Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Singapore-based Aspire, which wants to become the financial services “one-stop shop” for SMEs, announced that its business accounts have reached $1 billion in annualized transaction volume one year after launching. The company also unveiled Bill Pay, its latest feature that lets businesses manage and pay invoices by emailing them to Aspire’s AI-based digital assistant.

Launched in May 2020, Aspire’s online business accounts are targeted to startups and small- to medium-sized enterprises, and do not require minimum deposits or monthly fees. Co-founder and chief executive officer Andrea Baronchelli told TechCrunch more than 10,000 companies now use Aspire’s business accounts and that adoption was driven by two main reasons. The first was Aspire’s transition to a multi-product strategy early last year, after focusing on corporate cards and working capital loans. The second reason is the COVID-19 pandemic, which made it harder for companies to open accounts at traditional banks.

“We can go in and say we offer all-in-one financial tools for growing businesses,” he said. “People come in and use one thing first, and then we offer them other things later on, so that’s been a huge success for us.”

Founded in 2018, Aspire has raised about $41.5 million in funding so far, including a Series A announced in July 2019. Its investors include MassMutual Ventures Southeast Asia, Arc Labs and Y Combinator.

Baronchelli said Aspire’s business account users consist of two main segments. The first are “launchers,” or people who are starting their first businesses and need to set up a way to send and receive money. Launchers typically make less than $400,000 a year in revenue and their Aspire account serves as their primary business account. The second segment are companies that make about $500,000 to $2 million a year and already had another bank account, but started using Aspire for its credit line, expense management or foreign exchange tools, and decided to open an account on the platform as well.

The company has customers from across Southeast Asia, and is particularly focused on Singapore, Indonesia and Vietnam. For example, it launched Aspire Kickstart, with incorporation services for Singaporean companies, at the start of this year.

Bill Pay, its newest feature, lets business owners forward invoices by email to Aspire’s AI-based digital assistant, which uses optical character recognition and deep learning to pull out payment details, including terms and due dates. Then users get a notification to do a final check before approving and scheduling payments. The feature syncs with accounting systems integrated into Aspire, including Xero and QuickBooks. Baronchelli said Aspire decided to launch Bill Pay after interviewing businesses and finding that many still relied on Excel spreadsheets.

Aspire’s offerings overlap with several other fintech companies in Southeast Asia. For example, Volopay, Wise and Revolut offer business accounts, too, and Spenmo offers business cards. Aspire plans to differentiate by expanding its stack of multiple products. For example, it is developing tools for accounts receivable, such as invoice automation, and accounts payable, like a dedicated product for payroll management. Baronchelli said Aspire is currently interviewing users to finalize the set of features it will offer.

“I don’t want to close the door that others might come toward a multiple product approach, but if you ask me what our position is now, we are basically the only one that offers an all-in-one product stack,” he added. “So we are a couple years ahead of the competition and have a first-mover advantage.”

Powered by WPeMatico

Una Brands’ co-founders (from left to right): Tobias Heusch, Kiren Tanna and Kushal Patel. Image Credits: Una Brands

One of the biggest funding trends of the past year is companies that consolidate small e-commerce brands. Many of the most notable startups in the space, like Thrasio, Berlin Brands Group and Branded Group, focus on consolidating Amazon Marketplace sellers. But the e-commerce landscape is more fragmented in the Asia-Pacific region, where sellers use platforms like Tokopedia, Lazada, Shopee, Rakuten or eBay, depending on where they are. That is where Una Brands comes in. Co-founder Kiren Tanna, former chief executive officer of Rocket Internet Asia, said the startup is “platform agnostic,” searching across marketplaces (and platforms like Shopify, Magento or WooCommerce) for potential acquisitions.

Una announced today that it has raised a $40 million equity and debt round. Investors include 500 Startups, Kingsway Capital, 468 Capital, Presight Capital, Global Founders Capital and Maximilian Bitner, the former CEO of Lazada who currently holds the same role at secondhand fashion platform Vestiaire Collective.

Una did not disclose the ratio of equity and debt in the round. Like many other e-commerce aggregators, including Thrasio, Una raised debt financing to buy brands because it is non-dilutive. The round will also be used to hire aggressively in order to evaluate brands in its pipeline. Una currently has teams in Singapore, Malaysia and Australia and plans to expand in Southeast Asia before entering Taiwan, Japan and South Korea.

