Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

You’ve been busy. I’ve been busy. But people are talking about Slack all over Twitter, so let me catch us both up.

All the ruckus concerning Slack and its publicly traded stock appeared to kick off with a Business Insider story, which had the following headline:

Slack just scored its biggest customer deal ever, as IBM moves all 350,000 of its employees to the chat app

Given the context of the simmering Slack versus Teams battle, having Slack win what appeared to be a huge, new contract was big news. Slack’s shares shot higher, and the news engendered all sorts of headlines that now look a bit silly.

Slack may survive after all, after IBM choose [sic] them as exclusive supplier for 350,000 employees

Slack shares traded up sharply all day. They were worth 15.4% more than yesterday, and then, all of a sudden this fine afternoon, trading of Slack’s equity was halted, pending news.

This led to general chaos, with everyone trying to figure out what had happened. Had Google bought Slack? Had Slack bought a small poodle? Was IBM not a Slack customer? It wasn’t clear.

Halting a stock, to be clear, is a big deal, and instantly brings attention to the company in question. Public firms don’t hold for news much, as it’s no good and no fun. It’s also why earnings come after hours.

Later, Slack released an SEC filing, which included the fact that IBM was already one of its customers. This meant that IBM was not a new customer, and that the headline 350,000 employee figure would not manifest itself in that many novel seats of Slack sold.

The company itself put a final bit of ironmongery in the human plasticware, saying the following in the filing to tamp down the market’s enthusiasm:

IBM has been Slack’s largest customer for several years and has expanded its usage of Slack over that time. Slack is not updating its financial guidance for the fourth quarter of the fiscal year ended January 31, 2020 or for the fiscal year ended January 31, 2020.

Womp womp, I believe is the phrase.

Also this happened, but the day’s events appear to be mostly a lot of whatnot that wound up being not what we thought.

When Slack finally did begin to float in after-hours trading, it quickly gave back about half of its gains. Slack shares are currently worth $24.56 in after-hours trading. They started the day worth around $23, and traded as high as the mid $27s.

Now you know.

Powered by WPeMatico

Over the last few years, Facebook has been busy building out AI capabilities in areas like computer vision, natural language processing (NLP) and ‘deep learning,’ in part by acquiring promising startups in the space.

Understandably, this has seen the U.S. social networking giant look to the U.K. for AI talent, including an acqui-hire of NLP startup Bloosbury AI in 2018, and most recently, acquiring Scape Technologies, a British company using computer vision to offer more accurate location positioning for augmented reality.

Now TechCrunch has learned that a third U.K. acquisition quietly took place this December, seeing Facebook acquire Deeptide Ltd., the company behind Atlas ML, which is also the custodian of “Papers With Code,” the free and open resource for machine learning papers and code.

A regulatory filing for Deeptide reveals that Facebook became a majority owner on 13th December 2019. The same day, Atlas ML co-founder Robert Stojnic published a Medium post titled “Papers with Code is joining Facebook AI,” which went largely unnoticed outside of the machine learning research community.

Terms of the deal — or even that the acquisition took place — weren’t announced by Facebook at the time, beyond Stojnic’s sanctioned post. However, according to my sources within London’s tech community, the ballpark price is thought to have been around $40 million or thereabouts.

Founded in 2018 by Stojnic and Ross Taylor, Atlas ML wanted to “make it easier to discover and apply deep learning research”. The young startup was an alumni of Entrepreneur First (EF) — along with Bloomsbury and Scape — and raised subsequent seed funding from Episode1 and Kindred Capital.

I’ve contacted Facebook for comment and will update this post if and when I hear back.

Powered by WPeMatico

Scape Technologies, the London-based computer vision startup working on location accuracy beyond the capabilities of GPS, has been acquired by Facebook, according to a regulatory filing.

Full terms of the deal remain as yet unknown, although a Companies House update reveals that Facebook Inc. now has majority control of the company (more than 75%). However by looking at other filings, including a recent share issue, I understand the price could be about $40 million.

