First Round Capital

Auto Added by WPeMatico

Auto Added by WPeMatico

Today, Peloton is a bonafide success. The company, which sells $2,245 internet-connected exercise bikes, boasts a $4 billion valuation and a cult following.

That hasn’t always been the case. For years, Peloton battled for venture capital investment and struggled to attract buyers. Now that it’s proven the market for tech-enabled home exercise equipment and affiliated subscription products, a whole bunch of startups are chasing down the same customer segment.

Mirror, a New York-based company that sells $1,495 full-length mirrors that double as interactive home gyms, is closing in a round of funding expected to reach $36 million, sources and Delaware stock filings confirm, at a valuation just under $300 million. It’s unclear who has signed on to lead the round; we’ve heard a number of high-profile firms looked at Mirror’s books and passed. The company has previously raised a total of $38 million from Spark Capital, First Round Capital, Lerer Hippeau, BoxGroup and more.

Mirror declined to comment for this story.

Like Peloton, Mirror is sold for a hefty fee with a subscription to the service’s unlimited live and on-demand workouts that comes at an additional cost. The company hasn’t disclosed subscriber numbers, though The New York Times reported in February the business was selling $1 million worth of Mirrors — or some 650 units — per month.

The company has not only benefited from the Peloton effect, but also from a near-immediate interest from celebrities and influencers in its product. Kate Hudson, Alicia Keys, Reese Witherspoon, Jennifer Aniston and Gwyneth Paltrow are among the many celebrities to have publicly boasted about Mirror, undoubtedly boosting sales for the up-and-coming startup.

Venture capitalists were quick to show support for Mirror, too; in fact, the business attracted money at a $200 million valuation prior to launching its first product. Mirror began selling its sleek equipment, dubbed by The New York Times as “The Most Narcissistic Exercise Equipment Ever,” in September.

SAN FRANCISCO, CA – SEPTEMBER 06: Mirror Founder and CEO Brynn Putnam (L) and moderator Lucas Matney speak onstage during Day 2 of TechCrunch Disrupt SF 2018 at Moscone Center on September 6, 2018, in San Francisco, California. (Photo by Steve Jennings/Getty Images for TechCrunch)

The round comes amid a distinct boom in funding for fitness-related startups evidenced not only by Peloton’s mammoth valuation and hyped-over initial public offering expected soon but by the rapid uptick in small upstarts looking to capitalize on rising interest in fitness apps and equipment. In total, VCs bet some $2 billion on U.S. fitness startups in 2018, a record amount of funding for the space. So far this year, nearly $500 million has been allocated to the growing sector, per PitchBook, as entrepreneurs strive to bring the gym into the home.

Tonal, which sells personal exercise equipment that combines on-demand training with smart features, is among a small class of venture-backed fitness companies to have accumulated a large following. The company has raised $91.7 million in equity funding at a valuation of $185 million, according to PitchBook, from investors including L Catterton, Shasta Ventures, Mayfield and Sapphire Sport.

When it comes to early-stage efforts, there’s no shortage of recent fundraises. Last week, Livekick, which gives customers access to one-on-one personal training and yoga from their home, closed a $3 million seed round led by Firstime VC. Two weeks ago, fitness startup Future secured an $8.5 million round led by Kleiner Perkins’ Mamoon Hamid. For a $150 monthly fee, Future assigns personalized workout plans and a coach who tracks customers’ fitness activity through an Apple Watch. To keep users committed to their workout regimens, Future sends daily text messages with motivational feedback.

The AI-based personal training company Aaptiv, Plankk, which sells live fitness lessons led by Instagram stars, and audio coaching app Eastnine, have also recently launched.

Mirror was founded in late 2016 by Brynn Putnam, an entrepreneur behind Refine Method, a chain of boutique fitness studios located in New York. The former professional dancer spoke to TechCrunch’s Lucas Matney at Disrupt San Francisco in September about the future of the business.

“[We want] to enhance the human touch rather than to replace it,” Putnam said. “Our goal is not to be the next treadmill in your life, our goal is to be the next screen in your home,” Putnam said.

Ultimately, Putnam added, Mirror plans to scale beyond fitness content with potential extensions including physical therapy, fashion, beauty and education.

“We have the ability to create personalized premium content across a wide range of verticals, with fitness being our first vertical,” Putnam said.

Powered by WPeMatico

Aaron Patzer launched Mint to help consumers organize their finances. Now he’s raised $5.2 million from investors to launch Vital to bring that consumer-focused mindset to emergency rooms and hospitals to help them organize patient flow.

Patzer co-founded the company with his brother-in-law Justin Schrager, a doctor of emergency medicine at Emory University Hospital. The serial entrepreneur invested a million dollars and two years of peer-reviewed academic study and technical research and development to create Vital, according to a company statement.

Investors in the seed round include First Round Capital and DFJ, Bragiel Brothers, Meridian Street Capital, Refactor Capital and SV Angel. Alongside angel investors Vivek Garipalli, the chief executive of CloverHealth and Nat Turner and Zach Weinberg, the founders of Flatiron Health, these investors are hoping that Patzer can repeat in the healthcare industry the magic he brought to financial services.

