Fundings & Exits

Auto Added by WPeMatico

Auto Added by WPeMatico

TriggerMesh, a startup building on top of the open-source Kubernetes software to help enterprises go “serverless” across apps running in the cloud and traditional data centers, has raised $3 million in seed funding.

The round is led by Index Ventures and Crane Venture Partners. TriggerMesh says the investment will be used to scale the company and grow its development team in order to offer what it bills as the industry’s first “cloud native integration platform for the serverless era.”

Founded by two prominent names in the open-source community — Sebastien Goasguen (CEO) and Mark Hinkle (CMO), based in Geneva and North Carolina, respectively — TriggerMesh’s platform will enable organizations to build enterprise-grade applications that span multiple cloud and data center environments, therefore helping to address what the startup says is a growing pain point as serverless architectures become more prevalent.

TriggerMesh’s platform and serverless cloud bus is said to facilitate “application flow orchestration” to consume events from any data center application or cloud event source and trigger serverless functions.

“As cloud-native applications use a greater number of serverless offerings in the cloud, TriggerMesh provides a declarative API and a set of tools to define event flows and functions that compose modern applications,” explains the company.

One feature TriggerMesh is specifically talking up and very relevant to legacy enterprises is its integration functionality with on-premise software. Via its wares, it says it is easy to connect SaaS, serverless cloud offerings and on-premises applications to provide scalable cloud-native applications at a low cost and quickly.

“There are huge numbers of disconnected applications that are unable to fully benefit from cloud computing and increased network connectivity,” noted Scott Sage, co-founder and partner at Crane Venture Partners, in a statement. “Most companies have some combination of cloud and on-premises applications and with more applications around, often from different vendors, the need for integration has never been greater. We see TriggerMesh’s solution as the ideal fit for this need which made them a compelling investment.”

Powered by WPeMatico

ServiceNow announced today that it has acquired Loom Systems, an Israeli startup that specializes in AIOps. The companies did not reveal the purchase price.

IT operations collects tons of data across a number of monitoring and logging tools, way too much for any team of humans to keep up with. That’s why there are startups like Loom turning to AI to help sort through it. It can find issues and patterns in the data that would be challenging or impossible for humans to find. Applying AI to operations data in this manner has become known as AIOps in industry parlance.

ServiceNow is first and foremost a company trying to digitize the service process, however that manifests itself. IT service operations is a big part of that. Companies can monitor their systems, wait until a problem happens and then try to track down the cause and fix it — or, they can use the power of artificial intelligence to find potential dangers to the system health and neutralize them before they become major problems. That’s what an AIOps product like Loom’s can bring to the table.

Jeff Hausman, vice president and general manager of IT Operations Management at ServiceNow, sees Loom’s strengths merging with ServiceNow’s existing tooling to help keep IT systems running. “We will leverage Loom Systems’ log analytics capabilities to help customers analyze data, automate remediation and reduce L1 incidents,” he told TechCrunch.

Loom co-founder and CEO Gabby Menachem not surprisingly sees a similar value proposition. “By joining forces, we have the unique opportunity to bring together our AI innovations and ServiceNow’s AIOps capabilities to help customers prevent and fix IT issues before they become problems,” he said in a statement.

Loom has raised $16 million since it launched in 2015, according to PitchBook data. Its most recent round for $10 million was in November 2019. Today’s deal is expected to close by the end of this quarter.

Powered by WPeMatico

Placer.ai, a startup that analyzes location and foot traffic analytics for retailers and other businesses, announced today that it has closed a $12 million Series A. The round was led by JBV Capital, with participation from investors including Aleph, Reciprocal Ventures and OCA Ventures.

The funding will be used on research and development of new features and to expand Placer.ai’s operation in the United States.

Launched in 2016, Placer.ai’s SaaS platform gives its clients real-time data that helps them make decisions like where to rent or buy properties, when to hold sales and promotions and how to manage assets.

