funding

Auto Added by WPeMatico

Auto Added by WPeMatico

The dollars keep flowing into Latin America.

Today, Argentine personal finance management app Ualá announced it has raised $350 million in a Series D round at a post-money valuation of $2.45 billion.

SoftBank Latin America Fund and affiliates of China-based Tencent co-led the round, which included participation from a slew of existing backers, including funds managed by Soros Fund Management LLC, funds managed by affiliates of Goldman Sachs Asset Management, Ribbit Capital, Greyhound Capital, Monashees and Endeavor Catalyst. New funds, such as D1 Capital Partners and 166 2nd, also put money in the round in addition to angel investors such as Jacqueline Reses and Isaac Lee.

The round is believed to be the largest private raise ever by an Argentinian company and brings Ualá’s total raised to $544 million since its 2017 inception.

Founder and CEO Pierpaolo Barbieri, a Buenos Aires native and Harvard University graduate, has said his ambition was to create a platform that would bring all financial services into one app linked to one card.

Today, Ualá says it has developed “a complete financial ecosystem,” including universal accounts, a global Mastercard card, bill payment options, investment products, personal loans, installments (BNPL) and insurance. It has also launched merchant acquiring, Ualá Bis, a solution for entrepreneurs and merchants that allows selling through a payment link or mobile point-of-sales (mPOS).

The startup has issued more than 3.5 million cards in its home country and in Mexico, where it launched operations last year. The company claims that more than 22% of 18 to 25-year-olds in Argentina have a Ualá card. At the time of its Series C raise in November 2019, it had issued 1.3 million cards.

Image Credits: Ualá

Over 1 million users invest in the mutual fund available on the Ualá app, which the company claims is the second largest mutual fund in Argentina in number of participants. The company, which has aimed to provide more financial transparency and inclusion in the region, says that 65% of its users had no credit history prior to downloading the app.

Ualá plans to use its new capital to continue expanding within Latin America, develop new business verticals and do some hiring, with the plan of having 1,500 employees by year’s end. It currently has more than 1,000 employees.

“We are most impressed by Ualá’s ambition and execution. Our investment will propel the next stage of their vision, furthering a regional ecosystem that can make financial services more accessible and transparent across LatAm,” said Marcelo Claure, CEO of SoftBank Group International and COO of SoftBank Group, in a written statement.

Powered by WPeMatico

Luis Mario Garcia grew up in Mexico making deliveries for the grocery stores in his neighborhood. After honing his startup skills in San Francisco, he returned to Mexico with the idea of building a software company.

That’s when he met his co-founder Javier Gonzalez and the pair started Orchata in 2020, a mobile app enabling consumers to get groceries delivered in 15 minutes, with no substitutes and at supermarket prices. Products delivered include fresh fruit, beverages, bread, medicine and household essentials, Garcia told TechCrunch.

Orchata does this by operating a network of micro fulfillment centers — it is already operating in two cities — with technology for efficient picking and hyperfast delivery.

Online food delivery sales in Latin America are projected to reach $9.8 billion by 2024, with the global pandemic driving demand for faster delivery, according to Statista. Garcia sees three different waves in this market: the first one being traditional supermarkets, where you can spend hours, which led to the second wave of food delivery companies, including some big players in the region — for example Rappi in Colombia, which in July raised $500 million in Series F funding at a $5.25 billion valuation in a round led by T. Rowe Price, and Cornershop in Chile, which was acquired by Uber in 2019.

However, Garcia said many of these services still take more than an hour from order to doorstep and may require phone calls if an item is not available. He wants to be part of a third wave — software that is integrated with inventory and delivery that is super fast, and no substitutions.

“This is similar to what is going on around the world, but there is a huge opportunity to bring convenience, to be the Gopuff for Latin America, and we want to build it first in the region,” Garcia said.

The Monterrey-based company was part of Y Combinator’s summer 2020 cohort and on Friday announced a $4 million seed round from a group of investors, including Y Combinator, JAM Fund, FJ Labs, Venture Friends, Investo and Foundation Capital, and angel investors Ross Lipson, Mike Hennessey, Brian Requarth and Javier Mata.

Jonathan Lewy, co-founder of Grin Scooters and founder of Investo, is also an investor in Rappi. He said Garcia was building a product for the end user, with the key being the building of the infrastructure and inventory. Lewy believes Garcia understands how quick delivery should be done and that it is not just about offering a mobile app, but building the technology behind it.

