First Round Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

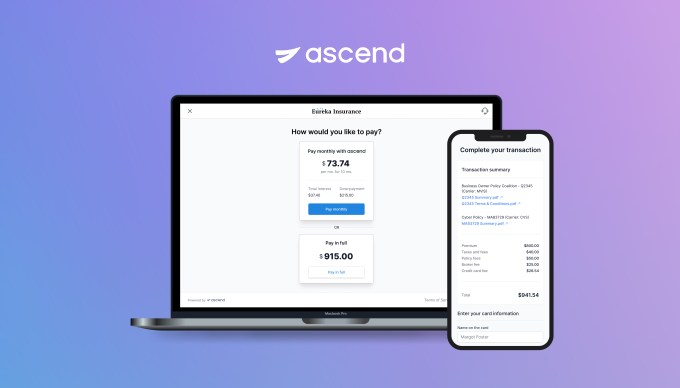

Ascend on Wednesday announced a $5.5 million seed round to further its insurance payments platform that combines financing, collections and payables.

First Round Capital led the round and was joined by Susa Ventures, FirstMark Capital, Box Group and a group of angel investors, including Coalition CEO Joshua Motta, Newfront Insurance executives Spike Lipkin and Gordon Wintrob, Vouch Insurance CEO Sam Hodges, Layr Insurance CEO Phillip Naples, Anzen Insurance CEO Max Bruner, Counterpart Insurance CEO Tanner Hackett, former Bunker Insurance CEO Chad Nitschke, SageSure executive Paul VanderMarck, Instacart co-founders Max Mullen and Brandon Leonardo and Houseparty co-founder Ben Rubin.

This is the first funding for the company that is live in 20 states. It developed payments APIs to automate end-to-end insurance payments and to offer a buy now, pay later financing option for distribution of commissions and carrier payables, something co-founder and co-CEO Andrew Wynn, said was rather unique to commercial insurance.

Wynn started the company in January 2021 with his co-founder Praveen Chekuri after working together at Instacart. They originally started Sheltr, which connected customers with trained maintenance professionals and was acquired by Hippo in 2019. While working with insurance companies they recognized how fast the insurance industry was modernizing, yet insurance sellers still struggled with customer experiences due to outdated payments processes. They started Ascend to solve that payments pain point.

The insurance industry is largely still operating on pen-and-paper — some 600 million paper checks are processed each year, Wynn said. He referred to insurance as a “spaghetti web of money movement” where payments can take up to 100 days to get to the insurance carrier from the customer as it makes its way through intermediaries. In addition, one of the only ways insurance companies can make a profit is by taking those hundreds of millions of dollars in payments and investing it.

Home and auto insurance can be broken up into payments, but the commercial side is not as customer friendly, Wynn said. Insurance is often paid in one lump sum annually, though, paying tens of thousands of dollars in one payment is not something every business customer can manage. Ascend is offering point-of-sale financing to enable insurance brokers to break up those commercial payments into monthly installments.

“Insurance carriers continue to focus on annual payments because they don’t have a choice,” he added. “They want all of their money up front so they can invest it. Our platform not only reduces the friction with payments by enabling customers to pay how they want to pay, but also helps carriers sell more insurance.”

Ascend app

Startups like Ascend aiming to disrupt the insurance industry are also attracting venture capital, with recent examples including Vouch and Marshmallow, which raised close to $100 million, while Insurify raised $100 million.

Wynn sees other companies doing verticalized payment software for other industries, like healthcare insurance, which he says is a “good sign for where the market is going.” This is where Wynn believes Ascend is competing, though some incumbents are offering premium financing, but not in the digital way Ascend is.

He intends to deploy the new funds into product development, go-to-market initiatives and new hires for its locations in New York and Palo Alto. He said the raise attracted a group of angel investors in the industry, who were looking for a product like this to help them sell more insurance versus building it from scratch.

Having only been around eight months, it is a bit early for Ascend to have some growth to discuss, but Wynn said the company signed its first customer in July and six more in the past month. The customers are big digital insurance brokerages and represent, together, $2.5 billion in premiums. He also expects to get licensed to operate as a full payment in processors in all states so the company can be in all 50 states by the end of the year.

The ultimate goal of the company is not to replace brokers, but to offer them the technology to be more efficient with their operations, Wynn said.

“Brokers are here to stay,” he added. “What will happen is that brokers who are tech-enabled will be able to serve customers nationally and run their business, collect payments, finance premiums and reduce backend operation friction.”

Bill Trenchard, partner at First Round Capital, met Wynn while he was still with Sheltr. He believes insurtech and fintech are following a similar story arc where disruptive companies are going to market with lower friction and better products and, being digital-first, are able to meet customers where they are.

