funding

Auto Added by WPeMatico

Auto Added by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture-capital-focused podcast where we unpack the numbers behind the headlines.

This is Equity Monday Tuesday, our weekly kickoff that tracks the latest private market news, talks about the coming week, digs into some recent funding rounds and mulls over a larger theme or narrative from the private markets. You can follow the show on Twitter here and myself here.

What a busy weekend we missed while mostly hearing distant explosions and hugging our dogs close. Here’s a sampling of what we tried to recap on the show:

It’s going to be a busy week! Chat tomorrow.

Equity drops every Monday at 7:00 a.m. PST, Wednesday, and Friday at 6:00 a.m. PST, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts!

Powered by WPeMatico

Influential entrepreneurs like Paul Graham and Naval Ravikant always preach the need for startups to have founders-turned-investors on their cap table. As Ravikant puts it, “founders want to know that the people they are taking money from have first-hand experience.”

His platform AngelList has helped individual founders-cum-investors source and participate in deals via collectives. However, some venture firms have taken this up a notch by bringing founders to create a fund and invest together.

Today, one of such, MAGIC Fund, a global collective of founders, is announcing that it has raised a second fund of $30 million to continue backing early-stage startups across Africa, Europe, Latin America, North America, and Southeast Asia.

Since the firm’s first fund launched in 2017, MAGIC has invested in 70 companies at pre-seed and seed stages across these emerging markets. Some of these companies include Retool, Novo, Payfazz, and Mono.

MAGIC Fund has 12 founders who act as general partners. TechCrunch caught up with managing partner Adegoke Olubusi and operating partner Matt Greenleaf to learn more about the fund’s thesis and activities.

Olubusi, who had built and exited a couple of startups over the years, also dabbled with angel investing for some time. In 2017, Olubusi’s current startup Helium Health got accepted into Y Combinator. It was there he met more founders like him who were angel investors with impressive portfolios. The interesting bit? Each founder wanted to invest in other companies during YC’s Demo Day.

“So about three years ago, I was at YC, and I was going to invest in my own batch. I was pitching on the day, but I was also listening to other pitches. However, it wasn’t just me; there were many other founders as well,” Olubusi said.

After building and exiting multiple startups, some founders turn into angel investing to support startups and their ecosystems. However, most of them tend to go alone and are stuck with cutting checks in their local markets, which limits opportunities.

Some MAGIC portfolio companies

Here’s a scenario. In 2016, when unicorns Flutterwave and Kavak raised their seed rounds in Nigeria and Mexico respectively, an African biotech founder who knew about Kavak and a Latin American edtech founder interested in African fintech would not have had the capacity to evaluate those deals even if they wanted; the reason being a lack of reach and experience in both the industry or geography.

Olubusi and the other founders knew this would be a limitation in the long run if they went solo. Thus, they decided to create MAGIC. The idea was to bring global founders together with diverse skillsets in diverse industries and geographies to evaluate deals better and drive value for each other. Hence, they can participate in two unicorns instead of one.

“Instead of us investing individually because obviously, we have somewhat limited capacity in terms of how much time we have as founders because of our respective companies, why don’t we collaborate on a strategy together and co-invest together?”

“The way we thought of MAGIC was a fund of micro funds built by founders for founders,” Greenleaf continued.

In some of the personal conversations I’ve had with founders about their investors, a recurring theme has been that the most useful investors didn’t necessarily sign the biggest checks. It’s a theme Olubusi also relates to all too well.

“It was like every time we think about it, everyone who gave the most money rarely had time for us. It was so frequent that we all identified this as an actual thing. What actually drove value for us were other investors who were founders and operators, and other experienced people who were able to help us find product-market fit and fight regulators. These were actually the people in the trenches with us.”

Olubusi believes the early-stage part of investing, particularly in pre-seed and seed, is where VCs who are founder-operators find their sweet spot. They are precious when startups are trying to figure out product-market fit. And unlike traditional investors who are looking to get multiples on investments, Olubusi argues that for founders-investors, what matters is how much value they can drive for startups.

Image Credits: MAGIC Fund

MAGIC’s play is even more essential considering that it also plays in emerging markets where on-the-ground operational help is needed in industries with numerous unknowns and uncertainties.

“There is so much money in the market now and early-stage decision making at pre-seed and seed should be left in the hands of founders. Because think about it really, to make an evaluation of whether I should invest in a healthcare or fintech company in Africa, it makes sense to have those who’ve spent years battling through it in the trenches make those decisions. And what we’re trying to do with the fund is publish as much information as possible and keep performing at the 100 percentile and say this is still the best strategy and is very scalable.”

MAGIC Fund 1 was $1.5 million and Olubusi says the investments performed 5x over the period of three years. As some of these companies exited, their founders invested in MAGIC and came on board as Fund 2 partners.

