Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

ServiceMax, a company that builds software for the field-service industry, announced yesterday that it will go public via a special purpose acquisition company, or SPAC, in a deal valued at $1.4 billion. The transaction comes after ServiceMax was sold to GE for $915 million in 2016, before being spun out in late 2018. The company most recently raised $80 million from Salesforce Ventures, a key partner.

Broadly, ServiceMax’s business has a history of modest growth and cash consumption.

ServiceMax competes in the growing field-service industry primarily with ServiceNow, and interestingly enough given Salesforce Ventures’ recent investment, Salesforce Service Cloud. Other large enterprise vendors like Microsoft, SAP and Oracle also have similar products. The market looks at helping digitize traditional field service, but also touches on in-house service like IT and HR giving it a broader market in which to play.

GE originally bought the company as part of a growing industrial Internet of Things (IoT) strategy at the time, hoping to have a software service that could work hand in glove with the automated machine maintenance it was looking to implement. When that strategy failed to materialize, the company spun out ServiceMax and until now it remained part of Silver Lake Partners thanks to a deal that was finalized in 2019.

TechCrunch was curious why that was the case, so we dug into the company’s investor presentation for more hints about its financial performance. Broadly, ServiceMax’s business has a history of modest growth and cash consumption. It promises a big change to that storyline, though. Here’s how.

The company’s pitch to investors is that with new capital it can accelerate its growth rate and begin to generate free cash flow. To get there, the company will pursue organic (in-house) and inorganic (acquisition-based) growth. The company’s blank-check combination will provide what the company described as “$335 million of gross proceeds,” a hefty sum for the company compared to its most recent funding round.

Powered by WPeMatico

Mortgages may not be considered sexy, but they are a big business.

If you’ve refinanced or purchased a home digitally lately, you may not have noticed the company powering the software behind it — but there’s a good chance that company is Blend.

Founded in 2012, the startup has steadily grown to be a leader in the mortgage tech industry. Blend’s white label technology powers mortgage applications on the site of banks including Wells Fargo and U.S. Bank, for example, with the goal of making the process faster, simpler and more transparent.

The San Francisco-based startup’s SaaS (software-as-a-service) platform currently processes over $5 billion in mortgages and consumer loans per day, up from nearly $3 billion last July.

Today, Blend made its debut as a publicly traded company on the New York Stock Exchange, trading under the symbol “BLND.” As of early afternoon, Eastern Time, the stock was trading up over 13% at $20.36.

On Thursday night, the company had said it would offer 20 million shares at a price of $18 per share, indicating the company was targeting a valuation of $3.6 billion.

That compares to a $3.3 billion valuation at the time of its last raise in January — a $300 million Series G funding round that included participation from Coatue and Tiger Global Management. Also, let’s not forget that Blend only became a unicorn last August when it raised a $75 million Series F. Over its lifetime, Blend had raised $665 million before Friday’s public market debut.

In filing its S-1 on June 21, Blend revealed that its revenue had climbed to $96 million in 2020 from $50.7 million in 2019. Meanwhile, its net loss narrowed from $81.5 million in 2019 to $74.6 million in 2020.

In 2020, the San Francisco-based startup significantly expanded its digital consumer lending platform. With that expansion, Blend began offering its lender customers new configuration capabilities so that they could launch any consumer banking product “in days rather than months.”

Looking ahead, the company had said it expects its revenue growth rate “to decline in future periods.” It also doesn’t envision achieving profitability anytime soon as it continues to focus on growth. Blend also revealed that in 2020, its top five customers accounted for 34% of its revenue.

Today, TechCrunch spoke with co-founder and CEO Nima Ghamsari about the company’s decision to go with a traditional IPO versus the ubiquitous SPAC or even a direct listing.

For one, Blend said he wanted to show its customers that it is an “around for a long time company” by making sure there’s enough on its balance sheet to continue to grow.

“We had to talk and convince some of the biggest investors in the world to invest in us, and that speaks to how long we’ll be around to serve these customers,” he said. “So it was a combination of our capital need and wanting to cement ourselves as a really credible software provider to one of the most regulated industries.”

Ghamsari emphasized that Blend is a software company that powers the mortgage process and is not the one offering the mortgages. As such, it works with the flock of fintechs that are working to provide mortgages.