By moving digital payments over to insurance, Ascend and others will lead the market, which is so big that there will be many opportunities for companies to be successful. The global commercial insurance market was valued at $692.33 billion in 2020, and expected to top $1 trillion by 2028.

Like other firms, First Round looks for team, product and market when it evaluates a potential investment and Trenchard said Ascend checked off those boxes. Not only did he like how quickly the team was moving to create momentum around themselves in terms of securing early pilots with customers, but also getting well known digital-first companies on board.

“The magic is in how to automate the underwriting, how to create a data moat and be a first mover — if you can do all three, that is great,” Trenchard said. “Instant approvals and using data to do a better job than others is a key advantage and is going to change how insurance is bought and sold.”

Powered by WPeMatico

Work insights platform Fin raised $20 million in Series A funding and brought in Evan Cummack, a former Twilio executive, as its new chief executive officer.

The San Francisco-based company captures employee workflow data from across applications and turns it into productivity insights to improve the way enterprise teams work and remain engaged.

Fin was founded in 2015 by Andrew Kortina, co-founder of Venmo, and Facebook’s former VP of product and Slow Ventures partner Sam Lessin. Initially, the company was doing voice assistant technology — think Alexa but powered by humans and machine learning — and then workplace analytics software in 2020. You can read more about Fin’s origins at the link below.

The new round was led by Coatue, with participation from First Round Capital, Accel and Kleiner Perkins. The original team was talented, but small, so the new funding will build out sales, marketing and engineering teams, Cummack said.

“At that point, the right thing was to raise money, so at the end of last year, the company raised a $20 million Series A, and it was also decided to find a leadership team that knows how to build an enterprise,” Cummack told TechCrunch. “The company had completely pivoted and removed ‘Analytics’ from our name because it was not encompassing what we do.”

Fin’s software measures productivity and provides insights on ways managers can optimize processes, coach their employees and see how teams are actually using technology to get their work done. At the same time, employees are able to manage their workflow and highlight areas where there may be bottlenecks. All combined, it leads to better operations and customer experiences, Cummack said.

