Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

GoDaddy has reached an agreement to acquire Over, the startup behind an app that helps businesses create the photos and videos they need for social media.

Justin Tsai, GoDaddy’s vice president of growth and product, said this acquisition is about acknowledging “a world of entrepreneurs who may never have a website.”

He told me, “Over’s capabilities really target those set of people, who may have an Instagram profile where they need to post visually engaging content but have never gone to GoDaddy.”

This follows GoDaddy’s relaunch of its website-building tools last fall under the new name Websites+Marketing, with additional features around email marketing, search engine optimization and maintaining a presence beyond your website, whether that’s on Facebook or Yelp.

Tsai said Websites+Marketing now has 1 million paying customers, but as more business started using it, “We started noticing users really had trouble creating great content as they go to those platforms. They didn’t know what to post or how to make that post really sing.”

That’s where Over comes in, offering a variety of customizable templates and layouts that should make it faster and easier to create eye-catching visual content. The goal, according to co-founder and CEO Matt Winn, is to “build guitars, not violins” — in the same way that someone can pick up a guitar and “strum a few cords,” they should be able to download Over and quickly “start creating really great content.”

In fact, the startup says it has more than 1 million active users of its own, who are using it to create more than 220,000 projects every day.

Tsai said GoDaddy and Over were initially discussing a partnership, but as it became clear that there was an opportunity to integrate the products more deeply, those discussions led to acquisition talks.

Over will continue to operate as a standalone app, and he said the team will continue to develop new features for the app. At the same time, they’ll be building integrations with Websites+Marketing, for example by taking Over and connecting it “into our insights tool to understand how different elements of [online] presence layer in together, to look at templates and how those actually help different types of small business owners.”

The financial terms of the acquisition were not disclosed. Winn said Over had previously raised funding from True Ventures and angel investors, and that the entire 76-person team will be joining GoDaddy. Over will continue to operate out of its Cape Town, South Africa headquarters.

Powered by WPeMatico

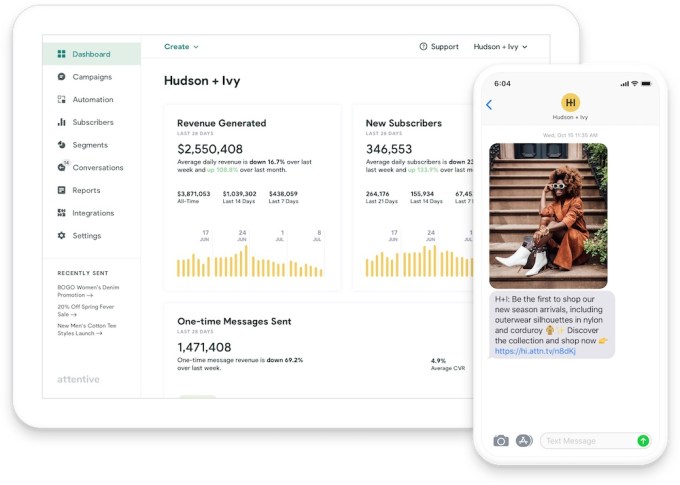

Less than six months after it announced $40 million in funding, Attentive has raised another $70 million — this time in Series C funding.

The new round was led by Sequoia and IVP, two firms that were part of the Series B. Previous investors Eniac Ventures and NextView Ventures also participated.

CEO Brian Long (who, along with his Attentive co-founder Andrew Jones, sold his previous startup TapCommerce to Twitter) told me that he wasn’t planning to raise money again so soon, but things were going even better than expected, with a client list that has grown to more than 750 businesses, including Coach, Urban Outfitters, CB2, PacSun, Party City and Jack in the Box.

Long noted that it’s always smarter to raise money when things are going swimmingly, rather than dealing with the “not-so-fun process” of trying to raise “when you really need it.”

He added, “When you see that you’re doing that well, you think, ‘Hey, we should hire a lot more people to support this growth.’ And then the other piece is just being able to move faster into new areas.”

Long attributed the success Attentive has had thus far to the growing importance of text messages as a channel for businesses to reach consumers, particularly as those consumers are less inclined to open marketing emails or download retailers’ mobile apps. And in contrast to broader messaging platforms, Long said Attentive is “focused on just doing this channel right.”

He said the platform is designed to solve the main problems faced by retailers trying to build a mobile messaging strategy — first, by helping them create a text subscriber list in a way that complies with regulations, then by offering “the ability to send messages that frankly aren’t going to piss people off.”

“We want the messages to be relevant for the consumer, we want to send them things that they care about,” Long said. “The package is on the way, real-time customer service, a product that you were looking at recently is on-sale … there’s a lot of data that you can put to work in order to do it at scale.”

