funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Monarch, a subscription-based platform that aims to help consumers “plan and manage” their financial lives, has raised $4.8 million in seed funding.

Accel led the round, which also included participation from SignalFire, and brings the Mountain View-based yet fully distributed startup’s total funding since its 2019 inception to $5.5 million.

Co-founder and CEO Val Agostino was the first product manager on the original team that built Mint.com. There, he said, he saw firsthand that Americans with a greater understanding of financial matters “needed software solutions that went beyond just tracking and budgeting.”

“They needed help planning their financial future and understanding the tradeoffs between competing financial priorities,” he said.

Monarch aims to help people address those needs with software it says “makes it easy” for people to outline their financial goals and then create a detailed, forward-looking plan toward achieving them.

“We then help customers track their progress against their plan and automatically course correct as their financial situation changes, which it always does,” Agostino said.

Monarch came out of private beta in early 2021 with apps for web, iOS and Android, and is priced at $9.99 per month or $89.99 per year. The startup intentionally opted to not be ad-supported or sell customers’ financial data.

These approaches are “misaligned with users’ financial interests,” Agostino said.

“We felt that a subscription business model would best support that ethos and align our users’ interests with our own,” he added. Since launching publicly, Monarch has been growing its paid subscriber base by about 9% per week.

Image Credits: Monarch

Monarch launched during the pandemic, the uncertainty of which carried over into people’s financial lives, believes Agostino.

“As a result, we saw a lot of people make use of Monarch’s forecasting features to compare different ‘what if ‘scenarios such as switching jobs or moving to a different city or state,” he said.

Earlier this month, TechCrunch reported on a company with a similar mission, BodesWell, teaming up with American Express on a financial planning tool for its cardholders. Agostino said that Monarch is similar to BodesWell in that both startups help customers map a financial plan and future.

“The difference is that Monarch also has a full suite of PFM tools, such as budgeting, reporting and investment analysis,” he said. “The benefit to the consumer is that because Monarch is connected to your entire financial picture, we can help you actually stay on track with your financial plan and/or update the plan in real time if needed.”

Accel’s Daniel Levine said that until he came across Monarch, he was “somehow still a Mint customer despite its obsolescence.”

Over the past decade, the landscape for financial products has expanded dramatically, with more people having brokerage and crypto accounts, for example, Levine said.

In his view, Monarch stands out for a couple of reasons. For one, it’s a subscription product.

“One thing I always hated about Mint was when it would suggest the objectively wrong credit card for me,” Levine said. “It has all of my transaction data, it should tell me the card with the best rewards for me. Monarch is set up to never compromise what’s best for the user in favor of advertising.”

Secondly, Monarch’s aim is to serve as the infrastructure for its customers. To do that, it needs to monitor all of someone’s finances.

“They need to track checking, credit cards, brokerage, real estate and crypto,” he said. “Monarch is committed to doing that. It’s an incredibly painful problem and even though Monarch is a new entrant in the space, I think they’ve clearly separated themselves on that dimension.”

Powered by WPeMatico

Paystone, a payments and integrated software company, secured another strategic investment this year, this time $23.8 million ($30 million CAD) from Crédit Mutuel Equity, the private equity arm of Crédit Mutuel Alliance Fédérale.

The Canada-based company got its start in 2008 as the payment processing company Zomaron, and rebranded itself as Paystone in 2019. Today it provides electronic payments and customer engagement technology to businesses, particularly those that provide services, CEO Tarique Al-Ansari told TechCrunch.

“Paystone is on a mission to help businesses grow, and we were enthralled by their commitment to that mission and their focus on service-oriented verticals,” said Léa Perge, investor at Crédit Mutuel Equity in Canada, via email.

While most of the company’s peers focus on product companies, Al-Ansari saw how underserved the service side was: their needs are different, and unlike retail, aren’t looking to sell online. Rather, they need an online presence and digital marketing to engage with customers, but their focus is being findable and having content that tells people why they should do business with them.

Paystone provides the marketing through content, help with reviews and with loyalty and rewards programs. However, rather than reward for spending, Paystone rewards for behavior. Refer a friend, get a reward. Write a review, get a reward. Al-Ansari calls it “payments as a benefit.” Referrals and reviews are how businesses become more findable, and the more content that’s out there, the more it helps people consider the business trustworthy, he added.

