a lack of new ideas to sell high end smartphones drags on the company’s bottom line.

The electronics maker is reporting estimated profit of 14.8 trillion Korean won (USD$13.2BN) on revenue of 58 trillion Korean won (USD$51.9BN) for the quarter.

Samsung’s expectation just misses an average estimate of 14.9 trillion won from 18 analysts polled by Thomson Reuters, and shares in the company are down just over 2 per cent on the earnings guidance news.

The Q2 forecast compares to profit of 15.64 trillion Korean Won (USD$14BN) on revenue of 60.56 trillion Korean Won (USD$54.2BN) for its Q1 — when Samsung reported a record operating profit off the back of growth in its semiconductor business plus the early global launch of its flagship Galaxy S9 smartphone.

Despite that Q1 high, it had prepared investors for a Q2 slowdown — warning in April of challenging conditions ahead, citing weakness in the display panel segment and a decline in profitability on the mobile side, amid rising competition in the high-end smartphone segment.

At the same time, the global smartphone market is shrinking — even in China, the erstwhile growth engine for smartphones after Western markets saturated. So Samsung’s smartphone business is facing a dual squeeze from shrinking sales opportunities and rising competition from the likes of China’s Huawei and Xiaomi — two rival Android device makers that have been carving out additional marketshare.

Meanwhile, Samsung’s main rival for high end smartphone profits, Apple, beat analyst estimates of iPhones shipments in its Q2 in May, despite an earlier miss in the holiday quarter — showing the staying power of its high end smartphone brand and a positive, if slow burn, response to how it’s iterating its mobile business, with the iPhone X.

Returning to Samsung, the positive story for the company — continued record growth for its chip business — is still not filling the smartphone-shaped profit hole in its books, even as restarting momentum in the smartphone segment is looking increasingly tough in a very tough market.

The Galaxy S9 is a solid smartphone but serving up more of the same equals diminishing returns in the fiercely competitive Android space. And investors look circumspect, with shares in Samsung down around 12% this year.

One wild card on the device innovation front: Samsung has been teasing its R&D work to build a foldable smartphone for multiple years. Ahead of Apple’s iPhone X flagship launch last year Samsung suggested it was targeting 2018 to finally release a product.

However this is also a risky strategy given the obvious manufacturing challenges, and — beyond that — question marks over whether a foldable smartphone is really the type of mainstream innovation that could fire up major momentum among high end handset buyers or be viewed as a niche gimmick.

Powered by WPeMatico

Airwallex, a three-year-old fintech startup focused on international payments for SMEs and businesses, is putting itself on the map after it raised an $80 million Series B round.

Based out of Melbourne, but with six offices in Asia and other parts of the world, Airwallex’s new funding round is the second-largest financing deal for an Australian startup in history. The round was led by existing investors Tencent, the $500 billion Chinese internet giant, and Sequoia China. Other participants included China’s Hillhouse, Horizons Ventures — the fund from Hong Kong’s richest man, Li Ka-Shing — Indonesia-based Central Capital Ventura (BCA) and Australia’s Square Peg, a firm from Paul Bassat, who took recruitment firm Seek to IPO and is one of Australia’s highest-profile founders.

The financing takes Airwallex to $102 million raised. Tencent led a $13 million Series A in May 2017, while Square Peg added $6 million more via a Series A+ in December. Mastercard is also a backer; the finance giant uses Airwallex to handle its “Send” product, while Tencent uses the service to power an overseas remittance service for its WeChat app.

Airwallex handles cross-border transactions for companies that do business in multiple countries using international currencies. So it’s not unlike a TransferWise-style service for SMEs that lack the capital to develop a sophisticated (and expensive) international banking system of their own.

The service uses wholesale FX rates to route overseas payments back to a client’s domestic bank and is capable of processing “thousands of transactions per second,” according to the company. A use case example might include helping a China-based seller return money earned in the U.S. or Europe via Amazon or other e-commerce services, or route sales revenue back directly from their own website.

Airwallex CEO Jack Zhang (far right) onstage at TechCrunch Shenzhen in 2017

China is a key market for Airwallex — which was started by four Australian-Chinese founders — as well as the wider Asian region, and in particular Australia, Hong Kong and Southeast Asia. With this new capital, Airwallex co-founder and CEO Jack Zhang said the company will increase its focus on Hong Kong and Southeast Asia, whilst also extending its business in Europe (where it has a London-based office) and pushing into North America.