“The HITECH* Act was well-intentioned, but now hospitals rely on outdated, slow, and inefficient software – and nowhere is it more painful than in the emergency room,” said Patzer, in a statement. “Doctors and nurses often put more time into paperwork and data entry than patient care. Vital uses smart, easy tech to reverse that, cutting wait times in half, reducing provider burnout and saving hospitals millions of dollars.”

Vital isn’t so much replacing the current system of electronic health records as providing a software integration layer that makes those systems easier to use, according to the company.

It’s basically a two-sided application with a survey for incoming patients. An admitting nurse begins the record and as a next step a patient receives a text to add details like height, weight, recent surgeries, medications and allergies, just as they would on a paper form. Patients can also submit a photo of themselves and their insurance card to expedite the process.

The information is then fed back into a tracking board that doctors and nurses use to prioritize care. A triage nurse then reviews the data and affirms that it is correct by taking vital signs and assessing patients.

All of that data is fed into an algorithm that analyzes the available information to predict a course of treatment and help staff in the emergency room prioritize who needs care first.

Vital’s selling the service to emergency rooms with a starting sticker price of $10,000 per month.

“Vital successfully built software with a modern, no-training-required interface, while also meeting HIPAA compliance. It’s what people expect from consumer software, but rarely see in healthcare,” says First Round investor Josh Kopelman, who’s taking a seat on the company’s board of directors. “Turning massive amounts of complex and regulated data into clean, easy products is what Mint.com did for money, and we’re proud to back a solution that’ll do the same in life and death situations.”

In some ways, Vital looks like the patient-facing admissions side of a coin that companies like Qventus have raised tens of millions of dollars to solve at the systems level.

Powered by WPeMatico

Airbase is a startup with a plan to change the way you think about accounting around spending. Instead of multiple workflows, it wants to create a simpler one involving, well, Airbase. It’s a bold move for any startup to take on something as entrenched as financials, but it’s giving it a shot, and today the company launched with a $7 million Series A investment.

First Round Capital was lead investor. Maynard Webb, Village Global, BoxGroup and Quiet Capital also participated. The deal closed at the end of November last year. This is the first external funding for the company, which company founder and CEO Thejo Kote had bootstrapped previously with $300,000 of his own money.

“At a high level, Airbase is the first all-in-one spend management system. It replaces a number of different systems that companies use to manage how they spend money,” Kote told TechCrunch.

He knows of what he speaks. Prior to starting this company, Kote co-founded Automatic, a startup that he sold to SiriusXM for more than $100 million in 2017. As a founder, he saw just how difficult it was to track the vast variety of spending inside a company, from supplies to subscriptions to food and drink.

“Think about the hundreds of things that companies spend money on, and the way in which the management of that happens is a pretty broken process today,” he said. For starters, it usually involves some sort of approval request in a tool like Slack, Jira or Google forms.

Once approved, the person requesting the expense will put that on a company credit card, then have to submit expense reports at the end of each month using a tool like Expensify. If you purchase from a vendor, then that involves an invoice and that has to be processed and paid. Finally it would need to be reconciled and accounted for in accounting software. Each step of this process ends up being time-consuming and costly for an organization.

Kote’s idea was to take this process and streamline it by removing the friction, which he saw as being related to the disparate systems in place to get the work done. He believed by creating a single workflow on a unified, single platform he could create a smoother system for everyone involved.

He is putting that single system between the bank and the accounting system, including a virtual Airbase Visa card that can take the place of physical cards if desired. Request for spending happens inside Airbase instead of an external tool. When the virtual card gets charged, bookkeeping and reconciliation gets handled in Airbase and pushed to your accounting package of choice.

Airbase workflow. Diagram: Airbase

This could be a difficult proposition for companies with existing systems in place, but could be attractive to startups and small companies whose accounting systems have not yet hardened. Perhaps that’s why most of Airbase’s customers are startups or SMBs with between 50 and 1000 employees, such as Gusto, Netlify and Segment.

Bill Trenchard, general partner at lead investor First Round Capital, says he has seen very little innovation in this space and that’s what drew him to Airbase. “Airbase has taken a bold step forward to create an entirely new paradigm. It delivers a real solution to the biggest problems finance teams face as their companies grow,” Trenchard said in a statement.

The company was founded in 2017 and has 22 employees. It has a sales office in San Francisco, but other employees are spread across four countries.

Powered by WPeMatico

Airbnb has completed its acquisition of the last-minute hotel booking application, HotelTonight, the company announced on Monday. The deal is Airbnb’s largest M&A transaction yet, and will accelerate the home-sharing giant’s growth as it gears up for an initial public offering.

Airbnb reportedly began talks to acquire HotelTonight months ago, and finally confirmed its intent to acquire the business in early March. Reports indicated a price tag of more than $400 million; Airbnb declined to comment on the size of the deal.