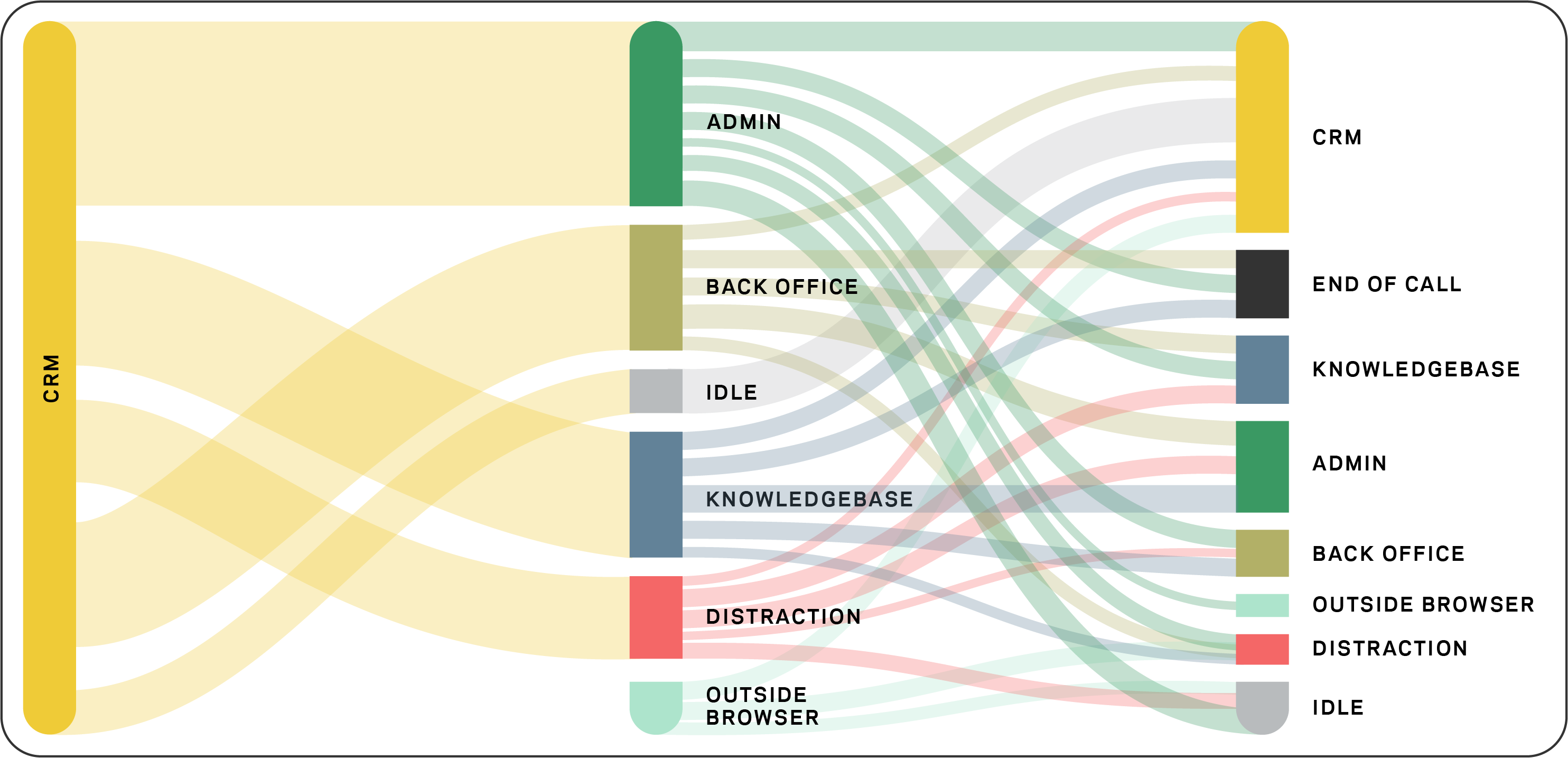

Graphic showing how work is really done. Image Credits: Fin

Fin’s view is that as more automation occurs, the company is looking at a “renaissance of human work.” There will be more jobs and more types of jobs, but people will be able to do them more effectively and the work will be more fulfilling, he added.

Particularly with the use of technology, he notes that in the era before cloud computing, there was a small number of software vendors. Now with the average tech company using over 130 SaaS apps, it allows for a lot of entrepreneurs and adoption of best-in-breed apps so that a viable company can start with a handful of people and leverage those apps to gain big customers.

“It’s different for enterprise customers, though, to understand that investment and what they are spending their money on as they use tools to get their jobs done,” Cummack added. “There is massive pressure to improve the customer experience and move quickly. Now with many people working from home, Fin enables you to look at all 130 apps as if they are one and how they are being used.”

As a result, Fin’s customers are seeing metrics like 16% increase in team utilization and engagement, a 25% decrease in support ticket handle time and a 71% increase in policy compliance. Meanwhile, the company itself is doubling and tripling its customers and revenue each year.

Now with leadership and people in place, Cummack said the company is positioned to scale, though it already had a huge head start in terms of a meaningful business.

Arielle Zuckerberg, partner at Coatue, said via email that she was part of a previous firm that invested in Fin’s seed round to build a virtual assistant. She was also a customer of Fin Assistant until it was discontinued.

When she heard the company was pivoting to enterprise, she “was excited because I thought it was a natural outgrowth of the previous business, had a lot of potential and I was already familiar with management and thought highly of them.”

She believed the “brains” of the company always revolved around understanding and measuring what assistants were doing to complete a task as a way to create opportunities for improvement or automation. The pivot to agent-facing tools made sense to Zuckerberg, but it wasn’t until the global pandemic that it clicked.

“Service teams were forced to go remote overnight, and companies had little to no visibility into what people were doing working from home,” she added. “In this remote environment, we thought that Fin’s product was incredibly well-suited to address the challenges of managing a growing remote support team, and that over time, their unique data set of how people use various apps and tools to complete tasks can help business leaders improve the future of work for their team members. We believe that contact center agents going remote was inevitable even before COVID, but COVID was a huge accelerant and created a compelling ‘why now’ moment for Fin’s solution.”

Going forward, Coatue sees Fin as “a process mining company that is focused on service teams.” By initially focusing on customer support and contact center use case — a business large enough to support a scaled, standalone business — rather than joining competitors in going after Fortune 500 companies where implementation cycles are long and there is slow time-to-value, Zuckerberg said Fin is better able to “address the unique challenges of managing a growing remote support team with a near-immediate time-to-value.”

Powered by WPeMatico

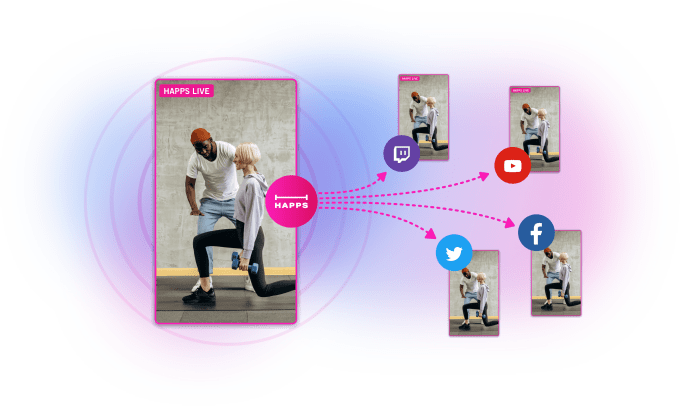

Happs, an app that lets creators stream live video simultaneously across social platforms, has raised $4.7 million in a post-seed round. The product originally began as a platform for independent journalists, but expanded its mission last year to offer tools to all online creators while connecting them through a new social network.

