Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Paytm, India’s most valuable startup, confirmed to its shareholders and employees on Monday that it plans to file for an IPO.

In a letter to shareholders and employees, Paytm said that it plans to raise money by issuing fresh equity in the IPO, and also sell existing shareholders’ shares at the event. The startup has offered its employees the option to sell their stakes in the firm.

This is the first time the Noida-headquartered firm, which is valued at $16 billion and has raised over $3 billion to date, has commented on its plans about the IPO. The startup said in the letter that it has received an in-principle approval from the board of directors to pursue the public market.

Paytm, which is backed by Alibaba and SoftBank, hasn’t shared when it plans to file for the IPO, but has sought shareholders’ response to their intention to sell stakes by the end of the month.

Two sources familiar with the matter told TechCrunch that Paytm plans to raise about $3 billion and is targeting a valuation of up to $30 billion in the IPO. Paytm declined to comment.

Paytm’s letter — obtained by TechCrunch — to shareholders on Monday.

This isn’t the first time Paytm has planned to explore the public route. Exactly 10 years ago, long before Paytm established itself as the largest mobile wallet firm and expanded to several financial and commerce services, the startup had filed with the regulator with intentions to become public. The startup at the time cancelled the IPO plan and instead raised money from VCs to explore new avenues for growth.

A lot is riding on a successful IPO of Paytm — which reported a consolidated loss of $233.6 million for the financial year that ended in March this year, down from $404 million a year ago. (The startup’s revenue fell 10% during this period to $437.6 million.) India’s stock markets are yet to be fully tested for tech startups’ stocks in the country — though retail investors have shown good signs in recent years.

The startup, which competes with Google Pay and Flipkart-backed PhonePe, has realigned its payments strategy in recent years to assume a leadership position in the merchant payments market.

In a report to its clients late last month, analysts at Bernstein said the startup’s credit tech vertical is likely to lead the next wave of its revenue growth.