The new funding gives Canada-based Paystone total funds raised in 2021 of $78.8 million in a mix of debt and equity. It raised $54.9 million in January, funds that were barely touched as of yet, Al-Ansari said.

Though he wasn’t actively seeking new funds, Al-Ansari had been speaking with Crédit Mutuel Equity, which used to be CIC Capital Canada, prior to the pandemic, and their deal was put on hold.

Crédit Mutuel Equity came back with similar interest, and taking into account the kind of talent Paystone wanted to go after and its acquisition strategy — the company has already acquired five companies — Al-Ansari decided to take the additional funds. He said it gives the company options to hire more and double down on building the company, as well as enough capital to look for more acquisitions.

This year, Paystone entered the U.S. market for the first time and will do a proper launch later this year. The company has over 30,000 merchant locations on its platform throughout North America, and Al-Ansari expects that to grow by 5,000 this year. The company has 150 employees currently, and another 50 are expected to come on board by the end of the year.

In addition, Al-Ansari expects growth to accelerate for the rest of the year. The company processes around $6 billion in credit card payments and is on track to bring in $55.7 million in revenue this year. It is cash flow positive, residuals from the company’s origins of being bootstrapped, he said.

“We want to become the go-to destination for service businesses to set up a digital presence to accept payments and provide loyalty and rewards,” Al-Ansari said. “We will do this by solidifying our market position and growing our platform with the tools that customers want.”

Powered by WPeMatico

Open-source framework startup Serverless Stack announced Friday that it raised $1 million in seed funding from a group of investors that includes Greylock Partners, SV Angel and Y Combinator.

The company was founded in 2017 by Jay V and Frank Wang in San Francisco, and they were part of Y Combinator’s 2021 winter batch.

Serverless Stack’s technology enables engineers to more easily build full-stack serverless apps. CEO V said he and Wang were working in this space for years with the aim of exposing it to a broader group of people.

While tooling around in the space, they determined that the ability to build serverless apps was not getting better, so they joined Y Combinator to hone their idea on how to make the process easier.

Here’s how the technology works: The open-source framework allows developers to test and make changes to their applications by directly connecting their local machines to the cloud. The problem with what V called an “old-school process” is that developers would upload their apps to the cloud, wait for it to run and then make any changes. Instead, Serverless Stack connects directly to the cloud for the ability to debug applications locally, he added.

Since its launch six months ago, Serverless Stack has grown to over 2,000 stars on GitHub and was downloaded more than 60,000 times.

Dalton Caldwell, managing director of YC, met V and Wang at the cohort and said he was “super impressed” because the pair were working in the space for a long time.

“These folks are experts — there are probably just half a dozen people who know as much as they do, as there aren’t that many people working on this technology,” Caldwell told TechCrunch. “The proof is in the pudding, and if they can get people to adopt it, like they did on GitHub so far, and keep that community engagement, that is my strongest signal of staying power.”

V has earmarked the new funding to expand the team, including hiring engineers to support new use cases.

Serverless initially gravitated toward specific use cases — APIs are now allowing its community to chime in and it is using that as a guide, V said. It recently announced more of a full-stack use case for building out APIs with a database and also building out the front end frameworks.

Ultimately, V’s roadmap includes building out more tools with a vision of getting Serverless Stack to the point where a developer can come on with an idea and take it all the way to an IPO using his platform.

“That’s why we want the community to drive the roadmap,” V told TechCrunch. “We are focused on what they are building and when they are in production, how they are managing it. Eventually, we will build out a dashboard to make it easier for them to manage all of their applications.”

Powered by WPeMatico

It’s pretty easy for individuals to send money back and forth, and there are lots of cash apps from which to choose. On the commercial side, however, one business trying to send $100,000 the same way is not as easy.

Paystand wants to change that. The Scotts Valley, California-based company is using cloud technology and the Ethereum blockchain as the engine for its Paystand Bank Network that enables business-to-business payments with zero fees.

The company raised $50 million Series C funding led by NewView Capital, with participation from SoftBank’s SB Opportunity Fund and King River Capital. This brings the company’s total funding to $85 million, Paystand co-founder and CEO Jeremy Almond told TechCrunch.