Meanwhile, Justin Mateen, general partner at JAM Fund, and co-founder of Tinder and an early-stage investor, met Garcia over a year ago and was one of the company’s first investors. He said Garcia’s and Gonzalez’s initial idea for the model of grocery stores was still not solving the problem, but then they pivoted to doing fulfillment and inventory themselves.

“He fits the mold of what I look for in a founder, and he is the type of founder that doesn’t give up,” Mateen said. “Luis finally agreed to let me double down on my investment. The model makes sense now, he is on to something and it is now going to be about execution of capital as he scales.”

Both Mateen and Lewy agree that there will be similar apps coming because food delivery is such a large market, but that Orchata has a clear advantage of owning the customer experience from beginning to end.

Having only launched four months ago, Orchata is already processing thousands of orders and is seeing 100% monthly growth. The new funding will enable Orchata to expand into three new cities in Mexico. Garcia is also eyeing Colombia, Brazil, Peru and Chile for future expansion.

The company is also targeting multiple use cases, including someone noticing a forgotten item while cooking to consumers shopping for the week or teenagers needing food for a party.

“We are going to be super convenient to customers, and we think every use case for food delivery will be this way in the future,” Garcia said. “We will eventually introduce our own brands and foods with the goal of being that app that is there anytime you need it.”

Powered by WPeMatico

Houston-based ThirdAI, a company building tools to speed up deep learning technology without the need for specialized hardware like graphics processing units, brought in $6 million in seed funding.

Neotribe Ventures, Cervin Ventures and Firebolt Ventures co-led the investment, which will be used to hire additional employees and invest in computing resources, Anshumali Shrivastava, Third AI co-founder and CEO, told TechCrunch.

Shrivastava, who has a mathematics background, was always interested in artificial intelligence and machine learning, especially rethinking how AI could be developed in a more efficient manner. It was when he was at Rice University that he looked into how to make that work for deep learning. He started ThirdAI in April with some Rice graduate students.

ThirdAI’s technology is designed to be “a smarter approach to deep learning,” using its algorithm and software innovations to make general-purpose central processing units (CPU) faster than graphics processing units for training large neural networks, Shrivastava said. Companies abandoned CPUs years ago in favor of graphics processing units that could more quickly render high-resolution images and video concurrently. The downside is that there is not much memory in graphics processing units, and users often hit a bottleneck while trying to develop AI, he added.

“When we looked at the landscape of deep learning, we saw that much of the technology was from the 1980s, and a majority of the market, some 80%, were using graphics processing units, but were investing in expensive hardware and expensive engineers and then waiting for the magic of AI to happen,” he said.

He and his team looked at how AI was likely to be developed in the future and wanted to create a cost-saving alternative to graphics processing units. Their algorithm, “sub-linear deep learning engine,” instead uses CPUs that don’t require specialized acceleration hardware.

Swaroop “Kittu” Kolluri, founder and managing partner at Neotribe, said this type of technology is still early. Current methods are laborious, expensive and slow, and for example, if a company is running language models that require more memory, it will run into problems, he added.

“That’s where ThirdAI comes in, where you can have your cake and eat it, too,” Kolluri said. “It is also why we wanted to invest. It is not just the computing, but the memory, and ThirdAI will enable anyone to do it, which is going to be a game changer. As technology around deep learning starts to get more sophisticated, there is no limit to what is possible.”

AI is already at a stage where it has the capability to solve some of the hardest problems, like those in healthcare and seismic processing, but he notes there is also a question about climate implications of running AI models.

“Training deep learning models can be more expensive than having five cars in a lifetime,” Shrivastava said. “As we move on to scale AI, we need to think about those.”

Powered by WPeMatico

Mobile field service startup Youreka Labs Inc. raised an $8.5 million Series A round of funding co-led by Boulder Ventures and Grotech Ventures, with participation from Salesforce Ventures.

The Maryland-based company also officially announced its CEO — Bill Karpovich joined to lead the company after previously general manager at IBM Cloud & Watson Platform.

Youreka Labs spun out into its own company from parent company Synaptic Advisors, a cloud consulting business focused on the customer relationship management transformations using Salesforce and other artificial intelligence and automation technologies.

