Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

The weekend provided no rest to news-wary reporters, with major announcements coming from Xiaomi, SoftBank and the Chinese government the past few days that will continue to change the global tech landscape.

One of the most important yet underreported stories of 2018 has been the development of Chinese Depository Receipts (known as CDRs). I wrote a comprehensive primer on the investment mechanism a few weeks ago, but the summary is that CDRs will give mainland Chinese investors access to overseas-listed stocks that set up the right custodian accounts. Due to domestic capital controls and relatively weak stock exchange rules in China, many Chinese tech giants are listed on overseas stock exchanges in New York and Hong Kong.

Beijing-based Xiaomi, which produces a line of phones and offers mobile software services, is launching one of the most anticipated IPOs of the year, with a valuation expected to top tens of billions of dollars. In its official filing, the company targeted a fundraise of $10 billion. While Xiaomi is a sterling example of the potential success of Chinese entrepreneurs, local retail buyers would likely have had no access to buy the stock, which will be listed in Hong Kong.

Fiona Lau and Julie Zhu at Reuters are now reporting that Xiaomi could be one of the first companies to take advantage of the new CDR mechanism, potentially reserving 30 percent of its new issue for CDR buyers. That would be about $3 billion if the assumptions of the fundraise play out.

If the CDR mechanism works as expected, Chinese companies and potentially many others could suddenly tap a vast new pool of capital, either in the IPO process or more generally. That could push valuations for many of these issues higher than they might otherwise go, since Chinese mainland investors have limited ability to invest in overseas stocks due to capital controls. A valuation that might cause a New York-based money manager to flee might be more than palatable to a Chinese investor.

While Chinese tech giants are likely to quickly offer CDR options to take advantage of their local brand power and increase upward pressure on their stock prices, the bigger question in my mind is how long it will take overseas companies to offer similar measures and get access to this capital market. While companies like Facebook and Google are blocked or mostly blocked from mainland China, other companies like Apple have strong brand presence in the country, and could theoretically offer a CDR as it strives for a $1 trillion valuation. There are huge legal and policy roadblocks to overcome of course, but such a debut would be a major milestone in China’s financial development.

Japan’s SoftBank Group, which owns a set of major tech and finance companies, announced a new group of senior execs late on Friday that sets up something of a leadership contest to succeed the group’s founder, Masayoshi Son.

Several years ago, Son had indicated that Nikesh Arora, who had spent a decade at Google and eventually rose to be the company’s chief business officer, would succeed him. Arora became president and chief operating officer of SoftBank, but would last less than two years before heading out from the role. As a sort of coda to that chapter, we learned late last week that Arora has joined Palo Alto Networks as its CEO.

Now, SoftBank has announced that three people will take leadership roles in the company, and all three will join its board of directors. Rajeev Misra, who runs the $100 billion SoftBank Vision Fund, will become an executive vice president (EVP) while maintaining his duties to the fund.

Katsunori Sago, who until recently was the chief investment officer of Japan Post, Japan’s largest savings bank with a $1.9 trillion portfolio, will join SoftBank as an EVP and chief strategy officer. Sago had been rumored to be considering leaving Japan Post just a few weeks ago. Finally, former Sprint CEO Marcelo Claure was named an EVP and SoftBank’s new chief operating officer. Claure was elevated to executive chairman of Sprint last month, while stepping down as CEO.

Each of the three are positioned around the key tentpoles of SoftBank. SoftBank’s core business remains telecom, on which Claure will presumably spend significant time. The group’s financial interests, which includes a 100 percent stake in Fortress Investment Group, will likely get significant attention from Sago. And the SoftBank Vision Fund, which has received splashy headlines with its massive investments in global unicorn startups, is obviously a key future pillar of the company, giving Misra a powerful perch in the group.

Masayoshi Son is 60 years old today. While retirement seems to be the least likely course of action for the energetic entrepreneur, clearly he is starting to think through succession in a more robust way than he did before with Arora. That should make SoftBank investors far more content, and also provide a little bit of a competitive dynamic at the top of the organization to drive the group’s results in the years to come.

