Asia

Auto Added by WPeMatico

Auto Added by WPeMatico

Banking tech startup Zeta is inching closer to the much sought-after unicorn status as it engages with investors to finalize a new round, two sources familiar with the matter told TechCrunch.

SoftBank Vision Fund 2 is in advanced stages of talks to lead a ~$250 million Series D round in the five-year-old startup, the sources said. The investment proposal values the Indian startup, co-founded by high-profile entrepreneur Bhavin Turakhia, at over $1 billion, up from $300 million in its maiden external funding (Series C) in 2019.

The round has yet to close, a third person said.

A SoftBank spokesperson declined to comment.

Five-year-old Zeta helps banks launch modern retail and fintech products. The thesis is that banks — largely operating on antiquated technologies — today don’t have the time and expertise to offer the best experience to hundreds of millions of customers and fintech firms they serve.

Zeta is attempting to help banks either use the startup’s cloud-native, API-first banking stack as its core framework or build services atop it to offer better a experience to all customers — think of improved mobile app and debit and credit features. It also offers API, SDKs and payment gateways to banks to work more efficiently with fintech firms.

The startup has amassed clients in several Asian and Latin American markets.

Turakhia, with his brother Divyank, started his first venture in 1998. Along the way, they sold four web companies to Endurance for $160 million. Zeta is the third startup Bhavin has co-founded since then — the other being business messaging platform Flock and Radix.

When the deal is finalized, Zeta would join a growing list of Indian startups that have turned a unicorn in recent months. Last week, social commerce Meesho — also backed by SoftBank Vision Fund 2 — fintech firm CRED, e-pharmacy firm PharmEasy, millennials-focused Groww, business messaging platform Gupshup and social network ShareChat attained the unicorn status.

The story was updated with additional details and to note that the round hasn’t closed.

Powered by WPeMatico

As expected, Southeast Asian superapp Grab is going public via a SPAC.

The combination, which TechCrunch discussed over the weekend, will value Grab on an equity basis at $39.6 billion and will provide around $4.5 billion in cash, $4 billion of which will come in the form of a private investment in public equity, or PIPE. Altimeter Capital is putting up $750 million in the PIPE — fitting, as Grab is merging with one of Altimeter’s SPACs.

Ride-sharing is a profitable business for Grab, though the segment did take a pandemic-induced whacking.

Grab, which provides ride-hailing, payments and food delivery, will trade under the ticker symbol “GRAB” on Nasdaq when the deal closes. The announcement comes a day after Uber told its investors it was seeing recovery in certain transactions, including ride-hailing and delivery.

Uber also told the investing public that it’s still on track to reach adjusted EBITDA profitability in Q4 2021. The American ride-hailing giant did a surprising amount of work clearing brush for the Grab deal. Extra Crunch examined Uber’s ramp toward profitability yesterday.

This morning, let’s talk through several key points from Grab’s SPAC investor deck. We’ll discuss growth, segment profitability, aggregate costs and COVID-19, among other factors. You can read along in the presentation here.

The impact on Grab’s operations from COVID-19 resembles what happened to Uber in that the company’s deliveries business had a stellar 2020, while its ride-hailing business did not.

From a high level, Grab’s gross merchandise volume (GMV) was essentially flat from 2019 to 2020, rising from $12.2 billion to $12.5 billion. However, the company did manage to greatly boost its adjusted net revenue over the same period, which rose from $1 billion to $1.6 billion.

Powered by WPeMatico

Dat Bike, a Vietnamese startup with ambitions to become the top electric motorbike company in Southeast Asia, has raised $2.6 million in pre-Series A funding led by Jungle Ventures. Made in Vietnam with mostly domestic parts, Dat Bike’s selling point is its ability to compete with gas motorbikes in terms of pricing and performance. Its new funding is the first time Jungle Ventures has invested in the mobility sector and included participation from Wavemaker Partners, Hustle Fund and iSeed Ventures.

Founder and chief executive officer Son Nguyen began learning how to build bikes from scrap parts while working as a software engineer in Silicon Valley. In 2018, he moved back to Vietnam and launched Dat Bike. More than 80% of households in Indonesia, Malaysia, Thailand and Vietnam own two-wheeled vehicles, but the majority are fueled by gas. Nguyen told TechCrunch that many people want to switch to electric motorbikes, but a major obstacle is performance.