During the 2008 economic downturn, Almond’s family lost their home. He decided to go back to graduate school and did his thesis on how commercial banking could be better and how digital transformation would be the answer. Gleaning his company vision from the enterprise side, Almond said what Venmo does for consumers, Paystand does for commercial transactions between mid-market and enterprise customers.

“Revenue is the lifeblood of a business, and money has become software, yet everything is in the cloud except for revenue,” he added.

He estimates that almost half of enterprise payments still involve a paper check, while fintech bets heavily on cards that come with 2% to 3% transaction fees, which Almond said is untenable when a business is routinely sending $100,000 invoices. Paystand is charging a flat monthly rate rather than a fee per transaction.

Paystand’s platform. Image Credits: Paystand

On the consumer side, companies like Square and Stripe were among the first wave of companies predominantly focused on accounts payable and then building business process software on top of an existing infrastructure.

Paystand’s view of the world is that the accounts receivables side is harder and why there aren’t many competitors. This is why Paystand is surfing the next wave of fintech, driven by blockchain and decentralized finance, to transform the $125 trillion B2B payment industry by offering an autonomous, cashless and feeless payment network that will be an alternative to cards, Almond said.

Customers using Paystand over a three-year period are able to yield average benefits like 50% savings on the cost of receivables and $850,000 savings on transaction fees. The company is seeing a 200% increase in monthly network payment value and customers grew two-fold in the past year.

The company said it will use the new funding to continue to grow the business by investing in open infrastructure. Specifically, Almond would like to reboot digital finance, starting with B2B payments, and reimagine the entire CFO stack.

“I’ve wanted something like this to exist for 20 years,” Almond said. “Sometimes it is the unsexy areas that can have the biggest impacts.”

As part of the investment, Jazmin Medina, principal at NewView Capital, will join Paystand’s board. She told TechCrunch that while the venture firm is a generalist, it is rooted in fintech and fintech infrastructure.

She also agrees with Almond that the B2B payments space is lagging in terms of innovation and has “strong conviction” in what Almond is doing to help mid-market companies proactively manage their cash needs.

“There is a wide blue ocean of the payment industry, and all of these companies have to be entirely digital to stay competitive,” Medina added. “There is a glaring hole if your revenue is holding you back because you are not digital. That is why the time is now.”

Powered by WPeMatico

The global pandemic highlighted inefficiencies and inconsistencies in healthcare systems around the world. Even co-founders Mayank Banerjee, Matilde Giglio and Alessandro Ialongo say nowhere is this more evident than in India, especially after the COVID death toll reached 4 million this week.

The Bangalore-based company received a fresh cash infusion of $5 million in seed funding in a round led by Khosla Ventures, with participation from Founders Fund, Lachy Groom and a group of individuals including Palo Alto Networks CEO Nikesh Arora, CRED CEO Kunal Shah, Zerodha founder Nithin Kamath and DST Global partner Tom Stafford.

Even, a healthcare membership company, aims to cover what most insurance companies in the country don’t, including making going to a primary care doctor as easy and accessible as it is in other countries.

Banerjee grew up in India and said the country is similar to the United States in that it has government-run and private hospitals. Where the two differ is that private health insurance is a relatively new concept for India, he told TechCrunch. He estimates that less than 5% of people have it, and even though people are paying for the insurance, it mainly covers accidents and emergencies.

This means that routine primary care consultations, testings and scans outside of that are not covered. And, the policies are so confusing that many people don’t realize they are not covered until it is too late. That has led to people asking doctors to admit them into the hospital so their bills will be covered, Ialongo added.

Banerjee and Giglio were running another startup together when they began to see how complicated health insurance policies were. About 50 million Indians fall below the poverty line each year, and many become unable to pay their healthcare bills, Banerjee said.

They began researching the insurance industry and talking with hospital executives about claims. They found that one of the biggest issues was incentive misalignment — hospitals overcharged and overtreated patients. Instead, Even is taking a similar approach to Kaiser Permanente in that the company will act as a service provider, and therefore, can drive down the cost of care.

Even became operational in February and launched in June. It is gearing up to launch in the fourth quarter of this year with more than 5,000 people on the waitlist so far. Its health membership product will cost around $200 per year for a person aged 18 to 35 and covers everything: unlimited consultations with primary care doctors, diagnostics and scans. The membership will also follow as the person ages, Ialongo said.