Looking ahead, he hopes to expand beyond the United States and Canada, and to move into industries beyond e-commerce — for example, into more traditional retail, and also to start working with colleges that are looking to attract more applicants.

“Attentive’s growth is a clear indication that people want to interact with brands in new ways, and brands are embracing messaging as an effective way to reach consumers,” said Sequoia partner Pat Grady in a statement. “We are thrilled to double down on our partnership with Attentive so they can continue to deliver fantastic results for their customers and valuable experiences for consumers.”

Attentive has now raised a total of $124 million.

Powered by WPeMatico

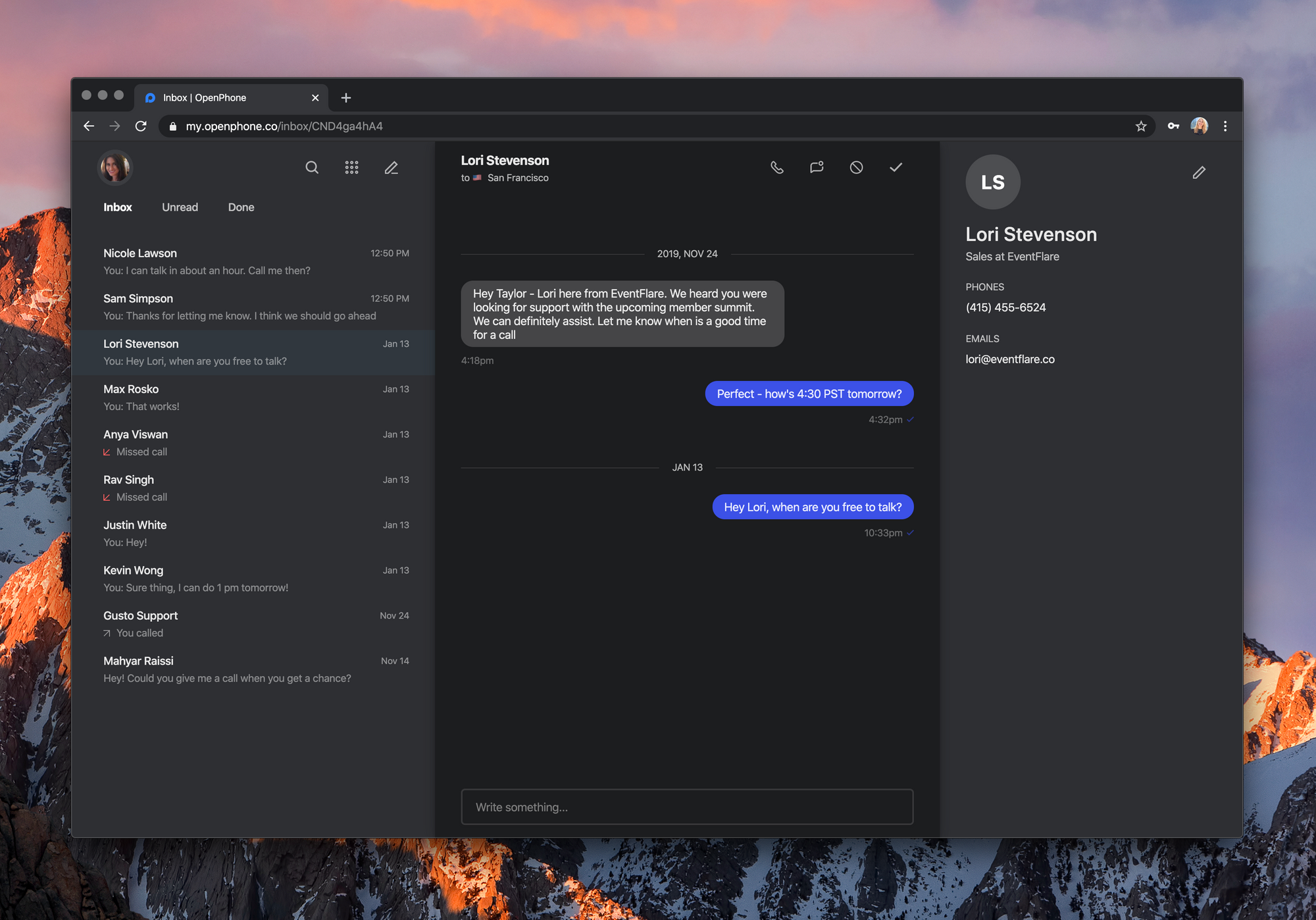

Y Combinator graduate OpenPhone is raising a $2 million funding round led by Slow Ventures. The company is working on an app that lets you seamlessly get a business phone number without a second phone or a second SIM card.

