Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

Meet Sproutl, a marketplace for gardeners living in the U.K. The startup founded by former Farfetch executives has raised a $9 million seed round. It wants to make gardening more accessible by providing a curated list of items, relevant advice as well as inspiration.

Index Ventures is leading the round in the startup with Ada Ventures and several business angels also participating. The funding round originally closed in April of this year.

“A few years ago, we bought a flat in London with a tiny little garden. We were both working full time in quite intense jobs with young kids. I went online assuming that I would be able to sort out this garden space. And I didn’t know a lot about gardening. And I just didn’t find anything that spoke to me as a new gardener. It felt like what was available was more for more knowledgeable people,” co-founder and CEO Anni Noel-Johnson told me.

If you’ve ever tried to search for gardening videos on YouTube, you may have ended up on long-winded videos with instructions that don’t make any sense to you. Similarly, there are not a lot of e-commerce websites focused on gardening specifically.

And yet, the market opportunity is quite big. There are millions of gardeners in the U.K. There are also quite a few independent garden centers, nurseries and shops with a turnover of several millions of pounds per year. More importantly, they generate the vast majority of their sales in store. Some of them have never sold anything online.

Sproutl is teaming up with those businesses so that they can find new customers across the U.K. Those third-party sellers list their items on Sproutl while the startup takes care of logistics, packaging sourcing and delivery.

On the marketplace, customers can buy indoor and outdoor plants, pots, gardening essentials and outdoor living products. Partners currently include Rosebourne, Polhill, Millbrook, Middleton, Bellr, Fertile Fibre and Horticus.

Anni Noel-Johnson, the CEO of the company, was the VP of Trading and Strategy at Farfetch. Sproutl CTO Andy Done also worked at Farfetch at some point as director of Data Engineering.

Hollie Newton is also going to be a key team member at Sproutl. She previously wrote a best-selling gardening book called “How to Grow.” She’s now the chief creative officer at Sproutl.

This is key to understanding Sproutl’s growth strategy. The company plans to provide a ton of content on all things related to your garden — the startup has already released a jargon buster. You might end up on Sproutl the next time you’re looking for gardening advice on Google.

And it’s also going to differentiate the platform from all-encompassing e-commerce platforms, such as Amazon. Other e-commerce companies focused on one vertical in particular, such as ManoMano, have been quite successful. With the right focus, Sproutl could quickly build a loyal customer base as well.

Powered by WPeMatico

Monarch, a subscription-based platform that aims to help consumers “plan and manage” their financial lives, has raised $4.8 million in seed funding.

Accel led the round, which also included participation from SignalFire, and brings the Mountain View-based yet fully distributed startup’s total funding since its 2019 inception to $5.5 million.

Co-founder and CEO Val Agostino was the first product manager on the original team that built Mint.com. There, he said, he saw firsthand that Americans with a greater understanding of financial matters “needed software solutions that went beyond just tracking and budgeting.”

“They needed help planning their financial future and understanding the tradeoffs between competing financial priorities,” he said.

Monarch aims to help people address those needs with software it says “makes it easy” for people to outline their financial goals and then create a detailed, forward-looking plan toward achieving them.

“We then help customers track their progress against their plan and automatically course correct as their financial situation changes, which it always does,” Agostino said.

Monarch came out of private beta in early 2021 with apps for web, iOS and Android, and is priced at $9.99 per month or $89.99 per year. The startup intentionally opted to not be ad-supported or sell customers’ financial data.

These approaches are “misaligned with users’ financial interests,” Agostino said.

“We felt that a subscription business model would best support that ethos and align our users’ interests with our own,” he added. Since launching publicly, Monarch has been growing its paid subscriber base by about 9% per week.

Image Credits: Monarch

Monarch launched during the pandemic, the uncertainty of which carried over into people’s financial lives, believes Agostino.

“As a result, we saw a lot of people make use of Monarch’s forecasting features to compare different ‘what if ‘scenarios such as switching jobs or moving to a different city or state,” he said.

Earlier this month, TechCrunch reported on a company with a similar mission, BodesWell, teaming up with American Express on a financial planning tool for its cardholders. Agostino said that Monarch is similar to BodesWell in that both startups help customers map a financial plan and future.