Product R&D is shared across Melbourne and Shanghai, while Hong Kong accounts for business development, compliance and more, Zhang explained. However, Airwallex’s locations in London and San Francisco are likely to account for most of the upcoming headcount growth planned following this funding. Right now, Airwallex has around 100 staff, according to Zhang.

The company is also aiming to expand its product range.

The firm is in the process of applying for a virtual banking license in Hong Kong, a third-party payment license in mainland China and a cross-border Chinese yuan license. One goal, Zhang revealed, is to offer working capital loans to SMEs to help them scale their businesses to the next level. Airwallex is working with an undisclosed partner to underwrite deals in the future. Zhang explained that the company sees a gap in the market since banks don’t have access to critical data on clients for loan assessments.

More generally, he’s bullish for the future, despite Brexit and the ongoing trade war between the U.S. and China.

“The trade war gives the Chinese yuan a lot of vitality, and we’ve seen more demand in the market. China’s belt road initiative has really taken off, too, and we’re seeing the impact in many, many of our payment corridors,” he explained. “Business has been booming, especially as traditional offline SMEs start to move online and go from domestic to global.”

“We want to be the backbone to support these new opportunities for businesses,” Zhang added.

Powered by WPeMatico

Cashify, a company that buys and sells used smartphones, is the latest India startup to raise capital from Chinese investors after it announced a $12 million Series C round.

Chinese funds CDH Investments and Morningside led the round, which included participation from Aihuishou, a China-based startup that sells used electronics in a similar way to Cashify and has raised more than $120 million. Existing investors, including Bessemer Ventures and Shunwei, also took part in the round.

This new capital takes Cashify to $19 million raised to date.

The business was started in 2013 by co-founders Mandeep Manocha (CEO), Nakul Kumar (COO) and Amit Sethi (CTO) initially as ReGlobe. The business gives consumers a fast way to sell their existing electronics; it deals mainly in smartphones but also takes laptops, consoles, TVs and tablets.

“When we began we saw a lot of transaction for phone sales moving from offline to online,” Manocha told TechCrunch in an interview. “But consumer-to-consumer [for used devices] is highly opaque on price discovery and you never know if you’re making the right decision on price and whether the transaction will take place in the timeframe.”

These days, the company estimates that the average upgrade cycle has shifted from 20 months to 12 months, and now it is doubling down.

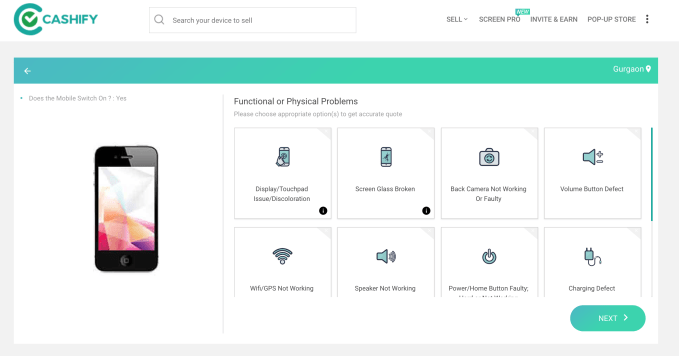

With Cashify, sellers simply fill out some details online about their device, then Cashify dispatches a representative who comes to their house to perform diagnostic checks and gives them cash for the device that day. The startup also offers an app which automatically carries out the checks — for example ensuring the camera, Bluetooth module, etc. all work — and offers a higher cash payment for the user since Cashify uses fewer resources.

A sample of the Cashify Q&A for selling a device

Beyond its website and app, Cashify gets devices from trade-in programs for Samsung, Xiaomi and Apple in India, as well as e-commerce companies like Flipkart, Amazon and Paytm Mall.

Used device acquired, what happens next is interesting.

The startup has built out a network of offline merchants who specialize in selling used phones. Each phone it acquires is then sold (perhaps after minor refurbishments) to that network, so it might pop up for sale anywhere in India.

