Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Shares of Chinese ride-hailing provider Didi are sharply lower this morning after news broke that its domestic regulators are investigating the newly public company. A loose translation of the probe’s official notice indicates that the cybersecurity review is “in order to prevent national data security risks, maintain national security and protect the public interest.”

Yesterday, regulators ordered Didi to stop registering new users during the investigation.

The move comes amid a larger reset of relations between China’s burgeoning technology sector and its autocratic government. Other fallouts from the campaign included the effective silencing of Jack Ma, the embarrassing cancellation of the Ant IPO and a crackdown on data collection from technology companies more broadly.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

China is not the only nation grappling with its technology sector; India has made consistent noise in recent months regarding tech firms inside its borders, for example. And there is effort inside the U.S. Congress to put some cap on Big Tech’s scale and power, though of the trio, the United States appears the least likely to take a real swipe at technology companies’ market influence.

That Didi has run afoul of China’s regulatory bodies is not a surprise; it’s a well-known tech company in the country with lots of consumer data. Similar data-rich tech shops in the country have come under increased scrutiny as well.

But to see Didi get taken to task mere days after its U.S. debut puts a bad taste in our mouths.

The way that this saga reads from the cynical perspective is that the Chinese Communist Party was willing to let the company go public in the United States, allowing it to raise billions of dollars from foreign sources. And that the ruling party was then content to leave them holding a midsized bag by announcing its cybersecurity probe.

Hanlon’s Razor is at play in this situation, naturally.

Didi has not published a new SEC filing since June 30, and, as of the time of writing, its investor relations page is devoid of any information regarding today’s news.

While going public, it’s worth noting that Didi did warn investors that it faces a host of risks relating to its status as a Chinese company, namely its government, and as a Chinese company going public in the United States. Observe the following risk factors that it shared while going public (emphasis added) that dealt with the company’s business operations:

- Our business is subject to numerous legal and regulatory risks that could have an adverse impact on our business and future prospects.

- Our business is subject to a variety of laws, regulations, rules, policies and other obligations regarding privacy, data protection and information security. Any losses, unauthorized access or releases of confidential information or personal data could subject us to significant reputational, financial, legal and operational consequences.

Powered by WPeMatico

Swedish gaming giant Modern Times Group (MTG) has acquired Indian startup PlaySimple for at least $360 million, the two firms said Friday.

MTG said it will pay 77% of the acquisition sum to Indian game developer and publisher in cash and the rest in company shares. There’s also another $150 million reward put aside if certain undisclosed performance metrics are hit, the two firms said.

Friday’s deal marks one of the largest exits in the Indian startup ecosystem. PlaySimple had raised $4 million Series A at a valuation of about $16 million from Elevation Capital and Chiratae Ventures in 2016. (The startup, which began its journey in Bangalore, raised just $4.5 million in total from external investors.)

And it’s clear why: the revenues of PlaySimple — which operates nine word games including “Daily Themed Crossword,” “Word Trip,” “Word Jam,” and “Word Wars” — grew by 144% y-o-y to $83 million last year and it was on track to hit over $60 million revenue in the first half of 2021.

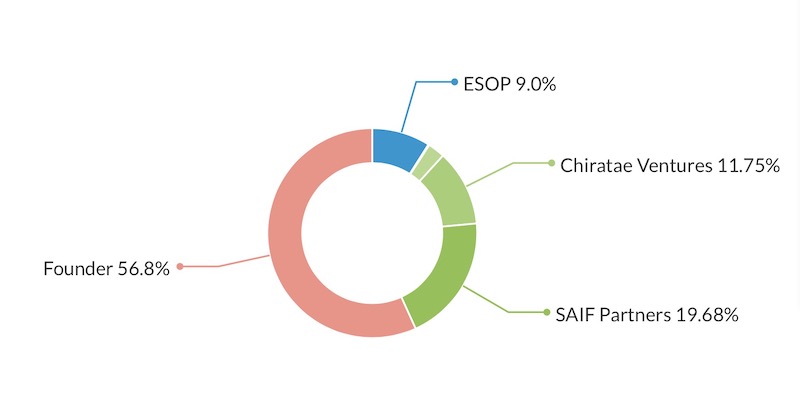

Cap table of PlaySimple after Series A in 2016.

“We’re very proud of the games we’ve developed over the years, and of the infrastructure and scale that we’ve achieved with our team,” said PlaySimple co-founders and management team members — Siddhanth Jain, Suraj Nalin and Preeti Reddy — in a joint statement.

“As we join the MTG family, we look forward to leveraging our proprietary technology across MTG’s gaming portfolio, expanding into the European market, investing in cutting-edge technology and building exciting new games.”

PlaySimple, which says its free-to-play games have amassed over 75 million installs and maintain nearly 2 million daily active users, plans to launch a number of games later this year and also expand into the card games genre.

“PlaySimple is a rapidly growing and highly profitable games studio that quickly has established itself as one of the leading global developers of free-to-play word games, an exciting new genre for MTG,” said Maria Redin, MTG Group President and CEO, said in a statement.