“The difference is that Monarch also has a full suite of PFM tools, such as budgeting, reporting and investment analysis,” he said. “The benefit to the consumer is that because Monarch is connected to your entire financial picture, we can help you actually stay on track with your financial plan and/or update the plan in real time if needed.”

Accel’s Daniel Levine said that until he came across Monarch, he was “somehow still a Mint customer despite its obsolescence.”

Over the past decade, the landscape for financial products has expanded dramatically, with more people having brokerage and crypto accounts, for example, Levine said.

In his view, Monarch stands out for a couple of reasons. For one, it’s a subscription product.

“One thing I always hated about Mint was when it would suggest the objectively wrong credit card for me,” Levine said. “It has all of my transaction data, it should tell me the card with the best rewards for me. Monarch is set up to never compromise what’s best for the user in favor of advertising.”

Secondly, Monarch’s aim is to serve as the infrastructure for its customers. To do that, it needs to monitor all of someone’s finances.

“They need to track checking, credit cards, brokerage, real estate and crypto,” he said. “Monarch is committed to doing that. It’s an incredibly painful problem and even though Monarch is a new entrant in the space, I think they’ve clearly separated themselves on that dimension.”

Powered by WPeMatico

News that China’s government may force domestic tutoring-focused companies to go nonprofit is taking a huge bite out of the value of several technology companies. Bloomberg notes that the value of companies like New Oriental Education & Technology Group and TAL Education are tumbling in light of the news, which would constitute merely the latest salvo against tech companies in the autocratic country.

New Oriental’s Hong Kong-listed shares fell 44.22% in after-hours trading after the nonprofit news broke, while NYSE-shares of TAL are off an even sharper 51.75% in pre-market trading. With Yahoo Finance listing a roughly $13.8 billion market cap for TAL ahead of its impending declines at the market open, billions of equity value are about to get deleted. The list goes on: China Online Education Group is off 39.97% in after-hours trading, for example.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

A new decision by China’s government to exert more control over a sector of its domestic economy should not surprise. And we shouldn’t be shocked that online tutoring is in the country’s targets; today’s news is a follow-up to prior regulatory action in the sector from earlier in the year.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

As China has become synonymous with edtech startups in recent years, the news impacts more than just public companies. The expected rules change may also hit a host of private, venture-backed companies.

For example, what will happen to Yuanfudao? The company was valued at $15.5 billion last year, offering what TechCrunch described as “live tutoring, an online Q&A arm and a math-problem-checking arm.” Will the company see its wings clipped?

Or how about Zuoyebang, which raised $1.6 billion in a single round last year? TechCrunch wrote that Zuoyebang offers “online courses, live lessons and homework help for kindergarten to 12th grade students.” Is it in trouble as well?

All this comes on the same day that shares in Zomato began to float, with the Indian online food delivery company seeing its shares close up nearly 65% in their first day’s trading. TechCrunch has viewed the Zomato IPO as a possible bellwether for the larger Indian startup market, and the results augur well for other growth-focused, loss-making unicorns in the country.

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

We were a smaller team this week, with Natasha and Alex together with Chris to sort through yet another summer frenzy of a week.

This time around we actually recorded live on Twitter Spaces, which was a first for the podcast. If you missed it, it’s probably because we didn’t promote the taping since it was just an experiment. Good news, though, is that it went well, and we’re going to do some more live tapings of the show with the entire crew on the mics. Make sure to follow the show on the Big Tweet to ensure that you can come hang with us next week. We’ll also do some Q&A at the end, if we’re in good moods.

Until then, let’s live in the present. Here’s what we got into in today’s show:

Powered by WPeMatico

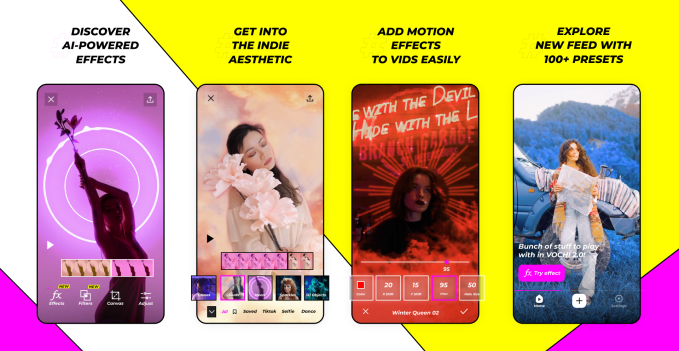

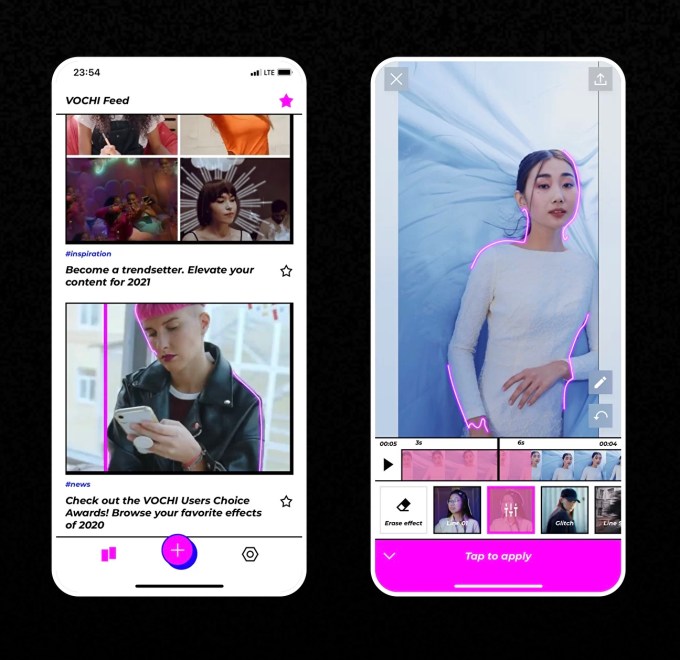

VOCHI, a Belarus-based startup behind a clever computer vision-based video editing app used by online creators, has raised an additional $2.4 million in a “late-seed” round that follows the company’s initial $1.5 million round led by Ukraine-based Genesis Investments last year. The new funds follow a period of significant growth for the mobile tool, which is now used by more than 500,000 people per month and has achieved a $4 million-plus annual run rate in a year’s time.

Investors in the most recent round include TA Ventures, Angelsdeck, A.Partners, Startup Wise Guys, Kolos VC and angels from companies like Belarus-based Verv and Estonian unicorn Bolt. Along with the fundraise, VOCHI is elevating the company’s first employee, Anna Buglakova, who began as head of marketing, to the position of co-founder and chief product officer.

According to VOCHI co-founder and CEO Ilya Lesun, the company’s idea was to provide an easy way for people to create professional edits that could help them produce unique and trendy content for social media that could help them stand out and become more popular. To do so, VOCHI leverages a proprietary computer vision-based video segmentation algorithm that applies various effects to specific moving objects in a video or to images in static photos.

“To get this result, there are two trained [convolutional neural networks] to perform semi-supervised Video Object Segmentation and Instance Segmentation,” explains Lesun, of VOCHI’s technology. “Our team also developed a custom rendering engine for video effects that enables instant application in 4K on mobile devices. And it works perfectly without quality loss,” he adds. It works pretty fast, too — effects are applied in just seconds.

The company used the initial seed funding to invest in marketing and product development, growing its catalog to over 80 unique effects and more than 30 filters.

Image Credits: VOCHI

Today, the app offers a number of tools that let you give a video a particular aesthetic (like a dreamy vibe, artistic feel, or 8-bit look, for example). It also can highlight the moving content with glowing lines, add blurs or motion, apply different filters, insert 3D objects into the video, add glitter or sparkles and much more.

In addition to editing their content directly, users can swipe through a vertical home feed in the app where they can view the video edits others have applied to their own content for inspiration. When they see something they like, they can then tap a button to use the same effect on their own video. The finished results can then be shared out to other platforms, like Instagram, Snapchat and TikTok.

Though based in Belarus, most of VOCHI’s users are young adults from the U.S. Others hail from Russia, Saudi Arabia, Brazil and parts of Europe, Lesun says.