With this new money, Cashify CEO Manocha said the company will develop an online resale site that will allow anyone to buy a used phone from the company’s network. Devices sold by Cashify online will be refurbished with new parts where needed, and they’ll include a box and six-month warranty to give a better consumer experience, Manocha added.

Today, Cashify claims to handle 100,000 smartphones a month, but it is planning to grow that to 200,000 by the end of this year. Cashify said its devices are typically low-end, those that retail for sub-$300 when new. A large part of that push comes from the online site, but the startup is also enlarging its offline merchant network and working to reach more consumers who are actually selling their device. That’s where Manocha said he sees particular value in working with Aihuishou.

Cashify is also developing other services. It recently started offering at-home repairs for customers and Manocha said that adding Chinese investors — and Aihuishou in particular — will help it with its sourcing of components for the repairs service and general refurbishments.

Cashify estimates that the used smartphone market in India will see 90 million phones sold this year, with as many as 120 million trading by 2020. That’s close to the 124 million shipments that analysts estimate India saw in 2017, but with surprisingly higher margins.

A reseller can make 10 percent profit on a device, Manocha explained, and Cashify’s own price elasticity — the difference between what it buys from consumers at and what it sells to resellers for — is typically 30-35 percent, he added. That’s more than most OEMs, but that doesn’t take into account costs on the Cashify side, which bring that number down.

“When I sell to a reseller, the margins aren’t that exciting, which is why we want to sell direct to consumers,” the Cashify CEO said.

The startup has plenty going on at home in India, but already it is considering overseas possibilities.

“We will focus on India for at least the next 12 months, but we have had discussions on markets that would make sense to enter,” Manocha said, explaining that the Middle East and Southeast Asia are early frontrunners.

“We are working very closely with one of the Chinese players and figuring out if we can do some business in Hong Kong because that’s the hub for second-hand phones in this part of the world,” he added.

Note: The original version of this article was updated to correct that Amit Sethi is CTO not CFO.

Powered by WPeMatico

Google is turning startup investor to further its goal of putting Google services like search, maps, and its voice assistant front and center for the next billion internet users in emerging markets. It has invested $22 million into KaiOS, the company that has built an eponymous operating system for feature phones that packs a range of native apps and other smartphone-like services. As part of the investment, KaiOS will be working on integrating Google services like search, maps, YouTube and its voice assistant into more KaiOS devices, after initially announcing Google apps for KaiOS-powered Nokia phones earlier this year.

“This funding will help us fast-track development and global deployment of KaiOS-enabled smart feature phones, allowing us to connect the vast population that still cannot access the internet, especially in emerging markets,” said KaiOS CEO Sebastien Codeville in a statement.

Our mobile world is dominated today by smartphones: there were about 1.6 billion of them sold last year. But feature phones have continued to move, too: it’s estimated that there were about 450 million-500 million of them shipped in 2017. And their sales are actually growing faster right now than their souped-up cousins.

KaiOS-powered phones play squarely in the latter category, and they are gaining traction in markets where feature phones still hold sway. In India, they have overtaken Apple’s iOS to become the second-most popular devices after Android handsets. KaiOS tells us that there have been more than 40 million KaiOS phones shipped to-date.

Google’s KaiOS investment could be seen as a way of introducing its services to feature phone users who might eventually graduate to smartphones. However, there is also scope for holding on to these users even as they stay in the feature phone category, which continues to evolve and become more functional.

“We’re excited to work with Google to deliver its services on more mobile devices,” said Codeville, the KaiOS CEO. “Having an intelligent voice assistant on an affordable mobile phone is truly revolutionary as it helps overcome some of the limitations a keypad brings.”

A Nokia device running KaiOS

KaiOS is a U.S.-based project that started in 2017, built on the ashes of Mozilla’s failed Firefox OS experiment, as a fork of the Linux codebase. Firefox OS was intended to be the basis of a new wave of HTML-5, low-cost smartphones. And while those devices and the wider ecosystem never really took off, KaiOS has fared significantly better.

KaiOS powers phones made by OEMs including Nokia (HMD), Micromax and Alcatel, and it works with carriers including Sprint and AT&T — it counts offices in North America, Europe and Asia. But its most significant deployment to date has been with India’s Reliance Jio, the challenger telco that disrupted the Indian market with affordable 4G data packages.