Tanna, who also founded Foodpanda and ZEN Rooms, launched Una along with Adrian Johnston, Kushal Patel, Tobias Heusch and Srinivasan Shridharan. He estimates that there are more than 10 million third-party sellers spread across different platforms in the Asia-Pacific.

“Every single seller in Asia is looking at multiple platforms and not just Amazon,” Tanna told TechCrunch. “We saw a big gap in the market where e-commerce is growing very quickly, but players in the West are not able to look at every platform, so that is why we decided to focus on APAC, launch the business there and acquire sellers who are selling on multiple platforms.”

Una looks for brands with annual revenue between $300,000 to $20 million and is open to many categories, as long as they have strong SKUs and low seasonality (for example, it avoids fast fashion). Its offering prices range from about $600,000 to $3 million.

Tanna said Una will maintain acquisitions as individual brands “because what’s working, we don’t change it.” How it adds value is by doing things that are difficult for small brands to execute, especially those run by just one or two people, like expanding into more distribution channels and countries.

“For example, in Indonesia there are at least five or six important platforms that you should be on, and many times the sellers aren’t doing that, so that’s something we do,” Tanna explained. “The second is cross-border in Southeast Asia, which sellers often can’t do themselves because of regulations around customs, import restrictions and duties. That’s something our team has experience in and want to bring to all brands.”

Amazon FBA roll-up players have the advantage of Amazon Marketplace analytics that allow them to quickly measure the performance of brands in their pipeline of potential acquisitions. Since it deals with different marketplaces and platforms, Una works with much more fragmented sources of data for revenue, costs, rankings and customer reviews. To scale up, the company is currently building technology to automate its valuation process and will also have local teams in each of its markets. Despite working with multiple e-commerce platforms, Tanna said Una is able to complete a deal within five weeks, with an offer usually happening within two or three days.

In countries where Amazon is the dominant e-commerce player, like the United States, many entrepreneurs launch FBA brands with the goal of flipping them for a profit within a few years, a trend that Thrasio and other Amazon roll-up startups are tapping into. But that concept is less common in Una’s markets, so it offers different team deals to appeal to potential sellers. Though Una acquires 100% of brands, it also does profit-sharing models with sellers, so they get a lump sum payment for the majority of their business first, then collect more money as Una scales up the brand. Tanna said Una usually continues working with sellers on a consulting basis for about three to six months after a sale.

“Something that Amazon players know very well is that they can find a product, sell it for four to five years, and then ideally make a multi-million deal exit and build another product or go on holiday,” said Tanna. “That’s something Asian sellers are not as familiar with, so we see this as an education phase to explain how the process works, and why it makes sense to sell to us.”

Powered by WPeMatico

An Indian startup that began its life after the global pandemic broke last year said on Tuesday it has concluded its third financing round as it enables hundreds of thousands of teachers in the world’s second-largest internet market to run classes online and serve their students.

Bangalore-based Teachmint said today it has raised $16.5 million in its Series A financing round. The round was led by Learn Capital, the San Francisco Bay Area-headquartered venture capital firm that focuses on edtech firms and has backed some of the world’s most promising online learning startups, including Coursera, Udemy, Nerdy, Minerva and Brainly.

CM Ventures, and existing investors Better Capital, which first invested in Teachmint before the startup had even registered itself, and Lightspeed India Partners also participated in the new round, which brings the Indian startup’s to-date raise to $20 million.

Teachmint helps teachers conduct classes online through an app on their Android smartphone, iPhone or the web. The startup has built an all-in-one product that allows teachers to kickstart a live class, do doubt-clearing sessions, take attendance, conduct webinars, collect fees, find new students, offer support via phone calls and take tests, among other tasks.

“When the pandemic broke, teachers were struggling with several tools including Google Meet, Zoom and even YouTube/Facebook Live to teach online. They were using additional tools like Google Forms for tests and WhatsApp for communication. It was a difficult and disconnected experience for most teachers as none of these tools were productised for teaching. That’s when we decided to build a mobile-first video-first solution specifically for teaching,” said Mihir Gupta, co-founder and chief executive of Teachmint, in an interview with TechCrunch.