The founders intend to use the new funding to build out their operational team, product and integration with hospitals. They are already working with 100 hospitals and secured a partnership with Narayana Hospital to deliver more than 2,000 COVID vaccinations so far, and more in a second round.

“It is going to take a while to scale,” Banerjee said. “For us, in theory, as we get better pricing, we will end up being cheaper than others. We have goals to cover the people the government cannot and find ways to reduce the statistics.”

Powered by WPeMatico

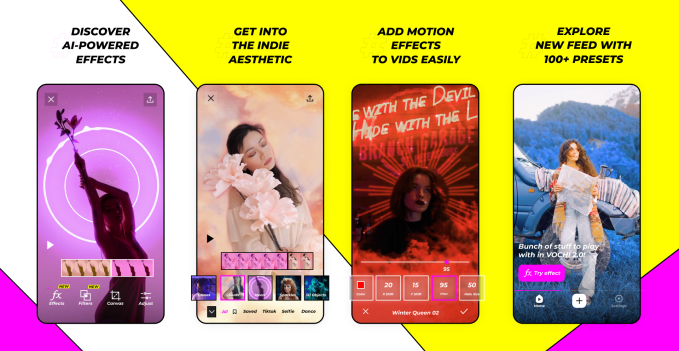

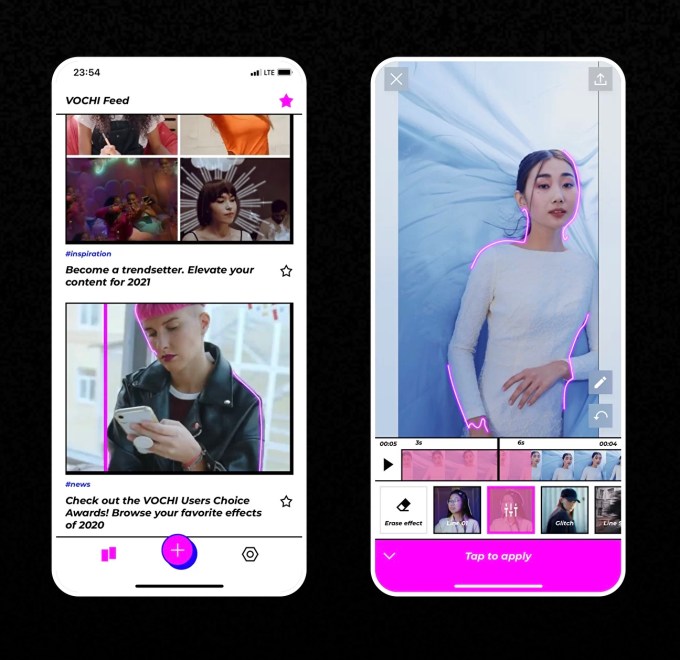

VOCHI, a Belarus-based startup behind a clever computer vision-based video editing app used by online creators, has raised an additional $2.4 million in a “late-seed” round that follows the company’s initial $1.5 million round led by Ukraine-based Genesis Investments last year. The new funds follow a period of significant growth for the mobile tool, which is now used by more than 500,000 people per month and has achieved a $4 million-plus annual run rate in a year’s time.

Investors in the most recent round include TA Ventures, Angelsdeck, A.Partners, Startup Wise Guys, Kolos VC and angels from companies like Belarus-based Verv and Estonian unicorn Bolt. Along with the fundraise, VOCHI is elevating the company’s first employee, Anna Buglakova, who began as head of marketing, to the position of co-founder and chief product officer.

According to VOCHI co-founder and CEO Ilya Lesun, the company’s idea was to provide an easy way for people to create professional edits that could help them produce unique and trendy content for social media that could help them stand out and become more popular. To do so, VOCHI leverages a proprietary computer vision-based video segmentation algorithm that applies various effects to specific moving objects in a video or to images in static photos.

“To get this result, there are two trained [convolutional neural networks] to perform semi-supervised Video Object Segmentation and Instance Segmentation,” explains Lesun, of VOCHI’s technology. “Our team also developed a custom rendering engine for video effects that enables instant application in 4K on mobile devices. And it works perfectly without quality loss,” he adds. It works pretty fast, too — effects are applied in just seconds.

The company used the initial seed funding to invest in marketing and product development, growing its catalog to over 80 unique effects and more than 30 filters.