The Stockholm-headquartered firm, which has also acquired Hutch and Ninja Kiwi in recent quarters, said PlaySimple will help it build a diversified gaming vertical. “Scaling and diversifying the GamingCo [an MTG subsidiary] helps to accelerate the operational performance while at the same time creating a more stable business,” the firm said.

Powered by WPeMatico

Istanbul in Turkey continues to prove itself as very fertile ground for casual gaming startups, which appear to be growing from small seedlings into sizable trees. In the latest development, Dream Games — a developer of mobile puzzle games — has raised $155 million in funding, a Series B that values the startup at $1 billion.

This is a massive leap for the company, which raised $50 million (the largest Series A in Turkey’s startup history) only 3.5 months ago. This latest round is being co-led by Index Ventures and Makers Fund, with Balderton Capital, IVP and Kora also participating. It also comes in the wake of a bigger set of deals in the world of gaming and developers in Turkey, the most prominent of which saw Zynga acquire Peak Games for $1.8 billion, amid other acquisitions. Dream is one of several startups in the region founded by alums from Peak.

The focus of the funding, and currently of Dream Games itself, is Royal Match, a puzzle game (iOS, Android) that launched globally in March.

The game has been a huge hit for Dream, with 6 million monthly active users and $20 million/month in revenues from in-game purchases (not ads), according to figures from AppAnnie. (A source close to the company confirmed the figures are accurate, but Dream did not disclose its revenue numbers or revenues directly.) This has catapulted it into the top-20 grossing games categories in the U.S., U.K., and Germany, the same echelon as much older and bigger titles like Candy Crush and Homescapes.

“The funding will be used for heavy user acquisition in every channel and every geography,” Soner Aydemir, co-founder and CEO, Dream Games, told me in an interview. He said Asia would be a focus in that, specifically Japan, South Korea and China. “Our main target is to scale the game so that it becomes one of the biggest games in the global market.”

The world of mobile gaming has in many respects been a very cyclical and fickle one: today’s hot title becomes tomorrow’s has-been, while for developers, they can go through dozens of development processes and launches (and related costs) before they find a hit, if they find a hit. The role of app-install ads and other marketing tools to juice numbers has also been a problematic lever for growth: take away the costs of running those and often the house of cards falls apart.

Aydemir agrees, and while the company will be investing in those aforementioned in-game ads to encourage more downloads of Royal Match, he also said that this strategy can work, but only if the fundamentals of the game are solid, as is the case here.

“If you don’t have good enough metrics, even with all the money in the world it’s impossible to scale,” he said. “But our LTV [lifetime value] is high, and so we think it can be scaled in a sustainable way because of the quality of the game. It always depends on the product.”

In addition to its huge growth, Dream has taken a very focused approach with Royal Match, working on it for years before finally releasing it.

“We spent so much time on tiny details, so many tests over several years to create the dynamics of the game,” he said. “But we also have a feel for it,” he added, referring to the team’s previous lives at Peak Games. “Our users really appreciate this approach.”

For now, too, the focus will just one the one game, he said. Why not two, I asked?

“We believe in Pixar’s approach,” Aydemir said. “When Pixar started, it was very low frequency, a movie every 2-3 years but eventually the rate increased. And it will be similar for us. This year we need to focus on Royal Match but if we can find a way to create other games, we will.”

He added that the challenge — one that many startups know all too well — is that building a new product, in this case a new game, can take the focus away when you are a small team and also working on sustaining and maintaining a current game. “That is the most difficult and challenging part. If we can manage it we will be successful; otherwise we will fail because our business model is basically creating new IP.” He added that it’s likely that another game will be released out into the world at the beginning of next year.

The focus, in any case, was one of the selling points for its investors. “The Dream Games team’s deep genre insight, laser-focus on detail and team chemistry has helped create the early success of Royal Match,” said Michael Cheung, General Partner at Makers Fund, in a statement. “We’re excited to be on the journey with them as they grow Royal Match globally.”

In terms of monetization, Dream Games is pretty firmly in the camp of “no ads, just in-app purchases,” he said. “It’s really bad for user experience and we only care about user experience, so if you put ads in, it conflicts with that.”

Some of the struggles of building new while improving old product will of course get solved with this cash, and the subsequent hiring that Dream Games can do (and it’s doing a lot of that, judging by the careers section of its website). As more startups emerge out of the country — not just in gaming but also areas like e-commerce, where startups like Getir are for example making big waves in instant grocery delivery — it will be interesting to see how that bigger talent pool evolves.

“Since its launch in early March, Royal Match has become one of the top casual puzzle titles globally, driven by once in a decade retention metrics. It speaks to the sheer quality of the title that the Dream Games team has built and the flawless polish and execution across the board,” commented Stephane Kurgan, venture partner at Index Ventures and former COO of King. Index is also the backer of Roblox, Discord, King and Supercell, in a statement.

Powered by WPeMatico

For most people in India, having to engage with banks doesn’t instill a sense of joy. Banks in the South Asian market are notorious for making unannounced spam calls to upsell customers loans and credit cards, even when they have been explicitly asked not to do so.

Moreover, when a customer does reach out to a bank with a query, it can take forever to get the job done. Take ICICI Bank, India’s third largest bank and until recently my only banking partner for over six years, for an example.