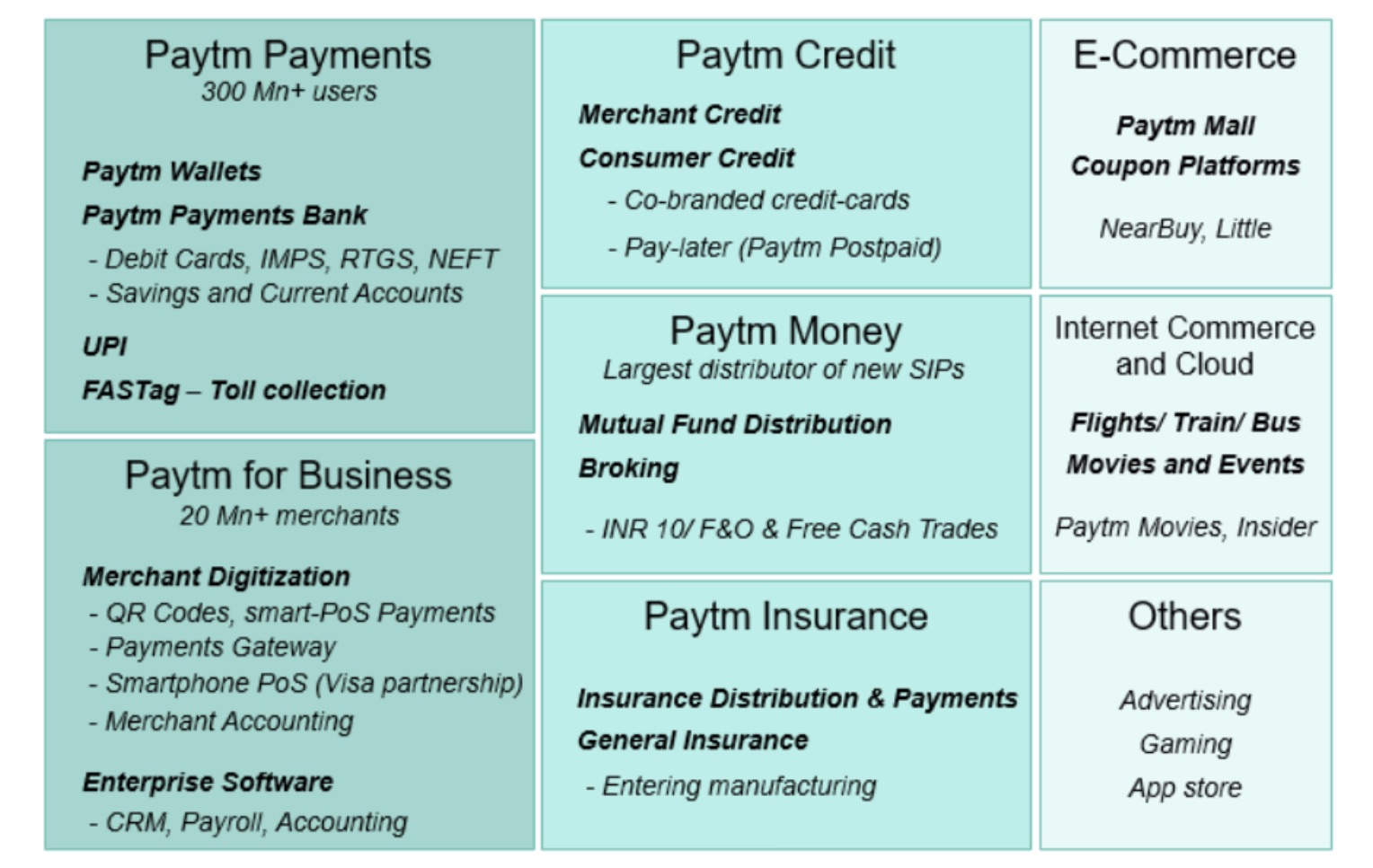

An overview of Paytm’s financial services ecosystem (Bernstein)

“With the advent of UPI, there has been a rising narrative that questioned Paytm’s market leadership,” the analysts wrote, referring to the exponential growth of payments stack developed by retail banks in India that has been adopted by several firms, including Google and PhonePe (as well as Paytm), and which has somewhat lowered the appeal of mobile wallets in India.

“However, under the hood, Paytm leads on merchant payments and has built an ecosystem of synergistic fintech verticals around its ‘super-app.’ The ecosystem spans payments (wallet/UPI), full-suite merchant acquiring, credit tech, digital bank, wealth, and insurance tech. We believe the super-app battle in India is not a ‘winner takes all’ but a game of execution, business building, and creating a superior customer experience with ecosystem integration,” Bernstein analysts added.

Paytm is the latest Indian giant startup that has expressed an interest in becoming public in recent months. Earlier this year, food delivery startup Zomato said it plans to raise $1.1 billion through an initial public offering. TechCrunch reported last month that Flipkart was in talks to raise over $1 billion in what is expected to be its financial fundraise ahead of an IPO.

Powered by WPeMatico

Think you’re living in a hyper-connected world? Huawei’s proprietary HarmonyOS wants to eliminate delays and gaps in user experience when you move from one device onto another by adding interoperability to all devices, regardless of the system that powers them.

Two years after Huawei was added to the U.S. entity list that banned the Chinese telecom giant from accessing U.S. technologies, including core chipsets and Android developer services from Google, Huawei’s alternative smartphone operating system was unveiled.

On Wednesday, Huawei officially launched its proprietary operating system HarmonyOS for mobile phones. The firm began building the operating system in 2016 and made it open-source for tablets, electric vehicles and smartwatches last September. Its flagship devices such as Mate 40 could upgrade to HarmonyOS starting Wednesday, with the operating system gradually rolling out on lower-end models in the coming quarters.

HarmonyOS is not meant to replace Android or iOS, Huawei said. Rather, its application is more far-reaching, powering not just phones and tablets but an increasing number of smart devices. To that end, Huawei has been trying to attract hardware and home appliance manufacturers to join its ecosystem.

To date, more than 500,000 developers are building applications based on HarmonyOS. It’s unclear whether Google, Facebook and other mainstream apps in the West are working on HarmonyOS versions.

Some Chinese tech firms have answered Huawei’s call. Smartphone maker Meizu hinted on its Weibo account that its smart devices might adopt HarmonyOS. Oppo, Vivo and Xiaomi, which are much larger players than Meizu, are probably more reluctant to embrace a rival’s operating system.