The funding was led by Bullpen Capital and Crosslink, Goodwater, Corazon, Rob Hayes of First Round Capital and Bangaly Kaba, previously at Instagram and Sequoia, also participated.

What sets Happs apart from some established competitors in the space is the team’s desire to not only build tools that help video creators produce professional-looking online streams, but to cultivate a kind of meta-community that brings people together from across other social media sites.

“We kind of view this as the essence of what the creator economy is all about,” Happs CEO Mark Goldman told TechCrunch. “The idea of locking creators into an individual platform is a very traditional way of thinking about content creation.”

Like Goldman, the other co-founders, David Neuman and Drew Shepard, come from the media world. Goldman was the founding COO of Current TV, an experimental TV channel that dabbled in user-generated content and eventually sold to Al Jazeera in 2013.

“The whole idea was to democratize media and open it up,” Goldman said of his time working on Current TV, which he connects directly to his interest in building Happs. “[We] loved the creativity unleashed by that.”

Online creators tend to be siloed within the app where they’ve built the biggest community, but Happs wants to empower them to reach as many followers as possible in a platform-agnostic way. For creators, the appeal with multistreaming is maximizing reach while making content efficiently. There’s a risk of alienating YouTube followers at the expense of your Twitch community if you don’t play your cards right, but some savvy content creators have turned toward the model to grow their audiences.

Happs connects people across platforms in a few ways. For one, Happs users can broadcast live to Facebook, YouTube, Twitter and Twitch simultaneously. The app also collects live comments from all supported social media sites and beams them into its own interface where they appear in a continuous cross-platform stream.

The integrated comment feature is nice built-in option for anyone who’s straddled comments across multiple devices simultaneously while livestreaming, which is no easy feat. When you’re streaming live you can feature a comment so that followers can see it on the screen no matter what platform they’re watching on.

Other companies in the space like OBS, Streamlabs and Restream are focused on the tools part of the equation, offering power users a useful backend for pushing out multi-streamed live video. Streamyard also offers multistreaming to Facebook, YouTube, Twitter and other platforms through a simple browser interface.

Unlike those services, Happs feels more like a social network, with familiar features like user profile photos, follower counts and a feed next to a “go live” button. Anyone can use the multi-streaming platform through its iOS or Android apps or a web interface, whether they’re a creator signing up for the tools or a fan looking to support the content they love.

Happs lacks some of its competitors’ bells and whistles, stuff like fancy customized graphics and lower-thirds, but has a few interesting tricks of its own. While streaming live on Happs, you can invite someone else on the app to join your feed for a real-time collaboration. The social networking elements are meant to encourage cross-platform creativity, so a YouTuber and a Twitch personality could hang out together and boost both of their reaches, all while streaming to a bunch of other apps.

Happs also offers users monetization tools from the get-go, with no requirements before they can start making money. That speaks to the app’s appeal for creators who might be less established or just starting out. Happs could be a much harder sell for a popular creator deeply invested in a platform like Twitch, which has rules against multi-streaming for most accounts that are allowed to monetize.

There are a few different ways to monetize. One lets anyone on Happs sponsor a broadcaster through regular monthly payments. The other is a one-off option that lets you chip in an award for any livestream, or to the VOD (video on demand) after the fact. The in-app currency is a virtual coin that users can buy or earn through doing stuff on the app. There are no plans for ads (yet, anyway).

The company will take 30% cut of subscription earnings, though according to Goldman they’ll be waiving those fees for an unspecified period of time to attract people to the platform.

“We raised this round to really build up product and tech team [and] to make the platform much more stable and reliable,” Goldman said. The company is looking forward to leveraging the new resources to “really go out now and get in front of creators so they know Happs exists.”

Powered by WPeMatico

After making investments in 57 startups together, Superhuman CEO Rahul Vohra and Eventjoy founder Todd Goldberg are back at it with a new $24 million fund and big ambitions amid a venture capital renaissance with fast-moving deals aplenty.

“Todd and Rahul’s Angel Fund” announced their first $7.3 million fund just weeks before the pandemic hit stateside last year and they were soon left with more access to deals than they had funding to support; they went on to raise $3.5 million in a rolling fund designed around making investments in later-stage deals beyond seed and Series A rounds.