It is now in its third month in figuring out who exactly in its relationship with Amazon is supposed to re-issue me a credit card. I have moved on with my life, and it looks like they did, too, likely before they even looked at my query.

Small and medium-sized businesses aren’t a big fan of banks, either. If you operate an early-stage startup, it’s anyone’s guess if you will ever be able to convince a bank to issue you a corporate account. So of course, startups — Razorpay and Open — took it upon themselves to fix this experience.

For consumers, too, in recent years, scores of startups have arrived on the scene to improve this banking experience. Whether you are a teenager, or just out of college, or a working professional, or don’t have a credit score, there are firms that can get you a credit card and loan.

But even these services have a ceiling limit of some sort. And customers aren’t loyal to any startup.

“A customer’s relationship is always with the entity where they park their savings deposit,” said Jitendra Gupta, a high-profile entrepreneur who has spent a decade in the fintech world. Since these customers are not parking their money with fintech, “the startups have been unable to disrupt the bank. That’s the hard reality.”

So what’s the alternative? Gupta, who co-founded CitrusPay (sold to Naspers’ PayU) and served as managing director of PayU, has been thinking about these challenges for more than two years.

“If you really want to change the banking industry, you cannot operate from the side. You have to fight from the centre, where they deposit their money. It’s a very time-consuming process and requires a lot of initial capital and experience with banks,” he told TechCrunch in an interview.

After more than a year and a half of raising about $24 million — from Sequoia Capital India, 3one4 Capital, Amrish Rau, Kunal Shah, Kunal Bahl, Tanglin Venture Partners, Rainmatter and others — Gupta is ready to launch what he believes will address a lot of the issues individuals face with their banks.

His new startup, called Jupiter, wants to bring “delight” to the banking experience, and it will launch in India on Thursday.

“We believe that a bank account should be a smart account, where it gives you insight, shares personalized tips and guides you through attaining some financial discipline,” he said.

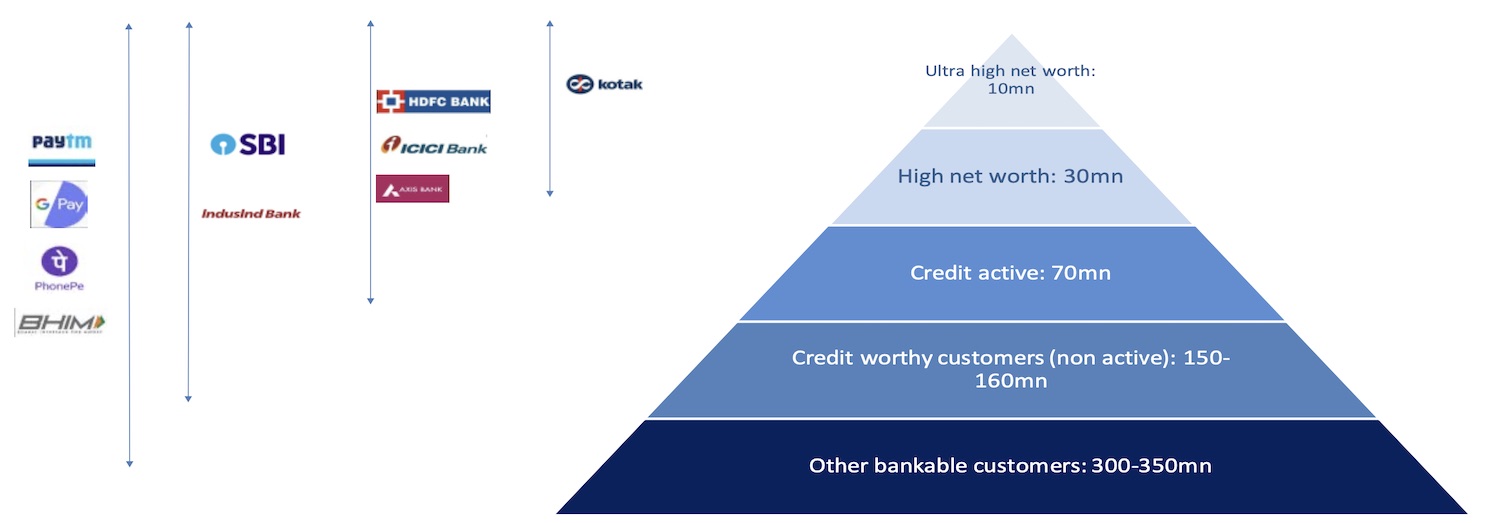

A snapshot of the reach of banks and fintech startups in India. Data: CIBIL, Statista, BofA Global Research. Image: BofA

To be sure, Jupiter, too, will offer loans and other financial services to customers. But instead of making irrelevant calls to customers, it will assess which of its customers are running short on money and give the option to take a credit line from its app itself, he said. “The upsell doesn’t need to happen by way of spam. It needs to happen by way of contextualization and personalization.”

“Jupiter has been built in a deep integration with the underlying bank, allowing the consumer to have a frictionless experience for all their banking needs,” said Amrish Rau, chief executive of Pine Labs, co-founder of CitrusPay and longtime friend of Gupta.