“A lot of them are using Blend under the hood, as the infrastructure layer,” he said.

Overall, Ghamsari believes this is just the beginning for Blend.

“One of the things about financial services is that it’s still mostly powered by paper. So a lot of Blend’s growth is just going deeper into this process that we got started in years ago,” he said. As mentioned above, the company started out with its mortgage product but just keeps adding to it. Today, it also powers other loans such as auto, personal and home equity.

“A lot of our growth is actually powered by our other lines of business,” Ghamsari told TechCrunch. “There’s a lot to build because the larger digitization trends are just getting started in financial services. It’s a relatively large industry that has lots of change.”

In May, digital mortgage lender Better.com announced it would combine with a SPAC, taking itself public in the second half of 2021.

Powered by WPeMatico

Visualping, a service that can help you monitor websites for changes like price drops or other updates, announced that it has raised a $6 million extension to the $2 million seed round it announced earlier this year. The round was led by Seattle-based FUSE, a relatively new firm with investors who spun out of Ignition Partners last year. Prior investors Mistral Venture Partners and N49P also participated.

The Vancouver-based company is part of the current Google for Startups Accelerator class in Canada. This program focuses on services that leverage AI and machine learning, and, while website monitoring may not seem like an obvious area where machine learning can add a lot of value, if you’ve ever used one of these services, you know that they can often unleash a plethora of false alerts. For the most part, after all, these tools simply look for something in a website’s underlying code to change and then trigger an alert based on that (and maybe some other parameters you’ve set).

Earlier this week, Visualping launched its first machine learning-based tools to avoid just that. The company argues that it can eliminate up to 80% of false alerts by combining feedback from its more than 1.5 million users with its new ML algorithms. Thanks to this, Visualping can now learn the best configuration for how to monitor a site when users set up a new alert.

“Visualping has the hearts of over a million people across the world, as well as the vast majority of the Fortune 500. To be a part of their journey and to lead this round of financing is a dream,” FUSE’s Brendan Wales said.

Visualping founder and CEO Serge Salager tells me that the company plans to use the new funding to focus on building out its product but also to build a commercial team. So far, he said, the company’s growth has been primarily product led.

As a part of these efforts, the company also plans to launch Visualping Business, with support for these new ML tools and additional collaboration features, and Visualping Personal for individual users who want to monitor things like ticket availability for concerts or to track news, price drops or job postings, for example. For now, the personal plan will not include support for ML. “False alerts are not a huge problem for personal use as people are checking two-three websites but a huge problem for enterprise where teams need to process hundreds of alerts per day,” Salager told me.

The current idea is to launch these new plans in November, together with mobile apps for iOS and Android. The company will also relaunch its extensions around this time, too.

It’s also worth noting that while Visualping monetizes its web-based service, you can still use the extension in the browser for free.

Powered by WPeMatico

In case you’ve not been paying attention, we’ll say it again: The global venture capital industry is on fire. The second quarter of 2021 was the largest single three-month period on record for dollars invested.

The data coming in points to a worldwide boom. The United States’ startup market had a huge Q2, and investors don’t expect the pace to slow in the country. Europe is also having one hell of a year. Around the world, 2021 is shaping up to be a breakout year for venture investment into startups. And that’s after several years of growing, record-breaking results.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

India is another good example of this trend. The country’s venture capital haul thus far in 2021 has nearly matched its 2020 total and is on pace for a record year. But as the third quarter gets underway, something perhaps even more important is going on: public-market liquidity.

The new trend is being spearheaded by Zomato, an Indian food delivery giant that could be valued at $8.6 billion in its public debut. Other major Indian unicorns are following it to the public markets, including fintech players like MobiKwik and Paytm, which is backed by Alibaba and its affiliate Ant Financial. The trio of companies could herald a rush of public offerings from Indian companies if their debuts prove lucrative and stable.

Today, The Exchange is taking a look at India’s recent venture capital results and digging more deeply into the country’s IPO pipeline, with help from VCs Kunal Bajaj of Blume Ventures and Manish Singhal of pi Ventures. We’ll also read the tea leaves when it comes to how Zomato’s IPO is performing thus far, and what we can learn from its early data. This will be fun!