“We closed right before COVID hit and we had one plan, but then everything accelerated,” Goldberg tells TechCrunch. “A lot of our companies started raising additional rounds.”

With their latest raise, Vohra and Goldberg are looking to maintain their wide outlook with a single fund, saying they plan to invest three-quarters of the fund in early-stage deals while saving a quarter of the $24 million for later-stage opportunities. Still, the duo know they likely could’ve chosen to raise more.

“A lot of our peers were scaling up into much larger funds,” Vohra says. “For us, we wanted to stay small and collaborative.”

Some of the firm’s investments from their first fund include NBA Top Shot creator Dapper Labs, open source Firebase alternative Supabase, D2C liquor brand Haus, alternative asset platform Alt, biowearable maker Levels and location analytics startup Placer. Their biggest hit was an early investment in audio chat app Clubhouse before Andreessen Horowitz led its buzzy seed round at a $100 million valuation. Clubhouse most recently raised at $4 billion.

The pair say they’ve learned a ton through the past year of navigating increasingly competitive rounds and that fighting for those deals has helped the duo hone how they market themselves to founders.

“You never want to be a passive check,” Goldberg says. “We do three things: we help companies find product/market fit, we help them super-charge distribution… and we help them find the best investors.”

A big part of the firm’s appeal to founders has been the “operator” status of its founders. Goldberg’s startup Eventjoy was acquired by Ticketmaster and Vohra’s Rapportive was bought by LinkedIn while his current startup Superhuman has maintained buzz for its premium email service and has raised $33 million from investors, including Andreessen Horowitz and First Round Capital.

Their new fund has an unusual LP base that’s made up of more than 110 entrepreneurs and investors, including 40 founders that Vohra and Goldberg have previously backed themselves. Backers of their second fund include Plaid’s William Hockey, Behance’s Scott Belsky, Haus’s Helena Price Hambrecht, Lattice’s Jack Altman and Loom’s Shahed Khan.

Powered by WPeMatico

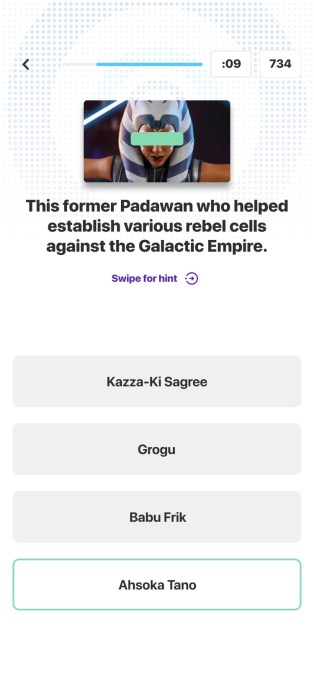

If you ask Nik Bonaddio why he wanted to build a new mobile trivia app, his answer is simple.

“In my life, I’ve got very few true passions: I love trivia and I love sports,” Bonaddio told me. “I’ve already started a sports company, so I’ve got to start a trivia company.”

He isn’t kidding about either part of the equation. Bonaddio actually won $100,000 on “Who Wants To Be A Millionaire?”, which he used to start the sports analytics company numberFire (acquired by FanDuel in 2014).

And today, after a period of beta testing, Bonaddio is launching BigBrain. He’s also announcing that the startup has raised $4.5 million in seed funding from FirstRound Capital, Box Group, Ludlow Ventures, Golden Ventures and others.

Of course, you can’t mention mobile trivia without thinking of HQ Trivia, the trivia app that shut down last year after some high-profile drama and a spectacular final episode.

Image Credits: BigBrain

But Bonaddio said BigBrain is approaching things differently than HQ in a few key ways. For starters, although there will be a handful of free games, the majority will require users to pay to enter, with the cash rewards coming from the entry fees. (From a legal perspective, Bonaddio said this is distinct from gambling because trivia is recognized as a game of skill.)

“The free-to-play model doesn’t really work for trivia,” he argued.

In addition, there will be no live video with a live host — Bonaddio said this would be “very, very difficult from a technical perspective and very cost ineffective.” Instead, he claimed the company has found a middle ground: “We have photos, we have different interactive elements, it’s not just a straight multiple choice quiz. We do try to keep it interactive.”

Plus, the simpler production means that where HQ was only hosting two quizzes a day, BigBrain will be hosting 20, with quizzes every 15 minutes at peak times.

Topics will range from old-school hip hop to college football to ’90s movies, and Bonaddio said different quizzes will have different prize structures — some might be winner take all, while others might award prizes to the top 50% of participants. The average quiz will cost $2 to $3 to enter, but prices will range from free to “$20 or even $50.”