The product, available in 10 local languages, is highly localised for India-specific needs, said Gupta.

More than 700,000 teachers from over 1,500 cities and towns have signed up on the platform in less than 10 months since the launch of Teachmint’s product, said Gupta.

“From the Learn Capital team’s first meeting with Teachmint’s co-founders several months ago, it was clear that their collective team had meticulously architected an end-to-end, multi-modal, and best-in-class solution enabling teachers in India to instantly and seamlessly digitize their classrooms,” said Vinit Sukhija, partner at Learn Capital, in a statement.

“Now with over 700,000 teachers, Teachmint has become India’s leading online teaching platform,” he said, adding that Learn Capital believes that Teachmint can eventually expand its offering outside of India.

Gupta said Teachmint is currently not monetizing its product, and doesn’t intend to do so in the immediate future as it is currently prioritizing reaching more teachers in India and also expand its offerings.

He said most teachers have learnt about Teachmint through friends as it has limited investment in marketing. Teachmint is open to exploring any strategic acquisition opportunities with smaller startups, he said.

Powered by WPeMatico

Hangry, an Indonesian cloud kitchen startup that wants to become a global food and beverage company, has raised a $13 million Series A. The round was led by returning investor Alpha JWC Ventures and included participation from Atlas Pacific Capital, Salt Ventures and Heyokha Brothers. It will be used to increase the number of Hangry’s outlets in Indonesia, including launching its first dine-in restaurants, over the next two years before it enters other countries.

Along with a previous round of $3 million from Alpha JWC and Sequoia Capital’s Surge program, Hangry’s Series A brings its total funding to $16 million. It currently operates about 40 cloud kitchens in Greater Jakarta and Bandung, 34 of which launched in 2020. Hangry plans to expand its total outlets to more than 120 this year, including dine-in restaurants.

Founded in 2019 by Abraham Viktor, Robin Tan and Andreas Resha, Hangry is part of Indonesia’s burgeoning cloud kitchen industry. Tech giants Grab and Gojek both operate networks of cloud kitchens that are integrated with their food delivery services, while other startups in the space include Everplate and Yummy.

One of the main ways Hangry sets itself apart is by focusing on its own brands, instead of providing kitchen facilities and services to restaurants and other third-party clients. Hangry currently has four brands, including Indonesian chicken dishes (Ayam Koplo) and Japanese food (San Gyu), that cost about 15,000 to 70,000 IDR per portion (or about $1 to $6 USD). Its food can be ordered through Hangry’s own app, plus GrabFood, GoFood and ShopeeFood.

“Given that Hangry has developed an extensive cloud kitchen network across Indonesia, we naturally would have interest from other brands to leverage our networks,” chief executive officer Viktor told TechCrunch. “However, our focus is to grow our brands since our brands are rapidly growing in popularity in Indonesia and require all kitchen resources that they need to realize their full potential.”

Providing food deliveries helped Hangry grow during COVID-19 lockdowns and social distancing, but in order to become a global brand within a decade, it needs to operate in multiple channels, he added.

“We knew that we will one day have to serve customers in all channels, including dine in,” said Viktor. “We started the hard way, doing delivery-first business, where we faced the challenges surrounding making sure our food still tastes good when it reaches customers’ homes. Now we feel ready to serve our customers in our restaurant premises. Our dine-in concept is an expansion of everything we’ve done in delivery channels.”

In a press statement, Alpha JWC Ventures partner Eko Kurniadi said, “In the span of 1.5 years, [Hangry] launched multiple brands across myriad tastes and categories, and almost all of them are amongst the best sellers list with superior ratings in multiple platforms, tangible examples of product-market fit. This is only the beginning and we can already foresee their growth to be a top local F&B brand in the country.”

Powered by WPeMatico

Four months after leading a $30 million growth round in Bibit, Sequoia Capital India has doubled down on its investment in the Indonesian robo-advisor app. Bibit announced today that the firm led a new $65 million growth round that also included participation from Prosus Ventures, Tencent, Harvard Management Company and returning investors AC Ventures and East Ventures.