Powered by WPeMatico

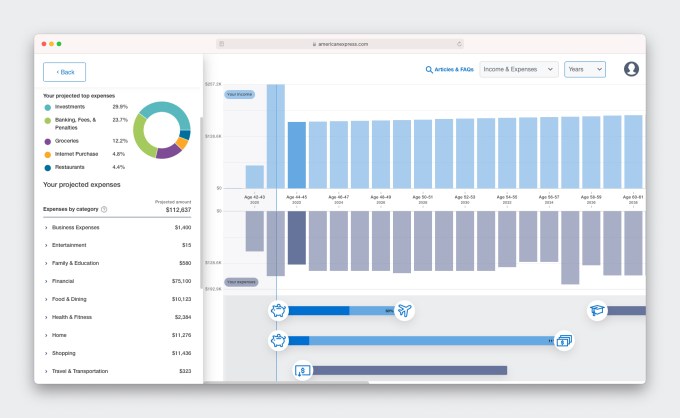

American Express is branching out into financial planning, with a little help from a seven-person startup called BodesWell.

This week, the credit card giant launched a pilot of its first self-service digital financial planning tool, dubbed “My Financial Plan (MFP).” The six-month pilot kicked off on July 11 with about 25,000 select Amex cardmembers.

American Express quietly invested in BodesWell in late 2020 via its venture arm, Amex Ventures. Since then, the financial services behemoth teamed up with the tiny startup to develop the financial planning tool for its users. The new product is designed to give users a complete picture of their financial health and help them make and achieve major life goals, such as buying a house or retirement.

TechCrunch talked with Amex Ventures’ Julia Huang, who led the investment and strategy around the new product, and BodesWell co-founder and CEO Matthew Bellows to learn more details.

The pair actually met while serving on a panel together in 2019.

“I was drawn to the fact that it was not a round-up savings tool, but rather a holistic tool to understand your full financial picture that could be used to plan for the financial impact of your life decisions,” Huang told TechCrunch.

Before deciding to invest in BodesWell, Huang says Amex Ventures — which over time has backed more than 70 startups — had “evaluated the space quite extensively.”

Huang introduced Bellows and his staff to Amex’s Digital Labs team and they embarked on jointly developing a specialized offering for Amex customers. (While Bellow is based in Boston, he says the startup is “globally distributed.”)

“Our goal is to democratize financial planning with our cardmembers by providing detailed insights and forecasts to help them with their holistic planning,” she told TechCrunch.

Image Credits: Amex Ventures

Bellows started BodesWell in early 2019 with the goal of empowering clients and customers to build their own financial plan.

“So much of financial planning software is aimed at financial advisors, and requires them to run it,” he said. “So, most people can’t get the benefits of financial planning…Our hope is to expand benefits to a lot more people.”

BodesWell will guide users in setting up a financial plan and will work even better if they sync with their other financial information via Plaid so it can “update in real time,” Huang said.

The tool “takes into account income, assets, expenses and liabilities — what cash flow looks like holistically so that users can drag & drop to plan life events,” Bellow said.

An estimated 85 million American households don’t have a financial, planner for a variety of reasons — including mistrust of a planner’s intentions or just feeling overwhelmed by the process.

The product is free during the pilot phase and American Express hasn’t yet determined if it will charge for it afterwards.

“We’re gauging first for engagement and the power of the product for our customers,” Huang told TechCrunch. “We want to make sure the product resonates and that we iterate on the product to make sure it’s good for the broader population. Our primary goal is that our customers use it and find it valuable.”

Amex Ventures has formed “some level of partnership” with more than two-thirds of its portfolio companies, she added.

“We try to engage with our portfolio in that way, to provide value with our startup ecosystem,” Huang said.

For its part, BodesWell had previously raised about $1.5 million from investors such as Cleo Capital, Ex Ventures, Riot.vc, GritCapital and Argon Capital and angels like HubSpot CEO Brian Halligan and Kintent CEO Sravish Sridhar.

Powered by WPeMatico

News broke this morning that Revolut, a U.K.-based consumer fintech player, raised a Series E round of funding worth $800 million at a valuation of $33 billion. Those figures are breathtaking not only due to their sheer scale, but also thanks to their radical divergence from Revolut’s preceding funding event.