As part of the deal, HotelTonight co-founder and chief executive officer Sam Shank will lead the boutique hotel category at Airbnb, one of the company’s newer units meant to help it scale beyond treehouses and quirky homes.

“When we founded HotelTonight, we sought to reimagine the hotel booking experience to be more simple, fast and fun, and to better connect travelers with the world’s best boutique and independent hotels,” Shank said in a statement. “We are delighted to take this vision to new heights as part of Airbnb.”

Shank launched the San Francisco-based company in 2010. Most recently, it was valued at $463 million with a $37 million Series E funding in 2017, according to PitchBook. HotelTonight raised a total of $131 million in equity funding from venture capital firms including Accel, Battery Ventures, Forerunner Ventures and First Round Capital.

Powered by WPeMatico

Hundreds gathered this week at San Francisco’s Pier 48 to see the more than 200 companies in Y Combinator’s Winter 2019 cohort present their two-minute pitches. The audience of venture capitalists, who collectively manage hundreds of billions of dollars, noted their favorites. The very best investors, however, had already had their pick of the litter.

What many don’t realize about the Demo Day tradition is that pitching isn’t a requirement; in fact, some YC graduates skip out on their stage opportunity altogether. Why? Because they’ve already raised capital or are in the final stages of closing a deal.

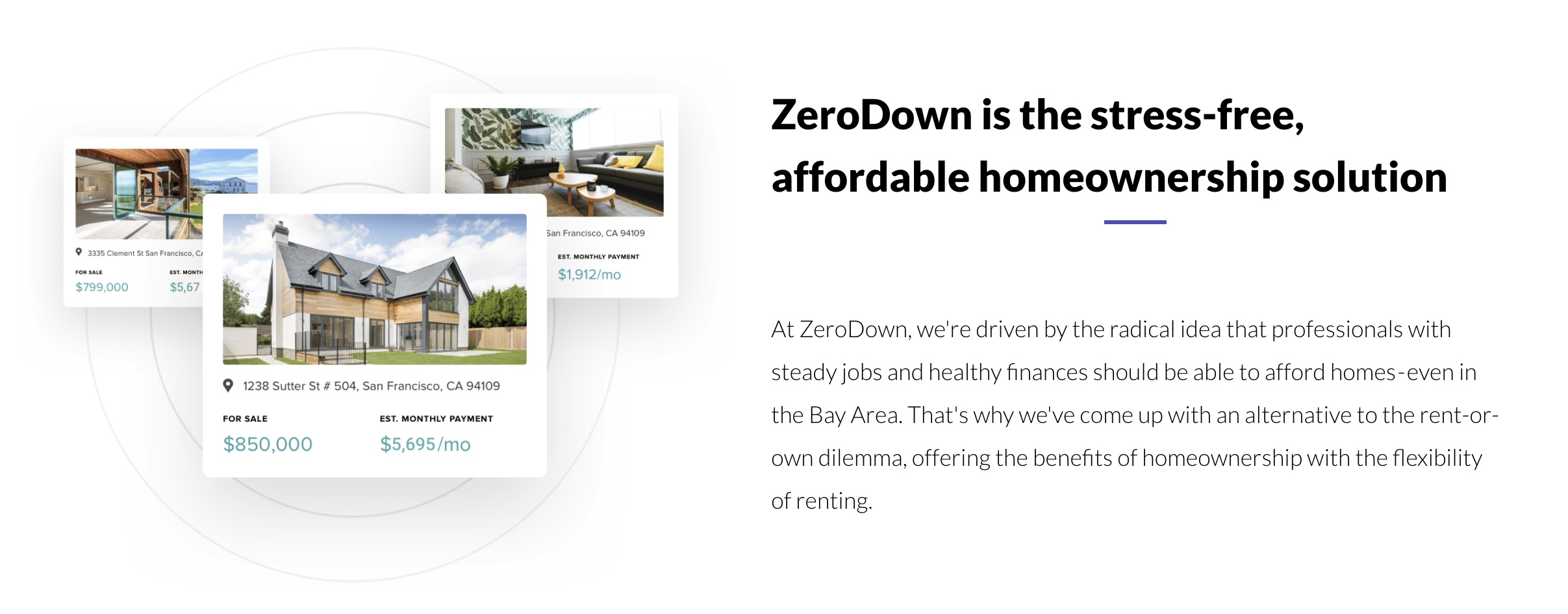

ZeroDown, Overview.AI and Catch are among the startups in YC’s W19 batch that forwent Demo Day this week, having already pocketed venture capital. ZeroDown, a financing solution for real estate purchases in the Bay Area, raised a round upwards of $10 million at a $75 million valuation, sources tell TechCrunch. ZeroDown hasn’t responded to requests for comment, nor has its rumored lead investor: Goodwater Capital.

Without requiring a down payment, ZeroDown purchases homes outright for customers and helps them work toward ownership with monthly payments determined by their income. The business was founded by Zenefits co-founder and former chief technology officer Laks Srini, former Zenefits chief operating officer Abhijeet Dwivedi and Hari Viswanathan, a former Zenefits staff engineer.