The startup, which employs 115 people, has developed a number of products for customers joining on day one. The products include the ability to buy now and pay later on UPI, a feature first offered in the market by Jupiter, and a mutual fund portfolio analyzer. A debit card, in-app chat with a customer service agent, expense categorisation, finding the right card, determining the existing health insurance coverage, and more are ready to ship, the startup said.

Jupiter is currently working on providing zero mark-up on forex transactions, and frictionless two-factor authentication. The startup has published a public Trello page where it has outlined the features it is working on and when it expects to ship them, as well as features suggested by its beta-testing customers. “I want to establish full transparency in what we are working on to build trust with customers,” said Gupta.

Jupiter will have its own customer relationship team that will engage with the startup’s users. The startup, which last month opened a waiting list for customers to sign up, had amassed more than 25,000 applications as of two weeks ago.

Even Jupiter, which one day wishes to disrupt the banking sector, currently has to partner with banks. Its partners are Federal Bank and Axis Bank.

I asked Gupta about the excitement his investors see in Jupiter. “Everyone believes, as you see with fintech giants such as Nubank globally, that we will become a full bank,” he said.

But for the time being, Gupta said he is not looking to partner with more banks. “I don’t want Jupiter to attract customers because they want to bank with Federal or Axis. I want them to come to Jupiter because they want to bank with Jupiter,” he said.

In the next 12 months, the startup hopes to serve more than 1 million customers.

Powered by WPeMatico

Krafton, which filed for an IPO earlier this week, has built a gigantic gaming empire. If the firm is able to raise the target $5 billion from the IPO it will be the largest public offering in its home country, South Korea. The firm has something to celebrate elsewhere in the world, too.

On Thursday, it pulled off another feat that no other firm has been able to achieve: Its sleeper hit title, PUBG Mobile, has made a return to India, which banned the title more than nine months ago.

The world’s second-largest internet market banned over 200 apps last year citing national security concerns. All the apps New Delhi blocked in the nation had links to China. The move was seen by many as retaliation as tension between the two nuclear-armed neighboring nations escalated last year.

Every other app that has been banned by India — and pulled by Google and Apple from their respective app stores in the country in compliance with local government orders — remains in that state. ByteDance, whose TikTok app identified India as its largest market, has significantly downsized its team in the country. (ByteDance runs several businesses in India and many remain operational. Employees have been instructed to stay off the radar.)

Which is what makes PUBG Mobile’s return to India all the more interesting. The game, which has been rebranded to Battlegrounds Mobile India in the South Asia market, is available to download from the Play Store for any user in the country — provided they sign up for an early access before the imminent launch.

Even as PUBG Mobile is now using a different moniker, the game follows the same plot, and the identical home screen greets users with the familiar ecstatic background score.

Moreover, users are offered a quick and straightforward option to migrate their PUBG Mobile accounts to the new app.

Rishi Alwani, the quintessential gaming reporter in India who edits IGN India, told TechCrunch that the new game is “essentially PUBG Mobile with data compliance, green blood, and a constant reminder that you’re in a ‘virtual world’ with such messaging present as you start a game and when you’re in menus.”

The changes are likely Krafton’s attempt to assuage previous concerns from the local authorities, some of whom had expressed concerns about the game’s affect on youngsters.

Image Credits: TechCrunch / screen capture

But these on-the-surface changes raise a set of bigger questions that have been a topic of discussion among several startup founders and policy executives in India in recent months:

Neither the Indian government nor Krafton have publicly said anything on this subject. Krafton, on its part, has taken steps to assuage India’s concerns. For instance, last year the South Korean firm cut ties with its publishing partner Tencent, the only visible Chinese affiliation — if the Indian government was indeed banning just Chinese apps. Krafton also publicly announced that it will be investing $100 million in India’s gaming ecosystem.

The Indian government’s order and the communication and compliance mechanism for concerned entities have been so opaque on this subject that it is unclear on what grounds Krafton has been able to bring the game back.

One explanation — albeit admittedly full of speculation — is that it’s a new app in the sense that it has a new app ID. In this instance, it happens to have a new developer account, too. Remember, India banned apps, and not the firms themselves. Several Tencent and Alibaba apps, for instance, remain available in India.

This would also explain how BIGO has been able to launch a new app — Tiki Video — under a new developer account and plenty of effort to conceal its connection. That app, which was launched in late February, has amassed over 16 million monthly active users, according to mobile insight firm App Annie. The app’s existence and affiliation with BIGO have not been previously reported.

But the question remains, are these simple workarounds enough to escape the ban? To be sure, some apps, including Battlegrounds Mobile India, are also hosting their data in the country now, and have agreed for periodic audits. So is that enough? And if it is, why aren’t most — if not all — apps making a return to India?

Regardless, the return of PUBG Mobile India is a welcome move for tens of millions of users in the country, many of whom — about 38 million last month, according to App Annie — were using workarounds themselves to continue to play the game.

Powered by WPeMatico

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the world’s second-largest internet market.

Apna, a startup by an Apple alum, is helping millions of such blue and gray-collar workers upskill themselves, find communities and land jobs. On Wednesday it announced its acceptance by the market has helped it raise $70 million in a new financing round as the startup prepares to scale the 16-month-old app across India.