At times, The Exchange, TechCrunch’s markets-and-startups column, runs into two topics worth exploring in a single day. Today is such a day. You can check out our earlier notes on the buy now, pay later startup market and Apple’s entrance into the BNPL space here. Now, let’s talk about neobanks.

As TechCrunch’s Ingrid Lunden wrote earlier today concerning the news:

This latest Series E is being co-led by Softbank Vision Fund 2 and Tiger Global, who appear to be the only backers in this round. It comes on the heels of rumors earlier this month Revolut was raising big. Revolut last raised about a year ago, when it closed out a Series D at $580 million, but what is stunning is how much its valuation has changed since then, growing 6x (it was $5.5 billion last year).

Stunning indeed.

Lunden also went on to report on the company’s changing financial picture based on Revolut’s recently released 2020 results. In this entry, we’re digging more deeply into those financial results and usage metrics detailed by the fintech megacorn.

The Exchange explores startups, markets and money.

Read it every morning on Extra Crunch or get The Exchange newsletter every Saturday.

The picture that emerges is one of a company with a rapidly improving financial image, albeit with some blank spaces regarding recent customer growth.

Powered by WPeMatico

The need for more affordable housing has never been more urgent as a shortage in the U.S. housing market persists.

Startups attempting to help address the shortage in a variety of ways abound. One such startup, Abodu, has raised $20 million in a Series A funding round led by Norwest Venture Partners. Previous backer Initialized Capital also participated in the financing, along with Redfin CEO Glenn Kelman, former Stockton, California Mayor Michael Tubbs, GGV investor Hans Tung and Paradox Capital’s Kyle Tibbitts.

The California legislature changed laws in 2017 to make it easier to build Accessory Dwelling Units (ADUs). Then on January 1, 2020, the state of California made it dramatically easier to add extra housing units to single-family home sites. Cities and local agencies have to quickly approve or deny ADU projects within 60 days of receiving a permit application. The state also now prevents cities from imposing minimum lot size requirements, maximum ADU dimensions or off-street parking requirements.

Redwood City, California-based Abodu, which builds prefabricated ADUs, was founded in 2018 to serve as a “one-stop shop” for building an ADU, or as some describe it, a home in a backyard.

Image Credits: Co-founders John Geary and Eric McInerney / Abodu

What sets the company apart from others in the space, its execs claim, is that it not only builds and installs the units, it helps homeowners with the painful process of getting permits. Abodu says it pre-approves its structural engineering with California state-level agencies to ensure its units can be built statewide and works with local agencies to pre-approve its foundation systems to ensure projects can proceed on predictable timelines.

It also claims to offer a cheaper and faster process than if one were to build an ADU from start to finish. Specifically, the startup claims that one of its backyard homes can be installed in just 10% of the time it would take for a traditional ADU to be built.

Abodu has been active in the market, selling and building its ADUs since the fall of 2019. Since then, it has put “dozens and dozens” of units in the ground, and has multiple dozen units in production on top of that, according to CEO and co-founder John Geary. So far, it’s operating in the Bay Area, Los Angeles and Seattle. The company claims it can deliver an ADU in as little as 30 days in San Jose and Los Angeles thanks to the cities’ pre-approval process. In other cities in California and Washington, turnaround is “as little as 12 weeks.” But a standard bespoke project takes 4-5 months from start to finish, according to Geary.

The startup’s three products include a 340-square foot studio; a 500-square foot one bedroom, one bath, and a 610-square foot two bedroom unit. All have kitchens and living space.

Pricing starts at $190,000, but the average project cost across all sizes is around $230,000, Geary said, inclusive of permits and site work.

There are a variety of use cases for ADUs, the most popular of which is to house family and for rental income.

“During the pandemic, multigenerational living has been at an all-time high. There are acute family needs that people are trying to solve for,” Geary said. “In addition, folks are earning extra money by renting them out to members of the community such as teachers or fireman, a single person or younger couple.”

Next, Abodu is eyeing the San Diego market.

Earlier this week, we covered the recent raise of Mighty Buildings, another Bay Area-based startup building ADUs and other housing. The biggest difference between the two companies, according to Geary, is that Mighty Buildings is focused on innovation in construction with its 3D-printed method.