MAGIC has also enlisted additional investors who, according to Olubusi, are respected for their investing abilities and ecosystem support. For instance, Olugbenga Agboola, Flutterwave CEO, is known across the African tech ecosystem as a founder who goes out of his way to help established and up-and-coming fintech companies. Hendra Kwik of Payfazz has such a reputation in Southeast Asia as well. They, alongside other founders, join MAGIC as limited partners.

Per the firm’s statement, one-third of the entire fund was contributed by the founder GPs. For its LPs, diversity play is considered as 50% of them are black while 33% are women. Some of them include Michael Seibel, Tim Draper, Rappi’s Andres Bilbao, Paystack’s Shola Akinlade, Katie Lewis, and Octopus Ventures’ Kirsten Connell. For its partners, MAGIC has brought on the likes of Stitchroom’s Tom Chen, Medumo’s Adeel Yang, Juice’s Michael Lisovetsky, and Troy Osinoff, and Evercare’s Temi Awogboro.

Magic Fund 2 will be writing $100,000 to 300,000 checks at pre-seed and seed stages focusing on fintech, healthcare, SaaS and enterprise, women’s health, developer tools.

What does the fund look for in founders? Olubusi gives two answers. One, MAGIC wants to back founders with incentives to stick through the hard times of a company.

“At pre-seed and seed, you don’t have enough data about a company to make an investment decision. Your bet is entirely on the founder and the founding team. What we know, having done this several times, is that things get harder. So when we’re looking at the founder, we’re evaluating whether or not the founder has the grit to stick through the toughest times which are going to come up.”

The second indicator factors if the founder has the willingness, openness, the flexibility to learn and use that knowledge to succeed. Greenleaf believes these strategies have incredibly helped the firm fund exceptional companies and maintain good relationships with founders.

“Most of these founders don’t view us as their investors. They view us as fellow founders who are helping them along their journey. I think that also ties into them keeping it real with us and allows us to see them as people, and not just founders. That’s one of the things that have worked in our favor,” he said.

Powered by WPeMatico

TechCrunch Early Stage is coming up soon, and all attendees can get 3 months of free access to Extra Crunch as a part of a ticket purchase. Extra Crunch is our members-only community focused on founders and startup teams.

Head here to buy your ticket to TC Early Stage.

Extra Crunch unlocks access to our investor surveys, private market analysis, and in-depth interviews with experts on fundraising, growth, monetization and other core startup topics. Get feedback on your pitch deck through Extra Crunch Live, and stay informed with our members-only Extra Crunch newsletter. Other benefits include an improved TechCrunch.com experience and savings on software services from AWS, Crunchbase, and more.

Learn more about Extra Crunch benefits here, and buy your TC Early Stage tickets here.

What is TC Early Stage?

TC Early Stage is a two-day virtual event where early-stage founders can take part in highly interactive group sessions with top investors and ecosystem experts. This particular Early Stage event has a focus on marketing and fundraising.

The event will take place July 8-9, and we’d love to have you join.

View the event agenda here, and purchase tickets here.

Once you buy your TC Early Stage pass, you will be emailed a link and unique code you can use to claim the free 3 months of Extra Crunch.

Already bought your TC Early Stage ticket?

Existing pass holders will be emailed with information on how to claim the free 3 months of Extra Crunch membership. All new ticket purchases will receive information over email immediately after the purchase is complete.

Already an Extra Crunch member?

We’re happy to extend a free 3 months of access to existing users. Please contact extracrunch@techcrunch.com, and mention that you are an existing Extra Crunch member who bought a ticket to TC Early Stage 2021: Marketing and Fundraising.

Powered by WPeMatico

Whether you are part of the accounting department, or just any employee at an organization, managing expenses can be a time-consuming and error-filled, yet also quite mundane, part of your job. Today, a startup called Pleo — which has built a platform that can help some of that work more smoothly, by way of a vertically integrated system that includes payment cards, expense management software, and integrated reimbursement and pay-out services — is announcing a big round of growth funding to expand its business after seeing strong traction.

The Copenhagen-based startup has raised $150 million — money that it will be using to continue building out more features for its users, and for business development. The round, which sets a record for being the largest Series C for a Danish startup, values Pleo at $1.7 billion, the startup has confirmed.

There are around 17,000 small and medium businesses now using Pleo, with companies at the medium end of that numbering around 1,000 employees. Now with Pleo moving into slightly larger customers (up to 5,000 employees, CEO Jeppe Rindom, said), the startup has set an ambitious target of reaching 1 million users by 2025, a very lucrative goal, considering that expenses management is estimated to be a $80 billion market in Europe (with the global opportunity, of course, even bigger).

It will also be using the funds simply to expand its business. Pleo has around 330 employees today spread across London, Stockholm, Berlin and Madrid, as well as in Copenhagen, and it will be using some of the investment to grow that team and its reach.