Unlike some of its video editor rivals, VOCHI offers a robust free experience where around 60% of the effects and filters are available without having to pay, along with other basic editing tools and content. More advanced features, like effect settings, unique presents and various special effects, require a subscription. This subscription, however, isn’t cheap — it’s either $7.99 per week or $39.99 for 12 weeks. This seemingly aims the subscription more at professional content creators rather than a casual user just looking to have fun with their videos from time to time. (A one-time purchase of $150 is also available, if you prefer.)

To date, around 20,000 of VOCHI’s 500,000 monthly active users have committed to a paid subscription, and that number is growing at a rate of 20% month-over-month, the company says.

Image Credits: VOCHI

The numbers VOCHI has delivered, however, aren’t as important as what the startup has been through to get there.

The company has been growing its business at a time when a dictatorial regime has been cracking down on opposition, leading to arrests and violence in the country. Last year, employees from U.S.-headquartered enterprise startup PandaDoc were arrested in Minsk by the Belarus police, in an act of state-led retaliation for their protests against President Alexander Lukashenko. In April, Imaguru, the country’s main startup hub, event and co-working space in Minsk — and birthplace of a number of startups, including MSQRD, which was acquired by Facebook — was also shut down by the Lukashenko regime.

Meanwhile, VOCHI was being featured as App of the Day in the App Store across 126 countries worldwide, and growing revenues to around $300,000 per month.

“Personal videos take an increasingly important place in our lives and for many has become a method of self-expression. VOCHI helps to follow the path of inspiration, education and provides tools for creativity through video,” said Andrei Avsievich, general partner at Bulba Ventures, where VOCHI was incubated. “I am happy that users and investors love VOCHI, which is reflected both in the revenue and the oversubscribed round.”

The additional funds will put VOCHI on the path to a Series A as it continues to work to attract more creators, improve user engagement and add more tools to the app, says Lesun.

Powered by WPeMatico

Is the trading boom of 2020 and 2021 slowing?

That’s a question The Exchange has had on its mind since Robinhood released its latest IPO filing. The popular U.S. consumer-focused investing app told investors in the document that it expects revenues to decline in the third quarter compared to its Q2 performance. The company highlighted historically strong crypto volumes in preceding quarters as part of the reason for its anticipated revenue decline.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

Naturally, we got to thinking about Coinbase.

It’s likely fair to say that Coinbase and Robinhood are bullish enough about the cryptocurrency market to be unbothered by short-term changes to crypto trading volumes. Coinbase discussed rising and falling consumer interest in trading cryptos in its own IPO filings, for example.

The now-public unicorn has lived through crypto ups and crypto downs. A decline in consumer interest in the next few months or quarters is not a huge deal, assuming one keeps a long enough perspective and the crypto-infused future that its fans expect comes to pass.

The boom in crypto demand among U.S. consumers lifted many a boat in recent quarters. Coinbase posted insanely good early-2021 results thanks to a bull run in cryptocurrency prices that drove retail interest and trading fees. Robinhood also saw a rush of crypto demand, something that TechCrunch explored here. And Square itself has seen crypto revenues explode.

The boom in crypto demand among U.S. consumers lifted many a boat in recent quarters. Coinbase posted insanely good early-2021 results thanks to a bull run in cryptocurrency prices that drove retail interest and trading fees. Robinhood also saw a rush of crypto demand, something that TechCrunch explored here. And Square itself has seen crypto revenues explode.

Sure, equities interest and demand for options also elevated the fortune of many consumer fintechs during the COVID-19 savings and investing boom. But crypto revenues had a big part to play. Let’s examine both situations through the lens of the latest from Robinhood.

There are some 316 mentions of “cryptocurrency” in Robinhood’s latest IPO filing. We’re going to stick to those we consider the most important.

As context, Robinhood shared preliminary Q2 data. We discussed it here if you want to go deeper into the aggregate figures. But after its disclosure of hard numbers, Robinhood had some interesting notes about the current quarter (emphasis TechCrunch):

Trading activity was particularly high during the first two months of the 2021 period, returning to levels more in line with prior periods during the last few weeks of the quarter ended June 30, 2021, and remained at similar levels into the early part of the third quarter. We expect our revenue for the three months ending September 30, 2021 to be lower, as compared to the three months ended June 30, 2021, as a result of decreased levels of trading activity relative to the record highs in trading activity, particularly in cryptocurrencies, during the three months ended June 30, 2021, and expected seasonality.