Reliance Jio offers its own range of KaiOS handsets, and coupling that with its low-cost data packages, KaiOS’ share of India’s phone market has reportedly jumped to 15 percent — overtaking Apple’s iOS in the process and putting it second behind only Android. (Jio’s own devices have actually increased the number of feature phones in India, such has been its impact in the country.)

That market share alone in a high-growth market like India is likely enough to pique Google’s interest.

“We want to ensure that Google apps and services are available to everyone, whether they are using desktops, smartphones, or feature phones.” said Anjali Joshi, VP of Product Management for Google’s Next Billion Users division, in a statement. “Following the success of the JioPhones, we are excited to work with KaiOS to further improve access to information for feature phone users around the world.”

Beyond this, the Next Billion business unit works on customizing the Google experience and services to fit the needs of new internet users in emerging markets, including the launch of new services like this neighborhoods app and a successful public WiFi program.

While Google continues to develop its Android smartphone platform, it has long been an advocate of expanding its services to other platforms, too, and that’s been the case with KaiOS.

In February, KaiOS announced that it would be adding Google Search, Google Maps and the Google Voice Assistant to the new Nokia 8110 feature phone, and it seems that this is the Google agreement that will be expanded to all models as part of Google’s investment.

To be clear, Google services are not the only ones on KaiOS. It added apps for Twitter and Facebook earlier this year, and it mixes dedicated KaiOS apps — WhatsApp is said to be coming — with others that are more basic HTML-5 web apps.

Google’s investment in KaiOS is the latest in a line of direct startup deals from the U.S. tech giant that sit alongside investments made by GV and CapitalG, its two investment arms. Google has also backed concierge service Dunzo and is partnering with the carrier Orange to make investments and potentially acquire startups in Europe, the Middle East and Africa.

Powered by WPeMatico

Microsoft today launched two new Azure regions in China. These new regions, China North 2 in Beijing and China East 2 in Shanghai, are now generally available and will complement the existing two regions Microsoft operates in the country (with the help of its local partner, 21Vianet).

As the first international cloud provider in China when it launched its first region there in 2014, Microsoft has seen rapid growth in the region and there is clearly demand for its services there. Unsurprisingly, many of Microsoft’s customers in China are other multinationals that are already betting on Azure for their cloud strategy. These include the likes of Adobe, Coke, Costco, Daimler, Ford, Nuance, P&G, Toyota and BMW.

In addition to the new China regions, Microsoft also today launched a new availability zone for its region in the Netherlands. While availability zones have long been standard among the big cloud providers, Azure only launched this feature — which divides a region into multiple independent zones — into general availability earlier this year. The regions in the Netherlands, Paris and Iowa now offer this additional safeguard against downtime, with others to follow soon.

In other Azure news, Microsoft also today announced that Azure IoT Edge is now generally available. In addition, Microsoft announced the second generation of its Azure Data Lake Storage service, which is now in preview, and some updates to the Azure Data Factory, which now includes a web-based user interface for building and managing data pipelines.

Powered by WPeMatico

Valve is officially bringing its Steam game platform to China as it aims to take a chunk of the world’s largest market of gamers.

Valve said it will work with local partner Perfect World, which it previously collaborated on to release major games Dota 2 and Counter-Strike: Global Offensive. Shanghai-based Perfect World will control local promotional, the selection of games and distribution. There’s no confirmed date for when the Steam China service will go live.

The move makes perfect sense. For one thing, Valve has a vast opportunity to tap into. China’s games market is booming, with Newzoo forecasting that it represented $32.5 billion in 2017, ahead of the U.S., Japan, Germany and the UK. PC gaming has always been the base for revenue, but mobile is growing fast with Tencent — one of the largest gaming firms on the planet — recently reporting that its mobile revenue has overtaken that of PC.

But, as with all things China, access is uncertain. Parts of Valve’s service were blocked in China last December, although the ability to guy games remained intact. It isn’t clear why the partial blockage occurred — China frequently upgrades its firewall technology which can trigger changes — but working with a local partner is a more reliable approach than going solo. That said, Perfect World will have to manage the inevitable government censorship demands.

