funding

Auto Added by WPeMatico

Auto Added by WPeMatico

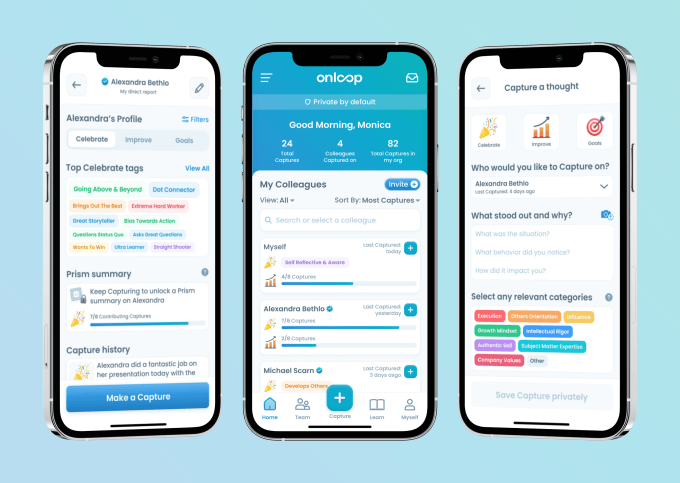

Performance reviews eat up a lot of a manager’s time and are often the most dreaded part of work. OnLoop aims to bring some joy into the process by enabling information-gathering to happen behind the scenes and be easier for hybrid workforces.

The Singapore-based company designed a mobile-first product that consistently gathers employee feedback and goals so that the company has better insights into how both individuals and teams are doing. The feedback is also captured and converted into auto-generated reviews that lay out all of the content collected for managers to then quickly put together a finished product.

The platform was in private beta since January 2021, and after a successful run with 25 companies, OnLoop raised $5.5 million co-led by MassMutual Ventures and Square Peg Capital along with Hustle Fund and a group of angel investors including XA Network, BCG’s Aliza Knox, Uber’s Andrew Macdonald, Ready’s Allen Penn, Google’s Bambos Kaisharis, Ripple’s Brooks Entwistle, Robert Hoyt, Nordstar’s Eddie Lee, Nas Academy’s Alex Dwek and hedge fund managers John Candeto and Keshav Lall.

OnLoop co-founder and CEO Projjal Ghatak spent over three years at Uber and said he saw his fair share of productivity tools, but still struggled to develop his own team as tasks and communication were done differently by each employee.

“This is the one problem that companies consistently complain about — not having the right tool to develop teams,” he added.

As someone who began spending more and more time on his phone, Ghatak wanted his product to be mobile-native and eliminate the need for managers to start from scratch on performance reviews each time. Rather than spend days gathering the information, as the name suggests, OnLoop continuously and automatically captures the data and converts it into a well-written summary.

OnLoop app. Image Credits: OnLoop

Having that continuous loop of information is good for morale, he said. He points to data that shows regular self-reflection and feedback increased productivity by 20%, and a Gallup study where only 14% of employees thought their performance reviews inspired them to improve.

“A lot of company culture is set by the leaders, so as they want to drive this culture in their organizations, we are the tool that drives this,” Ghatak said. “Our job is to help educate the teams on how to do that well. We hear time and time again to make it fun and convenient. Teams don’t realize that if you are helping colleagues understand, showing them a light they didn’t have before, it will drive impact.”

The new funding will be mainly invested into product development and R&D, including expanding product, data and engineering teams. The company will also look at its sales and marketing framework. The company currently has 22 employees.

OnLoop was able to convert some of its early adopters into paying customers and is now focusing on figuring out a scalable way to get the product into the hands of more teams.

Piruze Sabuncu, partner at Square Peg Capital, experienced the pain of performance reviews when she was working in Stripe’s Southeast Asia and Hong Kong region. One of the challenges she faced working with regional teams was that an employee’s direct manager could be located elsewhere, yet work closely with a manager in their respective office.

Square Peg itself uses OnLoop, and Sabuncu said she liked that it is mobile-first and was designed in a way that people didn’t open it up and dread using it.

“Who your manager is, is a big question, but it shouldn’t matter,” she added. “It would still be my duty to be capturing and developing the person even if they were not my direct person. Everyone is talking about remote and hybrid work, and it is not going anywhere — it is here to stay. We believe this is a huge opportunity, a $400 billion market to disrupt, and OnLoop is providing better ways to communicate and give feedback.”

Editor’s note: Due to error, the round amount and lead investors were updated following the announcement.

Powered by WPeMatico

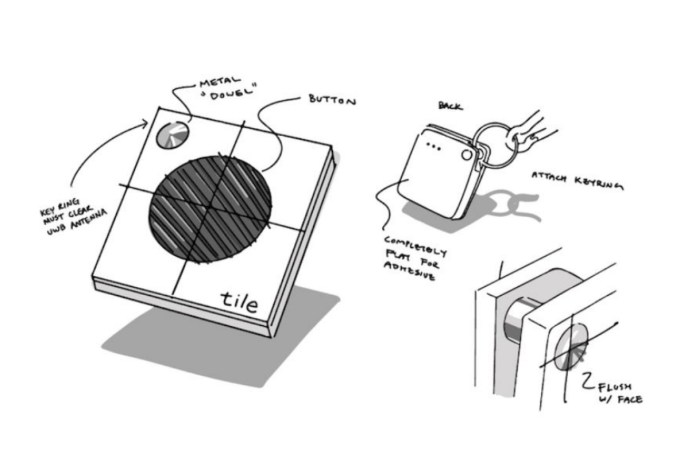

Tile, the maker of Bluetooth-powered lost item finder beacons and, more recently, a staunch Apple critic, announced today it has raised $40 million in non-dilutive debt financing from Capital IP. The funding will be put toward investment in Tile’s finding technologies, ahead of the company’s plan to unveil a new slate of products and features that the company believes will help it to better compete with Apple’s AirTags and further expand its market.