This brings Bibit’s total funding to $110 million, including a Series A announced in May 2019. Its latest round will be used on developing and launching new products, hiring and increasing Bibit’s financial education services.

Bibit was launched in 2019 by Stockbit, a stock investing platform and community, and is part of a crop of Indonesian investment apps focused on new investors. Others include SoftBank Ventures-backed Ajaib, Bareksa, Pluang and FUNDtastic. Bibit runs robo-advisor services for mutual funds, investing users’ money based on their risk profiles, and claims that 90% of its users are millennials and first-time investors.

According to Indonesia’s Financial Services Authority (Otoritas Jasa Keuangan), the number of retail investors grew 56% year-over-year in 2020. For mutual funds in particular, Bibit said investors grew 78% year-over-year to 3.2 million, based on data from the Indonesia Stock Exchange and Central Securities Custodian.

Despite the economic impact of COVID-19, interest in stock investing grew as people took advantage of market dips (the Jakarta Composite Index fell in the first quarter of 2020, but is now recovering steadily). Apps like Bibit and its competitors want to make capital investing more accessible with lower fees and minimum investment amounts than traditional brokerages like Mandiri Sekuritas, which also saw an increase in new retail investors and average transaction value last year.

But the percentage of retail investors in Indonesia is still very low, especially compared to markets like Singapore or Malaysia, presenting growth opportunities for investment services.

Apps like Bibit focus on content that helps make capital investing less intimidating to first-time investors. For example, Ajaib also presents its financial educational features as a selling point.

In a press statement, Sequoia Capital India vice president Rohit Agarwal said, “Indonesian mutual fund customers have grown almost 10x in the past five years. Savings via mutual funds is the first step towards investing and Bibit has helped millions of consumers start their investing journey in a responsible manner. Sequoia Capital India is excited to double down on the partnership as the company brings the same customer focus to stock investing with Stockbit.”

Powered by WPeMatico

In Indonesia, daily necessities often cost more in smaller cities and rural areas. Super co-founder and chief executive officer Steven Wongsoredjo said the price difference can vary from about 10% to 20% in Tier 2 and Tier 3 cities, to nearly 200% in eastern provinces. Super uses social commerce and a streamlined logistics chain to lower the cost of goods. The startup announced today it has raised an oversubscribed $28 million Series B led by SoftBank Ventures Asia.

Other participants included returning backers Amasia, Insignia Ventures Partners, Y-Combinator Continuity Fund and Bain Capital co-chairman Stephen Pagliuca, while partners from DST Global and TNB Aura invested for the first time in this round.

The funding brings Super’s total raised so far to more than $36 million, which the company says is the most funding an Indonesian social commerce startup has raised so far.

Super, which took part in Y Combinator’s winter 2018 batch, focuses mainly on cities or towns with a gross domestic product per capita of $5,000 USD or lower. It currently operates in 17 cities in East Java, and has a network of thousands of agents, or resellers, and hundreds of thousands of end buyers. The company will use its new funding to double its presence in the region and launch in other Indonesian provinces this year. It will also expand its product categories beyond fast-moving consumer goods (FMCG) and develop its recently-launched white label brand, SuperEats.

Wongsoredjo told TechCrunch that Super’s ultimate goal is to “build the Walmart Group of Indonesia without having a retail store and utilizing the social commerce aspect to build a sustainable model,” similar to the way Pinduoduo became one of China’s biggest e-commerce companies by focusing on smaller cities.

Prices for consumer goods are higher in small cities and rural areas because of two reasons, Wongsoredjo said. The first is that orders from smaller cities cost more to fulfill, with supply chain costs adding up, than larger orders, and the second is infrastructure that makes it harder for manufacturers and FMCG brands to truck goods into rural areas, so supply does not meet demand.

Super operates a central warehouse, along with smaller hubs closer to buyers. Most of Super’s products are supplied by regional FMCG brands, and group orders are delivered to agents, who in turn perform last-mile deliveries to their buyers. This keeps prices down by making its supply chain more efficient and enabling it to fulfill orders within 24 hours without relying on third-party logistics providers.