The founders’ experience building Zenefits, despite its shortcomings, helped ZeroDown garner significant buzz ahead of Demo Day. Sources tell TechCrunch the startup had actually raised a small seed round ahead of YC from former YC president Sam Altman, who recently stepped down from the role to focus on OpenAI, an AI research organization. Altman is said to have encouraged ZeroDown to complete the respected Silicon Valley accelerator program, which, if nothing else, grants its companies a priceless network with which no other incubator or accelerator can compete.

Overview .AI’s founders’ resumes are impressive, too. Russell Nibbelink and Christopher Van Dyke were previously engineers at Salesforce and Tesla, respectively. An industrial automation startup, Overview is developing a smart camera capable of learning a machine’s routine to detect deviations, crashes or anomalies. TechCrunch hasn’t been able to get in touch with Overview’s team or pinpoint the size of its seed round, though sources confirm it skipped Demo Day because of a deal.

Catch, for its part, closed a $5.1 million seed round co-led by Khosla Ventures, NYCA Partners and Steve Jang prior to Demo Day. Instead of pitching their health insurance platform at the big event, Catch published a blog post announcing its first feature, The Catch Health Explorer.

“This is only the first glimpse of what we’re building this year,” Catch wrote in the blog post. “In a few months, we’ll be bringing end-to-end health insurance enrollment for individual plans into Catch to provide the best health insurance enrollment experience in the country.”

TechCrunch has more details on the healthtech startup’s funding, which included participation from Kleiner Perkins, the Urban Innovation Fund and the Graduate Fund.

Four more startups, Truora, Middesk, Glide and FlockJay had deals in the final stages when they walked onto the Demo Day stage, deciding to make their pitches rather than skip the big finale. Sources tell TechCrunch that renowned venture capital firm Accel invested in both Truora and Middesk, among other YC W19 graduates. Truora offers fast, reliable and affordable background checks for the Latin America market, while Middesk does due diligence for businesses to help them conduct risk and compliance assessments on customers.

Finally, Glide, which allows users to quickly and easily create well-designed mobile apps from Google Sheets pages, landed support from First Round Capital, and FlockJay, the operator an online sales academy that teaches job seekers from underrepresented backgrounds the skills and training they need to pursue a career in tech sales, secured investment from Lightspeed Venture Partners, according to sources familiar with the deal.

Raising ahead of Demo Day isn’t a new phenomenon. Companies, thanks to the invaluable YC network, increase their chances at raising, as well as their valuation, the moment they enroll in the accelerator. They can begin chatting with VCs when they see fit, and they’re encouraged to mingle with YC alumni, a process that can result in pre-Demo Day acquisitions.

This year, Elph, a blockchain infrastructure startup, was bought by Brex, a buzzworthy fintech unicorn that itself graduated from YC only two years ago. The deal closed just one week before Demo Day. Brex’s head of engineering, Cosmin Nicolaescu, tells TechCrunch the Elph five-person team — including co-founders Ritik Malhotra and Tanooj Luthra, who previously founded the Box-acquired startup Steem — were being eyed by several larger companies as Brex negotiated the deal.

“For me, it was important to get them before batch day because that opens the floodgates,” Nicolaescu told TechCrunch. “The reason why I really liked them is they are very entrepreneurial, which aligns with what we want to do. Each of our products is really like its own business.”

Of course, Brex offers a credit card for startups and has no plans to dabble with blockchain or cryptocurrency. The Elph team, rather, will bring their infrastructure security know-how to Brex, helping the $1.1 billion company build its next product, a credit card for large enterprises. Brex declined to disclose the terms of its acquisition.

Y Combinator partners Michael Seibel and Dalton Caldwell, and moderator Josh Constine, speak onstage during TechCrunch Disrupt SF 2018. (Photo by Kimberly White/Getty Images)

Ultimately, it’s up to startups to determine the cost at which they’ll give up equity. YC companies raise capital under the SAFE model, or a simple agreement for future equity, a form of fundraising invented by YC. Basically, an investor makes a cash investment in a YC startup, then receives company stock at a later date, typically upon a Series A or post-seed deal. YC made the switch from investing in startups on a pre-money safe basis to a post-money safe in 2018 to make cap table math easier for founders.

Michael Seibel, the chief executive officer of YC, says the accelerator works with each startup to develop a personalized fundraising plan. The businesses that raise at valuations north of $10 million, he explained, do so because of high demand.

“Each company decides on the amount of money they want to raise, the valuation they want to raise at, and when they want to start fundraising,” Seibel told TechCrunch via email. “YC is only an advisor and does not dictate how our companies operate. The vast majority of companies complete fundraising in the 1 to 2 months after Demo Day. According to our data, there is little correlation between the companies who are most in demand on Demo Day and ones who go on to become extremely successful. Our advice to founders is not to over optimize the fundraising process.”