Bain Capital Ventures and Thrive Capital co-led this round, a Series C. Previous backers, including Creandum, Kinnevik, Founders, Stripes and Seedcamp, also participated. Stripes led the startup’s Series B in 2019. It looks like this round was oversubscribed: the original intention had been to raise just $100 million.

Like other business processes, managing expenses and handling company spending has come a long way in the last many years.

Gone are the days where expenses inevitably involved collecting paper receipts and inputting them manually into a system in order to be reimbursed; now, expense management software links up with company-issued cards and taps into a range of automation tools to cut out some of the steps in the process, integrating with a company’s internal accounting policies to shuffle the process along a little less painfully. And there are a number of companies in this space, from older players like SAP’s Concur through to startups on the cusp of going public like Expensify as well as younger entrants bringing new technology into the process.

But, there is still lots more room for improvement. Rindom, Pleo’s CEO who co-founded the company with CTO Niccolo Perra, said the pair came up with the idea for Pleo on the back of years of working in fintech — both were early employees at the B2B supply chain startup Tradeshift — and seeing first-hand how short-changed, so to speak, small and medium businesses in particular were when it came to tools to handle their expenses.

Pleo’s approach has been to build, from the ground up, a system for those smaller businesses that integrate all the different stages of how an employee might spend money on behalf of the company.

Pleo starts with physical and virtual payment cards (which can be used in, for example, Apple Wallet) that are issued by Pleo (in partnership with MasterCard) to buy goods and services, which in turn are automatically itemized according to a company’s internal accounting systems, with the ability to work with e-receipts, but also let people use their phones to snap pictures of receipts when they are only on paper, if required. This is pretty much table stakes for expense software these days, but Pleo’s platform is going a couple of steps beyond that.

Users (or employers) can integrate a users’ own banking details to make it easier to get reimbursed when they have had to pay for something out of their own pocket; or conversely to pay for something that shouldn’t have been charged on the card. And if there are invoices to be paid at a later date from the time of purchase, these too can be actioned and set up within Pleo rather than having to liaise separately with an accounts payable department to get those settled. Higher priced tiers (beyond the basic service for up to five users) also lets a company set spending limits for individual users. Pricing is based on number of users, per month.

Pleo also has built fraud protection services into the platform to detect, for example, cases when a card number might have been compromised and is being used for non-work purposes.

What’s notable is that the startup has built all of the tech that it uses, including the payments feature, from the ground up, to have full control over the features and specifically to be able to add more of them more flexibly over time.

“In the beginning we ran with a partner in services like payments, but it didn’t allow us to move fast enough,” Rindom said in an interview. “So we decided to take all of that in-house.”

It seems like this opens the door to a lot of possibilities for how Pleo might evolve in the years ahead now that it’s focused on hyper-growth. However, Rindom added that whatever the next steps might be, they will remain focused on continuing to solve the expenses problem.

“When it comes to our infrastructure we use it only for ourselves,” he said. “We have no plans of selling [for example, payments] as a service, even if we do have a lot of other ideas for broadening our offerings.” Indeed, the ability to pay invoices was launched only in April of this year. “We come up with things all the time, but will launch only those relevant to customers.” For now, at least.

That focus and perhaps even more than that the execution and customer traction are what have brought investors around to backing a fintech out of Copenhagen.

“The future of work empowers employees with the tools they need to be effective, productive, and successful,” said Keri Gohman, a partner at Bain Capital Ventures, in a statement. “Pleo understands this critical shift for modern companies toward employee centricity—providing workers with a fun-to-use spend management app that automatically tracks their corporate spending and generates expense reports, paired with the powerful tools businesses need to create full visibility and management of every penny spent.”

Bain has been a pretty active investor in European fintech, also backing GoCardless in its recent round. “BCV invests in founders who aren’t afraid to tackle big problems, and Jeppe and Nicco saw a big challenge that employers faced—tracking all corporate spending and reconciling expenses back to the general ledger—and solved it with elegant technology that both employers and employees love,” added Merritt Hummer, a partner at Bain Capital Ventures.

Thrive is also a notable backer here, and it will be interesting to see how and if Pleo links up with others in the VC’s portfolio, which include companies like Plaid, Gong and Trade Republic.

“Pleo has already transformed the way that over 17,000 companies think about managing their expenses, saving them time and lowering costs while increasing transparency,” noted Kareem Zaki, a general partner at Thrive Capital, in a statement. “We are excited to partner closely with the Pleo team to help drive their next phase of growth.”

Powered by WPeMatico

Therapy is rapidly becoming a standard part of many people’s lives, but 2020 interrupted that trend by nixing in-person sessions and forcing therapists to migrate their entire practice online — and it turns out that’s not so easy. Frame simplifies it with an all-in-one portal for clients and therapists, unifying the listings, tools and management software that run the countless small businesses making up the industry.