Image Credits: VOCHI

Today, the app offers a number of tools that let you give a video a particular aesthetic (like a dreamy vibe, artistic feel, or 8-bit look, for example). It also can highlight the moving content with glowing lines, add blurs or motion, apply different filters, insert 3D objects into the video, add glitter or sparkles and much more.

In addition to editing their content directly, users can swipe through a vertical home feed in the app where they can view the video edits others have applied to their own content for inspiration. When they see something they like, they can then tap a button to use the same effect on their own video. The finished results can then be shared out to other platforms, like Instagram, Snapchat and TikTok.

Though based in Belarus, most of VOCHI’s users are young adults from the U.S. Others hail from Russia, Saudi Arabia, Brazil and parts of Europe, Lesun says.

Unlike some of its video editor rivals, VOCHI offers a robust free experience where around 60% of the effects and filters are available without having to pay, along with other basic editing tools and content. More advanced features, like effect settings, unique presents and various special effects, require a subscription. This subscription, however, isn’t cheap — it’s either $7.99 per week or $39.99 for 12 weeks. This seemingly aims the subscription more at professional content creators rather than a casual user just looking to have fun with their videos from time to time. (A one-time purchase of $150 is also available, if you prefer.)

To date, around 20,000 of VOCHI’s 500,000 monthly active users have committed to a paid subscription, and that number is growing at a rate of 20% month-over-month, the company says.

Image Credits: VOCHI

The numbers VOCHI has delivered, however, aren’t as important as what the startup has been through to get there.

The company has been growing its business at a time when a dictatorial regime has been cracking down on opposition, leading to arrests and violence in the country. Last year, employees from U.S.-headquartered enterprise startup PandaDoc were arrested in Minsk by the Belarus police, in an act of state-led retaliation for their protests against President Alexander Lukashenko. In April, Imaguru, the country’s main startup hub, event and co-working space in Minsk — and birthplace of a number of startups, including MSQRD, which was acquired by Facebook — was also shut down by the Lukashenko regime.

Meanwhile, VOCHI was being featured as App of the Day in the App Store across 126 countries worldwide, and growing revenues to around $300,000 per month.

“Personal videos take an increasingly important place in our lives and for many has become a method of self-expression. VOCHI helps to follow the path of inspiration, education and provides tools for creativity through video,” said Andrei Avsievich, general partner at Bulba Ventures, where VOCHI was incubated. “I am happy that users and investors love VOCHI, which is reflected both in the revenue and the oversubscribed round.”

The additional funds will put VOCHI on the path to a Series A as it continues to work to attract more creators, improve user engagement and add more tools to the app, says Lesun.

Powered by WPeMatico

Sendlane, a San Diego-based multichannel marketing automation platform, announced Thursday it raised $20 million in Series A funding.

Five Elms Capital and others invested in the round to give Sendlane total funding of $23 million since the company was founded in 2018.

Though the company officially started three years ago, co-founder and CEO Jimmy Kim told TechCrunch he began working on the idea back in 2013 with two other co-founders.

They were all email marketers in different lines of business, but had some common ground in that they were all using email tools they didn’t like. The ones they did like came with too big of a price tag for a small business, Kim said. They set out to build their own email marketing automation platform for customers that wanted to do more than email campaigns and newsletters.

When two other companies Kim was involved in exited in 2017, he decided to put both feet into Sendlane to build it into a system that maximized revenue based on insights and integrations.

In late 2018, the company attracted seed funding from Zing Capital and decided in 2019 to pivot into e-commerce. “Based on our personal backgrounds and looking at the customers we worked with, we realized that is what we did best,” Kim said.

Today, more than 1,700 e-commerce companies use Sendlane’s platform to convert more than 100 points of their customers’ data — abandoned carts, which products sell the best and which marketing channel is working — into engaging communications aimed at driving customer loyalty. The company said it can increase revenue for customers between 20% and 40% on average.

The company itself is growing 100% year over year and seeing over $7 million in annual recurring revenue. It currently has 54 employees right now, and Kim expects to be at around 90 by the end of the year and 150 by the end of 2022. Sendlane currently has more than 20 open roles, he said.

That current and potential growth was a driver for Kim to go after the Series A funding. He said Sendlane became profitable last year, which is why it has not raised a lot of money so far. However, as the rapid adoption of e-commerce continues, Kim wants to be ready for the next wave of competition coming in, which he expects in the next year.