Though Seibel says the majority raise in the months following Demo Day, it seems the very best investors know to be proactive about reviewing and investing in the batch before the big event.

Khosla Ventures, like other top VC firms, meets with YC companies as early as possible, partner Kristina Simmons tells TechCrunch, even scheduling interviews with companies in the period between when a startup is accepted to YC to before they actually begin the program. Another Khosla partner, Evan Moore, echoed Seibel’s statement, claiming there isn’t a correlation between the future unicorns and those that raise capital ahead of Demo Day. Moore is a co-founder of DoorDash, a YC graduate now worth $7.1 billion. DoorDash closed its first round of capital in the weeks following Demo Day.

“I think a lot of the activity before demo day is driven by investor FOMO,” Moore wrote in an email to TechCrunch. “I’ve had investors ask me how to get into a company without even knowing what the company does! I mostly see this as a side effect of a good thing: YC has helped tip the scale toward founders by creating an environment where investors compete. This dynamic isn’t what many investors are used to, so every batch some complain about valuations and how easy the founders have it, but making it easier for ambitious entrepreneurs to get funding and pursue their vision is a good thing for the economy.”

This year, given the number of recent changes at YC — namely the size of its latest batch — there was added pressure on the accelerator to showcase its best group yet. And while some did tell TechCrunch they were especially impressed with the lineup, others indeed expressed frustration with valuations.

Many YC startups are fundraising at valuations at or higher than $10 million. For context, that’s actually perfectly in line with the median seed-stage valuation in 2018. According to PitchBook, U.S. startups raised seed rounds at a median post-valuation of $10 million last year; so far this year, companies are raising seed rounds at a slightly higher post-valuation of $11 million. With that said, many of the startups in YC’s cohorts are not as mature as the average seed-stage company. Per PitchBook, a company can be several years of age before it secures its seed round.

I did not talk to a single company in this batch raising under $10M post (admittedly I only was able to speak with a fraction of the 205).

— Peter Rojas (@peterrojas) March 20, 2019

Nonetheless, pricey deals can come as a disappointment to the seed investors who find themselves at YC every year but because their reputations aren’t as lofty as say, Accel, aren’t able to book pre-Demo Day meetings with YC’s top of class.

The question is who is Y Combinator serving? And the answer is founders, not investors. YC is under no obligation to serve up deals of a certain valuation nor is it responsible for which investors gain access to its best companies at what time. After all, startups are raking in larger and larger rounds, earlier in their lifespans; shouldn’t YC, a microcosm for the Silicon Valley startup ecosystem, advise their startups to charge the best investors the going rate?

Powered by WPeMatico

Women’s health has long been devoid of technological innovation, but when it comes to fertility options, that’s starting to change. Startups in the space are securing hundreds of millions in venture capital investment, a significant increase to the dearth of funding collected in previous years.

Fertility entrepreneurs are focused on a growing market: couples are choosing to reproduce later in life, an increasing number of female breadwinners are able to make their own decisions about when and how to reproduce, and overall, around 10% of women in the US today have trouble conceiving, according to the Centers for Disease Control and Prevention.

Startups, as a result, are working to improve various pain points in a women’s fertility journey, whether that be with new-age brick-and-mortar clinics, information platforms, mobile applications, wearables, direct-to-consumer medical tests or otherwise.

Although the investment numbers are still relatively small (compared to, say, scooters), the trend is up — here’s the latest from founders and investors in the space.

Clue, a period and ovulation-tracking app, co-founder and CEO Ida Tin talks at TechCrunch Disrupt Berlin 2017 (Photo by Noam Galai/Getty Images for TechCrunch)

This fall, TechCrunch received a tip that SoftBank, a prolific venture capital firm known for its nearly $100 billion Vision Fund, was investing in Glow, a period-tracking app meant to help women get pregnant. Max Levchin, Glow’s co-founder and a well-known member of the PayPal mafia, succinctly responded to a TechCrunch inquiry regarding the deal via e-mail: “Fairly sure you got this particular story wrong,” he wrote. Glow co-founder and chief executive officer Mike Huang did not respond to multiple requests for comment at the time.

Needless to say, some semblance of a SoftBank fertility deal got this reporter interested in a space that seldom populates tech blogs.

Femtech, a term coined by Ida Tin, the founder of another period and ovulation-tracking app Clue, is defined as any software, diagnostics, products and services that leverage technology to improve women’s health. Femtech, and more specifically the businesses in the fertility and contraception lanes, hasn’t made headlines as often as AI or blockchain technology has, for example. Probably because companies in the sector haven’t closed as many notable venture deals. That’s changing.

The global fertility services market is expected to exceed $21 billion by 2020, according to Technavio. Meanwhile, private investment in the femtech space surpassed $400 million in 2018 after reaching a high of $354 million the previous year, per data collected from PitchBook and Crunchbase. This year already several companies have inked venture deals, including men’s fertility business Dadi and Extend Fertility, which helps women freeze their eggs.