And in a discussion of some other performance metrics, including funded accounts and the like, Robinhood had this to say (emphasis TechCrunch):

We anticipate the rate of growth in these Key Performance Metrics will be lower for the period ended September 30, 2021, as compared to the three months ended June 30, 2021, due to the exceptionally strong interest in trading, particularly in cryptocurrencies, we experienced in the three months ended June 30, 2021, and seasonality in overall trading activities.

Falling revenue and slowing KPM growth is not really the world’s best set of metrics to flash up during an IPO run. But a quick scan of Robinhood’s 2020 revenues indicates it’s unlikely that the unicorn will be able to post year-over-year growth in the final two quarters of 2021. Still, its period of rapid-fire revenue growth appears to have come to an end after Robinhood posted top-line expansion in every quarter since Q4 2019.

Powered by WPeMatico

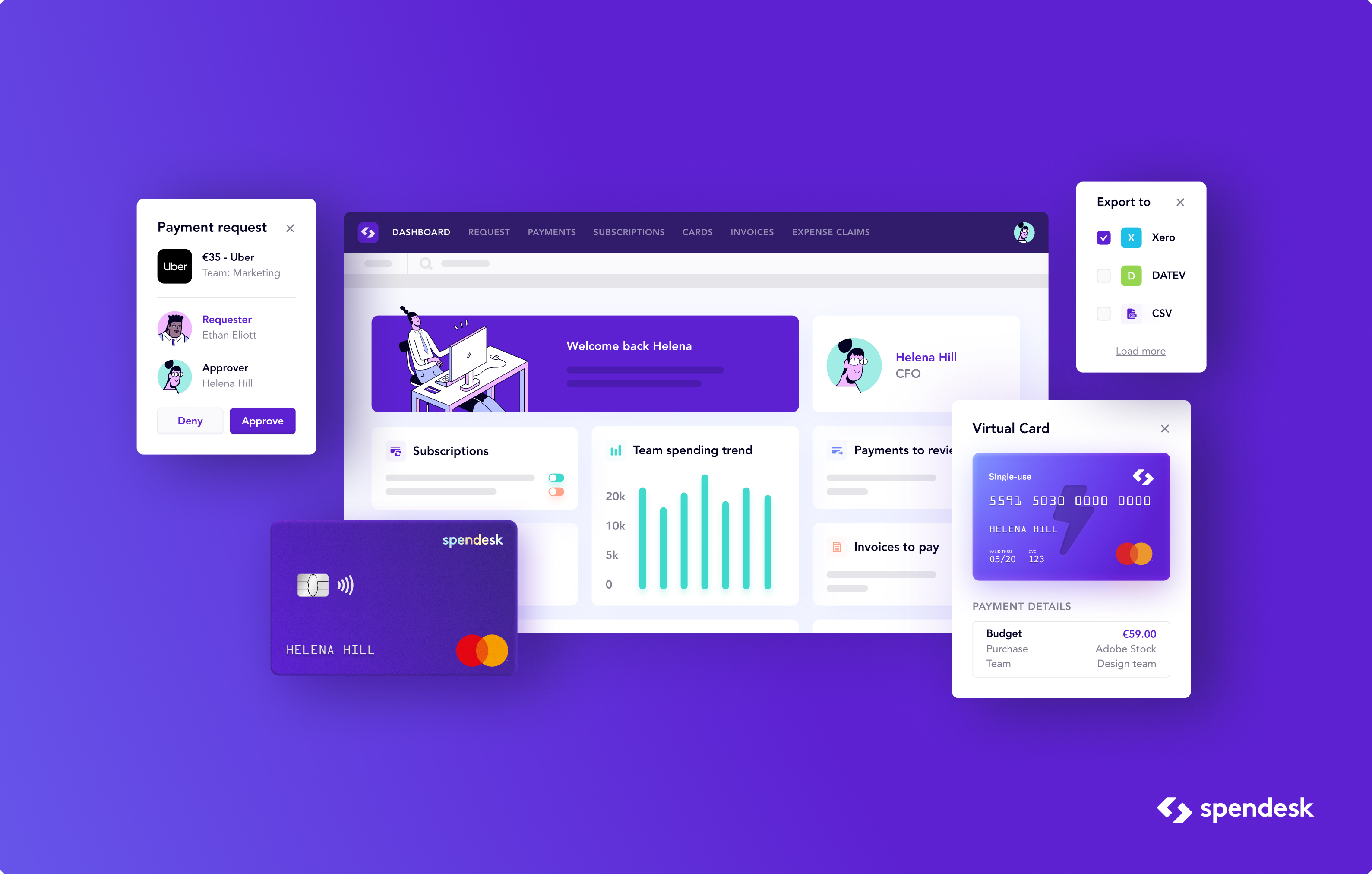

French startup Spendesk has announced earlier today that it has raised a $118 million funding round (€100 million) led by General Atlantic. Overall, the company has raised $189 million (€160 million) since its inception.

Existing investors Index Ventures and Eight Road Ventures participated once again in today’s funding round.

Spendesk, as the name suggests, focuses on all things related to spend management. Originally founded in startup studio eFounders, the startup first offered virtual and physical company cards for employees. While corporate cards are quite popular in the U.S., many small and medium companies in France can’t give a card to every single employee.

That’s why spending your company’s money can be a cumbersome process. You can borrow your boss’ card but they’ll have to trust you with it. You can pay with your own personal card but you want to be reimbursed as quickly as possible.

By combining a SaaS platform with corporate cards, it opens up a ton of possibilities. For instance, you can create an approval workflow for expensive purchases. You can set different budgets for different teams.

Over time, Spendesk has expanded beyond cards to manage expenses and invoice processing. It tries to automate some repetitive accounting tasks as well. Employees are automatically reminded that they have to attach a receipt for each transaction. You can export everything to Xero, Datev, Sage, Cegid or Netsuite.

If that pitch sounds familiar, it’s because there are a handful of European startups that are all doing well in this field. Soldo recently raised $180 million while Pleo snatched $150 million at a $1.7 billion valuation.