He considers companies like ActiveCampaign and Klaviyo to be in line with Sendlane, but says his company’s differentiator is customer service, boasting short wait times and chats that answer questions in less than 15 seconds.

He is also ready to go after the next vision, which is to unify data and insights to create meaningful interactions between customers and retailers.

“We want to start carving out a new space,” Kim added. “We have a ton of new products coming out in the next 12 to 18 months and want to be the single source for customer journey data insights that provides flexibility for your business to grow.”

Two upcoming tools include Audiences, which will unify customer data and provide insights, and an SMS product for two-way communications and enabled campaign-level sending.

Powered by WPeMatico

Tailor Brands, a startup that automates parts of the branding and marketing process for small businesses, announced Thursday it has raised $50 million in Series C funding.

GoDaddy led the round as a strategic partner and was joined by OurCrowd and existing investors Pitango Growth, Mangrove Capital Partners, Armat Group, Disruptive VC and Whip Media founder Richard Rosenblatt. Tailor Brands has now raised a total of $70 million since its inception in 2015.

“GoDaddy is empowering everyday entrepreneurs around the world by providing all of the help and tools to succeed online,” said Andrew Morbitzer, vice president of corporate development at GoDaddy, in a written statement. “We are excited to invest in Tailor Brands — and its team — as we believe in their vision. Their platform truly helps entrepreneurs start their business quickly and easily with AI-powered logo design and branding services.”

When Tailor Brands, which launched at TechCrunch’s Startup Battlefield in 2014, raised its last round, a $15.5 million Series B, in 2018, the company was focused on AI-driven logo creation.

The company, headquartered in New York and Tel Aviv, is now compiling the components for a one-stop SaaS platform — providing the design, branding and marketing services a small business owner needs to launch and scale operations, and within minutes, Yali Saar, co-founder and CEO of Tailor Brands told TechCrunch.

Over the past year, more users are flocking to Tailor Brands; the company is onboarding some 700,000 new users per month for help in the earliest stages of setting up their business. In fact, the company saw a 27% increase in new business incorporations as the creator and gig economy gained traction in 2020, Saar said.

In addition to the scores of new users, the company crossed 30 million businesses using the platform. At the end of 2019, Tailor Brands started monetizing its offerings and “grew at a staggering rate,” Saar added. The company yielded triple-digit annual growth in revenue.

To support that growth, the new funding will be used on R&D, to double the team and create additional capabilities and functions. There may also be future acquisition opportunities on the table.

Saar said Tailor Brands is at a point where it can begin leveraging the massive amount of data on small businesses it gathers to help them be proactive rather than reactive, turning the platform into a “consultant of sorts” to guide customers through the next steps of their businesses.

“Users are looking for us to provide them with everything, so we are starting to incorporate more products with the goal of creating an ecosystem, like WeChat, where you don’t need to leave the platform at all to manage your business,” Saar said.

Powered by WPeMatico

Slack set the standard in many ways for what knowledge workers want and expect out of a workplace collaboration app these days, but a lot has been left on the table when it comes to frontline workers. Today, one of the software companies that has built a popular app for that frontline crowd to become a part of the conversation is announcing a funding round that speaks to the opportunity to do more.

Yoobic, which provides an app for frontline and service workers to manage tasks, communicate with each other and management, and also go through training, development and other e-learning tasks, has picked up $50 million.

Highland Europe led the round, a Series C, with previous investors Felix Capital, Insight Partners and a family office advised by BNF Capital Limited also participating. (Felix led Yoobic’s Series A, while Insight Partners led the Series B in 2019.) Yoobic is not discussing valuation, but from what I understand from a reliable source, it is now between $300 million and $400 million.

The funding comes at a time of strong growth for the company.

Yoobic works with some 300 big brands in 80 countries altogether covering a mammoth 335,000 locations in sectors like retail, hospitality, distribution and manufacturing. Its customers include the likes of the Boots pharmacy chain, Carrefour supermarkets, Lancôme, Lacoste, Logitech, Lidl, Peloton, Puma, Vans, VF Corp, Sanofi, Untuckit, Roots, Canada Goose, Longchamp, Lidl, Zadig & Voltaire and Athletico.