“In the last three to six months, it feels like investor interest has gone through the roof,” Jake Anderson-Bialis, co-founder of FertilityIQ and a former investor at Sequoia Capital, told TechCrunch. “It’s three to four emails a day; people are coming out of the woodwork. It feels like somebody shook the snow globe here and it just hasn’t stopped for months now.”

Dadi, Extend Fertility and FertilityIQ are among a growing list of startups in the fertility space to crop up in recent years. FertilityIQ, for its part, provides a digital platform for fertility patients to research and review doctors and clinics. The company also collects data and issues reports, like this one, which ranked businesses by fertility benefits. Anderson-Bialis launched the platform with his wife, co-founder Deborah Anderson-Bialis, in 2016 after the pair overcame their own set of infertility issues.

Anderson-Bialis said he has recently fielded requests from seed, Series A and growth-stage investors interested in exploring the growing fertility market. His company, however, has yet to raise any outside capital. Why? He doesn’t see FertilityIQ as a venture-scale business, but rather a passion project, and he’s skeptical of the true market opportunity for other businesses in the space.

Powered by WPeMatico

As massive cross-platform gaming titles become even larger time-sucks for a lot of people, it’s probably worth reflecting on how to savor your in-game accomplishments.

Streaming of esports celebrities on sites like Twitch has taken off like no one imagined, but for the most part the toil-heavy editing process has left this attention largely focused on those with the ambitions of making gaming their full-time gig.

Athenascope is a small startup aiming to tap computer vision intelligence to record, review and recap what more novice gamers were able to pull off in their latest battle royale with a short, shareable highlight reel. The team is led by Chris Kirmse, who previously founded Xfire, a game messaging client that Viacom bought in 2006 for north of $100 million.

The company announced this week that they’ve closed a $2.5 million seed round led by First Round Capital to grow its tools and its team. They’re also rolling out their AI highlight reel tool for gamers. The tool is pretty customized for individual titles; they’re launching with support for Fortnite, Rocket League and PUBG, but Kirmse hopes to expand that list significantly in the future.

Josh Kopelman, a partner at First Round Capital who is joining Athenascope’s board, highlighted that a lot of existing tools for gaming entertainment are “really skewed towards the high-end.”

“They’re not democratized, they’re for professional gamers,” Kopelman told TechCrunch. “What I think Chris is trying to do with Athenascope is enable anyone to create these high-quality game highlights — what the pros have to do manually.”

The company is tackling a problem familiar to video-editing software companies: how to prevent footage from dying on the device. The answer here is the same as many others have posited, tapping computer vision deep learning to do the heavy lifting in determining which footage is interesting and worthy of a highlight reel. Athenascope has some key advantages over the companies like GoPro that are trying to do the same with real-world video, namely the games they support operate in fundamentally more predictable ways and 2D interface cues offer some pretty healthy indicators of when exciting stuff is going down.

The game isn’t a plug-in that needs pipeline access to your Fortnite account or anything, the product simply analyzes exactly what you’re seeing when you play. The startup is also working on cool tools that allow you to see multiple perspectives of individual moments in gameplay by essentially syncing footage from other people involved in a match that are also Athenascope’s service and giving a sort of multi-view replay.

The company has broader ambitions of how it can evolve these gaming insights with computer vision, including ways to help gamers learn about their strengths and weaknesses in a way that lets Athenascope serve as a sort of computer vision coach. For now though, the big focus is on getting gamers these entertaining snapshots of their gaming experiences in an intelligent way.

Powered by WPeMatico

We’re three weeks into January. We’ve recovered from our CES hangover and, hopefully, from the CES flu. We’ve started writing the correct year, 2019, not 2018.

Venture capitalists have gone full steam ahead with fundraising efforts, several startups have closed multi-hundred million dollar rounds, a virtual influencer raised equity funding and yet, all anyone wants to talk about is Slack’s new logo… As part of its public listing prep, Slack announced some changes to its branding this week, including a vaguely different looking logo. Considering the flack the $7 billion startup received instantaneously and accusations that the negative space in the logo resembled a swastika — Slack would’ve been better off leaving its original logo alone; alas…

On to more important matters.

Rubrik more than doubled its valuation

The data management startup raised a $261 million Series E funding at a $3.3 billion valuation, an increase from the $1.3 billion valuation it garnered with a previous round. In true unicorn form, Rubrik’s CEO told TechCrunch’s Ingrid Lunden it’s intentionally unprofitable: “Our goal is to build a long-term, iconic company, and so we want to become profitable but not at the cost of growth,” he said. “We are leading this market transformation while it continues to grow.”

Deal of the week: Knock gets $400M to take on Opendoor

Will 2019 be a banner year for real estate tech investment? As $4.65 billion was funneled into the space in 2018 across more than 350 deals and with high-flying startups attracting investors (Compass, Opendoor, Knock), the excitement is poised to continue. This week, Knock brought in $400 million at an undisclosed valuation to accelerate its national expansion. “We are trying to make it as easy to trade in your house as it is to trade in your car,” Knock CEO Sean Black told me.