Nguyen said that Dat Bike offers three times the performance (5 kW versus 1.5 kW) and 2 times the range (100 km versus 50 km) of most electric motorbikes in the market, at the same price point. The company’s flagship motorbike, called Weaver, was created to compete against gas motorbikes. It seats two people, which Nguyen noted is an important selling point in Southeast Asian countries, and has a 5000W motor that accelerates from 0 to 50 km per hour in three seconds. The Weaver can be fully charged at a standard electric outlet in about three hours, and reach up to 100 km on one charge (the motorbike’s next iteration will go up to 200 km on one charge).

Dat Bike’s opened its first physical store in Ho Chi Minh City last December. Nguyen said the company “has shipped a few hundred motorbikes so far and still have a backlog of orders.” He added that it saw a 35% month-over-month growth in new orders after the Ho Chi Minh City store opened.

At 39.9 million dong, or about $1,700 USD, Weaver’s pricing is also comparable to the median price of gas motorbikes. Dat Bike partners with banks and financial institutions to offer consumers twelve-month payment plans with no interest.

“These guys are competing with each other to put the emerging middle class of Vietnam on the digital financial market for the first time ever and as a result, we get a very favorable rate,” he said.

While Vietnam’s government hasn’t implemented subsidies for electric motorbikes yet, the Ministry of Transportation has proposed new regulations mandating electric infrastructure at parking lots and bike stations, which Nguyen said will increase the adoption of electric vehicles. Other Vietnamese companies making electric two-wheeled vehicles include VinFast and PEGA.

One of Dat Bike’s advantages is that its bikes are developed in house, with locally-sourced parts. Nguyen said the benefits of manufacturing in Vietnam, instead of sourcing from China and other countries, include streamlined logistics and a more efficient supply chain, since most of Dat Bike’s suppliers are also domestic.

“There are also huge tax advantages for being local, as import tax for bikes is 45% and for bike parts ranging from 15% to 30%,” said Nguyen. “Trade within Southeast Asia is tariff-free though, which means that we have a competitive advantage to expand to the region, compare to foreign imported bikes.”

Dat Bike plans to expand by building its supply chain in Southeast Asia over the next two to three years, with the help of investors like Jungle Ventures.

In a statement, Jungle Ventures founding partner Amit Anand said, “The $25 billion two-wheeler industry in Southeast Asia in particular is ripe for reaping benefits of new developments in electric vehicles and automation. We believe that Dat Bike will lead this charge and create a new benchmark not just in the region but potentially globally for what the next generation of two-wheeler electric vehicles will look and perform like.”

Powered by WPeMatico

Swiggy has raised about $800 million in a new financing round, the Indian food delivery startup told employees on Monday, as it looks to expand its business in the country quarters after the startup cut its workforce to navigate the pandemic.

In an email to employees, first reported by Times of India journalist Digbijay Mishra, Swiggy co-founder and chief executive Sriharsha Majety said the startup had raised about $800 million from new investors, including Falcon Edge Capital, Goldman Sachs, Think Capital, Amansa Capital and Carmignac, and existing investors Prosus Ventures and Accel.

“This fundraise gives us a lot more firepower than the planned investments for our current business lines. Given our unfettered ambition though, we will continue to seed/experiment new offerings for the future that may be ready for investment later. We will just need to now relentlessly invent and execute over the next few years to build an enduring iconic company out of India,” wrote Majety in the email obtained by TechCrunch.

Majety didn’t disclose the new valuation of Swiggy, but said the new financing round was “heavily subscribed given the very positive investor sentiments towards Swiggy.” According to a person familiar with the matter, the new round valued Swiggy at over $4.8 billion $4.9 billion. The startup has now raised about $2.2 billion to date.

Swiggy had raised $157 million last year at about $3.7 billion valuation. That investment is not part of the new round, a person familiar with the matter told TechCrunch.

He said the long-term goal for the startup, which competes with heavily-backed Zomato and new entrant Amazon, is to serve 500 million users in the next 10-15 years, pointing to Chinese food giant Meituan, which had 500 million transacting users last year and is valued at over $100 billion.

“We’re coming out of a very hard phase during the last year given Covid and have weathered the storm, but everything we do from here on needs to maximise the chances of our succeeding in the long-term,” wrote Majety.

Swiggy last year eliminated some jobs — so did Zomato — and scaled down its cloud kitchen efforts as it attempted to stay afloat during the pandemic, which had prompted New Delhi to enforce a months-long lockdown.