But that is just the tip of the iceberg. It’s estimated that there are 2.7 billion “deskless” (frontline and service) workers globally, accounting for no less than 80% of the world’s workforce. But here is the shocker: only 1% of IT budgets is currently spent on them. That speaks of huge opportunity for startups to build more here, but only if they (or the workers themselves) can manage to convince those holding the purse strings that it’s worth the investment.

So to that end, the funding will be used to hire more talent, to expand geographically — founded in London, the company is now headquartered in New York — and to expand its product. Specifically, Yoobic plans to build more predictive analytics to improve responsiveness and give more insight to companies about their usage, and to build out more tools to cater to specific verticals in the world of frontline work, such as manufacturing, logistics and transportation, Fabrice Haiat, CEO and co-founder of YOOBIC, told TechCrunch in an interview.

Yoobic started life several years ago with a focus specifically on retail — an area that it was concentrating on as recently as its last round in 2019, providing tools to help with merchandizing, communicating about stock between stores and more. While retail is still a sizeable part of its business, Yoobic saw an opening to expand into a wider pool of verticals with frontline and service employees that had many of the same demands as retail.

That turned out to be a fortunate pivot as the pandemic struck.

“COVID-19 had a big impact on us,” said Haiat, who co-founded the company with brothers Avi and Gilles. “The first two months we were in panic mode. But what happened was that businesses realized that frontline employees were critical to the success of their operations.”

Since COVID hit last year, he said that activity on the platform rose by 200%, and earlier this year it passed 1 million activities per month on its platform. “We are growing like crazy,” Haiat said.

There are a number of reasons why building for frontline workers is important. Roaming around without a fixed desk, spending more time with customers than looking at a screen or in meetings, and generally having different business priorities and practices are just a few of the reasons why software built for the former doesn’t necessarily work for the latter.

There have been a number of companies that have aimed to build services to address that gap — they stretch back years, in fact. And there have been some interesting moves to consolidate in the market among those building some of the more successful tools for people in the field: Crew recently got acquired by Square; ServiceMax acquired Zinc; and Facebook’s Workplace has been on a march to amass some of the world’s biggest companies as customers of its own communications platform with a strong play for frontline workers.

Haiat argues that while all of these are fine and well, none of them understand the full scope of the kinds of tools that those in the field really need. That ranges from practical features (such as a way to handle inventory management), through to features that companies would love to have for their employees as long as they can be delivered in an easy way (such as professional development and training). In that context, the basic communications that all of the current crop of apps for frontline workers offer feel like basic table stakes.

That close understanding of the gap in the market and what is needed to fix it is one reason why the company has seen such strong growth, as well as interest from investors.

“We’re excited to partner with YOOBIC, which, thanks to the highly impressive team led by Fabrice, Avi and Gilles, has clearly established itself as a leader in the digital workplace space with demonstrable market traction and impressive growth,” said Jean Tardy-Joubert, partner at Highland Europe, in a statement. “While companies have historically focused on digital investments for deskbound employees, the world is becoming distributed and decentralized. We anticipate a seismic shift that will see huge resources, technology, and capital shifted toward frontline teams.” Tardy-Joubert will be joining the Yoobic board with this round.

