Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

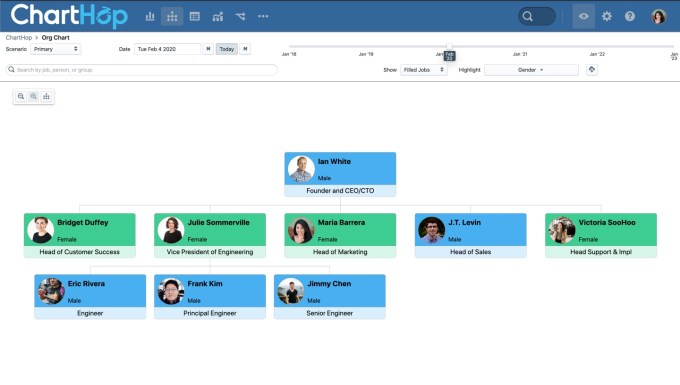

ChartHop, a startup that aims to modernize and automate the organizational chart, announced a $5 million seed investment today led by Andreessen Horowitz.

A big crowd of other investors also participated including Abstract Ventures, the a16z Cultural Leadership Fund, CoFound, Cowboy Ventures, Flybridge Capital, Shrug Capital, Work Life Ventures and a number of unnamed individual investors, as well.

Founder, CEO and CTO, Ian White says that at previous jobs including as CTO and co-founder at Sailthru, he found himself frustrated by the available tools for organizational planning, something that he says every company needs to get a grip on.

White did what any good entrepreneur would do. He left his previous job and spent the last couple of years building the kind of software he felt was missing in the market. “ChartHop is the first org management platform. It’s really a new type of HR software that brings all the different people data together in one place, so that companies can plan, analyze and visualize their organizations in a completely new way,” White told TechCrunch.

While he acknowledges that among his early customers, the Head of HR is a core user, White doesn’t see this as purely an HR issue. “It’s a problem for any executive, leader or manager in any organization that’s growing and trying to plan what the organization is going to look like more strategically,” he explained.

Lead investor at a16z David Ulevitch, also sees this kind of planning as essential to any organization. “How you structure and grow your organization has a tremendous amount of influence on how your company operates. This sounds so obvious, and yet most organizations don’t act thoughtfully when it comes to organizational planning and design,” Ulevitch wrote in a blog post announcing the investment.

The way it works is that out of the box it connects to 15 or 20 standard types of company systems like BambooHR, Carta, ADP and Workday, and based on this information it can build an organizational chart. The company can then slice and dice the data by department, open recs, gender, salary, geography and so forth. There is also a detailed reporting component that gives companies insight into the current makeup and future state of the organization.

The visual org chart itself is set up so that you can scrub through time to see how your company has changed. He says that while it is designed to hide sensitive information like salaries, he does see it as a way of helping employees across the organization understand where they fit and how they relate to other people they might not even know because the size of the company makes that impossible.

ChartHop org chart organized by gender. Screenshot: ChartHop

White says that he has dozens of customers already, who are paying ChartHop by the employee on a subscription basis. While his target market is companies with more than 100 employees, at some point he may offer a version for early-stage startups who could benefit from this type of planning, and could then have a complete history of the organization over the life of the company.

Today, the company has 9 employees, and he only began hiring in the fall when this seed money came through. He expects to double that number in the next year.

Powered by WPeMatico

BluBracket, a new security startup from the folks who brought you Vera, came out of stealth today and announced a $6.5 million seed investment. Unusual Ventures led the round with participation by Point72 Ventures, SignalFire and Firebolt Ventures.

The company was launched by Ajay Arora and Prakash Linga, who until last year were CEO and CTO respectively at Vera, a security company that helps companies secure documents by having the security profile follow the document wherever it goes.

Arora says he and Linga are entrepreneurs at heart, and they were itching to start something new after more than five years at Vera. While Arora still sits on the Vera board, they decided to attack a new problem.

He says that the idea for BluBracket actually came out of conversations with Vera customers, who wanted something similar to Vera, except to protect code. “About 18-24 months ago, we started hearing from our customers, who were saying, ‘Hey you guys secure documents and files. What’s becoming really important for us is to be able to share code. Do you guys secure source code?’”