The company has been a longtime leader in the lost item finder space, offering consumers small devices they can attach to items — like handbags, luggage, bikes, wallets, keys and more — which can then be tracked using the Tile smartphone app for iOS or Android. When items go missing, the Tile app leverages Bluetooth to find the items and can make them play a sound. If the items are further afield, Tile taps into its broader finding network consisting of everyone who has the app installed on their phone and other access points. Through this network, Tile is able to automatically and anonymously communicate the lost item’s location back to its owner through their own Tile app.

Image Credits: Tile

Tile has also formed partnerships focused on integrating its finding network into over 40 different third-party devices, including those across audio, travel, wearables and PC categories. Notable brand partners include HP, Dell, Fitbit, Skullcandy, Away, Xfinity, Plantronics, Sennheiser, Bose, Intel and others. Tile says it’s seen 200% year-over-year growth on activations of these devices with its service embedded.

To date, Tile has sold more than 40 million devices and has over 425,000 paying customers — a metric it’s revealing for the first time. It doesn’t disclose its total number of users, both free and paid combined, however. During the first half of 2021, Tile says revenues increased by over 50%, but didn’t provide hard numbers.

While Tile admits that the COVID-19 pandemic had some impacts on international expansions, as some markets have been slower to rebound, it has still seen strong performance outside the U.S., and considers that a continued focus.

The pandemic, however, hasn’t been Tile’s only speed bump.

When Apple announced its plans to compete with the launch of AirTags, Tile went on record to call it unfair competition. Unlike Tile devices, Apple’s products could tap into the iPhone’s U1 chip to allow for more accurate finding through the use of ultra-wideband technologies available on newer iPhone models. Tile, meanwhile, has plans for its own ultra-wideband-powered device, but hadn’t been provided the same access. In other words, Apple gave its own lost item finder early, exclusive access to a feature that would allow it to differentiate itself from the competition. (Apple has since announced it’s making ultra-wideband APIs available to third-party developers, but this access wasn’t available from day one of AirTag’s arrival.)

Image Credits: Tile internal concept art

Tile has been vocal on the matter of Apple’s anti-competitive behavior, having testified in multiple congressional hearings alongside other Apple critics, like Spotify and Match. As a result of increased regulatory pressure, Apple later opened up its Find My network to third-party devices, in an effort to placate Tile and the other rivals its AirTags would disadvantage.

But Tile doesn’t want to route its customers to Apple’s first-party app — it intends to use its own app in order to compete based on its proprietary features and services. Among other things, this includes Tile’s subscriptions. A base plan is $29.99 per year, offering features like free battery replacement, smart alerts and location history. A $99.99 per year plan also adds insurance of sorts — it pays up to $1,000 per year for items it can’t find. (AirTag doesn’t do that.)

Despite its many differentiators, Tile faces steep competition from the ultra-wideband-capable AirTags, which have the advantage of tapping into Apple’s own finding network of potentially hundreds of millions of iPhone owners.

However, Tile CEO CJ Prober — who joined the company in 2018 — claims AirTag hasn’t impacted the company’s revenue or device sales.

“But that doesn’t take away from the fact that they’re making things harder for us,” he says of Apple. “We’re a growing business. We’re winning the hearts and minds of consumers… and they’re competing unfairly.”

“When you own the platform, you shouldn’t be able to identify a category that you want to enter, disadvantage the incumbents in that category, and then advantage yourself — like they did in our case,” he adds.

Tile is preparing to announce an upcoming product refresh that may allow it to better take on the AirTag. Presumably, this will include the pre-announced ultra-wideband version of Tile, but the company says full details will be shared next week. Tile may also expand its lineup in other ways that will allow it to better compete based on look and feel, size and shape, and functionality.

Tile’s last round of funding was $45 million in growth equity in 2019. Now it’s shifted to debt. In addition to new debt financing, Tile is also refinancing some of its existing debt with this fundraise, it says.

“My philosophy is it’s always good to have a mix of debt and equity. So some amount of debt on the balance sheet is good. And it doesn’t incur dilution to our shareholders,” Prober says. “We felt this was the right mix of capital choice for us.”

The company chose to work with Capital IP, a group it’s had a relationship with over the last three years, and who Tile had considered bringing on as an investor. The group has remained interested in Tile and excited about its trajectory, Prober notes.

“We are excited to partner with the Tile team as they continue to define and lead the finding category through hardware and software-based innovations,” said Capital IP’s Managing Partner Riyad Shahjahan, in a statement. “The impressive revenue growth and fast-climbing subscriber trends underline the value proposition that Tile delivers in a platform-agnostic manner, and were a critical driver in our decision to invest. The Tile team has an ambitious roadmap ahead and we look forward to supporting their entry into new markets and applications to further cement their market leadership,” he added.

Powered by WPeMatico

Sorcero announced Thursday a $10 million Series A round of funding to continue scaling its medical and technical language intelligence platform.

The latest funding round comes as the company, headquartered in Washington, D.C. and Cambridge, Massachusetts, sees increased demand for its advanced analytics from life sciences and technical companies. Sorcero’s natural language processing platform makes it easier for subject-matter experts to find answers to their questions to aid in better decision making.