Insight Partners and Tiger Global co-led Apna’s $70 million Series B round, which valued the startup at $570 million. Existing investors Lightspeed India, Sequoia Capital India, Greenoaks Capital and Rocketship VC also participated in the round, which brings Apna’s to-date raise to over $90 million.

The startup, whose name is inspired from a 2019 Bollywood song, at its core is solving the network gap issue for workers. “Someone born in a privileged family goes to the best school, best college and makes acquaintance with influential people. Many born just a few kilometres away are dealt with a whole different kind of life and never see such opportunities,” said Nirmit Parikh, founder and chief executive of Apna, in an interview with TechCrunch.

Apna is building a scalable networking infrastructure, something that doesn’t currently exist in the market, so that these workers can connect to the right employers and secure jobs. “Apna’s focus on digitizing the process of job discovery, application and employer candidate interaction has the potential to revolutionize the hiring process,” said Griffin Schroeder, a partner at Tiger Global, in a statement.

The workers in India “already have a champion in them, we are just helping them find opportunities,” said Nirmit Parikh, founder and chief executive of Apna. (Apna)

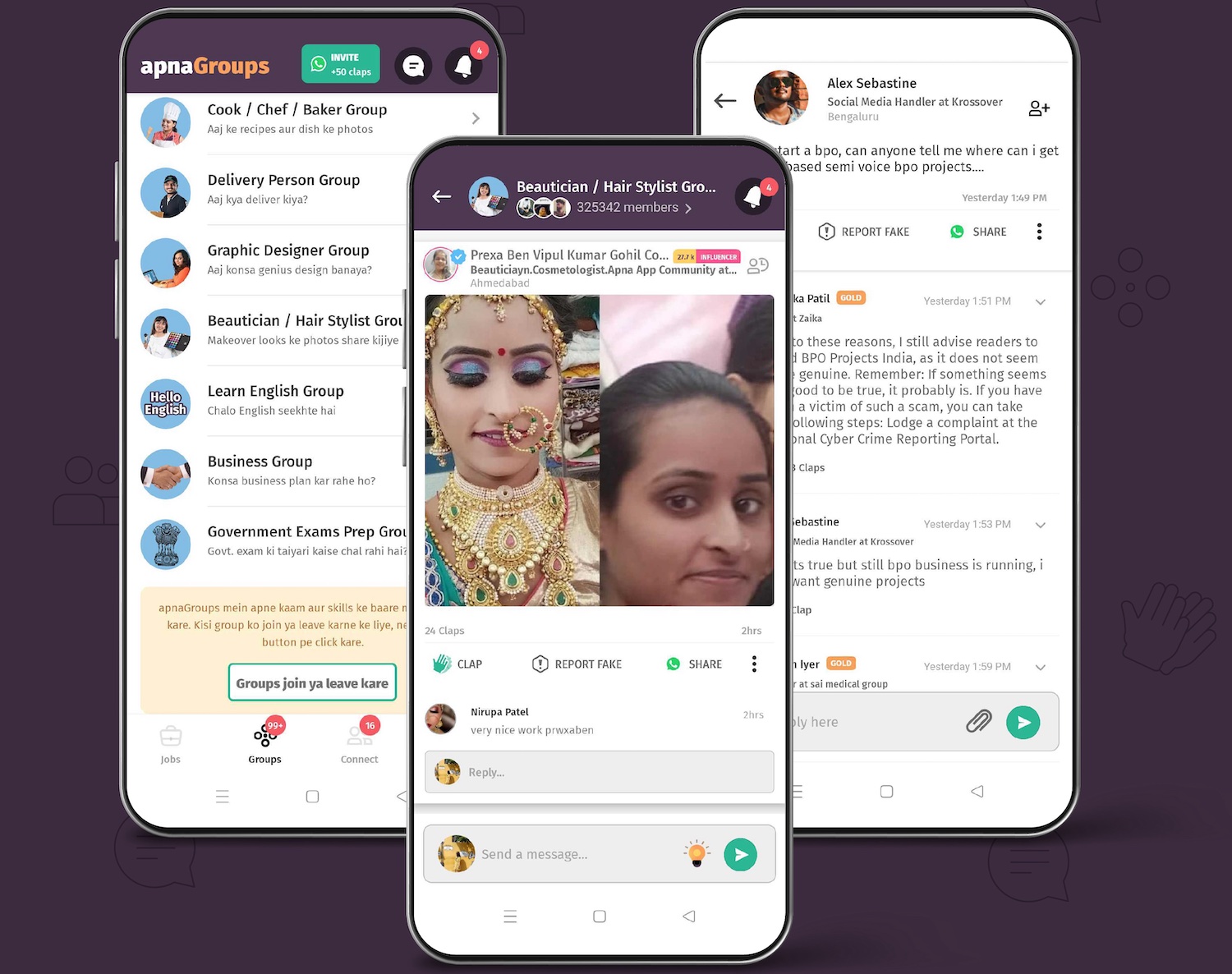

The startup’s eponymous Android app, available in multiple languages, features more than 70 communities today for skilled professionals such as carpenters, painters, field sales agents and many others.