Huawei’s goal is to collapse all HarmonyOS-powered devices into one single control panel, which can, say, remotely pair the Bluetooth connections of headphones and a TV. A game that is played on a phone can be continued seamlessly on a tablet. A smart soymilk blender can customize a drink based on the health data gleaned from a user’s smartwatch.

Devices that aren’t already on HarmonyOS can also communicate with Huawei devices with a simple plug-in. Photos from a Windows-powered laptop can be saved directly onto a Huawei phone if the computer has the HarmonyOS plug-in installed. That raises the question of whether Android, or even iOS, could, one day, talk to HarmonyOS through a common language.

The HarmonyOS launch arrived days before Apple’s annual developer event scheduled for next week. A recent job posting from Apple mentioned a seemingly new concept, homeOS, which may have to do with Apple’s smart home strategy, as noted by MacRumors.

Huawei denied speculations that HarmonyOS is a derivative of Android and said no single line of code is identical to that of Android. A spokesperson for Huawei declined to say whether the operating system is based on Linux, the kernel that powers Android.

Several tech giants have tried to introduce their own mobile operating systems, to no avail. Alibaba built AliOS based on Linux but has long stopped updating it. Samsung flirted with its own Tizen but the operating system is limited to powering a few Internet of Things, like smart TVs.

Huawei may have a better shot at drumming up developer interest compared to its predecessors. It’s still one of China’s largest smartphone brands despite losing a chunk of its market after the U.S. government cut it off from critical chip suppliers, which could hamper its ability to make cutting-edge phones. HarmonyOS also has a chance to create an alternative for developers who are disgruntled with Android, if Huawei is able to capture their needs.

The U.S. sanctions do not block Huawei from using Android’s open-source software, which major Chinese smartphone makers use to build their third-party Android operating system. But the ban was like a death knell for Huawei’s consumer markets overseas as its phones abroad lost access to Google Play services.

Powered by WPeMatico

Zenyum, a startup that wants to make cosmetic dentistry more affordable, announced today it has raised a $40 million Series B. This includes $25 million from L Catterton, a private equity firm focused on consumer brands. The round’s other participants were Sequoia Capital India (Zenyum is an alum of its Surge accelerator program), RTP Global, Partech, TNB Aura, Seeds Capital and FEBE Ventures. L Catteron Asia’s head of growth investments, Anjana Sasidharan, will join Zenyum’s board.

This brings Zenyum’s total raised so far to $56 million, including a $13.6 million Series A announced in November 2019. In a press statement, Sasidharan said, “Zenyum’s differentiated business model gives it a strong competitive advantage, and we are excited to partner with the founder management team to help them realize their growth ambitions.” Other dental-related investments in L Catteron’s portfolio include Ideal Image, ClearChoice, dentalcorp, OdontoCompany, Espaçolaser and 98point6.

Founded in 2018, the company’s products now include ZenyumSonic electric toothbrushes; Zenyum Clear, or transparent 3D-printed aligners; and ZenyumClear Plus for more complex teeth realignment cases.

Founder and chief executive officer Julian Artopé told TechCrunch that ZenyumClear aligners can be up to 70% cheaper than other braces, including traditional metal braces, lingual braces and other clear aligners like Invisalign, depending on the condition of a patients’ teeth and what they want to achieve. Zenyum Clear costs $2,400 SGD (about $1,816 USD), while ZenyumClear Plus ranges from $3,300 to $3,900 SGD (about $2,497 to $2,951 USD).

The company is able to reduce the cost of its invisible braces by combining a network of dental partners with a technology stack that allows providers to monitor patients’ progress while reducing the number of clinic visits they need to make.

First, potential customers send a photo of their teeth to Zenyum to determine if ZenyumClear or ZenyumClear Plus will work for them. If so, they have an in-person consultation with a dentists, including an X-ray and 3D scan. This costs between $120 to $170 SGD, which is paid to the clinic. After their invisible braces are ready, the patient returns to the dentist for a fitting. Then dentists can monitor the progress of their patient’s teeth through Zenyum’s app, only asking them to make another in-person visit if necessary.

ZenyumClear is currently available in Singapore, Malaysia, Indonesia, Hong Kong, Macau, Vietnam, Thailand and Taiwan, with more markets planned.