And yet, Spendesk doubled its revenue over the past year. Its team grew from 150 to 300 employees and it plans to double its headcount again over the next couple of years.

It means two things — the market opportunity is important and many customers are switching from old school workflows to modern SaaS products. That’s why three startups can grow at the same time.

“Traditionally, finance teams haven’t been equipped with the tools that can support this transformation,” Spendesk co-founder and CEO Rodolphe Ardant said in a statement. “In the past few years we have built the reference spend management solution for finance teams in Europe, which frees businesses and their people from administrative constraints of spending and managing money at work. While our solution is about empowering finance teams, we are actually delivering value to the entire business through the finance team.”

Spendesk currently has 3,000 clients, including Algolia, Soundcloud, Curve, Doctolib, Gousto, Raisin, Sezane and Wefox.

Image Credits: Spendesk

Powered by WPeMatico

New York-based startup Sketchfab has been acquired by Epic Games, the company behind Fortnite and Unreal Engine. Sketchfab has been building a platform to upload, download, view, share, sell and buy 3D assets. Essentially, it is the leading repository for 3D files on the web.

Epic Games isn’t disclosing the terms of the deal. Sketchfab will still operate as a separate brand and offering. Epic Games also says that all integrations with third-party tools will remain available, including with Unity.

The deal makes a ton of sense as Epic Games has been developing — and acquiring — some of the most popular creation tools. Unreal Engine has been one of the most popular video game engines of the past couple of decades.

More recently, Unreal Engine has been used for different use cases beyond video games, such as special effects, 3D explorations of virtual worlds, mixed reality projects and more.

But an engine without assets is pretty useless. That’s why creators either design their own 2D and 3D assets, outsource this process or buy assets directly. It led to the creation of an entire ecosystem of assets and creators.

Epic Games has its own Unreal Engine marketplace, but Sketchfab has been working on building the definitive 3D marketplace for many years with three important pillars — technology, reach and collaboration.

On the technology front, Sketchfab lets you view 3D models on any platform. The Sketchfab viewer works with all major browsers on both desktop and mobile — you can see an example on Sketchfab. It also works with VR headsets. You can upload 3D models from your favorite 3D modeling app, such as Blender, 3ds Max, Maya, Cinema 4D and Substance Painter.