Kendall Bird and Sage Grazer are old friends who happened to be in the right place at the right time — a strange thing to say about anyone anywhere at the start of 2020, but it’s true. The startup’s pitch of bringing your practice entirely online and offering all-online sessions, bookkeeping, scheduling and everything turned out to be exactly what would soon be needed — though as they tell it, it has actually been needed for some time.

Grazer, a therapist herself, experienced firsthand the unexpected difficulties of getting up and running.

“When I started my practice in 2016, I was really passionate about the clinical work, but I was very overwhelmed by setting up a business, marketing, financial stuff,” she said. “So we wanted to help other therapists through that.”

She and Bird happened to reconnect around that time and the two saw an opportunity to improve things.

“We think about therapists as being a one-on-one thing, but they’re really a small business,” said Bird, who formerly worked in marketing at Snapchat, Google and YouTube. “They’re underserved and undersupported as mental health professionals — they don’t have the back-office support that doctors do, and they’re not trained how to run businesses. It just made sense to build a scalable SaaS solution that lets these people work for themselves.”

The therapy industry, like other medical institutions, has two sides: client-facing and practitioner-facing. While there are a handful of services online that combine these, many essentially recruit therapists as contractors. If you want to run your own practice, you’ll likely be using a combination of specialty scheduling, telehealth, billing and other tools made with medical privacy considerations in mind.

“The therapy tools and services landscape is incredibly fragmented — the average therapist is using 5-7 tools, and most of those are not built for therapy,” said Bird.

And then of course there’s Psychology Today: a periodical that straddles the roles of pop psych and industry rag, but whose chief reason for existing for many is its voluminous therapist listings, which dominate search and provide an overwhelming first stop for anyone looking to find one in their area. But for such a personal and consequential decision these brief listings don’t give wary potential clients the impression they’re making an informed choice.

“We wanted an experience that was more approachable, uses language that doesn’t feel overwhelming or pathologizing,” said Grazer. “There are people going to therapy feeling alone and confused, who don’t identify with a disorder or checking a check box.”

Frame eschews the oversimplified “scroll through therapists near your area code” with a short quiz — not a diagnosis or personality test but just a few basic questions — that winnows down your choices to a handful of local and appropriate therapists, with whom you can instantly set up free introductory video calls. If you find someone you like, the rest of the professional relationship takes place on Frame, though of course soon in-person sessions may return.

For those not quite ready to take the plunge, the company organizes livestreamed sessions between volunteers and therapists to show what a full hour of work might look like. (Whatever courage it may take to confront one’s issues in therapy, it surely takes even more to do so with an audience.)

On the therapist’s side, Frame is meant to be a one-stop shop. Marketing and telehealth sessions are on there, as noted above, but so are things like scheduling, notes, billing, notifications, and so on, all tailored specifically to the needs of the industry. And while the shift to online services has been a long time coming, the company just happened to drop in just as the need went into overdrive.

“We built it before COVID ever existed — launched in March 2020 and had telehealth as an option, thinking ‘oh, well maybe some people will do this.’ The majority of therapists in America weren’t doing sessions online at the time… but after COVID they all are,” Bird said. “And they’re looking for these tools now because they’re seeing the rewards of running a lot of their business through telehealth.”

Many therapists are finding that after resisting the transition for years, they are encountering all kinds of benefits, explained Grazer. Like other industries, the flexibility inherent to shifting in-person meetings to virtual ones has been freeing and in some cases profitable. The change is here to stay.

The site is in a closed beta limited to a part of California at present, since therapists are limited to operating in-state and there are other regulations to consider, not to mention all the usual struggles of putting together a sprawling professional service. But the $3 million funding round, led by Maven Ventures, will help fill out the product and move the company toward a larger audience. Sugar Capital, Struck Capital, Alpha Edison and January Ventures participated in the raise.

The money is “almost exclusively going to engineering.” The goal is to open up the beta, expand to the rest of California, then move out to other states once they have the infrastructure to do so and have responded to feedback from the initial rollout.

“Sage and I are really aligned in the belief that the best way to make therapy more accessible to America is to support therapists,” said Bird.

Powered by WPeMatico

Last week was a good one for edtech in Europe.