Sequoia India principal Pieter Kemps told TechCrunch, “There are 300M customers in Zenyum’s core markets—Southeast Asia, Hong Kong, Taiwan—who have increased disposable income for beauty. We believe spend on invisible braces will grow significantly from the current penetration, but what it requires is strong execution on a complex product to become the preferred choice for consumers. That is where Zenyum shines: excellent execution, leading to new products, best-in-class NPS, fast growth, and strong economics. This Series B is a testament to that, and of the belief in the large opportunity down the road.”

Powered by WPeMatico

Here in the U.S. the concept of using a driver’s data to decide the cost of auto insurance premiums is not a new one.

But in markets like Brazil, the idea is still considered relatively novel. A new startup called Justos claims it will be the first Brazilian insurer to use drivers’ data to reward those who drive safely by offering “fairer” prices.

And now Justos has raised about $2.8 million in a seed round led by Kaszek, one of the largest and most active VC firms in Latin America. Big Bets also participated in the round, along with the CEOs of seven unicorns, including Assaf Wand, CEO and co-founder of Hippo Insurance; David Vélez, founder and CEO of Nubank; Carlos Garcia, founder and CEO of Kavak; Sergio Furio, founder and CEO of Creditas; Patrick Sigrist, founder of iFood and Fritz Lanman, CEO of ClassPass. (There’s a seventh CEO who wishes to remain anonymous). Senior executives from Robinhood, Stripe, Wise, Carta and Capital One also put money in the round.

Serial entrepreneurs Dhaval Chadha, Jorge Soto Moreno and Antonio Molins co-founded Justos, having most recently worked at various Silicon Valley-based companies including ClassPass, Netflix and Airbnb.

“While we have been friends for a while, it was a coincidence that all three of us were thinking about building something new in Latin America,” Chadha said. “We spent two months studying possible paths, talking to people and investors in the United States, Brazil and Mexico, until we came up with the idea of creating an insurance company that can modernize the sector, starting with auto insurance.”

Ultimately, the trio decided that the auto insurance market would be an ideal sector considering that in Brazil, an estimated more than 70% of cars are not insured.

The process to get insurance in the country, by any accounts, is a slow one. It takes up to 72 hours to receive initial coverage and two weeks to receive the final insurance policy. Insurers also take their time in resolving claims related to car damages and loss due to accidents, the entrepreneurs say. They also charge that pricing is often not fair or transparent.

Justos aims to improve the whole auto insurance process in Brazil by measuring the way people drive to help price their insurance policies. Similar to Root here in the U.S., Justos intends to collect users’ data through their mobile phones so that it can “more accurately and assertively price different types of risk.” This way, the startup claims it can offer plans that are up to 30% cheaper than traditional plans, and grant discounts each month, according to the driving patterns of the previous month of each customer.

“We measure how safely people drive using the sensors on their cell phones,” Chadha said. “This allows us to offer cheaper insurance to users who drive well, thereby reducing biases that are inherent in the pricing models used by traditional insurance companies.”

Justos also plans to use artificial intelligence and computerized vision to analyze and process claims more quickly and machine learning for image analysis and to create bots that help accelerate claims processing.

“We are building a design-driven, mobile first and customer experience that aims to revolutionize insurance in Brazil, similar to what Nubank did with banking,” Chadha told TechCrunch. “We will be eliminating any hidden fees, a lot of the small text and insurance-specific jargon that is very confusing for customers.”

Justos will offer its product directly to its customers as well as through distribution channels like banks and brokers.

“By going direct to consumer, we are able to acquire users cheaper than our competitors and give back the savings to our users in the form of cheaper prices,” Chadha said.

Customers will be able to buy insurance through Justos’ app, website or even WhatsApp. For now, the company is only adding potential customers to a waitlist but plans to begin selling policies later this year..

During the pandemic, the auto insurance sector in Brazil declined by 1%, according to Chadha, who believes that indicates “there is latent demand raring to go once things open up again.”

Justos has a social good component as well. Justos intends to cap its profits and give any leftover revenue back to nonprofit organizations.

The company also has an ambitious goal: to help make insurance become universally accessible around the world and the roads safer in general.

“People will face everyday risks with a greater sense of safety and adventure. Road accidents will reduce drastically as a result of incentives for safer driving, and the streets will be safer,” Chadha said. “People, rather than profits, will become the focus of the insurance industry.”