While we’re on the subject of VCs’ favorite industries, TechCrunch cybersecurity reporter Zack Whittaker highlights some new data on venture investment in the industry. Strategic Cyber Ventures says more than $5.3 billion was funneled into companies focused on protecting networks, systems and data across the world, despite fewer deals done during the year. We can thank Tanium, CrowdStrike and Anchorfree’s massive deals for a good chunk of that activity.

Send me tips, suggestions and more to kate.clark@techcrunch.com or @KateClarkTweets.

I would be remiss not to highlight a slew of venture firms that made public their intent to raise new funds this week. Peter Thiel’s Valar Ventures filed to raise $350 million across two new funds and Redpoint Ventures set a $400 million target for two new China-focused funds. Meanwhile, Resolute Ventures closed on $75 million for its fourth early-stage fund, BlueRun Ventures nabbed $130 million for its sixth effort, Maverick Ventures announced a $382 million evergreen fund, First Round Capital introduced a new pre-seed fund that will target recent graduates, Techstars decided to double down on its corporate connections with the launch of a new venture studio and, last but not least, Lance Armstrong wrote his very first check as a VC out of his new fund, Next Ventures.

More money goes toward scooters

In case you were concerned there wasn’t enough VC investment in electric scooter startups, worry no more! Flash, a Berlin-based micro-mobility company, emerged from stealth this week with a whopping €55 million in Series A funding. Flash is already operating in Switzerland and Portugal, with plans to launch into France, Italy and Spain in 2019. Bird and Lime are in the process of raising $700 million between them, too, indicating the scooter funding extravaganza of 2018 will extend into 2019 — oh boy!

TechCrunch’s Josh Constine introduced readers to Squad this week, a screensharing app for social phone addicts.

If you enjoy this newsletter, be sure to check out TechCrunch’s venture-focused podcast, Equity. In this week’s episode, available here, Crunchbase editor-in-chief Alex Wilhelm and I marveled at the dollars going into scooter startups, discussed Slack’s upcoming direct listing and debated how the government shutdown might impact the IPO market.

Powered by WPeMatico

The government shutdown entered its 21st day on Friday, upping concerns of potentially long-lasting impacts on the U.S. stock market. Private market investors around the country applauded when Uber finally filed documents with the SEC to go public. Others were giddy to hear Lyft, Pinterest, Postmates and Slack (via a direct listing, according to the latest reports) were likely to IPO in 2019, too.

Unfortunately, floats that seemed imminent may not actually surface until the second half of 2019 — that is unless President Donald Trump and other political leaders are able to reach an agreement on the federal budget ASAP. This week, we explored the government’s shutdown’s connection to tech IPOs, recounted the demise of a well-funded AR project and introduced readers to an AI-enabled self-checkout shopping cart.

1. Postmates gets pre-IPO cash

The company, an early entrant to the billion-dollar food delivery wars, raised what will likely be its last round of private capital. The $100 million cash infusion was led by BlackRock and valued Postmates at $1.85 billion, up from the $1.2 billion valuation it garnered with its unicorn round in 2018.

2. Uber’s IPO may not be as eye-popping as we expected

To be fair, I don’t think many of us really believed the ride-hailing giant could debut with a $120 billion initial market cap. And can speculate on Uber’s valuation for days (the latest reports estimate a $90 billion IPO), but ultimately Wall Street will determine just how high Uber will fly. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

N26, a German fintech startup, raised $300 million in a round led by Insight Venture Partners at a $2.7 billion valuation. TechCrunch’s Romain Dillet spoke with co-founder and CEO Valentin Stalf about the company’s global investors, financials and what the future holds for N26.

Bird is in the process of raising an additional $300 million on a flat pre-money valuation of $2 billion. The e-scooter startup has already raised a ton of capital in a very short time and a fresh financing would come at a time when many investors are losing faith in scooter startups’ claims to be the solution to the problem of last-mile transportation, as companies in the space display poor unit economics, faulty batteries and a general air of undependability. Plus, Aurora, the developer of a full-stack self-driving software system for automobile manufacturers, is raising at least $500 million in equity funding at more than a $2 billion valuation in a round expected to be led by new investor Sequoia Capital.

WeWork, a co-working giant backed with billions, had planned on securing a $16 billion investment from existing backer SoftBank . Well, that’s not exactly what happened. And, oh yeah, they rebranded.

After 20 long years, augmented reality glasses pioneer ODG has been left with just a skeleton crew after acquisition deals from Facebook and Magic Leap fell through. Here’s a story of a startup with $58 million in venture capital backing that failed to deliver on its promises.

7. Data point

Seed activity for U.S. startups has declined for the fourth straight year, as median deal sizes increased at every stage of venture capital.