Y Combinator, Kindred Ventures, Garage Capital, 122WEST Ventures and others are also participating in today’s funding round.

Compared to Aircall and other enterprise solutions, OpenPhone targets small and medium companies that want a mobile-first, easy-to-use solution to take advantage of a second phone number.

For instance, if you’re a freelancer and you hate handing out your personal phone number, OpenPhone lets you separate your personal and professional life more easily.

OpenPhone works on iPhone, iPad and Android. You also can use a web interface to interact with the app from your computer. It currently costs $10 per month per user. For that price, you get a local number, a toll-free number or you can port an existing phone number. Five thousand people are using OpenPhone right now.

You can then use that number for unlimited calls and texts in the U.S. and Canada. Behind the scene, OpenPhone uses your internet connection to establish voice-over-IP calls.

The startup has been working on collaborative features so you can use OpenPhone with multiple users. For instance, you can share a phone number with other users so your team can answer text messages faster and pick up the phone more often. The company has also launched a Slack integration that lets you receive a notification when somebody calls or texts your phone number.

Powered by WPeMatico

ServiceNow announced this morning that it has acquired Passage AI, a startup that helps customers build chatbots in multiple languages, something that should come in handy as ServiceNow continues to modernize its digital service platform. The companies did not share terms of the deal.

With Passage AI, ServiceNow gets a bushel of AI talent, which in itself has value, but it also gets AI technology, which should fit in nicely with ServiceNow’s mission. For starters, the company’s chatbot solutions gives ServiceNow an automated way to respond to customer/user inquiries.

Even more interesting for ServiceNow, Passage includes an IT automation component that uses ” a conversational interface to submit tickets, handle queries and take direct action through APIs,” according to the company website. It also gets an HR automation piece, giving the company an intelligent tool it could incorporate across its Now Platform in tools like ServiceNow Virtual Agent and Service Portal, as well as Workspaces in multiple languages.

The multilingual support was an aspect of the deal that appeals to Debu Chatterjee, senior director of AI Engineering at ServiceNow. “Building deep learning, conversational AI capabilities into the Now Platform will enable a work request initiated in German or a customer inquiry initiated in Japanese to be solved by Virtual Agent,” he said in a statement.

Companies are increasingly looking for ways to solve common customer problems using chatbots, while only bringing humans into the loop when the bot can’t answer the query. Passage AI gives ServiceNow much deeper knowledge in this growing area.

Passage AI, which launched in 2016, has raised $10.3 million, according to Crunchbase data. The company website lists a variety of large customers, including Mastercard, Shell, Mercedes-Benz and SoftBank. The acquisition comes less than a week after the company purchased another AI-focused startup, Loom Systems, one that concentrates on automating operations data.

The deal is expected to close this quarter. ServiceNow will be announcing earnings on Wednesday afternoon.

Powered by WPeMatico

What if it was easier to eat salad than junk food? Most diet routines take a ton of time, whether you’re cooking from scratch, making a meal kit or seeking a nutritious restaurant. But on-demand prepared food delivery companies like Sprig that tried to eliminate that work have gone bankrupt from poor unit economics.

Thistle is a different type of food startup. It delivers thrice-weekly cooler bags customized with meat-optional, plant-based breakfasts, lunches, dinners, snacks, sides and juices. By batching deliveries in the less-congested early morning hours and optimizing routes to its subscribers, or by mailing weekly boxes beyond its own geographies, Thistle makes sure you already have your food the moment you’re hungry. Whether you heat them up or eat them straight out of the fridge, you’re actually dining faster than you could even place an Uber Eats order.

The food on Thistle’s constantly rotating menu is downright tasty. You might get a sunrise chia parfait for breakfast, a chicken tropical mango salad for lunch, a microwaveable bulgogi noodle bowl for dinner, with beet hummus and kale-cucumber juice for snacks. Thistle’s not cheap, with meals averaging about $14 each. But compared to competitors’ on-demand delivery markups and service fees, wasting ingredients from the grocer and the hours of cooking for yourself, it can be a good deal for busy people.

“We see Thistle as part of a movement to make health convenient rather than a high willpower chore,” CEO Ashwin Cheriyan tells me. What Peloton did to shave time off getting a great workout, Thistle does for eating a nourishing meal. It makes the right choice the easiest choice.