Justos plans to use its new capital to set up operations, such as forming partnerships with reinsurers and an insurance company for fronting, since it is starting as an MGA (managing general agent).

It’s also working on building out its products such as apps, its back end and internal operations tools, as well as designing all its processes for underwriting, claims and finance. Justos’ data science team is also building out its own pricing model.

The startup will be focused on Brazil, with plans to eventually expand within Latin America, then Iberia and Asia.

Kaszek’s Andy Young said his firm was impressed by the team’s previous experience and passion for what they’re building.

“It’s a huge space, ripe for innovation and this is the type of team that can take it to the next level,” Young told TechCrunch. “The team has taken an approach to building an insurance platform that blends being consumer-centric and data-driven to produce something that is not only cheaper and rewards safety but as the brand implies in Portuguese, is fairer.”

Powered by WPeMatico

TaniHub Group, an Indonesian startup that helps farmers get better prices and more customers for their crops, has raised a $65.5 million Series B. The funding was led by MDI Ventures, the investment arm of Telkom Group, one of Indonesia’s largest telecoms, with participation from Add Ventures, BRI Ventures, Flourish Ventures, Intudo Ventures, Openspace Ventures, Tenaya Capital, UOB Venture Management and Vertex Ventures.

Openspace and Intudo are returning investors from TaniHub’s $10 million Series A, announced in May 2019. The new funding brings its total raised to about $94 million.

Founded in 2016, TaniHub now has more than 45,000 farmers and 350,000 buyers (including businesses and consumers) in its network. The company helps farmers earn more for their crops by streamlining distribution channels so there are fewer middlemen between farms and the restaurants, grocery stores, vendors and other businesses that buy their products. It does this through three units: TaniHub, TaniSupply and TaniFund.

TaniHub is its B2B e-commerce platform, which connects farmers directly to customers. Then orders are fulfilled through TaniSupply, the company’s logistics platform, which currently operates six warehousing and processing facilities where harvests can be washed, sorted and packed within an hour, before being delivered to buyers by TaniHub’s own couriers or third-party logistics providers.

Finally, TaniFund is a fintech platform that provides loans to farmers they can use while growing crops and pay off by selling through TaniHub. Co-founder and chief executive officer Eka Pamitra told TechCrunch its credit scoring system is based on three years of performance, the company’s agriculture value chain expertise and partnerships with financial institutions.

“More than 100 data points are considered when doing the credit risk assessment. For example, for cultivation financing products, TaniFund tailors each credit scoring based on agriculture risks and market risk of each commodity, on top of the typical borrower E-KYC scoring and process,” he explained. “Beyond credit scoring, having TaniSupply and TaniHub as a standby buyer within the ecosystem also helps to mitigate risk of each loan. TaniFund aims to further boost its credit scoring system with smarter data processing and better machine learning models.”

Pamitra said TaniHub will use its new funding to build the upstream and midstream parts of its supply chain — in other words, new cultivation areas, processing, packing centers and warehouses. The company will also expand its coverage beyond Java and Bali to source and sell locally, and continue improving its supply-demand forecast model to help farmers plan crop cultivation and timing, with the goal of reducing price fluctuations and maintaining a consistent supply. Pamitra added that TaniHub will also explore precision farming technology.

Over the last couple of years, TaniHub has started exporting several types of fruits and spices to the United Arab Emirates, Singapore and South Korea. This year, it plans to focus on expanding within Indonesia because the F&B (food and beverage) market there is worth $137 billion and the Indonesian agriculture sector is still highly fragmented, Pamitra said.

Despite the COVID-19 pandemic, TaniHub says it was able to grow its revenue 600% year-on-year in 2020 as demand for online groceries increased.

“We postponed our branch expansion plan and focused on increasing the seven existing warehouses’ since there was a surge of demand on the B2C segment and the process of onboarding farmers. This benefited us since the adoption of purchasing fresh groceries online increased significantly, and the willingness of farmers to work with us became remarkably high because the local traditional markets were closed due to lockdowns,” Pamitra said. “Since COVID-19, the eagerness of provincial governments to open communications for TaniHub to work with local farmers and SMEs in their region has been quite impactful.”

TaniHub is now working with several Indonesian government agencies, including the Ministry of Trade, Ministry of Agriculture and the Ministry of Cooperatives and SMEs, to onboard more farmers, F&B businesses and increase exports.