Monday’s reveal comes amid Zomato raising $910 million in recent months as the Gurgaon-headquartered firm prepares for an IPO this year. The last tranche of investment valued Zomato at $5.4 billion. During its fundraise, Zomato said it was raising money partially to fight off “any mischief or price wars from our competition in various areas of our business.”

A third player, Amazon, also entered the food delivery market in India last year, though its operations are still limited to parts of Bangalore.

At stake is India’s food delivery market, which analysts at Bernstein expect to balloon to be worth $12 billion by 2022, they wrote in a report to clients earlier this year. Zomato currently leads the market with about 50% market share, Bernstein analysts wrote.

“We find the food-tech industry in India to be well positioned to sustained [sic] growth with improving unit economics. Take-rates are one of the highest in India at 20-25% and consumer traction is increasing. Market is largely a duopoly between Zomato and Swiggy with 80%+ share,” wrote analysts at Bank of America in a recent report, reviewed by TechCrunch.

“The food delivery business is the strongest it’s ever been, and we’re now well on our way to drive continued growth over the next decade. In addition, some of our new bets like Instamart [grocery delivery business] are showing amazing promise while we’ve also made strides in setting up some of our other adjacencies for liftoff very soon.”

Powered by WPeMatico

On a recent morning in downtown Shenzhen, Lingyu queued up to order her go-to McMuffin. As she waited in line with other commuters, the 50-year-old accountant noticed the new vegetarian options on the menu and decided to try the imitation spam and scrambled egg burger.

“I’ve never had fake meat,” she said of the burger — one of five new breakfast items that McDonald’s introduced last week in three major Chinese cities featuring luncheon meat substitutes produced by Green Monday.

Although some investors worry the sudden boom of meat-substitute startups could turn into a bubble, others believe the market is far from saturated.

Lingyu, who works in her family business in Shenzhen, is exactly the type of Chinese customer that imitation meat companies want to attract beyond the young, trendy, eco-conscious urbanites. Her yuan means potentially more to meat replacement companies because it advances their business and climate agendas both. Eating less meat is one of the simplest ways to reduce an individual’s carbon footprint and help fight climate change.

McDonald’s hopes that its pea- and soy-based, zero-cholesterol, luncheon meat substitutes will carve out a piece of China’s massive dining market. Longtime rival KFC, and local competitor Dicos introduced their own plant-based products last year. Partnering with fast food chains is a smart move for companies that want to promote alternative protein to the masses, because these products are often pricey and are usually aimed at wealthy urbanites.

2020 could well have been the dawn of alternative protein in China. More than 10 startups raised capital to make plant-based protein for a country with increasing meat demand. Of these, Starfield, Hey Maet, Vesta and Haofood have been around for about a year; ZhenMeat was founded three years ago; and the aforementioned Green Monday is a nine-year-old Hong Kong firm pushing into mainland China. The competition intensified further last year when American incumbents Beyond Meat and Eat Just entered China.

Although some investors worry the sudden boom of meat-substitute startups could turn into a bubble, others believe the market is far from saturated.

“Think about how much meat China consumes a year,” said an investor in a Chinese soy protein startup who requested anonymity. “Even if alternative protein replaces 0.01% of the consumption, it could be a market worth tens of billions of dollars.”

In many ways, China is the ideal testbed for alternative protein. The country has a long history of imitation meat rooted in Buddhist vegetarianism and an expanding middle class that is increasingly health-conscious and willing to experiment. The country also has a grip on the global supply chain for plant-based protein, which could give domestic startups an edge over foreign rivals.

“I believe, in five years, China will see a raft of domestic plant-based protein companies that could be on par with industry leaders from Europe and North America,” said Xie Zihan, who founded Vesta to develop soy-based meat suitable for Chinese cuisine.

Hey Maet’s imitation meat dumplings. Image Credits: Hey Maet

Lily Chen, a manager at the Chinese arm of alternative protein investor Lever VC, outlines three categories of meat analog companies in China: Western giants such as Beyond Meat and Eat Just; local players; and conglomerates such as Unilever and Nestlé that are developing vegan meat product lines as a defense strategy. Lever VC invested in Beyond Meat, Impossible Foods and Memphis Meats.

“They all have their product differentiation, but the industry is still very early stage,” said Chen.