That was not a problem Vera was suited to solve, but it was a light bulb moment for Arora and Linga, who saw an opportunity and decided to seize it. Recognizing the way development teams operated has changed, they started BluBracket and developed a pair of products to handle the unique set of problems associated with a distributed set of developers working out of a Git repository — whether that’s GitHub, GitLab or BitBucket.

The first product is BluBracket CodeInsight, which is an auditing tool, available starting today. This tool gives companies full visibility into who has withdrawn the code from the Git repository. “Once they have a repo, and then developers clone it, we can help them understand what clones exist on what devices, what third parties have their code, and even be able to search open source projects for code that might have been pushed into open source. So we’re creating what we call a blueprint of where the enterprise code is,” Arora explained.

The second tool, BluBracket CodeSecure, which won’t be available until later in the year, is how you secure that code including the ability to classify code by level importance. Code tagged with the highest level of importance will have special status and companies can attach rules to it like that it can’t be distributed to an open source folder without explicit permission.

They believe the combination of these tools will enable companies to maintain control over the code, even in a distributed system. Arora says they have taken care to make sure that the system provides the needed security layer without affecting the operation of the continuous delivery pipeline.

“When you’re compiling or when you’re going from development to staging to production, in those cases because the code is sitting in Git, and the code itself has not been modified, BluBracket won’t break the chain,” he explained. If you tried to distribute special code outside the system, you might get a message that this requires authorization, depending on how the tags have been configured.

This is very early days for BluBracket, but the company takes its first steps as a startup this week and emerges from stealth next week at the RSA security conference in San Francisco. It will be participating in the RSA Sandbox competition for early security startups at the conference, as well.

Powered by WPeMatico

“I don’t feel good about that. That sucks,” Chrys Bader-Wechseler reflects when asked about the bullying that went down on the anonymous app Secret he co-founded in 2013. After $35 million raised, 15 million users and a spectacular flame out two years later, the startup was dead. “Since I left Secret I feel alive and aligned with my values and my purpose again.”

But there was one bright side to Secret letting you post without a name or consequences. People opened up, got vulnerable and felt less alone when comments revealed they weren’t the only person dealing with a certain struggle. What Bader learned from watching Secret’s users “do this in the dark” was the realization that “actually, we need to learn to do this in the light, to have that same kind of dialogue, but do it openly with each other.”

So began the journey to Bader’s new startup Ikaria that’s exclusively revealing itself to the world today on TechCrunch. It’s a different kind of chat app, named after the Greek island where a close-knit community helps extend people’s lifespans. The six-person Santa Monica team is funded by a $1.5 million seed round led by Initialized Capital and Fuel Capital. People can sign up for early beta access here.

During a long interview about the startup, Bader and his co-founder Sean Dadashi were cagey about exactly how Ikaria works, as it’s still in development. Amidst all the philosophical context about the app’s intention, I was able to pull out a few details about what the product will actually look like.

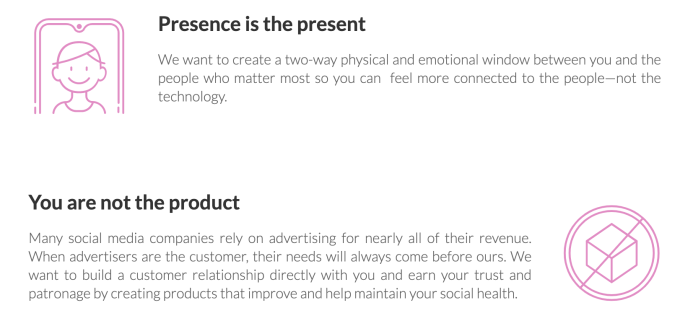

“Basically, since 2004, technology has created this monumental shift in the human social experience. We’re more connected than ever technically but all the studies show we’re lonelier than ever,” Bader explains. “It’s like eating McDonald’s to get healthy. It’s not the right source of nutrition for our social well-being because true connection requires a level of vulnerability, presence, self-disclosure and reciprocity that you don’t really get on these platforms.”