CityRock Venture Partners, the growth fund of H/L Ventures, and Harmonix Fund co-led the round and were joined by new investors Rackhouse, Mighty Capital and Leawood VC, as well as existing investors, Castor Ventures and WorldQuant Ventures. The new investment gives Sorcero a total of $15.7 million in funding since it was founded in 2018.

Prior to starting Sorcero, Dipanwita Das, co-founder and CEO, told TechCrunch she was working in public policy, a place where scientific content is useful, but often a source of confusion and burden. She thought there had to be a more effective way to make better decisions across the healthcare value chain. That’s when she met co-founders Walter Bender and Richard Graves and started the company.

“Everything is in service of subject-matter experts being faster, better and less prone to errors,” Das said. “Advances of deep learning with accuracy add a lot of transparency. We are used by science affairs and regulatory teams whose jobs it is to collect scientific data and effectively communicate it to a variety of stakeholders.”

The total addressable market for language intelligence is big — Das estimated it to be $42 billion just for the life sciences sector. Due to the demand, the co-founders have seen the company grow at 324% year over year since 2020, she added.

Raising a Series A enables the company to serve more customers across the life sciences sector. The company will invest in talent in both engineering and on the commercial side. It will also put some funds into Sorcero’s go-to-market strategy to go after other use cases.

In the next 12 to 18 months, a big focus for the company will be scaling into product market fit in the medical affairs and regulatory space and closing new partnerships.

Oliver Libby, partner at CityRock Venture Partners, said Sorcero’s platform “provides the rails for AI solutions for companies” that have traditionally found issues with AI technologies as they try to integrate data sets that are already in existence in order to run analysis effectively on top of that.

Rather than have to build custom technology and connectors, Sorcero is “revolutionizing it, reducing time and increasing accuracy,” and if AI is to have a future, it needs a universal translator that plugs into everything, he said.

“One of the hallmarks in the response to COVID was how quickly the scientific community had to do revolutionary things,” Libby added. “The time to vaccine was almost a miracle of modern science. One of the first things they did was track medical resources and turn them into a hook for pharmaceutical companies. There couldn’t have been a better use case for Sorcero than COVID.”

Powered by WPeMatico

CoderSchool, a Ho Chi Minh City, Vietnam-based online coding school startup, announced today $2.6 million in pre-Series A funding to scale up its online coding school platform.

This round was led by Monk’s Hill Ventures, with participation from returning seed investors Iterative, XA Network and iSeed Ventures. CoderSchool raised a seed round led by TRIVE Ventures in 2018.

CoderSchool will use the funding to accelerate its online teaching platform growth and technology infrastructure expansion for the company’s technical education programs that guarantee employment upon graduation.

The company, founded in 2015 by Charles Lee and Harley Trung, who previously worked as software engineers, pivoted from offline to online in early 2020 to bring high-quality technical training to everyone, everywhere. After switching to a fully online learning program, the company recorded 100% quarter-over-quarter (QoQ) growth in fully online enrollment, it said in a statement.

“Coding is the future. At CoderSchool, we believe everyone in Southeast Asia deserves a chance to be part of that future,” the company co-founder and CEO Lee said.

In Vietnam, the demand for IT talent is dramatically increasing by 47% a year, while supply is only increasing by 8% year-on-year.

“The need for strong engineers and developers in Southeast Asia has never been as pertinent as it is today with the growth of tech companies and digital businesses,” said Michele Daoud, partner of Monk’s Hill Ventures. “We have been impressed by the team’s focus on setting the standard for coding education in the region. We are excited to partner with CoderSchool to provide both opportunity and access to the millions of aspiring students in Vietnam.”

Given the strong engineer demand in Vietnam, the domestic market size is estimated between $100 million – $200 million, and still increasing every year, according to Lee. CoderSchool has been focusing on Vietnam for the last six years, but plans to enter the global market following the next round, Lee said, without providing exact timetable.

CoderSchool, which offers full-stack web development, machine learning and data sciences courses at a lower cost, has trained more than 2,000 alumni up to date, and recorded over 80% job placement rate for full-time graduates, getting jobs at companies such as BOSCHE, Microsoft, Lazada, Shopee, FE Credit, FPT Software, Sendo, Tiki and Momo.

“After having taught over 2,000 students, we’ve been able to refine our [coding education] content. We rewrote our full-stack web development course — from Ruby, Phyton to JavaScript — in two years, and added new machine learning and data science courses to our program,” Lee told TechCrunch.

CorderSchool’s online program enables students to interact with instructors and classmates before, during and after scheduled class sessions with its human-driven learning strategy. CoderSchool currently has 15 instructional staff, and plans to hire 35 additional instructors by Q4 2022.

CoderSchool’s data analytics has improved individual student performance while also allowing CoderSchool to increase its classroom size at scale, reaching a peak of 107 enrollments in a data science class.