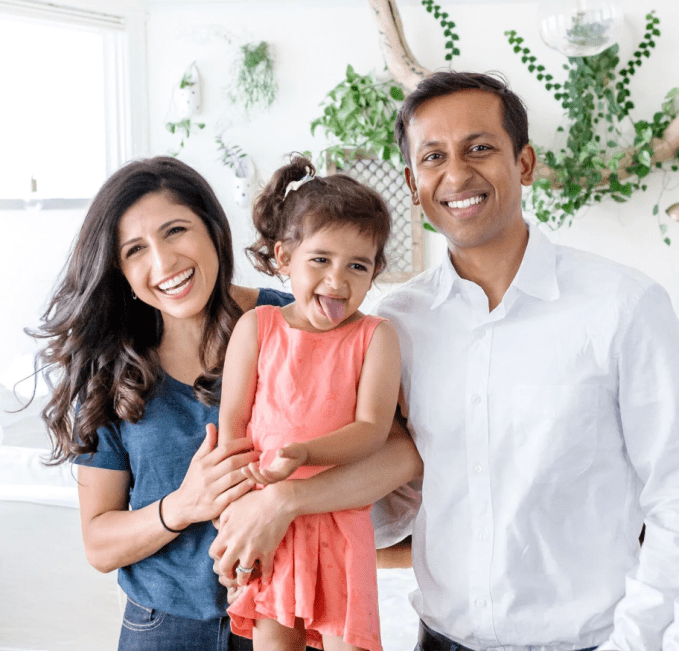

Thistle COO Shiri Avnery and CEO Ashwin Cheriyan with their daughter

The idea of a button you can push to make you healthier has attracted a new $5.65 million Series A round for Thistle led by its first institutional investor, PowerPlant Ventures . Bringing the startup to $15 million in funding, the cash will expand Thistle’s delivery domain. Dan Gluck of PowerPlant, which has also funded food break-outs like Beyond Meat, Thrive Market and Rebbl, will join the board.

Currently Thistle delivers in-person to the Bay Area, LA metro, San Diego and Sacramento while shipping to most of Washington, Oregon, Utah, Idaho, Nevada and Arizona. Thistle actually held off on raising more since launching in 2013 to make sure it hammered out unit economics to prevent an implosion. It’s also planning broader meal options, additional product lines and fresh distribution strategies like getting stocked in office smart kitchens or subsidized by wellness plans.

“The reasons that so many food delivery companies have failed likely fall into two buckets: one, a lack of focus on margins and unit economics, and two, premature geographic expansion before proving out the business model,” says Cheriyan. “Thistle makes money similar to how a well-run restaurant would make money — by having strong gross margins, efficient customer acquisition costs and solid customer retention / lifetime metrics. We currently deliver tens of thousands of meals on a weekly basis to customers on the West Coast and our annual average growth rate since launch has been 100%+.”

It’s nice that Thistle hasn’t gone out of business, because I’ve been eating its salads 6X a week for three years. It’s been the most efficient way for me to get healthier and lose weight after a half-decade of ordering takeout sandwiches and then feeling sluggish all day. I legitimately look forward to each one since they often have 20+ ingredients and only repeat every few months, so they’re never boring.

It has helped me keep my work-from-home lunches to about 20 minutes so I have more time for writing. Thistle is one of the few startups I consistently recommend to people. When asked how I lost 25lbs before my wedding, I point to Peloton cycling, Future remote personal training and Thistle salads — none of which require me to leave the house.

Cheriyan tells me, “We wanted the better-for-you and better-for-planet choice to be the default choice.”

Thistle has already pivoted past the business model burning tons of cash across the startup world. The company started as an on-demand cold-pressed juice delivery service, sending hipster glass bottles of watermelon and charcoal extract to doors around San Francisco. It was 2013, yoga was booming and people were paying crazily high prices for liquified lemongrass. Health made simple seemed like a sure bet to the founding team of Alap Shah, Naman Shah, Sheel Mohnot and Johnny Hwin, some of whom run Studio Management, a family office and startup incubator. [Disclosure: Hwin and Alap Shah are friends of mine, but didn’t pitch or discuss this article with me.]

Thistle eventually straightened things out with a shift to subscriptions and batched delivery under the leadership of the newly added co-founders, Cheriyan and his wife and COO Shiri Avnery. “I came from a family of physicians — both my parents, brother, and enough aunts, uncles, and cousins are doctors that they could start a small hospital,” Cheriyan, a former corporate attorney in M&A tells me. “A common point of frustration was about patients suffering from diet-related illnesses who were unable to make a lifestyle change because it was too hard.”

Avnery, a PhD in air pollution and climate change’s impact on agriculture, had become exasperated with the slow pace of policy change and the inaction of governments and corporations. The two quit their jobs, moved to San Francisco, and searched for a point of leverage for positively influencing people’s diets and interaction with the environment. They teamed up with the founders and launched Thistle v1.

A lack of experience in logistics led to the initial detour into on-demand. But rather than trying to fix the problem with VC money, Thistle stayed lean and discovered the opportunity nestled between Uber Eats and Blue Apron: sending people food they don’t have to eat now, but that takes low or no time to prepare when they’re peckish. Through its app, users can customize their meal plans, ban their allergens, pause deliveries and see what they’ll eat next.