The company is developing robotic smart mobile assistants that enable frontline workers to perform their jobs more safely and efficiently. This includes things like guided procedures, smart forms and photo or video capture. Youreka is also embedded in existing Salesforce mobile applications like Field Service Mobile so that end-users only have to operate from one mobile app.

Youreka has identified four use cases so far: healthcare, manufacturing, energy and utilities and the public sector. Working with companies like Shell, P&G, Humana and the Transportation Security Administration, the company’s technology makes it possible for someone to share their knowledge and processes with their colleagues in the field, Karpovich told TechCrunch.

“In the case of healthcare, we are taking complex medical assessments from a doctor and pushing them out to nurses out in the field by gathering data into a simple mobile app and making it useful,” he added. “It allows nurses to do a great job without being doctors themselves.”

Karpovich said the company went after Series A dollars because it was “time for it to be on its own.” He was receiving inbound interest from investors, and the capital would enable the company to proceed more rapidly. Today, the company is focused on the Salesforce ecosystem, but that can evolve over time, he added.

The funding will be used to expand the company’s reach and products. He expects to double the team in the next six to 12 months across engineering to be able to expand the platform. Youreka boasts 100 customers today, and Karpovich would also like to invest in marketing to grow that base.

In addition to the use cases already identified, he sees additional potential in financial services and insurance, particularly for those assessing damage. The company is also concentrated in the United States, and Karpovich has plans to expand in the U.K. and Europe.

In 2020, the company grew 300%, which Karpovich attributes to the need of this kind of tool in field service. Youreka has a licensing model with charges per end user per month, along with an administrative license, for the people creating the apps, that also charges per user and per month pricing.

“There are 2.5 million jobs open today because companies can’t find people with the right skills,” he added. “We are making these jobs accessible. Some say that AI is doing away with jobs, but we are using AI to enhance jobs. If we can take 90% of the knowledge and give a digital assistant to less experienced people, you could open up so many opportunities.”