Other social commerce companies in Indonesia include KitaBeli, ChiliBeli and Woobiz. Wongsoredjo said Super had a headstart to serve smaller cities and rural areas because it does not focus on Jabodetabek, or the greater Jakarta region. Its headquarters and core operations teams are also all outside of major cities.

“We believe that by not having Jabodetabek’s presence in our DNA, we can build unique social commerce products with the hyperlocal touch to serve rural communities much better,” Wongsoredjo added. “We want to go after the rest of 90% of the market that is still under-penetrated.”

In statement, SoftBank Ventures Asia partner Cindy Jin said, “We have been impressed by the Super team’s deep knowledge and commitment to Indonesia’s underserved regions, and believe that a truly local team like theirs will be well equipped to navigate and build out a platform in this hyperlocal market.”

Powered by WPeMatico

AfterShip launched in 2012 to help online sellers track packages across different carriers, but since then it has built a suite of data analytics tools covering almost every step of the shopping experience, from email marketing to customer retention. The Hong Kong-headquartered startup announced today it has raised a $66 million Series B led by Tiger Global, with participation from Hillhouse Capital’s GL Ventures.

AfterShip’s last round of funding was a $1 million Series A in 2014. Co-founder Andrew Chan told TechCrunch that the company has been profitable since its launch and grew mainly through word-of-mouth referrals and partnerships, like a Shopify integration, that boosted its profile. But the company recently added a sales team and will use its latest capital on international hiring for sales and customer support. It also plans to launch new products and expand further in the United States, where about 70% of AfterShip’s customers are located.

The company’s software enables sellers to track shipments made through more than 740 carriers and handles more than 6 billion shipments each year. AfterShip’s partners with about 10,000 companies, including some of the biggest names in e-commerce: Shopify (where it is used by 50,000 merchants), Magento, Squarespace, Amazon, eBay, Etsy, Groupon, Rakuten, Wish and retail brands like Dyson and Inditex.

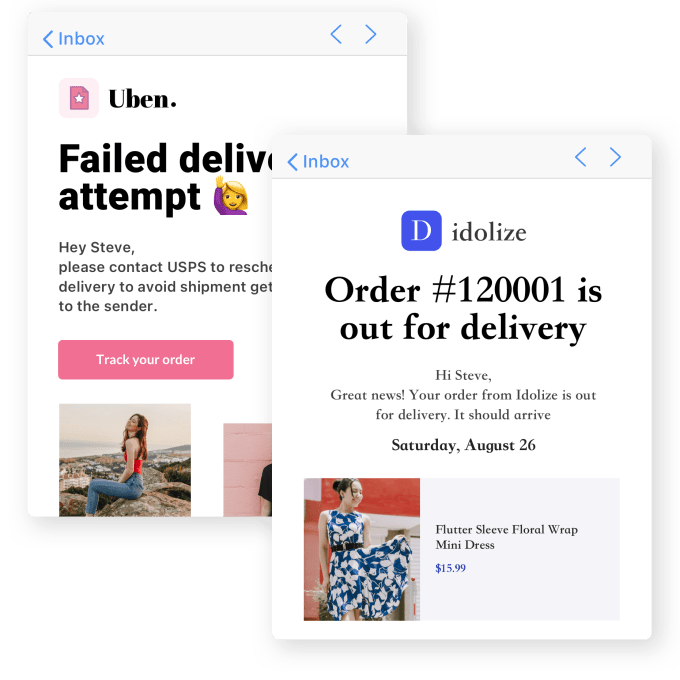

A branded shipment tracking page and email created with AfterShip’s software. Image Credits: AfterShip

AfterShip’s core product is its shipment tracking platform, but it also makes apps for shoppers, including self-service returns and package tracking, and sales and marketing tools for merchants that let them get more use out of data from shipments. Chan explained that package tracking is also a user engagement tool for sellers that lets them show more product recommendations and promotions to shoppers. AfterShip’s tools enables merchants to create their own branded tracking pages and notifications. Other features allow them to track the performance of different carriers, create email marketing campaigns and increase customer retention.

Its CRM capabilities help AfterShip differentiate from other shipment tracking aggregator providers.

“When we think of our vision, we look at what Salesforce is doing, but is there an e-commerce Salesforce that can cover more topics for sales people to use,” Chan said.