Despite having no official presence in China, more than one-quarter of Steam users have the language set to Basic Chinese, second only to English, according to a user survey. Whilst that also accounts for the Chinese diaspora, it is a sign that Steam already has significant traction among China’s gamers.

There’s plenty of competition in this space, so Valve won’t simply waltz into dominance. Tencent has its own Steam-like platform while NetEase has partnered with big U.S. gaming companies like Bungie and Blizzard.

Powered by WPeMatico

A month after it filed for a much-anticipated Hong Kong IPO, Xiaomi has revealed a little more financial information after a monster 621-page document disclosed a $1.1 billion (seven billion RMB) loss for the first quarter of the year.

The IPO, which could raise up to $10 billion value Xiaomi at high as $100 billion, is set to be the largest IPO raise since Alibaba went public in the U.S. in 2014. That prospect got a boost with a dose of positive financial growth despite a loss incurred by one-off payments.

The document filed was an application to issue a CDR as part of a dual-listing that would include Mainland China, showed that Xiaomi’s revenue for the quarter jumped to 34 billion RMB, or $5.3 billion. That’s compared to 114.6 billion RMB ($17.9 billion) in total sales for all of last year, according to digging from TechCrunch partner site Technode.

While Xiaomi posted a loss for the quarter, the firm actually posted a 1.038 billion RMB ($162 million) profit for the period when one-time items are excluded. Xiaomi previously registered a 43.9 billion RMB ($6.9 billion) loss in 2017 on account of issuing preferred shares to investors (54 billion RMB) but it did post a slim profit in 2016.

The company is ranked fourth based on global smartphone shipments, according to analyst firm IDC, and it is one of the few OEMs to buck slowing sales in China.

China is, as you’d expect, the primary revenue market but Xiaomi is increasingly less dependent on its homeland. For 2017 sales, China represented 72 percent, but it had been 94 percent and 87 percent, respectively, in 2015 and 2016. India is Xiaomi’s most successful overseas venture, having built the business to the number one smartphone firm based on market share, and Xiaomi is pledging to double down on other global areas.

Interestingly there’s no mention of expanding phone sales to the U.S., but Xiaomi has pledged to put 30 percent of its IPO towards growing its presence in Southeast Asia, Europe, Russia “other regions.” Currently, it said it sells products in 74 countries, that does include the U.S. where Xiaomi sells accessories and non-phone items.

Despite its design progress, relative age as an eight-year-old company and the fact it is shooting for a $100 billion, Xiaomi left some spectators disappointed when it wheeled out a very iPhone X-looking new device earlier this month. While the company claims the Mi 8 is packed with new technology, it’s hard to look past the fact that a number of its visual designs are identical to Apple’s flagship smartphone. Xiaomi could have made a stronger statement of intent with the launch, but it will hope its financials can do the talking as it moves into the last moments of preparation before its public listing.

Powered by WPeMatico

M17 Entertainment, a Taipei-based live streaming and dating app group, priced its IPO this morning on the NYSE and was expected to open trading today according to their final press release. But with just a little more than two hours to go before market closing, it’s still not trading, and no one seems to know why.

An interview I had scheduled with the CEO earlier this afternoon was canceled at the last minute, with the company’s representative saying that M17 couldn’t comment since its shares were not yet actively trading, and thus the company remains under an SEC-mandated quiet period.

M17 has had a rocky non-debut so far. Originally targeting a fundraise of $115 million of American Depository Receipts (shares of foreign companies listed domestically on the NYSE), the company concluded its roadshow raising less than half of its target, for a final investment of $60.1 million. The company priced its ADR shares at $8 each, with each ADR representing 8 shares of the stock’s Class A security.

My colleague Jon Russell has covered the company’s rapid growth over the past three years. It was formed from the merger of dating app company Paktor and live-streaming business 17 Media. Joseph Phua, who was CEO of Paktor, became CEO of the joint M17 company following the merger. Together, the two halves have raised tens of millions in venture capital.