On the app, users connect to each other and help with leads and share tips to improve at their jobs. The app also offers people the opportunity to upskill themselves, practice with their interview performance, and become eligible for even more jobs. The startup said it’s building Masterclass-like skilling modules, outcome or job based skilling, and also enabling peer-to-peer learning via its vertical communities. It plans to launch career counselling and resume building feature.

And that bet is working. The startup has amassed over 10 million users and just last month it facilitated more than 15 million job interviews, said Parikh. All jobs listed on the Apna platform are verified by the startup and free of cost for the candidates.

Apna has partnered with some of India’s leading public and private organizations and is providing support to the Ministry of Minority Affairs of India, National Skill Development Corporation and UNICEF YuWaah to provide better skilling and job opportunities to candidates.

Apna app (Apna)

More than 100,000 recruiters — including Byju’s, Unacademy, Flipkart, Zomato, Licious, Burger King, Dunzo, Bharti-AXA, Delhivery, Teamlease, G4S Global and Shadowfax — in the country today use Apna’s platform, where they have to spend less than five minutes to post job posts and are connect to hyperlocal candidates with relevant skills in within two days.

Apna has built the “market leading platform for India’s workforce to establish digital professional identity, network, access skills training, and find high quality jobs,” said Nikhil Sachdev, managing director, Insight Partners, in a statement.

“Employers are engaging with Apna at a rapid pace to help find high quality talent with low friction which is leading to best in class customer satisfaction scores. We believe that our investment will enable Apna to continue their steep growth trajectory, scale up their operations, and improve access to opportunities for India’s workforce.”

The startup plans to deploy the fresh capital to scale across India and eventually take the app to international markets, said Parikh. Apna, which has recently seen high-profile individuals from firms such as Uber, BCG and Swiggy join the firm, is also actively hiring for several tech roles in the South Asian market.

Apna has built the infrastructure and brand awareness in the market that it can launch in a new city within two days and drive over 10,000 interviews there in less than two days, it said.

“Our first goal is to restart India’s economy in the next couple of months and do whatever we can to help,” said Parikh, who was part of the iPhone product-operations team at Apple.

Powered by WPeMatico

How big is the market in India for a neobank aimed at teenagers? Scores of high-profile investors are backing a startup to find out.

Bangalore-based FamPay said on Wednesday it has raised $38 million in its Series A round led by Elevation Capital. General Catalyst, Rocketship VC, Greenoaks Capital and existing investors Sequoia Capital India, Y Combinator, Global Founders Capital and Venture Highway also participated in the new round, which brings FamPay’s to-date raise to $42.7 million.

TechCrunch reported early this month that FamPay was in talks with Elevation Capital to raise a new round.

Founded by Sambhav Jain and Kush Taneja (pictured above) — both of whom graduated from Indian Institute of Technology, Roorkee in 2019 — FamPay enables teenagers to make online and offline payments.

The thesis behind the startup, said Jain in an interview with TechCrunch, is to provide financial literacy to teenagers, who additionally have limited options to open a bank account in India at a young age. Through gamification, the startup said it’s making lessons about money fun for youngsters.

Unlike in the U.S., where it’s common for teenagers to get jobs at restaurants and other places and understand how to handle money at a young age, a similar tradition doesn’t exist in India.

After gathering the consent from parents, FamPay provides teenagers with an app to make online purchases, as well as plastic cards — the only numberless card of its kind in the country — for offline transactions. Parents credit money to their children’s FamPay accounts and get to keep track of high-ticket spendings.

In other markets, including the U.S., a number of startups including Greenlight, Step and Till Financial are chasing to serve the teenagers, but in India, there currently is no startup looking to solve the financial access problem for teenagers, said Mridul Arora, a partner at Elevation Capital, in an interview with TechCrunch.

It could prove to be a good issue to solve — India has the largest adolescent population in the world.

“If you’re able to serve them at a young age, over a course of time, you stand to become their go-to product for a lot of things,” Arora said. “FamPay is serving a population that is very attractive and at the same time underserved.”

The current offerings of FamPay are just the beginning, said Jain. Eventually the startup wishes to provide a range of services and serve as a neobank for youngsters to retain them with the platform forever, he said, though he didn’t wish to share currently what those services might be.

Image Credits: FamPay

Teens represent the “most tech-savvy generation, as they haven’t seen a world without the internet,” he said. “They adapt to technology faster than any other target audience and their first exposure with the internet comes from the likes of Instagram and Netflix. This leads to higher expectations from the products that they prefer to use. We are unique in approaching banking from a whole new lens with our recipe of community and gamification to match the Gen Z vibe.”

“I don’t look at FamPay just as a payments service. If the team is able to execute this, FamPay can become a very powerful gateway product to teenagers in India and their financial life. It can become a neobank, and it also has the opportunity to do something around social, community and commerce,” said Arora.

During their college life, Jain and Taneja collaborated and built an app and worked at a number of startups, including social network ShareChat, logistics firm Rivigo and video streaming service Hotstar. Jain said their work with startups in the early days paved the idea to explore a future in this ecosystem.