Powered by WPeMatico

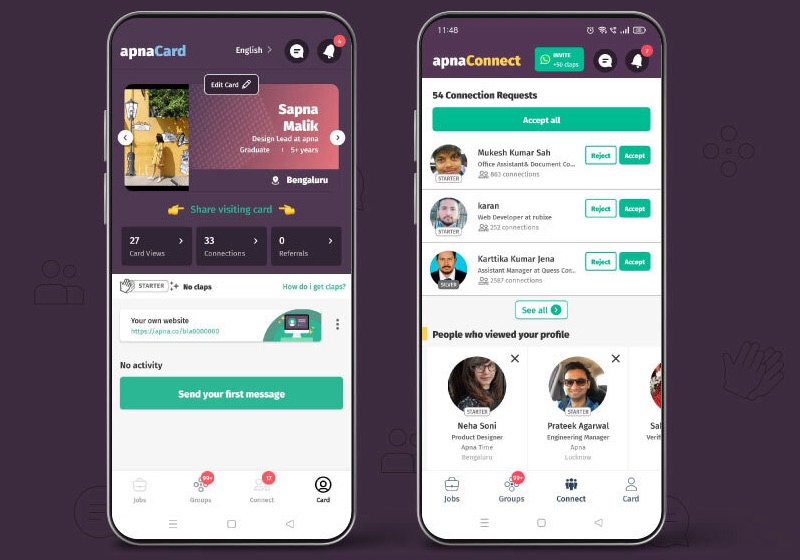

A 22-month-old startup that is helping millions of blue- and gray-collar workers in India learn new skills and find jobs has become the youngest firm to join the coveted unicorn status in the world’s second-largest internet market.

Apna announced on Thursday that it has raised $100 million in a round led by Tiger Global. The new round — a Series C — valued Apna at $1.1 billion. TechCrunch reported last month that Tiger Global, an existing investor in Apna, was in talks to lead a $100 million financing round in the startup at the unicorn valuation.

Owl Ventures, Insight Partners, Sequoia Capital India, Maverick Ventures and GSV Ventures also participated in the new round, which is the third investment secured by Apna this year. Apna was valued at $570 million in its Series B round in June this year.

The investors’ excitement comes as Apna has demonstrated an impressive growth in recent months. The startup has amassed over 16 million users on its 15-month-old eponymous Android app, up from 10 million in June this year.

Indian cities are home to hundreds of millions of low-skilled workers who hail from villages in search of work. Many of them have lost their jobs amid the coronavirus pandemic that has slowed several economic activities in the South Asian market.

Apna has built a platform that provides a community to these workers. In the community, they engage with each other, exchange notes to perform better at interviews and share tips to negotiate better compensation.

Image Credits: Apna

On top of this, Apna connects these workers to potential employers. In an interview with TechCrunch, Apna founder and chief executive Nirmit Parikh said more than 150,000 employers — including Zomato, Bharti AXA, Urban Company, BYJU’S, PhonePe, Burger King, Delhivery, Teamlease and G4S Global — are on the platform, and over 5 million jobs are active.

The startup, whose name is inspired from a cheerful 2019 Bollywood song, has facilitated over 18 million job interviews in the past 30 days, he said. Apna is currently operational in 28 Indian cities.

The idea for Apna came, Parikh has said, after he was puzzled to find that even as there are hundreds of millions of blue- and gray-collar workers in India, locating them when you need assistance with a task often proves very difficult.

Prior to starting Apna, Parikh, who previously worked at Apple, met these workers and went undercover as an electrician and floor manager to understand the problems they were facing. The problem, he found, was the disconnect. Workers had no means to find who needed them for jobs, and they were also not connected with one another. The community aspect of Apna, which now has over 70 such groups, is aimed at addressing this challenge.

The Apna app allows these workers to learn new skills to become eligible for more work opportunities. Apna has emerged as one of the fastest growing upskilling platforms — and that would explain why GSV Ventures and Owl Ventures, two high-profile firms known to back edtech startups, are investing in the Bangalore-based firm.

“Apna’s viral adoption is driven by a novel social and interactive approach to connecting employers with job seekers. We expect job seekers in search of meaningful connections and vetted opportunities to drive Apna’s continued explosive growth across India — and the world,” said Griffin Schroeder, partner at Tiger Global, in a statement.

Now the startup, which has started to monetize the platform, is ready to aggressively expand. Parikh said Apna will continue to expand to more cities in India and by early next year, Apna will begin its global expansion. Parikh said the startup is eyeing expansion in the USA, South East Asia and Middle East and Africa.

“We have already created a dent. Now we want to impact the lives of 2.3 billion,” he said. “We will require crazy amounts of resources and a world-class team to deliver. It’s a herculean task, and is going to take a village. But somebody has to solve it.”

Powered by WPeMatico

SmartNews, a Tokyo-headquartered news aggregation website and app that’s grown in popularity despite hefty competition from built-in aggregators like Apple News, today announced it has closed on $230 million in Series F funding. The round brings SmartNews’ total raise to date to over $400 million and values the business at $2 billion — or as the company touts in its press release, a “double unicorn.” (Ha!)

The funding included new U.S. investors Princeville Capital and Woodline Partners, as well as JIC Venture Growth Investments, Green Co-Invest Investment, and Yamauchi-No.10 Family Office in Japan. Existing investors participating in this round included ACA Investments and SMBC Venture Capital.

Founded in 2012 in Japan, the company launched to the U.S. in 2014 and expanded its local news footprint early last year. While the app’s content team includes former journalists, machine learning is used to pick which articles are shown to readers to personalize their experience. However, one of the app’s key differentiators is how it works to pop users’ “filter bubbles” through its “News From All Sides” feature, which allows its users to access news from across a range of political perspectives.

It has also developed new products, like its COVID-19 vaccine dashboard and U.S. election dashboard, that provide critical information at a glance. With the additional funds, the company says it plans to develop more features for its U.S. audience — one of its largest, in addition to Japan — that will focus on consumer health and safety. These will roll out in the next few months and will include features for tracking wildfires and crime and safety reports. It also recently launched a hurricane tracker.