What kind of quiz might cost that much money to enter? As an example, Bonaddio said that in a survey of potential users, he found, “There are no casual ‘Rick and Morty’ fans … They’re almost completely price sensitive, and since they’ve seen every episode, they can’t fathom a world where someone knows more about ‘Rick and Morty’ than they do.”

Powered by WPeMatico

Jim Jackson developed timber and farmland in Eastern Washington, protected from coastal rains by the peaks of the Cascade mountains, building out a clutch of apple farms and other properties on the state’s sunny side for 40 years.

Traditionally, he raised money to expand operations for his farms through his existing network, which meant asking previous investors to pool together and come up with the cash.

But more recently, Jackson turned to a fundraising platform that operates entirely online. Like hundreds of other farmers, he’s using a service called AcreTrader to raise money for agricultural development projects. AcreTrader is one of a growing number of companies revolutionizing the way farm and forestland are acquired, developed and commercialized across the United States.

There’s lots of farmland in the U.S. Bill Gates, Microsoft founder and the world’s third-richest man, is the nation’s largest owner of farmland, holding roughly 242,000 acres. That number seems high until you compare it with the 897.4 million acres of land that are currently arable and used for farming in the U.S.

Another 823 million acres of forests dot the United States, the majority of which are privately owned.

Taken together, that’s a massive amount of real estate with economic potential that’s traditionally been accessible only to the ultrawealthy to acquire and finance for development. Now, startups like AcreTrader and others including Tillable, ($8.3 million) FarmTogether ($3.7 million), and Harvest Returns are bringing marketplace models to the farming world — potentially bringing hundreds of thousands of investable acres to financiers looking to diversify.

Powered by WPeMatico

Optimizely co-founder Dan Siroker said the idea for his new startup Scribe goes back to a couple of personal experiences — and although Scribe’s first product is focused on Zoom, those experiences weren’t Zoom-related at all.

Instead, Siroker recalled starting to go deaf and then having an “epiphany” the first time he put in a hearing aid, as he recovered a sense he thought he’d lost.

“That really was the spark that got me thinking about other opportunities to augment things your body naturally fails at,” he said.

Siroker added that memory was an obvious candidate, particularly since he also has aphantasia — the inability to visualize mental images, which made it “hard to remember certain things.”

It may jog your own memory if I note that Siroker founded Optimizely with Pete Koomen in 2010, then stepped down from the CEO role in 2017, with the testing and personalization startup acquired by Episerver last year. (And now Episerver itself is rebranding as Optimizely.)

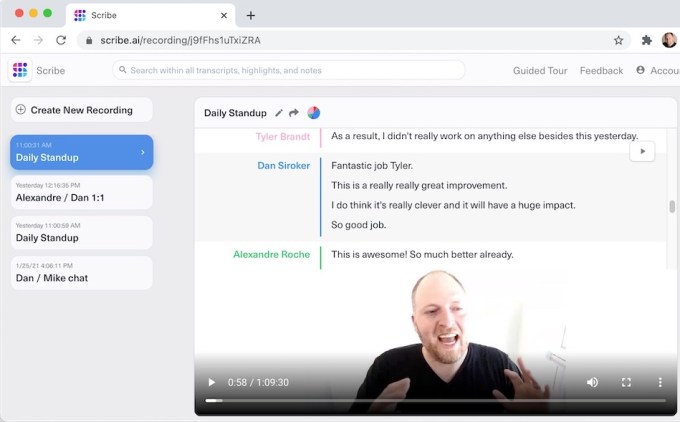

Fast-forward to the present day and Siroker is now CEO at Scribe, which is taking signups for its first product. That product integrates into Zoom meetings and transforms them into searchable, shareable transcripts.

Siroker demonstrated it for me during our Zoom call. Scribe appears in the meeting as an additional participant, recording video and audio while creating a real-time transcript. During or after the meeting, users can edit the transcript, watch or listen to the associated moment in the recording and highlight important points.

From a technological perspective, none of this feels like a huge breakthrough, but I was impressed by the seamlessness of the experience — just by adding an additional participant, I had a full recording and searchable transcript of our conversation that I could consult later, including while I was writing this story.

Image Credits: Scribe

Although Scribe is recording the meeting, Siroker said he wants this to be more like a note-taking replacement than a tape recorder.

“Let’s say you and I were meeting and I came to that meeting with a pen and paper and I’m writing down what you’re saying,” he said. “That’s totally socially acceptable — in some ways, it’s flattering … If instead, I brought a tape recorder and plopped in front of you and hit record — you might actually have this experience — with some folks, that feels very different.”

The key, he argued, is that Scribe recordings and transcripts can be edited, and you can also turn individual components on and off at any time.