Powered by WPeMatico

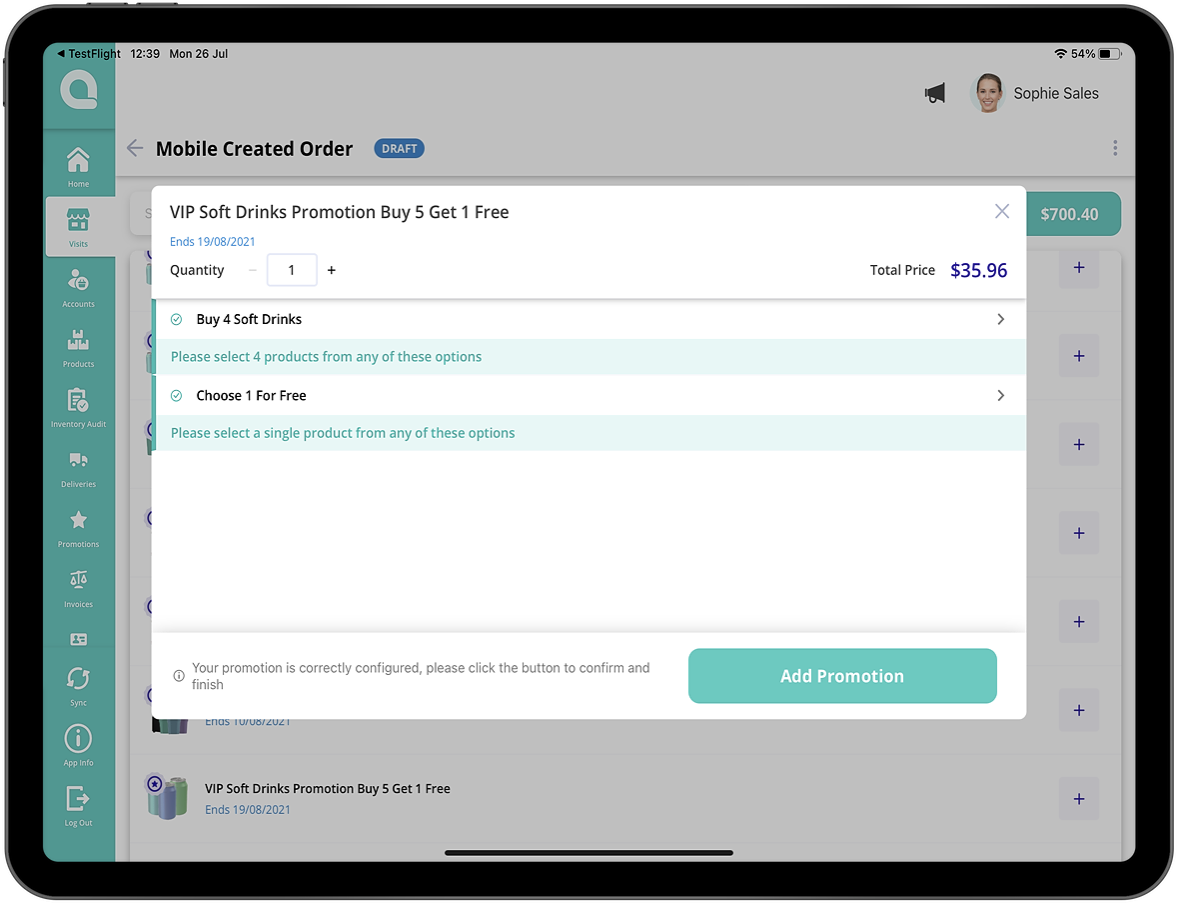

Aforza, developing cloud and mobile apps for consumer goods companies, announced a $22 million Series A round led by DN Capital.

The London-based company’s technology is built on the Salesforce and Google Cloud platforms so that consumer goods companies can digitally transform product distribution and customer engagement to combat issues like unprofitable promotions and declining market share, Aforza co-founder and CEO Dominic Dinardo told TechCrunch. Using artificial intelligence, the company recommends products and can predict the order a retailer can make with promotions and pricing based on factors like locations.

The global market for consumer packaged goods apps is forecasted to reach $15 billion by 2024. However, the industry is still using outdated platforms that, in some cases, lead to a loss of 5% of sales when goods are out of stock, Dinardo said.

Aforza’s trade promotion designer mobile image. Image Credits: Aforza

Dinardo and his co-founders, Ed Butterworth and Nick Eales, started the company in 2019. All veterans of Salesforce, they saw how underserved the consumer goods industry was in terms of moving to digital.

Aforza is Dinardo’s first time leading a company. However, from his time at Salesforce he feels he got an education like going to “Marc Benioff’s School of SaaS.” The company raised an undisclosed seed round in 2019 from Bonfire Ventures, Daher Capital, DN Capital, Next47 and Salesforce Ventures.

Then the pandemic happened, which had many of the investors leaning in, which was validation of what Aforza was doing, Dinardo said.

“Even before the pandemic, the consumer goods industry was challenged with new market entrants and horrible legacy systems, but then the pandemic turned off pathways to customers,” he added. “Our mission is to improve the lives of consumers by bringing forth more sustainable products and packaging, but also helping companies be more agile and handle changes as the biggest change is happening.”

Joining DN Capital in the round were Bonfire Ventures, Daher Capital and Next47.

Brett Queener, partner at Bonfire Ventures, said he helped incubate Aforza with Dinardo and Eales, something his firm doesn’t typically do, but saw a unique opportunity to get in on the ground floor.

Also working at Salesforce, he saw the consumer goods industry as a major industry with a compelling reason to make a technology shift as customers began expecting instant availability and there were tons of emerging startups coming into the direct-to-consumer space.

Those startups don’t have a year or two to pull together the kind of technology it took to scale. With Aforza, they can build a product that works both online and off on any device, Queener said. And rather than planning promotions on a quarterly basis, companies can make changes to their promotional spend in real time.

“It is time for Aforza to tell the world about its technology, time to build out its footprint in the U.S. and in Europe, invest more in R&D and execute the Salesforce playbook,” he said. “That is what this round is about.”

Dinardo intends on using the new funding to continue R&D and to double its employee headcount over the next six months as it establishes its new U.S. headquarters in the Northeast. It is already working with customers in 20 countries.

As to growth, Dinardo said he is using his past experiences at startups like Veeva and Vlocity, which was acquired by Salesforce in 2020, as benchmarks for Aforza’s success.

“We have the money and the expertise — now we need to take a moment to breathe, hire people with the passion to do this and invest in new product tiers, digital assets and even payments,” he said.

Powered by WPeMatico

The technology industry is often thought of as being the domain of the young and the new. We see an emphasis on young founders (“40 Under 40”), innovative ideas and disruptive challenges to legacy brands, incumbent companies and “old” ways of thinking.