The aggregator’s business model is largely focused on advertising, as the company has said before that 85-90% of Americans aren’t paying to subscribe to news. But SmartNews’ belief is that these news consumers still have a right to access quality information.

In total, SmartNews has relationships with more than 3,000 global publishing partners whose content is available through its service on the web and mobile devices.

To generate revenue, the company sells inline ads and video ads, where revenue is shared with publishers. Over 75% of its publishing partners also take advantage of its “SmartView” feature. This is the app’s quick-reading mode, an alternative to something like Google AMP. Here, users can quickly load an article to read, even if they’re offline. The company promises publishers that these mobile-friendly stories, which are marked with a lightning bolt icon in the app, deliver higher engagement — and its algorithm rewards that type of content, bringing them more readers. Among SmartView partners are well-known brands like USA Today, ABC, HuffPost and others. Currently, over 70% of all SmartNews’ pageviews are coming from SmartView first.

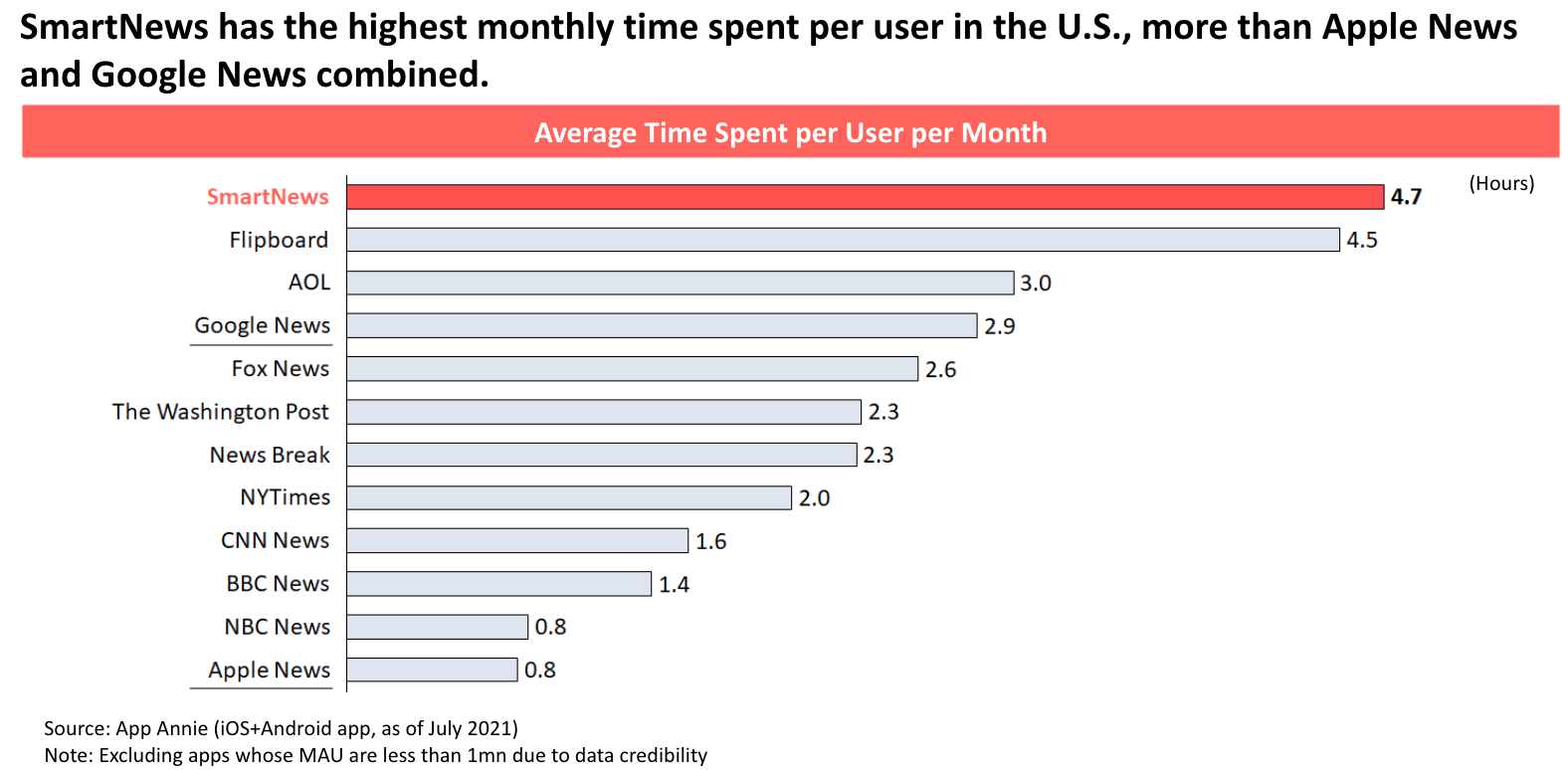

SmartNews’ app has proven to be very sticky, in terms of attracting and keeping users’ attention. The company tells us, citing App Annie July 2021 data, that it sees an average time spent per user per month on U.S. mobile devices that’s higher than Google News or Apple News combined.

Image Credits: App Annie data provided by SmartNews

The company declined to share its monthly active users (MAUs), but had said in 2019 it had grown to 20 million in the U.S. and Japan. Today, it says its U.S. MAUs doubled over the last year.

According to data provided to us by Apptopia, the SmartNews app has seen around 85 million downloads since its October 2014 launch, and 14 million of those took place in the past 365 days. Japan is the largest market for installs, accounting for 59% of lifetime downloads, the firm noted.