“We decided early on that we didn’t want to reinvent the wheel from the construction standpoint,” Geary said. “Instead, we looked at ‘how can we solve for speed and ease?’ ”

Abodu operates with an asset-light model, and doesn’t own any factories. Instead, it has built a network of factory “partners” across the Western U.S. that builds its units depending on how their capacities look at any given time.

Naturally, the company’s investors are bullish on the company’s business model.

Jeff Crowe, managing partner of Norwest Venture Partners, believes that Abodu’s “beautifully crafted units” are just one of the company’s selling points.

“John, Eric, and their team manage the end-to-end process of permitting, building, and installing on behalf of their customers,” he told TechCrunch. “And with the expedited permitting that Abodu has been granted in over two dozen cities, it has faster time-to-installation than other ADU market participants. The result has been very high levels of customer satisfaction and rapid growth.”

Former Stockton Mayor Tubbs said Abodu is tackling two of California’s most consequential issues: the statewide housing shortage and its impacts on racial and economic segregation in our neighborhoods.

“By making it fast and accessible for normal homeowners to build high-quality backyard housing units, Abodu’s success will mean integrating options for both renters and homeowners in the same neighborhoods, while supporting small landlords and property owners in building equity in their homes,” he wrote via email.

Powered by WPeMatico

The gamification of payments is not a new concept.

A number of companies are attempting to combine gamification and payments in creative ways. And today, one such company, Play2Pay, has raised $13 million in a Series A round of funding.

The Miami-based startup has a straightforward mission. It wants to give consumers a way to reduce their bills — it claims by an average of 30%! — by playing games, watching videos and completing daily challenges, offers and surveys.

Play2Pay was bootstrapped for the first five years of its life, raising its first external capital in June of 2020 — a $7.5 million seed round from individual angel investors. Telesoft Partners led its Series A round, which included participation from Harbor Spring Capital and individual investors including former AT&T vice chairman Ralph de la Vega, former Reuters CEO Tom Glocer, Madison Dearborn Partners co-founder and senior advisor Jim Perry and Virtusa founder and former CEO, Kris Canekeratne.

The alternative payment platform says it brokers a “value exchange” between brands and consumers, converting attention and engagement into a currency, which can be redeemed for bill payment. Meanwhile, brands get a new way to promote their products and services.

Play2Pay founder and CEO Brian Boroff started the company in 2015 based on a vision that prepaid mobile phone users should have an alternative way to pay for their mobile phone service and that wireless carriers would adopt an ad-funded commercial model.

Today, the company claims to be positioned to be the world’s first “ad supported payment rail” directly integrated into payments platforms of major service providers and financial institutions. It also claims to be the only company that converts user engagement directly into bill payment.

Image Credits: Play2Pay

The “opt-in” offering is currently available to more than 100 million mobile subscribers across the United States, United Kingdom, Mexico, Brazil and Indonesia through partnerships with telecom companies such as AT&T Mexico, Cricket in the U.S., TIM in Brazil, lndosat Ooredoo in Indonesia and U.K.-based Lycamobile.

The rewarding approach seems to be resonating with users. From June 2020 to June 2021, the startup saw its ARR (annual recurring revenue) spike by nearly 300%, according to Boroff, a telecom veteran.

Among the users engaged on the platform, about 25% generated revenue daily, he said. And service providers realized up to 17% revenue expansion as a result of subscriber engagement on the Play2Pay platform, according to Boroff.

“Our distribution model is B2B2C, with Tier-1 service providers worldwide directly integrating our bill payment capability. We’re growing our audience through promotion of the service to their customer base,” he told TechCrunch.

End users, he added, can share their targeting preferences in exchange for value, giving mobile app developers and brands more information when promoting their own products and services to Play2Pay’s audience.

The platform is free for service providers and merchants, meaning the payment does not have costs or fees from interchange, acquirers, chargebacks or gateways.

Instead, Play2Pay generates revenue from mobile app developers and brands. Those developers and brands pay to access Play2Pay’s mobile audience in order to promote their products and services. For example, a mobile gaming company might pay Play2Pay $100 for every user that downloads their app from the Play2Pay app and plays the game for a period of time (such as two hours). Through its technology and partner network, Play2Pay has attribution tracking to ensure that the end user and mobile gaming company both know how much progress has been made toward completing that goal. Other formats include watching videos, completing surveys and more conventional native advertising in some areas.