Ikaria isn’t another feed. It’s a safe space where you can chat with close friends and family, or people going through similar life challenges. Members of these group chats will optionally go through guided experiences that help them reflect on and discuss what’s going on in their hearts and minds. This could become a whole new media format where outside creators or mental health professionals could produce and contribute their own guided experiences.

“Part of the reason we’re announcing this is that . . . it’s a call to action to involve all these practitioners and people who are doing these types of things and giving them a platform to allow them to facilitate these kind of group bonding experiences through a platform where they can extend their practices into the digital world,” Bader tells me. What Calm and Headspace did for making meditation more mainstream and accessible, Ikaria wants to do for mental health through online togetherness.

Ikaria already has a sizable closed beta going, which the startup plans to continue until it finds product fit, and it hopes to know its official release timeline by the end of the year. “We’re not going to launch this until we know 40% of people would be disappointed if they couldn’t use it.”

Rather than monetizing by exploiting people’s attention, Ikaria plans to develop a “customer relationship” with users, which could mean subscription access or in-app payments for buying content. Perhaps one user could act as the sponsor and purchase an experience for their whole group chat. Until then, it’s got its seed funding from Initialized, Fuel Capital, F7 Ventures, Ryan Hoover’s Weekend Fund, Backend Capital, Day One Ventures, Shrug, Todd Goldberg and Superhuman’s Rahul Vohra.

“The hope is that eventually this would be an app you use instead of iMessage, to increase your sense of presence,” Bader explains, revealing its grand ambitions. Why would we need to replace our core chat apps? Well for one thing, they don’t understand who really matters to you. If an app understood who your mom is, it could give her messages special prevalence or remind you to contact her.

Bader met Dadashi through an offline men’s group for discussing life, love and everything in the wake of Secret’s collapse and a rough romantic breakup. After just a few weeks of these meetups, they say they felt closer to each other than to most of their friends. Only later did Bader, a designer by trade, discover that Dadashi was a coder who’d been CTO of electronics company MHD Enterprises before starting a travel and lifestyle startup for mental wellness, called Somatic Studios. They tried working together on an app for sharing quotes from your friends but scrapped it.

Together, the pair went on to research the rapid rise of other vulnerability-focused meetup organizations like the one where they met, including Evryman, ManKind Project, Quilt, Authentic Relating, Circling, and T-Groups. Though they knew that to have a chance at impact at scale, they’d need to build a mobile app familiar enough to get people over the hurdle of starting a mindfulness practice. They laid out a few principles to build by: a focus on relationships instead of Likes and followers, conscious design that won’t exploit people’s attention or weaknesses, no ads, and keeping all data private and in control of the user.

There are other startups hoping to address the sad state of mental health from different angles. Talkspace offers a mobile connection to licensed therapists, though it can be pricey at $65 to $99 per week. 7 Cups and TalkLife makes peer-to-peer counseling from volunteers free, though these aren’t professionals. There are also plenty of journaling products, gratitude practice apps and wellness podcasts out there. But Ikaria’s approach, combining mental health content with group chats of people you trust, feels unique.

Having known Bader since the Secret days, it’s obvious that working with Dadashi has made him happier and more centered. Ikaria is an app he can wake up feeling good about each day. “You know, I don’t like to speak ill of David [Byttow, Secret’s CEO who sources say was verbally abusive to employees], but that relationship was very, very toxic and taxing for me. And this time around with Sean, as I’m sure you can tell, is the polar opposite.”

If Ikaria can help people develop the open and honest relationships with friends or peers like building it has done for Bader and Dadashi, it could be a beacon amidst a sea of time unwell spent.

Powered by WPeMatico

HQ Trivia is dead. Today the company laid off its full staff of 25 and will cease operation of its trivia, sports and word guessing games, a source close to the company confirmed.

HQ Trivia had a deal in the works to be acquired, but the buyer pulled out yesterday and investors aren’t willing to fund it any longer, CEO and co-founder Rus Yusupov said in a statement attained by CNN Business’ Kerry Flynn:

“We received an offer from an established business to acquire HQ and continue building our vision, had definitive agreements and legal docs, and a projected closing date of tomorrow, and for reasons we are still investigating, they suddenly changed their position and despite our best efforts, we were unable to reach an agreement,” Yusupov writes. “Unfortunately, our lead investors are no longer willing to fund the company, and so effective today, HQ will cease operations and move to dissolution. All employees and contractors will be terminated as of today.”