“This latest round of funding further affirms the strength of our mission, and fuels our drive to expand our presence and launch features that specifically appeal to users and publishers in the United States,” said SmartNews co-founder and CEO Ken Suzuki. “Our investors both in the U.S. and globally acknowledge the tremendous growth potential and value of SmartNews’s efforts to democratize access to information and create an ecosystem that benefits consumers, publishers and advertisers,” he added.

The company says the new funds will be used to invest in further U.S. growth and expanding the company’s team. Since its last fundraise in 2019, where it became a unicorn, the company more than doubled its headcount to approximately 500 people globally. it now plans to double its headcount of 100 in the U.S., with additions across engineering, product, and leadership roles.

The Wall Street Journal reports SmartNews is exploring an IPO, but the company declined to comment on this.

The SmartNews app is available on iOS and Android across more than 150 countries worldwide.

Powered by WPeMatico

Relyance AI, an early-stage startup that is helping companies stay in compliance with privacy laws at the code level, announced a $25 million Series A today. At the same time, they revealed a previously unannounced $5 million seed round.

Menlo Ventures and Unusual Ventures led the A round, while Unusual was sole lead on the seed. Serial entrepreneur Jyoti Bansal from Unusual will join the board under the terms of the deal. His partner John Vrionis had previously joined after the seed round. Matt Murphy from Menlo is coming on as a board observer. The company has now raised $30 million.

Relyance takes an unusual approach to verifying that data stays in compliance working at the code level, while ingesting contracts and existing legal requirements as code to ensure that a company is in compliance. Company co-CEO and co-founder Abhi Sharma says that code-level check is key to the solution. “For the first time, we are building the legal compliance and regulation into the source code,” Sharma told me.

He added, “Relyance is actually embedded within the DevOps pipeline of our customers’ infrastructure. So every time a new ETL pipeline is built or a machine learning model is receiving new source code, we do a compiler-like analysis of how personal sensitive data is flowing between internal microservices, data lakes and data warehouses, and then get a metadata analysis back to the privacy and compliance professionals [inside an organization].”

Leila R. Golchehreh, the other founder and co-CEO, brings a strong compliance background to the equation and has experienced the challenge of keeping companies in compliance firsthand. She said that Relyance also enables companies to define policy and contracts as code.

“Our approach is specifically to ingest contracts. We’ve actually created an algorithm around how [you] actually write a good data protection agreement. We’ve extracted those relevant provisions and we will compare that against [your] operational reality. So if there’s a disconnect, we will be able to raise that as an intelligent insight of a data misalignment,” she said.

With 32 employees, the co-founders hope to double or perhaps even triple that number in the next 12-18 months. Golchehreh and Sharma are a diverse co-founder team and they are attempting to build a company that reflects that. They believe being remote-first gives them a leg up in this regard, but they also have internal policies to drive it.

“The recruiters we work with have a mandate internally to say, ‘Hey, we really want to hire good people and diverse people.’ Relyance as a company is the genesis of two individuals from two completely different ends of the spectrum coming together. And I think hopefully, we can do our job of relaying that into the company as we scale,” Sharma said.

The two founders have been friends for several years and began talking about forming a company together in 2019 over a pizza dinner. The idea began to gel and they launched the company in February 2020. They spent some time talking to compliance pros to understand their requirements better, then in July 2020 began building the solution they have today. They released a beta in February and began quietly selling it in March.

Today they have a number of early customers working with their software, including Dialpad, Patreon, Samsara and True.

Powered by WPeMatico

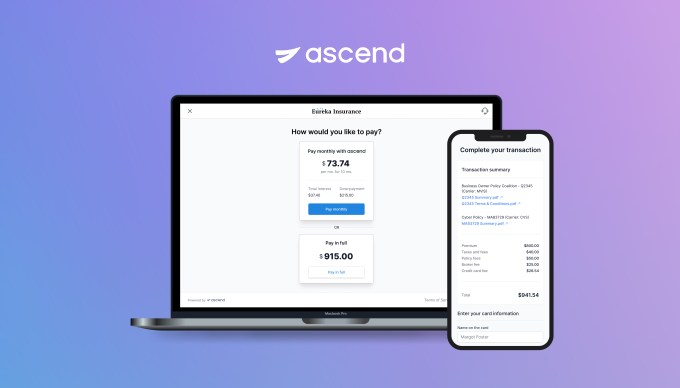

Ascend on Wednesday announced a $5.5 million seed round to further its insurance payments platform that combines financing, collections and payables.

First Round Capital led the round and was joined by Susa Ventures, FirstMark Capital, Box Group and a group of angel investors, including Coalition CEO Joshua Motta, Newfront Insurance executives Spike Lipkin and Gordon Wintrob, Vouch Insurance CEO Sam Hodges, Layr Insurance CEO Phillip Naples, Anzen Insurance CEO Max Bruner, Counterpart Insurance CEO Tanner Hackett, former Bunker Insurance CEO Chad Nitschke, SageSure executive Paul VanderMarck, Instacart co-founders Max Mullen and Brandon Leonardo and Houseparty co-founder Ben Rubin.

This is the first funding for the company that is live in 20 states. It developed payments APIs to automate end-to-end insurance payments and to offer a buy now, pay later financing option for distribution of commissions and carrier payables, something co-founder and co-CEO Andrew Wynn, said was rather unique to commercial insurance.

Wynn started the company in January 2021 with his co-founder Praveen Chekuri after working together at Instacart. They originally started Sheltr, which connected customers with trained maintenance professionals and was acquired by Hippo in 2019. While working with insurance companies they recognized how fast the insurance industry was modernizing, yet insurance sellers still struggled with customer experiences due to outdated payments processes. They started Ascend to solve that payments pain point.