Prior to arriving at FamPay, Jain said the duo had thought about several more ideas for a startup. The early days of FamPay were uniquely challenging to the founders, who had to convince their parents about their decision to do a startup rather than joining firms or startups as had most of their peers from college. Until being selected by Y Combinator, Jain said he didn’t even fully understand a cap table and dilutions.

He credited entrepreneurs such as Kunal Shah (founder of CRED) and Amrish Rau (CEO of Pine Labs) for being generous with their time and guidance. They also wrote some of the earliest checks to the startup.

The startup, which has amassed over 2 million registered users, plans to deploy the fresh capital to expand its user base and product offerings, and hire engineers. It is also looking for people to join its leadership team, said Jain.

Powered by WPeMatico

Carro, one of the largest automotive marketplaces in Southeast Asia, announced it has hit unicorn valuation after raising a $360 million Series C led by SoftBank Vision Fund 2. Other participants include insurance giant MSIG and Indonesian-based funds like EV Growth, Provident Growth and Indies Capital. About 90% of vehicles sold through Carro are secondhand, and it offers services that cover the entire lifecycle of a car, from maintenance to when it is broken down and recycled for parts.

Founded in 2015, Carro started as an online marketplace for cars, before expanding into more verticals. Co-founder and chief executive officer Aaron Tan told TechCrunch that, roughly speaking, the company’s operations are divided into three sections: wholesale, retail and fintech. Its wholesale business works with car dealers who want to purchase inventory, while its retail side sells to consumers. Its fintech operation offers products for both, including B2C car loans, auto insurance and B2B working capital loans.

Carro’s last funding announcement was in August 2019, when it said it had extended its Series B to $90 million. The company’s latest funding will be used to fund acquisitions, expand its financial services portfolio and develop its AI capabilities, which Carro uses to showcase cars online, develop pricing models and determine how much to charge insurance policyholders.

It also plans to expand retail services in its main markets: Indonesia, Thailand, Malaysia and Singapore. Carro currently employs about 1,000 people across the four countries and claims its revenue grew more than 2.5x during the financial year ending March 2021.

The COVID-19 pandemic helped Carro’s business because people wanted their own vehicles to avoid public transportation and became more receptive to shopping for cars online. Those factors also helped competitors like OLX Autos and Carsome fare well during the pandemic.

The adoption of electric vehicles across Southeast Asia has resulted in a new tailwind for Carro, because people who buy an EV usually want to sell off their combustion engine vehicles. Carro is currently talking to some of the largest electric vehicle countries in the world that want to launch in Southeast Asia.

“For every car someone typically buys in Southeast Asia, there’s always a trade-in. Where do cars go, right? We are a marketplace, but on a very high level, what we’re doing is reusing and recycling. That’s a big part in the environmental sustainability of the business, and something that sets us apart of other players in the region,” Tan said.

Cars typically stay in Carro’s inventory for less than 60 days. Its platform uses computer vision and sound technology to replicate the experience of inspecting a vehicle in-person. When someone clicks on a Carro listing, an AI bot automatically engages with them, providing more details about the cost of the car and answering questions. They also see a 360-degree view of the vehicle, its interior and can virtually start the engine to see how it sounds. Listings also provide information about defects and inspection reports.

Since many customers still want to get an in-person look before finalizing a purchase, Carro recently launched a beta product called Showroom Anywhere. Currently available in Singapore, it allows people to unlock Carro cars parked throughout the city, using QR codes, so they can inspect it at any time of the day, without a salesperson around. The company plans to add test driving to Showroom Anywhere.

“As a tech company, our job is to make sure we automate everything we can,” said Tan. “That’s the goal of the company and you can only assume that our cost structure and our revenue structure will get better along the years. We expect greater margin improvement and a lot more in cost reduction.”

Pricing is fixed, so shoppers don’t have to engage in haggling. Carro determines prices by using machine-learning models that look at details about a vehicle, including its make, model and mileage, and data from Carro’s transactions as well as market information (for example, how much of a particular vehicle is currently available for sale). Carro’s prices are typically in the middle of the market’s range.

Cars come with a three or seven-day moneyback guarantee and 30-day warranty. Once a customer decides to buy a car, they can opt to apply for loans and insurance through Carro’s fintech platform. Tan said Carro’s loan book is about five years old, almost as old as the startup itself, and is currently about $200 million.

Carro’s insurance is priced based on the policyholders driving behavior as tracked by sensors placed in their cars. This allows Carro to build a profile of how someone drives and the likelihood that they have an accident or other incident. For example, someone will get better pricing if they typically stick to speed limits.

“It sounds a bit futuristic,” said Tan. “But it’s something that’s been done in the United States for many years, like GEICO and a whole bunch of other insurers,” including Root Insurance, which recently went public.

Tan said MSIG’s investment in Carro is a “statement that we are really trying to triple down in insurance, because an insurer has so much linkage with what we do. The reason that MSIG is a good partner is that, like ourselves, they believe a lot in data and the difference in what we call ‘new age’ insurance, or data-driven insurance.”