Powered by WPeMatico

When it comes to tough environments to build new technology, firefighting has to be among the most difficult. Smoke and heat can quickly damage hardware, and interference from fires will disrupt most forms of wireless communications, rendering software all but useless. From a technology perspective, not all that much has really changed today when it comes to how people respond to blazes.

Qwake Technologies, a startup based in San Francisco, is looking to upgrade the firefighting game with a hardware augmented reality headset named C-THRU. Worn by responders, the device scans surrounding and uploads key environmental data to the cloud, allowing all responders and incident commanders to have one common operating picture of their situation. The goal is to improve situational awareness and increase the effectiveness of firefighters, all while minimizing potential injuries and casualties.

The company, which was founded in 2015, just raised about $5.5 million in financing this week. The company’s CEO, Sam Cossman, declined to name the lead investor, citing a confidentiality clause in the term sheet. He characterized the strategic investor as a publicly-traded company, and Qwake is the first startup investment this company has made.

(Normally, I’d ignore fundings without these sorts of details, but given that I am obsessed with DisasterTech these days, why the hell not).

Qwake has had success in recent months with netting large government contracts as it approaches a wider release of its product in late-2021. It secured a $1.4 million contract from the Department of Homeland Security last year, and also secured a partnership with the U.S. Air Force along with RSA in April. In addition, it raised a bit of angel funding and participated in Verizon’s 5G First Responder Lab as part of its inaugural cohort (reminder that TechCrunch is still owned by Verizon).

Cossman, who founded Qwake along with John Long, Mike Ralston, and Omer Haciomeroglu, has long been interested in fires, and specifically, volcanos. For years, he has been an expeditionary videographer and innovator who climbed calderas and attempted to bridge the gap between audiences, humanitarian response, and science.

“A lot of the work that I have done up until this point was focused on earth science and volcanoes,” he said. “A lot of projects were focused on predicting volcanic eruptions and looking at using sensor networks and different things of that nature to make people who live in those regions that are exposed to volcanic threats safer.”

During one project in Nicaragua, his team suddenly found itself lost amidst the smoke of an active volcano. There were “thick, dense superheated volcanic gases that prevented us from navigating correctly,” Cossman said. He wanted to find technology that might help them navigate in those conditions in the future, so he explored the products available to firefighters. “We figured, ‘Surely these men and women have figured out how do you see in austere environments, how do you make quick decisions, etc.’”

He was left disappointed, but also with a new vision: to build such technology himself. And thus, Qwake was born. “I was pissed off that the men and women who arguably need this stuff more than anybody — certainly more than a consumer — didn’t have anywhere to get it, and yet it was entirely possible,” he said. “But it was only being talked about in science fiction, so I’ve dedicated the last six years or so to make this thing real.”

Building such a product required a diverse set of talent, including hardware engineering, neuroscience, firefighting, product design and more. “We started tinkering and building this prototype. And it very interestingly got the attention of the firefighting community,” Cossman said.

Qwake offers a helmet-based IoT product that firefighters wear to collect data from environments. Image Credits: Qwake Technologies

Qwake at the time didn’t know any firefighters, and as the founders did customer calls, they learned that sensors and cameras weren’t really what responders needed. Instead, they wanted more operational clarity: not just more data inputs, but systems that can take all that noise, synthesize it, and relay critical information to them about exactly what’s going on in an environment and what the next steps should be.

Ultimately, Qwake built a full solution, including both an IoT device that attaches to a firefighter’s helmet and also a tablet-based application that processes the sensor data coming in and attempts to synchronize information from all teams simultaneously. The cloud ties it all together.

So far, the company has design customers with the fire departments of Menlo Park, California and Boston. With the new funding, the team is looking to advance the state of its prototype and get it ready for wider distribution by readying it for scalable manufacturing as it approaches a more public launch later this year.

Powered by WPeMatico

Investment apps in Southeast Asia are attracting a lot of funding, and now some are raising fast follow-on rounds, too. For example, Indonesian robo-advisor app Bibit raised $65 million in May just four months after a $30 million growth round. Now Singapore-based Syfe is announcing that it has closed a $40 million SGD (about $29.6M USD) Series B, only nine months after its Series A. It also said all of Syfe’s full-time employees will receive equity in the company.