The insurance industry is largely still operating on pen-and-paper — some 600 million paper checks are processed each year, Wynn said. He referred to insurance as a “spaghetti web of money movement” where payments can take up to 100 days to get to the insurance carrier from the customer as it makes its way through intermediaries. In addition, one of the only ways insurance companies can make a profit is by taking those hundreds of millions of dollars in payments and investing it.

Home and auto insurance can be broken up into payments, but the commercial side is not as customer friendly, Wynn said. Insurance is often paid in one lump sum annually, though, paying tens of thousands of dollars in one payment is not something every business customer can manage. Ascend is offering point-of-sale financing to enable insurance brokers to break up those commercial payments into monthly installments.

“Insurance carriers continue to focus on annual payments because they don’t have a choice,” he added. “They want all of their money up front so they can invest it. Our platform not only reduces the friction with payments by enabling customers to pay how they want to pay, but also helps carriers sell more insurance.”

Ascend app

Startups like Ascend aiming to disrupt the insurance industry are also attracting venture capital, with recent examples including Vouch and Marshmallow, which raised close to $100 million, while Insurify raised $100 million.

Wynn sees other companies doing verticalized payment software for other industries, like healthcare insurance, which he says is a “good sign for where the market is going.” This is where Wynn believes Ascend is competing, though some incumbents are offering premium financing, but not in the digital way Ascend is.

He intends to deploy the new funds into product development, go-to-market initiatives and new hires for its locations in New York and Palo Alto. He said the raise attracted a group of angel investors in the industry, who were looking for a product like this to help them sell more insurance versus building it from scratch.

Having only been around eight months, it is a bit early for Ascend to have some growth to discuss, but Wynn said the company signed its first customer in July and six more in the past month. The customers are big digital insurance brokerages and represent, together, $2.5 billion in premiums. He also expects to get licensed to operate as a full payment in processors in all states so the company can be in all 50 states by the end of the year.

The ultimate goal of the company is not to replace brokers, but to offer them the technology to be more efficient with their operations, Wynn said.

“Brokers are here to stay,” he added. “What will happen is that brokers who are tech-enabled will be able to serve customers nationally and run their business, collect payments, finance premiums and reduce backend operation friction.”

Bill Trenchard, partner at First Round Capital, met Wynn while he was still with Sheltr. He believes insurtech and fintech are following a similar story arc where disruptive companies are going to market with lower friction and better products and, being digital-first, are able to meet customers where they are.

By moving digital payments over to insurance, Ascend and others will lead the market, which is so big that there will be many opportunities for companies to be successful. The global commercial insurance market was valued at $692.33 billion in 2020, and expected to top $1 trillion by 2028.

Like other firms, First Round looks for team, product and market when it evaluates a potential investment and Trenchard said Ascend checked off those boxes. Not only did he like how quickly the team was moving to create momentum around themselves in terms of securing early pilots with customers, but also getting well known digital-first companies on board.

“The magic is in how to automate the underwriting, how to create a data moat and be a first mover — if you can do all three, that is great,” Trenchard said. “Instant approvals and using data to do a better job than others is a key advantage and is going to change how insurance is bought and sold.”

Powered by WPeMatico

In order to support a buildout of renewable energy, which tends to over-generate electricity at certain times of day and under-generate at others, the grid is going to need a lot of batteries. While lithium-ion works fine for consumer electronics and even electric vehicles, battery startup EnerVenue says it developed a breakthrough technology to revolutionize stationary energy storage.

The technology itself — nickel-hydrogen batteries — isn’t actually new. In fact, it’s been used for decades in aerospace applications, to power everything from satellites to the International Space Station and the Hubble Telescope. Nickel-hydrogen had been too expensive to scale for terrestrial applications, until Stanford University professor (and now EnerVenue chairman) Yi Cui determined a way to adapt the materials and bring the costs way, way down.

Nickel-hydrogen has a number of key benefits over lithium-ion, according to EnerVenue: it can withstand super-high and super-low temperatures (so no need for air conditioners or thermal management systems); it requires very little to no maintenance; and it has a far longer lifespan.

The technology has caught the eye of two giants in the oil and gas industry, energy infrastructure company Schlumberger and Saudi Aramco’s VC arm, which together with Stanford University have raised $100 million in Series A funding. The investment comes around a year after EnerVenue raised a $12 million seed. The company is planning on using the funds to scale its nickel-hydrogen battery production, including a Gigafactory in the U.S., and has entered a manufacturing and distribution agreement with Schlumberger for international markets.

“I spent almost three and a half years prior to EnerVenue looking for a battery storage technology that I thought could compete with lithium-ion,” CEO Jorg Heinemann told TechCrunch in a recent interview. “I had essentially given up.” Then he met with Cui, who had managed through his research to bring the cost down from around $20,000 per kilowatt hour to $100 per kilowatt hour within line of sight — a jaw-dropping decrease that puts it on-par with existing energy storage technology today.

EnerVenue CEO Jorg Heinemann Image Credits: EnerVenue (opens in a new window)

Think of a nickel-hydrogen battery as a kind of battery-fuel cell hybrid. It charges by building up hydrogen inside a pressure vessel, and when it discharges, that hydrogen gets reabsorbed in water, Heinemann explained. One of the key differences between the batteries in space and the one’s EnerVenue is developing on Earth is the materials. The nickel-hydrogen batteries in orbit use a platinum electrode, which Heinemann said accounts for as much as 70% of the cost of the battery. The legacy technology also uses a ceramic separator, another high cost. EnerVenue’s key innovation is finding new, low-cost and Earth-abundant materials (though the exact materials they aren’t sharing).