A sample of Thistle 8 meal plans

“The unit economics problem most heavily plagued the early on-demand food companies. Food / labor waste and inefficient deliveries were likely the biggest reasons why the economics were unsustainable without venture life support. We know this personally as Thistle started our delivery service as an on-demand company before quickly realizing that the unit economics couldn’t sustain a healthy business,” Cheriyan explains, regarding companies like Sprig, DoorDash and Grubhub. Beyond unsold food, “the margins very likely did not support ordering a $12-$15 single meal for immediate delivery when average hourly driver wages reached $18-20.”

Meal kits were supposed to make dining healthier and cheaper, but they proved too much of a chore and led customers to boxes of ingredients piling up unused. Munchery and Nomiku went out of business while giants like Blue Apron have incinerated hundreds of millions of dollars and seen their share prices sink.

“The meal kit companies fared a little better from a gross margin perspective (due to pre-orders and more efficient deliveries), but suffer most from an easy-to-copy business model. This led to a rise in copycats, and, as a result, heavily rising customer acquisition costs, low switching costs and poor retention,” Cheriyan tells me. “Fundamentally the meal kit companies face another challenge, which is that people have less and less time to cook and are increasingly looking for ready-to-eat options.”

A slower, steadier approach with less overhead, more convenience and fewer direct competitors has helped Thistle grow to 400 employees, from culinary to engineering to logistics.

Still, it’s vulnerable. It may still be too expensive for some markets and demographics. Logistics experts like Amazon and Whole Foods could try to barge into the market. Cloud kitchens without dining rooms are making restaurant food more affordable for delivery. And another startup could always take the gamble on raising a ton of cash and subsidizing prices to steal market share, especially where Thistle doesn’t operate yet.

Thistle could counter these threats by further eliminating delivery costs by selling through partners like office smart fridges where employees pay on the spot, or equipping gym lobbies with more than just Muscle Milk.

“One opportunity we’re excited to test is attended and unattended retail — it would be great to be able to pick up Thistle products at your local grocery store, gym or coffee shop,” Cheriyan says. As for offices, “Today’s corporate lunchtime solutions often require a trade-off between health and convenience: either wait in line for 30+ minutes at your favorite salad spot for a healthy option, or opt into catered restaurant meals that leave you feeling sluggish and unproductive.” Thistle could help employers prevent the 3pm energy lull.

The startup’s focus on plant-forward meals also centers it in the path of another megatrend: the shift to environmentally conscious diets. Almost 60% of Americans are trying to eat less meat and 50% are eating meat-alternatives like Impossible Burgers. That stems both from interest in the humane treatment of animals and how 15% of green house emissions come from livestock. But 45% of Americans say they hate to cook. That’s why Thistle makes pre-made meals where meat and egg are optional, but the food is healthy and delicious without them.

In the age of Uber, we’ve acclimated to an effortless life. The new wave of “push-button health” startups like Thistle could finally take the hassle out of aligning your actions in the gym or kitchen with your intentions.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

SaaS stocks had a good run in late 2019. TechCrunch covered their ascent, a recovery from early-year doldrums and a summer slowdown. In 2020 so far, SaaS and cloud stocks have surged to all-time highs. The latest records are only a hair higher than what the same companies saw in July of last year, but they represent a return to form all the same.

Given that public SaaS companies have now managed to crest their prior highs and have been rewarded for doing so with several days of flat trading, you might think that there isn’t much room left for them to rise. Not so, at least according to Atlassian . The well-known software company reported earnings after-hours yesterday and the market quickly pushed its shares up by more than 10%.

Why? It’s worth understanding, because if we know why Atlassian is suddenly worth lots more, we’ll better grok what investors — public and private — are hunting for in SaaS companies and how much more room they may have to rise.

Powered by WPeMatico

Video advertising company Eyeview shut down in December, but its technology will live on thanks to an acquisition by Aki Technologies.

Aki CEO Scott Swanson told me that he’s anticipating serious growth in the demand for ad personalization, particularly as consumers see personalization everywhere else online.

Swanson argued that Eyeview’s technology stands out thanks to its focus on video, with “the ability to generate millions of permutations of a video creative and store them in the cloud.” It offers even more opportunities when combined with Aki’s existing platform, which delivers ads targeted for specific “mobile moments,” like whether the viewer is relaxing at home or out running errands.

Plus, the acquisition allows Aki to expand beyond mobile advertising to desktop and connected TV.