In a press statement, MDI Ventures director of portfolio management Sandhy Widyasthana said, “TaniHub Group has an important role in transforming the agriculture sector and has proven that its presence can deliver positive impact on the quality of life of farmers. We hope our investment can help them continue their work and expand their coverage to more and more farming communities in Indonesia.”

Powered by WPeMatico

Farmers and food businesses, like restaurants, deal with the same issue: a fragmented supply chain. Secai Marche wants to streamline agricultural logistics, making fulfillment more cost-efficient and enabling food businesses to bundle products from different farmers into the same order. The company is headquartered in Japan, with operations in Malaysia, and plans to expand into Singapore, Thailand and Indonesia. This week, it announced 150 million JPY (about $1.4 million USD) in pre-Series A funding from Rakuten Ventures and Beyond Next Ventures to build a B2B logistics platform for farmers that sell to restaurants, hotels and other F&B (food and beverage) businesses.

This round brings Secai Marche’s total raised to about $3 million. The capital will be used to expand its fulfillment infrastructure, including a network of warehouses and cold chain logistics, hire more people for its engineering team and sales and marketing.

Secai Marche was founded in 2018 by Ami Sugiyama and Shusaku Hayakawa, and currently serves 130 farmers and more than 300 F&B businesses. Before launching the startup, Sugiyama spent four years working in Southeast Asia, including managing restaurants and cafes in Malaysia. During that time, she started to import green tea from Japan, intending to sell it directly to customers in Malaysia. But she realized supply chain inefficiencies not only made it hard to meet demand, but also ensure quality for all kinds of ingredients.

Meanwhile, Hayakawa was operating a farm in Japan and working on agriculture control systems that predicted weather and crop growth to help farmers maintain consistent quality.

Both Sugiyama and Hayakawa ended up at consulting firm Deloitte, researching how to create a more efficient supply chain for Japanese agricultural exports to Singaporean F&B businesses. Policies implemented by Prime Minister Yoshihide Suga’s administration aim to increase Japanese agricultural exports from 922.3 billion JPY (about $8.5 billion) in 2020 to 2 trillion JPY (about $18.5 billion) by 2025, and 5 trillion JPY (about $46.1 billion) in 2030.

Seche Marche’s goal is to make it easier for farmers to sell their crops to F&B businesses domestically or overseas.

“We found that not only farmers in Japan, but also all farmers in Southeast Asia have the same problem in terms of the current supply chain,” Sugiyama told TechCrunch. “So we left Deloitte and started our own business to connect not only farmers in Japan, but farmers in all Asian countries.”

Secai Marche’s logistics management tech is what differentiates it from other wholesaler platforms. It uses an AI-based algorithm to predict demand based on consumption trends, seasonal products and farmer recommendations, said Hayakawa. Secai Marche runs its own warehouse network, but mostly relies on third-party logistics providers for fulfillment, and its platform assigns orders to the most efficient transportation method.

This allows F&B businesses to consolidate orders from farmers, so they can order smaller batches from different places without spending more money. About 30% of Secai Marche’s products are shipped to other countries, while the rest are sold domestically.

Secai Marche is reaching out to farmers who want to increase their customer base. About 30% of its products currently come from Japanese farms, 50% from Malaysia and the rest from other ASEAN countries. Sugiyama and Hayakawa said the COVID-19 pandemic affected Secai Marche’s expansion plans because it originally planned to enter Singapore this year, but had to slow down since they were unable to travel and meet with farmers.

On the other hand, many farmers have started selling directly to consumers through social media like Instagram or Facebook, and have approached Secai Marche for help with fulfillment, logistics, repacking and quality control.

Correction: Funding amount corrected to say $1.4 million instead of $1 million.

Powered by WPeMatico

Steve Sy, CEO of Great Deals, and William Chiongbian II, CEO of Fast Group, sign the contract for the companies’ strategic partnership. Image Credits: Great Deals

Founded in 2014, Great Deals is an e-commerce enabler that helps brands like Abbot, L’Oréal and Unilever build their online retail operations in the Philippines. The startup announced today that it has raised $30 million in Series B funding led by Fast Group, one of the Philippines’ biggest logistics firms, with support from CVC Capital Partners. Navegar, which led Great Deals’ Series A, also returned for this round.