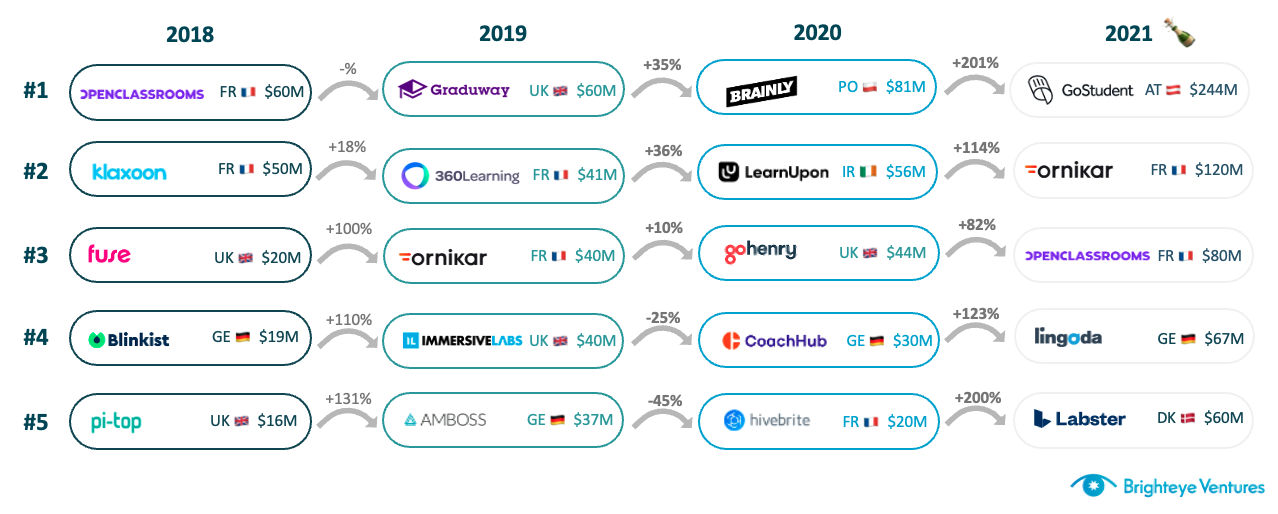

GoStudent became Europe’s first edtech unicorn (IPO’d companies aside), raising its third round in 12 months and the biggest ever in the sector in Europe. Brighteye Ventures’ analysis showed that VC investments in European edtech had breached $1 billion in a calendar year for the first time, even without GoStudent’s mega-round, with six months left to go.

Edtech deal flow in 2021 looks set to match or even outpace 2020 levels, per the report: At $9.4 million, average deal size is triple 2020 levels; seven companies have raised $50 million in five different markets; and the U.K. has more than three times as many deals as the next individual market.

Deal-size progression in edtech over the years. Image Credits: Brighteye Ventures

It’s interesting that we are not seeing enormous increases in deal count. The $1.05-billion mark in the report is spread across 111 transactions — there were 237 in 2020, so we could expect a similar total this year. More funding and stable deal count of course means that we are seeing significant increases in deal size.

It seems generalist investors are recognizing that edtech investments can reap outsized returns, similar to sectors like deep tech, health tech and fintech.

We can draw a few conclusions from this. We can construe that companies created last year and in previous years matured significantly during the pandemic due to increased demand. Moreover, this rapid natural selection process provided insights on verticals and possible winners.

Lastly, it seems generalist investors are recognizing that edtech investments can reap outsized returns, similar to sectors like deep tech, health tech and fintech.

This is contributing to larger early rounds than we have seen in previous years — investors can’t pick the winner, but they can slant the playing field instead. We therefore expect to see a surge in the number of pre-seed, seed and Series A rounds in the second half of 2021, as companies founded during the pandemic begin to raise meaningful funding.