But one of the things I’ve learned on my journey in co-founding my latest startup is that technology should be enabling and accessible to all, and nowhere is this more critical than for empowering our older adults.

Older adults are one of the most underrepresented audiences for new technology products and platforms. There is a massive opportunity to provide products and services that will make life better for today’s seniors and future generations of older adults to come. Founders in every space, from edtech to healthcare, from financial services to robotics, can make a bigger impact if we recognize the opportunity of being of service to older adults.

One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults.

Older adults often get overlooked by tech companies. In fairness, it can be hard (and insensitive and uninspiring) to market products and services as being “for old people,” because people in this group don’t tend to think of themselves as “old.”

One of the best strategies for tech companies that want to serve the older adult market is to focus your value proposition on empowering older adults. Don’t make a product “for old people” — make a product that helps older adults lead a healthier, more active, more connected life.

Whether it’s the education tech space, financial services, health tech, consumer products or other innovative digital services for seniors, tech companies have big opportunities to empower older adults.

We are seeing some great examples, including:

Older adults have so much to offer. Instead of approaching this market as a “problem” to be solved, startups should engage with older adults as an active, curious, ready-to-learn group of people who are eager to be empowered.

It often seems like so many consumer-facing apps today are created for younger people. But there’s a big disconnect between where so much of the tech industry’s attention and investment is going and the spending power and lifestyle preferences of today’s older adults.

Older adults are the most underserved demographic for the tech world. They’re also one of the fastest-growing age cohorts. The number of people worldwide who are 65 and older is expected to grow from 524 million in 2010 to 1.5 billion in 2050.

The “silver economy,” driven by the spending power of older adults, is expected to grow into the 2030s because the senior population is the wealthiest age group and their numbers are growing 3.2% per year (compared with 0.8% for the overall population).

Powered by WPeMatico

Singapore is home to fewer than six million people, making it one of the smallest ASEAN countries, in terms of population. It is a young country as well — having gained independence in 1963 — and resides in a neighborhood with far larger economies, including China, Indonesia, and Vietnam. When the country first became independent, its mandate was to simply survive rather than thrive.

So how does a country evolve from a position of relative uncertainty, with comparatively few resources, to one that leads the ASEAN region in venture capital investment and has been home to 10 unicorns?

Countries around the world examine Singapore’s ecosystem from a distance, hoping to learn from, and emulate, its story. The World Bank Group recently published a report, The Evolution and State of Singapore’s Start-up Ecosystem, documenting the country’s experience in building its startup ecosystem and the challenges facing it.

This article presents an overview of the report’s key findings and offers a few key recommendations on what other countries can learn from Singapore’s experience, as well as what Singapore itself can do to maintain progress.

As of 2019, Singapore had over $19 billion in PE and VC assets under management, more than twice that of neighboring Indonesia, Philippines, Vietnam, Malaysia, and Thailand combined. In that same year, the country was home to an estimated 3,600 tech startups and nearly 200 different intermediary and supporting organizations (accelerators, co-working spaces, coding academies, etc.) – some which have a multinational presence, such as Blk71, whose Singapore headquarters has been referred to as “the world’s most tightly packed entrepreneurial ecosystem.”

While assessing the size and strength of startup ecosystems is an evolving method, Start-up Genome priced Singapore’s ecosystem at over $25 billion, five times the global median.

Arguably, the most eye-catching hallmark of this ecosystem is its population of current and former unicorns. Collectively, Singapore has been home to ten unicorns, three of which have offered an IPO (Nanofilm, Razer and Sea) and two of which have been acquired – one by giant Alibaba (Lazada) and one by Chinese streaming powerhouse YY (Bigo Live). The remaining five are Trax, Acronis, JustCo, PatSnap, and Grab – the ASEAN region’s largest unicorn to date.

The education sector is also prominent in Singapore’s ecosystem. Universities like the National University of Singapore (NUS) and Nanyang Technological University (NTU) are deeply embedded into this ecosystem, helping with R&D commercialization linkages, incubation, talent/knowledge transfer, and other areas.

Numerous factors have contributed to building Singapore’s startup ecosystem, with government intervention and leadership being the dominant driving forces. The government has spent more than USD60 billion over the past several decades to enhance the country’s R&D infrastructure, create VC funds, and launch accelerators and other support organizations.