The transaction was advised by Rocket Equities. The investment by Fast Group, which has a fleet of more than 2,500 vehicles and 90,000 stores in its distribution network, marks the beginning of a strategic partnership. Great Deals will use part of the new capital to build an automated fulfillment center, and the deal will help it increase its penetration outside the Greater Manila Area and offer more Instant Commerce, or deliveries under one hour.

Great Deals currently operates only in the Philippines, but plans to expand regionally next year, founder and chief executive officer Steve Sy told TechCrunch.

In a statement, Fast Group president and chief executive officer William Chiongbian II said, “The Fast Group sees a lot of synergies with Great Deals in building capacity. We are privileged to contribute to the growth of Philippine e-commerce, as it relies heavily on a strong supply chain backbone.”

Some of Great Deals’ other clients include Nestlé, Samsonite, GSK, Bayer and Fila. In addition to serving as an e-commerce distributor, it offers an end-to-end services for brands, including digital content production, marketing campaign coordination and management of marketplace listings (Great Deals’ partners include Lazada, Shopee, Zalora, Zilingo, Shopify and Magento).

Powered by WPeMatico

The University of Tokyo Edge Capital Partners (UTEC), a deep-tech investment firm, announced the first close of its fifth fund, which is expected to total 30 billion JPY (or about $275 million USD) by June 2021. UTEC currently has about $780 million in total assets under management, and says this makes it one of the largest venture capital funds focused on science and tech in Japan, and one of the largest deep-tech funds in Asia.

UTEC is an independent firm that works closely with universities. It is associated with The University of Tokyo (UTokyo), where it has a partnership with its Technology Licensing Office (TLO) to spin off and invest in companies that originated as research projects. It has also worked with researchers from Waseda University, Kyoto University, Stanford, UC Berkeley, Carnegie Mellon, Cambridge University, the National University of Singapore and the Indian Institute of Technology, among other institutions.

Broadly speaking, UTEC focuses on three areas: healthcare and life sciences, information technology and physical sciences and engineering. More specifically, it is looking for tech that addresses some of the most important issues in Japan, including an aging population, labor shortage and the digitization of legacy industries.

“UTEC 5 will allow us to provide more funds from seed/early to pre-IPO/M&A stages in Japan and worldwide, on a wider scale and in a more consistent manner,” said managing partner and president Tomotaka Goji in a statement. “I believe this will further help our startups expand to address the global issues of humankind.”

The firm also partners with other funds, including Arch Venture Partners and Blume Ventures, to find investment opportunities around the world.

UTEC’s portfolio already includes more than 80 Japanese startups and 30 startups from other places, including the United States, India, Southeast Asia and Europe. So far, 25 of its investments have exited. Thirteen went public and now have an aggregated market cap of about $15 billion, and 12 were through mergers and acquisitions.

Some of its exits include 908 Devices, a mass spectrometry company that went public on Nasdaq last year; Fyusion, a computer vision startup acquired by Cox Automotive; and Phyzios, which was acquired by Google in 2013.

About half of UTEC’s portfolio are university spin-offs. For companies that originated in academic research, UTEC supports their commercialization by helping hire crucial talent, including executive positions, business development and go-to-market strategies. The firm’s first check size is about $500,000 to $5 million, and it also usually provides follow-on capital.

“We typically double-down on our investment in subsequent funding rounds of the company and can invest up to about $23 million per company over its lifecycle,” UTEC principal Kiran Mysore, who leads their global AI investments, told TechCrunch.

UTEC’s other investments include personal mobility robotics company BionicM, which started at UTokyo and spatial intelligence solution developer Locix, spun-off from UC Berkeley. The firm also helps startups collaborate with academic institutions. For example, Indian biotech Bugworks collaborates with the Tokyo Institute of Technology and Japanese industrial robotics startup Mujin now works with Carnegie Mellon.

Powered by WPeMatico

As the famous phrase goes, “software is eating the world” — and now software is eating dentistry. Or, perhaps more accurately, the arena of orthodontics — the specialty of dentistry that deals with things like braces — is slowly but surely being digitalized.