Powered by WPeMatico

Competition in China’s gaming industry is getting stiffer in recent times as tech giants sniff out potential buyouts and investments to beef up their gaming alliance, whether it pertains to content or distribution.

Bilibili, the go-to video streaming platform for young Chinese, is the latest to make a major gaming deal. It has agreed to invest HK$960 million (about $123 million) into X.D. Network, which runs the popular game distribution platform TapTap in China, the company announced on Thursday.

Dual-listed in Hong Kong and New York, Bilibili will purchase 22,660,000 shares of X.D.’s common stock at HK$42.38 apiece, which will grant it a 4.72% stake.

The partners will initiate a series of “deep collaborations” around X.D.’s own games and TapTap, without offering more detail.

Though known for its trove of video content produced by amateur and professional creators, Bilibili derives a big chunk of its income from mobile games, which accounted for 40% of its revenues in 2020. The ratio had declined from 71% and 53% in 2018 and 2019, a sign that it’s trying to diversify revenue streams beyond distributing games.

Tencent has similarly leaned on games to drive revenues for years. The WeChat operator dominates China’s gaming market through original titles and a sprawling investment portfolio whose content it helps operate and promote.

X.D. makes games, too, but in recent years it has also emerged as a rebel against traditional game distributors, which are Android app stores operated by smartphone makers. The vision is to skip the high commission fees charged by the likes of Huawei and Xiaomi and monetize through ads. X.D.’s proposition has helped it attract a swathe of gaming companies to be its investors, including fast-growing studios Lilith Games and miHoYo, Alibaba, as well as ByteDance, which built up a 3,000-people strong gaming team within six years.

Bilibili’s investment further strengthens X.D.’s matrix of top-tier gaming investors. Tencent is conspicuously absent, but it’s no secret that ByteDance is its new nemesis after Alibaba. The TikTok parent recently outbid Tencent to acquire Moonton, a gaming studio that has gained ground in Southeast Asia, according to Reuters. Douyin, the Chinese version of TikTok, is also vying for user attention away from content published on WeChat.

Powered by WPeMatico

Airwallex, the fintech company for cross-border businesses, announced today it has added $100 million more to its Series D round, bumping its valuation up to $2.6 billion. The extension was led by Greenoaks, with participation from Grok Ventures and returning investors Skip Capital and ANZi Ventures.

Co-founder and chief executive officer Jack Zhang told TechCrunch that the new funding will be used for Airwallex’s United States launch in the second quarter of this year, expand its payment coverage to new regions like the Middle East, Africa, Eastern Europe and Latin America, and add more products, including physical cards.

This latest extension brings Airwallex’s Series D round to $300 million, and total equity raised so far to $500 million. Airwallex first announced its Series D in April 2020 after raising $160 million, then another tranche that added $40 million in September 2020.

Airwallex reached unicorn valuation after its Series C in March 2019. The company was founded in Melbourne in 2015, and now has more than 600 employees across 12 offices in Australia, China, Hong Kong, the United Kingdom, Japan and the United States. In its announcement today, Airwallex said it is also hiring for more than 500 positions.

Airwallex’s products for cross-border businesses include foreign currency accounts and multi-currency debit cards with Visa, international money transfers and a suite of APIs that allow companies to do things like accept and manage international payments, and manage their foreign exchange risk.

Powered by WPeMatico

Y Combinator’s latest batch — W21 — features 350 startups from 41 nations. Fifty percent of the firms, the highest percentage to date, in the new batch are based outside of the United States.

India is the second-largest demographic represented in the new batch. The world’s second-largest internet market has delivered 43 startups in the new batch, another record figure in the history of the storied venture firm. (For comparison, the W20 batch had 25 Indian startups, up from 14 in S20, 12 each in S19 and W19 and one each in W16, S15 and W15.)

“YC going remote has helped make YC more attractive to companies at different stages and far away geographies. For companies in India, founders no longer have to spend three months away from their customers or teams. Covid has also taught us that building a program that is remote and more software based makes YC more accessible to founders around the globe,” the firm said in a statement to TechCrunch.

“When it comes to choosing founders in India, we accept them based on the same criteria we judge companies from anywhere else. Founders must be able to communicate their local context to investors. That is an important skill.”

Here’s a list of startups, in no particular order, from India that have made it to YC W21, with some context — wherever possible — on what they are attempting to build (several have elected to stay off the record).