Carro is also expanding its after-sale services, including Carro Care, in all four of its markets. Its after-sale services reach to the very end of a vehicle’s lifecycle and its customers include workshops around the world. For example, if a Toyota Corolla breaks down in Singapore, but its engine is still usable, it might be extracted and shipped to a repair shop in Nairobi, and the rest of its parts recycled.

“One thing I always ask in management meetings, is tell me where do cars go to die in Indonesia? Where do cars go to die in Thailand? There has to be a way, so if there is no way, we’re going to find a way,” said Tan.

In a statement, SoftBank Investment Advisers managing partner Greg Moon said, “Powered by AI, Carro’s technology platform provides consumers with full-stack services and transparency throughout the car ownership process. We are delighted to partner with Aaron and the Carro team to support their ambition to expand into new markets and use AI-powered technology to make the car buying process smarter, simpler and safer.”

Powered by WPeMatico

Tiger Global is in talks to lead a $30 million round in Indian edtech startup Classplus, according to sources familiar with the matter.

The new round, which includes both primary investment and secondary transactions, values the five-year-old Indian startup at over $250 million, two sources told TechCrunch.

The new round follows another ~$30 million investment that was led by GSV recently, one of the sources said. The new round hasn’t closed, so terms may change.

Classplus — which has built a Shopify-like platform for coaching centers to accept fees digitally from students and deliver classes and study material online — also raised $10.3 million in September last year from Falcon Edge’s AWI, cricketer Sourav Ganguly and existing investors RTP Global and Blume Ventures. That round had valued Classplus at about $73 million, according to research firm Tracxn.

Classplus didn’t respond to a request for comment. Sources requested anonymity, as the matter is private.

As tens of millions of students — and their parents — embrace digital learning apps, Classplus is betting that hundreds of thousands of teachers and coaching centers that have gained reputation in their neighborhoods are here to stay.

The startup is serving these hyperlocal tutoring centers that are present in nearly every nook and cranny in India. “Anyone who was born in a middle-class family here has likely attended these tuition classes,” Mukul Rustagi, co-founder and chief executive of Classplus, told TechCrunch last year.

“These are typically small and medium setups that are run by teachers themselves. These teachers and coaching centers are very popular in their locality. They rarely do any marketing and students learn about them through word-of-mouth buzz,” he said then.

Rustagi had described Classplus as “Shopify for coaching centers.” Like Shopify, Classplus does not serve as a marketplace that offers discoverability to these teachers or coaching centers and instead it offers a way for these teachers to leverage its tech platform to engage with customers.

This year, Tiger Global has backed — or in talks to back — about two dozen startups in India.

Powered by WPeMatico

BukuWarung, a fintech focused on Indonesia’s micro, small and medium enterprises (MSMEs), announced today it has raised a $60 million Series A. The oversubscribed round was led by Valar Ventures, marking the firm’s first investment in Indonesia, and Goodwater Capital. The Jakarta-based startup claims this is the largest Series A round ever raised by a startup focused on services for MSMEs. BukuWarung did not disclose its valuation, but sources tell TechCrunch it is estimated to be between $225 million to $250 million.

Other participants included returning backers and angel investors like Aldi Haryopratomo, former chief executive officer of payment gateway GoPay, Klarna co-founder Victor Jacobsson and partners from SoftBank and Trihill Capital.

Founded in 2019, BukuWarung’s target market is the more than 60 million MSMEs in Indonesia, according to data from the Ministry of Cooperatives and SMEs. These businesses contribute about 61% of the country’s gross domestic product and employ 97% of its workforce.

BukuWarung’s services, including digital payments, inventory management, bulk transactions and a Shopify-like e-commerce platform called Tokoko, are designed to digitize merchants that previously did most of their business offline (many of its clients started taking online orders during the COVID-19 pandemic). It is building what it describes as an “operating system” for MSMEs and currently claims more than 6.5 million registered merchant in 750 Indonesian cities, with most in Tier 2 and Tier 3 areas. It says it has processed about $1.4 billion in annualized payments so far, and is on track to process over $10 billion in annualized payments by 2022.

BukuWarung’s new round brings its total funding to $80 million. The company says its growth in users and payment volumes has been capital efficient, and that more than 90% of its funds raised have not been spent. It plans to add more MSME-focused financial services, including lending, savings and insurance, to its platform.

BukuWarung’s new funding announcement comes four months after its previous one, and less than a month after competitor BukuKas disclosed it had raised a $50 million Series B. Both started out as digital bookkeeping apps for MSMEs before expanding into financial services and e-commerce tools.

When asked how BukuWarung plans to continue differentiating from BukuKas, co-founder and CEO Abhinay Peddisetty told TechCrunch, “We don’t see this space as a winner takes all, our focus is on building the best products for MSMEs as proven by our execution on our payments and accounting, shown by massive growth in payments TPV as we’re 10x bigger than the nearest player in this space.”

He added, “We have already run successful lending experiments with partners in fintech and banks and are on track to monetize our merchants backed by our deep payments, accounting and other data that we collect.”

BukuWarung’s new funding will be used to double its current workforce of 150, located in Indonesia, Singapore and India, to 300 and develop BukuWarung’s accounting, digital payments and commerce products, including a payments infrastructure that will include QR payments and other services.

Powered by WPeMatico