In press statement, Pengfei Wang, global partner at Tiger Global, said, “AfterShip leads the charge in making the shipping process more transparent and reliable for consumers and companies alike. As growth in e-commerce spirals ever upward, we are excited to partner with AfterShip and its leadership team as they continue to advance technology in this critical and expanding industry.”

Powered by WPeMatico

In Hefei, a Chinese city known for its relics from the Three Kingdoms period and its manufacturing industry today, Maxim Rate was thrilled to find a small studio crafting a Western role-playing game, a genre that attracts lovers of gritty aesthetics and dark storylines.

“The design and computer graphics are really good. You can’t tell they are a Chinese team,” said Rate.

Rate’s mission is to find Chinese studios like the bootstrapped Hefei team and help them woo international players. As Chinese regulators tighten rules on game publishing and make licenses hard to obtain, small studios find themselves struggling. Since last year, Apple has pulled thousands of unlicensed games from its Chinese App Store at the behest of local authorities. Small-time developers began to look beyond their home turf.

“The problem is these startups have no experience in overseas expansion,” said Rate.

An avid gamer himself, Rate quit his job at a Chinese cross-border payment firm last year and launched a part-incubator, part-investment vehicle to take Chinese games abroad. The firm, called Westward Gaming Ventures, took inspiration from Zheng He, a Chinese diplomat and explorer who embarked on state-sponsored naval expeditions to the “Western Oceans” during the Ming Dynasty.

Westward plans to raise 200 million yuan ($30 million) for its debut fund, Rate told TechCrunch in an interview. It plans to deploy the capital over the next three years with an intended check size of 2-4 million yuan per studio. It’s currently in talks with 20-30 teams that span a wide range of genres.

The Chinese fund being established is a so-called Qualified Foreign Limited Partners Fund, which, Rate said, for the first time will enable foreign investors (USD and EUR) to invest directly in Chinese gaming firms. Only a few institutions own a license for QFLP, and while Westward itself doesn’t hold one, it gained legitimacy for direct foreign investment by partnering with the private equity arm of a major Chinese financial conglomerate, which declined to be named at this stage.

To navigate such regulatory complications, Westward also seeks help from its advisors, including one that oversaw the legal and financial process of one of the largest joint ventures established between Chinese and foreign gaming firms in recent years. The partnership, which can’t be named, was also the first time a foreign entity has become the majority shareholder in a gaming joint venture in China.

China limits foreign investments in areas it considers sensitive, such as value-added services, so many companies resort to setting up elaborate offshore entities to receive overseas funding. The restriction makes it difficult for resource-strapped studios to land foreign investors, who could help them venture into global markets. They are left with the option of getting backed or bought by Chinese giants like Tencent or ByteDance.

The idea of Westward is not just to lower the barriers for independent Chinese games to secure foreign capital but also to better prepare them for overseas expansion.

“Chinese gaming studios, big or small, used to rely heavily on ads for user acquisition when they went abroad,” said Rate. “Sometimes a game would take off, but the team had no idea why, so they continued to test. Those who failed may just give up.”

But taking a game abroad is not as simple as translating it, hitting the publish button and launching an ad campaign on Facebook.

Westward’s plan is to get involved in a game’s early development phase and help them position: Is it an RPG? Is the targeted user a casual or serious player? What’s the graphic style? In addition, the firm also plans to supply developers with workspace, technical assistance, marketing and localization expertise, connection to publishers and overseas operation help.

Image Credits: Westward Gaming Ventures

To provide post-investment support, Westward has partnered up with V+ Gaming Society, an incubator for games headquartered in Shenzhen, which Westward also calls home.

Chinese tech companies are facing mounting challenges in the West as geopolitical tensions rise. Many now prefer calling themselves “global firms” and even deny their Chinese roots outright.

But for Westward, the games it helps create don’t need to pretend they are non-Chinese. “Most players don’t consider where a game is from if it is a really good game,” said Rate.

“We actually hope to see elements of Chinese culture in these games that can be understood by overseas players.”

Amy Ho, a partner at Westward along with Rate and Edward He, said one of the few Chinese games that have managed to be both “Chinese” and transcend cultural boundaries is “Chinese Parents.” The simulation game became a global hit by letting users experience what it is like to raise a child in China.