The chip wars between China and the rest of the world continue to heat up. Now, it looks like Samsung, the world’s largest chipmaker, is in the crosshairs of Beijing, according to a Wall Street Journal report by Yoko Kubota. In addition to Samsung, Micron and SK Hynix were also ensnared in the investigation.

China has made building a strong indigenous chip industry a core pillar of its economic development strategy. In addition to a comprehensive plan known as Made in China 2025, the country has also been attempting to put together the world’s largest semiconductor venture capital investment fund, which in aggregate could have tens of billions of dollars in capital at its disposal.

The investigations against Samsung and the two chipmakers comes at the same time that China has also once again delayed the close of Qualcomm’s acquisition of NXP Semiconductors. Qualcomm has been waiting for months to get Beijing’s approval on that deal, which would provide the company a fresh source of revenue and a renewed product mix in strategic areas like automotive.

The use of economic investigations to help and hurt Chinese companies and their competitors is starting to become a mainstay. The United States used the negative conclusions of its investigation into Chinese telecommunications company ZTE in order to cut off its export licenses, practically killing the company. While the U.S. has now started to walk back that threat by floating the option of a large fine, it is clear that these sorts of tit-for-tat investigations are going to continue into the future.

Powered by WPeMatico

Excited to announce that this year’s The Europas Unconference & Awards is shaping up! Our half day Unconference kicks off on 3 July, 2018 at The Brewery in the heart of London’s “Tech City” area, followed by our startup awards dinner and fantastic party and celebration of European startups!

The event is run in partnership with TechCrunch, the official media partner. Attendees, nominees and winners will get deep discounts to TechCrunch Disrupt in Berlin, later this year.

The Europas Awards are based on voting by expert judges and the industry itself. But key to the daytime is all the speakers and invited guests. There’s no “off-limits speaker room” at The Europas, so attendees can mingle easily with VIPs and speakers.

What exactly is an Unconference? We’re dispensing with the lectures and going straight to the deep-dives, where you’ll get a front row seat with Europe’s leading investors, founders and thought leaders to discuss and debate the most urgent issues, challenges and opportunities. Up close and personal! And, crucially, a few feet away from handing over a business card. The Unconference is focused into zones including AI, Fintech, Mobility, Startups, Society, and Enterprise and Crypto / Blockchain.

We’ve confirmed 10 new speakers including:

Eileen Burbidge, Passion Capital

Carlos Eduardo Espinal, Seedcamp

Richard Muirhead, Fabric Ventures

Sitar Teli, Connect Ventures

Nancy Fechnay, Blockchain Technologist + Angel

George McDonaugh, KR1

Candice Lo, Blossom Capital

Scott Sage, Crane Venture Partners

Andrei Brasoveanu, Accel

Tina Baker, Jag Shaw Baker

We’d love for you to ask your friends to join us at The Europas – and we’ve got a special way to thank you for sharing.

Your friend will enjoy a 15% discount off the price of their ticket with your code, and you’ll get 15% off the price of YOUR ticket.

That’s right, we will refund you 15% off the cost of your ticket automatically when your friend purchases a Europas ticket.

So you can grab tickets here.

Public Voting is still humming along. Please remember to vote for your favourite startups!

Awards by category:

Hottest Media/Entertainment Startup

Hottest E-commerce/Retail Startup

Hottest Marketing/AdTech Startup

Hottest Enterprise, SaaS or B2B Startup

Hottest Platform Economy / Marketplace

Hottest Cyber Security Startup

Hottest Internet of Things Startup

Fastest Rising Startup Of The Year

Hottest GreenTech Startup of The Year

Best Angel/Seed Investor of the Year

Hottest VC Investor of the Year

Hottest Blockchain/Crypto Startup Founder(s)

Hottest Blockchain Protocol Project

Hottest Corporate Blockchain Project

Hottest Blockchain ICO (Europe)

Hottest Financial Crypto Project

Hottest Blockchain for Good Project

Hottest Blockchain Identity Project

Hall Of Fame Award – Awarded to a long-term player in Europe

The Europas Grand Prix Award (to be decided from winners)

The Awards celebrates the most forward thinking and innovative tech & blockchain startups across over some 30+ categories.