Placer.ai analyzes foot traffic and also creates consumer profiles to help clients make marketing and ad spending decisions. It does this by collecting geolocation and proximity data from devices that are enabled to share that information. Placer.ai’s co-founder and CEO Noam Ben-Zvi says the company protects privacy and follows regulation by displaying aggregated, anonymous data and does not collect personally identifiable data. It also does not sell advertising or raw data.

The company currently serves clients in the retail (including large shopping centers), commercial real estate and hospitality verticals, including JLL, Regency, SRS, Brixmor, Verizon* and Caesars Entertainment.

“Up until now, we’ve been heavily focused on the commercial real estate sector, but this has very organically led us into retail, hospitality, municipalities and even [consumer packaged goods],” Ben-Zvi told TechCrunch in an email. “This presents us with a massive market, so we’re just focused on building out the types of features that will directly address the different needs of our core audience.”

He adds that lack of data has hurt retail businesses with major offline operations, but that “by effectively addressing this gap, we’re helping drive more sustainable growth or larger players or minimizing the risk for smaller companies to drive expansion plans that are strategically aggressive.”

Others startups in the same space include Dor, Aislelabs, RetailNext, ShopperTrak and Density. Ben-Zvi says Placer.ai wants to differentiate by providing more types of real-time data analysis.

“While there are a lot of companies touching the location analytics space, we’re in a unique situation as the only company providing these deep and actionable insights for any location in the country in a real-time platform with a wide array of functionality,” he said.

*Disclosure: Verizon Media is the parent company of TechCrunch.

Powered by WPeMatico

Tencent, one of the world’s biggest video and online gaming companies by revenue, today made another move to help cement that position. The Chinese firm has made an offer to fully acquire Funcom, the games developer behind Conan Exiles (and others in the Conan franchise), Dune and some 28 other titles. The deal, when approved, would value the Oslo-based company at $148 million (NOK 1.33 billion) and give the company a much-needed cash injection to follow through on its longer-term strategy around its next generation of games.

Funcom is traded publicly on the Oslo Stock Exchange, and the board has already recommended the offer, which is being made at NOK 17 per share, or around 27% higher than its closing share price the day before (Tuesday).

The news is being made with some interesting timing. Today, Tencent competes against the likes of Sony, Microsoft and Nintendo in terms of mass-market, gaming revenues. But just earlier this week, it was reported that ByteDance — the publisher behind breakout social media app TikTok — was readying its own foray into the world of gaming.

If it goes ahead, that would set up another level of rivalry between the two companies. Tencent also has a massive interest in the social media space, specifically by way of its messaging app WeChat . While many consumers will have multiple apps, when it comes down to it, spending money in one represents a constraint on spending money in another. ByteDance currently profits from having content on its social apps related to Tencent gameplay, so building its own content could be one way of moving away from that. The two have (naturally) also been battling it out in court in China over unfair competition claims, in part related to that gaming content.

Today, Tencent is one of the world’s biggest video game companies: in its last reported quarter (Q3 in November), Tencent said that it make RMB28.6 billion ($4.1 billion) in online gaming revenue, with smartphone games accounting for RMB24.3 billion of that.

Acquisitions and controlling stakes form a key part of the company’s growth strategy in gaming. Among its very biggest deals, Tencent paid $8.6 billion for a majority stake in Finland’s Supercell back in 2016. It also has a range of controlling stakes in Riot Games, Epic, Ubisoft, Paradox, Frontier and Miniclip. These companies, in turn, also are making deals: just earlier this month it was reported (and sources have also told us) that Miniclip acquired Israel’s Ilyon Games (of Bubble Shooter fame) for $100 million.

Turning back to Funcom, Tencent was already an investor in the company: it took a 29% stake in it in September 2019 in a secondary deal, buying out KGJ Capital (which had previously been the biggest shareholder).

“Tencent has a reputation for being a responsible long-term investor, and for its renowned operational capabilities in online games,” said Funcom CEO Rui Casais at the time. “The insight, experience, and knowledge that Tencent will bring is of great value to us and we look forward to working closely with them as we continue to develop great games and build a successful future for Funcom.”