With HQ we showed the world the future of TV. We didn’t get to where we hoped but we did stretch the world’s imagination for what’s possible on our smartphones. Thanks to everyone who helped build this and thanks for playing.

— Rus (@rus) February 14, 2020

Launched in October 2017, TechCrunch wrote the first coverage of the 12-question live video trivia game started by two of the former Vine founders. Users could win real money by answering all the questions and not being eliminated in multiple daily games. HQ Trivia had raised more than $15 million, including a Series A led by Founders Fund. At one point it had more than 2.3 million concurrent players.

But eventually the novelty began to wear off. Cheaters came in, splitting the prize money down to just a few dollars or cents per winner. Copycats emerged internationally. Engineering issues led users to get kicked out of the game.

Then tragedy struck. Co-founder Colin Kroll passed away. That exacerbated internal problems at HQ Trivia. Product development was slow, leading users to grow tired of the game. New game types and viral features materialized too late.

A failed internal mutiny saw staffers prepare to petition the board to remove Yusupov from the CEO position. When he caught wind of the plot, organizers of the revolt were fired. Morale sunk. By July 2019, downloads were just 8% of their previous year’s, and 20% of the staff was laid off. HQ managed about 15 million all-time installs, peaking at 2 million in February 2018, while last month it had just 67,000, according to Sensor Tower.

The demise of HQ Trivia demonstrates the fickle nature of the gaming industry, and the startup scene as a whole. Momentary traction is no guarantee of future success. Products must continually evolve and adapt to their audience to stay relevant. And executives must forge ahead while communicating clearly with their teams, even amongst uncertainty, or find their companies withered by the rapid passing of time.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re adding five names to the $100 million annual recurring revenue (ARR) club and listing all preceding members in a single post. This series, which was a bit of an accident, if I’m being honest, has included more than a dozen companies that have reached $100 million ARR, along with a handful more that are close.

Today we’re adding Seismic, ThoughtSpot, Noom, Riskified and Moveable Ink to the list. As always, we have funding histories, growth metrics and interviews below on the new group. But at this juncture, as we head toward the two-dozen company mark, it’s a good time to ask, what is this list that we’re compiling?

At first, the goal of the jokingly-named “$100 million ARR club” was to highlight companies that were of real scale, an idea designed to gently push back against the “unicorn” moniker. As more and more unicorns were born and the private-capital world became adept at getting startups of all maturity levels over the requisite $1 billion valuation threshold, the term began to feel too diluted to have much signaling value.

While, in contrast, $100 million in ARR felt much more “hard” to the valuation metric’s comparable squishiness. But, since that first post, more and more companies have written in, sharing hard metrics and the series has continued. Perhaps we’re really just compiling an IPO watchlist, a grouping of firms that will probably go (or should go) public in the next 18 months.

Let’s dig into our new additions. Then, we’ll list all our prior entrants with links to our preceding coverage in case you are playing catch up. With that, here’s the entire $100 million ARR club a list of companies that we think could go public inside the next six quarters.

Powered by WPeMatico

When Google announced that it was acquiring data analytics startup Looker for $2.6 billion, it was a big deal on a couple of levels. It was a lot of money and it represented the first large deal under the leadership of Thomas Kurian. Today, the company announced that deal has officially closed and Looker is part of the Google Cloud Platform.

While Kurian was happy to announce that Looker was officially part of the Google family, he made it clear in a blog post that the analytics arm would continue to support multiple cloud vendors beyond Google.

“Google Cloud and Looker share a common philosophy around delivering open solutions and supporting customers wherever they are—be it on Google Cloud, in other public clouds, or on premises. As more organizations adopt a multi-cloud strategy, Looker customers and partners can expect continued support of all cloud data management systems like Amazon Redshift, Azure SQL, Snowflake, Oracle, Microsoft SQL Server and Teradata,” Kurian wrote.

As is typical in a deal like this, Looker CEO Frank Bien sees the much larger Google giving his company the resources to grow much faster than it could have on its own. “Joining Google Cloud provides us better reach, strengthens our resources, and brings together some of the best minds in both analytics and cloud infrastructure to build an exciting path forward for our customers and partners. The mission that we undertook seven years ago as Looker takes a significant step forward beginning today,” Bien wrote in his post.