Further filings show that Scape’s previous venture capital representatives have resigned from the Scape board and are replaced by two Facebook executives.

Scape’s backers included Entrepreneur First (EF) — the startup is an alumni of the company builder program — along with LocalGlobe, Mosaic Ventures, and Fly Ventures.

Noteworthy is that EF and Fly Ventures have both already had a joint exit to Facebook of sorts, when Bloomsbury AI was acqui-hired by the social networking behemoth (a story that I also broke).

Founded in 2017, Scape Technologies was developing a “Visual Positioning Service” based on computer vision which lets developers build apps that require location accuracy far beyond the capabilities of GPS alone.

The technology initially targeted augmented reality apps, but also had the potential to be used to power applications in mobility, logistics and robotics. More broadly, Scape wanted to enable any machine equipped with a camera to understand its surroundings.

Scape CEO and co-founder Edward Miller previously described Scape’s “Vision Engine” as a large-scale mapping pipeline that creates 3D maps from ordinary images and video. Camera devices can then query the Vision Engine using the startup’s “Visual Positioning Service” API to determine their exact location with far greater precision than GPS can ever provide. The Visual Positioning Service was made available to select developers via Scape’s SDK.

Meanwhile the acquisition by Facebook, no matter what form it takes, looks like a good fit given the U.S. company’s investment in next generation platforms, including VR and AR. It is also another — perhaps, worrying — example of U.S. tech companies hoovering up U.K. machine learning and AI talent early.

Update: A Facebook spokesperson provided the following statement: “We acquire smaller tech companies from time to time. We don’t always discuss our plans.”

Powered by WPeMatico

With Casper’s public offering earlier this week, we’ve closed the book on the first two venture-backed IPOs of note in 2020. Casper, joined by One Medical, carried over $870 million of private capital, venture and otherwise, across the finish line.

Even though each IPO featured an unprofitable tech-enabled business that had posted sub-30% growth and gross margins under 50% (far more, in the case of One Medical), they wound up miles apart in terms of their market reception and resulting valuation, measured in revenue multiples terms.

So what can we learn from the two IPOs as we look ahead to other unicorn debuts in 2020? A great number of things that help set the stage for the rest of 2020’s IPO class. Let’s discuss three observations that stick out the most.

The surprise of the year so far has been the public market’s reaction to One Medical’s IPO. The company, today worth $3.13 billion, is trading at 11.3x times the top end of its 2019 revenue projections (the company has yet to close the books on its Q4 accounting).

Powered by WPeMatico

Hello and welcome back to Equity, TechCrunch’s venture capital-focused podcast, where we unpack the numbers behind the headlines.

This week was something fun. First, we were back as a group in the San Francisco studio, which is always fun. Even better, we had NEA’s Rick Yang on hand to chat with Danny and Alex about the week. Yang, as old-school Equity listeners will recall, was on the show back in 2017. (Equity turns three soon, which is somewhat amazing.)

All that aside, let’s talk about what we talked about. As always, we kicked off with three rounds:

After that we chugged through a mountain of news. First up, the confirmation of a story that we mentioned on the show before, namely the existence of a new venture fund (angel pool, perhaps) from the CEO of email startup Superhuman Rahul Vora and Eventjoy founder Todd Goldberg. The $7 million vehicle is going to cut pre-seed sized checks ($75,000 to $200,000), which should make it a popular pit stop for pre-revenue companies.

What next? Well, Casper of course. The company’s IPO pricing and debut was this week, something that we’ve had something to say about. That, and the latest from One Medical’s strong post-IPO performance, and the news that Asana has filed privately to go public in a direct listing.

That last item was of particular interest, as the company hasn’t raised as much cash as other companies that we’ve seen direct list, the Spotifys and Slacks of the world. So has it raised capital that we haven’t heard about, or has it simply not spent the capital it has raised? If it had spent the money, then wouldn’t it want to raise some like with a traditional IPO? Mysteries! Riddles that will be solved when we get to see the damn filing.

Oh, and Spotify continues to pour money into podcasting. Which everyone ’round the table thought was pretty smart.

Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and all the casts.

Powered by WPeMatico

This morning Carta, a startup that helps private companies manage equity, announced it has created an investing vehicle called Carta Ventures. The well-funded unicorn wants to invest in young startups that it sees building off of its data-driven perspective into the world of private companies, helping to foster an ecosystem around its core products and services.

As TechCrunch has reported, the world of corporate venture capital has seen an enormous rise in the number of players active in the category, as cash-rich incumbents of all sizes deploy cash as a way to both keep an ear to the ground in their market and surrounding areas, and perhaps drive some cash-on-cash returns to boot. Companies like Slack have also compiled investing entities while private to put capital to work in companies that plug into their platform.

With all the activity in corporate venture capital, why do we care about Carta Ventures? Mostly because Carta itself is of growing importance in the expanding and increasingly crucial world of private companies, and the company has some pretty specific things it’s looking to invest in.

Carta works with private companies to help with certain valuation varietals, cap tables and reporting. It also offers tools and services for the venture class. This puts it squarely in the middle of the private market, which is in the midst of a long crescendo.

Investment into private companies is growing. The number of public companies is falling, and it’s taking longer for private companies to go public. The companies staying private are worth hundreds of billions of dollars. Hell, even The Economist dug into the private company boom, noting that “[i]nstitutional investors are rushing headlong into private markets, especially into venture capital, private equity and private debt.”

And Carta provides behind-the-scenes sinew and tissue to both the players (startups and other private companies) and their fuel (investors of all stripes). Efforts that sum to the startup working to expand the world of companies supporting those same firms through its new venture fund.

Carta wants to accelerate (and even instigate, as we’ll see) companies that add to its own platform, making investing and participating in the private markets a bit more limpid and simple — two things that the world of private capital and its constituent bets have never had in abundance.

To get a grip on who Carta wants to fund and why, TechCrunch caught up with James McGillicuddy, who heads up strategy for the company. Starting with the basics, the capital that Carta Ventures plans to invest will come out of Carta’s own accounts. McGillicuddy said that the entity will invest “balance sheet capital, with no outside structure,” meaning that the setup is “very much from the corporate ventures playbook.”

Standard so far, then. Next we wanted to know about how many general partners Carta Ventures would muster to go into the market. Instead of answering that directly, McGillicuddy discussed a number of existing internal staffers, and a collection of folks that he considers a “pretty good group of folks in the classical sense on the investment committee that will be able to help these entrepreneurs and guide them towards a business that we think should exist now that we [are] programmatically opening up access to the markets.”

Carta Ventures intends to write seed checks, according to a pre-release copy of a blog post shared with TechCrunch. McGillicuddy added that Carta Ventures’ “first priority is helping folks think through how to leverage our platform to build things that we think should exist, that we don’t have the expertise [in].”

As you can tell from McGillicuddy’s last two answers, there is intentionality afoot at Carta Ventures in terms of what it wants to see built.

In a blog post written by Carta CEO Henry Ward, three companies are mentioned: A startup focused on helping other companies come up with fair and market-fitting “total compensation” for employees including both cash and stock; a startup focused on “build[ing] analytic investment tools for venture as an asset class;” and one final startup focused on executing and publishing research on private companies.

I was curious why Carta wouldn’t just build this out itself, given how precise its anticipation of what it wants to be built. McGillicuddy said that the best people for all things that Carta wants to see aren’t inside its offices (true), and that even if some of those folks were already working for Carta, his company has “many other priorities and so many things to build.”

Fair enough. But it indicates that Carta isn’t just building a corporate venture arm to go out and put money to work in companies that could later eat its lunch. Instead, it wants to put to use capital as a lever to power particular firms that could extend its reach.

Carta’s venture fund is willing to put money to work in idea-stage companies, provided that you’re doing stuff that it finds enticing (see above). And Carta is willing to put you up in its office and so forth. It’s there to help if you want it.

Why is all this happening? Carta isn’t public and probably isn’t profitable. How can it afford to have its own venture arm? This is how:

That was back in mid-2019 when it raised $300 million at a $1.7 billion valuation.