In retrospect, this was laying the groundwork and relationships for a bigger deal just months down the line.

“We have a great relationship with Tencent as our largest shareholder and we are very excited to be part of the Tencent team,” Casais said in a statement today. “We will continue to develop great games that people all over the world will play, and believe that the support of Tencent will take Funcom to the next level. Tencent will provide Funcom with operational leverage and insights from its vast knowledge as the leading company in the game space.”

The rationale for Funcom is that the company had already determined that it needed further investment in order to follow through on its longer-term strategy.

According to a statement issued before it recommended the offer, the company is continuing to build out the “Open World Survival segment” using the Games-as-a-Service business model (where you pay to fuel up with more credits); and is building an ambitious Dune project set to launch in two years.

“Such increased focus would require a redirection of resources from other initiatives, the most significant being the co-op shooter game, initially scheduled for release during 2020 that has been impacted by scope changes due to external/market pressures with increasingly strong competition and internal delays,” the board writes, and if it goes ahead with its strategy, “It is likely that the Company will need additional financing to supplement the revenue generated from current operations.”

Powered by WPeMatico

LumApps, the cloud-based social intranet for the enterprise, has closed $70 million in Series C funding. Leading the round is Goldman Sachs Growth, with participation from Bpifrance via its Growth Fund Large Venture.

Others participating include Idinvest Partners, Iris Capital, and Famille C (the family office of Courtin-Clarins). The round brings the total raised by the French company to around $100 million.

Founded in Paris back in 2012, before launching today’s proposition in 2015, LumApps has developed what it describes as a “social intranet” for enterprises to enable employees to better informed, connect and collaborate. The SaaS integrates with other enterprise software such as G Suite, Microsoft Office 365 and Microsoft SharePoint, to centralize access to corporate content, business applications and social features under a single platform. The central premise is to help companies “break down silos” and streamline internal communication.

LumApps customers include Airbus, Veolia, Valeo, Air Liquide, Colgate-Palmolive, The Economist, Schibsted, EA, Logitech, Toto, and Japan Airlines, and the company claims to have achieved year-on-year revenue growth of 100%.

“Our dream was to enable access to useful information in one click, from one place and for everyone,” LumApps founder and CEO Sébastien Ricard told TechCrunch when the company raised its Series B early last year. “We wanted to build a solution that bridged [an] intranet and social network, with the latest new technologies. A place that users will love.”

Since then, LumApps has added several new offices and has seven worldwide: Lyon, Paris, London, New York, Austin, San Francisco, and Tokyo. Armed with additional funding, the company will continue adding significant headcount, hiring across engineering, product, sales and marketing. There are also plans to expand to Canada, more of Asia Pacific, and Germany.

“We’re actually looking at hiring 200 people minimum,” Ricard tells me. “We’re growing fast and have ambitious plans to take the product to new heights, including fulfilling our vision of making LumApps a personal assistant powered by AI. This will require a significant investment in top engineering/AI talent globally”.

Asked to elaborate on what machine learning and AI could bring to a social intranet, Ricard says the vision is to make LumApps a personal assistant for all communications and workflows in the enterprise.

“We see a future where this personal assistant can make predictive suggestions based on historical data and actions. Applying AI to prompt authors with suggested content, flagging important items that demand attention, and auto-archiving old content, are a few examples. Managing the massive troves of content and data companies have today is critical”.

Ricard also sees AI playing a big role in data security. “Employees have a high-degree of control with regard to data sharing and AI can help manage what employees can share in the workplace. This is more long-term but it’s where we’re headed,” he says.

“In the short-term, we’re making investments in automating as many workflows as possible with the goal of reducing or eliminating administrative tasks that keep employees from more productive tasks, including team collaboration and knowledge sharing”.