The financial terms of the deal were not disclosed, but Swanson said that in addition to acquiring the technology, he’s also working to bring on old Eyeview clients and hire Eyeview team members (he estimated that he’s hired nearly 15 so far and is aiming for around 20). At the same time, he acknowledged that there are challenges in resurrecting a business that had been shut down.

“The technology itself was decommissioned, it was taken down, it was backed up in the cloud,” Swanson said. “As the acquisition proceeds, we’ll literally be taking the code base and relaunching it in the cloud … Hiring the people was super important, and then because it’s not a traditional acquisition where we get customers and stuff, we have to go call up all the customers one-by-one, just as we have to hire people one-by-one.”

Eyeview had raised nearly $80 million in funding before running out of cash and laying off a team of around 100 employees. (Aki, meanwhile, has raised only a seed round of $3.75 million back in 2016; Swanson said the company has grown organically since then.) The news came only a few months after digital media veteran Rob Deichert took over as CEO.

“While it was disappointing to have to shut down the Eyeview business, I’m very happy that the technology assets have found a home with Aki,” Deichert told me via email. “Their business is a logical fit for the technology.”

And despite Eyeview’s misfortunes, Swanson said he’s confident that the company still works as a standalone business: “Look, these guys have been running a business that was full of really happy customers who were seeing good results and seem to have been disappointed when they shut down.”

The bigger issue, he suggested, is the adtech industry as a whole, with advertisers feeling fatigued “with having too many options,” along with a lack of “appetite on the large exit side.”

“The broader trend here is for companies that operate profitably and can support themselves effectively to become a little bit more tech-enabled managed services business,” Swanson said.

Powered by WPeMatico

Layoffs in the technology and venture-backed worlds continued today, as 23andMe confirmed to CNBC that it laid off around 100 people, or about 14% of its formerly 700-person staff. The cuts would be notable by themselves, but given how many other reductions have recently been announced, they indicate that a rolling round of belt-tightening amongst well-funded private companies continues. (TechCrunch confirmed the numbers with the company.)

Mozilla, for example, cut 70 staffers earlier this year. As TechCrunch’s Frederic Lardinois reported earlier in January, the company’s revenue-generating products were taking longer to reach market than expected. And with less revenue coming in than expected, its human footprint had to be reduced.

23andMe and Mozilla are not alone, however. Playful Studios cut staff just this week, 2019 itself saw more than 300% more tech layoffs than in the preceding year and TechCrunch has covered a litany of layoffs at Vision Fund-backed companies over the past few months, including:

Scooter unicorns Lime and Bird have also reduced staff this year. The for-profit drive is firing on all cylinders in the wake of the failed WeWork IPO attempt. WeWork was an outlier in terms of how bad its financial results were, but the fear it introduced to the market appears pretty damn mainstream by this point. (Forsake hope, alle ye whoe require a Series H.)

The money at risk, let alone the human cost, is high. Zume has raised more than $400 million. 23andMe has raised an even sharper $786.1 million. Rappi? How about $1.4 billion. And Oyo? $3.2 billion so far. Every company that loses money eventually dies. And every company that always makes money lives forever. It seems that lots of companies want to jump over the fence, make some money and rebuild investor confidence in their shares.

It’s just too bad that the rank-and-file are taking the brunt of the correction.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Today we’re digging into One Medical’s updated IPO filing released this week. The document contains directional pricing information that will help us understand where the tech-enabled medical care startup expects the market to value itself and also details its Q4 2019 Preliminary Estimated Unaudited Financial Results, which gives us a fuller picture of its financial health.

As we’ll see, One Medical’s expected valuation matches secondary-market transactions in the firm’s equity, and, at the upper-end of its proposed IPO range, represents a solid boost to its final private valuation. Afterwards, we’ll dig back through the company’s numbers, figure out its implied revenue multiple and make a bullish and bearish argument for the company’s hoped-for IPO valuation.

It’s going to be fun! (For a general dive into the company’s IPO filing, head here.)