Powered by WPeMatico

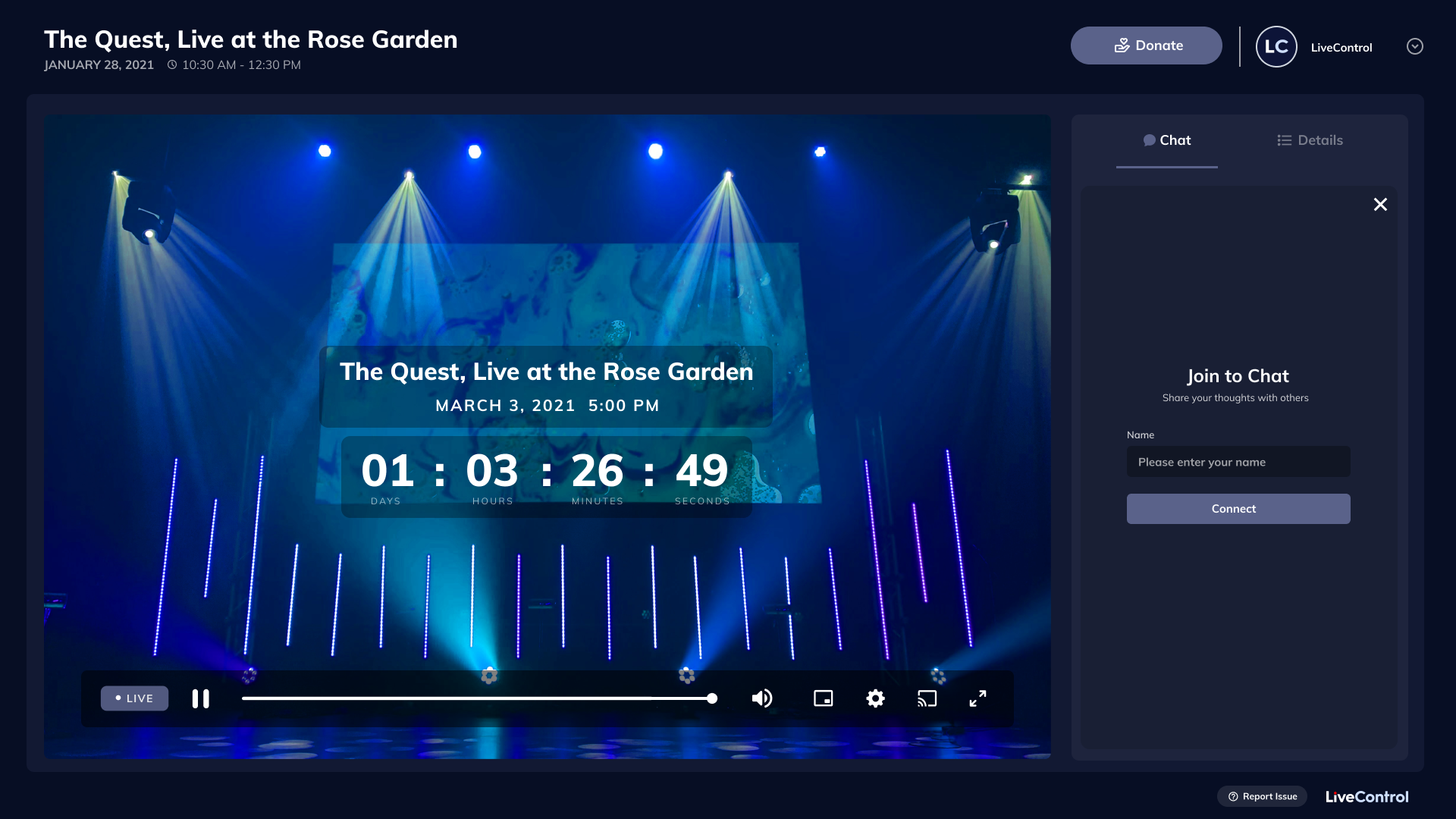

One thing seems certain: The past year-and-a-half has fundamentally transformed the world of live events. The pandemic left plenty of venues scrambling for alternative revenue streams and, in many cases, shutting down for good.

On the flip side, it’s been a massive driver for those companies working to expand the reach of in-person events. Take LiveControl, which just raised a $30 million Series A led by Coatue and featuring existing investors First Round Capital, Box Group, Susa Ventures and TriplePoint. The round brings the So Cal company’s total funding to $33 million, on the heels of a $3.2 million seed led by FRC last August.

The company offers a production suite that’s a sort of plug and play solution for venues. “What if you could snap your fingers and an entire video product crew would appear, for just $150?” CEO Patrick Coyne asked, extremely rhetorically in a comment offered to TechCrunch.

Image Credits: LiveControl

LiveControl says its technology has been deployed in “hundreds” of spots in the U.S., everywhere from music venues and comedy clubs to Broadway theaters and religious institutions. With its device agnostic software and support, the company also provides third-party camera hardware as part of a package, for a more out-of-the-box solution.

The latest funding round will go toward accelerating its technology and expanding employee headcount from 40 people to 120 over the next year and a half. LiveControl and its investors are clearly bullish on the possibilities here. But there remain broader questions around how much audience members’ interest in remote viewing regresses to the mean once venues reopen across the country and world.

“Video is now table stakes for most organizations, venues and creators,” says Coyne. “We’re only seeing it accelerate, and everyone is forward leaning to make bigger investments to improve their video quality.”

Powered by WPeMatico