Meanwhile, LumApps says it may also use part of the Series C for M&A activity. “We’re growing fast and we’re looking at different areas for expansion opportunities,” Ricard says. “This includes retail and manufacturing and some business functions like HR, marketing and communications. We don’t have concrete plans to acquire any companies at the moment but we are keeping our options open as acquiring best-in-breed technologies often makes more sense from a business perspective than building it yourself”.

Powered by WPeMatico

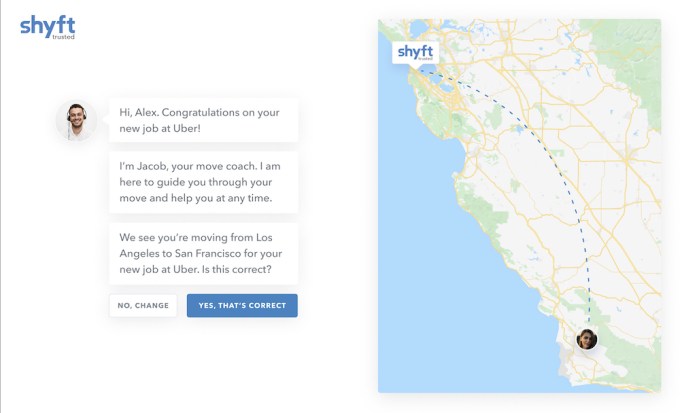

Shyft is announcing it has raised $15 million in Series A funding to make the moving process less painful — specifically in the situations where your employer is paying for the move.

Other startups are looking to offer concierge-type services for regular moving — I used a service called Moved last year and liked it. But Shyft co-founder and CEO Alex Alpert (who’s spent years in the moving business) told me there are no direct competitors focused on corporate relocation.

“Even at the highest levels, the process is totally jacked up,” Alpert said. “We saw an opportunity to partner with corporations and relocation management companies to build a customized, tech-driven experience with more choices, more flexibility and to be able to navigate the quoting process seamlessly.”

So when a company that uses Shyft decides to relocate you — whether you’re a new hire or just transferring to a new office — you should get an email prompting you to download the Shyft app, where you can chat with a “move coach” who guides you through the process.

You’ll also be able to catalog the items you want to move over a video call and get estimates from movers. And you’ll receive moving-related offers from companies like Airbnb, Wag, Common, Sonder and Home Chef.

And as Alpert noted, Shyft also partners with more traditional relocation companies like Graebel, rather than treating them as competitors.

The company was originally called Crater and focused on building technology for creating accurate moving estimates via video. It changed its name and its business model back in 2018 (Alpert acknowledged, “It wasn’t a very popular pitch in the beginning: ‘Hey, we’re building estimation software for moving companies.’ “), but the technology remains a crucial differentiator.

“Our technology is within 95% accurate at identifying volume and weight of the move,” he said. “When moving companies know the information is reliable, they can bid very aggressively.”

As a result, Alpert said the employer benefits not just from having happier employees, but lower moving costs.

The new funding, meanwhile, was led by Inovia Capital, with participation from Blumberg Capital and FJ Labs.

“There’s a total misalignment between transactional relocation services and the many logistical, social, and lifestyle needs that come with moving to a new city,” Inovia partner Todd Simpson said in a statement. “As businesses shift towards more distributed workforces and talent becomes accustomed to personalized experiences, the demand for a curated moving offering will continue to grow.”

Powered by WPeMatico

AppsFlyer has raised a massive Series D of $210 million, led by General Atlantic.

Founded in 2011, the company is best known for mobile ad attribution — allowing advertisers to see which campaigns are driving results. At the same time, AppsFlyer has expanded into other areas, like fraud prevention.

And in the funding announcement, General Atlantic Manager Director Alex Crisses suggested that there’s a broader opportunity here.

“Attribution is becoming the core of the marketing tech stack, and AppsFlyer has established itself as a leader in this fast-growing category,” Crisses said. “AppsFlyer’s commitment to being independent, unbiased, and representing the marketer’s interests has garnered the trust of many of the world’s leading brands, and we see significant potential to capture additional opportunity in the market.”