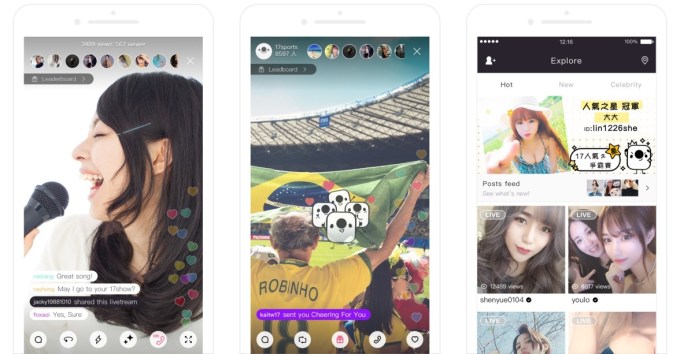

M17 provides live-streaming and dating apps throughout “Developed Asia”

The company’s main product is a live-streaming product where creators can build their fan bases and brands. Fans can purchase virtual gifts to send to their favorite artists, and those points are proving to be extraordinarily lucrative for the company. The company, according to its amended F-1 statement, has seen tremendous revenue growth, netting $37.9 million of revenue in the first three months of this year. The company has also been able to attract more live-streaming talent, increasing its contracted artists from 999 at the end of December 2016 to 7,719 at the end of March this year.

That’s where the good news ends for the company. Despite that revenue growth, operating losses are torrential, with the company losing $24.8 million in the first three months of this year. The company in its statement says that it has $31.4 million in cash and cash equivalents, giving it limited runway to continue operations without a strong IPO debut.

User growth has been mostly stagnant. Active monthly users has increased from 1.5 million to 1.7 million between March 31 of 2017 and 2018. What the company has succeeded in doing is monetizing those users much better. The percentage of users paying on the platform has more than doubled over the same time period, and the value of those users has increased more than 40 percent to $355 per user per month.

The big challenge for M17 is revenue quality. Live streaming represents 91.4 percent of the company’s revenues, but those revenues are concentrated on a handful of “whales” who buy a freakishly high number of virtual gifts. The company’s top 10 users represent 11.8 percent of all revenues (that’s $447,220 per user in the first three months this year!), and its top 500 users accounted for almost a majority of total revenues. That concentration on the demand side is just as heavy on the supply side. M17’s top 100 artists accounted for more than a third of the company’s revenue.

That concentration has improved over the past few months, according to the company’s filing. But Wall Street investors have learned after Zynga and other whale-based revenue models that the sustainability of these businesses can be tough.

Finally, one complication for many investors wary of the increasing use of dual-class stock issues is the governance of the company. Phua, the CEO, will have 56.3 percent of the voting rights of the company, and M17 will be a controlled company under NYSE rules according to the company’s amended filing. Class B shares vote at a 20:1 ratio with Class A share voting rights.

All of this is to say that while the company has had some dizzying growth in its revenue numbers over the past 24 months, that success is moderated by some significant challenges in revenue concentration that will have to be a top priority for M17 going forward. Why the company priced and hasn’t traded remains a mystery, and we have reached out for more comments.

Powered by WPeMatico

While crowdfunding company Indiegogo has been running a pilot program in China for the past couple of years, it’s now building on those efforts with the launch of the Indiegogo China Global Fast-Track Program.

CEO David Mandelbrot is in Shenzhen, China this week to announce the program, which is designed to help Chinese entrepreneurs reach a global audience. In an email, he told me:

The China Pilot Program is officially out of pilot phase — today, we are officially launching the Indiegogo Global Fast Track. During the pilot phase, the team experimented with different ways to help service Chinese brands and manufacturers who were looking to launch products overseas. After helping companies raise over $100 million and launch over 3,000 China-based projects over two years time, the team has finalized its new suite of services.

Those services include guidance around crowdfunding and marketing in the United States and other countries, access to a network of more than 65 service providers (including retailers and marketing firms, as well as Indiegogo’s manufacturing partner Arrow Electronics and shipping partner Ingram Micro) and Chinese-to-English consultation with bilingual staff.

Even while in the pilot phase, Indiegogo has had some success stories in helping Chinese companies launch globally. For example, Bluetooth headphone company crazybaby raised more than $4 million across three campaigns.

Mandelbrot said Indiegogo also has opened a satellite office in the Tencent incubator in Shenzhen — a manufacturing hub that’s become a hub for hardware startups, too.

Powered by WPeMatico