Startups can apply for an award or be nominated by anyone, including our judges. It is free to enter or be nominated.

Instead of thousands and thousands of people, think of a great summer event with 1,000 of the most interesting and useful people in the industry, including key investors and leading entrepreneurs.

• No secret VIP rooms, which means you get to interact with the Speakers

• Key Founders and investors speaking; featured attendees invited to just network

• Expert speeches, discussions, and Q&A directly from the main stage

• Intimate “breakout” sessions with key players on vertical topics

• The opportunity to meet almost everyone in those small groups, super-charging your networking

• Journalists from major tech titles, newspapers and business broadcasters

• A parallel Founders-only track geared towards fund-raising and hyper-networking

• A stunning awards dinner and party which honors both the hottest startups and the leading lights in the European startup scene

• All on one day to maximise your time in London. And it’s PROBABLY sunny!

That’s just the beginning. There’s more to come…

Interested in sponsoring the Europas or hosting a table at the awards? Or purchasing a table for 10 or 12 guest or a half table for 5 guests? Get in touch with:

Petra Johansson

Petra@theeuropas.com

Phone: +44 (0) 20 3239 9325

Powered by WPeMatico

Japanese gamers and manga aficionados and every combination thereof will get a treat this summer with the release of a NES Classic Edition loaded with games from the pages of Weekly Jump. The beloved manga mag is celebrating its 50th anniversary and this solid gold Famicom is part of the festivities.

There’s basically no chance this Jump-themed NES will get a release in the US — first because hardly any Americans will have read any of these manga (with a couple exceptions) and second because even fewer will have played the Famicom games associated with them.

Familiar… and yet…

That said, this nurtures the hope inside me that we will at some point see other themed NES Classics; the original has, of course, a fantastic collection — but there are dozens more games I would have loved to see on there.

You can hack the thing pretty easily and put half the entire NES library on it, but Nintendo’s official versions will have been tested and perhaps even tweaked to make sure they run perfectly (though admittedly emulation problems aren’t common for NES games).

More importantly it’s possible these hypothetical themed consoles may come with new accessories that I desperately need, like a NES Advantage, Zapper (not sure how it would work), or NES Max. Perhaps even a Power Glove?

In the meantime, at least if you missed the chance to buy one the first time around, you can grab one come the end of June.

Powered by WPeMatico

Lenovo has teased a new arrival that might top Apple’s iPhone X in a bid to deliver a true all-screen smartphone.

Apple’s iPhone X goes very close but for a tiny bezel and its distinctive notch, but Lenovo’s Z5 seems like it might go a step further, according to a teaser sketch (above) shared by Lenovo VP Chang Cheng on Weibo that was first noted by CNET.

The device is due in June and Cheng claimed it is the result of “four technological breakthroughs” and “18 patented technologies,” but he didn’t provide further details.

The executive previously shared a slice of the design — see right — on Weibo, with a claim that it boasts a 95 percent screen-to-body ratio.

Indeed, the image appears to show a device without a top screen notch à la the iPhone X. Where Lenovo will put the front-facing camera, mic, sensors and other components isn’t clear right now.

A number of Android phone-makers have copied Apple’s design fairly shamelessly. That’s ironic given that Apple was widely derided when it first unveiled the phone.

Nonetheless, the device has sold well and that’s captured the attention of Huawei, Andy Rubin’s Essential, Asus and others who have embraced the notch. The design is so common now that Google even moved the clock in Android P to make space for the notch.

Time will tell what Lenovo adds to the conversation. The company is in dire need of a hit phone — it trails the likes of Xiaomi, Oppo, Vivo and Huawei on home soil in China — and the hype on the Z5 is certainly enough to raise hope.