Sketchfab can also convert any format into glTF and USDZ file formats. Those formats work particularly well on Android and iOS.

When it comes to reach, Sketchfab has grown tremendously over the years. In 2018, the company shared some metrics — 1 billion views, 2 million members and 3 million 3D models. Around the same time, the company launched a store so that creators can buy and sell assets directly on the platform.

Finally, Sketchfab launched an interesting feature for companies that work with 3D models all the time — Sketchfab for Teams. It’s a software-as-a-service play that lets you share a Sketchfab account with the rest of the team. Essentially, it works a bit like a shared Google Drive folder — but for 3D models.

With today’s acquisition, Epic Games is making some immediate changes. Starting today, store fees have been reduced from 30% to 12% — just like on the Epic Games Store. The company lowered commissions on ArtStation immediately after acquiring ArtStation, as well.

As for Sketchfab users paying a monthly subscription fee, everything is a bit cheaper now. All features in the Plus plan are now available for free, all features in the Pro plan are available to Plus subscribers, etc.

“We built Sketchfab with a mission to empower a new era of creativity and provide a service for creators to showcase their work online and make 3D content accessible,” Sketchfab co-founder and CEO Alban Denoyel said in the announcement. “Joining Epic will enable us to accelerate the development of Sketchfab and our powerful online toolset, all while providing an even greater experience for creators. We are proud to work alongside Epic to build the Metaverse and enable creators to take their work even further.”

With the acquisitions of ArtStation and Capturing Reality, Epic Games has been on an acquisition spree. It’s clear that the company wants to build an end-to-end developer suite for the gaming industry.

Powered by WPeMatico

Pivot Bio makes fertilizer — but not directly. Its modified microorganisms are added to soil and they produce nitrogen that would otherwise have to be trucked in and dumped there. This biotech-powered approach can save farmers money and time and ultimately may be easier on the environment — a huge opportunity that investors have plowed $430 million into in the company’s latest funding round.

Nitrogen is among the nutrients crops need to survive and thrive, and it’s only by dumping fertilizer on the soil and mixing it in that farmers can keep growing at today’s rates. But in some ways we’re still doing what our forebears did generations ago.

“Fertilizer changed agriculture — it’s what made so much of the last century possible. But it’s not a perfect way to get nutrients to crops,” said Karsten Temme, CEO and co-founder of Pivot Bio. He pointed out the simple fact that distributing fertilizer over a thousand — let alone ten thousand or more — acres of farmland is an immense mechanical and logistical challenge, involving many people, heavy machinery and valuable time.

Not to mention the risk that a heavy rain might carry off a lot of the fertilizer before it’s absorbed and used, and the huge contributions of greenhouse gases the fertilizing process produces. (The microbe approach seems to be considerably better for the environment.)

Yet the reason we do this in the first place is essentially to imitate the work of microbes that live in the soil and produce nitrogen naturally. Plants and these microbes have a relationship going back millions of years, but the tiny organisms simply don’t produce enough. Pivot Bio’s insight when it started more than a decade ago was that a few tweaks could supercharge this natural nitrogen cycle.

“We’ve all known microbes were the way to go,” he said. “They’re naturally part of the root system — they were already there. They have this feedback loop, where if they detect fertilizer they don’t make nitrogen, to save energy. The only thing that we’ve done is, the portion of their genome responsible for producing nitrogen is offline, and we’re waking it up.”

Other agriculture-focused biotech companies like Indigo and AgBiome are also looking at modifying and managing the plant’s “microbiome,” which is to say the life that lives in the immediate vicinity of a given plant. A modified microbiome may be resistant to pests, reduce disease or offer other benefits.

It’s not so different from yeast, which as many know from experience works as a living rising agent. That microbe has been cultivated to consume sugar and produce a gas, which leads to the air pockets in baked goods. This microbe has been modified a bit more directly to continually consume the sugars put out by plants and put out nitrogen. And they can do it at rates that massively reduce the need for adding solid fertilizer to the soil.