When the private capital markets are wiling to throw that much money at you, why not put it to work funding smaller companies who may profit off of your private company platform?1

Powered by WPeMatico

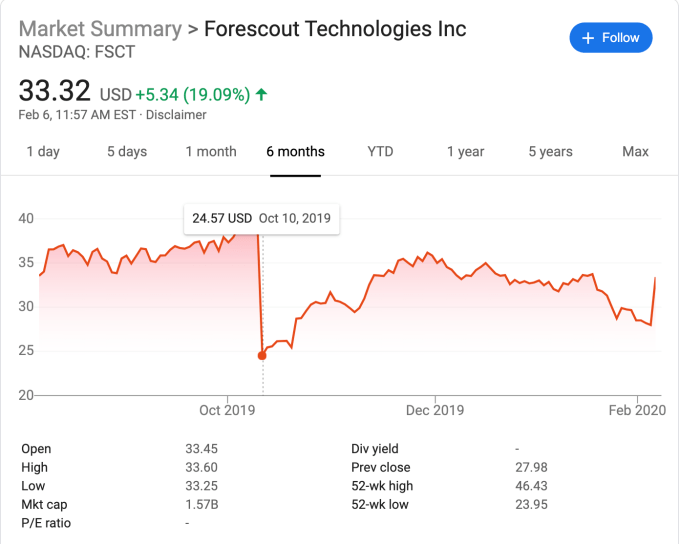

Forescout, the network security company that has been publicly traded since 2017, announced today it was going private again. Private equity firms Advent International and Crosspoint Capital are acquiring the company in an all-cash purchase of $1.9 billion.

The two private equity firms will pay $33 per share, which represented a premium of 30% over the company’s closing price of $25.45 on October 19, 2019. The stock hit $39.87 on October 4th before starting a precipitous drop later that month, dropping to $24.57 on October 10th.

Not coincidentally, that was the day the company reported its earnings and had a bad revenue miss. Projections had revenue in the $98.8 million – $101.8 million range. Actual reported revenue was far less, at $91.6 million, according to data from the company.

In the earnings call that followed on November 7th, Forescout president and CEO Michael DeCesare tried to blame the bad results on extended sales, but it didn’t really help, as private equity firms swooped in to make the deal. “We experienced extended sales cycles across several of our customers that pushed out deals and which did not become apparent until we entered the final days of the quarter. We do not believe that any of these deals have been lost to competitors,” he told analysts.

In a statement today, DeCesare tried to put a positive spin on the acquisition. “This transaction represents an exciting new phase in the evolution of Forescout. We are excited to be partnering with Advent International and Crosspoint Capital, premier firms with security DNA and track records of success in strengthening companies and supporting them through transitionary times.”

Forescout is not a young company, having launched way back in 2000. It raised almost $290 million, according to PitchBook data. It went public on October 26, 2017.

The deal is not finalized as of yet. The company has a go-shop provision in place until March 8th in which it can try to find a better deal, but that seems unlikely. Should they fail to find a better suitor, the deal is expected to close in the second quarter, at which point the company will cease to be publicly traded.

Powered by WPeMatico

Snafu Records is bringing a new approach to finding musical talent — founder and CEO Ankit Desai described the Los Angeles-headquartered startup as “the first full-service, AI-enabled record label.”

It’s a world that Desai knows well, having spent the past five years working on digital and streaming strategy at Capitol Records and Universal Music Group. He argued that there’s still a vast pool of musical talent that the record labels are ill-equipped to tap into.

“If there’s some girl in Indonesia whose music the world is dying to hear, they’re never going to get the chance,” he said. “The bridge to connect her to the world doesn’t exist today. The music business is entrenched in a very old way of working, finding artists through word-of-mouth.”

There are other companies like Chartmetric creating software to help the labels scout artists, but Desai said, “I used to be the one buying the service. What always ended up happening was that we were trying to put 21st century technology into a 20th century machine.”