Powered by WPeMatico

Trust wants to give smaller businesses the same advantages that large enterprises have when marketing on digital and social media platforms. It came out of beta with $9 million in seed funding from Lerer Hippeau, Lightspeed Venture Partners, Upfront Ventures and Upper90.

The Los Angeles-based company was started in 2019 by a group of five Snap alums working in various roles within Snap’s revenue product strategy business. They were building tools for businesses to fund success with digital marketing, but kept hearing from customers about the advantage big advertisers had over smaller ones — the ability to receive good payment terms, credit lines, as well as data and advice.

Aiming to flip the script on that, the group created Trust, which is a card and business community to help digital businesses navigate the ever-changing pricing models to market online, receive the same incentives larger advertisers get and make the best decision of where their marketing dollars will reach the furthest.

Trust dashboard

Trust does this in a few ways: Its card, built in partnership with Stripe, enables businesses to increase their buying power by up to 20 times and have 45 days to make payments on their marketing investments, CEO James Borow told TechCrunch. Then as part of its community, companies share knowledge of marketing buys and data insights typically reserved for larger advertisers. Users even receive news via their dashboard around their specific marketing strategy, he added.

“The ad platforms are walled gardens, and most people don’t know what is going on inside, so our customers work together to see what is going on,” Borow said.

The growth of e-commerce is pushing more digital marketing investments, providing opportunity for Trust to be a huge business, Borow said. E-commerce sales in the U.S. grew by 39% in the first quarter, while digital advertising spend is forecasted to increase 25% this year to $191 billion. Meanwhile, Google, Facebook, Snapchat and Twitter all recently reported rapid growth in their year-over-year advertising revenues, Borow said.

The new funding will go toward increasing the company’s headcount.

“We have active customers on the platform, so we wanted to ramp up hiring as soon as we went into general release,” he added. “We are leaving beta with 25 businesses and a few hundred on our waitlist.”

That list will soon grow. In addition to the funding round, Trust announced a strategic partnership with social shopping e-commerce platform Verishop. The company’s 3,500 merchants will receive priority access to the Trust card and community, Borow said.

Andrea Hippeau, partner at Lerer Hippeau, said she knew Borow from being an investor in his previous advertising company Shift, which was acquired by Brand Networks in 2015.

When Borow contacted Lerer about Trust, Hippeau said this was the kind of offering that would be applicable to the firm’s portfolio, which has many direct-to-consumer brands, and knew marketing was a huge pain point for them.

“Digital marketing is important to all brands, but it is also a black box that you put marketing dollars into, but don’t know what you get,” she said. “We hear this across our portfolio — they spend a lot of money on ad platforms, yet are treated like mom-and-pop companies in terms of credit. When in reality Casper is outspending other companies by five times. Trust understands how important marketing dollars are and gives them terms that are financially better.”

Powered by WPeMatico

Cart.com, a Houston-based company providing end-to-end e-commerce services, brought in its third funding round this year, this time a $98 million Series B round to bring its total funding to $143 million.

Oak HC/FT led the new round of funding and was joined by PayPal Ventures, Clearco, G9 Ventures, Mercury Fund, Valedor Partners and Arsenal Growth. Strategic investors in the Series B include Heyday CEO Sebastian Rymarz and Casper CEO Philip Krim. This new round follows a $25 million Series A round, led by Mercury and Arsenal in July, and a $20 million seed round from Bearing Ventures.

Cart.com CEO Omair Tariq, who was previously an executive at Home Depot and COO of Blinds.com, co-founded the company in September 2020 with Jim Jacobson, former CEO of RTIC Outdoors.

Tariq told TechCrunch that the company provides software, services and infrastructure to businesses so they can scale online. Cart.com is taking the best parts of selling direct-to-consumer on marketplaces like Amazon and Shopify to create value for brands. Tariq said he is pioneering the term “e-commerce-as-a-service” to bring together under one platform a suite of business tools like storefront software, marketing, fulfillment, payments and customer service.

“We see the power of having an interconnected platform,” Tariq said. “There also needs to be a hybrid between selling direct-to-consumer and on Amazon and Shopify for companies that don’t have the money to pay for a percentage of their sales and receive no access to customers or data, and needing 20 different plug-ins that are not connected.”