“We’ve taken what is traditionally tons and tons of physical materials, and shrunk that into a powder, like baker’s yeast, that you can fit in your hand,” Temme said (though, to be precise, the product is applied as a liquid). “All of a sudden managing that farm gets a little easier. You free up the time you would have spent sitting in the tractor applying fertilizer to the field; you’ll add our product at the same time you’d be planting your seeds. And you have the confidence that if a rainstorm comes through in the spring, it’s not washing it all away. Globally about half of all fertilizer is washed away… but microbes don’t mind.”

Instead, the microbes just quietly sit in the soil pumping out nitrogen at a rate of up to 40 pounds per acre — a remarkably old-fashioned way to measure it (why not grams per square centimeter?), but perhaps in keeping with agriculture’s occasional anachronistic tendencies. Depending on the crop and environment, that may be enough to do without added fertilizers at all, or it might be about half or less.

Whatever the proportion provided by the microbes, it must be tempting to employ them, because Pivot Bio tripled its revenue in 2021. You might wonder why they can be so sure only halfway through the year, but as they are currently only selling to farmers in the northern hemisphere and the product is applied at planting time early in the year, they’re done with sales for the year and can be sure it’s three times what they sold in 2020.

The microbes die off once the crop is harvested, so it’s not a permanent change to the ecosystem. And next year, when farmers come back for more, the organisms may well have been modified further. It’s not quite as simple as turning the nitrogen production on or off in the genome; the enzymatic pathway from sugar to nitrogen can be improved, and the threshold for when the microbes decide to undertake the process rather than rest can be changed as well. The latest iteration, Proven 40, has the yield mentioned above, but further improvements are planned, attracting potential customers on the fence about whether it’s worth the trouble to change tactics.

The potential for recurring revenue and growth (by their current estimate they are currently able to address about a quarter of a $200 billion total market) led to the current monster D round, which was led by DCVC and Temasek. There are about a dozen other investors, for which I refer readers to the press release, which lists them in no doubt a very carefully negotiated order.

Temme says the money will go toward deepening and broadening the platform and growing the relationship with farmers, who seem to be hooked after giving it a shot. Right now the microbes are specific to corn, wheat and rice, which of course covers a great deal of agriculture, but there are many other corners of the industry that would benefit from a streamlined, enhanced nitrogen cycle. And it’s certainly a powerful validation of the vision Temme and his co-founder Alvin Tamsir had 15 years ago in grad school, he said. Here’s hoping that’s food for thought for those in that position now, wondering if it’s all worth it.

Powered by WPeMatico

Zoom is taking advantage of the impressive rise in its stock price in the past year to make its first major acquisition. The popular video conferencing firm, which was valued at about $9 billion at its IPO two years ago, said Sunday evening it has agreed a deal to buy cloud call centre service provider Five9 for about $14.7 billion in an all-stock transaction.

20-year-old Five9 will become an operating unit of Zoom after the deal, which is expected to close in the first half of 2022, the two firms said.

The proposed acquisition is Zoom’s latest attempt to expand its offerings. In the past year, the video conferencing software has added several office collaboration products, a cloud phone system, and an all-in-one home communications appliance.

The acquisition of Five9 — which has amassed over 2,000 customers worldwide including Citrix and Under Armour and processes over 7 billion minutes of calls annually — will help Zoom enter the “$24 billion” market for contact centers, the company said.

“We are continuously looking for ways to enhance our platform, and the addition of Five9 is a natural fit that will deliver even more happiness and value to our customers,” said Eric S. Yuan, founder and chief executive of Zoom, in a statement.

Joining forces will offer both firms “significant” cross-selling opportunities in each other’s respective customer bases, the two firms said.

“Businesses spend significant resources annually on their contact centers, but still struggle to deliver a seamless experience for their customers,” said Rowan Trollope, chief executive of Five9.

“It has always been Five9’s mission to make it easy for businesses to fix that problem and engage with their customers in a more meaningful and efficient way. Joining forces with Zoom will provide Five9’s business customers access to best-of-breed solutions, particularly Zoom Phone, that will enable them to realize more value and deliver real results for their business. This, combined with Zoom’s ‘ease-of use’ philosophy and broad communication portfolio, will truly enable customers to engage via their preferred channel of choice.”

The two firms will do a joint Zoom call Monday to share more about the transaction.

Powered by WPeMatico