QuestBook, from CreatorOS, is an app for professionals to teach in bite-sized courses using chat and a mobile-first experience. We wrote about CreatorOS last year.

Leap Club is attempting to build a Good Eggs for India. Leap Club users can order fresh and organic groceries sourced from local farms through the startup’s website or through WhatsApp. The startup says it delivers the item to customers within 12 hours of harvesting. Leap Club is already garnering over $14,000 in monthly revenue.

CashBook is building a cash account app for small businesses in India. There are over 60 million small businesses in the country, nearly all of which currently rely on traditional ways — pen and paper — for bookkeeping. The startup launched its app just six months ago and has already amassed 200,000 monthly active users. In the month of February, CashBook logged cash transactions of $511 million.

GimBooks is attempting to solve a similar problem as CashBook, though from a different angle. The startup says it offers industry-based invoicing and bookkeeping with integrated banking and payments. Its app has been downloaded more than 1.4 million times, amassed over 11,000 paying customers and clocked revenues of over $450,000.

BusinessOnBot is banking on the popularity of WhatsApp in India, where the Facebook-owned app has amassed over 450 million monthly active users. BusinessOnBot says it is building Shopify on WhatsApp for direct-to-consumer brands and small and medium-sized businesses, helping them acquire users and automate sales.

ZOKO is helping businesses do sales, marketing and customer support on WhatsApp.

Prescribe is a Shopify for hospitals. Its platform is aimed at helping doctor’s offices run their business online. Users can book appointments, chat with the doctor, pay and refer friends on WhatsApp.

Chatwoot is an open-source customer engagement suite alternative to Intercom and Zendesk. Over 1,000 companies are already using Chatwoot and it’s clocking $32,000 in ARR from six customers.

Weekday is helping companies hire engineers who are crowdsourced by their network of scouts. The startup says it has found a way to solve the biggest problem with referrals — that it doesn’t scale.

Fountain9 helps food brands and retailers reduce food wastage. According to some estimates, over $260 billion worth of food is wasted every year due to mismanaged inventory.

Dyte is attempting to build a Stripe for live video calls. The startup says a firm can integrate its branded, configurable and programmable video calling service within 10 minutes using the Dyte SDK.

YourQuote has built a writing platform, with over 100 million posts. It has over 250,000 daily active users. The startup clocked revenues of $200,000 last year and is profitable.

Fifthtry is building a GitHub for product documentation. The tool blocks code changes until documentation has been approved. It has piloted its tool with three companies, all of which have over 100 developers. The startup plans to launch its tool publicly next month.

Voosh is building an OYO for restaurants and dark kitchens in India, helping them improve their economics using tech.

Kodo is building a Brex for India, helping Indian startups and small businesses secure corporate credit cards. (Banks and other credit card companies are still not addressing this opportunity. The problem Brex solved in the U.S. is even acute in India, Deepti Sanghi, co-founder and chief executive of Kodo, said in the presentation.

Krab provides instant loans for trucking companies in India. India’s logistics market, despite being valued at $160 billion, remains one of the most inefficient sectors that continues to drag the economy. In recent years, a handful of startups have started to explore ways to work with trucking companies.

Bueno Finance says it wants to help the next billion users in India get access to financial services. It says it wants to solve for short-term cash needs of customers by using digital credit card over UPI. It was to build a Chime for India, and has amassed 70,000 customers.

Betterhalf is building a Match.com for 100 million Indians. It says it is generating $75,000 in monthly revenues, a figure that is growing 30% every month.

Pensil is helping teachers who use YouTube monetize their courses. “YouTube is the largest education platform in India — but it’s not built for teachers,” said Surender Singh, co-founder of Pensil, at the presentation on Tuesday. The startup has built tools to allow teachers to create content, facilitate discussions and collect payments.

AcadPal operates an eponymous app for India’s 10 million teachers to share homework with a tap. The startup is attempting to target a $1.4 billion market, which consists of over 400,000 private schools.

Pragmatic Leaders is attempting to build a platform to provide cost-effective alternative to an MBA. It is already clocking a monthly revenue of $112,000 and is cash-flow positive.

Splitsub is addressing a problem that tens of millions of users in India face — subscription fatigue. It says it has built a Pinduoduo for online subscriptions in India, allowing group buying and sharing of online subscriptions for services such as Netflix and Spotify.