“This is not a permanent record,” he said. “This is a shared artifact that we all create as we have a meeting that — just like a Google Doc — you can go back and make changes.”

That said, it’s still possible that Scribe could record some embarrassing comments, and the recordings could eventually get meeting participants in trouble. (After all, leaked company meeting recordings have already prompted a number of news stories.) Siroker said he hopes that’s “not common,” but he also argued that it could create an increased sense of transparency and accountability if it happens occasionally.

Scribe has raised around $5 million in funding, across a round led by OpenAI CEO Sam Altman and another led by First Round Capital.

Image Credits: Scribe

Siroker told me he sees Zoom as just the “beachhead” for Scribe’s ambitions. Next up, the company will be adding support for products like Google Meet and Microsoft Teams. Eventually, he hopes to build a new “hive mind” for organizations, where everyone is “smarter and better” because so many of their conversations and knowledge are now searchable.

“Where we go after that really depends on where we think we can have the biggest positive impact on people’s lives,” he said. “It’s harder to make a case for personal conversations you have with a spouse but … I think if you strike the right balance between value and privacy and control, you could really get people to adopt this in a way that actually is a win-win.”

And if Scribe actually achieves its mission of helping us to record and recall information in a wide variety of contexts, could that have an impact on our natural ability to remember things?

“Yes is the answer, and I think that’s okay,” he responded. “Your brain has limited energy … Remembering the things somebody said a few weeks ago is something a computer can do amazingly. Why waste your precious brain cycles doing that?”

Early Stage is the premier ‘how-to’ event for startup entrepreneurs and investors. You’ll hear first-hand how some of the most successful founders and VCs build their businesses, raise money and manage their portfolios. We’ll cover every aspect of company-building: Fundraising, recruiting, sales, product market fit, PR, marketing and brand building. Each session also has audience participation built-in – there’s ample time included for audience questions and discussion.

Powered by WPeMatico

Typically when we talk about tech and security, the mind naturally jumps to cybersecurity. But equally important, especially for global companies with large, multinational organizations, is physical security — a key function at most medium-to-large enterprises, and yet one that to date, hasn’t really done much to take advantage of recent advances in technology. Enter Base Operations, a startup founded by risk management professional Cory Siskind in 2018. Base Operations just closed their $2.2 million seed funding round and will use the money to capitalize on its recent launch of a street-level threat mapping platform for use in supporting enterprise security operations.

The funding, led by Good Growth Capital and including investors like Magma Partners, First In Capital, Gaingels and First Round Capital founder Howard Morgan, will be used primarily for hiring, as Base Operations looks to continue its team growth after doubling its employe base this past month. It’ll also be put to use extending and improving the company’s product and growing the startup’s global footprint. I talked to Siskind about her company’s plans on the heels of this round, as well as the wider opportunity and how her company is serving the market in a novel way.

“What we do at Base Operations is help companies keep their people in operation secure with ‘Micro Intelligence,’ which is street-level threat assessments that facilitate a variety of routine security tasks in the travel security, real estate and supply chain security buckets,” Siskind explained. “Anything that the chief security officer would be in charge of, but not cyber — so anything that intersects with the physical world.”

Siskind has firsthand experience about the complexity and challenges that enter into enterprise security since she began her career working for global strategic risk consultancy firm Control Risks in Mexico City. Because of her time in the industry, she’s keenly aware of just how far physical and political security operations lag behind their cybersecurity counterparts. It’s an often overlooked aspect of corporate risk management, particularly since in the past it’s been something that most employees at North American companies only ever encounter periodically when their roles involve frequent travel. The events of the past couple of years have changed that, however.

“This was the last bastion of a company that hadn’t been optimized by a SaaS platform, basically, so there was some resistance and some allegiance to legacy players,” Siskind told me. “However, the events of 2020 sort of turned everything on its head, and companies realized that the security department, and what happens in the physical world, is not just about compliance — it’s actually a strategic advantage to invest in those sort of services, because it helps you maintain business continuity.”

The COVID-19 pandemic, increased frequency and severity of natural disasters, and global political unrest all had significant impact on businesses worldwide in 2020, and Siskind says that this has proven a watershed moment in how enterprises consider physical security in their overall risk profile and strategic planning cycles.

“[Companies] have just realized that if you don’t invest [in] how to keep your operations running smoothly in the face of rising catastrophic events, you’re never going to achieve the profits that you need, because it’s too choppy, and you have all sorts of problems,” she said.

Base Operations addresses this problem by taking available data from a range of sources and pulling it together to inform threat profiles. Their technology is all about making sense of the myriad stream of information we encounter daily — taking the wash of news that we sometimes associate with “doom-scrolling” on social media, for instance, and combining it with other sources using machine learning to extrapolate actionable insights.