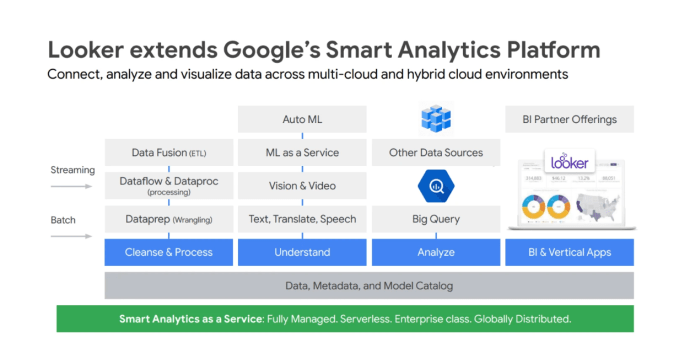

At the time the deal was announced in June, the company shared a slide, which showed where Looker fits in what they call their “Smart Analytics Platform,” which provides ways to process, understand, analyze and visualize data. Looker fills in a spot in the visualization stack while continuing to support other clouds.

Slide: Google

Looker was founded in 2011 and raised more than $280 million, according to Crunchbase. Investors included Redpoint, Meritech Capital Partners, First Round Capital, Kleiner Perkins, CapitalG and PremjiInvest. The last deal before the acquisition was a $103 million Series E investment on a $1.6 billion valuation in December 2018.

Powered by WPeMatico

Marketing startup Habu is emerging from stealth today and announcing that it has already raised $15 million in Series A funding.

The company comes out of super{set}, the startup studio created by Krux founders Tom Chavez and Vivek Vaidya. In fact, Chavez is Habu’s chairman, Vaidya serves as CTO and their former Krux colleague Matt Kilmartin (who eventually became chief customer officer for Salesforce’s consumer engagement platform after Salesforce acquired Krux) is the startup’s CEO.

Kilmartin told me that Habu was created to solve a “still elusive” marketing challenge — delivering “omni-channel orchestration for the entire customer journey.” In other words, he’s saying that chief marketing officers are still struggling to deliver personalized messages to potential customers across every channel and at every stage.

Kilmartin argued that’s because they’re challenged by new privacy regulations, plus the fact that many marketing tools struggle to integrate data from the major digital ad platforms. And then there are the limitations of the big marketing clouds (including Kilmartin’s old employer Salesforce), which he said are “stitching together all the stuff they bought — their goal is to have everyone go all-in on one of their stacks.”

So Habu isn’t trying to build yet another marketing platform. Instead, the company describes its core product as a “marketing data operating system” that can be used alongside the aforementioned clouds, bringing a company’s customer data together across platforms, then providing automated insights and recommendations on how to use that data to deliver personalized marketing. And it does this in a way that complies with privacy regulations like GDPR and CCPA.

“We’re trying not to be a platform,” Kilmartin said. “It’s a modular, interoperable suite of services.”

Habu’s software can pull in a marketer’s first-party customer data, as well as data from platforms like Google and Facebook. Kilmartin said that while these platforms remain a “blind spot” for many marketers, “They have APIs and frameworks to be able to do this, it just requires a level of sophistication. And there just aren’t that many extra data scientists that these brands have sitting around.”

In addition to super{set}, Habu’s funding comes from Ridge Ventures. And although Habu is only launching publicly today, it already has customers in the CPG and media industries.

Update: An earlier version of this story incorrectly identified some of Habu’s customers.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

This morning we’re exploring Airbnb’s march to the public markets. The popular DIY hospitality startup promised last year that it would go public in 2020. That timeline means that its 2019 performance will be included in an eventual S-1 filing, putting the results on public display.

Recent news, however, doesn’t paint a perfect picture for the famous unicorn. Indeed, Airbnb’s history of rapid growth and profitability appears to have been replaced by slowing growth and profit struggles. The Wall Street Journal reported results from the company’s third quarter that are at once encouraging — a return to profitability — and troublesome; Airbnb’s first three quarters of 2019 are in the red as a group, a change from historical profitability.