The benchmark Rate gave was the generation of Japanese games that began exporting 20-30 years ago, which he described as “Japanese” in spirit but “globalized” in graphics and game design.

There have already been globally successful titles from Chinese makers like Tencent and rising studios Lilith and Mihoyo. In the past, many Chinese users on Steam would be asking foreign titles to rush out Chinese versions. Now, it’s not uncommon to see Western users demanding English editions of Chinese games, Rate observed.

Rather than politics, the bigger challenge, especially for small studios, is how to “collect key data for product iteration while complying with local privacy laws,” said Ho.

Westward expects 50-70% of its capital to come from Chinese institutions. The presence of Chinese investments inevitably leads to questions around censorship. Ho said while Westward provides resources and capital to studios, it will work to ensure their independence from investor influence.

If things go well, Westward could help facilitate cultural exchange between China and the rest of the world. Beijing has been trying to export the country’s soft power, and games may be a suitable conduit, suggested Rate. Amid the ongoing trade war, having foreign funding in Chinese companies may also do good to China’s “brand”, he said.

Powered by WPeMatico

Robotic process automation has become buzzy in the last few months. New York-based UiPath is on course to launch an initial public offering after gaining an astounding valuation of $35 billion in February. Over in China, homegrown RPA startup Laiye is making waves as well.

Laiye, which develops software to mimic mundane workplace tasks like keyboard strokes and mouse clicks, announced it has raised $50 million in a Series C+ round. The proceeds came about a year after the Beijing-based company pulled in the first tranche of its Series C round.

Laiye, six years old and led by Baidu veterans, has raised over $130 million to date according to public information.

Leading investors in the Series C+ round were Ping An Global Voyager Fund, an early-stage strategic investment vehicle of Chinese financial conglomerate Ping An, and Shanghai Artificial Intelligence Industry Equity Investment Fund, a government-backed fund. Other participants included Lightspeed China Partners, Lightspeed Venture Partners, Sequoia China and Wu Capital.

RPA tools are attracting companies looking for ways to automate workflows during COVID-19, which has disrupted office collaboration. But the enterprise tech was already gaining traction prior to the pandemic. As my colleague Ron Miller wrote this month on the heels of UiPath’s S1 filing:

“The category was gaining in popularity by that point because it addressed automation in a legacy context. That meant companies with deep legacy technology — practically everyone not born in the cloud — could automate across older platforms without ripping and replacing, an expensive and risky undertaking that most CEOs would rather not take.”

In one case, Laiye’s RPA software helped the social security workers in the city of Lanzhou speed up their account reconciliation process by 75%; in the past, they would have to type in pensioners’ information and check manually whether the details were correct.

In another instance, Laiye’s chatbot helped automate the national population census in several southern Chinese cities, freeing census takers from visiting households door-to-door.

Laiye said its RPA enterprise business achieved positive cash flow and its chatbot business turned profitability in the fourth quarter of 2020. Its free-to-use edition has amassed over 400,000 developers, and the company also runs a bot marketplace connecting freelance developers to small-time businesses with automation needs.

Laiye is expanding its services globally and boasts that its footprint now spans Asia, the United States and Europe.

“Laiye aims to foster the world’s largest developer community for software robots and built the world’s largest bot marketplace in the next three years, and we plan to certify at least one million software robot developers by 2025,” said Wang Guanchun, chair and CEO of Laiye.

“We believe that digital workforce and intelligent automation will reach all walks of life as long as more human workers can be up-skilled with knowledge in RPA and AI”.

Powered by WPeMatico

More than a year after the pandemic began, remote work shows no signs of going away. While it has its cons, it remains top of mind for potential employees around the world before joining a new company.

But while most people in Africa still go to physical offices despite the pandemic, a few companies have nevertheless embraced this concept. Andela, a New York-based startup that helps tech companies build remote engineering teams from Africa, was one of the first to publicly announce it was going remote on the continent.

Today, it is doubling down on this effort by announcing the global expansion of its engineering talent. Over the past six months, the company has seen a 750% increase in applicants outside Africa. More than 30% of Andela’s inbound engineer applications also came from outside the continent in March alone. Half this number came from Latin America while Africa saw a 500% increase in applications as well.