Cart.com went after the new funding after seeing validation of its idea: brands coming to them wanting more products and services, which led to acquisitions. The company has acquired seven companies so far, including — AmeriCommerce, Spacecraft Brands and, more recently, DuMont Project and Sauceda Industries. Tariq is planning for another three or four by the end of the year.

In addition, it received inbound interest from strategic investors, like Oak and PayPal, which Tariq said was going to enable the company “to be more successful faster.”

Allen Miller, principal at Oak HC/FT, said after spending time with Tariq to understand his vision about Cart.com’s software, payments and services, he felt that the company was doing something that didn’t exist in today’s commerce infrastructure.

He said that Cart.com is well positioned to help companies, like those with $1 million in sales, stay focused on growing the business while Cart.com stitches together all of the tools for them to operate in the background.

“It’s a unique offering to merchants that has a high value proposition,” Miller said. “The vision and drive that Omair and Jim have, along with an inspiring mission they want to achieve — to be brand-centric and help the next generation of merchants. These guys also have a good playbook on finding companies and teams to acquire, as well as handling the post M&A to have everyone on one platform.”

The new financing will enable Cart.com to further invest in technology development and to increase headcount by at least 15 times, with plans to go from fewer than two dozen employees to more than 300 team members by the end of the year. The company has nearly 70 jobs posted on its website for positions in engineering, technology, digital marketing and e-commerce. Tariq also expects half of the funds to go toward more acquisitions.

Cart.com currently serves over 2,000 e-commerce brands, including GNC, Haymaker Coffee and KeHE, and processes more than $700 million in gross merchandise value per year. The company saw revenue increase 400% since the platform’s launch in November.

In addition, the company has nine fulfillment centers across the country, and is increasing its access to reach 80% of the U.S. population with two-day shipping, Tariq added.

“We are giving the power back to brands by giving them what they need to operate e-commerce,” he said. “There are still a few pieces to fill in so brands have a unified experience, but with us, they can add fulfilment, marketing or customer conversion tools with the click of a couple of buttons.”

Powered by WPeMatico

Will Clem knows all too well about restaurant workers not showing up for a shift. At least one person would have car trouble or need to stay home with sick children, and it became a common occurrence on the weekends for the co-founder of Memphis Meats and owner of Baby Jacks BBQ in Memphis.

Needing to fill a shift one Friday night, Clem decided to prop his laptop in the drive-thru lane of one of his restaurants and took orders from home by remoting into the system. No one noticed that he wasn’t actually taking orders from the kitchen itself. Thus came the idea for Bite Ninja, a remote hiring technology platform for restaurants.

Clem connected with Orin Wilson to start the company in 2020 and worked for a year on the technology before launching it in March. Today, the company announced $675,000 in pre-seed funding led by Y Combinator, AgFunder and Manta Ray.

With many restaurants unable to find workers as a result of the global pandemic, Clem and Wilson wanted to build a technology that would enable restaurants to go back to normal operating hours, or even reopen their stores. At the same time, the workers, or “Ninjas” as they are referred to, can work the drive-thru or counter for a lunch or dinner rush shift from home, but appear on-screen to customers via menu boards, Wilson said.

Bite Ninja drive-thru. Image Credits: Bite Ninja

“When a restaurant is slammed, you need an army of people to work the rush, but it is not reasonable to ask them to get in their uniform and get in their cars, last-minute, to clock in for just an hour or two,” he added. “They have control of their schedule and can pick the right shift for them. It is so popular that we typically have five to 10 people bidding on each shift.”

Bite Ninja is providing a better experience and reaches potential workers that would not necessarily have an interest in performing fast food work. Many of the 3,000 Ninjas already working with the company are stay-at-home moms and retirees with customer service experience, but who can’t physically come into a store, Clem said. In addition, the company is working with the Nurse-Family Partnership to help women get back into the workforce.

The company initially ran three pilot programs and has expanded services to curbside and front cashier stations. The funding will enable Bite Ninja to scale initiatives, hire additional software engineers and prepare for a rollout at national food chains.

Since launching earlier this year, Bite Ninja is already being used in a few thousand stores.

Manuel Gonzalez, partner at AgFunder, said restaurants are a big part of entrepreneurship, but the pandemic forced more than 110,000 of them out of business.

“Bite Ninja’s solution is one that decreases costs to restaurant owners, but increases the income of the worker,” he said. “It also helps entrepreneurs and the community because restaurants are important for economic, cultural, community and social points of view.”

Powered by WPeMatico