Powered by WPeMatico

Xiaomi, the Chinese smartphone maker that’s looking to raise as much as $10 billion in a Hong Kong IPO, is continuing to grow its presence in the American market after it announced plans to bring its smart home products to the U.S..

The company is best known for its well-priced and quality smartphones, but Xiaomi offers hundreds of other products which range from battery chargers to smart lights, air filter units and even Segway. On the sidelines of Google I/O, the company quietly made a fairly significant double announcement: not only will it bring its smart home products to the U.S., but it is adding support for Google Assistant, too.

The first products heading Stateside include the Mi Bedside Lamp, Mi LED Smart Bulb and Mi Smart Plug, Xiaomi’s head of international Wan Xiang said, but you can expect plenty more to follow. Typically, Xiaomi sells to consumers in the U.S. via Amazon and also its Mi.com local store, so keep an eye out there.

Xiaomi just announced during #io8 that our smart home products will work with the Google Assistant. The initial selection of compatible products includes Mi Bedside Lamp, Mi LED Smart Bulb and Mi Smart Plug, which will be coming to the U.S soon! https://t.co/f65lj2jNej pic.twitter.com/nEXMiIyyZ8

— Wang Xiang (@XiangW_) May 10, 2018

Smartphones, however, are a different question.

Xiaomi CEO Lei Jun — who stands to become China’s richest man thanks to the IPO — previously said the company is looking to bring its signature phones to the U.S. by early 2019 at the latest.

There’s no mention of that in Xiaomi’s IPO prospectus, which instead talks of plans to move into more parts of Europe and double down on Russia and Southeast Asia. Indeed, earlier this week, Xiaomi announced plans to expand beyond Spain and into France and Italy in Europe, while it has also inked a carrier deal with Hutchinson that will go beyond those markets into the UK and other places.

You can expect that it will take its time in the U.S., particularly given the concerns around Chinese OEMs like Huawei — which has been blacklisted by carriers — and ZTE, which has had its telecom equipment business clamped down on by the U.S. government.

Powered by WPeMatico

China’s government has made technological independence from the United States one of its highest priorities. And now it appears to be putting its money where its messaging has been.

According to The Wall Street Journal, China is close to finalizing a $47 billion investment fund that would finance semiconductor research and chip startup development. The fund, formally the China Integrated Circuit Industry Investment Fund Co., appears to be underwritten predominantly by government capital sources.

Such a fund has been rumored for months, with the size of the fund ranging widely. Just two weeks ago, Reuters reported the fund would be $19 billion, while Bloomberg reported $31.5 billion two months ago. The exact number appears to be under intense negotiation among the Chinese leadership, and is also responsive to the increasingly tense trade negotiations with the United States.

If the $47 billion number pans out, it would be identical in size to a $47 billion fund that was financed by Tsinghua University, China’s leading engineering university, to spur the development of an indigenous semiconductor industry back in 2015.

China is highly dependent on foreign tech in its semiconductor industry, importing 90 percent of its chips in order to power its fast-growing economy. The Chinese government has always been wary of that dependency, but its fears were heightened in recent weeks after the United States banned American companies from selling components to ZTE, a prominent Chinese telecom equipment manufacturer.

Chinese President Xi Jinping has gone on something of an indigenous innovation tour in recent weeks, visiting factories across the country and encouraging further investment in the country’s technology industry. From the Communist Party of China’s official newspaper the People’s Daily two weeks ago, “National rejuvenation relies on the ‘hard work’ of the Chinese people, and the country’s innovation capacity must be raised through independent efforts, President Xi Jinping said on Tuesday.”

While the numbers discussed are eye-popping, so are the costs of developing leading-edge semiconductor technology. As semiconductors have grown more complex, costs have skyrocketed to maintain Moore’s Law. Intel spent more than $13 billion on R&D expenses alone in 2017, according to IC Insights, with Qualcomm, Broadcom, and Samsung each spending more than $3 billion.

While China may try to play catchup in the broad category of semiconductors, it is strategically placing its money on new areas like 5G wireless and artificial intelligence-focused chips where it might become a leading provider of technology. Concerns over 5G in particular have galvanized American attention on Qualcomm and its ability to compete in what is rare virgin territory in the telecom equipment space.