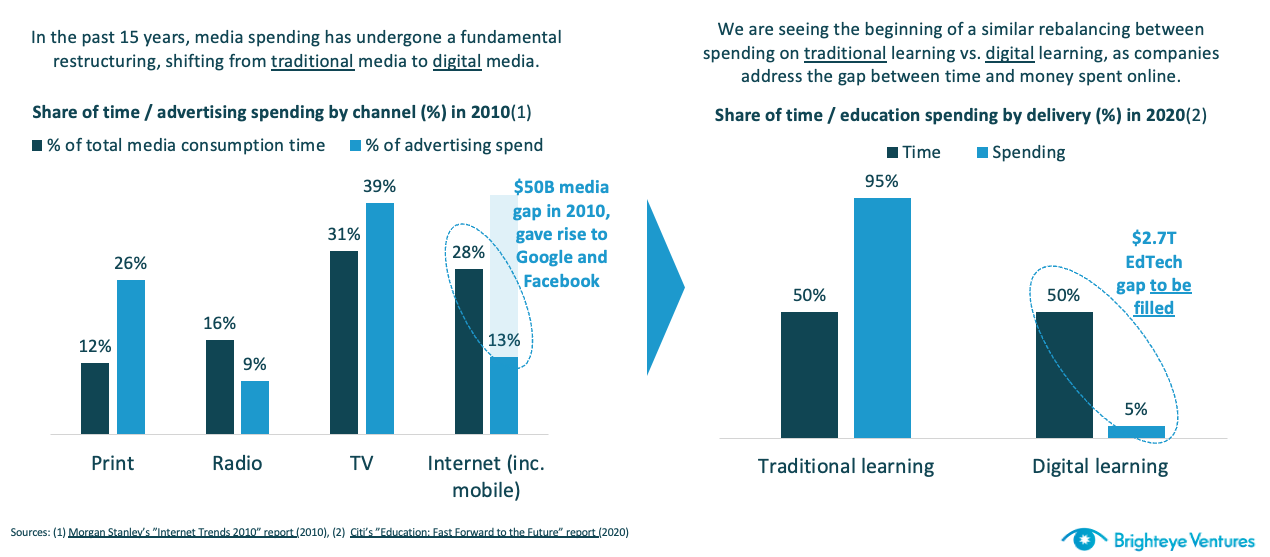

Another reason that edtech is being taken seriously by generalist investors is that the true size of the market (and the extent of digitization to come) is becoming more conceivable.

Edtech spending is growing like media spending did in the 2010s. Image Credits: Brighteye Ventures

Powered by WPeMatico

Most companies don’t announce their first venture investment after almost 20 years in the business, nor do they announce that round is the equivalent of a good startup’s entire private fundraising history. But Articulate, a SaaS training and development platform, is not your typical company and today it announced a whopping $1.5 billion investment on a $3.75 billion valuation.

You can call it Series A if you must label it, but whatever it is, it’s a hefty investment by any measure. General Atlantic led the round with participation from Blackstone Growth and Iconiq Growth. GA claims it’s one of the largest A rounds ever, and I’m willing to bet it’s right.

CEO Adam Schwartz founded the company with his life savings in 2002 and hasn’t taken a dime of outside investment since. “Our software enables organizations to develop, deliver, and analyze online training that is engaging and effective for enterprises and SMBs,” Schwartz explained.

He says that the company started back in 2002 as a plug-in for PowerPoint. Today it is a software service with the goal of helping enable everyone to deliver training, even if they aren’t a training professional. Articulate actually has two main products, one is a set of tools for companies building training that connects to an enterprise learning management system or LMS. The other is aimed at SMBs or departments in an enterprise.

Its approach seems to be working with the company reporting it has 106,000 customers across 161 countries including every single one of the Fortune 100. Schwartz was loath to share any additional metrics, but did say they hope to use this money to grow 10x over the next several years.

Company president Lucy Suros, who has been with the organization for a decade, says even with this success, they see plenty of opportunity for growth and they felt taking this capital now would really enable them to accelerate.

“We are the most dominant player by far in course authoring apps, but when you look at that whole ecosystem and you think about where companies are in transforming from instructor-led training to online training, they’re still really in the early innings so there’s a lot of opportunity,” she said.

Anton Levy, co-president and managing director at General Atlantic, who is leading the investment for the firm, says that this is a “big, bold, incredible business” and that’s why they’re making an investment of this size and scope. “The reason we’re stepping up in such a large way, and what’s such a large check for us, is because of the business they’ve built, the team they’ve built, and frankly the market opportunity that they’re playing in and their ambition,” he said.

Today the company has 300 employees and they have been working as a remote company long before COVID. With the new capital, that number could triple over the next several years. Suros says that when she started at the company, there were 50 employees, mostly male engineers and she went to work to make it a more diverse work environment.

“We’ve put emphasis and a lot of just structural things in place to ensure that we are bringing more [diverse] people to the table, and then supporting folks once they’re here,” she said. With the new capital, the company announced a lot of new benefits and she said those were developed with the idea of helping break down barriers for under-represented groups in their ranks including covering gender transition-related costs.

She says that one of the benefits of becoming more visible as a company is being able to talk about and their human-centered organization framework, the set of principles the company put in place to define its values. “[We think about] how that can impact the employees and drive human flourishing for its own sake, and that also happens to lead to better business outcomes. But we’re really also interested in it from [the standpoint that] we want to be good and do good in the world and promote human flourishing at work,” she said.

The company seems to have been doing just fine up until now, but with this kind of capital, it aims to take the business to another level, while trying to be good corporate citizens as they do that.

Powered by WPeMatico

Istanbul in Turkey continues to prove itself as very fertile ground for casual gaming startups, which appear to be growing from small seedlings into sizable trees. In the latest development, Dream Games — a developer of mobile puzzle games — has raised $155 million in funding, a Series B that values the startup at $1 billion.

This is a massive leap for the company, which raised $50 million (the largest Series A in Turkey’s startup history) only 3.5 months ago. This latest round is being co-led by Index Ventures and Makers Fund, with Balderton Capital, IVP and Kora also participating. It also comes in the wake of a bigger set of deals in the world of gaming and developers in Turkey, the most prominent of which saw Zynga acquire Peak Games for $1.8 billion, amid other acquisitions. Dream is one of several startups in the region founded by alums from Peak.

The focus of the funding, and currently of Dream Games itself, is Royal Match, a puzzle game (iOS, Android) that launched globally in March.