Crisses and General Atlantic’s co-president and global head of technology, Anton Levy, are both joining AppsFlyer’s board of directors. Previous investors Qumra Capital, Goldman Sachs Growth, DTCP (Deutsche Telekom Capital Partners), Pitango Venture Capital and Magma Venture Partners also participated in the round, which brings the company’s total funding to $294 million.

AppsFlyer said it works with more than 12,000 customers, including eBay, HBO, Tencent, NBC Universal, Minecraft, US Bank, Macy’s and Nike. It also says it saw more than $150 million in annual recurring revenue in 2019, up 5x from its Series C in 2017.

Co-founder and CEO Oren Kaniel said that as attribution becomes more important, marketers need a partner they can trust. And with AppsFlyer driving $28 billion in ad spend last year, he argued, “There’s a lot of trust there.”

Kaniel added, “It doesn’t really matter how sophisticated your marketing stack is, or whether you have AI or machine learning — if the data feed is wrong … everything else will be wrong. I think companies realize how sensitive and critical this data platform is for them. I think that in the past couple of years, they’re investing more in selecting the right platform.”

In order to ensure that trust, he said that AppsFlyer has avoided any conflicts of interest in its business model — a position that extends to fundraising, where Kaniel made sure not to raise money from any of the big players in digital advertising.

And moving forward, he said, “We will never go into media business, never go into media services. We want to maintain our independence, we want to maintain our previous unbiased positions.”

Kaniel also argued that while he doesn’t see regulations like Europe GDPR and California’s CCPA hindering ad attribution directly, the regulatory environment has justified AppsFlyer’s investment in privacy and security.

“Even more than just being in compliance, [with AppsFlyer], marketers all of a sudden have full control of their data,” he said. “Let’s say on the web, probably your website is sending data and information to partners who don’t need to have access to this information. The reason is, there’s no logic, there’s a lot of pixels going everywhere, the publishers don’t have control. If you use our platform, you have full control, you can configure the exact data points that you’d like to share.”

Powered by WPeMatico

Tink, the European open banking platform, is disclosing €90 million in new funding, just 11 months after the Sweden-headquartered company announced a €56 million round of funding.

Co-leading this new round is Dawn Capital, HMI Capital and Insight Partners. The round also includes the incumbent postal operator and Italy’s largest financial services network Poste Italiane as a new investor, along with existing investors Heartcore Capital, ABN AMRO Ventures and BNP Paribas’ venture arm, Opera Tech Ventures.

The injection of capital will enable Tink to accelerate its European expansion plans and further develop its product accordingly.

“During 2020, we are committed to building out our platform with more bank connections and, on top of that, expand our product offering,” Tink co-founder and CEO Daniel Kjellén tells me. “Our aim is to become the preferred pan-European provider of digital banking services and increase our local presence across the region”.

Originally launched in Sweden in 2013 as a consumer-facing finance app with bank account aggregation at its heart, Tink has long since repositioned its offering to become a fully-fledged open banking platform, requisite with developer APIs, to enable banks and other financial service providers to ride the open banking/PSD2 train.

Through its various APIs, Tink provides four pillars of technology: “Account Aggregation,” “Payment Initiation,” “Personal Finance Management” and “Data Enrichment.” These can be used by third parties to roll their own standalone apps or integrated into existing banking applications.

“We have grown significantly, both in terms of our platform’s connectivity and as an organisation,” says Kjellén, when asked what has changed in the last 11 months. “We have during the year launched our platform in Belgium, Austria, the U.K., Germany, Spain, the Netherlands, Portugal and Italy. In total, our open banking platform is right now live in twelve European markets and connects to more than 2,500 banks that reach more than 250 million bank customers across Europe”.

The company’s headcount has also grown a lot, too. In the beginning of 2019 it sat at around 120, but is now at 300 employees. Most but not all are based in its headquarters in Stockholm, alongside local offices including recently opened sites in Paris, Helsinki, Oslo, Madrid, Warsaw, Milan and Copenhagen.