Heinemann also hinted that an advanced team within the company is working on a separate technology breakthrough that could bring the cost down even further, to the range of around $30 per kilowatt hour or less.

Those aren’t the only benefits. EnerVenue’s batteries can charge and discharge at different speeds depending on a customer’s needs. It can go from a 10-minute charge or discharge to as slow as a 10-20 hour charge-discharge cycle, though the company is optimizing for a roughly two-hour charge and four- to eight-hour discharge. EnerVenue’s batteries are also designed for 30,000 cycles without experiencing a decline in performance.

“As renewables get cheaper and cheaper, there’s lots of time of the day where you’ve got, say, a one- to four-hour window of close to free power that can be used to charge something, and then it has to be dispatched fast or slow depending on when the grid needs it,” he said. “And our battery does that really well.”

It’s notable that this round was funded by two companies that loom large in the oil and gas industry. “I think nearly 100% of the oil and gas industry is now pivoting to renewables in a huge way,” Heinemann added. “They all see the future as, the energy mix is shifting. We’re going to be 75% renewable by mid-century, most think it’s going to happen quicker, and those are based on studies that the oil and gas industry did. They see that and they know they need a new play.”

Image Credits: EnerVenue

Don’t expect nickel-hydrogen to start appearing in your iPhone anytime soon. The technology is big and heavy — even scaled down as much as possible, a nickel-hydrogen battery is still around the size of a two-liter water flask, so lithium-ion will definitely still play a major role in the future.

Stationary energy storage may have a different future. EnerVenue is currently in “late-stage” discussions on the site and partner for a United States factory to produce up to one gigawatt-hour of batteries annually, with the goal of eventually scaling even beyond that. Heinemann estimates that the tooling cap-ex per megawatt hour should be just 20% that of lithium ion. Under the partnership with Schlumberger, the infrastructure company will also be separately manufacturing batteries and selling them in Europe and the Middle East.

“It’s a technology that works today,” Heinemann said. “We’re not waiting on a technology breakthrough, there’s no science project in our future that we have to go achieve in order to prove out something. We know it works.”

Powered by WPeMatico

Cross-border commerce company Zonos raised $69 million in a Series A, led by Silversmith Capital Partners, to continue building its APIs that auto classify goods and calculate an accurate total landed cost on international transactions.

St. George, Utah-based Zonos is classifying the round as a minority investment that also included individual investors Eric Rea, CEO of Podium, and Aaron Skonnard, co-founder and CEO of Pluralsight. The Series A is the first outside capital Zonos has raised since it was founded in 2009, Clint Reid, founder and CEO, told TechCrunch.

As Reid explained it, “total landed cost” refers to the duties, taxes, import and shipping fees someone from another country might pay when purchasing items from the U.S. However, it is often difficult for businesses to figure out the exact cost of those fees.

Global cross-border e-commerce was estimated to be over $400 billion in 2018, but is growing at twice the rate of domestic e-commerce. This is where Zonos comes in: The company’s APIs, apps and plugins simplify cross-border sales by providing an accurate final price a consumer pays for an item on an international purchase. Businesses can choose which one or multiple shipping carriers they want to work with and even enable customers to choose at the time of purchase.

“Businesses can’t know all of a country’s laws,” Reid added. “Our mission is to create trust in global trade. If you are transparent, you bring trust. This was traditionally thought to be a shipping problem, but it is really a technology problem.”

As part of the investment Todd MacLean, managing partner at Silversmith Capital Partners, joined the Zonos board of directors. One of the things that attracted MacLean to the company was that Reid was building a company outside of Silicon Valley and disrupting global trade far from any port.

He says while looking into international commerce, he found people wound up being charged additional fees after they have already purchased the item, leading to bad customer experiences, especially when a merchant is trying to build brand loyalty.

Even if someone chooses not to purchase the item due to the fees being too high, MacLean believes the purchasing experience will be different because the pricing and shipping information was provided up front.

“Our diligence said Zonos is the only player to take the data that exists out there and make sense of it,” MacLean said. “Customers love it — we got the most impressive customer references because this demand is already out there, and they are seeing more revenue and their customers have more loyalty because it just works.”

In fact, it is common for companies to see 25% to 30% year over year increase in sales, Reid added. He went on to say that due to fees associated with shipping, it doesn’t always mean an increase in revenue for companies. There may be a small decrease, but a longer lifetime value with customers.

Going after venture capital at this time was important to Reid, who saw global trade becoming more complex as countries added new tax laws and stopped using other trade regulations. However, it was not just about getting the funding, but finding the right partner that recognizes that this problem won’t be solved in the next five years, but will need to be in it for the long haul, which Reid said he saw in Silversmith.

The new investment provides fuel for Zonos to grow in product development and go-to-market while also expanding its worldwide team into Europe and Asia Pacific. Eighteen months ago, the company had 30 employees, and now there are over 100. It also has more than 1,500 customers around the world and provides them with millions of landed cost quotes every day.

“Right now, we are the leader for APIs in cross-border e-commerce, but we need to also be the technology leader regardless of the industry,” Reid added. “We can’t just accept that we are good enough, we need to be better at doing this. We are looking at expanding into additional markets because it is more than just servicing U.S. companies, but need to be where our customers are.”

Powered by WPeMatico