For American companies like Intel and Qualcomm, which are used to holding de facto monopolies on entire swaths of the semiconductor market, the renewed competition from China is going to pressure them to push their tech forward faster.

Powered by WPeMatico

It’s a time of optimism and transition at Nintendo, where brisk sales of the Switch have bolstered its bottom line and new leadership signals a fresh approach to the market. Shuntaro Furukawa, the new president, told the Nikkei that one of his plans is to pursue mobile gaming with more vigor, aiming to build it into a billion-dollar business.

Furukawa is taking over from Tatsumi Kimishima, who took the helm temporarily after the tragic and sudden death of the beloved Satoru Iwata in 2015. He’s only 46, and clearly as a member of the younger generation has a different outlook on mobile, which the company completely avoided until very recently.

“The idea that something will emerge that transforms into something big, in the same manner as game consoles, is the defining motive of the Nintendo business,” he told the Nikkei. “From what I can see, smartphone games are the ones I want to expand the most.”

He said he envisions the smartphone side of the game company to become a 100 billion yen business — short of a billion at the present exchange rate, but why not round up? The company did a trillion yen in sales last year, so it’s not like we’re going to run out of zeroes.

The company’s tentative forays into the field have been a mixed success. Pokémon GO was, of course, a worldwide phenomenon, but widely criticized for half-baked gameplay and other issues. Mario Run was a perfectly fun game, but many mobile players balked at its high up-front price. Then Fire Emblem: Heroes has proven popular and a financial success — but its reliance on “loot box” mechanics and in-game microtransactions soured the experience for many.

A new game and franchise, Dragalia Lost, is coming this summer.

Clearly Nintendo is still finding its feet in this relatively unfamiliar territory, though long practice with the DS (in many ways very like a smartphone) means that mobile gaming, if not a core competency, is at least core-adjacent. And popular franchises like Advance Wars and Professor Layton are great matches for mobile.

No one should expect a smartphone equivalent to sprawling, beautiful games like Breath of the Wild, but Nintendo has handheld fun in its blood, and there’s no reason to think they won’t nail it after a few tries.

Powered by WPeMatico

There has long been speculation and evidence of cheating software for PlayerUnknown’s Battlegrounds (PUBG), but action is being taken to stamp it out. The makers of the smash-hit game have confirmed that they have worked with authorities in China who have dished out over $5 million in fines to at least 15 people caught developing hacks that help players cheat.

PUBG, in case you missed it, is one of the top-grossing games in the world this year. A shoot-up battle royale game that sees players battle to survive to the end, PUBG grossed $700 million in revenue via PC sales last year and that’s only increased in 2018 as the title landed on mobile. It’s particularly big in China where internet giant Tencent is the publishing partner.

That Tencent link might have proved useful, as Bluehole — the company behind PUBG — revealed in a statement that Chinese authorities have helped it clamp down on hacking programs, handing out the huge number of fines in the process:

Here’s some translated information from the local authorities we worked with on this case:

“15 major suspects including “OMG”, “FL”, “火狐”, “须弥” and “炎黄” were arrested for developing hack programs, hosting marketplaces for hack programs, and brokering transactions. Currently the suspects have been fined approximately 30mil RNB ($5.1mil USD). Other suspects related to this case are still being investigated.

While the programs were being developed in China and there were users there too, it isn’t clear whether that reach extended to gamers in the U.S. and other countries.

Beyond just cheating, there is also a significant risk for those who use the hacked software.

Bluehole said it found evidence that the programs were used by their developers to infect host PCs in order to “control users’ PC, scan their data, and extract information illegally.” Some, it is said, used Trojan Horse software to steal user information — that could mean information from when they shop online (like credit card numbers), the content of emails, and more.

Powered by WPeMatico

Chinese authorities revealed over the weekend that they have the capability of retrieving deleted messages from the almost universally used WeChat app. The admission doesn’t come as a surprise to many, but it’s rare for this type of questionable data collection tactic to be acknowledged publicly.