To whit, Impress, a Southern European player in direct-to-consumer orthodontics, has raised a $50 million Series A funding round led by CareCapital (a dental division of Hillhouse Capital in Asia), along with Nickleby Capital, UNIQA Ventures and investors including Michael Linse, Valentin Pitarque, Peter Schiff, Elliot Dornbusch and others. All existing shareholders, such as TA Ventures and Bynd VC, also participated.

Impress is an homage to the direct-to-consumer startups in this area in the U.S., such as SmileDirect, and now plans to scale across Europe from its existing bases in Spain, Italy, Portugal, the U.K. and France.

The company was founded in 2019 in Barcelona by orthodontist Dr. Khaled Kasem and serial entrepreneurs Diliara and Vladimir Lupenko.

Speaking from Barcelona, Lupenko told me that the idea was to “combine the best orthodontic tradition with the most innovative technology in the sector.”

As things stand, most of the time, consumers can usually only access cosmetic teeth alignment treatments or orthodontic medical treatments in conventional clinics. The new wave of clinics employs 3D scans and panoramic X-rays to check nerve and bone health.

Impress’s model is to offer these high-quality medical treatments directly to consumers, by developing its own chain of orthodontic clinics, which also put an emphasis on design and a “modern” patient experience, it says.

As Diliara Lupenko says: “We didn’t copy what other companies in the space were doing and approached the market from a different angle from the get-go. We doubled down on the doctor-led digital model which brought us way better conversion rates and treatment quality even though on paper it looked complex in the beginning. It’s still very complex but we were able to crack it and scale exponentially.”

Impress now has 75 clinics in Spain, Italy, the U.K., France and Portugal, which optimize costs and automate key parts of the value chain.

It now says it’s approaching €50 million in annual run-rate and is projected to grow to €150 million of revenue in 12 months.

Andreas Nemeth, managing partner of UNIQA Ventures GmbH commented: “Impress’s customer-centric focus, as well as its demonstrated ability to blitzscale, attracted us to the business. Vladimir and his team leverage technology to create a seamless customer journey for invisible orthodontics and optimized their cost structure in a unique way using software.”

Powered by WPeMatico

Serialized fiction app Radish has been acquired by Kakao Entertainment in a transaction valued at $440 million. Kakao Entertainment is owned by Kakao, the South Korean internet giant whose services include its eponymous messaging platform. Radish founder Seungyoon Lee will hold onto his role as its chief executive officer, while also becoming Kakao Entertainment’s global strategy officer to lead its growth in international markets.

Radish claims millions of users in North America, and the acquisition will be help Kakao Entertainment expand its own webtoons and web novel business there, and in other English-speaking markets. Radish will retain management autonomy and continue operating as its own brand.

Founded in 2015, Radish originally focused on user-generated content, but now the core of its business is Radish Originals, or serial fiction series designed specifically for the app. The company said the launch of Radish Originals in 2018 helped propel its growth, with revenue increasing more than 10 times in 2020 from the previous year.

Radish monetizes content through its micropayments system, which allows users to read several free episodes before making payments of about 20 to 30 cents to unlock new episodes (users also have the option of waiting an hour to unlock episodes for free). About 90% of its revenue now comes from Radish Originals.

The acquisition means that Radish Originals’ intellectual property will now be adapted by Kakao into webtoons, videos and other content, increasing their reach. Since 2016, Kakao Entertainment has adapted several web novels including “What’s Wrong with Secretary Kim?,” “A Business Proposal” and “Solo Leveling” into webtoons and other media.

Lee told TechCrunch that Radish started exclusively distributing several of Kakao Entertainment’s most popular original series, like “What’s Wrong with Secretary Kim?” last month. It plans to launch more content from Kakao Entertainment’s portfolio and are also “looking at ways in which we can make original localized novel adaptions of Kakao’s popular stories,” he added.

In a press statement, Kakao Entertainment CEO Jinsoo Lee said, “Radish has firmly established itself as a leading web novel platform and yet we see even greater growth potential… With the combination of Kakao’s expertise in the IP business and Radish’s strong North American foothold, we are excited about what we can achieve together.”

The acquisition has been approved by Radish’s board of directors, which includes a representative from SoftBank Ventures Asia, its largest investor, and the majority of its shareholders. Radish’s other backers include Lowercase Capital, K50 Ventures, Nicolas Bergruen, Charlie Songhurst, Duncan Clark and Amy Tan, the best-selling author.

Powered by WPeMatico