Perhaps better positioned than most, I asked Kjellén what types of use cases are really resonating with open banking, given that many industry commentators don’t think it has quite yet lived up to the hype.

“Many of our customers are seeing the advantage of being able to build smart multi-banking products with the data that they are now able to fetch and use to add value for their end users,” he says. “The use cases that really show the potential of open banking that we see our customers thriving with are those that leverage the full value of the financial data to deliver truly personalised experiences at scale, or remove friction in the user journey to a minimum, such as proactive price comparison, enhanced credit scoring and onboarding. Use cases such as these show that the consumer’s data can really work for them and bring improvements to their everyday interactions”.

One example Kjellén gives me is Klarna, the checkout credit provider, which he says is using open banking to provide a “wonderful” in-app experience. “I love that I as a consumer can now choose to change my mind and slice up the payments for a purchase I have already paid in full with my bank card,” he explains. “This shows how the potential of open banking goes way beyond just accessing a transaction history and allows the most innovative players, such as Klarna, to create a new standard in consumer experience”.

Kjellén says another standout use-case is using PSD2 APIs to verify identity to complete any type of customer registration completely automatically. “[That is] something that I find very innovative. It automates the previously time-consuming administration on the business side and delivers a completely seamless digital service on the end user side,” he says.

Meanwhile, Tink says its customer numbers have “quadrupled” in the past year, and includes PayPal, Klarna, NatWest, ABN AMRO, BNP Paribas Fortis, Nordea and SEB. “More than 4,000 developers are currently using Tink to build and power new innovative financial services and products,” adds Kjellén.

Powered by WPeMatico

Continuing our irregular surveys of the public markets, two things happened this week that are worth our time. First, a third domestic technology company — Alphabet — passed the $1 trillion market capitalization threshold. And, second, software as a service (SaaS) stocks reached record highs on the public markets after retreating over last summer.

The two milestones, only modestly related events, indicate how temperate the public waters are for technology companies today, a fact that should extend warmth into the private market where startups, and their venture capital backers, work.

The happenings are good news for technology startups for a number of reasons, including that major tech players have never had as much wealth in hand with which to buy smaller companies, and strong SaaS valuations help both smaller startups fundraise, and their larger brethren possibly exit.

Indeed, the stridently good valuations that major tech companies and their smaller siblings enjoy today should be just the sort of market conditions under which unicorns want to debut. We’ll continue to make this point so long as the public markets continue to rise, pricing tech companies that have already floated higher like the cliche’s own tide.

But while Alphabet, Microsoft and Apple are worth $3.68 trillion as a trio, and SaaS stocks are now worth 12.3x times their revenue (using enterprise value instead of market cap, for those keeping score at home), not every private, venture-backed company will necessarily benefit from public investor largesse.

How much the current public-market tech valuation expansion will help companies that are increasingly sorted into the tech-enabled bucket isn’t clear; some companies that went public in 2019 were quickly spit up by investors unwilling to support valuations that matched or rose above their final private valuations. SmileDirectClub was one such offering.

The dividing line between what counts as tech — often fuzzy — appears to be slicing along gross margin lines, and the repeatability of business. The higher margin, and more recurring a company is, the more it’s worth. This market reality is why SaaS stocks’ recent return to form is not a surprise.

For Casper and One Medical, the first two venture-backed IPO hopefuls of the year, the more tech-ish they can appear between now and pricing the better. Because technology companies today are valued so highly, perhaps even a faint dusting of tech will save their valuations as they cross the chasm between private and adult.

Powered by WPeMatico

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

Yesterday, TechCrunch reported that Eaze, a well-known cannabis-focused startup, is struggling to stay in business amidst a cash crunch, leadership turmoil, banking issues and a business model pivot. It’s a compelling, critical read.

The news, however, asks a question: How are other cannabis-focused startups faring? We’ll explore the question through the lens of fundraising and the public market results of public cannabis companies in Canada.

Powered by WPeMatico