Powered by WPeMatico

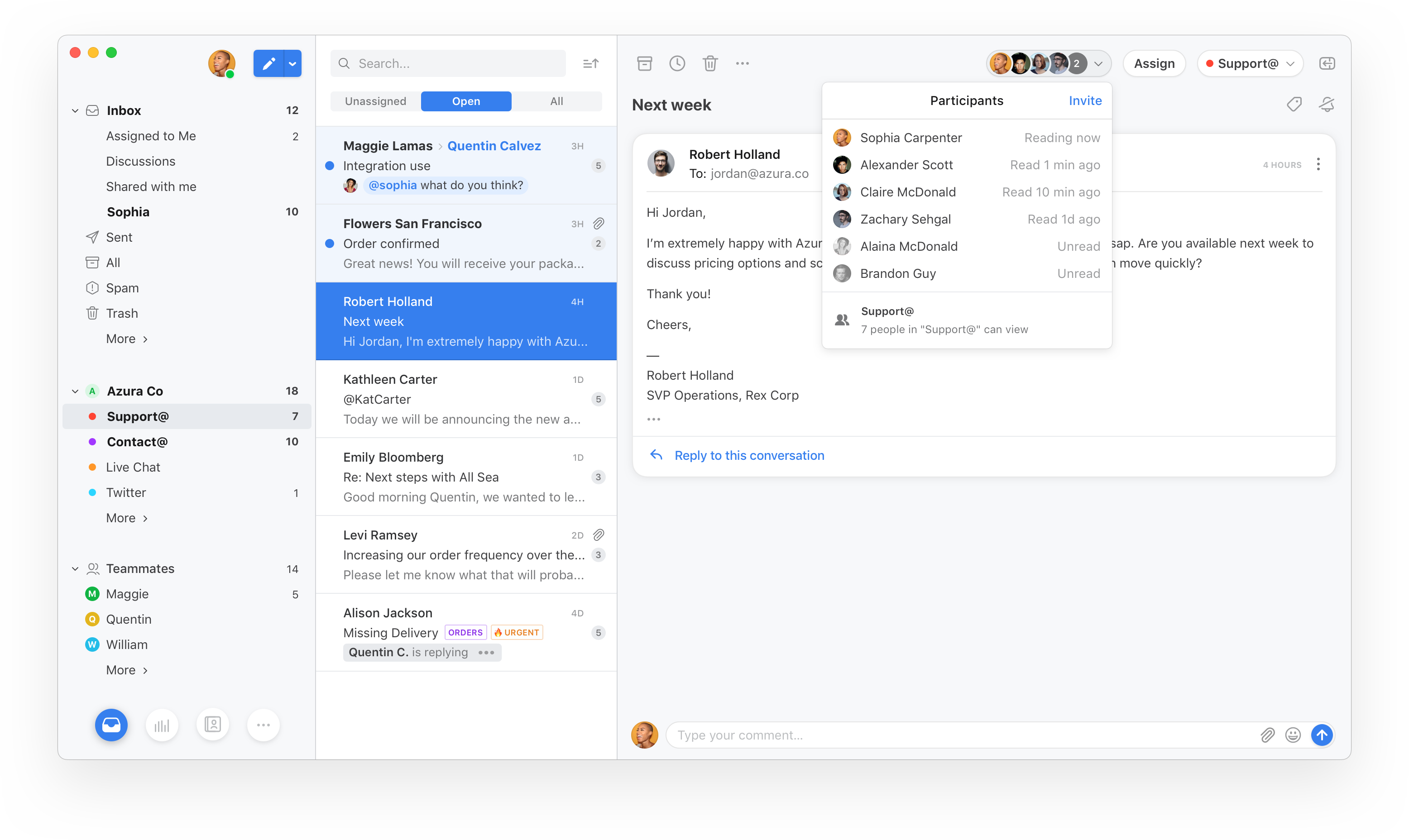

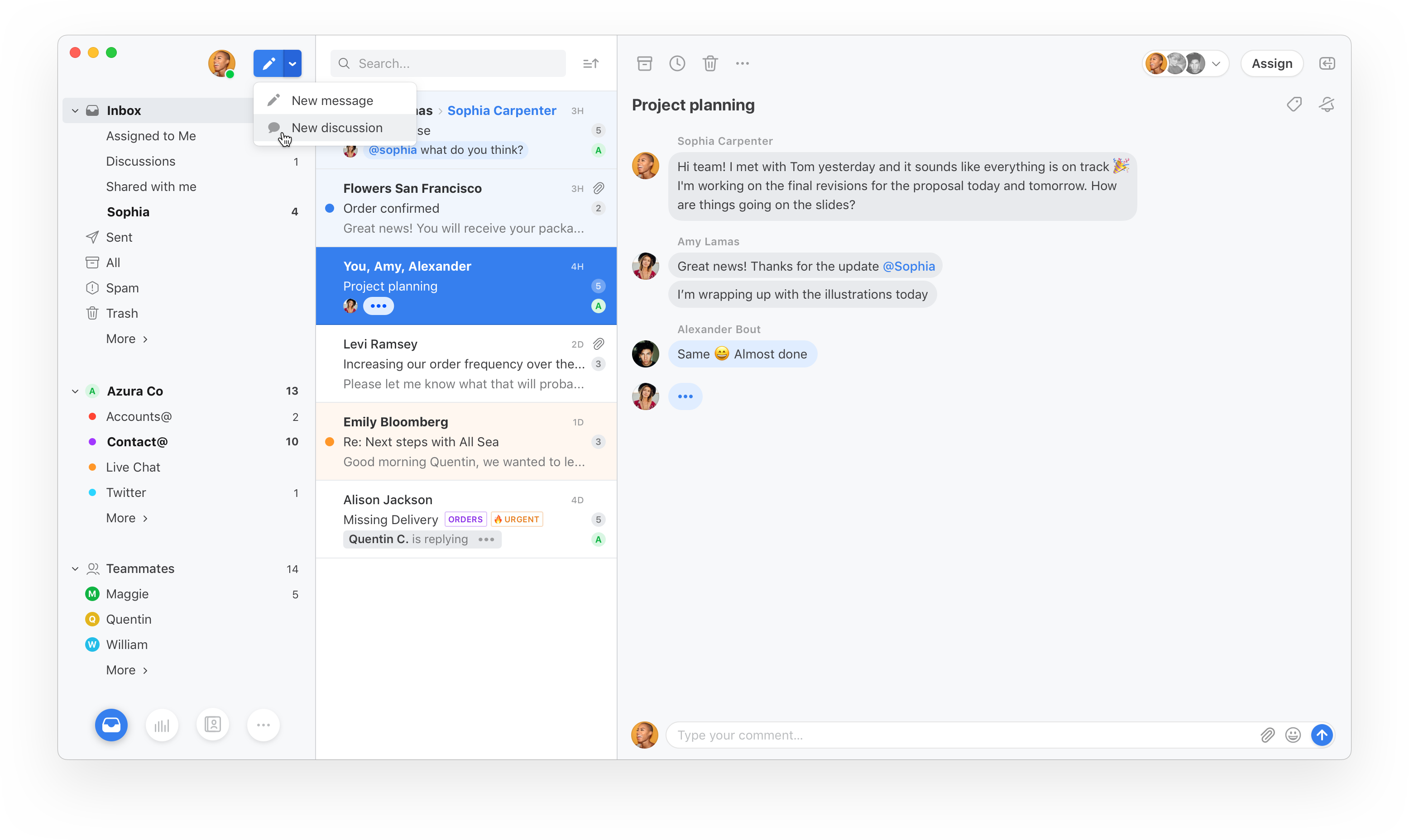

Front is raising a $59 million Series C funding round. Interestingly, the startup hasn’t raised with a traditional VC firm leading the round. A handful of super business angels are investing directly in the productivity startup and leading the round.

Business angels include Atlassian co-founder and co-CEO Mike Cannon-Brookes, Atlassian President Jay Simons, Okta co-founder and COO Frederic Kerrest, Qualtrics co-founders Ryan Smith and Jared Smith and Zoom CEO Eric Yuan. Existing investors Sequoia Capital, Initialized Capital and Anthos Capital are participating in this round, as well.

While Front doesn’t share its valuation, the company says that the valuation has quadrupled compared to the previous funding round. Annual recurring venue has also quadrupled over the same period.

The structure of this round is unusual, but it’s on purpose. Front, like many other startups, is trying to redefine the future of work. That’s why the startup wanted to surround itself with leaders of other companies who share the same purpose.

“First, because we didn’t need to raise (we still had two years of runway), and it’s always better to raise when we don’t need it. The last few months have given me much more clarity into our go-to-market strategy,” Front co-founder and CEO Mathilde Collin told me.

Front is a collaborative inbox for your company. For instance, if you want to share an email address with your co-workers (support@mycompany.com or jobs@mycompany.com), you can integrate those shared inboxes with Front and work on those conversations as a team.

It opens up a ton of possibilities. You can assign conversations to a specific person, @-mention your co-workers to send them a notification, start a conversation with your team before you hit reply, share a draft with other people, etc.

Front also supports other communication channels, such as text messages, WhatsApp messages, a chat module on your website and more. As your team gets bigger, Front helps you avoid double replies by alerting other users when you’re working on a reply.

In addition to those collaboration features, Front helps you automate your workload as much as possible. You can set up automated workflows so that a specific conversation ends up in front of the right pair of eyes. You can create canned responses for the entire team, as well.

Front also integrates with popular third-party services, such as Salesforce, HubSpot, Clearbit and dozens of others. Front customers include MailChimp, Shopify and Stripe.

While Front supports multiple channels, email represents the biggest challenge. If you think about it, email hasn’t changed much over the past decade. The last significant evolution was the rise of Gmail, G Suite and web-based clients. In other words, Front wants to disrupt Outlook and Gmail.

With today’s funding round, the company plans to iterate on the product front with Office 365 support for its calendar, an offline mode and refinements across the board. The company also plans to scale up its sales and go-to-market team with an office in Phoenix and a new CMO.

Powered by WPeMatico