The machine, in other words, is the record label itself. So he decided to create a label of his own — Snafu Records, which is officially launching today.

The startup is also announcing that it has raised $2.9 million in seed funding led by TrueSight Ventures, with participation from Day One Ventures, ABBA’s Agnetha Fältskog, Spotify’s John Bonten, William Morris’ Samanta Hegedus Stewart, Soundboks founder Jesper Theil Thomsen, Headstart.io founder Nicholas Shekerdemian and others.

The Snafu approach, Desai said, uses technology “to essentially turn everyone listening to music into a talent scout on our behalf.”

The company’s algorithms are supposedly looking at around 150,000 tracks from unsigned artists each week on services like YouTube, Instagram and SoundCloud, and evaluating them based on listener engagement, listener sentiment and the music itself — Desai said the sweet spot is to be 70 or 75% similar to the songs on Spotify’s top 200 list, so that the music sounds like what’s already popular, while also doing just enough to “break the mold.”

This analysis is then translated into a score, which Snafu uses to go “from this firehose of music, distill it down to 15 or 20 per week, and then the human [team] gets involved.”

The goal is to sign musicians as Snafu artists, who then get access the company’s industry expertise (including advice from the label’s head of creative Carl Falk, who’s written songs for Madonna, One Direction and Nicki Minaj) and marketing support in exchange for a share of streaming revenue. Desai added that Snafu will share more of the revenue with artists and lock them in for shorter periods of time than a standard record contract.

Asked whether streaming (as opposed to touring or merchandising) will provide enough money for Snafu to build a big business, Desai said, “Economics-wise, streaming sometimes does get a bad rap sometimes. It’s a bit misunderstood — there’s still just as many artists making really, really good numbers through streaming, it’s just a different kind of artist.”

And while Snafu is only officially launching today, it has already signed 16 artists, including the Little Rock-based duo Joan and the jazz musician Mishcatt, whose song “Fade Away” has been streamed 5 million times in the five weeks since it was released.

“There’s a major opportunity for Ankit and the Snafu team to build a new innovative and enduring music label at the intersection of technology and deep industry expertise,” said Hampus Monthan Nordenskjöld, founding partner at TrueSight Ventures, in a statement. “The music industry is going through a tectonic shift and we’re extremely excited to work with Snafu as they redefine what it means to be a music label in the 21st century.”

Powered by WPeMatico

In part two of a survey that asks top VCs about exciting opportunities in open source and dev tools, we dig into responses from 10 leading open-source-focused investors at firms that span early to growth stage across software-specific firms, corporate venture arms and prominent generalist firms.

In the conclusion to our survey, we’ll hear from:

These responses have been edited for clarity and length.

Powered by WPeMatico

The once-polarizing world of open-source software has recently become one of the hotter destinations for VCs.

As the popularity of open source increases among organizations and developers, startups in the space have reached new heights and monstrous valuations.

Over the past several years, we’ve seen surging open-source companies like Databricks reach unicorn status, as well as VCs who cashed out behind a serious number of exits involving open-source and dev tool companies, deals like IBM’s Red Hat acquisition or Elastic’s late-2018 IPO. Last year, the exit spree continued with transactions like F5 Networks’ acquisition of NGINX and a number of high-profile acquisitions from mainstays like Microsoft and GitHub.

Similarly, venture investment in new startups in the space has continued to swell. More investors are taking shots at finding the next big payout, with annual invested capital in open-source and dev tool startups increasing at a roughly 10% compounded annual growth rate (CAGR) over the last five years, according to data from Crunchbase. Furthermore, attractive returns in the space seem to be adding more fuel to the fire, as open-source and dev tool startups saw more than $2 billion invested in the space in 2019 alone, per Crunchbase data.

As we close out another strong year for innovation and venture investing in the sector, we asked 18 of the top open-source-focused VCs who work at firms spanning early to growth stages to share what’s exciting them most and where they see opportunities. For purposes of length and clarity, responses have been edited and split (in no particular order) into part one and part two of this survey. In part one of our survey, we hear from:

Powered by WPeMatico