The game has been a huge hit for Dream, with 6 million monthly active users and $20 million/month in revenues from in-game purchases (not ads), according to figures from AppAnnie. (A source close to the company confirmed the figures are accurate, but Dream did not disclose its revenue numbers or revenues directly.) This has catapulted it into the top-20 grossing games categories in the U.S., U.K., and Germany, the same echelon as much older and bigger titles like Candy Crush and Homescapes.

“The funding will be used for heavy user acquisition in every channel and every geography,” Soner Aydemir, co-founder and CEO, Dream Games, told me in an interview. He said Asia would be a focus in that, specifically Japan, South Korea and China. “Our main target is to scale the game so that it becomes one of the biggest games in the global market.”

The world of mobile gaming has in many respects been a very cyclical and fickle one: today’s hot title becomes tomorrow’s has-been, while for developers, they can go through dozens of development processes and launches (and related costs) before they find a hit, if they find a hit. The role of app-install ads and other marketing tools to juice numbers has also been a problematic lever for growth: take away the costs of running those and often the house of cards falls apart.

Aydemir agrees, and while the company will be investing in those aforementioned in-game ads to encourage more downloads of Royal Match, he also said that this strategy can work, but only if the fundamentals of the game are solid, as is the case here.

“If you don’t have good enough metrics, even with all the money in the world it’s impossible to scale,” he said. “But our LTV [lifetime value] is high, and so we think it can be scaled in a sustainable way because of the quality of the game. It always depends on the product.”

In addition to its huge growth, Dream has taken a very focused approach with Royal Match, working on it for years before finally releasing it.

“We spent so much time on tiny details, so many tests over several years to create the dynamics of the game,” he said. “But we also have a feel for it,” he added, referring to the team’s previous lives at Peak Games. “Our users really appreciate this approach.”

For now, too, the focus will just one the one game, he said. Why not two, I asked?

“We believe in Pixar’s approach,” Aydemir said. “When Pixar started, it was very low frequency, a movie every 2-3 years but eventually the rate increased. And it will be similar for us. This year we need to focus on Royal Match but if we can find a way to create other games, we will.”

He added that the challenge — one that many startups know all too well — is that building a new product, in this case a new game, can take the focus away when you are a small team and also working on sustaining and maintaining a current game. “That is the most difficult and challenging part. If we can manage it we will be successful; otherwise we will fail because our business model is basically creating new IP.” He added that it’s likely that another game will be released out into the world at the beginning of next year.

The focus, in any case, was one of the selling points for its investors. “The Dream Games team’s deep genre insight, laser-focus on detail and team chemistry has helped create the early success of Royal Match,” said Michael Cheung, General Partner at Makers Fund, in a statement. “We’re excited to be on the journey with them as they grow Royal Match globally.”

In terms of monetization, Dream Games is pretty firmly in the camp of “no ads, just in-app purchases,” he said. “It’s really bad for user experience and we only care about user experience, so if you put ads in, it conflicts with that.”

Some of the struggles of building new while improving old product will of course get solved with this cash, and the subsequent hiring that Dream Games can do (and it’s doing a lot of that, judging by the careers section of its website). As more startups emerge out of the country — not just in gaming but also areas like e-commerce, where startups like Getir are for example making big waves in instant grocery delivery — it will be interesting to see how that bigger talent pool evolves.

“Since its launch in early March, Royal Match has become one of the top casual puzzle titles globally, driven by once in a decade retention metrics. It speaks to the sheer quality of the title that the Dream Games team has built and the flawless polish and execution across the board,” commented Stephane Kurgan, venture partner at Index Ventures and former COO of King. Index is also the backer of Roblox, Discord, King and Supercell, in a statement.

Powered by WPeMatico

The number of startups acquiring e-commerce businesses, especially those operating on Amazon, to grow and scale is increasing as more people than ever are shopping online.

The latest such startup to raise capital is Forum Brands, which today announced it has raised $27 million in equity funding for its technology-driven e-commerce acquisition platform.

Norwest Venture Partners led the round, which also included participation from existing backers NFX and Concrete Rose.

Brenton Howland, Ruben Amar and Alex Kopco founded New York-based Forum Brands last summer during the height of the COVID-19 pandemic. Its self-proclaimed goal was to use data to innovate through acquisition.

“We’re buying what we think are A+ high-growth e-commerce businesses that sell predominantly on Amazon and are looking to build a portfolio of standalone businesses that are category leaders, on and off Amazon,” Howland said. “A source of inspiration for us is that we saw how consumer goods and services changed fundamentally for what we think is going to be for decades and decades to come, accelerating the shift toward digital.”

Forum Brands founding team. Image Credits: Forum Brands

Forum’s technology employs “advanced” algorithms and over 60 million data points to populate brand information into a central platform in real time, instantly scoring brands and generating accurate financial metrics.