Those sources of information include “government statistics, social media, local news, data from partnerships, like NGOs and universities,” Siskind said. That data set powers their Micro Intelligence platform, and while the startup’s focus today is on helping enterprises keep people safe, while maintaining their operations, you can easily see how the same information could power everything from planning future geographical expansion, to tailoring product development to address specific markets.

Siskind saw there was a need for this kind of approach to an aspect of business that’s essential, but that has been relatively slow to adopt new technologies. From her vantage point two years ago, however, she couldn’t have anticipated just how urgent the need for better, more scalable enterprise security solutions would arise, and Base Operations now seems perfectly positioned to help with that need.

Powered by WPeMatico

Product managers can only be successful if they can make effective use of both quantitative and qualitative data. But mapping the former to the latter, and collecting high-quality data, is a huge challenge to organizations looking to rapidly productize and innovate.

UserLeap, a company founded by serial product manager Ryan Glasgow, thinks it has found a better way, and so do its investors. The company today announced the close of a $16 million Series A financing led by Accel (Dan Levine led the round), with participation from angels like Elad Gil, Dylan Field, Ben Porterfield, Akshay Kothari, Jack Altman and Bobby Lo.

One of the main challenges of rapid product development is that the ratio of quantitative data to qualitative data isn’t equal. It can take weeks or even months to get results from user surveys, and that’s only if users actually respond. According to UserLeap, the average response rate for email surveys is between 3% and 5%. To add to the headache, PMs and data teams usually have to parse that information and organize it manually.

UserLeap offers product teams the ability to put a short line of code into their product that then delivers contextual micro-surveys to users right within the product. The company says that these micro-surveys usually see a 20% to 30% response rate, and sometimes that even pops all the way to 90%.

Plus, the UserLeap dashboard processes the natural language from respondents and organizes the data. For example, if one user references price and another references cost, those responses are grouped together.

Because the surveys are built right into the product and targeted to a specific action or flow, and because the data is parsed and automatically sorted, product teams usually have access to this data within a few hours.

UserLeap charges based on the number of end users tracked, plus the number of surveys sent out per month, offering tiers for those surveys in groupings of five. Glasgow says this is a bit of a differentiator when compared to other survey products like SurveyMonkey or TypeForm.

“We have a usage-based pricing model, where our competitors often have a seat-based pricing model,” said Glasgow. “We don’t care how many people have access to us. Really, our goal is to get you to use our product.”

In other words, the insights gleaned from UserLeap can be shared and used across the entire organization without affecting the price.

This latest funding brings UserLeap’s total funding to $20 million — First Round Capital previously led a $4 million seed round.

Customers include Square, Opendoor and Codecademy. Thus far, the company has tracked more than 500 million visitors, and gotten 600,000 survey question responses.

The UserLeap team is currently made up of 15 people, with females representing 50% and people of color making up 33% of the leadership team. Across the company, women represent 32% of the team and people of color represent 42%.

“UserLeap cares deeply about diversity and inclusion,” said Glasgow. “Having a diverse team helps to ensure our employees feel comfortable and valued so that they can bring their whole selves to work. For that reason, UserLeap has a part-time recruiting sourcer dedicated to engaging underrepresented candidates and these efforts have contributed towards our diversity goals.”

Powered by WPeMatico

While the world awaits the Airbnb IPO filing that could come as early as next week, Upstart dropped its own S-1 filing. The fintech startup facilitates loans between consumers and partner banks, an operation that attracted around $144 million in capital prior to its IPO.

First Round Capital, Khosla Ventures, Third Point Ventures, Rakuten and The Progressive Corporation led rounds in the startup, according to Crunchbase data.

There’s quite a lot to like in Upstart’s IPO filing, including rapidly advancing revenues and recent profitable period. However, the company’s revenue concentration could be a concern to some investors who recall what recently happened to Fastly shares after losing a large customer.

PitchBook data indicates that the company was last valued at $750 million thanks to its 2019 Series D worth $50 million. Can Upstart reach unicorn status with its IPO? Let’s peek at the numbers and try to answer the question.

Upstart’s technology uses what it describes as artificial intelligence (AI) to approve consumer loans. It collects consumer demand for credit and connects that demand to bank partners who fund the loans. The company’s AI-powered credit tool can give consumers “higher approval rates [and] lower interest rates,” according to its S-1 filing, which offers banks “access to new customers, lower fraud and loss rates, and increased automation.”

If Upstart’s AI tool can, in fact, more intelligently determine consumer creditworthiness, everyone could come out a winner, with consumers paying less and banks adding to their loan books without taking on outsized risk.

Powered by WPeMatico