When Andela launched in 2014, it built hubs in Nigeria, Kenya, Rwanda and Uganda to source, vet and train engineers to be part of remote teams for international companies. It also tested satellite models in Egypt and Ghana as substitutes to physical hubs.

The company would issue a call for applications, select a few (less than 1%), pay them a salary for the first six months and provide them with housing and food. It also helped developers improve their skills via training and mentorship. Over 100,000 engineers have taken part in the company’s learning network and community, and, as of 2019, Andela had more than 1,500 engineers on its payroll.

However, after noticing that this model wasn’t sustainable, it began to make changes.

In September 2019, it let go of 420 junior engineers across Kenya, Uganda and Nigeria. Nine months later, citing the pandemic, it laid off 135 employees while introducing salary cuts for senior staff. But despite the layoffs, the pandemic provided some form of clarity to how Andela wanted to operate — which was remote, judging by the success of the satellite models.

“In the very beginning, a developer had to be in Lagos to work with Andela. Then it became living in Nigeria. Then Kenya. Then Uganda, Rwanda,” CEO Jeremy Johnson told TechCrunch. “Before the pandemic, Andela was opening applications in country after country. The pandemic came and changed that as we opened up to the entire continent.”

Shutting down its existing physical campuses and going remote also helped the company focus on getting engineers with more experience to meet its clients’ requirements. That experiment, which the company conducted in less than a year, is also part of its mission to be a global company.

“That went so well and we thought ‘what if we accelerated it now that we’re remote and just enable applicants from anywhere?’ because it was always the plan to become a global company. That was clear, but the timing was the question. We did that and it’s been an amazing experiment,” Johnson added.

Now with its global expansion, its clients can tap into regional expertise to support international growth.

According to a statement released by the firm, it currently has engineers from 37 countries across Africa, Asia, Latin America, North America and Europe.

Johnson didn’t go into details about how many of these engineers are getting jobs from Andela or even its total developer count. He’s more interested in helping its clients solve the diversity issues that have plagued many Western corporations.

Andela is currently working with eight companies that have hired its engineers in Latin America and Africa. In addition to the diversity play, the CEO says that means Andela engineers get to prove themselves on a global playing field in a way the company has “always wanted to see.”

Andela serves more than 200 customers, including GitHub, ViacomCBS, Pluralsight, Seismic, Cloudflare, Coursera and InVision. GitHub is one company that seems to be benefitting from Andela’s new offerings. The company’s VP of Engineering, Dana Lawson, in a statement said, “As a business in the developer tool space, a lot of us are trying to enter those areas of the world (Southeast Asia, Latin America and Africa) where the emergent developers are coming so we can better understand their needs. Having a local presence there with amazing talent is super valuable to building a global product.”

Image Credits: Andela

In its quest to become a global company, going up against competition is unavoidable for the seven-year-old company. But since most of these companies are horizontal marketplaces (providing a wide range of expertise), whereas Andela is vertical, Johnson believes there’s enough market share to be acquired by the company.

“We are focused on building digital products, and because of that, we’re able to do more, essentially, for our customers… That’s where our focus is — [building long-term relationships] and around building great digital products,” the CEO said.

The company was founded by Jeremy Johnson, Christina Sass, Nadayar Enegesi, Ian Carnevale, Brice Nkengsa and Iyinoluwa Aboyeji. It has raised more than $180 million (up to Series D) from firms like Chan Zuckerberg Initiative, Generation Investment Management, Google Ventures and Spark Capital, at a valuation of about $700 million.

While announcing the layoffs last year, Andela said it was on an annual revenue run rate of $50 million. But when asked how this number has changed over the past year, Johnson said the company is “growing at a healthier pace as we’ve ever had.”

The future of remote work is global and Johnson believes Andela provides the vital link to talent wherever it is found. The company’s head of talent operations, Martin Chikilian, echoed similar sentiments regarding the expansion.

“We’ve seen exponential growth and interest from engineers from across Africa who want to work with some of the world’s most exciting technology-focused companies,” he said. “Growing our network of talent from Africa to include more markets is a unique proposition and we continue to match talent with opportunity beyond geographical boundaries.”

Powered by WPeMatico