The M&A team also uses data to contact brand owners “in just three clicks.” But Forum says it already knows which brands meet its acquisition criteria before ever making contact with brand owners.

“The decision to acquire comes within 48 hours and once terms are agreed upon, entrepreneurs get paid in 30 days or less for their brand, with additional income benefits through post-acquisition partnerships,” according to the company.

Its apps leverage analytics to push recommendations to drive growth and financial performance for brands. Then, its multichannel approaches aimed at positioning the brands for “long-term category leadership.”

“We are using a lot of data science and machine learning techniques to build technology that allows us to eventually operate efficiently a large portfolio of digital brands at scale,” Kopco said.

The company is undeterred by the increasingly crowded space based on the belief that the market opportunity is so huge, there’s plenty of room for multiple players.

“We are very much in the day zero consolidation of the e-commerce space, and the market is very, very large,” Amar told TechCrunch. “And based on our data, 98% or 99% of all sellers are still operating independently. So, this is not a winner-takes-all market. There will be multiple winners, and we’ve built a strategy to be one of these winners.”

Norwest Venture Partners’ Stew Campbell believes that the number of sellers who reach a point where they have trouble scaling either due to the lack of resources or time is only going to grow. And Forum Brands intends to capitalize on that.

“There’s a continued need for more liquidity options for the entrepreneurs behind many Amazon-first brands. Forum helps entrepreneurs recognize value, which can be significant too many,” he said. ”After acquisition, the Forum team drives operational efficiencies and scale to create better customer experiences for shoppers on Amazon.”

Campbell emphasizes that his firm was drawn to Forum Brands’ team, which the company also touts as a differentiator.

Co-founder and COO Kopco worked in a variety of product roles for several years at Amazon and Jon Derkits, Forum’s VP of brand growth, is also ex-Amazon. Overall, three-fourths of its operating team are former Amazonians. Co-CEO and co-founder Howland was an investor for two years at Cove Hill Partners and is a former McKinsey consultant. Prior to founding Forum, Co-CEO and co-founder Amar was a growth equity investor at TA Associates.

Campbell says his firm has seen many other models in this market, “but the Forum team blends long-term mindsets and focus on technology, while bringing operational and M&A expertise.”

If this all sounds familiar, it’s because TechCrunch also recently covered the raise of Acquco, which has a similar business model to that of Forum Brands and also involves former Amazon employees. In May, that startup raised $160 million in debt and equity to scale its business. Thrasio is another high-profile player in the space, and has raised $850 million in funding this year. Other startups that have recently attracted venture capital include Branded, which recently launched its own roll-up business on $150 million in funding, as well as Berlin Brands Group, SellerX, Heyday, Heroes and Perch. And, Valoreo, a Mexico City-based acquirer of e-commerce businesses, raised $50 million of equity and debt financing in a seed funding round announced in February.

Also, earlier this month, Moonshot Brands announced a $160 million debt and equity raise to “acquire high-performing Amazon third-party sellers and direct-to-consumer businesses on Shopify and WooCommerce with established brand equity.” That company says that since its founding in 2020, it has achieved a $30 million revenue run rate. Among its investors are Y Combinator, Joe Montana’s Liquid 2 Ventures and the founders of Hippo, Lambda School and Shift.

Powered by WPeMatico

Capping off our dig into the early-stage venture capital market, we’re taking a quick look at Europe this morning. Previously, The Exchange tucked into the United States’ early-stage market for startup capital, uncovering startups using abundant seed capital to get more done before raising a Series A, while others were using pedigree, team and market size to accelerate their first lettered raise.

For both cohorts, it appeared that a rapid-fire Series B could be in the offing, with VCs looking to get capital into winners early.

The Exchange explores startups, markets and money. Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The Latin American venture capital market for early-stage startups had a number of similar hallmarks. That shouldn’t have been surprising. According to Seth Pierrepont, a partner at London-based Accel, “fundraising dynamics are now no longer U.S.- or European-specific — they’re global.” Fundraising over videoconferencing services like Zoom has done more than make geographical distances less impactful inside of countries — it’s even made national borders and even oceans less meaningful.

Is the European startup market similar to what we’ve seen in Latin America and the United States — a cognate for the North American venture capital scene, given its outsized global weight by round count and amount invested?

Largely, yes, a trend that appears to be shaking up prices and the talent wars. This morning, we’re taking a final look at the early-stage venture capital market, this time through a European lens, with an assist from a few investors from the continent.

Broadly, early-stage venture capital rounds in Europe are happening “earlier and are larger in size,” according to Draper Esprit’s Vinoth Jayakumar, an investor based in London. The correlate of larger rounds being raised while startups are younger is valuation expansion, according to Jayakumar, who said that prices are going up “because larger rounds are very dilutive to founders if done at normal — or in this case too low — valuations.”

Powered by WPeMatico