Zingbus has built a platform for bus travel between Indian cities. (Several startups in India are helping users get cabs, three-wheelers autos and two-wheelers bikes. Buses have remained largely untapped.)

Tilt is building a docked bike-sharing platform for Indian campuses. The startup, which has generated about $20,000 in revenues this month so far, says it has been profitable for the past 18 months.

FanPlay is a platform for social media influencers, helping them monetize by playing mobile games with their fans and followers.

(Also read: Why Y Combinator Went 8,725 Miles Away From Mountain View To Find The Next Big Startup)

In India only a fraction of the nation’s 1.3 billion people currently have access to insurance and some analysts say that digital firms could prove crucial in bringing these services to the masses. According to rating agency ICRA, insurance products had reached less than 3% of the population as of 2017.

An average Indian makes about $2,100 a year, according to the World Bank. ICRA estimated that of those Indians who had purchased an insurance product, they were spending less than $50 on it in 2017.

Three startups in the current batch are planning to disrupt this market, which is largely commanded by state and bank-backed insurers.

GroMo is an app for independent agents to sell insurance in India. Most insurance policies in India are sold by agents. The startup says it is already generating monthly revenues of over $200,000.

Bimaplan is attempting to replace the agents with an app and reach users by a referral network. The app launched last month and has already sold 700 policies this month.

BimaPe helps users better understand their policies, and make informed decisions about whether those policies are right for them. The startup, leveraging New Delhi’s new regulations, is using a government issued ID card to fetch insurance policies.

Codingal is an online, after-school program for K-12 students in India to learn computer science. There are roughly 270 million K-12 students in the country.

Unschool provides professional education for college students in India. The founders say, “As former leaders in youth-run organisations with 3,000 members and edtech startups in India, we saw how colleges are not preparing students for the real world.”

Flux Auto builds self-driving kits for trucks.

SigNoz is an open-source alternative to DataDog, a $30 billion company, helping developers find and solve issues in their software deployed on cloud. The startup says recent laws such as GDPR and CPRA have helped drive adoption of SigNoz.

Pibit.ai are APIs to turn unstructured documents into structured data.

Invoid creates identity workflows in India. It’s tapping into a huge market opportunity: About 11 billion know-your-customers authentication is conduced by firms in India each year.

Redcliffe Lifesciences performs genetic testing and IVF treatments across India. Its revenue in March has topped $600,000.

Veera Health is an online clinic that treats Polycystic Ovary Syndrome (PCOS), a lifelong condition that affects 10-20% women in India. The startup says it launched 12 weeks ago, and 85% members have reported feeling “in control” of their PCOS after 1 month.

Snazzy is SmileDirectClub for India. The startup says it sells clear aligners that are 70% cheaper than those sold by dentists.

BeWell Digital is building the operating system for India’s 1.5 million hospitals, labs, clinics and pharmacies by starting with insurance regulatory compliance.

Triomics is operating a SaaS platform for end-to-end automation of clinical trials.