As noted by the South China Morning Post, an anti-corruption commission in Hefei province posted Saturday to social media that it has “retrieved a series of deleted WeChat conversations from a subject” as part of an investigation.

The post was deleted Sunday, but not before many had seen it and understood the ramifications. Tencent, which operates the WeChat service used by nearly a billion people (including myself), explained in a statement that “WeChat does not store any chat histories — they are only stored on users’ phones and computers.”

The technical details of this storage were not disclosed, but it seems clear from the commission’s post that they are accessible in some way to interested authorities, as many have suspected for years. The app does, of course, comply with other government requirements, such as censoring certain topics.

There are still plenty of questions, the answers to which would help explain user vulnerability: Are messages effectively encrypted at rest? Does retrieval require the user’s password and login, or can it be forced with a “master key” or backdoor? Can users permanently and totally delete messages on the WeChat platform at all?

Fears over Chinese government access to data held or handled by Chinese companies has led to a global backlash against those companies, including some countries (including the U.S.) banning Chinese-made devices and services from sensitive applications or official use altogether.

Powered by WPeMatico

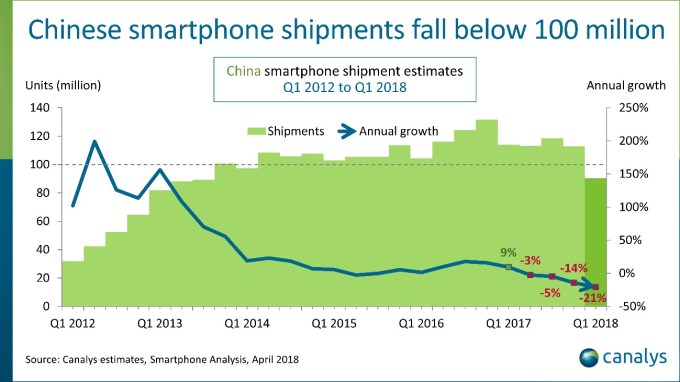

Analysts have long-warned of a growth crunch in China’s smartphone space, and it’s looking like that’s very much the case right now.

China’s smartphone growth has been the feel-good story for domestic OEMs who have clocked impressive figures as the billion-plus population has rushed online via mobile devices. However, the market reached saturation point in 2017 — when sales stopped growing for the first time — and the first quarter of this year is already showing savage results.

In a report released today, Canalys claimed that shipments across the industry fell by 21 percent year-on-year in Q1.

The total number of mobile devices shipped in China dropped below the 100 million mark in a quarter for the first time since late 2013, the firm added.

“Eight of the top 10 smartphone vendors were hit by annual declines, with Gionee, Meizu and Samsung shrinking to less than half of their respective Q1 2017 numbers,” the report read.

Ouch.

Of the field, only Xiaomi — the firm tipped for an IPO at a $100 billion valuation — was able to post positive momentum as its numbers grew by 37 percent to reach 12 million. That was enough to see it overtake Apple into fourth place, but Xiaomi numbers are still heavily reliant on its $150 Redmi range, which isn’t as lucrative as its higher-end products.

Huawei, Oppo and Vivo led the market. Somewhat incredibly, those three firms plus Xiaomi now account for a very dominant 73 percent of all shipments, which Canalys believes is bad for consumers and smartphone aficionados in China.

“The level of competition has forced every vendor to imitate the others’ product portfolios and go-to-market strategies,” analyst Mo Jia said in a statement. “While Huawei, Oppo, Vivo and Xiaomi must contend with a shrinking Chinese market, they can take comfort from the fact that it will continue to consolidate, and that their size will help them last longer than other smaller players.”

There might be a bright spark coming soon. Canalys anticipates growth in the second quarter as Oppo, Vivo and Huawei trot out new flagship devices. But China’s once-booming industry is now having to contend with the same issue as the U.S.: consumers don’t upgrade their phone as frequently as carriers would like.

Powered by WPeMatico