If Airbnb goes public soon, as it has promised, its recent, trailing results will matter. To get ready for its IPO, let’s rewind through what we’ve learned about Airbnb’s revenue, revenue growth and profitability over the years. Doing this will help us understand how the startup went from rising profitability to posting, through the first three quarters of 2019, a nine-figure net loss.

The Airbnb public offering (likely a direct listing) is going to be the financial event of the year. Get excited.

The following data points were culled from a host of reports over the past half decade. Each is accompanied by its original source, and I encourage you to read the pieces to get a feel for how Airbnb has been discussed through time. The tone of Airbnb coverage largely tracks its performance; when Airbnb was at the steepest part of its growth curve, the media was enthused. Lately, however, the writing is a bit different.

You’ll see why:

Powered by WPeMatico

Infosys is a huge consulting organization based in India, which works with clients as they implement complex software integrations. Today, the company announced it was buying Simplus, a Salesforce integration consultant, for $250 million.

The company, which is based in Salt Lake City, Utah, launched in 2014 and has raised almost $50 million, according to Crunchbase data. It brings a wide range of Salesforce consulting, training and integration services along with general Salesforce expertise, which Infosys hopes to put to work.

The acquisition follows the purchase of Fluido, another Salesforce consulting shop, in 2018. The moves suggest that Infosys wants to build deeper expertise around Salesforce and make that a key piece of its consulting operations moving forward.

Brent Leary, a CRM industry veteran, who is owner at CRM Essentials, says that Simplus is well-positioned in the Salesforce ecosystem to capture lucrative cloud integration services, and it should help expand Infosys’s Salesforce consulting arm. “By acquiring Simplus, it allows Infosys to grab more market share, while extending Salesforce capabilities to offer existing clients,” Leary told TechCrunch.

Ravi Kumar, president at Infosys, sees it in similar terms. “Simplus will be a valuable addition to the Infosys family. Complementing our industry knowledge and existing Salesforce footprint with their strong presence in key markets, deep Salesforce consulting and advisory expertise will help accelerate the transformation journey of incumbent companies,” Kumar said in a statement.

Holger Mueller, an analyst at Constellation Research, says Simplus should especially help in the area of Quote-to-Cash, that period after the sale when quotes are shared, contracts are signed and cash is collected on the sale. “It creates the opportunity for Infosys to break out of the vendor services silos and connect its Salesforce services with its ERP services (SAP, Oracle),” he said.

The deal is expected to close in Infosys’s fiscal 2020 fourth quarter. Per usual, it is subject to standard regulatory approval.

Powered by WPeMatico

Impala has raised another round of funding just a few months after raising an $11 million Series A round. This time, the startup is raising a $20 million Series B round led by Lakestar. Latitude Ventures is also participating in the round.

The company is building a service that works pretty much like Plaid, but for hotel rooms. The hotel industry relies on old-school “property management systems” to manage rooms, room types, pricing, extras, taxes, etc.

Instead of asking hotels to switch to an entirely different property management system, the company is upgrading those systems with a modern API. This way, you can build applications that query hotel data directly with a few lines of code. You get a standardized JSON response from the API.

Impala is currently compatible with a handful of property management systems. The company is still adding more systems in order to cover a wider range of hotels.

Three hundred hotels are currently working with Impala, such as Accor hotels (Mercure) and Hyatt-branded hotels. The company currently has a backlog of 3,500 hotels. It really shows that the industry has been waiting for a product like this.

While Impala is still focused on surfacing data in an easy-to-code manner, the company is already thinking beyond read-only data. The startup wants to let developers book rooms directly using the Impala API.

It could open up hotel bookings to many other services. For instance, you could imagine being able to book rooms on Lonely Planet’s website. Services selling train tickets and flights could upsell you with hotel rooms.

In order to offer rooms on the usual hotel booking services from Booking Holdings websites (Booking.com, Priceline, Agoda, Kayak…) and Expedia Group websites (Expedia, Hotels.com, HomeAway, Trivago…), many hotels currently work with channel managers to send out information to multiple services at once. In the future, Impala could replace those channel managers with its API.

Powered by WPeMatico