Powered by WPeMatico

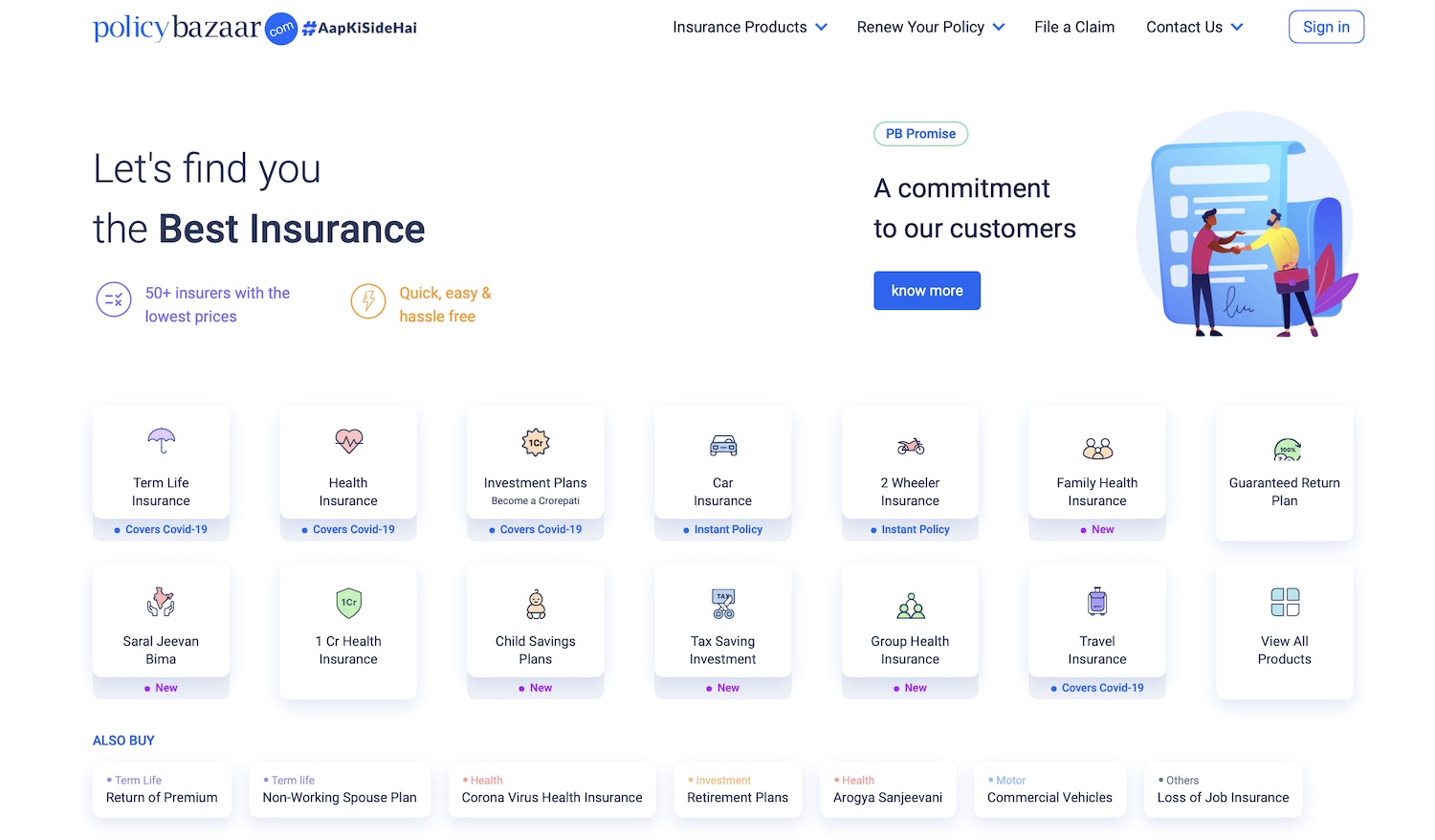

Policybazaar has raised $75 million as the Indian online insurance platform looks to expand its presence in UAE and Middle East.

Sarbvir Singh, chief executive of Policybazaar, told TechCrunch that the startup had raised $75 million, but didn’t elaborate. Falcon Edge Capital led the new tranche of investment in the Indian startup, which has raised about $630 million to date, according to research firm Tracxn.

The 12-year-old startup, which counts SoftBank Group’s Vision Fund and Tiger Global among its investors, is among a handful of startups that is attempting to upend India’s insurance market, which is largely commanded by state and bank-backed insurers.

Policybazaar serves as an aggregator that allows users to compare and buy policies — across categories including life, health, travel, auto and property — from dozens of insurers on its website without having to go through conventional agents.

A screengrab of Policybazaar website

In India only a fraction of the nation’s 1.3 billion people currently have access to insurance and some analysts say that digital firms could prove crucial in bringing these services to the masses. According to rating agency ICRA, insurance products had reached less than 3% of the population as of 2017.

An average Indian makes about $2,100 in a year, according to World Bank. ICRA estimated that of those Indians who had purchased an insurance product, they were spending less than $50 on it in 2017.

In a recent report, analysts at Bernstein estimated that Policybazaar commands 90% of share in the online insurance distribution market. The platform also sells loans, credit cards and mutual funds. The startup says it sells over a million policies a month.

“India has an under-penetrated insurance market. Within the under-penetrated landscape, digital distribution through web-aggregators like Policybazaar forms <1% of the industry. This offers a large headroom for growth,” Bernstein analysts wrote to clients.

The startup, which is working on an initial public offering slated for next year, said it will use the fresh investment to expand its presence across the UAE and Middle East regions.