The latest round’s lead investor is Valar Ventures, which also led Syfe’s Series A, marking the fintech-focused venture capital firm’s first investment in an Asian startup. Returning investors Presight Capital and Unbound participated, too.

This brings Syfe’s total raised so far to $70.7 million SGD (about $52.3 million USD) since it was founded in 2019. The startup did not disclose its Series B post-money valuation, but founder and chief executive officer Dhruv Arora told TechCrunch it increased 3.6 times from its Series A. The company also hasn’t disclosed total user numbers, but assets under management have grown four times since January, thanks in large part to user referrals and the launch of new products like Syfe Cash+ and Core portfolios.

“To be honest, we weren’t really looking to raise a Series B,” Arora told TechCrunch. “We saw some of the positive outcomes of resources from our Series A. We really scaled up the team and started launching new products and options for our users.” Syfe probably could have waited another six months to a year to raise a new round, he added, but its investors approached the startup again and offered good terms for another round.

About 50% to 70% of new users each month come through recommendations from existing customers, which keeps Syfe’s acquisition costs extremely low, Arora says. Since the beginning of this year, it has also doubled its team in Singapore to more than 100 people, allowing the startup to explore different kind of distribution strategies and partnerships. The app currently has users in 42 countries, but only actively markets in Singapore, where it holds a Capital Markets Services license from the Monetary Authority of Singapore (MAS). It has plans to announce a second market soon.

Syfe was founded in 2017 and launched its app in July 2019. Prior to starting Syfe, Arora was an investment banker at UBS Investment Bank before serving as vice president and head of growth at Indian grocery delivery startup Grofers.

While retail investment rates are still low in Southeast Asia, interest has jumped significantly over the past year. One of the reasons most commonly cited is the economic impact of COVID-19, which motivated people to earn returns from their money instead of keeping it in saving accounts.

“Most of my career has been within Hong Kong, Singapore and parts of India. I think culturally we’ve always been told to save, save, save,” Arora says. “It made sense because banks were giving good interest rates, but now the majority of economies are in negative real rate of interest.” Along with consumers’ growing familiarity with online wallets and other digital financial services, this set the stage for investment apps to come in, attracting customers who might not have gone to traditional brokerages.

Arora says he expected people to become more interested in investing, but gradually, over the course of about five to seven years. Instead, that shift is happening much more quickly. “My view is that tomorrow’s saving accounts become smart investing accounts. That’s been my view ever since we started Syfe, but this last year has made it evident that it has to happen and has to happen much bigger. So I think this wave will continue,” he says.

While many investment apps focus on millennial users, Syfe’s target demographic is wider. In the last six to nine months, Arora says there has been an uptick in users aged 50 and above on the platform, and its oldest user is 93 years old.

“The users in that segment have become a bigger percentage and the reality is that they typically have more disposable income. The average customer in their 50s will deploy, in our experience, almost twice the more conventional demographic which might be between 30 to 40,” says Arora.

Out of the many investment apps that have emerged in Southeast Asia, users most often compare Syfe to Stashaway, Endowus and Autowealth when shopping around for a platform. Arora says the space has a lot of room to grow because retail investment in the region is still very low. “I think it’s still super early in the game. There is enough room for multiple players and I think more will come into this domain, because if you can get your acquisition metrics into place, this can be a very profitable business.”

In terms of differentiating, Syfe is focused on new product development and user localization and personalization so customers can create more customized portfolios.

Syfe has a team of financial advisors for users who want person-to-person consultations, but Arora says most of Syfe’s investors rely entirely on its app to decide how to invest. Over the last nine months, it has only added one new advisor to its team, while focusing on making its user interface more intuitive.

“The human touch is optional, but it’s not necessary and in many cases, it’s only needed to help people understand the offering once,” says Arora. “But our goal is always going to be technology company and for the app to become so intuitive that whether you are 18 or 93, you are able to use the offering with very limited guidance.”

In a press statement, Valar Ventures founding partner Andrew McCormack says, “Syfe was our first investment in Asia and we’ve been impressed by its rapid, sustained growth over the past couple of years. The opportunity for the company to meet the saving and investment needs of a burgeoning mass-affluent consumer population in Asia remains significant, and we are confident that Syfe will continue to expand at pace.”

Powered by WPeMatico