Key takeaways:

1. Seed activity for U.S. startups declined for the fourth straight year

2. Median U.S. seed deal was the highest on record in Q4 at $2.1M

3. Seed activity as a % of deals shrunk to 25%

4. Companies securing seed deals are older than ever https://t.co/exr8DRQRAF— Kate Clark (@KateClarkTweets) January 9, 2019

8. Meanwhile, in startup land…

This week edtech startup Emeritus, a U.S.-Indian company that partners with universities to offer digital courses, landed a $40 million Series C round led by Sequoia India. Badi, which uses an algorithm to help millennials find roommates, brought in a $30 million Series B led by Goodwater Capital. And Mr Jeff, an on-demand laundry service startup, bagged a $12 million Series A.

9. Finally, Meet Caper, the AI self-checkout shopping cart

The startup, which makes a shopping cart with a built-in barcode scanner and credit card swiper, has revealed a total of $3 million, including a $2.15 million seed round led by First Round Capital .

Want more TechCrunch newsletters? Sign up here.

Powered by WPeMatico

Uber is expected to raise $10 billion later this year in one of the largest U.S. initial public offerings in history. The float will value the ride-hailing giant somewhere between $76 billion — the valuation it garnered with its last private financing — and $120 billion — a sky-high figure assigned by Wall Street bankers that’s had even early Uber investors scratching their heads.

A new report from The Information pegs Uber’s initial market cap at $90 billion. To develop the estimate, the site analyzed undisclosed documents Uber provided creditors in 2017 “in which the company projected it would double net revenue to $14.2 billion by 2019,” ran revenue multiples and compared Uber to GrubHub, which investors say is the business’s closest comparison.

Uber declined to comment on The Information’s analysis.

Uber confidentially filed for its long-awaited IPO last month, marking the beginning of a race to the stock markets between it and U.S. competitor Lyft, which filed just hours before, according to a source with knowledge of the situation. Founded in 2009 by Travis Kalanick, Uber has brought in about $20 billion in a combination of debt and equity funding. It counts SoftBank as its largest shareholder in a cap table that also lists Toyota, T. Rowe Price, Fidelity, TPG Growth and many more. As for the skepticism surrounding Uber’s lofty $120 billion valuation, the eye-popping figure seems unachievable considering the company isn’t profitable and has and continues to burn through cash.

An IPO that large would certainly make its investors happy. First Round Capital, for example, seeded Uber with $1.6 million in the company’s first two funding rounds in 2010 and 2011, according to The Wall Street Journal. At a $120 billion valuation, First Round’s shares would be worth some $5 billion. The venture capital firm, however, sold some of its shares to SoftBank alongside Benchmark, which itself would otherwise own shares worth about $14 billion.

Bradley Tusk, an early Uber investor who signed on to help the company surmount political and regulatory barriers in 2011, own shares said to be worth $100 million, though he too gave up 42 percent of his equity in a secondary sale to SoftBank, he recently told TechCrunch.

“I’m quite happy with the 120 number,” Tusk said. “But … I am a little surprised by [it], it does seem to be a really aggressive number.”

“Any investment in Uber is obviously a long-term bet on the future, like someone who invested in Amazon in the early days,” Tusk added. “One thing [Uber chief executive officer Dara Khosrowshahi] is doing well is really expanding Uber into a mobility company as opposed to just a ride-hailing company.”

Dara Kowsrowshahi, chief executive officer of Uber, looks on following an event in New Delhi, India, on Thursday, Feb. 22, 2018. Photographer: Anindito Mukherjee/Bloomberg via Getty Images

Uber has opted to go public in a year poised to see the most high-flying unicorn IPOs in history. As we’ve reported in great detail on this site, both Lyft and Uber are planning to float, as are Slack and Pinterest . Many of these companies, however, made the call to make their public markets debut before the stock market took a quick turn south. Poor performing stocks may discourage unicorns from emerging from their cozy VC-protected stalls.

Uber will garner increased scrutiny from Wall Street investors as they begin to parse out its true value. Fortunately the company, which like Amazon has long prioritized growth over profit, has “’clear levers’ it could pull in order to turn on the cash spigots if it wanted to, by reducing its marketing spending both in the U.S. and developing markets and by finding partners to help finance its self-driving car development,” according to The Information. “Pulling those levers would slow revenue growth by a third—from a 33% growth in net revenue to 22 percent growth in net revenue in 2019 [but] it would save Uber $2 billion annually.”

In its third quarter 2018 financial results, Uber posted a net loss of $939 million on a pro forma basis and an adjusted EBITDA loss of $527 million, up about 21 percent quarter-over-quarter. Revenue for Q3 was up five percent QoQ at $2.95 billion and up 38 percent year-over-year.

“We had another strong quarter for a business of our size and global scope,” Uber chief financial officer Nelson Chai said in a statement. “As we look ahead to an IPO and beyond, we are investing in future growth across our platform, including in food, freight, electric bikes and scooters, and high-potential markets in India and the Middle East where we continue to solidify our leadership position.”

We can speculate on Uber’s valuation for days but ultimately Wall Street will determine just how high Uber will go. For now, all we can do is sit and wait for the company to relinquish its S-1 to the masses.

Powered by WPeMatico