“PolicyBazaar has shown stellar innovation, execution, and relentlessness in establishing itself as the market leader in online insurance aggregation in India. We believe the playbook it has established over the last 10 years in being the most efficient sales channel for insurance manufacturers, can act as a catalyst to gain market leadership in the GCC,” said Navroz Udwadia, co-founder of Falcon Edge Capital, in a statement.

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico

Northvolt, the Swedish battery manufacturer which raised $1 billion in financing from investors led by Goldman Sachs and Volkswagen back in 2019, has signed a massive $14 billion battery order with VW for the next 10 years.

The big buy clears up some questions about where Volkswagen will be getting the batteries for its huge push into electric vehicles, which will see the automaker reach production capacity of 1.5 million electric vehicles by 2025.

The deal will not only see Northvolt become the strategic lead supplier for battery cells for Volkswagen Group in Europe, but will also involve the German automaker increasing its equity ownership of Northvolt.

As part of the partnership agreement, Northvolt’s gigafactory in Sweden will be expanded and Northvolt agreed to sell its joint venture share in its Salzgitter, Germany factory to Volkswagen as the car maker looks to build up its battery manufacturing efforts across Europe, the companies said.

The agreement between Northvolt and VW brings the Swedish battery maker’s total contracts to $27 billion in the two years since it raised its big $1 billion cash haul.

“Volkswagen is a key investor, customer and partner on the journey ahead and we will continue to work hard with the goal of providing them with the greenest battery on the planet as they rapidly expand their fleet of electric vehicles,” said Peter Carlsson, the co-founder and chief executive of Northvolt, in a statement.

Northvolt’s other partners and customers include ABB, BMW Group, Scania, Siemens, Vattenfall and Vestas. Together these firms comprise some of the largest manufacturers in Europe.

Back in 2019, the company said that its cell manufacturing capacity could hit 16 gigawatt hours and that it had sold its capacity to the tune of $13 billion through 2030. That means that the Volkswagen deal will eat up a significant portion of expanded product lines.

Founded by Carlsson, a former executive at Tesla, Northvolt’s battery business was intended to leapfrog the European Union into direct competition with Asia’s largest battery manufacturers — Samsung, LG Chem and CATL.

Back when the company first announced its $1 billion investment round, Carlsson had said that Northvolt would need to build up to150 gigawatt hours of capacity to hit targets for 2030 electric vehicle sales.

The plant in Sweden is expected to hit at least 32 gigawatt hours of production, thanks in part to backing by the Swedish pension fund firms AMF and Folksam and Ikea-linked IMAS Foundation, in addition to the big financial partners Volkswagen and Goldman Sachs.

Northvolt has had a busy few months. Earlier in March the company announced the acquisition of the Silicon Valley-based startup company Cuberg.

That acquisition gave Northvolt a foothold in the U.S. and established the company’s advanced technology center.

The acquisition also gives Northvolt a window into the newest battery chemistry that’s being touted as a savior for the industry — lithium metal batteries.

Cuberg spun out of Stanford University back in 2015 to commercialize what the company called its next-generation battery, combining a liquid electrolyte with a lithium metal anode. The company’s customers include Boeing, BETA Technologies, Ampaire and VoltAero, and it was backed by Boeing HorizonX Ventures, Activate.org, the California Energy Commission, the Department of Energy and the TomKat Center at Stanford.

Cuberg’s cells deliver 70% increased range and capacity versus comparable lithium ion cells designed for electric aviation applications. The two companies hope they can apply the technology to Northvolt’s automotive and industrial product portfolio with the ambition to industrialize cells in 2025 that exceed 1,000 Wh/L, while meeting the full spectrum of automotive customer requirements, according to a statement.

“The Cuberg team has shown exceptional ability to develop world-class technology, proven results and an outstanding customer base in a lean and efficient organization,” said Peter Carlsson, CEO and co-founder, Northvolt in a statement. “Combining these strengths with the capabilities and technology of Northvolt allows us to make significant improvements in both performance and safety while driving down cost even further for next-generation battery cells. This is critical for accelerating the shift to fully electric vehicles and responding to the needs of the leading automotive companies within a relevant time frame.”

Early Stage is the premier “how-to” event for startup entrepreneurs and investors. You’ll hear firsthand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company building: Fundraising, recruiting, sales, product-market fit, PR, marketing and brand building. Each session also has audience participation built-in — there’s ample time included for audience questions and discussion. Use code “TCARTICLE at checkout to get 20% off tickets right here.

Powered by WPeMatico